Abstract

In this paper, a new technique is investigated to speed up the order of accuracy for American put option pricing under the Black–Scholes (BS) model. First, we introduce the mathematical modeling of American put option, which leads to a free boundary problem. Then the free boundary is removed by adding a small and continuous penalty term to the BS model that cause American put option problem to be solvable on a fixed domain. In continuation we construct the method of lines (MOL) in space and reach a non-linear problem and we show that the proposed MOL is more stable than the other kinds. To deal with the non-linear problem, an algorithm is used based on the predictor–corrector method which corresponds to two parameters, \(\theta \) and \(\phi \). These parameters are chosen optimally using a rational approximation to determine the order of time convergence. Finally in numerical results a second order convergence is shown in both space and time variables.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The development of modern option pricing began with the publication of the Black–Scholes (BS) option pricing formula in 1973, which was used in computing the value of the European option pricing Black and Scholes (1973). This model is so important in financial mathematics, that Robert Merton and Myron Scholes shared the 1997 Nobel Prize for economics (Fischer Black having died in 1995) because of this innovative Merton (1973) and Myneni (1992). The BS formula computes the value of an European option pricing based on the underlying asset, strike price, volatility of the asset, and the expiration time of option pricing Hull (1997). The European option pricing has the ability of exercising only at expiring date, while the American option pricing could be permitted at any time during the life of option. So, the American option pricing is more complicated. Analytical solutions of BS models for American option pricing problems are seldom available, therefore a numerical techniques must be used. Using numerical methods for solving American option pricing problem has been the subject of numerous researches during the last decades Barraquand and Pudet (1994), Amin and Khanna (1994) and Broadie and Detemple (1996). Elementary introductions to the topic can be found out, in Kwok (1998), Kwok (2009), Ross (1999), San-Lin (2000), Meng et al. (2014), Wilmott (1998), Wilmott et al. (1993), Yonggeng et al. (2002) and Song and Yang (2014). Typically, at any time there is a particular value of the asset, which makes the boundary between two regions: in one side the option pricing should be hold and the other side one should exercise it. An extended BS model with a non-linear penalty source term is considered. The penalty method for solving option pricing problems was introduced by Zvan et al. (1998). This term allows applicability of BS model beyond the basic European option pricing. In the penalty method, the free boundary is removed by adding a small and continuous penalty term to the BS model. Consequently, it is converted to a non-linear problem and can be solved on a fixed domain. The non-linear problem will be dealt with by MOL. Afterward, the non-linear problem is solved by predictor–corrector method which depends on the parameters \(\theta \) and \(\phi \) Fitzsimons et al. (1992). The main idea of this paper is showing that for many test parameters the backward finite difference (FD) approximation is more stable than the central and forward techniques, which is different from what presented in Khaliq et al. (2006). Then we use a rational approximation to speed up the convergence rate in time variable with respect to \(\theta \)-method which is of order \(O(\varDelta t)+O(\varDelta S)^2\) for the American option pricing and it is shown in Fitzsimons et al. (1992) that the order of the given method is \(O(\varDelta t)^2+O(\varDelta S)^2\).

The remainder of the paper is organized as follows: In Sect. 2, the BS model for American put option pricing is introduced using the penalty method. The order of accuracy for the \(\theta \)-method and some stability conditions for the penalty method are given in Sect. 3. In Sect. 4, we use the MOL for converting partial differential equation (PDE) of BS model to an ordinary differential equation (ODE). Then we combine a particular predictor–corrector method Fitzsimons et al. (1992) with rational approximation to get high order of accuracy for American put option. In Sect. 5, the numerical results are presented for various time and space step sizes. Finally, a brief conclusion is given in Sect. 6.

2 BS Model for American Put Option Problem by Penalty Method

The BS model for American put option pricing takes the form of a free boundary problem. Letting \(S(t)\) be the price at time \(t\), then the value \(V(S,t)\) of an American put option is formulated as follows Neftci (2000)

where \(\overline{S}(t)\) denotes the free boundary. The parameters \(\sigma \), \(r\) and \(E\) denote the volatility of the underlying asset, the interest rate and the exercise price of the option, respectively. Note that, the value \(V(S,t)\) of the option must satisfy the positivity constraint

because, for American put option an early exercise is permitted.

Analytical solution of the BS model of American option pricing problem is seldom available, therefore a numerical techniques must be used. Thus a penalty term is added to BS model of American put option and give a non-linear parabolic PDE on a fixed domain (see Appendices 1 and 2 for more details). The penalty term is given by Zvan et al. (1998)

where \(0 < \epsilon << 1 \) is a small regularization parameter, \(C \ge rE\) is a positive constant and \(q(S)\) is defined by:

So the free boundary problem (1) is reduced to the following nonlinear PDE:

3 The \(\theta \)-Method and Its Consistency

Following discretization on the domain \([0,S_{\infty } ] \times [0,T],\) the well-known \(\theta \)-method applied to (5) takes the form Duffy (2006) (We apply forward for time steps and central for space steps):

We consider \(\theta \)-methods that arise by treating the penalty term explicitly in (6), that is, by replacing \(V^n_j\) by \(V^{n+1}_j\) in that term, we obtain

A detailed analysis is provided in Nielsen et al. (2002) for certain schemes applied to (5) using upwind differencing where it was concluded that a time step constraint was needed to preserve the positivity constraint if the penalty term was treated explicitly. In particular, for the corresponding linear (or semi-) implicit backward Euler method the constraint is

see Khaliq et al. (2006).

Now we prove that the \(\theta \)-method has the order \(O(\varDelta t)+O(\varDelta S)^2\) . By using Taylor expansion for \(V^{n}_{j+1},\;V^{n}_{j-1}\) and \(V^{n+1}_{j}\), we get

Substituting from (9) in (7) implies

or the simplified form

By adding and subtracting the term

and nothing that

we have

Using Taylor expansion we have

then by substituting in (13), we obtain

On the other hand, for American put option we have

thus we write

since \(\frac{\vert V^{n+1}_j-q(S_j)\vert }{\epsilon }<1\) and \(\frac{\vert V^{n}_j-q(S_j)\vert }{\epsilon }<1\).

By substituting

in (17), we get

Therefore, the truncation error of the \(\theta \)-method is of order \(O(\varDelta t)+O(\varDelta S)^2\). In the next section, we use the MOL and predictor–corrector technique to get high accuracy for time and obtain parameters of this method using rational approximation.

4 Rational Approximation and Stability

By defining \(\tau := T-t\), we consider (6) in the more conventional form

Applying the MOL semi-discretization approach Duffy (2006) by using a central FD for the first order derivative, \(\frac{\partial V}{\partial S}\), it can be written in the compact form

where \(F(\tau ,V)=AV+g(\tau ,V)\), in which \(g(\tau , V) \) is the non-linear discretized penalty term and \(A\) is the nonsymmetric tridiagonal matrix

where

for \( i=2,\ldots ,N-1 \).

Now we use the predictor–corrector method for solving (20). For simplicity, we assume a uniform time step size \(k\). Then for the corrector

we use the \(\theta \)-method to compute the predicted solution \(\widehat{V}^{n+1}\):

For \(\theta =0\) and \(\phi =\frac{1}{2}\), (21) reduces to the modified Euler method. We treat the implicit non-linear term \(g(\tau , V)\), explicitly, in both the predictor and corrector throughout evaluating \(g\) at the current available values. This yields the following linear implicit method with tridiagonal coefficient matrix \(T=I-k\theta A\),

The following definitions and lemmas are recalled from Brayton et al. (1972), Lambert (1978) and Mock (1983). The linear stability properties of the linear implicit method (23) are determined through applying to the scalar equation \(\frac{\partial v}{\partial t}=\lambda v\), \(\; Re(\lambda )<0\). Applying (23) to this problem yields \(v_{n + 1} = R(q)v_n\), \(q = k\lambda \) with the rational stability function

(see Voss and Casper (1989), Voss and Khaliq (1999) and Fitzsimons et al. (1992)).

Definition 1

A numerical method is said to be A-stable if its region of absolute stability contains the whole of the left half-plane. A one-step numerical method is said to be L-stable if it is A-stable and if, in addition, when it is applied to the scalar test equation \(y ' = \lambda y\), where \(\lambda \) is a complex constant with \(\text{ Re }(\lambda ) < 0\), it has the form \(y_{k+1} = R(k\lambda )y_k\), where \(\mid R(k\lambda )\mid \rightarrow 0\) as \(\text{ Re }(k\lambda )\rightarrow -\infty \).

Definition 2

Let q be a complex number and let \(R^S_T(q)\), where \(S >0, T > 0, \) be given by

where all the \(a_i\) and \(b_i\) are real and \(a_0 = b_0= 1\). We say that \(R^S_T(q)\) is an \((S, T)\) Rational approximation of order \(P\) to \(e^q \) if \(R^S_T(q) = e^q + O(q^{P+1})\). If \(P = S + T\), it is called the \(Pad\acute{e}\) approximation to \(e^q\).

Remark 1

Consider the \((2, 2)\) Rational approximation \(R^2_2(q)\) containing the free parameters \(\xi \) and \(\zeta \)

It is of order 2 in general and of order 3, if \(\xi \ne 0\), \(\zeta =\frac{1}{3}\). It is a \(Pad\acute{e}\) approximation of order 4, if \(\xi =0\), \(\zeta =\frac{1}{3}\).

Theorem 1

Butcher (2008) \(R^2_2(q; \xi ,\zeta )\) is A-stable iff

-

(a)

all poles of \(R^2_2(q; \xi ,\zeta )=\frac{N(q)}{D(q)}\) are in the right half-plane.

-

(b)

\( E(y)= \mid D(iy)\mid ^2-\mid N(iy)\mid ^2\ge 0\), for all real y.

Proof

The necessity of (a) follows from the fact that if \(q^*\) is a pole, then \(\lim _{q\rightarrow q^*} \mid R(q)\mid = \infty \), and hence \(|R(q)| > 1\), for \(q\) close enough to \(q^*\). The necessity of (b) follows from the fact that \(E(y) < 0\) implies that \(|R(iy)| > 1\), so that \(|R(q)| > 1\) for some \(q =-\epsilon +iy\) in the left half-plane. Sufficiency of these conditions follows from the fact that (a) implies that R is analytic in the left half-plane so that, by the maximum modulus principle, \( |R(q)| > 1\) in this region implies \( |R(q)| > 1 \) on the imaginary axis, which contradicts (b). \(\square \)

Lemma 1

\(R^2_2(q; \xi ,\zeta )\) is A-stable iff \(\xi \ge 0\), \(\zeta \ge 0\), and L-stable iff \(\xi =\zeta >0\).

Proof

Let \(R^2_2(q; \xi ,\zeta )\) be A-stable. Then by Theorem 1, (a) and (b) are true, thus both of the roots of \(D(q)=0\) must be in the right half-plane, that is,

thus

and

From (28), we conclude that \(\xi \ge 0\) and \(\zeta \ge 0\), since otherwise, we should have \(\xi < 0\) and \(\zeta < 0\), this yields \(\xi +\zeta <0\) and \(1+\xi -\sqrt{(1-2\xi +\xi ^2-4\zeta )}\le 0\), which contradicts (27).

Conversely, let \(\xi \ge 0\), \(\zeta \ge 0\). Then we show that \(R^2_2(q; \xi ,\zeta )\) is A-stable. Since \(\xi \ge 0\), \(\zeta \ge 0\), then (28) and (26) are clearly true. To prove (27), it is clear that \(\frac{1+\xi }{\xi +\zeta }\ge 0, \) when \(1-2\xi +\xi ^2-4\zeta < 0\). Let \(1-2\xi +\xi ^2-4\zeta \ge 0\). Since \(\xi +\zeta \ge 0\), we should prove \(1+\xi -\sqrt{(1-2\xi +\xi ^2-4\zeta )}\ge 0\). If

then

or equivalently

which contradicts the hypothesis \(\xi \ge 0\), \(\zeta \ge 0\). Thus by Theorem 1, \(R^2_2(q; \xi ,\zeta )\) is A-stable.

To prove the second part, let \(\xi =\zeta >0\), then (25) is converted to

Therefore \(\mid R^2_2(q; \xi ,\xi )\mid \rightarrow 0\) as \(\text{ Re }(q)\rightarrow -\infty \), so according to the Definition 1 \(R^2_2(q; \xi ,\xi )\) is L-stable. Conversely, let \(R^2_2(q; \xi ,\xi )\) be L-stable, then by Definition 1, it is A-stable and so by the first part, we have \(\xi \ge 0\), \(\zeta \ge 0\), and since \(\mid R^2_2(q; \xi ,\xi )\mid \rightarrow 0\), as \(\text{ Re }(q)\rightarrow -\infty \), we get \(\xi =\zeta >0\), (see (25)). \(\square \)

According to the Remark 1, and Lemma 1, the predictor–corrector method is L-stable, if

and

which implies

Substituting from (31) in (30) and solving it, yields

We choose

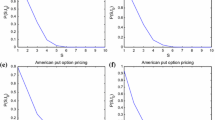

since this choice yields more accurate results on various test problems. We use a rational approximation for three different kinds of FD and draw the numerical results for different data of BS model as shown in Fig. 1a, b, c, d and e.

a Plots of \(R(q)\) for three kinds of FD with \( \sigma =0.25\) and \(r=0.05\). b Plots of \(R(q)\) for three kinds of FD with \( \sigma =0.3\) and \(r=0.02\). c Plots of \(R(q)\) for three kinds of FD with \( \sigma =0.2\) and \(r=0.1\). d Plots of \(R(q)\) for three kinds of FD with \( \sigma =0.15\) and \(r=0.07\). e lots of \(R(q)\) for three kinds of FD with \( \sigma =0.1\) and \(r=0.01\)

The Fig. 1a, b, c, d and e show that the backward FD is more stable than the forward and central FDs for the first derivative, \(\frac{\partial V}{\partial S}\), of BS model.

5 Numerical Results

The numerical simulations are run on a computer with an Intel(R) Pentium processor 2.00 GHz 8 GB RAM and the software programs are written in Matlab.

Let \(V_{PC}\) denote the approximate solution obtained by the MOL and predictor–corrector method developed in Sect. 4. The error on \(V_{PC}\) at the current time \((\tau = T )\) is computed as

The exact solution \(V(S,T)\), needed in (32) is not available.

Remark 2

For a call (put) option, either European or American, when the current asset price is higher, it has a strictly higher (lower) chance to be exercised and when exercises, it induces higher (lower) cash inflow. Therefore, the call (put) option price functions are increasing (decreasing) of the asset price, that is,

or

It is shown in Fig. 2 that our results are true for \(T=\tau \), according to Remark (2).

Therefore, more accurate estimation is obtained using the FD method with a large number of time and space steps (\(N_{\tau }\), \(N_{S}\)).

To compute the error of approximate solution from (32), we save the solution for \(N_S=1{,}000\) and \(N_{\tau }=10, 100, 1{,}000,\) then we compare it with the results obtain for \(N_{S}=10, 50,200, 400, 800\). See the numerical results in Table 1a, b and c for the above mentioned values of \(N_{\tau }\) and \(N_{S},\) and \(\sigma = 2,\; T = 1\), \(S_{\infty } = 2,\; r = 0.1, \;E = 1\) and \(\epsilon =\frac{T}{N_{\tau }}rE\) (see 8).

In Table 1d, we save the approximate solution for \(N{\tau }=10\) and \(N_S=1{,}000\), then we change the parameters to \(N_{S}=10, 50, 200, 400, 800\), \(\sigma =0 .25,\; T = 1\), \(S_{\infty } = 2,\; r = 0.02\) and \(E = 1.\)

Finally, we save the approximate solution for \(N{\tau }=10\) and \(N_S=1{,}000\), then we change the parameters to \( \sigma =0 .3,\; T = 1\), \(S_{\infty } = 2,\; r = 0.02,\;E = 1\) and obtain the Table 1e for \(N_{S}=10, 50, 200, 400, 800\). In this section numerical solution showed which \(\varDelta t \rightarrow 0\) (\(\epsilon \longrightarrow 0\)) the estimated option values provided by the penalty approach, \(V_{PC}(S,T)\), converge towards the \(V(S,T)\) (in (32)) and \(V_{PC}(S,T)\) is obtained satisfied financial condition (Remark (2)).

6 Conclusion

We investigated the stability and consistency of American put option pricing and we showed the truncation error of \(\theta \)-method is of order \(O(\varDelta t)+O (\varDelta S)^2.\) We obtained a high accuracy by using MOL and predictor–corrector method which depends on the parameters \(\theta \) and \(\phi \). By using Rational approximation, we obtained \(\theta \) and \(\phi \) to guarantee L-stability for American put option under the popular BS model. We used three different kinds of FD, i.e. backward, central and forward FDs for the first order space derivative in BS model, \(\frac{\partial V}{\partial S}\) and showed by numerical results that the backward method is more stable and more accurate than the others for \(\frac{\partial V}{\partial S}\).

References

Amin, K., & Khanna, A. (1994). Convergence of American option values from discrete to continuous-time financial models. Mathematical Finance, 4, 289–304.

Barraquand, J., & Pudet, T. (1994). Pricing of American path-dependent contingent claims. Paris: Digital Research Laboratory.

Black, F., & Scholes, M. S. (1973). THE pricing of options and corporate liabilities. The Journal of Political Economy, 81, 637654.

Brayton, R. K., Gustavson, F. G., & Hachtel, G. D. (1972). A new efficient algorithm for solving differential-algebraic systems using implicit backward differentiation formulas. Proceedings of the IEEE, 60(1), 98–108.

Brennan, M., & Schwartz, E. (1977). The valuation of American put options. The Journal of Finance, 32, 449–462.

Broadie, M., & Detemple, J. (1996). American option valuation: New bounds, approximations, and a comparison of existing methods. Review of Financial Studies, 9(4), 121–150.

Butcher, J. C. (2008). Numerical methods for ordinary differential equations (2nd ed.). Chichester: Wiley.

Duffy, D. J. (2006). Finite difference methods in financial engineering (A partial differential equation approach). England: Wiley.

Fitzsimons, C. J., Liu, F., & Miller, J. H. (1992). A second-order L-stable time discretisation of the semiconductor device equation. Journal of Computational and Applied Mathematics, 42, 175–186.

Hull, J. C. (1997). Options, futures and other derivatives. Boston: Prentice Hall.

Khaliq, A. Q. M., Voss, D. A., & Kazmi, S. H. K. (2006). A linearly implicit predictorcorrector scheme for pricing American options using apenalty method approach. Journal of Banking and Finance, 30, 459–502.

Kwok, Y. K. (1998). Mathematical models of financial derivatives. Heidelberg: Springer.

Kwok, Y. K. (2009). mathematical models of financial derivatives. Second Edition. Singapore:Springer Finance ISSN.

Lambert, J. D. (1978). Complctational methods in ordinav differential equations. New York: Wiley.

Meng, Wu, Nanjing, H., & Huiqiang, M. (2014). American option pricing with time-varying parameters. Computational Economics, 241, 439–450.

Merton, R. C. (1973). The theory of rational option pricing. Bell Journal of Economics and Management Science, 4, 141–183.

Mock, M. S. (1983). Analysis of mathematica1 models of semiconductor. Dublin: Derices Boole.

Myneni, R. (1992). The pricing of the American option. Annals of Applied Probability, 2(1), 1–23.

Neftci, S. N. (2000). An introduction to the mathematics of financial derivatives. London: Academic Press.

Nielsen, B., Skavhaug, O., & Tveito, A. (2002). Penalty and front-fixing methods for the numerical solution of American option problems. The Journal of Computational Finance, 5, 67–98.

Ross, S. H. (1999). An introduction to mathematical finance. Cambridge: Cambridge University Press.

San-Lin, C. (2000). American option valuation under stochastic interest rates. Computational Economics, 3, 283–307.

Song, D., & Yang, Z. (2014). Utility-based pricing, timing and hedging of an American call option under an incomplete market with partial information. Computational Economics, 44, 1–26.

Voss, D. A., & Casper, M. J. (1989). Efficient split linear multistep methods for stiff ODEs. SIAM Journal on Scientific Computing, 10, 990–999.

Voss, D. A., & Khaliq, A. Q. M. (1999). A linearly implicit predictorcorrector method for reaction diffusion equations. Journal of Computational and Applied Mathematics, 38, 207216.

Wilmott, P., Dewynne, J., & Howison, S. (1993). Option pricing, mathematical models and computation. Oxford: oxford Financial Press.

Wilmott, P. (1998). The theory and practice of financial engineering. New York: Wiley.

Yonggeng, G., Jiwu, S., Xiaotie, D., & Weimin, Z. (2002). A new numerical method on American option pricing. Computational Economics, 45, 181–188.

Zvan, R., Forsyth, P. A., & Vetzal, K. R. (1998). Penalty methods for American options with stochastic volatility. Journal of Computational and Applied Mathematics, 91, 199–218.

Acknowledgments

The authors would like to thank anonymous reviewers for their useful comments and suggestions.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

1.1 Solving an Ordinary Differential Equation by Penalty Method

We consider a simple ordinary differential equation

with the additional constraint that

The solution to this problem can be computed analytically and is given by

Suppose, however, that we want to solve the initial-value problem (34)–(35) numerically. Then we would have to check, for each time step, whether the constraint is satisfied or not. Let \(u_n\) be a numerical approximation of \(u(t_n)\) where \(t_n=n\varDelta t\) , and \(\varDelta t >0\) is the time step. We compute a numerical solution of the initial-value problem (34)–(35) using an explicit finite-difference scheme:

where \(u_0=2\). This corresponds to a Brennan-Schwartz type of algorithm for pricing American put options Brennan and Schwartz (1977).

An equation which approximates this property fairly well can be derived by adding an extra term to equation (35). Consider the initial-value problem

where \(\epsilon >0\) is a small parameter. Note that, initially, \(v = 2\), so the penalty term is

For more detail see Nielsen et al. (2002).

Now we use predictor–corrector method developed in Sect. 4 for solving (38). For simplicity, we assume a uniform time step size \(\varDelta t\) and \(T=1+\varDelta t\theta \), then for the corrector

the predicted solution \(\widehat{v}^{n+1}\) is given by

Table 2, show the maximum absolute error:

where \(u(t_n)\) and \(v_n\) are the exact and approximate solution of Eq. (34), respectively.

Appendix 2

1.1 Penalty Method for American Put Option Nielsen et al. (2002)

In this section we derive an implicit and a semi-implicit scheme. For both schemes we assume that

Under this mild assumption it turns out that the implicit scheme is stable, whereas the semi-implicit scheme is stable if the additional condition (8) (see Sect. 3) is satisfied.

Using the notation introduced above, we consider forward FD for \(\frac{\partial V}{\partial S}\) and obtain the following scheme:

Here, we put \(V^{n+\frac{1}{2} }_j= V^n_j\) in the fully implicit scheme and \( V^{n+\frac{1}{2}}_j = V^{n+1}_j \) in the semi-implicit scheme. The scheme (42) can be rearranged as

Our aim is to show that

We do this in two steps; first, we show that

and next that

In order to prove (45), we introduce

By substituting (47) in (43) and that \(q_j=E-S_j\), we have

where \(u^{n+\frac{1}{2}}_j = u^n_j \) in the fully implicit case and \(u^{n+\frac{1}{2}}_j = u^{n+1}_j \) in the semiimplicit case. Define

and let \(k\) be an index such that

For \( j = k,\) it follows from (48) that

or

Let us now consider the fully implicit case. Here (52) takes the form

If we assume that

then we have

where

Since

(see (41)), and

it follows from (55) that

Consequently, by induction on \(n\), it follows from (47) that

Next we consider the semi-implicit scheme and we assume that (8) holds. It follows from (52) that

we assume that \(u^{n+1}\ge 0\), and thus \(u^{n+1}_k \ge 0\).

Let

then

(see (41)), and

so \(G'(x) \ge 0 \) for \(x \ge 0 \) provided that (8) holds. Hence, we have

and thus by (47)

Next we consider (46), i.e, we want to show that

As above, we define

and let \(k\) be an index such that

It follows from (43) that

or

Since we have just seen that

both in the fully implicit and in the semi-implicit case, it follows from (71) that

and then it follows by induction on \(n\) that

Theorem 2

If (41) holds, the numerical solution computed by the fully implicit scheme (42) satisfies the bound

Similarly, if (41) and (8) hold, the numerical solution computed by the semi-implicit version of (42) satisfies the bound (75).

We can implement backward and central FDs similar to forward FDs for \(\frac{\partial V}{\partial S}\) and obtain similar results.

Rights and permissions

About this article

Cite this article

Kalantari, R., Shahmorad, S. & Ahmadian, D. The Stability Analysis of Predictor–Corrector Method in Solving American Option Pricing Model. Comput Econ 47, 255–274 (2016). https://doi.org/10.1007/s10614-015-9483-x

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-015-9483-x