Abstract

In analyses that attempt to estimate the costs of species invasions, it has been typical to report the costs of management and/or to multiply per-unit costs by the number affected to arrive at a total. These estimates are of limited value for most policy questions. We start our discussion by recognizing that biological pollutants such as aquatic invasive species are like conventional pollutants in important ways and appeal to the well-developed literature on conventional pollution to guide our thinking into how best to conceptualize the problem. We use a standard pollution control framework to identify the margins over which costs and benefits should be estimated to guide wise decision-making. We then use examples from the literature to illustrate how transactions in related markets can be used to estimate the benefits of management. The roles of adaptation, mitigation, and species population growth have particular relevance and are highlighted. In the final section of the paper, we think through the conditions under which investing in genetic biocontrol methods would be economically justified.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Aquatic invasive species are known to have dramatic effects where they have become introduced and established. Experience has shown that invading species can out-compete or prey on valuable species, can change important characteristics of aquatic ecosystems, and can harm man-made underwater infrastructure (Mack et al. 2000; Connelly et al. 2007). In a general sense, aquatic invaders are biological pollutants that reduce the services that aquatic systems provide (Horan et al. 2002). These services might include recreational opportunities for anglers that depend on healthy aquatic ecosystems or the availability of water flows for commercial cooling purposes. A fundamental question related to aquatic invasive species is whether management activities such as prevention, suppression and eradication generate economic benefits that are greater than the associated management costs and, if so, by how much (Finnoff et al. 2007; Simberloff 2009; Horan and Lupi 2010).

The papers in this issue discuss research into techniques which will primarily affect management costs. Is it possible to develop methods using genetic biocontrol that are more effective or that can add to the effectiveness of currently available methods? Might these offer the promise of achieving permanent reductions in invasive aquatic species populations? Are these potential new methods more effective or less costly to implement than existing methods? Is it possible to characterize the likelihood of success of these new methods? In addition, what are the costs, such as non-target ecological costs, beyond the financial outlays incurred by management agencies and individuals? Fundamentally, what is the least costly way to achieve control with current technologies and how might new technologies reduce these costs? Knowing the change in effectiveness that would be achievable with the implementation of genetic biocontrol is essential to the evaluation of whether the time and effort involved in conducting research and development and navigating the approval process will prove to be worthwhile.

The central question in benefit estimation is about the tradeoff between the goods we are interested in and other goods of value. When goods are exchanged in markets, the tradeoff is summarized by relative market prices. However, ecosystem services like the increased aquatic ecosystem services that come with reductions in invasive species populations fall into the category of non-market goods and so values must be inferred either from markets for related goods (revealed preference) or through direct elicitation (stated preference). The literature on estimating non-market benefits is deep and extensive, and some of these methods have been rigorously applied to specific invasive species cases (e.g., Lupi et al. 2003; Horsch and Lewis 2009; Lovell and Drake 2009). In addition, back-of-the-envelope calculations using readily available data have been used to provide information about damage caused by aquatic invasive species (e.g., OTA 1993; Pimentel et al. 2000).

Biological pollutants such as aquatic invasive species are like conventional pollutants in important ways. The well-developed literature on conventional pollution can be used to guide our thinking into how best to manage the problem. In this paper, we use a standard pollution control framework to identify some of the main concepts involved when considering how aggressively to manage invasive species. We then use examples from the literature to illustrate how transactions in related markets can be used to estimate the benefits of management. However, while there is a strong analogy between biological and conventional pollutants, it is unwise to carry the analogy too far. In particular, unlike conventional air and water pollutants which tend to dissipate quickly, biological pollutants can reproduce. This population growth requires us to think about the future consequences of current management choices. We examine some of these considerations below. Finally, we return to the pollution control framework and think through the conditions under which investing in genetic biocontrol methods would be economically justified.

Framework

In the standard pollution control framework (Baumol and Oates 1988), the baseline from which to begin the analysis is the maximum amount of pollution–the amount emitted without regard to the costs of pollution on the environment. From this baseline, pollution can be reduced up to the maximum abatement level at which no pollution is emitted. Pollution abatement is achieved using increasingly expensive means: the marginal cost of pollution abatement increases as pollution is reduced from its maximum. On the benefit side, the marginal benefit of reducing the first few units of pollution is high and declines as the environment becomes cleaner. In an applied setting, an important first step would be to specify the scope of the problem as a foundation for determining how much each level of control would cost for the relevant polluters and the types and values of the benefits accruing to those affected by pollution.

Figure 1 provides an analogous conceptual view of invasive species control. From the baseline at the origin where the invader is not controlled, this figure shows an increasing marginal cost of control from where the population is at its maximum up to the point of eradication where species numbers are driven to zero. Embedded in this curve is the idea that the easiest and cheapest options are exploited first, and that further reductions become more and more costly: the manager uses the best option for each additional increment of control. The marginal benefit of control (the damage that is avoided by removing that unit of population from the environment) is highest with the first few units removed and declines as numbers are reduced. As with the pollution model, this simple formulation is a powerful conceptual framework yet is lacking in important details that require careful definition in an applied setting: the geographic scope, the species, the time horizon, the affected parties, and so on.

The total costs and benefits of alternative levels of control are the areas underneath the marginal control cost and benefit functions. With no control of the invader, total benefits and total costs are both equal to zero; net benefits also equal zero. At this point, the maximum damage occurs (A + B + C)—no damages are avoided. At the other extreme, if the species is eradicated, all the potential damages are avoided, so total benefits are equal to A + B + C. Total control costs are equal to B + C + D. Net benefits of eradication are A − D, which may in fact be negative if D is larger than A. Where marginal benefit equals marginal control cost (c*), total benefits, i.e., total damages avoided, are A + B and damages incurred are C. Because control costs total B, net benefits are A. This is the level of control at which highest net benefits are achieved.

We may choose to view this problem in terms of damage costs incurred rather than damage costs avoided. Without control, the only cost in this sum is damage cost: A + B + C. With eradication, the only cost is control cost: B + C + D. The lowest sum of control and damage costs (B + C) is found where the two curves intersect. So, whether the goal is to maximize net benefits or to minimize the sum of damage and control costs, the best choice is the control level where the marginal curves intersect (Table 1).

Figure 1 shows a case in which the best option is somewhere between the two extremes of no control and eradication. However, the optimal decision may turn out to be at one of the two extremes. No control is optimal if the marginal control cost curve is everywhere above the marginal benefits curve: even the first unit of control is costlier than its benefits. Eradication would be optimal if the marginal control cost curve is everywhere below the marginal benefits curve: the benefit of reducing the population from a low level to zero is higher than the cost of doing so.

Any level of control between the extreme of no control and the extreme of eradication can also be evaluated to determine net benefits. Consider, for example, Fig. 2. Figure 2a illustrates a low level of control, where total benefits “a + b” less control costs “b” yield positive net benefits “a”. With a high level of control as shown in Fig. 2b, total benefits “e + f” less control costs “f + g” yield net benefits “e − g”. These net benefits are positive if area “g” is less than area “e”.

This straightforward framework helps isolate the important inputs into wise decision making: at its most basic, an action is worth taking if the benefits of that action outweigh the costs. In addition, the smaller the increments over which decisions can be made, the more accurately a manager can identify the best decision. If the choice is between no control and low control, low control is often better. However, the optimal level of control (identified in Fig. 1) would be better yet. An important empirical question in an applied setting, then, is the magnitude of the benefits and costs of incrementally reducing the size of the invasive species population from the baseline.

Estimating benefits

Lovell et al. (2006) survey the growing literature on estimating damages from aquatic invasive species. They summarize many studies, some of which focus on a particular species and others which attempt a comprehensive assessment. They note a wide array of approaches used to address the issue. It is worth emphasizing here that damages and benefits are two sides to the same coin: the benefits of invasive species control are the damages that are avoided because the species is controlled. Often, studies report the annual total damages caused by invaders. These totals could represent damages in the absence of control (area A + B + C in Fig. 1, with zero benefits), damages when little control effort is applied (c + d in Fig. 2a, with benefits a + b) or damages with high control effort (h in Fig. 2b, with benefits e + f). These estimates, by themselves, provide only a sense of the magnitude of the problem. They must be coupled with control cost estimates, preferably at a range of control levels, to suggest a course of action.

In estimating benefits, it is important to consider first to whom the benefits would accrue in order to determine the correct measure. For example, zebra mussels (Dreissena polymorpha) are infamous for attaching to underwater infrastructure such as water intake pipes for power plants and water treatment plants. Corporate financial statements are a good place to look for evidence on how much prevention activities would be worth to plants on uninfested yet vulnerable waterways. In another example, sea lampreys (Petromyzon marinus) have damaged lake trout (Salvelinus namaycush) populations in the Great Lakes. Sea lamprey suppression programs have had the effect of allowing trout populations to rebound, benefiting recreational anglers (Swanson and Swedberg, 1980). In the sections below, we highlight some of the important components of benefit estimation in the context of aquatic invasive species research.

Zebra mussel studies

Benefits = avoided damages

Managers do not have, as yet, any effective means to reduce zebra mussel populations in infested lakes. Instead, management efforts are focused on prevention of movement of zebra mussels to new lakes. The “benefit” that can be estimated and represented in a marginal benefit/cost framework is the damage that is avoided in uninfested lakes due to prevention activities relative to the baseline case of infestation if no prevention occurred. Therefore, to estimate benefits we need to know the damages that would have been caused had the zebra mussel invaded currently uninfested lakes. The best source of this information is the damage caused by zebra mussels in lakes that have already been invaded.

Market activity can substitute for a non-market benefit

Clogged pipes increase operating costs because the zebra mussels must be removed for water treatment plants to operate. Pipes that have been cleaned out via chemical or mechanical means are equivalent to pipes that have not been affected at all: the two are perfect substitutes for each other. Therefore, the market activity that provides information about the non-market benefit of having an uninfested lake is the removal of zebra mussels from underwater pipes. Because a lake is infested, the power plant incurs costs that restore the functionality of the affected pipes: these costs are estimates of damage where zebra mussels have invaded and can be used to estimate the benefits where zebra mussel infestations have been prevented or delayed. The accuracy of the estimate depends on how well removal substitutes for having an uninfested lake to begin with. In this case, removal is probably a good substitute for the benefits to power plants of uninfested waters.

Adaptation may reduce damages

The zebra mussel case illustrates another important point. Early estimates of projected zebra mussel damage took the cost per power plant and assumed that these costs would be incurred for each affected plant into the foreseeable future (Pimentel et al. 2000). However, the motivation to avoid the repeated costs of removal inspired the design of a technological fix to prevent zebra mussels from attaching to pipes. Once the up-front cost of installing capital equipment has been incurred, ongoing maintenance and its associated costs can be reduced or discontinued. Connelly et al. (2007) found that the current average annual costs per facility are two-thirds of their levels in the early years of the invasion. The present value of the damage cost in an infested area is the (lower) capital cost and the stream of lower maintenance costs rather than the sum of high current maintenance costs extrapolated into the future. Early work overestimated damage costs because it was difficult to foresee the technological innovation that would solve the problem. This lesson may be applicable in other cases where large ongoing costs are predicted: substitutes for currently available technology may become available and estimates based on current technology may prove to be too high.

Benefit estimates may be incomplete

With the zebra mussel case, it should be noted that damage estimates that rely exclusively on costs to power plants and water treatment plants are incomplete because they do not account for damages to recreation or to native ecosystems. In addition to examining businesses’ balance sheets, we must consider how individuals’ welfare is affected by invaders and how to measure these welfare changes. One species for which these kinds of studies have been conducted is the sea lamprey.

Sea lamprey studies

The quality of outdoor recreation is not a commodity traded in a market, yet has value to individuals. Two measures of the dollar value of non-market goods to individuals are commonly used by economists (Freeman 2003): the willingness to pay for an improvement or the willingness to accept a worse outcome. Developing methods to estimate these non-market values has been a major contribution of economists in recent years, and some of these methods have been used in the context of invasive species.

Frank Lupi et al. (2003) sought to estimate the value of reducing the size of the sea lamprey population in the Great Lakes. For sea lamprey, a main source of value is reversing the loss to recreational trout fishing. Improved recreational fishing benefits are estimated using a travel cost model where individuals reveal their preferences for the nonmarket good—trout fishing quality—by incurring travel costs to visit recreational fishing sites. The travel cost model is coupled with a model that relates sea lamprey populations to trout abundance. Lupi et al. examined several scenarios relative to the baseline of no control in order to evaluate the net benefits of different levels of control. Their research illustrates three key insights: marginal benefits may not be constant, evaluating an entire marginal benefit function is difficult as a practical matter, and the time dimension is important.

Marginal benefits may fall with increased control

Lupi et al. recognized that the benefits of improved fishing quality are not directly proportional to the increases in catch rates per unit effort. Unlike studies such as Koonce et al. (1993), they allow for the possibility of diminishing marginal benefit such that the first few units of improvement are more highly valued than subsequent units. This is critical: assuming constant marginal benefits is appealing because of its simplicity, but there is a danger of wildly overestimating the benefits of improving catch rates if the benefit of all improvements is assumed to be as high as the benefit of the first improvement.

Finding marginal benefits for all levels of control is a challenge

This study evaluated only a few possible scenarios rather than the full range from no control to complete eradication. The complexity of the biological modeling coupled with the model of angler behavior makes it difficult to examine every possibility. Practically speaking, it is difficult to estimate the full range of benefits from no control to eradication. Instead, it is more reasonable to evaluate a finite set of well-defined scenarios. Any action for which the net benefits exceed the net benefits of “no control” would be worth taking, and it would be best to select the scenario with the highest net benefit. However, as this paper demonstrates, selecting the best option is a complicated matter and results can be sensitive to underlying assumptions and modeling decisions.

The time dimension is fundamental to problems involving biological pollutants

With problems involving biological populations, the temporal dimension is key. It takes time to bring sea lamprey populations down and for trout populations to recover. The rate of time preference becomes an essential part of the analysis because the management alternatives yield different patterns of benefits and costs over time. In their study, Lupi et al. found that the conclusion about which management option is best depended on the choice of the discount rate. More generally, bioeconomic modeling (see Olson and Roy (2008) for an invasive species application) emphasizes that optimal management choices should be made in a forward-looking manner, taking population dynamics into account as well as the fact that all future management actions will also be optimally chosen.

Non-market methods to estimate benefits

With zebra mussels, researchers have used industry costs to estimate damages and, with sea lamprey, they have used travel cost recreational demand models. Besides these methods, economists have used property value studies, stated preference approaches, and averting expenditure methods. Some of these might be fruitfully applied to aquatic invasive species. Common carp were purposefully introduced in many lakes and rivers in the United States in the nineteenth century (McDonald 1883). Carp consume vegetation and alter habitat for native fish. In addition, because they disturb sediment on lake floors, they increase turbidity and nutrient concentrations leading to declines in water quality (Breukelaar et al. 1994). One of the sources of value for reducing carp populations is, then, the resulting improvement in water quality. Improving water quality in a lake can lead to increased amenity and aesthetic values. For nearby property owners, this increased attractiveness may lead to improved property values which reflect the present value of a higher stream of benefits coming from the lake amenity. One approach to measuring the value of improved water quality is, then, the hedonic property value method (Rosen 1974) which assesses the contributions of the features of the property (square feet, number of bedrooms, quality of nearby amenities) to its overall value. Other methods (e.g., travel cost) can account for the value of improved water quality for those who travel to the water body for recreation. This, linked with a model that relates the carp population to water quality, could provide an estimate of the value of reducing carp abundance.

A second category of methods involves direct elicitation of preferences. These methods put individuals in situations in which the answers they give to questions provide information about how much they value a non-market good. In one recent example, McIntosh et al. (2010) use stated preference methods to find the value of delaying the onset of damages from invasive species.

Common pitfalls

The goal of benefit estimation is to provide information that will be useful in making management decisions. However, it is often easy to misinterpret data and research results. Here, we highlight two potential pitfalls: using information about control costs incorrectly and assuming that marginal benefits are constant over the range of analysis.

Control costs

Information about public expenditures on invasive species management is readily available in government publications. When these expenditures are for the purpose of reducing the size of the invasive species population or limiting its spread, these are most properly thought of as total (not marginal) costs that belong on control cost side of the ledger. It is not likely, however, that government agencies have estimates of both the marginal control cost and marginal benefit functions in hand when they make decisions about how much effort to put into controlling invasive species populations. Government expenditures on control may be lower or higher than the amount necessary to bring about the optimum. In the context of Fig. 2, control costs may be low (b) with high damage costs (c + d) or they may be high (f + g) with low damage costs (h). Without more information, we can’t know whether these control efforts achieve the optimal level of population suppression.

Three points can be emphasized here. First, the assumption is that managers are choosing the most cost-effective strategies first before turning to more expensive means: the marginal control cost curve represents the cheapest way to achieve invasive species population control. Second, control costs are not the same as damage costs. Control costs come from management activities (prevention, suppression, etc.) and damage costs are suffered because of the presence of the invader (clogged pipes, reduced recreation, poor water quality, etc.). Third, while knowing the amount spent on control by government agencies may provide some sense of the magnitude of the problem, this information alone is not enough to answer the question of whether managers should scale back or step up control efforts.

One way that information about control costs would be informative about the damage side of the ledger is if they are incurred by private individuals rather than by government agencies. Then, the literature on the “averting expenditure” method of estimating benefits would be relevant (Courant and Porter 1981). A classic example of the averting expenditure method is in the context of air pollution. To avoid the effects of air pollution, individuals may install air purifiers in their homes. If an individual purchases an air purifier, the benefit of reduced exposure to air pollution must be at least as great as the cost of the air purifier. Therefore, the cost of the air purifier is a lower bound on the value of clean air to the homeowner. In the context of invasive species, a lakeshore property owner may apply herbicide to suppress aquatic plants near a dock or swimming area. Because the property owner incurred these costs, it must be that the value of the result is higher than the cost of herbicide application. Zebra mussel removal, discussed above, is another example. For this logic to hold most cleanly, the action taken must be a perfect substitute for the invader to be absent and must not provide any other services. If, as in the zebra mussel and aquatic plant examples, the suppression activities provide no other services yet are not a perfect substitute for the good, the averting expenditure approach can provide a lower bound estimate of the benefit to individuals (Abdalla 1994).

Government spending on control can’t be interpreted in the same way. The decision process through which management agencies choose how intensively to control invasive species populations is not the same as an individual’s. Although citizens may exert influence in order to persuade governments to take action, there is no direct link between commonly-used welfare measures and government spending. The often-reported data on control costs reflect just that—the costs incurred by governments to control invaders, not estimates of benefits.

Constant marginal benefits

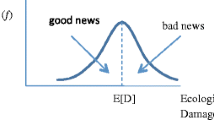

The simplest approach is to assume that the damage cost is constant per unit of the invasive species so that the marginal benefit curve is flat. For example, if one additional Asian carp causes $100 in expected medical costs, then ten Asian carp could be thought to cause $1,000, and so on. The marginal benefit of reducing the size of the population would then be $100 per individual. Though it may be possible to come up with examples where the constant per-unit damage assumption is realistic, this assumption is not likely to hold up in general. In an analogy to natural assets that are thought to be beneficial like water birds affected by an oil spill, if a single bird is worth $100, are ten birds worth $1,000 and 1,000 birds worth $100,000? Probably not: the willingness to pay to avoid damage to birds likely falls as more birds are saved (Bockstael et al. 2000). Economists would attribute this to diminishing marginal utility of a good: demand curves slope down because individuals with limited budgets allocate their dollars where they add the most benefit/satisfaction. Multiplying a per-unit value by the number affected can lead to an unreasonably high number that doesn’t account for limits on ability to pay. For invasive species, the benefit of controlling the first few is probably higher than getting rid of subsequent units: the marginal benefit of control likely slopes down. Allowing for a declining marginal benefit of species control would reduce values that are calculated as the constant cost per unit multiplied by the number of units removed. This downward sloping marginal benefit curve probably accounts for management programs that stop short of trying to eradicate a problematic species, since the marginal benefit of reducing an already small population is dwarfed by the marginal cost of doing so. From a practical standpoint, it is important to recognize that the level and slope of the marginal benefit curve will vary among species.

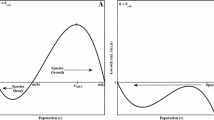

Alternative control technologies

Genetic biocontrol methods offer the potential of improved control of invasive fish. Perhaps the most active area of research is into methods to reduce populations of common carp (see articles in this issue, including Sorensen, Thresher, others). Common carp are responsible for compromised water quality (Lougheed et al. 1998), reduced aquatic vegetation, and reduced native and game fish and waterfowl populations (Bajer et al. 2009). Current control technologies include chemical (e.g., rotenone), biological, and mechanical (seining, barriers) means. These methods vary in their effectiveness and their side effects, and none have proven to be successful in eradicating carp, so they must be applied on a continuous basis to keep populations suppressed. Deploying control resources more effectively lowers the marginal control cost function, allowing the same amount of funds to achieve more control (Fig. 3).

Before adoption of the new technology, the net benefits of controlling at the optimal rate (c*) are area a. After adoption, if the level of control is held constant, the control costs are reduced by area b so that net benefits are a + b. However, the optimal level of invasive fish control increases because the marginal control costs are reduced. If the invasive is controlled at this new post-adoption optimal level (c**) the net benefits are a + b + d: these benefits are b + d greater than before adoption. In this case, the net change in control costs is e − b which, depending on the magnitude of the two areas, may actually represent an increase in control costs. However, the increase in benefits compensates for the potential increase in control costs.

In order to decide whether to adopt the new technology, it is important to evaluate whether the additional net benefits of this new technology (the stream of benefits b + d over the foreseeable future) are greater than the start-up investment costs. This form of analysis can be extended to consider multiple new technologies including, possibly, technologies with more modest reductions in ongoing control costs but with lower initial start-up investment costs.

An important consideration is that investment in research and development (R&D) of new techniques for controlling invasives may not always be successful. This can be due to unsuccessful attempts at developing a new technique, failure of a new technique developed in controlled settings to work properly in the field or failure of the new technique to reduce the marginal costs of control. Of particular concern with genetic biocontrol is the success of transgenic or triploid fish at reducing populations in complex natural aquatic ecosystems. The trait may not perform as intended and/or the overall invasive fish population may be able to overcome the suppressive effects of biocontrol on a population subset (Kapuscinski and Patronski 2005).

In a rough sense, the uncertainty of success can be represented by a probability (π) that the R&D will be successful in the field and lower marginal control costs. However, there is a probability (1-π) that the R&D will be unsuccessful or fail to lower marginal control costs. The additions to expected net benefits are, then, π · (b + d). The value of the stream of benefits from the new technology must be discounted relative to the case where we know for sure that the technology will work. In addition, the present value (PV) of a technology that will not be operational for a number of years is lower than one that is available now.

Replacing existing methods with genetic biocontrol methods could achieve reductions in invasive fish populations, but over a very long time horizon (John Teem—current issue). Continuous effort to introduce altered fish would be necessary to reduce invasive fish populations to acceptable level. Generally, we would have to calculate the present value of net benefits (NB) using a standard present value formula where t indexes time and r is the discount rate:

In the simpler case where results are immediate and net benefits are constant, this formula simplifies considerably: the present value of net benefits is equal to net benefits divided by the discount rate:

With this simple formula, current one-time investments in research and development could be compared with potential increases in expected net benefits into the future, calculated as the probability of success (π) times the area b + d. If the present value of expected net benefits is greater then the cost of investment in research and development, the present value criterion suggests that new techniques should be pursued.

Expressing the problem in this way highlights the factors influencing the decision to pursue genetic biocontrol as part of the suite of management options. First, increases in the probability of success would increase expected net benefits. This would have the effect of reducing the threshold increase in annual net benefits required to justify investment. Second, increasing the scope over which new techniques can be replicated and applied would tend to shift the marginal benefit function up, resulting in increases in the present value of aggregate net benefits. Third, it is worth emphasizing that the marginal control cost curve in these examples is already optimized for any level of population reduction. The lowest marginal cost curve post-adoption may integrate both conventional methods with the new techniques so that the new marginal control cost function may reflect multiple technologies. If the new technology is more expensive than existing technology up to the optimal level of control, the change in control costs will not affect the choice of control method. Fourth, the time dimension of benefits and costs is critical to the calculation of present values. Application of these new methods may require introducing modified fish into the aquatic ecosystems so that the size of the population would have to increase in the near term. Genetic biocontrol methods must be able to offset these increased short-term damages with long term reductions in damages caused by the invasive population.

Conclusions

The benefit-cost criterion is an appealing framework for decision making: an action is worth taking if the benefits of that action outweigh the costs. In this paper, we have outlined the elements of applying this criterion to decisions involving management of aquatic invasive species. A well-equipped decision maker will know the whole range of marginal benefits and costs, from low to high levels of control, including costs that may be external to the management agency. Population dynamics play a pivotal role, as current control can inhibit population growth into the future.

We soon see that the application of these basic ideas in a management context involves a series of thorny problems, starting with the definition of the scope of the issue and including questions about the efficacy and non-target effects of alternative control strategies. Although most decision-makers recognize the importance of economic considerations, it becomes tempting to simplify that component of the problem using assumptions such as a constant per-unit benefit of control or a simple extrapolation of control costs into the future. Interdisciplinary studies such as the sea lamprey research discussed above avoid these pitfalls and show how the integration of economics and population biology can provide useful information to policy decisions.

Thinking through the implications of introducing a control technology that is, as yet, in its early development phase is even more challenging. Besides the question of whether the new technology will be effective in reducing the size of invasive fish population is the question of potentially harmful side effects of genetic biocontrol technologies. The evaluation of this technology presents an opportunity for ecologists and economists to work closely to identify and estimate the most important margins for decision making.

References

Abdalla CW (1994) Groundwater values from avoidance cost studies: implications for policy and future research. Amer J Agr Econ 76:1062–1067

Bajer P, Sullivan G, Sorensen P (2009) Effects of a rapidly increasing population of common carp on vegetative cover and waterfowl in a recently restored Midwestern shallow lake. Hydrobiologia 632:235–245. doi:10.1007/s10750-009-9844-3

Baumol WJ, Oates WE (1988) The theory of environmental policy, 2nd edn. Cambridge University Press, Cambridge

Bockstael NE, Freeman AM, Kopp RJ, Portney PR, Smith VK (2000) On measuring economic values for nature. Environ Sci Technol 34:1384–1389. doi:10.1021/es990673l

Breukelaar ALE, Klein BJ, Tatrai I (1994) Effects of benthivorous bream (Abramis brama) and carp (Cyprinus carpio) on sediment resuspensions and conconcentrations of nutrients and chlorophyll A. Freshw Biol 32:113–121. doi:10.1111/j.1365-2427.1994.tb00871.x

Connelly NA, O’Neill CR, Knuth BA (2007) Economic impacts of zebra mussels on drinking water treatment and electric power generation facilities. Environ Manage 40:105–112. doi:10.1007/s00267-006-0296-5

Courant PN, Porter RC (1981) Averting expenditure and the cost of pollution. J Environ Econ Manag 8:321–329. doi:10.1016/0095-0696(81)90044-9

Finnoff D, Shogren JF, Leung B, Lodge D (2007) Take a risk: preferring prevention over control of biological invaders. Ecol Econ 62:216–222. doi:10.1016/j.ecolecon.2006.03.025

Freeman AM (2003) The measurement of environmental and resource values: theory and methods. Resources for the future, Washington

Horan RD, Lupi F (2010) The economics of invasive species control and management: the complex road ahead. Resource Energy Econ 32:477–482. doi:10.1016/j.reseneeco.2010.07.001

Horan RD, Perrings C, Lupi F, Bulte EH (2002) Biological pollution prevention strategies under ignorance: the case of invasive species. Amer J Agr Econ 84:1303–1310

Horsch EJ, Lewis DE (2009) The effects of aquatic invasive species on property values: evidence from a quasi-experiment. Land Econ 85:391–409

Kapuscinski AR, Patronski TJ (2005) Genetic methods for biological control of non-native fish in the Gila River Basin Contract report to the US fish and wildlife service. University of Minnesota, Institute for Social, Economic, and Ecological Sustainability, Saint Paul

Koonce JH, Eshenroder RL, Christie GC (1993) An economic injury level approach to establishing the intensity of sea lamprey control in the Great Lakes. N Am J Fish Manage 13:1–14. doi:10.1577/1548-8675

Lougheed VL, Crosbie B, Chow-Fraser P (1998) Predictions on the effect of common carp (Cyprinus carpio) exclusion on water quality, zooplankton, and submergent macrophytes in a Great Lakes wetland. Can J Fish Aquat Sci 55:1189–1197

Lovell SJ, Drake LA (2009) Tiny stowaways: analyzing the economic benefits of a U.S. Environmental Protection Agency permit regulating ballast water discharges. Environ Manage 43:546–555. doi:10.1007/s00267-008-9215-2

Lovell SJ, Stone SF, Fernandez L (2006) The economic impacts of aquatic invasive species: a review of the literature. Agr Resource Econ Rev 35:195–208

Lupi F, Hoehn JP, Christie GC (2003) Using an economic model of recreational fishing to evaluate the benefits of sea lamprey (Petromyzon marinus) control on the St Marys River. J Great Lakes Res 29(Supplement 1):742–754. doi:10.1016/S0380-1330(03)70528-0

Mack RN, Simberloff D, Lonsdale RN, Evans H, Clout M, Bazzaz FA (2000) Biotic invasions: causes, epidemiology, global consequences and control. Ecol Appl 10:689–710

McDonald M (1883) Report of the distribution of carp during the season of 1882. United States Commission on Fish and Fisheries, Washington

McIntosh CR, Shogren JF, Finnoff DC (2010) Invasive species and delaying the inevitable: valuation evidence from a national survey. Ecol Econ 69:632–640. doi:10.1016/j.ecolecon.2009.09.014

Olson LJ, Roy S (2008) Controlling a biological invasion: a non-classical dynamic economic model. Econ Theory 36:453–469. doi:10.1007/s00199-007-0281-0

OTA (U.S. Congress Office of Technology Assessment) (1993) Harmful non-indigenous species in the United States. U.S. Government Printing Office, Washington

Pimentel D, Lach L, Zuniga R, Morrison D (2000) Environmental and economic costs of nonindigenous species in the United States. Bio Sci 50:53–65. doi:10.1641/0006-3568

Rosen S (1974) Hedonic prices and implicit markets: product differentiation in pure competition. J Polit Econ 82:34–55

Simberloff D (2009) We can eliminate invasions or live with them: successful management projects. Biol Invasions 11:149–157. doi:10.1007/s10530-008-9317-z

Swanson BL, Swedberg DV (1980) Decline and recovery of the Lake Superior Gull Island Reef lake trout (Salvelinus namaycush) population and the role of Sea Lamprey (Petromyzon marinus) predation. Can J Fish Aquat Sci 37:2074–2080. doi:10.1139/f80-248

Acknowledgments

The authors gratefully acknowledge insightful comments from Anne Kapuscinski, Leah Sharpe and two anonymous reviewers. This research has been supported by the Minnesota Agricultural Experiment Station.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Homans, F.R., Smith, D.J. Evaluating management options for aquatic invasive species: concepts and methods. Biol Invasions 15, 7–16 (2013). https://doi.org/10.1007/s10530-011-0134-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10530-011-0134-4