Abstract

This study investigates the effect of corporate political connections on IPO performance in an emerging economy. More specifically, it examines how CEO political connections affect the IPO performance of 428 firms in China from 2000 to 2004. The empirical results show that CEO political connections have a positive impact on firms’ ability to raise capital from public markets. The results also show that CEO political connections with the central government play a more important role in IPO performance than political connections with regional governments. In addition, the positive effect of central political connections on IPO performance is weaker in market-restricted regions but stronger in highly regulated industries. The findings highlight the contingent value of CEO political connections in an emerging economy.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Prior research has explored the impact of corporate political connections on key strategic issues, such as bank financing (e.g., Claessens, Feijen, & Laeven, 2008; Khwaja & Mian, 2005), corporate bailouts (e.g., Faccio, Masulis, McConnell, & Offenberg, 2006), government subsidy access (e.g., Wu & Liu, 2011), and firm performance (e.g., Fan, Wong, & Zhang, 2007; Fisman, 2001). Most studies view corporate political connections as a particular type of resource that provides firms with potential information, reference, and legitimacy benefits (Hillman, 2005; Li & Zhang, 2007; Peng & Luo, 2000). However, financial economics research tends to treat political connections as a governmental intervention that negatively affects firm performance (e.g., Cheung, Jing, Rau, & Stouraitis, 2005; Fan et al., 2007). To reconcile such inconsistency, strategy scholars have begun examining the contingent value of corporate political connections by investigating several critical firm and environmental factors (e.g., Wu & Liu, 2011). Despite these research efforts, there is little understanding of whether uneven values occur in different levels and/or types of corporate political connections and how these values vary across different institutional environments.

This study strives to fill this research gap by investigating the contingent value of political connections of chief executive officers (CEOs) in the context of firms undergoing initial public offerings (IPOs) in China. This study defines IPO performance as the net proceeds a firm raises from the public through an IPO (Certo, Holcomb, & Holmes, 2009). China offers a suitable context to test the effects of political connections on IPO performance because (1) as the largest emerging economy, it faces so-called institutional void issues—that is, it lacks sufficient institutions to support basic business operations (Child & Tse, 2001; Khanna & Palepu, 1997)—and (2) managerial political connections are common in China and increasingly important during the transition from a central planning system to a market economy (Li & Zhang, 2007; Xin & Pearce, 1996). In this context, CEO political connections can function as a mechanism that reduces external uncertainty and increases access to governmental resources. In addition, according to signaling theory, when the uncertainty to directly observe the quality of a substance is high, the effect of signals is most salient (Lee, Bach, & Baik, 2011; Milgrom & Roberts, 1986). In sum, we argue that such political connections can signal to market investors the firms’ ability to cope with the institutional environment, thus increasing firms’ IPO performance.

More important, we propose that CEO political connections are not uniform in their effects on firm outcomes, such as IPO performance, but rather vary across both the different levels of corporate political connections and the institutional conditions under which the firm is operating. Together, these two dimensions—the level of CEO political connections and the restrictiveness of institutional environments—form the basis of our exploration into the contingent value of CEO political connections for IPO firms. More specifically, we focus on two levels of political connections: connections with the central government and connections with regional governments (e.g., Nee, 1992; Wu, 2007). We also use two institutional factors (i.e., the regional market restriction and the regulated industry) as moderators of political connection effects. Our key claims are twofold. First, because the central government dominates the pace of economic transformation and controls the allocation of key resources, central corporate political connections may have greater positive effects on IPO firms than regional ones. Second, we propose that the institutional environment moderates the effect of corporate political connections such that certain levels of connections matter more or less under certain conditions. The theoretical underpinning for our claim is that different types of institutional environments focus investor attention on different sets of strategic factors that, in turn, fit the specific institutional environment. Political connections provide important signals of a firm’s value; thus, they become more or less important depending on investor concerns in the specific market context.

Understanding how circumstances modify the effects of political connections at various levels on IPO success is an important undertaking, especially considering recent arguments that political connections can have negative effects on firm outcomes (e.g., Fan et al., 2007). Miller and Shamsie (1996) propose that the value and contribution of different types of organizational resources are contingent on the institutional environment in which organizations operate. Thus, attempting to understand the contingent value of corporate political connections should help strategy scholars better understand how to navigate in different institutional environments. Our findings suggest that though central political connections lead to better IPO performance than regional political connections, such an effect is less prominent in market-restricted regions than in more highly regulated industries.

In addition, we explore the application of signaling theory to IPOs in emerging economies. Prior research, especially that based on a Western context, tends to focus on the value of signaling effectiveness when applying signaling theory to the IPO context (Certo et al., 2009; McBain & Krause, 1989). However, as Kim and Ritter (1999) noted, for IPOs in growing and uncertain industries, financial information may not be a good determinant of equity values. This argument can be particularly true for emerging economies, where institutional voids make it extremely difficult for investors to observe which factors lead to firm performance. In this situation, outside investors tend to rely on the legitimacy value of signals, rather than the underlying economic rationales, when evaluating a firm’s performance (Peng, 2004). Accordingly, we argue that corporate political connections provide a signal of a firm’s legitimacy in the local market, thus leading to better IPO performance. Thus, we further extend Peng’s (2004) signaling argument by exploring the legitimacy implications of signaling theory in the IPO context in China.

This article proceeds as follows: we first review the significance of corporate political connections and their application to the IPO market in emerging economies. This section highlights the importance of studying corporate political connections in the context of IPO performance. We then develop hypotheses on the effects of corporate political connections on IPO performance, specifying how different institutional environments modify the effects of political connections at various levels on IPO success. We test these hypotheses with a sample of 428 Chinese IPO firms during the 2000–2004 period. A detailed explanation of the research design and the study’s findings follow. Finally, we discuss the theoretical and practical implications of these findings and identify future research directions that might enhance current understanding of the role of political connections in firm performance.

Literature review and hypotheses development

Corporate political connections and application to the IPO market in emerging economies

Prior research emphasizes the significance of corporate political activities. These activities involve “attempts to shape government policy in ways favorable to the firm” and thus have important implications for firm performance (Hillman, Keim, & Schuler, 2004: 837). As a special form of social capital, corporate political connections enable firms to enjoy a variety of benefits, including information access, preferential treatment in bidding for government contracts, and relaxed regulatory oversightFootnote 1 (Faccio, 2006; Hillman, 2005; Hillman, Zardkoohi, & Bierman, 1999; Lester, Hillman, Zardkoohi, & Cannella, 2008). Consequently, by establishing linkages with governmental agencies by appointing top executives with prior political backgrounds, firms can reduce uncertainty and transaction costs and thus improve profitability (Fisman, 2001).

Research also suggests that such connections play a more important role in firm performance in emerging economies because “government and societal influences are stronger in these emerging economies than in developed economies” (Hoskisson, Eden, Lau, & Wright, 2000: 252). Emerging economies are characterized by fast economic development and the transition of governmental policies to a market-based system (Hoskisson et al., 2000). As a result, uncertainty tends to be higher because of the frequent change of government policies and regulations (Devlin, Grafton, & Rowlands, 1998). Also during this transition legal systems are not well developed and institutional voids are inevitable, which results in more discretionary power of government in resource allocation (Keister, 2000; Yiu, Bruton, & Lu, 2005). Therefore, in emerging economies, political connections can act as an effective mechanism to reduce uncertainty and substitute for formal institutional support (Xin & Pearce, 1996).

Given the weak institutional environment in emerging economies, political connections are particularly useful for IPO firms to overcome the liability of market newness. An IPO event can be deemed a milestone in a firm’s developmental path because it indicates that the privately held firm has gone public. A successful IPO can help firms raise capital from outside investors for future growth (Certo et al., 2009). In turn, an IPO firm must demonstrate its ability to handle the new demands as a publicly traded firm to attract external investors during the transition process (Certo, 2003). According to Rock (1986), resolving the information asymmetry between external investors and IPO firms is a critical challenge for IPO success. Such an information gap between investors and IPO firms is particularly prominent in emerging economies in which institutional voids are greater and market uncertainty is higher because of the governmental influence on the economy (Peng & Luo, 2000). Accordingly, IPO firms in emerging economies must find ways to signal their abilities to cope with institutional voids and to mitigate market uncertainty to outside investors.

Corporate political connections can serve as effective signals to external investors about the firm’s ability to cope with institutional voids in its future growth. As Certo (2003) noted, an effective signal must be (1) observable/known in advance and (2) costly to imitate. A company’s corporate political connections can be observable and known in advance of the IPO if information on top managers’ backgrounds (e.g., prior political appointments) appears in the prospectus filing (Anderson, Beard, & Bom, 1995; Chan, Wang, & Wei, 2004). In addition, corporate political connections are costly to imitate because finding suitable candidates with political backgrounds is not always feasible (Hillman, 2005). Thus, for outside investors, corporate political connections can indicate a firm’s ability to overcome the liability of market newness.

In addition, as noted by prior signaling theory research (i.e., Lee et al., 2011; Sanders & Boivie, 2004; Spence, 1974), the effectiveness of signaling will be stronger when it is difficult to directly observe codified knowledge regarding the intrinsic quality of an investment. In this situation, investors tend to reply on alternative information sources to better estimate the value of their investment. Given the complexity of the institutional environment in emerging economies, an IPO firm’s political connections will help to better communicate the idiosyncratic attributes that will differentiate the focal firm from its competitors. Therefore, we argue that corporate political connections can serve as a well-sought signal for outside investors to estimate its intrinsic value.

Corporate political connections and IPO performance

Corporate political connections can send a mixed signal to public investors. From a financial economic perspective, corporate political connections are a type of government intervention through which the government seeks rents and extracts resources from the intervened regional business (Hellman, Jones, & Kaufmann, 2003; Shleifer & Vishny, 1994). Such government intervention behavior through corporate political connections can negatively affect firm performance, because politicians’ rent seeking and resource extraction help fulfill their personal or political agendas, which are contrary to firm value maximization (Cheung et al., 2005; Fan et al., 2007; Nee & Cao, 2005; Shleifer & Vishny, 1994). For example, in countries with higher levels of corruption, political connections may increase unethical corporate behaviors, such as bribery, which in turn affect firm performance negatively (Faccio, 2010).

Despite the potential negative implications of political connections for performance, in emerging economies, such as China, it is difficult to separate corporate political connections from human capital and the signaling benefits a politically connected CEO can bring to the IPO firm. Therefore, we argue that the benefits of corporate political connections can surpass the potential costs, helping IPO firms overcome the liability of market newness and signal to potential investors that they can cope with uncertain institutional environments after IPO. In emerging economies, governmental policies and regulations evolve over time, and substantial uncertainties exist regarding the interpretation and application of laws and regulations (Devlin et al., 1998; Hoskisson et al., 2000). Consequently, even well-known multinational corporations (e.g., Starbucks) can be confused about their operations in emerging economies. For example, in its 2007 annual report, Starbucks (2007: 12) stated that “many of the risks and uncertainties of doing business in China are solely within the control of the Chinese government.”

We argue that in emerging economies, firms must send signals to potential investors and demonstrate their abilities to cope with such risks and uncertainties. Thus, corporate political connections can act as an information conduit between the government and the firm and familiarize the firm with political processes. As Hillman et al. (1999: 68) claimed, in developed economies “the political process is so complex that it is virtually impossible for corporations to understand all of its aspects and procedures.” The political process is even more complex in emerging economies given the powerful government agencies and the transient policies and regulations. By appointing former governmental officials as top executives, firms become more familiar with explicit and implicit political rules and processes, thus reducing information asymmetry, operational uncertainty, and transaction costs when interacting with governmental agencies (Faccio, 2006; Hillman, 2005).

Furthermore, top managers with former affiliations to either central or regional governments can help firms favorably reshape their political environments through lobbying activities (Hillman & Wan, 2005; Luo, 2001), which may enhance business expansion and market performance (Ghemawat & Khanna, 1998; Hillman, Cannella, & Paetzold, 2000; Pfeffer, 1972). The formation of public policy is an outcome of the interplay between governmental policy makers and multiple interest groups, including business firms (Coate, Higgins, & McChesney, 1990). Corporate political connections can help firms access related policy makers and influence their attitudes and preferences toward a specific industry and/or firm. Consequently, firms with such connections can benefit from preferential government policies and treatments, such as tax reduction, selective government contracts, and long-term loans from state-owned banks (Faccio, 2006; Hillman, 2005; Hillman et al., 1999; Lester et al., 2008). Such an effect is more prominent in emerging economies in which governments still play a major role in resource allocation and dominate the pace and direction of economic transition (Hoskisson et al., 2000; Xin & Pearce, 1996).

As a result, appointing top managers with political connections increases the firm’s legitimacy in the eyes of potential investors (Hillman et al., 1999). Establishing linkages with prominent, established organizations is an effective way for private firms to signal their legitimacy to external investors (Galaskiewicz & Wasserman, 1989). Despite government control in both developed and emerging economies (e.g., Hillman et al., 1999), firms, especially private ones, have a strong incentive to become politically connected in emerging economies (Chen, 2007), and this can be particularly true in China; many scholars (e.g., Chen, Li, & Liang, 2011) contend that China’s transition process from a planned to a market-based economy has created a unique value orientation, called the “Chinese official standard.” The Chinese official standard implies that the valuation of a firm (or a person’s worth or status) is based on its standing in the government bureaucratic system, and connections with government agencies increase a firm’s legitimacy in the eyes of the public. The unique aspects of signaling legitimacy complement signaling theory’s emphasis on effectiveness, potentially adding new meanings to signaling theory in the context of transitional economies.

Therefore, we argue that the benefits of corporate political connections outweigh the potential costs associated with governmental intervention and politicians’ rent-seeking behaviors in emerging economies, particularly in China. In summary, corporate political connections act as signals to external investors that the firm can effectively handle environmental uncertainty, reduce transaction costs, mitigate or eliminate perceived threats, obtain growth opportunities, and gain legitimacy. Consequently, firms with corporate political connections may be able to alleviate investor concerns about their liability of market newness and achieve superior IPO performance. For example, Francis, Hasan, and Sun (2009) showed that corporate political connections help firms in emerging economies understand governmental policies on IPOs and, in turn, achieve a higher offering price, avoid underpricing, and obtain lower fixed costs during the IPO process. In the context of China, empirical studies have also shown that the presence of corporate political connections improves a newly listed firm’s chance of obtaining additional government subsidies to overcome its liability of newness (Wu & Liu, 2011). From these arguments, we posit that corporate political connections boost a firm’s IPO performance in China.

Hypothesis 1

Corporate political connections have a positive effect on firm IPO performance.

Levels of corporate political connections

Although politically connected firms are likely to achieve superior IPO performance, we also argue that firms’ relationship with the government varies depending on the levels of corporate political connections. Most countries adopt a hierarchical administrative structure in their governmental system. For example, in China, the administrative bureaucratic system comprises one central government, 34 provincial governments (including 23 provinces, 5 autonomous regions, 4 municipalities directly under the central government, and 2 special administrative regions), and many municipal and county governments. In terms of the administrative hierarchy, China’s central and provincial governments correspond to the federal and state governments in the United States, respectively. In general, prior research classifies corporate political connections into two levels: connections with the central/federal government and connections with regional governments (including the province/state and other lower levels). Hillman et al. (1999) acknowledged the existence of different levels of corporate political connections and focused on the connections with the federal cabinet and the US House of Representatives and Senate. Similarly, Qian and Li (2010) divided CEO political connections into central and regional levels and found that compared with regional government connections, central government connections have a distinct impact on firm performance.

Such a distinction is particularly salient in emerging economies in which regional governments are empowered to issue business licenses, coordinate economic development, and tax at regional levels (Hill, 2002; Walder, 1995). In China, more than 50% of the government budget is now under control of regional governments (Nee, 1992), which means that firms depend less on central governmental agencies for key resources and administrative permissions. As a result, each level of the national bureaucratic system possesses certain power in policy making and administrative control over firms within its jurisdictional areas (Nee, 1992; Wu, 2007). A central government’s direct policy inducement and encouragement to appoint firm top executives (Nee, 1992; Wu, 2007) lead to closely linked central government political connections in a country. In a similar vein, political connections can be embedded in a specific regional institutional environment and thus lead to close links with regional governments. Therefore, it is necessary to analyze how different levels of corporate political connections vary in terms of their effects on IPO performance in emerging economies.

Although both levels of corporate political connections are beneficial, we argue that external investors put more value on connections with the central government than on those with regional governments for two reasons. First, in most emerging economies, the central government guides and dominates the pace of economic transition (Nee, 1992; Wu, 2007). In China, the central government still controls the degree of marketization in the market-oriented economic reform, issues key policies and regulations on the adjustment of industrial structures, and dominates the major reforms in the pricing system, state-owned enterprises, and the banking system (Nee, 1992; Wu, 2007). Despite decentralization, central governments in emerging economies still control a large amount of fiscal budget and administrative power. Thus, compared with connections with the regional government, connections with the central government can help firms access more timely information on future governmental policies and reduce operational uncertainty.

Second, corporate political connections with the central government help firms obtain resources and administrative support from regional governments. A prominent feature of China’s administrative bureaucratic systems is the structural correspondence of departments between central and regional governments. For example, at the central government level, the Ministry of Commerce of China is responsible for the administration of national market development; correspondingly, at the province or city level, a regional government institute called the Department of Commerce is responsible for monitoring regional market development and reports to the Ministry of Commerce. Within such a hierarchical system, connections with the central government can help bridge relationships at the regional government level. In summary, we expect that corporate political connections with the central government confer more timely information and more governmental resources. Given that IPOs target nationwide investors, corporate political connections with the central government transmit a stronger and more legitimate signal to external investors than connections with regional governments, thus helping firms raise more capital.

Hypothesis 2

Corporate political connections with the central government have a more positive impact on firm IPO performance than corporate connections with regional governments.

The contingent value of corporate political connections

Political connections not only provide resources for firms to fill institutional voids but also draw favorable treatments that help firms navigate through specific institutional voids (Keister, 2000; Yiu et al., 2005). Thus, the value of political connections may be contingent on the institutional conditions in which firms are embedded (Guillén, 2000). That is, corporate political connections can provide value only if they match the institutional environment in which a firm operates. Consequently, this study identifies two relevant dimensions of institutional restrictiveness from prior literature—namely, market restriction and industry regulation (Fan et al., 2007; Lu & Ma, 2008)—and explores how the impact of different levels of corporate political connections on IPO performance varies across industries and regions with different levels of restrictiveness.

Regional market restriction

Regional market restriction refers to the level of underdevelopment of regional market economies due to the influence of regional governments on factor and product markets (Keister, 2000). In an emerging economy, although the central government’s policies toward a free market are the most relevant institutional condition for firms (Guillén, 2000), a high level of heterogeneity among sub-national regions exists in terms of social, political, and economic institutions (Chan, Makino, & Isobe, 2010). Consequently, IPO firms in different regions must cope with distinct institutional environments to overcome the liability of newness.

In areas with high market restriction, regional governments control most of the regional economy, as well as regional resources, which are critically related to the institutional voids in these areas (Child & Tse, 2001; Walder, 1995). Moreover, regional governments in many emerging economies have pursued regional protectionism to protect their regional interests by blocking free-trade flows across regions (Hong, 1997; Luo, 2001). Such protectionism poses substantial challenges to inter-regional business and hampers the integration of national markets (Hong, 1997; Luo, 2001; Young, 2000).

In addition, regional governments in China have strong incentives to promote their interests to enhance regional gross domestic product growth, which serves as a major promotion criterion for regional government officials. Therefore, corporate political connections with regional governments can act as policy arms because top managers may have been appointed primarily to promote regional economic growth and fiscal revenue. This can be particularly true for IPO firms, which are geared to attract nationwide capital inflows to their local regions. In this sense, the regional political connections of an IPO firm’s CEO can be an important conduit through which the firm not only gains regional governmental support but also accesses and acquires valuable regional resources that are otherwise unavailable because of institutional voids in these restricted areas.

In contrast, firms with corporate political connections at the central level might not have strong political connections with regional governments because the central government’s interests may not align with those of the regional governments in China (Wu, 2007). Firms with central-level political connections might be unable to access critical resources controlled by regional governments. Furthermore, strong regional protectionism in more restricted regions also makes it difficult for firms with top executives from different political backgrounds, including central political connections, to exchange resources with other firms in these areas. As a result, IPO firms that have political connections with the central government may not be able to leverage their political capital effectively because their connections are outside the restricted areas and substantial barriers prevent bridging into these areas. Accordingly, we expect that regional corporate political connections are more effective than central political connections in filling the heightened institutional voids in regions with high market restriction. In turn, these connections more effectively signal IPO firms’ ability to overcome liability of market newness to outside investors, thus leading to superior performance in the IPO market.

Hypothesis 3

In regions with high market restriction, the effect of central political connections on IPO performance will be weakened while the effect of regional political connections strengthened.

Industry regulation

Industry regulation refers to the extent to which governments supervise a specific industry (e.g., Fan et al., 2007; Hillman, 2005). In China, governments typically regulate industries by stipulating specific entry requirements, controlling the pattern and speed of industry reform, and intervening in business activities, such as materials procurement, distribution, and marketing (Luo, 2003). In most cases, the central government specifies the rules of regulated industries for the whole nation. For example, the State Council has the power to promulgate industry regulations, while regional governments deal with routine regional administration, which is under the central government’s supervision (Wu, 2007).

Typically, industry regulation in emerging economies leads to structural entry barriers (Bain, 1956; Mahmood & Mitchell, 2004), which should protect IPO firms from fierce competition at the stage of market newness. In addition, firms connected with the right level of government can more effectively lobby industry policy makers, thus improving their competitive advantages and interests (Peng, Lee, & Wang, 2005; Yiu et al., 2005). This strong lobbying power also makes industry protectionist policies, when developed, more difficult to change (Evans, 1979; Guillén, 2000; Kock & Guillén, 2001). Furthermore, corporate connections with the central government, such as industry ministries, can help firms better interpret and leverage preferential treatments so that they can take advantage of these treatments to improve firm performance. Therefore, by establishing political connections with industry policy makers at the central government, IPO firms can not only secure their dominant positions in the industry competition but also establish strategic relationships with critical external stakeholders.

Accordingly, for an IPO firm in a regulated industry, central political connections can serve as important channels through which the firm can enjoy favorable policies or gain access to critical resources. In contrast, corporate political connections with the regional government may not generate the desired advantages to an IPO firm because the regional government does not control the valuable and rare resources in these industries. Therefore, Chinese investors are likely to interpret an IPO firm’s central political connections as a signal of the firm’s ability to outperform rivals in heavily regulated industries, which in turn leads to superior IPO performance.

Hypothesis 4

In regulated industries, the effect of central political connections on IPO performance will be strengthened, while the effect of regional political connections will be weakened.

Methods

Sample

To test our hypotheses, we used a sample of firms that undertook IPOs in China between 2000 and 2004. Although the fundamental concerns with political connections are quite general and relevant to most countries (Hillman, 2005), China offers a suitable context to test the effects of political connections on firm performance because it is the largest emerging economy (Child & Tse, 2001) with important and ubiquitous political connections (Li & Zhang, 2007; Peng & Luo, 2000; Xin & Pearce, 1996). For example, Wong, Opper, and Hu (2004) reported that 56% of listed firms retained connections with the government and ministries. Fan et al. (2007) also reported that nearly 27% of their sampled firms were politically connected. Despite the undergoing transition from a central-planned economy to a market-oriented economy, the Chinese government and affiliated politicians still play an important role in policy making and resource allocation (Nee, 1992; Peng & Heath, 1996). Furthermore, considerable institutional variations exist across regions and industries within China (Lu & Ma, 2008), thus providing a suitable context for examining the contingent value of political connections.

We obtained a list of Chinese domestic firms that went public on the Shanghai and Shenzhen Stock Exchanges from the SINOFIN Information Services database, constructed by the China Center for Economic Research at Peking University. Researchers have applied this database and argued that it is one of the most comprehensive financial databases on Chinese public companies (e.g., Fan et al., 2007). We obtained an initial sample of 453 firms in the 2000–2004 period. After we deleted cases with missing values, 428 firms remained for statistical analysis. These firms came from 13 broad industries, including agriculture, mining, manufacturing, public utility, construction, transportation and storage, information technology, wholesale and retailing, financial and insurance service, real estate, social service, media and cultural industry, and others. We collected information on corporate political connections from the sampled firms’ IPO prospectuses.

Dependent variable

IPO performance

We employed IPO net proceeds to indicate IPO performance (e.g., Pagano, Panetta, & Zingales, 1998). Given that IPOs’ goal is to access external capital by selling equity shares (Brau & Fawcett, 2006; Pagano et al., 1998), IPO net proceeds can directly measure the amount of capital an IPO generates (Certo et al., 2009). The value of IPO proceeds equals the product of the offer price and the number of shares provided for IPO. The value of net proceeds is the difference between IPO proceeds and the costs of IPO (Ibbotson & Ritter, 1995). In performing robustness checks, we also tested the sensitivity of the results to another measure of IPO performance, based on the combinative index developed by Gulati and Higgins (2003). This indicator integrates four financial measures, including net proceeds, pre-money market valuation, 90-day market valuation, and 180-day market valuation. This combinative index helps balance the short- and long-term performance measures to provide a more comprehensive assessment of IPO performance (Gulati & Higgins, 2003). These four measures were highly correlated with one another in this study (Cronbach’s α = .90). We followed Gulati and Higgins (2003) to derive this composite performance index of IPO success.

Independent variables

Following prior research (e.g., Fan et al., 2007; Qian & Li, 2010), we measured the variable corporate political connections with the CEO’s prior work experiences in the government. Prior research suggests that information on a firm’s upper echelon can serve as a high-quality signal to indicate the firm’s future growth potential (Lawless, Ferris, & Bacon, 1998). Empirical studies show that characteristics such as top managers’ work experience, prestige, and heterogeneity can influence firms’ IPO performance (Higgins & Gulati, 2006; Lester et al., 2008). The upper echelons literature further indicates that the CEO is the most important executive in a company because he or she can both enhance strategic decision-making processes (Papadakis & Barwise, 2002) and influence the dynamics of the top management team (Carpenter, Geletkanycz, & Sanders, 2004; Peterson, Smith, Martorana, & Owens, 2003). Thus, CEO characteristics provide a key signal to potential investors in the IPO context.

To collect a CEO’s background information, we manually collected the IPO prospectuses for all firms that went public on two Chinese stock markets during the 2000–2004 period. Two independent coders followed Hillman’s (2005) approach to code the information of CEO political experience. Both coders were MBA students with several years of work experience and were trained before beginning the coding work. The inter-rater agreement was .98, indicating good consistency between the coders (Snow & Hambrick, 1980). CEO political connections were recorded only when the two raters reached agreement. Political experience includes civil service, military service, and membership in the People’s Congress or the People’s Political Consultative Conference at various levels.

We then measured CEO political connections with a dummy variable, where 1 indicates that the CEO had work experience with the government and 0 indicates otherwise. We also generated two dummy variables, one representing CEO central political connection and the other reflecting CEO regional political connection. The former indicates that the CEO’s prior work experience was at the level of central government, and the latter indicates that the CEO’s prior work experience was at the regional level.

Regional market restriction

We assessed the degree of market restriction of a firm’s registration province by using the Market Development Index developed by the National Economic Research Institute in China. In this index, each province in China is scored on a continuous scale since 1997, ranging from provinces with the highest market restrictions to provinces with the most economic openness (Fan & Wang, 2006). Such indices are computed with data from Chinese statistical yearbooks, reports from the administrations for industry and commerce, and surveys. Several factors are covered in this index, including the relationship between the regional market and the regional government, development of private sectors, product and factor markets, and regional legal systems. Accordingly, we reversed the score of the Market Development Index to measure the extent of market restriction in a given province.

Regulated industry

Industries vary in terms of the level of government control (Baron, 2000; Hillman, 2005); some are heavily regulated, while others are not. This study followed Fan et al. (2007) and treated the following industries as heavily regulated in China: natural resources, public utilities, and finance and real estate. A dummy variable indicated whether an IPO firm was in these regulated industries (1 equals yes, and 0 equals no).

We controlled for several variables that might influence a firm’s ability to attract external capital. Because firm size is related to firm performance and corporate governance (Dalton, Daily, Ellstrand, & Johnson, 1998), we controlled for firm size, which we measured as the natural logarithm of the number of employees (Hillman, 2005; Peng & Luo, 2000). IPO literature also reports that firm age can influence a firm’s IPO performance (e.g., Megginson & Weiss, 1991). Therefore, we included firm age as a control, which we measured as the number of years since the firm’s incorporation. We also included a firm’s pre-IPO performance and measured it by its net profit over total assets (return on assets) in the year before the IPO. Return on assets is a common accounting-based measure of financial performance (Berman, Wicks, Kotha, & Johns, 1999) and has been previously validated in China (e.g., Peng & Luo, 2000).

Previous literature indicates that investors may react differently to firms with older CEOs because these executives can signal greater credibility to the market (Cohen & Dean, 2005). Accordingly, firms with older CEOs may achieve superior IPO performance. Therefore, we included CEO age and measured it in years (e.g., Certo, Covin, Daily, & Dalton, 2001; Higgins & Gulati, 2006). Research also indicates that the level of executive education influences managerial cognitive complexity and subsequent firm performance (Hitt & Tyler, 1991). This study adjusted measures from Barker and Mueller (2002) and applied a four-point scale to indicate the level of CEO education (1 = no college degree; 2 = junior college degree; 3 = undergraduate degree; 4 = postgraduate degree). We also controlled for CEO tenure to help control for potential CEO self-selection issues before IPO.Footnote 2 That is, if an IPO firm is competitive, political officials may self-promote to be appointed as the CEO of the firm right before IPO. Conversely, if an IPO firm is less competitive, the IPO firm may seek prominent government officials to fill the position of CEO right before IPO to enhance the probability of IPO success. Therefore, CEOs with shorter tenures may indicate a potential self-election issue before IPO. Accordingly, we incorporated CEO tenure, measured as the CEO’s number of years in office in the IPO firm, in our main regression (e.g., Simsek, 2007). In addition, we controlled for CEO duality, which we measured with a dummy variable, where 1 indicates that the CEO was also the chairman of the board (Finkelstein & D’Aveni, 1994).

Extant research shows that state-owned enterprises may differ from non-state-owned ones in terms of profitability (e.g., Dewenter & Malatesta, 2001). We controlled for this by adding the dummy variable SOE to indicate whether a firm is state owned or not (1 equals state owned, and 0 equals not). We also included a dummy variable (VC backing) to indicate whether an IPO was backed by any venture capital (Fried, Bruton, & Hisrich, 1998). We controlled for underwriter reputation because previous research indicates that underwriter reputation affects investors’ perceptions of the quality of firms undergoing IPO, which in turn influences IPO performance (Carter, Dark, & Singh, 1998). We followed Megginson and Weiss (1991) and measured underwriter reputation as the total dollar amount that an underwriter had brought to market in the past 5 years. There are two stock exchange markets in China: Shanghai and Shenzhen. To control for the effect of IPO location, we included a dummy variable, IPO market, to indicate whether a firm was listed on Shanghai or Shenzhen (1 equals Shanghai, and 0 equals Shenzhen). Because general economic conditions and market environments can change over time, we included year dummies to control for the IPO timing effect, with 2004 being the reference year.

Analytical approach

Given the cross-sectional nature of our research design, we employed hierarchical linear modeling (HLM) to separate industry effects from the hypothesized firm effects. As Hofmann (1997) noted, HLM offers a more advanced way to examine data with hierarchically nested structures (e.g., firms can be grouped as an industry) than the traditional ordinary least squares (OLS) approach for two reasons. First, HLM acknowledges the partial interdependence of members within the same group. Second, HLM can simultaneously test the effects of lower-level units (e.g., firms) and higher-level groups (e.g., industries) on the lower-level outcome (e.g., firm performance) in one model. These advantages come from HLM’s ability to simultaneously estimate fixed effects, as the traditional OLS model does, and random coefficients, which are parameter estimates that are allowed to vary across groups. Therefore, HLM can help refine our empirical estimation of both the firm- and industry-level effects on IPO performance.

Results

Table 1 exhibits the means, standard deviations, and correlations of variables examined in this study. Of note, more than 20% of CEOs in our sampled firms had political connections, which is similar to the results reported in prior research (e.g., Fan et al., 2007). Furthermore, the amount of net proceeds was positively related to CEO political connections and CEO central political connections, providing some preliminary support for our main hypotheses. To test the potential problem of multicollinearity, we checked the variance inflation factor (VIF) for each independent variable and found that the mean VIF value was 1.33, which suggests that multicollinearity is not likely to be an issue in our analysis. In addition, to reduce the potential problem of multicollinearity when testing the interaction terms in Hypotheses 3 and 4, we mean-centered the independent variables to create the interaction terms (Aiken & West, 1991). Furthermore, to ensure comparability of results, we mean-centered the independent variables in all equations, regardless of whether they are used for interaction terms. For ease of interpretation, however, all variables reported in Table 1 are not mean-centered.

Table 2 presents the results of the HLM regressions using net proceeds as the dependent variable. Model 1 of Table 2 presents the base model with only control variables entered; Model 2 adds the effect of CEO political connections; Model 3 separates CEO political connections into two levels: central political connections and regional political connections; Model 4 adds the interactions between regional market restriction and two levels of CEO political connections; Model 5 adds the interactions between regulated industry and two levels of CEO political connections; and Model 6 presents the full model with all variables. All models appearing in Table 2 are statistically significant.

Hypothesis 1 proposes a positive relationship between CEO political connections and IPO performance. The inclusion of CEO political connections significantly improves the explanatory power of Model 1. In addition, the coefficient of CEO political connections is .17, which is statistically significant (p < .1), thus providing partial support for Hypothesis 1.

Hypothesis 2 posits that firms with CEO political connections with the central government have greater IPO performance than firms with CEO political connections with regional governments. As Model 3 shows, separation of the two levels of CEO political connections improves the explanation power of the model. In addition, significant differences emerge between the coefficients of these two levels of connections. The coefficient of CEO central political connections is positive and significant (coefficient = .89, p < .001), while the coefficient of CEO regional political connections is negative and nonsignificant (coefficient = −.05, p > .1). These results suggest that (1) IPO firms with CEO central political connections are significantly and positively different from the base group (i.e., IPO firms without political connections) and (2) IPO firms with CEO regional political connections are not significantly different from the base group. However, to conduct a more rigorous and direct test for Hypothesis 2, we employed the Wald test to further examine whether the coefficients of central political connections and regional political connections are statistically different from each other. We conducted this test in Stata using “test” command after running the regression model. The result indicates that the difference between these two coefficient estimates is statistically significant (χ 2 = 10.60, p < .01), in support of Hypothesis 2.

Hypothesis 3 proposes that in regions with high market restrictiveness, the effect of central political connections will be weakened, while the effect of regional political connections will be strengthened. As Model 4 shows, the coefficient estimation of the interaction term between CEO central political connections and regional market restriction is negative and significant (coefficient = −1.52, p < .001), and the coefficient estimation of the interaction term between CEO regional political connections and market restriction is positive and nonsignificant (coefficient = .01, p > .1). These results suggest that in regions with high market restriction, the effect of central political connections on IPO performance is weaker; however, no evidence suggests that the effect of regional political connections is strengthened. In addition, we used the Wald test to better test the difference between the coefficient of the interaction between CEO central political connections and regional market restriction and the coefficient of the interaction between CEO regional connections and regional market restriction. The results show a significant difference between the coefficient estimates (χ 2 = 83.09, p < .001), thus providing partial support for Hypothesis 3.

Hypothesis 4 posits that in regulated industries, the effect of central political connections will be strengthened, while the effect of regional political connects will be weakened. Model 5 tests this hypothesis: the coefficient estimation of the interaction term between CEO central political connections and regulated industry is positive and significant (coefficient = 5.38, p < .01), while the coefficient estimation of the interaction term between CEO regional political connections and regulated industry is negative and nonsignificant (coefficient = −.18, p > .1). These results suggest that the effect of central political connections on IPO performance is stronger in regulated industries; however, no evidence suggests that the effect of regional political connections is weaker. We also used the Wald test to further examine the difference between the coefficient of the interaction between CEO central political connections and regulated industry and the coefficient of the interaction between CEO regional connections and regulated industry. The results show that the chi-square is statistically significant (χ 2 = 65.86, p < .001), thus providing partial support for Hypothesis 4.

Among the control variables, the variable of firm size has a positive and significant relationship to IPO net proceeds across the models. This result suggests that larger IPO firms are more likely to achieve superior IPO performance in China. In addition, the coefficients of CEO age and education are significant (p < .05 for CEO education across Models 1–5; p < .01 for CEO age, except for Models 3 and 4, where p < .05). These results suggest that both CEO political and human capital affect firm IPO performance. In contrast, the variable of regional market restriction has a negative and significant effect on net proceeds across the models, suggesting that IPO firms from regions with high market restriction are less likely to achieve success in the IPO market. In addition, the coefficients of underwriter reputation are positive and significant in Models 4–6, suggesting that underwriter reputation may also increase net proceeds of IPO firms in China.

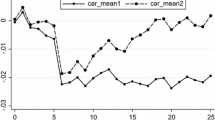

To further illustrate the relationships among levels of CEO political connections, regional market restriction, and IPO performance, we depict the empirical findings in Figure 1 by defining high and low degrees of regional market restriction based on one standard deviation above and below the mean. As the figure shows, in regions with a high degree of market restriction, firms with CEO regional political connections have significantly greater IPO performance than those with CEO central political connections; in contrast, in regions with a low degree of market restriction, firms with CEO central political connections have superior IPO performance.

Similarly, Figure 2 depicts the relationships among levels of CEO political connections, industry regulation, and IPO performance. We classify industries into two groups: high industry regulation versus low industry regulation. As Figure 2 shows, in highly regulated industries, firms with CEO central political connections have significantly greater IPO performance than firms with CEO regional political connections; however, such a gap decreases in less regulated industries.

To further validate our empirical findings, we conducted sensitivity analyses using different measures of the main variables and different regression models. First, we replaced the amount of net proceeds by IPO success, a composite index for IPO performance, and ran the HLM regression. As Table 3 shows, the sign and significance of all key variables (except CEO political connections) remained quantitatively similar, reflecting the same pattern as in Table 2.

Second, we adopted alternative measures of CEO tenure to better test the potential effects of CEO with shorter tenure on IPO performance. Although the variable of CEO tenure was not significant in both Tables 2 and 3, it is important to further validate the robustness of our findings. To further test the effects of CEOs with different tenure lengths on IPO performance, we coded a series of dummy variables of CEO tenure by using one-, two-, or three-year tenure experience as the cutoff point. We tested our regression models with each of these dummy variables and found that their coefficients were not significant in our regression models. The insignificance of the results suggests that CEO tenure does not have an effect on IPO performance in our sample; however, we acknowledge that this result may also be due to the two self-selection effects evening out in our sample.

Third, we applied the OLS model, instead of using HLM regression, to run the regressions for both dependent variables (net proceeds and IPO success) and observed similar empirical results.Footnote 3 These robustness tests suggest that our findings are quite consistent.

Discussion

Our work builds on prior research that emphasizes the value of political connections in strategic management (e.g., Hillman, 2005). With a sample of Chinese firms that went public between 2000 and 2004, we find that CEO political connections have a positive effect on IPO performance. This finding is consistent with prior studies on political connections (e.g., Fisman, 2001; Hillman, 2005; Peng & Luo, 2000; Xin & Pearce, 1996), though it does not rule out the potential negative implications of political connections, such as government interventions, for IPO firms (Fan et al., 2007; Shleifer & Vishny, 1994). However, we note that the negative relationship between political connections and IPO performance can sometimes be confounded by other aspects of CEO characteristics. For example, the notion that CEO political connections cause inefficiency may be due to the appointment of less capable CEOs. From a resource-based view, managerial social connection is a critical social capital (Peng & Luo, 2000) that cannot be separated from other aspects of CEO human capital. Thus, to better tackle this issue, we included several individual-level variables, including CEO education, age, and tenure, to control for CEO human capital. The results of corporate political connections remained positively and significantly related to IPO performance. This suggests that the positive impact of political connections likely overcomes the negative side of government intervention. In this sense, it is more accurate to interpret CEO political connections not as efficiency-enhancing signals but rather as legitimacy-enhancing ones. That being said, given the positive effect of CEO political connections on IPO performance, IPO firms with less competitiveness may be motivated to hire politically connected government officials as CEOs to enhance their IPO proceeds.

In addition, we highlight distinct characteristics of two levels of political connections and provided empirical support for their divergent roles on firm performance. Although extant research recognizes the existence of different levels of political connections (e.g., Faccio, 2006; Hillman et al., 1999), few studies directly test their divergent values in an IPO setting (see Fan et al., 2007, for an exception). Our results show that only CEOs with central political connections have a positive impact on IPO performance. This suggests that the value of a firm’s corporate government connections can vary across levels of connections. This finding also reflects the hierarchical levels of corporate political connections in improving firm performance in emerging economies. Our results thus suggest that scholars should conceptually differentiate levels of political connections, especially when undertaking research in emerging economies in which central and regional governments are undergoing the reallocation of administrative powers.

More important, this study adopts a contingency perspective and identifies the conditions under which different levels of political connections are beneficial to IPO performance. Our theory suggests that depending on the market conditions in which a firm is embedded, certain levels of prominent connections may be more or less beneficial. Xin and Pearce (1996) argued that managerial personal networks are valuable in situations in which formal institutional supports are lacking. Our findings confirm that CEO political connections can act as substitutes for formal institutions, and they further suggest that the value of different levels of CEO political connections varies across institutional environments in IPO firms. In regions with a high degree of market restrictions, the positive effect of CEO central political connections on IPO performance diminishes. In contrast, in regulated industries, CEO central political connections tend to improve IPO performance. Together, these two dimensions of institutional environments—regional market restriction and industry regulation—moderate the benefits associated with political connections. This result suggests that the need for environmental linkages is a function of the levels and types of dependence facing the organization (Boyd, 1990; Pfeffer & Salancik, 1978) in the context of IPO performance in emerging economies. Therefore, our findings provide a deeper understanding of the interplay between levels of political connections and market restrictiveness.

Our results also show that market-restricted regions moderate the effect of CEO central political connections on IPO performance. This reflects the rising conflicts between the central government and the regional ones as economic reform and decentralization take effect in emerging economies (Wu, 2007). Given that regional governments can implement central policies independently and with discretionary power, it is not surprising that central policy is not always effectively enforced at the regional level. Such a phenomenon is more obvious in less developed provinces in China, in which the ideology of feudalism remains strong. Therefore, our findings represent an important addition to extant literature; that is, specific levels of political connections only matter in certain institutional environments.

Furthermore, our work contributes to the emerging literature on sub-national regions (Chan et al., 2010). Emerging economies are characterized by preferential governmental policies toward different regions and subsequently developmental disparity across a country (Wu, 2007). This study extends the idea that substantial differences exist among regions in terms of institutional structures and infrastructures (Oi, 1992; Porter, 1990) by examining the interaction between regional market restrictiveness and corporate political connections. Our findings suggest that regional disparity moderates the impact of key resources on firm performance, thus highlighting the importance of matching strategic resources to regional institutions.

Finally, this study enriches IPO literature by integrating corporate political connections and institutional traits in the setting of IPO, which is an important stage for private firms because a successful IPO not only provides access to external capital for future development but also creates a public market for founders and other shareholders to cash in their wealth in the future. The IPO process is a signal that allows a focal firm to demonstrate its value and disclose its internal information to external investors (Certo et al., 2009). This study builds on signaling theory and suggests that depending on the characteristics of the institutional environment in which a focal firm is embedded, different logics can prevail. Our results suggest that depending on which concern prevails, different levels of corporate political connections will have different signaling values, affecting investor decisions and, thus, IPO performance.

Limitations and future research directions

This study has several limitations, which also provide directions for further research. First, we focused on CEO political connections, a critical form of political capital for IPO firms because of its signaling effects; yet research and practice also report firms’ use of other, more subtle types of venues to build political ties, including current employees or board members being appointed or elected as government officials (Hillman et al., 1999), corporate campaign contributions to federal deputies (Claessens et al., 2008), and friendship ties with current government officials (Peng & Luo, 2000). Further research could examine why firms might use different types of political ties and how to appropriate from these different types of political capitals. A second limitation pertains to the use of archival information to measure CEO political connections. Further research could enhance existing knowledge of corporate political connections by using other methods, such as surveys, to understand firms’ motivations to use political connections in the IPO process. Third, we acknowledge that political connections are only one aspect of CEO social capital. A CEO can bring other human and social capitals to the firm. Thus, further research might benefit by using an upper echelon theory perspective to provide a more comprehensive examination of the role of the CEO in IPO performance. Furthermore, we acknowledge the existence of potential self-selection issues for CEOs with political connections. As we noted previously, politically capable government officials may seek the CEO position of highly competitive firms. In this way, CEO political connections may reflect the competitiveness of the IPO firm, rather than the political capital of the firm. Fourth, although we controlled for underwriter reputation, which is a better signal of IPO firm competitiveness, and did not find a negative effect of CEO tenure on net proceeds in our regressions, further research could employ the Heckman model to tease out the self-selection issues.

Conclusion

In conclusion, although a significant amount of research examines the role of CEO political connections, our study is the first to empirically investigate the contingent value of CEO political connections on IPO performance. We incorporate different levels of political connections and different institutional conditions in emerging economies in this study. We propose and find that CEO political connections with the central government has a more positive effect on IPO performance than CEO political connections with regional governments, particularly when the focal firm operates in a regulated industry or when the firm is located in regions with less market restrictions. We contribute to extant research by providing a better understanding of how CEO political connections are related to firm performance, especially IPO performance. As political capital receives more attention in strategy research, additional studies on the contingent value of CEO political connections would prove particularly useful in advancing existing knowledge of how firms use political capital in business competition.

Notes

Although research has also included implicit political connections as part of corporate political connections, such as familial relationships, personal networks with politicians (Peng & Luo, 2000), and corporate political networking activities (Li & Zhang, 2007), the current study focuses on explicit political connections (i.e., top executives’ prior work experiences in the government). The advantages of focusing on explicit political connections are twofold. First, explicit political connections are more straightforward and objective than informal connections (Hillman, 2005). Second, only explicit political connections are reported in IPO prospectuses. Therefore, only they can serve as prominent signals to public investors about the IPO firm’s political connections.

We thank an anonymous reviewer for this comment.

The results, which are not shown here, are available from the corresponding author on request.

References

Aiken, L. S., & West, S. G. 1991. Multiple regression: Testing and interpreting interactions. Thousand Oaks, CA: Sage.

Anderson, S. C., Beard, T. R., & Bom, J. A. 1995. Initial public offerings: Findings and theories. Boston: Kluwer Academic.

Bain, J. S. 1956. Barriers to new competition. Cambridge: Harvard University Press.

Barker, V. L., & Mueller, G. C. 2002. CEO characteristics and firm R&D spending. Management Science, 48: 782–801.

Baron, D. 2000. Business and its environment, 3rd ed. Upper Saddle River, NJ: Prentice Hall.

Berman, S. L., Wicks, A. C., Kotha, S., & Johns, T. M. 1999. Does stakeholder orientation matter? The relationship between stakeholder management models and firm financial performance. Academy of Management Journal, 42: 488–506.

Boyd, B. 1990. Corporate linkages and organizational environment: A test of the resource dependence model. Strategic Management Journal, 11: 419–430.

Brau, J. C., & Fawcett, S. E. 2006. Initial public offerings: An analysis of theory and practice. Journal of Finance, 61: 399–436.

Carpenter, M. A., Geletkanycz, M. A., & Sanders, W. G. 2004. Upper echelons research revisited: Antecedents, elements, and consequences of top management team composition. Journal of Management, 30: 749–778.

Carter, R. B., Dark, F. H., & Singh, A. K. 1998. Underwriter reputation, initial returns, and the long-run performance of IPO stocks. Journal of Finance, 53: 285–311.

Certo, S. T. 2003. Influencing initial public offering investors with prestige: Signaling with board structures. Academy of Management Review, 28: 432–446.

Certo, S. T., Covin, J. G., Daily, C. M., & Dalton, D. R. 2001. Wealth and the effects of founder management among IPO-stage new ventures. Strategic Management Journal, 22: 641–658.

Certo, S. T., Holcomb, T. R., & Holmes, R. M. 2009. IPO research in management and entrepreneurship: Moving the agenda forward. Journal of Management, 35: 1340–1378.

Chan, C. M., Makino S., & Isobe, T. 2010. Does subnational region matter? Foreign affiliate performance in the United States and China. Strategic Management Journal, 31: 1226–1243.

Chan, K., Wang, J., & Wei, K. C. J. 2004. Underpricing and long-term performance of IPOs in China. Journal of Corporate Finance, 10: 409–430.

Chen, W. 2007. Does the colour of the cat matter? The red hat strategy in China’s private enterprises. Management and Organization Review, 3: 55–80.

Chen, X. P., Li., X., & Liang X. 2011. Why do business leaders pursue political connections in China. Paper presented at the 71st Academy of Management Annual Conference, San Antonio, Texas.

Cheung, Y. L., Jing, L., Rau, P. R., & Stouraitis, A. 2005. Guanxi, political connections, and expropriation: The dark side of state ownership in Chinese listed companies. Working paper, City University of Hong Kong, Hong Kong.

Child, J., & Tse, D. K. 2001. China’s transition and its implications for international business. Journal of International Business Studies, 32: 5–21.

Claessens, S., Feijen, E., & Laeven, L. 2008. Political connections and preferential access to finance: The role of campaign contributions. Journal of Financial Economics, 88: 554–580.

Coate, M. B., Higgins, R. S., & McChesney, F. S. 1990. Bureaucracy and politics in FTC merger challenges. Journal of Law and Economics, 33: 463–482.

Cohen, B. D., & Dean, T. J. 2005. Information asymmetry and shareholder evaluation of IPOs: Top management team legitimacy as a capital market signal. Strategic Management Journal, 26: 683–690.

Dalton, D., Daily, C., Ellstrand, A., & Johnson, J. 1998. Meta-analytic review of board composition, leadership structure, and financial performance. Strategic Management Journal, 19: 269–290.

Devlin, R. A., Grafton, R. Q., & Rowlands, D. 1998. Rights and wrongs: A property rights perspective of Russia’s market reform. Antitrust Bulletin, 43: 275–296.

Dewenter, K. L., & Malatesta, P. H. 2001. State-owned and privately owned firms: An empirical analysis of profitability, leverage, and labor intensity. American Economic Review, 91: 320–334.

Evans, P. 1979. Dependent development. Princeton, NJ: Princeton University Press.

Faccio, M., 2006. Politically connected firms. American Economic Review, 96: 369–386.

Faccio, M. 2010. Differences between politically connected and nonconnected firms: A cross-country analysis. Financial Management, 39: 905–928.

Faccio, M., Masulis, R. W., McConnell, J. J., & Offenberg, M. S., 2006. Political connections and corporate bailouts. Journal of Finance, 61: 2597–2635.

Fan, G., & Wang, X. 2006. NERI index of marketization of China’s provinces. Beijing: Economics Science Press.

Fan, J. P. H., Wong, T. J., & Zhang, T. 2007. Politically connected CEOs, corporate governance, and post-IPO performance of China’s newly partially privatized firms. Journal of Financial Economics, 84: 330–357.

Finkelstein, S., & D’Aveni, R. A. 1994. CEO duality as a double-edged sword: Boards of directors balance entrenchment avoidance and unity of command. Academy of Management Journal, 37: 1079–1108.

Fisman, R., 2001. Estimating the value of political connections. American Economic Review, 91: 1095–1102.

Francis, B. B, Hasan, I., & Sun, X. 2009. Political connections and the process of going public: Evidence from China. Journal of International Money and Finance, 28: 696–719.

Fried, V. H., Bruton, G. D., & Hisrich, R. D. 1998. Strategy and the board of directors in venture capital-backed firms. Journal of Business Venturing, 13: 493–503.

Galaskiewicz, J., & Wasserman, S. 1989. Mimetic processes within an interorganizational field: An empirical test. Administrative Science Quarterly, 34: 454–479.

Ghemawat, P., & Khanna, T. 1998. The nature of diversified business groups: A research design and two case studies. Journal of Industrial Economics, 46: 35–61.

Guillén, M. 2000. Business groups in emerging economies: A resource-based view. Academy of Management Journal, 43(3): 362–380.

Gulati, R., & Higgins, M. C. 2003. Which ties matter when? The contingent effects of interorganizational partnerships on IPO success. Strategic Management Journal, 24: 127–144.

Hellman, J. S., Jones, G., & Kaufmann, D. 2003. Seize the state, seize the day: State capture and influence in transition economies. Journal of Comparative Economics, 31: 751–773.

Higgins, M. C., & Gulati, R. 2006. Stacking the deck: The effects of top management background on investor decision. Strategic Management Journal, 27: 1–25.

Hill, H. 2002. Spatial disparities in developing East Asia: A survey. Asia-Pacific Economic Literature, 16: 10–35.

Hillman, A. J. 2005. Politicians on the board of directors: Do connections affect the bottom lines?. Journal of Management, 31: 464–481.

Hillman, A. J., Cannella, A., & Paetzold, R. 2000. The resource dependence role of corporate directors: Strategic adaptation of board composition in response to environmental change. Journal of Management Studies, 37: 235–256.

Hillman, A. J., Keim, G. D., & Schuler, D. 2004. Corporate political activity: A review and research agenda. Journal of Management, 30: 837–858.

Hillman, A. J., & Wan, W. P. 2005. The determinants of MNE subsidiaries’ political strategies: Evidence of institutional duality. Journal of International Business Studies, 36: 332–340.

Hillman, A. J., Zardkoohi, A., & Bierman, L. 1999. Corporate political strategies and firm performance: Indications of firm specific benefits from personal service in the US government. Strategic Management Journal, 20: 67–81.

Hitt, M. A., & Tyler, B. B. 1991. Strategic decision models: Integrating different perspectives. Strategic Management Journal, 12: 327–351.

Hofmann, D. 1997. An overview of the logic and rationale of hierarchical linear models. Journal of Management, 23: 723–744.

Hong, K. 1997. Regional policy in the Republic of Korea. Regional Studies, 31: 417–434.

Hoskisson, R. E., Eden. L., Lau, C. M., & Wright, M. 2000. Strategies in emerging economies. Academy of Management Journal, 43: 249–267.

Ibbotson, R. G., & Ritter, J. R. 1995. Initial public offerings. In R. A. Jarrow, V. A. Maksimovic & W. T. Ziemba (Eds.). North-Holland handbooks of operations research and management science: 993–1016. Amsterdam: North-Holland.

Keister, L. 2000. Chinese business groups: The structure and impact of interfirm relations during economic development. Oxford: Oxford University Press.

Khanna, T., & Palepu, K. 1997. Why focused strategies may be wrong for emerging markets. Harvard Business Review, 75: 41–51.

Khwaja, A. I., & Mian, A. 2005. Do lenders favor politically connected firms? Rent provision in emerging financial market. Quarterly Journal of Economics, 120: 1371–1411.

Kim M, Ritter J. 1999. Valuing IPOs. Journal of Financial Economics, 53: 409–437.

Kock, C. J., & Guillén, M. 2001. Strategy and structure in developing countries: business groups as an evolutionary response to opportunities for unrelated diversification. Industrial and Corporate Change, 10: 77–113.

Lawless, R. M., Ferris, S. P., & Bacon, B. 1998. Influence of legal liability on corporate financial signaling. Journal of Corporation Law, 23: 209–243.

Lee, S.-H., Bach, S. B., & Baik, Y. S. 2011. The impact of IPOs on the values of directly competing incumbents. Strategic Entrepreneurship Journal, 5: 158–177.

Lester, R. H., Hillman, A., Zardkoohi, A., & Cannella, A. A., Jr. 2008. Former government officials as outside directors: The role of human and social capital. Academy of Management Journal, 51: 999–1013.

Li, H., & Zhang, Y. 2007. The role of managers’ political networking and functional experience in new venture performance: Evidence from China’s transition economy. Strategic Management Journal, 28: 791–804.

Lu, J., & Ma, X. 2008. The contingent value of local partners’ business group affiliation. Academy of Management Journal, 51: 295–314.

Luo, Y. 2001. Determinants of entry in an emerging economy: A multilevel approach. Journal of Management Studies, 38: 443–472.

Luo, Y. 2003. Industrial dynamics and managerial networking in an emerging market: The case of China. Strategic Management Journal, 24: 1315–1327.

Mahmood, I., & Mitchell, W. 2004. Two faces: Effects of business group market share on innovation in emerging economies. Management Science, 50: 1348–1365.

McBain, M. L., & Krause, D. S. 1989. Going public: The impact of insiders’ holdings on the price of initial public offerings. Journal of Business Venturing, 4: 419–428.

Megginson, W. L., & Weiss, K. A. 1991. Venture capitalist certification in initial public offerings. Journal of Finance, 46: 879–903.

Milgrom, P., & Roberts, J. 1986. Price and advertising signals of product quality. Journal of Political Economy, 94: 796–821.

Miller, D., & Shamsie, J. 1996. The resource-based view of the firm in two environments: The Hollywood film studios from 1936 to 1965. Academy of Management Journal, 39: 519–543.

Nee, V. 1992. Organizational dynamics of market transition: Hybrid forms, property rights, and mixed economy in China. Administrative Science Quarterly, 37: 1–27.

Nee, V., & Cao, Y. 2005. Market transition and the firm: Institutional change and income inequality in urban China. Management and Organization Review, 1: 23–56.

Oi, J. C. 1992. Fiscal reform and the economic foundations of local state corporatism in China. World Politics, 45: 99–126.

Pagano, M., Panetta, F., & Zingales, L. 1998. Why do companies go public? An empirical analysis. Journal of Finance, 53: 27–64.

Papadakis, V. M., & Barwise, P. 2002. How much do CEOs and top managers matter in strategic decision-making?. British Journal of Management, 13: 83–95.

Peng, M. W. 2004. Outside directors and firm performance during institutional transitions. Strategic Management Journal, 25: 453–471.

Peng, M. W., & Heath, P. S. 1996. The growth of the firm in planned economies in transition: Institutions, organizations, and strategic choice. Academy of Management Review, 21: 492–528.

Peng, M. W., Lee, S., & Wang, D. 2005. What determines the scope of the firm over time? A focus on institutional relatedness. Academy of Management Review, 30: 622–633.

Peng, M. W., & Luo, Y. 2000. Managerial ties and firm performance in a transition economy: The nature of a micro–macro link. Academy of Management Journal, 43: 486–501.

Peterson, R. S., Smith, D. B., Martorana, P. V., & Owens, P. D. 2003. The impact of chief executive officer personality on top management team dynamics: One mechanism by which leadership affects organizational performance. Journal of Applied Psychology, 88: 795–808.

Pfeffer, J. 1972. Size and composition of corporate boards of directors: The organization and its environment. Administrative Science Quarterly, 17: 218–228.

Pfeffer, J., & Salancik, G. 1978. The external control of organizations: A resource-dependence perspective. New York: Harper & Row.

Porter, M. E. 1990. The competitive advantage of nations. New York: Free Press.

Qian, C., & Li, J. 2010. The contingent value of CEO political connections. Paper presented at the Annual Meeting of the Academy of Management, Montreal, Canada.

Rock, K. 1986. Why new issues are underpriced. Journal of Financial Economics, 15: 187–212.

Sanders, W., & Boivie, S. 2004. Sorting things out: Valuation of new firms in uncertain markets. Strategic Management Journal, 25: 167–186.

Shleifer, A., & Vishny, R., 1994. Politicians and firms. Quarterly Journal of Economics, 109: 995–1025.

Simsek, Z. 2007. CEO tenure and organizational performance: An intervening model. Strategic Management Journal, 28: 653–662.

Snow, C. C., & Hambrick, D. C. 1980. Measuring organizational strategies. Academy of Management Review, 5: 527–538.

Spence A. 1974. Market signaling: Information transfer in hiring and related processes. Cambridge: Harvard University Press.