Abstract

We aggregate different dimensions of corporate social responsibility (CSR) activities following the stakeholder framework proposed in Clarkson (Acad Manag Rev 20(1), 92–117, 1995) and present consistent evidence that CSR strengths targeting different stakeholders have their unique impact on firm risk and financial performance. Institutional CSR activities that target secondary stakeholders are negatively associated with firm risk, measured by total risk and systematic risk. Technical CSR that target primary stakeholders are positively associated with firm financial performance, measured by Tobin’s Q, ROA, and cash flow returns. Our results, based on a sample of S&P 500 component firms over the period of 1995–2009, are consistent with the risk management view of “altruistic” CSR activities and with the stakeholder salience theory. We also show that the impact of CSR activities on risk varies with the ethical climate, as proved in our subsample analyses on pre- and post-Sarbanes–Oxley periods. Our empirical analyses mitigate possible omitted variables and endogeneity concerns that are often overlooked in previous research. Our findings are robust to alternative CSR measures, to alternative risk and performance measures, and to alternative estimation methods.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

As researchers, managers, and investors try to understand the changing ethical environment and the increasing emphases on corporate social responsibility (CSR) and thrive therein, a large and growing literature has emerged over the past several decades on the links between CSR and firm risk, as well as CSR and firm financial performance. The empirical literature has been trying to establish the business case for CSR by providing consistent evidence that there is either a positive relationship between CSR and firm financial performance or a negative relationship between CSR and firm risk, or both (McGuire et al. 1988; Brammer and Millington 2008; Godfrey et al. 2009). While there are more consensuses over the negative relationship between CSR and firm risk (Orlitzky and Benjamin 2001), evidence for the positive relationship between CSR and financial performance remain inconclusive (McWilliams and Siegel 2000; Margolis and Walsh 2003). A number of meta-analyses have attempted to identify a number of data and methodological issues in CSR research related to risk and financial performance: lack of meaningful aggregation of different CSR dimensions, short and small data sample involving multiple industries without considering time sensitivity, less-than-perfect econometric techniques, as well as a size effect that may cloud may findings in CSR research (Orlitzky and Benjamin 2001; Orlitzky et al. 2003; Godfrey and Hatch 2007; Udayasankar 2008).

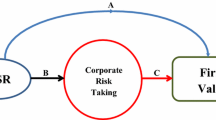

We attempt in this study to examine both the CSR-risk and the CSR-financial performance links, while taking good care of the data and methodological concerns. Our main contribution is that we aggregate different dimensions of CSR activities following the stakeholder framework proposed in Clarkson (1995) and present consistent evidence that CSR strengths targeting different stakeholders have their unique impact on firm risk and financial performance. Stakeholders are persons or groups that have, or claim, ownership, rights, or interests in a firm and its activities (Freeman 1984). As firms and their managers manage relationships with their stakeholders (Clarkson 1995), it is important to keep the targeted stakeholders in mind when considering the CSR–corporate financial performance (CFP) link. Primary stakeholders, including employees, consumers, shareholders, etc., have direct economic exchange with a firm and the firm cannot survive as a going concern without continuing participation of primary stakeholders. Secondary stakeholders, on the other hand, are those who influence or affect, or are influenced or affected by the firm, but who do not have direct economic exchange with the firm. The firm is not dependent for its survival on secondary stakeholders (Clarkson 1995). Despite the wide variety of CSR activities that may be used to target primary and secondary stakeholders, there are shared features that distinguish the two: primary stakeholders possess power, legitimacy, and urgency so that managers would prioritize the relationships with primary stakeholders over those with secondary stakeholders (Mitchell et al. 1997). Hence, we believe the aggregation based on targeted stakeholders provides both a meaningful and a parsimonious framework to investigate the CSR-risk and CSR-financial performance links. We further hypothesize a heterogeneous impact of CSR activities with different targeting stakeholders on the CSR-risk and CSR-financial performance links. To test our hypothesis, we follow the Mattingly and Berman (2006) construct and we differentiate CSR activities as institutional CSR (ICSR hereafter) that target secondary stakeholders and technical CSR (TCSR hereafter) that target primary stakeholders.

We then conduct a longitudinal analysis using a large sample of S&P 500 component firms over the period of 1995–2009. We construct size-adjusted CSR measures and industry-adjusted performance measures to capture the difference in risk and financial performance across firms with similar size and in the same industry but different engagement in CSR activities. We also conduct time sensitivity test and hypothesize a change in the CSR-risk link after 2002, when Sarbanes–Oxley (SOX) came into effect. Finally, we estimate the heterogeneous impact of CSR activities with different targeting stakeholders using ordinary least squares regressions that adjust for firm and time clustering effect as well as firm fixed effects regressions for our unbalanced panel data that alleviate biases from time-invariant firm-specific unobservable factors. We also conduct a number of robustness tests ranging from alternative regression techniques to using instrumental variables to mitigate endogeneity concerns.

We find consistent empirical evidence that there is a heterogeneous impact of CSR activities with different targeting stakeholders on the CSR-risk link and that such a link becomes more salient in post-SOX years. Only ICSR strengths are negatively associated with firm risk, measured by both relative stock volatility and Beta. Such negative CSR-risk link is more salient in volatile markets and for firms with no social impact and high intangible assets. We do not find any supporting evidence for a negative relation between TCSR strengths and the same firm risk measures. Instead, we find that TCSR strengths are positively associated with Tobin’s Q, ROA, and cash flow return measures, while ICSR strengths are not. We further provide empirical evidence that there is a causal effect going from higher ICSR strengths to lower firm risk and we find no reverse causality.

Our empirical work on the heterogeneous CSR-risk and CSR-financial performance links expands the current literature. This is probably the first study that investigates both CSR-risk and CSR-financial performance links using a meaningful and parsimonious stakeholder framework and we find consistent evidence that only ICSR strengths are negatively associated with firm risk, while only TCSR strengths are positively associated with firm financial performance. Compared to Godfrey et al. (2009) who find a negative ICSR-risk link in times of firm-specific negative shock, this study identifies a negative ICSR-risk link when market-wide negative shock hits. Further, this study finds while ICSR satisfies secondary stakeholders through a “back door” mechanism that provides value-protecting benefit, TCSR pleases primary stakeholders through a value-enhancing “front door” mechanism that is captured by improved Tobin’s Q, ROA, and cash flow return measures.

The article proceeds as follows: The first section reviews related literature and develops hypotheses. The second section describes data and variables. The third section reports empirical findings and conducts robustness checks. The concluding section discusses the limitations and interesting implications of the findings.

Literature and Hypothesis Development

Relate CSR to Firm Risk

Risk is defined as uncertainty about outcomes or events, especially with respect to the future (Bloom and Milkovich 1998; Brigham and Gapenski 1996). Firm risk measures the amount of financial performance fluctuations over time (Donaldson 1999). Anecdotal evidence and previous studies have found a negative relation between CSR and firm risk. As Kalwarski (2008) shows by citing statistics for the period of the 2007–2008 market meltdown, do-good investments hold up better and suffer less economic loss than the general financial market’s returns.

Stakeholder theory (Freeman 1984) suggests that firms could do well by doing good and satisfying their stakeholders. For example, high levels of CSR strengths can be negatively associated with firm risk through lower probabilities of suffering lawsuits and fines, less stringent regulatory controls, more stable relation with the government and the financial community (McGuire et al. 1988). Husted (2005) proposes a real option theory-based view of CSR and suggests that CSR participation should be negatively related to ex-ante downside business risk.

Godfrey (2005) presents a rigorous theory arguing that corporate philanthropy generates positive moral capital among communities and stakeholders, which will alleviate stakeholders’ sanction against the firm when negative shocks hit. Godfrey et al. (2009) apply this risk management view of CSR to a sample of 178 firms and find that only participation in ICSR helps lower the impact of negative firm-level shock on stock price. They hence argue for the “insurance-like” benefit of CSR activities that target secondary stakeholders. Also built on Godfrey (2005), Luo and Bhattacharya (2009) show that CSR activities help build firm reputation and lower undesirable firm idiosyncratic risk. Oikonomou et al. (2012) analyze the relation between firm market risk measures and five individual dimensions of CSR strengths and concerns separately using a utility-based analysis and find that CSR is negatively related to systematic risk (Beta), especially during the down markets. Combining various theoretical arguments and empirical evidence, we believe that

Hypothesis 1:

CSR is negatively associated with lower firm risk.

Stakeholder Characteristics, Firm Risk, and Financial Performance

As CSR activities are driven by firms, and in particular managers who manage relationships with various stakeholder groups, appropriate differentiation of stakeholder groups that the firm interacts with is of fundamental importance. Scholars have attempted to provide both meaningful and parsimonious categorizations (Clarkson 1995; Freeman et al. 2008). Clarkson (1995) shows that a stakeholder framework based on how firms manage their relationships with different stakeholders should be used to better assess the impact of CSR activities. He argues that an outsider may view CSR activities as socially responsible yet they are actually driven by market force and decided by managers who are only interested in results. Clarkson (1995) also shows that the differentiation of CSR activities into those targeting primary and secondary stakeholders captures managers’ interest and enables us to examine whether managers accomplish their results by making socially responsible decisions. Even though the definitions vary slightly, primary stakeholders dominate secondary stakeholders in all three key attributes that describe stakeholder saliency—power, legitimacy, and urgency—as presented in Mitchell et al. (1997).

Primary stakeholders make legitimate claims on the firm and its managers, and they have the power and urgency to enforce these claims. CSR activities targeting primary stakeholders are likely to result in exchange capital, which would be consumed in the exchange as primary stakeholders recognize their power and the nature of such exchange. With their power, primary stakeholders could demand superior financial and social performance, and their demand is likely to receive immediate attention. Even though the theory and empirical evidence for the CSR-financial performance link is inconclusive (Margolis and Walsh 2003; McWilliams and Siegel 2000), we expect to observe more immediate and observable results from managers’ dealing with their primary stakeholders by way of CSR activities.

Secondary stakeholders, on the other hand, have little power and urgency in pressing their legitimate claims on the firm and its managers. Therefore, ICSR strengths, which are CSR activities that target secondary stakeholders, are unlikely to be viewed as purely self-interested actions by managers designed to enhance exchange capability. Godfrey et al. (2009) point out that ICSR are more likely to be viewed as voluntary acts of social beneficence and reflect the firm’s moral characteristics. As secondary stakeholders recognize the “altruistic” and pure nature of ICSR, they grant moral capital, which belongs to reputational capital for doing social good, to the firm for its engagement in CSR activities. Positive moral capital will provide “insurance-like” benefits when the firm is subject to negative events and face sanctions from stakeholders (Godfrey 2005).

We therefore have the following hypotheses:

Hypothesis 2a:

ICSR strengths are associated with lower firm risk.

Hypothesis 2b:

TCSR strengths are associated with better firm performance.

Characteristics of the ICSR-Risk Link

If moral capital provides “insurance-like” benefits, the protection will be more salient during harsh times, when it is most needed. Existing literature supports such a conjecture. For example, Bansal and Clelland (2004) suggest that CSR can help protect and decouple the illegitimate activity from the rest of the organization in a crisis. Peloza (2009) notes that “social responsibility actions act as an insurance policy that can provide safety nets and mitigate harm from negative events.” Godfrey et al. (2009) show that ICSR strengths’ are associated with less negative abnormal stock returns when a firm is hit by legal/regulatory shocks.

Depending on the macroeconomic conditions, as an aggregation of all the stocks, the market could exhibit high volatility and low volatility itself. In a highly volatile market, higher uncertainty and vulnerability is expected for each firm. If moral capital provides insurance-like protection, we have:

Hypothesis 3a:

ICSR strengths are associated with lower firm risk, and more so in volatile markets.

When a firm faces degradation in value of its relational wealth, moral capital accumulated at the firm will mitigate stakeholder propensities for negative sanctions against the firm (Godfrey 2005). Further, because moral capital provides protection for relationship-based intangible assets (Godfrey et al. 2009), firms with higher intangible assets should benefit more from it.

Hypothesis 3b:

ICSR strengths are associated with lower firm risk for firms with high intangible assets.

While stakeholders impute ethical value to ICSR activities and grant moral capital to such social beneficences, they also determine whether such activities are a genuine manifestation of the firm’s intentions, motivations, and character. The greater the level of consistency between the ethical values from the two parties, the more pure the firm’s intention to engage in corporate philanthropy, the more moral capital could be generated (Godfrey 2005). On the other hand, participation in CSR activities may not resolve problems for a firm with negative social impact because stakeholders may see an inconsistency between moral behavior history and CSR (Godfrey et al. 2009). Combining the above arguments, we arrive at:

Hypothesis 3c:

ICSR strengths are associated with lower firm risk for firms with no negative social impact.

Ethical Climate Change and the ICSR-Risk Link

In the past decade, ethical climate has undergone major changes. More than ever before, firms must provide evidence of their adherence to ethical principles and guidelines (Martin and Cullen 2006). In the wake of the Enron scandal, investors learned a good lesson and regulators passed Sarbanes–Oxley Act in 2002, which requires public firms to adopt and to disclose publicly their ethical codes of conduct (Paine et al. 2005). Corporate social performance has become a key measure for overall corporate performance. For example, S&P 500 component firms and Fortune 500 firms that report their annual social performances have increased from close to zero in 2000 to 53 % in 2012. According to the G&A Institute 2012 report, the percentage has jumped in just 1 year: from 19 to 53 % for S&P 500 firms and from 20 to 57 % for Fortune 500 firms, in 2012. This suggests the increasing salience of ethics and CSR to stakeholders. As pointed out in Barnett and Vaicys (2000), the ethical climate influences stakeholders’ imputation of ethical values and ethical judgments. The changing ethical climate, together with changing views of ethical value and CSR activities may well influence the function of moral capital.

Media, especially social media, which barely existed 10 years ago, now plays an important role in our daily life. Media is capable of generating more attention now than ever before. As documented in Zyglidopoulos et al. (2012), media attention leads to increase in CSR strengths. On the other hand, media attention on CSR concerns could be viral and stir immediate sanction.Footnote 1 The drastic change in the social environment and how it influences stakeholders are also likely to lead to time-varying function of moral capital.

Finance literature documents that investors’ risk aversion varies overtime. Orlitzky and Benjamin (2001) argue that after the burst of the dot.com stock market bubble, investors were more focused on the underlying risk associated with equity investments and less mindful of capital gains and dividends. Abel (1999), Constantinides (1990), and Campbell and Cochrane (2000) present models consistent with a counter-cyclical relationship between aggregate risk aversion and risk premium change. Following the above arguments, we have

Hypothesis 4:

The negative relation between ICSR strengths and firm risk varies over time.

Data

Our sample covers all S&P 500 index component firms, excluding those in regulated industries,Footnote 2 over time period 1995 to 2009.Footnote 3 Since S&P 500 firms are both a representative group and one with high visibility compared to the firm universe, using this sample helps alleviate biases due to size effect, which have been discussed in CSR research (Brammer and Millington 2008). We use Kinder, Lydenberg, and Domini’s (KLD) Socrates data for corporate social performance, Compustat for financial variables, Center for Research in Security Prices (CRSP) for volatility and Beta of stock return information. There are 5,289 total firm-year observations with no missing information based on 583 unique firms for this study.

CSR Variables

KLD database has covered thousands of firms on their environmental, social, and governance performances since 1991. KLD has always covered S&P 500 firms and it expanded its corporate social performance (CSP hereafter) rating coverage in 2003 to thousands more smaller firms in Russell 2000. KLD offers the advantage of multiple rating criteria for social performance (Vaidyanathan 2008) and has been used intensely by researchers in CSR-related studies (Godfrey et al. 2009; Mattingly and Berman 2006; Luo and Bhattacharya 2009; Oikonomou et al. 2012; Kabongo et al. 2013, etc.).

KLD assigns a qualitative indicator zero/one score to CSR strengths and CSR concerns for rating purposes on an annual basis, with CSR strengths representing positive social performance and CSR concerns representing negative social performance. Five major qualitative areas of social performance ratings in the data are widely used in empirical studies of the link between CSR and risk as well as CSR and financial performance: employee relations, product quality, community relations, environmental issues, and diversity issues. Mattingly and Berman (2006) find that four of the above five dimensions of CSR (except for the environmental issues dimension) could be linked to distinct constructs which either target primary or secondary stakeholders and define ICSR and TCSR accordingly. They also point out that CSR strengths and concerns are both empirically and conceptually distinct constructs that should not be combined. Following their insights, we construct our measure of ICSR strengths as the total strength score for diversity and community dimensions and the measure of TCSR strengthsFootnote 4 as the total strength score for product and employee dimensions. Our measures of ICSR and TCSR concerns are calculated as the total concern scores for the corresponding KLD categories, respectively.

Size effect has been a major concern for using the KLD database for CSR studies, as larger firms tend to exhibit more CSR strengths and concerns, and the qualitative ratings do not reflect the dollar value of each CSR-related activity. Besides sticking to a sample with S&P 500 firms, we attempt a two-pronged approach in order to alleviate the size effect. First, we calculate the net strength scores by summing up the indicator variables for strengths and subtract the sum of the indicator variables for concerns of ICSR and TCSR, respectively. At the same time the net CSR measures mitigate size effect, they involve an implicit assumption that CSR strengths and concerns are similar constructs and could be combined. Such assumption may be unwarranted as argued in previous research (Mattingly and Berman 2006). To overcome such critique, we construct another set of ICSR/TCSR strengths variables that are adjusted by the mean ICSR/TCSR strengths of the quintile into which a firm’s asset size falls. We also construct the size-adjusted ICSR/TCSR concerns variables in a similar fashion. This set of size-adjusted CSR variables measures the difference between a firm’s CSR strength and the mean of its similarly-sized peers, which are more likely to capture the variation in ICSR/TCSR driven by factors other than firm size.

Panel A of Table 1 reports that on average, our sample of S&P 500 firms scores 2.8 on overall CSR strengths, 1.6 on ICSR strengths and 1.0 on TCSR strengths, with a large variation across firms. The scores on ICSR and TCSR concerns are 0.42 and 1.82, respectively. The net strength scores are 1.16 and −0.84 for ICSR and TCSR, respectively. The size-adjusted ICSR and TCSR strengths scores are both close to zero: 2.0E−9 for ICSR and 1.9E−8 for TCSR, but with a large variation, with standard deviation being 1.6 and 1.2. The correlation between the ICSR and TCSR strengths scores is positive at 0.4 for the raw measures and 0.3 for the size-adjusted measures.

Risk Variables

We use market-based risk measures in this study. We investigate the relation between ICSR/TCSR strengths and concerns and two market risk measures, relative stock volatility for total firm risk and Beta for systematic firm risk. Even though idiosyncratic risk can be diversified away in a large portfolio, as a measure for total market risk, stock volatility reflects the uncertainty in the stock and matters to the firm. We further conceptualize a firm’s total risk as relative stock volatility to the market, which is essentially a measure for firm total risk net of market impact. By excluding the impact of market conditions, our relative volatility measures focus on the everyday relative total risk of a firm, which includes but is not limited to negative legal or regulatory shocks to the firm. Hence our risk measure is in the context of a market-wide environment, while Godfrey et al. (2009)’s risk measure is in the context of firm-specific negative shocks. We also include Beta as the measure of firm systematic risk, which is embedded in the firm’s business and cannot be diversified away even in a large portfolio. We lag all CSR measures by 1 year as we are most interested in the effect of CSR on future firm risk. Because each CSR rating is taken as of each fiscal year end, CSR activities may spread over any time of the fiscal year (t − 1). We calculate stock volatility of the next fiscal year (t) for each firm using the 12-month returns of t (with no overlapping month from t − 1). The relative volatility of a firm to the market (RelRetVol t ) is computed by dividing its stock volatility by the contemporaneous CRSP value weighted index volatility (year t). The size-adjusted relative volatility (Size-Adjusted RelRetVol t ) is computed by dividing the firm’s stock volatility by that of a size portfolio, which contains all firms with sizes falling in the same quintile.

Beta is estimated from a market model using daily stock returns over the past 24 months as described in Eq. (3). We update the Beta estimates by including the next 12 months of returns for observations of the same firms in the next fiscal year.

As we see from Panel A of Table 1, the relative volatility ratio calculated based on the CRSP value weighted index ranges between 0.4 and 12.3 with a mean of 2.7, and the relative volatility ratio calculated based on the matching size portfolio varies between 0.2 and 6.8 with a mean of 1. Beta ranges between −0.4 and 3.8 with a mean of 1.0 and a standard deviation of 0.5.

Financial Performance Variables

We use both market-based (Tobin’s Q) and accounting-based measures (ROA_E and EBITDA/TA) for firm financial performance. Tobin’s Q is calculated as a firm’s market value relative to its book value, hence it reflects the market’s perception of a firm’s future profitability. ROA_E is a measure of return on assets (ROA), calculated as the ratio of earnings before interests and taxes (EBIT) to total assets. EBITDA/TA can be viewed as a measure of cash flow return, calculated as the ratio of earnings before interests, taxes, depreciation, and amortization (EBITDA) to total assets, which reflects cash flow based return and short-term profitability at the firm after stripping away the influence from using leverage. As all three financial performance variables vary widely across industries, we use industry-adjusted financial performance measures (industry-adjusted Q, ROA_E, and EBITDA/TA) to remove unobserved industry heterogeneity.

The mean financial performance measures are both positive, ranging from 12.2 % for ROA_E to 16.7 % for EBITDA/TA. The mean Tobin’s Q is a healthy 2.4 with a standard deviation of 2.3, ranging between 0.6 for the minimum and 78.6 for the maximum. Panel A of Table 1 provides summary statistics for our main variables.

Control Variables

We include aggregated CSR concern score (CSRconcern), firm size (Log(assets), measured in natural log of firm assets in million U.S. dollars) and other firm characteristics as control variables that have been shown in other studies to be associated with CSP: (1) Book leverage ratio (Leverage, total book value of debt/total book value of assets); (2) Measure of operating performance (ROA, calculated as ratio of net income to total assets); (3) Tobin’s Q (Q); (4) Ratio of property, plant, and equipment to total assets (PPE/assets); (5) Research and development expenses (R&D, ratio of R&D expenses to total assets; if R&D is missing, this variable is set to 0)Footnote 5; and (6) Number of years since firm inception (Firm age, measured in natural log of years). We also control for fixed year effects and Fama and French 12 industry (or firm) fixed effects to account for the impact of any unobserved missing year effect and/or firm characteristics on our results.

Empirical Results

Univariate Analysis

As a first step, we compare firm risk and performance measures at firms with above-median as well as median and below levels of ICSR/TCSR, both strengths and concerns, using a simple two-sample t test on mean. A quick glance of results in Table 2 shows a negative relation between net CSR strengths and firm risk, consistent with previous literature by McGuire et al. (1988) and supports Hypothesis 1.

More interestingly, our results show that when CSR activities are differentiated into strengths and concerns as well as ICSR/TCSR with respect to their different targeting stakeholders, there is a heterogeneous relation between CSR activities and firm risk:

First, CSR strengths are associated with lower firm risk and CSR concerns are associated with higher firm risk, be it total risk or systematic risk.

Second, ICSR strengths and concerns are more likely to be associated with firm risk measures than TCSR strengths and concerns.

Third, TCSR strengths are more likely to be associated with firm performance measures than ICSR strengths.

Our univariate analysis suggests that CSR activities in general help reduce the firm’s stock volatility and Beta, but such protection varies between ICSR and TCSR activities. ICSR strengths are associated with lower firm risk, while TCSR strengths are associated with better financial performance instead. Our finding that the negative relation only exists between ICSR strengths and firm risk is consistent with the evidence presented in Godfrey et al. (2009), who argue that only ICSR strengths generate moral capital which provides insurance-like benefits.

As we see from Panel B in Table 2, results based on size-adjusted CSR measures are consistent with those based on raw measures in most cases. But when we compare the impact of TCSR concerns on relative stock volatility, higher TCSR concerns are associated with lower relative volatility, which is counter-intuitive. Results from the same comparison based on the size-adjusted measures show higher risk at firms with higher TCSR concerns instead. The latter is also consistent with regression results when firm size is controlled. We believe that this is a piece of evidence that suggests size-adjusted CSR measures are more immune to size effect than the raw measures. In the reporting that follows, we will present results using both the size-based measures and raw measures as a cross robustness check.

Regression Analysis

We proceed with regression analyses to better understand the impact of ICSR and TCSR strengths on firm risk and financial performance. To test our hypotheses, we focus on the relation between ICSR strengths and risk, and the relation between TCSR strengths and financial performance, controlling for firm characteristics that are known to influence such relation. We start with an ordinary least squares regression with standard errors clustered at both firm and year levels, following Petersen (2009) and Thompson (2011). We examine the impact of ICSR/TCSR strengths using individual ICSR and TCSR strengths while controlling for overall CSR concerns and firm characteristics following Eq. (4):

The regression equations using net CSR strengths measures can be summarized as follows in (5).

We are interested in how previous CSR activities affect a firm’s stock volatility, so all the CSR variables are lagged by 1 year relative to the volatility measures.Footnote 6 We also lag all other control variables by 1 year to alleviate endogeneity concerns.

Panel A of Table 3 reports results from the above baseline regression equations and the expected signs of coefficient estimates. Theory and empirical evidence suggest that CSR concerns lead to higher firm risk, while CSR strengths, especially ICSR strengths, are negatively associated with firm risk (McGuire et al. 1988; Godfrey et al. 2009, among many others). They are however, muted on the impact of TCSR strengths on firm risk. The dependent variable is relative volatility ration in Columns (1)–(5) and is Beta in Columns (6)–(8) of Table 3—Panel A. Results in Column (2) show that relative stock volatility is positively related to CSR concerns and is not related to CSR strengths. Results in Column (4) show that size-adjusted relative stock volatility is negatively related to ICSR strengths only and is positively related to TCSR strengths and CSR concerns. Based on estimates in Column (4) (t-stat = −2.4), a one standard deviation increase of ICSR strength level is associated with 4.8 % of a standard deviation decrease of relative stock volatility. Results in Column (6) show that only ICSR strengths are negatively associated with firm systematic risk, Beta. A one standard deviation of increase of ICSR strengths level is associated with 8.6 % of a standard deviation of decrease in Beta. A one standard deviation of increase in CSR concern is associated with of 7.8 % of a standard deviation increase of relative stock volatility. This suggests that impact caused by CSR concerns is larger in magnitude than that caused by CSR strengths. When using net CSR strengths measures, both net ICSR strengths and net TCSR strengths are negatively associated with firm risk. Because both CSR strengths and concerns influence firm risk, it is hard to differentiate whether ICSR or TCSR, whether strengths or concerns, are driving such negative relation. Combining results reported in Columns (4), (5), and (8) of Panel A, we see that the negative relation between NetTCSRstrength and firm risk is actually driven by TCSRconcern, not by TCSRstrength. Combining results in Panel A of Table 3 on the relation of CSR, ICSR, and TCSR strengths with firm risk, we conclude that only ICSR strengths are negatively associated with firm risk. The negative association between net TCSR strengths and firm risk may largely be driven by the positive relation between TCSR concerns and firm risk.

We expect that firm size (Log(assets)) would be negatively related to firm risk as larger firms tend to have less volatile stock prices and systematic risk. The coefficient estimates on Log(assets) are negative significant for all specifications in Table 3 Panel A. Leverage is positively related to relative stock volatility as higher leverage leads to more volatile cash flows at the firm. Leverage is also negatively related to Beta. Firms with lower business risk usually have lower Beta, and these firms usually use leverage to improve their performance, which is likely to result in a negative relation between Leverage and Beta. Firms with high ROA in the previous years have less volatility and lower Beta, as expected. Firms with higher Tobin’s Q (Q) are more volatile as these firms are more likely growth firms that face more uncertainty. The ratio of a company’s property, plant, and equipment over total assets (PPE_TA) is used as a proxy variable for asset tangibility, which may influence firm risk and financial performance. As firms mature, measured by Firm age, relative stock volatility and Beta both go down, as expected. The number of CSR concerns leads consistently to higher relative stock volatility and higher Beta, whether the measure is adjusted for size effect or not, also as expected.

We next investigate the relation between ICSR/TCSR strengths and firm financial performance using the following empirical model and report results in Panel B of Table 3. The control variables are similar to those in Eqs. (4) and (5) while the dependent variables are either Tobin’s Q, or ROA_E, or EBITDA/AT.Footnote 7

Columns (1)–(4) of Panel B of Table 3 show that CSR strengths and TCSR strengths in particular are always positively associated with Tobin’s Q, ROA_E, and EBITDA/TA measures, whether they are raw measures or industry-adjusted measures. The relation between ICSR strengths and firm financial performance measures is positive, but not statistically significant when industry-adjusted performance measures are employed. As a control variable, CSR concerns are negatively associated with ROA_E and EBITDA/TA but not Tobin’s Q. Other control variables all have the expected signs: Firm size (Log(assets)) is negatively related to ROA measures as it gets more difficult to accomplish higher ROA for larger firms; leverage is positively related to industry-adjusted Tobin’s Q as leverage usage could provide tax shield for profitable firms, which results in improved firm value; high R&D expenses are associated with lower ROA measures (though insignificant) but with higher Q as investors value R&D’s positive impact on future profitability; and Firm age is also positively associated with industry-adjusted Q, ROA_E, and EBITDA/TA.

Our findings in Table 3 provide convincing support for Hypotheses 2a and 2b that TCSR and ICSR strengths have heterogeneous impact on firm risk and financial performance. TCSR strengths target primary stakeholders who possess more power and urgency, and as a result TCSR strengths are associated with improved firm financial performance measures that are more immediate and directly observable. ICSR strengths target secondary stakeholders who lack the power and urgency and are associated with lower firm risk, which is less immediate and less directly observable.

We next explore whether ICSR strengths’ impact on firm risk is insurance-like and how it may differ with respect to different firm characteristics. To be insurance-like, the protection from ICSR strengths should come in times of need. We introduce a dummy variable HighVol to capture the more volatile years in the market, which are times such protection will be more valuable. HighVol is set to 1 if the year is during the great recession years (2007–2009) and dot.com bubble burst years (2000–2002), closely resembling those identified in Oikonomou et al. (2012). HighVol is set to 0 in other years of our sample period.

Firms with higher percentage of intangible assets usually have higher market to book value ratio, as well as higher Tobin’s Q. We introduce a dummy variable HighQ that is set to one when a firm’s Tobin’s Q is higher than median and zero when it is below median. Because in general, the relationship-based intangible asset value at a firm is uninsurable, such protection should be more valuable for firms with higher percentage of intangible assets.

We then re-estimate the relationship between risk measures and ICSR, TCSR, as well as the interaction between ICSR, TCSR, HighQ and HighVol dummies, controlling for the same firm characteristics and firm fixed effects. Results reported in Table 4 show that ICSR strengths are negatively associated with size-adjusted relative volatility ratio in volatile markets and for firms with high intangible assets. ICSR strengths are negatively related to Beta for all firms in all times, whether it is in a volatile market or not, and whether the firm has high percentage of intangible assets or not. TCSR strengths do not have any significant relation with firm risk. Our findings support Hypotheses 3a and 3b.

Do ICSR strengths have a similar negative relation with firm risk for firms with negative social impact? Godfrey et al. (2009) and Jo and Na (2012) analyze different data samples in different periods and present empirical evidence supporting opposite answers. To identify firms with negative social impact, we follow Jo and Na (2012) and assign dummy variable Sin to one if the industry a firm belongs to is tobacco, gambling, weapons, alcohol, adult entertainment and other controversial firms and to zero otherwise. Our results in Table 5 show that in general, ICSR strengths are only associated with lower relative stock volatility and lower Beta for firms without negative social impact. Again, TCSR strengths are not associated with lower firm risk regardless of the firm’s negative social impact status. Hence Hypothesis 3c is supported.

Finally, we examine whether the impact of ICSR and TCSR strengths varies with ethical climates. The passage of Sarbanes–Oxley in 2002 represents an implementation of higher ethical standards in the corporate world. We divide our full sample period into two: pre-Sarbanes–Oxley (hereafter SOX, 1995–2001) and post-SOX (2002–2009) and test for the relation between CSR strengths and firm risk measures. As we see from the results in Table 6, the negative relation between ICSR strengths and firm risk is only significant in post-SOX years. In pre-SOX years, the above relation is negative but not significant. What is more, there is a positive relation between TCSR strengths and Beta in pre-SOX years and it turns negative and insignificant in post-SOX years. The sub-period analysis shows that the impact of CSR activities on firm risk is time-varying. As ethical value and code is more emphasized in our society, stakeholders and investors especially impute different values from CSR activities. Results in Table 6 also show that size-adjusted TCSR concerns are associated with higher relative stock volatility in the post-SOX period. Such relation is positive yet insignificant in pre-SOX years. This provides another piece of evidence consistent with the consequence of higher ethical standards: it leads not only to more appreciation of CSR strengths, but also to more sanction against CSR concerns. All these findings support Hypothesis 4.

Granger Causality Test

It would be interesting to investigate whether there is any causal effect between ICSR and firm risk, as either direction seems plausible. ICSR strengths may generate moral capital that provides insurance-like protection which causes lower firm risk (Godfrey et al. 2009). Or as a firm grows in size, it is likely to face less uncertainty and have more resources to engage in more CSR activities. So the negative relation between firm risk and CSR/ICSR could be due to reverse causality. To address this concern that is related to size effect, we conduct a Granger causality test using size-adjusted CSR measures and report the results in Table 7.

The Granger causality test explores the direction of the causal relationship between relative volatility and ICSR strengths at the firm level. We regress the difference in size-adjusted relative volatility over year t and t − 1 on the difference in size-adjusted ICSR strengths over year t − 1 and t − 2 as well as year t − 2 and t − 3. We also regress the difference in size-adjusted ICSR strength over year t and t − 1 on the difference in size-adjusted relative volatility over year t − 1 and t − 2 as well as year t − 2 and t − 3. Both regressions have the same control variables as those in Eqs. (4) and (5). As we can see from Table 7, higher lagged ICSR activities Granger causes lower stock volatility, while lower lagged stock volatility does not Granger cause higher ICSR activities. Results from the Granger causality test confirm that ICSR strengths lead to volatility reduction, not the other way around.

Further Robustness Checks

We conduct a number of robustness checks and the results confirm our findings. First, we use a set of alternative dependent variables and re-estimate Eq. (4). Similar to the construct of RelRetVol and Size-Adjusted RelRetVol, we form our alternative relative volatility measure based on 2-year-after monthly returns by calculating the 24-month volatility for the stock and market, respectively, in fiscal year t and t + 1 when considering the impact of CSR activities in fiscal year t − 1. We find similar results using alternative total risk measures: RelRetVol2 and Size-Adjusted RelRetVol2, supporting our Hypotheses 1–5.

In Mattingly and Berman (2006), environmental strength loads on the factor “institutional weakness,” which leads Godfrey et al. (2009) to include only two components: community and diversity strength for measure of ICSR. We construct two alternative ICSR measures (Alt ICSRstrength and Alt Size-Adjusted ICSRstrength) that include three components with the added environmental strength score and our results remain unchanged.

Corporate governance ratings from the KLD database have been questioned for their quality and many CSR-related studies exclude corporate governance ratings and focus on the remaining five categories only (Jo and Harjoto 2011, 2012, etc.). Others include corporate governance strengths for TCSR (Godfrey et al. 2009). We include in regression Eq. (4) two alternative TCSR measures (Alt TCSRstrength and Alt Size-Adjusted TCSRstrength) that include corporate governance strength score from the construct of TCSR and find qualitatively unchanged results. The results from robustness checks using alternative measures of firm risk and CSR are not reported for space consideration, and are available upon request.

As all of our dependent variables (RelRetVol, Beta, industry-adjusted Tobin’s Q, ROA_E and EBITDA/TA measures) are bounded ratios, we re-estimate the relation between them and ICSR and TCSR strengths using Tobit regressions. The results are reported in Table 8 and are qualitatively the same as those from the OLS with two way clustering and panel firm fixed effects regressions.

Finally, we test for endogeneity concern for our regression since ordinary least squares estimators are inconsistent when endogenous explanatory variables exist. We introduce the following two instrumental variables for the two suspected endogenous variables—net ICSR and net TCSR strengths, and re-estimate the relation between ICSR/TCSR strengths and firm risk, as well as financial performance, using instrumental variable regressions.

-

Annual average of in-state ICSR/TCSR net strengths for all other firms in the same state (State mean NetICSRstrength and State mean NetTCSRstrength)

-

Average of ICSR/TCSR strengths for all other firms with same three-digit SIC codes (Industry mean NetICSRstrength and Industry mean NetTCSRstrength)

A valid instrumental variable requires meeting two criteria: it should affect the level of net ICSR/TCSR strengths, and it should not affect firm risk or financial performance through other channels except for its direct effect on net ICSR/TCSR strengths. Intuitively, mean net ICSR/TCSR strengths for all firms in one state should affect net ICSR/TCSR strengths at a specific firm because of certain shared statewide influence. The mean net ICSR/TCSR strengths for all firms with same 3-digit SIC codes should similarly affect net ICSR/TCSR strengths because of certain industry shared influence. The two instrumental variables explain over 30 % of variation in net ICSR/TCSR strengths and are unlikely to be weak instruments. We report the results from the instrumental variable regressions in Table 9. There is a positive significant relation between net ICSR/TCSR strengths and the two instruments. Along with higher explanatory power of two instruments, the insignificant Hansen’s J-statistics show that instruments are valid. The GMM C-statistics for both Beta and Tobin’s Q are insignificant with p values at 0.8 and 0.2, suggesting that net ICSR/TCSR strengths are likely not endogenous. This provides further relief that our findings on the heterogeneous impact of ICSR and TCSR strengths on firm risk and financial performance are not spurious.

Discussion and Concluding Remarks

Before discussing the findings of our study and considering its broader implications, we recognize the limitations of our work. Using KLD data as the source of CSP has its own critiques. For example, Entine (2003) notes several credulity problems as the data are stretched to meet the objectives of individual researchers as individual item scores get combined across dimensions into larger constructs. Even though we differentiate the five dimensions of CSR ratings of KLD based on a meaningful concept, the targeting stakeholders of the CSR activities, the aggregation of ratings across dimensions still subject itself to such criticism. Even though we study to use size-adjusted CSR scores to mitigate the size effect inherent in the KLD database, continuous CSR variable, if available, would be preferred to fully address such concern.

Theoretical Implications

We conduct a robust analysis of heterogeneous impact of CSR activities with different targeted stakeholders in this study by mending several major data and methodology drawbacks in previous studies as pointed out in Orlitzky and Benjamin (2001) and Orlitzky et al. (2003). First and foremost, we analyze the CSR-risk and CSR-financial performance links in the primary/secondary stakeholder framework as argued in Clarkson (1995) and document heterogeneous impact of ICSR and TCSR strengths. Second, we use a large panel dataset of representative S&P 500 index component firms over the period of 1995–2009. We also construct size-adjusted measures to alleviate the notorious size bias in CSR studies. Third, we attempt to capture the time sensitivity of such impact of CSR activities. Fourth, we apply firm fixed effects regression that addresses the concern of having missing variables. Our study provides relieving evidence that after SOX, stakeholders value ethics more as both ICSR and TCSR strengths have stronger impact on firm risk and financial performance, respectively, during the post-SOX period.

Our main contribution is that this may be the first study that investigates the heterogeneous impact of CSR strengths that target different stakeholders on CFP, addressing both the CSR-risk and CSR-performance links. We find that the impact of TCSR that target primary stakeholders is more immediate and easily observable: TCSR concerns are associated with immediate higher firm risk and TCSR strengths are associated with higher Tobin’s Q, ROA_E, and EBITDA/TA. On the other hand, the impact of ICSR that target secondary stakeholders is less immediate and not as easily observable: ICSR concerns are not associated with immediate higher firm risk and ICSR strengths are associated with lower firm risk. The negative relation between ICSR strengths and firm risk is stronger in volatile markets.

Our findings also confirm the “insurance-like” benefit of ICSR for the CSR-risk link in the context of market-wide shocks. Such benefit is similar to those documented in Godfrey et al. (2009) in the context of negative firm-level shocks, but have a much broader coverage. Further, our findings provide more insight into the non-uniform CSR impact on both CSR-risk and CSR-return links, which varies with targeted stakeholders. Such “insurance-like” protection is more salient in volatile markets for firms with higher proportion of intangible assets and firms without negative social impact. Such “insurance-like” benefit is also time-varying, becoming more salient in post-SOX period.

Finally, our empirical findings survive endogeneity tests and other robust checks with alternative risk measures, alternative ICSR/TCSR strengths measures, and alternative regression methods. This alleviates concern that our results may be driven by endogeneity, or the size effect, or a particular construct of ICSR and TCSR measures, or a particular regression method.

Practical Implications

Our study should be of great interest to policy makers and corporate managers. We show that the differentiation of CSR activities based on the targeting stakeholders is meaningful and that participation in ICSR and TCSR has different outcomes. It not only provides empirical evidence that supports what stakeholder theories suggest about the heterogeneous benefits of CSR activities, but also confirms that the outcomes from different CSR activities managers engage into manage relationships with different stakeholder groups match what they have hoped for. We provide empirical evidence for the “insurance-like” protection through ICSR strengths in the context of market-wide shocks, and for enhancing financial performance through TCSR strengths, which makes a solid business case for firms to participate in CSR activities. We show that higher ethical standard raised by the regulators guide stakeholders in their ethical judgment when imputing value to corporate activities.

Notes

“In the Internet era, even a 64-year-old retired math teacher can become a threat to a large company.” Wall Street Journal (C1, Feb 19, 2013).

Financial (SIC 6000-6999) and regulated utility firms (SIC 4900-4999) are not included in our sample.

KLD used ticker as identifier for the firms it covered prior to 1995 and switched to CUSIP as firm identifiers since 1995. To minimize the possibility of misidentified firms when combining data with Compustat, which uses CUSIP as firm identifiers, we work with data starting from 1995.

Godfrey et al. (2009) include corporate governance dimension for TCSR as well. We construct an alternative measure for TCSR strengths and concerns following their approach and find qualitatively the same results, which are available upon request.

In unreported results, we show that our results on the relation of ICSR/TCSR with risk and performance still hold in a smaller sample when firms with missing R&D information are excluded. Results are available upon request.

ROA is included as independent variables when dependent variables are ROA_E or EBITDA/TA. Q is not included as independent variables when dependent variable is Tobin’s Q.

References

Abel, A. B. (1999). Risk premia and term premia in general equilibrium. Journal of Monetary Economics, 43(1), 3–33.

Bansal, P., & Clelland, I. (2004). Talking trash: Legitimacy, impression management, and unsystematic risk in the context of the natural environment. Academy of Management Journal, 47(1), 93–103.

Barnett, T., & Vaicys, C. (2000). The moderating effect of individuals’ perceptions of ethical work climate on ethical judgments and behavioral intentions. Journal of Business Ethics, 27(4), 351–362.

Bloom, M., & Milkovich, G. T. (1998). Relationships among risk, incentive pay, and organizational performance. Academy of Management Journal, 41(3), 283–297.

Brammer, S., & Millington, A. (2008). Does it pay to be different? An analysis of the relationship between corporate social and financial performance. Strategic Management Journal, 29(12), 1325–1343.

Brigham, E. F., & Gapenski, L. C. (1996). Intermediate financial management (5th ed.). Orlando, FL: Dryde.

Campbell, J. Y., & Cochrane, J. H. (2000). Explaining the poor performance of consumption-based asset pricing models. The Journal of Finance, 55(6), 2863–2878.

Clarkson, M. E. (1995). A stakeholder framework for analyzing and evaluating corporate social performance. Academy of Management Review, 20(1), 92–117.

Constantinides, G. M. (1990). Habit formation: A resolution of the equity premium puzzle. Journal of Political Economy, 98(3), 519–543.

Donaldson, L. (1999). Performance-driven organizational change: The organizational portfolio. Thousand Oaks, CA: Sage.

Entine, J. (2003). The myth of social investing: A critique of its practice and consequences for corporate social performance research. Organization & Environment, 16(3), 352–368.

Freeman, R. E. (1984). Strategic management: A stakeholder approach. Boston: Pitman.

Freeman, R. E., Harrison, J. S., Wicks, A. (2008). Managing for stakeholders: Survival, reputation, and success. New Haven, CT: Yale University Press.

G&A Governance & Accountability Institute, Inc. (2012) 2012 corporate ESG/sustainability/responsibility reporting—Does it matter?

Godfrey, P. C. (2005). The relationship between corporate philanthropy and shareholder wealth: A risk management perspective. Academy of Management Review, 30(4), 777–798.

Godfrey, P. C., & Hatch, N. W. (2007). Researching corporate social responsibility: an agenda for the 21st century. Journal of Business Ethics, 70, 87–98.

Godfrey, P. C., Merrill, C. B., & Hansen, J. M. (2009). The relationship between corporate social responsibility and shareholder value: An empirical test of the risk management hypothesis. Strategic Management Journal, 30(4), 425–445.

Husted, B. W. (2005). Risk management, real options, and corporate social responsibility. Journal of Business Ethics, 60(2), 175–183.

Jo, H., & Harjoto, M. (2011). Corporate governance and firm value: The impact of corporate social responsibility. Journal of Business Ethics, 103(3), 351–383.

Jo, H., & Harjoto, M. (2012). The causal effect of corporate governance on corporate social responsibility. Journal of Business Ethics, 106(1), 53–72.

Jo, H., & Na, H. (2012). Does CSR reduce firm risk? Evidence from controversial industry sectors. Journal of Business Ethics, 110(4), 441–456.

Kabongo, J., Chang, K., & Li, Y. (2013). The impact of operational diversity on corporate philanthropy: An empirical study of U.S. companies. Journal of Business Ethics, 116(1), 49–65.

Kalwarski, T. (2008, July 14). Do-good investments are holding up better, Business Week, p. 15.

Luo, X., & Bhattacharya, C. B. (2009). The debate over doing good: Corporate social performance, strategic marketing levers, and firm-idiosyncratic risk. Journal of Marketing, 73(6), 198–213.

Margolis, J. D., & Walsh, J. P. (2003). Misery loves companies: Rethinking social initiatives by business. Administrative Science Quarterly, 48(2), 268–305.

Martin, K. D., & Cullen, J. B. (2006). Continuities and extensions of ethical climate theory: A meta-analytic review. Journal of Business Ethics, 69(2), 175–194.

Mattingly, J. E., & Berman, S. L. (2006). Measurement of corporate social action: Discovering taxonomy in the Kinder Lydenburg Domini ratings data. Business & Society, 45(1), 20–46.

Mcguire, J. B., Sundgren, A., & Schneeweis, T. (1988). Corporate social responsibility and firm financial performance. Academy of Management Journal, 31(4), 854–872.

McWilliams, A., & Siegel, (2000). Corporate social responsibility and financial performance: correlation or misspecification? Strategic Management Journal, 21(5), 603–609.

Mitchell, R., Agle, B., & Wood, D. (1997). Toward a theory of stakeholder identification and salience: Defining the principle of who and what really counts. Academy of Management Review, 22, 853–886.

Oikonomou, I., Brooks, C., & Pavelin, S. (2012). The impact of corporate social performance on financial risk and utility: A longitudinal analysis. Financial Management, 41(2), 483–515.

Orlitzky, M., & Benjamin, J. D. (2001). Corporate social performance and firm risk: A meta-analytic review. Business & Society, 40(4), 369–396.

Orlitzky, M., Schmidt, F. L., & Rynes, S. L. (2003). Corporate social and financial performance: A meta-analysis. Organization studies, 24(3), 403–441.

Paine, L., Deshpandé, R., Margolis, J. D., & Bettcher, K. E. (2005). Up to Code: Does your company’s conduct meet world-class standards? Harvard Business Review, 38(12), 122–133.

Peloza, J. (2009). The challenge of measuring financial impacts from investments in corporate social performance. Journal of Management, 35(6), 1518–1541.

Petersen, M. A. (2009). Estimating standard errors in finance panel data sets: comparing approaches. Review of Financial Studies, 22, 435–480.

Thompson, S. B. (2011). Simple formulas for standard errors that cluster by both firm and time. Journal of Financial Economics, 99, 1–10.

Udayasankar, K. (2008). Corporate social responsibility and firm size. Journal of Business Ethics, 83(2), 167–175.

Vaidyanathan, B. (2008). Corporate giving: A literature review. Working paper, Center for the Study of Religion and Society, University of Notre Dame.

Zyglidopoulos, S. C., Georgiadis, A. P., Carroll, C. E., & Siegel, D. S. (2012). Does media attention drive corporate social responsibility? Journal of Business Research, 65, 1622–1627.

Acknowledgments

We would like to thank Gary Monroe (Section Editor) and an anonymous referee for comments and suggestions that greatly improved the paper’s quality. Ying Li would also like to thank Sundar Balakrishnan, Paul Collins, Steve Holland, Kevin Laverty, and Sandeep Krishnamurthy for helpful discussions and comments.

Author information

Authors and Affiliations

Corresponding author

Appendix: Definitions of Variables

Appendix: Definitions of Variables

RelRetVol | 12 month stock volatility t /12 month CRSP value weighted index volatility t |

Size-Adjusted RelRetVol | 12 month stock volatility t /12 month CRSP size quintile portfolio volatility t |

RelRetVol2 | 24 month stock volatility t,t+1/24 month CRSP value weighted index volatility t,t+1 |

Size-Adjusted RelRetVol2 | 24 month stock volatility t,t+1/24 month CRSP size quintile portfolio volatility t,t+1 |

Beta | Beta is measured using the previous 2 years daily data |

CSRstrength | A sum of the CSR strengths across community, diversity, environment, employee relation, and product quality [COMstrength + DIVstrength + ENVstrength + EMPstrength + PROstrength] |

Size-Adjusted CSRstrength | CSR strengths adjusted by the mean value of CSR strength score in the size portfolio; size portfolio is determined by quintile of total assets |

CSRconcern | A sum of the CSR concerns across community, diversity, environment, employee relation, and product quality [COMconcern + DIVconcern + ENVconcern + EMPconcern + PROconcern] |

Size-Adjusted CSRconcern | CSR concerns adjusted by the mean value of CSR concern score in the size portfolio; size portfolio is determined by quintile of total assets |

NetCSRstrength | CSRstrength − CSRconcern |

ICSRstrength | ICSR strengths [COMstrength + DIVstrength] |

Alt ICSRstrength | Alternative ICSR strengths [COMstrength + DIVstrength + ENVstrength] |

Size-Adjusted ICSRstrength | ICSR strengths adjusted by the mean value of the ICSR strength score in the size portfolio; size portfolio is determined by quintile of total assets |

Alt Size-Adjusted | Alternative size-adjusted ICSRstrength |

ICSRconcern | ICSR concerns [COMconcern + DIVconcern] |

Size-Adjusted ICSRconcern | ICSR concerns adjusted by the mean value of ICSR concern score in the size portfolio; size portfolio is determined by quintile of total assets |

NetICSRstrength | ICSRstrength—ICSRconcern |

TCSRstrength | TCSR strengths [EMPstrength + PROstrength] |

Alt TCSRstrength | Alternative TCSR strengths [EMPstrength + PROstrength + CGOVstrength] |

Size-Adjusted TCSRstrength | TCSR strengths adjusted by the mean value of TCSR strength score in the size portfolio; size portfolio is determined by quintile of total assets |

Alt Size-Adjusted TCSRstrength | Alternative Size-adjusted TCSRstrength |

TCSRconcern | TCSR concerns [EMPconcern + PROconcern + CGOVconcern] |

Size-Adjusted TCSRconcern | TCSR concerns adjusted by the mean value of TCSR concern score in the size portfolio; size portfolio is determined by quintile of total assets |

NetTCSRstrength | TCSRstrength—TCSRconcern |

HighVol | If in volatile periods (2000–2002 and 2007–2009), takes 1, else 0. |

Log (assets) | Firm size measured by book value of assets at fiscal year t [AT] |

Leverage | Debt to assets ratio [(DLC + DLTT)/AT] |

ROA | Net income divided by assets [NI/AT] |

ROA_E | EBIT divided by assets [EBIT/AT] |

Cash flow return | EBITDA divided by assets [BITDA/AT] |

Q | Tobin’s Q, measured by market value of assets divided by book value of assets [(PRCC_F*CSHO + AT − CEQ)/AT)] |

HighQ | If size-adjusted Q > median(Q), takes 1, else 0. |

Size-Adjusted ICSRstrength by HighQ | Size-Adjusted ICSRstrength*HighQ |

Size-Adjusted TCSRstrength by HighQ | Size-Adjusted TCSRstrength*HighQ |

Size-Adjusted ICSRstrength by HighVol | Size-Adjusted ICSRstrength*HighVol |

Size-Adjusted TCSRstrength_HighVol | Size-Adjusted TCSRstrength*HighVol |

PPE/assets | Property, plant & equipment divided by assets [PPENT/AT] |

R&D | R&D expense [XRD/AT] |

Firm age | Fiscal year minus the first year that the firm is reported in Compustat |

State mean NetICSRstrength | Annual NetICSRstrength score average located in the same state |

State mean NetTCSRstrength | Annual NetTCSRstrength score average located in the same state |

Industry mean NetICSRstrength | Mean NetICSRstrength scores of firms in the same three-digit SIC codes |

Industry mean NetTCSRstrength | Mean NetTCSRstrength scores of firms in the same three-digit SIC codes |

Rights and permissions

About this article

Cite this article

Chang, K., Kim, I. & Li, Y. The Heterogeneous Impact of Corporate Social Responsibility Activities That Target Different Stakeholders. J Bus Ethics 125, 211–234 (2014). https://doi.org/10.1007/s10551-013-1895-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-013-1895-8