Abstract

In this article we study interval games in oligopolies following the \(\gamma \)-approach. First, we analyze their non-cooperative foundation and show that each coalition is associated with an endogenous real interval. Second, the Hurwicz criterion turns out to be a key concept to provide a necessary and sufficient condition for the non-emptiness of each of the induced core solution concepts: the interval and the standard \(\gamma \)-cores. The first condition permits to ascertain that even for linear and symmetric industries the interval \(\gamma \)-core is empty. Moreover, by means of the approximation technique of quadratic Bézier curves we prove that the second condition always holds, hence the standard \(\gamma \)-core is non-empty, under natural properties of profit and cost functions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Oligopolistic collusion has first been modeled by means of repeated games. On the basis of the paradigm called the “Folk theorem”, these models try to explain how a cooperative agreement is implemented as a Nash equilibrium. The main idea is that if firms do not discount the future too much, none will have any interest in defecting from the collusive agreement because they rationally anticipate future punishments in the periods following their defection (Friedman 1971; Abreu 1988).

More recently, the complementary issue on the coalitional rationality of cooperative agreements in industries has been investigated by means of oligopoly TU (Transferable Utility)-games and the study of the core solution concept (Zhao 1999; Norde et al. 2002; Driessen and Meinhardt 2005; Lardon 2012; Lekeas and Stamatopoulos 2014). In oligopolies, any core solution is viewed as a joint profit distribution among firms obtained from an industry production plan (a joint strategy between all the firms) such that no coalition can guarantee higher payoffs for all its members by breaking off from the cooperative agreement within the grand coalition.

In general, oligopoly TU-games are founded on non-cooperative approaches in which firms form cartels (acting as a single player) and obtain a unique joint profit, i.e., a coalitional worth. We can cite three main approaches to convert a strategic oligopoly game into a cooperative one. The first two are called the \(\alpha \) and \(\beta \)-approaches and are suggested by Aumann (1959). According to the first, each cartel computes its max–min profit, i.e., the profit it can guarantee regardless of what outsiders do. The second approach consists in computing the min–max cartel profit, i.e., the minimal profit for which external firms can prevent the cartel from getting more. The continuity of profit functions and the compacity of strategy sets are sufficient to ensure the uniqueness of any cartel profit. The third approach is called the \(\gamma \)-approach, and proposed by Chander and Tulkens (1997). It is more plausible in the context of oligopoly industries. It considers a competition setting in which the cartel faces external firms acting individually. The cartel profit is then enforced by partial agreement equilibrium, a generalization of Nash equilibrium allowing cooperation. In addition to previous assumptions, the differentiability of the inverse demand function is essential in order to ensure that each cartel obtains a unique joint profit.Footnote 1

However, in many oligopolies the inverse demand function may be continuous but not differentiable. Katzner (1968) shows that demand functions derived from quite nice utility functions, even of class \(C^2\), may not be differentiable everywhere.Footnote 2 The purpose of this article is to take this issue into consideration in cooperative oligopoly games. With the weaker assumption of continuity, we show that it is not possible to consider the set of oligopoly TU-games insofar as the worth of a coalition may be not unique. As a consequence, we must investigate the more general class of oligopoly interval games. An interval game assigns to each coalition a closed and bounded real interval that represents all its potential worths. Interval games have been studied by Alparslan-Gök et al. (2009, 2011) and Han et al. (2012), and successfully applied to mountain, airport and bankruptcy situations in which worth intervals are given exogenously. Unlike these works, the worth interval of a coalition is endogenized in oligopoly situations by a competition setting which makes our analysis richer. To the best of our knowledge, this is the first economic application dealing with the developing theory of interval games.

Regarding core solution concepts, we consider two extensions, the interval core and the standard core.Footnote 3 The interval core is specified in a similar way as the core for TU-games by using the methods of interval arithmetic Moore (1979). The standard core is defined as the union of the cores of all TU-games for which the worth of each coalition belongs to its worth interval. We deal with the problem of the non-emptiness of the interval and the standard \(\gamma \)-cores, i.e., the cores under the \(\gamma \)-approach. To this end, we use a decision theory criterion, the Hurwicz criterion Hurwicz (1951), that consists in combining, for any coalition, the worst and the best worths that it can obtain in its worth interval. The first (second) result states that the interval (standard) \(\gamma \)-core is non-empty if and only if the oligopoly TU-game associated with the best (worst) worth of each coalition in its worth interval admits a non-empty \(\gamma \)-core. We show that even for linear and symmetric industries, the first condition fails to be satisfied, hence the interval \(\gamma \)-core is empty. By means of the approximation technique of quadratic Bézier curves, we specify natural properties of profit and cost functions under which the second condition always holds, hence the standard \(\gamma \)-core is non-empty.

The remainder of the article is structured as follows. In Sect. 2 we study the endogenization of coalitional worth intervals in oligopolies following the \(\gamma \)-approach and present preliminary results on the set of equilibrium outputs. In Sect. 3 we first give the setup of interval games. Then, after introducing the Hurwicz criterion, we provide two necessary and sufficient conditions for the non-emptiness of the interval and the standard \(\gamma \)-cores. Furthermore, we identify industry types in which these cores are empty or not. Finally, Sect. 4 presents some concluding remarks.

2 Endogenization of coalitional worth intervals

An oligopoly situation is a quadruplet \((N,(q_i,C_i)_{i\in {N}},p)\) where \(N=\lbrace {1,2,\ldots ,n}\rbrace \) is the set of firms, \(q_i\ge 0\) denotes firm i’s production capacity constraint, \(C_i:{\mathbb {R}}_+\longrightarrow {\mathbb {R}}_+\), \(i\in {N}\), is firm i’s cost function and \(p:{\mathbb {R}}_+\longrightarrow {\mathbb {R}}_+\) represents the inverse demand function of real variable X for which there exists \(\xi >0\) such that \(p(X)=0\) for all \(X\ge \xi \). Throughout this article, we assume that:

-

(a)

the inverse demand function p is continuous, strictly decreasing and concave on \([0,\xi ]\);

-

(b)

each cost function \(C_i\) is continuous, strictly increasing and convex.

The strategic oligopoly game \((N,(X_i,\pi _i)_{i\in {N}})\) associated with the oligopoly situation \((N,(q_i,C_i)_{i\in {N}},p)\) is defined as follows:

-

1.

the set of firms is \(N=\lbrace {1,2,\ldots ,n}\rbrace \);

-

2.

for each \(i\in {N}\), the individual strategy set is \(X_i=[0,q_i]\subseteq {\mathbb {R}}_+\) where \(x_i\in {X_i}\) represents the quantity produced by firm i;

-

3.

the set of strategy profiles is \(X_N=\prod _{i\in {N}}X_i\) where \(x=(x_i)_{i\in {N}}\) is a representative element of \(X_N\); for each \(i\in {N}\), the individual profit function \(\pi _i:X_N\longrightarrow {\mathbb {R}}\) is defined as:

$$\begin{aligned} \pi _i(x)=p(X)x_i-C_i(x_i)\text{, } \end{aligned}$$where \(X=\sum _{i\in {N}}x_i\) is the joint production.

Note that firm i’s profit depends on its individual output \(x_i\) and on the total output of its opponents \(\sum _{j\in {N\backslash {\lbrace {i}\rbrace }}}x_j\).

2.1 Equilibrium concepts with cooperation

Partial agreement equilibrium is a solution concept which generalizes Nash equilibrium and permits to formalize the possibility for some firms to cooperate facing other firms acting individually. Let \({\mathcal {P}}(N)\) be the power set of N and call a subset \(S\in {{\mathcal {P}}(N)}\), a coalition. We denote by \(X_S=\prod _{i\in {S}}X_i\) the strategy set of coalition \(S\in {{\mathcal {P}}(N)}\) and \(X_{-S}=\prod _{i\not \in {S}}X_i\) the set of outsiders’ strategy profiles where \(x_S=(x_i)_{i\in {S}}\) and \(x_{-S}=(x_i)_{i\not \in {S}}\) are the representative elements of \(X_S\) and \(X_{-S}\) respectively. Furthermore, for any coalition \(S\in {{\mathcal {P}}(N)}\), define \(B_S:X_{-S}\twoheadrightarrow X_S\) the best reply correspondence of coalition S as:

We denote by \(x_S^*\in {B_S(x_{-S})}\) a best reply strategy of coalition S and by \(\tilde{x}_{-S}=(\tilde{x}_i)_{i\not \in {S}}\in {\prod _{i\not \in {S}}B_{\lbrace {i}\rbrace }(x_S,\tilde{x}_{-S\cup i})}\) an outsiders’ individual best reply strategy profile where \(S\cup i\) stands for \(S\cup \lbrace {i}\rbrace \). The strategy profile \((x_S^*,\tilde{x}_{-S})\in {X_N}\) is called a partial agreement equilibrium under S. We denote by \(\mathbf {X}^S\subseteq X_N\) the set of partial agreement equilibria under S.

In order to be complete, we adopt a more general approach in which any coalition structure can occur in the industry. A coalition structure \({\mathcal {P}}\) is a partition of the set of firms N, i.e., \({\mathcal {P}}=\lbrace {S_1,\ldots ,S_k}\rbrace \), \(k\in {\lbrace {1,\ldots ,n}\rbrace }\). An element of a coalition structure, \(S\in {{\mathcal {P}}}\), is called an admissible coalition in \({\mathcal {P}}\). We denote by \(\Pi (N)\) the set of coalition structures.

Given a strategic oligopoly game \((N,(X_i,\pi _i)_{i\in {N}})\) and a coalition structure \({\mathcal {P}}\in {\Pi (N)}\), we say that a strategy profile \(\hat{x}\in {X_N}\) is an equilibrium under \({\mathcal {P}}\) if:

Note that a partial agreement equilibrium under S corresponds to an equilibrium under coalition structure \({\mathcal {P}}^S=\lbrace {S}\rbrace \cup \lbrace {\lbrace {i}\rbrace : i\not \in {S}}\rbrace \).

2.2 Aggregate strategic oligopoly games

In order to study the equilibrium concepts defined above, we construct an aggregate strategic oligopoly game for which a Nash equilibrium represents the aggregate equilibrium outputs of the admissible coalitions. Given a strategic oligopoly game \((N,(X_i,\pi _i)_{i\in {N}})\) and a coalition structure \({\mathcal {P}}\in {\Pi (N)}\), the aggregate strategic oligopoly game \(({\mathcal {P}},(X^{S},\pi _{S})_{S\in {{\mathcal {P}}}})\) is defined as follows:

-

1.

the set of players (or admissible coalitions) is \({\mathcal {P}}\);

-

2.

for each \(S\in {{\mathcal {P}}}\), the coalition strategy set is \(X^{S}=[0,q^S]\subseteq {\mathbb {R}}_+\), \(q^S=\sum _{i\in {S}}q_i\), where \(x^S=\sum _{i\in {S}}x_i\in {X^S}\) represents the quantity produced by coalition S;

-

3.

the set of strategy profiles is \(X^{{\mathcal {P}}}=\prod _{S\in {{\mathcal {P}}}}X^S\) where \(x^{{\mathcal {P}}}=(x^S)_{S\in {{\mathcal {P}}}}\) is a representative element of \(X^{{\mathcal {P}}}\); for each \(S\in {{\mathcal {P}}}\), the coalition cost function \(C_S:X^S\longrightarrow {\mathbb {R}}_+\) is defined as:

$$\begin{aligned} C_S(x^S)=\min _{x_S\in {A(x^S)}}\sum _{i\in {S}}C_i(x_i) \end{aligned}$$(1)where \(A(x^S)=\lbrace {x_S\in {X_S}:\sum _{i\in {S}}x_i=x^S}\rbrace \) is the set of strategies of coalition S that permit it to produce the quantity \(x^S\); for each \(S\in {{\mathcal {P}}}\), the coalition profit function \(\pi _S:X^{{\mathcal {P}}}\longrightarrow {\mathbb {R}}\) is defined as:

$$\begin{aligned} \pi _S(x^{{\mathcal {P}}})=p(X)x^S-C_S(x^S) \end{aligned}$$(2)

In order to define the best reply correspondence of the admissible coalitions, for each \(S\in {{\mathcal {P}}}\), we denote by \(X^{-S}=X^{{\mathcal {P}}\backslash {\lbrace {S}\rbrace }}\) the set of outsiders’ strategy profiles where \(x^{-S}=x^{{\mathcal {P}}\backslash {\lbrace {S}\rbrace }}\) is a representative element of \(X^{{\mathcal {P}}\backslash {\lbrace {S}\rbrace }}\). For each \(S\in {{\mathcal {P}}}\), define \(B^S:X^{-S}\twoheadrightarrow X^S\) the best reply correspondence* of coalition S as:

Given an aggregate strategic oligopoly game \(({\mathcal {P}},(X^{S},\pi _{S})_{S\in {{\mathcal {P}}}})\), we say that a strategy profile \(\hat{x}^{{\mathcal {P}}}\in {X^{{\mathcal {P}}}}\) is a Nash equilibrium if:

We denote by \(\mathbf {X}^{{\mathcal {P}}}\subseteq X^{{\mathcal {P}}}\) the set of Nash equilibria of \(({\mathcal {P}},(X^{S},\pi _{S})_{S\in {{\mathcal {P}}}})\).

The construction of \(({\mathcal {P}},(X^{S},\pi _{S})_{S\in {{\mathcal {P}}}})\) permits to establish that there exists a Nash equilibrium \(\hat{x}^{{\mathcal {P}}}\in {\mathbf {X}^{{\mathcal {P}}}}\) if and only if there exists an equilibrium under \({\mathcal {P}}\), \(\hat{x}\in {X_N}\), such that \(\hat{x}_S\in {A(\hat{x}^S)}\) for any \(S\in {{\mathcal {P}}}\). Hence, the set of incomes of S enforced by \(\mathbf {X}^S\) and the set of incomes of S enforced by \(\mathbf {X}^{{\mathcal {P}}^S}\) are equal,Footnote 4

This equality will be useful for the study of equilibrium outputs.

2.3 Characterization of aggregate equilibrium outputs

Before studying properties of the set of equilibrium outputs, we express any Nash equilibrium of an aggregate strategic oligopoly game \(({\mathcal {P}},(X^{S},\pi _{S})_{S\in {{\mathcal {P}}}})\) as the fixed point of a one-dimensional correspondence. Given a coalition structure \({\mathcal {P}}\in {\Pi (N)}\) and an admissible coalition \(S\in {{\mathcal {P}}}\) the coalition profit function* \(\psi _S:X^S\times X^S\times X^N\longrightarrow {\mathbb {R}}\) is defined as:

and represents the income of S after changing its strategy from \(x^S\) to \(y^S\) when the joint production was X. For each \(S\in {{\mathcal {P}}}\), define \(R_S:X^N\twoheadrightarrow X^S\) the best reply correspondence** of coalition S as:

For any \(x^S\in R_S(X)\), coalition S does not have any interest to change its strategy from \(x^S\) to another strategy \(y^S\ne x^S\). For each \({\mathcal {P}}\in {\Pi (N)}\), the one-dimensional correspondence \(R_{{\mathcal {P}}}:X^N \twoheadrightarrow X^N\) is defined as:

Proposition 2.1

Let \(({\mathcal {P}},(X^{S},\pi _{S})_{S\in {{\mathcal {P}}}})\) be an aggregate strategic oligopoly game. Then, it holds that \(\hat{x}^{{\mathcal {P}}}\in {\mathbf {X}^{{\mathcal {P}}}}\) if and only if \(\hat{X}\in {R_{{\mathcal {P}}}(\hat{X})}\) where \(\hat{X}=\sum _{S\in {{\mathcal {P}}}}\hat{x}^S\).

The proof is given in the “Appendix”. The properties of the set of Nash equilibria \(\mathbf {X}^{{\mathcal {P}}}\) are now established.

Proposition 2.2

Let \(({\mathcal {P}},(X^{S},\pi _{S})_{S\in {{\mathcal {P}}}})\) be an aggregate strategic oligopoly game. Then

-

(i)

the set of Nash equilibria \(\mathbf {X}^{{\mathcal {P}}}\) is a polyhedron;

-

(ii)

the equilibrium total output is the same for any Nash equilibrium, i.e.:

$$\begin{aligned} \exists \bar{X}\in {X^N} \text{ s.t. } \forall \hat{x}^{{\mathcal {P}}}\in {\mathbf {X}^{{\mathcal {P}}}}, \sum _{S\in {{\mathcal {P}}}}\hat{x}^S=\bar{X}\text{; } \end{aligned}$$ -

(iii)

for each \(S\in {{\mathcal {P}}}\), the set of incomes of S enforced by \(\mathbf {X}^{{\mathcal {P}}}\), \(\pi _S(\mathbf {X}^{{\mathcal {P}}})\), is a compact real interval.

The proof can be found in the “Appendix”. Proposition 2.2 calls for two comments. First, point (ii) implies that \(\bar{X}\) is the unique fixed point of the one-dimensional correspondence \(R_{{\mathcal {P}}}\). Hence the set of incomes of N enforced by \(\mathbf {X}^{\lbrace {N}\rbrace }\) is a singleton (a degenerate interval). Second, the set of Nash equilibria \(\mathbf {X}^{{\mathcal {P}}}\) may be empty without the continuity and the concavity of p. So, both properties turn out to be minimal assumptions required in our analysis of oligopoly interval games.

2.4 Towards oligopoly interval games

In order to complete the endogenization of coalitional worth intervals, it remains to show that any coalition can be endowed with a compact real interval. Recall that a partial agreement equilibrium under S corresponds to an equilibrium under coalition structure \({\mathcal {P}}^S=\lbrace {S}\rbrace \cup \lbrace {\lbrace {i}\rbrace : i\not \in {S}}\rbrace \). For any coalition \(S\in {\mathcal {P}}(N)\) it follows directly from (4) and (iii) of Proposition 2.2 that the set of incomes of S enforced by the set of partial agreement equilibria under S has an interval structure.

Corollary 2.3

Let \((N,(X_i,\pi _i)_{i\in {N}})\) be a strategic oligopoly game. Then for any \(S\in {{\mathcal {P}}(N)}\), the set of incomes of S enforced by the set of partial agreement equilibria \(\mathbf {X}^S\), \(\sum _{i\in {S}}\pi _i(\mathbf {X}^S)\), is a compact real interval.

The \(\gamma \)-approach used to define endogenous interval games in oligopolies is illustrated in the following example.

Example 2.4

Consider the oligopoly situation \((N,(q_i,C_i)_{i\in {N}},p)\) where \(N=\lbrace {1,2,3}\rbrace \), for each \(i\in {N}\), \(q_i=5/3\) and \(C_i(x_i)=97x_i\), and the inverse demand function is defined as:

Clearly, the inverse demand function p is continuous, piecewise linear and concave on [0, 5] but it is not differentiable on ]0, 5[ at point \(\bar{X}=3\). Assume that coalition \(\lbrace {2,3}\rbrace \) forms. We show that a strategy profile \(x\in {X_N}\) is a partial agreement equilibrium under \(\lbrace {2,3}\rbrace \), i.e., \(x\in {\mathbf {X}^{\lbrace {2,3}\rbrace }}\), if and only if it satisfies (i) \(X=\bar{X}\) and (ii) \(x_2+x_3\in {[4/3,147/50]}\).

\([\Longleftarrow ]\) Take \(x\in {X_N}\) satisfying (i) and (ii). By (i) we have:

and

If firm 1 increases his output by \(\epsilon \in {]0,5/3-x_1]}\), its new payoff will be:

Conversely, if it decides to decrease its output by \(\delta \in {]0,x_1]}\), it will obtain:

Similarly, if coalition \(\lbrace {2,3}\rbrace \) increases its output by \(\epsilon +\epsilon '\in {]0,10/3-x_2-x_3]}\) where \(\epsilon \in {[0,5/3-x_2]}\) and \(\epsilon '\in {[0,5/3-x_3]}\), its new payoff will be:

On the contrary, if it decreases its output by \(\delta +\delta '\in {]0,x_2+x_3]}\) where \(\delta \in {[0,x_2]}\) and \(\delta '\in {[0,x_3]}\), it will obtain:

In all cases (7), (8), (9) and (10), given (ii), neither firm 1 nor coalition \(\lbrace {2,3}\rbrace \) can improve their incomes. We conclude that any strategy profile \(x\in {X_N}\) satisfying (i) and (ii) is a partial agreement equilibrium under \(\lbrace {2,3}\rbrace \).

\([\Longrightarrow ]\) Take any \(x\in {\mathbf {X}^{\lbrace {2,3}\rbrace }}\). By point (ii) of Proposition 2.2 we know that \(\bar{X}=3\) is the unique equilibrium total output. It follows that \(x\in {\mathbf {X}^{\lbrace {2,3}\rbrace }}\) is such that \(X=\bar{X}\). Moreover, given (i) and by (7), (8), (9) and (10) we deduce that \(x\in {\mathbf {X}^{\lbrace {2,3}\rbrace }}\) satisfies \(x_2+x_3\in {[4/3,147/50]}\).

Hence, by (i) and (ii) we conclude that the set of incomes of coalition \(\lbrace {2,3}\rbrace \) enforced by \(\mathbf {X}^{\lbrace {2,3}\rbrace }\) is [4, 8.82].

In a similar way, we can compute the set of incomes of other coalitions \(S\in {{\mathcal {P}}(N)}\) enforced by \(\mathbf {X}^S\):

S | \(\lbrace {i}\rbrace \) | \(\lbrace {i,j}\rbrace \) | \(\lbrace {1,2,3}\rbrace \) |

|---|---|---|---|

\(\sum _{i\in S}\pi _i(\mathbf {X}^S)\) | [0.18, 5] | [4, 8.82] | [9, 9] |

Observe that the set of incomes of the grand coalition is a degenerate interval as discussed earlier.

3 Oligopoly interval games and the cores

Before introducing the framework of interval games, we briefly recall the setup of classical TU-games. The set of players is given by \(N=\lbrace {1,\ldots ,n}\rbrace \) where i is a representative element. A TU-game is a pair (N, v) where \(v:{\mathcal {P}}(N)\longrightarrow {\mathbb {R}}\) is a characteristic function with the convention \(v(\emptyset )=0\), which assigns a number \(v(S)\in {{\mathbb {R}}}\) to each coalition \(S\in {{\mathcal {P}}(N)}\). This number v(S) is the worth of coalition S. For any fixed set of players N, we denote by \(G^N\) the set of TU-games where v is a representative element of \(G^N\).

In a TU-game \(v\in {G}^N\), each player \(i\in {N}\) may receive a payoff \(\sigma _i\in {{\mathbb {R}}}\). A vector \(\sigma =(\sigma _1,\ldots ,\sigma _n)\) is a payoff vector. We say that a payoff vector \(\sigma \in {{\mathbb {R}}^n}\) is acceptable if \(\sum _{i\in {S}}\sigma _i\ge v(S)\) for any coalition \(S\in {{\mathcal {P}}(N)}\), i.e., the payoff vector provides a total payoff to members of coalition S that is at least as great as its worth. We say that a payoff vector \(\sigma \in {{\mathbb {R}}^n}\) is efficient if \(\sum _{i\in {N}}\sigma _i=v(N)\), i.e., the payoff vector provides a total payoff to all players that is equal to the worth of the grand coalition N. The core C(v) of a TU-game \(v\in {G}^N\) is the set of all payoff vectors that are both acceptable and efficient:

Given a payoff vector in the core, the grand coalition could form and distribute its worth to its members in such a way that no coalition can contest this sharing by breaking off from the grand coalition.

In order to define oligopoly TU-games under the \(\gamma \)-approach Chander and Tulkens (1997), we consider the \(\gamma \)-characteristic function based on partial agreement equilibrium. Given a strategic oligopoly game \((N,(X_i,\pi _i)_{i\in {N}})\), the \(\gamma \)-characteristic function \(v_\gamma :{\mathcal {P}}(N)\longrightarrow {\mathbb {R}}\) is defined as:

where \((x_S^*,\tilde{x}_{-S})\in X_N\) is a partial agreement equilibrium under S. For any fixed set of players N, we denote by \(G^N_o\subseteq G^N\) the set of oligopoly TU-games.

As established in the previous section, the set of TU-games is not suitable insofar as the worth of a coalition may be not unique. As a consequence, we need the more general approach of interval games. Let \(I({\mathbb {R}})\) be the set of all closed and bounded real intervals. Take \(J,K\in {I({\mathbb {R}})}\) where \(J=[\underline{J},\overline{J}]\) and \(K=[\underline{K},\overline{K}]\), and \(k\in {{\mathbb {R}}_+}\). Then:

-

\(J+K=[\underline{J}+\underline{K},\overline{J}+\overline{K}]\);

-

\(kJ=[k\underline{J},k\overline{J}]\).

We see that \(I({\mathbb {R}})\) has a cone structure.

An interval game (N, w) is a set function \(w:{\mathcal {P}}(N)\longrightarrow I({\mathbb {R}})\) with the convention \(w(\emptyset )=[0,0]\), which assigns a closed and bounded real interval \(w(S)\in {I({\mathbb {R}})}\) to each coalition \(S\in {{\mathcal {P}}(N)}\). The interval w(S) is the worth interval of coalition S denoted by \([\underline{w}(S),\overline{w}(S)]\) where \(\underline{w}(S)\) and \(\overline{w}(S)\) are the lower and the upper bounds of w(S) respectively. Thus, an interval game fits all the situations where any coalition knows with certainty only the lower and upper bounds of its worth interval. For any fixed set of players N, we denote by \({\textit{IG}}^{N}\) the set of interval games where w is a representative element of \(\textit{IG}^{N}\).Footnote 5

There are two main ways of generalizing the definition of the core for interval games. The first core solution concept is the interval core. For each \(J=[\underline{J},\overline{J}]\) and \(K=[\underline{K},\overline{K}]\in {I({\mathbb {R}})}\), we say that J is weakly better than K, which we denote \(J\succcurlyeq K\), if \(\underline{J}\ge \underline{K}\) and \(\overline{J}\ge \overline{K}\). We denote by \(I({\mathbb {R}})^n\) the set of n -dimensional interval vectors where I is a representative element of \(I({\mathbb {R}})^n\). In an interval game \(w\in {IG}^N\), each player \(i\in {N}\) may receive a payoff interval \(I_i\in {I({\mathbb {R}})}\). An interval vector \(I=(I_1,\ldots ,I_n)\) is a payoff interval vector. We say that a payoff interval vector \(I\in {I({\mathbb {R}})^n}\) is acceptable if \(\sum _{i\in {S}}I_i\succcurlyeq w(S)\) for any coalition \(S\in {{\mathcal {P}}(N)}\), i.e., the payoff interval vector provides a total payoff interval to members of coalition S that is weakly better than its worth interval. We say that a payoff interval vector \(I\in {I({\mathbb {R}})^n}\) is efficient if \(\sum _{i\in {N}}I_i=w(N)\), i.e., the payoff interval vector provides a total payoff interval to all players that is equal to the worth interval of the grand coalition N. The interval core \({\mathcal {C}}(w)\) of an interval game \(w\in {IG}^N\) is the set of all payoff interval vectors that are both acceptable and efficient:

Given a payoff interval vector in the interval core, the grand coalition could form and distribute its worth interval to its members in such a way that no coalition can contest this sharing by breaking off from the grand coalition.

The second core solution concept is the standard core. Given an interval game \(w\in {IG}^N\), a TU-game \(v\in {G}^N\) is called a selection of w if for any \(S\in {{\mathcal {P}}(N)}\) we have \(v(S)\in {w(S)}\). We denote by Sel(w) the set of all selections of \(w\in {IG^N}\). The standard core C(w) of an interval game \(w\in {IG}^N\) is defined as the union of the cores of all its selections \(v\in {G}^N\):

A payoff vector \(\sigma \in {{\mathbb {R}}^n}\) is in the standard core C(w) if and only if there exists a TU-game \(v\in {Sel(w)}\) such that \(\sigma \) belongs to the core C(v).

As demonstrated in the previous section, it is always possible to define an oligopoly interval game under the \(\gamma \)-approach. It follows from Corollary 2.3 that we can convert a strategic oligopoly game \((N,(X_i,\pi _i)_{i\in {N}})\) into an oligopoly interval game under the \(\gamma \)-approach denoted by \((N,w_\gamma )\) where \(w_\gamma :{\mathcal {P}}(N)\longrightarrow I({\mathbb {R}})\) is a set function defined as:

The worth interval \(w_\gamma (S)\) of each coalition \(S\in {{\mathcal {P}}(N)}\) is denoted by \([\underline{w}_\gamma (S),\overline{w}_\gamma (S)]\) where \(\underline{w}_\gamma (S)\) and \(\overline{w}_\gamma (S)\) are the minimal and the maximal incomes of S enforced by \(\mathbf {X}^S\) respectively.Footnote 6 For any fixed set of firms N, we denote by \(IG^N_o\subseteq IG^N\) the set of oligopoly interval games.

3.1 The Hurwicz criterion

An oligopoly interval game \(w_\gamma \in {IG^N_o}\) fits all the situations where each coalition \(S\in {{\mathcal {P}}}(N)\) knows with certainty only the lower and upper bounds \(\underline{w}_\gamma (S)\) and \(\overline{w}_\gamma (S)\) of all its potential worths. Consequently, the expectations of each coalition \(S\in {{\mathcal {P}}}(N)\) on its potential worths are necessarily focused on its worth interval \(w_\gamma (S)\). In order to define the expectations of each coalition \(S\in {{\mathcal {P}}(N)}\), we use a decision theory criterion, the Hurwicz criterion Hurwicz (1951), that consists in doing a convex combination of the lower and upper bounds of all its potential worths, i.e., \(\mu _S\underline{w}_\gamma (S)+(1-\mu _S)\overline{w}_\gamma (S)\) where \(\mu _S\in {[0,1]}\). The number \(\mu _S\in {[0,1]}\) can be regarded as the degree of pessimism of coalition S. A vector \(\mu =(\mu _S)_{S\in {{\mathcal {P}}(N)}}\) is an expectation vector. To any expectation vector \(\mu \in {\prod _{S\in {{\mathcal {P}}(N)}}[0,1]}\), we associate the oligopoly TU-game \(v_\gamma ^\mu :{\mathcal {P}}(N)\longrightarrow {\mathbb {R}}\) defined as:

where \(v_\gamma ^\mu \in {Sel(w_\gamma )}\). The two necessary and sufficient conditions for the non-emptiness of the interval and the standard \(\gamma \)-cores are derived from particular selections of \(w_\gamma \), i.e., \(v_\gamma ^0=\overline{w}_\gamma \) and \(v_\gamma ^1=\underline{w}_\gamma \) respectively.

3.2 The non-emptiness of the interval \(\gamma \)-core

The generalization of the balancedness property from TU-games (Bondareva 1963; Shapley 1967) to interval games is the \({\mathcal {I}}\)-balancedness property (Alparslan-Gök et al. 2011). It is a necessary and sufficient condition to guarantee the non-emptiness of the interval core. For each \(S\in {{\mathcal {P}}(N)}\), \(e^S\in {{\mathbb {R}}^n}\) is the vector with coordinates equal to 1 in S and equal to 0 outside S. A map \(\lambda :{\mathcal {P}}(N)\backslash {\lbrace {\emptyset }\rbrace }\longrightarrow {\mathbb {R}}_+\) is balanced if \(\sum _{S\in {{\mathcal {P}}(N)\backslash {\lbrace {\emptyset }\rbrace }}}\lambda (S)e^S=e^N\). An interval game \(w\in {IG}^N\) is strongly balanced if for any balanced map \(\lambda \) it holds that:

An interval game \(w\in {IG}^N\) is \({\mathcal {I}}\) -balanced if for any balanced map \(\lambda \) it holds that:Footnote 7

Theorem 3.1

(Alparslan-Gök et al. 2011) Let \(w\in {IG^N}\) be an interval game. Then, it holds that:

-

(i)

if the interval game \(w\in {IG^N}\) is strongly balanced, then it is \({\mathcal {I}}\)-balanced;

-

(ii)

the interval game \(w\in {IG^N}\) has a non-empty interval core if and only if it is \({\mathcal {I}}\)-balanced.

In the set of oligopoly interval games, we success in establishing an alternative necessary and sufficient condition based on the minimum degree of pessimism of any coalition, i.e., \(\mu _S=0\) for each \(S\in {\mathcal {P}}(N)\).

Theorem 3.2

The oligopoly interval game \(w_\gamma \in {IG^N_o}\) has a non-empty interval \(\gamma \)-core if and only if the oligopoly TU-game \(v_\gamma ^0\in {Sel(w_\gamma )}\) as defined in (12) has a non-empty \(\gamma \)-core.

Proof

\([\Longrightarrow ]\) Assume that \({\mathcal {C}}(w_\gamma )\ne {\emptyset }\) and take any payoff interval vector \(I\in {{\mathcal {C}}(w_\gamma )}\). Then, it holds that \(\sum _{i\in {N}}I_i=w_\gamma (N)\) implying that \(\sum _{i\in {N}}\overline{I}_i=\overline{w}_\gamma (N)\), and for any \(S\in {{\mathcal {P}}(N)}\) it holds that \(\sum _{i\in {S}}I_i\succcurlyeq w_\gamma (S)\) implying that \(\sum _{i\in {S}}\overline{I}_i\ge \overline{w}_\gamma (S)\). Let \(\sigma \in {{\mathbb {R}}^n}\) be a payoff vector such that \(\sigma _i=\overline{I}_i\) for each \(i\in {N}\). It follows from \(\overline{w}_\gamma =v_\gamma ^0\) that \(\sum _{i\in {N}}\sigma _i=v_\gamma ^0(N)\) and \(\sum _{i\in {S}}\sigma _i\ge v_\gamma ^0(S)\) for any \(S\in {{\mathcal {P}}(N)}\). Hence, we conclude that \(\sigma \in {C(v_\gamma ^0)}\).

\([\Longleftarrow ]\) Assume that \(C(v_\gamma ^0)\ne {\emptyset }\). By the balancedness property, it holds for any balanced map \(\lambda \) that:

Since the worth interval of the grand coalition is degenerate, we have \(v_\gamma ^0(N)=\overline{w}_\gamma (N)=\underline{w}_\gamma (N)\). Hence, from \(v_\gamma ^0=\overline{w}_\gamma \) and by (13) we deduce that the oligopoly interval game \(w_\gamma \in {IG^N_o}\) is strongly balanced, i.e., for any balanced map \(\lambda \) it holds that:

By (i) and (ii) of Theorem 3.1, we conclude that \(w_\gamma \in {IG^N_o}\) is \({\mathcal {I}}\)-balanced, and therefore has a non-empty interval \(\gamma \)-core. \(\square \)

One can ask in which industry types the non-emptiness of \(C(v_\gamma ^0)\) is satisfied. Example 2.4 shows that even for a very simple oligopoly situation, this condition fails to be satisfied since \(\sum _{i\in {N}}v_\gamma ^0(\lbrace {i}\rbrace )=15>9=v_\gamma ^0(N)\), hence the core of \(v_\gamma ^0\in {Sel(w_\gamma )}\) and the interval \(\gamma \)-core are empty. This is a consequence of the non-differentiability of the inverse demand function p at point \(\bar{X}=3\). Indeed, at this point it is possible for a deviating coalition to obtain a large income on a partial agreement equilibrium since it is no incentive for other firms to change their outputs on any neighborhood of \(\bar{X}=3\).

3.3 The non-emptiness of the standard \(\gamma \)-core

Once again, in the set of oligopoly interval games we establish an alternative necessary and sufficient condition for the non-emptiness of the standard \(\gamma \)-core based on the maximum degree of pessimism of any coalition, i.e., \(\mu _S=1\) for each \(S\in {\mathcal {P}}(N)\).

Theorem 3.3

Let \(w_\gamma \in {IG^N_o}\) be an oligopoly interval game and \(v_\gamma ^1\in {Sel(w_\gamma )}\) be the oligopoly TU-game as defined in (12). Then \(C(w_\gamma )=C(v_\gamma ^1)\).Footnote 8

Proof

First, it follows from \(v_\gamma ^1\in {Sel(w_\gamma )}\) that \(C(v_\gamma ^1)\subseteq \bigcup _{v_\gamma ^\mu \in {Sel(w_\gamma )}}C(v_\gamma ^\mu )=C(w_\gamma )\).

It remains to show that \(C(w_\gamma )\subseteq C(v_\gamma ^1)\). If \(C(w_\gamma )=\emptyset \) we have obviously \(C(w_\gamma )\subseteq C(v_\gamma ^1)\). So, assume that \(C(w_\gamma )\ne {\emptyset }\) and take any payoff vector \(\sigma \in {C(w_\gamma )}\). Thus, there exists an expectation vector \(\bar{\mu }\) such that \(\sigma \in {C(v_\gamma ^{\bar{\mu }})}\):

Since the worth interval of the grand coalition N is degenerate we have \(v_\gamma ^{\bar{\mu }}(N)=v_\gamma ^1(N)\), and therefore by (14), \(\sum _{i\in {N}}\sigma _i=v_\gamma ^1(N)\). Moreover, by (12) it holds that \(v_\gamma ^{\bar{\mu }}\ge v_\gamma ^1\) implying by (14) that \(\sum _{i\in {S}}\sigma _i\ge v_\gamma ^1(S)\) for any \(S\in {{\mathcal {P}}(N)}\). Hence, we conclude that \(\sigma \in {C(v_\gamma ^1)}\) which proves that \(C(w_\gamma )\subseteq C(v_\gamma ^1)\). \(\square \)

It follows directly from Theorem 3.3 that the oligopoly interval game \(w_\gamma \in {IG^N_o}\) has a non-empty standard \(\gamma \)-core if and only if the oligopoly TU-game \(v_\gamma ^1\in {Sel(w_\gamma )}\) has a non-empty \(\gamma \)-core. In Example 2.4, both the \(\gamma \)-core of \(v_\gamma ^1\in {Sel(w_\gamma )}\) and the standard \(\gamma \)-core are equal and are non-empty.

In the following, the purpose is to identify in which industry types the core of \(v_\gamma ^1\) is non-empty by approximating the inverse demand function p. First, we denote by \({\mathcal {X}}\) the denumerable set of points in \(]0,\xi [\) where the inverse demand function p is non-differentiable.Footnote 9 The Weierstrass approximation theorem states that any continuous function defined on a compact interval can be uniformly approximated as closely as desired by a sequence of polynomial functions. In particular, we denote by \((p_\epsilon )_{\epsilon >0}\) a sequence of inverse demand functions satisfying assumption (a) and, in addition, differentiable on \(]0,\xi [\) that uniformly converges to the inverse demand function \(p_0=p\),Footnote 10 i.e., for each \(\zeta >0\), there exists \(\epsilon '>0\) such that for all \(\epsilon <\epsilon '\), it holds that:

Second, we generalize some definitions in Sect. 2. Given a sequence \((p_\epsilon )_{\epsilon >0}\), a coalition structure \({\mathcal {P}}\in {\Pi (N)}\) and an admissible coalition \(S\in {{\mathcal {P}}}\), for each \(\epsilon >0\) we define:

-

the individual profit function \(\pi _i^\epsilon :X_N\longrightarrow {\mathbb {R}}\) as:

$$\begin{aligned} \pi _i^\epsilon (x)=p_\epsilon (X)x_i-C_i(x_i)\text{; } \end{aligned}$$ -

the coalition profit function \(\pi _S^\epsilon :X^{{\mathcal {P}}}\longrightarrow {\mathbb {R}}\) as:

$$\begin{aligned} \pi _S^\epsilon (x^{{\mathcal {P}}})=p_\epsilon (X)x^S-C_S(x^S)\text{; } \end{aligned}$$ -

the coalition profit function* \(\psi _S^\epsilon :X^S\times X^S\times X^N\longrightarrow {\mathbb {R}}\) as:

$$\begin{aligned} \forall x^S\le X, \psi _S^\epsilon (y^S,x^S,X)=p_\epsilon (X-x^S+y^S)y^S-C_S(y^S)\text{; } \end{aligned}$$ -

the best reply correspondence** \(R_S^\epsilon :X^N\twoheadrightarrow X^S\) as:

$$\begin{aligned} R_S^\epsilon (X)=\bigg \lbrace {x^S\in {X^S}:x^S\in {\arg \max _{y^S\in {X^S}}\psi _S^\epsilon (y^S,x^S,X)}}\bigg \rbrace \text{; } \end{aligned}$$ -

the one-dimensional correspondence \(R_{{\mathcal {P}}}^\epsilon :X^N \twoheadrightarrow X^N\) as:

$$\begin{aligned} R_{{\mathcal {P}}}^\epsilon (X)=\bigg \lbrace {Y\in {X^N}:Y=\sum _{S\in {{\mathcal {P}}}}x^S\quad \text{ and } \quad \forall S\in {{\mathcal {P}}}, x^S\in {R_S^\epsilon (X)}}\bigg \rbrace \text{; } \end{aligned}$$ -

the \(\gamma \)-characteristic function \(v_\gamma ^\epsilon :{\mathcal {P}}(N)\longrightarrow {\mathbb {R}}\) as:

$$\begin{aligned} v_\gamma ^\epsilon (S)=\sum _{i\in {S}}\pi _i^\epsilon (x_S^*,\tilde{x}_{-S})\text{, } \end{aligned}$$

where \((x_S^*,\tilde{x}_{-S})\in {X_N}\) is a partial agreement equilibrium under S of the strategic oligopoly game \((N,(X_i,\pi _i^\epsilon )_{i\in {N}})\). For each \(\epsilon >0\), as the inverse demand function \(p_\epsilon \) is differentiable on \(]0,\xi [\), it follows that the worth of any coalition \(S\in {{\mathcal {P}}(N)}\), \(v_\gamma ^\epsilon (S)\), is unique (Lardon 2012). We denote by \(\mathbf {X}_\epsilon ^S\subseteq X_N\) the set of partial agreement equilibria under S of the strategic oligopoly game \((N,(X_i,\pi _i^\epsilon )_{i\in {N}})\) and by \(\mathbf {X}^{{\mathcal {P}}}_\epsilon \subseteq X^{{\mathcal {P}}}\) the set of Nash equilibria of the aggregate strategic oligopoly game \(({\mathcal {P}},(X^S,\pi _S^\epsilon )_{S\in {{\mathcal {P}}}})\).

For each \(\epsilon >0\), we denote by \(\hat{x}^{{\mathcal {P}}}_\epsilon \in {\mathbf {X}^{{\mathcal {P}}}_\epsilon }\) the unique Nash equilibrium of the aggregate strategic oligopoly game \(({\mathcal {P}},(X^S,\pi _S^\epsilon )_{S\in {{\mathcal {P}}}})\).Footnote 11 Moreover, from (ii) of Proposition 2.2 we denote by \(\bar{X}\) the unique equilibrium total output of the aggregate strategic oligopoly game \(({\mathcal {P}},(X^S,\pi _S)_{S\in {{\mathcal {P}}}})\).

Lemma 3.4

Let \({\mathcal {P}}\in {\Pi (N)}\) be a coalition structure, \((p_\epsilon )_{\epsilon >0}\) a sequence that uniformly converges to p and \((\hat{x}_\epsilon ^{{\mathcal {P}}})_{\epsilon >0}\) the associated sequence of Nash equilibria. If the sequence \((\hat{x}_\epsilon ^{{\mathcal {P}}})_{\epsilon >0}\) convergesFootnote 12 to a strategy profile \(\hat{x}^{{\mathcal {P}}}_0\in {X^{{\mathcal {P}}}}\) then it holds that:

-

(i)

\(\sum _{S\in {{\mathcal {P}}}}\hat{x}^S_0=\bar{X}\);

-

(ii)

\(\forall S\in {{\mathcal {P}}}\), \(\hat{x}^S_0\in {R_S(\bar{X})}\);

-

(iii)

\(\hat{x}_0^{{\mathcal {P}}}\in {\mathbf {X}^{{\mathcal {P}}}}\).

Proof

From Proposition 2.1, for each \(\epsilon >0\) we have \(\sum _{S\in {{\mathcal {P}}}}\hat{x}_\epsilon ^S=\hat{X}_\epsilon \in {R_{{\mathcal {P}}}^\epsilon (\hat{X}_\epsilon )}\). By the definitions of \(R_S^\epsilon \) and \(R_{{\mathcal {P}}}^\epsilon \) it holds that:

For each \(S\in {{\mathcal {P}}}\), the uniform convergence of the sequence \((p_\epsilon )_{\epsilon >0}\) to p implies that the sequence \((\psi _S^\epsilon )_{\epsilon >0}\) uniformly converges to \(\psi _S\). This result, the continuity of any coalition profit function* \(\psi _S^\epsilon \), \(\epsilon >0\), and (15) imply for each \(S\in {{\mathcal {P}}}\) that:

It follows from (16) that \(\sum _{S\in {{\mathcal {P}}}}\hat{x}^S_0\in {R_{{\mathcal {P}}}(\sum _{S\in {{\mathcal {P}}}}\hat{x}^S_0)}\). From (ii) of Proposition 2.2, \(\bar{X}\) is the unique fixed point of \(R_{{\mathcal {P}}}\). Hence, we deduce that \(\sum _{S\in {{\mathcal {P}}}}\hat{x}^S_0=\bar{X}\), and therefore by (16) \(\hat{x}^S_0\in {R_S(\bar{X})}\) for any \(S\in {{\mathcal {P}}}\) which proves points (i) and (ii).

Finally, point (iii) is a consequence of points (i) and (ii) by Proposition 2.1. \(\square \)

Lemma 3.5

Let \(S\in {{\mathcal {P}}(N)}\) be a coalition, \((p_\epsilon )_{\epsilon >0}\) a sequence that uniformly converges to p and \((\hat{x}_\epsilon ^{{\mathcal {P}}^S})_{\epsilon >0}\) the associated sequence of Nash equilibria. If the sequence \((\hat{x}_\epsilon ^{{\mathcal {P}}^S})_{\epsilon >0}\) convergesFootnote 13 to a strategy profile \(\hat{x}_0^{{\mathcal {P}}^S}\in {X^{{\mathcal {P}}^S}}\) then it holds that \(\lim _{\epsilon \longrightarrow 0}v_\gamma ^\epsilon (S)\in {w_\gamma (S)}\).

Proof

Take any \(\epsilon >0\). By (4) we know that the set of incomes of S enforced by \(\mathbf {X}_\epsilon ^S\) and the set of incomes of S enforced by \(\mathbf {X}^{{\mathcal {P}}^S}_\epsilon \) are equal, i.e., \(\sum _{i\in {S}}\pi _i(\mathbf {X}_\epsilon ^S)=\pi _S(\mathbf {X}_\epsilon ^{{\mathcal {P}}^S})\). Hence, for each \(\epsilon >0\) it holds that:

where \(\hat{x}_\epsilon ^{{\mathcal {P}}^S}\in {\mathbf {X}_\epsilon ^{{\mathcal {P}}^S}}\) is the unique Nash equilibrium of the aggregate strategic oligopoly game \(({\mathcal {P}}^S,(X^{T},\pi _{T}^\epsilon )_{T\in {{\mathcal {P}}^S}})\). The uniform convergence of the sequence \((p_\epsilon )_{\epsilon >0}\) to p implies that the sequence \((\pi _S^\epsilon )_{\epsilon >0}\) uniformly converges to \(\pi _S\). It follows from this result and the continuity of \(\pi _S\) that:

From (iii) of Lemma 3.4 we know that \(\hat{x}_0^{{\mathcal {P}}^S}\in {\mathbf {X}_\epsilon ^{{\mathcal {P}}^S}}\). Hence, by (17) we have \(\lim _{\epsilon \longrightarrow 0}v_\gamma ^\epsilon (S)\in {\pi _S(\mathbf {X}^{{\mathcal {P}}^S})}\). By (4), we know that the set of incomes of S enforced by \(\mathbf {X}^S\) and the set of incomes of S enforced by \(\mathbf {X}^{{\mathcal {P}}^S}\) are equal. Thus, by (11) it holds that:

Hence, we conclude that \(\lim _{\epsilon \longrightarrow 0}v_\gamma ^\epsilon (S)\in {w_\gamma (S)}\).\(\square \)

Theorem 3.6

Let \(w_\gamma \in {IG^N_o}\) be an oligopoly interval game and \((p_\epsilon )_{\epsilon >0}\) a sequence that uniformly converges to p. If for each \(\epsilon >0\), the oligopoly TU-game \(v_\gamma ^\epsilon \in {G^N_o}\) admits a non-empty \(\gamma \)-core then it holds that \(C(w_\gamma )\ne {\emptyset }\).

Proof

By the definition of the core, for each \(\epsilon >0\) there exists a payoff vector \(\sigma ^\epsilon \in {{\mathbb {R}}^n}\) such that:

By (18), the sequence \((\sigma ^\epsilon )_{\epsilon >0}\) is bounded in \({\mathbb {R}}^n\). Thus, there exists a subsequence of \((\sigma ^\epsilon )_{\epsilon >0}\) that converges to a point \(\sigma ^0\in {{\mathbb {R}}^n}\). Without loss of generality we denote by \((\sigma ^\epsilon )_{\epsilon >0}\) such a subsequence.

First, take any coalition \(S\in {{\mathcal {P}}(N)}\) and consider the coalition structure \({\mathcal {P}}^S=\lbrace {S}\rbrace \cup \lbrace {\lbrace {i}\rbrace :i\not \in {S}}\rbrace \). By the compacity of each coalition strategy set \(X^T\), \(T\in {{\mathcal {P}}^S}\), there exists a subsequence of \((\hat{x}^{{\mathcal {P}}^S}_{\epsilon })_{\epsilon >0}\) denoted by \((\hat{x}^{{\mathcal {P}}^S}_{\epsilon _{k}})_{\epsilon _{k}>0}\), \(k\in {{\mathbb {N}}}\), that converges to a strategy profile \(\hat{x}^{{\mathcal {P}}^S}_0\in {\mathbf {X}^{{\mathcal {P}}^S}}\) by point (iii) of Lemma 3.4. Thus, by (18) it holds that:

It follows from Lemma 3.5 that \(\lim _{\epsilon _{k}\longrightarrow 0}v_\gamma ^{\epsilon _{k}}(S)\in {w_\gamma (S)}\) for any \(S\in {{\mathcal {P}}(N)}\). From this result, we deduce that there exists an expectation vector \(\bar{\mu }\) such that:

Second, consider the grand coalition \(N\in {{\mathcal {P}}(N)}\). By a similar argument to the one in the first part of the proof and (18) it holds that:

It follows from Lemma 3.5 that \(\lim _{\epsilon _{k}\longrightarrow 0}v_\gamma ^{\epsilon _{k}}(N)\in {w_\gamma (N)}\). As the worth interval of the grand coalition is degenerate, it holds that:

By (19) and (20) we conclude that \(\sigma ^0\in {C(v_\gamma ^{\bar{\mu }})\subseteq C(w_\gamma )}\) since \(v_\gamma ^{\bar{\mu }}\in {Sel(w_\gamma )}\).\(\square \)

One can ask which properties on profit and cost functions ensure that for any \(\epsilon >0\), the oligopoly TU-game \(v_\gamma ^\epsilon \) admits a non-empty \(\gamma \)-core. When the inverse demand function p is differentiable Lardon (2012) shows that if:

-

(c)

either any individual profit function \(\pi _i\) is concave on the set of strategy profiles \(X_N\);

-

(d)

or any cost function \(C_i\) is linear and each firm has the same marginal cost:

$$\begin{aligned} \exists c\in {{\mathbb {R}}_+} \text{ s.t. } \forall i\in {N}, C_i(x_i)=cx_i\text{, }\end{aligned}$$

then the associated oligopoly TU-game \(v_\gamma \in {G^N_o}\) has a non-empty \(\gamma \)-core. Hence, we deduce from Theorem 3.6 the following result.

Corollary 3.7

Let \(w_\gamma \in {IG^N_o}\) be an oligopoly interval game and \((p_\epsilon )_{\epsilon >0}\) a sequence that uniformly converges to p such that for each \(\epsilon >0\) assumption (c) or (d) is satisfied. Then, it holds that \(C(w_\gamma )\ne {\emptyset }\).

Note that if the inverse demand function p is differentiable, all worth intervals of \(w_\gamma \in {IG^N_o}\) are degenerate, i.e., \(w_\gamma =\lbrace {v_\gamma }\rbrace \) where \(v_\gamma \in {G^N_o}\). Thus, the standard core of \(w_\gamma \) is equal to the core of \(v_\gamma \).

The above results on the non-emptiness of the standard \(\gamma \)-core which use approximation techniques are illustrated in the following example.

Example 3.8

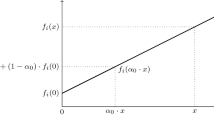

On the basis of Example 2.4 we construct a sequence \((p_\epsilon )_{\epsilon >0}\) that uniformly converges to the inverse demand function p which is not differentiable at point \(\bar{X}=3\). For each \(0<\epsilon <2\), define the quadratic function function \(f_{\bar{X}}^\epsilon :[3-\epsilon ,3+\epsilon ] \longrightarrow {\mathbb {R}}_+\) as:Footnote 14

where \(X=(Y-3+\epsilon )/2\epsilon \). The inverse demand function \(p_\epsilon : {\mathbb {R}}_+ \longrightarrow {\mathbb {R}}_+\) is then given by:

Note that \(f_{\bar{X}}^\epsilon (3-\epsilon )=p(3-\epsilon )=100+\epsilon \) and \(f_{\bar{X}}^\epsilon (3+\epsilon )=p(3+\epsilon )=100-50\epsilon \). Moreover, it holds that \(f_{\bar{X}}'^\epsilon (3-\epsilon )=p'(3-\epsilon )=-1\) and \(f_{\bar{X}}'^\epsilon (3+\epsilon )=p'(3+\epsilon )=-50\). Hence \(p_\epsilon \) is continuous on [0, 5] and differentiable on ]0, 5[. It follows from \(\lim _{\epsilon \longrightarrow 0}f_{\bar{X}}^\epsilon (3)=p(3)=100\) that the sequence \((p_\epsilon )_{\epsilon >0}\) uniformly converges to p.

For any coalition \(S\in {\mathcal {P}}(N)\), the differentiability of \(p_\epsilon \) permits to use the first order conditions in order to compute the unique Nash equilibrium of the aggregate strategic oligopoly game \(({\mathcal {P}}^S,(X^T,\pi _T^\epsilon )_{T\in {{\mathcal {P}}^S}})\). The results are summarized in the following table:

S | \(\lbrace {i}\rbrace \) | \(\lbrace {i,j}\rbrace \) | \(\lbrace {1,2,3}\rbrace \) |

|---|---|---|---|

\(\lim _{\epsilon \longrightarrow 0}\hat{x}_\epsilon ^{{\mathcal {P}}^S}\) | (1, 1, 1) | (1.5, 1.5) | (3) |

\(\lim _{\epsilon \longrightarrow 0}v_\gamma ^\epsilon (S)\) | 3 | 4.5 | 9 |

For any \(S\in {\mathcal {P}}(N)\), it holds that \(\sum _{T\in {{\mathcal {P}}^S}}\hat{x}^T_0=\bar{X}=3\) and \(\lim _{\epsilon \longrightarrow 0}v_\gamma ^\epsilon (S)\in w_\gamma (S)\) as enunciated by point (i) of Lemma 3.4 and Lemma 3.5 respectively. Moreover, note that for each \(\epsilon >0\), assumption (d) is satisfied which implies that \(C(v_\gamma ^\epsilon )\ne \emptyset \). By Theorem 3.6 and/or Corollary 3.7, we conclude that \(C(w_\gamma )\ne \emptyset \).

4 Concluding remarks

In this article, we have focused on interval games in oligopolies. We have showed that the \(\gamma \)-approach suggested by Chander and Tulkens (1997) permits to endogenize the coalitional worth intervals. A particularity to the set of oligopoly interval games is that the worth interval of the grand coalition is degenerate which may be not the case in the set of interval games. We have exploited this property in order to characterize the non-emptiness of the interval and the standard \(\gamma \)-cores. Furthermore, we have identified industry types in which both cores are empty or not.

The expectations of any coalition (its degree of pessimism) have been formalized by the Hurwicz criterion which turns out to be a key concept in our analysis. An alternative way to extend the analysis of expectations would be to consider a continuous probability distribution f defined on worth intervals and construct the associated expected oligopoly TU-game \(v_\gamma ^f= \int _{w_\gamma } vf(v) \mathrm {d}v\). This is left for future work.

Notes

The complementary issue on the threats expressed by players (firms) within coalition (cartel) has been investigated by Myerson (1978).

We use the term “standard core” instead of the term “core” in order to distinguish the core solution concepts for interval games and TU-games.

The proof can be found in Lardon (2012). The “if” part of the result implies that \(\sum _{i\in {S}}\pi _i(\mathbf {X}^S)\subseteq \pi _S\left( \mathbf {X}^{{\mathcal {P}}^S}\right) \) while the “only if” part implies that \(\sum _{i\in {S}}\pi _i(\mathbf {X}^S)\supseteq \pi _S\left( \mathbf {X}^{{\mathcal {P}}^S}\right) \).

Note that if each worth interval of an interval game \(w\in {{\textit{IG}}^N}\) is degenerate, i.e., \(\underline{w}=\overline{w}\), then w corresponds to the TU-game \(v\in {G}^N\) where \(v=\underline{w}=\overline{w}\). In this sense, the set of TU-games \(G^N\) is included in the set of interval games \({\textit{IG}}^N\).

As the worth interval \(w_\gamma (N)\) is degenerate, we have \(\underline{w}_\gamma (N)=\overline{w}_\gamma (N)\).

A TU-game \(v\in {G^N}\) is balanced if for every balanced map \(\lambda \) it holds that:

$$\begin{aligned} \sum _{S\in {{\mathcal {P}}(N)\backslash {\lbrace {\emptyset }\rbrace }}}\lambda (S)v(S)\le v(N)\text{. }\end{aligned}$$Thus, when all worth intervals are degenerate strong balancedness and \({\mathcal {I}}\)-balancedness properties coincide with balancedness property.

By defining the standard core* of an interval game \(w\in {IG^N}\) as the intersection of the cores of all its selections \(v\in {G^N}\):

$$\begin{aligned} C^*(w)=\bigcap _{v\in {Sel(w)}}C(v)\text{, } \end{aligned}$$we obtain the opposite result to Theorem 3.3, i.e., \(C^*(w_\gamma )=C(v_\gamma ^0)\).

The concavity of the inverse demand function p on \([0,\xi ]\) ensures that \({\mathcal {X}}\) is at most denumerable.

Proposition 5.1 in the “Appendix” states that the sequence \((p_\epsilon )_{\epsilon >0}\) always exists.

This uniqueness result is established in Lardon (2012).

For any \(S\in {\mathcal {P}}\) every coalition strategy set \(X^S\) is compact. Hence it follows from the Bolzano–Weierstrass theorem that \(\lim _{\epsilon \longrightarrow 0}(\hat{x}_\epsilon ^{{\mathcal {P}}})_{\epsilon >0}\in X^{{\mathcal {P}}}\).

See footnote 3.4.

This function is derived from the approximation technique of quadratic Bézier curves detailed in the “Appendix”.

References

Abreu, D. (1988). On the theory of infinitely repeated games with discounting. Econometrica, 56, 383–396.

Alparslan-Gök, S., Branzei, O., Branzei, R., & Tijs, S. (2011). Set-valued solution concepts using interval-type payoffs for interval games. Journal of Mathematical Economics, 47, 621–626.

Alparslan-Gök, S., Miquel, S., & Tijs, S. (2009). Cooperation under interval uncertainty. Mathematical Methods of Operations Research, 69, 99–109.

Aumann, R. (1959). Acceptable points in general cooperative n-person games. In Iuce Tucker (Ed.), Contributions to the theory of games IV. Annals of Mathematics Studies (Vol. 40). Princeton: Princeton University Press.

Bézier, P. (1976). Numerical definition of experimental surfaces. Neue Technik, 18(7–8), 487–489 and 491–493.

Bondareva, O. N. (1963). Some applications of linear programming methods to the theory of cooperative games. Problemi Kibernetiki, 10, 119–139.

Chander, P., & Tulkens, H. (1997). The core of an economy with multilateral environmental externalities. International Journal of Game Theory, 26, 379–401.

Debreu, G. (1972). Smooth preferences. Econometrica, 40, 603–615.

Debreu, G. (1976). Smooth preferences: A corrigendum. Econometrica, 44, 831–832.

Driessen, T. S., & Meinhardt, H. I. (2005). Convexity of oligopoly games without transferable technologies. Mathematical Social Sciences, 50, 102–126.

Friedman, J. W. (1971). A noncooperative equilibrium for supergames. Review of Economic Studies, 38, 1–12.

Han, W., Sun, H., & Xu, G. (2012). A new approach of cooperative interval games: The interval core and Shapley value revisited. Operations Research Letters, 40, 462–468.

Hurwicz, L. (1951). Optimality criteria for decision making under ignorance. Discussion Paper 370, Cowles Commission.

Katzner, D. W. (1968). A note on the differentiability of consumer demand functions. Econometrica, 36(2), 415–418.

Lardon, A. (2012). The \(\gamma \)-core of cournot oligopoly games with capacity constraints. Theory and Decision, 72, 387–411.

Lekeas, P. V., & Stamatopoulos, G. (2014). Cooperative oligopoly games with boundedly rational firms. Annals of Operations Research, 223(1), 255–272.

Monteiro, P. K., Páscoa, M. R., & da Costa Werlang, S. R. (1996). On the differentiability of the consumer demand function. Journal of Mathematical Economics, 25, 247–261.

Moore, R. (1979). Methods and applications of interval analysis. Philadelphia: SIAM.

Myerson, R. B. (1978). Threat equilibria and fair settlements in cooperative games. Mathematics of Operations Research, 3(4), 265–274.

Norde, H., Pham Do, K. H., & Tijs, S. (2002). Oligopoly games with and without transferable technologies. Mathematical Social Sciences, 43, 187–207.

Okuguchi, K., & Szidarovszky, F. (1990). The theory of oligopoly with multi-product firms. Berlin: Springer.

Rader, T. (1973). Nice demand functions. Econometrica, 41, 913–935.

Rader, T. (1979). Nice demand functions II. Journal of Mathematical Economics, 6, 253–262.

Shapley, L. S. (1967). On balanced sets and cores. Naval Research Logistics Quaterly, 14, 453–460.

Zhao, J. (1999). A \(\beta \)-core existence result and its application to oligopoly markets. Games and Economic Behavior, 27, 153–168.

Author information

Authors and Affiliations

Corresponding author

Additional information

I wish to thank Sylvain Béal for providing numerous suggestions that substantially improved the exposition of the article.

Appendix

Appendix

1.1 Proofs of propositions in Sect. 2

Proof of Proposition 2.1

\([\Longrightarrow ]\) Take \(\hat{x}^{{\mathcal {P}}}\in {\mathbf {X}^{{\mathcal {P}}}}\) and let \(\hat{X}=\sum _{S\in {{\mathcal {P}}}}\hat{x}^S\). By (3), for each \(S\in {{\mathcal {P}}}\) it holds that:

Hence, we conclude that \(\hat{X}\in {R_{{\mathcal {P}}}(\hat{X})}\).

\([\Longleftarrow ]\) Take \(\hat{X}\in {R_{{\mathcal {P}}}(\hat{X})}\). By (6), it holds that \(\hat{X}=\sum _{S\in {{\mathcal {P}}}}\hat{x}^S\) and for each \(S\in {{\mathcal {P}}}\), \(\hat{x}^S\in {R_S(\hat{X})}\). By the same argument to the one in the first part of the proof it follows that for each \(S\in {{\mathcal {P}}}\) we have \(\hat{x}^S\in {B^S(\hat{x}^{-S})}\), and therefore \(\hat{x}^{{\mathcal {P}}}\in {\mathbf {X}^{{\mathcal {P}}}}\). \(\square \)

Proof of Proposition 2.2

First, we show points (i) and (ii). For each \(S\in {{\mathcal {P}}}\), \(X^S\) is compact and convex. It follows from the continuity, the strict monotonicity and the convexity of any cost function \(C_i\), that coalition cost function \(C_S\) as defined in (1) is continuous, strictly increasing and convex. Moreover, the inverse demand function p is continuous, strictly decreasing and concave on \([0,\xi ]\). It follows from Theorem 3.3.3 (page 30) in Okuguchi and Szidarovszky (1990) that \(\mathbf {X}^{{\mathcal {P}}}\) is a polyhedron and that the equilibrium total output \(\bar{X}\) is the same for any Nash equilibrium which proves points (i) and (ii).

Then, we prove point (iii). From Lemma 3.3.1 (page 27) in Okuguchi and Szidarovszky (1990) we deduce for any \(S\in {{\mathcal {P}}}\) and all \(X\in {X^N}\) that \(R_S(X)\) as defined in (5) is a (possibly degenerate) closed and bounded interval which we denote by \([\alpha _S(X),\beta _S(X)]\). By point (ii), we know that there exists a unique equilibrium total output \(\bar{X}\). It follows that the polyhedron \(\mathbf {X}^{{\mathcal {P}}}\) can be represented as the intersection of the orthotope \(\prod _{S\in {{\mathcal {P}}}}R_S(\bar{X})=\prod _{S\in {{\mathcal {P}}}}[\alpha _S(\bar{X}),\beta _S(\bar{X})]\) and the hyperplane \(\big \lbrace {x^{{\mathcal {P}}}\in {X^{{\mathcal {P}}}}:\sum _{S\in {{\mathcal {P}}}}x^S=\bar{X}}\big \rbrace \), i.e.,

The polyhedron \(\mathbf {X}^{{\mathcal {P}}}\) is compact and convex as the intersection of two compact and convex sets. Since a convex set is always connected, we deduce that the polyhedron \(\mathbf {X}^{{\mathcal {P}}}\) is compact and connected. Moreover, the continuity of the inverse demand function p and of any coalition cost function \(C_S\) implies that the coalition profit function \(\pi _S\) as in (2) is continuous. It follows that the set \(\pi _S(\mathbf {X}^{{\mathcal {P}}})\) is compact and connected as the image of a compact and connected set by a continuous function. Since a subset of \({\mathbb {R}}\) is connected if and only if it is an interval, we conclude that \(\pi _S(\mathbf {X}^{{\mathcal {P}}})\) is a compact real interval, which proves point (iii).\(\square \)

1.2 Approximation of the inverse demand function

Given an inverse demand function p satisfying assumption (a), we construct a sequence of inverse demand functions which, in addition, are differentiable on \(]0,\xi [\), denoted by \((p_\epsilon )_{\epsilon >0}\) that uniformly converges to p by means of the approximation technique of Bézier curves Bézier (1976).

A Bézier curve is a parametric curve defined through specific points called control points. A particular class of Bézier curves are quadratic Bézier curves defined with three control points \(X_0\), \(X_1\) and \(X_2\):

Formally, this quadratic Bézier curve is the path traced by the function \(B:[0,1]\longrightarrow {\mathbb {R}}^2\) defined as:

Proposition 5.1

Let p be an inverse demand function satisfying assumption (a). Then, there exists a sequence of inverse demand functions \((p_\epsilon )_{\epsilon >0}\) which, in addition, are differentiable on \(]0,\xi [\) that uniformly converges to p.

Proof

First, for any \(X\in {{\mathcal {X}}}\) and each \(\epsilon >0\), we define a quadratic Bézier curve. The steps of this construction are illustrated below:

For any \(X\in {{\mathcal {X}}}\), define \(N_\epsilon (X)\) the neighborhood of X with radius \(\epsilon \) as:

For any \(X\in {\mathcal {X}}\), there exists \(\bar{\epsilon }>0\) such that for all \(\epsilon <\bar{\epsilon }\), it holds that \(N_\epsilon (X)\subset ]0,\xi [\). Moreover, since \({\mathcal {X}}\) is at most denumerable, there exists \(\bar{\bar{\epsilon }}>0\) such that for all \(\epsilon <\bar{\bar{\epsilon }}\) it holds that:

In the remainder of the proof, we assume everywhere that \(\epsilon <\min \lbrace {\bar{\epsilon },\bar{\bar{\epsilon }}}\rbrace \). Take any \(X\in {{\mathcal {X}}}\). For each \(\epsilon >0\), in order to construct the quadratic Bézier curve, we consider three control points given by \(X_0=(\inf N_\epsilon (X),p(\inf N_\epsilon (X)))\), \(X_2=(\sup N_\epsilon (X),p(\sup N_\epsilon (X)))\) and \(X_1\) defined as the intersection point between the tangent lines to the curve of p at points \(X_0\) and \(X_2\) respectively. Given these three control points, the quadratic Bézier curve is the path traced by the function \(B_X^\epsilon :[0,1]\longrightarrow {\mathbb {R}}^2\) defined as in (21). It is well-known that the quadratic Bézier curve \(B_X^\epsilon \) can be parametrized by a polynomial function denoted by \(f_X^\epsilon :\overline{N_\epsilon (X)}\longrightarrow {\mathbb {R}}_+\) where \(\overline{N_\epsilon (X)}\) is the closure of \(N_\epsilon (X)\).

Then, for each \(\epsilon >0\) we define the inverse demand function \(p_\epsilon :{\mathbb {R}}_+\longrightarrow {\mathbb {R}}_+\) as:

By the construction of control points \(X_0\), \(X_1\) and \(X_2\), it follows from the properties of the inverse demand function p and of the quadratic Bézier curves defined above that \(p_\epsilon \) as defined in (22) is strictly decreasing, concave on \([0,\xi ]\) and differentiable on \(]0,\xi [\).

It remains to show that the sequence \((p_\epsilon )_{\epsilon >0}\) uniformly converges to p. Take \(\zeta >0\) and assume that \(Y\not \in {{\mathcal {X}}}\). It follows that there exists \(\epsilon _1>0\) such that for each \(\epsilon <\epsilon _1\) and for any \(X\in {{\mathcal {X}}}\) we have \(Y\not \in {N_{\epsilon }(X)}\). Hence, by (22) for each \(\epsilon <\epsilon _1\) we have \(p_{\epsilon }(Y)=p(Y)\), and so \(|{p_{\epsilon }(Y)-p(Y)}|=0<\zeta \). Then, assume that \(Y\in {{\mathcal {X}}}\). For each \(\epsilon >0\) we denote by \(G_Y^\epsilon \) the convex hull of the set of control points \(\lbrace {X_0,X_1,X_2}\rbrace \):

By the construction of control points \(X_0\), \(X_1\) and \(X_2\) it holds that:

Moreover, recall that \(B_Y^\epsilon \) is defined as a convex combination of control points \(X_0\), \(X_1\) and \(X_2\). Hence, for each \(\epsilon >0\) we have \(B_Y^\epsilon \subseteq G_Y^\epsilon \), and therefore \((Y,f_Y^\epsilon (Y))\in {G_Y^\epsilon }\). By (23) we deduce that there exists \(\epsilon _2>0\) such that for each \(\epsilon <\epsilon _2\), we have:

Finally, take \(\epsilon _3=\min \lbrace {\epsilon _1,\epsilon _2}\rbrace \). It follows for each \(\epsilon <\epsilon _3\) that:

which proves that the sequence \((p_\epsilon )_{\epsilon >0}\) uniformly converges to p.\(\square \)

Rights and permissions

About this article

Cite this article

Lardon, A. Endogenous interval games in oligopolies and the cores. Ann Oper Res 248, 345–363 (2017). https://doi.org/10.1007/s10479-016-2211-7

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-016-2211-7