Abstract

The purpose of this study is to examine the relationship between voluntary sustainability reporting and firm value, as measured by Tobin’s q. We test three main hypotheses developed from signaling theory and the sustainability reporting literature on a large panel of reporting and non-reporting organizations for the period 2011–2020. The results of a fixed effects panel model suggest that, in general, sustainability reporting is negatively related to Tobin’s q. However, the results also indicate that the relationship between sustainability reporting and Tobin’s q becomes increasingly positive over time. Our conclusion is that sustainability reporting is initially a costly signal, but that it eventually enhances firm value as companies learn how to better communicate sustainability initiatives to stakeholders and investors learn how to properly evaluate reports. Finally, in an analysis of sustainability reporting organizations, we find that external assurance is positively associated with Tobin’s q. External audits appear to increase the credibility of reports. Implications for marketing theory and practice are discussed.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Voluntary sustainability reporting is becoming more common, as evidenced by the hundreds of organizations that have adopted the Global Reporting Initiative (GRI) standards or similar reporting frameworks within the last decade (Sethi et al., 2017). Sustainability reporting is rooted in the Triple Bottom Line (TBL) approach to measuring corporate performance (Wheeler & Elkington, 2001). TBL encourages organizations “to track and manage economic (not just financial), social, and environmental value added—or destroyed” (Elkington, 2018, p. 3). GRI’s reporting platform embodies the TBL concept because the GRI standards provide a systematic way for businesses to describe their environmental, social, and economic impacts to stakeholders. The processes involved in sustainability reporting may help organizations better understand how their activities affect different stakeholder groups, and reporting has the potential to increase corporate accountability (Nikolaeva & Bicho, 2011).

Organizations also use sustainability reports as marketing communications tools (Rodriguez et al., 2006; Sweeney & Coughlan, 2008). Reports often describe corporate activities to combat climate change, fight poverty, eliminate inequality, improve product quality, and achieve a more sustainable future. According to a recent McKinsey survey, executives believe voluntary disclosures of environmental, social, and governance (ESG) activities—through sustainability reports or similar media—positively affect financial performance (Delevingne et al., 2020). Marketing academics hold equally positive views of sustainability reporting (Crittenden et al., 2011; Varadarajan, 2017). However, few empirical studies have investigated the relationships between sustainability reporting and market-based measures of financial performance. Therefore, the question of whether reporting affects objective measures of firm value has yet to be answered, and related questions about the changing nature of corporate and investor attitudes toward sustainability reporting remain unanswered. Organizations should be lauded for authentic sustainability initiatives, but that does not necessarily mean that firm-controlled communications about sustainability are valued by financial market participants.

The considerable expenses associated with sustainability reporting, its opportunity costs, and investor concerns about greenwashing give rise to the possibility that reporting may detract from firm value rather than enhance it. The first argument against sustainability reporting is rooted in the Friedman doctrine. The Friedman doctrine maintains that management’s primary responsibility is to act in accordance with stockholders’ interests, which typically involve increasing stockholders’ wealth (Friedman, 1970). One potential drawback of sustainability reporting is that it is very expensive. Creating and publishing a sustainability report may cost a company upwards of one million U.S. dollars (Levy et al., 2010). Today’s investors are more concerned about environmental and social performance than the typical investor in Friedman’s time, but if an executive spends significant resources on well-intentioned social or environmental programs that fail to produce tangible economic benefits for shareholders, then conventional investors may be hesitant to invest in that company. Moreover, sustainability reporting incurs opportunity costs. Investors may disapprove of diverting resources away from advertising, research and development (R&D), personal selling, and other traditional marketing activities to fund sustainability reporting (Woodroof et al., 2019). Whereas traditional marketing activities are known to increase firm value and thus generate shareholder wealth, sustainability reporting’s effects on firm value remain unclear. In addition, potential investors may distrust the veracity of nonfinancial disclosures (Kim & Lyon, 2015). Within the last few years, complaints from watchdog groups, academics, and institutional investors have pushed the United States Securities and Exchange Commission (SEC) to examine several organizations for promoting false or misleading claims about their contributions to sustainable development (Chung & Michaels, 2019; Styles, 2020). These mounting concerns about greenwashing may cause potential investors to discredit information in sustainability reports (Uyar et al., 2020).

By contrast, the received view in the marketing literature is that sustainability reporting is part of a constructive shift in industrial norms toward more sustainable business practices (Chabowski et al., 2011). The case for sustainability reporting as a positive contributor to firm value aligns with key concepts from stakeholder theory, such as stakeholder engagement (Herremans et al., 2016), and the organizational legitimacy literature (Deegan, 2010). Consumers, employees, regulators, individual investors, and institutional investors are calling for corporations to be more transparent about their sustainability initiatives (Herremans et al., 2016). Previous research demonstrates that sustainability reporting is an effective way to engage stakeholders in that it reduces information asymmetry (Cui et al., 2018), which ultimately helps investors predict future cash flows (Christensen et al., 2021). Furthermore, advocates of stakeholder management argue that the processes involved in sustainability reporting should benefit shareholders because sustainability-oriented firms will outperform their competitors in the long term (Zou et al., 2019), as sustainability reporting helps organizations meet stakeholders’ expectations for corporate social performance (Nikolaeva & Bicho, 2011).

Despite the purported benefits of sustainability reporting, researchers and practitioners still know relatively little about reporting’s impact on firm value. The purpose of this study is to analyze sustainability reporting’s effect on firm value. We investigate the following research questions: (1) In general, does sustainability reporting have a negative or positive effect on firm value? (2) Has the effect evolved over time? (3) For reporting organizations, which characteristics of sustainability reports are most important to investors? To answer our research questions, we develop and test three main hypotheses rooted in signaling theory (Spence, 1973, 2002) and the interdisciplinary literature on sustainability reporting. We compare reporting firms to nonreporting firms in a sample of publicly traded North American companies for the period 2011 through 2020. The results of a fixed effects panel model indicate that sustainability reporting initially has a negative effect on firm value, as measured by Tobin’s q. However, the relationship between reporting and Tobin’s q becomes positive over time. In a separate analysis of GRI member organizations, we find that external audits of reports are positively associated with Tobin’s q.

This study has implications for theory and practice. First, our study answers calls for more research on sustainability reporting’s long term effects on firm value (Nikolaeva & Bicho, 2011; Zou et al., 2019), and it partially addresses the gap in sustainability reporting research in developed economies (Wang & Li, 2016). Second, we contribute to the sustainability reporting literature by demonstrating that the relationship between reporting and firm value is more complex than previous research suggests. The main effect of reporting on Tobin’s q is negative across all model specifications, but when the effect is allowed to change over time, the relationship between reporting and Tobin’s q becomes less negative and eventually turns positive. We believe that this change in sign reflects an important shift in investors’ attitudes towards sustainability reporting. Investors place more value on sustainability reporting now than in the early 2010’s, and 2018 represents an inflection point. Since 2018, the relationship between reporting and firm value is positive across all industries. Third, for reporting companies, we find that external auditing is positively correlated with firm value. Our conclusion is that external audits improve the credibility of ESG information in reports.

The rest of the paper is organized as follows. We first review the relevant literature on sustainability reporting. Second, we elaborate upon our theoretical framework, which is grounded in signaling theory (Spence, 1973, 2002). Next, we develop hypotheses from signaling theory and prior research on sustainability reporting. The first hypothesis is split into competing hypotheses that propose reporting could function as a negative or positive signal to investors. The second hypothesis proposes that the relationship between reporting and firm value becomes more positive over time, regardless of the initial sign. The third hypothesis suggests that three characteristics of reports could enhance their credibility and positively contribute to firm value. We then describe the research design, including sampling, data collection procedures, measurement of variables, model specification, and endogeneity tests. The results section follows. The paper concludes with a discussion of the study’s implications and limitations.

Conceptual development and theoretical framework

Sustainability reporting is a manifestation of the TBL approach to measuring corporate performance (Wheeler & Elkington, 2001). Sustainability reporting standards, such as the GRI standards, provide a useful framework for organizations that voluntarily disclose information about their sustainability expenditures and ESG initiatives (Kaptein & Van Tulder, 2003). Executives are increasingly relying on sustainability reports as part of a larger strategy to attract and retain customers, employees, supply chain partners, and investors (Branco & Rodrigues, 2008). In fact, most of the S&P 500 and Fortune Global 250 organizations now publish annual sustainability reports (Whalen, 2020), and the practice is growing in emerging economies (Varadarajan, 2017; Zou et al., 2019). From a managerial perspective, sustainability reporting is a valuable marketing and public relations communications tool when directed at customers (Sweeney & Coughlan, 2008). Sustainability reporting also raises public awareness of firms’ positive and negative impacts on the economy, the environment, and society, and thus reporting promotes transparency and corporate accountability (Rodriguez et al., 2006). From a theoretical perspective, reporting signals the firm’s commitment to sustainability (Connelly et al., 2011b).

Literature review

Accounting and finance researchers often study how nonfinancial disclosures in annual reports and press releases affect traditional metrics of financial performance, but relatively few studies of sustainability reporting appear in mainstream marketing journals or interdisciplinary business journals. The extant literature fits within three distinct categories. The first category consists of conceptual studies, in which sustainability reporting is placed within a broader context of business ethics and marketing strategy. Stakeholder theory, legitimacy theory, and the concept of information asymmetry are prominently featured in these conceptual studies. Crittenden et al. (2011) argue that sustainability reporting is an integral part of market-oriented sustainability because the report communicates the organization’s core ideology to internal and external stakeholders. Reporting also provides a medium for firms to describe sustainable innovations, which may be a source of competitive advantage (Varadarajan, 2017). Moreover, the sustainability report is part of the dialog between management and stakeholders (Kaptein & Van Tulder, 2003), and effective discourse concerning ESG expenditures may reduce information asymmetry (Rhodes, 2010) and protect organizational legitimacy (Palazzo & Scherer, 2006).

The second category of research is empirical, and it looks at the determinants of sustainability reporting decisions. The literature indicates that competitive pressure and stakeholder pressure play important roles in sustainability reporting (e.g., Fernandez-Feijoo et al., 2014; Nikolaeva & Bicho, 2011). Several firm characteristics influence reporting decisions, including firm size (e.g., Branco & Rodrigues, 2008; Holder-Webb et al., 2008), industry category (e.g., Fernandez-Feijoo et al., 2014; Friske et al., 2020), profitability (Friske et al., 2020; Roberts, 1992), analyst following (e.g., Harjoto & Jo, 2011), ownership/shareholder characteristics (e.g., Ntim & Soobaroyen, 2013; Reverte, 2009), and media exposure (e.g., Nikolaeva & Bicho, 2011). Additionally, the composition of the board of directors influences the decision to publish sustainability reports—ethnically diverse boards, boards with female directors, and boards with independent directors are more likely to issue reports (e.g., Holder-Webb et al., 2008; Husted & de Sousa-Filho, 2019).

The final category of sustainability reporting research looks at three types of outcomes associated with reporting: (1) nonfinancial outcomes, (2) effects on investment decisions, and (3) stock market reactions. Adoption of a sustainability reporting framework may bring about changes in management structure and strategic decision making (Vigneau et al., 2015), and it may ultimately reduce environmentally and socially irresponsible business practices (Du et al., 2017). Furthermore, research indicates that investors use sustainability reports to inform investment decisions (Brown-Liburd et al., 2018). Cui et al. (2018) confirm Rhodes’ (2010) proposition that sustainability reporting reduces information asymmetry between managers and investors. The reduction in information asymmetry might explain why the first issuance of a sustainability report improves analyst forecast accuracy (Muslu et al., 2019). It may also explain why sustainability reports generate positive abnormal returns for firms listed on emerging economy stock markets (Wang & Li, 2016; Zou et al., 2019), and why the positive relationship between reporting and cumulative abnormal returns is stronger for firms in weak information environments (Du et al., 2017).

This study is most closely related to the third category of research. Our study is similar to the aforementioned studies in that the focus is on reporting, not on the economic effects of sustainability programs and policies themselves. However, there are some key differences between previous research and the current study. First, unlike many studies which examine the short term stock market reactions to the first issuance of sustainability reports (i.e., Wang & Li, 2016; Zou et al., 2019), the present study analyzes the effects of sustainability reporting on firm value for multiple years beyond the initial adoption of reporting standards. Second, this study answers calls for more research on the effects of sustainability reporting in developed markets (Zou et al., 2019). Third, we measure firm value with Tobin’s q, which is the “most widely accepted firm value measure in the marketing, management, and finance literature” (Lenz et al., 2017, p. 681). Fourth, we investigate how the relationship between reporting and firm value changes over time. Fifth, because we have access to the actual sustainability reports, we can also investigate how the inclusion of stakeholder feedback, external assurance, and additional sustainability standards affect firm value in a subset of reporting organizations. Table 1 provides a summary of findings from our study and prior empirical work on the subject. For a more detailed description of sustainability reporting research, see Christensen and colleagues’ overview (Christensen et al., 2021).

Signaling theory

The theoretical framework for this study is grounded in signaling theory. Signaling theory explains how parties resolve information asymmetries about unobservable quality (Connelly et al., 2011a). Since 2001 when Akerlof, Spence, and Stiglitz won the Nobel Prize in economics for their work on signaling theory, the theory has become increasingly popular in finance, marketing, and management research (Connelly et al., 2011a). Signaling theory has five essential components: the signaler, the signal, the receiver, receiver feedback, and the signaling environment. Signalers are insiders who have access to information that is not available to outsiders. They communicate to outsiders through signals. Typically, signalers deliberately send positive information to outsiders, but there are times when insiders unintentionally send negative information to outsiders. Regardless of whether the signal is positive or negative, intentional or unintentional, it has the potential to reduce information asymmetry by adding to the existing information set of external stakeholders. The most impactful signals are observable, costly to imitate, and credible (Ross, 1977). Receivers interpret the signal and stand to gain from the information in the signal. Depending upon how receivers interpret the signal, they may send feedback to signalers to facilitate more efficient signaling in the future. The signaling environment affects the transmission and interpretation of signals and feedback (Connelly et al., 2011a).

A firm’s managers (i.e., signalers) use sustainability reporting to signal their intentions to engage in sustainable business practices to interested stakeholders (i.e., receivers). External stakeholders scan reports for nonfinancial information to add to their existing knowledge of firm activities, and they may use that information to make decisions regarding the firm (Connelly et al., 2011b). For instance, institutional investors scan sustainability reports for information related to regulatory risk and climate change risk before making investment decisions (Krueger et al., 2020). Sustainability reporting has the potential to reduce information asymmetry between managers and external stakeholders, but receiver interpretations of the signal are subjective and may vary from one type of stakeholder to another (Connelly et al., 2011b). Furthermore, the signaling environment affects receiver interpretations of the signal, as does the credibility of the signal.

Receivers of sustainability report signaling include customers, employees, regulators, shareholders, and potential investors. Customers, employees, and regulators are putting increased pressure on organizations to develop impactful environmental and social programs that support sustainable development goals (Xie et al., 2019). On one hand, a growing segment of investors are interested in owning shares of organizations that align with their moral codes, as evidenced by robust spending in ESG funds and corresponding growth in socially responsible investing (SRI) options (Riedl & Smeets, 2017). For the segment of investors increasingly concerned about environmental and social performance in addition to financial performance, sustainability reporting should be interpreted as a positive signal of management’s commitment to sustainability. On the other hand, a different segment of investors could view reporting as an expense that is more indicative of an agency cost or an opportunity cost than an investment that generates shareholder wealth (Masulis & Reza, 2015). Some investors even believe that sustainability reports do not contain material information and are tantamount to greenwashing (Kim & Lyon, 2015). In either case, skeptical investors could perceive sustainability reporting as a signal that the firm is pursuing a costly or unnecessary disclosure strategy at the expense of R&D, advertising, and other traditional marketing activities that are known to increase firm value. Accordingly, sustainability reporting may function as a negative, unintentional signal of managers’ wasteful intentions, which could lead to lower values of Tobin’s q (DesJardine et al., 2021). To determine how investors perceive sustainability reporting, we test competing hypotheses of negative and positive effects on firm value.

Factors associated with the signaling environment are likely to influence receivers’ interpretations of sustainability reporting signals. Time is a relevant, but often overlooked, element of the signaling environment because it affects the strength of the signal. The strength of a signal may increase over time through repetition, but an isolated signal may decay over time (Bergh et al., 2014). Organizations learn how to increase the effectiveness of their signals by studying receiver feedback. In addition, receivers learn how to better interpret signals over time (Kromidha & Li, 2019). With respect to sustainability reporting, investors are putting pressure on firms to disclose information about their sustainability-related risks, and firms are responding to this pressure by disclosing such information in sustainability reports (Christensen et al., 2021). Moreover, a growing number of investors are placing sustainability at the center of their investment decisions, and thus they are searching for sustainability signals in the market (Hartzmark & Sussman, 2019). Organizations can learn how to better disclose ESG information in sustainability reports by engaging with sustainability-focused investors, as managers use investor feedback to shape the content and format of information that appears in future reports. As more and more investors shift their money into sustainability-focused companies, reporting could become a stronger, more visible signal of the firm’s commitment to sustainability. Therefore, we investigate whether the effect of sustainability reporting changes over time.

The value of sustainability reporting also depends upon the credibility of the information in reports. Three key determinants of a signal’s effectiveness are observability, cost of imitation, and credibility. With respect to sustainability reporting, observability is not a primary issue because reports are published online and are publicly available. The cost of imitation is relatively high, assuming firms follow one of the many standardized reporting frameworks that are available to mitigate dishonest signaling. There are significant expenses involved in following the reporting standards set forth by GRI and similar non-governmental organizations (NGOs; Levy et al., 2010). Firms that adopt such standards often need to change organizational structure to be in compliance, so imitation would require significant managerial commitment and resources (Brown et al., 2009). Given sustainability reports are already observable and costly, the most salient characteristic of effective reporting is credibility because stakeholders often suspect that nonfinancial disclosures are immaterial, inaccurate, or misleading (Kim & Lyon, 2015). Some institutional investors and activist investors have even accused firms of greenwashing in their sustainability reports (Chung & Michaels, 2019; Styles, 2020). In response, firms may take actions to improve the perceived credibility of their reports. First, many firms have adopted standardized reporting frameworks, such as GRI, which require firms to disclose key metrics regardless of whether the information improves or harms corporate reputation. Second, firms may create stakeholder panels to provide input in the reporting process and to verify a report’s authenticity. Third, firms may hire accounting firms, engineering firms, or specialized consultancies to audit the reports. Fourth, firms may incorporate additional sustainability standards in their reports. For instance, a firm that uses the GRI reporting framework may also meet ISO 26000 standards, and that type of information is often included in a GRI sanctioned report to enhance its credibility.

Hypotheses

In this section, we derive three main hypotheses from signaling theory and previous research on sustainability reporting. The first main hypothesis is split into two competing hypotheses. One competing hypothesis proposes that reporting is a negative signal to investors and thus the relationship between sustainability reporting and firm value is negative, based on arguments rooted in the Friedman doctrine, agency costs, and opportunity costs. The other competing hypothesis presents the received view in the marketing literature that reporting is a positive signal and thus the relationship is positive, based on arguments rooted in stakeholder theory (Freeman, 1984) and organizational legitimacy (Suchman, 1995). The second main hypothesis proposes that the relationship between reporting and firm value is not static and evolves over the ten years in the sample. The third hypothesis, which focuses on the subsample of firms that issue GRI sanctioned sustainability reports, proposes that stakeholder panels, external audits, and additional sustainability standards increase firm value.

Sustainability reporting: A negative signal?

Despite the many reasons why sustainability reporting may function as a positive signal to investors, the literature also provides contradictory evidence that sustainability reporting may negatively impact market value. One potential drawback is that the implementation of sustainability reporting requires a substantial amount of company resources (Levy et al., 2010). Firms that adopt a sustainability reporting framework, such as GRI, must commit significant human and financial resources on an ongoing basis to meet the standards of the certification process as well as implement firm-specific strategic considerations in reporting (Nikolaeva & Bicho, 2011). For instance, the GRI standards provide guidance about what to report (i.e., performance indicators) and how to report (i.e., reporting protocols), but managers of GRI sanctioned companies still need to spend significant time and attention on developing sustainability initiatives that align with the organization’s mission. Oftentimes, managers may need to develop new routines, form new committees, or reorganize departments in order to facilitate sustainability reporting, which could require additional resources (Brown et al., 2009). Today’s investors care about a firm’s environmental and social initiatives, but there are limits to how much financial performance they are willing to tradeoff for environmental and social performance (Riedl & Smeets, 2017). Management has a fiscal responsibility to generate wealth for shareholders (Friedman, 1970; Mishra & Modi, 2016), and there remains a possibility that the expenses associated with reporting detract from shareholder wealth without providing meaningful benefits to other stakeholder groups (Krüger, 2015).

The lack of a clear connection between sustainability reporting and financial metrics exacerbates the problem. Shareholders and potential investors have limited ability to verify whether the expenses involved in sustainability reporting generate shareholder wealth because the metrics for ESG performance do not align with traditional metrics of financial performance (Jensen, 2002). If sustainability reporting does not appear to be a value adding activity, then investors may question why managers are allocating resources toward reporting in the first place. Reporting thus elevates the potential for agency costs (Jensen, 2002; Masulis & Reza, 2015).

Furthermore, investors may recognize that the practice of sustainability reporting incurs substantial opportunity costs. Shareholders are not only concerned with the immediate financial consequences of strategic decisions. They are also projecting whether strategic decisions result in the most efficient use of available resources (Woodroof et al., 2019). Potential investors may believe that the more time, resources, and attention that managers dedicate to sustainability reporting initiatives, the less they will have for traditional profit generating activities, such as R&D and advertising (Bhagwat et al., 2020). For the above reasons, sustainability reporting may deter potential investors from the firm and lower the firm’s market value.

H1a

In general, sustainability reporting is negatively related to firm value.

Sustainability reporting: A positive signal?

The received view in the marketing literature is that the majority of investors value the stakeholder management practices embodied in sustainability reports. An important aspect of a market-oriented approach to sustainability, which is a strategic resource and a potential source of competitive advantage, is the effective management of stakeholder relationships (Hult, 2011). Proponents of stakeholder theory claim that corporations have inherent obligations to a wide range of constituents in addition to shareholders (Freeman, 1984). Under stakeholder theory, management’s responsibility is to balance the competing demands of the firm’s key stakeholders (Maignan et al., 2005). If management cannot satisfy the company’s major stakeholder groups, then financial performance will suffer in the long run (Freeman, 1984). The sustainability report can be operationalized as an important tool of stakeholder management (Nielsen & Thomsen, 2007). Reporting serves to inform key stakeholders of the company’s investments in sustainability. This type of disclosure is an attempt to engage stakeholders with discussions about the company’s ESG projects, problems, and future opportunities (Morsing & Schultz, 2006). Investors who believe in the long term benefits of stakeholder management would view sustainability reporting as a logical application of stakeholder engagement and as an outcome of good corporate governance (Hörisch et al., 2014). Accordingly, such investors would believe reporting is a sound investment which could positively affect firm value (Snider et al., 2003).

Managers may also use sustainability reporting to achieve organizational legitimacy (Deegan, 2010). Reporting boosts corporate image and reputation (Adams, 2002). By adopting a sustainability reporting framework, an organization can claim legitimacy by meeting social norms and expectations about ESG transparency (Nikolaeva & Bicho, 2011). GRI is one legitimation agent among many NGOs dedicated to sustainability standard-setting, and firms achieve some level of credibility by submitting their reports to GRI and becoming members of the GRI community (Brown et al., 2009). Furthermore, the sustainability report is a marketing communications tool that can highlight unique ESG initiatives undertaken by the firm, which might further enhance the firm’s reputation (Nikolaeva & Bicho, 2011). The adoption and implementation of a sustainability reporting framework signals to potential investors that the firm is “a legitimate corporate citizen with sustainable plans for the future” (Nikolaeva & Bicho, 2011, p. 141).

Additionally, voluntary nonfinancial disclosures have positive spillover effects on financial disclosures (Reverte, 2009). Transparency in sustainability reports is correlated with transparency in financial reporting, and consequently, reporting should reduce information asymmetry. Investors may be drawn to firms that issue sustainability reports because reporting allows them to properly assess risks that are not evident in financial statements and letters to shareholders, such as climate change risks and regulatory risks (Lucas & Noordewier, 2016). In summary, investors that identify proactive stakeholder management practices, corporate reputation, and transparency as important intangible assets may be drawn to firms that engage in sustainability reporting, and thus sustainability reporting may be positively associated with firm value.

H1b

In general, sustainability reporting is positively related to firm value.

The signaling environment: Temporal effects

Time is a relevant element of the signaling environment. An important aspect of a sustainability reporting program, once implemented, is represented by the commitment of the reporting organization to continuously issue reports over time (Searcy & Buslovich, 2014). Managers use reports to track their progress from year-to-year, to show stakeholders how the firm is evolving into a more sustainable organization, and to build corporate reputation (Searcy & Buslovich, 2014). Continuous monitoring of ESG metrics, development of new sustainability initiatives, and annual publications of sustainability reports produce temporal effects that may influence firm value. Signaling theory maintains that firms may increase the strength of a signal over time through repetition (Bergh et al., 2014). In the case of sustainability reporting, firms may learn how to increase the effectiveness of their stakeholder communications by studying and acting on receiver (i.e., stakeholder) feedback. With experience, managers will improve their ability to disclose material ESG information in sustainability reports while avoiding greenwashing; in essence, managers improve their abilities to communicate relevant ESG information to investors over time.

Investor attitudes toward sustainability and nonfinancial disclosures are evolving. Within the past few years, institutional investors have joined regulators, academics, and the general public in calling for improved disclosures of ESG issues (Hartzmark & Sussman, 2019). BlackRock CEO Larry Fink has stated, “all investors…need a clearer picture of how companies are managing sustainability-related questions” (2020, p. 2020) and “better sustainability disclosures are in companies’ as well as investors’ own interests” (2021, p. 4). The signaling theory literature suggests that investors learn how to better interpret firm signals over time (Kromidha & Li, 2019). In the case of sustainability reporting, investors should become more efficient at extracting material information related to climate risk, regulatory risk, and other sustainability risks that could affect future cash flows (Krueger et al., 2020), and they would be more likely to reward firms that meet their information expectations. As firms adjust to investor expectations for sustainability communications and learn from past reporting experiences, the effectiveness and strength of sustainability reporting as a signal is likely to improve (Bergh et al., 2014). This synergy may translate into increases in valuations for firms that issue sustainability reports.

H2

The relationship between sustainability reporting and firm value is increasingly positive over time.

Credibility and the effectiveness of the signal

The effectiveness of sustainability reporting as a signal depends upon the observability, cost of imitation, and credibility of the information contained therein (Ross, 1977). We argue that the credibility of a report is relatively more important than the other characteristics. Reports are readily observable on company websites and in publicly available online depositories (Global Reporting Initiative, 2021), so investors can observe reports whenever they choose. The cost of imitation is unlikely to be an issue, as firms that are willing to send dishonest signals face serious expenses in following and implementing the reporting standards mandated by GRI and other sustainability NGOs (Levy et al., 2010). However, credibility is very important because some financial market participants suspect that voluntary nonfinancial disclosures are immaterial, inaccurate, or misleading (Kim & Lyon, 2015). Therefore, it is incumbent on reporting firms to improve the perceived credibility of reports.

Firms can take steps to ensure stakeholders that the information in sustainability reports is credible. The first step involves adopting sustainability standards (Nikolaeva & Bicho 2011). Sustainability standards associated with GRI and similar NGOs are designed to “stimulate, guide, and help organizations account for socially and environmentally desirable behavior” (Christensen et al., 2017, p. 239). These standards provide companies with a means of understanding their impacts on the economy, the environment, and society in accordance with the TBL framework. The standards also create a systematic way for organizations to communicate their impacts to interested stakeholders.

As a second step, some firms create stakeholder panels to provide input in the reporting process and to establish a report’s authenticity. Management must constantly balance the competing—and often conflicting—demands of various stakeholder groups to achieve organizational legitimacy (Herremans et al., 2016). Unlike financial reporting, which is mostly focused on issues that affect shareholders alone, sustainability reporting must recognize a broader range of issues that affect multiple stakeholder groups (Junior et al., 2014). Managing multiple stakeholder groups is a challenge, and to ensure that the organization is meeting the information needs of different groups, the organization may form a stakeholder panel to provide guidance and feedback on its sustainability programs. A stakeholder panel is an independent committee consisting of experts from different stakeholder groups that are affected by the organization’s business activities. Panel members direct management’s attention to issues that are not adequately addressed by the firm’s current sustainability initiatives so that no salient stakeholder group is overlooked. Furthermore, the panel releases a statement on the organization’s overall sustainability efforts, which is typically included in the report. Organizations that take the extra step of creating stakeholder panels to improve stakeholder engagement do so to increase the report’s (i.e., the signal’s) credibility (Herremans et al., 2016). In short, increased stakeholder engagement should result in more credible reports, which should lead to increased firm value.

H3a

The inclusion of formalized stakeholder feedback in the sustainability report is positively related to firm value.

As organizations face pressure to be transparent about their sustainability initiatives (Nikolaeva & Bicho, 2011), they may attempt to increase credibility by adding extra layers of assurance to their GRI reports (Manetti & Toccafondi, 2012). In some cases, simply meeting the minimum GRI standards may not be enough to gain credibility in the eyes of industry peers, regulators, and other salient stakeholders (Christensen et al., 2017). Firms may contract with independent third parties (e.g., accounting firms, engineering firms, or sustainability consultants) to audit the information in sustainability reports, which is roughly equivalent to hiring accounting firms to audit financial statements. The audits result in external assurance statements that certify the reports are accurate. External assurance reduces agency costs and confers greater user confidence in the validity of ESG data. Moreover, providing external assurance attests to an organization’s commitment to transparency and its desire to maintain a positive image (Simnett et al., 2009). In summary, organizations that hire external agents to audit sustainability reports are likely to produce highly credible reports, which may positively affect market valuation.

H3b

An external audit of the sustainability report is positively related to firm value.

Although one goal of sustainability reporting is to increase transparency, stakeholders are often dissatisfied with how firms disclose information on important environmental and social topics (Kim & Lyon, 2015). Complaints about greenwashing are increasing, and some stakeholders discount the information in sustainability reports (Uyar et al., 2020). In response, proactive organizations may adopt multiple sustainability standards to ensure stakeholders that they are genuinely committed to sustainable economic development. Incorporating additional sustainability standards in a report goes above and beyond GRI’s requirements. However, a firm that uses the GRI sustainability reporting framework may also meet ISO 26000 standards or comply with the UN Sustainable Development Goals, the OECD Guidelines for Multinational Enterprises, or a combination of the above. These additional standards may be explicitly mentioned in a GRI sanctioned report to further enhance its credibility. Although the specifics of the standards vary depending on the standard-setting organization, they are all designed to address questions related to the ESG performance of organizations (Vigneau et. al. 2015). We suggest that firms may enhance the credibility of their reports by incorporating additional standards in the reports.

H3c

The explicit use of other reporting standards (in addition to GRI) in the sustainability report is positively related to firm value.

Method

In this section, we describe important aspects of the research design. We begin with a description of the full sample used to test H1a, H1b, and H2. We also describe the subsample of reporting organizations used to test H3. Next, we define all variables used in the analysis and identify their sources. The calculation of Tobin’s q, our dependent variable, appears in Eq. 1. Thereafter, we explain our analytical approach. The empirical analysis relies on fixed effects panel models with Newey West standard error estimates that are robust to autocorrelation and heteroscedasticity.

Sample description

We collected firm-level data from multiple sources and report-level data from GRI. First, we identified all publicly traded firms that issued a sustainability report during the period 2011 through 2020 as recorded by GRI. In addition to providing sustainability standards and certifying reports, GRI maintained a comprehensive database of sustainability reports until early 2022. We hired a professional data processing company to capture PDF copies of the reports from GRI’s Sustainability Disclosure Database (2021) along with accompanying firm and report information, including the name of the firm that published the report, the year of the report, stakeholder panel and feedback data, the name of the organization that audited the report, and a list of additional sustainability standards included in the report. The full sample contains not only GRI-sanctioned reports but also other self-contained reports that follow different reporting protocols. However, organizations that may have described their sustainability programs on company websites or in annual reports are not included in the sample—the reports in the sample are all self-contained reports. We crosschecked a random sample of 100 organizational records in the Sustainability Disclosure Database with matching information in the organizations’ sustainability reports. We did not find any inaccurate or otherwise invalid entries, which provides evidence that the initial data collection process was effective. Second, we merged the data from the Sustainability Disclosure Database with the population of firms in the COMPUSTAT database for the period 2011 through 2020. COMPUSTAT contains data for the dependent variable and several control variables. After the initial merge, we added board of directors and executive data from RiskMetrics and ExecuComp to the dataset. Finally, we added financial analyst data from I/B/E/S. Upon completion of the last merge, the full sample used to test H1a, H1b, and H2 contains 9,077 firm-year observations. Recall that H3 focuses on the attributes of sustainability reports, and thus the firm-level characteristics of nonreporting organizations are immaterial to H3. To test H3, we created a smaller subsample of firms that issued GRI-certified reports from the full sample. The subsample for H3 contains 1,232 firm-year observations.

Variables

Dependent variable

The dependent variable is Tobin’s q. Tobin’s q is a common proxy for firm value, which is also referred to as market value (Anderson et al., 2004). Tobin’s q is an appropriate measure of firm value for the following reasons. First, theory predicts that sustainability expenditures most likely affect firm value in the long run (as opposed to the short run), and Tobin’s q is a metric that emphasizes long run performance (Lenz et al., 2017). Second, Tobin’s q, as a market-based measure of firm value, captures the influence of external stakeholders in the valuation process (Nekhili et al., 2017). Third, Tobin’s q is not as sensitive to accounting conventions as other popular measures of firm value, and thus it is easier to compare firms across industries (Lenz et al., 2017; Nekhili et al., 2017). We follow previous marketing studies in using the Chung and Pruitt (1994) calculation of Tobin’s q:

where MVE = (share price at the end of the financial year) × (number of common shares outstanding), PS = liquidating value of the firm’s preferred shares, DEBT = (current liabilities – current assets) + (book value of inventories) + (book value of long term debt), and AT = book value of total assets. In short, Tobin’s q is equal to the ratio of the sum of the market value of equity, preferred stock, and debt to the book value of total assets.

Independent variables

The focal independent variable in the test of H1 is labeled “Sustainability Report.” Sustainability reports are manifestations of the TBL approach to sustainability (Wheeler & Elkington, 2001). The GRI reporting standards provide an organized framework for businesses to communicate their environmental, social, and economic impacts to different stakeholder groups. In the analysis, Sustainability Report is a binary variable that takes a value of “1” if the firm issued a sustainability report and “0” otherwise in year t, according to the GRI archives. The statistical significance and sign of the regression coefficient for Sustainability Report will determine whether H1a or H1b is supported.

To test H2, which predicts that the relationship between sustainability reporting and firm value becomes more positive in later years, we first create a count variable called “Temporal Effect” that coincides with the year of the observation. Temporal Effect represents the annual progression of time. We set the first year in the sample, 2011, to a value of “0”. The next year, 2012, is set to a value of “1”. The year 2013 is set to a value of “2”. We continue in this manner so that the year 2020 is set to a value of “9” (Bryk & Raudenbush, 2002). Now that we have a linear estimate for time, we interact this variable with the Sustainability Report variable. The significance and sign of the resulting interaction term (Sustainability Report*Temporal Effect) allows us to determine whether the effect of sustainability reporting on Tobin’s q increases, decreases, or remains the same from 2011 to 2020. This type of analysis is known as direct trend assessment (Pauwels & Hanssens, 2007, p. 296).

To test H3, we focus on three characteristics of sustainability reports. The focal independent variable in the test of H3a is labeled “Stakeholder Feedback.” Stakeholder Feedback is a binary variable that takes a value of “1” if a panel of stakeholders or industry experts provides feedback on a sustainability report and a value of “0” otherwise. The focal independent variable in the test of H3b is labeled “External Assurance.” External Assurance is a binary variable that takes a value of “1” if an external entity audits the organization’s report and a value of “0” otherwise. Accounting firms (e.g., KPMG) are the most common external assurance providers, although some engineering firms (e.g., Bureau Veritas) and small consultancies (e.g., AENOR) also audit sustainability reports. The focal independent variable in the test of H3c is labeled “Additional Sustainability Standards.” Additional Sustainability Standards is an indicator variable that takes a value of “1” if the firm references other sustainability standards in the report and a value of “0” otherwise. The additional standards include the UN Global Compact, ISO 26000, and OECD Guidelines for Multinational Enterprises. Positive regression coefficients for Stakeholder Feedback, External Assurance, and Additional Sustainability Standards will provide evidence for H3a, H3b, and H3c, respectively.

Control variables

Previous research demonstrates that marketing variables (e.g., advertising intensity), financial variables (e.g., dividend payout ratio), and certain top management team characteristics (e.g., CEO age) influence a wide range of strategic decisions that ultimately affect firm value (Martin et al., 2018; Whitler et al., 2018). Because many these of same variables also affect the adoption of sustainability reporting standards (Christensen et al., 2021), we include them in the model as controls. We will describe the control variables in alphabetical order. First, “Advertising Intensity” is included in the model because it is a proxy for media exposure (Servaes & Tamayo, 2014). Advertising Intensity is the ratio of advertising expenses to total assets (Servaes & Tamayo, 2014). This measure is consistent with prior research, and the scaling factor of total assets reduces positive skew and makes it easier to compare firms of much different sizes (Luo & de Jong, 2012). We operationalize “Analysts” as the natural logarithm of the number of financial analysts following the firm. The logarithmic transformation makes the highly skewed data more suitable for use in a panel regression model (Luo et al., 2012). “BOD: Age” is the mean age of board members. “BOD: Size” is a count of board members. These variables are important to corporate governance and their operationalization is consistent with Bommaraju et al. (2019). “CEO: Age” is the age of the CEO in years, which could affect firm value (Cline & Yore, 2016) and also controls for generational differences in attitudes toward sustainability. “CEO: Gender” controls for potential gender differences that could affect financial, environmental, and social performance (Manner, 2010). We code “CEO: Gender” as a “1” if the CEO is female, “0” otherwise based on the binary coding scheme in the ExecuComp database. “CEO: Salary” is the natural logarithm of direct cash compensation of the CEO (in thousands $USD). CEO compensation affects a wide range of strategic decisions, and the logarithmic transformation of the compensation data is necessary because it does not approximate a normal distribution (O’Connell & O’Sullivan, 2011). “Charity Relationships” is the number of board members reporting membership on a charity board. This control variable is included in the model because board members that serve on charity boards may be more likely to advocate for social and environmental initiatives (Friske et al., 2020). “Dividend Payout” is the ratio of dividends paid to net income. “Financial Leverage” is the percentage of the firm’s total liabilities to total assets. “Liquidity” is the proportion of current assets to current liabilities. The finance literature indicates that the three aforementioned financial variables directly affect Tobin’s q, and thus they are typically included in marketing studies of firm value as controls (Martin et al., 2018). “R&D Intensity,” which enables firms to create superior customer value, is the ratio of research and development expenses to total assets (Bommaraju et al., 2019). “Sales Growth” is the percentage of the year-to-year change in sales revenue. It is necessary to control for sales growth because faster growing firms are likely to have higher market valuations than slower growing firms (Bommaraju et al. 2019; Martin et al., 2018). Finally, “SG&A Intensity” is the ratio of selling, general, and administrative expenses minus R&D expenses to total assets (Currim et al., 2018). This final marketing variable has been shown to positively influence firm performance (Currim et al., 2018).

Descriptive statistics and correlation matrix

Table 2 provides a summary of the variables discussed in the previous section along with definitions, measures, and data sources. Table 3 contains descriptive statistics.

Table 4 provides the correlation matrix for the variables. Correlation coefficients among the independent variables and control variables are relatively low, but we still calculate variance inflation factors (VIF) to assess the potential for multicollinearity. We use a value of 4.00 as the threshold in determining whether multicollinearity is problematic (Ballings et al., 2018). The VIF averages 1.49 across all estimations with a maximum value of 3.64. The VIF values indicate that the regression coefficients are not affected by multicollinearity.

Analytical approach

Analysis for H1 and H2

First, we use a Hausman specification test to determine whether a random effects or fixed effects panel regression model is appropriate (Hausman, 1978). We reject the null hypothesis of the Hausman specification test (m = 267.85, d.f. = 16, p < 0.01) and conclude that a fixed effects model is more appropriate for the analysis. We build the fixed effects panel model in a stepwise fashion. Model 1 consists of the control variables. Model 2 adds Sustainability Report to the list of controls. Model 3 adds Temporal Effect. Model 4 contains the control variables, Sustainability Report, Temporal Effect, and the interaction of Sustainability Report*Temporal Effect. The specification of Model 4 follows:

where \({\alpha }_{i}\) represents firm-specific intercepts that capture heterogeneities across firms in the fixed effects model and \({u}_{i,t}\) is an error term. Newey West standard error estimates are used in the analysis. Newey West standard errors are robust to heteroscedasticity and autocorrelation, two common problems in panel data (Newey & West, 1994).

One benefit of the fixed effects model is that it controls for time-invariant firm characteristics regardless of whether such characteristics are measured. Although the fixed effects model accounts for potential endogeneity caused by omitted variable bias, it does not account for other sources of endogeneity, such as selection bias. Selection bias could affect the results of this study because sustainability reporting firms are not randomly selected from a larger population; organizations voluntarily issue sustainability reports (Christensen et al., 2021). Therefore, we need to determine if endogeneity influences the relationship between Sustainability Report and Tobin’s q. To address selection bias and other potential sources of endogeneity, we rely on an instrument-free, control function approach described in Vella (1998) and Wooldridge (2010, 2014) and employed in the marketing literature by Germann and colleagues (2015). This method is similar to a Heckman selection model, and its interpretation is similar to the Gaussian copula approach, but it works with a binary endogenous regressor (Papies et al., 2017).

The modeling process takes two steps. In the first step, we fit a random effects panel probit model with dummy variables for each year to the Sustainability Report data. The predictor variables for this probit model are based on our review of the sustainability reporting literature (see the Literature Review section for more information). The probit model contains variables that are not included in the second step of the analysis for identification purposes. Once we estimate the panel probit model of Sustainability Report, we save the generalized residuals to use as a control function in the second step (Vella, 1998; Wooldridge, 2010, 2014).Footnote 1 The generalized residuals are equivalent to the inverse Mills ratio, which is the ratio of the normal probability distribution function to the cumulative distribution function (Papies et al., 2017; Vella, 1998). In the second step, we add the generalized residuals to Model 4 to create a new model: Model 5. We label the control function “Residual” in Model 5. Including Residual in the equation will control for correlation between the error term in the fixed effects panel model and the potentially endogenous regressor, Sustainability Report.

The variable of interest for H1 is Sustainability Report. The variable of interest for H2 is Sustainability Report*Temporal Effect. The variable of interest for the endogeneity check is Residual. By referring to the coefficient of Residual, we can test the null hypothesis that the relationship between sustainability reporting and firm value is exogenous (Wooldridge, 2014). If the coefficient for Residual is not significant at the p = 0.05 level, then we can assume that endogeneity does not substantially bias the results of the analysis (Wooldridge, 2014). If the regression coefficient for Residual is statistically significant, it will indicate a potential endogeneity problem. In which case, inclusion of the control function in the panel regression model should correct (or at least mitigate) endogeneity bias in the estimate of \({\beta }_{1}\) (Wooldridge, 2014).

Analysis for H3

In the analysis of H3, we estimate a fixed effects panel model with Newey West standard errors to determine if the inclusion of stakeholder feedback, external assurance, and additional sustainability standards affect firm value. The model specification follows:

where \({\rm X}_{i,t}\) represents a vector of the control variables that appear in Eq. 2, \({\alpha }_{i}\) represents firm-specific intercepts that capture heterogeneities across firms, and \({u}_{i,t}\) is an error term. The modeling approach here is similar to the previous analysis. However, there is no need to check for endogeneity caused by selection bias in this model because we are only analyzing firms that issue reports. The estimates of \({\beta }_{1}\), \({\beta }_{2}\), and \({\beta }_{3}\) are of interest for H3a, H3b, and H3c, respectively.

Results

The results associated with H1 and H2 appear in Table 5. The coefficient for Sustainability Report is statistically significant (p < 0.05) and negative in Model 2, Model 3, Model 4, and Model 5. This finding supports H1a. In general, sustainability reporting is negatively associated with Tobin’s q. However, the coefficient of the interaction term, Sustainability Report*Temporal Effect, is statistically significant (p < 0.01) and positive in Model 4 and Model 5. The interpretation is that the evolving relationship between sustainability reporting and Tobin’s q becomes less negative and eventually turns positive over time. This result supports H2.

Many of the control variables are statistically significant and have the expected sign, which give credence to the modeling approach. For example, the positive relationship between R&D Intensity and Tobin’s q, as well as the positive relationship between Sales Growth and Tobin’s q, align with previous marketing research on firm value (Lenz et al., 2017; Martin et al., 2018; Whitler et al., 2018). Furthermore, the control function, Residual, is not statistically significant (p > 0.10). The interpretation is that endogeneity is not a serious problem in the analysis (Becker et al., 2022; Wooldridge, 2014). Finally, the relatively high R2 statistic (R2 = 0.785) indicates that the model explains much of the variance in Tobin’s q.

Figure 1 plots Sustainability Report’s effect on Tobin’s q from 2011 to 2020. Initially, sustainability reporting has a negative impact on firm value. This negative effect gradually becomes less negative, and it eventually turns positive. From 2011 to 2020, most firms in the sample increase in value, but valuations increase at a faster rate for companies that produce sustainability reports. After 2018, sustainability reporting firms have higher values of Tobin’s q than nonreporting firms, ceteris paribus. These results provide additional support for H2.

To test H3, we estimate a fixed effects panel model with Newey West standard errors for the subset of firms that issue sustainability reports. This model includes the Stakeholder Feedback, External Assurance, and Additional Sustainability Standards variables along with the control variables used in the previous analysis. The results associated with H3 appear in Table 6. The coefficient for External Assurance is statistically significant (p < 0.05) and positive. The coefficients for Stakeholder Feedback and Additional Reporting Standards (p > 0.10) are not statistically significant. These findings support H3b; they do not support H3a or H3c. In unreported results, several control variables are statistically significant and have the expected sign, which lend credence to the model. The relatively high R2 statistic (R2 = 0.854) also suggests that the model provides a good fit to the data.

Post hoc analysis

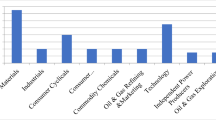

We have established that the temporal component of the signaling environment affects the sustainability reporting—firm value relationship, but it seems likely that other elements in the signaling environment could affect receivers’ interpretation of sustainability reports. Institutional norms about sustainability reporting vary across industries, and investors may have different ESG information expectations based on industry (Fernandez-Feijoo et al., 2014). Therefore, a firm’s industrial category could be another factor in the signaling environment that shapes the interpretation of signals and feedback. To investigate industry’s influence on the sustainability reporting—firm value relationship, we start by creating indicator variables for industrial categories based on four-digit Standard Industrial Classification (SIC) codes. Industries identified in the post hoc analysis include mining, retail trade, services, transportation and public utilities, and wholesale trade. We then create interaction effects for each of the industry dummy variables by multiplying them by Sustainability Report, and we add the interaction terms along with the industry dummies to the fixed effects panel model represented in Eq. 2. Although the main effect of sustainability reporting on Tobin’s q remains negative and statistically significant at the p = 0.01 level, some of the industry interactions are negative and some are positive. Interestingly, the interaction of the transportation and public utilities indicator variable by Sustainability Report is statistically significant and positive (\(\beta\) = 0.111, t = 2.13, p = 0.03), which suggests that reporting has always been perceived as a positive signal by investors in transportation companies and utilities. Similarly, the interaction of the wholesale trade indicator variable by Sustainability Report is marginally significant and positive (\(\beta\) = 0.156, t = 1.93, p = 0.05). These results indicate that even in the early 2010’s investors valued sustainability disclosures in industries associated with pollution and high carbon emissions.Footnote 2

There are two caveats regarding the post hoc analysis that require elaboration. First, because industrial classification rarely changes within the ten-year period of the sample, the fixed effects estimator in the model subsumes most of the industry-level effects. Second, there is an unequal distribution of firms across industries in the sample, and this limits the statistical power of the analysis for some industrial categories.

Discussion

In this paper, we investigate how sustainability reporting influences firm value, as measured by Tobin’s q. Using a large, unbalanced panel of reporting and nonreporting organizations, we first test competing hypotheses developed from signaling theory and previous research on sustainability reporting. H1a posits sustainability reporting is negatively related to firm value, thereby challenging the received view in the marketing literature. H1b posits sustainability reporting is positively related to firm value, which is more consistent with assumptions in the marketing literature. The results of our analysis suggest that, in general, sustainability reporting is negatively associated with firm value. However, the relationship between reporting and firm value is evolving. The results associated with H2 indicate that sustainability reporting’s impact on firm value becomes positive over time. In addition, the post hoc analysis reveals that the relationship between sustainability reporting and firm value has been positive for a longer time in industries that produce a high level of carbon emissions (e.g., transportation and utilities). Finally, our findings demonstrate that reporting firms can take steps to achieve relatively higher market valuations. External audits of sustainability reports are positively associated with Tobin’s q.

Implications for theory

Our study answers calls for research on sustainability reporting’s long term effects on firm value (Nikolaeva & Bicho, 2011; Zou et al., 2019). Our study also answers calls for research on the sustainability reporting—firm value relationship in developed economies (Wang & Li, 2016). Unlike prior studies, which document a positive stock market reaction to the initial adoption of a sustainability reporting framework (Wang & Li, 2016; Zou et al., 2019), our study reveals a negative main effect on firm value. This finding runs counter to most expectations in the marketing literature.

However, the negative main effect of reporting on Tobin’s q tells only one part of a more complicated story because the interaction effect of Sustainability Report*Temporal Effect is positive. If we extrapolate the parameter estimates from the main effect and the interaction effect, we find that the relationship between sustainability reporting and Tobin’s q turns positive after 2018. Investor attitudes toward sustainability disclosures evolved over the last decade. Important stakeholders, including institutional investors, are demanding more transparency from firms regarding their sustainability initiatives (Fink, 2020, 2021). The positive results associated with the test of H2 indicate that firms learn from this feedback and improve their sustainability signaling over time. The reporting literature can now move away from concerns about the direct expenses, agency costs, and opportunity costs associated with reporting and move toward best practices of how to structure reports and how to frame sustainability initiatives in ways that appeal to multiple stakeholder groups.

The post hoc analysis reveals that sustainability reporting has a consistent positive effect on Tobin’s q for the subset of firms in the transportation and public utilities sector. We believe this result emphasizes the importance of the signaling environment, which influences the interpretation of signals. Not only do transportation and utility companies have significant impacts on the environment, but the public has been aware of these impacts for a relatively long time (Branco & Rodrigues, 2008; Fernadez-Feijoo et al. 2014). Even in the early 2010’s, when sustainability reporting may have been regarded as an overreach in most industries, investors valued disclosures from transportation and utility companies. Sustainability reports are particularly valuable for transportation firms and utilities because they provide material information about firm assets (e.g., green technologies) and liabilities (e.g., climate change and regulatory risks) that will affect future cash flows (Mozumder et al., 2011; Piecyk & Björklund, 2015). In short, a sustainability report provides an intentional, positive signal to shareholders and potential investors that a transportation firm or a public utility is aware of its industry-related risks and is proactively managing them.

Recently, academics and prominent institutional investors have criticized firms for including immaterial, inaccurate, or misleading information in sustainability reports (Chung & Michaels, 2019; Kim & Lyon, 2015; Styles, 2020). The credibility of sustainability reporting as a signal has been called into question, but we find that firms may take steps to counteract this criticism. External audits of sustainability reports are positively associated with Tobin’s q as they enhance the validity of reports (Manetti & Becatti, 2009). Investors are more likely to trust the information in an audited report, and they are less likely to assume that the firm is greenwashing if the report is audited.

In sum, the results of our study align with the core tenets of signaling theory. Effective signals are costly and honest (Connelly et al., 2011a). Sustainability reporting meets both criteria, and thus reporting is an effective signal of the firm’s commitment to marketing practices that are within, and supportive of, sustainable economic development (Hunt, 2011). Reporting is costly not only in terms of the obvious financial costs associated with reporting, but also with respect to its initial negative effect on firm value. Firms that adopted sustainability reporting standards before 2018 may have suffered in the short run, but their investments ultimately paid off as institutional norms regarding reporting have changed and investors have called for more and better sustainability disclosures. Clearly, the signaling environment influences receivers’ interpretations of the signal. Now that the sustainability movement is reaching maturity, investors have become more appreciative of reporting and are interpreting reporting as a positive signal. Industry also provides important context; therefore, this aspect of the signaling environment cannot be ignored.

Finally, our results imply that management can enhance the credibility of the signal, and thus limit accusations of false signaling (i.e., greenwashing), by hiring external organizations to audit sustainability reports.

Implications for practice

For the past few years, corporate executives have claimed that voluntary disclosures of sustainability expenditures and activities increase firm value (Delevingne et al., 2020). They may have spoken their beliefs into existence. The negative main effect of Sustainability Report contrasted with the positive interaction effect of Sustainability Report*Temporal Effect suggests that in the early 2010’s most investors interpreted reporting as a negative signal, but their attitudes gradually changed. Firms that issued sustainability reports in the early stages of the sustainability movement may not have seen an increase in valuations, but reporting has recently become an important and valuable signal of the firm’s commitment to sustainable economic development. Organizations that do not engage in reporting should consider initiating a reporting program now if they want to benefit from the trend.

Organizations that currently publish reports should continue to publish them, even though reporting is initially a costly endeavor. Once a firm embarks on a reporting program, it should not stop, as it will likely benefit from organizational learning and reputational effects moving forward. The fact that the relationship between reporting and firm value is increasingly positive over time, regardless of industry, suggests that sustainability reporting is becoming a business norm. We advise managers of sustainability reporting organizations to be patient. Even if they have not seen returns in the short term, they should see positive returns within the next few years. This advice is critical for managers of transportation and logistics companies as well as utilities. The results of the post hoc analysis suggest that firms in highly visible and environmentally sensitive industries have the most to gain from sustainability reporting, and thus the need to adopt sustainability reporting standards is more urgent for firms in these industries.

Finally, our results imply that reporting firms benefit from external audits. External auditing cuts down on false signaling via greenwashing and raises the credibility of the information contained in the report. Audits add costs to the process of reporting, but if audits also enhance firm value, they could be worth the price. Furthermore, if sustainability reporting becomes an institutional norm, then external auditing may be necessary to create a separating equilibrium among a larger number of firms that publish reports.

Limitations and future research directions

Although this study makes multiple contributions to theory and practice, it has limitations. First, our study underscores the importance of context in sustainability research. We begin to see a clearer picture of reporting when we use both a static, overall measure of reporting and a dynamic measure of reporting that allows for change over time. Various aspects of the signaling environment influence the relationship between reporting and firm value. Therefore, we stress that our analysis may only be applicable to developed financial markets that are similar to the U.S. market. We do not test the relationship in a developing financial market, in which agency costs and transparency are greater concerns. Sustainability reporting may have a much different effect on Tobin’s q for firms in emerging and developing markets. Second, Tobin’s q is an important measure of firm value, but there are other measures of firm value that could be equally important to managers. For example, managers of large, established firms may be interested in metrics such as return on assets (ROA) or return on equity (ROE) because their firms’ growth rates are limited by factors associated with age and size. Third, we only study firms that voluntarily report on their sustainability initiatives, so we cannot draw any conclusions about firms that are legally obligated to publish sustainability reports. It may be instructive to repeat this study in a market that has a uniform set of sustainability disclosure requirements for all firms, or a market in which nearly all listed firms choose to report, because these factors may alleviate selection bias and limit endogeneity by design. Fourth, this study is one of the first to find a negative relationship between sustainability reporting and firm value. However, our focal variable is the presence (or absence) of the report. There is consistency among GRI reports, which is why we focused our analysis of report characteristics on GRI member organizations, but no two reports are identical. There are underlying characteristics of some reports which may make them more valuable to the investor community than others, and as such, increase the issuing firms’ market value. Consequently, investigating the quality of reporting through computer-aided text analysis may provide meaningful insights.

Notes

The results of the random effects probit model are available upon request from the corresponding author.

The full table of results from the post hoc analysis is available upon request.

References

Adams, C. A. (2002). Internal organisational factors influencing corporate social and ethical reporting. Accounting, Auditing & Accountability Journal, 15(2), 223–250.

Anderson, E. W., Fornell, C., & Mazvancheryl, S. K. (2004). Customer satisfaction and shareholder value. Journal of Marketing, 68(4), 172–185.

Ballings, M., McCullough, H., & Bharadwaj, N. (2018). Cause marketing and customer profitability. Journal of the Academy of Marketing Science, 46(2), 234–251.

Becker, J. M., Proksch, D., & Ringle, C. M. (2022). Revisiting Gaussian copulas to handle endogenous regressors. Journal of the Academy of Marketing Science, 50(1), 46–66.

Bergh, D. D., Connelly, B. L., Ketchen, D. J., Jr., & Shannon, L. M. (2014). Signalling theory and equilibrium in strategic management research: An assessment and a research agenda. Journal of Management Studies, 51(8), 1334–1360.

Bhagwat, Y., Warren, N. L., Beck, J. T., & Watson, G. F., IV. (2020). Corporate sociopolitical activism and firm value. Journal of Marketing, 84(5), 1–21.

Bommaraju, R., Ahearne, M., Krause, R., & Tirunillai, S. (2019). Does a customer on the board of directors affect business-to-business firm performance? Journal of Marketing, 83(1), 8–23.

Branco, M. C., & Rodrigues, L. L. (2008). Factors influencing social responsibility disclosure by Portuguese companies. Journal of Business Ethics, 83(4), 685–701.

Brown, H. S., de Jong, M., & Levy, D. L. (2009). Building institutions based on information disclosure: Lessons from GRI’s sustainability reporting. Journal of Cleaner Production, 17(6), 571–580.

Brown-Liburd, H., Cohen, J., & Zamora, V. L. (2018). CSR disclosure items used as fairness heuristics in the investment decision. Journal of Business Ethics, 152(1), 275–289.

Bryk, A. S., & Raudenbush, S. W. (2002). Hierarchical Linear Models: Applications and Data Analysis Methods. Sage.

Chabowski, B. R., Mena, J. A., & Gonzalez-Padron, T. L. (2011). The structure of sustainability research in marketing, 1958–2008: A basis for future research opportunities. Journal of the Academy of Marketing Science, 39(1), 55–70.

Christensen, H. B., Hail, L., & Leuz, C. (2021). Mandatory CSR and sustainability reporting: Economic analysis and literature review. Review of Accounting Studies, 26(3), 1176–1248.

Christensen, L. T., Morsing, M., & Thyssen, O. (2017). License to critique: A communication perspective on sustainability standards. Business Ethics Quarterly, 27(2), 239–262.

Chung, J. & Michaels, D. (2019). ESG funds draw SEC scrutiny. Wall Street Journal. Retrieved from https://www.wsj.com/articles/esg-funds-draw-sec-scrutiny-11576492201. Accessed 1 Nov 2020.

Chung, K. H., & Pruitt, S. W. (1994). A simple approximation of Tobin’s q. Financial Management, 23(3), 70–74.

Cline, B. N., & Yore, A. S. (2016). Silverback CEOs: Age, experience, and firm value. Journal of Empirical Finance, 35, 169–188.

Connelly, B. L., Certo, S. T., Ireland, R. D., & Reutzel, C. R. (2011a). Signaling theory: A review and assessment. Journal of Management, 37(1), 39–67.

Connelly, B. L., Ketchen, D. J., Jr., & Slater, S. F. (2011b). Toward a “theoretical toolbox” for sustainability research in marketing. Journal of the Academy of Marketing Science, 39(1), 86–100.