Abstract

This paper assesses the relationship between corporate social responsibility (CSR) and downside equity tail risk, a field of research that is underdeveloped at this moment. Using global equities data over the period of January 2003 to December 2011, inclusive, the downside tail risk of each company is estimated using techniques of extreme value theory and CSR is approached using stakeholder theory. Our findings show a significant relationship between certain aspects of CSR and downside tail risk. The nature of the relationship differs across region, stakeholder and time. Furthermore, the relationships we found are sequential, which makes a causal link between CSR and tail risk plausible.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Recently, two apparently distinct topics in financial economics have attracted increasing attention. Tail risk awareness has risen among risk managers ever since the onset of the 2007/08 financial crisis. At the same time, public sensitivity towards corporate social responsibility has grown. This paper is one of the first academic attempts to combine both subjects by addressing the relationship between extreme negative daily equity returns and a company’s level of corporate social responsibility (CSR). We investigate the incidence of extreme negative equity returns in association with corporate social responsibility. Our hypothesis is that equity of socially responsible companies has more stable returns and show less extreme negative daily equity returns resulting in companies with greater CSR having lower downside tail risk. The intuition is that socially responsible companies are less vulnerable to company-specific events that adversely influence the equity price. Presently, there exists considerable research on the relationship between CSR and equity returns. However, these studies have left the analysis of the relationship between downside tail risk and CSR largely untouched, instead focussing on the entire distribution of returns. A notable exception is the study of Kim et al. (2014) which focusses on stock price ‘crash risk’, but defines crash risk as “the conditional skewness of return distribution, rather than the likelihood of extreme negative returns”. Our study concentrates exclusively on the left tail of the return distribution, uses a different CSR dataset and also offers an international angle.

We find an economically significant relationship between company-level stakeholder CSR indices and downside tail risk, consistent with Kim et al. (2014), which varies over time and geography. Our results indicate that greater CSR scores in terms of employee rights and safety, contractor oversight, environmental management and customer satisfaction are significantly related to downside tail risk. Our findings contribute to practical applications in the area of risk management, by facilitating risk managers’ portfolio specifications.

CSR and Financial Performance

The evolution of the concept and definition of CSR commenced with the work of Bowen (1953). He proposed an initial definition of the social responsibility of a business, which is “to pursue those policies, to make those decisions, or to follow those lines of action which are desirable in terms of the objectives and values of our society”. In the 1960s, McGuire (1963) stated that CSR supposes that “the corporation has not only economic and legal obligations but also certain responsibilities to society which extend beyond these obligations”. What these responsibilities are exactly was not made clear. The element of doing something more than is legally required, returns consistently in later definitions.Footnote 1 Later definitions of CSR emphasise the interests of ‘corporate stakeholders’ which should be evaluated when making business decisions (Freeman 1984).

Matten and Moon (2008) address the question of how and why corporate social responsibility differs among countries and how and why it changes. By applying two schools of thought in institutional theory, they conceptualise, among others, the differences between CSR in the United States and Europe. They argue that national differences in CSR can be explained by historically grown institutional frameworks that shape “national business systems” (Whitley 1997). Matten and Moon (2008) suggest that companies, depending on the country they are rooted in, have implicit or explicit CSR policies. This distinction between implicit or explicit CSR enables “better understanding of what CSR consists of, its institutional underpinnings and the national contexts in which corporations operate” and how “different national backgrounds influence their CSR agendas” (Matten and Moon 2008, p. 419). Explicit CSR usually refers to voluntary corporate programmes and strategies that combine social and business value as a responsibility of the firm. They argue that explicit CSR is primarily a corporate responsibility rather than that of a governmental authority or broader formal or informal institutions. Their idea of explicit CSR fits in with the argument that CSR must come from intrinsic motivation and should exceed strictly legal requirements (McWilliams and Siegel 2001). Alternatively, implicit CSR consists of values, norms and rules that result in mandatory and customary requirements for corporations within the wider collective society’s interests and concerns. The conduct of corporations practising implicit CSR in Scandinavian countries, for example, might be equal to those practising explicit CSR outside that region. Implicit CSR is conceived as a voluntary and deliberate corporate decision, whereas explicit CSR is the result of a deliberate, voluntary and often strategic decision made by a corporation (Matten and Moon 2008, pp. 409–410).

Theoretically, there are various ways in which CSR can be related to financial performance. Different motives of companies to engage in CSR activities result in different expected relations (Wu and Shen 2013; Bénabou and Tirole 2010; Baron 2001; Dam et al. 2009). Companies may face a trade-off between social responsibility and financial performance, and therefore pursuing socially responsible activities may be costly, reducing average financial performance and equity returns (see e.g. Aupperle et al. 1985; Ullmann 1985). Cornell and Shapiro (1987) argue, based on stakeholder theory, that when making decisions, companies must take non-explicit claims into account (e.g. timely delivery, product enhancement and job security) since non-explicit claims potentially create value for the shareholder and increase average equity returns. The intuition here is that CSR acts as a signal that non-explicit claims will be honoured and that the participation of some stakeholders in the company facilitates an anticipation of shareholder concerns (see e.g. Wood 1991; Orlitzky and Benjamin 2001).

The theoretical relationship between CSR and a company’s downside risk is two sided as well. For instance, McGuire et al. (1988) argue that the disregard of stakeholders non-explicit claims, although not directly legally enforceable, may lead to lawsuits with uncertain outcomes, increasing a company’s risk. The participation of companies in CSR activities can also be seen as creating a form of goodwill or ‘moral capital’ for the company, which subsequently acts as insurance-like protection when negative events occur (see Godfrey 2005; Gardberg and Fombrun 2006; Godfrey et al. 2009). Godfrey (2005) refers to relational wealth as intangible assets that are based on relationships with stakeholders. These relationships result in a good reputation for the company (Soppe et al. 2011). Relational wealth, however, only emerges when there is consistency between the company’s CSR activity and the ethical values of the stakeholders, and when the CSR activity is regarded as genuine by the stakeholders. Markets cannot provide insurance against losses to relational wealth since the basic criteria for a functioning insurance market are lacking. However, moral capital does protect relational wealth in two ways: (1) the probability of negative acts are reduced and (2) if negative acts against a stakeholder occur, the decrease of relational wealth will be diminished. Further explanation is required for the second proposition. Godfrey (2005) uses the mens rea doctrine from common law, which implies that an offence only occurs when both a ‘bad act’ and a ‘bad mind’ are present. Furthermore, he argues that when a company commits a bad act, its stakeholders will assess the ‘bad mind’ of the company in determining their sanctions against the company. Moral capital supposes that this type of ‘bad mind’ is absent and that the bad act was neither intentional nor will it happen again in the future.

Contrary to this view, Hemingway and Maclagan (2004) argue that CSR can be used to cover up corporate misbehaviour. This implies a positive relationship between CSR and downside risk. Moreover, if CSR activities are not genuine, are merely undertaken for legal reasons or are for other reasons not reducing actual downside risk (Matten and Moon 2008), they might still raise the expectations of investors that downside risk is reduced. In this case of deliberate unvirtuous behaviour, CSR might increase downside risk.

Empirical research mainly examines the relationship between CSR and average equity returns or accounting measures of financial performance. Margolis et al. (2009) analyse the average correlation between CSR and financial returns found in 251 studies and find that a 10 % increase in CSR performance is correlated with a 1.3 % increase in financial returns. Related to this body of literature are studies that compare investments in CSR portfolios with conventional portfolios, either by examining the first and second order of the return distribution (such as Bauer et al. 2005) or using more advanced concept such as Marginal Conditional Stochastic Dominance (Belghitar et al. 2014). Other studies examined the relationship between CSR and market and idiosyncratic risk, where risk is usually measured in a mean-variance framework (see e.g. Bouslah et al. 2013; Lee and Faff 2009).

Krueger (2013) took a different approach by examining the reaction of the stock market to positive and negative events concerned with a company’s CSR in the period 2001–2007 using US companies. The author finds that “investors respond strongly negatively to negative events and weakly negatively to positive events”. This research suggests that if CSR efforts reduce the probability of negative CSR events occurring, fewer negative stock market movements are expected. This is the hypothesis that is tested by Kim et al. (2014) for the period 1995–2009 in the US. The authors build on research suggesting that companies with better CSR have higher standards of transparency in financial reporting (Kim et al. 2014, p. 2). Kim et al. (2014), however, use the conditional skewness of the return distribution to measure crash risk consistent with Chen et al. (2001), which is a “narrow and euphemistic definition” of crashes (Chen et al. 2001, p. 348). We instead propose to employ extreme value theory to obtain a more direct measure of downside risk.

Extreme Returns and Tail Risk

In classic asset pricing theory, returns are assumed to follow a normal distribution. However, the assumption of normality has been shown to be be a naive one (see e.g. Mandelbrot 1963; Fama 1965; Cont 2001). It has instead been demonstrated empirically that equity returns tend to follow a heavy-tailed distribution (see e.g. Jansen and De Vries 1991; Longin 1996). The heavy-tailed property indicates that extreme returns (positive and negative) are more probable than under the assumption of normality. While these extreme price movements may result from exposure to large aggregate macro shocks, they may also result from fluctuations related to company or industry-specific events. These industry-specific or idiosyncratic shocks may be related to the CSR policy of a company if the adoption (or neglect) of certain socially responsible actions lead to a dampening (or amplification) of equity price movements. Under the heavy-tail assumption, we test whether adherence to CSR policies are related to the probability of a company experiencing extreme returns on equity.

Empirical evidence suggests that equity returns follow a heavy-tailed distribution (see Mandelbrot 1963; Jansen and De Vries 1991). Therefore, the Gaussian distribution under estimates the probability of extreme loss. Heavy tails refer to the fact that the tail region of the distribution function exhibits a power law decay, as opposed to the exponential decay of the Gaussian distribution. Mathematically, we denote the return of a financial asset by \(R\), with the distribution function \(F(x) = \Pr (R \le x)\). The distribution function \(F\) is heavy-tailed if its left tail can be approximated by a power law as

where \(\alpha\) is the tail shape parameter, commonly referred to as the tail index, and \(A\) indicates the scale of the distribution. In contrast to the Gaussian distribution, heterogeneity in the downside tail risk of a heavy-tailed distribution manifests via differences in the tail shape and scale of the distribution. Note that in the Gaussian setup, tail risk is driven entirely by the variance.

In order to quantify downside risk exposure, it has been, and remains, a common practice to adopt and implement a Value-at-Risk (VaR) measure. The downside tail risk of a company is therefore defined using the VaR measure in this paper.Footnote 2 The VaR indicates the magnitude of an extreme event at a given tail probability within a fixed time period. More specifically, define \({\text {VaR}}(p)\) as

Utilising the EVT setup in (3.1), we can compute the VaR under a heavy-tailed framework, where \({\text {VaR}}(p)\) is jointly determined by the tail index and scale as

We use (3.2) as our measure of downside tail risk.

According to the moral capital theory described in the “CSR and Financial Performance” section, socially responsible behaviour of companies influences the impact of CSR-related events on the value of the company. In a socially responsible company, one would expect fewer adverse CSR-related events to occur and therefore fewer highly negative price movements (i.e. a less pronounced left tail of the return distribution). However, an alternative reasoning is that one bad act can destroy all moral capital since the CSR behaviour is no longer considered genuine, thus making companies with a large moral capital more vulnerable for bad acts. It can be speculated that after an isolated event in which a company does not comply with its raised CSR expectations, investors may adjust their prior beliefs on a company’s outlook. This may cause a sharp negative adjustment to the company’s equity value, and therefore give rise to a positive relationship between CSR and downside tail risk.

Data and Empirical Methodology

Quantifying CSR

The measurement of CSR performance was initially attempted by analysing annual self-reported company disclosures (Abbott and Monsen 1979). However, the difficulty in measuring CSR is due to the lack of a uniform definition of CSR that would provide a framework or model that can be used to collect, organise and analyse corporate data. To provide such a framework, Clarkson (1995) suggests that CSR should be measured using a stakeholder theory as a starting assumption.Footnote 3

The sustainability data we use are based on CSR questionnaires and assessments that were conducted on an annual basis from 2003 until 2007. The data were provided by Dutch Sustainability Ratings (DSR), a social rating agency from Bunnik, a branch of the Triodos Bank in the Netherlands at that time.Footnote 4 DSR was a network partner of SiRi.Footnote 5 The dataset consists of 2,114 companies from the MSCI World Index. CSR is approached using the stakeholder model where stakeholders are categorised by community, employees, shareholders, contractors, environment and customers. All companies are assigned annual scores for 175 specific aspects of CSR. These scores are assessments of rating analysts based on questionnaires filled in by the companies, public company documents, press releases, information from associations, non-profit organisations and non-governmental organisations, and personal contacts between rating analysts and the companies, all based on criteria drawn up beforehand. Scores from 0 to 100 % are assigned for each aspect, depending on how well the performance of the company on that aspect corresponded to the criteria drawn up.Footnote 6 The companies’ scores are independent rather than relative to other companies. Four themes are rated for each stakeholder: communication and transparency of policy, formal policy statements, management systems, performance and controversies. The aggregation of the 175 aspects per stakeholder follows the mapping of Soppe et al. (2011) resulting in a CSR index per stakeholder, ranging from 0 to 100. Examples of some aspects that are taken into account, grouped per stakeholder, are as follows:

-

Community charity and ethical programmes such as anti-bribery and whistle-blowing procedures.

-

Employees safety procedures, employee rights and participation of employees in management.

-

Shareholders/Governance traditional measures of corporate governance, such as board composition and the presence of committees within the board of directors. Corporate governance is considered to be in the interest of the shareholder, because it reduces the agency problem between shareholders and management (Shleifer and Vishny 1997).

-

Contractors the responsibility taken by the company for the supply chain, for example, with regard to child labour, employee safety and human rights.

-

Environment pollution and environmental management systems.

-

Customers product safety and customer satisfaction.

CSR indices for the six groups of stakeholders are available for the period January 2003 to December 2007, although not all companies had ratings for all years. The number of companies with a CSR rating increases per year, as shown in Table 1. Of the initial 2,114 companies in the database, 2,099 had a CSR rating for at least one year and of these, 1,286 companies have sufficient return data available (see next subsection).

The companies are scored independently, and the CSR indices for the six groups of stakeholders are calculated as an average score of relevant companies, available for the years from 2003 to 2007. The number of companies included is shown in Table 1. The sample is dynamically structured, which implies that the number and composition of the evaluated companies alter interchangeably each year on various grounds. New companies can enter the list halfway through the research period (say year t), for example, which implies that the code NA is assigned to this company for the years t \(-\)1 and t \(-\)2 etcetera. If a company disappears from the list due to, for instance, a merger or acquisition in year t, the code NA is assigned for the corresponding year and the years after year t if the companies remain unevaluated. Both selection and survival bias might be the concerns here. Selection bias might be present because the number of companies in sample has increased over the years and initially consisted mainly of the larger companies of the MSCI World Index. Survival bias could be present because larger companies might have a higher probability of making it into the final sample. If size is related to CSR, this might distort the results. Therefore, we control for size in our analyses.

Tail Risk Estimation

Stock prices are also obtained from DatastreamFootnote 7 in local currency. These indices are converted to daily logarithmic returns. The number of returns per timing window varies between 1,043 (period 2004–20007) and 1,045 (period 2007–2010). For a company to be included in the analysis, return data have to be available for the entire period. CSR data have to be available for at least 1 year, and the number of zero-return days had to be limited to prevent them distorting the tail parameter estimates. The maximum number of zero-return observations is set at 10 %.

We consider the heavy-tailed feature of equity returns by employing univariate EVT to calculate each company's VaR on its equity returns. The estimation of the tail index for each company \(i\), \(\alpha _i\), is achieved by way of the Hill estimator (Hill et al. 1975). With ranking the observations \(X_{i,1},\cdots , X_{i,n}\), as \(X_{i,(1)}\ge X_{i,(2)} \ge \cdots \ge X_{i,(n)}\), the Hill estimator \(\hat{\alpha }_i\) is defined as

From the estimate in (4.1), we are able to estimate both the scale parameter \(A\) and the VaR for a given probability level \(p\) as follows:

We have argued that the theoretical foundation for a relationship between CSR and idiosyncratic returns is stronger than for total returns (i.e. idiosyncratic and systematic returns). Idiosyncratic returns are therefore used to estimate the tail characteristics. To obtain idiosyncratic returns, we remove the systematic component of returns assuming a CAPM setup. We check for robustness using total returns.

In order to remove the dependence imposed by a common market factor, we impose a correction by analysing idiosyncratic returns. We calculate the residual equity returns over the market return (defined as the return on the MSCI World Index because all sample companies are drawn from this index) by estimating a single-factor market model in each estimation period as

The error term, \(\epsilon _{i,s}\), is assumed to follow the standard assumptions of Ordinary Least Squares (OLS) regression. The idiosyncratic returns are calculated by

We use the estimated idiosyncratic returns (\(\hat{\epsilon }_{i,s}, \hat{\epsilon }_{j,s}\)) instead of raw returns as the data set on (\(X_{i,s}, X_{j,s}\)) in the estimation.

Another technical issue in the estimation is the sequence choice of the intermediate \(k\). A considerable amount of literature is dedicated to finding the optimal \(k\) for a given sample. If \(k\) is too large, meaning that one has moved away from the part of the distribution that has a Pareto distribution, the estimator will be biased. If \(k\) is too small, there will be much variation in the estimator due to the small sample size. To find the optimal \(k\), Hall (1990) and Danielsson et al. (2001) propose a bootstrap procedure. We do not implement a bootstrapping procedure as it requires a large number of observations to perform well. A value for \(k\) of 3–4 % of the number of observations is generally used to circumvent this problem. To check if a threshold value \(k\) of 3.5 % is acceptable, Hill-plots of the 2008–2011 returns for ten randomly chosen equities are visually inspected to check the stability of the tail index estimator. It appears that after \(k\) = 30, the tail index estimators are stable. With an average of 1,044 observations over the windows, a threshold of 3.5 % results in \(k\) = 37, which seems quite acceptable.

Finally, there is empirical evidence that the tail indices of return distributions across equities are homogeneous (see e.g. Jansen and De Vries 1991; Jansen et al. 2000). However, considerable variation may exist in the scale parameter (Hyung and de Vries 2001). Moore et al. (2013a) propose a general framework that explains a homogeneous left tail index for asset return distributions, on the assumption that investors have homogeneous safety-first preferences and are sufficiently risk averse. If it is indeed the case that the left tail index is homogeneous in the cross section, all heterogeneity in the tail risk that is empirically observed must be captured by the scale parameter. However, the tail index seems to be homogeneous only for a specific period of time, namely 2008–2011 (Moore et al. 2013b). Even though we assume a heterogeneous tail index in our analysis, we also conduct a robustness check for the alternative assumption of a homogeneous tail index.

Controls

In order to test the relative impact of CSR-related activity on the downside tail risk of a company’s downside tail risk, we must control for other factors that potentially drive downside tail risk. The market risk exposure is a potential driver of tail risk. Furthermore, market risk is likely to be related to CSR (see e.g. Orlitzky and Benjamin 2001; El Ghoul et al. 2011; Bouslah et al. 2013). We control for this using idiosyncratic returns in the main analysis. When raw returns are used in our robustness checks, we control for market exposure with the market beta. The leverage (Bhandari 1988), liquidity (Amihud and Mendelson 1986; Datar et al. 1998), size and book-to-market value (Fama and French 1993), and price-earnings ratio (Basu 1977) are well-known risk factors that may effect the downside risk of equity returns. Therefore, we will control for these factors in our analysis.Footnote 8 There is empirical evidence that the geography and tail risk of a company are related (Gençay and Selçuk 2004). Since the market on which the equity of a company is traded is important, companies have been grouped into three regions based on the location of their headquarters: the Americas, Asia and Europe. Finally, the return distribution of equities appears to vary across industries. The cross-sectional differences in the return distributions of equities across industries are likely to give rise to cross-sectional differences in tail risk. Moreover, there is evidence of a heterogeneous relationship between CSR and financial performance across industries (Hoepner et al. 2010).

Regressions

Firstly, the estimate set out in (4.3) is regressed on the control variables:Footnote 9

This model is then extended with the CSR variables:

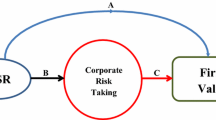

With respect to the timing of the cross-sectional relationship between CSR scores and the return characteristics, a rolling window was used. The CSR scores of a company in year \(t\) are related to its tail characteristics in the period \(t+1\) to \(t+5\). This is graphically shown in Fig. 1. For regressions where multiple timing windows are aggregated, a panel data setup was used including period-fixed effects.

The literature review in the “CSR and Financial Performance” section suggests there is a relationship between VaR and the CSR indices. At least one coefficient for the CSR variables in (4.7) is therefore expected to differ from zero. The sign of the coefficients is expected to be negative because a negative relationship between CSR and tail risk is expected (Table 2).

Results

Descriptive Statistics

Our analysis initially separates by geography into three groups: the Americas, mainly including the US, with a total of 542 companies; Asia, mainly including Japan and Australia, with a total of 285 companies, and Europe, with a total of 459 companies. The descriptive statistics of the CSR indices per stakeholder for the year 2007 are given in Table 3. The development over time of the average of the indices is shown in Fig. 2. This graph shows a general increase in the indices between 2003 and 2007, with the exception of stakeholder employees and the environment.

The tail index, scale parameter and the 1 % VaR are estimated according to (4.1), (4.2) and (4.3), respectively. Descriptive statistics of the estimated tail index, scale parameter and 1 %-VaR calculated with \(k=37\) for the period 2007–2011 are given in Table 4 using idiosyncratic returns, and in Table 5 using raw returns.

The distributions of the tail index, scale parameter and the 1 % VaR for the various timing windows are shown in Figs. 3, 4 and 5. The distributions appear to be sufficiently close to the normal distribution to allow an OLS regression. It is interesting to note the considerable shift of the scale and VaR distributions to the right when comparing the 2003 window with the other windows. This is also shown in Tables 4 and 5, where the mean and median scale parameters increase dramatically between the 2003 and the 2004 window. This is most likely caused by the 2008 financial downturn, which is not captured in the 2003 window (ranging from 2004 to 2007) but is captured in the subsequent timing windows.

The Pearson correlations among the CSR indices for the different stakeholders and the control variables are given in Table 6. The CSR indices for the various stakeholders are generally highly correlated, which is not uncommon (Greenley and Foxall 1997). We explicitly test our regression coefficients for multicollinearity by estimating Variance Inflation Factors (VIFs). The VIFs do not exceed 5 and usually the values are well below 2. None of the variables has a consistently high VIF across multiple regressions. This suggests that multicollinearity is not a major problem in our analysis.

Tail Risk and Control Variables

The results of the regression of the estimated 1 % VaR on the control variables, as given in 4.6, are provided in Tables 7 (per year) and 8 (per area).

Leverage is positively related to the VaR in all except the 2003 window. This relationship is consistent with Moore et al. (2013b), who find a positive relationship between leverage and the scale parameter for the period 2008–2011. In economic terms, this analysis indicates a cross-sectional 10 percentage point increase in debt, ceteris paribus increases the 1 % VaR by around 0.25 percentage points in the last timing windows.

The book-to-market ratio is negatively associated with the VaR in all the timing windows, except that for 2003 and in the separate regression for Asia. The negative relationship is also consistent with Moore et al. (2013b), who find a slightly significant positive relationship between book-to-market value and tail risk. Economically, this means that companies with a relative high market value compared to their book value, the growth companies, generally carry less tail risk.

The coefficients on the earnings-price ratio are conflicting, as they are positive and highly significant in America, but negative and highly significant in Europe. This is consistent with Moore et al. (2013b) who do not find a convincing relationship between earning-price ratio and tail risk.

Size is consistently and significantly associated with the VaR; the effect is negative. This is consistent with results in Moore et al. (2013b). The larger the company, the less its tail risk. In economic terms, a cross-sectional increase of 1 % decreases the VaR by 0.42 percentage points in America, 0.33 in Europe and 0.27 in Asia.

The results for liquidity are mixed. The spread is generally positively related to the VaR, except in the 2007 timing window and in Europe, where the relationship is negative. Moore et al. (2013b) find a more consistent positive relationship between the spread and the tail risk parameter. This, however, is understandable because the scope of this research was limited to the US. A positive relationship between spread and tail risk is more intuitive, because companies with a higher spread will generally encounter more sudden jumps in the price. Turnover is positively and significantly related to the VaR in all windows and in all areas.

Tail Risk and CSR

This section describes the cross-sectional relationship between CSR variables and tail risk. The model of (4.7) has been used to construct Tables 9 and 10.

Firstly, it should be noted that the information criteria decrease for the 2003 timing window and in Europe. This implies that the CSR variables which are added to the model decrease the residual sum of squares (RSS) sufficiently to compensate for the loss of degrees of freedom. For the 2005 and 2007 timing windows and in Asia, the Akaike information criterion (AIC) decreases but the Schwarzs Bayesian information criterion (BIC) increases. This is because the BIC places a stiffer penalty on the inclusion of more variables in the model. For the 2004 and 2006 timing windows and in America, both the AIC and the BIC increase. This indicates a poorer fit of the model including CSR in these cases. Overall, adding CSR variables to the model increases the fit of the model in some cases, but decreases the fit in others. This can be explained due to the fact that some of the CSR variables might only be significantly related to tail risk under specific circumstances. To ensure that adding CSR to the model and searching for significant relationships is a meaningful exercise, a F test is performed on the joint significance of the CSR variables. This test rejects the null hypothesis (all coefficients for the CSR variables being equal to zero) in all cases, except for the 2005 timing window.

To start with the control variables, most coefficients remain consistent with the results presented in Table 7. In the 2003 window (2004–2007), the significance of the coefficients of book-to-market ratio, earnings-price ratio and spread changes.

Focusing on our main analysis regarding CSR, the effect of Community on the VaR is significant in the 2007 window (2008–2011). The effect is only found in America and is only marginally significant. A cross-sectional increase of 10 points in Community performance increases the VaR by 0.11 percentage points. This effect might be due to the fact that Community also includes transparency measures such as whistle-blowing programmes. Such transparency measures might actually harm a company’s financial performance when bad events occur compared to a non-transparent company, which is better able to hide bad events. Another reason can be that the average Community score in America (64.3) is slightly higher than in Europe (60.2) and Asia (57.9). It could be that there is already so much community involvement in America that a higher score does no longer lead to a reduction of tail risk. The high implicit expectations of shareholders in the US can even increase tail risk because of the specific US culture on community involvement (see Matten and Moon 2008).

The Employee category is significant and negatively related to the VaR in the 2007 window. This suggests that when a company performs well towards its employees, its equity carries less tail risk. Economically, a cross-sectional increase of 10 points in the performance towards employees leads to a decrease in the daily 1 % VaR by 0.10 percentage points. However, because this effect is not found in other timing windows, it should be interpreted with caution.

Governance appears to be unrelated to tail risk. Table 8, however, shows that an effect can be found in Europe, which is positive. One way to explain these findings is through the notion that the definition of corporate governance highly depends on the location of the companies. For example, what is considered as good corporate governance in the US is not necessarily considered good corporate governance by German standards. This increases the difficulty of measuring corporate governance performance.

The Contractors category is positively and significantly related to the VaR in the 2003 window and negatively in the 2007 window, while a negative effect is found for Europe. The reason for this might be that in Europe, over the last few years, investors and consumers have paid more attention to social wrongs in the supply chain (Smith et al. 2010). Companies that pay more attention to these issues therefore have a lower tail risk.

Environment is positively and significantly related to the VaR in Europe. In economic terms, the coefficient shows that a 10-point increase in environmental performance increases the daily 1 % VaR by 0.09 percentage points. This might be explained by the fact that the average Environment score of European companies is considerably higher compared to America: 50.7 versus 37.6, respectively. Since the Environment score of European companies is relatively good already, a further increase in environmental efforts might no longer be effective in reducing the environmental risks the company is exposed to. However, it would increase the expectations of investors, which the company might not be able to meet, in turn resulting in higher tail risk.

The Customers category is negatively and significantly related to the VaR in America and only in the last timing windows. In economic terms, a 10-point increase in performance towards consumers decreases the 1 % daily VaR by 0.08 percentage points in America. The reason that this effect is only noticed in America may be that American companies are more vulnerable towards the changing preferences of consumers and are more likely to involve a return shock if they perform badly towards their consumers (leading, for example, to a class action, which is much more common in America than in Europe). Another reason can be that the average consumer performance of American companies is much lower than European companies: 43.9 versus 62.0, respectively. Since the performance of European companies towards their customers is already good, improving this further might have no effect in reducing tail risk.

Overall, most statistically significant relationships are found in the 2008–2011 timing window, which uses the CSR data of 2007. This is interesting to note because in 2007 many first signs of the 2008 financial crises began to appear, including the reduction of available liquidity, the start of foreclosure proceedings in the US property market and the decline of global equity markets. Most relationships are negative, indicating that companies with high CSR in 2007 had a lower tail risk in the subsequent years when the full financial crisis unfolded. Combined with the observation that no significant relationships are observed in the 2007–2010 window which uses 2006 CSR data, this suggests that CSR is of particular importance to maintain in the run up to a finance crisis in order to reduce tail risk during turbulent times and the stabilising period afterwards.Footnote 10 This is consistent with the theory of CSR being an insurance-like protection which is most valuable in extreme market conditions.

The reasons as to why CSR and tail risk seem less strongly related overall in Asia—particularly in Table 10—are subject to further research, especially because in Japan—which accounts for a large share of the Asian companies in the sample—there has been a large increase in CSR attention in recent years (Tanimoto 2009). The large variety of CSR activity and reporting across Asian companies might also play a role in the unclear results (Chapple and Moon 2005).

Robustness Analysis

If the tail index is cross-sectionally homogeneous in a common market (Moore et al. 2013a, b), the variation in the empirically estimated tail index consists of noise around the true tail index. This, in turn, disturbs the estimation of the scale parameter and the VaR. It is therefore worth estimating the scale, and subsequently the VaR, using a homogeneous tail index for each market geography. This assumption would imply that all variations in tail risk are explained by the scale parameter. The average tail index during the period 2004–2011 is 2.84 in America, 3.07 in Europe and 3.14 in Asia. These values are assumed to be homogeneous tail indices for the respective areas. The regressions of 1 % VaR on the control variables and CSR variables are repeated; the results are shown in Tables 11 and 12. The results for the control variables do not materially change from the analysis using a heterogeneous tail index. This means that the variation in tail risk is mainly expressed via the scale parameter, which suggests the validity of the homogeneous tail index hypothesis. The following relationships between CSR and tail risk turn out to be robust when a homogeneous tail index is assumed (Table 13):

-

A negative relationship between employees and tail risk in the period 2008–2011, now predominantly found in Asia.

-

A negative relationship between contractors and tail risk in Europe.

-

A positive relationship between environment and tail risk in Europe.

-

A negative relationship between customers and tail risk in America.

Our primary analysis uses idiosyncratic returns to estimate the tail parameters. However, most of the theories that describe the tails of the return distribution concentrate on raw returns instead of idiosyncratic returns. It is therefore interesting to check whether the coefficients of the control variables and CSR variables change when raw returns are used. A control variable \(Beta\), representing the market beta of the equity in the timing window, is now included to provide some corrections for market risk. The results of the regression of the 1 % VaR on the control and CSR variables are shown in Tables 14 and 11. The significances of the control variables are generally in line with the previous results. The control variable \(Beta\)which is now included is highly significant, which shows that tail risk is highly dependent on systematic risk. With regard to the CSR variable, all significant relationships that were found in the previous section are shown to be robust for the use of raw returns instead of idiosyncratic returns. This indicates that using idiosyncratic returns to estimate tail risk does not give very different results compared to using raw returns when adjusting for beta.

Conclusion

Our results indicate towards a significant relationship between certain aspects of CSR and downside tail risk. Our panel data design of the study suggests that the relationships are sequential: CSR performance in a specific year is associated with a higher or lower VaR in the four years to follow. This makes a causal relationship between CSR and tail risk plausible, although only in specific cases with regard to period and area.

The nature of the relationship between CSR and tail risk differs per area and per CSR aspect, and varies over time. The relationship appears strongest in extreme market conditions. The results indicate that a high employees score is associated with less tail risk in the period 2008–2011, predominantly in Asia. Furthermore, a higher score for customers is associated with less tail risk in America. Finally in Europe, a high score for contractors is associated with less tail risk. These negative associations are consist with the hypothesis that companies with high CSR performance are less affected by adverse CSR-related events. On the other hand, a high score on environment seems to increase tail risk in Europe, presumably because the environment commitment of European companies is already high, and more efforts merely reduce the adverse effect investors expect but not the actual risk. In America, a higher score for community is associated with more tail risk, which can be explained in a similar way.

The economical relevance of the relationships found appears to be small, but it must be noted that even minor variations in the VaR in terms of percentages can have great impact on the monetary value. CSR can therefore be a relevant aspect in assessing a company’s tail risk.

Notes

There is a debate on whether businesses actually have responsibilities towards society, other than to increase profits. Friedman 1970) defends the opinion that businesses cannot have responsibilities, and that the best contribution businesses can make to society is to make profits. This debate, however, does not fall within the scope of this paper.

Another common measure of downside risk that has gained tractability over the past years is the expected shortfall (ES). The ES measures the expected loss on a portfolio given a violation of the VaR criteria. A common critique of the VaR measure is that it is not subadditive, and therefore, not a coherent risk measure. The ES resolves this concern by having the property of subaddivity. However, Danielsson et al. (2001) show that in the tail region the VaR also maintains a subadditive property.

Even when a stakeholder approach is chosen to measure CSR, several measurement issues remain. Turker (2009) categorises four approaches toward measuring CSR using the stakeholder method: the use of reputation indices, issue indicators, content analysis of corporate publications and scales measuring CSR perception at the individual managerial level. A well-known example of a reputation index is the Fortune index, which ranks the top 50 global companies according to their CSR performance. Issue indicators are one or more specific indicators, such as pollution or corporate crime, which are assumed to proxy for the entire CSR performance of a company. Content analysis of corporate publication is growing in popularity as companies pay more attention to social disclosure, but the information companies give in a corporate report can be different from their actual actions (see McGuire et al. 1988). The individual scale method measures the CSR values and attitudes of individual managers, but is not suitable for measuring organisational involvement with socially responsible activities (Turker 2009). In summary, there are various ways to measure CSR, but all methods have their advantages and disadvantages and it is presumably best to combine different methods.

DSR Bunnik was taken over by Sustainalytics Amsterdam in January 2010.

Established in Fribourg (CH), SiRi was a cooperation of 10 European social research companies that developed a common research questionnaire for analysing companies from different countries according to an identical structure on their corporate social responsibility. See www.siricompany.com for more information. The organisations ended their cooperation by the end of 2009.

A specific example of one aspect is the transparency of the employee policy. A score of 100 % is assigned if the company annually disclosed a report that contained a description of different programmes for employees, covered at least half of the employees of the company and is no older than two years. A score of 80 % is assigned if the company only published a code of conduct, although this code of conduct had to cover at least half of the employees. A score of 40 % is assigned if the report is older than two years, applies to less than half of the employees or had not been made public. A score of 30 % is assigned if the company is working on its first report. A score of 0 % is assigned if there is no report and the company did not plan to publish one.

The six control variables leverage, market-to-book ratio, price-earnings ratio (PE), size and the two proxies for liquidity, namely spread and turnover, are all retrieved from Datastream as well.

We measure the leverage as a ratio of debt-to-equity. The liquidity is measured in two ways: bid-ask spread and total share turnover, and the size of the company is captured by market capitalisation.

The regression model was extended with dummy variables for geography and industry.

The MSCI World Index reached its lowest point in February 2009.

References

Abbott, W. F., & Monsen, R. J. (1979). On the measurement of corporate social responsibility: Self-reported disclosures as a method of measuring corporate social involvement. Academy of management journal, 22(3), 501–515.

Amihud, Y., & Mendelson, H. (1986). Asset pricing and the bid-ask spread. Journal of financial Economics, 17(2), 223–249.

Aupperle, K. E., Carroll, A. B., & Hatfield, J. D. (1985). An empirical examination of the relationship between corporate social responsibility and profitability. Academy of management Journal, 28(2), 446–463.

Baron, D. P. (2001). Private politics, corporate social responsibility, and integrated strategy. Journal of Economics & Management Strategy, 10(1), 7–45.

Basu, S. (1977). Investment performance of common stocks in relation to their price-earnings ratios: A test of the efficient market hypothesis. The Journal of Finance, 32(3), 663–682.

Bauer, R., Koedijk, K., & Otten, R. (2005). International evidence on ethical mutual fund performance and investment style. Journal of Banking & Finance, 29(7), 1751–1767.

Belghitar, Y., Clark, E., & Deshmukh, N. (2014). Does it pay to be ethical? Evidence from the ftse4good. Journal of Banking & Finance, 47, 54–62.

Bénabou, R., & Tirole, J. (2010). Individual and corporate social responsibility. Economica, 77(305), 1–19.

Bhandari, L. C. (1988). Debt/equity ratio and expected common stock returns: Empirical evidence. The Journal of Finance, 43(2), 507–528.

Bouslah, K., Kryzanowski, L., & MZali, B. (2013). The impact of the dimensions of social performance on firm risk. Journal of Banking & Finance, 37(4), 1258–1273.

Bowen, H. R. (1953). Social responsibilities of the businessman. New York: Harper & Row.

Chapple, W., & Moon, J. (2005). Corporate social responsibility (CSR) in asia a seven-country study of CSR web site reporting. Business & Society, 44(4), 415–441.

Chen, J., Hong, H., & Stein, J. C. (2001). Forecasting crashes: Trading volume, past returns, and conditional skewness in stock prices. Journal of Financial Economics, 61(3), 345–381.

Clarkson, M. E. (1995). A stakeholder framework for analyzing and evaluating corporate social performance. Academy of management review, 20(1), 92–117.

Cont, R. (2001). Empirical properties of asset returns: Stylized facts and statistical issues. Quantitative Finance, 1, 223–236.

Cornell, B., & Shapiro, A. C. (1987). Corporate stakeholders and corporate finance. Financial Management, 16, 5–14.

Dam, L., Koetter, M., & Scholtens, L. J. R. (2009). Why do firms do good? Evidence from managerial efficiency. Evidence from Managerial Efficiency (March 17, 2009).

Danielsson, J., de Haan, L., Peng, L., & de Vries, C. G. (2001). Using a bootstrap method to choose the sample fraction in tail index estimation. Journal of Multivariate analysis, 76(2), 226–248.

Datar, V. T., Naik, N. Y., & Radcliffe, R. (1998). Liquidity and stock returns: An alternative test. Journal of Financial Markets, 1(2), 203–219.

El Ghoul, S., Guedhami, O., Kwok, C. C. Y., & Mishra, D. R. (2011). Does corporate social responsibility affect the cost of capital? Journal of Banking & Finance, 35(9), 2388–2406.

Fama, E. F. (1965). The behavior of stock-market prices. Journal of Business, 38, 34–105.

Fama, E. F., & French, K. R. (1993). Common risk factors in the returns on stocks and bonds. Journal of Financial Economics, 33(1), 3–56.

Freeman, R. E. (1984). Strategic management: A stakeholder approach. Cambridge: Cambridge University Press.

Friedman, M. (1970). The social responsibility of business is to increase its profits. New York: The New York Times.

Gardberg, N. A., & Fombrun, C. J. (2006). Corporate citizenship: Creating intangible assets across institutional environments. Academy of Management Review, 31(2), 329–346.

Gençay, R., & Selçuk, F. (2004). Extreme value theory and value-at-risk: Relative performance in emerging markets. International Journal of Forecasting, 20(2), 287–303.

Godfrey, P. C. (2005). The relationship between corporate philanthropy and shareholder wealth: A risk management perspective. Academy of Management Review, 30(4), 777–798.

Godfrey, P. C., Merrill, C. B., & Hansen, J. M. (2009). The relationship between corporate social responsibility and shareholder value: An empirical test of the risk management hypothesis. Strategic Management Journal, 30(4), 425–445.

Greenley, G. E., & Foxall, G. R. (1997). Multiple stakeholder orientation in uk companies and the implications for company performance. Journal of Management Studies, 34(2), 259–284.

Hall, P. (1990). Using the bootstrap to estimate mean squared error and select smoothing parameter in nonparametric problems. Journal of Multivariate Analysis, 32(2), 177–203.

Hemingway, C. A., & Maclagan, P. W. (2004). Managers’ personal values as drivers of corporate social responsibility. Journal of Business Ethics, 50(1), 33–44.

Hill, B. M., et al. (1975). A simple general approach to inference about the tail of a distribution. The annals of statistics, 3(5), 1163–1174.

Hoepner, A., Yu, P. S., & Ferguson, J. (2010). Corporate social responsibility across industries: When can who do well by doing good? Available at SSRN 1284703.

Hyung, N., de Vries, C. G. (2001). Portfolio diversification effects and regular variation in financial data. Technical report, Tinbergen Institute Discussion Paper.

Jansen, D. W., & De Vries, C. G. (1991). On the frequency of large stock returns: Putting booms and busts into perspective. The review of economics and statistics, 73, 18–24.

Jansen, D. W., Koedijk, K. G., & De Vries, C. G. (2000). Portfolio selection with limited downside risk. Journal of Empirical Finance, 7(3), 247–269.

Kim, Y., Li, H., & Li, S. (2014). Corporate social responsibility and stock price crash risk. Journal of Banking & Finance, 43, 1–13.

Krueger, P. (2013). Corporate goodness and shareholder wealth. Available at SSRN 2287089.

Lee, D. D., & Faff, R. W. (2009). Corporate sustainability performance and idiosyncratic risk: A global perspective. Financial Review, 44(2), 213–237.

Longin, F. M. (1996). The asymptotic distribution of extreme stock market. Journal of Business, 69, 383–403.

Mandelbrot, B. B. (1963). The variation of certain speculative prices. The Journal of Business, 36, 394–419.

Margolis, J. D., Elfenbein, H. A., & Walsh, J. P. (2009). Does it pay to be good... and does it matter? A meta-analysis of the relationship between corporate social and financial performance. Available at SSRN 1866371.

Matten, D., & Moon, J. (2008). Implicit and explicit CSR: A conceptual framework for a comparative understanding of corporate social responsibility. Academy of management Review, 33(2), 404–424.

McGuire, J. B., Sundgren, A., & Schneeweis, T. (1988). Corporate social responsibility and firm financial performance. Academy of management Journal, 31(4), 854–872.

McGuire, J. W. (1963). Business and society. New York: McGraw-Hill.

McWilliams, A., & Siegel, D. (2001). Corporate social responsibility: A theory of the firm perspective. Academy of management review, 26(1), 117–127.

Moore, K., Sun, P., De Vries, C., & Zhou, C. (2013a). The cross-section of tail risks in stock returns. Available at SSRN 2240131.

Moore, K., Sun, P., De Vries, C., & Zhou, C. (2013b). The drivers of downside equity tail risk. Available at SSRN 2240135.

Orlitzky, M., & Benjamin, J. D. (2001). Corporate social performance and firm risk: A meta-analytic review. Business & Society, 40(4), 369–396.

Shleifer, A., & Vishny, R. W. (1997). A survey of corporate governance. The Journal of Finance, 52(2), 737–783.

Smith, N. C., Palazzo, G., & Bhattacharya, C. B. (2010). Marketings consequences. Business Ethics Quarterly, 20(4), 617–641.

Soppe, A., Schauten, M., Soppe, J., & Kaymak, U. (2011). Corporate social responsibility reputation (CSRR): Do companies comply with their raised csr expectations & quest. Corporate Reputation Review, 14(4), 300–323.

Tanimoto, K. (2009). Structural change in corporate society and CSR in Japan. Corporate social responsibility in Asia (pp. 45–65). New York: Routledge.

Turker, D. (2009). Measuring corporate social responsibility: A scale development study. Journal of Business Ethics, 85(4), 411–427.

Ullmann, A. A. (1985). Data in search of a theory: A critical examination of the relationships among social performance, social disclosure, and economic performance of us firms. Academy of Management Review, 10(3), 540–557.

Whitley, R. (1997). Business systems. The IEBM handbook of organizational behaviour (pp. 173–186). London: International Thomson Business Press.

Wood, D. J. (1991). Corporate social performance revisited. Academy of Management Review, 16(4), 691–718.

Wu, M. W., & Shen, C. H. (2013). Corporate social responsibility in the banking industry: Motives and financial performance. Journal of Banking & Finance, 37(9), 3529–3547.

Acknowledgments

The support of the Economic and Social Research Council (ESRC) in funding the Systemic Risk Centre is gratefully acknowledged [grant number ES/K002309/1].

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Diemont, D., Moore, K. & Soppe, A. The Downside of Being Responsible: Corporate Social Responsibility and Tail Risk. J Bus Ethics 137, 213–229 (2016). https://doi.org/10.1007/s10551-015-2549-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-015-2549-9