Abstract

Corruption as a non-market strategy for firms has gained increasing attention in the field of strategy management. However, the effect of corruption on innovation is unclear, especially in the context of transition economies. Using institutional theory, we examine the relationship between corruption and new product innovation and identify the contextual conditions of the relationship. Using the World Bank Enterprise Survey data from China, our empirical results show that corruption has a positive effect on firms’ new product innovation. Moreover, we find that policy instability and competitive threats from the informal sector positively moderate the relationship between corruption and new product innovation. Using post hoc analysis, we find that the potentially positive effect of corruption on new product innovation is the consequence of inherent institutional weaknesses in transition economies; as the level of institutional development increases, the effect of corruption on firms’ new product innovation will gradually decrease. Overall, our findings provide new insights into understanding corrupt behaviors in transition economies and present managerial implications for firms’ ethical dilemmas in a transition economy context. We argue that the key to overcoming these ethical dilemmas lies in promoting pro-market institutional reform to reduce the potential benefits of corruption.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

In recent years, the role of corruption as a non-market strategy for firms has gained increasing attention (Birhanu et al. 2016). However, the effect of corruption on firms’ growth, whether positive or negative, remains unclear. One view argues that corruption is considered to be the “grease” for firms’ growth. According to the “grease” view, corruption can reduce firms’ operating and transaction costs by reducing payments of government taxes, tariffs, and license fees (Iriyama et al. 2016) and can help firms improve their entry strategies (Dreher and Gassebner 2013), investment decisions (Birhanu et al. 2016), and growth efficacy (Vial and Hanoteau 2010). However, another view argues that corruption is like “sand” for firms’ growth (e.g., Fisman and Svensson 2007; Zhou and Peng 2012). According to the “sand” view, corruption, functioning as a bribery tax (Waldemar 2012), extracts firms’ capital from investment in innovation (Anokhin and Schulze 2009) and undermines firms’ legitimacy (Schembera and Scherer 2017). We argue that whether corruption is seen as “grease” or “sand” for firms’ growth in transition economies is determined by contextual factors.

Although research on corruption at the country level reveals that corruption is perceived as the “grease” that supports innovation in weak institutional settings (Méon and Weill 2010), few studies have examined the effects of corruption on innovation at the firm level (e.g., Ayyagari et al. 2014; Paunov 2016). In particular, little research offers a systematic overview of the contextual conditions of the relationship between corruption and firms’ new product innovation in transition economies. In this context, two prominent characteristics of transition economies should be considered: policy instability and the informal sector (Iriyama et al. 2016; Marquis and Raynard 2015).

Policy instability, defined as the likelihood that government officers may change the rules of the game due to a lack of institutional constraints, has become a major obstacle to firms’ operation in transition economies (Hiatt and Sine 2014; Wright et al. 2005). A high level of policy instability may result in greater managerial discretion (Kozhikode and Li 2012). Within this context, firms may use non-market strategies, such as bribery, to decrease firms’ cost and risk in innovation activities. Second, firms perceive a greater competitive threat from the informal sector in transition economies (Iriyama et al. 2016). Informal sector firms, which are not formally registered with that state and which do not pay taxes or other levies to the state, can achieve a cost advantage more easily compared with formal sector firms (Webb et al. 2009). Under such circumstances, formal firms are more likely to maintain their competitive advantage led by innovation via bribery. Therefore, policy instability and competitive threats from the informal sector may have different effects on how corruption affects firms’ new product innovation.

Hence, this work examines the effects of corruption on new product innovation and explores how policy instability and competitive threats from the informal sector affect this relationship in transition economies, offering theoretical insights in four areas.

First, this study provides a comprehensive theoretical framework by emphasizing the joint effect of non-market strategies and institutional factors on market strategies. Prior research at the firm level has generally focused on corruption and investment efficiency (e.g., O’Toole and Tarp 2014) or on firms’ adoption of quality certificates (e.g., Paunov 2016). Our study extends prior research in the non-market strategy literature (e.g., Montiel et al. 2012) by examining the effect of corruption on new product innovation at the firm level. Furthermore, little attention has been given to comprehensively testing the joint effects of non-market strategies and institutional factors on market strategies (i.e., new product innovation). In this study, we develop the literature on corruption (e.g., Iriyama et al. 2016; Paunov 2016) by proposing a research framework that considers the contingent role of institutional factors. We argue that the relationship between corruption and new product innovation can be especially strong in cases where high levels of policy instability exist and where significant competitive threats from the informal sector occur. Therefore, we also enrich previous work that focuses on the effect of institutional factors on innovation (e.g., McCann and Bahl 2017; Shinkle and McCann 2014) by investigating the joint effect of non-market strategies and institutional factors on new product innovation.

Second, we contribute to the literature by examining the moderating effect of policy instability on the relationship between corruption and new product innovation. Policy instability in transition economies has important effects on how firms conduct their new product innovation activities. However, few studies refer to the effect of policy instability on the link between firms’ innovation and non-market strategies. We contribute to the literature by providing theoretical insights and empirical validation of the boundary conditions in which corruption can affect firms’ new product innovation. Increased levels of uncertainty and changes in the institutional setting that firms face may trigger strategy diversification (Jensen et al. 2010). Our results offer new insights by illustrating how the policy environment can affect firms’ strategies, thereby contributing to institutional theory within innovation management research.

Third, we contribute to the literature by showing how competitive threats from the informal sector in combination with corruption can have profound effects on firms’ new product innovation. The extant research mainly focuses on the direct effects of corruption on firms’ growth and investment (e.g., Birhanu et al. 2016; O’Toole and Tarp 2014). We add to the literature by showing that the effects of corruption on firms’ innovation actions depend on the level of perceived threat from the informal sector. Focusing on corruption and competitive threats from the informal sector allows us to better examine the antecedents of firms’ innovation in transition markets. Moreover, we extend the work of Iriyama et al. (2016) by demonstrating how non-market strategies (i.e., corruption) interact with informal competition to affect market strategies (i.e., new product innovation). Our study further analyzes the role of institutional environments in shaping the relationship between non-market strategies and market strategies.

Fourth, we contribute to the recent literature on the link between corruption and business ethics in transition economies. Although corruption is illegal, in the context of weak institution in transition economies, corruption has a certain legitimacy (Webb et al. 2009). Firms in transition economies may use non-market strategies (e.g., bribery and corruption) to cope with policy instability and competitive threats from the informal sector (Athanasouli and Goujard 2015), even if doing so may subject them to moral and legal risks. Hence, firms in transition economies face the dilemma of how to reconcile non-market strategies with ethical behavior. Using post hoc analysis, we confirm that firms’ moral decision-making is affected by the institutional context. Hence, we provide new ethical implications for the prevalence of corruption and the dilemma of new product innovation in transition economies. On the one hand, we build on the work of previous studies that discuss how corruption greases the wheel for firms’ growth (e.g., Méon and Weill 2010; Vial and Hanoteau 2010) by showing that the effect of corruption on new product innovation is the result of inherent institutional weaknesses in transition economies. Thus, our study further identifies the internal “black box” of the “grease” role of corruption in previous work (e.g., Méon and Weill 2010; Vial and Hanoteau 2010). On the other hand, we extend the literature on business ethics (e.g., Baucus et al. 2008; Huang and Rice 2012) by revealing that efforts to foster new product innovation can also encompass concerns for ethical behavior in transition economies and that the key to overcoming ethical dilemmas lies in improving the level of institutional development and implementing strong political reforms to control corruption. Overall, our findings provide new implications for dealing with ethical dilemmas, which a rapidly transforming economy that suffers from the combination of high corruption levels and fast economic growth might face.

Theory and Hypotheses

Theoretical Framework

According to institutional theory, firms must actively respond to formal and informal institutional requirements and struggle to obtain critical resources to survive and achieve success (Scott 2013).

Accordingly, the institutional environment drives firms’ potential strategies selection, which includes market and non-market strategies (Wu and Zhao 2015; Zhou et al. 2013). In this context, firms tend to develop close relationships with governments, who control critical resources with respect to firms’ survival and development (Beets 2005). Particularly, the dependent relationship between governments and firms is strengthened in transition economies. In transition economies—which are characterized by weak regulatory infrastructure, fast-paced turbulent change, and a greater degree of informality (Marquis and Raynard 2015)—government officials have greater discretion over resource allocation and law enforcement (Zhou and Peng 2012). Hence, government officials’ discretionary power may give them more opportunities to obtain firms’ illegal payments. This phenomenon further increases firms’ transaction costs for those critical resources controlled by the government. Thus, the strong dependent relationship with the government induces firms to adopt divergent strategies, such as corruption, to reduce uncertainty (Marquis and Raynard 2015).

Moreover, the continuous institutional reforms and rapid economic growth in transition economies also increase the likelihood of policy instability, which promotes opportunistic behavior and corruption (Marquis and Raynard 2015; Wright et al. 2005). More specifically, policy instability may strengthen a firm’s dependence on the government, and firms in a transition context are more likely to use non-market strategies, such as bribery, to reduce this dependence and to promote the transaction process with the government.

Additionally, in recent years, the informal sector has come to play an increasingly significant role in transition economies. In transition economies, both informal and formal sector firms co-exist in the same market and compete with one another. The prevalence of the informal sector enables the relationships between formal firms and governmental officials to become increasingly important because formal firms need to compete for market resources with both the formal and informal sectors. Moreover, both sectors are required to maintain good relationships with the government to improve their capacity for development and survival. Thus, in transition economies, the threat from informal sector firms erodes the value of those critical resources for innovation that are controlled by the government, such as business licensing and permits, which further strengthens the effects of corruption on innovation. Therefore, formal firms must maintain close ties with local governments to obtain resources more effectively (Marquis and Raynard 2015).

Policy instability and the threat from the informal sector have become prominent features in transition economies (Iriyama et al. 2016; Marquis and Raynard 2015). The specific environment of a transition economy encourages us to believe that the effect of corruption on firms’ new product innovation likely depends on these institutional factors. Based on the close links between policy instability, competitive threats from the informal sector, and corruption (e.g., Alexeev and Song 2013; Marquis and Raynard 2015) and building on the recognition that firms in transition economies face a unique set of circumstances, we use institutional theories to explain how policy instability and competitive threats from the informal sector affect firms’ dependence on the government and, consequently, their strategic selection and innovation output. Thus, we propose the model in Fig. 1 as a way for these firms to achieve superior new product innovation.

Corruption

Corruption, which is generally reflected by the informal payment that firms are expected or requested to pay by government officials, is seen as a financial incentive for government officials to affect policy-making to favor the demander’s interests (Insead and Chatain 2008). Firms connect with government officials with the goal of shaping policies and rules that are beneficial to them (Iriyama et al. 2016). Therefore, managers sometimes try to gain the support of government officials through corruption to aid their operations (Luo 2011).

Generally, corruption plays a “grease the wheel” role in transition economies (Mendoza et al. 2015) and serves as “speed” money that facilitates firms’ new product innovation activities (Dreher and Gassebner 2013). First, new product innovation is characterized by high risk, uncertainty, and information asymmetries (Anokhin and Schulze 2009). The uncertainty and long-term nature of the innovation process and governments’ substantial control over key resources creates more opportunities for rent-seeking by corrupt government officials (Jensen et al. 2010). Hence, firms are enticed to use corruption as a strategy to reduce risk and informal asymmetries in the process of innovation and to decrease the negative effect of environmental uncertainties. Second, new product innovation activities require new equipment, information, and resources; this fact offers opportunities for rent-seeking by government officials, thereby increasing the likelihood that firms will pay bribes (Waldemar 2012). Third, a firm’s new product innovation activities must go through several layers of approval from multiple government agencies—often including the obtaining of licenses and permits, the granting of quality certificates and patents, and the registering of a new trademark—all of which force greater dependence on the government, thereby causing a higher likelihood of corruption (Ayyagari et al. 2014). In this respect, corruption can help firms bypass capricious bureaucratic processes (Huang and Rice 2012) and provide access to government research and development (R&D) subsidies. Fourth, corruption activities allow firms to foster informal relationships with public officials, thereby reaping the accompanying benefits (de Jong et al. 2012). For example, in transition economies where public institutions are inefficient, corruption may help firms obtain government services more quickly (Paunov 2016), facilitate new product innovation by promoting higher levels of social capital and increasing trust in the government in certain institutional settings, or aid firms’ deployment into the market.

Overall, firms that engage in corruption can grease the institutional wheel and reduce their operating risks, thereby reducing the uncertainty of their new product innovation activities. We therefore hypothesize the following:

H1

Firms that engage in corruption in weak institutions have a positive relation to their new product innovation.

Policy Instability

The strong influence of the government is a critical factor that differentiates the business environment of emerging and transition economies from developed economies (Douma et al. 2006). According to institutional theory, in transition markets that are characterized by fast-paced turbulent change, firms need to shape an effective institutional environment to improve their performance and long-term survival (Marquis and Raynard 2015). Therefore, firms must consider the overall stability of the policy environment in their operational decisions (Marquis and Raynard 2015). Generally, firms prefer regions with low policy instability and prefer the government to be credibly committed to policies and rules that reduce operational risk (Henisz and Zelner 2005). However, in transition economies, policy instability becomes a prevalent phenomenon (Cuervo-Cazurra 2008) because of the government’s high level of discretion in decision-making, which may reduce the credibility of its commitments and may increase the level of policy instability (García-Canal and Guillén 2008).

The level of policy instability or the risk of unfavorable changes in policy may create a difficult operating environment for firms (Hiatt and Sine 2014) and adversely affect firms’ interests (García-Canal and Guillén 2008; Holburn and Zelner 2010). Further, policy instability increases firms’ dependence on the government and strengthens the effect of corruption on firms’ new product innovation in environments in which the rules are opaque and unstable. Therefore, unstable government policies result in firms having to make more informal payments to the government to acquire the necessary resources for new product innovation, thereby creating a greater chance for corruption (Lee and Weng 2013). In this case, corruption can help firms address the uncertainty and risks stemming from political factors (Martin et al. 2007).

Thus, we hypothesize as follows:

H2

Policy instability positively moderates the relationship between corruption and firms’ new product innovation.

Competitive Threats from the Informal Sector

According to institutional theory, the informal economy consists of economic activities that occur in informal institutional boundaries (Webb et al. 2013). Informal firms, which are defined as firms that produce and sell legal goods and services yet remain unregistered with government authorities, are seen as a part of the informal economy (De Castro et al. 2014; London and Hart 2004; Webb et al. 2009). In recent years, the informal economy has induced firms to exploit opportunities occurring outside of formal institutional boundaries (Webb et al. 2009). Further, informal institutions may serve to tilt the competitive balance, making it increasingly difficult for firms to establish a competitive advantage (Mathias et al. 2015). In particular, as the Internet economy has rapidly developed and business models have dramatically changed, formal firms increasingly perceive competitive threats from informal sector firms (Iriyama et al. 2016).

First, informal firms, which have a cost advantage over formal firms, erode formal firms’ market share. Second, competitive threats from the informal sector may increase formal firms’ uncertainty and failure rate as they innovate new products. In this case, corruption is an effective competition strategy for formal firms and can decrease the threat from their informal sector competitors. As Alexeev and Song (2013) note, stronger market competition is primarily associated with greater corruption. Within the context of a greater competitive threat from the informal sector, formal firms engage in more corruption to obtain government licenses, reduce administrative and operational costs, and improve competitive positions (Iriyama et al. 2016).

In conclusion, informal sector firms have posed an increasing threat to formal sector firms in transition markets in recent years. Competitive threats from the informal sector may enhance the positive relationship between corruption and formal firms’ new product innovation. Therefore, we hypothesize the following:

H3

Competitive threats from the informal sector positively moderate the relationship between corruption and formal firms’ new product innovation.

Research Methodology

Sample and Data

The firm-level data for this study were collected by the World Bank Enterprise Survey in 2012 (the Chinese dataset). Of the questionnaires sent, 2848 responses were received from 2700 privately owned or mixed-ownership firms and 148 fully state-owned firms (all sampled firms were legally registered, viz., formal sectors firms). After deleting the invalid observations for the variables used in this study, we obtained valid responses from 2099 firms in 26 sectors. The survey respondents were firms’ senior managers.

Our study is focused on China’s transition economy. First, compared with market economies, a transitional economy has unique characteristics, such as a lack of formal institutional support, a lack of market-supporting institutions, and less developed surrounding services (Peng and Luo 2000). The characteristics of transitional economy force firms to face more complicated and fluid environments (Lau et al. 2008). Second, corruption has increasingly become a pervasive issue during China’s economic transition (Hung 2008). During the past 30 years, China’s economic growth has been rapid compared with other regions globally. China also presents some unique characteristics, such as strong government intervention and prevalent corruption. Although China has launched a vigorous anti-corruption campaign since 2013, according to the Corruption Perceptions Index (CPI) issued by Transparency International, China ranked 100 (CPI score = 36), 83 (CPI score = 37), and 79 (CPI score = 40) in 2014, 2015, and 2016, respectively.Footnote 1 Although the ranking has risen since 2015, China’s corruption level remains high. Thus, the anti-corruption effort still has a long way to go in China.

The use of perceptual data collected using the survey method may raise concerns associated with common method variance (CMB). Therefore, the World Bank uses several methods to reduce potential CMB in the survey process. First, to reduce the self-censoring bias, the item on corruption uses indirect framing. Second, although corruption is often underreported, the bias is not a concern because the World Bank ensures the anonymity of the survey participants who were affected by corruption. As this body of World Bank data has also been used in prior studies (e.g., Iriyama et al. 2016; Lau et al. 2013), this survey is believed to provide comprehensive firm-level data in the context of a transition country that can be used for examining firms’ non-market activities.

Measures

Dependent Variables

New Product Innovation

Previous research in this field of inquiry uses indicators of new products to measure new product innovation levels. For example, Zhang and Li (2010) measure new product innovation through the introduction of new products; the launch of new products into the market; and the development of new, superior products. Moreover, Klingebiel and Rammer (2014) measure new product innovation by the amount of revenue generated by new product sales. Because using the absolute value of new product sales has the advantage of providing greater construct validity than applying a ratio of new product sales (Klingebiel and Rammer 2014), we measure a firm’s new product innovation by the “logarithm of firm’s new product sales.”

Independent Variables

Corruption

Many previous studies used informal payments to measure corruption levels. For example, Lau et al. (2013) examined the “percentage of informal payments to public officials” to evaluate corporate corruption. Iriyama et al. (2016) used an informal gift or payment that is expected or requested by government officials to measure corruption. Following Lau et al. (2013), we gauged corruption by the “percentage of total annual sales paid as informal payment.” Because larger firms may engage in more corruption than smaller firms (Lee and Weng 2013), we used this indicator to reduce the potential size effect.

Policy Instability

Policy instability refers to the unstable policies or rules that may increase firms’ uncertainty of the operation process. Following García-Canal and Guillén (2008) and Athanasouli and Goujard (2015), we measured policy instability as a dummy variable indicating whether a firm regards political instability as a severe problem.

Competitive Threats from the Informal Sector

The informal and Internet economies in transition markets are pervasive. Firms face competitive threats from both formal and informal sector firms (Iriyama et al. 2016). According to the data from the World Bank survey, we used 0–1 variables to measure whether a firm was subject to competitive threats from informal sector firms.

Control Variables

Export

Previous research suggests that a close link between exports and innovation (e.g., Roper and Love 2002). Following Paunov (2016), we measured exports by “the percentage of a firm’s total sales that are directly exported.”

Firm Size

Research indicates that firm size affects firms’ strategic orientation and performance (Peng and Luo 2000). Accordingly, we controlled for the effect of firm size on new product innovation. Following Chang and Xu (2008), we measured firm size by “the logarithm of the total sales.”

Firm Age

Firm age may reflect the trust gap between new entrants and older incumbents with the government. A greater trust gap increases the transaction costs of corruption activities on new product performance. Following Lee and Weng (2013), we measured firm age by the “logarithm of 2012 minus the year that the firm was formally registered.”

State-Owned Enterprises

State-owned enterprises (SOEs), which may have fewer incentives for innovation, are pervasive in China. Following Chen et al. (2011), we defined SOEs as a dummy variable indicating whether a firm is part of an SOE.

Manufacturing Sector

The effects of corruption may differ, depending on whether firms operate in the manufacturing or services sectors (Paunov 2016). Accordingly, we controlled for the effect of the industry on new product innovation by defining it as a dummy variable indicating whether a firm belongs to the manufacturing sector.

R&D

Firms’ R&D activity, which is an important indicator of absorptive capacity (Escribano et al. 2009), is seen as a crucial way to support innovation. Thus, we controlled for the effect of firms’ R&D activities on new product innovation (Klingebiel and Rammer 2014).

Technology Licensing

Technology licensing is often viewed as an important strategy that firms use to achieve innovation (Tsai and Wang 2007). Thus, we controlled for the effect of technology licensing on new product innovation. We used a dummy variable to indicate whether a firm “uses a technology license from a foreign-owned company” (Paunov 2016).

Manager Experience

O’Toole and Tarp (2014) indicate that the industry experience of senior managers affects a firm’s investment efficiency. Thus, we controlled for the effect of manager experience on new product innovation. Following O’Toole and Tarp (2014), we measured manager experience by “the number of years of experience the top manager has had working in this sector.”

Variable definitions and sources are shown in Table 1.

Results

Regression Analysis

Variable correlation coefficients are shown in Table 2. The results indicate that corruption is significantly correlated with new product innovation. In addition, the control variables—including firm size, firm age, R&D, technology licensing, and manager experience—are significantly correlated with new product innovation.

To avoid the endogeneity concern, following Lee and Weng (2013), we used the average corruption level by other firms operating within the same industry and location (city) as the instrumental variable. The results of the ordinary least squares (OLS) and instrumental variable (IV) regressions are shown in Table 3. The results of Model 1 in Table 3 show that the control variables—including exports, size, SOEs, manufacturing sector, R&D, technology license, manager experience, city size, and business city—have significant effects on new product innovation.

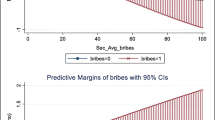

The results of Model 1 in Table 3 show that corruption exerts a significant positive effect on new product innovation, providing support for H1. This finding indicates that corruption can earn higher investment returns by increasing new product sales. Models 2 and 3 added the interaction terms into Model 1. To reduce the potential concern for multicollinearity, the independent and moderator variables were mean-centered before the creation of interaction terms. The results of Model 2 indicate that policy instability moderates the relationship between corruption and new product innovation, providing support for H2. This finding indicates that policy instability significantly affects the role of corruption as a facilitator of new product innovation. To facilitate interpretation, we plotted this significant interaction effect in Fig. 2. Figure 2 suggests that for firms in the context of greater policy instability, the positive relationship between corruption and new product innovation is stronger.

The results of Model 3 imply that competitive threats from the informal sector moderate the relationship between corruption and new product innovation, providing support for H3. Similarly, we plotted this significant interaction effect in Fig. 3. As demonstrated in Fig. 3, the positive relationship between corruption and new product innovation is stronger when firms face greater competitive threats from the informal sector.

Robustness Tests

To test the robustness of our main findings, we conducted three complementary analyses. First, we used panel data from an expanded sample of 27 transition countries (WBES) that faced similar institutional environments as China from 2008 to 2013 to further test the effect of corruption on new product innovation. The results shown in Table 4 indicate that corruption exerts a significant positive effect on new product innovation and that policy instability and competitive threats from the informal sector positively moderate the relationship between corruption and new product innovation. We confirm that the findings of the transnational sample are consistent with the Chinese sample, thereby providing additional support for our conclusions.

Second, following previous works (e.g., Zhang and Li 2010), we applied two new measures for the dependent variable of “new product innovation” to test the robustness of the relationship between corruption and new product innovation. First, we used the question on the World Bank questionnaire that asked “Over the last 3 years, what type of innovation activities has your company engaged in?” to measure new product innovation (i.e., “new product innovation composition”), with eight possible response items: (a) introducing new technology and equipment, (b) introducing new quality control procedures, (c) introducing new managerial processes, (d) providing technology training for staff, (e) introducing a new product or service, (f) adding new features to existing products or services, (g) reducing production costs, and (h) improving production flexibility. For these items, we coded firms with a “1” for those that answered “yes” to at least one of the items above and “0” otherwise. We also used another question on the World Bank questionnaire that asked “In the last 3 years, has your company introduced any new products or services?” to measure new product innovation by using a dummy variable (i.e., “new product innovation dummy”). We coded firms with a “1” for those that answered “yes” and “0” otherwise. Because the dependent variable is a dummy variable, we adopted the logit model to estimate the relationship between corruption and new product innovation. As shown in Table 5, the robustness results suggest that the two new measures for new product innovation provided additional support for our findings.

Third, we applied a new measure for the independent variable of “corruption” to test the robustness of our findings. Following previous work (e.g., Iriyama et al. 2016), we used the question on the World Bank questionnaire dealing with firms’ possible informal payments to measure corruption, namely, “Has your company been expected or requested to provide an informal gift or payment by government officials to obtain approval on applications for (a) an electrical connection, (b) a water connection, (c) a telephone connection, (d) a construction-related permit, (e) any of these inspections or meetings, (f) an import license, or (g) an operating license?” We coded firms with a “1” for those that answered “yes” to at least one of these options and “0” otherwise. The robustness results, shown in Table 6, suggest that the new measure for corruption remains positive and significant, thereby providing support for our findings.

Post hoc Analysis

Our empirical evidence and various robustness tests suggest that corruption demonstrates a positive effect on firms’ new product innovation in transition economies. However, this finding is not consistent with the work of some previous researchers, who have argued that corruption impedes firms’ operations and growth (e.g., Waldemar 2012; Zhou and Peng 2012). Thus, we conducted the following post hoc analyses: (a) adopting an additional moderator, institutional development, to investigate why corruption was found to have a positive effect on firms’ new product innovation in our research setting; and (b) adopting two additional moderators, SOEs and exports, to investigate whether institutional embeddedness affects the relationship between corruption and firms’ new product innovation in our research setting.

Institutional weaknesses in transition economies impede the functioning of market selection forces, which may affect firms’ strategic decisions and behaviors (Chang and Wu 2014). In this respect, corruption may be a substitute for formal market and legal institutions in the absence of the latter. Thus, firms’ innovation behaviors are actually distorted by weak institutional systems in transition economies. Given that corruption is a function of distinct institutional contexts (Nguyen et al. 2016), we argue that the relationship between corruption and new product innovation will be affected by the level of institutional development. Here, institutional development is defined as the degree of adherence to free-market policies or level of market orientation (Shinkle and Kriauciunas 2010). When the level of regional institutional development is high, free-market conditions can provide financial incentives, regulatory frameworks, and intellectual property protections for firms’ new product innovation activities (McCann and Bahl 2017). Accordingly, firms can gain a competitive advantage by implementing the market strategy of new product innovation. Moreover, as the institutional systems develop further, firms may experience less government invention when engaging in innovative activities. Thus, in the context of a high level of institutional development, according to the transaction cost theory, corruption, which acts like a tax on firms by imposing operational and innovation investment costs on them, will reduce a firm’s profits from its innovations (Athanasouli and Goujard 2015; Ayyagari et al. 2014). Hence, we propose that as the level of institutional development increases, the effect of corruption on firms’ new product innovation will gradually decrease.

The marketization index, constructed by the National Economic Research Institute (NERI), captures the progress of marketization in China each year (Chang and Wu 2014). A high level of marketization denotes an elevated level of institutional development (Shinkle and Kriauciunas 2010). Hence, we used the NERI marketization index as the proxy variable for local institutional development to test the effect of institutional development on the relationship between corruption and new product innovation. The results shown in Table 7 indicate that the level of institutional development weakens the relationship between corruption and new product innovation. Thus, the post hoc analysis suggests that the potentially positive effect of corruption on new product innovation is attributable to institutional loopholes and barriers in transition economies; as the level of institutional development increases, the effect of corruption on firms’ new product innovation may gradually decrease.

Second, we used SOEs and exports as additional moderators to analyze the effect of corruption on different types of firms to further test the potential effect of the institutional embeddedness on the relationship between corruption and new product innovation. The results shown in Table 8 suggest that corruption may bring more innovation benefits for SOEs compared to non-SOEs. Because SOEs that usually have a good and close relationship with government officials can easily obtain policy information, government support, and resources for innovation (Zhou et al. 2017), the effect of corruption on new product innovation in transition economies is strengthened for SOEs compared to non-SOEs. Although the results in Table 8 indicate that the interaction of ‘exports × corruption’ is not significant, the negative value reveals that corruption may bring less innovation benefits for exporting firms compared to non-exporting firms. The possible reasons are that exporting firms whose product sales mainly focus on overseas markets tend to experience less government invention than non-exporting firms in engaging in innovative activities. Hence, excessive corruption for exporting firms may impede their innovation by weakening the business environment needed to support innovation activities (Anokhin and Schulze 2009). Moreover, exporting firms also face corruption risks abroad; hence, they orient more toward global anti-corruption norms. Thus, the effect of corruption on new product innovation in transition economies may be weakened for exporting compared to non-exporting firms. Hence, the effect of corruption on firms’ new product innovation depends on the level of institutional embeddedness.

Discussion and Implications

In recent years, corruption has become an important non-market strategy for improving the new product innovation of firms in transition economies. However, compared with the substantial literature on corruption and economic efficiency/growth, research on the theoretical relationship between corruption and innovation is meager (Nguyen et al. 2016). We fill this gap in the literature by examining the relationship between corruption and new product innovation using data from 2099 firms in China. Our empirical evidence suggests that corruption has a positive effect on firms’ new product innovation. In this respect, corruption can help firms in transition economies overcome government ineffectiveness, bureaucratic red tape, and rigid malfunctioning institutions, thereby enabling them to obtain more innovation resources and sustain their innovation strategies (Dreher and Gassebner 2013). However, our findings are not consistent with previous studies that reveal that corruption may result in increased transaction costs, less transparency, and more inefficient markets (e.g., Fisman and Svensson 2007; Waldemar 2012). In this regard, we provide some underlying mechanisms for this discrepancy using post hoc analysis, which will be analyzed in the following sections.

Our findings also indicate that policy instability strengthens the effect of corruption on firms’ new product innovation. A deeper reason is that institutional barriers increase the level of policy uncertainty, which strengthens the effect of corruption on firms’ innovation. In transition economies, government officials have a high level of discretion over both resource allocation and law enforcement (Zhou and Peng 2012). Furthermore, the greater burden of government regulation makes the rules more confusing to comply with and more opaque (Mudambi et al. 2013). Therefore, firms must expend more time in their governmental relationships, which often means offering more gifts to government officials to acquire the necessary resources for new product innovation. Thus, when stable policies are lacking, corruption is considered a feasible solution for firms who seek innovation.

Moreover, our findings reveal that competitive threats from the informal sector strengthen the role of corruption in facilitating firms’ new product innovation. Informal sector firms have become an important part of transition economies in recent years. However, corruption has become deeply rooted for another reason, namely the fierce competition between the formal and informal sectors in transition economies. Under increasing competitive pressure from the informal sector, formal firms need to sustain their competitive advantage by giving gifts and cultivating relationships with government officials (Peng and Luo 2000).

Our post hoc analysis provides the rationale for our findings as to why corruption has a positive effect on firms’ new product innovation in our research setting. First, using the NERI marketization index, we reveal that institutional development weakens the relationship between corruption and new product innovation. As institutional systems develop, corruption may act as a barrier by increasing a firm’s operational and innovation investment costs (Athanasouli and Goujard 2015; Paunov 2016). In particular, as the level of institutional development increases, both policy instability and competitive threats from the informal sector are likely to be gradually reduced (Assenova and Sorenson 2017). Therefore, the positive effect of corruption on firms’ new product innovation may be gradually decreased; even in the medium to long run, the negative effect of corruption may outweigh the positive effect. For example, in China, as the pro-market institutional reform develops further, the vigorous anti-corruption campaign in recent years has imposed enormous costs for corrupt firms because corruption disclosures and scandals undermine their legitimacy (Pfarrer et al. 2008) and cause them to incur regulatory sanctions as well as social sanctions (Schembera and Scherer 2017). Further, a lack of legitimacy due to corruption will impede firms’ access to stakeholder support and innovative resources and cause them to face a higher probability of failure (Elsbach 2003).

Second, we find that the effects of corruption on firms’ new product innovation differ depending on firm type. Our findings indicate that corruption may create more innovation benefits for SOEs compared to non-SOEs. Our findings suggest that excessive corruption for non-SOEs may increase their operational costs because firm managers must use more resources to address public sector requirements (Athanasouli and Goujard 2015) and increase their innovation investment costs if government permits and services become more expensive or difficult (Anokhin and Schulze 2009; Paunov 2016), thereby hampering their motivation for innovation. Overall, using the institutional perspective, our findings suggest that the effect of corruption on firms’ new product innovation depends on the levels of institutional development and institutional embeddedness.

Ethical Implications: A Dilemma

Innovation and corruption are both important issues in the context of transition economies. Some scholars argue that issues related to corruption may be a function of institutional contexts, within which moral decisions regarding business are made (e.g., Nguyen et al. 2016). Thus, we argue that firms in transition economies face a dilemma between their new product innovation and unethical behavior. In particular, in the context of unstable policy and a greater threat from informal sectors, the institutional barriers impel the supply side of bribery of firms; thus, the firms operate in a perceived absence of institutional order with endemic corruption. Therefore, firms in weak institutional environments may face significant moral dilemmas because they often must work within the context of a corrupt system to survive (Dyer and Mortensen 2005).

Accordingly, one question raised is why unethical business behaviors (i.e., corruption) are prevalent in weak institutions in transition economies. Two possible reasons are that they serve (a) as an active measure for firms to sustain their resource stock and to pursue new competitive advantage or (b) as a passive defense against various bureaucratic inefficiencies and institutional weaknesses. However, regardless of the exact reasons, this troubling phenomenon is rooted in inherent institutional weaknesses. The institutional context in transition economies is characterized by an underdeveloped institutional framework, an ineffective legal system, less developed capital markets, and pervasive government intervention (Iriyama et al. 2016; Paunov 2016). In this context, the opportunity to access innovation resources is unfair, and massive amounts of red tape interfere with the normal business transactions (Huang and Rice 2012). Thus, corruption is seen as a substitute for formal institutional support in a weak institutional environment (de Jong et al. 2012), and firms are likely to make informal payments to obtain the relevant innovation resources or speed transactions with the government (Bardhan 1997). In addition, the context of policy instability and the greater threat from informal sectors in transitional economies lead to an overemphasis on market-oriented values in the pursuit of profit, which may create the potential for moral hazards in managerial behavior, such as bribery and corruption.

In the above analysis, we discussed the reasons for this result in our setting. Based on the results of post hoc analysis, even if firms may enjoy short-term benefits from corruption or bribery, they may suffer from long-term problems during the phases of growth and innovation. Given that corruption is an illegal activity, a positive effect of corruption is rarely achieved in the long run, especially as the level of institutional development increases. Moreover, corrupt officials are usually open to a smaller number of firms they know well (Paunov 2016). Accordingly, corruption can actually create artificial barriers for other non-corrupt firms because it leads to the misallocation and inefficient use of resources, undermines fair market competition and the foundations of institutional trust, and creates disincentives for non-corrupt firms in the process of new product innovation. Some firms may benefit individually from corruption at the expense of others, but the practice remains fundamentally negative for the entire economy (Bhagwati 1982). Given that corruption is an unethical behavior that may damage the ethical fibers of society (Bryant and Javalgi 2016), we need to hold a rational view of its short-term positive effects. As described below, we need to pay more attention to the “traps” behind this unethical behavior.

The first “trap” of corruption is that although firms may accelerate their new product innovation via gift-giving in the short term, bribery also increases the costs of business innovation. According to Ayyagari et al. (2014), corruption acts as a tax on firms by increasing the cost to innovate. This is particularly true if corrupt officials prefer to engage in longer term relations with firms to reduce the risks of being caught (Paunov 2016). As such, bribery may evolve into a form of strategic investment for firms in the long term (Luo 2004). From the supply side, it should be made clear that corruption is a potential shortcut for firms to achieve new product innovation in the short term. However, in the long run, it may indeed jeopardize firms’ long-term survival (Huang and Rice 2012). Specifically, under the context of policy instability, government services become both more expensive and more uncertain (Paunov 2016); thus, firms are likely to pay more bribes to obtain the necessary resources or to receive permits. Hence, corruption will impose a greater innovation investment cost that may reduce a firm’s profits from its innovations. Here, a firm may have to adopt cheaper and more inefficient production technologies rather than investing in long-term innovation.

The second “trap” of corruption is that although new product innovation via corruption can have positive effects in our research setting, it also causes tremendous damage to firms, creating the potential for moral hazards in managerial behavior. Given that corruption in any form is thought of as something like a disease that causes many social and economic ills (Bryant and Javalgi 2016), an entire firm is likely to be blamed for the corrupt acts of its members, and the firm may face dire economic consequences and a deteriorated reputation (Aguilera and Vadera 2008). In addition, as Pelletier and Bligh (2008) note, emotional reactions to the unethical conduct of top managers are frequently antecedents to undesirable employee and organizational outcomes. As such, corruption as an unethical behavior may well undermine a firm’s ethical culture, thereby indirectly damaging employee behaviors. Overall, we argue that fighting against corruption is vital to highlight the true costs of this behavior and its potential major damage, or “trap,” to firms in the long run.

The ethical dilemma only holds in the short run. First, as institutional systems develop further, corruption as a barrier to firms may impose enormous costs on them (Athanasouli and Goujard 2015; Paunov 2016). In particular, when corruption benefits are less than the losses or costs caused by corruption, corruption appears to no longer be an effective non-market strategy for firms. Second, China has established the goal of building the rule of law,Footnote 2 along with deepening market-oriented institutional reforms, and policy instability and competitive threats from the informal sector may be decreasing. Accordingly, the living space of corruption may become smaller. Third, given that corruption that violates social norms will damage firms’ legitimacy (Pfarrer et al. 2008), as the level of institutional development increases, firms tend to actively participate in anti-corruption campaigns by formulating anti-corruption policies. Meanwhile, institutional environments will also prioritize anti-corruption practices (Schembera and Scherer 2017). Therefore, the ethical dilemma may dissolve in the long run.

Managerial Implications

Given that corruption remains a widespread phenomenon in transition economies in recent years, our findings have important implications for practitioners and policy-makers concerned with the management of corruption, innovation, and business-government relations. This study reveals how firms’ management practices depend on the institutional environment. First, policy instability and an informal economy may influence firms’ application of non-market strategies (i.e., corruption). Second, the development of institutional systems may weaken the role of corruption as a non-market strategy for firms.

First, our findings have important implications for governance and institutional reform in transition economies. Given that firm-level ethical choices are often influenced by their institutional environments (Martin et al. 2007), and the control of corruption and its relationship with innovation is a complex issue (Anokhin and Schulze 2009), our results suggest that the key to solving the ethical dilemma lies in the development of institutional systems. Thus, governments in transition economies should continue to promote pro-market institutional reform to reduce the potential of policy instability and an informal economy to inhibit the application of corruption as a non-market strategy. More specifically, governments should curtail their officials’ discretion for allocating resources, enhance the effectiveness of public services, and improve the transparency and integrity of legislation. Then, government policies should focus on controlling corruption and stimulating new product innovation by developing objective criteria and creating equal conditions whereby firms receive innovation-related government services (Paunov 2016). Moreover, creating a good ethical climate is vital to controlling the corruption in transition economies. Here, governments should not only develop effective policies to improve the business ethics climate but should also encourage public procurement officers to develop favorable moral schema through socialization and training (Ntayi et al. 2013).

Second, managers should have a clear understanding of the role of corruption. Our results suggest that good business–government relations are a valid non-market strategy for improving firms’ new product innovation in low-quality, fierce-market institutional environments. However, the effect of corruption on firms’ output depends on the quality of the institutions (Méon and Weill 2010). Thus, on the one hand, firms should ensure a good balance between new product innovation and the government “guanxi” network to avoid the corruption “traps.” For example, managers may place greater emphasis on improving their innovative performance by shaping their internal operational capabilities. On the other, firms in transition economies should improve their ethical standards and inhibit the use of corruption. If bribery reduction is to be achieved, firms, as the main suppliers of bribes, play a vital role in fighting corruption (Calderón et al. 2009). Hence, firms need to effectively educate top managers and their employees about what is considered legal and moral in the firms’ daily operations (i.e., ethics training). Further, given that top managers are charged with making decisions on behalf of owners and other stakeholders (Collins et al. 2009), they should cultivate a favorable ethical climate to meld their firms’ culture and values to form a foundation for an ethical corporate culture.

Overall, it should be noted that corruption is likely to be one result of the existing institutional environments of a country in the short run; thus, any examination of firm behavior should incorporate such institutional bearings. In the long run, we call for increased integration between firms’ new product innovation and its associated business ethics. In so doing, the economic and social benefits of new product innovation can be enjoyed while the risks to firms and society can be minimized.

Limitations and Future Research

Several limitations need to be addressed. One limitation is that because corruption is seen to be a sensitive topic for firms and corruption data are lacking, we only use informal payments to government officials to measure corruption. Future research may adopt other forms, such as private-to-private corruption, nepotism, and excessive lobbying, to measure corruption comprehensively.

Second, given that corruption is an unethical behavior with potential negative effects, such as corruption disclosures and scandals involving sanctions and costs for firms (Pfarrer et al. 2008; Schembera and Scherer 2017), the positive effect of corruption on firms’ innovation in transition economies is only a short-term effect, and in the medium to long term, corruption may damage firms’ growth and innovation. Thus, to further identify the “sand” side of corruption in the medium to long term, future research should use panel data to explore the dynamic relationship between corruption and innovation along with the evolution of institutional development and institutional embeddedness.

Third, as firms’ behaviors (e.g., anti-corruption practices) may also affect institutional change or development (Castro and Ansari 2017; Schembera and Scherer 2017), examining the interaction mechanism between firm (anti-) corruption and institutional development by using long-term longitudinal data would be another fruitful line of research for future studies.

Nonetheless, our study represents a vital step in deepening the understanding of how non-market strategies and the institutional environment shape the operational decision-making of firms in transition economies. Therefore, the above limitations are critical to expanding this research. We believe that the implications of corruption, as well as its causes and ethical dilemmas, for firms in China could provide important insights into other transitional economies worldwide.

References

Aguilera, R. V., & Vadera, A. K. (2008). The dark side of authority: Antecedents, mechanisms, and outcomes of organizational corruption. Journal of Business Ethics, 77(4), 431–449.

Alexeev, M., & Song, Y. (2013). Corruption and product market competition: An empirical investigation. Journal of Development Economics, 103, 154–166.

Anokhin, S., & Schulze, W. S. (2009). Entrepreneurship, innovation, and corruption. Journal of Business Venturing, 24(5), 465–476.

Assenova, V. A., & Sorenson, O. (2017). Legitimacy and the benefits of firm formalization. Organization Science, 28(5), 804–818.

Athanasouli, D., & Goujard, A. (2015). Corruption and management practices: Firm level evidence. Journal of Comparative Economics, 43(4), 1014–1034.

Ayyagari, M., Demirgüç-Kunt, A., & Maksimovic, V. (2014). Bribe payments and innovation in developing countries: Are innovating firms disproportionately affected? Journal of Financial and Quantitative Analysis, 49(1), 51–75.

Bardhan, P. (1997). Corruption and development: a review of issues. Journal of Economic Literature, 35(3), 1320–1346.

Baucus, M. S., Norton, W. I., Jr., Baucus, D. A., & Human, S. E. (2008). Fostering creativity and innovation without encouraging unethical behavior. Journal of Business Ethics, 81(1), 97–115.

Beets, S. D. (2005). Understanding the demand-side issues of international corruption. Journal of Business Ethics, 57(1), 65–81.

Bhagwati, J. (1982). Directly unproductive, profit-seeking (DUP) activities. Journal of Political Economy, 90(5), 988–1002.

Birhanu, A. G., Gambardella, A., & Valentini, G. (2016). Bribery and investment: Firm-level evidence from Africa and Latin America. Strategic Management Journal, 37(9), 1865–1877.

Bryant, C. E., & Javalgi, R. G. (2016). Global economic integration in developing countries: The role of corruption and human capital investment. Journal of Business Ethics, 136(3), 437–450.

Calderón, R., Álvarez-Arce, J. L., & Mayoral, S. (2009). Corporation as a crucial ally against corruption. Journal of Business Ethics, 87, 319–332.

Castro, A., & Ansari, S. (2017). Contextual “readiness” for institutional work. A study of the fight against corruption in Brazil. Journal of Management Inquiry. doi: 10.1177/1056492617696887.

Chang, S. J., & Wu, B. (2014). Institutional barriers and industry dynamics. Strategic Management Journal, 35(8), 1103–1123.

Chang, S. J., & Xu, D. (2008). Spillovers and competition among foreign and local firms in China. Strategic Management Journal, 29(5), 495–518.

Chen, S., Sun, Z., Tang, S., & Wu, D. (2011). Government intervention and investment efficiency: Evidence from China. Journal of Corporate Finance, 17(2), 259–271.

Collins, J. D., Uhlenbruck, K., & Rodriguez, P. (2009). Why firms engage in corruption: A top management perspective. Journal of Business Ethics, 87(1), 89–108.

Cuervo-Cazurra, A. (2008). Better the devil you don’t know: Types of corruption and FDI in transition economies. Journal of International Management, 14(1), 12–27.

De Castro, J. O., Khavul, S., & Bruton, G. D. (2014). Shades of grey: How do informal firms navigate between macro and meso institutional environments? Strategic Entrepreneurship Journal, 8(1), 75–94.

de Jong, G., Tu, P. A., & van Ees, H. (2012). Which entrepreneurs bribe and what do they get from it? Exploratory evidence from Vietnam. Entrepreneurship Theory and Practice, 36(2), 323–345.

Douma, S., George, R., & Kabir, R. (2006). Foreign and domestic ownership, business groups, and firm performance: Evidence from a large emerging market. Strategic Management Journal, 27(7), 637–657.

Dreher, A., & Gassebner, M. (2013). Greasing the wheels? The impact of regulations and corruption on firm entry. Public Choice, 155(3–4), 413–432.

Dyer, W. G., Jr., & Mortensen, S. P. (2005). Entrepreneurship and family business in a hostile environment: The case of Lithuania. Family Business Review, 18(3), 247–258.

Elsbach, K. D. (2003). Organizational perception management. Research in Organizational Behavior, 25, 297–332.

Escribano, A., Fosfuri, A., & Tribó, J. A. (2009). Managing external knowledge flows: The moderating role of absorptive capacity. Research Policy, 38(1), 96–105.

Fisman, R., & Svensson, J. (2007). Are corruption and taxation really harmful to growth? Firm level evidence. Journal of Development Economics, 83(1), 63–75.

García-Canal, E., & Guillén, M. F. (2008). Risk and the strategy of foreign location choice in regulated industries. Strategic Management Journal, 29(10), 1097–1115.

Henisz, W. J., & Zelner, B. A. (2005). Legitimacy, interest group pressures, and change in emergent institutions: The case of foreign investors and host country governments. Academy of Management Review, 30(2), 361–382.

Hiatt, S. R., & Sine, W. D. (2014). Clear and present danger: Planning and new venture survival amid political and civil violence. Strategic Management Journal, 35(5), 773–785.

Holburn, G. L. F., & Zelner, B. A. (2010). Political capabilities, policy risk, and international investment strategy: Evidence from the global electric power generation industry. Strategic Management Journal, 31(12), 1290–1315.

Huang, F., & Rice, J. (2012). Firm networking and bribery in China: Assessing some potential negative consequences of firm openness. Journal of Business Ethics, 107(4), 533–545.

Hung, H. (2008). Normalized collective corruption in a transitional economy: Small treasuries in large Chinese enterprises. Journal of Business Ethics, 79(1–2), 69–83.

Insead, L. C., & Chatain, O. (2008). Competitors’ resource-oriented strategies: Acting on competitors’ resources though interventions in factor markets and political markets. Academy of Management Review, 33(1), 97–121.

Iriyama, A., Kishore, R., & Talukdar, D. (2016). Playing dirty or building capability? Corruption and HR training as competitive actions to threats from informal and foreign firm rivals. Strategic Management Journal, 37(10), 2152–2173.

Jensen, N. M., Li, Q., & Rahman, A. (2010). Understanding corruption and firm responses in cross-national firm-level surveys. Journal of International Business Studies, 41(9), 1481–1504.

Klingebiel, R., & Rammer, C. (2014). Resource allocation strategy for innovation portfolio management. Strategic Management Journal, 35(2), 246–268.

Kozhikode, R. K., & Li, J. (2012). Political pluralism, public policies, and organizational choices: Banking branch expansion in India, 1948–2003. Academy of Management Journal, 55(2), 339–359.

Lau, C. K. M., Demir, E., & Bilgin, M. H. (2013). Experience-based corporate corruption and stock market volatility: Evidence from emerging markets. Emerging Markets Review, 17, 1–13.

Lau, C. M., Yiu, D. W., Yeung, P. K., & Lu, Y. (2008). Strategic orientation of high technology firms in a transitional economy. Journal of Business Research, 61(7), 765–777.

Lee, S. H., & Weng, D. H. (2013). Does bribery in the home country promote or dampen firm exports? Strategic Management Journal, 34(12), 1472–1487.

London, T., & Hart, S. L. (2004). Reinventing strategies for emerging markets: Beyond the transnational model. Journal of International Business Studies, 35(5), 350–370.

Luo, Y. (2004). An organizational perspective of corruption. Management and Organization Review, 1(1), 119–154.

Luo, Y. (2011). Strategic responses to perceived corruption in an emerging market: Lessons from MNEs investing in China. Business and Society, 50(2), 350–387.

Marquis, C., & Raynard, M. (2015). Institutional strategies in emerging markets. The Academy of Management Annals, 9(1), 291–335.

Martin, K. D., Cullen, J. B., Johnson, J. L., & Parboteeah, K. P. (2007). Deciding to bribe: A cross-level analysis of firm and home country influences on bribery activity. Academy of Management Journal, 50(6), 1401–1422.

Mathias, B. D., Lux, S., Crook, T. R., Autry, C., & Zaretzki, R. (2015). Competing against the unknown: The impact of enabling and constraining institutions on the informal economy. Journal of Business Ethics, 127(2), 251–264.

McCann, B. T., & Bahl, M. (2017). The influence of competition from informal firms on new product development. Strategic Management Journal, 38(7), 1518–1535.

Mendoza, R. U., Lim, R. A., & Lopez, A. O. (2015). Grease or sand in the wheels of commerce? Firm level evidence on corruption and SMEs. Journal of International Development, 27(4), 415–439.

Méon, P. G., & Weill, L. (2010). Is corruption an efficient grease? World Development, 38(3), 244–259.

Montiel, I., Husted, B. W., & Christmann, P. (2012). Using private management standard certification to reduce information asymmetries in corrupt environments. Strategic Management Journal, 33(9), 1103–1113.

Mudambi, R., Navarra, P., & Delios, A. (2013). Government regulation, corruption, and FDI. Asia Pacific Journal of Management, 30(2), 487–511.

Nguyen, N. A., Doan, Q. H., Nguyen, N. M., & Tran-Nam, B. (2016). The impact of petty corruption on firm innovation in Vietnam. Crime, Law and Social Change, 65(4–5), 377–394.

Ntayi, J. M., Ngoboka, P., & Kakooza, C. S. (2013). Moral schemas and corruption in Ugandan public procurement. Journal of Business Ethics, 112(3), 417–436.

O’Toole, C. M., & Tarp, F. (2014). Corruption and the efficiency of capital investment in developing countries. Journal of International Development, 26(5), 567–597.

Paunov, C. (2016). Corruption’s asymmetric impacts on firm innovation. Journal of Development Economics, 118, 216–231.

Pelletier, K. L., & Bligh, M. C. (2008). The aftermath of organizational corruption: Employee attributions and emotional reactions. Journal of Business Ethics, 80(4), 823–844.

Peng, M. W., & Luo, Y. (2000). Managerial ties and firm performance in a transition economy: The nature of a micro-macro link. Academy of Management Journal, 43(3), 486–501.

Pfarrer, M. D., Decelles, K. A., Smith, K. G., & Taylor, M. S. (2008). After the fall: Reintegrating the corrupt organization. Academy of Management Review, 33(3), 730–749.

Roper, S., & Love, J. H. (2002). Innovation and export performance: Evidence from the UK and German manufacturing plants. Research Policy, 31(7), 1087–1102.

Schembera, S., & Scherer, A. G. (2017). Organizational strategies in the context of legitimacy loss: Radical versus gradual responses to disclosed corruption. Strategic Organization, 15(3), 301–337.

Scott, W. R. (2013). Institutions and organizations: Ideas, interests, and identities. Los Angeles: Sage Publications.

Shinkle, G. A., & Kriauciunas, A. P. (2010). Institutions, size and age in transition economies: Implications for export growth. Journal of International Business Studies, 41(2), 267–286.

Shinkle, G. A., & McCann, B. T. (2014). New product deployment: The moderating influence of economic institutional context. Strategic Management Journal, 35(7), 1090–1101.

Tsai, K. H., & Wang, J. C. (2007). Inward technology licensing and firm performance: A longitudinal study. R&D Management, 37(2), 151–160.

Vial, V., & Hanoteau, J. (2010). Corruption, manufacturing plant growth, and the Asian paradox: Indonesian evidence. World Development, 38(5), 693–705.

Waldemar, F. S. (2012). New products and corruption: Evidence from Indian firms. The Developing Economies, 50(3), 268–284.

Webb, J. W., Bruton, G. D., Tihanyi, L., & Ireland, R. D. (2013). Research on entrepreneurship in the informal economy: Framing a research agenda. Journal of Business Venturing, 28(5), 598–614.

Webb, J. W., Tihanyi, L., Ireland, R. D., & Sirmon, D. G. (2009). You say illegal, I say legitimate: Entrepreneurship in the informal economy. Academy of Management Review, 34(3), 492–510.

Wright, M., Filatotchev, I., Hoskisson, R. E., & Peng, M. W. (2005). Strategy research in emerging economies: Challenging the conventional wisdom. Journal of Management Studies, 42(1), 1–33.

Wu, J., & Zhao, H. (2015). The dual effects of state ownership on export activities of emerging market firms: An inducement–constraint perspective. Management International Review, 55(3), 421–451.

Zhang, Y., & Li, H. (2010). Innovation search of new ventures in a technology cluster: The role of ties with service intermediaries. Strategic Management Journal, 31(1), 88–109.

Zhou, K. Z., Gao, G. Y., & Zhao, H. (2017). State ownership and firm innovation in China: An integrated view of institutional and efficiency logics. Administrative Science Quarterly, 62(2), 375–404.

Zhou, X., Han, Y., & Wang, R. (2013). An empirical investigation on firms’ proactive and passive motivation for bribery in China. Journal of Business Ethics, 118(3), 461–472.

Zhou, J. Q., & Peng, M. W. (2012). Does bribery help or hurt firm growth around the world? Asia Pacific Journal of Management, 29(4), 907–921.

Acknowledgements

This study was funded by the National Natural Science Foundation of China (Grant Number: 71472118; 71472063; 71772118). The authors also thank the anonymous referees for their valuable suggestions.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

All authors declare that they have no conflict of interest

Informed Consent

This article does not contain any studies with human participants or animals performed by any of the authors.

Rights and permissions

About this article

Cite this article

Xie, X., Qi, G. & Zhu, K.X. Corruption and New Product Innovation: Examining Firms’ Ethical Dilemmas in Transition Economies. J Bus Ethics 160, 107–125 (2019). https://doi.org/10.1007/s10551-018-3804-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-018-3804-7