Abstract

In this paper, we analyze the extent to which process or product innovation accentuates or mitigates the corruption obstacle for Tunisian firms. Using firm-level data from the World Bank Enterprise Survey conducted in 2013, we empirically test how innovation accentuates or mitigates the corruption obstacle. We show that innovation has a negative and statistically significant effect on the corruption obstacle. Besides, we prove that competition and the obstacle to corruption are negatively related. This result teaches that the Tunisian firms face a rent-shifting corruption.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Innovation is generally known as the key factor in firms’ competitiveness. It is also the major driver of countries’ economic development. There are a considerable number of theoretical and empirical academic studies dealing with innovation. Many of them have focused on analyzing the relationship between innovation and firms’ economic performance.Footnote 1 Other works have been interested in identifying the factors boosting companies to innovate.Footnote 2 On the other hand, very few are the studies that have investigated the magnitude of the barriers to innovation. These barriers contribute to preventing innovation and slowing down its process (e.g., lack of funding, difficulties in finding skilled employers, legislative barriers, and inability of cooperating with good partners). Mohnen and Rosa (2001) used survey data on Canadian firms to identify factors that explain the perception of barriers in the communications, finance, and technical service industries. In addition, Mohnen et al. (2008) studied the importance and the effect of financial constraints on innovation in the case of Dutch firms. Recently, Sandra (2013) has identified barriers to organizational innovation.Footnote 3 She based her analysis on the study of 35 semi-directive interviews conducted in six French industrial firms.

Although the aforementioned studies point to the existence of factors that inhibit innovation, they nevertheless give little importance to the obstacles related to a country’s institutional quality, namely corruption. Corruption has always been among the most important concepts that economists and practitioners have debated for decades. The majority of them have been interested in analyzing its causes and consequences. They have also provided some policy considerations and solutions to this practice. The major questions they have mainly addressed are the following: is corruption always harmful? If so, how to reduce and/or avoid it? What are the tools to battle it? Corruption is ascribed numerous definitions. For instance, Transparency International defines it as “the abuse of entrusted power for private gain. It can be classified as grand, petty and political, depending on the amounts of money lost and the sector where it occurs”.Footnote 4 The World Bank regards it as “the single greatest obstacle to economic and social development. It undermines development by distorting the role of law and weakening the institutional foundation on which economic growth depends”.Footnote 5 Corruption has several forms, such as bribery, extortion, fraud, falsification, and informal practices.

As shown in the literature, corruption has no precise economic impacts (for further details, see the literature review below). Some works regard it as a good contributor to the economic growth and performance. In this vein, it was argued that its effect can be positive in some situations. For instance, bribes can be used to improve the quality of public services. The main argument stipulating that corruption can have beneficial effects is known as the “grease the wheels” hypothesis. Other works link corruption to the worst way through which political and public decision-makers govern the country’s affairs; corruption has then a tendency to harm the nations’ well-being. Under a corrupt system,Footnote 6 the wealth of the nation is, typically, in the hand of a limited number of corruptors who somewhat handle and manage institutions to the latter’s best interests.

The negative consequences of corruption can be perceived at the micro and macro levels. At the micro-level, corruption reduces firms’ competitiveness and limits their market power. In this setting, Antonio and Bob (2014) argue that “Firms have no incentive to improve product quality, and the productivity gains and innovation that would come from new firms is halted. In other words, [corruption] undermines the competitiveness of the economy, hampering investment and the creation of jobs”.Footnote 7 At the macro-level, corruption is a factor of economic recession. It decreases the GDP per-capita, lowers the economic development, intensifies social instability, implies higher unemployment and inflation rates, etc. (Mauro 1995; Fisman and Svensson 2007; Beltrán 2016). It may also inhibit the foreign direct investors (Wei 2000; Egger and Winner 2005). It strengthens the informal economy which, in turn, undermines the public-private relationships.

Although entrepreneurs have always a tendency to overcome the corruption magnitude through undertaking innovation efforts, corruption per se remains an obstacle and/or a big problem that impede these efforts. Actually, the relationship between corruption and innovation is considered a new topic. It is a groundbreaking issue to which intellectuals in the field are going to pay a particular attention.

As proven in the literature, corruption in the developed countries has been, in some way, effectively contained (Dirienzo and Das 2014). However, scholars have shown that corruption is becoming a dominating phenomenon in the third world. Thus, it is well-observed that the intensity of corruption is larger in the developing and/or emerging countries. This is linked to the weak social, economic, and political infrastructures in these countries. For instance, according to the enterprise survey realized by the World Bank in 2013, 54.78% of Egyptian companies identify corruption as a major or serious problem and 45.18% of Moroccan firms consider corruption as a severe constraint. Tunisia, our case of study, also suffers from corruption. In 2019 and according to the CPI of Transparency International, Tunisia is ranked the 74th among 180 countries and territories in terms of corruption.Footnote 8 According to the Global Financial Integrity (hereafter GFT), the Tunisian GDP decreases yearly by 2% because of corruption. GFT assessed that Tunisia has lost 1.2 billion dollars every year between 2000 and 2008. This is caused by bribes, subordination, and falsification of the criminal activities.Footnote 9 This bad practice is mainly related to the corrupt political systems that had governed Tunisia before the 2011 Revolution and even during the democratic transition. The country’s resources and the education systems have also deteriorated. Furthermore, the wealth distribution is distinctly oriented to the coastal regions where resident and foreign capitalists are willing to invest.Footnote 10 As argued by Yahyaoui (2009): “Those in power enjoy an aura of prestige and privilege, which sets them above the law and ordinary people. They allow bribery and irregularity, and manipulate public money, which eventually lead to corruption, smuggling boom, and the rise of parallel trade, counterfeit goods, which is often based on the ascendant crime networks”.Footnote 11

Tunisian companies have always had a tendency to increase their R&D efforts to lower their marginal production costs (i.e., process innovation; aiming to achieve economies of scale) and therefore to obtain competitive advantage in the final market (market power).Footnote 12 These companies seek to improve the quality of their products and thus increase the range of the varieties on the market (i.e., product innovation; to extract the consumers’ surplus). Thus, the extent to which corruption is an obstacle to the innovation activities is likely to be their main concern.

The post-Revolution governments have devoted larger efforts to help Tunisian firms to enlarge their innovation portfolios. For instance, the use of the new ICT becomes remarkable and the R&D-related reform programs are increasing. Yet, the corrupt system continues to be solid. It reaches the majority of the business activities, in particular those related to the R&D and innovation activities. The corrupt officials cooperate with lobbies and politicians in order to prevent the rising of new products and technological processes that do not belong to the lobbies’ coalition.

In Tunisia, to reinforce the links within the innovation system, policies do exist but the innovation ecosystem is still emerging. According to the Strategic Economic and Social Development Plan,Footnote 13 the reforms will be oriented towards the constitution of a national innovation system, with the creation of techno-parks and the establishment of partnerships between universities, firms, and research institutes. The aim is to attract investment in activities with high added-value technologies. Thus, the investigation of the Tunisian innovation ecosystem shows strong incentives for the development of ICT sectors. This holds even if many obstacles exist, in particular the ineffectiveness of the implementation of political plans and the lack of cooperation between the public and private sectors.

Despite the abundance of the literature on innovation, the analysis of the relationship between innovation and corruption remains a noteworthy issue. Empirical studies on this relationship are rather limited for developing countries, Tunisia in particular. Therefore, it is necessary to empirically investigate the hypothesis claiming that corruption can alter Tunisian firms’ innovation.

The scope of this paper is then to analyze the extent to which (process or product) innovation accentuates or mitigates the corruption obstacle for Tunisian firms.

To address this issue, we organize our paper as follows. “Innovation and Corruption: Literature Review” presents a literature review on the relationship between innovation and corruption. “The Empirical Model” contains a description of the data set, the variables used in the empirical analysis and the econometric model. “Estimation Results” analyzes the main results. “Conclusions, Implications, and Future Research” is devoted to conclusions, implications and future research.

Innovation and Corruption: Literature Review

During the last two decades, corruption has been widely investigated academically. Some empirical studies discussed the relationship between corruption and economic growth. Their results were divergent. Some of them have shown that corruption can have a negative impact on economic growth. For instance, Mauro (1995) and Wei (2000) proved that corruption constitutes an obstacle for the economy because it hampers the economic growth. Rock and Bonnett (2004) focused on the relationship between corruption, growth, and investment. They found that, in small developing countries, corruption slows growth and/or reduces investment. However, this result is inversed in the case of the large East Asian newly industrializing economies. Other frameworks analyzed the effect of corruption on the Foreign Direct Investment (FDI). Castro and Nunes (2013) investigated the impact of corruption on FDI inflows. Using 73 countries during the period 1998–2008, they suggest that the FDI inflows are greater in countries where corruption is lower. Further, they noted that corruption control can be an important strategy to enhance the FDI inflows. Using a random set of Ugandan firms across the main industrial categories during the period 1995–1997, Fisman and Svensson (2007) deduced that bribery payments and the taxation rate negatively affect the firms’ growth. They noticed that this result concords with the firm-level corruption theories. Beltrán (2016) tested the corruption-employment relationship. She used a representative data for Latin American firms. The author showed that corruption, measured by bribes, decreases employment.

Some other works showed that corruption could have a positive impact on economic growth. For instance, Barreto (2001) determined a positive relationship between corruption and GDP per-capita growth. Thereby, Lau et al. (2015) indicated that corruption “greases the wheels” of economic growth for countries in the European and Central Asia (ECA) region. Egger and Winner (2005) found a positive relationship between corruption and FDI. These authors suggested that corruption is a key factor that encourages FDI. Vial and Hanoteau (2010) showed that corruption, measured as bribes and indirect tax payments, has a positive effect on firms’ growth. In addition, other scholars such as Alexeev and Song (2013) analyzed the correlation between competition and corruption. They deduced that fierce competition is associated with higher corruption.

It is often argued that corruption, whatever its forms, has harmful effects on business operations. Indeed, it eventually reduces employment, hinders the entry of FDI, reduces firms’ competitiveness, and creates inequality. But what about the innovation-corruption relationship? To answer this question, a stream of empirical studies is growing. Lau et al. (2015) analyzed the determinants of product innovations. They proved that corruption promotes countries’ innovative capabilities in the ECA region. Nguyen et al. (2016) showed that, for Vietnamese firms, informal payments encourage innovation. These authors revealed that, in the short run, bribery has a negligible effect but it facilitates innovation (they interpret innovation as a short run objective). Indeed, the positive effect of innovation may more than compensate the negative effect of bribery.Footnote 14 This result supports the “grease the wheels” hypothesis. Mahagaonkar (2010) ascertained that corruption has a positive effect on marketing innovation and a negative effect on product innovation and organization innovation. Waldemar (2012) concluded that corruption reduces the probability to innovate. Nguyen and Jaramillo (2014) argued that the firms’ return on innovation is lower in countries with a low institutional quality level. They relate this result to the fact that bad institutional environments discourage firms to innovate. In the same context, Dirienzo and Das (2014) found that corruption represents a major obstacle for countries’ innovation activities. These authors noticed that this effect is mitigated in wealthier countries. Goedhuys et al. (2016) indicate the negative effect of corruption on the probability to innovate.

In the context of this literature review, questions remain limited to whether innovation is affected by corruption problem. It is interesting to know whether corruption is a major obstacle when the firm starts to innovate. To the best of our knowledge, the only paper that has addressed this issue is Wong (2015). Using cross-sectional data from the World Bank Enterprise Survey covering 26 African and Latin American/Caribbean countries in 2006, Wong (2015) finds that innovative firms see corruption as a major problem compared to non-innovating ones.

We draw on Wong (2015) by examining the innovation-corruption relationship in the Tunisian context. In this regard, we analyze how Tunisian firms perceive corruption. Is it considered an obstacle for the Tunisian firms’ innovation? To this end, we formulate the following assumptions (see Fig. 1):

Figure 1 is a schematic representation of the theoretical links between corruption obstacle, process innovation, and product innovation. Therefore, we expect the product or process innovation to negatively affect corruption obstacle. Thus, H1 and H2 are stated as follows:

-

H1: Product innovation is negatively associated with corruption obstacle.

-

H2: Process innovation is negatively associated with corruption obstacle.

The Empirical Model

Data Source

To test how innovation fosters the corruption obstacle, we used the Enterprise Survey data carried out by the World Bank in 2013.Footnote 15 The data were collected in partnership with the European Bank for Reconstruction and Development (EBRD) and the European Investment Bank (EIB). The World Bank Enterprise Survey (hereafter WBES) is carried on firm-level surveys to a representative sample of firms in the non-agricultural formal sector in an economy including manufacturing, retail, and service firms. The WBES relied on interviews with companies that belong to the abovementioned sectors. To warrant the representativeness of the sample, the WBES data are collected through a stratified random sampling by using the industry, region of establishment location, and establishment size.Footnote 16 Indeed, the survey covers small (5 to 19 employees), medium (20 to 99 employees), and large (more than 99 employees) firms from manufacturing (food, garments, and other manufacturing) and services sectors (retail and other services) located in five Tunisian regions (Tunis, Sfax, Northeast, South Coast/West, and Interior).Footnote 17

The questionnaire used for the survey offers a wide range of data. Apart from general information on the firm’s characteristics, the questionnaire includes several sections such as access to finance, competition, capacity, labor, performance, corruption, innovation, and the business environment. The dataset consists of 592 Tunisian enterprises. In this paper, we have dropped the missing responses as well as the “Do not know” and “Does Not Apply” responses from the dataset. This has led to cross section data of 2013 that included only 534 firms in Tunisia.

Definition of Variables

Since the main object is to analyze the effect of the product and process innovation on the corruption obstacle, we describe in what follows the dependent variable and how it was measured.

Dependent Variable

Corruption Obstacle

Prior empirical studies have used different indicators in order to measure corruption. Ades and Di Tella (1999) measured corruption by subjective indicators that are related to the whole country. Barasa et al. (2017) adopted a composite measure of firm-level perceptions of governance of the institutional quality at the regional level. This measure is constructed by using factor analysis so as to synthesize information about the perceptions of corruption, rules of law and regulatory quality. In this paper, we rely on a measure adopted by Wong (2015). This variable answers the question: To what degree is corruption an obstacle to this establishment’s current operations? The answers to this question are ordered according to a 5-point scale ranging from 0 to 4: (0) no obstacle, (1) a minor obstacle, (2) a moderate obstacle, (3) a major obstacle, or (4) a very severe obstacle.

Independent Variables

Innovation

The majority of the previous studies that have focused on the innovation topic measured innovation by the number of patents or the percentage of new product sales (Mairesse and Mohnen 2003). In this paper, we use two innovation indicators. The first one is a dummy variable equal to 1 if the establishment has introduced new or significantly improved products or services and 0 otherwise. The second one is another dummy variable that takes the value 1 if the firm has introduced any new or significantly improved methods of manufacturing products or services and 0 otherwise. These two measures are in accordance with prior research (Wong 2015; Barasa et al. 2017).

Firm Size

The relationship between innovation and firm size has been largely examined in several previous works. Wong (2015) measured the size of the firm using an ordinal variable equal to 1 if the firm is small (with less than 20 employees), equal to 2 if the firm has a medium size (with 20 to 99 employees), and equal to 3 if the firm is large (with 100 or more employees). Barasa et al. (2017) used a binary variable as measure of firm size. This variable takes the value 1 if the number of full-time permanent employees is greater than 20 employees and 0 otherwise. Asiedu and Freeman (2009), in turn, used two dummy variables to measure the firm size. The first variable, relative to a small firm, takes 1 if the number of employees is less than 50 and 0 otherwise. The second variable, corresponding to a medium firm, takes 1 if the number of employees is greater than 50 but less than 500 and 0 otherwise. In this paper, we choose the logarithm of the total annual sales for all products and services as a firm size measure. More precisely, the respondents are asked to answer the following question: “In the 2012 fiscal year, what were this establishment’s total annual sales for all products and services?”

Competition

Wong (2015) and Beltrán (2016) measured competition by a dummy that takes 1 if the numbers of competitors is greater than 5 and 0 otherwise. Because of the low response rate regarding the number of competitors, we used a discrete variable that measures competitive pressure. It takes three modalities depending on the main market in which the establishment sells its main product: local, national, or international.

Finance

We have introduced this variable in our model to know how the surveyed firms fund their operations. We use a dummy variable equal to 1 if the firm has a line of credit or a loan from a financial institution and 0 otherwise.

Exports

In this paper, we use the information provided by the survey about the percentage of the national establishment’s sales. We define exports as a continuous variable that corresponds to the percentage of a firm’s sales outside the country.

Vintage of the Firm

The firm’s vintage is determined by the year when the establishment began its operations. More precisely, this measure indicates the number of years during which the firm has been acting in the market until the year of the survey (2013).

Employee Level of Education

The Enterprise Survey data provides information on the level of education attained by employees. In this paper, we have adopted the number of full-time employees holding a university or higher degree as a measure of the education level attained by employees.

Legal Status of the Firm

In line with Barasa et al. (2017), we measured the legal status of the firm by a dummy variable. The latter takes 1 if the establishment is organized as a shareholding company (with shares traded either in the stock market or privately). It takes 0 if the establishment is organized as a sole proprietorship, partnership, limited partnership, or has another form.

R&D activities

This variable is binary. It takes the value 1 if the firm “spends on formal R&D activities” and 0 otherwise. More precisely, the respondents were asked to answer the following question: “During the last three years, did the establishment spend on formal R&D activities?”

Model Specification and Estimation

We analyze the extent to which innovative companies regard corruption as a major obstacle in comparison with those that do not innovate. Indeed, the responses to the question about the different corruption obstacles are classified according to a 5-point scale. The value 0 designates that corruption does not represent an obstacle for the development of the firm’s operations while the value 4 sets corruption as a very severe obstacle. The ordered structure of the dependent variable corrup _ obst allows the use of ordered discrete choice models. We use an ordered logit model. As the values taken by the ordered multinomial variable corrup _ obst are grouped into intervals, we obtain only one continuous unobservable latent variable corrup _ obst∗. This kind of model assumes that the values are identical for all observations. Indeed, the level of corrup _ obst∗ is parameterized by the threshold parameters cj and a constant is therefore not introduced in the linear model. For this modeling specification, it is not possible to simultaneously estimate both the constant β0 and all cut points (cj). Actually, the introduction of β0 in the model can counteract each cj. To avoid this identification constraint problem, we can either drop the constant from the linear prediction or set the first threshold to zero (Boes and Winkelmann 2006; Jackman 2000).Footnote 18 This model is written as followsFootnote 19:

The threshold parameters cj are in an ascending order (cj + 1 ≥ cj) where the variable \( corrup\_ obs{t}_i^{\ast } \) is defined by:

where Xi represents the vector of the explanatory variables and εiis a random error term which is assumed to have a logistic distribution. The probabilities that corrup _ obsti will take on each of the values 0 to 4 are equal to:

where Λ(.) denotes the standard logistic cumulative distribution function.

The likelihood function of an observation i is:

where yij is defined as:

Parameters β and cj, j = 0, ...4 are estimated using the ordered logit model by maximizing the log-likelihood function.

Estimation Results

Descriptive Statistics

The CPI ranks countries and territories based on how corrupt their public sector is perceived to be. The score 0 indicates that the country is highly corrupt while the score 100 indicates that the country is very clean. According to CPI 2019, Somalia and South Sudan are the most corrupt countries in the world rankings, while the least corrupt countries are Switzerland, Sweden, Singapore, Finland, Denmark, and New Zealand. The latter has a score of 87 allowing it to take the first place. The CPI shows that Egypt ranks 106th with a score of 35. Algeria ranks 106th with a score of 35, followed by Morocco which ranks 80th with a score of 41 points. Compared to these African countries, Tunisia ranks 74th with a score of 43 points.

The Tunisian Institute of Competitiveness and Quantitative Studies (hereafter TICQS) and the WBES are interested in the corruption topic. According to TICQS in 2014, 42% of respondents adjudge that corruption has increased compared to 2013, while 44% declare that corruption has kept the same magnitude.Footnote 20 Although most of the companies surveyed found that corruption still persisted, only 26% of these companies consider it to be a major or severe obstacle that impedes their activities.

The summary statistics relating to our sample show that around 49% of companies indicated that they have introduced at least one innovation.Footnote 21 A total of 25.65% of these companies reported that they have introduced a product innovation during the last three years before 2013, and 23.4% of them mentioned that they have introduced a process innovation (see Table 1 below).

Regarding the relationship between innovation and firm size, the 2012 Investment Climate Assessment Survey (hereafter ICAS) demonstrates that 47% of Tunisian firms have introduced an improved or a new product. According to this survey, large firms report the highest level of innovation (55.8%). In contrast with ICAS, we show that 41.92% of innovative firms are medium-sized (having between 20 and 99 employees). This rate is higher compared to the larger firms. We relate this result to the fact that the medium enterprises are more incentivized to avoid the rude competition they face. Thus, their aim would be to commit in R&D efforts in order to reduce their marginal production costs. It would also be to capture additional market shares by improving the quality of their products.

The WBES survey provides information on the firm’s business sectors. These sectors are classified into five activities: (1) food, (2) garments, (3) other manufacturing, (4) retail, and (5) other services. Based on the data collected from this survey, we also explore the distribution of innovative companies by business sector. We show that the largest number of innovative companies is located in the third sector (34.23%), followed by companies operating in the fifth one (27.69%).

Firm location can also be a factor affecting the innovation decision. The survey defined five regions: Tunis, Sfax, Northeast, South Coast/West, and Interior. According to the World Bank data, Table 1 shows that the shares of innovative Tunisian companies in different regions are very close. Indeed, statistics show that Sfax has a large number of innovative companies (24.23%) followed by Northeast (23.46%), South Coast/West (23.08%), and Tunis (20.38%), while the Interior region is very low on innovation (only 8.85%).

Table 2 shows that 16.41% of innovative firms regard corruption as a major obstacle to the development of their operations. Also, it indicates that 14.5% of innovative firms consider corruption as a very severe obstacle which obstructs their business activities.

Table 3 presents each variable’s means and standard deviations. The table also provides statistical tests based on each coefficient’s variance inflation factor (hereafter VIF). According to Neter et al. (1996), the values of the individual VIF are greater than 10 and the values of average VIF are greater than 6 indicating, hence, a multicollinearity problem. In our context, we notice that the mean VIF is about 1.55 and the VIF of each variable is inferior to 10. According to this result, it is proven that there is no multicollinearity problem between the explanatory variables used in these models.

To check for endogeneity problem, we have utilized an instrumental for innovation (which may be a source of endogeneity) in accordance with the standard two-stage instrumental approach. Following Arundel et al. (2008), we have instrumented the variable “innovation” by the variable “R&D activities.” The Durbin-Wu-Hausman test for endogeneity is shown to be nonsignificant for the two types of innovation, thus indicating the absence of the endogeneity problem (for more details, see Davidson and Mackinnon 1993).Footnote 22

Regression Results

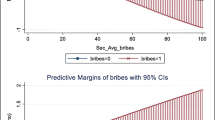

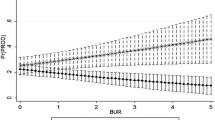

The results of the ordered logit marginal effects are shown in Tables 4 and 5. Table 4 presents the effect of product innovation on the corruption obstacle. The first column of this table shows the results of running an ordered logit model with only the dependent variable for corruption obstacle and the explanatory variable for product innovation (model 1). The estimation results of this model show that the sign of the marginal effect associated with the product innovation variable is negative, and this variable is statistically significant. This means that the introduction of a new product or service lowers corruption. When control variables are added to take into account the firm characteristics (model 2), the marginal effect associated with the product innovation variable keeps the same sign and magnitude. Also, the results show that the R-squared increased. Then, we also add other control variables such as firm size and education (Model 3). We show that with these controls, the sign of the marginal effect of product innovation remains the same. Thus, the effect of product innovation on the corruption obstacle is always both negative and statistically significant. Taking into account the sectors dummy variables (Model 4), we prove that the sign of the marginal effect associated with the product innovation variable is negative, and this variable is statistically significant. Indeed, the R-squared increased compared to the other models.

Table 5 shows the effect of process innovation on the corruption obstacle. Likewise, we adopted 4 models. The estimations results show that the marginal effects associated with the process innovation variable are negative, and this variable is statistically significant for all models. The R-squared has thus increased. Based on these 4 models, we conclude that process innovation has a negative and very significant effect on the corruption obstacle.

These results contradict those obtained by Wong (2015) as they depict that innovation softens the corruption obstacle.Footnote 23 First, we argue that process innovation can be regarded as a substitute to the cost-reducing corruption. Firms do not need, then, to resort to corruption so as to reduce their marginal production costs. For instance, e-banking platforms contribute to prevent corrupt agents from seeking bribes so as to provide some banking services (Bhatnagar 2003). Second, product innovation has a tendency to be also a substitute to the rent-shifting corruption in the sense that firms can capture additional market power by increasing their product varieties. As it is well-known, product differentiation softens competition between firms. Therefore, the firms that invest so as to improve the quality of their products can reduce their willingness to pay bribes. More precisely, they do not need the help of the public officials to access markets or regions where business lobbies act severely.

In line with Emerson (2006), we show that besides the variable of interest Product/Process Innovation, the variable market competition has a negative and statistically significant effect on the perception of corruption (model 2 in Tables 4 and 5). This means that corruption is inversely related to product market competition. We can relate our interesting result to the fact that WBES firms face a corruption related to rent shifting. This contradicts Alexeev and Song’s findings (2013). Indeed, the latter have mentioned that the relationship between competition and corruption depends on the nature of the corruption itself. They have proven that this relationship is positive in the case of a cost-reducing corruption but negative in the case of a rent-shifting corruption. These authors argue that a fierce competition is generally associated with a greater corruption critical level. When a company gains higher profits, it will be considered a source of profit for the corrupt lobbies which, therefore, try to take part of the company’s profitability. To do so, they provide efforts so as to inhibit its smooth operations and urge it to join their corrupt networks. It is for this main reason that the company holding a significant market power regards corruption as a major obstacle for its business activities.

In accordance with this analysis, it may also be important to note that the majority of the industries in Tunisia are composed of SMEs. These undertake business activities that are mainly concentrated on non-durable goods and services. On the one hand, they find themselves in front of a fierce competition because of the increasing entry flows; the availability of the market investment opportunities is a common feature and highly attractive. On the other hand, these SMEs suffer from the speedy innovation process that generally characterizes the Tunisian innovation ecosystem. The Schumpeter’s gale dominates in the sense that any innovation outcome can be easily replaced by new ones. Even with larger R&D efforts, Tunisian firms cannot capture a dominant position in the market that prevents them from competition.

Enterprises’ external funding is very important because of the increasing financial needs they face. For instance, the increase in the credit demand by the firm is used to raise its investment activities and therefore its production. In this paper, we introduce the variable finance in the model in order to analyze the link between obtaining a financial credit and corruption. Indeed, the question we address in this setting is: does having a line of credit or a loan from a financial institution reduce or increase the corruption level? In response to this question, we show that the variable finance is positively correlated with the perceived corruption. The intuition behind this finding is that the increase in credit demand by a firm tends to increase its capital. Therefore, once the company increases its capital, it has a tendency to seduce corruptors who raise their efforts so as to capture some of its rents.

Conclusions, Implications, and Future Research

This paper endeavored to analyze the extent to which Tunisian firms consider corruption as a major obstacle to their operations. Among these activities, we focus on innovation activities. In this paper, we distinguish between product innovation and process innovation. To test our hypotheses, we rely on the World Bank Enterprise Survey conducted in 2013. By using the ordered logit model, we show that both product and process innovation have a negative and significant effect on the corruption obstacle. We suggest that innovation allows firms to break up with the existing corrupted systems through the creation of information and communication technologies (ICT) that, in turn, induce the rise of a new anti-corruption network. Intuitively, we can relate this result, for instance, to the fact that launching new software applications helps agents to disclose on or ban the observed corruption behavior. In addition, the corruptors will incur higher switching costs when they try to decrypt these ICTs and therefore use them for their own interest. Public authorities have also a tendency to adopt these technologies in a bid to handle the corrupt activities. Indeed, the ICT contributes to lessening the corruption obstacle that private and public decision-makers suffer from.

As mentioned above, innovation has always been a key factor that allows firms to earn substantial power in the final market. The efforts undertaken to reach a successful innovation outcome are typically very expensive. The required R&D expenditures are going to increase. Besides, institutional constraints (laws and regulation rules) can also threaten the success of any innovation project. In addition to these innovation obstacles, corruption is also a major barrier that hampers not only the innovation process but also the decision to make it. To overcome the negative effect of corruption on innovation, any government should address some mechanisms. The main results reached in our paper have interesting policy implications not only for the Tunisian firms’ managers but also for the Tunisian government and politicians. Although the country has set up an independent anti-corruption agency since 2014, the “Instance de la Bonne Gouvernance et de la Lutte Contre la Corruption (IBGLCC)”, the relationship between corruption and innovation has been in full debate during the transition period. Our paper adds to this strident debate by generating some results whose interpretation deserves the attention of the Tunisian policy makers. They are advised to boost innovative activities through several measures.

For instance, Tunisian policy makers should do the following:

-

Eliminate the institutional and legislative innovation barriers

-

Enforce e-government services using the ICT technologies

-

Set up an innovation agency that can impede the corruptors to extract the innovation budget or outcome to their own interests

-

Allow a fair access to the governmental information and services

-

Facilitate licensing procedures

-

Help potential innovators to protect their innovation outcomes

-

Offer firms fiscal incentives allowing them to locate out of the coastal region

-

Set up protocols that encourage the partnership between public and private firms

-

Connect the universities and the research institutes with the business environment

-

Extend the network of the R&D facilities across the country

These measures can not only foster innovation in the country but also help reduce the extent of corruption.

We recommend that the public decision-makers should do the following:

-

Disconnect politics from the economy.

-

Ensure political stability in order to give confidence to domestic and foreign investors. This will reduce cooperation by business lobbies and politicians.

-

Invest in new technologies in order to limit the costs of bureaucracy and the extent of petty corruption.

-

Encourage cooperation in R&D between SMEs. For instance, subsidizing any act of cooperation will be crucially useful. The R&D cooperation will transform the market structure from competitive to quasi-monopolistic. This results in higher concentrated industries and limits the illegal role of corrupt officers.

-

Strengthen the capacity of the corruption agency not only by providing the required funding for all its activities, but also by hiring a skilled and specialized workforce.

-

Establish appraisal systems that will play a key role in investigating allegations of corruption and take firm actions when necessary.

Although our study provides important insights regarding the effect of process and product innovation on corruption obstacle, it can be extended in several ways. First, in this paper, we have focused particularly on the Tunisian context; the results might not be generalizable to other countries. Second, due to the limited data availability, we have used a qualitative variable in order to measure corruption. Third, because of the nature of the data collected (cross-section data), we have studied the static effect of innovation on corruption. Fourth, we have limited our analysis to data sets from 2013.

In light of these limitations, the following research perspectives are suggested. First, we propose extending the analysis to a multi-country context, i.e., MENA region in order to make some comparisons. Second, it could also be of interest to use other indicators such as the number of bribes to generalize the results. Third, we note that the dynamic feature of the innovation process could be an important topic to deal with in a future research. Fourth, it would be possible to analyze newest data sets. Finally, the availability of panel data might allow researchers to investigate the causal effect of corruption on innovation in different regions.

Notes

According to OECD ( 2005), a product innovation is the introduction of some significant changes in the product characteristics. Process innovation represents significant changes in methods of both production and distribution. The organizational innovation is defined as the new management forms that firms adopt. The marketing innovation takes the form of carrying on new commercialization methods (for instance, change in the product design, and product pricing method).

For more details, see https://www.transparency.org.

For more details, see https:/www.worldbank.org.

According to the Corruption Perceptions Index (hereafter CPI), a system is said to be corrupt when its score approaches 0.

Antonio and Bob (2014) p 126

For more details, see https://www.transparency.org/news/feature/corruption_perceptions_index_2019.

World Bank (2014): “The unfinished revolution: bringing opportunity, good jobs and greater wealth to all Tunisians”. Report N° 86179-TN, p117

Cited in Murphy and Albu (2017)

In fact, innovation may not always need R&D activities. For some developing countries, innovative activities can be successful without R&D. Thus, the causality between R&D and innovation might not be so clear. We are grateful to an anonymous referee for pointing this out.

Innovative firms have to deposit administrative files for their innovations to be brought to the market. These procedures, especially legal ones, can take a long time. As a result, these firms have a tendency to pay bribes to public officials so as to speed up the implementation of their innovation projects.

Due to the lack of appropriate recent data to carry out such analysis for Tunisia, we were obliged to base our study on data from 2013.

For more details, see http://www.enterprisesurveys.org/Methodology/.

Northeast region is composed of Ariana, Ben Arous, Bizerte, Manouba, and Nabeul. South Coast/West consists of Sousse, Monastir, Mahdia, Gabes, and Medenine, and the Interior region includes Beja, Gafsa, Jendouba, Kairouan, Kasserine, Kebili, Kef, Sidi Bouzid, Siliana, Tataouine, and Tozeur.

We are grateful to an anonymous referee for pointing this out.

For further details, see Greene (2003).

For more details, see the TICQS’s 2014 report.

A firm is regarded as innovative when declaring that it has introduced (during the last three years, i.e., before the date of the survey) product innovation, process innovation, organizational innovation, and marketing innovation.

The estimates relating to the standard two-stage instrumental approach are available upon request.

Even if our results reveal that boosting innovative activities helps mitigating corruption obstacle, one may expect that the reverse can hold, i.e., innovation may strengthen corruption obstacle. For instance, the new innovating firms may face incumbent lobbies that are already used to some strategic tools that inhibit the emergence of new techniques and/or products.

References

Ades, A., & Di Tella, R. (1999). Rents, competition, and corruption. The American Economic Review, 89(4), 982–993.

Alexeev, M., & Song, Y. (2013). Corruption and product market competition: An empirical investigation. Journal of Development Economics, 103, 154–166.

Antonio, N., & Bob, R. (2014). The unfinished revolution: Bringing opportunity, good jobs and greater wealth to all Tunisians. Poverty Reduction and Economic Management Department. World Bank, May 24, 2014.

Arundel, A. , Bordoy, C., & Kanerva, M. (2008). Neglected innovators: How do innovative firms that do not perform R&D innovate? Results of an analysis of the Innobarometer 2007 Survey No. 215, INNO-Metrics Thematic Paper. MERIT March 31.

Asiedu, E., & Freeman, J. (2009). The effect of corruption on investment growth: Evidence from firms in latin america, sub-saharan africa, and transition countries. Review of Development Economics, 13(2), 200–214.

Barasa, L., Kimuyu, P., Vermeulen, P., Knoben, J., & Kinyanjui, B. (2017). Institutions, resources and innovation in developing countries: A firm level approach. Research Policy, 46, 280–291.

Barreto, R. A. (2001). Endogenous corruption, inequality and growth: Econometric evidence. Working paper 01-2, ISSN 1444-8866.

Beltrán, A. (2016). Does corruption increase or decrease employment infirms? Applied Economics Letters, 23(5), 361–364. https://doi.org/10.1080/13504851.2015.1076137.

Bhatnagar, S. (2003). E-government and access to information. In P. Eigen (Ed.), Global corruption report (pp. 24–32). Berlin: Transparency International Press.

Boes, S., & Winkelmann, R. (2006). Ordered response models. Allgemeines Statistishes Archiv, 90(1), 167–181.

Cainelli, G., Evangelista, R., & Savona, M. (2006). Innovation and economic performance in services: A firm-level analysis. Cambridge Journal of Economics, 30(3), 435–458.

Castro, C., & Nunes, P. (2013). Does corruption inhibit foreign direct investment?. Política. Revista de Ciencia Política, 51(1), 61–83. https://doi.org/10.5354/0716-1077.2013.27418.

Crépon, B., Duguet, E., & Mairessec, J. (1998). Research, innovation and productivity: An econometric analysis at the firm level. Economics of Innovation and New Technology, 7(2), 115–158.

Davidson, R., & Mackinnon, J. G. (1993). Estimation and Inference in Econometrics. New York: Oxford University Press.

Dirienzo, C., & Das, J. (2014). Innovation and role of corruption and diversity: A cross-country study. International Journal of Cross Cultural Management, 15(1), 51–72.

Duguet, E. (2006). Innovation height, spillovers and TFP growth at the firm level: Evidence from French manufacturing. Economics of Innovation and New Technology, 15(4–5), 415–442.

Egger, P., & Winner, H. (2005). Evidence on corruption as an incentive for foreign direct investment. European Journal of Political Economy, 21(4), 932–952.

Emerson, P. M. (2006). Corruption, competition and democracy. Journal of Development Economics, 81(1), 193–212.

Fisman, R., & Svensson, J. (2007). Are corruption and taxation really harmful to growth? Firm level evidence. Journal of Development Economics, 83(1), 63–75.

Goedhuys, M., Mohnen, P., & Ans Taha, T. (2016). Corruption, innovation and firm growth : Firm-level evidence from Egypt and Tunisia. Eurasian Business Review, 6(3), 299–322.

Greene, W. H. (2003). Econometric analysis. 5th Edition, Pearson Education India.

Jackman, S (2000). Models for ordered outcomes. Political Science, 150C/350C, 1–14. Available on https://web.stanford.edu/class/polisci203/ordered.pdf.

Lau, C. K. M., Yang, F. S., Zhang, Z., & Leung, V. K. (2015). Determinants of innovative activities: Evidence from Europe and Central Asia region. The Singapore Economic Review, 60(01), 1550004.

Mahagaonkar P. (2010) Corruption and Innovation. In Money and Ideas. International Studies in Entrepreneurship, vol 25. New York: Springer. https://doi.org/10.1007/978-1-4419-1228-2_5.

Mairesse, J., & Mohnen. P (2003). R&D and productivity: a reexamination in light of the innovation surveys. In DRUID Summer Conference (pp. 12–14). Available on http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.472.7535&rep=rep1&type=pdf.

Mairesse, J., & Mohnen, P. (2010). Using innovation surveys for econometric analysis, mimeo UNU-MERIT.

Mansury, M. A., & Love, J. H. (2008). Innovation, productivity and growth in us business services: A firm-level analysis. Technovation, 28(1), 52–62.

Mauro, P. (1995). Corruption and growth. The Quarterly Journal of Economics, 110, 681–712.

Mohnen, P. & Rosa, J. (2001). Les obstacles à l’innovation dans les industries de services au Canada. L'Actualité économique, 77(2), 231–254. https://doi.org/10.7202/602351ar.

Mohnen, P., Plam, F. C., Schim van der Loeff, S., & Tiwari, A. (2008). Financial constraints and other obstacles: Are they a threat to innovation activity. De Economist, 156(2), 201–214.

Mongo, M. (2013). Les déterminants de l’innovation : Une analyse comparative service/industrie à partir des formes d’innovation développées. Revue d'Économie Industrielle, 143, 71–108.

Murphy, J., & Albu, O. B. (2017). The politics of transnational accountability policies and the (re) construction of corruption: The case of Tunisia, Transparency International and the world Bank. Accounting Forum, 42, 32–46. https://doi.org/10.1016/j.accfor.2017.10.005.

Neter, J., Kutner, M. H., Nachtsheim, C. J., & Wasserman, W. (1996). Applied linear statistical models, 4th Edition. New York: WCB McGraw-Hill.

Nguyen, H.,& Jaramillo, P. A. (2014). Institutions and firms’ return to innovation: Evidence from the World Bank enterprise survey. World Bank Policy Research Working Paper (6918).

Nguyen, A.N., Q. Doan., Nguyen, M.N and T-N Ninh (2016). The impact of petty corruption on firm innovation in Vietnam. Crime Law Soc Change https://doi.org/10.1007/s10611-016-9610-1.

OCDE (2005) La mesure des activités scientifiques et technologiques. Manuel d’Oslo, Principes directeurs pour le recueil et l’interprétation des données sur l’innovation, 2005.

Raymond, L., & St-Pierre, J. (2010). R&D as a determinant of innovation in manufacturing smes: An attempt at empirical clarification. Technovation, 30(1), 48–56.

Rock, M., & Bonnett, H. (2004). The comparative politics of corruption: Accounting for the East Asian paradox in empirical studies of corruption, growth and investment. World Development, 32(6), 999–1017.

Roper, S., & Hewitt-Dundas, N. (1997). Innovation, networks and the diffusion of manufacturing best practice. Belfast: Northern Ireland Economic Research Centre.

Sandra, D. (2013). Les barrières à l’innovation organisationnelles : le cas du Lean Managment. Managment International, 17(4), 121–144.

Vial, V., & Hanoteau, J. (2010). Corruption, manufacturing plant growth, and the Asian paradox: Indonesian evidence. World Development, 38(5), 693–705.

Waldemar, F. S. (2012). New products and corruption: Evidence from Indian firms. The Developing Economies, 50(3), 268–284.

Wei, S.-J. (2000). How taxing is corruption on international investors? Review of Economics and Statistics, 82(1), 1–11.

Wong, A. (2015). Do innovative firms find corruption to be a Big- ger problem than non-innovative firms? Evidence from African, Latin American and Caribbean Countries. Ph. D. thesis, University of Ottawa. Available on https://ruor.uottawa.ca/bitstream/10393/32369/1/Wong_Andrew_2015_researchpaper.pdf.

World Bank. (2014). World Bank Enterprise Surveys. http://www.enterprisesurveys.org

Yahyaoui, M. (2009). Political Corruption: The case of Tunisia. Nawaat.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Sdiri, H., Ayadi, M. Does Innovation Foster or Mitigate the Corruption Obstacle? Firm-Level Evidence from Tunisia. J Knowl Econ 13, 367–386 (2022). https://doi.org/10.1007/s13132-020-00707-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13132-020-00707-4