Abstract

This study addresses the supply chain configuration problem of manufacturer faced with multiple channel choices. We investigate the optimal combination of traditional and online sales channels for different product categories with differing customer preference of the online channel. We have considered three distinct dual-channel supply chain configurations comprising of a manufacturer, a traditional channel and an online channel viz. retailer–e-tailer; company store–e-tailer; and retailer–e-marketplace. As the manufacturer will face a quantity allocation decision between traditional and online channels, the competition is modeled using Cournot model with the manufacturer as the Stackelberg leader. Values of optimal order quantity and price for the different entities have been established. Influence of variation in customer preference of online channel on the optimal policies is also examined. We find that the manufacturer prefers retailer–e-marketplace configuration for products with high customer preference of online channel and company store–e-tailer configuration for products with low customer preference of online channel. In addition, we find that the retailer–e-tailer configuration is dominated by company store–e-tailer and retailer–e-marketplace configuration irrespective of the product’s customer preference of online channel.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Emergence of online sales channels has induced remarkable structural change in supply chains [4, 7, 8]. Nowadays most of the firms are redesigning their supply chains by adopting a mixed sales channel structure comprising of traditional and online sales channels [49]. For instance, firms such as Sony, Dell, Nike, IBM and Apple are selling their products through both traditional brick-and-mortar stores and online sales channels [8, 15, 16]. Traditional brick-and-mortar stores can take the form of an independent retailer, a franchisee or a manufacturer owned retail outlet. Similarly, online sales channel could be manufacturer’s own website (levi.com), an e-tailer (who buys the product from the manufacturer and further resells it to the customers through a website e.g. koovs.com) or an e-marketplace (which displays the product and facilitates the sales transaction on behalf of the manufacturer e.g. Amazon.in, Flipkart.com). In this context of multiple channel choices, it is imperative for the manufacturer to choose the right mix of online and traditional channels to maximize the profit.

While choosing the supply chain configuration, the manufacturer has to consider the product category since individual product characteristic influences customer channel choice largely [1, 5, 30, 33]. Product categories such as books, e-books, and antivirus software are highly suitable to the online channels (high web-product fit) whereas product categories such as automobiles, furniture, jewellery, and perishable food items are not so suitable with the online sales channels (poor web-product fit) [23, 30]. The difference in web-product fit across product categories is due to the limitations associated with the online sales channels [8, 27, 28, 31]. Thus, it is safe to assume that the customers prefer online channels for products having high web-product fit and traditional channels for products with low web-product fit [30]. Despite such a strong association, there is scant literature addressing the relationship between customer preference of online channel and optimal channel configuration of the manufacturer. In this study, we try to bridge this gap by investigating the influence of customer preference of online channel on the optimal channel configuration decision of the manufacturer.

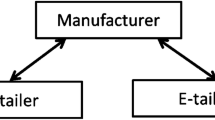

Another major aspect to be considered while configuring the sales channels is the shift in customer preference of the online channel owing to the inherent advantages of online shopping (such advantages include convenience [7], 24/7 operation [31], ease of price comparison, product variety) and the radical customer friendly transformation of online retailing industry. To minimize the differences between traditional selling and online selling, internet firms are modifying their operations by investing in the infrastructure. Many e-tailers have built fulfilment centres for minimizing the delivery time. In India, web grocers such as Bigbasket.com and Localbanya.com are successful especially in cities by offering same day delivery. When it comes to the apparel purchase from online channels, the major concern is the fit uncertainty. However, in the recent past, the online apparel industry is successful in alleviating the fit uncertainty with the help of technological solutions provided by firms such as Virtusize and Fittiquette. Thus, we can see that internet firms are improving operations according to their respective product categories to augment online channel preference. Considering this transformation, we also investigate the impact of increase in customer preference of online channel on the optimal policies of the manufacturer and other members in the supply chain. Observing the real life examples, we have considered three distinct dual-channel supply chain (DCSC) configurations comprising of competing traditional and online channels. In the first configuration, we have assumed that the manufacturer is selling through an independent traditional retailer and an e-tailer. The second configuration comprises of the manufacturer owned retailer store (company store) and an independent e-tailer. The third configuration is a combination of independent traditional retailer and an e-marketplace. By analysing the three configurations, we try to address the following questions.

-

1.

Which dual-channel configuration yields the maximum profit for the manufacturer for different product categories?

-

2.

What is the influence of increase in online channel preference of the product on the optimal policies of the manufacturer?

-

3.

How does the customer preference of online channel of the product influence the profit of the retailer and e-tailer?

We propose a Cournot competition model to derive the optimal policies of the manufacturer and other supply chain members for different product categories in terms of their customer preference of online channel. We find that the manufacturer should use a combination of company store and e-tailer combination for selling products with low customer preference for the online channel. However, for selling products with high customer preference of online channel, the manufacturer should use a combination of retailer and e-marketplace. The manufacturer would make more profit by using a combination of one direct channel and an intermediary than using two intermediaries in a DCSC configuration. The retailer would be better off in competing with e-tailer than e-marketplace and the e-tailer would be better off in competing with the retailer than company stores. In the next section, we review previous research related to our study.

2 Literature review

Our study relates to the two streams of research (1) channel configuration decision of the manufacturer under DCSC configuration (2) customer preference of online channel.

2.1 Channel configuration decision of the manufacturer

There are sufficient number of studies addressing DCSC competition on various issues such as pricing [11, 19, 24, 38], service [13], production strategies [29], inventory policies [34, 50] and channel co-ordination [6, 32, 51]. We focus on those studies, which address manufacturer’s channel configuration problem of adding an online channel to its existing traditional channel. One of such pioneering study done by Chiang et al. [8], investigated the impact of introducing a direct online channel. They concluded that the direct online channel helps the manufacturer to exert control over the retailer, thereby increasing manufacturer’s profit and consumer surplus could use the direct online channel. Xu et al. [39] extended Chiang’s study by considering the effect of delivery lead-time on channel structure strategy. Contrary to the results of Chiang et al. [8], Yoo and Lee [51] concluded that entry into online sales does not always result in improved consumer welfare by the reduction of price. Hendershot and Zhang [18] addressed the channel selection decision by the upstream firm and inferred that the presence of direct sales channel is beneficial for the firm as it allows price discrimination among higher-value consumers. Chun et al. [12] investigate manufacturer’s optimal channel strategies when faced with an online channel entry decision and discuss the implications of these strategies by incorporating customer heterogeneity and retail service. Tsay and Agarwal [35] examine the channel configuration strategy and conclude that direct online channel addition is beneficial for both the manufacturer and the traditional brick and mortar reseller with necessary price adjustment by the manufacturer. Using Stackelberg game model, Cai et al. [2] examine how the channel selection problem is influenced by the price discount contract under DCSC competition. Wang et al. [37] study optimal channel structure for new and remanufactured products under three different channel structures. Chiang and Monahan [9] compare ‘e-tailer only’ and ‘retailer only’ strategy with dual-channel strategy under the assumption of stochastic demand.

We noticed that none of the above-mentioned studies has considered the different types of the online channel (firm’s own website, e-tailer, or e-marketplace). In addition, the DCSC competition literature is devoid of considering the traditional channel as the direct channel whereas, in reality, numerous manufacturers sell the product through their own retailer stores and thereby reaching directly to the customers [36]. In this study, we address this gap by including two forms of online retailing, i.e. inventory owning e-tailer and e-marketplace, and manufacturer-owned retail outlet (company store) as the direct traditional channel, to the DCSC framework. Furthermore, the manufacturer has to allocate optimal quantities between competing channels. To the best of our knowledge, optimal quantity allocation between the channels and subsequent quantity competition is not addressed in the literature. We address this gap by modeling the dual channel competition as a Cournot competition and thereby help firms in designing strategies for optimal allocation to maximize the profit.

2.2 Customer preference of online channel

Customers’ channel preference (denoted as \(\theta\) in our study) is a broad construct, which can be studied from different perspectives [14, 17]. In this paper, we focus on studies that connect channel preference to the product category. Liang and Huang [27] empirically determined customer acceptance of online channel for different product categories and found that product characteristics determine the compatibility of the product with the web. Kacen et al. [23] also did a similar study in which they compared the consumer valuation of online stores and traditional stores for three kinds of product categories viz. durable goods, non-durable goods, and perishable goods. The role of customer acceptance of online channel in determining the channel configuration strategy was examined by Chiang et al. [8]. Later, Yan [40] renamed customer acceptance of online channel as web-product fit and examined the influence of web-product fit on pricing strategies under different market structures based on channel power. Yan [41] also examined the impact of web-product fit on the profit of the retailer and manufacturer having a DCSC configuration. The impact of web-product fit has been considered in various DCSC competition studies addressing issues such as cooperative advertising [10, 47, 48], information sharing [43, 45, 46], channel co-ordination [44] and return policy [42]. Hua et al. [20] renamed customer acceptance of online channel to customer preference of online channel and used in the demand function to split the base demand into two parts—(1) demand for traditional retailer, and (2) demand for the online channel. The assumption is that higher the customer preference of online channel for a product, higher the demand in the online channel and lower the demand for the traditional channel. A similar approach is followed in [3, 21]. However, we can see a different approach in some studies [6, 25, 26, 32] in which a parameter indicating loyalty to the traditional channel instead of online channel is used to split the demand. We follow the approach used by Hua et al. [20] and use similar demand functions to examine the optimal channel configuration of the manufacturer.

3 Model

We consider a two-echelon DCSC with manufacturer selling through a traditional and an online channel. The manufacturer is called ‘he’ and is represented by the subscript ‘m’. We have selected two forms of traditional retailing and two forms of online retailing and named them using established terminologies based on their business operations. Independent traditional/brick and mortar retailer, who buys the product from the manufacturer and resells it to customers through its store is referred to as ‘retailer.’ Similarly, ‘e-tailer’ relates to an independent online retailer who obtains the product from the manufacturer and resells it to customers through its website. Online marketplace such as Amazon.com or Sears.com, which displays the product of the manufacturer and facilitates the sales transaction primarily on a commission basis, is called as ‘e-marketplace.’ Company store refers to manufacturer-owned brick and mortar retail outlet, which only sells manufacturer’s brand. Retailer and e-tailer are called ‘she’ and is represented by the subscripts ‘r’ and ‘e’ respectively. We have three distinct DCSC configurations with each configuration comprising of a traditional (brick and mortar) channel and an online channel. The configurations are as follows

-

1.

DCSC I Retailer–e-tailer configuration (Fig. 1a)—under this configuration, the manufacturer sells the product to the retailer and e-tailer at per unit wholesale prices of \(w_{r}^{RE}\) and \(w_{e}^{RE}\) respectively. Both retailer and e-tailer resell the product at prices \(p_{r}^{RE}\) and \(p_{e}^{RE}\) per unit respectively.

-

2.

DCSC II Company store–e-tailer configuration (Fig. 1b)—under this configuration, the manufacturer sells the product directly to the customers through its company stores at price \(p_{x}^{XE}\) and to an E-tailer at a wholesale price \(w_{e}^{XE}\). The E-tailer resells the product to the customers at a price of \(p_{e}^{XE}\).

-

3)

DCSC III Retailer–e-marketplace configuration (Fig. 1c)—under this configuration, the manufacturer sells the product directly to customers through an E-marketplace at a price of \(p_{o}^{RO}\) and to a retailer at a wholesale price of \(w_{r}^{RO}\). The retailer resells the product to customers at a price \(p_{r}^{RO}\). The E-marketplace acts as an agent of the manufacturer on a per unit sales commission of \(\alpha\) for its service.

We assume that the demands are linear in nature with higher own price sensitivity than the cross price sensitivity as in [6, 13, 22, 25].

Demand for the retailer/company store

Demand for the E-tailer/E-marketplace

where \(D_{j}^{i}\) is the demand for the traditional channel with a superscript \(i\) indicating the specific DCSC under consideration i.e. \(i = RE,XE,RO\) for retailer–e-tailer, company store–e-tailer, and retailer–e-marketplace DCSCs respectively. The subscript \(j\) indicates the kind of traditional channel under consideration i.e. \(j = r,x\) for retailer and company store respectively. Similarly \(D_{k}^{i}\) is the demand for the online channel with the subscript \(k = e,o\) for e-tailer and e-marketplace respectively. This convention is used for the all the expressions (Price \(\left( p \right)\), Order quantity \(\left( Q \right)\) and Profit \(\left( \pi \right)\) in the paper. \(\theta\) represents the customer preference of online channel for a product [20]. In the literature \(\theta\) has been referred to as web-product fit [40] and customer acceptance of online channel [8]. Kacen et al. [23] empirically estimated \(\theta\) values of different product categories as shown in Table 1. \(a\) is the base demand i.e. the demand for the product when the price is zero. The value of \(\theta\) directly determines the share of base demand for the channels. From the demand Eqs. (1a) and (1b) it is obvious that at higher values of \(\theta\), the base demand for the online channel will be high and that of the traditional channel will be low. The converse is also true i.e. the lower \(\theta\) value is preferable for the traditional channel. \(b\) represent the own-price sensitivity of traditional (retailer/company store) and online (e-tailer/e-marketplace) channels. Similarly, \(c\) represent the cross-price sensitivity of traditional (retailer/company store) and online (e-tailer/e-marketplace). Own price sensitivity is greater than cross price sensitivity (i.e. \(b > c\)) as in [6, 13, 15, 20, 21].

3.1 Model assumptions

-

1.

The manufacturer is a monopolist. i.e. the specific brand of product is not available for sale elsewhere [8]. In other words, a customer can buy the product either from the traditional channel or from the online channel. The traditional channel could be a retailer or company store and the online channel could be an e-tailer or e-marketplace depending on the DCSC under consideration.

-

2.

The manufacturer does not constrain the sale price in the direct channel (e-marketplace, company store) to be always more than wholesale price to the retailer/e-tailer as in [6, 8]. In other words, depending on the customer preference of online channel, the wholesale price for the channel intermediary (retailer/e-tailer) could be higher than the sale price in the competing direct channel (e-marketplace, company store). Because of which the channel intermediary will prefer to buy the product from direct channel bypassing the manufacturer. However, in our study, it is assumed that the manufacturer restricts the cross-selling between channels using his channel power. Practically this is done by limiting the order size in the direct channel. For example, in Amazon.com, some manufacturer’s limit the order quantity on a certain number (say 2–3) so that channel intermediaries will not be able to buy the product in bulk and resell it to the customers.

-

3.

The interaction between manufacturer and retailers follow Stackelberg model with the manufacturer being the leader and retailer being followers as in [6, 8, 13, 25, 39]. It is safe to assume that the manufacturer has more channel power since there are two channels.

-

4.

The game is played under complete information [40,41,42]. It means that the manufacturer has complete information about the downstream supply chain members’ demand function. In addition, the customers have information about the product price in two channels.

4 Equilibrium analysis of dual-channel supply chain configurations

4.1 Retailer–e-tailer dual-channel configuration

Under retailer–e-tailer configuration, the manufacturer announces the wholesale price. Observing the wholesale price, the retailer, and the e-tailer independently decides on their retail price and order quantity. We find the optimal retail prices and wholesale price by applying the principle of backward induction.

The demand for the retailer and e-tailer are as follows

The profit of the retailer and the e-tailer are as follows.

The objective of the retailer and e-tailer is to maximize the profit [i.e. (3a) and (3b)] with respect to \(p_{r}^{RE}\) and \(p_{e}^{RE}\).Since \(\pi_{r}^{RE}\) and \(\pi_{e}^{RE}\) are concave functions in \(p_{r}^{RE}\) and \(p_{e}^{RE}\) \(\left( {\frac{{\partial^{2} \pi_{r}^{RE} }}{{\partial p_{r}^{{RE^{2} }} }} = \frac{{\partial^{2} \pi_{e}^{RE} }}{{\partial p_{e}^{{RE^{2} }} }} = - 2b} \right)\) we can find \(p_{r}^{RE*}\) and \(p_{e}^{RE*}\) from the First Order Conditions (FOCs) \(\frac{{\partial \pi_{r}^{RE} }}{{\partial p_{r}^{RE} }} = 0{\text{ and }}\frac{{\partial \pi_{e}^{RE} }}{{\partial p_{e}^{RE} }} = 0\), as shown in Proposition 1.

Proposition 1

For the retailer–e-tailer dual-channel configuration, the optimal prices of the retailer and the e-tailer are as follows:

With Proposition 1, we can obtain the optimal order quantities of retailer and e-tailer from Eqs. (2a) and (2b) as shown in the following corollary.

Corollary 1

For the retailer–e-tailer dual-channel configuration, the optimal order quantities are:

Now using the principle of backward induction, we can find the optimal wholesale price at which the manufacturer should sell the product to the retailer and e-tailer.

Proposition 2

For the retailer–e-tailer dual-channel configuration, the manufacturer’s optimal wholesale price for the retailer and e-tailer are:

“Appendix 1” shows the proof of Proposition 2. The influence of variation in \(\theta\) on the optimal policies is presented in Corollary 2.

Corollary 2

From Corollary 2(a) we can understand that the retailer reduces the price whereas the e-tailer increases the price with increase in \(\theta\) . It is intuitive that when online channel preference is increasing, more customers will choose e-tailer enhancing the demand with a consequent reduction in the retailer’s demand. Because of this demand shift, the retailer will reduce her price and e-tailer will increase her price.

It can be observed from Corollary 2(b) that the retailer’s order quantity comes down with increase in \(\theta\). This can be explained by the shift in demand towards the e-tailer owing to the increased online channel preference, which is also the reason behind the increased order quantity of the e-tailer. From Corollary 2(c), we can see that as \(\theta\) increases, the manufacturer charges a lower wholesale price for the retailer and higher wholesale price for the e-tailer. This can be associated with the earlier conclusions regarding variation in price and order quantity with respect to increasing online channel preference. The increase in price by the e-tailer can also be seen as a reaction to the increase in wholesale price. Similarly, the reduction in price by the retailer could be a result of decreased wholesale price. Anyway, such price changes will reduce the channel conflict and help the retailer to stay in business in the face of increasing online channel preference. However, we can see that despite getting the product at a lower wholesale price the retailer’s order quantity comes down. Similarly, the e-tailer orders a higher quantity from the manufacturer in spite of the higher wholesale price. Thus the impact of the change in online channel preference is prominent than the impact of the reduction in wholesale price on the order quantity variation.

From the optimal prices, wholesale prices and order quantities, we can find the optimal profit of the manufacturer, retailer, and e-tailer as shown in Corollary 2.

Corollary 3

For the retailer–e-tailer dual-channel supply chain configuration, the optimal profit of the manufacturer, retailer, and e-tailer are:

The influence of variation in \(\theta\) on the optimal profits of manufacturer, retailer, and e-tailer are presented in Corollary 4.

Corollary 4

Corollary 4 indicates that the manufacturer’s profit will increase with increase in \(\theta\) only when the \(\theta\) is more than 0.5. When \(\theta < 0.5\) , the manufacturer’s profit will decrease with increase in \(\theta\) . Corollary 4 shows the importance for the manufacturer to support the retailer especially when \(\theta\) is low. When \(\theta < 0.5\) , manufacturer derives his profit mainly from the retailer. Therefore, it is beneficial for the manufacturer to support retailer in the face of increasing \(\theta\) . This indirectly reinforces \(\frac{{\partial w_{r}^{RE*} }}{\partial \theta } < 0\) . Corollary 4 also shows that retailer’s profit will decrease with increase in \(\theta\) and the e-tailer’s profit will increase with increase in \(\theta\) irrespective of the value of \(\theta\).

4.2 Company store–e-tailer dual-channel configuration

In this supply chain configuration, the manufacturer is selling through company store and e-tailer. The manufacturer acts as both a supplier and a competitor to the e-tailer. Under company store–e-tailer configuration, the manufacturer announces his wholesale price for the e-tailer and price in the company store. e-tailer sets her price after observing the wholesale price and price in the company store.

Demand for the company store and the e-tailer is given by

Profit of the e-tailer

We can find the optimal price of the e-tailer from Eq. (5) since \(\pi_{e}^{XE}\) is concave in \(p_{e}^{XE}\)

Since \(\pi_{e}^{XE}\) is concave in \(p_{x}^{XE} \;{\text{and}}\;w_{e}^{XE}\), we can get optimal price in the company store and optimal wholesale price for the e-tailer from F.O.C \(\frac{{\partial \pi_{e}^{XE} }}{{\partial p_{x}^{XE} }} = 0\;{\text{and}}\;\frac{{\partial \pi_{e}^{XE} }}{{\partial w_{e}^{XE} }} = 0\) as shown below

By solving the above-mentioned simultaneous equations, we can obtain the optimal values as shown in Proposition 3.

Proposition 3

For the company store–e-tailer configuration, optimal price of the manufacturer in the company store and optimal wholesale price for the e-tailer are:

The concavity of \(\pi_{e}^{XE}\) is established in “Appendix 2”. Now we find the optimal value of e-tailer’s price by substituting optimal values of Proposition 3 in Eq. (12).

Corollary 5

For the company store–e-tailer configuration, optimal price of the e-tailer is:

By substituting the optimal prices in Eqs. (10a) and (10b), we will get optimal order quantity of the e-tailer and the optimal quantity to be allotted to the company store as shown in Corollary 6.

Corollary 6

For the company store–e-tailer configuration, the optimal order quantity of e-tailer and optimal quantity to be allotted to the company store are:

The influence of variation in \(\theta\) on the optimal policies of the manufacturer and e-tailer are presented in Corollary 7.

Corollary 7

From Corollary 7(a), we can see that, with the increase in \(\theta\), the manufacturer increases the wholesale price for the e-tailer and reduces the price in the company store. As in retailer–e-tailer DCSC, the increase in \(\theta\) leads to declining demand in the traditional channel, which is the company store in this case. The drop in demand further compels the manufacturer to reduce the price in the company store. However, the manufacturer gains by increasing the wholesale price to the e-tailer who enjoys higher demand owing to the increase in \(\theta\). From Corollary 7(a), we can also see that the e-tailer increases the price with respect to increase in \(\theta\). This can be understood as the response of increase in wholesale price by the manufacturer or as a response to the increased demand resulting from improved \(\theta\). From Corollary 7(b) we can see that the manufacturer allots lower quantity to the company store and e-tailer orders a higher quantity with increase in \(\theta\). From the optimal values of prices, wholesale price and order quantities, we can find the optimal profits of the manufacturer and e-tailer as shown in Corollary 8.

Corollary 8

For the company store–e-tailer DCSC, the optimal profits of the manufacturer and e-tailer are:

The influence of variation in \(\theta\) on the optimal profits of the manufacturer and e-tailer are presented in Corollary 9.

Corollary 9

From Corollary 9(a), we can see that profit of the manufacturer increases with increase in \(\theta\) only if the \(\theta\) is lower than a threshold value. Similarly, the profit of the e-tailer increases with increase in \(\theta\) only if \(\theta\) is greater than a threshold value. Understanding of the threshold values of \(\theta\) can gives a road map for investments related to \(\theta\) improvement.

Numerical example We use a numerical example for understanding the implication of corollary 9 practically. We use the following values for numerical examples \(a = 300,b = 1.5,c = 0.5,\;{\text{and}}\;s = 50\). The values are chosen considering the previous studies [6, 13, 25] and the logical relationship among the variables (for e.g. own-price effect is larger than cross price effect). Numerical substitution of Corollary 9(a) gives \(\theta = 0.67\) only below which increase in \(\theta\) can increase the profit of the manufacturer. If \(\theta > 0.67\), the manufacturer’s profit will decrease with increase in \(\theta\). In other words, if the manufacturer is selling products with a low value of \(\theta\), he can safely consider company store–e-tailer configuration as long as the \(\theta\) improves to a threshold value. If \(\theta\) continuously improves and exceeds the threshold value, it will no longer be profitable for the manufacturer to hold on to company store–e-tailer configuration. In Corollary 9(b), \(\theta { = 0} . 1 6\) and we can understand that e-tailer’s profit increases with improvement in \(\theta\) when \(\theta > 0.16\). Since most of the products fall under this category, it is beneficial for the e-tailer to be competing with company stores in the context of increasing \(\theta\).

4.3 Retailer–e-marketplace dual-channel configuration

In this supply chain configuration, the manufacturer is selling through an e-marketplace and an independent retailer. The manufacturer is engaged in a commission contract with the e-marketplace. The e-marketplace receives a certain percentage of product price as commission \((\alpha )\) on per unit sold. Sales commission is the major source of the revenue for the e-marketplaces and it varies from 5 to 15% depending on the product category. We have not considered other charges imposed by e-marketplaces such as listing fee, subscription fee, payment gateway fee etc. since the revenue model varies from one e-marketplace to another. For example, Flipkart, an Indian e-marketplace operates solely through a commission-based revenue model whereas Amazon charges a monthly subscription fee and listing fee in addition to commission per sales transaction (refer to www.browntape.com). In this supply chain configuration, the manufacturer acts as both a competitor and a supplier to the retailer.

Under the retailer–e-marketplace DCSC, manufacturer announces its wholesale price for the retailer and price in the e-marketplace. Retailer sets its price after observing the wholesale price and price in the e-marketplace. As shown in the previous analysis, we apply backward induction to find the optimal prices.

Demand for the retailer and the e-marketplace is given by

Profit of the retailer

Since \(\pi_{r}^{RM}\) is concave in \(p_{r}\), we can get optimal price for the e-tailer by solving the equation \({{\partial \pi_{r}^{RO} } \mathord{\left/ {\vphantom {{\partial \pi_{r}^{RO} } {\partial p_{r}^{RO} }}} \right. \kern-0pt} {\partial p_{r}^{RO} }} = 0\)

Since \(\pi_{e}^{RO}\) is concave in \(p_{o}^{RO} {\text{ and }}w_{r}^{RO}\), we can get optimal price charged by the manufacturer in the e-marketplace and optimal wholesale price for the retailer from F.O.C \(\frac{{\partial \pi_{r}^{RO} }}{{\partial w_{r}^{RO} }} = 0\;{\text{and}}\;\frac{{\partial \pi_{o}^{RO} }}{{\partial p_{o}^{RO} }} = 0\) as shown below:

By solving the above-mentioned simultaneous equations, we can obtain the optimal values as shown in Proposition 4.

Proposition 4

For the retailer–e-marketplace configuration, optimal price of the manufacturer in the E-marketplace and optimal wholesale price for the retailer are:

The concavity of \(\pi_{m}^{RO*}\) is shown in “Appendix 3”. To understand the effect of wholesale price reduction on the price of the retailer we find the optimal retailer price by substituting \(p_{o}^{RO*} \;{\text{and}}\;w_{r}^{RO*}\) in Eq. (22).

Corollary 10

For the retailer–e-marketplace configuration, optimal price of the retailer is:

By substituting the optimal prices in Eqs. (20a) and (20b), we will get optimal order quantity of the retailer and the optimal quantity to be allotted to the e-marketplace as shown in Corollary 4.

Corollary 11

For the retailer–e-marketplace configuration, the optimal order quantity of retailer and optimal quantity to be allotted to the e-marketplace are:

Corollary 12 shows the influence of variation in \(\theta\) on the optimal policies of the manufacturer and retailer.

Corollary 12

From Corollary 12(a), we can find that with the increase in \(\theta\), the manufacturer reduces the wholesale price for the retailer and increases price in the e-marketplace. The reason is straightforward. With more customers preferring online channel (e-marketplace) for the product, the manufacturer can afford to increase the price in the e-marketplace. With the reduction in wholesale price for the retailer, she could either have a better margin or adopt price reduction with enhancement in demand. Thus, we can say that the manufacturer tries to alleviate the possible channel conflict by supporting the retailer by reducing the wholesale price. From Corollary 12(a) we can see that the retailer reduces her price with increase in \(\theta\). This can be a response of the retailer to the decreased wholesale price by the manufacturer or because of the lower demand for the retailer due to the shift of customers towards e-marketplace. From Corollary 12(b) we can also find that, with increase in \(\theta\), the retailer reduces her order quantity and the manufacturer allots more quantity to the e-marketplace. The obvious reason behind the variation in order quantity with increase in \(\theta\) is the shift in demand towards the e-marketplace and subsequent reduction in demand for the retailer. In Corollary 12(c), we have also examined the effect of variation in sales commission rate on the price in e-marketplace and wholesale price for the retailer. The Recent hike in commission by the Indian e-marketplace Flipkart makes this examination relevant. As expected, with the increase in commission rate, the manufacturer increases his price in the e-marketplace. In addition, the manufacturer reduces the wholesale price for the retailer. This could help the manufacturer to induce the retailer to reduce her price to enhance the demand and thereby balancing the demand through the competing sales channels. From the optimal prices, wholesale price and order quantities, we can find the optimal value for manufacturer’s profit and retailer’s profit as shown in Corollary 13.

Corollary 13

For the retailer–e-marketplace DCSC, the optimal profits of the manufacturer and retailer are:

The expansion of terms is shown in “Appendix 4”. Corollary 14 shows the influence of variation in \(\theta\) on the optimal profits of the manufacturer and retailer.

Corollary 14

The expression for \(\hat{\theta }_{m}^{RO}\) is shown in “Appendix 5”. Corollary 14(a) indicates that the profit of the manufacturer increases with increase in \(\theta\) only if \(\theta\) exceeds a certain threshold value i.e. \(\hat{\theta }_{m}^{RO}\) .In addition, we can see that the profit of the retailer decreases with increase in \(\theta\) irrespective of the value of \(\theta\).

Numerical example To understand the practical significance of the threshold value, we use a numerical example with values as \(a = 300,b = 1.5,c = 0.5,\;{\text{and}}\;s = 50\). In addition, we assume the value of e-marketplace commission \(\left( \alpha \right)\) as 0.1 (10%). We obtain, \(\theta = 0.38\) with the numerical example. It means that the profit of the manufacturer will increase with increase in \(\theta\) only if the product’s \(\theta > { 0} . 3 8\). For those products with \(\theta < 0.38\), manufacturer’s profit will decrease with increase in \(\theta\). Corollary 14(b) indicates that the retailer’s profit will decrease with respect to increase in \(\theta\) irrespective of the \(\theta\) value.

4.4 Comparative study of three dual-channel supply chain configurations

4.4.1 Profit of the manufacturer

In this section, we compare the profit of the manufacturer under the three different dual-channel supply chain configurations and make the following proposition.

Proposition 5

Irrespective of the value of online channel preference, profit of the manufacturer will be always greater under company store–e-tailer configuration than under retailer–e-tailer configuration. i.e.

The proof of the proposition is shown in “Appendix 6”. Proposition 5 indicates that retailer–e-tailer DCSC is dominated by company store–e-tailer configuration irrespective of the product category. In other words, the manufacturer is better off by replacing the traditional channel intermediary by direct traditional channel i.e. manufacturer-owned retail outlet.

Numerical example In Fig. 2, we illustrate the Proposition 5 by a numerical example. From Fig. 2, we can see that the profit of the manufacturer under company store–e-tailer configuration is always higher than the profit of the manufacturer under retailer–e-tailer configuration. However, for products with low \(\theta\) value, the profit difference is very high and for products with high \(\theta\) value, the profit difference is very less.

Proposition 6

The threshold value of online channel preference above which the manufacturer will prefer retailer–e-marketplace configuration to retailer–e-tailer configuration is given by:

The expansion of terms in the expression of \(\hat{\theta }_{RO > RE}\) and the proof of Proposition 6 is shown in “Appendix 7”. Proposition 6 indicates that the profit of the manufacturer will be higher under retailer–e-marketplace configuration than the retailer–e-tailer configuration for products having \(\theta > \hat{\theta }_{RO > RE}\).

Numerical example From the numerical example (\(a = 300,b = 1.5,c = 0.5,\;{\text{and}}\;s = 50\)), we illustrate the profit comparison in Fig. 3. As we can see from Fig. 3, manufacturer’s profit is higher in the retailer–e-marketplace configuration for \(\theta > \hat{\theta }_{RO > RE}\). With the numerical example, we obtain the value of \(\hat{\theta }_{RO > RE}\) as 0.2. Since most of the product categories have \(\theta > 0.2\), it is beneficial for the manufacturer to sell through an e-marketplace than through an e-tailer. This explains the large product variety available under e-marketplaces such as Amazon.com, Flipkart.com etc. We can also understand from Fig. 3 that for products having very high \(\theta\)(books, software etc.) the manufacturer’s profit is much better if sold through e-marketplace.

Proposition 7

The threshold value of online channel preference below which the manufacturer will prefer company store–e-tailer configuration to retailer–e-marketplace configuration is given by:

The expansion of terms in the expression of \(\hat{\theta }_{CE > RO}\) and the proof of Proposition 7 is given in “Appendix 8”. Proposition 7 indicates that the manufacturer will better off if he chooses company store–e-tailer configuration instead of retailer–e-marketplace configuration if the \(\theta\) of his product is less than \(\hat{\theta }_{XE > RO}\).

Numerical example The numerical value of \(\hat{\theta }_{XE > RO}\) is obtained as 0.57 (for \(a = 300,b = 1.5,c = 0.5,s = 50\)). The profit variation with respect to \(\theta\) is illustrated in Fig. 4. From Fig. 4, we can say that it is better for the manufacturer to sell through company store–e-tailer configuration if the \(\theta\) of his product is less than 0.57. Similarly, if the \(\theta > 0.57\), the manufacturer should adopt a retailer–e-marketplace configuration.

4.4.2 Profit of the retailer and E-tailer

First, we compare the profit of the retailer under retailer–e-tailer configuration and retailer–e-marketplace configuration and make the following proposition.

Proposition 8

The threshold value of online channel preference above which the retailer prefer to compete with e-tailer than e-marketplace is given by,

The proof of Proposition 8 and expansion of terms in \(\theta_{RE > RO}^{r}\) is shown in “Appendix 1”. Proposition 8 indicates that retailer will be more profitable in competing with an e-tailer than competing with an e-marketplace by selling a product with \(\theta > \theta_{RE > RO}^{r}\) . In other words, the retailer’s profit depends on the channel configuration strategy of the manufacturer and the online channel preference of the product. The threshold value \(\theta_{RE > RO}^{r}\) has two implications: (1) if the retailer is engaged in selling products having \(\theta > \theta_{RE > RO}^{r}\) , it is gainful for the retailer to associate with a manufacturer selling through e-tailers, and (2) if the manufacturer is selling products having \(\theta < \theta_{RE > RO}^{r}\) and is already competing with e-marketplace, there is no need for the e-tailer to invest further to improve the online channel preference of the product.

Numerical example From the numerical example (\(a = 300,b = 1.5,c = 0.5,{\text{ and }}s = 50\)), we obtain \(\theta_{RE > RO}^{r} = 0.12\). From Fig. 5, we can see that retailer’s profit is higher when competing with e-tailer than with e-marketplace for \(\theta > 0.12\).

Now, we compare the profit of the e-tailer under retailer–e-tailer configuration and company store–e-tailer configuration and make the following proposition.

Proposition 9

The threshold value of online channel preference above which the e-tailer prefer to compete with retailer than with company store is given by:

The proof of proposition is shown in “Appendix 10”. Proposition 9 indicates that the e-tailer will be more profitable in competing with the retailer than competing with the company store by selling a product with \(\theta > \theta_{RE > XE}^{e}\) . In other words, if the e-tailer is engaged in selling product with \(\theta < \theta_{RE > XE}^{e}\) , she should try to associate with manufacturers operating through company stores. Alternately, if the e-tailer is already engaged in competition with company stores of the manufacturer and selling products having \(\theta < \theta_{RE > XE}^{e}\) , then the e-tailer need not invest further to improve the \(\theta\) of its products.

Numerical example From the numerical example (\(a = 300,b = 1.5,c = 0.5,s = 50\)), we obtain \(\theta_{RE > XE}^{e}\) = 0.1. Since most product categories fall under this category, we can conclude that it is better for the e-tailer to compete with retailer than with company store. From Fig. 6, we can see that e-tailer’s profit is higher when competing with retailer than with company store for \(\theta > 0.1\).

From Propositions 8 and 9, we can understand the role of online channel preference of the product on the profit of the retailer and e-tailer. The insights from the propositions may help managers in making the right choice of channel configuration by considering the online channel preference of the product under consideration or to make investment decisions for improving online channel preference of the product.

Table 2 provides a summary of findings to understand the impact of variation in customer preference of online channel on the optimal policies of the manufacturer, retailer, and e-tailer.

5 Discussions

5.1 The channel configuration decision of the manufacturer

Our results show that manufacturer should select the optimal channel configuration by considering the product category. For a manufacturer selling products having low customer preference of online channel, it is better to sell through company stores and e-tailers. Products having low compatibility with the online channel such as apparels, food items, expensive and high-involvement products such as jewellery etc. come under this category. For a manufacturer selling products with high customer preference of online channel, it is advantageous to choose a retailer–e-marketplace configuration. Products such as books, computer accessories, low involvement products and digital products (e-books, software, movies) come under this category.

Further, we propose the strategies to be adopted by supply chain members i.e. retailer and e-tailer. In a DCSC with the manufacturer as the Stackelberg leader, it is profitable for the retailer to compete with an e-tailer irrespective of the product category. Similarly, it is advantageous for the e-tailer to compete with a retailer irrespective of the product category

5.2 The impact of variation in customer preference of online channel on the dynamics of dual-channel supply chain competition

We find that across all supply chain configurations, the price and order quantity in the traditional channel (retailer and company store) decreases with increase in customer preference for online channel. On the contrary, price and order quantity in the online channel (e-tailer and e-marketplace) increase with increase in customer preference for online channel. With the increase in online channel preference, manufacturer reduces the wholesale price for the traditional channel and increases the wholesale price for the online channel. Similarly, we can see that the profit of the traditional channel decreases and profit of online channel increases with increase in online channel preference. Further, the profit of the manufacturer increases only when the products are having online channel preference greater than 0.5 in the retailer–e-tailer configuration irrespective of the value of the parameters. It means that under retailer–e-tailer DCSC, a manufacturer’s efforts for increasing online channel preference will pay off only if it exceeds 0.5. Likewise, in other DCSCs, there are threshold values of online channel preference beyond which the manufacturer can enjoy higher profit with increase in online channel preference. Managers investing in improving online channel preference should continue to do so at least until the threshold value is reached so that the returns can be realized. The threshold value depends on several parameters such as base demand, own price sensitivity and cross price sensitivity. Depending on the industry and product, managers can estimate the threshold value and invest accordingly. One example of such a product category is the apparel. There has been a radical shift in the online channel preference for apparels. In the early stages of e-commerce, apparel was perceived to be unsuitable for the online channel. Contrary to the expectations, now it ranks as a top selling product category across various online sales platforms. Such transformations necessitate the manufacturer to reconfigure the supply chains.

The underlying mechanism behind the price and profit dynamics is the shift in demand with respect to the variation of customer preference for online channel. As customer preference for online channel increases, demand for online channel increases and the demand for traditional channel decreases with subsequent increment in the price and order quantity of online channel and reduction in the price and order quantity of traditional channel. Because of the price hike, a portion of price sensitive customers might migrate to the competing channel. It is important for the managers to understand the feedback effect of such changes and act accordingly. The game theoretical model of our study captures the dynamics of competition and triggers further questions.

The role of the manufacturer as a Stackelberg leader is also significant in influencing the dynamics of competition. In the event of increasing online channel preference, the manufacturer can support the traditional channel intermediary i.e. the retailer by reducing the wholesale price and make more profit from the online channel by increasing the wholesale price for the online channel intermediary i.e. e-tailer. Manufacturer, being the Stackelberg leader can establish an equilibrium in the dynamic scenario by supporting the intermediaries by varying wholesale prices. Manufacturer’s support is important for the traditional channel to survive in the context of increasing online channel preference.

6 Conclusions

In this study, we compared the performance of three dual-channel configurations (retailer–e-tailer, company store–e-tailer, retailer–e-marketplace) taking into account four different formats of retailing viz. company owned retail store, independent retail store, e-tailer, and e-marketplace. We quantified the profit of supply chain members of three different dual-channel configurations in terms of profit. We find that the manufacturer gains from the company store–e-tailer configuration when the product is having low customer preference for the online channel and from retailer–e-marketplace configuration when the product is having high customer preference of the online channel. In both cases, the retailer–e-tailer configuration is dominated by the other configurations. On the contrary, the retailer–e-tailer configuration is the preferred configuration for both retailer and e-tailer. Thus, there is a conflict of interest between the members of supply chain. However, for the manufacturer, who is also the decision maker, preferring e-marketplace to e-tailer is a gainful option.

The main contribution of our study is the consideration of the different modalities and corresponding operational differences in the distribution channels. We have also established the link between customer preference of online channel for the product and the supply chain configuration. Specifically, we find that manufacturers selling products having low online channel preference should consider the combination of company stores and e-tailers and the manufacturers selling products having high online channel preference should consider the combination of retailers and e-marketplaces. The findings of our study can help managers in deciding the optimal values of the sale price, wholesale price and order quantity. In the era of exploding online sales and transforming supply chain configurations, it is imperative to develop the optimal policies for firms, which will maximize the firm profit. It is also interesting to note that while it is gainful for both the retailers and e-tailers to operate under completely decentralized supply chain structure, operating under partially decentralized (partially integrated) supply chain structure is more beneficial for the manufacturers.

This research can be extended in several ways. We have assumed the manufacturer as a Stackelberg leader and the retailer/e-tailer to be Stackelberg followers. However, E-marketplace such as Amazon.com or retailer such as Walmart can be a Stackelberg leader. Future works can be based on shifting the channel power to other supply chain members. In addition, we have assumed that the manufacturer has complete information regarding the downstream chain members’ demand function. Consideration of asymmetric information regarding market demand or manufacturer’s production cost is another aspect to be studied in future. The work can also be extended by adding a 3PL service provider to the online channel. There is ample scope for investigating the performance of different supply chain structures by varying the 3PL ownership. In reality, Indian E-marketplace like Flipkart has their logistics arm namely E-kart whereas the competitor Amazon.in depends on independent courier delivery services. Incorporating such variations can yield insights that are more practical. It will also be interesting to investigate whether the manufacturer should allow reselling between channels without imposing price constraints.

References

Brynjolfsson, E., Hu, Y., & Rahman, M. S. (2009). Battle of the retail channels: How product selection and geography drive cross-channel competition. Management Science, 55(11), 1755–1765. doi:10.1287/mnsc.1090.1062.

Cai, G., Zhang, Z. G., & Zhang, M. (2009). Game theoretical perspectives on dual-channel supply chain competition with price discounts and pricing schemes. International Journal of Production Economics, 117(1), 80–96.

Cao, E., Ma, Y., Wan, C., & Lai, M. (2013). Contracting with asymmetric cost information in a dual-channel supply chain. Operations Research Letters, 41(4), 410–414. doi:10.1016/j.orl.2013.04.013.

Cattani, K. D., Gilland, W. G., & Swaminathan, J. M. (2004). Coordinating traditional and internet supply chains. In Handbook of quantitative supply chain analysis (pp. 643–677). Springer.

Cheema, A., & Papatla, P. (2010). Relative importance of online versus offline information for Internet purchases: Product category and Internet experience effects. Journal of Business Research, 63(9–10), 979–985. doi:10.1016/j.jbusres.2009.01.021.

Chen, J., Zhang, H., & Sun, Y. (2012). Implementing coordination contracts in a manufacturer Stackelberg dual-channel supply chain. Omega, 40(5), 571–583. doi:10.1016/j.omega.2011.11.005.

Chen, K. Y., Kaya, M., & Özer, Ö. (2008). Dual sales channel management with service competition. Manufacturing and Service Operations Management, 10(4), 654–675. doi:10.1287/msom.1070.0177.

Chiang, W. K., Chhajed, D., & Hess, J. D. (2003). Direct marketing, indirect profits: A strategic analysis of dual-channel supply-chain design. Management Science, 49(January 2003), 1–20.

Chiang, W. Y. K., & Monahan, G. E. (2005). Managing inventories in a two-echelon dual-channel supply chain. European Journal of Operational Research, 162(2), 325–341. doi:10.1016/j.ejor.2003.08.062.

Choudhary, A., Suman, R., Dixit, V., Tiwari, M. K., Fernandes, K. J., & Chang, P. C. (2015). An optimization model for a monopolistic firm serving an environmentally conscious market: Use of chemical reaction optimization algorithm. International Journal of Production Economics, 164, 409–420. doi:10.1016/j.ijpe.2014.10.011.

Chun, S. H., & Kim, J. C. (2005). Pricing strategies in B2C electronic commerce: Analytical and empirical approaches. Decision Support Systems, 40(2), 375–388. doi:10.1016/j.dss.2004.04.012.

Chun, S. H., Rhee, B.-D., Park, S. Y., & Kim, J. C. (2011). Emerging dual channel system and manufacturer’s direct retail channel strategy. International Review of Economics and Finance, 20(4), 812–825. doi:10.1016/j.iref.2011.02.006.

Dan, B., Xu, G., & Liu, C. (2012). Pricing policies in a dual-channel supply chain with retail services. International Journal of Production Economics, 139(1), 312–320. doi:10.1016/j.ijpe.2012.05.014.

Devaraj, S., Fan, M., & Kohli, R. (2012). Antecedents satisfaction and of B2C preference. Channel Validating, 13(3), 316–333.

Ding, Q., Dong, C., & Pan, Z. (2016). A hierarchical pricing decision process on a dual-channel problem with one manufacturer and one retailer. International Journal of Production Economics, 175, 197–212. doi:10.1016/j.ijpe.2016.02.014.

Dumrongsiri, A., Fan, M., Jain, A., & Moinzadeh, K. (2008). A supply chain model with direct and retail channels. European Journal of Operational Research, 187, 691–718. doi:10.1016/j.ejor.2006.05.044.

Frambach, R. T., Roest, H. C. A., & Krishnan, T. V. (2008). The impact of consumer internet experience on channel preference and usage intentions across the different stages of the buying process. Journal of Interactive Marketing, 22(4), 1–12. doi:10.1002/dir.

Hendershott, T., & Zhang, J. (2006). A model of direct and intermediated sales. Journal of Economics and Management Strategy, 15(2), 279–316. doi:10.1111/j.1530-9134.2006.00101.x.

Hua, G., Cheng, T. C. E., & Wang, S. (2011). Electronic books: To “e” or not to “e”? A strategic analysis of distribution channel choices of publishers. International Journal of Production Economics, 129(2), 338–346. doi:10.1016/j.ijpe.2010.11.011.

Hua, G., Wang, S., & Cheng, T. C. E. (2010). Price and lead time decisions in dual-channel supply chains. European Journal of Operational Research, 205(1), 113–126. doi:10.1016/j.ejor.2009.12.012.

Huang, S., Yang, C., & Zhang, X. (2012). Pricing and production decisions in dual-channel supply chains with demand disruptions. Computers and Industrial Engineering, 62(1), 70–83. doi:10.1016/j.cie.2011.08.017.

Jagmohan, S. R., & Roy, A. (2000). Market information and firm performance. Management Science, 46(8), 1075–1084. doi:10.1287/mnsc.1090.1119.

Kacen, J. J., Hess, J. D., & Kevin Chiang, W.-Y. (2013). Bricks or clicks? Consumer attitudes toward traditional stores and online stores. Global Economics and Management Review, 18(1), 12–21. doi:10.1016/S2340-1540(13)70003-3.

Kurata, H., Yao, D. Q., & Liu, J. J. (2007). Pricing policies under direct vs. indirect channel competition and national vs. store brand competition. European Journal of Operational Research, 180(1), 262–281. doi:10.1016/j.ejor.2006.04.002.

Li, B., Zhu, M., Jiang, Y., & Li, Z. (2016). Pricing policies of a competitive dual-channel green supply chain. Journal of Cleaner Production, 112, 2029–2042. doi:10.1016/j.jclepro.2015.05.017.

Li, Q. H., & Li, B. (2013). Dual-channel supply chain equilibrium problems regarding retail services and fairness concerns. Applied Mathematical Modelling, 40, 7349–7367. doi:10.1016/j.apm.2016.03.010.

Liang, T. P., & Huang, J. S. (1998). An empirical study on consumer acceptance of products in electronic markets: a transaction cost model. Decision Support Systems, 24, 29–43. doi:10.1016/S0167-9236(98)00061-X.

Limayem, M., Khalifa, M., & Frini, A. (2000). What makes consumers buy from Internet? A longitudinal study of online shopping. IEEE Transactions on Systems, Man, and Cybernetics Part A: Systems and Humans, 30(4), 421–432. doi:10.1109/3468.852436.

Liu, B., Zhang, R., & Xiao, M. (2010). Joint decision on production and pricing for online dual channel supply chain system. Applied Mathematical Modelling, 34(12), 4208–4218. doi:10.1016/j.apm.2010.04.018.

Phau, I., & Poon, S. M. (2000). Factors influencing the types of products and services purchased over the Internet. Internet Research, 10(2), 102–113. doi:10.1108/10662240010322894.

Ramanathan, R. (2011). An empirical analysis on the influence of risk on relationships between handling of product returns and customer loyalty in E-commerce. International Journal of Production Economics, 130(2), 255–261. doi:10.1016/j.ijpe.2011.01.005.

Saha, S. (2014). Channel characteristics and coordination in three-echelon dual-channel supply chain. International Journal of Systems Science, 7721, 1–15. doi:10.1080/00207721.2014.904453.

Schoenbachler, D. D., & Gordon, G. L. (2002). Multi-channel shopping: Understanding what drives channel choice. Journal of Consumer Marketing, 19(1), 42–53. doi:10.1108/07363760210414943.

Takahashi, K., Aoi, T., Hirotani, D., & Morikawa, K. (2011). Inventory control in a two-echelon dual-channel supply chain with setup of production and delivery. International Journal of Production Economics, 133(1), 403–415. doi:10.1016/j.ijpe.2010.04.019.

Tsay, A. A., & Agrawal, N. (2004). Channel conflict and coordination in the E-commerce age. Production and Operations Management, 13(1), 93–110. doi:10.1111/j.1937-5956.2004.tb00147.x.

Wang, Y., Bell, D. R., & Padmanabhan, V. (2009). Manufacturer-owned retail stores. Marketing Letters, 20(2), 107–124. doi:10.1007/s11002-008-9054-1.

Wang, Z. B., Wang, Y.-Y., & Wang, J.-C. (2016). Optimal distribution channel strategy for new and remanufactured products. Electronic Commerce Research, 16(2), 269–295. doi:10.1007/s10660-016-9225-8.

Xing, X., Yang, Z., & Tang, F. F. (2006). A comparison of time-varying online price and price dispersion between multichannel and Dotcom DVD retailers. Journal of Interactive Marketing, 20(2), 3–20. doi:10.1002/dir.20058.

Xu, H., Liu, Z. Z., & Zhang, S. H. (2012). A strategic analysis of dual-channel supply chain design with price and delivery lead time considerations. International Journal of Production Economics, 139, 654–663. doi:10.1016/j.ijpe.2012.06.014.

Yan, R. (2008). Pricing strategy for companies with mixed online and traditional retailing distribution markets. Journal of Product and Brand Management, 17(1), 48–56. doi:10.1108/10610420810856512.

Yan, R. (2008). Profit sharing and firm performance in the manufacturer-retailer dual-channel supply chain. Electronic Commerce Research, 8(3), 155–172. doi:10.1007/s10660-008-9020-2.

Yan, R. (2009). Product categories, returns policy and pricing strategy for e-marketers. Journal of Product and Brand Management, 18(6), 452–460. doi:10.1108/10610420910989776.

Yan, R. (2010). Demand forecast information sharing in the competitive online and traditional retailers. Journal of Retailing and Consumer Services, 17(5), 386–394. doi:10.1016/j.jretconser.2010.03.019.

Yan, R. (2011). Managing channel coordination in a multi-channel manufacturer-retailer supply chain. Industrial Marketing Management, 40(4), 636–642. doi:10.1016/j.indmarman.2010.12.019.

Yan, R., & Pei, Z. (2011). Information asymmetry, pricing strategy and firm’s performance in the retailer-multi-channel manufacturer supply chain. Journal of Business Research, 64(4), 377–384. doi:10.1016/j.jbusres.2010.11.006.

Yan, R., & Pei, Z. (2012). Incentive-compatible information sharing by dual-channel retailers. International Journal of Electronic Commerce, 17(2), 127–157. doi:10.2753/JEC1086-4415170205.

Yan, R., & Pei, Z. (2015). The strategic value of cooperative advertising in the dual-channel competition. International Journal of Electronic Commerce, 19(3), 118–143. doi:10.1080/10864415.2015.1000225.

Yan, R., Cao, Z., & Pei, Z. (2016). Manufacturer’s cooperative advertising, demand uncertainty, and information sharing. Journal of Business Research, 69(2), 709–717. doi:10.1016/j.jbusres.2015.08.011.

Yan, R., Guo, P., Wang, J., & Amrouche, N. (2011). Product distribution and coordination strategies in a multi-channel context. Journal of Retailing and Consumer Services, 18(1), 19–26. doi:10.1016/j.jretconser.2010.09.001.

Yao, D. Q., Yue, X., Mukhopadhyay, S. K., & Wang, Z. (2009). Strategic inventory deployment for retail and e-tail stores. Omega, 37(3), 646–658. doi:10.1016/j.omega.2008.04.001.

Yoo, W. S., & Lee, E. (2011). Internet channel entry: A strategic analysis of mixed channel structures. Marketing Science, 30(1), 29–41. doi:10.1287/mksc.1100.0586.

Acknowledgements

The authors gratefully acknowledge the editors and the anonymous reviewers for their constructive comments and valuable guidance. The authors would also like to thank University Grants Commission-India for supporting the study under UGC JRF scheme under the Grant Number 1528 (NET-DEC 2012).

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

By substituting the optimal order quantities of the retailer and e-tailer given in Corollary 1, we will get the optimal profit of the manufacturer as

Since the manufacturer is interested in maximizing his profit with respect to the wholesale prices, the optimal wholesale prices can be obtained by solving the first order conditions \(\frac{{\partial \pi_{m}^{RE} }}{{\partial w_{r}^{RE} }} = 0\) and \(\frac{{\partial \pi_{m}^{RE} }}{{\partial w_{e}^{RE} }} = 0\). It can be shown that \(\pi_{m}^{{}}\) is concave since the Hessian matrix of \(\pi_{m}^{RE}\) \(\left( {H(\pi_{m}^{RE} )} \right)\) is negative definite.

Hessian matrix is negative definite (Both the sign of first order and second order leading principal minors are negative since \(b^{2} > c^{2}\)).

Appendix 2

Profit of the manufacturer (profit from the company store + profit from e-tailer) is given by

It can be shown that \(\pi_{m}^{XE}\) is concave since the Hessian matrix of \(\pi_{m}^{XE}\) (\(H(\pi_{m}^{XE} )\)) is negative definite.

Negative definiteness is confirmed by the negative signs (since \(c^{2} < 2b^{2}\)) of both first order and second order leading principal minors.

Appendix 3

Profit of the manufacturer (profit from the e-marketplace + profit from the retailer) is given by

Manufacturer optimizes this profit by choosing appropriate price in the e-marketplace and wholesale price for the retailer. The F.O.Cs \(\frac{{\partial \pi_{m}^{RO} }}{{\partial p_{o}^{RO} }} = 0\) and \(\frac{{\partial \pi_{m}^{RO} }}{{\partial w_{r}^{RO} }} = 0\) will yield the optimum values shown in Result 4. It can be shown that \(\pi_{m}^{RO}\) is concave since the Hessian matrix of \(\pi_{m}^{RO}\) (\(H(\pi_{m}^{RO} )\)) is negative definite.

Negative definiteness is confirmed by the negative signs (since \(0 < \alpha < 1\;{\text{and}}\;c^{2} < 2b^{2}\)) of both first order and second order leading principal minors.

Appendix 4

Appendix 5

Appendix 6

We have \(\pi_{m}^{XE*} - \pi_{m}^{RE*} = \frac{{\left( {\left( {b - c} \right)\left( {2b + c} \right)s - a\left( {2b\left( {1 - \theta } \right) + c\theta } \right)} \right)^{2} }}{{32b^{3} - 8bc^{2} }} > 0\). Hence the proof.

Appendix 7

Solving \(f(\theta )\) for \(\theta\) \(\begin{aligned} & \Rightarrow \hat{\theta }_{RO > RE} = \frac{{\Pi_{1} - \Pi_{2} - \Pi_{3} }}{{2a^{2} \left( {2b^{2} - 3bc + c^{2} } \right)\xi }} \\ & \quad {\text{where }}\Pi_{1} = ac\left( {4b^{3} \left( {1 - \alpha } \right)\left( {1 - 3\alpha } \right) - 4c^{3} \left( {1 - \alpha } \right)^{2} - 2bc^{2} \left( {1 - \alpha } \right)\left( {2 - 3\alpha } \right) + b^{2} c\left( {4 - \alpha \left( {14 - 9\alpha } \right)} \right)} \right) \\ & \Pi_{2} = a\left( {2b^{2} - 3bc + c^{2} } \right)(2s\left( {b^{2} - c^{2} } \right)\left( {2b + c} \right)\left( {2\left( {1 - \alpha } \right)(c^{2} - b^{2} ) - \alpha bc\left( {2 - \alpha } \right)} \right) \\ & \Pi_{3} = \sqrt {a^{2} b^{2} \alpha^{2} \left( {4b^{4} - 5b^{2} c^{2} + c^{4} } \right)\left( {abc + 2s\left( {b - c} \right)\left( {2b^{2} - c^{2} } \right)} \right)^{2} \left( {8b^{2} \left( {1 - \alpha } \right) - c^{2} \left( {8 - \alpha \left( {8 - \alpha } \right)} \right)} \right)} \\ & \xi = \left( {2bc\left( {1 - \alpha } \right)(b^{2} - c^{2} ) + 2c^{4} \left( {1 - \alpha } \right)^{2} + 4b^{4} \left( {1 - \alpha } \right)\left( {1 - 2\alpha } \right) + b^{2} c^{2} \left( {\alpha \left( {16 - 9\alpha } \right) - 6} \right)} \right) \\ \end{aligned}\)

Appendix 8

Solving \(f(\theta )\) for \(\theta\)

Appendix 9

Solving \(f(\theta )\) for \(\theta\) gives the value of \(\theta_{RE > RO}^{r}\)

Appendix 10

Solving \(f(\theta )\) for \(\theta\) gives the value of \(\theta_{RE > CE}^{e}\)

Rights and permissions

About this article

Cite this article

Rofin, T.M., Mahanty, B. Optimal dual-channel supply chain configuration for product categories with different customer preference of online channel. Electron Commer Res 18, 507–536 (2018). https://doi.org/10.1007/s10660-017-9269-4

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10660-017-9269-4