Abstract

This paper examines the relationship between organisation structure and innovation performance in a large sample of UK small and medium-sized enterprises. It asks whether there is an optimal structure and whether this differs between different firm environments and between young and older firms. We find that the influences on the ability to innovate differ from those on the commercialisation of innovations. We show that decentralised decision-making, supported by a formal structure and written plans, supports the ability to innovate in most circumstances and is superior to other structures. We also find some evidence that young firms operating in high technology sectors with informal structures have a greater tendency to be innovative. In addition, we find very few differences between young and older firms in terms of their optimal structures in low technology sectors.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper analyses the relationship between innovation performance and a number of organisational determinants within different commercial environments. The frame of reference for this study is small UK firms with up to 499 employees operating in manufacturing and business services. We argue below that there are three key factors that may be used to distinguish their commercial environment: firm age, firm size and whether the firm is in a high-tech sector. Firms that are young, small and operate in a high-tech sector are deemed to operate in a more hostile, uncertain and dynamic environment than other firms; consequently, they may have to adopt an organisational form appropriate for their circumstances.

The seminal work of Burns and Stalker drew a distinction between the formal structure of the management system of an organization and the organisation’s private or informal structure ‘through which individuals attempt to realize ends other than those of the concern itself’ (Burns and Stalker 1961, p. 98). These researchers argued that such informal structures may exert a decisive influence over the efficiency of the organisation and in particular over the ability of the management system to deal with changes in the external environment due to technical and commercial change. Their empirical case analysis of the interplay between formal and informal structures was based on a sample of established firms employing between 150 and 1,500 people faced with making a transition into new, more technically turbulent markets. Their analysis led them to identify two contrasting forms of management system which were appropriate in contrasting external circumstances (Burns and Stalker 1961, pp. 119–122). They identified an organic form of management system best suited to technically turbulent environments and for maximising commitment to organisational goals by individuals. This system is characterised by a distributed network of control and authority, lateral rather than vertical directions of communication, task flexibility, decentralised decision-making, knowledge sharing and teamwork. They contrasted it with a mechanistic structure that was more appropriate for more stable environments. In mechanistic structures, there is a specialised differentiation of functional tasks, hierarchical structures of control and communication, precise definitions of rights, methods and obligations, centralisation of decision-making and knowledge and a lack of flexibility. These authors stress that these systems are to be seen as representing a polarity with several possible intermediary stages in between. They also argue that firms may oscillate between forms. Much subsequent quantitative work has reinforced the finding that organic systems perform better in more turbulent environments (e.g. Khandwalla 1976/1977; Covin and Slevin 1989; Damanpour 1991), but there have been some dissenting voices. Thus, Stinchcombe (1965) and, most recently, Sine et al. (2006) have argued that for newly formed organisations to overcome the liability of newness and lack of familiarity with handling technical and commercial turbulence, clarity of decision-making rules and hierarchy may be essential.

In this paper, we re-examine these issues for a large sample of small and medium-sized UK firms in conventional and high-tech industries. We focus directly on innovation performance rather than business growth, or profits, and we characterise the attributes of an organisation’s system in a way which permits a more direct consideration of the interplay between certain elements of organisation structure. In keeping with Green et al. (2008), we recognise congruent alignments between elements of organisational structure and management decision style, and we suggest that these alignments may differ across different types of firms and different environments. These issues are explored further in the next section.

Section 2 offers a brief overview of the relevant literature and introduces our hypotheses. In Sect. 3 and the Appendix, we introduce the data used for this study and discuss our choices of innovation performance measures and the explanatory and control variables. Section 4 presents the sample’s organisational form characteristics. The main empirical findings are reported in Sect. 5, and our summary and conclusions are given in Sect. 6.

2 Literature review and hypotheses

Burns and Stalker (1961) argued that the environment in which the firm operates determines the optimal structure of the organisation. They considered two types of structure at the opposite ends of a spectrum that ranges from organic to mechanistic and suggested, as discussed above, that the organic form will work best when the external environment is dynamic, turbulent or hostile.

More recently, the dynamic capabilities approach emphasises the importance of internal technological, organisational and managerial processes in sustaining competitive advantage in environments undergoing rapid change (Teece et al. 1997). Burns and Stalker are put in a new light in the dynamic capabilities literature, but the conclusions are unchanged. Dynamic capabilities are supported by specialisation, decentralisation, responsiveness, lack of formalisation and flexibility, and these are characteristics of the organic structure.

The Burns and Stalker analysis was extended to the small firm sector by Covin and Slevin (1989) in their analysis of organisation structure, strategic posture and financial performance within different business environments. Their conclusion, namely, that performance is positively related to an organic structure in hostile economic environments, also lent support to the initial Burns and stalker hypothesis.

On the other hand, Stinchcombe (1965) argued that new firms may suffer from a ‘liability of newness’ because of their structural deficiencies. New firms will lack established routines, past experience and adequate relationships with their supplier and customer bases. Their lack of structure leads to role ambiguity and uncertainty that should be addressed by adopting a more formalised structure. His arguments have been tested recently on a sample of new ventures in the Internet sector by Sine et al. (2006) who found that new firms with greater formalisation, specialisation and administrative intensity outperform those with more organic structures.

Dalton et al. (1980), in their review of various models of organisational structure and the evidence for its link with performance, took firm size, span of control, flat/tall hierarchy (which is related to the previous two), administrative intensity (ratio of managers to all employees), specialisation (number of different specialities in management team or the firm), formalisation (emphasis on written rules and procedures) and centralisation (concentration of decision making) as the most important dimensions. They found the relationships to be ‘most vexing and ambiguous … and tenuous’ (Dalton et al. 1980, p. 60), possibly because while they found organisation structure to be important for performance, its effect was not strong enough to overcome stochastic and other influences.

In a subsequent review, Damanpour (1991) performed a meta-analysis of the relationships between organisational innovation and 13 of its potential organisational determinants. Organisational innovation was very similar to the first measure of innovation performance used in this study—the adoption or introduction of an innovation by the organisation. The structure measures were similar to those used by Dalton et al. (1980), but included functional differentiation (the extent to which the firm is departmentalised) and a number of management team characteristics, such as professionalism, tenure, technical knowledge and communications (internal and external). He concluded that organisation structure is in general a significant determinant of innovation and was supportive of the conclusion drawn by Burns and Stalker (1961). Organic organisations would be expected to have higher specialisation (though there is some dispute about this since although it would increase the knowledge base; it would also increase coordination costs and decrease flexibility), differentiation and professionalism and lower formalisation and centralisation. Damanpour's meta-analysis suggested that these determinants were associated with a higher innovation propensity. Finally, Wally and Baum (1994) studied what they termed high-velocity environments in which decision speed and performance were positively correlated. They found that decision speed was assisted by centralisation and hampered by formalisation.

This evidence suggests that, at least for innovation performance, organisation structure matters but that the way it matters varies in ways that may modify the original Burns and Stalker (1961) model, allowing different combinations of formality and centralisation to be appropriate under different circumstances (a view reinforced in the work of Green et al. 2008).

In this paper, in order to explore these patterns of relationships, we consider two core aspects of organisation: centralisation and formality. We then develop hypotheses about how different combinations of centralisation and formality are related to innovation performance under different circumstances.

Centralisation is measured by the extent to which the chief executive involves others in key decision-making. The second measure of organisation structure, formality, is measured in terms of functional specialisation. Formality is thus measured in this paper by the chief executive’s perception of whether the firm has an informal structure or one based on functions, products, or markets. We take functional specialisation as a characteristic of mechanistic forms and informal structures as characteristic of organic forms.

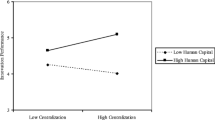

We are interested in examining whether some combinations of formality and centralisation are more common than others and to identify which combinations work best in terms of innovation performance. It is possible to have four combinations of formality and centralization. We interpret the mechanistic extreme as characterised by centralised decision-making (taken here to mean direct control of the both strategic and operating decisions by the chief executive) and formality. The organic extreme is characterised by decentralisation and informality.

This leads to our first hypothesis, which draws upon the work of Burns and Stalker (1961), Covin and Slevin (1989) and Damanpour (1991). Turbulent and hostile environments require dynamic capabilities which are supported by specialisation, decentralisation, responsiveness, lack of formalisation and flexibility—all of which are characteristics of the organic structure.

Hypothesis 1:

Decentralised and informal structures will be associated with superior innovation performance in technically turbulent environments.

We augment this central hypothesis with two additional hypotheses which argue that other combinations of centralisation and formality are optimal. The first of these builds on the work of Stinchcombe (1965) and Sine et al. (2006) and argues that young firms are potentially at a disadvantage relative to more established firms due to their lack of structure. It is argued that the introduction of formality in young firms reduces role ambiguity, decreases the cost of coordination and improves decision-making. Therefore, decentralisation needs to be combined with formality in new firms to overcome the ‘liability of newness’.

Hypothesis 2:

Decentralised and formal structures will be associated with superior innovation performance in young firms.

Our third hypothesis derives from the work of Wally and Baum (1994) who found that the pace of strategic decision-making was assisted by centralisation and hampered by formalisation. They argued that centralisation reduces coordination and conflict costs as well as the need for consensus-seeking and information-sharing, while formalisation encourages organisational inertia. This proposal suggests that the combination of centralisation and informality will be better suited for environments that are changing rapidly.

Hypothesis 3:

Centralisation combined with informality will be associated with superior innovation performance in technically turbulent environments.

In carrying out our analysis we control for the technological environment and the age of the firm as required by our hypotheses. In addition, recent studies of the determinants of innovation (e.g. Vaona and Pianta 2008; Simonen and McCann 2008) have found that the determinants differ between small and larger businesses. There is also evidence to suggest that the optimal organisation structure may differ according to firm size (e.g. Meijaard et al. 2005; Sine et al. 2006). We therefore include firm size as a moderating factor along with age. We test our hypotheses simultaneously by allowing different combinations of decentralisation and formality to enter our performance equations directly.

3 Data and variables used

Data for this study are drawn from the Small and Medium-Sized Business Survey 2002 (CBR2002) conducted by the Centre for Business Research (CBR) at Cambridge University for 2,130 small and medium-sized enterprises (SMEs) in the British manufacturing and business services sectors. Previous surveys of British SMEs had been carried out by the CBR in 1991, 1995, 1997 and 1999, and many of the questions used in the 2002 survey had been used in the earlier surveys. The SMEs in the CBR2002 sample are defined as firms that have fewer than 500 employees. The survey questionnaire covers not only innovation and business performance, but also management and organisation structure characteristics. The survey produced an achieved sample of 2,130 firms with an overall response rate of 17%. A response bias analysis revealed no significant response biases. Details of the data and how they were collected are contained in Cosh and Hughes (2003).

Missing values among our analysis variables reduced the sample size to 1,955 firms.Footnote 1 Among the latter are 1,073 firms which had innovated in the previous 3 years and had provided information on their percentage of innovative sales. The mean number of employees is 64; 47.5% of the firms are small firms with 1–19 employees, and 52.5% are larger firms with 20–499 employees. Of the firms in the sample, 18% operate in high-tech sectors. The rich information embedded in this survey allows us to explore the impact of management and organisational structure on SME innovative performance and compare the different economic environments.

3.1 Innovation performance measures

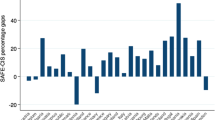

Two innovation performance measures are used in this study. The first concerns the ability to innovate and is applied to the whole sample using a binary variable that has the value 1 for firms that have introduced an innovation within the previous 3 years and 0 for other firms. This measure enables examination of the factors that are conducive to innovation. The second concerns the commercialisation of these innovations and is applied only to innovators. This variable is commonly used in innovation performance analysis (e.g. Laursen and Salter 2006) since it is derived from questions that are found in both the CBR surveys and in the Community Innovation Surveys. It measures the proportion of sales in the past financial year that was from new, or significantly improved, products or services.

3.2 Organisation structure variables

The literature abounds with characteristics that may be used to measure organisational form [e.g. good reviews may be found in Dalton et al. (1980) and Damanpour (1991)]. The most commonly used characteristics are formalisation and centralisation, but others include specialisation, standardisation, configuration, functional specialisation, professionalism, experience and administrative intensity. This study uses centralisation and formality as measures of organisational structure.

Centralisation is measured by whether the SME business leader has direct control of the both strategic and operating decisions. Where this is the case, we consider that the concentration of power results in the organisation being centralised in terms of its decision-making process; the remainder of the cases are grouped as decentralised.

Formalisation is a measure of the extent to which the organisation has structured channels of information and authority which are supported by written procedures and rules. Many studies have used proxies for this measure, while retaining this designation. In this study we measure the formality of the structure of the firm’s management organisation. Firms could classify themselves as having an informal structure or as having a variety of other, more formal structures based on functional specialisations, products, or regions, among others. This set of responses is classified in our analysis as either informal or formal.

For reasons discussed earlier and discussed further in the next section, we consider the four possible combinations of centralisation and formality in order to explore which choices firms make under these different conditions and whether the combination matters for their innovation performance.

3.3 Environmental variables

The uncertainty, dynamism and hostility of the economic environment have been argued to be important determinants of the optimal organisational form (see discussion above). The analysis we present in this paper examines these determinants principally in two ways. First, high-tech sectors will in general be more dynamic and turbulent environments than conventional sectors. High-tech sectors are of particular significance given the important role played by high-tech SMEs in innovation (Audretsch 2001). The identification of high-tech sectors is based on the standard UK definition (Butchart 1987).

Second, the environment facing young firms will be more hostile and uncertain than that for more established firms. The definition of what is a young firm is to some extent arbitrary, but some guidance can be taken from the business failures literature since failure may represent the outcome of hostile and uncertain environments. For the UK, the analysis of value-added tax (VAT) de-registrations by Daly (1987) shows that they peak at about 10% in the second and third years of a firm’s life and then fall away to reach about 4% after 8 years. In this study we define young firms as those up to 8 years from their foundation. These two measures, high-tech and young, are used individually and jointly to investigate our hypotheses.

In addition, we experiment with a number of other measures that might capture the degree of uncertainty, hostility and turbulence in the firm’s environment. One approach separates the sample into those engaged in R&D and those who were not. Another examines those firms who perceived the riskiness of innovation to be highly significant, or crucial, separately from other firms. Finally, firms that saw increasing competition as a significant, or crucial, threat to their business are examined separately from other firms. The results of these investigations are not reported here, but they provide no support for our first and third hypotheses.

The third influence on the firm’s commercial and competitive environment included in our findings is its size. Firm size also has an important effect on the efficacy of different choices of organisation structure (Kimberly 1976). Firm size is investigated here by separating the firms into two size groups—those with fewer than 20 employees and those with 20 or more employees. There is much diversity among small and medium-sized businesses, and so there is no unique and clear-cut size that represents the point when businesses face different pressures and have to adopt different solutions (see the discussion in Curran 1986). However, there is some evidence that a cut-off of 20 employees represents a sensible compromise (e.g. Atkinson and Meager 1994).Footnote 2

3.4 Control variables

Business planning is another aspect of a firm’s organisation. Planning is measured by the number of written plans the firm has and so has elements of both professionalism and formalisation. We know whether each firm had written plans for: business planning, human resources and management accounts. Planning was measured by identifying the existence of each of these for each firm and scoring 1 for each; the lowest score was 0 (no written plans) and the highest was 3 (all three written plans).

The existence of performance-related pay (PRP) schemes is also examined since they form part of organisational design (Athey and Roberts 2001) and their use and effectiveness may differ across different organisational forms and economic environments and so affect performance (e.g. Laursen and Foss 2003; Foss and Laursen 2005; Black and Lynch 2004).

Other factors that are used as control variables are inputs to the innovation process. We include a variable that distinguishes whether a firm has engaged in R&D over the previous 3 years and a variable which identifies those that have had external collaboration over the same period. For a discussion of the importance of these variables, the reader is referred to Simonen and McCann (2008).

A full list of the variables, their definitions and sample statistics can be found in Table 5 in the Appendix. A correlation matrix is provided in Table 6 in the Appendix.

4 Organisational form characteristics

The argument proposed by Burns and Stalker (1961) that organic structures are more supportive of innovation and perform better in dynamic environments requires some measure of organicity. In terms of our analysis, formal, centralised organisations are closest to those associated with a mechanistic structure, while informal, decentralised organisations might be termed organic. This differentiation suggests that a two-way classification of these variables might be worthwhile and is supported by similar findings concerning congruent alignments of management decision style and organisation structure found by Green et al. (2008). Furthermore, hypotheses 2 and 3 propose that other combinations of centralisation and formality are optimal.

This two-way classification is provided in Table 1 and shows that each of the four cells is well populated. Contrary to our supposition that centralisation and formality might be positively correlated, we can see that formal is associated with decentralised and informal with centralised (Spearman’s rho is 0.38 in each case). However, about 15% of the sample is found in each of the other two groupings (that we argued above most closely resemble the mechanistic and organic forms). Table 1 also shows the mean values of the control variables in each of the cells. There are statistically significant differences between the cells in terms of these variables: small firms are more likely to be centralised and have informal structures; young firms are more likely to have informal structures; high-tech firms are more likely to be decentralised and have formal structures. However, despite these propensities, it is clear that firms within the same size class or age bracket or sector make different choices about their organisational structure. This result confirms Meijaard et al. (2005)’s finding that small firms are very diverse in terms of organisational structure. It would therefore be interesting to discover whether their innovation performance is influenced by these choices—and we investigate this in the next section.

5 Organisational structure and innovation performance

The first set of tests use logistic regression analysis to explore the determinants of innovation activity for the whole sample. The dependent variable takes the value 1 when a firm has introduced an innovation in the previous 3 years, and 0 otherwise. The findings are presented in Table 2 and provide both summary statistics and estimates of marginal effects and their significance. The model is tested using the whole data [columns (1) and (2)] and for small/large firms [columns (3) and (4)], high-tech/conventional sectors [columns (5) to (8)] and young/old firms [columns (9) to (12)] in separate groups. As a further test of our models, interaction terms between organisational form and both the high-tech and young dummy variables are included where appropriate.Footnote 3

The findings for the whole sample in the first two columns show that the choice of organisational structure does matter for this measure of innovation performance. Firms that chose a decentralised, but formal structure exhibit a significantly greater tendency than any of the other forms to have introduced an innovation in recent years. For the whole sample, the other forms appear to be equally inferior in terms of generating innovation (with an 8–10% lower probability of having innovated after taking account of the other variables). In addition, we find that planning makes a significant contribution to the likelihood of innovation. These results suggest that in order to benefit from a decentralisation of decision-making, the firm needs to adopt some degree of formality in its organisation.

These findings also show that collaboration with others (10% effect), engagement in R&D activity (33% effect) and operating in a high-tech sector (11% effect) are all associated with a much higher likelihood of having introduced an innovation, as was expected. However, the use of PRP is not significantly related to this measure of innovation performance. The dummy variable for young firms is not statistically significant, nor is the logarithm of firm age when used as an alternative to this dummy variable.Footnote 4

The third and fourth columns in Table 2 examine whether the appropriate organisational form for innovation varies between small (1–19 employees) and larger (20–499 employees) firms. For small firms, the negative coefficients for each of the organisational structures support the view that decentralised, yet formal structures are best for this size group, but the decentralised, informal structure is not significantly different. However, much the same picture emerges for larger firms with similar negative marginal effects for the two informal organisational forms. The principal difference between small and larger firms in the relationship between innovation performance and structure is that the centralised, formal structure appears to be significantly worse for small businesses. When this was tested by the inclusion of size as an organisational form interaction term, none of the terms were found to be statistically significant. We conclude that, for this sample at least, we find no difference between small and larger firms in terms of the appropriate organisational form for innovation performance. Collaboration, R&D activity and operating in a high-tech sector are also positively associated with the likelihood of introducing an innovation, with somewhat larger effects for small firms. Planning is also highly significant for this latter size of firm in terms of its impact on innovation propensity.

Having not found a size effect, we are left with the comparison of high-tech with conventional sectors and young firms with older firms in order to test our hypotheses. In order to assess whether the impact of organisation structure on innovation performance differs for young firms, or for those operating in high-tech sectors, we therefore test the models for these groups separately; in addition, we create interaction terms between the structure variables and the age and high-tech dummy variables. If we first compare high-tech [column (5)] with conventional sectors [column (7)], we find that for conventional sectors, the decentralised, formal structure is superior to the other three forms (each of which has a statistically significant negative marginal effect). For high-tech sectors, the differences between the organisational form effects are not statistically significant, but their signs suggest that the decentralised structures may perform better.

The comparison of columns (6) and (8) reinforce the findings for firms operating in conventional sectors, suggesting that the decentralised, formal structure is superior for both young and older firms. The equivalent results for high-tech sectors show some differences between young and older firms. Older firms in these sectors appear to benefit from the decentralised, formal structure, but the findings are not statistically significant. However, for young, high-tech firms, the interaction terms are significant and suggest (weakly) that these firms may benefit from informal structures in terms of their propensity to innovate.

These findings can be examined further in columns (9) to (12). For older firms we find that the decentralised, formal structure is significantly better [column (11)], but among young firms the organisational form effects are not statistically significant. When the high-tech interaction terms are included, the conclusions for older high-tech firms do not change our finding that the best organisational form is the decentralised, formal structure. For young firms, the interaction terms are statistically significant and support our suggestion above that the informal structures are somewhat superior for young, high-tech firms.

Table 3 summarises our tentative conclusions about the impact of organisational form on innovation propensity. It is clear that the decentralised, formal structure is generally superior but that there are some weak differences in the impact of organisational form between high-tech and conventional sectors and between young and older firms within the high-tech sectors. The table also shows the ratio of the number of firms making the ‘right’ choice compared with the total number of firms in each group. Overall, less than half of our sample has selected the organisational form that our analysis suggests is preferred for their circumstances.

Before turning to the second set of results, it is worth assessing the support the above findings offer to our hypotheses. Hypothesis 1 suggests that the decentralised, informal structure may be best suited to technically turbulent sectors. Our findings summarised in Table 3 suggest that high-tech will benefit more from informal structures than conventional firms and that the decentralised, informal structure is superior for such firms in terms of their innovation performance. Therefore, we find support for this hypothesis. Hypothesis 2 suggests that young firms should adopt decentralised, formal structures. The comparison between young and older firms does not lend much support to this hypothesis. While it appears to be the case that young firms in conventional sectors should adopt this form, this is also the case for older firms in these sectors. Within the high-tech sectors, we find no support for this proposition for this sample. Finally, Hypothesis 3 argues that firms in technically turbulent sectors will improve their innovation performance by combining centralisation and informality. We find that the centralised, informal structure is superior to the decentralised, formal alternative among young, high-tech firms, but have no evidence that it is a better organisational form than decentralised, formal structure. We can offer only limited support to this hypothesis.

The second set of results, presented in Table 4, examines innovation performance measured by the proportion of the firm’s sales due to new—or significantly—improved, goods or services. Since the dependent variable is bounded by the values 0% and 100%, we have used Tobit censored regressions. As we have already examined the factors that lead to a firm innovating, this analysis is restricted to those firms in the sample that had introduced an innovation within the previous 3 years. It therefore examines their success in commercialising their innovation. In particular, we investigate whether the organisational form adopted by the firm is associated with its innovation performance and whether this differs by firm size, age or sector.

The findings for all firms in the first column provide no evidence that the choice of organisational form matters for innovators in terms of influencing the proportion of their sales from new or improved goods and services. None of the organisational form variables is significant, nor is the planning variable that measures the extent of their written planning activities. Younger, smaller firms do have more success, based on this measure of innovation performance, but this success appears not to depend significantly on their choice of organisational form [see column (2)].

While collaboration with others was found to be strongly associated with a firm’s innovation propensity, we find it not to be related to the commercialisation success of these innovations.Footnote 5 However, we again find that R&D activity and operating within a high-tech environment are, as we might expect, significantly related to the percentage of innovative sales in the firm’s sales mix. Interestingly, while the use of PRP is significantly associated with the commercialisation of innovation, it was found to have an insignificant effect on the likelihood of innovating (see Table 2).

The second column of Table 4 also shows the results for combining organisational forms with whether the firm is operating in a high-tech environment. These results suggest that the decentralised, formal organisational form works best in high-tech sectors and that the informal structures are the worst. The significance of the other variables is unchanged by the inclusion of these interaction terms.

Columns (3) and (4) in Table 4 show the analysis for small and larger firms separately. In neither of these groupings do we find that any of the organisational form variables is significant, and we cannot observe any size effect on the relationship between organisational form and innovative sales. The remaining columns permit the examination of the impact on this relationship for young firms and for those operating in a high-tech sector.

A comparison of high-tech and conventional sectors in columns (5) and (7) suggests that the decentralised, formal organisation is superior in the high-tech sectors, but the differences are not statistically significant. While any organisational form appears to be equally good in the conventional sectors, the interaction terms in columns (6) and (12) suggest that the decentralised, formal structure is better only for older, high-tech firms. Similarly, the results in columns (8) and (12) support the view that there is no impact of organisational form on innovation success for older firms in the conventional sectors.

For young, high-tech firms, we can interpret columns (6) and (10) as suggesting that these firms may benefit from decentralised structures, both formal and informal, but none of these coefficients is statistically significant. In the same way, columns (8) and (10) imply (weakly) that the decentralised, formal structure is the worst choice for young firms in conventional sectors.

Uniquely for the high-tech sector, the PRP effect is negative—but not significant. However, further analysis of our data reveals that performance pay has a significantly negative relationship with innovation performance for informal organisations, but a significantly positive effect for formal organisations.

Overall, the findings in Table 4 have only weak significance and must be treated with caution; as such, they cannot be used to support—or refute—our hypotheses. However, they do suggest that the appropriate organisational form may depend on the firm’s stage of development and its objectives.

6 Summary and conclusions

This paper analyses the impact of organisational form on innovation performance in different commercial environments. Specifically, it focuses on whether the choices over the combination of the centralisation of decision-making and the formality of structure influence innovation performance and whether different combinations perform better in technically turbulent environments and at different stages of a firm’s development. Two measures of innovation performance are adopted, and it is possible that they could be subject to different determinants since carrying out an innovation and the successful commercialisation of it may require different skills, organisation structures and supporting policies.

We find that a variety of choices were made by firms in terms of their organisational characteristics and that these choices were not simply related to firm age, size or sector. The only grouping that was dominated by one particular form occurred among the larger firms, with 62% of them choosing a formal, but decentralised structure. It is therefore relevant to examine whether this observed variety of choices actually mattered in terms of innovation performance. We show above that in terms of innovation propensity, it clearly did matter. Firms that selected a decentralised, formal structure exhibit a significantly higher tendency to have introduced an innovation; having written plans also helps.

For firms operating in conventional sectors, this dominant organisational form is found to be superior to the other three organisational forms and this appears to be the case for both young and older firms. However, we show above that only 42% of young firms and 26% of older firms adopted this optimal form for innovation propensity. In competitive markets, innovation should be a priority and so these firms should consider changing their organisational form.

For older firms in the high-tech sectors we find that a decentralised form should be adopted to improve the firm’s innovation propensity and that it could have either a formal or informal structure. The reason for this may be that in such sectors, it is important to involve a wider range of staff in decision-making due to the wide—and changing—skills and knowledge required. A much higher proportion of this group were ‘organisationally optimal’, with 62% of the firms having already adopted either decentralised formal or decentralised informal structures. One possible explanation is that innovation is a more important objective in the high-tech sectors and, being older, this group had benefitted from more time to find their appropriate organisational form.

Our final group of firms under scrutiny were young firms operating in high-tech sectors. For these firms it appears that their creativity is supported by an informal structure and that having decentralised decision-making is less important. One explanation may be that there is a trade-off for these firms between the benefits of a fully organic structure (i.e. decentralised and informal) and the greater decision speed afforded by centralised decision-making. Only 44% of firms in this group adopted informal structures, and the rest may benefit from re-assessing whether a less formal structure might aid their innovation.

The picture is somewhat different for the second measure of innovation performance that examines the success at commercialising innovations. The results here suggest much weaker impacts of organisational form on this measure of performance than those found for the propensity to innovate. They do suggest, however, that firms may have to change their structures when moving from major innovations to the stage of commercialisation. For example, while the decentralised, formal structure is ‘optimal’ for innovation for young firms operating in conventional sectors, the other organisational forms are somewhat superior in terms of commercialising the innovation, although these findings are not statistically significant. The tentative conclusion is that, for this group, innovation success might be best followed up by changing their organisational form or by organisationally separating the management of the discovery of innovations from their commercialisation. Similarly, we find some evidence to suggest that high-tech firms that have succeeded in innovating may need to move towards the decentralised, formal structure in order to benefit from the commercialisation of their innovation as they get older.

Finally, we return to the hypotheses set out at the beginning. The first of these (Burns and Stalker 1961) argues that technically turbulent environments would be best served by decentralised, formal structures. Taking our results for both measures of innovation performance, we certainly find a difference in the ‘optimal’ organisational form between the high-tech and conventional sectors. The organic, decentralised and informal structure is found to be the superior in terms of innovation propensity for young, high-tech firms and also one of the best (the other being decentralised, formal) for older, high-tech firms. The findings for the commercialisation of innovation were much weaker but suggested that at that stage, firms might need to move towards the decentralised, formal structure. Therefore, we find some support for Hypothesis 1.

Our second hypothesis (Stinchcombe 1965) suggests that young firms would have better innovation performance with the decentralised, formal structure. We find this structure to be ‘optimal’ in most circumstances, but it is the comparison between young and older firms that best tests the hypothesis. We find no significant differences between young and older firms in terms of the impact of organisational structure on innovation performance. In addition, we show that young, high-tech firms do better with informal structures in terms of their innovation propensity. We conclude that we find no support for Hypothesis 2.

Our third hypothesis (Wally and Baum 1994) argues that the centralised, informal structure will be superior in technically turbulent sectors in which decision clarity and speed are important. In general, we find that the decentralised organisational form is better than centralised for both innovation propensity and the commercialisation of innovation. The one exception to this was for innovation propensity among small, high-tech firms where the choice of informality was more important than whether decision-making was decentralised. However, even in this case, we find no evidence that the centralised, informal form is superior to the decentralised, informal form and so can lend little support to Hypothesis 3.

In summary, we can be confident that organisational form matters for innovation success and that the decentralised, formal structure works best in most circumstances. The only exception that we find is that of young firms operating in high-tech sectors, which benefit from informal structures. We can also conclude that the organisational form most appropriate for achieving an innovation may not be best suited for its exploitation. The remainder of our findings, while intuitively reasonable, do require further study with other data before we can attach any confidence to them.

Notes

The missing values for the individual variables were as follows: size (4); age (9); planning (4); PRP (97); R&D active (58); and whether innovated (35).

We also experimented with three size classes: 1–9 employees; 10–99 employees; and 100–499 employees, and the findings were consistent with those reported in this paper.

We also experimented with interacting the size dummy with the organisation form variables, but in none of the models were these interaction terms found to be statistically significant. They are not presented here.

The models presented here were all estimated using the logarithm of age and its squared term in replacement of the young dummy variable. The coefficients were not statistically reported, and so these results are not presented here.

We have run all the models with and without the variable that measures collaboration, and the findings are not materially different. We present the findings without this variable in Table 4.

References

Athey, S., & Roberts, J. (2001). Organizational design: Decision rights and incentive contracts. Organizational Economics, 91, 200–205.

Atkinson, J., & Meager, N. (1994). Running to stand still: The small firm in the labour market. In J. Atkinson & D. Storey (Eds.), Employment, the small firm and the labour market (pp. 28–102). London and New York: Routledge.

Audretsch, D. B. (2001). Research issues relating to structure, competition and performance of small technology-based firms. Small Business Economics, 16, 37–51.

Black, S. E., & Lynch, L. M. (2004). What’s driving the new economy?: the benefits of workplace innovation. The Economic Journal, 114, 97–116.

Burns, T., & Stalker, G. M. (1961). The management of innovation. London: Tavistock Publications.

Butchart, R. L. (1987). A new definition of the high technology industries, economic trends. London: HMSO.

Cosh, A. D., & Hughes, A. (2003). Enterprise challenged: Policy and performance in the British SME sector 1999–2002. Cambridge: ESRC Centre for Business Research University of Cambridge.

Covin, J. G., & Slevin, D. P. (1989). Strategic management of small firms in hostile and benign environments. Strategic Management Journal, 10, 75–87.

Curran, J. (1986). Bolton fifteen years on: A review and analysis of small business research in Britain (pp. 1971–1986). London: Small Business Research Trust.

Dalton, D. R., Tudor, W. D., et al. (1980). Organisation structure and performance: A critical review. Academy of Management Review, 5, 49–64.

Daly, M. (1987). Lifespan of businesses registered for VAT. British Business, 3(April), 28–29.

Damanpour, F. (1991). Organisational innovation: A meta-analysis of effects of determinants and moderators. Academy of Management Journal, 34, 555–590.

Foss, N. J., & Laursen, K. (2005). Performance pay, delegation and multitasking under uncertainty and innovativeness: An empirical investigation. Journal of Economic Behaviour and Organisation, 58, 246–276.

Green, K. M., Covin, J. G., & Slevin, D. P. (2008). Exploring the relationship between strategic reactiveness and entrepreneurial orientation: The role of structure-style fit. Journal of Business Venturing, 23, 356–383.

Khandwalla, P. N. (1976/1977). Some top management styles, their context and performance. Organization and Administrative Sciences, 7, 21–52.

Kimberly, J. R. (1976). Organizational size and the structuralist perspective: A review, critique and proposal. Administrative Science Quarterly, 21, 571–597.

Laursen, K., & Foss, N. J. (2003). New human resource management practices, complementarities and the impact on innovation performance. Cambridge Journal of Economics, 27, 243–263.

Laursen, K., & Salter, A. (2006). Open for innovation: The role of openness in explaining innovation performance among UK manufacturing firms. Strategic Management Journal, 27, 131–150.

Meijaard, J., Brand, M. J., & Mosselman, M. (2005). Organisational structure and performance in Dutch small firms. Small Business Economics, 25, 83–96.

Simonen, J., & McCann, P. (2008). Innovation R&D cooperation and labour recruitment: Evidence from Finland. Small Business Economics, 31, 181–194.

Sine, W. D., Mitsuhashi, H., & Kirsch, D. A. (2006). Revisiting Burns and Stalker: Formal structure and new venture performance in emerging economic sectors. Academy of Management Journal, 49, 121–132.

Stinchcombe, A. (1965). Social structure and organizations. In J. March (Ed.), Handbook of organizations (pp. 142–193). Chicago: Rand McNally.

Teece, D. J., Pisano, G., & Shuen, A. (1997). Dynamic capabilities and strategic management. Strategic Management Journal, 18, 509–533.

Vaona, A., & Pianta, M. (2008). Firm size and innovation in European manufacturing. Small Business Economics, 30, 283–299.

Wally, S., & Baum, J. R. (1994). Personal and structural determinants of the pace of strategic decision making. Academy of Management Journal, 37, 932–956.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Cosh, A., Fu, X. & Hughes, A. Organisation structure and innovation performance in different environments. Small Bus Econ 39, 301–317 (2012). https://doi.org/10.1007/s11187-010-9304-5

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11187-010-9304-5