Abstract

Exploring the effect of an economic crisis on the carbon market can be propitious to understand the formation mechanisms of carbon pricing, and prompt the healthy development of the carbon market. Through the ensemble empirical mode decomposition (EEMD), a multiscale event analysis approach is proposed for exploring the effect of an economic crisis on the European carbon market. Firstly, we determine the appropriate carbon price data of the estimation and event windows to embody the impact of the interested economic crisis on carbon market. Secondly, we use the EEMD to decompose the carbon price into simple modes. Hilbert spectra are adopted to identify the main mode, which is then used to estimate the strength of an extreme event on the carbon price. Thirdly, we perform a multiscale analysis that the composition of the low-frequency modes and residue is identifying as the main mode to capture the strength of the interested economic crisis on the carbon market, and the high-frequency modes are identifying as the normal market fluctuations with a little short-term effect on the carbon market. Finally, taking the 2007–2009 global financial crisis and 2009–2013 European debt crisis as two cases, the empirical results show that contrasted with the traditional intervention analysis and event analysis with the principle of “one divides into two”, the proposed method can capture the influences of an economic crisis on the carbon market at various timescales in a nonlinear framework.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

As a cost-effective way for dealing with the global climate change, the carbon market has played a pivotal role (Zhang and Wei 2010), as instructed by the Paris COP21 Agreements in December 2015. In 2005, in order to realize the \(\hbox {CO}_{2}\) emissions reduction task committed to the Kyoto protocol at the lowest cost, the European Union (EU) launched the EU Emissions Trading Scheme (EU ETS). As an emerging policy-based artificial market, the carbon market is not only affected by the internal market mechanisms, but also impacted by the external heterogeneity events, such as compliance events, national allocation plans (NAP), and verified emissions announcements, especially economic crises (Bel and Joseph 2015). Actually, in recent years, the European economic downturn has significant effects on EU ETS, which has caused a significant reduction in the carbon price, even changed the mechanism of carbon pricing. In 2013, China has launched seven carbon market pilots, and will establish a national carbon market by 2017. Therefore, exploring the impact of economic crises on the European carbon market is not only conducive to understand the formation mechanism of carbon pricing, but also is help for construction of China’s national carbon market.

In recent years, exploring the impact of external heterogeneity events on the European carbon market has been attracting more and more attention (Bel and Joseph 2015; Alberola et al. 2008; Jia et al. 2016; Lepone et al. 2011; Zhu et al. 2015; Brouwers et al. 2016). Although the research methods tend to be diversified, they can be roughly divided into two categories. The first one is the intervention analysis which examines whether a structural change in the time series is led by an event (Box and Tiao 1975). If there is a structural change, the intervention analysis is performed on the assumption that the carbon price change can meet a specified model so as to capture the changing amplitude and model affected by the external heterogeneity event. A dummy variable is defined as the external heterogeneity event, which is introduced into the specified model. Through estimating the coefficient of the dummy variable, and verifying its significance, the effect intensity of the event on the carbon market can be obtained. Alberola et al. (2008), Bel and Joseph (2015) and Jia et al. (2016) successively adopted the intervention analysis to evaluate the impact of external heterogeneity events such as economic crises and verified emissions announcements on the EU ETS. Their empirical analysis found that the institutional information disclosure is one of the most significant influences on the carbon market. The second category is the event analysis. Event analysis is considered as a standard tool to measure the impact of an economic crisis in the financial field, which can also explore the effect of an abnormal event on the carbon market (MacKinlay 1997). Lepone et al. (2011), Zhu et al. (2015) and Brouwers et al. (2016) successively used the event analysis to examine the impact of an external heterogeneity event on the carbon market, and all achieved favorable results.

Previous literature is helpful for understanding the formation mechanism of the carbon pricing. However, two main drawbacks are found in existing studies: firstly, both the intervention analysis and event analysis are only suitable for the linear stationary series generally. On the contrary, the carbon price series is usually nonlinear and nonstationary (Zhu et al. 2016). Moreover, both of them are based on the principle of “one divides into two”, which assumes that the carbon price affected by the event is composed of two parts: a normal component and a shock of an event. Hence, the significance level can be estimated by modeling for the two parts respectively. Otherwise, the latest literature Zhu et al. (2014) and Yu et al. (2015) showed that the effects of an external heterogeneity event on the carbon market should be multiscale rather than two-scale. Although the carbon price is the composition of simple modes, the number of simple modes is more than two generally. Therefore, an external heterogeneity event has a multiscale effect on carbon market. Only decomposing carbon price into two simple components cannot fully describe the multiscale influence of an external heterogeneity event, so that the reliability of their analyses results is poor.

This research aims to overcome the existing drawbacks of exploring the impact of economic crises on the European carbon market, and develop a multiscale event analysis through ensemble empirical mode decomposition (EEMD) to exploring the impact of economic crises on the European carbon market. The main contributions of this study have two aspects: firstly, an EEMD-based event analysis with Hilbert spectrum is constructed for exploring the effect of an external heterogeneity event on the European carbon market. The proposed method involves three steps: (i) event analysis, (ii) multiscale decomposition, and (iii) multiscale analysis. Secondly, taking the 2007–2009 global financial crisis and 2009–2013 European debt crisis as two cases, the empirical results show that: compared with the traditional intervention analysis and event analysis under the principle of “one divides into two”, the proposed method can capture the influences of an external heterogeneity event on the carbon market at various timescales in a nonlinear framework.

The remaining of this study is organized as follows: the research methods are elaborated in the Sect. 2, empirical analysis is given in Sect. 3, and conclusions and the corresponding proposals are reported in Sect. 4.

2 Methodology

2.1 Empirical Mode Decomposition (EMD)

As an adaptive data analysis method for a nonlinear and non-stationary time series, EMD can decompose the carbon price into a set of simple modes called intrinsic mode functions (IMFs) and a residue (Huang et al. 1998).

Setting the original carbon price as x(t), the processes of EMD are following:

(1) Confirming all local maximum points and local minimum points of carbon price, x(t);

(2) Connecting all local maximum points and local minimum points by utilizing the cubic spline curves respectively to form the upper envelope curve \(e_{\mathrm{max1}} (t)\) and the lower envelope curve \(e_{\mathrm{min1}} (t)\).

(3) Obtaining the mean envelope curve \(m_1 (t)\) by averaging the upper envelope curve \(e_{\mathrm{max1}} (t)\) and the lower envelope curve \(e_{\mathrm{min1}} (t):m_{1} (t)=[e_{\mathrm{max1}} (t)+e_{\mathrm{min1}} (t)]/2\).

(4) Calculating the difference \(d_1 (t)\) between x(t) and \(m_1 (t):d_1 (t)=x(t)-m_{1}(t)\).

(5) Judging whether \(d_1 (t)\) meets the conditions of IMF. If it meets the conditions provided in Huang et al. (1998), \(d_1 (t)\) is defined as the first IMF; while if \(d_1 (t)\) does not meet the conditions, it is taken as the original series to obtain the mean envelope curve \(m_{11} (t)\) of the upper and lower envelope curves of \(d_1 (t)\), then to judge whether \(d_{11} (t)=d_1 (t)-m_{11} (t)\) meets the conditions of IMF. If not, the steps are repeated for k times to obtain \(d_{1k} (t)=d_{1(k-1)} (t)-m_{1k} (t)\) to make \(d_{1k} (t)\) meet the conditions of IMF. Let \(c_1 (t)=d_{1k} (t)\), and \(c_1 (t)\) is the first IMF of x(t).

(6) Separating \(c_1 (t)\) from x(t). The residue, \(r_{1} (t)=x(t)-c_1 (t)\) is taken as the original series. Then steps (1)–(5) are repeated to obtain m IMFs and one residue \(r_m (t)\). At the point, the original carbon price is the sum of all IMFs and the final residue: \(x(t)=\sum \nolimits _{j=1}^m {c_j (t)+r_m (t)}\).

2.2 Ensemble EMD (EEMD)

Although EMD shows great advantages in processing the non-stationary and nonlinear carbon price, there is still a disadvantage of the traditional EMD algorithm, namely the decomposition results may be mode mixing. It means that a single IMF contains the sparsely distributed time scales or some similar time scales are broken down into different IMFs. In order to overcome this shortcoming, Wu and Huang (2009) proposed a novel EEMD algorithm. The procedures of EEMD algorithm are following:

(1) A series of white noise \(n_i \left( t \right) ,i=1,2,\ldots ,n\) are added in the carbon price x(t) by repeating n times, and \(n_i \left( t \right) \sim N\left( {0,\sigma ^{2}} \right) :x_i \left( t \right) =x\left( t \right) +n_i \left( t \right) \), where \(N(\cdot )\) is a normal distribution, \(\sigma \) is a standard deviation, and \(n_i \left( t \right) \) is the added white Gaussian noise at the ith time.

(2) Through EMD decomposing \(x_i \left( t \right) \) respectively, several IMFs \(c_{ij} (t)\) and one residue \(r_i (t)\) are obtained, where \(c_{ij} (t)\) is the jth IMF obtained by EMD decomposition after adding \(n_i \left( t \right) \).

(3) Repeating the steps above. The ensemble mean of the corresponding IMFs is defined as the final decomposition result: \(c_j \left( t \right) =\frac{1}{n}\sum \nolimits _{i=1}^n {c_{ij} \left( t \right) } \), where n is the number of an ensemble. The greater n is, the sum of each corresponding IMF to white Gaussian noise is more close to 0.

Although the EEMD algorithm can effectively solve the mode mixing existed in traditional EMD algorithm, it still has a limitation that end effect is produced usually. The main reason is that the envelope curves of carbon price are determined by EEMD using the cubic spline function. However, owing to the uncertainty of the cubic spline function, “flying wing” at both carbon price ends is produced. With the EEMD decomposition, the end effect contaminates the internal carbon price, which can also increase the false IMFs to affect the decomposition accuracy. Therefore, we use the sequence image symmetric extension method (Lin et al. 2012) to restrain the end effect of EEMD.

2.3 Hilbert Transform

Each IMF \(c_j (t)\) is changed into \(\tilde{c}_j (t)\) in a transform plane through the Hilbert transform (Huang et al. 1998):

where p is the Cauchy principle value.

According to the definition of Hilbert transform, \(c_j (t)\) and \(\tilde{c}_j (t)\) are complex conjugate pairs, and they can form a complex series, \(c_j^A (t)\):

The corresponding amplitude and instantaneous frequency are respectively defined as:

The phase angle \(\theta \) is defined as \(\theta _j (t)=\arctan \frac{\tilde{c}_j (t)}{c_j (t)}\), and the Hilbert spectrum is defined as \(H(\omega ,t)=A^{2}(\omega ,t)\).

At time t, the marginal spectrum of frequency in the range of \(\left[ {\omega _a ,\omega _b } \right] \) is defined as:

2.4 An EEMD-Based Event Analysis for the Impact of Economic Crises on Carbon Market

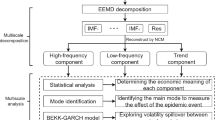

To thoroughly exploring the impact of an economic crisis on the European carbon market, an EEMD-based event analysis is proposed, as shown in Fig. 1. In the proposed approach, three main steps are involved, i.e., event analysis, multiscale decomposition and multiscale analysis.

(1) Event analysis Firstly, we determine economic crises, and select the appropriate carbon price data to embody the impact of the economic crises on carbon market. Then, we divide the carbon price data into the estimation and event windows. The event window refers to the time range of carbon price affected by the economic crises, while the estimation window is the time range of carbon price without the influence of the economic crises. Finally, we obtain a primary qualitative understanding of the effect intensity and mode of the economic crises on carbon market through a graphical analysis.

(2) EEMD decomposition The selected carbon price data are decomposed into a set of IMFs and one residue by the EEMD algorithm.

(3) Multiscale analysis Firstly, we identifying the main mode of event window by using the statistical analysis and compositional methods, which plays an important role in carbon price fluctuations, from the decomposed IMFs. The main mode is a single IMF or the composition of several IMFs. For the lack that the main mode cannot contain the influence of short-term noise on the carbon price, it is identified as the strength of the economic crisis on carbon market during the event window (Zhang et al. 2008). Since the influence of an economic crisis on carbon market is multiscale, besides identifying the main mode, it is necessary to examine whether the other IMFs are abnormal in the event window. Due to the great uncertainty of carbon market brought by the economic crisis, short-term fluctuations of carbon price increase. Namely, the high-frequency IMFs in the event window should be abnormal. It can be judged by comparing their fluctuations in the event and estimation windows by using the Hilbert transform and t test methods. Besides, in order to test the effect caused by the economic crisis is temporary or permanent, we choose a longer time interval to inspect if there is a structural breakpoint during or after the event window by using the structural breakpoint test method. Finally, we summarize the influences of economic crises on carbon market so as to provide a support for related decision-makings.

3 Empirical Analysis

In order to verify the effectiveness of the proposed EEMD-based event analysis, we explore the influences of two economic crises on the European carbon market: 2007–2009 global financial crisis, and 2009–2013 European debt crisis.

3.1 Examining the Impact of 2007–2009 Global Financial Crisis on the EU ETS

(1) Event analysis The 2007–2009 global financial had a strong impact on the EU ETS during that period. The United States subprime mortgage crisis began in Spring 2006, and swept through the global major financial markets in August 2007. In September 2008, some quite financial institutions were bankrupted or were taken over by the governments. The crisis continued to be worsening, and rapidly developed as another global financial crisis. The crisis impacted the global economic growth, at the same time, seriously affected the EU ETS, even led to a great collapse of carbon price. Later on, the United States, European Union, Japan, etc. have taken a series of bailouts. Until April 2009, the global financial market recovered gradually, and the crisis was over.

As the most liquid carbon market under the EU ETS at present, European Climate Exchange (ECX) is the largest carbon market all over the world, which can largely reflect the overall state of the EU ETS. Therefore, we select the carbon price in ECX to examine the influence of 2007–2009 global financial crisis on EU ETS. The estimation window is defined from January 2, 2007 to August 8, 2007 and from April 1, 2009 to December 31, 2009; while the event window is defined from August 9, 2007 to March 31, 2009. Thus, the analysis window is from January 2, 2007 to December 31, 2009 with 768 daily trading prices totally. Figure 2 presents the daily carbon price in the analysis window with unit of €/t.

As shown in Fig. 2, for the lack that the concrete progress was unclear for carbon traders before the crisis, from August 2007 to August 2008, EU ETS was influenced by uncertainty and the price changes were relatively smooth. The average price was 25.92 €/t, which suggested that EU ETS was at “high carbon price era”. From September 2008 to February 2009, the crisis broke out fully so that some main countries were plunged into an economic panic. Industrial production was badly affected, meanwhile, carbon price decreased sharply from more than 30 €/t to less than 10 €/t. And it fell to a new low of 9.43 €/t on February 12, 2009. From March 2009 to December 2009, the economy recovered gradually with the joint efforts of numerous nations. During the period, carbon price was steady at around 15 €/t.

(2) EEMD decomposition The carbon price in analysis window is decomposed by using the EEMD algorithm. The EEMD was implemented in the Matlab R2013a software package produced by the MathWorks Inc, and run on a personal computer with an Intel Core i3-2130 Duo CPU 3.40 GHz and 4.0 GB RAM. Among the abundant Matlab functions library, we have used the randn function to obtain the normally distributed random numbers, the find and diff functions to find out all the local maximal and minimal positions and values of the carbon price, and the spline function to form the cubic spline interpolation. In the meantime, inspired by Wu and Huang (2009), the input parameters of EEMD were set as follows: \(\sigma \) is 0.2 times of the standard deviation of the carbon price series; n is 100; and the terminal condition is the maximum times of sifting, namely 10 times. The carbon price is decomposed into seven IMFs and one residue, presented in Fig. 3, in which the last res is the residue. Comparing with the original carbon price in the analysis window, it is apparent that the IMFs including the residue are more simple, more smooth and more regular, therefore, they are more likely to be explored.

(3) Mode analysis Firstly, we identify the main mode. As for each IMF including the residue in the event window, a few statistics, including the average period, Pearson correlation coefficient, Kendall correlation coefficient and variance percentage (Zhang et al. 2008), are applied to investigate the relationships between each IMF, residue and the original carbon price. For an IMF with length of n with s peaks and troughs, its average period is defined as \(\bar{{T}}=2n/s\). The variance percentage is defined that the variance of an IMF accounts for the percentage of that of the original carbon price. Their results are listed in Table 1. For the lack of only considering the contribution to variation of the original carbon price in the event window, the sum of the variance percentages in Table 1 is less than 1. For \(\hbox {IMF}_{3},\, \hbox {IMF}_{4}\) and \(\hbox {IMF}_{5}\), although there are high correlations between them and the original carbon price, their variance percentages are low, which are much less than those of \(\hbox {IMF}_{6},\, \hbox {IMF}_{7}\) and res, 11.73, 11.23 and 21.62% respectively. Both the correlations between \(\hbox {IMF}_{1},\, \hbox {IMF}_{2}\) and the original carbon price, and their variance percentages are very low. Thus, the sum of \(\hbox {IMF}_{6},\, \hbox {IMF}_{7}\) andres is identified as the main mode. Figure 4 reports the comparison between the main mode and the original carbon price. It can be found that the main mode and original carbon price have an overall consistent evolution. In terms of the main mode, we can obtain that the influence of 2007–2009 global financial crisis on EU ETS is 17.09 €/t, rather than 24.95 €/t, which is defined as the difference between the highest point and the lowest point in the event window. For the difference between 17.09 €/t and 24.95 €/t, it is because that the latter includes, however, the former excludes, the influences of irregular short-term fluctuations of high-frequency modes on the EU ETS.

Secondly, we explore the high-frequency modes. The high-frequency modes, \(\hbox {IMF}_{1}\sim \hbox {IMF}_{5}\), have the mean periods of 3, 6, 14, 32 and 70 days respectively, which can reveal the short-term fluctuations of the original carbon price. They have low correlations with the original carbon price, as well as have little variance percentages. All the amplitudes of high-frequency modes are within 2 €/t. Thereby, although the short-term fluctuations are violent, they have limited influences on the EU ETS. At the same time, in the event window, all the means of high-frequency modes are approximate to 0. Thus, we can deduce that the mean of sum of \(\hbox {IMF}_{1}\sim \hbox {IMF}_{5 }\) is 0, which can be verified by the fine-to-coarse reconstruction algorithm (Zhang et al. 2008) to test whether the sum from \(\hbox {IMF}_{1}\) to \(\hbox {IMF}_{i}\) deviates significantly from 0 at the \(\hbox {IMF}_{i}\). We perform the fine-to-coarse reconstruction algorithm via the Statistical Product and Service Solutions (SPSS) software package developed by the IBM corporation, and obtain the test results, as reported in Table 2. At the significance level of 0.05, it can be found that the mean of sum of \(\hbox {IMF}_{1}\sim \hbox {IMF}_{6}\, (s_6 )\) deviates significantly from 0. Therefore, \(\hbox {IMF}_{1}\hbox {-IMF}_{5}\) are the high-frequency modes, while \(\hbox {IMF}_{6} \sim \hbox {IMF}_{7}\) are low frequency modes, and the residue is the trend of the carbon price. Therefore, the fluctuations of \(\hbox {IMF}_{1}\sim \hbox {IMF}_{5}\) cannot change the mean of the carbon price, which demonstrates that identifying \(\hbox {IMF}_{6},\, \hbox {IMF}_{7}\) and res as the main mode is reasonable.

Thirdly, we use the Hilbert transform to explore whether the crisis has induced the increase of short-term volatilities of the carbon price. We use the Hilbert–Huang spectrum analysis software package developed by Huang et al. obtained from the website of RCADA (http://rcada.ncu.edu.tw/) to present the Hilbert spectrum for the carbon price in the analysis window, as shown in Fig. 5. The horizontal axis stands for time, while the vertical axis is frequency, and the frequency is standardized to an interval of [0, 1]. Energy is represented by color points, which means that the lighter the color, the less the corresponding energy to the time and frequency; on the contrary, the deeper the color, the greater the energy. For comparison, the original carbon price is also painted on the corresponding panel in a red line. Here energy is defined as \(\left| {A_j (\hbox {t})} \right| ^{2}\). On the whole timeline, the energy is concentrated in the low frequency IMFs because the main mode is low-frequency. In the high frequency region, it can be observed that the intensity of grey spots from the 157th day to the 576th trading day in the event window is higher than that of the estimation window, as well as the energy. Thus, the energy in the event window is much higher than that in the estimation window. Furthermore, the t test result shows that the amplitude of highest-frequency mode, \(\hbox {IMF}_{1}\), of the event window is significantly higher than that of the estimation window. Therefore, during the crisis, it can be deduced that the fluctuations of carbon price increased significantly.

Last but not the least, for verifying the impact of the crisis is temporary or permanent, we use the Bai–Perron structural breakpoints test (Bai and Perron 2003) to explore the structural changes of the monthly average carbon price from January 2006 to April 2012. On the basis of the Bayesian information criteria (BIC), three breakpoints are detected out: September 2007, October 2008, and May 2011. It can be found that the latest breakpoint to the crisis is in October 2008. Due to the hysteresis effect, the breakpoint did not appear immediately after the full-blown of this crisis. Thus, we can deduce that the breakpoint in October 2008 is induced by this crisis. Therefore, the crisis is a stepped event, which has a permanent impact on the EU ETS.

According to the analyses above, we can summarize the influence of 2007–2009 global financial crisis on the EU ETS as follows: \(\textcircled {1}\) This crisis has a multiscale influence on the carbon market: long-term slump at a large scale and short-term fluctuations at a small scale. \(\textcircled {2}\) The short-term effects are described by the high-frequency modes, so they cannot impact the tread of carbon price in the long term. \(\textcircled {3}\) The main influence of this crisis on the carbon market is captured by the main modes including the low-frequency modes and the residue. This crisis is a stepped event, which has made a structural change of carbon price. Thus, this crisis can impact the carbon price in the long term.

3.2 Examining the Impact of 2009–2013 European Debt Crisis on the EU ETS

Since the detailed analyses are provided in Sect. 3.1, only simple outlines and conclusions are given in this section.

The European debt crisis started at the end of 2009. At that time, Fitch downgraded Greece credit rating from \(\hbox {A}^{-}\) to \(\hbox {BBB}^{+}\) with a negative outlook. Afterwards, Standard & Poor and Moody also lowered Greece sovereign debt rating, and the sovereign debt crisis spread to the “PIIGS”, Portugal, Italy, Ireland, Greece and Spain from March 2010. Especially, in November 2011, as the main European countries including Germany and France were drawn into the crisis, the European debt crisis broke out fully, which had lasted for over two years and gradually faded at the end of 2013.

Similar to 2007–2009 global financial crisis, we chose the carbon price in ECX to explore the influence of European debt crisis on the EU ETS. The estimation window is defined from April 1, 2009 to December 7, 2009, while the event window is from December 8, 2009 to December 16, 2013, so the analysis window is from April 1, 2009 to December 16, 2013, with 1209 daily price data in total, shown in Fig. 6, with unite of €/t. The carbon price kept stable at around 15 €/t before the full-blown of European debt crisis. On May 2, 2011, the local peak was 19.69 €/t. As the debt crisis deteriorated from June 2011 to October 2011, the carbon price fell from over 15 €/t to less than 10 €/t. In November 2011, the European debt crisis worsened further, and the carbon price experienced another decline to 6 €/t until it hit the lowest point, 2.78 €/t on April 17, 2013.

The EEMD algorithm is used to decompose the carbon price in the analysis window. The parameters are same with those utilized in Sect. 3.1. As illustrated in Fig. 7, the carbon price is decomposed into eight IMFs and one residue. Table 3 lists the statistical analyses in the event window. So, \(\hbox {IMF}_{6},\, \hbox {IMF}_{7},\, \hbox {IMF}_{8}\) and res are identified as the main mode. The reasons are as follows: first, in terms of correlation, \(\hbox {IMF}_{6},\, \hbox {IMF}_{7},\, \hbox {IMF}_{8}\), res and DEC13 are highly correlative to the original carbon price. Both the Pearson correlation coefficient and Kendall correlation coefficient are significant at the significant level of 0.01. Second, from the perspective of variance percentage, compared with the other IMFs, \(\hbox {IMF}_{6},\, \hbox {IMF}_{7},\, \hbox {IMF}_{8}\) andres contribute more to the variation of original carbon price. Third, the results of fine-to-coarse reconstruction algorithm, shown in Table 4 manifest that: the mean of the sum of \(\hbox {IMF}_{1 }\sim \hbox {IMF}_{6},\, (s_6 )\) has a significant deviation from 0 at the significant level of 0.05. In term of the main mode, we can obtain that the overall impact of European debt crisis on the carbon price was 15.45 €/t, which is less than that of 2007–2009 global financial crisis, 17.09 €/t. As shown in Fig. 8, the main mode can describe the evolution of the carbon price as a whole. As presented in Fig. 9, similar to the global financial crisis, the Hilbert spectrum for the carbon price in the analysis window shows that the carbon price fluctuations increased during the European debt crisis. The t test result also shows that the amplitude of highest-frequency mode, \(\hbox {IMF}_{1}\), in the event window is significantly higher than that of the estimation window. Similar to the global financial crisis, we also used the Bai-Perron structural breakpoints test to detect the structural changes of monthly carbon price from April 2008 to December 2013, and two breakpoints are found: May 2011 and November 2011. It can be found that the times of these two breakpoints are in line with the European debt crisis. At the same time, these breakpoints appeared immediately when the European debt crisis escalated and broke out at a full scale. It can be deduced that both the breakpoints are produced by the European debt crisis. Therefore, the European debt crisis is also a stepped event like the global financial crisis, which has an impact on the carbon market in the long term.

3.3 A Comparison Between the Two Crises

Comparing the global financial crisis and the European debt crisis, a few common and different characteristics are summarized as follows: firstly, both have multiscale influences on the carbon market: long-term slump at a large scale and short-term fluctuations at a small scale. Secondly, the high-frequency modes have a little short-term effect on the carbon market, and cannot impact the long-term tread of the carbon price. Thirdly, the low-frequency modes and the residue are the main mode, which has the main long-term influence of the two crises on the carbon market. Last but not the least, as stepped events, both have so significantly negative effects on the carbon market as to cause the structural changes in the carbon price. Meanwhile, there is also a difference between these two crises that the impact of the global financial crisis on the carbon market is more serious than that of the European debt crisis. The former dropped by 17.26 €/t, while the latter declined by 15.44 €/t. However, the former had caused one structural change in the carbon price one month later than the full-blown of this crisis, while the latter had caused two structural changes in the carbon price immediately when the European debt crisis escalated and fully broke out. From this perspective, the impact of the European debt crisis on the carbon market is more serious than that of the global financial crisis. The main reason may lie in that our selected carbon market is the EU ETS.

4 Conclusions and Future Work

This paper develops a novel ensemble empirical mode decomposition-based event analysis and Hilbert spectra to examine the influences of economic crises on the EU ETS. The 2007–2009 global financial crisis and the 2009–2013 European debt crisis are taken as two cases to verify the effectiveness of the proposed method. It is found that both economic crises have seriously affected the carbon market, and caused several structural changes in the carbon price. The empirical results show that, contrasted with the traditional intervention analysis and event analysis with the principle of “one divides into two”, the proposed method can capture the influences of an economic crisis on the carbon market at various timescales in a nonlinear framework. Therefore, the proposed approach appears as a new tool for engineers, computer scientists and economists.

However, there are some limitations of the proposed method. First, the precision of EEMD decomposition can directly affect the estimating accuracy of the impact of an economic crisis on the carbon market. In this study, we have adopted the sequence image symmetric extension EEMD method to decompose the carbon price. How to find a better decomposition method or to improve EMD/EEMD algorithms to enhance the decomposition precision of carbon price is our future work. Second, in this study, the effectiveness of the proposed method is only verified by two economic crises, or stepped events. But the influence of an impulsive event on carbon market is less than that of a stepped event on carbon price. Hence, whether this method is suitable for exploring the impact of an impulsive event on the carbon market needs to be further tested. Last but not the least, the aim of estimating the effect of an economic crisis on the carbon market is to help improve the forecasting accuracy of carbon price (Zhu and Wei 2013). Thus, how to integrate the obtained effect of an economic crisis to increase the carbon price prediction is also our future research task, as a direct extension of the works by Zhu et al. (2015).

Change history

31 March 2017

An erratum to this article has been published.

References

Alberola, E., Chevallier, J., & Cheze, B. (2008). Price drives and structural breaks in European carbon prices 2005–2007. Energy Policy, 36(2), 787–797.

Bai, J., & Perron, P. (2003). Computation and analysis of multiple structural change models. Journal of Applied Econometrics, 18, 1–22.

Bel, G., & Joseph, S. (2015). Emission abatement: Untangling the impacts of the EU ETS and the economic crisis. Energy Economics, 49, 531–539.

Box, G. E. P., & Tiao, G. C. (1975). Intervention analysis with applications to economic and environmental problems. Journal of the American Statistical Association, 70(349), 70–79.

Brouwers, R., Schoubben, F., Hulle, C. V., & Uytbergen, S. V. (2016). The initial impact of EUETS verification events on stock prices. Energy Policy, 94, 138–149.

Huang, N. E., Shen, Z., & Long, S. R. (1998). The empirical mode decomposition and the Hilbert spectrum for non-linear and non-stationary time series analysis. Proceedings of the Royal Society of London, 454, 903–995.

Jia, J. J., Xu, J. H., & Fan, Y. (2016). The impact of verified emissions announcements on the European Union emissions trading scheme: A bilaterally modified dummy variable modelling analysis. Applied Energy, 173, 567–577.

Lepone, A., Rahman, R. T., & Yang, J. Y. (2011). The impact of European Union Emissions Trading Scheme (EU ETS) National Allocation Plans (NAP) on Carbon Markets. Low Carbon Economy, 2, 71–90.

Lin, D. C., Guo, Z. L., An, F. G., & Zeng, F. L. (2012). Elimination of end effects in empirical mode decomposition by mirror image coupled with support vector regression. Mechanical Systems and Signal Processing, 1(31), 13–28.

MacKinlay, A. C. (1997). Event studies in economics and finance. Journal of Economic Literature, 35(1), 13–39.

Wu, Z. H., & Huang, N. E. (2009). Ensemble empirical mode decomposition: A noise-assisted data analysis method. Advances in Adaptive Data Analysis, 1(1), 1–41.

Yu, L., Li, J. J., Tang, L., & Wang, S. (2015). Linear and nonlinear Granger causality investigation between carbon market and crude oil market: A multi-scale approach. Energy Economics, 51, 300–311.

Zhang, X., Lai, K. K., & Wang, S. Y. (2008). A new approach for crude oil price analysis based on Empirical Mode Decomposition. Energy Economics, 30, 905–918.

Zhang, Y. J., & Wei, Y. M. (2010). An overview of current research on EU ETS: Evidence from its operating mechanism and economic effect. Applied Energy, 87(6), 1804–1814.

Zhu, B. Z., Ma, S. J., Chevallier, J., & Wei, Y. M. (2014). Modelling the dynamics of European carbon futures price: A Zipf analysis. Economic Modelling, 38, 372–380.

Zhu, B. Z., Ma, S. J., Chevallier, J., & Wei, Y. M. (2015). Examining the structural changes of European carbon futures price 2005–2012. Applied Economics Letters, 22(5), 335–342.

Zhu, B. Z., Shi, S. T., Chevallier, J., Wang, P., & Wei, Y. M. (2016). An adaptive multiscale ensemble learning paradigm for nonstationary and nonlinear energy price time series forecasting. Journal of Forecasting, 35(7), 633–651.

Zhu, B. Z., Wang, P., Chevallier, J., & Wei, Y. M. (2015). Carbon price analysis using empirical mode decomposition. Computational Economics, 45(2), 195–206.

Zhu, B. Z., & Wei, Y. M. (2013). Carbon price prediction with a hybrid ARIMA and least squares support vector machines methodology. Omega, 41(3), 517–524.

Acknowledgements

We express our gratitude to the National Natural Science Foundation of China (71473180, 71201010 and 71303174), National Philosophy and Social Science Foundation of China (14AZD068, 15ZDA054), Natural Science Foundation for Distinguished Young Talents of Guangdong (2014A030306031), Guangdong Young Zhujiang Scholar (Yue Jiaoshi [2016]95), Department of Education of Guangdong ([2013]246, [2014]145), Guangdong key base of humanities and social science: Enterprise Development Research Institute and Institute of Resource, Environment and Sustainable Development Research, and Guangzhou key base of humanities and social science: Centre for Low Carbon Economic Research for funding supports.

Author information

Authors and Affiliations

Corresponding authors

Rights and permissions

About this article

Cite this article

Zhu, B., Ma, S., Xie, R. et al. Hilbert Spectra and Empirical Mode Decomposition: A Multiscale Event Analysis Method to Detect the Impact of Economic Crises on the European Carbon Market. Comput Econ 52, 105–121 (2018). https://doi.org/10.1007/s10614-017-9664-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-017-9664-x

Keywords

- European carbon market

- Economic crisis

- Ensemble empirical mode decomposition

- Event analysis

- Hilbert transform