Abstract

The aim of this paper is to propose a fuzzy chance constrained goal programming model for solving a multi-attribute financial portfolio selection problem under two types of uncertainty namely randomness and fuzziness. The chance-constrained goals are considered as random variables. The obtained portfolio through this model is the portfolio of the best compromise where the financial decision-maker was asked to make tradeoffs among conflicting and incommensurable attributes such as the expected return, risk and the earning price ratio. The proposed model has been applied to the Tunisian stock exchange market for the period July 2003 to December 2007.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Markowitz (1952) published his pioneering work which laid the foundation of modern portfolio analysis. Through this model the Financial Decision-Maker (FDM) desires optimizing the expected return and the financial risk. The mean–variance analysis of Markowitz (1952) was limited to the risk adjusted return and excluding several other important factors. The literature review reveals that in practice the FDM likes to integrate simultaneously other incommensurable and conflicting factors and also his/her preferences. Solving the multi-attribute financial portfolio problem requires an aggregation procedure such as the Goal Programming (GP). This model is the most widely utilized approach in multi-criteria decision making aid and financial portfolio selection (Aouni 2009, 2010; Aouni et al. 2014; Tamiz et al. 1995). Aouni et al. (2014) and Jones et al. (2010) provide a quite an exhaustive literature review on the application of GP for portfolio selection problem within different application contexts where the available information can be deterministic and precise, fuzzy and stochastic as well.

Several GP variants have been developed to handle the uncertainty related to the securities for the financial portfolio selection. These variants are based on probability and fuzzy theories. Tamiz et al. (1996) suggest a two stage GP model for selecting the best financial portfolio. Aouni et al. (2005) have proposed the first formulation of the stochastic GP model that integrates explicitly the FDM’s preferences through the satisfaction functions concept where the aspiration levels are considered as stochastic variables with a normal distribution. Ben Abdelaziz et al. (2007, 2009), proposed a stochastic GP approach to generate a satisfying portfolio under the assumption of non-normality of the equity returns and they suggested the generation of a limited number of scenarios from an observed random distribution.

The proposed GP model by Arenas Parra et al. (2001) is based on the investor’s preferences where the aspiration levels (goals) are fuzzy and expressed through an interval. Alinezhad et al. (2011) reformulated a multi-objective fuzzy problem as a fuzzy GP model by using MINMAX fuzzy GP and they applied it to a fuzzy allocated portfolio. In this model, the decision-making parameter and goals are considered as unbalanced triangular fuzzy numbers.

The existing fuzzy and stochastic GP formulations for portfolio selection are dealing with the uncertainty and the fuzziness that are considered separately. The existing models do not combine simultaneously the uncertainty and fuzziness. Fuzzy-Stochastic models could be applied to select securities to build the financial portfolio of the best compromise where randomness and fuzziness are combined.

In this paper, the concept of fuzzy probability distribution will be proposed to handle the uncertainty related to the portfolio decision-making parameters. The paper aims to develop a fuzzy chance-constrained GP formulation for portfolio selection under both types of uncertainty. Stochastic uncertainty is related to the chance constrained goals that are assumed independent random variables. Fuzzy uncertainty uses approximate values provided by the FDM to evaluate the decision-making parameters such as the satisfying probability level for the chance constrained goals and the importance relation for the objectives.

The other important issue related to the portfolio selection problem is risk measurement. The different existing GP variants for portfolio selection minimize the risk of the return (Arenas Parra et al. 2001; Ben Abdelaziz et al. 2009) or the Beta coefficient for computational simplicity (Aouni et al. 2005). Szego (2002) found that the use of this frame-work with assets that present returns defined by non-elliptic distributions can underestimate extreme events that may cause losses. In this paper a chance constraint on probability of losses is used among the decision criteria to describe probabilistically the market risk of a trading portfolio.

This paper is organized as follows, in Sect. 2; we will describe the model formulation. The third section will be devoted to the fuzzy stochastic goals with the transformation procedures for obtaining their equivalent deterministic goals and a fuzzy chance-constrained GP model. In Sect. 4, we will propose a fuzzy multi-objective programming model for constructing fuzzy preference relations and we will formulate a fuzzy chance-constrained GP model integrating the fuzzy preference of the FDM. In Sect. 5, we will illustrate our formulation through some data from the Tunisian Stock Market where the collected data are from July 2003 to December 2007. Some concluding remarks will be formulated within Sect. 6.

2 Model formulation

For the stochastic constraints or objectives, chance-constrained technique specifies satisfaction thresholds as a degree for achievement of the stochastic constraints. The chance constrained technique was effective in reflecting probability distributions in the right-hand sides of the constraints or objectives; however, it cannot reflect ambiguity. In fact, in many situations such as in the stock market, the FDM is not able to specify precise values for the parameters. For instance, it is generally more realistic to give a certain range for the value or to define these satisfaction thresholds as fuzzy numbers. Therefore, a concept of fuzzy probability distribution will be proposed to describe this type of uncertainty. So the considered decision-making problem can be expressed as a fuzzy stochastic satisfaction constrained problem.

Consider the following fuzzy stochastic constrained satisfaction problem:

where \(\hbox {X}\in \hbox {R}^{\mathrm{n}}\) is the decision vector having n decision variables \(\left( {\hbox {X}_1 ,\hbox {X}_2 ,\ldots ,\hbox {X}_\mathrm{n}}\right) , \mathrm{c}\) is a constant matrix, C is a constant vector, F is the feasible solution set, \(\hbox {P}_\mathrm{r} \) indicates the stochastically defined goals, in which \(\left( {\mathop \sum \nolimits _{\mathrm{i}=1}^\mathrm{n} \hbox {a}_{\mathrm{ij}} } \right) \) represents the \(\hbox {j}{\mathrm{th}}\) random objective for achievement of the associated goal level \(\hbox {b}_\mathrm{j} \),\((\hbox {a}_{\mathrm{ij}} )\) is a random variable and \({\upbeta }_\mathrm{j} \) is the fuzzy satisfying probability level for achievement of the aspired level of the \(\hbox {j}{\mathrm{th}}\) goal. And where \({\widetilde{>}}\) indicates the fuzziness of \(\ge \) restriction as per indicated by Zimmermann (1978).

3 The deterministic equivalent formulation

Within this section we will be providing the deterministic equivalent mathematical model of the fuzzy stochastic model.

3.1 Membership function for modeling parameter fuzziness

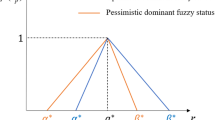

In fuzzy programming, the fuzzy probabilistic goals are characterized by their associated membership functions. From model (1), the fuzzy probabilistic goal can be presented as:

Let us consider a probability \({\uptheta }_{\mathrm{j }} (0<{\uptheta }_\mathrm{j} <{\upbeta }_\mathrm{j} )\) as the lower tolerance range. According to Pal et al. (2003), the membership function \({\upmu }_\mathrm{j} \left( \hbox {X} \right) \quad \forall \hbox { j}=1,\ldots ,\hbox {m};\) for each fuzzy probabilistic goal, could be expressed as follows:

3.2 Chance-constrained approach

In some decision-making situations related to financial market, it is quite difficult for the FDM to predict some parameter values. This is due to the uncertainty of occurrence of the state of nature attached to each decision-making parameter. In order to develop our model, we have inspired by Hulsurkar et al. (1997) and we have used the chance-constrained programming approach to obtain the deterministic equivalent of the stochastic model. From model (1), we can obtain:

Assume that \(\hbox {a}_{\mathrm{ij}} \) is a random variable having normal distribution with the mean \(\hbox {E}(\hbox {a}_{\mathrm{ij}} )\) and the variance \(\hbox {var}(\hbox {a}_{\mathrm{ij}} )\). Assuming that the covariance between the random variables \(\hbox {a}_{\mathrm{ik}} \) and \(\hbox {a}_{\mathrm{kj}} \) is known, we will define a random variable \(\hbox {d}_\mathrm{j} \) as follows:

Since \(\hbox {a}_{\mathrm{i}1} ,\ldots ,\hbox {a}_{\mathrm{im}}\) are random variables and normally distributed and \(\hbox {X}_1 ,\hbox {X}_2,\ldots ,\hbox {X}_\mathrm{n}\) are unknown, \(\hbox { d}_\mathrm{j} \) will be normally distributed with:

and

where \(\hbox {V}_\mathrm{j} \) is the \(\hbox {j}{\mathrm{th}}\) covariance matrix defined as follows:

The objectives highlighted in (4) can be expressed as follows:

and

where

This is a standard normal random variable with a mean equal to zero and variance equal to one. Thus, the probability of having \(\hbox {d}_\mathrm{j} \) less than or equal to \(\hbox { b}_\mathrm{j} \) can be written as:

where \({\upphi }(\hbox {z})\) represents the cumulative density function of the standard normal random variable evaluated at z. If \(\hbox {K}_{{\upbeta }_\mathrm{j} } \) denotes the value of the standard normal variable at which \({\upphi }\left( {\hbox {K}_{{\upbeta }_\mathrm{j} } } \right) ={\upbeta }_\mathrm{j} \) then the constraint (10) can be replaced by:

This inequality will be satisfied only if:

or

Substituting Eqs. (6) and (7) in Eq. (15), we get:

Then, introducing the crisp expression (3) in to (16), the membership function \({\upmu }_\mathrm{j} \left( \hbox {X} \right) \) will be as follows:

4 Fuzzy chance-constrained GP for modeling the FDM fuzzy preference

In this section, we will propose a fuzzy stochastic approach based on the GP model. The membership functions defined in Eq. (17) are utilized to formulate a weighted additive fuzzy chance-constrained GP model as follows:

where \(\hbox {w}_\mathrm{j} \) is the fuzzy weight of the \(\hbox { j}{\mathrm{th}}\) objective, also called the preferred weight attached to the \(\hbox {j}{\mathrm{th}}\) objective by the FDM. These weights reflect the FDM’s preferences for the different fuzzy objective. Up to now, some studies dealt with the FDM’s preference where the parameters are usually subjectively fixed and considered as crisp values (Aouni et al. 2005; Mansour et al. 2007). As it is known, decision making is a basic human activity, in which most decision processes are based on preference relations. However, the FDM often finds it difficult to describe his preference precisely, because most decisions must be made under risk, uncertainty, and incomplete or fuzzy information. The fuzzy approach is effective for modeling such preferences relations which allow FDM to give vague or imprecise responses when he/she is in the process of comparing the importance relation among the objectives.

Therefore, in this paper, the weights of the objectives are considered fuzzy coefficients. In order to elucidate these coefficients, we put forward the following definitions.

Definition 1

Let us consider \(\hbox {L}=(\hbox {l}_{\mathrm{jk}} )_{\mathrm{mxm}} \) as a preference relation, where L is a fuzzy preference relation (Tanino 1984), if:

where \(\hbox {l}_{\mathrm{jk}} \quad \forall \hbox { j},\hbox {k}=1,2,\ldots ,\hbox {m};\quad \forall \hbox {j}\ne \hbox {k}\) represents the preference intensity of objective j comparatively to k.

Definition 2

Let \(\hbox {L}=(\hbox {l}_{\mathrm{jk}} )_{\mathrm{mxm}} \) be a fuzzy preference relation, then L is called an additive consistent fuzzy preference relation, if the following additive transitivity (given by Tanino 1984) is satisfied:

Let

be the weight vector of the additive preference relation \(\hbox {L}=(\hbox {l}_{\mathrm{jk}} )_{\mathrm{mxm}} \) where

If \(\hbox {L}=(\hbox {l}_{\mathrm{jk}} )_{\mathrm{mxm}} \) is an additive consistent preference relation, then such a preference relation is given by:

However, in the general case, Eq. (26) does not hold. Here, we refer to Xu (2004) and we shall relax Eq. (26) by looking for the weight vector of the fuzzy preference relation \(\hbox {L}=(\hbox {l}_{\mathrm{jk}} )_{\mathrm{mxm}}\) that approximates Eq. (26) by minimizing the error \({\upvarepsilon }_{\mathrm{jk}} \) where:

Thus, we can construct the following multi-objective programming model:

The previous problem (28) can also be formulated as the following GP model:

where \({\updelta }_{\mathrm{jk}}^+ \) and \({\updelta }_{\mathrm{jk}}^- \) are the positive and negative deviations from the target goal \({\upvarepsilon }_{\mathrm{jk}} \) respectively.

The model (29) can be reformulated as a fuzzy multiple objective programming model, as follows:

The weight vector \(\hbox {W}\left( {\hbox {w}_1 ,\hbox {w}_2 ,\ldots ,\hbox {w}_\mathrm{m} } \right) ^{\mathrm{T}}\) of the fuzzy preference relation \(\hbox {L}=(\hbox {l}_{\mathrm{jk}} )_{\mathrm{mxm}} \quad \forall \hbox { j}, \hbox {k}=1,2,\ldots ,\hbox {m};\quad \forall \hbox {j}\ne \hbox {k}\), can be obtained by solving the mathematical model (30).

Combining models (18) and (30) will result to a fuzzy chance-constrained GP model that integrates explicitly the fuzzy preference of the FDM, as follows:

In the next section we will illustrate this model through an application from the Tunisian Stock Exchange Market.

5 Application to the Tunisian Stock Exchange Market

In this section, we consider a sample of 45 stocks from the Tunisian Stock Exchange Market to illustrate our fuzzy chance constrained GP portfolio selection approach and the proposed solution strategy to get the best financial portfolio set. The collected data are from July 2003 to December 2007 (Table 1). The data were downloaded from the following website: www.bvmt.com.tn. We have considered one month as a basic period to obtain the historical returns and the monthly price-earning ratio (PER) over fifty four periods (months). The goal values and the tolerance limits are provided by an exchange intermediate FDM (Table 2). The three objectives considered in this application case are as follows.

-

a.

Rate of return This objective measures the profitability of each security. In portfolio selection; the FDM wants to maximize the chance of the total investment return no less than a certain aspired level. The rate of return is as follows:

$$\begin{aligned} \hbox {R}_\mathrm{i} =\frac{\left( {\hbox {P}_{\mathrm{it}} -\hbox {P}_{\mathrm{i},\hbox {t}-1+} \hbox {D}_{\mathrm{i},\hbox {t}} } \right) }{\hbox {P}_{\mathrm{i},\hbox {t}-1} } \quad \forall \hbox { i}=1,\ldots ,\hbox {n}; \end{aligned}$$(32)where \(\hbox {P}_{\mathrm{i},\hbox {t}} \) is the price of security i at time t and \(\hbox {D}_{\mathrm{i},\hbox {t}} \) is the dividend received during the period \(\left[ {\hbox {t}-1,\hbox {t}} \right] \).

-

b.

Price-Earning Ratio (PER) The Price-Earning Ratio (PER) of a security measures the time it takes to cover the price by future income. This objective can be formulated as follows: A valuation ratio of a company’s current share price compared to its per-share earnings.

$$\begin{aligned} \hbox {PER}_\mathrm{i} =\frac{\hbox {Market value per stock i}}{\hbox {earnings per stock i}} \quad \forall \hbox { i}=1,\ldots ,\hbox {n}; \end{aligned}$$(33)where \(\hbox {PER}_\mathrm{i} \) is the PER for the \(\hbox {i}{\mathrm{th}}\) stock.

-

c.

Value-at- Risk (VaR) The Value-at-Risk (VaR) is used in various engineering applications, including financial ones. VaR risk constraints are equivalent to chance-constraints on probabilities of losses. Some risk communities prefer VaR, others prefer chance (or probabilistic) functions. Lucas and Klaassen (1998) define the VaR as the maximum expected loss on an investment over a specified horizon given some confidence level. The \(\hbox {VaR}_{{\upbeta }_\mathrm{j} } \)of the loss is as follows:

$$\begin{aligned} \hbox {VaR}_{{\upbeta }_\mathrm{j} } =\hbox {Min}\left\{ {\hbox {VaR |P}_\mathrm{r} \left[ {\mathop \sum \nolimits _{\mathrm{i}=1}^\mathrm{n} \hbox {X}_\mathrm{i} \hbox {R}_\mathrm{i} \le \hbox {VaR}} \right] \ge {\upbeta }_\mathrm{j} } \right\} \end{aligned}$$(34)The parameter \({\upbeta }_{\mathrm{j }} \)represents the confidence level.

In order to determine the weights of the different objectives, we suppose that there are three objectives under consideration. The FDM provides his/her preferences over these three objectives in the following fuzzy preference relation: Consider the following fuzzy comparison matrix L (e.g. \(\hbox {l}_{12} =0.6\)) represents the preference degree of objective 1 to 2, the degree is provided by the FDM.

Based on the data of Tables 1 and 2, we will formulate the mathematical model that provides the most satisfactory portfolio for the FDM, as follows:

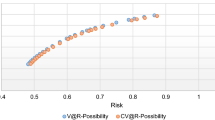

The software LINGO package was used to solve model (36). By solving this model, we obtained the weight vector \(\hbox {W}\left( {\hbox {w}_1 ,\hbox {w}_2 ,\ldots ,\hbox {w}_\mathrm{m} } \right) ^{\mathrm{T}}\) of incomplete fuzzy preference relation and also the proportions \(\hbox {X}_\mathrm{i} \) to be invested in security i.

The value of membership functions \({\upmu }_1 ,{\upmu }_2 ,{\upmu }_3 \) are 0.9917, 0.9544 and 1 respectively. These results show that the proposed fuzzy stochastic GP approach provides a financial portfolio with a higher level of the FDM’s satisfaction. In order to compare our results with those obtained by the normalizing rank aggregation method (Xu et al. 2009), we first generated the values of the weights derived by our fuzzy chance-constrained GP approach by integrating fuzzy preference of the FDM. These are given in Table 3 and we compared them with those obtained from the normalizing rank aggregation method.

By using Xu et al. (2009) method, we obtained the following equations:

The weight vector can be obtained by using Eq. (37). Then the comparison is carried on by using the Euclidean Distance (Golany and Kress 1993):

The E criterion is a quadratic error measure that evaluates the sum of the deviations between ratio of weights and their corresponding entry in the matrix. The criterion measures the actual (Euclidean) distance between the ratios obtained by the derived weights and the ratio-scale raw data. So the best method is one having the minimum Euclidean distance criterion value. From Table 3, we notice that the Fuzzy Chance-Constrained GP approach outperforms the normalizing rank aggregation method.

6 Concluding remarks

In this paper we have developed a fuzzy chance-constrained goal programming approach for the financial portfolio selection where the satisfying probability level of the chance constrained objectives and the importance relation among such objective are fuzzy and random. We assumed that the stochastic uncertainty is related to the chance-constrained objectives that are independent. The Financial Decision Maker’s preferences were considered as fuzzy and not well defined. The fuzzy chance constraints on the probabilities of losses were used to describe the market risk. The proposed model has been applied to the Tunisian Stock Exchange Market for the period July 2003 to December 2007. The obtained results look promising.

References

Alinezhad, A., Zohrehbandianb, M., Kianc, M., Ekhtiaric, M., & Esfandiari, N. (2011). Extension of portfolio selection problem with fuzzy goal programming: A fuzzy allocated portfolio approach. Journal of Optimization in Industrial Engineering, 4, 69–76.

Aouni, B. (2009). Multi-attribute portfolio selection: New perspectives. Information Systems and Operational Research Journal, 47(1), 1–4.

Aouni, B. (2010). Portfolio selection through the goal programming model: An overview. Journal of Financial Decision Making, 6(2), 3–15.

Aouni, B., Ben Abdelaziz, F., & Martel, J. M. (2005). Decision maker’s preferences modelling in the stochastic goal programming. European Journal of Operational Research, 162, 610–618.

Aouni, B., Colapinto, C., & La Torre, D. (2014). Portfolio management through the goal programming model: Current state-of-the-art. European Journal of Operational Research, 234, 536–545.

Arenas Parra, M., Bilbao Terol, A., & Rodríguez Uria, M. V. (2001). A fuzzy goal programming approach to portfolio selection. European Journal of Operational Research, 133, 287–297.

Ben Abdelaziz, F., Aouni, B., & El Fayedh, R. (2007). Multi-objective stochastic programming for portfolio selection. European Journal of Operational Research, 177(3), 1811–1823.

Ben Abdelaziz, F., El Fayedh, R., & Rao, A. (2009). A discrete stochastic goal program for portfolio selection: The case of United Arab Emirates equity market. INFOR Information Systems and Operational Research, 47, 5–13.

Golany, B., & Kress, M. (1993). A multicriteria evaluation of methods for obtaining weights from ratio-scale matrices. European Journal of Operational Research, 69, 210–220.

Hulsurkar, S., Biswal, M. P., & Sinha, S. B. (1997). Fuzzy programming approach to multi-objective stochastic linear programming problems. Fuzzy Sets and Systems, 88, 173–181.

Jones, D.,Tamiz, M., & Ries, J. (2010). New developments in multi-objective and goal programming. In Lecture notes in economics and mathematical systems (1st Edition). Springer.

Lucas, A., & Klaassen, P. (1998). Extreme returns, downside risk, and optimal asset allocation. Journal of Portfolio Management, 25, 71–79.

Mansour, N., Rebai, A., & et Aouni, B. (2007). Portfolio selection through imprecise goal programming model: Integration of the manager’s preferences. Journal of Industrial Engineering International, 3, 1–8.

Markowitz, H. (1952). Portfolio selection. The Journal of Finance, 7, 77–91.

Pal, B. B., Moitra, B. N., & Maulik, U. A. (2003). Goal programming procedure for fuzzy multiobjective linear fractional programming problem. Fuzzy Sets and System, 139, 395–405.

Szego, G. (2002). Measures of risk. Journal of Banking and Finance, 26, 1253–1272.

Tamiz, M., Hasham, R., Jones, D. F., Hesni, B., & Fargher, E. K. (1996). A two staged goal programming model for portfolio selection. In M. Tamiz (Ed.), Lecture notes in economics and mathematical systems (Vol. 432). Berlin: Springer.

Tamiz, M., Jones, D. F., & et El-Darzi, E. (1995). A review of goal programming and its applications. Annals of Operations Research, 58, 39–53.

Tanino, T. (1984). Fuzzy preference orderings in group decision making. Fuzzy Sets Systems, 12, 117–131.

Xu, Z. S. (2004). Goal programming models for obtaining the priority vector of incomplete fuzzy preference relation. International Journal of Approximate Reasoning, 36, 261–270.

Xu, Y., Da, Q., & et Liu, L. (2009). Normalizing rank aggregation method for priority of a fuzzy preference relation and its effectiveness. International Journal of Approximate Reasoning, 50, 1287–1297.

Zimmermann, H. J. (1978). Fuzzy programming and linear programming with several objective functions. Fuzzy Sets and Systems, 1, 45–55.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Messaoudi, L., Aouni, B. & Rebai, A. Fuzzy chance-constrained goal programming model for multi-attribute financial portfolio selection. Ann Oper Res 251, 193–204 (2017). https://doi.org/10.1007/s10479-015-1937-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-015-1937-y