Abstract

The present paper examines the Mergers and Acquisitions’ (M&As’) effects on the European banking efficiency levels based on a sample of 43 listed commercial banks in eight countries (Portugal, Italy, Ireland, Greece, Spain, Germany, France and Finland). We applied a Data Envelopment Analysis (DEA) in two groups of countries and conducted a second-stage analysis under two different models adjusted for credit-risk factors. This is the first time that DEA, an effective nonparametric method for evaluating efficiency, has been applied in the exploration of the European banking sector M&As that occurred during a crisis period characterized by uncertainty and inconvenient circumstances that influenced performance. The results imply significant effects of the capital adequacy ratio and non-performing loans on DEA scores, and demonstrate the past effects on their performance. Moreover, the results reveal that M&As negatively affect the efficiency levels in both “strong” and “weak” banking systems, whereas technical efficiency levels are positively affected by the growth perspective of the origin countries, regardless of whether banks are involved in one or more M&As. The M&As’ inability to improve the financial stability of the banking system during the examined crisis period of 2007–2015 led to an examination of the merging banks’ concentration levels, before and after the M&A strategy. The results revealed a positive merger effect, only when a M&A takes place under specific levels of market concentrations (i.e., when competition increases).

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

During the last decade, the European Banking Industry was shocked by several turbulent events, the most significant of which was Private Sector Involvement (PSI), i.e., firm recapitalizations and Mergers and Acquisitions (M&As). Concerning the latter, the outcome of M&As is uncertain, since they comprise complex strategies that do not always yield desirable results in terms of the bidder’s performance.

In the present study, we use the second-stage approach of Data Envelopment Analysis (DEA), the most effective nonparametric method for evaluating efficiency to explore the effects of M&As on bank technical efficiency and to answer the question of whether the M&As that took place during the financial crisis were a means of efficiency enhancement or were mandatory reformations intended to bail out banks (Montgomery et al. 2014; Lamb and Tee 2012). Our sample consists of all listed commercial banks in Portugal, Italy, Ireland, Greece, Spain, Germany, France and Finland over the period 2007–2015, which covers the years in which the crisis unfolded in the Eurozone area.

To discuss returns to scale and the scale efficiency of the merged institutions, we estimate efficiency under constant returns to scale (CRS). In addition, we follow the approach in which results are compared based on different two-stage, semi-parametric models of production. A cross-sectional panel data set that covers banking and environmental factors is examined, based on the approach of Huber/White, the variance–covariance robustness method of Tobit regression and the approach of two algorithms, bias-correction on efficiency scores, introduced by Simar and Wilson (2007).

To test the effects of M&As, we rely on a second-stage methodology that takes into account the factors of capital adequacy, credit risk and general economic environment through a number of banking and environmental variables, as well as two sets of dummy variables and captures both the short-term and long-term effects of M&As on efficiency and the bidder bank’s participation in more than one M&A during a year. To test the M&As’ effects in different external environments, we also include a dummy variable for “weak” and “strong” countries (Garden and Ralston 1999).

Our study contributes to prior literature in the following manner. While DEA methodology and Simar and Wilson (2007) algorithms have become a driving force of efficiency analysis and have been used with numerous applications, in various fields of economics, these popular but technically involved estimators have not yet been applied in the exploration of European banking sector M&As, specifically those occurring during a financial crisis period.

Overcoming the weaknesses of the Tobit and truncated censored regression models, the paper provides evidence on whether M&As are a resolution mechanism that improves efficiency levels and provides economies of scale benefits or leads banks to a weakened risk and performance profile. As covered by Simar and Wilson (2007), the conventional two-step approaches are inappropriate for regressing on Decision Making Unit (DMU) characteristics, since they lack of well-defined data generating mechanisms. Due to this issue, the censored regression models are not appropriate; as DEA generates complex patterns of correlation between estimated efficiency scores, misleading inferences may be extracted based on the use of such two-step approaches. In our study, we address these issues by implementing the algorithms that Simar and Wilson (2007) proposed for the correction of standard errors and bias correction on efficiency scores. Nevertheless, the results of a naive, censored and conventional truncated regression on DMU characteristics are included in this study’s appendix.

The present study offers evidence on the relationships between M&A strategies that change market structure and banking performance, and in the context of competition levels, this study explains and predicts the relation between M&A strategies and banking efficiency. Nevertheless, no study has applied the above methodological approach to examine the effect of bank M&As on efficiency, taking into consideration the effect of the repeated M&A strategies as preparatory actions, both in the short and long term (Fatemi et al. 2017). For the DEA efficiency scores’ computation and the determination of the DMU efficiency dependence on several characteristics, the two-method approach we implement is based on a two-stage approach and on the algorithmic process of Simar and Wilson (2007).

The remainder of the paper is set as follows. Section 2 presents the literature review. Section 3 presents the methodological steps covered on this study. Section 4 discusses the data samples used. Section 5 presents the metrics of the empirical analysis and reports the results. Section 6 concludes the findings.

2 Literature review

Ouenniche and Carrales (2018) present the main steps of a two-stage and three-stage analysis and deduce that by suggesting that some efficiency drivers should be discarded when they should not, performing CCR and BCC models might result in regression-based feedback. Therefore, they proposed SBM-based metrics to measure pure technical efficiency and scale efficiency. To overcome the interdependence problem of DEA two-stage models, Bou-Hamad et al. (2017) proposed an integrated DEA with a boosted Generalized Least Mixed Method (GLMM) approach applied on a sample of banks in MENA countries to investigate the bank and country level factors that can affect and predict bank efficiency. In their attempt to focus on the possible risks behind a second-stage analysis, Fethi and Pasiouras (2010) highlight Simar and Wilson (2007) conclusions, which criticized all models used in a second-stage analysis, suggesting that a Tobit regression yields biased and inconsistent estimations and that, in some cases, it can generate a misleading estimation.

In addition, Chortareas et al. (2011, 2012) examine the levels of efficiency in 22 European countries during 2000–2008 using both accounting ratios and DEA. They applied truncated regressions and generalized linear models accompanied with robustness tests. Their results reveal that the more strict the capital requirements and supervision are, the better the efficiency levels, especially in the higher-quality countries’ institutions. Pasiouras et al. (2018) examine the impact of regulation requirements on the banks profit efficiency, and the results indicate a negative relation.

Note that some recent studies have used DEA and the Simar and Wilson (2007) truncated estimator with bootstrapped confidence intervals to examine the determinants of bank efficiency. Typically, Delis and Papanikolaou (2009) examine the effect of bank-specific industry and macroeconomic factors on bank efficiency. DeYoung et al. (2009) provided a review covering over 150 studies of recent, financial institution M&A literature; taking into account both geographic and product diversification via mergers, they summarize the results of these studies.

Dı́az et al. (2004), Humphrey and Vale (2004), Kapopoulos and Siokis (2005), Campa and Hernando (2006), Fritsch (2007), Altunbaş and Marqués (2008), and Hagendorff and Keasey (2009) argue that the impact of mergers on bank performance is positive, resulting in either higher levels of efficiency or profits.

Using a step-by-step approach, Tziogkidis et al. (2018) examined the effects of the Greek banks’ productivity levels. To analyze the statistical significance of productivity levels due to repeated institutional reformations and deregulations, they proposed a different bootstrap DEA method. To measure the levels of productivity change, Tziogkidis et al. (2018) used the Global Malmquist Index (GMI), which was estimated under an input-oriented DEA model and assumed CRS for the examined sample. The results indicated that the enhancement of productivity was related to the reduction of the banks’ inputs, while on the other hand, declines in improvement are related to declines in securities and in net loans.

Kosmidou and Zopounidis (2008) conclude that in a competitive environment, primarily, the big banks survive, but that small banks continue their operations through the specialization of their activities. Cybo-Ottone and Murgia (2000), conclude that neither bidders, nor target banks ameliorated their efficiency levels due to mergers. Valverde et al. (2003), Halkos and Salamouris (2004), Rezitis (2006), Behr and Heid (2011), Liargovas and Repousis (2011), and Montgomery et al. (2014) conclude that these consolidations had no serious effects on cost efficiency.

Dı́az et al. (2004) and Campa and Hernando (2006) stress that at least 7 years are required to perceive the effects on cost efficiencies. Halkos and Salamouris (2004) and Rezitis (2006) note that it is necessary to study an M&A over long periods in order to draw more reliable conclusions. Similarly, Wu et al. (2011) present a merger dynamic DEA model to gauge the pre-merger firms and post-merger firms in multi-period situation and conclude that there are significant gains in the bank branches’ mergers. Certainly, the M&As’ effects on efficiency depend on the level of credit risk that the bidder bank can withstand, as this risk can be approached by loan loss provisions, equity or non-performing loans (Simper et al. 2017).

3 Methodology

We use the BCC input-oriented DEA model, which emphasizes the minimum resources required by a bank (Banker et al. 1984). Through the proposed BCC input-oriented model, an optimal solution (θ, λ, s + , s −) will be performed according to the following equation:

where θ is the technical efficiency score, λ is a vector assigned to the individual productive units, and s+ and s− are the output and input slacks.

Moreover, we separate the technical efficiency into pure and scale technical efficiency.Footnote 1 In so doing, we use the CCR input-oriented model (Charnes et al. 1978) in order to calculate the relevant ratio of scale efficiency (θi).

To validate the DEA results, the input data (xm) of all examined banks are proportionally scaled using a randomly generated scale factor θi/τm,b for replication b (Simar and Wilson 1998). Employing the same method, the technical efficiency score θi,b is recomputed using the revised data. The experiment is iterated 1000 times. The 5th and 95th percentiles of the 1000 observations provide the confidence limits (Hadad et al. 2012; Casu and Molyneux 2003).

Three different two-stage semi-parametric models are used to capture the variation of technical efficiency scores and to regress the technical efficiency of the first stage on different environmental and banking factors (Pasiouras 2007; Casu and Molyneux 2003). Specifically, we follow the approach of Simar and Wilson (2007), and for the regression analysis for the DEA scores, we compare the results of the naive censored regression, the conventional truncated regression, the Simar and Wilson (2007) 1st algorithm that corrects the standard errors and the 2nd algorithm; however, bias-correction is used on the efficiency scores (Fernandes et al. 2018).Footnote 2 Through the two-step approach, it is possible to conduct some tests on the significance of each environmental or banking factor and to study the conjunction effect of these variables on efficiency.Footnote 3

The major justification for the above methodological structure is to examine whether other macroeconomic and internal environmental factors of the analyzed banking industry affect the efficiency of the examined samples (such as their concentration levels, the banking leverage, the market share, and the NPLs-non performing loans). Choosing the algorithms of Simar and Wilson (2007) enhanced the final results, since biased estimations on the estimators were diminished. Finally, the separation of two different regression models, into the basic and the credit risk model, was used in order to examine the effects of several factors on the efficiency scores; this examination considered the behavior of M&As under different periodical frames and in reference to dummy-variables covering the distinction of two country samples (weak and strong), the amount of the samples’ non-performing loans, the level of banking industry concentration and the examined industries’ operation under regulated institutional frameworks denoted by an antitrust and control environment.

Lovell et al. (1995) proposed the Tobit regression as a method that takes into consideration censored values for the technical efficiency variable. However, Simar and Wilson (2007) have shown that the Tobit regression alone yields biased estimators and that a bootstrapped truncated regression should be applied instead.Footnote 4

A common problem is that the announcement of a takeover or merger affects a bank’s internal environment for at least one period prior to the announcement and for some periods following the announcement (Dı́az et al. 2004). At the same time, we attempt to capture the effect of more than one consolidation strategy within the same period and augment our models with an additional set of dummy variables capturing the existence of more than one merger or acquisition strategy (one, two, or more consolidation strategies) within the current period; this is described by the following two models:

-

Basic model

-

Risk model

where GDP is the growth of the gross domestic product in a country (expressed as a percentage change per capital), BL is the country’s multiplier ratio between the financial assets of the banking sector and their equity,Footnote 5 and MS is the market share of each bank and is calculated by total assets. TCR is the bank’s total capital ratio, NPL is the ratio of non-performing loans to gross loans in an examined country, and BNPL is the natural logarithm of the amount of bank non-performing loans.Footnote 6 The \( D_{k,t} \) variable is a set of dummy variables that captures both the upfront changes and short-term and long-term effects on bank efficiency. The index k = 2,…,4 denotes three different dummies for the effects of an M&A strategy in a mid-term horizon; these effects are explained in the section below. Finally, DDl,t is a set of dummy variables that capture the effect of the repeated M&A strategies from the same bank for 1 year and are explained in the section below. The index l = 1,2 indicates whether a DMU is in more than one strategy.

Moreover, DHHI is a dummy variable that tests the application of HHI test levels set by the European Commission and is used to examine the expected impact of the merger on the relevant markets. More specifically, we focus on the impact of a post-merger HHI that is between 1000–2000 with a delta below 250, in agreement with the relevant FED regulation under which, a merger can take place effectively only if the value of the HHI is smaller than 1800 units before the merger and will be increased by less than 200 units after the merger strategy. We also include a dummy for “weak” and “strong” countries (DC) to avoid regressing separately on three sub-samples and to enhance the robustness (all sample countries, “weak” countries and “strong” countries sub-sample). The DC dummy variable takes the value 1 if the examined bank belongs to “strong” country and equals 0 otherwise, enabling us to assess the effect of M&As under different external environments. Finally, i refers to the cross-section dimension of the balanced data sample, and t refers to the period dimension: i takes values from 1 to 387, and t from 2007 to 2015.

In terms of methodology used, we have created the DHHI variable in order to include the regulation of the European Commission for competition rules in reference to the examination of the efficiency levels of the sample banking systems. Based on the high levels of the M&A related concentration that appear in the European Banking Industry, we decided to analyze the potential relation between the banks’ efficiency levels and the levels of concentration, taking into account the international activity of the examined banks (Abbsoglu et al. 2007).

For this purpose, the DHHI index is the most appropriate measure, as it is widely used in the US Department of Justice and the Federal Reserve in order to examine the effects of the M&As on the competition levels of the banking industry (Valverde et al. 2003). Accordingly, this index is highly indicative when used for the analysis of horizontal M&As, which seem to specifically affect banking concentration levels; considering horizontal M&As in the context of the components of economic theory, ceteris paribus, the concentration in a specific banking system is an important factor of the industry’s structure and severely affects the competition levels (Rhoades 1993b). As the competition increases either due to the new banks’ entrance in the industry or due to the creation of a more viable local competition, the incumbent banks respond by increasing their level of cost efficiency (Evanoff and Ors 2002).

Our primary concern in estimating models 7 and 8, is to evaluate whether there are significant shifts in the efficiency level of the sample banks resulting from the announcement of the participation in an M&A strategy related to the banks’ capital adequacy and credit risk. This is tested with the D1 dummy included in models 7 and 8 and is based on the assumption that the first signs of an M&A strategy are visible a year before the announcement of an M&A, either from a bank’s credit risk levels or from its capital inadequacy. In this way, we consider the existence of M&A momentum.

The preparation during the period prior to the merger announcement is of vital importance. During this period, a bank should have begun the process of integration, making key leadership decisions, and developing a structure and timetable for the completion of the process. The structure of the new bank, including the new management team structure responsible for the completion of the M&A, is determined before the announcement. Moreover, the risks before the M&A are mainly related to the pricing of the acquired company. Thus, we want to take into consideration the real aspects of decision-making within banks.

Using the interaction terms \( D_{1} TCR_{t} \) and \( D_{1} BNPL_{t} \), we shed light on the effects of capital adequacy and the credit risk of the bidder banks. Therefore, when the coefficient associated with the D1 dummy variable takes a value of 1, it represents the unique effect of only the total capital ratio and non-performing loans on bidder banks.

Moreover, if the coefficient ak (k = 2, 3, 4) is found to be significantly different from zero, then the announcement of an M&A significantly affects the efficiency of the sample banks in the mid-term and long-term period. Finally, if ml (l = 1, 2) is found to be significantly different from zero, then we verify whether the repeated involvement of a bidder bank in a merger or acquisition affects the efficiency of the institution.

4 Sample data

4.1 Examined sample

The empirical analysis is based on a sample of active, listed commercial banks in Portugal, Ireland, Italy, Greece, Spain, Germany, France, and Finland and covers the period 2007–2015. More specifically, we use a balanced panel dataset (Orbis–Bureau van Dijk database). Any data not contained in the database (e.g., the number of employees) were collected manually from consolidated annual reports of the sample banks, while the required environmental data were extracted from the Eurostat, OECD, and World Bank databases.

We excluded from the dataset all banks that had an inadequate number of observationsFootnote 7 and concluded with a panel set of 387 firm-year observations for 43 listed commercial banking institutions.

The selection of the above countries allows for the examination of whether M&A strategies likely have different aims, incentives and effects across southern and northern Eurozone commercial banks (growth or bailout reasons) (Mirzaei and Moore 2014). We are interested in how M&As have different effects on efficiency in “strong” and “weak” banking systems. We consider Portugal, Ireland, Italy, Greece and Spain in our sample as “weak” banking systems. Although Ireland and Spain have been relieved from tight supervision and austerity programs, they are still considered to be countries in crisis, albeit one of reduced intensity. The other three weak economies of Portugal, Greece and Spain are grouped together due to high national budget deficits relative to GDP, and high, or rising, government debt levels.

In terms of the financial crisis period selection, it seems that the banks’ strategic movements represent ways of reaction to overall investment fear risks; these reaction ways in turn lead to the necessity of M&A activities, as a means of reducing the risk of withdrawal for future funding programs. In addition, after 2015, the dependency on and the continuation of M&As decrease to more minimum levels, since until 2015, there were banks that performed more than 1 M&A within an annual examination period.

On the other hand, on the funding side, there existed an extensive wholesale funding dependence, which may have exposed banks to excessive risks if there had been a sudden withdrawal of funding in the wholesale funding market, which was the case during the crisis. In the short term, a reduction in domestic credit, particularly in smaller banks, may present significant risks to the banks, but in the long-term, a large body of research on the above indicates that an M&A strategy leads to higher levels of efficiency (Fethi and Pasiouras 2010).

On the other hand, we consider Germany, France and Finland as “strong” banking systems based on a relevant publication of the World Economic Forum (2016). Martin (2016) states that Finland is included in the list of the 14 countries with the safest banking systems in the world, because Finish cooperative banks and savings banks bear a small level of risk.Footnote 8 According to Micu and Micu (2016), the core drivers of economic growth are Germany and France, but the banking system in Finland gained the award as the “safest” banking system in 2016, as the majority of transactions took place with plastic money, confirming the general trust in all savings in the banking system (Martin 2016).

An important issue for choosing to separate the initial sample of banks into a “strong” and “weak” sub-sample of banking industries relied on the fact that the continued diminishing of bank profitability observed in specific countries of the south seems to be related with the effects of the amount of cyclical and structural factors. Further on, the key cyclical effect is related to the difficulties in enhancing the banks’ revenue levels in an environment characterized by low nominal growth percentages and low interest rates, which in turn yielded relatively flat rate curves. Therefore, the net interest income of the examined “weak” countries decreased in the period of 2011–2015, because the compression of margins was only one part offsetting the increased credit growth levels, keeping them at moderate levels.

Finally, as signs of a steady paced economic recovery became evident, the decreased profitability levels due to cyclical factors continued. In both “strong” and “weak” countries, there seemed to be structural and institutional challenges that needed to be faced. Among them, the large amount of NPLs, which gained momentum since 2008, created a negative cost efficiency and excess capacity levels in the examined banks (Waddock and Graves 2006).

4.2 Analysis of examined variables

4.2.1 DEA inputs and outputs

Following the input and output choices of Pasiouras (2007), the input variables in this study are the fixed assets, the deposits, and short-term funding, as well as the number of employees and the loan loss provisions. The output variables are the loans and other earning assets of each bank.

Table 1 presents the summary statistics of the DEA inputs-outputs and other variables, such as the number of employees and the ratio of the return on equity. The loan loss provisions variable denotes a bank’s credit risk exposure, which likely affects the technical efficiency scores, as it captures the possibility of customer defaults. The higher the credit risk exposure is, the higher the expenses set aside as an allowance for bad loans. The number of employees is a measure of banking reformations, which have a significant impact on technical efficiency. More specifically, it is assumed that technical efficiency can be enhanced by reducing the personnel and administration costs or by other organizational changes, such as an increase in ATMs (Apergis and Rezitis 2004).

4.2.2 Second-stage variables

Table 2 presents the number of M&As that took place in the examined Eurozone commercial banking sectors. The relevant dates were collected manually from Orbis’ database field of M&As’ News.

The second stage requires the use of some macroeconomic and banking factors that could express the effects of the financial crisis (Dietrich and Wanzenried 2011). The total assets variable is assumed to capture the differences in efficiency owing to different size. In models, we use the market share, calculated as a ratio of total assets, in order to scale the variables and to enhance likely differences between variables. Halkos and Salamouris (2004) are among those who point out the positive relationship between size and efficiency. Wheelock and Wilson (1995) examine the hypothesis of “too big to fail”, according to which the larger banks are possibly more efficient, as they can take advantage of economies of scale and can hire skilled and professional managers.

For a further examination of the banks market share, the HHI index was included as a concentration measure of each sector’s competition level. The market share refers to the individual bank-level share and is calculated by taking the total assets of all listed and unlisted active commercial banks in the sample. Our choice of the HHI index is due to its statistical significance as a competition measure. It is calculated as the sum of the squares of the weights for all banks. Demsetz (1973) and Peltzman (1977) argue that high levels of bank effectiveness produce higher concentration levels. Hence, an efficient bank likely not only increases its shareholder value or reduces prices but also increases its size and acquires market power (European Commission 2014).

The HHI index was included to measure the impact of mergers on concentrations levels within the marketplace. According to the US Department of Justice, a merger is valid if HHI is smaller than 1800 units before the merger and is increased by less than 200 units after the merger. If these guidelines are violated, the banking sector will be negatively affected by upcoming mergers; hence, competition will decrease. Since we deal with European banks, we propose a DHHI factor, which is adapted to European HHI thresholds (1000 ≤ HHI ≤ 2000 and delta HHI change ≤ 200) and significantly captures differences in the efficiency variability of the total banks’ sample versus the weak banks’ sample (European Commission 2014).

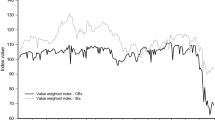

Our approach applies this hypothesis to the Eurozone banking system by considering that M&A strategies preserve market balance. Hence, Fig. 1 presents the average concentration HHI index results, which seem to reflect that “stronger” industries have better results than those in countries in crisis. Though market concentration is increased at the Eurozone level (historical maximum in 2015), the new banking system structure indicates that overall efficiency maintains an enhancement trend. Additionally, in terms of transactions and total value, M&As within and outside the euro area have decreased in recent years (European Central Bank 2015).

In brief, the ratio of a country’s banks’ non-performing loans to total gross loans captures the country-level credit risk. Moreover, bank capital to assets denotes the ratio of bank capital and reserves to total assets and measures a country’s banking system’s capital adequacy. General government debt is an indicator of an economy’s health and a key factor for the sustainability of government finance. Similarly, a bank’s non-performing loans measures the asset quality in its loan portfolio. A high number of non-performing loans signals a deterioration of the credit portfolio.

Banking sector leverage is used alongside other measurements of financial leverage to determine the overall financial stability of the sector and to investigate its financial health. Leverage is computed as the ratio of selected financial assets (currency and deposits, debt securities and loans) to total equity (shares and other equity, except mutual fund shares).

Finally, two sets of M&A dummy variables, namely, the time set and the replication set, capture the time and intensity effects, respectively, of M&A cases. More specifically, 1 year before the examined bank’s involvement as a bidder bank in any M&A, the time set dummy D1 takes the value of 1 (Dickerson et al. 1997). Likewise, if the examined bank is not involved in any bank M&A, D2,t takes the value of 1. One year after the event, D3,t takes the value of 1, and 2 to 5 years after the strategy, D4,t takes the value of 1 (Beitel and Schiereck 2001). All of these dummy variables are examined through each of the period years. Finally, the second set of dummies tries to assess the participation of the bidder bank, and two different dummy variables are created. If the bank is participating in only one M&A event, DD1,t takes the value of 1; if the examined bank participates in more than two strategies, DD2,t takes the value of 1.

The use of the time set of dummy variables helps to overcome the lag problem between the M&A activity and a change in efficiency, as it captures momentum effects on banks’ performance. Based on previous studies, such as Dı́az et al. (2004) and Rhoades (1994), this study makes the assumption that the effect of an M&A can be interpreted in banking and financial activities from the year of the event to 5 years after the event, taking into consideration that in a crisis period, M&As may take the character of a resolution mechanism that would then be carried out and completed in the medium-long-term (Behr and Heid 2011; De Guevara and Maudos 2007; Valverde and Humphrey 2004; Cuesta and Orea 2002; Huizinga et al. 2001; Resti 1998). Despite the fact that the examined period of the M&As’ effect should be short and near the date of disclosure of the operation, the optimal length of the time that should be analyzed in order to ascertain the M&A impact is not clearly defined.

At this point, we should refer to the D1 variable, which captures the effects of possible inside information 1 year before the application of a consolidation strategy or strategies. Linder and Crane (1993) and Rhoades (1993a) compared bank performances in a period prior to and after an M&A in order to assess cost, revenue and profit changes. They concluded that cost cuts and efficiency improvements were not significantly linked to M&A strategies.

With respect to the D1 variable, we make the assumption that before many M&A events, some institutional investors may have access to price sensitive information, such as an imminent takeover or a merger offer; therefore, the changes in the efficiency level start to be visible 1 year before the event. We define this short period as a pre-merger or pre-acquisition period, as it is likely that in the pre-consolidation period, banks begin new activities that have been instituted by governments as immediate and effective measures required to restructure the ailing banking units.

Before the initialization of an acquisition, the existence of risks is observed mostly in reference to the acquired bank, since the value of the acquisition should be hedged with the value of the expected revenues. After all, an M&A creates costs, whereas on the other hand, in merger activities where the main transactive mean is considered to be cash, arbitrage opportunities occur since at least 1 month to 1 year before the merger, the target bank operates transactions below the bid price. During this preparatory period, after the merger announcement and taking for granted that the M&A will be completed, the arbitrageur buys the target company’s stocks and takes advantage of the difference between the arbitrageur’s purchase price and the higher price paid for the consolidation strategy (Stowell 2010).

Finally, in the present paper, we examine the effects of M&As on the Eurozone Banks efficiency before the date of the merger announcement, as during this time, managers should create considerable strategies, pre-examine the M&A deal, exercise extensive due diligence, frame an executable plan and communicate all of the above to the internal and external stakeholders (Terjesen 2019).

In contrast to Dı́az et al. (2004), we also include the DD1 and DD2 dummy variables in order to identify the case where a bank carries out more than one M&A during the same year, capturing the urgent need of many commercial banks to be restructured in order to overcome the difficulties of the recent financial crisis (Micu and Micu 2016).

5 Empirical findings

Efficiency changes, such as the launching of new products, economies of scope, stronger market power, and economies of scale, may have occurred due to other circumstances that may have taken place during the examined year (Beitel and Schiereck 2001; Berger et al. 1999). The analysis reveals that all core banks appear to have high levels of efficiency during the whole period. The banks that participated in M&A strategies weakened their risk and efficiency profile, as in most cases, mergers were made with banks that had a worse risk profile (Fig. 2).

The most important inconvenient situations that should be solved in a crisis are recapitalization, the restoration of the depositors’ confidence and the reduction of the liquidity dependence on the central bank.

5.1 First-stage analysis: DEA efficiency results

Technical efficiency (θ) indicates that the banking systems of “strong” countries appear to exhibit a better management of resources than scale efficiency (Chrysov and Pasiouras 2009). It should be stressed that target banks, which comprise banks primarily from the sample of “weak” countries, are not sound and therefore appear to have high numbers of poorly performing loans and an inefficient means of management resources, especially after 2012.

Capital markets and investors may believe that M&As will have more positive effects or will result in a smaller decrease in efficiency in the short term than in the long term. During the long term, the newly created banks fail to achieve the expected results, as they have to face problems, such as a new organization structure, that appear in the post-merger phase (Fiordelisi 2009).

In Fig. 3, both the ROE ratio and the DEA scores are presented in order to check the robustness of DEA efficiency results. The above measures follow a downward trend from 2007 to 2013, while in 2014, an amelioration of efficiency is observed. These findings are similar to those of Ahmad and Luo (2010): both DEA scores and ROE results are similar. DEA scores, unlike ROE, provide a performance score and a ranking of banks and take into account multiple inputs and outputs (Gaganis and Pasiouras 2013).

Table 3 presents the results of the efficiency effects of M&As in Eurozone banks (Buch and DeLong 2004; Vennet 1996, 2002). The improvements are identified by the Italian banks’ ability to monitor borrowers after mergers and thereby provides support for the positive and statistically significant relation between M&As and efficiency levels, since efficiency and credit risk increased after the mergers’ effects.

On the other hand, German commercial banks exhibit a negative relation between efficiency and the concentration indices, as increased expenses allow for uncollected loans and loan payments that lead to lower efficiency scores. German banks were totally engaged in mergers, with HHI performing results between 1000 and 2000 units at the post-merger level and HHI increases by 250 or more units after the merger, which supports negative merger efficiency effects on competition decrease. The above assumption was also violated by the Greek and Spanish samples.

Moreover, for French commercial banks, merger efforts seem to have been impeded, leading to decreased levels of efficiency. In the Spanish sample, the value of assets increased by 2.5% in 2014–2015 and led to a statistically significant increase in efficiency levels. Nearly half of the sample’s efficiency reduction in 2008 is explained by transactions that occurring in Spain and other major economies, such as Germany, Italy and France, contributed to the assets’ reduction.

In the Greek banking sector, for the period 2007–2009, the non-traditional banking activities were riskier and more profitable. Large banks, which survived the crisis period, presented lower levels of capital, fewer sources of stable funding and more complex balance sheet structures than smaller banks. Hence, though efficiency scores and increased loan loss provisions reflected a negative relation, the Greek banking system tried to protect its largest banks by imposing higher capital adequacy standards relative to assets.

In this study, both pure and scale efficiency are not significantly correlated with banking leverage (BL). Both the samples of “weak” and “strong” countries have an average leverage ratio of 0.18, supporting the financial homogeneity in the European banking system. Banks may survive competition only if their size is above predefined thresholds, where a threshold is higher when bank finances are more abundant (Wang 2015) (Tables 4, 5).

Measuring the effect of M&As reveals that 93% of these consolidation strategies lead to diseconomies of scale after 1 year. Taking for granted that the Weitzman marginal private cost curve is U-shaped, there is a threshold of scale beyond which banks operate under diseconomies of scale. The large-sized banks that are created after M&As have to face increased bank scale effects, such as the costs incurred by bank customers, the risks incurred by banks, or the risks that the banking system may impose more broadly on society (Wheelock and Wilson 2011). Similarly, Hughes et al. (2001) suggest that M&As do not contribute to the banks’ cost minimization but to their value maximization. Therefore, while many bankers support that ‘too big to fail’ banks can lower their costs, we still remain skeptical about the effects of size expansion on cost minimization and efficiency.

5.1.1 Bootstrapped DEA results

Although the study sample is not small, since we do not know in advance the distribution of technical efficiency scores, we apply the Simar and Wilson (1998) bootstrap method for 1000 iterations. The bandwidth for the Simar and Wilson (1998) bootstrap method is equal to 0.014, and the bias correction is applied to observations when the bias/variance > 4. Note that the bias correction interval may exceed [0–1] and that the displayed interval is trimmed to [0–1] (truncated data). The average for the estimated efficiency scores is equal to 0.71234 with a standard deviation of 0.192765, while the average for the bootstrapped efficiency scores is equal to 0.71235 with a standard deviation of 0.192760 (Fig. 4).

5.2 Second-stage analysis: bias-corrected technical efficiency scores

As presented below, the basic and the credit risk models are estimated under the two algorithms of the Simar and Wilson (2007) approach for all the examined countries in the bank panel dataset. For this reason, in both algorithmic approaches, a DC dummy explanatory variable has been included covering the “weak” vs “strong” countries’ data sub-sample. For consistency reasons and in order to indicate the differences between the Simar and Wilson (2007) algorithms and the Tobit and truncated approach, the analytical results are presented in the appendix.

In the 1st column (Table 6), the statistically significant variables of the basic model are the market share, the DC variable (which denotes the separation of the sample into “strong” and “weak” countries), the TCR variable (which denotes the total capital ratio of the banks) and the D1TCR variable, which denotes whether the capital adequacy of banks is affected by possible mergers 1 year before their realization. According to this model and under the application the first algorithm of Simar and Wilson (2007), the banks’ market share positively affects the efficiency scores. This finding is in contrast to that of Staikouras et al. (2008), who noticed a negative correlation between cost inefficiency and bank capitalization and market share. The DC estimator results indicate that powerful banks exhibit an enhanced efficiency performance.

D1TCR has a positive impact on the banks’ efficiency: pre-merger information affects the level of the capital adequacy of the “strong” banking systems. This is true for bidder banks (but not the acquired ones) and is demonstrated by the negatively statistically significant effect of the TCR estimator.

Furthermore, the 2nd column (Table 6) displays the results of the credit risk model applied under the 1st algorithm. These results are similar to the previous ones, as the statistically significant variables mostly include the following: the market share, the capital adequacy ratio and the merger effects 1 year before for the related banks, the variables that refer to the non-performing loans in the country and the bank level and the corresponding effect of the mergers 1 year before on the NPLs. In this case, the separation of banks into “strong” and “weak” samples does not reflect the effects on the examined banks’ efficiency scores.

The non-performing loans tend to negatively affect the efficiency scores of banks after taking into account the existence of pre-merger information for the bidder banks. As a concluding remark, it seems that the inclusion of variables that examine country- and bank-level NPLs in the credit risk model and that are estimated under the 1st algorithm approach has an objective influence on the examined banks’ efficiency scores but does not also demonstrate a statistically significant and long-term effect of M&As on the DEA efficiency scores.

On the other hand, according to Table 6, which refers to the basic model, compared to the model’s outcomes under the 1st algorithm’s approach, its results under the 2nd algorithm’s approach are significantly improved. Specifically, the relation between the GDP growth index and the DEA estimated scores suggests that “strong” countries positively affect the estimated results. Likewise, the market share variable positively affects the efficiency scores of the examined banks; the DHHI variable also affects the efficiency scores but not at a statistically significant level. The DHHI variable indicates whether the examined banking industries operate within the predetermined limits for the level of competition control and the avoidance of the creation of monopolies. If this is true, then the realized M&As positively affect the examined banks’ technical efficiency scores.

The effect of the DHHI variable is positive but not highly statistically significant,Footnote 9 which in turn reinforces our initial assumption. Similar to the previous findings above, the efficiency scores are enhanced when the examined banks are divided into “strong” and “weak” industries, in which the capital adequacy ratios of TCR and D1TCR present analogous behavior. However, in this case also, the D3 variable is negative and statistically significantly related to the DEA technical efficiency scores. The M&As’ effects 1 year after their realization are starting to negatively and statistically affect the efficiency of the examined banks.

Finally, in Table 6, under the 2nd algorithm approach, in comparison to the results produced by its predecessors, the results of the credit risk model estimators present the best performance. In this case, the statistically significant variables that justify the consistency of the initial assumptions include the DHHI variable, which presents a strong and positive effect on the banks’ efficiency. The market share and the GDP growth index present positive effects on the banks’ efficiency scores, the GDP growth index indicates a weaker effect, which is also indicated by the DC estimator, which in this case presents negative and statistically significant results and differs with the rest of the model cases.

The variables referring to NPLs seem to present similar effects in efficiency scores and are equally statistically significant. Notably remarkable is the fact that the estimated statistical error for the last model is smaller than that in the other models that were estimated and analyzed. At the end of the above analysis, further descriptive information, information results and model choice criteria tests are presented for each sample that was examined. According to these assessment criteria, under the approach of the 2nd algorithm, compared to the other models that were estimated, the credit risk model best captures and describes the characteristics of the independent variables examined.

DD1 and DD2 factors are of considerable statistical significance, implying the importance of studying the frequency of M&As strategies in a single year. The CNPL and D1BNPL variables measure the effects of M&As 1 year before their application on non-performing loans at the country and bank levels, respectively, the TCR and D1TCR variables also measure these M&A effects on the banks’ capital adequacy ratios.

From the overall statistical error of the estimations and for the basic and credit risk model approaches, we may observe that unlike the Tobit regression, the truncated regression improves the overall estimated errors of the regressions. However, the estimates of the overall statistical errors of the 1st and 2nd algorithms for both the basic and the credit risk models present results that are clearly better and concern the whole sample of the examined banks.

6 Conclusions and implications

The concentration levels of merging banks before and after the M&A strategy have a positive effect on efficiency only when the consolidation strategies take place under specific levels of market concentration (i.e., when competition increases). The stronger countries that were engaged in different sorts of activities do not demonstrate high market concentration levels. The large banks in these countries try to perform M&As as a consolidation mechanism to obtain non-viable banking institutions and as a means of offering long-term solutions.

The generic policy implications are that Eurozone banks should adopt benchmarking procedures to regularly evaluate their concentration levels (HHI) in comparison to efficiency. Therefore, M&A activities should be promoted only when this is permitted according to the existing concertation levels and the level of economies of scale. Therefore, it appears that growth is not achieved through M&A, implying that the market might already be concentrated. European regulators should be aware that the fragmentation and the complexity of the United European Banking System requires specific analysis and that it is truly difficult to arrive at a conclusion that can be generalized for all the Eurozone countries.

Based on the fact that the acquirer bank may fail to achieve the expected M&A benefits, especially in the long-term, it is mandatory to focus on the post M&A integration phase, and to study the different effects of economies of scale, technology skills, banking management and integration strategies and how these strategies can be implemented in the quickly changing and uncertain European banking system. The estimates of the potential average M&As cost savings, achieved through the exploitation of economies of scale or scope tend to vary widely and currently are generally unclear.

Notes

Banker et al. (1984) suggest the use of VRS in order to break down overall efficiency into pure technical efficiency, which refers to the ability of managers to use their resources efficiently, and scale efficiency, which refers to the exploitation of economies of scale by working at a production level where the profitability boundary is experiencing CRS. Pure technical efficiency scores resulting from variable economies of scale are higher or equal to those achieved under constant economies of scale.

Simar and Wilson (2007) recommended two algorithms (a 1st algorithm and a 2nd algorithm) that are differentiated by either the use of uncorrected (1st algorithm) or bias-corrected (2nd algorithm) efficiency scores. In contrast to naive two-step approaches, the Simar and Wilson (2007) algorithms take into consideration the fact that as DEA efficiency scores are bounded, they depend on how inefficiency is designated and the ability of DEA to derive a multiplicated and generally unidentified correlation pattern among estimated efficiency scores.

The main advantages of this approach include its easy application, its ability to use multiple macroeconomic variables simultaneously without influencing the number of profitable banks, the needlessness of determining the orientation of the effect of each factor in efficiency, its ability to handle parallel continuous and categorical variables, and its ability to be used when some (or all) of the environmental variables are common to a subset of units (Pastor 2002).

Simar and Wilson (2007) argue that the conventional Tobit and truncated censored two-step regression analysis approaches for the determination of DEA estimated efficiency scores are inappropriate for two main reasons. First, as the two-step approaches lack a well-defined data generating mechanism, the censored regression models are unfit for producing unbiased estimators under high differentiations in their standards errors. The DEA efficiency score artificially takes the value of 1 (θ = 1) by making the assumption that the sample is finite and that a DMU is fully efficient in this specific determinate sample; this in turn creates differences between the true production possibility frontier and the estimated DEA frontier. Second, DEA efficiency scores are correlated under unknown forms.

According to the OECD database, a BL indicator covers the banking sector (covering central banks and monetary financial institutions, S121 and S122_3, respectively, in the System of National Accounts terminology), as well as other financial intermediaries, except insurance corporations and pension funds (S123). Data are compiled under the 2008 System of National Accounts (SNA 2008).

It is important to include the variable of non-performing loans in this analysis since numerous studies found that banks that face potential failure have high ratios of non-performing loans and also have low measured efficiency (Fiordelisi 2009; Berger and Humphrey 1997; Wheelock and Wilson 1995). In other words, non-performing loans and efficiency are closely related.

The only listed banks removed from the dataset include Banca Sistema (Italy), Abanca Corporacion Bancaria (Spain), Fidor Bank AG (Germany), and Fonciere de Paris (France), as their data are not available for more than two-thirds of the examined period.

Luxembourg and Estonia are not included in our final dataset, as no listed banks can be found according to the Orbis database report.

Statistically significant at the 15% level.

References

Abbsoglu, O. F., Aysan, A. F., & Gunes, A. (2007). Concentration, competition, efficiency and profitability of the Turkish banking sector in the post-crises period. Munich Personal RePEc Archive.

Ahmad, W., & Luo, R. (2010). Comparison of banking efficiency in Europe: Islamic versus conventional banks In S.-J. Kim, & M. D. Mckenzie (ed.) International Banking in the new era: post-crisis challenges and opportunities. International Finance Review, (vol. 11, pp. 361–389). Emerald Group Publishing Limited.

Altunbaş, Y., & Marqués, D. (2008). Mergers and acquisitions and bank performance in Europe: The role of strategic similarities. Journal of Economics and Business, 60(3), 204–222.

Apergis, N., & Rezitis, A. (2004). Cost structure, technological change, and productivity growth in the Greek banking sector. International Advances in Economic Research, 10(1), 1–15.

Banker, R., Charnes, A., & Cooper, W. (1984). Some models for estimating technical and scale inefficiencies in data envelopment analysis. Management Science, 30(9), 1078–1092.

Behr, A., & Heid, F. (2011). The success of bank mergers revisited. An assessment based on a matching strategy. Journal of Empirical Finance, 18(1), 117–135.

Beitel, P., & Schiereck, D. (2001). Value creation at the ongoing consolidation of the European Banking Markets.

Berger, A. N., Demsetz, R. S., & Strahan, P. E. (1999). The consolidation of the financial services industry: Causes, consequences, and implications for the future. Journal of Banking & Finance, 23(2), 135–194.

Berger, A., & Humphrey, D. (1997). Efficiency of financial institutions: International survey and directions for future research. European Journal of Operational Research, 98, 175–212.

Bou-Hamad, I., Anouze, A. L., & Larocque, D. (2017). An integrated approach of data envelopment analysis and boosted generalized linear mixed models for efficiency assessment. Annals of Operations Research, 253(1), 77–95.

Buch, C. M., & DeLong, G. (2004). Cross-border bank mergers: What lures the rare animal? Journal of Banking & Finance, 28(9), 2077–2102.

Campa, J. M., & Hernando, I. (2006). M&As performance in the European financial industry. Journal of Banking & Finance, 30(12), 3367–3392.

Casu, B., & Molyneux, P. (2003). A comparative study of efficiency in European banking. Applied Economics, 35(17), 1865–1876.

Charnes, A., Cooper, W., & Rhodes, E. (1978). Measuring the efficiency of decision making units. European Journal of Operational Research, 2(6), 429–444.

Chortareas, G. E., Garza-Garcia, J. G., & Girardone, C. (2011). Banking sector performance in Latin America: Market power versus efficiency. Review of Development Economics, 15(2), 307–325.

Chortareas, G. E., Girardone, C., & Ventouri, A. (2012). Bank supervision, regulation, and efficiency: Evidence from the European Union. Journal of Financial Stability, 8(4), 292–302.

Chrysov, A., & Pasiouras, F. (2009). Efficiency in greek banking industry: A comparison of foreign and domestic banks. International Journal of the Economics and Business, 16(2), 221–237.

Commission, European. (2014). EU competition law merger legislation. European Union: Competition Handbooks.

Cuesta, R., & Orea, L. (2002). Time varying efficiency and stochastic distance functions: The effect of mergers on Spanish savings banks. Journal of Banking & Finance, 26, 2231–2247.

Cybo-Ottone, A., & Murgia, M. (2000). Mergers and shareholder wealth in European banking. Journal of Banking & Finance, 24, 831–859.

De Guevara, J. F., & Maudos, J. (2007). Explanatory factors of market power in the banking system. The Manchester School, 75(3), 275–296.

Delis, M. D., & Papanikolaou, N. I. (2009). Determinants of bank efficiency: Evidence from a semi-parametric methodology. Managerial Finance, 35(3), 260–275.

Demsetz, H. (1973). Industry structure, market rivalry, and public policy. Journal of Law and Economics, 16, 1–9.

DeYoung, R., Evanoff, D. D., & Molyneux, P. (2009). Mergers and acquisitions of financial institutions: A review of the post-2000 literature. Journal of Financial Services Research, 36(2–3), 87–110.

Dı́az, B. D., Olalla, M. G., & Azofra, S. S. (2004). Bank acquisitions and performance: Evidence from a panel of European credit entities. Journal of Economics and Business, 56(5), 377–404.

Dickerson, A. P., Gibson, H. D., & Tsakalotos, E. (1997). The impact of acquisitions on company performance: Evidence from a large panel of UK firms. Oxford Economic Papers, 49(3), 344–361.

Dietrich, A., & Wanzenried, G. (2011). Determinants of bank profitability before and during the crisis: Evidence from Switzerland. Journal of International Financial Markets, Institutions and Money, 21(3), 307–327.

European Central Bank (2015). Report on financial structures. Eurosystem.

Evanoff, D. D., & Ors, E. (2002). Local market consolidation and bank productive efficiency. FRB of Chicago-Working Paper.

Fatemi, A. M., Fooladi, I., & Garehkoolchian, N. (2017). Gains from mergers and acquisitions in Japan. Global Finance Journal, 32, 166–178.

Fernandes, F. D. S., Stasinakis, C., & Bardarova, V. (2018). Two-stage DEA-truncated regression: Application in banking efficiency and financial development. Expert Systems with Applications, 96, 284–301.

Fethi, M., & Pasiouras, F. (2010). Assessing bank efficiency and performance with the operational research and artificial intelligence techniques: ‘A survey’. European Journal of Operational Research, 204(2), 189–198.

Fiordelisi, F. (2009). Mergers and acquisitions in European banking. Berlin: Springer.

Fritsch, M. (2007). Long term effects of bank acquisitions in central and Eastern Europe. Available at SSRN 1008838.

Gaganis, C., & Pasiouras, F. (2013). Financial supervision regimes and bank efficiency: International evidence. Journal of Banking & Finance, 37, 5463–5475.

Garden, K. A., & Ralston, D. E. (1999). The x-efficiency and allocative efficiency effects of credit union mergers. Journal of International Financial Markets, Institutions and Money, 9(3), 285–301.

Hadad, M., Hall, M., Kenjegalieva, K., Santoso, W., & Richard, S. (2012). A new approach to dealing with negative numbers in efficiency analysis: An application to the Indonesian banking sector. Expert Systems with Applications, 39(9), 8212–8219.

Hagendorff, J., & Keasey, K. (2009). Post-merger strategy and performance: Evidence from the US and European banking industries. Accounting & Finance, 49(4), 725–751.

Halkos, E., & Salamouris, D. (2004). Efficiency measurement of the greek commercial banks with the use of financial ratios: A data envelopment analysis approach. Management Accounting Research, 15, 201–224.

Hughes, J. P., Mester, L. J., & Moon, C. G. (2001). Are scale economies in banking elusive or illusive? Evidence obtained by incorporating capital structure and risk-taking into models of bank production. Journal of Banking & Finance, 25, 2169–2208.

Huizinga, H., Nelissen, J., & Vennet, R. (2001). Efficiency Effects of Bank Mergers and Acquisitions. Tinbergen Institute Discussion Paper.

Humphrey, D. B., & Vale, B. (2004). Scale economies, bank mergers, and electronic payments: A spline function approach. Journal of Banking & Finance, 28(7), 1671–1696.

Kapopoulos, P., & Siokis, F. (2005). Market structure, efficiency and rising consolidation of the banking industry in the Euro area. Bulletin of Economic Research, 57(1), 67–91.

Kosmidou, K., & Zopounidis, C. (2008). Measurement of bank performance in Greece. South-Eastern Europe Journal of Economics, 1(1), 79–95.

Lamb, J. D., & Tee, K.-H. (2012). Resampling DEA estimates of investment fund performance. European Journal of Operational Research, 223, 834–841.

Liargovas, P., & Repousis, S. (2011). The impact of mergers and acquisitions on the performance of the Greek Banking Sector: An event study approach. International Journal of Economics and Finance, 3, 89–100.

Linder, J. C., & Crane, D. B. (1993). Bank mergers: Integration and profitability. Journal of Financial Services Research, 7(1), 35–55.

Lovell, C., Pastor, J., & Turner, J. (1995). Measuring macroeconomic performance in the OECD: A comparison of European and non-European countries. European Journal of Operational Research, 87, 507–518.

Martin, W. (2016). These are the 14 countries with the safest banks in the world, Business Insider UK.

Micu, A., & Micu, I. (2016). Mergers and acquisitions in the banking sector during the financial crisis. SEA-Practical Application of Science, 11, 385–392.

Mirzaei, A., & Moore, T. (2014). What are the driving forces of bank competition across different income groups of countries? Journal of International Financial Markets, Institutions and Money, 32, 38–71.

Montgomery, H., Harimaya, K., & Takahashi, Y. (2014). Too big to succeed? Banking sector consolidation and efficiency. Journal of International Financial Markets, Institutions and Money, 32, 86–106.

Ouenniche, J., & Carrales, S. (2018). Assessing efficiency profiles of UK commercial banks: A DEA analysis with regression-based feedback. Annals of Operations Research, 266(1–2), 551–587.

Pasiouras, F. (2007). Estimating the technical and scale efficiency of commercial Greek banks: The impact of credit risk, the impact of credit risk, off-balance activities, and international operations. Research in International Business and Finance. http://papers.ssrn.com/sol3/papers.cfm?abstract_id=939524.

Pasiouras, F., Gaganis, C., Galariotis, E., & Staikouras, C. (2018). Bank profit efficiency and financial consumer protection policies. SSRN Electronic Journal.

Pastor, J. M. (2002). Credit risk and efficiency in the european banking system: A three stage analysis. Applied Financial Economics, 12, 895–911.

Peltzman, S. (1977). The gains and losses from industrial concetration. Journal of Law and Economics, 20, 229–263.

Resti, A. (1998). Regulation can foster mergers, can mergers foster efficiency? The Italian case. Journal of Economics and Business, 50(2), 157–169.

Rezitis, N. (2006). Productivity growth in the greek banking industry: A non-parametric approach. Journal of Applied Economics, 9(1), 119–138.

Rhoades, S. A. (1993a). Efficiency effects of horizontal (in-market) bank mergers. Journal of Banking & Finance, 17(2–3), 411–422.

Rhoades, S. A. (1993b). The Herfindahl-hirschman index. Federal Reserve Bulletin, 79, 188.

Rhoades, S. A. (1994). A summary of merger performance studies in banking, 1980-93, and an assessment of the operating performance and event study methodologies. Fed. Res. Bull., 80, 589.

Simar, L., & Wilson, P. W. (1998). Sensitivity analysis of efficiency scores: How to bootstrap in nonparametric frontier models. Management Science, 44(1), 49–61.

Simar, L., & Wilson, P. W. (2007). Estimation and inference in two-stage, semi-parametric models of production processes. Journal of Econometrics, 136(1), 31–64.

Simper, R., Hall, M. J., Liu, W., Zelenyuk, V., & Zhou, Z. (2017). How relevant is the choice of risk management control variable to non-parametric bank profit efficiency analysis? The case of South Korean banks. Annals of Operations Research, 250(1), 105–127.

Staikouras, C., Mamatzakis, E., & Koutsomanoli-Filippaki, A. (2008). Cost efficiency of the banking industry in the South Eastern European region. Journal of International Financial Markets, Institutions and Money, 18(5), 483–497.

Stowell, D. P. (2010). An introduction to investment banks, hedge funds, and private equity: The new paradigm. Cambridge: Academic Press.

Terjesen, S. (2019). Mergers and acquisitions: patterns, motives, and strategic fit. QFinance.

These are the 14 countries with the safest banks in the world. (2016, Business Insider UK.

Tziogkidis, P., Matthews, K., & Philippas, D. (2018). The effects of sector reforms on the productivity of Greek banks: A step-by-step analysis of the pre-Euro era. Annals of Operations Research, 266(1–2), 531–549.

Valverde, S. C., & Humphrey, D. B. (2004). Predicted and actual costs from individual bank mergers. Journal of Economics and Business, 56(2), 137–157.

Valverde, S. C., Humphrey, D. B., & Fernandez, F. R. (2003). Bank deregulation is better than mergers. Journal of International Financial Markets, Institutions and Money, 13(5), 429–449.

Vennet, R. V. (1996). The effect of mergers and acquisitions on the efficiency and profitability of EC credit institutions. Journal of Banking & Finance, 20(9), 1531–1558.

Vennet, R. V. (2002). Cost and profit efficiency of financial conglomerates and universal banks in Europe. Journal of Money, Credit, and Banking, 34(1), 254–282.

Waddock, S. A., & Graves, S. B. (2006). The impact of mergers and acquisitions on corporate stakeholder practices. Journal of Corporate Citizenship, 22, 91–109.

Wang, T. (2015). Competition and increasing returns to scale: A model of bank size. Economic Journal, 125(585), 989–1014.

Wheelock, D. C., & Wilson, P. W. (1995). Explaining bank failures: Deposit insurance, regulation, and efficiency. Review of Economics and Statistics, 77, 689–700.

Wheelock, D. C., & Wilson, P. W. (2011). Do large banks have lower costs? New estimates of returns to scale for U.S. Banks. Federal Reserve Bank of St. Louis Working Paper No. 2009-054E.

World Economic Forum (2016). These are the 14 countries with the safest banks in the world. https://www.weforum.org/.

Wu, D. D., Zhou, Z., & Birge, J. R. (2011). Estimation of potential gains from mergers in multiple periods: A comparison of stochastic frontier analysis and Data Envelopment Analysis. Annals of Operations Research, 186(1), 357–381.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Galariotis, E., Kosmidou, K., Kousenidis, D. et al. Measuring the effects of M&As on Eurozone bank efficiency: an innovative approach on concentration and credibility impacts. Ann Oper Res 306, 343–368 (2021). https://doi.org/10.1007/s10479-020-03586-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-020-03586-9

Keywords

- Data envelopment analysis (DEA)

- Technical efficiency

- Bootstrapping

- Herfindahl–Hirschman Index (HHI)

- Second stage analysis

- Mergers and acquisitions