Abstract

With the increase in overseas acquisitions by Chinese multinational enterprises (CMNEs), corporations face the challenge of designing and building global architecture to enhance their performance in post-acquisition integration. A well-known design rule that CMNEs could follow is the mirroring hypothesis. However, the effectiveness of this hypothesis in aligning a CMNE’s organizational structure with the underlying technical system after acquiring a new subsidiary remains unclear. Using a fuzzy set qualitative comparative analysis to analyze 34 cross-border acquisitions by CMNEs, we clarify the boundary conditions of the mirroring hypothesis and identify four archetypes of design patterns, namely, modularized mirroring, integral mirroring, mirror breaking, and mirror misted-up. We also identify the respective performance implications of these archetypes on the post-acquisition integration of CMNEs. This study presents a comprehensive assessment of the mirroring hypothesis and contributes to the discussion on global architecture design by emerging multinational enterprises in general.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Over the past two decades, emerging multinational enterprises (EMNEs) have become major players in the arena of international mergers and acquisitions (M&As) (Buckley, Elia, & Kafouros, 2014; Yamakawa, Peng, & Deeds, 2008; Yan et al., 2018). China,Footnote 1 as the largest emerging economy, has gained considerable attention from international business researchers for its significant growth in outward foreign direct investment (OFDI) in the past 20 years (Deng, 2013). Among the burgeoning wave of enterprises venturing abroad, most Chinese multinational enterprises (CMNEs) use international M&As to leapfrog into advanced positions and gain access to state-of-the-art technologies from developed countries (Buckley et al., 2014; Luo & Tung, 2018; Liu & Meyer, 2018). Despite the increasing popularity and scale of overseas acquisitions by CMNEs (e.g., Haier’s acquisition of GE Appliances in 2016, Vanke’s acquisition of Global Logistic Properties in 2017, and Great Star’s acquisition of Arrow in 2018), the performance outcomes of these acquisitions vary considerably (i.e., Lenovo’s integration of IBM’s PC business, and the failure of TCL’s acquisition of Thomson’s TV division). Previous research has attributed such variations in performance to the post-acquisition integration process (Haspeslagh & Jemison, 1991; Kale & Singh, 2017; Liu & Meyer, 2018). Thus, understanding which organizational design rule can effectively integrate the overseas acquisition subsidiaries of CMNEs is critical.

This study examines whether CMNEs will follow the well-known mirroring hypothesis in designing global architecture and the conditions under which mirroring design may enhance or harm post-acquisition integration performance. The mirroring hypothesis is considered one of the most intriguing conjectures in organizational design research (Cabigiosu & Camuffo, 2012; Colfer & Baldwin, 2016; Sanchez & Mahoney, 1996; c.f. Colfer & Baldwin, 2016 for a review). Its key prediction, from a normative perspective, is that modular (integrated) technological architectures and loosely (tightly) coupled organizational structures should mirror each other to ensure superior performance. A growing stream of research has tested the performance implications of the mirroring hypothesis in a variety of contexts, thereby considerably enhancing the knowledge on how firms can improve the coordination and management of complex systems. However, industrial experience and recent studies indicated that mirroring is a non-universally optimal pattern, and thus its effectiveness is subject to doubt (e.g., Furlan, Cabigiosu, & Camuffo, 2014; Colfer & Baldwin, 2016; Sorkun & Furlan, 2017). Therefore, a holistic picture is required to investigate the interdependent effects of different boundary conditions on the performance outcome of the mirroring design.

The burgeoning of CMNEs in the international business landscape challenges the received mirroring hypothesis and presents an important opportunity for obtaining a nuanced understanding of the hypothesis and its normative implications. With their home country characterized by institutional voids, information opaqueness (Khanna & Palepu, 2010; Li, Li, & Wang, 2019), critical resource shortage, and technological backwardness (Wang et al. 2014; Lebedev et al., 2015), CMNEs are thus motivated to escape such weaknesses and acquire superior technology and resources in advanced countries (Witt & Lewin, 2007; Luo & Bu, 2018). Nevertheless, they are still subject to the liabilities of their origin (Madhok & Keyhani, 2012; Thite et al., 2012). As a result, CMNEs are confronted simultaneously with tremendous challenges in managing the complexity associated with the integration of acquired subsidiaries and the complex dilemma of “integration–autonomy.” Furthermore, CMNEs may lack architectural and systemic knowledge (Li & Oh, 2016; Rugman, 2010). As such, they may not possess the level of established architectural knowledge necessary to attain congruence between organizational and technological architectures when managing foreign subsidiaries (Tee, 2019). They may likewise be unable to follow pre-existing architectural designs to integrate knowledge from acquired targets. Similarly, CMNEs may be bound by geographic constraints, organizational rigidities, and cultural conflicts (Bauer, Matzler, & Wolf, 2016; Hennart, 2009; Mudambi, 2011), thus failing to effectively coordinate with foreign subsidiaries in an integrative system. In light of these conditions, exploring the question of whether mirroring is still the optimal choice for CMNEs to access superior performance is an intriguing endeavor.

Echoing the call for a contingent view of the mirroring hypothesis, we conduct fuzzy set qualitative comparative analysis (fsQCA) to take a set-theoretic approach in examining CMNE configurations of global architectural design and boundary conditions. The set-theoretic method enables a holistic analysis of the configurational patterns of the mirroring hypothesis owing to its ability to simultaneously examine complex configurations of multiple interdependent conditions (Fiss, 2007; Ragin, 2008). The present study examines the performance implications of various configurational patterns between technological and organizational architectures in the integration process of CMNEs. Thus, it not only sheds new light on the discussion of the mirroring hypothesis but also promotes an in-depth understanding of how CMNEs can effectively integrate knowledge from overseas acquisitions. Thus, we are able to connect research on modularity to the classic literature on post-acquisition integration.

The remainder of the paper is structured as follows. First, we outline the theoretical framework to examine the contingent conditions of the mirroring hypothesis. Second, we describe the research context and methodology and provide a summary of the results. Third, we conclude with an extended discussion, where generalizable propositions are developed from the findings. Moreover, we discuss the implications and contributions of the study and offer suggestions for future research.

Theoretical background

Boundary conditions of mirroring hypothesis

The literature on organizational design argues that technological architecture and organizational structure should mirror each other. This relationship is framed as the mirroring hypothesis (Baldwin & Clark, 2000; Sanchez & Mahoney, 1996). From a normative standpoint, this hypothesis can be considered an approach to organizational problem solving, which recommends an optimal and cost-minimizing method for setting up a technological architecture and its corresponding organization (Colfer & Baldwin, 2016). In other words, an integrated organization should be designed to correspond to an integrated technical system and minimize costs, whereas a modular organizational architecture should be designed to correspond to a modular technical system.

Prior research has found substantial evidence supporting the mirroring hypothesis in various contexts (e.g., Baldwin, 2008; Sanchez & Mahoney, 1996), such as buyer–supplier relationship (Cabigiosu & Camuffo, 2012), knowledge management (Kapoor & Adner, 2012), and alliances and project collaboration (e.g., Tiwana, 2008a, b; Tee, Davies, & Whytec, 2019). However, scholars have increasingly questioned the efficacy of this hypothesis (Furlan et al., 2014; Tee, 2019). For example, Furlan et al. (2014) found that the effectiveness of mirrored systems is subject to certain conditions, such as the speed of technological change. In other cases, a strictly mirrored system may preclude firms from anticipating architectural innovations and impede organizational adaptation because of the firms’ limited coordination capacity to change the organizational architecture in the short run (Aggarwal & Wu, 2014).

In a recent comprehensive review of empirical studies concerning the mirroring hypothesis, Colfer and Baldwin (2016) observed two types of deviation from mirroring, i.e., misted-up mirror and broken mirror, which are also depicted as partially mirrored and un-mirrored systems, respectively. The authors suggested that, in certain cases, mirroring leads to a trap of “premature” modularization, where several unexpected interdependencies are missed and thus cause the system to fail entirely. On these occasions, strategically “breaking” the mirror or partial mirroring can lead to superior performance. Overall, the reasons behind the criticisms against the mirroring hypothesis can be interpreted as related to its context-specific boundary conditions. However, the literature on boundary conditions is highly fragmented (Sorkun & Furlan, 2017) and overlooks the interdependence between boundary conditions. Thus, calling for a highly nuanced examination alongside a contingent view of the mirroring hypothesis and its boundary conditions is important (Colfer & Baldwin, 2016; Sorkun & Furlan, 2017).

To explore the boundary conditions of the mirroring hypothesis, Colfer and Baldwin (2016) emphasized that its crux rests on whether a system can effectively coordinate separated organizational units (modules) when informationally isolated from one another. In other words, separated organizational units should tacitly coordinate with one another despite the lack of knowledge about the development in other units. Only then can the mirrored system function effectively. If organizational units cannot accurately identify the interdependence between them and effectively coordinate their actions, then the mirroring hypothesis will raise doubts. Accordingly, Colfer and Baldwin indicated that the effectiveness of intra-organizational coordination is subject to the compatibility of strategic motivations, equality of status, existence of a common ground, and dynamics of the technological environment. Architects and managers must assess these four conditions together to trade off economies of mirroring in favor of potential benefits. However, thus far, no empirical study has examined how these conditions and their interplay influence the performance of a mirroring, un-mirrored, or partially mirroring design.

The present study aims to apply the theoretical framework of Colfer and Baldwin (2016) by empirically examining the interplay among the four causal factors on the performance of a certain design pattern. Specifically, it aims to determine how the multiple configurations of such factors can lead to the success or failure of a certain design pattern. In the next section, we first address the unique context of CMNEs and their architectural design of overseas acquisitions and elaborate on how the four factors influence the effectiveness of architectural design in the context of post-acquisition integration by CMNEs.

Architectural Design of Overseas Acquisitions of CMNEs

Given the increasing popularity and importance of cross-border acquisitions (CBAs), scholars have devoted great efforts in understanding CBA performance (Buckley, Elia, & Kafouros, 2014; Cording, Christmann, & King, 2008; Datta, 1991; Kale & Singh, 2017). Researchers have found that the success of acquisitions hinges on post-acquisition integration strategies (Colman & Lunnan, 2011; Cording et al., 2008; Datta, 1991; Homburg & Bucerius, 2005; Puranam, Singh, & Chaudhuri, 2009; Bauer et al., 2016; Kale & Singh, 2017).

Despite the increase in CBAs by CMNEs in recent years (Buckley et al. 2014; Awate et al., 2015; Xie & Li, 2017), success rates are low and a large majority of CBAs by CMNEs in advanced countries fail to achieve expectations. Researchers suggested that CMNEs are particularly susceptible to integration problems (Peng, 2012). However, limited knowledge is available on the effectiveness of various post-acquisition architectural design strategies in the context of post-acquisition integration by CMNEs. In fact, the CBAs of CMNEs are distinct from the acquisitions of MNEs in advanced countries (AMNEs) (Lebedev, Peng, Xie, & Stevens, 2015; Xie & Li, 2017). First, in contrast to AMNEs that venture abroad to exploit their ownership advantage and competence (Awate, Larsen, & Mudambi, 2015), CMNEs originated from emerging markets with institutional voids and information opaqueness (Khanna & Palepu, 2010; Li, Li, & Wang, 2019). In addition, CMNEs are typically faced with a shortage of critical resources (Popli, Ladkani, & Gaur, 2017; Luo & Bu, 2018; Yan et al., 2018) and technological backwardness (Lebedev et al., 2015; Ramamurti, 2012). Therefore, they are highly motivated to internationalize into advanced countries to overcome their weaknesses and acquire advanced resources and technologies. Second, CMNEs suffer from the liabilities of foreignness and origin (Cuervo-Cazurra et al., 2018; Madhok & Keyhani, 2012; Thite, Wilkinson, & Shah, 2012) when venturing into advanced countries, leading to potential conflicts and target resistance (Peng et al., 2018; Zhang et al., 2018). The above characteristics create a complex “integration–autonomy” dilemma, which poses challenges in implementing the mirroring rule and ensuring its effectiveness. Specifically, CMNEs lack architectural and systemic knowledge, which challenges the latent assumptions of mirroring. The situations facing most CMNEs may compromise the mirroring hypothesis because it requires sufficient architectural and systemic knowledge and coordination to enable a one-to-one mapping between organizational and technological architectures.

Overall, industry evidence and theoretical guidance inspired us to comprehensively assess contingent factors when exploring the success or failure of a particular architectural design pattern, particularly in the context of success in post-acquisition integration by CMNEs. On the basis of Colfer and Baldwin’s (2016) framework, this study builds a theoretical explanation outlining how and when configurations of the four characteristics (i.e. strategic motivation, knowledge disparity, organizational identification, and technological dynamism) facilitate or impede the success of mirroring or un-mirrored patterns (Burton & Galvin, 2018; Colfer & Baldwin, 2010, 2016; Furlan et al., 2014).

Strategic motivation

As indicated by previous literature, compatible motivations between organizational units are critical to the success of mirrored architectural design. In the context of international acquisitions, the congruence of motivations between a firm’s headquarters and its acquired target can be reflected by the strategic motivation of the headquarters. In general, a firm expands overseas to explore or exploit business opportunities (Kedia, Gaffney, & Clampit, 2012; March, 1991; Richards & Yang, 2007) despite the variety of strategic motivations guiding the international expansion of multinational enterprises (Benito, 2015; Dunning, 1993; Von Zedtwitz & Gassmann, 2002).

Acquired foreign subsidiaries have an incentive to protect and appropriate their existing technological properties and strive for increased autonomy (Ambos, Asakawa, & Ambos, 2011). CMNEs, which lean toward exploitation-oriented acquisition, aim to adapt their existing technologies or products to the needs of the local market and are, therefore, focused on product localization. Thus, CMNEs will not pose a serious threat to the technologies of foreign subsidiaries. In these cases, headquarters and foreign subsidiaries can easily reach a consensus superordinate goal, thereby facilitating cooperative and joint efforts (Colfer & Baldwin, 2016). A tightly coupled structure can thus be effective in coordinating and sharing information, nurturing a cooperative atmosphere between the headquarters and its subsidiaries, and, finally, realizing a synergy between the headquarters and its overseas subsidiaries.

Conversely, exploration-oriented acquisitions are expected to bring sophisticated technologies and research output back to the parent companies, which may increase the concerns of subsidiaries regarding technology leakage and unwanted knowledge spillover (Richards & Yang, 2007). Such situation indicates that the incompatibility of motivations between the headquarters and its subsidiaries will increase the reluctance of foreign subsidiaries to be fully integrated by the acquiring headquarters and fully engage in cooperative action and projects. Thus, in this scenario, a loosely coupled modular structure may work effectively to prevent potential resistance and conflicts in post-acquisition integration as well as encourage future exploration and innovation (Mudambi, 2011).

Knowledge disparity

To facilitate intra-organizational coordination, an organization should develop frameworks to support reciprocity and good faith among its units (Colfer & Baldwin, 2010). The reason is that only when these separated organizational units interact based on a relatively equal and mutually benefiting framework can they sustain a continuing relationship to minimize potential opportunistic behaviors. Debate surrounds the issue of whether the headquarters can apply administrative power to force a subsidiary to coordinate with other subsidiaries (Mudambi, Pedersen, & Andersson, 2014; Pfeffer & Salancik, 1978). However, extensive research has shown that subsidiaries, especially foreign ones, can exert a high degree of autonomy and often gain the upper hand in a power relationship with the headquarters (Mudambi et al., 2014; Najafi-Tavani, Zaefarian, Naudé, & Giroud, 2015). This situation can be particularly salient for the relationship between CMNEs and their subsidiaries from developed countries.

A noticeable disparity exists in configurations of institutions that foster the development of technology and innovation between a CMNE’s home country and advanced economies. The headquarters of CMNEs often find themselves in inferior positions relative to the foreign subsidiaries in terms of technological capabilities (He & Khan, 2015), especially with regard to information exchange on technology and innovation. In this sense, the equality of status between CMNEs and their foreign subsidiaries can be reflected by the knowledge disparity and distance between the home and host countries.

In the research on the capacity to innovate, create, and transfer knowledge, knowledge disparity is an important institutional dimension (Berry, Guillén, & Zhou, 2010; Furman, Porter, & Stern, 2002) because it captures the differences between countries in terms of inputs allocated to the creation of knowledge, technology, and innovation. This aspect likewise highlights the quality of the institutions that help transform such inputs into innovation outputs (Guler & Guillén, 2010). A high level of knowledge disparity introduces friction (Shenkar, Luo, & Yeheskel, 2008) and complexity (Vermeulen & Barkema, 2002) as well as intensifies the power asymmetry between foreign subsidiaries and the headquarters. In this case, a decentralized and decoupling structure that reduces status differences may facilitate knowledge and information flow and enhance performance (Rulke & Galaskiewicz, 2000). However, when knowledge disparity between a CMNE’s headquarters and its foreign subsidiaries is minimal, establishing technological interdependence and exchanging knowledge on an equal footing become easier, which in turn enhances the effectiveness of mirroring.

Organizational identification

In the context of the acquisition and post-acquisition integration processes, we argue that organizational identification, that is, the extent to which the acquired subsidiary can accept and adopt the CMNE’s organizational identity, indicates the level of tacit common ground between the CMNE and its acquired subsidiary.

Organizational identification refers to the “perception of oneness with or belongingness to an organization” (Mael & Ashforth, 1992: 104). This definition reflects the loyalty and commitment to an organization (Cox Jr., 1991) and influences the behavior and coordination between organizational units (Hogg, Terry, & White, 1995). Strong identification may increase the satisfaction of employees with the focal organization and act as a glue that bonds two separate organizations (Ashforth & Mael, 1989; Foreman & Whetten, 2002). In this manner, coordination of interdependence and integration of the knowledge bases of the acquired subsidiary are facilitated (Grant, 1996; Kogut & Zander, 1992), coordination cost is reduced, and the economics of a tightly coupled organizational and technological architecture is enhanced. By contrast, the lack of organizational identification may amplify prejudice and induce potential conflicts, which consequently increase the burden of coordination and elicit problems in cooperation and integration. In following this thread, we maintain that the existence of organizational identification improves the effectiveness of an integral mirroring design.

Technological dynamism

Technological dynamism refers to the speed and frequency at which technologies change in a given target market (Im & Workman Jr., 2004). A high level of technological dynamism requires highly complex coordination devices and extensive information-sharing (Furlan et al., 2014). When technologies are relatively stable, a mirroring structure is widely proven to be a common and generally efficient approach for deploying organizational resources and solving technical problems (Colfer & Baldwin, 2016). However, when the technological environment becomes more dynamic, on the one hand, the complexity of the underlying technological interdependence increases. This dynamism exerts a heavy burden and challenge for CMNEs that have limited architectural knowledge in mirroring organizational architecture with technological architecture. On the other hand, uncertainty, informational asymmetries, and potential for moral hazards accordingly increase in the presence of a high degree of technological change, creating the need for improved information exchange between the headquarters and its foreign subsidiaries (Brusoni et al., 2001). Furthermore, researchers have demonstrated that modular design cannot reduce these interdependencies (Brusoni et al., 2001; Argyres & Bigelow, 2010; Sorkun & Furlan, 2017). In line with the aforementioned reasoning, a highly integrative organizational structure will be beneficial for dealing with dynamic and fast-changing underlying technological interdependencies to maintain compatibility (Sorkun & Furlan, 2017; Furlan et al., 2014).

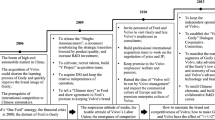

In summary, we extend the literature on organizational design to assess overseas acquisitions by CMNEs and derive a set of causal conditions, which interact with the organizational design and corresponding technological system and contribute to the post-acquisition integration performance. These conditions interdependently generate various needs for a certain level of coordination and architectural knowledge as well as exert an influence on the architect’s coordination capability and architectural knowledge, thereby facilitating or eroding the economics of mirroring. This study considers the interdependent relationships among the aforementioned four conditions and their conjunctural effects on the effectiveness of mirroring. Thus, a configurational approach to theory building which has been increasingly adopted in business research is employed (Crilly, 2011; Fiss, 2007, 2011; Misangyi & Acharya, 2014). Figure 1 displays the theoretical framework of the study. In the following section, the adopted methodology for exploring the conditions under which a mirrored system can help CMNEs enhance integration performance is discussed. The conditions under which CMNEs are required to seek architectural innovation to break mirrors are highlighted as well.

Methods

Research design

Given the holistic perspective of post-acquisition architectural design, this study utilizes the technique of fsQCA, which is particularly suited to the study for several reasons. First, while traditional regression-based analysis is suitable for isolating the effect of individual factors, fsQCA models the concept of conjunctural causation (Schneider, Schulze-Bentrop, & Paunescu, 2010). This feature enables the study to address the interdependence of causal factors and investigate how architectural design (i.e., technological and organizational) may simultaneously merge with an array of organizational and environmental factors into various configurations of mutually reinforcing or functionally substitutable elements that contribute to integration effectiveness (Ragin, 2008; Schneider et al., 2010). Second, in contrast to cluster analysis and deviation scores, fsQCA allows for a detailed analysis of how causal conditions collectively contribute to the outcome in question (Crilly, 2011; Fiss, 2007, 2011), thereby enabling the thorough exploration of post-acquisition architectural design and outcome. Third, fsQCA is suitable for analysis based on a small- to medium-sized sample (Ragin, 2008), which is likely the case for projects based on relevant internal interview information. Moreover, fsQCA permits equifinality, which acknowledges that multiple pathways for achieving the same organizational outcome are available. This view contrasts with the universal prescription on how a certain pattern of architectural design may benefit or impede the learning and innovation of CMNEs in the post-acquisition integration process (Ragin, 2000). This characteristic is particularly relevant to the objective of the study, that is, exploring suitable design patterns for CMNEs. In summary, this method is well suited for examining the configurations underlying a given outcome of interest without being subjected to the limitations of regression-based techniques (Campbell, Sirmon, & Schijven, 2016).

Sample and data

We used qualitative and quantitative data based on a sample of 34 CBAs by CMNEs in the manufacturing industries (SIC codes 20–39). The selection is mainly based on three reasons. First, as previously described, CMNEs act as pioneers and role models for other MNEs in terms of foreign ventures (Buckley et al., 2018). According to statistics, China has been the most promising source of foreign investments among non-developed nations over the past five years (UNCTAD, 2017), especially with regard to the mode of acquisitions (Center for China and Globalization, 2016; Zhang et al., 2018). Second, manufacturing is the proverbial core of China’s economy in terms of its key role in GDP and annual growth rate, and it underpins the remarkable increase of internalization of Chinese firms. Specifically, manufacturing accounts for over 40% of OFDI in China (MOFCOM, 2017; CCG Report, 2018). Owing to the significance of Chinese manufacturing firms, they are frequently referenced in the literature on emerging multinational and international businesses (e.g., Zheng, Wei, Zhang, & Yang, 2016; Ai & Tan, 2018). Third, the exploratory nature of this study requires in-depth interviews to depict the entire picture of the acquisition, post-entry integration process, and performance outcome. Therefore, owing to data accessibility and the operability of interviews, we selected Chinese manufacturing firms as the sample of our study. This sample is characterized by representativeness and can provide abundant evidence and insights to drive the theoretical conclusions and empirical implications of the study. Moreover, it can enrich the relevant literature and proffer guidance of practice for Asian EMNEs that are embedded in a similar institutional environment and are facing similar challenges when venturing abroad.

The study selected 2004–2013 as the observation window for three reasons. First, the surge of CBAs by Chinese firms started in the middle of the first decade of the new millennium, according to the Statistical Bulletin of China’s MOFCOM (2012). Second, 2004 was used as the starting point because Chinese companies started to systematically disclose M&A information in the same year. Third, a three-year period has been suggested as a sufficient amount of time for observing changes in acquisition performance (Cording, Christmann, & King, 2008; Lubatkin, Schulze, Mainkar, & Cotterill, 2001). Therefore, a three-year interval was considered for verifying the performance of recent acquisitions in the sample.

To identify a set of manufacturing CMNEs, we reviewed the name list of National Level Technology Centers jointly produced by China’s Ministry of Science and Technology, National Development and Reform Commission, Ministry of Finance, and General Administration of Customs. This name list is a reliable source for identifying Chinese manufacturing firms with a strong motivation to venture abroad because these firms are typically industry frontrunners highly driven to narrow the gap with leaders in global competition. The sample was filtered using the following criteria. a) Firms must belong to the manufacturing industries (SIC codes 20–39). b) Firms must have an operating revenue of more than US$ 50 million. c) Firms should have invested in advanced countries through acquisition between 2004 and 2013. Firms whose CBAs were mainly based on reorganization (e.g., holding constructions), financial transactions, and natural resource-seeking or who were simply establishing an information point or sales outlet abroad were excluded. A total of 135 firms were obtained after filtering.

Using the name list derived from the aforementioned procedure, from May 2015 to February 2016, we first contacted the firms within the sampling frame to explain the purpose of the project and invite them to participate. From this method, 41 CMNEs expressed their willingness to participate. After confirming the target firm list, we gathered public information and primary data on CBA events. As the primary approach, data were collected from multiple sources, such as archival data, site visits, and semi-structured interviews (Table 1) to enhance data triangulation. The interviewees (face-to-face or by telephone) were executives and employees with prior involvement in CBAs. The objective was to obtain detailed information about the entire process of an acquisition, such as ex-ante motivation, ex-post architectural design, and performance. Before each interview, the informants were provided an interview protocol to facilitate understanding and preparedness (Table 2). After each session, interviewees were furnished with a case report based on the transcripts to check for accuracy and increase research validity.

Archival data were collected for each CBA from internal documents, third-party publications, firm annual reports, website information, and video interviews. These data formed the basis for understanding each sampled CBA and refining the interview questions, which also enabled the study to validate the data collected from the interviews.

Of the 41 CMNEs who expressed a willingness to participate during the interview invitation process, 17 were unable to grant interviews owing to privacy policies. Therefore, the final sample consisted of 24 CMNEs (i.e., an inclusion rate of 58.54%) with a total of 34 overseas acquisitions in 14 advanced countries (Table 3). Comparative t-tests revealed that the 17 restrained CMNEs were non-statistically different from the 24 CMNEs in the final sample in terms of firm size, age, and ownership. To control for the recency effect, the same questions were posed to multiple interviewees, that is, from project directors to employees, who were encouraged to use historical information (e.g., memos, notes, or slides of project meetings). The data sourcing process ensured that the data were rich and in depth, which increased the transferability of the findings. In this manner, the development of a conceptual model was encouraged, which enabled us to triangulate data and ensure that the findings and conclusions were convincing and accurate (Yin, 1994). To check for potential sampling bias, we also conducted a comparative t-test between the sample of publicly listed CMNEs and the final sample. Results indicated that the firms in the final sample did not differ significantly from firms in the full sample that were excluded from the study in terms of firm size (t = 1.03, p = 0.31), age (t = 0.14, p = 0.89), and ownership (t = 1.64, p = 0.11). The findings indicate that sampling bias was not a concern.

After the initial data collection, a team of four management PhD students was assigned to calibrate the key conditions and outcomes. These students were familiar with the relevant literature and involved in the prior data collection process. The second author, together with the four students, first discussed and confirmed the guidelines for calibration, after which the students then calibrated the data independently. Reliability was guaranteed by the high rate of inter-coder agreement (k = 0.857). In the case of disagreements, the students reviewed and discussed the context and interview material together to reach a consensus.

Definition and calibration of outcome

Post-acquisition performance

In this study, post-acquisition performance refers to the improvement in overall performance of a CMNE with regard to technological development, capability improvement, and global competition due to the CBA. Objective measurements, such as accounting-based measures, ignore the importance of the integration phase and fail to capture the effect of fine-grained, privately known values created by acquisitions (Cording, Christmann, & Weigelt, 2010). Thus, we followed prior research (Cording et al., 2008; Datta, 1991; Homburg & Bucerius, 2005; Ahammad, Tarba, Liu, & Glaister, 2016) to assess integration performance from the managerial perspective. Specifically, we asked senior managers to describe their perceptions on post-acquisition performance three years after completion of acquisition. This approach provides a reasonable period in which to assess the likely effect of certain integration decisions and choices made following the acquisition (Saxton & Dollinger, 2004). Specifically, we asked senior managers to address the following issues: 1) the extent to which the acquisition met the intended goal, 2) the extent to which the acquisition enhanced the capability and competitive advantage of the firm, and 3) the extent to which managers considered the acquisition a success. To gain a thorough understanding of the responses, we also asked the respondents to provide evidence and detailed examples or objective data. In this manner, answers and assertions could be supported, such as the growth rate of patent application, new product development, number of industry standards, and advanced modifications to products after the acquisition and collaborations between local and overseas teams. Table 4 presents representative examples of calibrations.

Membership scores were set according to the following guidelines. First, if the acquisition was considered a failure and did not achieve the intended goal, which was the basis for making the acquisition in the first place, then a full non-membership score of 0 was given. Second, if the acquisition fulfilled the strategic goal, transferred technologies to the CMNE, and helped the CMNE improve its basic innovative capability to a certain degree, then a score of 0.33 was given. Third, if the acquisition in general facilitated the technological upgrading of the CMNE to a large extent and helped the headquarters launch new products and achieve new product development certification or qualifications, then a score of 0.67 was given. Finally, if the acquisition was considered a success and largely contributed to the CMNE’s technology upgrading and technological capability building (e.g., upgrade to a world- or country-leading level), then a full membership score of 1 was given.

Definition and calibration of causal conditions

Organizational modularity

Organizational modularity refers to the degree of decoupling of organizational units regarding various dimensions, such as coordination, geography, culture, and electronic connectivity (Fine et al., 2005; Sorkun & Furlan, 2017). In this study, organizational modularity is defined as the degree of decoupling between the headquarters and acquired overseas subsidiary dyads. The term indicates the extent to which the acquired overseas subsidiary can autonomously and independently operate with minimal information-sharing with the headquarters (Gokpinar, Hopp, & Iravani, 2010; Sanchez & Mahoney, 1996; Colfer & Baldwin, 2010). We calibrated this variable in terms of the autonomy level of the foreign subsidiary according to culture, operation, and coordination level between the headquarters and the subsidiary (Sanchez & Mahoney, 1996). We set the membership scores as follows. First, when the foreign subsidiary was tightly connected with the headquarters, relying heavily on the headquarters for decision making, and engaged in frequent and intensive ongoing communication and information sharing, we set a full non-membership score of 0 in organizational modularity. Second, when the foreign subsidiary was designed with a certain level of autonomy in decision making (e.g., in charge of basic production operation) and maintains communication and information sharing with the headquarters on a semi-regular basis, we coded it as 0.33. Third, when the subsidiary was designed to have a significant level of autonomy (e.g., in charge of functions, such as labor disputes, procurement, and distribution), with minimal links to and interaction with the headquarters, we coded it as 0.67. Fourth, when the subsidiary was granted full autonomy (e.g., in charge of HR, strategic planning, and information system), perfectly preserved its organizational culture, and loosely coupled with the headquarters, we coded it as a full membership score of 1.

Technological modularity

Following prior research (Sanchez & Mahoney, 1996; Schilling, 2000; Tiwana, 2008b), we defined technological modularity as the looseness of coupling between the technological architectures of the acquired overseas subsidiary and the headquarters with which it has functional, procedural, or informational interdependencies. This variable was calibrated from the dimensions of standardized interfaces and interdependencies between headquarters and new subsidiaries in technical systems (Sanchez & Mahoney, 1996; Tiwana, 2008b). As with the calibration process of organizational modularity, we calibrated technological modularity using the following rules: 0 when no well-defined and stable interfaces are present in the technological architecture and a high level of technological interdependencies exists between the subsidiary and the headquarters; 0.33 when several simple but ambiguous interfaces are present and a low level of technological interdependencies exists between the subsidiary and the headquarters; 0.67 when several standardized interfaces are present and a mild level of technological interdependencies exists between the subsidiary and the headquarters; and 1 when well-defined and stable interfaces are present in the technological architectures, a shared structured development procedure is implemented, and a minimal level of unnecessary technological interdependencies exists between the subsidiary and the headquarters.

Strategic motivation

In the study, we mainly assessed the strategic motivation of the CMNEs using exploration versus exploitation to inform the calibration. Particularly, CMNEs with exploitation motivations tend to sustain or utilize existing technology to exploit new foreign markets (Cui, Meyer, & Hu, 2014). Conversely, CMNEs with exploration motivations tend to search for advanced technological knowledge from foreign markets (Li, Li, & Shapiro, 2012). We calibrated this motivation using a three-value fuzzy set. We set a score of 1 for full membership, that is, cases where the acquisition of a foreign subsidiary was primarily driven by the R&D capacity and technology superiority of the foreign subsidiary. A partial membership score of 0.5 was given to CMNEs that presented a mix of exploration and exploitation motivations for foreign acquisitions. Lastly, a non-membership score of 0 was given to cases where the CMNE mainly utilized its subsidiary to expand new markets or focus on product localization. Data were sourced from accounts given by the respondents regarding their expectations of and motivations for target acquisition and were triangulated using documentary evidence.

Knowledge disparity

Knowledge disparity gauges the extent of the gap that exists between the parent company and its foreign subsidiary in terms of knowledge bases (Cummings & Teng, 2003). The present study mainly focused on country-level knowledge distance because CMNEs tend to be subject to the liability of origin. A key source of this liability comes from the differences between national innovation systems (Berry et al., 2010). Country-level knowledge distance captures the difference in knowledge stock between an MNE’s country of origin and the country of acquired subsidiaries. We adopted the method of Berry et al. (2010) to measure knowledge score in terms of the number of patents and scientific articles per a population of 1 million for each country involved in the study (Furman et al., 2002; Nelson & Rosenberg, 1993). The range of knowledge distance between China and target countries in our sample was 1.91 to 29.29. The largest distance threshold, crossover threshold, and smallest distance threshold were set to 22.45, 10.90, and 6.46 (i.e., the 75th, 50th, and 25th percentiles in our sample), respectively. Therefore, thresholds above 22.45 were considered to have a full membership, those between 10.90 and 22.45 were coded as 0.67, those between 6.46 and 10.90 were coded as 0.33, and those below 6.46 were coded as non-membership within the set.

Organizational identification

In the context of CBAs, organizational identification is defined as the degree to which subsidiary executives and employees experience a state of attachment to the parent firm (Ashforth & Mael, 1989; Kostova & Roth, 2002). Organizational identification is a cognitive connection between the subsidiary and the headquarters according to the similarity and consistency of routines, organizational cultures, strategies, expertise, and cooperation experience (Reger, Gustafson, Demarie, & Mullane, 1994; Srikanth & Puranam, 2011). We maintain that architects and system integrators are often driven by their perception of a situation when making organizational design decisions. Therefore, we calibrated this condition by using the perceptions of the headquarters regarding the levels of acceptance and attachment of the acquired subsidiaries toward the headquarters. Specifically, we scored full membership (1) for cases where the headquarters perceived that the acquired subsidiary had a strong attachment to the CMNE and a high acceptance of the acquisition transaction. We allocated partial membership (0.67) to cases where the headquarters perceived lukewarm attachment and a general acceptance of the acquisition. We assigned a low degree of membership (0.33) to cases where the headquarters perceived a low acceptance and a certain level of resentment from the acquired subsidiary. Lastly, we scored non-membership (0) for cases where the headquarters perceived neither attachment with the acquired subsidiary nor rejection of the headquarters by the acquired subsidiary.

Technological dynamism

Technological dynamism refers to the rate and frequency at which technologies change in an industry (Im & Workman Jr, 2004; Spanos & Voudouris, 2009). Following Cosh, Fu, and Hughes (2012), we reason that firms operating in high-tech industries experience more uncertainty and dynamism than their counterparts in low-tech sectors. Therefore, we referred to the Directorate for Science, Technology and Industry ISIC Rev. 3 Technology Intensity Definition (OECD, 2011),Footnote 2 which divides manufacturing industries into categories based on R&D intensity. We scored full membership (1) for industries listed in the high-technology categories (e.g., telecommunication, biotech, and optical instruments industries), partial membership (0.5) to firms listed in the medium- to high-technology categories (e.g., machinery and apparatus, motor vehicle, and semi-trailer industries), and non-membership (0) to enterprises listed in the medium-low- and low- technology categories (e.g., metal products, food products, textiles, and footwear industries).

Analyses

Primary analyses for the study were carried out with fsQCA 2.5 software. Analysis was initiated by testing whether any of the causal conditions qualified as a necessary condition for superior post-acquisition integration in accordance with Ragin (2008). The purpose of this step is to identify the presence of any potential necessary conditions to be signaled in the subsequent sufficiency analysis of configurational solutions. If a condition is deemed necessary, then it should be excluded from the subsequent fsQCA sufficiency analysis (Ragin, 2008). In fsQCA, a condition is considered “necessary” or “almost always necessary” if its presence is required to induce a given outcome. As shown in Table 5, we tested whether any of the six causal conditions was necessary to account for superior post-acquisition performance. Results suggested that none of the individual conditions exceeded the consistency threshold of 0.90 for a necessary condition (Schneider et al., 2010). Hence, all the causal conditions are retained for the subsequent fsQCA procedure.

To identify the configurations of boundary conditions and architectural design patterns associated with either high or low post-acquisition performance, fsQCA 2.5 software first created a truth table of all logically possible combinations of the causal conditions. To identify the relevant combinations, we maintained combinations associated with at least one observation. Setting a frequency threshold of one observation was acceptable given that the objective of the study was to build a theory from a relatively small sample (Ragin, 2006). The consistency threshold was then set to 0.80, which is considered sufficient for establishing a consistent subset relationship (Misangyi & Acharya, 2014). Table 6 shows that when the causal combinations of conditions exceeded an appropriate cut-off consistency score, they were categorized as sufficient. The outcome was assigned a value of 1 in the table; otherwise, it was assigned a value of 0. These configurations were then minimized using the Quine–McCluskey algorithm based on Boolean logic as part of the fsQCA 2.5 software application, thereby identifying the various configurations that are sufficient for the outcome. We repeated this procedure with the negation of high post-acquisition performance to derive configurations sufficient for low post-acquisition performance.

Results

Table 7 shows the results of fuzzy set analysis of the causal effect of configurations of architectural design on post-acquisition performance. The configurational solutions are presented in a style that follows the recommendation of Ragin and Fiss (2008), which has been widely adopted in the literature (see Crilly, 2011; Fiss, 2011; Ragin, 2008). The notation “●” represents the presence of a condition, “a” represents its absence, and a blank space indicates a “do not care” situation, which means that a given condition can be either present or absent (i.e., it is not causally related to the outcome). In addition, large circles indicate core conditions that are central to a given configuration, whereas small circles point to peripheral conditions that play a contributing role but are not vital in explaining the outcome emerging from a specific archetype. Solutions are grouped according to core conditions (Fiss, 2011).

As shown in Table 7, five solutions consistently induce superior performance, whereas four configurations fail to produce superior performance. Out of the five solutions reflecting good outcomes, two pairs of solutions (1a and 1b and 2a and 2b) are “neutral permutations.” This finding indicates that the two pairs of solutions share central conditions and differ in contributing conditions only. We also found two neutral permutations (4a and 4b) among the solutions that indicate inferior performance. The results also underscore asymmetric causality, where the combinations of factors are asymmetric across “successful” and “unsuccessful” configurations and are not simply the opposite of each other.

Table 7 reports on two measures of fit, namely, consistency and coverage. The consistency score measures how well the solution corresponds to the data (Ragin, 2006). This score was calculated for each configuration separately and, subsequently, for the solution as a whole. The measure of consistency can range from 0 to 1 and measures how well the solution corresponds to the data (Crilly, 2011; Ragin, 2008). A high value indicates consistency between the theoretical relationship and actual data. The study presents the following scores: 0.93 for “high-performance” solutions, 0.96 for the “absence of high-performance” solutions as a whole, and between 0.90 and 1.0 for each configuration. These findings suggest the presence of clear set-theoretic relationships. Solution coverage measures the empirical importance of the solution as a whole (Ragin, 2006). In the present study, the overall coverage is 0.72 for the “high-performance” group and 0.57 for the “absence of high-performance” group. This result indicates that the majority of the outcome is covered by the listed causal paths. The raw coverage for the single causal paths ranged from 0.10 to 0.45, and the nine causal paths exceeded the value of 0 for the unique coverage indicator (Ragin, 2008).

Findings

Our findings demonstrate that the configurations of our conditions, rather than the conditions in isolation, are associated with the post-acquisition performance of CMNEs. We further elaborate on the implications of the findings and link the results back to the data to discuss real-life examples for each prototypical case.

Prototypical successful integration

Modularized mirroring (solutions 1a and 1b)

At the core of the first archetype lies organizational modularity, technological modularity, and common organizational identification, which provide evidence for “mirrored performs well” (Sanchez & Mahoney, 1996). Two permutations of this type exist, as indicated by the peripheral conditions of motivation (1a) and the absence of knowledge disparity and technological dynamics (1b). Despite the variation, the two solutions indicate that the existence of strong organizational identification is key to the success of a modular-mirrored design (organizational modularity and technological modularity). This finding is consistent with prior research on the mirroring hypothesis and highlights the importance of a common ground between organizational units in developing modular architectures for technology and organization.

In particular, the existence of common organizational identification between the headquarters and the acquired subsidiary can bond employees psychologically (Puranam et al., 2009; Puranam & Srikanth, 2007). In this manner, coordination and information sharing can be facilitated when the headquarters intends to explore the existing knowledge of the acquired target, as suggested by solution 1a. To empirically interpret this archetype, we refer to the case of Goldwind’s integration of Vensys in Germany. Both companies are wind turbine manufacturers. Goldwind acquired 70% of Vensys with the goal of developing the permanent magnet direct-drive technology for wind turbines. After more than a decade of cooperation with and proximity to Goldwind, including organizational culture and management paradigm, technicians in Vensys considered Goldwind a “family member.” Thus, they were willing to assist Goldwind in further exploring and absorbing knowledge from within the host country market. As such, Goldwind implemented a modularized design of technological and organizational systems. Moreover, Goldwind fully activated Vensys’s potential capability and leveraged knowledge transfer. As the CEO of Goldwind stated, “Partnership provides mutual benefits to both parties so that success is maximized. Together with Vensys, we possess substantial R&D expertise to lead the industry.”

In addition, as suggested in solution 1b, a low level of knowledge disparity between the home and host countries and a stable technological environment can also support the achievement of superior performance by building good faith. In this process, continuing coordination and its effectiveness are ensured by identifying underlying interdependencies. The acquisition of Schwing by the Xuzhou Construction Machinery Group (XCMG) is a good illustration of this scenario. The stable industry environment of construction machinery manufacturing and the relatively low knowledge gap between XCMG and Schwing fostered an ideal condition for the two companies to develop trust and common identification. Therefore, we put forth the following.

Proposition 1:

A modularized mirroring architecture with an adequate level of common ground between CMNEs and foreign subsidiaries is sufficient to achieve superior integration performance.

Mirror-breaking (solutions 2a and b)

The key feature of the two solutions is the combination of a strong modularized technological architecture and an integrative organizational structure. We labeled the two solutions “mirror-breaking.” Despite the breaking down of the mirroring hypothesis, the results suggest that two unique configurations can still assist CMNEs in innovative architectural design with the aim of achieving success in post-acquisition integration. Both configuration solutions contain a high congruence between strategic motivation and substantial knowledge disparity between the headquarters and the acquired subsidiary. To reiterate, two permutations are discernible. The first indicates the presence of organizational identification (2a), while the other pertains to the absence of identification and technological dynamics (2b).

As shown in 2a, strong organizational identification, congruent strategic motivation, and considerable knowledge disparity exist. This finding about knowledge disparity may create difficulties in matching organizational design to a modular technology system. However, the congruent strategic motivations and common organizational identification between the headquarters and its overseas subsidiaries may assist in establishing trust and good faith to support integration in an organizational structure. For instance, Mindray acquired Datascope to better exploit its product in the United States market. Despite the relatively modular technological architecture of Mindray and Datascope, their common ground and shared organizational identification enabled Mindray to select an integrated organizational structure to better generate synergies when integrating with Datascope.

Conversely, solution 2b suggests that moderate mirror-breaking can be effective when congruent strategic motivation and considerable knowledge disparity exist while common identification and technological dynamics are absent. The major difference between 2a and 2b is that the latter does not have a strong organizational identification and is situated in a stable technological environment. For instance, we cite the case of Haier’s acquisition of Sanyo. Although Sanyo showed considerable disidentification with Haier because of different organizational cultures and compensation systems, a relatively stable industry environment provided Haier with sufficient time to adjust and be innovative in its organizational structure and integrate technology from Sanyo. On the basis of the analysis, we put forth the following.

Proposition 2:

A mirror-breaking architecture (strong technological modularity without strong organizational modularity) can lead to superior integration performance when a congruent strategic motivation but large knowledge disparity exists between CMNEs and their foreign subsidiaries.

Mirror-misting (solution 3)

The third archetype is labeled as the “mirror-misting” design. Notably, a large black circle is located in the position of organizational modularity while the position of technological modularity is blank. This representation indicates that organizational modularity remains high irrespective of the degree of modularity of the technological architecture. The success of a mirror-misting design is contingent on four configuration conditions: strategic motivation to explore and absorb new technology, high knowledge disparity, common organizational identification between CMNEs and the acquired target, and a stable technological environment.

In this solution, the potential conflicts and coordination burden induced by the incompatibility of motivations and inequality of status are buffered and mitigated by a strong identification with the acquired target, a relatively stable technological environment, and a modularized organizational structure. The structural separation in an organizational system can help preserve the foreign subsidiary’s capacity and flexibility for ongoing exploration and innovation (Puranam et al., 2009). The strong identification can implicitly bond actors to satisfy the need for coordination even if the underlying technological architecture is integral design-wise. For instance, Geely acquired the Australian company Drivetrain Systems International (DSI) in 2009 with the intention to access and absorb the latter’s sophisticated automatic transmission (AT) technology. The two companies shared a strong common ground, as Geely had been the largest customer of DSI for many years before the acquisition. After the acquisition, “Geely kept DSI’s brand and preserved their autonomy in operation” (Conghui An, vice presidentFootnote 3 for Geely). Furthermore, “Geely’s and DSI’s technology teams together created a ‘combined fleet’ by developing the seven-speed dual-clutch transmission and localizing this technology in all of Geely’s nine types of cars” (Fuquan Zhao, vice president for Geely). By acquiring and integrating DSI, Geely moved swiftly to digest the AT technology, reduced the cost of their car models, upgraded their competitiveness, and “filled the gap in China’s automatic transmission field” (Xueliang Yang, Geely’s director of public relations). In summary, we put forth the following.

Proposition 3:

A mirror-misting architecture (organizational modularity regardless of technological modularity) can lead to superior integration performance when CMNEs intend to explore new technology from foreign subsidiaries with common organizational identification traits in a knowledge-distant country and a stable technology environment.

Prototypical unsuccessful integration

Two archetypes of unsuccessful post-acquisition integration were uncovered in our analyses (summarized on the right panel in Table 7). We labeled these archetypes as integral mirroring (i.e., an integrative organizational design mirroring an integrative technical system) and mirror-breaking (i.e., architectural design with organizational modularity without technological modularity). Configuration 4a is an empirical path to unsuccessful mirror-breaking, and configurations 4b, 5, and 6 are three empirical paths to unsuccessful mirroring. Specifically, the core conditions of solutions 4a and b demonstrate that if organizational identification is sufficiently lacking, then integrative technological architecture will not enable superior performance despite small knowledge disparity and stable underlying technology. For instance, despite the integrative technological architecture between Wolong and its acquired target ATB in Austria, Wolong failed to effectively integrate ATB’s technology owing to the lack of common ground between the two companies. Solution 5 suggests that CMNEs with proactive exploitive strategies may suffer inferior integration performance when adopting an integral mirroring structure in the absence of sufficient organizational identification. Solution 6 indicates that if the acquisition is motivated by technology-seeking, then an integrative organizational structure will most likely fail even when the CMNE enjoys a certain level of identification from the acquired firm. The reason behind this mechanism is that a high level of integration can destroy the innovative capabilities that contributed to the attractiveness of the acquired organization (Birkinshaw, Bresman, & Håkanson, 2000; Graebner, 2004; Puranam, Singh, & Zollo, 2003). On the basis of the aforementioned discussion, we put forth the following.

Proposition 4:

A mirror-breaking architecture (organizational modularity without technological modularity) can lead to poor integration performance in the absence of sufficient common ground between CMNEs and the foreign subsidiaries.

Proposition 5:

An integral mirroring architecture (organizational integrality accompanied by technological integrality) frequently leads to poor integration performance.

Discussion and conclusion

This study used the fsQCA method to investigate when and why the architectural patterns of organizational and technological designs contribute to superior post-acquisition integration performance. Our results identify four archetypes of global architecture design for CMNEs as well as their effects on integration performance. Our models capture the main variables from the empirical challenges of CMNEs’ post-acquisition integration after CBAs and theoretical arguments from the literature on organizational design (i.e. mirroring hypothesis). Accordingly, we proffer a nuanced picture of the mirroring hypothesis. Our findings suggest that the mirrored and un-mirrored designs can hold and lead to superior performance or collapse under failure combined with different sets of conditions in the context of CMNE CBAs. Indeed, in several cases, a misting design continues to contribute to success. Our findings infuse new insights into the mirroring hypothesis framework and the literature on post-acquisition integration of CMNEs. We then elaborate on the study’s unique contributions to theory development and industry practices.

Theoretical contributions

First, the study sheds light on the boundary conditions of the mirroring hypothesis. Although it refrains from advocating the mirroring hypothesis, the study proposes a new and holistic framework to reexamine the efficacy of the hypothesis. Finally, the study proffers a nuanced and comprehensive understanding of such hypothesis. Specifically, it adopts a set-theoretic approach to test the interdependent effects of technological dynamism, knowledge disparity, strategic motivation, and organizational identification on the effectiveness of CMNEs’ post-acquisition architectural designs. As such, it enables the identification of when and why the mirroring hypothesis works or fails and presents a unified picture of the mirroring hypothesis in terms of theory, evidence, and exceptions. The findings are an answer to the recent call for a comprehensive and nuanced contingent theory of the mirroring hypothesis and its effectiveness (Colfer & Baldwin, 2016). With attention drawn toward the “when and why” questions, the results explain why effectiveness can vary across acquisition projects for the same industry or even in the same firm using a common architectural design.

Second, the study offers novel insights with respect to the literature on post-acquisition integration. By cross-fertilizing the literature on organizational design in general and the mirroring hypothesis in particular to the global architecture design practice for CMNEs, this study ventures beyond the general view of the design for post-acquisition integration (e.g., decentralization versus centralization or light-touch versus absorptive integration). Specifically, it deconstructs the architecture design into organizational and technological architectures, thus deepening the understanding on how CMNEs solve the “integration–coordination” dilemma. The study likewise found that post-acquisition integration performance is contingent on organic combinations of strategic motivation, knowledge disparity between home and host countries, organizational identification of the acquired subsidiary, and technological dynamics of the CMNEs. In several cases, breaking the mirror and misting up the mirror can be beneficial. However, following the mirroring principle (i.e., integral-mirroring) can also lead to failure on several occasions. As such, this study provides evidence that superior and inferior performance are not symmetrical outcomes. That is, the modularized mirroring design can contribute to success, but this does not mean that the non-modularized mirroring design will automatically lead to failure. This distinction is theoretically important and methodologically formative.

Third, the study addresses organizational identification issues during post-acquisition integration. Pioneering work on acquisition and integration has studied the effect of industry relatedness, perceived similarity, or technological overlap on integration and performance (e.g., Haspeslagh & Jemison, 1991; Larsson & Finkelstein, 1999; Lee & Lieberman, 2010; Sears & Hoetker, 2014). The results indicated that organizational identification is a major concern in the process of post-acquisition integration (Colman & Lunnan, 2011; Elstak, Bhatt, Van Riel, Pratt, & Berens, 2015; Vora & Kostova, 2007). The liability of origin and the resulting stereotype image exacerbate the difficulty of acquiring identification from the target subsidiary and its employees. Thus, organizational identification becomes an increasingly intractable problem after CMNE acquisition. The question then arises: “What types of architecture design can be beneficial and workable without triggering conflicts?” This dilemma then becomes an urgent and vital problem for determining the post-acquisition success of CMNEs. An exploration into the empirical wisdom of CMNE practices reveals that the dark side of disidentification can be mitigated by a loosely coupled organizational design pattern. In addition, a tightly coupled organizational design can further enhance the “glue effect” and tacit coordination role of identification. We also find that organizational identification can be complementary to explicit coordination in the absence of conditions in which an integrative structure can satisfy the underlying coordination needs. Therefore, organizational identification provides a resolution that enables acquirers, to a certain extent, to link externally sourced organizational capabilities to internal ones without destroying those capabilities. We identify a link between individual-level cognitive factors and organizational-level architecture design strategies and empirically verify the interrelations between identity and strategy (Anthony & Tripsas, 2016; Ravasi, Tripsas, & Langley, 2017). Thus, we have responded to the call for a deeper understanding of the identity–strategy nexus.

Managerial implications

In addition to providing theoretical contributions, the study offers managerial implications, especially for CMNEs that are seeking to build and upgrade technological capabilities by acquiring foreign firms. First, the study confirms that latecomer firms can upgrade their capabilities by internationally acquiring advanced technologies and capabilities with appropriately designed architecture, even when confronted with the dual liabilities of origin and foreignness. The findings can assist CMNEs to understand which architectural patterns are viable and beneficial when faced with different internal and external conditions. Moreover, CMNEs can determine how these architectures provide distinct benefits, as well as identify associated risks, in the course of acquiring and assimilating knowledge and capabilities. In particular, three archetypes of successful design rules for CMNEs are proffered for reference. We further caution managers to realize that no universal optimal design rules exist and suggest that the presence, strength, and configurations of these contingent factors and their impacts on optimal organizational design be carefully analyzed.

Second, identification plays a key role in the integration process because it acts as a tacit coordinator and, therefore, brings synergy benefits without inducing potential damage or conflicts. Moreover, identification can help mitigate and buffer the coordination burden induced by the liability of origin and incompatible interests. Therefore, an imperative step that architects in the headquarters should take is to consider the organizational identification of an account as a factor in the integration and architecture design.

Third, in consideration of technologically lagging status and inferior capabilities for system-wide orchestration and coordination, the majority of CMNEs will find that a loosely coupled technological architecture will be beneficial in general. The two archetypes of unsuccessful integration as presented in this study illustrate this notion.

Limitations and future directions

Our study has some limitations that can provide avenues for future research. The first is the limited diversity problem, which is an intrinsic limitation of the qualitative comparative analysis technique (Crilly et al., 2012; Ragin, 2008). This issue is a potential threat to the internal validity of the current research. In contrast to regression-based analyses, control variables cannot be included in fsQCA, and the total number of causal conditions is constrained by the sample size. We followed Ragin’s (2008) suggestion to derive a causal condition from an existing overarching theoretical framework and selected the most important conditions. We were able to describe only the most common patterns that emerged from the sample. Although the choice of causal conditions leads to parsimonious theory building, it can cause potential threats of “limited diversity” insufficiency. We acknowledge that other potential important causal conditions exist. Therefore, future studies are recommended to include more causal conditions wherever possible and further test the validity of the current findings.

Second, we developed tentative propositions about the configurations based on a small sample of CMNEs, which may pose a threat to external validity. The data source availability of in-depth information about post-acquisition integration limits the size of the final sample. The limited small sample size (obs = 34) cannot generate sufficient empirical cases to cover all theoretical possibilities and may lead to a problem in generalizability. Moreover, manufacturing EMNEs from China are unique to those originating from other emerging markets, which may limit the generalization of our findings and propositions to a large extent. Future research can focus on EMNEs from multiple emerging countries or on the context of service-oriented EMNEs. Further studies can employ a larger sample size in other contexts to uncover additional configurations, investigate more variations of EMNEs, and draw precise and comprehensive conclusions. In so doing, the generalizability of the findings can be enhanced.

Third, our results may suffer from an endogeneity problem. Corrections, such as the Heckman two-stage model or instrumental variables, are presently unavailable for fsQCA. Given that the method is relatively young and methodological developments are ongoing (Meuer, 2014), this shortcoming may be partly ameliorated in the future. Another option is to carry out this proposal with other approaches to identify which model or technique can provide more reliable results.

Lastly, according to Colfer and Baldwin (2016), mirroring or modularization is a dynamic process. However, the present study focused only on the static role of mirroring or un-mirrored forms. In fact, successful patterns may lose their efficacy with changes in other conditions and dynamics, and vice versa. Future research can delve deep into other fine-grained time periods, and longitudinal studies can provide insights into how mirroring or un-mirrored relationships evolve over time.

Acknowlegment

We thank APJM editor Ajai Gaur, three anonymous reviewers, and participants at the 2017 Academy of International Business for their constructive comments and valuable guidance. This research is partly funded by grants from the National Natural Science Foundation of China (Grant No. 71902173, and 71732008), and China Postdoctoral Science Foundation (Grant No. 2018M642473, 2019T120529).

Notes

We thank one of the reviewers for suggesting the need to rephrase the research context, specifically the context of CMNEs, instead of EMNEs in general. Given the uniqueness of manufacturing EMNEs emerging from China, we followed this advice in this version and modified the main body of our manuscript.

This classification includes industries with SIC codes 15–37. Although our initial list of firms is derived from the list of all manufacturing industries (SIC codes 20–39), the final sample excludes any observation from the instruments and related products industry (SIC code: 38) and miscellaneous manufacturing industries (SIC code: 39). However, the classification remains sufficient for us to calibrate the variable of technological dynamics.

Conghui An was vice president during the time of the acquisition of DSI and has become the executive director of Geely in 2011.

References

Ai, Q., & Tan, H. 2018. The intra-firm knowledge transfer in the outward M&A of EMNCs: Evidence from Chinese manufacturing firms. Asia Pacific Journal of Management, 35(2):399–425.

Aggarwal, V. A., & Wu, B. 2014. Organizational constraints to adaptation: Intrafirm asymmetry in the locus of coordination. Organization Science, 26(1): 218–238.

Ahammad, M. F., Tarba, S. Y., Liu, Y., & Glaister, K. W. 2016. Knowledge transfer and cross-border acquisition performance: The impact of cultural distance and employee retention. International Business Review, 25(1): 66–75.

Ambos, B., Asakawa, K., & Ambos, T. C. 2011. A dynamic perspective on subsidiary autonomy. Global Strategy Journal, 1(3–4): 301–316.

Anthony, C., & Tripsas, M. 2016. Organizational identity and innovation.

Argyres, N., & Bigelow, L. 2010. Innovation, modularity, and vertical deintegration: Evidence from the early US auto industry. Organization Science, 21(4): 842–853.

Ashforth, B. E., & Mael, F. 1989. Social identity theory and the organization. Academy of Management Review, 14(1): 20–39.

Awate, S., Larsen, M. M., & Mudambi, R. 2015. Accessing vs sourcing knowledge: A comparative study of R&D internationalization between emerging and advanced economy firms. Journal of International Business Studies, 46(1): 63–86.

Baldwin, C. Y. 2008. Where do transactions come from? Modularity, transactions, and the boundaries of firms. Industrial and Corporate Change, 17(1): 155–195.

Baldwin, C. Y., & Clark, K. B. 2000. Design rules: The power of modularity. MIT Press. Cambridge, MA.

Bauer, F., Matzler, K., & Wolf, S. 2016. M&A and innovation: The role of integration and cultural differences—A central European targets perspective. International Business Review, 25(1): 76–86.

Benito, G. R. 2015. Why and how motives (still) matter. The Multinational Business Review, 23(1): 15–24.

Berry, H., Guillén, M. F., & Zhou, N. 2010. An institutional approach to cross-national distance. Journal of International Business Studies, 41(9): 1460–1480.

Birkinshaw, J., Bresman, H., & Håkanson, L. 2000. Managing the post-acquisition integration process: How the human integration and task integration processes interact to foster value creation. Journal of Management Studies, 37(3): 395–425.

Brusoni, S., Prencipe, A., & Pavitt, K. 2001. Knowledge specialization, organizational coupling, and the boundaries of the firm: Why do firms know more than they make? Administrative Science Quarterly, 46(4): 597–621.

Buckley, P. J., Elia, S., & Kafouros, M. 2014. Acquisitions by emerging market multinationals: Implications for firm performance. Journal of World Business, 49(4): 611–632.

Buckley, P. J., Clegg, L. J., Voss, H., Cross, A. R., Liu, X., & Zheng, P. 2018. A retrospective and agenda for future research on Chinese outward foreign direct investment. Journal of International Business Studies, 49(1): 4–23.

Burton, N., & Galvin, P. 2018. When do product architectures mirror organisational architectures? The combined role of product complexity and the rate of technological change. Technology Analysis & Strategic Management, 30(9): 1057–1069.

Cabigiosu, A., & Camuffo, A. 2012. Beyond the “mirroring” hypothesis: Product modularity and interorganizational relations in the air conditioning industry. Organization Science, 23(3): 686–703.

Campbell, J. T., Sirmon, D. G., & Schijven, M. 2016. Fuzzy logic and the market: A configurational approach to investor perceptions of acquisition announcements. Academy of Management Journal, 59(1): 163–187.

Center for China and Globalization (CCG) Report. 2016. Report on chinese enterprises globalization. Social Sciences Academic Press (China). Beijing.

Colfer, L., & Baldwin, C. Y. 2010. The mirroring hypothesis: Theory, evidence and exceptions. Harvard Business School Finance Working Paper (10-058).

Colfer, L. J., & Baldwin, C. Y. 2016. The mirroring hypothesis: Theory, evidence, and exceptions. Industrial and Corporate Change, 25(5): 709–738.

Colman, H. L., & Lunnan, R. 2011. Organizational identification and serendipitous value creation in post-acquisition integration. Journal of Management, 37(3): 839–860.