Abstract

The market for remanufactured products is large and growing rapidly, accelerated by the widespread popularity of internet sales and online auctions. Whereas extant remanufacturing research focuses primarily on such operations management issues in collecting of end-of-life products, remanufacturing technologies, production planning, and inventory control, we consider an operations-marketing interaction issue by identifying the optimal channel structures for marketing new and remanufactured products. Specifically, based on observations from current practice, we consider three channel strategies a dominant manufacturer can adopt: (1) marketing both new and remanufactured products through an independent retailer; (2) marketing the remanufactured products through the independent retailer, while controlling the new product sales by using its own online channel; (3) marketing the remanufactured products through the manufacturer-owned online channel, while selling new products through the independent retailer. Our results show that the manufacturer prefers to differentiate new and remanufactured products by opening a direct online channel, no matter how the system parameters change. However, which type of products (new or remanufactured) the manufacturer should sell through the online channel depends on the cost saving from remanufacturing, the customer’s acceptance of remanufactured products and the online inconvenience cost. Furthermore, this paper shows that, compared with channel strategy I where the manufacturer sells both new and remanufactured products through an independent retailer, this dual channel strategy benefits the end consumers, but might do harm to the retailer and the total supply chain in some situations.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Nowadays, with the popularization of electronic commerce, more and more consumers prefer to purchase products online. According to Forrester Research (March 2012), the total e-commerce sales of Europe in 2011 has reached over £82 billion, and the online shoppers are growing at the rate of 12 %, which will result in £146 billion transaction values of online shopping by the year 2016. The advent of e-commerce has prompted many manufacturers that previously sold their products indirectly through third-party retailers to establish online channels to sell products to the consumers directly. Some well-known examples are Compaq, Hewlett–Packard, IBM, Eastman Kodak, Nike, Mattel, and Apple, among others [31, 39, 41].

Besides, due to rapid innovation and development in science and technology as well as customer behavior in pursuing latest style, the life cycle of many products becomes shorter and shorter, especially for those technology-based products. This trend yields a large number of waste products. If these waste products are not handled well, they will generate the environmental pollution issues and waste lots of resources. Therefore, remanufacturing activities are becoming more and more prevalent in many industries, especially in those international well-known companies such as Apple, Canon, HP, Lenovo and Panasonic [50]. Recent estimates for remanufactured product sales exceed $100 billion per year with consumer markets representing approximately $10 billion worth of sales per year [19]. On the one hand, the government devotes a lot of effort to encouraging enterprises to engage in collecting and remanufacturing. For example, the State Council of China issued “several opinions on speeding up the development of recycling economy” in 2005 and clearly supported the development of remanufacturing [40]. On the other hand, it might be profitable for a firm to engage in remanufacturing, because remanufacturing saves not only a lot of raw materials but also much of energy compared with producing new products [20, 50]. Although research studies on the remanufacturing supply chains have increased noticeably in the past two decades, much of the literature focuses primarily on collecting of end-of-life products, remanufacturing technologies, production planning and inventory control (see, e.g., [14, 17, 37], among many others). To the best of our knowledge, there is little literature addressing the problem of choosing appropriate channel structures for marketing new and remanufactured products.

Traditionally, the manufacturer sells both new and remanufactured products through independent retailers. However, this practice leaves the manufacturer a risk of the retailer’s opportunism behavior to sell the remanufactured products as new ones to the consumers, which might do harm to the manufacturer’s reputation as well as its profitability. A typical example is the case between HP and its dealer, like Hong Hengchang. Please refer to [29] for more details. As a result, many manufacturers try to differentiate new and remanufactured products through different sales channel structures. One option is selling remanufactured products through the manufacturer-owned online channel, while the new products are still sold through the independent retailers. For example, Apple sells refurbished (note that, Apple uses the term “refurbished” instead of remanufactured) products directly through its online store with the same One-Year Limited Warranty a customer can get with the new products [3]. Other examples include Bosch Tools, Canon, Gateway, and Sun [4]. Another option is selling the new products through the manufacturer-owned online channel, while maintaining the remanufactured products sold through the independent retailers. For example, Panasonic sells its new products through its own online store and some traditional retailers, while subcontracts the marketing activity for its remanufactured Toughbook computers to three authorized retailers—Telrepco, Buy Tough, and Rugged Depot [33]. Similar cases also appear in the auto mobile industry [50].

Based on the real-life examples in practice, we develop three channel structures for marketing new and remanufactured products in this paper, namely, (1) marketing both new and remanufactured products through an independent retailer; (2) marketing remanufactured products through the manufacturer’s own online channel, while new products are sold through the retailer; (3) marketing the remanufactured products through the retailer, while controlling the new product sales by using its own online channel. These models allow us to answer the following questions:

-

(i)

which channel structure is the best choice of the dominant manufacturer?

-

(ii)

how do different channel structures affect the retailer, the supply chain efficiency and the end consumers?

-

(iii)

how do the system parameters affect the equilibrium outcomes?

Our analysis leads to the following main results.

First, compared with selling both new and remanufactured products through an independent retailer, the manufacturer is better off by differentiating new and remanufactured products through a dual channel strategy. However, there is no clear dominance among those channel strategies. That is, from the dominant manufacturer’s perspective, the optimal channel structure is of threshold type, mainly depending on the cost saving from remanufacturing, the customer’s acceptance of the remanufactured products and the online inconvenience cost. To be specific, under the lower cost saving case, when the customer’s acceptance of remanufactured products and the online inconvenience cost are not sufficient large, the best choice for the manufacturer is channel strategy II where new products are sold through the manufacturer-owned e-channel. Otherwise, channel structure III becomes the best choice. Under the high cost saving case, we can show that the best choice is channel structure III when the acceptance of remanufactured products is sufficient high but the online inconvenience cost is low. As the online inconvenience cost increases, the superiority of channel structure II over the other two strategies becomes more significant, and becomes the best choice for the manufacturer no matter what the customer’s acceptance of the remanufactured products is.

Second, we can show that the retail prices of both new and remanufactured products will be lower under channel strategy II (III) in comparison with those in channel strategy I. That is, the consumers are better off under a dual channel strategy since they can buy products at lower prices. Furthermore, we get that the retailer can also benefit from the dual channel strategy in some common situations, which is counter-intuitive. Therefore, a dual channel strategy might yield a win–win outcome for all the members involved in a supply chain in some situations. However, our results show that the dual channel strategy might be harmful to the whole supply chain since it cannot enable the supply chain to achieve the highest profit in all situations. Instead, channel strategy I might be the best choice from the perspective of the whole supply chain.

The reminder of the paper is organized as follows. Section 2 reviews the related literature and explains our contributions in more detail. Section 3 describes the key elements of our basic model and introduces notations and assumptions. Section 4 outlines our three models, and conducts a comparison study to report our main findings. Section 5 concludes the paper.

2 Literature review

Our paper relates to the research stream on dual channel management. Among many others, one important stream of previous studies on dual channel management mainly focuses on pricing strategies to alleviate the potential channel conflict (see, e.g., [6, 9, 26, 27, 48], among many others). Other related issues on dual channel management include supply chain coordination (see, e.g., [35, 47]), service competition (see, e.g., [8, 12, 31]), product variety (see, e.g., [28, 34, 43]), disruptions (see, e.g., [25, 38]), among many others. However, these aforementioned studies only consider relevant issues with regard to new products. This paper differs from the existing literature by introducing remanufactured products to the market in addition to new products, and studies the manufacturer’s problem of choosing an appropriate channel strategy to manage new and remanufactured products.

Our work is also closely related to the literature on the remanufacturing. Current studies to this topic mainly focus on collecting of used products from customers, remanufacturing technologies, inventory control and production planning with a given channel structure (see, e.g., [5, 13, 21, 37], among many others). Two steams of remanufacturing literature are very relevant to our paper. The first stream is the relevant studies which focus on the pricing and competitive behaviors between new and remanufactured products. For example, Ferrer and Swaminathan [15] develop a multi-period model in which the manufacturer makes new products in the first period and uses returned cores to offer remanufactured products along with new products in future periods. They characterize the production quantities and prices associated with self-selection in both monopoly and duopoly environments, and explore the effect of various parameters in the Nash equilibrium. However, this paper assumes there is no difference between the new and remanufactured products in terms of customer’s willing-to-pay and prices. Ferrer and Swaminathan [16] extend the model of Ferrer and Swaminathan [15] by considering a situation where the remanufactured product is differentiated from the new one, and characterize the optimal remanufacturing and pricing strategies for a firm in two-period, multi-period and infinite planning horizons respectively. Atasu et al. [4] investigate the problem of whether or not to offer remanufactured products. This research shows that the remanufacturing decision is driven by factors such as competition, cost savings, cannibalization and product life-cycle effects. Wu [42] studies the problem of price and service competition between new and remanufactured products in a supply chain consisting of a traditional manufacturer, a remanufacturer and a retailer. Abbey et al. [2] investigate the optimal pricing of new and remanufactured products using a model of consumer preferences based on extensive experimentation. In contrast to the common wisdom that the new product prices should decrease when remanufactured products enter the market, this paper shows that the optimal price of new product should increase. San Gan [36] develop a model that optimizes the price for new and remanufactured short life-cycle products where demands are time-dependent and price sensitive.

The second stream of remanufacturing literature that mostly related to our paper address the problem of choosing an appropriate channel for marketing new and remanufactured products. However, there are very few studies in this stream. Two exceptions are [40] and [50]. Wang et al. [40] consider situations where the remanufacturer has two options for selling the remanufactured products. One is that the remanufacturer provides the remanufactured products to a manufacturer who only produces new products, and then the new product manufacturer sells both new and remanufactured products to customers. The other option is that the remanufacturer sells the remanufactured products directly to customers. Obviously, the setting in [40] is different from ours since we consider one manufacturer producing both new and remanufactured products and deciding whether or not to open a direct online channel. Yan et al. [50] consider that a manufacturer produces both new and remanufactured products and has two options for marketing their products. One is marketing the remanufactured products directly to the end consumers through its own online channel but wholesaling new products to an independent retailer. The other one is wholesaling new products to an independent retailer but subcontracting the marketing activity of remanufactured products to another independent retailer. In addition to the channel strategies considered in [50], we further consider two possible channel strategies for the manufacturer. One is that the manufacturer can sell both new and remanufactured products through one independent retailer (i.e., channel strategy I in our paper), and the other one is that the manufacturer can sell the remanufactured products through the independent retailer but control the marketing of new products through its own online channel (i.e., channel strategy II in our paper). Besides, the above two studies assume the consumer has no preference between different marketing channels. We relax this assumption and impose an online inconvenience cost to model the preference difference between the retail channel and the online channel. Due to these differences, some new and interesting results and managerial insights are established.

3 Model description and assumptions

Consider a stylized two-echelon supply chain consisting of one manufacturer and one retailer. The manufacturer (a male) is the Stackelberg leader and produces both new and remanufactured products. This implicitly assumes that the manufacturer and the remanufacturer are the same entity. We believe this assumption is appropriate for two reasons. First, many original equipment manufacturers, including Apple, Bosch, Cannon, Hewlett-Packard, Lenovo, Panasonic and Xerox, have now engaged in remanufacturing activities. Second, this assumption has been widely used in previous studies (see, e.g., [ 4, 7, 16, 36, 37, 45, 50], among many others). The manufacturer’s products can be sold through the traditional retail channel or the online channel. Therefore, the manufacturer has the following three options for marketing their products:

-

(1)

Channel strategy I marketing both new and remanufactured products through the traditional retail channel (See Fig. 1a). Under this case, the manufacturer sells the new product at a wholesale price of w n /unit and the remanufactured product at w r /unit to the retailer. The retailer then resells these products to the consumers at p n /unit and p r /unit respectively. The subscript “n” and “r” in the above notations refer to the new products and remanufactured products, respectively.

-

(2)

Channel strategy II marketing the remanufactured products through the retail channel but selling the new products through its own e-channel (See Fig. 1b). Under this case, the manufacturer wholesales the remanufactured products to the retailer at w r /unit, and the retailer then sells them to the end consumers at p r /unit. The manufacturer also sells the new products to the end consumers at a retail price of p n /unit through his own online channel.

-

(3)

Channel strategy III marketing the new products through the retail channel but selling the remanufactured products through its own e-channel (See Fig. 1c). Under this case, the manufacturer sells the new products to the retailer at w n /unit, and the retailer then resells them to the end consumers at p n /unit. The manufacturer also sells the remanufactured products to the end consumers at p r /unit through his own online channel.

In order to develop our model, we make the following assumptions:

Assumption 1

The manufacturer produces the new products at c n /unit, and produces the remanufactured products at c r /unit. We assume c n > c r to ensure that making a remanufactured product is less costly than producing a new one. This assumption is widely accepted in previous research (see, e.g., [16, 37, 51], among many others). In practice, cost reduction is a main reason for many manufacturers to engage in remanufacturing, which provides 30–70 % cost savings compared with producing products with full new components [20, 22]. Without loss of generality, we assume c r = 0, which is in accordance with previous research like [44] and [50].

Assumption 2

At a certain stage of the product life cycle, there are overall Q potential consumers in the retailing market. Consumers are heterogeneous with respect to their willingness to pay for the new products V, which is assumed to be uniformly distributed between 0 and 1. Let β ∈ (0,1) denote the customer’s value discount for the remanufactured products. That is, when a consumer values the new product at V, it values the remanufactured product lower, i.e., βV, where β < 1. This assumption is appropriate reflection of reality. First, the lower willingness-to-pay model reflects that the consumers may feel uncertain about the remanufactured product’s quality, since many firms (like Apple, Cannon, Hewlett Packard, among many others) provide a much shorter warranty for remanufactured products than for the new products (see, e.g., [32, 50]). Second, consumers may believe that the remanufactured products are somehow contaminated or dirty due to prior ownership of the products—a concept embodied in the literature regarding the psychological concept of disgust [1].

Assumption 3

To consider a consumer’s preference between the retail channel and the online channel, we assume the customer incurs a cost of t when purchasing products online. The variable t can be explained from two aspects. First, if the product is purchased from the online channel, typically the consumer will be charged a shipping and handling fee [23, 49]. This is the explicit cost for the consumer, and thus he will take this cost into account when he makes the purchasing decision. Second, the variable t can also be regarded as the reduction of the consumer’s willingness to pay (or reservation value) for the products purchased from the online channel. The consumer often values the products purchased from the online channel less than what purchased from the retail channel. This is because the online channel provides consumers with only a virtual description of the product, which eliminates the use of touch, taste, smell, and often sound from the set of senses used in the pre-purchase evaluation and can cause evaluation mistakes [9]. Even if the product may be returned after a mistaken purchase, the refund is typically only partial, therefore reducing the expectation of consumption value [11]. Furthermore, the consumer will be asked to wait several days for delivery, which further decreases the value of the products sold through the online channel [23]. We capture the decrease in value by the parameter t. That is, when the products are sold through the traditional retail channel, the willingness to pay for the new products (or remanufactured products) is V (or βV). However, when the consumer purchases products from the online channel, the willingness to pay for the new products (or remanufactured products) will be V−t (or βV−t).

Assumption 4

All the supply chain members have access to the same information of all the system parameters. This assumption of information symmetry was widely used in the literature (see, e.g., [24, 37, 46], among many others) to control for inefficiencies and risk-sharing issues resulting from information asymmetry [50].

4 Equilibrium analysis for various distribution channel strategies

In the following subsections, we will first derive the optimal outcomes for each of the three channel strategies, and then conduct a comparative study to identify the manufacturer’s best channel choice under various conditions.

4.1 Channel strategy I

Under this case, both new and remanufactured products are sold through an independent retailer. The decision sequence under this situation is as follows. First, the manufacturer determines the wholesale prices of the new products w n and the remanufactured products w r charged to the retailer. Second, given any (w n ,w r )-values, the independent retailer subsequently determines the optimal retail price of the new products p n and the remanufactured products p r . At last, the consumers in the retail market decide which product to buy via evaluating its corresponding utility. The sequential game is usually solved by using backward induction (see, e.g., [10, 31]). Therefore, we first consider how would a consumer react to any given (p n , p r ) values declared by the retailer. Given assumption 2, a consumer gets a utility of U n = V−p n from the new product and a utility of U r = βV−p r from the remanufactured product. The consumer purchases the new product if U n > 0 and U n > U r . Similarly, the consumer will purchase the remanufactured product if U r > 0 and U n < U r . Therefore, the self-selection demand functions for the new and remanufactured products are given as follows.

Note that, the variables q n and q r in the above equations denote the demand functions (or order quantities) for the new and remanufactured products respectively. They may have the superscript as ‘Y’, where ‘Y’ may be ‘I’ for channel strategy I, “II” for channel strategy II, and “III” for channel strategy III. The functions stated above indicate that the demand for new products increases when their price decreases or when the price of remanufactured products increases, and vice versa. Since the manufacturer would only consider prices that would lead to non-negative demand, we will disregard the situation “p r ≥ βp n ”.

After identifying how consumers select either product, the retailer then determines the optimal retail prices p n and p r to maximize her own profit which can be stated as:

where π Y X denotes the profit for entity “X” under situation “Y”. The subscript “X” may be “M” for the manufacturer, “R” for the retailer, and “C” for the whole channel; and the superscript “Y” denotes the corresponding channel strategy. It is easily shown that the Hessian matrix of Eq. (2) is negative definite due to \( \frac{{\partial^{2} \pi_{R}^{I} }}{{\partial^{2} p_{n} }} = - \frac{2Q}{1 - \beta } < 0,\;\frac{{\partial^{2} \pi_{R}^{I} }}{{\partial^{2} p_{r} }} = - \frac{2Q}{\beta (1 - \beta )} < 0 \), and \(\frac{{\partial^{2} \pi_{R}^{I} }}{{\partial^{2} p_{n} }} \cdot \frac{{\partial^{2} \pi_{R}^{I} }}{{\partial^{2} p_{r} }} - \frac{{\partial^{2} \pi_{R}^{I} }}{{\partial p_{n} \partial p_{R} }} \cdot \frac{{\partial^{2} \pi_{R}^{I} }}{{\partial p_{r} \partial p_{n} }} = \frac{{4Q^{2} }}{\beta (1 - \beta )} > 0 \) for any \( \beta \in (0,1) \), which means Eq. (2) is a jointly concave function with respect to p n and p r . Therefore, solving the first order conditions with respect to p n- and p r gives

The superscript “rf” in Eq. (3) denotes the optimal “r esponse f unction” for the retailer. Obviously, the optimal retail price for new products (remanufactured products) is only related to its respective wholesale price.

At the last step, the dominant manufacturer determines the optimal wholesale prices w n and w r to maximize his own profit by taking the retailer’s optimal response functions into consideration. Therefore, substituting Eq. (3) into Eq. (1) gives the manufacturer’s problem of maximizing his profit as:

Again, we can easily prove that the Hessian matrix of Eq. (4) is negative definite due to \( \frac{{\partial^{2} \pi_{M}^{I} }}{{\partial^{2} w_{n} }} = - \frac{Q}{1 - \beta } < 0,\;\frac{{\partial^{2} \pi_{M}^{I} }}{{\partial^{2} w_{r} }} = - \frac{Q}{\beta (1 - \beta )} < 0,\;\frac{{\partial^{2} \pi_{M}^{I} }}{{\partial^{2} w_{n} }} \cdot \frac{{\partial^{2} \pi_{M}^{I} }}{{\partial^{2} w_{r} }} - \frac{{\partial^{2} \pi_{M}^{I} }}{{\partial w_{n} \partial w_{r} }} \cdot \frac{{\partial^{2} \pi_{M}^{I} }}{{\partial w_{r} \partial w_{n} }} = \frac{{Q^{2} }}{\beta (1 - \beta )} > 0 \) for all \( \beta \in (0,1) \), satisfying the second order condition for a maximum. Solving the first order conditions with respect to w n and w r gives the optimal pricing policies for the manufacturer and the retailer in the following proposition.

Proposition 1

-

(a)

The optimal wholesale prices charged by the manufacturer are

\( w_{n}^{I*} = \frac{{c_{n} + 1}}{2}, \, w_{r}^{I*} = \frac{\beta }{2} \).

-

(b)

The optimal retail prices charged by the retailer are

\( p_{n}^{I*} = \frac{{c_{n} \,+ \,3}}{4}, \, p_{r}^{I*} = \frac{3\beta }{4} \).

The superscript “*” in proposition 1 indicates the optimal solutions. Proposition 1 shows that the optimal equilibrium prices of new products are fully determined by its own cost, and the equilibrium prices of remanufactured products are only relative to the value discount parameter β. Substituting the optimal price decisions into Eqs. (1), (2) and (4) gives the optimal demand quantities and the optimal profits as follows:

Corollary 1

-

(a)

The optimal demand quantities of the new and the remanufactured products are respectively given by

\( q_{n}^{I*} = \frac{Q}{4}\left( {1 - \frac{{c_{n} }}{1 - \beta }} \right), \, q_{r}^{I*} = \frac{{Qc_{n} }}{4(1 - \beta )} \).

-

(b)

The optimal profits of the manufacturer, the retailer and the whole channel are respectively given by

In order to ensure that the demand quantities are non-negative, we have the following assumption:

This assumption indicates that the consumer’s acceptance of remanufactured products cannot be too high (i.e., β < 1−c n ); otherwise, the potential consumers will be not willing to buy new products (i.e., q I* n < 0).

From the expressions in Proposition 1 and Corollary 1, the impact of the cost saving (i.e., c n ) and the value discount parameter (i.e., β) on the equilibrium outcomes can be derived in the following Corollary.

Corollary 2

-

(a)

∂w I* n /∂c n > 0, ∂w I* r /∂β > 0, ∂p I* n /∂c n > 0 and ∂p I* r /∂β > 0;

-

(b)

∂q I* n /∂c n < 0, ∂q I* n /∂β < 0, ∂q I* r /∂c n > 0, and ∂q I* r /∂β > 0;

-

(c)

∂π I* R /∂c n < 0, ∂π I* R /∂β > 0;

-

(d)

∂π I* M /∂c n < 0, ∂π I* M /∂β > 0;

-

(e)

∂π I* C /∂c n < 0, ∂π I* C /∂β > 0.

From Corollary 2, we can get the following managerial insights: (i) the optimal equilibrium prices of new products will increase as the production cost c n increases. As a result, the demand quantity for new products decreases as the product cost increases. The optimal equilibrium prices of remanufactured products increases as the value discount parameter β increases. A higher value discount parameter means that the consumers perceive the two types of products more substitutable, which leads to a higher demand quantity for remanufactured products, and thus a lower demand quantity for new products. (ii) Corollary (c) to (e) indicates that all the players as well as the whole supply chain will be hurt by a higher product cost, but will benefit from a higher β. Therefore, if the companies want to enhance their profitability, they have two effective ways. One is to reduce the production cost as much as possible by investing in process innovation (see, e.g., [18]). Another method is that the manufacturer as well as the retailer should devote more effort to persuading the customers that there is little even no difference between new and remanufactured products by advertising or providing longer warranty for remanufactured products.

Corollary 3

-

(a)

w I* n > w I* r , and p I* n > p I* r ;

-

(b)

q I* n > q I* r when β ∈ (0,1−2c n ); q I* n < q I* r when β ∈ (1−2c n ,1−c n ).

Corollary 3(a) indicates that the manufacturer will set a lower wholesale price to the retailer due to the lower acceptance of the remanufactured products. This will in turn induce a lower retail price, which is consistent with previous literature. As reported in [30], the prices of remanufactured products are typically 30–40 % lower than those of new products.

Corollary 3(b) shows that the demand quantity for new products is larger than the demand quantity for remanufactured products when β is not too large (i.e., β < 1−2c n ); otherwise, the demand quantity for remanufactured products will exceed that for new products. This can be understood as follows. As β increases, the consumers’ perception of the difference between new and remanufactured products diminishes, and thus the remanufactured products become more attractive due to the price advantage shown in Corollary 3(a).

4.2 Channel strategy II

Under this case, the new products are sold through the manufacturer’s own online channel, while the remanufactured products are sold through an independent retailer. Following the same logic in Sect. 4.1, we can derive the demand quantity for either product type as:

In contrast to channel strategy I, the manufacturer sells new products directly to the customers through his own online channel, and thus the retailer’s problem at this situation can be formulated as

The manufacturer’s problem of optimizing his profit can be stated as:

By solving this classical Stackelberg game, we can obtain the optimal pricing policies for the manufacturer and the retailer in the following proposition.

Proposition 2

-

(a)

Under channel strategy II, the equilibrium prices charged by the manufacturer are:

$$ w_{r}^{II*} = \frac{\beta }{2}, \, p_{n}^{II*} = \frac{{1 + c_{n} - t}}{2}. $$ -

(b)

Under channel strategy II, the equilibrium price charged by the retailer is

$$ p_{r}^{II*} = \frac{{\beta (c_{n} + t + 2)}}{4}. $$

With Proposition 2, we can derive the equilibrium demand quantities and profits summarized in the following corollary.

Corollary 4

-

(a)

The optimal demand quantities of new and remanufactured products are

$$ q_{n}^{II*} = \frac{{Q\left[ {\beta (t + c_{n} - 2) + 2(1 - t - c{}_{n})} \right]}}{4(1 - \beta )}, \, q_{r}^{II*} = \frac{{Q(t + c_{n} )}}{4(1 - \beta )}. $$ -

(b)

The optimal profits of the manufacturer and the retailer are

$$ \begin{aligned} \pi_{M}^{II*} &= \frac{{Q\left\{ {\beta \left[ { - c_{n}^{2} + 2(2 - t)c_{n} + 4t - t^{2} - 2} \right] + \left[ {2c_{n}^{2} + 4(t - 1)c_{n} + 2 + 2t^{2} - 4t} \right]} \right\}}}{8(1 - \beta )}, \hfill \\ \pi_{R}^{II*} &= \frac{{Q\beta (c_{n} + t)^{2} }}{16(1 - \beta )}, \, \pi_{C}^{II*} = \pi_{M}^{II*} + \pi_{R}^{II*} \hfill \\ \end{aligned} $$

To facilitate comparison of the interior solutions to three channel strategies, as in [37] and [50], we impose the following assumption.

From Proposition 2 and Corollary 4, the impact of system parameters on the equilibrium outcomes is summarized in the following corollary.

Corollary 5

-

(a)

∂w II* r /∂β > 0;

-

(b)

∂p II* n /∂c n > 0 , ∂p II* n /∂t < 0; ∂p II* r /∂c n > 0, ∂p II* r /∂β > 0, and ∂p II* r /∂t > 0;

-

(c)

∂q II* n /∂c n < 0, ∂q II* n /∂β < 0, and ∂q II* n /∂t < 0;

-

(d)

∂q II* r /∂c n > 0, ∂q II* r /∂β > 0, and ∂q II* r /∂t > 0;

-

(e)

∂π II* R /∂c n > 0, ∂π II* R /∂β > 0, and ∂π II* R /∂t > 0;

-

(f)

∂π II* M /∂c n < 0, ∂π II* M /∂β > 0, and ∂π II* M /∂t < 0;

-

(g)

∂π II* C /∂β > 0 for all β∈(0,1); ∂π II* C /∂c n < 0 and ∂π II* C /∂t < 0 if β < 4(1−t−c n )/(4−t−c n ); otherwise, ∂π II* C /∂c n > 0 and ∂π II* C /∂t > 0.

Corollary 5(a) shows that, the wholesale price of remanufactured products increases as β increases, which is consistent with that in channel strategy I. Since new product is sold through the manufacturer’s online channel under this case, Corollary 5(b) shows that its retail price is only relative to the production cost c n and online cost t, but not influenced by the consumer’s acceptance of remanufactured products. Furthermore, the retail price of new products increases (decreases) as the production cost (online cost) increases. For remanufactured products, Corollary 5(b) shows that the retail price in traditional channel depends on not only the value discount parameter, but also the parameters relative to new products sold in online channel, which is different from that in channel strategy I. Besides, we know that the retail price of remanufactured products increases as the online cost t increases. This is because some customers will switch from the online channel to the traditional channel when online inconvenience cost t increases, which gives the retailer some leeway to increase its retail price.

Corollary 5(e) shows that the retailer’s profit always increases with the production cost c n , the value discount parameter β, and online cost t. This is because the demand of new products will decrease while the demand of remanufactured products will increase as these parameters increase, which are stated in Corollary 5(c) and 5(d). A higher demand together with a higher retail price for remanufactured products leads to a higher profit for the retailer.

Corollary 5(f) shows that the manufacturer’s profit decreases with product cost c n and online inconvenience cost t, but increases with the value discount parameter β. This can be explained as follows. Actually, the manufacturer’s revenue comes from two streams: one is the new product sales in online channel and the other one is the remanufactured product sales in traditional channel. All other things being kept constant, when only the production cost c n (or online inconvenience cost t) increases, the loss from the decreased demand of new products exceeds the gain from the increased demand of remanufactured products, and this leads to the manufacturer’s profit decreasing with c n (or t). In contrast, the gain from the increased demand of remanufactured products exceeds the loss from the decreased demand of new products as β increases, which results in the manufacturer’s profit increasing with β.

The whole channel’s profit is a combination of the manufacturer and the retailer’s profits. Therefore, Corollary 5(g) shows that the whole channel’s profit increases with β in the whole interval since both the manufacturer and the retailer’s profits increase with β. However, the total channel’s profit is not monotonic with c n and t. Specifically, when β is relative small (i.e., β < 4(1−t−c n )/(4−t−c n )), the wholesale channel’s profit decreases with c n (or t). This is because the whole channel’s profit mainly comes from the new product sales under this situation. As the production cost c n (online inconvenience cost t) increases, the revenue from remanufactured products will increase but the revenue from new products will decrease. The gain from the remanufactured products exceeds the loss from the new products, which leads to the phenomenon that the total channel’s profit decreases with c n (or t). However, when β is relative large (i.e., β > 4(1−t−c n )/(4−t−c n )), the whole channel’s profit mainly comes from the remanufactured products. As the production cost c n or online inconvenience cost t increases, more customers will choose to buy remanufactured products from the traditional channel, which leads to a higher revenue from the remanufactured products. Therefore, the total channel’s profit will increase as c n (t) increases.

Given the expressions in proposition 2 and the conditions in Eq. (9), we have the following proposition.

Corollary 6

-

(a)

p II* n > p II* r when β < [2(1 + c n −t)]/(2 + t + c n ); otherwise, p II* n < p II* r ;

-

(b)

p II* n > p II* r when t < [(2−β)(1 + c n )−β]/(2 + β); otherwise, p II* n < p II* r .

-

(c)

q II* n > q II* r when β < (2−3t−3c n )/(2−t−c n ); otherwise, q II* n < q II* r ;

-

(d)

q II* n > q II* r when t < [2−3c n −(2−c n )β]/(3−β); otherwise, q II* n < q II* r .

Corollary 6(a, b) implies that when the new and remanufactured products are differentiated by different distribution channels, the retail price of the remanufactured products is not necessarily lower than the price of the new products. On the contrary, when the customer’s value discount β or the online inconvenience cost t exceeds a certain threshold, the retailer will charge a higher retail price for the remanufactured products. There are two potential reasons for this phenomenon. First, the double marginalization problem in the traditional retail channel makes the cost of selling remanufactured products for the retailer is higher than that for the manufacturer to sell new products. The retailer transfers this cost to the consumers by charging a higher retail price. Second, the higher the β-value (t value) is, the more (lower) the customer values the remanufactured (new) products. This also gives the retailer some space to increase the retail price of remanufactured products. Although this result is somehow counter-intuitive, it is not entirely unrealistic. However, as reported in [4], there could be some consumers who value the remanufactured products more because of its environmental friendliness. Interestingly, a higher retail price of the remanufactured products does not lead to a lower demand. In contrast, Corollary 6(c, d) show that, the demand for remanufactured products is larger than the demand for new products when β (or t) exceeds a certain threshold.

4.3 Channel strategy III

Under this case, the remanufactured products are sold directly through the manufacturer’s own online channel, while the new products are sold through an independent retailer. Similarly, we can derive the demand for either product type as follows.

Under this situation, the manufacturer sells remanufactured products directly to customers, and therefore the profit function of the retailer is shown as

The manufacturer’s profit-maximizing problem can then be stated as:

By means of the method similar to that of the above two models, the two players’ optimal pricing decisions under this channel strategy are derived as shown in the following proposition.

Proposition 3

-

(a)

Under channel strategy III, the equilibrium prices charged by the manufacturer are

$$ w_{n}^{III*} = \frac{{1 + c_{n} }}{2}, \, p_{r}^{III*} = \frac{\beta - t}{2}. $$ -

(b)

Under channel strategy III, the equilibrium retail price charged by the retailer is

$$ p_{n}^{III*} = \frac{{c_{n} + t - \beta + 3}}{4}. $$

With Proposition 3, we can find the optimal demand quantities and profits of both supply chain members. These results are summarized in Corollary 6.

Corollary 7

-

(a)

The optimal demand quantities of new and remanufactured products are

$$ q_{n}^{III*} = \frac{{Q(1 - \beta - c_{n} + t)}}{4(1 - \beta )}, \, q_{r}^{III*} = \frac{{Q\left[ { - \beta^{2} + (1 + t + c_{n} )\beta - 2t} \right]}}{4(1 - \beta )\beta }. $$ -

(b)

The optimal profits of the manufacturer and the retailer under channel strategy III are

$$ \begin{aligned} \pi_{M}^{III*} &= \frac{{Q\left\{ { - \beta^{3} + 2(c_{n} + t)\beta^{2} + 2t^{2} - \left[ {t^{2} + 2(c_{n} + 1)t - (c_{n} - 1)^{2} } \right]\beta } \right\}}}{8\beta (1 - \beta )}, \hfill \\ \pi_{R}^{III*} &= \frac{{Q ( 1 { - }\beta { + }t - c_{n} )^{2} }}{16(1 - \beta )}, \, \pi_{C}^{III*} = \pi_{M}^{III*} + \pi_{R}^{III*} \hfill \\ \end{aligned} $$

In order to ensure “q III* n > 0” and “q III* r > 0”, we make the following assumption:

where \( \beta_{2} = {{\left( {1 + t + c_{n} - \sqrt {(1 + t + c_{n} )^{2} - 8t} } \right)} \mathord{\left/ {\vphantom {{\left( {1 + t + c_{n} - \sqrt {(1 + t + c_{n} )^{2} - 8t} } \right)} 2}} \right. \kern-0pt} 2} \), \( \beta_{3} = {{\left( {1 + t + c_{n} + \sqrt {(1 + t + c_{n} )^{2} - 8t} } \right)} \mathord{\left/ {\vphantom {{\left( {1 + t + c_{n} + \sqrt {(1 + t + c_{n} )^{2} - 8t} } \right)} 2}} \right. \kern-0pt} 2} \), and \( t_{2} = {{\left( { - \beta^{2} + (1 + c_{n} )\beta } \right)} \mathord{\left/ {\vphantom {{\left( { - \beta^{2} + (1 + c_{n} )\beta } \right)} {(2 - \beta )}}} \right. \kern-0pt} {(2 - \beta )}}. \)

Based on Proposition 3 and Corollary 7, we investigate the sensitivity analysis of some useful parameters on the optimal decision variables as well as optimal profits of the players involved and the whole supply chain. These results are summarized in the following corollary.

Corollary 8

-

(a)

∂w III* n /∂c n > 0;

-

(b)

∂p III* n /∂c n > 0, ∂p III* n /∂β < 0, ∂p III* n /∂t > 0; ∂p III* r /∂β > 0, and ∂p III* r /∂t < 0;

-

(c)

∂q III* n /∂c n < 0, ∂q III* n /∂t > 0; ∂q III* n /∂β < 0 if t < c n , and ∂q III* n /∂β > 0 if t > c n ;

-

(d)

∂q III* r /∂c n > 0, ∂q III* r /∂t < 0; when t < c n , ∂q III* r /∂β > 0; when t > c n , ∂q III* r /∂β > 0 if β < \( {{\left[ {2t - \sqrt {2t(t - c_{n} )} } \right]} \mathord{\left/ {\vphantom {{\left[ {2t - \sqrt {2t(t - c_{n} )} } \right]} {(t + c_{n} )}}} \right. \kern-0pt} {(t + c_{n} )}} \) or β > \( {{\left[ {2t + \sqrt {2t(t - c_{n} )} } \right]} \mathord{\left/ {\vphantom {{\left[ {2t + \sqrt {2t(t - c_{n} )} } \right]} {(t + c_{n} )}}} \right. \kern-0pt} {(t + c_{n} )}} \) , otherwise, ∂q III* r /∂β < 0.

-

(e)

∂π III* R /∂c n < 0, ∂π III* R /∂β < 0, and ∂π III* R /∂t > 0;

-

(f)

∂π III* M /∂c n < 0, and ∂π III* M /∂t < 0;

-

(g)

∂π III* C /∂c n < 0.

Note that, remanufactured products are now sold directly to the customers through the manufacturer’s own online channel. Therefore, as shown in Corollary 8(b), the retail price of remanufactured products decreases while the retail price of new products increases as the online inconvenience cost t increases, which in turn leads to a higher demand of new products but a lower demand of remanufactured products. Besides, when the production cost c n increases, the manufacturer will charge a higher wholesale price to the retailer, which in turn results in a higher retail price of new products to the consumers. As a result, the demand of new products decreases while the demand of remanufactured products increases with c n as stated in Corollaries 8(c, d). We can also get from Corollary 8(b) that a higher β always enables the manufacturer to charge a higher retail price for remanufactured products. Due to the cannibalization effect, the retailer has to set a lower retail price for new products. However, a higher β does not necessarily lead to a higher demand but sometime even a lower demand for remanufactured products as shown in Corollary 8(d). This is because there are two effects, the perceived value of remanufactured products and the online inconvenience cost, affecting the customer’s decision of whether or not to buy remanufactured products. When the online inconvenience cost is sufficient small (i.e., t < c n ), the former effect dominates the latter, and thus the demand of remanufactured products increases with β. Due to the existence of cannibalization effect, the demand of new products decreases with β under this situation as shown in Corollary 8(c). Otherwise, the latter effect becomes the dominant one when the customer’s acceptance of remanufactured products is relatively-medium, and thus we get that the demand of remanufactured products will decrease as β increases under this situation.

Corollaries 8(e–g) show that the profits of the manufacturer, the retailer, as well as the whole supply chain all decrease in c n . Therefore, the supply chain should keep the production cost as low as possible. Besides, we can get that the manufacturer will be hurt but the retailer will benefit as the online inconvenience cost t increases. The only ambiguity in this model is whether the manufacturer’s profit rise or fall when β increases. On the one hand he obtains higher revenue from the remanufactured products. On the other hand, the revenue from new products will be lower. It is analytically unclear which of these two effects is more important.

Comparing the corresponding decisions for new and remanufactured products in Proposition 3 and Corollary 7, we have the following corollary.

Corollary 9

-

(a)

p III* n > p III* r for all β or t values.

-

(b)

q III* n > q III* r when β < t/c n or t > βc n ; otherwise, q III* n < q III* r .

Corollary 9(a) indicates that the manufacturer will set a lower retail price for the remanufactured product in comparison with the retail price of the new products set by the retailer, no matter how the system parameters vary. However, a lower retail price does not necessarily yield a higher demand for the remanufactured products. In fact, as shown in Corollary 9(b), only when the customer’s acceptance of the remanufactured products (the online inconvenience cost) is sufficient high (low), the demand for the remanufactured products will exceed the demand for new products.

4.4 Comparative study of three channel strategies

Based on the optimal solutions given in propositions 1, 3, and 5, we will derive some interesting insights into different channel strategies. First of all, it is of interest to understand how channel strategies affect the optimal decisions of each player. The following proposition summarizes the comparison results for the optimal pricing decisions.

Proposition 4

-

(a)

w I* n = w III* n , and w I* r = w II* r ;

-

(b)

p I* n > p III* n > p II* n ;

-

(c)

p I* r > p II* r > p III* r .

Proposition 4(a) means that when the manufacturer opens a direct online channel to sell the remanufactured products (new products), he does not change the transaction term to the retailer. That is, the wholesale prices for the new products (remanufactured products) in channel I and channel III (channel II) are equal. This is because the manufacturer’s direct online channel will compete with the retailer’s channel. In order to avoid reducing the retailer’s profit unduly, the manufacturer sets an equal wholesale price.

Proposition 4(b) shows that the retail price of the new products is lowest in channel II, and highest in channel I. This is because new products are sold by the manufacturer through its own online channel in channel II. The unit cost of selling new products for the manufacturer is lower than the unit selling cost for the retailer, thus the manufacturer sets a lowest retail price for the new products. In channel III, the retailer selling new products faces fiercer competition from remanufactured products sold online. In order to compete with the manufacturer’s online channel, the retailer sets a lower retail price in channel III compared with the retail price in channel I where there is no such competition. Following the same reason, we can observe in Proposition 4(c) that the retail price for the remanufactured products is lowest in channel III where remanufactured products are sold by the manufacturer through its own online channel, and is highest in channel I where there is no channel competition. Both proposition 4(b, c) indicate that the manufacturer’s direct channel is beneficial to the end consumers since the consumers can buy products at lower price.

Having compared the optimal price decisions of the three channel strategies, we now turn our attention to the equilibrium demand quantities. The following proposition provides the comparison results for the optimal quantities of new and remanufactured products in three channel strategies.

Proposition 5

-

(a)

if β < β 4 , q II* n > q III* n > q I* n ; if β 4 < β < β 5 , q III* n > q II* n > q I* n ; if β > β 5 , q III* n > q I* n > q II* n , where β 4 = (1-c n -3t)/(1−t−c n ), and β 5 = (1−c n −2t)/(1−t−c n ).

-

(b)

if “t > 3−2√2” or “t < 3−2√2 and β < β 6 ” or “t < 3−2√2 and β > β 7 ”, q III* r < q I* r < q II* r ; if t < 1/8 and β 8 < β < β 9 , q I* r < q II* r < q III* r ; otherwise, q I* r < q III* r < q II* r ; where β 6 = [1 + t−√(t 2−6t + 1)]/2, β 7 = [1 + t + √(t 2−6t + 1)]/2, β 8 = [1−√(1−8t)]/2, β 9 = [1 + √(1−8t)]/2.

Proposition 5 shows that the sales quantities for new (remanufactured) products in channel I can never be the highest. Instead, we can show that, in most cases (i.e., β < β 5 for new products, and β 6 < β < β 7 for remanufactured products), the sales quantities for new (remanufactured) products in channel I become the lowest. This indicates that opening a direct channel not only can effectively avoid the retailer’s opportunism behavior of selling the remanufactured products as new, but also can be served as an effective method to expand the company’s market share. Together with the fact that the retail prices for both new and remanufactured products are the highest in channel I shown in proposition 4, we know that the consumers fare worst under the channel strategy I in most cases. This also can partially explain why some companies (like Apple and Hewlett–Packard) try to differentiate new and remanufactured products by using different channel strategies.

Now we turn to compare the retailer’s profit under three channel structures. With some algebra, we have the following proposition.

Proposition 6

-

(a)

π I* R > π II* R if β < β 10 ; otherwise, π I* R < π II* R , where β 10 = \( {{(1 - c_{n} )^{2} } \mathord{\left/ {\vphantom {{(1 - c_{n} )^{2} } {\left[ {c_{n}^{2} - 2(1 - t)c_{n} + 1 + t^{2} } \right]}}} \right. \kern-0pt} {\left[ {c_{n}^{2} - 2(1 - t)c_{n} + 1 + t^{2} } \right]}} \);

-

(b)

π I* R < π III* R if c n < 1/2 and t > \( {1 \mathord{\left/ {\vphantom {1 {\left[ {4(1 - 2c_{n} )} \right]}}} \right. \kern-0pt} {\left[ {4(1 - 2c_{n} )} \right]}} \) ; otherwise, π I* R > π III* R if β 11 < β < β 12 , and π I* R < π III* R if β < β 11 or β > β 12 , where β 11 = \( {{\left( {1 + 2t - \sqrt {1 - 4t(1 - 2c_{n} )} } \right)} \mathord{\left/ {\vphantom {{\left( {1 + 2t - \sqrt {1 - 4t(1 - 2c_{n} )} } \right)} 2}} \right. \kern-0pt} 2} \) , β 12 = \( {{\left( {1 + 2t + \sqrt {1 - 4t(1 - 2c_{n} )} } \right)} \mathord{\left/ {\vphantom {{\left( {1 + 2t + \sqrt {1 - 4t(1 - 2c_{n} )} } \right)} 2}} \right. \kern-0pt} 2} \);

-

(c)

π II* R > π III* R if β∈(β 13 ,1); otherwise, we have π II* R < π III* R , where

$$ \beta_{13} = {{\left[ {c_{n}^{2} - 2(1 - t)c_{n} + t^{2} + 2t + 2 - (t + c_{n} )\sqrt {(2 - c_{n} )^{2} + t^{2} + 2t(2 + c_{n} )} } \right]} \mathord{\left/ {\vphantom {{\left[ {c_{n}^{2} - 2(1 - t)c_{n} + t^{2} + 2t + 2 - (t + c_{n} )\sqrt {(2 - c_{n} )^{2} + t^{2} + 2t(2 + c_{n} )} } \right]} 2}} \right. \kern-0pt} 2} $$

It is intuitively expected that the retailer might prefer channel strategy I, because there is horizontal competition when the manufacturer adopts a dual channel strategy. The horizontal competition yields cannibalization effect, which might result in lower profit for the retailer in comparison with that in channel strategy I. However, Proposition 6 shows that it is not always the case. To be specific, we can show that “π I* R < π II* R and π I* R < π III* R ” holds when “\( c_{n} < 1/2,t > {1 \mathord{\left/ {\vphantom {1 {\left[ {4(1 - 2c_{n} )} \right]}}} \right. \kern-0pt} {\left[ {4(1 - 2c_{n} )} \right]}} \) and β > β 10” or “c n > 1/2, and β > max(β 10, β 12)” or “c n > 1/2, and β 10 < β < β 11”. That is, in some cases, controlling the sales of both new and remanufactured products might yield the lowest profit for the retailer. This result is important and somewhat counter-intuitive. As shown in previous studies such as [48], one issue that the manufacturer concerns when he decides whether or not to open a direct channel is that the online channel might reduce the retailer’s profit which gives rise to “channel conflict.” However, our results show that the retailer actually can benefit from the dual channel strategy in some common situations. This might be due to the fact that the whole market share is expanded when new and remanufactured products are differentiated by selling through different channels as shown in Proposition 5.

Although we can analytically compare the price decisions, the demand quantities and the retailer’s profits in different channel strategies, we fail to do that for the equilibrium profits for the manufacturer and the whole channel. In order to facilitate comparison, we first consider a special case with t = 0; i.e., a customer shows no preference between the two marketing channels. Based on this assumption, we have the following proposition.

Proposition 7

-

(a)

π I* M < π II* M , π I* M < π III* M , π II* M > π III* M if β < (1−c n ) 2 and π II* M < π III* M if β > (1−c n ) 2;

-

(b)

π I* C < π II* C , π I* C < π III* C , π II* C > π III* C if β < (1-c n ) 2 and π II* C < π III* C if β > (1−c n ) 2;

Proposition 7 shows that the profits of the manufacturer and the whole supply chain are always the lowest in channel strategy I, which indicates that the manufacturer as well as the whole supply chain always benefits from a dual channel strategy. This is because the double marginalization problem is partially alleviated when the manufacturer opens a direct online channel, which results in lower retail prices and thus higher sales quantities for both new and remanufactured products in comparison with those in channel strategy I. A higher overall demand further increases the manufacturer as well as the whole channel’s profit. Since the manufacturer is better off under the dual channel strategy, a nature question arose here is that which product, new or remanufactured products, the manufacturer should sell in its own online channel. Proposition 7(a) shows that when the customer’s acceptance of remanufactured products is sufficient high (i.e., β > (1−c n )2), the manufacturer prefers to sell remanufactured products rather than new products. Otherwise, the manufacturer is better off by selling new products. This is because as the β-value increases, the difference between the new and remanufactured products perceived by the consumers decreases and thus the competition between new and remanufactured products becomes fiercer, which in turn leads to the cannibalization effect intensified, causing the manufacturer to derive less revenue from new products. As a result, channel strategy III becomes the manufacturer’s best choice.

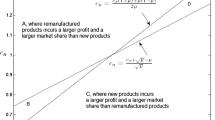

In order to examine the impact of the online inconvenience cost t on the profits of the manufacturer and the whole supply chain, we turn to the numerical investigation through Maple programs using the parameter setting as follows: without loss of generality, we fix “Q” at 1, and consider two levels of production cost, namely, c n = 0.1 and 0.5, to denote the lower and higher cost saving cases. This is in accordance with previous literature, such as [4, 16, 44], among many others. We then vary the β and t values to present the impact of these two factors on the profits of the manufacturer and the whole supply chain by considering the constraints given in Eqs. (5), (9) and (13). Figure 2 depicts the variation of the relevant optimal profits with respect to β. Note that, “—” represents the corresponding profits for channel strategy I; “…” is for channel strategy II; and “– – –” is for channel strategy III. According to Fig. 2, we have the following observations.

-

(1)

The manufacturer’s profit in channel strategy I can never be the highest one no matter how the system parameters change. That is, the manufacturer always has the incentive to differentiate new and remanufactured products by opening a direct online channel.

-

(2)

Consider first the lower cost saving case (i.e., c n = 0.1). Figures 2a, c show that, as the online inconvenience cost t increases, the superiority of channel strategy III (i.e., selling remanufactured products through the manufacturer’s own online channel) over other two channel strategies first decreases and then increases, and becomes the highest one at last when t is sufficient large (i.e., t = 0.2). Therefore, we can conclude that the best channel choice of the manufacturer is channel strategy II when both β and t are not sufficient large; otherwise, channel strategy III becomes the best choice for the manufacturer.

-

(3)

Now consider the higher cost saving case. In contrast to the lower cost saving case, Figs. 2d, e, f show that the superiority (inferiority) of channel strategy II (channel strategy III) over other two channel strategies becomes more significant as the online inconvenience cost t increases. When t approaches its upper limit, we can get that the manufacturer achieves its highest (lowest) profit under channel strategy II (channel strategy III) no matter what the customer’s acceptance of remanufactured products is. Therefore, the manufacturer’s best channel choice under this situation is channel strategy III when β is sufficient high and t is sufficient low; otherwise, channel strategy II becomes the best choice for the manufacturer.

It is also of interest to understand how system parameters affect the total channel’s profit. Figure 3 depicts the variation of the whole supply chain’s profit with β under different (c n , t)-combinations. Based on these figures, we have the following observations.

-

(1)

Under the lower cost saving case, the total channel profit under channel strategy I can never be the highest. In other words, a dual channel strategy (channel strategy II or channel strategy III) enhances the total channel’s profit, which leaves a potential to achieve a win–win outcome.

-

(2)

Under the higher cost saving case, we can show that the dual channel strategy cannot enable the supply chain to achieve the highest profit any more. Instead, the total channel’s profit under channel strategy I might become the highest one as the online inconvenience cost t increases. This result is also somewhat counter-intuitive. As we know, the vertical competition between the manufacturer and the retailer induces a double marginalization problem. When the manufacturer opens a direct sales channel, the double marginalization problem might be alleviated to some extent. Therefore, it is expected to yield a higher profit for the whole supply chain in comparison with channel strategy I. However, our results show that this might be not the case when the online inconvenience cost is taken into consideration. This underlines the necessity of considering the customer’s preference difference between different marketing channels when the manufacturer decides which channel strategy to adopt.

5 Conclusions and discussions

Remanufacturing has been attracting more and more attention both from industry and academia in recent years due to government legislations and increasing awareness of its potential profitability. Researchers have devoted a lot of effort so far to developing various models to investigate the relevant issues regarding to remanufacturing activities, such as collecting of the end-of-life products, production planning, and inventory control. Different from the existing literature, this paper considers how to develop appropriate channel strategy for a manufacturer to market its products. To be specific, the manufacturer faces the channel decision making problem on whether to establish an online channel, if yes, which type of products should be sold through its own online channel. Motivated by the observed industrial practice, we develop three channel structures and investigate the performance of each channel structure from all the supply chain members’ perspective, including the manufacturer, the retailer, the consumer and the whole supply chain. Our results show that the manufacturer as well as the end consumers prefers a dual channel strategy no matter how the system parameters change, but often at the expense of the retailer’s loss. However, which type of products the manufacturer should sell through the online channel depends on the cost saving from remanufacturing, the customer’s acceptance of remanufactured products and the online inconvenience cost. Therefore, our results underline the necessity for the manufacturer to evaluate the performance of each channel under various combinations of system parameters before the channel decision is made.

To summarize, the main contribution of this paper is to shed some lights on investigating how different channel structures for marketing new and remanufactured products impact each player’s profitability in a supply chain. Our research can thus help the manager to identify the most beneficial channel strategy under various environments. However, this paper suffers from some limitations.

First, we only consider three possible channel strategies for the manufacturer to handle its products. In reality, it is possible for the manufacturer to sell the new products through some retailers while selling the remanufactured products through other authorized independent retailers. We label this channel strategy as channel strategy IV. We have done the formulation and computational work for this channel strategy. Our preliminary results show that, when the online inconvenience cost is sufficiently low, the manufacturer always prefers a dual channel strategy. However, as the online inconvenience cost increases, the superiority of the dual channel strategy over channel strategy IV diminishes. When the online inconvenience cost is sufficiently high (e.g., t = 0.2), channel strategy IV becomes the best choice for the manufacturer. These results are not presented in the main paper, but can be supplied to interested readers by the authors separately. Besides, the manufacturer can sell both new and remanufactured products through the manufacturer’s own online channel. Unfortunately, the model in this paper cannot handle this situation because the consumer will never choose the online channel to buy the new products, and thus this channel strategy will degenerate to channel strategy III. It would be interesting to compare this channel strategy with the other three channel strategies considered in the current paper by using a different model such as the ‘nested-logit’ model to capture the individual customer’s purchasing decision (see more details in [34]).

Second, we use an online inconvenience cost to model the difference between online and offline channels. However, the difference between online and offline channels might be in other forms. For example, the retailer can provide various pre-sales services, such as making customers experience the product for free or guiding customer purchases with sales personnel, to compete with the manufacturer’s online channel.

Last, we only consider a one-period model where the origins of remanufactured product supply are ignored. In reality, the remanufactured products are reusable returns from earlier sales and thus the supply of remanufactured products might be constrained by the collection yield defined as the fraction of new products made in period i that is available for remanufacturing in period i + 1 in Ferrer and Swaminathan [16]. Therefore, a possible direction for future research is to consider multi-period or infinity-period models.

References

Abbey, J. D., Blackburn, J. D., & Guide Jr, V. D. R. (2015). Optimal pricing for new and remanufactured products. Journal of Operations Management, 36, 130–146.

Abbey, J. D., Meloy, M. G., Daniel, V., Guide, R, Jr, & Atalay, S. (2015). Remanufactured products in closed-loop supply chains for consumer goods. Production and Operations Management, 24(3), 488–503.

Apple. (2014). Welcome to apple store. Retrieved July 2015, http://store.apple.com/us/browse/home/specialdeals

Atasu, A., Sarvary, M., & Van Wassenhove, L. N. (2008). Remanufacturing as a marketing strategy. Management Science, 54(10), 1731–1746.

Cai, X., Lai, M., Li, X., Li, Y., & Wu, X. (2014). Optimal acquisition and production policy in a hybrid manufacturing/remanufacturing system with core acquisition at different quality levels. European Journal of Operational Research, 233(2), 374–382.

Cattani, K., Gilland, W., Heese, H. S., & Swaminathan, J. (2006). Boiling frogs: Pricing for a manufacturer adding a direct channel that competes with the traditional channel. Production and Operations Management, 15(1), 40–56.

Chen, J. M., & Chang, C. I. (2013). Dynamic pricing for new and remanufactured products in a closed-loop supply chain. International Journal of Production Economics, 146(1), 153–160.

Chen, K. Y., Kaya, M., & Özer, Ö. (2008). Dual sales channel management with service competition. Manufacturing & Service Operations Research, 10(4), 654–675.

Chiang, W. K., Chhajed, D., & Hess, J. D. (2003). Direct marketing, indirect profits: A strategic analysis of dual-channel supply-chain design. Management Science, 49(1), 1–20.

Choi, S. C. (1991). Price competition in a channel structure with a common retailer. Marketing Science, 10(4), 271–296.

Chu, W., Gerstner, E., & Hess, J. (1998). Dissatisfaction management with opportunistic consumers. Journal of Service Research, 1(2), 140–155.

Dan, B., Xu, G., & Liu, C. (2012). Pricing policies in a dual-channel supply chain with retail services. International Journal of Production Economics, 139(1), 312–320.

Debo, L. G., Toktay, L. B., & Wassenhove, L. N. V. (2006). Joint life-cycle dynamics of new and remanufactured products. Production and Operations Management, 15(4), 498–513.

Ferguson, M. E., & Toktay, L. B. (2006). The effect of competition on recovery strategies. Production and Operations Management, 15(3), 351–368.

Ferrer, G., & Swaminathan, J. M. (2006). Managing new and remanufactured products. Management Science, 52(1), 15–26.

Ferrer, G., & Swaminathan, J. M. (2010). Managing new and differentiated remanufactured products. European Journal of Operational Research, 203(2), 370–379.

Fleischmann, M., Bloemhof-Ruwaard, J. M., Dekker, R., van der Laan, E., van Nunen, J. A. E. E., & Van Wassenhove, L. N. (1997). Quantitative models for reverse logistics: A review. European Journal of Operational Research, 103(1), 1–17.

Gilbert, S. M., & Cvsa, V. (2003). Strategic commitment to price to stimulate downstream innovation in a supply chain. European Journal of Operational Research, 150, 617–639.

Giuntini, R., Advisor 2012. Personal communication. The Remanufacturing Institute.

Giuntini, R., & Gaudette, K. (2003). Remanufacturing: The next great opportunity for boosting US productivity. Business Horizons, 46(6), 41–48.

Gong, X., & Chao, X. (2013). Technical note-optimal control policy for capacitated inventory systems with remanufacturing. Operations Research, 61(3), 603–611.

Gray, C., & Charter, M. (2007). Remanufacturing and product design: Designing for the 7th generation. Farnham: The Center for Sustainable Design University College for the Creative Arts.

Hess, J., Gerstner, E., & Chu, W. (1996). Controlling product returns in direct marketing. Marketing Letters, 7(4), 307–317.

Hua, G. W., Wang, S. Y., & Cheng, T. C. E. (2010). Price and lead time decisions in dual-channel supply chains. European Journal of Operational Research, 205(1), 113–126.

Huang, S., Yang, C., & Zhang, X. (2012). Pricing and production decisions in a dual-channel supply chains with demand disruptions. Computers & Industrial Engineering, 62(1), 70–83.

Khouja, M., Park, S., & Cai, G. (2010). Channel selection and pricing in the presence of retail-captive consumers. International Journal of Production Economics, 125(1), 84–95.

Kurata, H., & Bonifield, C. M. (2007). How customization of pricing and item availability information can improve e-commerce performance. Journal of Revenue and Pricing Management, 5(4), 305–314.

Kurata, H., Yao, D. Q., & Liu, J. J. (2007). Pricing policies under direct vs. indirect channel competition and national vs. store brand competition. European Journal of Operational Research, 180(1), 262–281.

Lin, J. (2010). Former employees expose the scandal about Hong Hengchang sells refurbished HP computers as new (in Chinese). Southern Metropolis Daily, Guangzhou GA, 16, 1–2.

Mitra, S., & Webster, S. (2008). Competition in remanufacturing and the effects of government subsidies. International Journal of Production Economics, 111(2), 287–298.

Mukhopadhyay, S. K., Zhu, X., & Yue, X. (2008). Optimal contract design for mixed channels under information asymmetry. Production and Operations Management, 17(6), 641–650.

Ovchinnikov, A. (2011). Revenue and cost management for remanufactured products. Production and Operations Management, 20(6), 824–840.

Panasonic. (2014). Panasonic buy refurbished. Retrieved July 2015, http://www.panasonic.com/business/toughbook/buy-refurbished-toughbook.asp

Rodríguez, B., & Aydın, G. (2015). Pricing and assortment decisions for a manufacturer selling through dual channels. European Journal of Operational Research, 242(3), 901–909.

Ryan, J. K., Sun, D., & Zhao, X. (2013). Coordinating a supply chain with a manufacturer-owned online channel: A dual channel model under price competition. IEEE Transactions on Engineering Management, 60(2), 247–259.

San Gan, S., Pujawan, I. N., & Widodo, B. (2015). Pricing decision model for new and remanufactured short-life cycle products with time dependent demand. Operations Research Perspectives, 2, 1–12.

Savaskan, R. C., Bhattacharya, S., & Van Wassenhove, L. N. (2004). Closed-loop supply chain models with product remanufacturing. Management Science, 50(2), 239–252.

Soleimani, F., Khamseh, A. A., & Naderi, B. (2014). Optimal decisions in a dual-channel supply chain under simultaneous demand and production cost disruptions. Annals of Operations Research,. doi:10.1007/s10479-014-1675-6.

Tsay, A. A., & Agrawal, N. (2004). Channel conflict and coordination in the ecommerce age. Production and Operations Management, 13(1), 93–110.

Wang, K., Zhao, Y., Cheng, Y. H., & Choi, T. M. (2014). Cooperation or competition? Channel choice for a remanufacturing fashion supply chain with government subsidy. Sustainability, 6(10), 7292–7310.

Wilder, C. (1999). HP’s online push. Information Week, May 31.

Wu, C. H. (2012). Price and service competition between new and remanufactured products in a two-echelon supply chain. International Journal of Production Economics, 140(1), 496–507.

Xiao, T., Choi, T. M., & Cheng, T. C. E. (2014). Product variety and channel structure strategy for a retailer-Stackelberg supply chain. European Journal of Operational Research, 233(1), 114–124.

Xiong, Y., Yan, W., Fernandes, K., Xiong, Z. K., & Guo, N. (2012). “Bricks vs. Clicks”: The impact of manufacturer encroachment with a dealer leasing and selling of durable goods. European Journal of Operational Research, 217(1), 75–83.

Xiong, Y., Zhou, Y., Li, G., Chan, H. K., & Xiong, Z. (2013). Don’t forget your supplier when remanufacturing. European Journal of Operational Research, 230(1), 15–25.

Xu, H., Liu, Z. Z., & Zhang, S. H. (2012). A strategic analysis of dual channel supply chain design with price and delivery lead time considerations. International Journal of Production Economics, 139(2), 654–663.

Xu, G., Dan, B., Zhang, X., & Liu, C. (2014). Coordinating a dual-channel supply chain with risk-averse under a two-way revenue sharing contract. International Journal of Production Economics, 147, 171–179.

Yan, R. (2008). Profit sharing and firm performance in the manufacturer-retailer dual-channel supply chain. Electronic Commerce Research, 8(3), 155–172.

Yan, R., & Yeh, R. (2009). Consumer’s online purchase cost and firm profits in a dual-channel competitive market. Marketing Intelligence & Planning, 27(5), 698–713.

Yan, W., Xiong, Y., Xiong, Z. K., & Guo, N. (2015). Bricks vs. clicks: Which is better for marketing remanufactured products? European Journal of Operational Research, 242(2), 434–444.

Zhou, Y., Xiong, Y., Li, G., Xiong, Z., & Beck, M. (2013). The bright side of manufacturing-remanufacturing conflict in a decentralized closed-loop supply chain. International Journal of Production Research, 51(9), 2639–2651.

Acknowledgments

The authors would like to thank the anonymous referees whose relevant suggestions have contributed to improve the paper. This research is supported by the National Natural Science Foundation of China (NSFC) Projects No. 71301113, 71271030, 71471125 and 71432002, and the China Postdoctoral Science Foundation 2015M580469.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Wang, ZB., Wang, YY. & Wang, JC. Optimal distribution channel strategy for new and remanufactured products. Electron Commer Res 16, 269–295 (2016). https://doi.org/10.1007/s10660-016-9225-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10660-016-9225-8