Abstract

This article investigates whether investors consider the reliability of companies’ sustainability information when determining the companies’ market value. Specifically, we examine market reactions (in terms of abnormal returns) to events that increase the reliability of companies’ sustainability information but do not provide markets with additional sustainability information. Controlling for competing effects, we regard companies’ additions to an internationally important sustainability index as such events and consider possible determinants for market reactions. Our results suggest that first, investors take into account the reliability of sustainability information when determining the market value of a company and second, the benefits of increased reliability of sustainability information vary cross-sectionally. More specifically, companies that carry higher risks for investors (e.g., higher systematic investment risk, higher financial leverage, and higher levels of opportunistic management behavior) react more strongly to an increase in the reliability of sustainability information. Finally, we show that the benefits of an increase in the reliability of sustainability information are higher in times of economic uncertainty (e.g., during economic downturns and generally high stock price volatilities).

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

“Sustainability” has been frequently used by companies to describe their economical, social, and environmental orientation. The most common definition of “sustainability” was developed by the United Nations World Commission on Environment and Development (1987) in the so-called “Brundtland Report.” According to this report, sustainable development is a “development that meets the needs of the present without compromising the ability of future generations to meet their own needs.” Companies implementing sustainability principles into their corporate strategy need to take environmental and social aspects into account. Although companies may be motivated by responsibility and altruism, they may also decide to implement sustainable principles to maximize future long-term earnings (Adams and Zutshi 2004, p. 34; King 2002).

A growing number of studies analyze how investor behavior is influenced by the extent to which a company applies sustainability principles. Most studies focus on the policy’s impact on the market value or performance of the company. Some argue that good relationships with various stakeholders, such as employees or suppliers, can improve corporate performance and minimize transaction costs with stakeholders (Freeman 1984). With strong relationships, employees will be more productive and motivated, and suppliers will deliver products of higher quality and with fewer delays. Yet, substantial CSR measures are associated with additional costs that can lower the market value of a company. Thus, determining the optimal level of CSR measures seems to be a difficult task for many companies.

Several studies have analyzed the general relationship between the application of CSR principles and company performance. The results of these studies vary widely (Margolis and Walsh 2003). Although Derwall and Koedijk (2009), Orlitzky et al. (2003), Posnikoff (1997), Van de Velde et al. (2005), and Waddock and Graves (1997) find a positive relationship between company performance and corporate sustainability efforts, Aupperle et al. (1985), Brammer and Pavelin (2006), and Wright and Ferris (1997) document a negative relationship. Teoh et al. (1999) do not find evidence for any relationship at all. Several papers provide an overview of these studies, state theoretical explanations for this relationship, and mention theoretical and methodological problems (e.g., De Bakker et al. 2005; Margolis and Walsh 2003).

Another stream in the CSR literature evaluates the short-term and long-term impacts of a company’s addition to a sustainability stock index. Publishers of sustainability indexes require companies to meet a set of sustainability performance criteria to be listed in the index. Inclusion in a sustainability index is often seen as evidence of high sustainability performance (comparable to a CSR “certification”; Consolandi et al. 2009). Consequently, inclusion in (or deletion from) such an index is a strong signal for an increase (or decline) in a company’s sustainability performance relative to its competitors. Moreover, a listing in a reputable sustainability index demonstrates responsible behavior and provides companies with operating legitimacy. As a result, socially responsible investment (SRI) funds have grown tremendously during the last few years. A recent report from the European Sustainable Investment Forum (EUROSIF) (2010) estimated that the SRI sector in Europe has 5 trillion Euro assets under management, which is equivalent to an 87% increase in the last 2 years. The so-called “core SRI” comprises 1 trillion Euros and relies on strict positive screening (e.g., excluding companies from investment portfolios after assessing their ethical values). The so-called “broad SRI” encompasses another 4 trillion Euros and utilizes a simpler screening method. According to EUROSIF, the core SRI represents approximately 10% of the asset management industry in Europe as of 2010.

Becchetti et al. (2009) empirically analyze the reactions of the capital markets to inclusion in and deletions from the Domini 400 Social Index (renamed the FTSE KLD 400 Social Index in 2009) from 1990 to 2004. They find a significant upward trend in the absolute values of abnormal returns both for inclusions and deletions as well as a significant negative effect on abnormal returns for companies that have been deleted from the index. Curran and Moran (2007) evaluate the impact of an addition to and a deletion from the FTSE4 Good UK Index. They find neither significantly positive reactions to the announcement of an addition nor significantly negative reactions to the announcement of a deletion from the index. Consolandi et al. (2009) document limited evidence for the superior performance of companies listed in the Dow Jones Sustainability Index (DJSI) STOXXFootnote 1 relative to those STOXX 600 companies not included in the DJSI STOXX. In an event study covering the years 2001–2006, Consolandi et al. (2009) find low but significantly positive (negative) excess returns for companies added to (deleted from) the DJSI STOXX. In addition, they examine liquidity effects and document an increase in stock trading volumes of companies that have recently been included in the index.

Dilling (2008) documents contradictory results for the Dow Jones Sustainability World Index (DJSI World). For 2002 (the initial year of the DJSI World) and 2003, significantly positive market reactions to inclusions are documented, whereas significantly negative market reactions to inclusions are documented for 2004 and 2005. Cheung (2011) analyzes investor reactions to announcements of the composition of the DJSI World. For the years 2002–2008, he finds a significant increase in stock returns after an addition to the index and a significant decrease in stock returns after a deletion from the index. The increase in the number of empirical studies that examine sustainability indexes shows that sustainability indexes have gained importance and might be appropriate indicators of investor demands and reactions.

The aforementioned studies, however, do not explicitly analyze how and in what environment information regarding a company’s sustainability performance is made available to investors. In addition, these studies do not investigate to what extent investors perceive this information to be reliable. We contribute to this literature by offering a new interpretation of an addition to a sustainability index, and we argue that such events increase the reliability of sustainability information.

Legitimacy theory suggests that disclosure of sustainability information can influence the relationship between a company and its stakeholders (Freeman 1984). Thus, companies voluntarily disclose social and environmental information (Suchman 1995, pp. 574–576). How sustainability performance is perceived by investors is affected by information from various sources including corporate social responsibility (CSR) reports, corporate sustainability reports, information from a company’s website, press releases, reports about the company, sustainability rankings, and so on. In most countries, only a minimal amount of sustainability information is required by law to be disclosed (e.g., information in accounting notes and management reports). In addition, sustainability information is widely published voluntarily and without sufficient review by independent institutions. As a result, investors find it difficult to evaluate the reliability of this highly relevant information, especially when the information is published by the company itself or by other institutions with a specific interest in influencing or even manipulating the information. Adding to the investors’ difficulties, contradictions or inconsistencies may also appear in the available information.

Information is useful to investors only if it simultaneously fulfills the criteria of relevance and reliability. If a piece of information lacks relevance or reliability, investors will unwittingly use biased estimations regarding the “true” market value of a given company. In this study, we analyze whether an increase in the reliabilityFootnote 2 of sustainability information that is already publicly available affects the investor’s ability to valuate this information. Furthermore, we investigate whether the reaction to such an increase depends on certain company-specific characteristics or on overall economic conditions. To do so, we conduct an event study that evaluates market reactions to an increase in the reliability of sustainability information that the market could not anticipate and thus not price beforehand. As a proxy for such an event, we use the addition of a company to the most important European sustainability index, the DJSI STOXX. This index indicates which of the biggest European companies perform best in terms of fulfilling the sustainability criteria.

Inclusion in the index does not provide new sustainability information about a company to market participants, as information about sustainability performance is published throughout the entire year. Hence, participants in the capital markets usually acquire the relevant information before the composition of the index is announced. Controlling for potentially confounding index listing effects, we assume that all market reactions to an inclusion in a sustainability index are caused by the perception of increased reliability of the information on sustainability performance.

In our study, we analyze market reactions to increased reliability of sustainability information and the determinants of the magnitude of this reaction. We find that investors consider the reliability of sustainability information when determining the market value of a company. Moreover, the magnitude of investor reactions is greater for companies with higher investment and information risks (e.g., higher systematic investment risk, higher financial leverage, and a higher level of opportunistic behavior of the management). Finally, we document that the benefits of an increase in the reliability of sustainability information are higher in times of economic uncertainty (i.e., during economic downturns and times of high stock volatilities).

Background

Companies provide information about their sustainability performance in sustainability reports, CSR reports, and less-focused reporting instruments (e.g., financial statements and accounting notes). Companies that voluntarily publish sustainability reports often use guidelines that specify the content of these reports to facilitate the efficient use and anticipation of the information. Since 2000, the Global Reporting Initiative (GRI) has issued a set of guidelines that have become a globally accepted standard for sustainability reporting. These guidelines are designed to meet the information requirements of various stakeholders in a company (Freeman 1984, p. 25; Fassin 2009, pp. 114–115). The GRI framework mandates disclosure of the economic, environmental, and social performance of each company (GRI 2006). The GRI classification of sustainability performance into the three aforementioned dimensions matches the classification used by the publishers of the DJSI STOXX. Accordingly, the sustainability report is one of the most important sources of information used by the publishers of the DJSI STOXX to assess a company’s sustainability performance. In addition to sustainability reports, many companies publish timely information on a regular basis; for example, many companies announce the achievement of sustainability goals on their websites (Gelb and Strawser 2001, p. 11). Moreover, several other sources (e.g., television, radio, print, and internet media) provide information on a company’s sustainability performance.

It is challenging for investors to assess a company’s sustainability performance accurately even if detailed sustainability reports are available because most of the available data are qualitative in nature and thus difficult to link to future financial performance. Moreover, companies might provide such information for self-serving reasons. For example, companies might disseminate sustainability information to distract the public from environmental or ethical questions posed by their core operations. Moreover, they might provide favorable information and disguise or conceal questionable practices.

As with all information, sustainability information needs to meet a certain degree of reliability to be considered by investors when determining a company’s market value. According to Fama et al. (1969), any information, irrespective of its content, influences stock prices only if the information is relevant and reliable. Thus, the framework of the GRI’s Sustainability Reporting Guidelines requires that information be relevant and reliable (GRI 2006). Furthermore, the conceptual frameworks of the United States Generally Accepted Accounting Principles (US-GAAP) and the International Financial Reporting Standards (IFRS) also demand that companies fulfill these criteria. Their demands are not surprising because these two criteria are universally valid and derived from information theory (Haroutunian et al. 2008). Relevance and reliability help to assess whether given information can be classified as useful when making a decision. In fact, failure to comply with these criteria suggests that the information released by a company is not useful for decision making (Streim 2000).

In our study, we focus on additions to the DJSI STOXX. This index follows a best-in-class approach. The index is composed of the leading 20% companies in terms of sustainability criteria of the Dow Jones STOXX 600 Index, which consists of the 600 largest European companies. Categorized into 58 DJSI sectors, companies are assessed in terms of general and industry-specific criteria. The companies are compared against their peers and ranked accordingly on an annual basis. Although a 20%-best-in-class approach was chosen, the number of companies constituting the index does not necessarily equal 120 (i.e., 20% of 600 companies). Deviations may occur due to roundings: if one sector consists of three companies, the leading 20% are rounded up into one company.

In the review process, relative criteria are used to rank a company’s sustainability performance. Within one sector, only the best companies, in a relative sense, are added to the index. Nevertheless, a sector is only eligible for the DJSI STOXX if the highest ranked company has a corporate sustainability performance score of at least 50% of the maximum score. Low-performing sectors are eliminated from the review process. Thus, the selection of eligible sectors is based on absolute criteria.

A pre-defined set of criteria is used to assess the economic, environmental, and social performance of companies in eligible sectors. One source of information is the sustainability reports that are published by the company. Another source of information is a multiple-choice questionnaire that is completed by a senior representative of the company participating in the annual review. Further sources include analysts’ reviews, press releases, articles, and stakeholder commentary written about a company over the previous year. In addition, questions that arise from the questionnaire or from reports are clarified in personal interviews between the analysts and companies. Finally, an external assurance report documents whether the corporate sustainability assessments have been conducted in accordance with the defined rules. Once the components of the index are selected, they are continually monitored throughout the year.

Experts such as the publishers of a specialized index can assess the reliability of sustainability information more easily than investors can. The group of investors contains both professional institutional investors and private individual investors. Compared to institutional investors, and especially compared to individual investors, the publishers have several advantages. These advantages include more expertise in assessing the sustainability performance of companies, greater power to demand further information, and greater facility in benchmarking and comparing a company’s sustainability information to that of its peers. By assessing a company’s sustainability performance and publishing sustainability indexes, these publishers act as mediators between companies and investors. Thus, we assume that an index publisher’s decision to add a company to a sustainability index instantly increases the reliability of the sustainability information about the company. If our assumption holds true, then this increase in reliability should lower a company’s risk and lead to an increase in its share price. This market reaction should vary cross-sectionally with respect to the determinants of the magnitude of this increase in reliability.

Hypotheses Development

The previous literature suggests several competing hypotheses to explain the market reactions to market index additions and deletions. The price pressure hypothesis (Harris and Gurel 1986) assumes that index additions do not convey any new information; rather, they cause shifts in demand. Investors expect to be compensated for the transaction costs and portfolio risks that occur when they immediately sell securities that they would not trade otherwise; thus, they accommodate these demand shifts. Harris and Gurel (1986) find an immediate increase in the volume of price and trading after an addition as well as a subsequent reversal of the price reaction. Similarly, the distribution effect hypothesis (i.e., the “imperfect substitutes hypothesis”) predicts that after an addition to an index, equilibrium prices change when demand curves shift to eliminate excess demand. This hypothesis assumes that securities are not close substitutes for each other. In contrast to the price pressure hypothesis, the distribution effect hypothesis does not predict price reversals in the period after the addition(s) because the new price reflects a new equilibrium distribution of shareholders. Shleifer (1986), Beneish and Whaley (1996), Lynch and Mendenhall (1997), Kaul et al. (2000), Blume and Edelen (2001), and Wurgler and Zhuravskaya (2002) present evidence in line with this hypothesis. In our study, we investigate additions to a sustainability index that is not tracked by many specific index funds. Thus, we do not predict that a price pressure or a permanent shift in the demand curve occurs after an addition. We control for these effects by documenting not only the market price reactions, but also the changes in trading volume after the index composition changes.

The “information certification hypothesis” (Denis et al. 2003) argues that an addition to an index does carry information because the index publisher can pick stocks that have higher prospects even if the index publisher does not claim to do so. Again, this effect should play a minor role in our study because the (future) performance of the company is not a decisive criterion for selecting additions to the DJSI STOXX. However, we control for the possible effects of the information certification hypothesis by including the future and expected earnings as additional control variables.

The “investor awareness hypothesis” (Chen et al. 2004) argues that additions to an index can increase investor awareness and decrease information searching costs because such events increase the amount of information available to investors and reduce information asymmetry problems. According to this hypothesis, an addition to an index is followed by a positive market price reaction but not necessarily by an increase in trading volume. However, the market price of deleted companies may not decline. The positive market price reaction might also be caused by a self-fulfilling prophecy (Merton 1948). Investors expect a stock price to increase if the company is added to a sustainability index. Hence, investors buy stocks of those companies that were added to a sustainability index. With an increase in demand of the added companies, in fact their stock prices increase. The DJSI STOXX publisher adopts the “best-in-class” approach to add companies to or delete companies from the DJSI STOXX. This approach does not use the positive screening method, which selects companies doing business in a sustainable manner, or the negative screening method, which deletes companies violating established corporate sustainability practices. Instead, this approach chooses (deletes) companies whose overall social, environmental, and economic score is the highest (lowest). Thus, a company may be deleted not because of the absolute value of its sustainability practices but because its sustainability scores pale in comparison to those of other companies. As a result, investors interpret index deletion events differently from index addition events.

As a corollary of the investor awareness hypothesis, we propose the “increase in information reliability hypothesis” to explain market reactions to additions (deletions) to (from) stock indexes. As mentioned above, investors demand that all published information fulfill the criteria of relevance and reliability to be useful for decision making (Ball 2006; Cormier et al. 2010; Schipper 2003). Sustainability information is usually forward-looking due to the long-term perspective of sustainability concepts. Thus, sustainability information is highly relevant for investors. At the same time, the forward-looking nature of sustainability information causes it to lack reliability. One way to increase the reliability of sustainability information is to establish external and independent assessments of this information. For example, if the publishers of sustainability indexes confirm the sustainability information published about a company, this “increase in reliability” can be considered a new piece of information to the stock market, which itself fulfills the criteria of relevance and reliability. Based on this logic, we state the following hypothesis:

Hypothesis 1

Investors react positively to an increase in the reliability of companies’ sustainability information.

The two following hypotheses relate to potential determinants of the magnitude of investor reactions to an increase in the reliability of sustainability information. In Hypothesis 2, we focus on company-specific determinants associated with uncertainties in information. First, we expect the sustainability information of companies with a higher investment risk (e.g., risk of bankruptcy and of disproportionate stock price changes) to benefit more from an objective external assessment of sustainability information. An increase in reliable information on sustainability performance can minimize transaction costs with stakeholders and help a company generate positive moral capital. This moral capital provides an insurance-like protection for the company (Godfrey 2005; Godfrey et al. 2009) against sanctions in future crises or negative events (Peloza 2006). Accordingly, future cash flows will be more stable (Luo and Bhattacharya 2009), and the cost of capital will decrease. These effects might be more pronounced for companies with a higher risk. Second, we state that companies that a priori show a better information environment (less information risk) are less positively affected by the external validation of sustainability information. In particular, a better information environment can be assumed when the stock price is less affected by noise trading (Ali et al. 2003; Ashbaugh-Skaife et al. 2006). Furthermore, an information policy that is regarded as more opportunistic can be considered a determinant of information uncertainty (Beatty et al. 2002; Dechow et al. 1995, 1996). We hypothesize as follows:

Hypothesis 2

The magnitude of investor reactions to an increase in the reliability of companies’ sustainability information is higher for companies showing a higher level of information uncertainty.

Hypothesis 3 relates to the impact of the company’s general economic environment on the magnitude of market reactions to an increase in the reliability of sustainability information. Previous literature suggests that transparency and the existence of high-quality information on companies can mitigate the adverse impact of economic downturns (e.g., Brunnermeier and Pedersen 2009; Vayanos 2004) due to investors engaging in a “flight to information quality.” Furthermore, in serious economic downturns, investors may prefer investments in companies with an elaborate long-term strategy and a sustainable business model. Both lines of reasoning lead to increased weight being placed on the reliability of information during the investing process in times of financial crisis or economic downturns. We expect investor reactions to an increase in the reliability of sustainability information to be stronger during such times. Thus, we state the following hypothesis:

Hypothesis 3

The magnitude of investor reactions to an increase in companies’ sustainability information is stronger in times of economic uncertainty.

Research Design

Sample Selection and Data

The focus of this study is the reactions of capital markets to an increase in the reliability of sustainability information. To examine this effect, we rely on the composition of the DJSI STOXX, which is the most important European sustainability index. The DJSI STOXX contains companies that comprise the top 20% in sustainability performance in the Dow Jones STOXX 600, which includes the largest European companies. The publishers of the DJSI STOXX decide which companies are listed in the index based on an independent evaluation of the companies’ sustainability performances (i.e., their economic, environmental, and social performances). The publishers of the DJSI STOXX conduct an annual review of the composition of the index. A press release in the third quarter of each year reveals which companies are added to and deleted from the index. According to the code of procedures of the DJSI STOXX, the index composition changes are publicly available for the first time on the day of the press release.

Our sample contains all of the companies that were added to the DJSI STOXX from its inception in October 2001 and in the subsequent annual reviews until 2008. We use an event study to analyze the reaction of the stock market to a company’s addition to this index for eight subsequent years, including the stock market’s reactions to the inception. We also explore whether a relation exists between the stock price at the announcement of an addition to the DJSI STOXX and certain characteristics of the company under investigation.

Over the examination period, 359 companies were added to the DJSI STOXX. These companies represent the initial sample of this study.Footnote 3 We use the methodology of continuously compounded daily stock returns based on return indexes to explicitly take into account dividend payments and stock splits. As the quality of daily returns depends on the underlying trading volume, we exclude returns that do not result from trading activities. Alternatively, we use the methodology of non-continuously compounded returns, which leads to less normally distributed cumulative abnormal returns (CAR i ). Overall, the empirical findings are largely identical. The return and trading volume data are taken from the Thomson Financial Worldscope database. To calculate CAR i , we require that at least 50% (75%) of the daily returns are available over the estimation period (in the event window).Footnote 4 Our database does not provide all of the required data for 15 companies. As a result, we end up with a sample of 344 CAR i for each event window. Data for further analyses are also taken from the Thomson Financial Worldscope database.Footnote 5

Table 1 provides an overview of the industry distribution of the total sample following the 12-industry classification system proposed by Fama and French (2008). Based on this system, 15.1% of the sample companies belong to the banking or insurance industry, and 14.8% are companies from the manufacturing industry. All other industries represent <10% of our sample.

Table 2 provides an overview of the country distribution of the total sample. The United Kingdom, Germany, and France represent 34.6, 13.4, and 12.2% of our sample, respectively. All other countries represent <10% of our sample. 14 companies are from countries with less than five available observations.

Event Study Methodology

CAR i are computed by taking the sum of daily abnormal returns over a given time period (event window). To calculate daily abnormal returns, we use the well-established market-model methodology (MacKinlay 1997, p. 18), where the companies’ expected daily returns are subtracted from the companies’ realized daily returns. Expected daily returns are determined by a company-specific market model (Lintner 1965; Sharpe 1964) in which the realized daily returns of a company i (R it ) is regressed on the daily returns of the market portfolio m (R mt ) over the 100 trading days prior to the event window, as shown in Eq. 1. As a proxy for the market portfolio, we use a self-computed value-weighted portfolio of all publicly traded European companies.Footnote 6

In Eq. 1, α0i and α1i are event- and company-specific regression coefficients, and u it is the residual of Eq. 1. To illustrate market reactions to an increase in the reliability of sustainability information, we define three event windows that surround the event day. We use the day of the DJSI STOXX publisher’s press release as our event day and focus on three event windows: “event window 1”: [−2;2]; “event window 2”: [−5;5]; and “event window 3”: [−10;10].Footnote 7

Multiple Regression Analysis

To explain market reactions to an increase in the reliability of sustainability information (measured as CAR i ), we perform multiple regression analyses. We regress CAR i cross-sectionally on a range of variables corresponding to Hypotheses 2 and 3, including country, industry, company size, and index-inclusion effects. We take heteroskedasticity explicitly into account by using consistent covariance matrix estimates (White 1980). We estimate the following regression (including binary variables capturing the country and industry level):

All variables are defined in detail in Table 3: β0 to β12 are regression coefficients, and v i is the residual of the regression. In this regression, we capture different aspects associated with investor’s company-specific investment and information risks. We reason that the externally induced increase in the reliability of sustainability information is higher for companies with higher investment and information uncertainties.

BETA i is the systematic investment risk of a company (Bowman 1979; Hill and Stone 1980). A higher value indicates that a company generally reacts more sensitively to economic or stock market changes and thus implies higher uncertainties in future stock price development for investors. Following well-established asset pricing models (e.g., Beaver 1972; Jensen 1972), the risk premium of a company depends on BETA i as higher values lead to higher costs of capital. LEVERAGE i is the financial leverage ratio of a company. Higher values of LEVERAGE i imply higher financing risk. Companies with a high leverage ratio pose risks for investors because their capital structures are characterized by a high proportion of debt. The financial advantages of debt anticipated in stock prices (e.g., tax shields) are accompanied by uncertainties concerning the future development of the company (e.g., bankruptcy risk) (Castanias 1983; Hill and Stone 1980; Hurdle 1974; McConnell and Servaes 1995). SYNCHRONICITY i is the R 2 from a classical CAPM (Roll 1988), which is widely used in the literature as a proxy for the quality of the information environment (Teoh et al. 2009). In line with Ali et al. (2003), Ashbaugh-Skaife et al. (2006), Shiller (1981), and West (1988), we state that the higher explanatory power of asset pricing regression models stems from less noise in stock returns and thus fewer information uncertainties.Footnote 8 OPPORTUNISM i is the unsigned proportion of discretionary accruals. This measure is frequently used in the accounting literature to measure earnings management (e.g., Jones 1991; Dechow et al. 1995) and thus companies’ efforts to influence information provided in financial reports (e.g., Burgstrahler and Dichev 1997). Even if these efforts are not necessarily illegal, we assume that companies showing higher values of OPPORTUNISM i are more willing to opportunistically influence information (Dechow et al. 1996), which leads to higher skepticism from the capital markets toward information published by the company in general. Thus, investors also anticipate this information risk when analyzing the sustainability information published by a company.

As stated in Hypothesis 3, we also expect the economic environment to influence the reactions of the capital markets to an increase in the reliability of sustainability information. To capture overall market uncertainties, we include MKTVOLA i , which is the yearly volatility of the market portfolio. Higher values of MKTVOLA i indicate higher overall market uncertainties.

Empirical Findings and Discussion

Capital Market Reactions

To test Hypothesis 1, we begin by computing CAR i over the three event windows surrounding the day of the announcement of the index composition changes. Table 4 shows the results. For the shortest event window ([−2;2]), we find a highly significant positive mean (median) market reaction of 1.233% (t-stat. = 4.24) (0.599% (z-stat. = 3.52)). We find a highly significant positive mean (median) market reaction of 1.950% (t-stat. = 4.38) (1.105% (z-stat. = 4.06)) for the second event window ([−5;5]). For the longest event window ([−10;10]), we find a highly significant positive mean (median) market reaction of 4.707% (t-stat. = 5.92) (2.131% (z-stat. = 5.59)). Furthermore, in accordance with Brown and Warner (1985) and Corrado (1989), the specific test statisticsFootnote 9 of the event study indicate a significantly positive market reaction for each event window. Thus, our findings are consistent for all three event windows. As no additional content concerning the sustainability performance of the company is announced on the event day, we assume that these market reactions can be attributed to an increase in the reliability of the previously published sustainability information. We argue that the judgment behind the composition of the index is well founded and based on pre-defined criteria. Consequently, we interpret these market reactions as evidence that an increase in the reliability of sustainability information constitutes important information for investors. These results support our first hypothesis, which states that investors react positively to an increase in the reliability of a company’s sustainability information. However, we are aware of competing explanations of these market reactions in the literature. To rule out these alternative explanations, we perform additional tests in the following sections.

Determinants of Stock Market Reactions

We provide descriptive statistics on the variables used in our regression in Table 5. The companies used to detect the effects of an increase in the reliability of sustainability information in this study show a systematic risk (BETA i ) of 0.887 and a financial leverage ratio (LEVERAGE i ) of 67.876%. The means and medians do not differ substantially for these measures. The mean (median) market synchronicity measure (SYNCHRONICITY i ) is 12.027% (5.731%), and the mean (median) unsigned proportion of discretionary accruals (OPPORTUNISM i ) is 14.924% (6.522%). The average yearly market portfolio stock volatility (MKTVOLA i ) is 0.755%.

The mean average return on assets over the two fiscal years prior to their inclusion in the index (PERFPRE i ) (over the two fiscal years after (PERFPOST i )) is 4.570% (4.262%). The respective median is 4.278% (3.939%). The mean (median) of the abnormal trading volume measure, developed by Harris and Gurel (1986) (ATOVER i ), indicates that no substantial abnormal trading activities in terms of absolute stock turnovers by volume exist at the time of the addition to the index. The mean (median) growth rate of stock liquidity (ΔTOVER i ) is 4.172% (−1.777%), and the mean (median) total change in the ownership structure (ΔOWNERSHIP i ) is −10.404% (0.000%). The mean (median) number of employees (SIZE i ) is 58,544 (32,596).

Table 6 shows correlations for CAR i for all three event windows, all continuous variables of interest, and additional continuous variables (i.e., those used to capture index listing effects). This table provides evidence for Hypothesis 2, as OPPORTUNISM i is negatively correlated with several CAR i on a statistically significant level. In line with Hypothesis 3, we also find a significantly positive correlation between MKTVOLA i and CAR i . Additional correlations provide some evidence for the presence of index listing effects because higher CAR i are associated with an increase in ownership concentration (ΔOWNERSHIP i ). Aside from a highly significant positive correlation of BETA i and SYNCHRONICITY i , correlations between other exogenous variables are moderately low. Furthermore, the pre- and post-index inclusion performance measures (PERFPRE i and PERFPOST i ) show highly significant positive correlations. We will keep these findings in mind and take serious precautions to avoid a multicollinearity bias in the following sections.

Table 7 provides further evidence (in the form of univariate tests) for the impact of our variables of interest on the reactions of the capital market. We compare each company’s market reaction (in terms of CAR i ) concerning several variables of interest. Panel A of Table 7 shows that the investors’ reactions are stronger for companies with a higher systematic stock performance risk (BETA i ) by trend, but we cannot document a positive impact of the financial leverage ratio (LEVERAGE i ) on the market reaction. In Panel B of Table 7, we show that companies with more noise trading (SYNCHRONICITY i ) show significantly stronger reactions from the market, but we are not able to document that management opportunism (OPPORTUNISM i ) has any significant impact. Finally, as shown in Panel C of Table 7, we find that the magnitude of the market reaction to an increase in the reliability of sustainable information is higher in times of economic uncertainty (MKTVOLA i ). Overall, these univariate results provide limited initial evidence for our hypotheses. As these findings could be influenced or even driven by unexamined or latent characteristics, we apply a set of multiple regression analyses to simultaneously evaluate the impact of several variables of interest.

Table 8 shows the results of regressing the CAR i for each event window on the variables of interest and on a set of additional variables that capture potential index-inclusion effects resulting from competing hypotheses. Furthermore, we include SIZE i as a proxy for the size of a company. Even though all of the analyzed companies are among Europe’s largest 600 companies, their sizes vary considerably. This variable also captures biasing effects arising from the general information environment, as larger companies, on average, tend to publish more detailed information, show more analyst coverage, and have a higher public observance than smaller companies do (Lang and Lundholm 1996; Zhang 2006). Finally, we include INITIAL i as a control variable to determine if the initial composition of the index leads to different market reactions on average. We run our regressions for each of our three event windows separately. Models 1, 3, and 5 are performed without the additional variables, models 2, 4, and 6 use all of the variables, as stated in Eq. 2.

The first two variables of interest refer to the investment risk of the company. We include these variables because investors holding stocks of high-risk companies are particularly interested in company-specific information. We find that a higher systematic stock risk (in terms of BETA i ) leads to higher positive market reactions. These findings hold for each event window at a highly significant level. For event windows 2 and 3, we observe that a higher financial leverage ratio (LEVERAGE i ), indicating a higher investment risk (e.g., bankruptcy risk), is associated with higher positive market reactions.

The next two variables of interest refer to the information risk of a company. We conjecture that companies with a less reliable information environment are more strongly affected by an increase in the reliability of important pieces of information. We document that fewer uncertainties about the “true” market value of a company (i.e., less noise trading) result in significantly higher CAR i for each regression model (SYNCHRONICITY i ). Furthermore, we find that higher management opportunism (OPPORTUNISM i ) leads to higher positive market reactions, but these findings are only slightly significant for model 6. Overall, our regression results provide evidence in favor of Hypothesis 2.

To test Hypothesis 3, we begin by evaluating the effect of the overall economic environment on the magnitude of the market reactions to an increase in the reliability of sustainability information. Including the yearly volatility of the European market portfolio as a proxy for market uncertainty (MKTVOLA i ), we document a significantly positive impact on CAR i for event windows 2 and 3.

In regression models 2, 4, and 6, we include additional variables to control for the impacts of competing hypotheses. The “information certification hypothesis” predicts that positive market reactions occur because of the prospect of the company’s higher profitability in the future. However, we do not find a significantly positive association between the market reaction and the future performance of the company (PERFPOST i ). Thus, we conclude that the “information certification hypothesis” is not a substantial driver of the magnitude of the market reaction. Contrary to the “price pressure hypothesis,” we do not find a significantly positive relation between the magnitude of the market reaction and the stock liquidity.

We find that the stock liquidity of the company before and after the index listing (ΔTOVER i ) has no significantly positive impact on the magnitude of the market reaction. Furthermore, we find that an increase of the ownership concentration (ΔOWNERSHIP i ) has only a marginally significant positive impact on the magnitude of the market reaction in models 2 and 6. We also find that smaller companies benefit more from the objective external assessment of their sustainability performance (SIZE i ). Controlling for the initial listing effect (INITIAL i ), we document a significantly higher market reaction for the first time the composition of the index was announced.

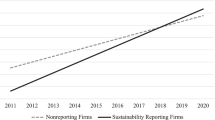

In our regression analyses, we control for industry and country effects. The CAR i of different industries vary cross-sectionally (un-tabulated findings) at a highly significant level. ANOVA F-test statistics for event windows 1, 2, and 3 are (F-stat. = 2.69)***, (F-stat. = 3.76)***, and (F-stat. = 3.58)***, respectively.Footnote 10 The adjusted χ2-test statistics for event windows 1, 2, and 3 are (adj. χ2-stat. = 22.87)***, (adj. χ2-stat. = 17.12), and (adj. χ2-stat. = 27.08)***, respectively. In our regression analyses, industry effects are not consistent at all (un-tabulated findings). Cross-sectional variations by country are less significant. ANOVA F-test statistics for event windows 1, 2, and 3 are (F-stat. = 1.34), (F-stat. = 2.65)***, and (F-stat. = 2.01)***, respectively. Adjusted χ2-test statistics for event windows 1, 2, and 3 are (adj. χ2-stat. = 4.82), (adj. χ2-stat. = 13.97), and (adj. χ2-stat. = 7.13), respectively. Again, the effects in our regression analyses are inconsistent. In line with Dilling (2008), we find that the initial listing of the index leads to significantly higher positive market reactions for event windows 1, 2, and 3, with a mean-inequality of (t-stat. = 2.69)***, (t-stat. = 3.76)***, and (t-stat. = 3.58)***, respectively, and a median-inequality of (z-stat. = 1.83)*, (z-stat. = 3.98)***, and (z-stat. = 5.86)***, respectively. The inclusion of the initial listing largely explains the divergence of our findings from those of Consolandi et al. (2009). Aside from this divergence, we are not able to document any trend over time at any conventional significance level.

Further Discussion of Competing Hypotheses

As explained previously, prior researchers have discussed alternative explanations for market reactions to index inclusions. To evaluate whether index inclusions could be explained by the “price pressure hypothesis,” as suggested by Harris and Gurel (1986), we also analyze the trading volume around the time of the index inclusion and the reversals of price reactions after the index inclusion. We measure the abnormal trading volume over each event window in accordance with Harris and Gurel (1986), as described in Panel B of Table 3. In contrast to the claims of the “price pressure hypothesis,” we neither find an increase of trading volume immediately after an addition to the index nor a reversal of the price reaction in the days after the addition (see the increase of the positive market reactions with the length of the event windows). Specifically, we find for event windows 1, 2, and 3 an average abnormal trading volume of 0.996 (t-stat. = 0.32), 0.999 (t-stat. = 0.06), and 1.008 (t-stat. = 1.05), respectively, as well as a median abnormal trading volume of 0.996 (z-stat. = 0.34), 1.002 (z-stat. = 0.15), and 1.005 (z-stat. = 0.27), respectively.

The “information certification hypothesis” predicts that positive market reactions occur because of the prospect of higher profitability of the company in the future. However, we do not find significant differences in the profitability of companies newly included in the DJSI STOXX and the profitability of STOXX 600 companies not included in the DJSI. The mean (median) profitability of companies included in the DJSI STOXX over the 2 years after the index inclusion is 4.262% (3.939%), and companies of the STOXX 600 not included in the DJ STOXX show a mean (median) profitability of 4.526% (4.049%) in the same time period (mean-inequality test: t-stat. = 0.395; median-inequality test: z-stat. = 0.958).

Interaction of Company Risks and Economic Uncertainties

We examine whether our company-level risks occur in times of economic uncertainty. We thus include the interactions of our company-level investment and information risk measures (inclusion of individual interactions but also simultaneous inclusion of four interactions) with our proxy for economic uncertainty in each cross-sectional regression. Un-tabulated regression results show that the interaction term BETA i · MKTVOLA i is positive at a significant level for each model (t-statistics higher than 2.00 for each model indicating significance of 5% or more), but other interactions are widely insignificant and show inconsistent effects. These findings suggest that the systematic investment risk of a company affects the reactions of the market to the company’s addition to the index during times of economic uncertainty. However, we are not able to provide broader evidence for the impact of the underlying economic situation on the abovementioned risk.Footnote 11

Effects of a Deletion from the Sustainability Index

The main challenge of this study is to examine the effects of an increase in the reliability of sustainability information. To do so, we represent this increase by using the effects of an addition to the sustainability index. Consequently, a deletion from the DJSI STOXX should decrease the reliability of the sustainability information and result in negative CAR i in each event window. However, we are not able to document such an effect at a high level of significance. For event windows 1, 2, and 3, we find mean CAR i of 0.130% (t-stat. = 0.35), −0.171% (t-stat. = 0.40), and 0.439% (t-stat. = 0.60), respectively, and median CAR i of −0.223% (z-stat. = 0.78), −0.817% (z-stat. = 1.44) and −0.830% (z-stat. = 0.64), respectively. We take these heterogeneous and insignificant findings as evidence for a trade-off between the increased reliability of the (low) sustainability performance of a company (positive impact) and the economic consequences of being delisted from the index (negative impact). An alternative reason for the insignificant market reactions on index deletions is that the circumstances that lead to the deletions may be anticipated by investors before the index publisher’s decision is published. This alternative explanation seems plausible because renunciations and infringements of sustainability principles are usually well documented by the media. When a delisting announcement can be anticipated, the capital markets should have already priced the consequences of delisting. Thus, the official announcement of the delisting does not provide new information to the capital markets. For example, in 2007, BP was accused of serious safety failures and pollution of the environment after one of BP’s refineries exploded (Baker et al. 2007). In 2008, Société Générale lost 4.9 billion Euros in a trading fraud that uncovered shortcomings in their organizational structure (The New York Times 2008). In both cases, this information was published before their deletions were officially announced, allowing the capital markets to anticipate their deletions.

Both companies (BP and Société Générale) have been picked as examples for failures in their sustainability performance. When these failures became obvious, the capital market knew about the shortcomings in their sustainability performance. Thus, the capital market was able to anticipate the deletion of these companies from the index prior to the following annual index composition. Similarly obvious examples do not exist for additions to the sustainability index. On the one hand, this lies in the nature of media coverage, since the media more often report negative than positive news. On the other hand, an investor cannot tell by a single positive news report if the company shows a good overall sustainability performance. A good overall sustainability performance is needed to be listed in the sustainability index. Thus, deletions can easier be anticipated by the capital market than additions. Accordingly, additions can easier be statistically measured than deletions.

The assessment of the publisher of the index is more reliable than the assessment of an investor who does not have an extensive expertise in assessing sustainability performance. Yet, the publisher’s assessment is not fully reliable, since companies that only pretend to act sustainably, might be listed wrongly until they show obvious failures (like BP and Societé Génerále).

The index publisher assesses information that is publicly available and information that is based on the questionnaire filled by the company that potentially will be listed. If the overall sustainability performance is positive, the company will be listed. Thus, companies might be listed wrongly because they have concealed bad sustainability performance. In addition, the sustainability performance of a company might change over time, when short-term targets become more important to the company’s management than long-term targets. Consequently, the assessment of the publisher of the index is much more reliable than the assessment of an investor without extensive expertise in assessing sustainability performance. However, even the assessment of the publisher is not guaranteed to be fully accurate at all times.

Further Sensitivity Analyses

First, we use alternative methods to calculate CAR i . In particular, we use the well-established market-adjustment methodology (e.g., Palmrose et al. 2004, p. 68). For event windows 1, 2, and 3, we find mean market-adjusted CAR i of 0.659% (t-stat. = 1.25), 1.277% (t-stat. = 2.93), and 3.646% (t-stat. = 3.00), respectively. Regressions for the market-adjusted values lead to findings that are consistent with our original model in principle; however, the findings suffer from very low overall fits.

Second, we perform our tests again using alternative benchmark indexes: the unmodified STOXX 600 and a self-computed, equally weighted index containing all European publicly traded companies. Market reactions evaluated based on the STOXX 600 as the benchmark index are lower but hold on a relatively high level of significance. For event windows 1, 2, and 3, we find average CAR i of 0.243% (t-stat. = 1.59), 0.957% (t-stat. = 2.00), and 2.984% (t-stat. = 1.56), respectively. Overall, the findings concerning Hypotheses 2 and 3 are comparable, but the overall fits of the regression models are almost bisected. We attribute this lower level of investor reaction to the companies added to the DJSI STOXX remaining in the STOXX 600. As a result, the benchmark index itself is seriously influenced by their inclusion. Using an equally weighted index containing all European publicly traded companies, we document similar market reactions: for event windows 1, 2, and 3, we find average CAR i of 1.297% (t-stat. = 3.36), 1.358% (t-stat. = 2.41), and 3.869% (t-stat. = 4.37), respectively. In our regression models, several variables showing significant effects remain at least at the aforementioned levels of significance. Nonetheless, the overall fits of the regression models are lower.

Third, to capture the impact of various aspects of the market reaction, we include a set of control variables in our regression models, as shown in Table 6. To ensure that our findings are not overly influenced by the definitions of these variables, we replace these definitions with alternative ones. For BETA i (SYNCHRONICITY i ), CAPM-beta (R 2) based on the STOXX 600 acts as a proxy for the market portfolio, and 3 month EURIBOR acts as the risk-free rate calculated over the fiscal year. For LEVERAGE i , we use the percentage of debt to common equity at the beginning of the fiscal year. For OPPORTUNISM i , we use the unsigned abnormal working capital accruals, as defined by DeFond and Park (2001). For PERFPRE i and PERFPOST i , we use the return on equity, defined as net income scaled by lagged total equity over each fiscal year. For SIZE i , we use the average daily market capitalization in thousand Euro over the fiscal year. Using these alternative definitions increases multicollinearity in the regression analyses, but we find neither distinguishingly different impacts on the market reactions nor importantly different overall fits of the regressions. In addition, we aggregate our four company risk indicators, which correspond to Hypothesis 2, by using a principal components analysis (PCA) (Jolliffe 1982) that results in only two factor scores with an Eigenvalue higher than one that represent 71.145% of the total information. We also observe that the overall market uncertainty measure (MTKVOLA i ) has a highly significant positive impact on several regression models, explaining the magnitude of the CAR i , as shown in Table 7. We do not pursue these regression models because both factor scores of the company risk indicator variables, which show an insignificant impact in each regression model, cannot be interpreted in several settings. We also evaluate if the ownership structure of the company influences the magnitude of the CAR i as it seems to be thinkable that companies which are dominated by large shareholders react differently to the index inclusion. We define the ownership structure of the company as the percentage of closely held shares at the end of the fiscal year. However, we are not able to detect any impact of this variable within our multivariate cross-sectional analyses. We do not include the ownership structure in our final multivariate regression as once more considerable multicollinearity issues concerning the further control variables arise.

Fourth, in line with Hypothesis 3, we attempt to evaluate the impact of the general economic environment on the magnitude of market reactions by including the volatility of the market portfolio (MKTVOLA i ) in our multiple regressions, as shown in Table 7. We are aware that this variable covers only one possible aspect (i.e., market uncertainty) of the general economic environment. For this reason, we alternatively use the overall performance of the European market portfolio for each year and the growth rate of the gross domestic product of all European countries as control variables. The findings for the company risk indicator variables under Hypothesis 2 hold or even become more significant, yet serious multicollinearity biases arise. In addition, the findings vary considerably throughout the different regression models. Thus, we concentrate on the volatility of the market portfolio as only this variable has a consistently negative impact on the CAR i (as predicted in Hypothesis 3). Moreover, this variable has the highest explanatory power (in terms of adjusted R 2) of all of the variables discussed above.

Conclusions

Information about the sustainability performance of a company is described almost universally as highly important for investors’ decisions. A wide range of theoretical and empirical studies discuss the relevance of such information, coming to heterogeneous conclusions. However, less attention, especially in empirical studies, has been devoted to reliability, which is the second indispensable component of useful information. In most countries, little disclosure about the sustainability performance of companies is required or enforced by law. As a result, sustainability information is published widely and voluntarily without sufficient external review from independent institutions.

We set out to explore whether this lack of reliability of sustainability information is taken into account by investors when determining the market value of a company. To achieve this goal, we examined the reactions of the market for events that increase the reliability of companies’ sustainability information but do not provide additional CSR information to the market. To fulfill these requirements, we analyzed the additions of companies to an internationally important sustainability index and considered possible determinants for the reactions of the market.

First, our results suggest that investors consider the reliability of sustainability information when determining the market value of a company. We find positive reactions to an objective external assessment of sustainability information in the form of highly significant positive abnormal returns for short time windows surrounding the day a company is added to the sustainability index. This finding seems plausible as we expected no further anticipation of relevant sustainability information (which can be positive or negative from the investors’ perspective) but an increase in the reliability of this information.

Second, we document that the benefits of an increase in the reliability of sustainability information vary cross-sectionally. Using univariate tests and multiple regression approaches, we find that investors of companies characterized by a higher “investment risk” (e.g., higher systematic stock return risk and higher financial leverage ratio) benefit even more from the objective external assessment. Furthermore, we show that the positive market reaction related to the increase in the reliability of sustainability information is higher for companies with a higher “information risk” (e.g., less predictable future stock performance and higher “information manipulation slope” of the management).

Third, evaluating the impact of the overall economic environment, we find that the benefits of an increase in the reliability of sustainability information are considerably higher in times of economic uncertainty (e.g., in times of economic downturns and of higher stock volatility).

In our empirical study, we account for confounding events and biasing effects at several stages. Based on well-established, fundamental economic theory, we develop three hypotheses concerning the reliability of sustainability information, which we tested empirically. We provide a wide range of sensitivity analyses to ensure the robustness of our findings and to evaluate whether our findings could be explained by competing hypotheses. We take our theoretical substantiation and our statistical findings as indication but not as ultimate proof for the described impacts. Future research at this intersection of ethics, business, and psychology might help to understand the mechanisms behind investors’ valuation of highly abstract and qualitative pieces of information such as the sustainability performances of companies.

Notes

On August 18, 2010, the DJSI STOXX was renamed the “Dow Jones Sustainability Europe Index” (DJSI Europe).

Please note that our arguments and empirical analyses refer to investors’ behavior, which is influenced by the investors’ perceptions of the reliability of sustainability information and not directly by the characteristics of the sustainability information itself.

In detail: 151 companies were listed when the DJSI STOXX was launched on October 15, 2001. In annual reviews of the DJSI STOXX composition, the following numbers of companies were added to the index: 2002: 57, 2003: 25, 2004: 26, 2005: 25, 2006: 26, 2007: 17, and 2008: 30. In total, 168 companies were deleted from the index over the examination period (2001–2008).

In addition to these data requirements, we assume zero daily abnormal returns when no data are available in the event window.

To avoid further eliminations for our regression analyses, we collect by hand single missing data items to directly calculate discretionary accruals for 59 companies from the annual consolidated reports in accordance with the definition of the Thomson Financial Worldscope database.

We also consider two modifications of this event-study approach. First, we allow for a gap of 10 trading days between the estimation window and the respective event window. Second, we re-perform our analyses using a two-split event window (50 trading days before and after the event window). Both modifications lead to quite identical findings, for the overall market reaction as well as for the cross-sectional analyses.

Unlike Consolandi et al. (2009), we do not analyze the effects on and after the day of the effective change of the index composition.

The event study-specific test statistics developed by Brown and Warner (1980) as well as by Corrado (1989) explicitly take stock returns over the estimation period into account. While the metric proposed by Brown and Warner (1985) is a parametric test statistic, the metric developed by Corrado (1989) is a rank-based non-parametric test statistic. For a discussion of the statistical advantages and attributes of these specific test statistics, see Brown and Warner (1980, 1985) and Corrado and Zivney (1992), Corrado and Truong (2008).

In this paragraph: ***p < 0.01, **p < 0.05, and *p < 0.1.

We note that CAR i and the interaction term BETA i · MKTVOLA i is related by construction. Thus, we cannot ultimately rule out that these findings are technically driven by the definition of variables.

References

Adams, C., & Zutshi, A. (2004). Corporate social responsibility: Why business should act responsibly and be accountable. Australian Accounting Review, 14(3), 31–39.

Ali, A., Hwang, L.-S., & Trombley, M. (2003). Arbitrage risk and the book-to-market anomaly. Journal of Financial Economics, 69(2), 355–373.

Ashbaugh-Skaife, H., Gassen, J., & LaFond, R. (2006). Does stock price synchronicity represent firm-specific information? The international evidence. Working paper.

Aupperle, K. E., Carroll, A. B., & Hatfield, J. D. (1985). An empirical examination of the relationship between corporate social responsibility and profitability. Academy of Management Journal, 28(2), 446–463.

Baker, J. A., Bowman, F. L., Erwin, G., Gorton, S., Hendershot, D., Leveson, N., et al. (2007). The report of the BP U.S. refineries independent safety review panel. Available at http://www.bp.com/bakerpanelreport/.

Ball, R. (2006). International financial reporting standards (IFRS): Pros and cons for investors, accounting and business research. International Accounting Policy Forum, pp. 5–27.

Beatty, A. L., Ke, B., & Petroni, K. R. (2002). Earnings management to avoid earnings declines across publicly and privately held banks. The Accounting Review, 77(3), 547–570.

Beaver, W. (1972). The behavior of security prices and its implications for accounting research (methods). The Accounting Review, 47(4), 407–437.

Becchetti, L., Ciciretti, R., & Hasan, I. (2009). Corporate social responsibility and shareholder’s value: An empirical analysis. Working paper.

Beneish, M. D., & Whaley, R. E. (1996). An anatomy of the “S&P Game”: The effects of changing the rules. The Journal of Finance, 51(5), 1909–1930.

Blume, M., & Edelen, R. (2001). On S&P 500 index replication strategies. Working paper.

Bowman, R. G. (1979). The theoretical relationship between systematic risk and financial (accounting) variables. Journal of Finance, 34(3), 617–630.

Brammer, S. J., & Pavelin, S. (2006). Corporate reputation and social performance: The importance of fit. Journal of Management Studies, 43(3), 435–455.

Brown, S. J., & Warner, J. B. (1980). Measuring securities price performance. Journal of Financial Economics, 8(3), 205–258.

Brown, S. J., & Warner, J. B. (1985). Using daily stock returns. Journal of Financial Economics, 14(1), 3–31.

Brunnermeier, M., & Pedersen, L. (2009). Market liquidity and funding liquidity. Review of Financial Studies, 22(6), 2201–2238.

Burgstrahler, D., & Dichev, I. (1997). Earnings management to avoid earnings decreases and losses. Journal of Accounting and Economics, 24(1), 99–126.

Castanias, R. (1983). Bankruptcy risk and optimal capital structure. Journal of Finance, 38(5), 1617–1635.

Chen, H., Noronha, G., & Singal, V. (2004). The price response to S&P 500 index additions and deletions: Evidence of asymmetry and a new explanation. Journal of Finance, 59(4), 1901–1929.

Cheung, A. (2011). Do stock investors care about corporate sustainability? Evidence from an event study. Journal of Business Ethics, 99(2), 145–165.

Clark, N., & Jolly, D. (2008). Société Générale loses $7 billion in trading fraud. The New York Times, January 24, 2008.

Consolandi, C., Jaiswal-Dale, A., Poggiani, E., & Vercelli, A. (2009). Global standards and ethical stock indexes: The case of the Dow Jones sustainability Stoxx index. Journal of Business Ethics, 87(Supplement 1), 185–197.

Cormier, D., Ledoux, M.-J., & Magnan, M. (2010). The informational contribution of social and environmental disclosures for investors. Working paper.

Corrado, C. J. (1989). A nonparametric test for abnormal security-price performance in event studies. Journal of Financial Economics, 23(2), 385–395.

Corrado, C. J., & Truong, C. (2008). Conducting event studies with Asia-Pacific security market data. Pacific-Basin Finance Journal, 16(5), 493–521.

Corrado, C. J., & Zivney, T. L. (1992). The specification and power of the sign test in event study hypothesis tests using daily stock returns. Journal of Financial and Quantitative Analysis, 27(3), 465–478.

Curran, M. M., & Moran, D. (2007). Impact of the FTSE4 good index on firm price: An event study. Journal of Environmental Management, 82(4), 529–537.

De Bakker, F. G. A., Groenwegen, P., & Den Hond, F. (2005). A bibliometric analysis of 30 years of research and theory on corporate social performance. Business and Society, 44(3), 283–317.

Dechow, P., Sloan, R., & Sweeney, A. (1995). Detecting earnings management. The Accounting Review, 70(2), 193–225.

Dechow, P., Sloan, R., & Sweeney, A. (1996). Causes and consequences of earnings manipulations: An analysis of firm subject to enforcement actions by the SEC. Contemporary Accounting Research, 13(1), 1–36.

DeFond, M. L., & Park, C. (2001). The reversal of abnormal accruals and the market valuation of earnings surprises. The Accounting Review, 76(3), 375–404.

Denis, D., McConnell, J. J., Ovtchinnikov, A. V., & Yu, Y. (2003). S&P 500 index additions and earnings expectations. The Journal of Finance, 58(5), 1821–1840.

Derwall, J., & Koedijk, K. (2009). Social responsible fixed-income funds. Journal of Business, Finance and Accounting, 36(1–2), 210–229.

Dilling, P. F. (2008). The effect of the inclusion to the Dow Jones sustainability world index on firm value—An empirical event study. Conference paper.

Durnev, A., Morck, R., & Bernard, Y. (2004). Value-enhancing capital budgeting and firm-specific stock return variation. Journal of Finance, 59(1), 65–105.

Durnev, A., Morck, R., Yeung, B., & Zarowin, P. (2003). Does greater firm-specific return variation mean more or less informed stock pricing? Journal of Accounting Research, 41(5), 797–836.

EUROSIF. (2010). Available at http://www.eurosif.org/research/eurosif-sri-study/european-sri-study-2010.

Fama, E. F., Fisher, L., Jensen, M. C., & Roll, R. (1969). The adjustment of stock prices to new information. International Economic Review, 10(1), 1–21.

Fama, E. F., & French, K. R. (2008). Industry classification. Available at http://mba.tuck.dartmouth.edu/pages/faculty/ken.french.

Fassin, Y. (2009). The stakeholder model refined. Journal of Business Ethics, 84(1), 113–135.

Freeman, E. (1984). Strategic management: A stakeholder approach. Boston: Pitman.

Gelb, D. S., & Strawser, J. A. (2001). Corporate social responsibility and financial disclosures: An alternative explanation for increased disclosure. Journal of Business Ethics, 33(1), 1–13.

Global Reporting Initiative [GRI]. (2006). Sustainability reporting guidelines (3rd ed.). Amsterdam, The Netherlands.

Godfrey, P. C. (2005). The relationship between corporate philanthropy and shareholder wealth: A risk management perspective. Academy of Management Review, 30(4), 777–798.

Godfrey, P. C., Merrill, C. B., & Hansen, J. M. (2009). The relationship between corporate social responsibility and shareholder value: An empirical test of the risk management hypothesis. Strategic Management Journal, 30(4), 425–445.

Haroutunian, E., Haroutunian, M., & Haroutunian, A. (2008). Reliability criteria in information theory and statistical hypothesis testing. Foundation and Trends in Communications and Information Theory, 4(2–3), 97–263.

Harris, L., & Gurel, E. (1986). Price and volume effects associated with changes in the S&P 500 list: New evidence for the existence of price pressures. The Journal of Finance, 41(4), 815–829.

Hill, N., & Stone, B. K. (1980). Accounting betas, systematic operating risk, and financial leverage: A risk-composition approach to the determinants of systematic risk. Journal of Financial and Quantitative Analysis, 15(3), 595–637.

Hurdle, G. J. (1974). Leverage, risk, market structure and profitability. The Review of Economics and Statistics, 56(4), 478–485.

Jensen, M. (1972). Capital markets: Theory and evidence. Bell Journal of Economics and Management Science, 3(2), 357–398.

Jolliffe, I. T. (1982). A note on the use of principal components in regression. Applied Statistics, 31(3), 300–303.

Jones, J. J. (1991). Earnings management during import relief investigations. Journal of Accounting Research, 29(2), 193–228.

Kaul, A., Mehrotra, V., & Morck, R. (2000). Demand curves for stocks “Do” slope down: New evidence form an index weights adjustment. The Journal of Finance, 55(2), 893–912.

King, A. (2002). How to get started in corporate social responsibility. Financial Management, Oct. 5.

Kothari, S. P., Leone, A. J., & Wasley, C. E. (2005). Performance matched discretionary accrual measures. Journal of Accounting and Economics, 39, 163–197.

Lang, M., & Lundholm, R. (1996). Corporate disclosure policy and analyst behavior. The Accounting Review, 71(4), 467–492.

Lintner, J. (1965). The valuation of risk assets and the selection of risky investments in stock portfolios and capital budgets. Review of Economics and Statistics, 47(1), 13–37.

Luo, X., & Bhattacharya, C. B. (2009). The debate over doing good: Corporate social performance, strategic marketing levers, and firm-idiosyncratic risk. Journal of Marketing, 73(6), 198–213.

Lynch, A., & Mendenhall, R. (1997). New evidence on stock price effects associated with changes in the S&P 500. Journal of Business, 70, 351–384.

MacKinlay, A. C. (1997). Event studies in economics and finance. Journal of Economic Literature, 35(1), 13–39.

Margolis, J. D., & Walsh, J. P. (2003). Misery loves companies: Rethinking social initiatives by business. Administrative Science Quarterly, 48(2), 268–305.

McConnell, J. J., & Servaes, H. (1995). Equity ownership and the two faces of debt. Journal of Financial Economics, 39(1), 131–157.

Merton, R. K. (1948). The self-fulfilling prophecy. Antioch Review, 8(2), 193–210.

Morck, R., Yeung, B., & Yu, W. (2000). The information content of stock markets: Why do emerging markets have synchronous stock price movements? Journal of Financial Economics, 58(1–2), 215–260.

Orlitzky, M., Schmidt, F. L., & Rynes, S. L. (2003). Corporate social and financial performance: A metaanalysis. Organizational Studies, 24(3), 403–441.

Palmrose, Z.-V., Richardson, V. J., & Scholz, S. (2004). Determinants of market reactions to restatement announcements. Journal of Accounting and Economics, 37(1), 59–89.

Peloza, J. (2006). Using corporate social responsibility as insurance for financial performance. California Management Review, 48(2), 52–72.

Posnikoff, J. F. (1997). Disinvestment from South Africa: They did well by doing good. Contemporary Economic Policy, 15(1), 76–86.

Roll, R. (1988). R2. Journal of Finance, 43(3), 541–566.

Schipper, K. (2003). Principles-based accounting standards. Accounting Horizons, 17(1), 61–72.

Sharpe, W. F. (1964). Capital asset prices: A theory of market equilibrium under conditions of risk. Journal of Finance, 19(3), 425–442.

Shiller, R. J. (1981). The use of volatility measures in assessing market efficiency. Journal of Finance, 36(2), 291–304.

Shleifer, A. (1986). Do demand curves for stocks slope down? The Journal of Finance, 41(3), 579–590.

Streim, H. (2000). Die Vermittlung von entscheidungsnützlichen Informationen durch Bilanz und GuV–Ein nicht einlösbares Versprechen der internationalen Standardsetter. Betriebswirtschaftliche Forschung und Praxis, 52(2), 111–131.

Suchman, M. C. (1995). Managing legitimacy: Strategic and institutional approaches. Academy of Management Journal, 20(3), 571–610.

Teoh, S. H., Wazzan, C. P. C., & Welch, I. (1999). The effect of socially activist investment policies on the financial markets: Evidence from South African boycott. Journal of Business, 72(1), 35–89.

Teoh, S. H., Yang, Y., & Zhang, Y. (2009). R-square and market efficiency. Working paper.

United Nations World Commission On Environment and Development. (1987). Our common future. Oxford: Oxford University Press.

Van de Velde, E., Vermeir, W., & Corten, F. (2005). Corporate social responsibility and financial performance. Corporate Governance, 5(3), 129–138.

Vayanos, D. (2004). Flight to quality, flight to liquidity, and the pricing of risk. Working paper.

Waddock, S. A., & Graves, S. B. (1997). The corporate social performance–financial performance link. Strategic Management Journal, 18(4), 303–319.

West, K. (1988). Dividend innovations and stock price volatility. Econometrica, 56(1), 37–61.

White, H. (1980). A heteroskedasticity-consistent covariance matrix and a direct test for heteroskedasticity. Econometrica, 48(4), 817–838.

Wright, P., & Ferris, S. P. (1997). Agency conflict and corporate strategy: The effect of divestment on corporate value. Strategic Management Journal, 18(1), 77–83.

Wurgler, J., & Zhuravskaya, E. (2002). Does arbitrage flatten demand curves for stocks. Journal of Business, 75(4), 583–608.

Zhang, X. F. (2006). Information uncertainty and stock returns. Journal of Finance, 61(1), 105–136.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Lackmann, J., Ernstberger, J. & Stich, M. Market Reactions to Increased Reliability of Sustainability Information. J Bus Ethics 107, 111–128 (2012). https://doi.org/10.1007/s10551-011-1026-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10551-011-1026-3