Abstract

Pressure on developing economies to make quantifiable emissions reduction commitments has led to the introduction of intensity based emissions targets, where reductions in emissions are specified with reference to some measure of economic output. The Copenhagen commitments of China and India are two prominent examples. Intensity targets substantially increase the complexity of policy simulation and analysis, because a given emissions intensity target could be satisfied with a range of emissions and output combinations. Here, a simple algorithm, the Iterative Method, is proposed for an energy economic model to find a unique policy solution that achieves an emissions intensity target at minimum economic loss. We prove the mathematical properties of the algorithm, and compare its numerical performance with other methods’ in the existing literature.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Designing, modelling and analysing global climate policies are becoming increasingly complex. Pressure on developing economies to make quantifiable emissions reduction commitments has led to the introduction of intensity based emissions targets under the United Nations Framework Convention on Climate Change (UNFCCC 2010), where reductions in emissions are specified with reference to some measure of output, generally gross domestic product (GDP). The Copenhagen commitments of China and India are two prominent examples.

The promotion of emissions intensity targets in international climate agreements has been driven by developing economies arguing against limits to growth. It increases flexibility and allows for continued growth and development because an intensity target for emissions allows there to be a range of possible emission and output combinations that are consistent with the intensity target. For instance, according to the US Energy Information Administration (EIA)’s International Energy Statistics, China’s emissions intensities of 2007 and 2009 were both at 2.178 billion metric tons (BMT) \(\hbox {CO}_{2}\) per trillion US dollars ($) of GDP, while the annual GDPs differed by nearly 0.5 trillion $ and \(\hbox {CO}_{2}\) emissions by more than 1.2 BMT (see Fig. 1).

From a modelling perspective, intensity targets substantially increase the complexity of policy analysis, with respect to both theoretical design and computational implementation. As is demonstrated in Fig. 1, although the emission and GDP trajectories are smooth and monotone, there can be sharp turnarounds in the emission intensity, potentially leading to multiple policy solutions to a carbon intensity target. Theoretical design therefore involves specifying the criteria for selecting a particular emissions and output combination that is consistent with the intensity target. This allows policy instruments to be modelled and heterogeneous policy options to be consistently compared across economies. Computational implementation involves developing the modelling tools capable of accounting for the complex interaction that occurs between emissions policy instruments, emissions levels and output effects under an emissions intensity target.

Serious studies on theoretical design and computational implementation regarding modelling emissions intensity targets are lagging behind the advancement of climate policy in the real world. There leaves much to be explored in this field: what criteria is acceptable to select a combination of emissions and GDP profile among many possible combinations consistent with the intensity target; how to assess the policy implications in the intensity targeting context; how can intensity targets be comparable with emissions level targets?

In this paper, we attempt to address some of the questions listed above. We first specify a plausible criterion for selecting a particular emissions and output combination that is consistent with the intensity target: to minimize economic loss, as measured by the deviation in GDP from the BAU projection in the absence of policy. Then, a simple algorithm is proposed for an energy economic model to find a unique policy solution that achieves the intensity target while satisfying the criteria as defined. We have also compared our proposed algorithm to other approaches in the existing literature. The motivation here is to enable further research in this area by providing a relatively simple solution to the complex problem of modeling emissions intensity in a way that enables consistent comparison with emissions level targets.

To our knowledge, there exists no previous study addressing the complexity of intensity based emissions targets or offering an algorithm for model simulation. This technical note therefore fills a gap in the literature.

2 Literature review

Our paper fits into the large research area that considers the tradeoffs between carbon emissions and economic growth. Humans produce carbon emissions by burning coal, oil, and natural gas to generate energy for power, heat, industry, and transportation, which are essential for the economy. Therefore, the reduction of carbon has important economic implications for developing countries, such as China and India (see Yi et al. 2011; Lv et al. 2012; Yang and Yang 2012; Govindaraju and Tang 2013; Liao and Cao 2013; Wang et al. 2013; Wu et al. 2014). As there is a significant \(\hbox {CO}_{2}\) intensity convergence across the world (Zhu et al. 2014), intensity based emissions targets appears to be an appealing approach to global equality and development. They are materialized in the recent Copenhagen Accord (UNFCCC 2010).

There have been intensive debates in the literature, regarding whether or not the use of intensity based emissions targets can help reduce economic uncertainty, particularly uncertainty in GDP (see Ellerman and Sue Wing 2003; Quirion 2005; Jotzo and Pezzey 2007; Newell and Pizer 2008; Marschinski and Edenhofer 2010). Model-based study is a good tool to verify these confronting arguments (see Tian and Whalley 2009; McKibbin et al. 2011; Lu et al. 2013; Zhang et al. 2013; Hübler et al. 2014). However, an intensity target could be met by a range of possible emission and output combinations, so any comparison with level targets can be misleading unless we explore all the possible combinations.

The existing modelling literature deals with the emissions intensity target by three main approaches. The first approach (Naïve Method) is to translate the emissions intensity target into emissions level target using the business-as-usual (BAU) GDP projection in the absence of policy (see Hübler et al. forthcoming). This does not solve the emissions intensity target and will lead to an underestimation of the carbon price. Specifically, the model’s simulated GDP will usually decrease as a carbon policy is placed, leading to a higher intensity than the target even if the emissions level is reduced. The second approach (Direct Method) is to directly solve for the policy (e.g. a carbon price) such that the emissions intensity, a combination of functions of GDP and emissions in terms of policy instruments, is equal to the target (see Zhang et al. 2013). This may be problematic if multiple solutions exist, making it difficult to consistently compare policy options across economies. The third one is the Iterative Method proposed in this paper which has been implemented in McKibbin et al. (2011) and Lu et al. (2013). It finds the carbon policy that meets the emissions intensity target while securing the highest GDP outcome. In other words, the Iterative Method will minimize the economic cost as measure by deviation from the BAU. This is more policy relevant and appealing to need of developing countries for continued growth and development.

The flow chart of each method is listed in Fig. 2. We shall show shortly that the Iterative Method is a refinement of the Naïve Method, and it will perform better than the Direct Method in the presence of multiple solutions.

3 Preliminary assumptions

As is discussed in the introduction, any given emissions intensity target could be satisfied with a range of emissions and GDP level combinations, and the first step in generating a solution is to define the criteria for selecting a particular combination. In the algorithm presented here, the policy solution is chosen so as to achieve the emissions intensity target and minimize the deviation in GDP with reference to the model’s BAU projection in the absence of policy. Given that the promotion of emissions intensity targets in international climate agreements has been driven by developing economies arguing against limits to growth, the specification is policy relevant and appealing from a practical viewpoint because GDP can be easily measured. We note that minimizing GDP loss is not the only possible (and usually not the best) objective of selecting a policy solution. Other objectives could also be chosen such as minimizing welfare loss of households if the model is based on a utility function, and the distributional effects of a policy across sub-regions and households should be also considered. But our approach is a useful starting point for future research.

To define the problem and its solution explicitly, let \(R=\left( {-\infty ,\infty } \right) \), \(R_+ :=[0,\infty )\), and \(R_{++} :=(0,\infty )\). Let \(\varepsilon \in R_{++} \) be the emissions intensity target in year t (say, 2020) and let \(\tau \in R\) be the carbon policy that is implemented in year s, such that \(s \le t\) (say, 2015). Let G and E be the model projections such that \(G(\tau )\) and \(E(\tau )\) correspond to the level of GDP and emissions in year t given policy \(\tau \) that is implemented in year s, and \(G(\tau )\), \(E(\tau ) \in R_+ \). The BAU projections are denoted G(0) and E(0). In the scope of this paper, the carbon policy is assumed to be a carbon tax, or its price equivalence in a cap-and-trade system. “Carbon policy” is referred to as a singular noun because the evolution of carbon policy is generally assumed to start with an initial price and to follow a per annum growth rate that corresponds to the real rate of interest for the economy.Footnote 1 This so-called “Hotelling Rule” mimics the expected behaviour of an efficient emissions market that allows for banking and borrowing of emissions rights.

The following four assumptions are made regarding an energy economic model. These assumptions are general, and we provide justification following each of them.

Assumption 1

There exists at least one policy \(\tau ^{*}\in R_+ \)such that \(E(\tau ^{*})/G(\tau ^{*})=\varepsilon \).

This assumption ensures that there is a solution to the problem. Let \(\tau _m \) be the minimum of all \(\tau ^{*}\hbox {s}\) that satisfy \(E(\tau ^{*})/G(\tau ^{*})=\varepsilon \). By Assumption 1, \(\tau _m \) exists.

Assumption 2

The projection function E is continuous and weakly decreasing in \(\tau \).

This assumption implies that the policy instrument is effective for domestic emissions reduction, that is, increasing the carbon price results in a reduction (or at least no increase) in the level of emissions. In the context of this paper, by stating that “E is decreasing in \(\tau \)”, we mean, for example, that a country’s emissions in 2020 will be lower than it would otherwise be if a carbon policy is implemented in 2015; but not that a country’s emissions in 2020 will be lower than its emissions in 2015 due to the implementation of a carbon policy. In reality, developing countries such as China and India are carrying out carbon emission reduction policies, but this does not directly result in emission reductions. Instead, we see reduction in the emissions intensity of these countries, because they are emitting less than what they would otherwise do given the same pace of GDP growth.

Assumption 3

The projection function G is continuous. It satisfies: (1) \(G(\tau )>G(\tau _m )\) for all \(\tau \in [0,\tau _m )\); and (2) G is weakly decreasing on \([\tau _m ,\infty )\).

Property (1) of Assumption 3 states that achieving the emissions intensity target incurs a higher economic cost than not doing so or doing less. Property (2) implies that the adverse impact of the carbon price on economic output gradually becomes unambiguous, and it also allows for the possibility that overall GDP is unaffected, for instance, via structural adjustment in energy consumption.

It is not difficult to see that Assumption 3 is satisfied when the projection function G is continuous and strictly decreasing in \(\tau \). However, this is not conversely necessary since Assumption 3 does not require that \(\tau _1 <\tau _2 \Rightarrow G(\tau _1 )>G(\tau _2 )\) for any \(\tau _1 ,\tau _2 \in [0,\tau _m )\). In other words, GDP does not need to be linearly related to the carbon policy. Wiggling and humps of the projection function over \([0,\tau _m )\) are allowed. The intuition behind is that, with avoided climate damages as well as a secondary tax reduction effect, GDP may jump up in response to the imposition of a modest carbon price. This secondary effect is most likely to occur when the carbon price revenue is recycled to households as a lump sum transfer or used to cut the rates of other distortionary taxes, such as capital taxes (see McKibbin et al. 2009, 2015). Reboud effects of this type have been intensively studied in the economic literature as the “double dividend” of carbon taxes (Parry et al. 1999; Parry and Bento 2000). This suggests the nonlinear relation between GDP and the carbon policy.

Assumptions 1–3, together, imply that \(\tau _m \) leads to the highest GDP and emissions level combination. In other words, \(\tau _m \) is the policy solution that achieves the emissions intensity target and minimizes the deviation from the baseline GDP, i.e., G(0).

Assumption 4

\(\frac{E(0)}{G(0)}>\varepsilon \).

This assumption implies that the simulation model’s BAU carbon intensity will be higher than the country’s committed target and that an active carbon policy is therefore needed. Assumptions 1–4, together, ensure that projection function E is not flat. Otherwise, we will have \({E(0)}/{G(0)}={E(\tau _m )}/{G(0)}>\varepsilon ={E(\tau _m )}/{G(\tau _m )}\) and consequently \(G(0)<G(\tau _m )\), contradicting Assumption 3.

4 The Iterative Method

Here we present our algorithm. For \(k\ge 0\) and \(\tau _k \ge 0\), define the operator T such that \(\tau _{k+1} =T(\tau _k )\) means \(\tau _{k+1} \) solves \(E(\tau _{k+1} )=\varepsilon \times G(\tau _k )\). In practice, the operator T is the model-specific numerical utility to backsolve for a carbon price \(\tau _{k+1} \) that meets the predetermined emissions target \(\varepsilon \times G(\tau _k )\). We use the term “backsolve”, because energy economic models are normally constructed with the natural closure,Footnote 2 such that the carbon price is exogenous and emissions are endogenous. To backsolve, for example, energy economic models that are built using GAMS.Footnote 3 or GEMPACKFootnote 4 can exogenize emissions and endogenize the carbon price in the alternative closure, and let the software compute the solution.

Under Assumptions 1–4, the carbon policy solution can be found by the following algorithm.

Panel c of Fig. 2 contains a flow chart of the Iterative Method. Specifically, we start with the natural closure and set \(\tau _0 =0\). With the BAU GDP projection, G(0), we derive an intermediate ‘target’ level of emissions, \(\varepsilon \times G(0)\). We then switch to the alternative closure and let the model backsolve for \(\tau _1 \) such that \(E(\tau _1 )=\varepsilon \times G(0)\). This is identical to the Naïve Method up to the point; but our algorithm will continue to obtain the associated GDP projection \(G(\tau _1 )\). Subsequently, we derive a new intermediate ‘target’ level of emissions \(\varepsilon \times G(\tau _1 )\), and let the model backsolve for \(\tau _2 \) such that \(E(\tau _2 )=\varepsilon \times G(\tau _1 )\). The iteration is continued until we have \(\tau _{k+1} =\tau _k =\tau ^{*}\), which implies \(E(\tau ^{*})=\varepsilon \times G(\tau ^{*})\), or equivalently, \(E(\tau ^{*})/G(\tau ^{*})=\varepsilon \).

We provide a mathematical proof in the Appendix showing how the Iterative Mothod works to find \(\tau _m \)that achieves the emissions intensity target at minimum economic cost. In the following, we shall demonstrate the application of our algorithm and compare its numerical performance with other methods’ in the existing literature.

5 Application

5.1 A stylized model

Instead of using a large-scale energy economic model that is less transparent, let us consider a stylised reduced form that is sketched in the top panel of Fig. 3. This is a comparative static model for China, and it shows the relation between the country’s emissions and GDP in 2020 and the carbon price that starts in 2015 and increases by 4% annually through 2020. In the absence of a carbon price, the country emits 8.5 BMT of \(\hbox {CO}_{2}\), and produces 7.5 trillion $ of GDP, consistent with the G-Cubed projections for China in 2020 (see e.g., McKibbin et al. 2011; Lu et al. 2013); and the country’s emission intensity is above 1.1 BMT \(\hbox {CO}_{2}\) per triillion dollars of GDP, close to China’s \(12^{\mathrm{th}}\) Five-Year Plan for 2015.Footnote 5 In other words, we have assumed that China’s carbon intensity will stay almost the same from 2015 to 2020 without a carbon price.

The country’s emissions and GDP are functions of the carbon price ($ per tonne of \(\hbox {CO}_{2})\) that starts in 2015 and increases by 4 % annually through 2020, such that

when \(0\le \tau <5\);

when \(5\le \tau <30\);

when \(30\le \tau <50\);

when \(50\le \tau <70\); and

when \(\tau \ge 70\). Intuitively, we have assumed that the introduction of the carbon price (when \(\tau <30)\) will encourage the uptake of low-hanging-fruit mitigation technologies, which effectively reduces emissions. The impact of the carbon price on the economy is minor, and “double dividend” exists (when \(\tau <5)\). However, current technologies are limited in their mitigation potential, and the economy will endure hardship if the carbon price rises continuously (when \(30\le \tau <50)\). If the carbon price is sufficiently high (when \(50\le \tau <70)\), backstop technologies will become available, reducing the economic costs of mitigation. GDP and emissions will be constant when \(\tau \ge 70\).Footnote 6 These lower bounds are set according to China’s annual GDP and emissions in the early 2000’s (see Fig. 1).

The stylized model is designated to reflect nonlinear and discontinuous dynamics of the socioeconomic system that are associated with step changes of energy supply and demand, and future technological progress. It is not difficult to verify that the model satisfies Assumptions 1–4 of Sect. 3.

5.2 Implementation

Following China’s commitment to the Copenhagen Accord as of 2020, we assume that the government has committed to reducing emissions intensity to 0.9 BMT \(\hbox {CO}_{2}\) per trillion $. This is equivalent to a 40 % reduction from the 2005 level.Footnote 7 For reference, let us call it “Target \(\varepsilon \)”. As is suggested in the bottom panel of Fig. 3, the country’s emissions intensity target can be achieved by three possible carbon prices: (around) $23, $38 or $55.Footnote 8 Notably, the carbon price of $23 results in the highest possible GDP of around 7 trillion $ which is the closest to the BAU projection. In contrast, carbon prices of $38 and $55 lead to lower GDPs of 6 and 4.5 trillion $, respectively. In other words, the economic loss, as measured by the deviation in GDP from a BAU projection, is minimized when the carbon price is set to $23.

The execution of our Iterative Method is visualized as the arrows in Fig. 4. It follows the steps of Sect. 4, and converges quickly to the cost-minimizing carbon price of $23.

5.3 Numerical performance

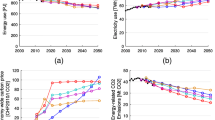

To compare their performances in Python,Footnote 9 we simulate the stylized model using the Naïve Method (Hübler et al. forthcoming), the Direct Method (Zhang et al. 2013), and our proposed Iterative Method. The results are summarized in Fig. 5.

Panel 1 of Fig. 5 shows the carbon price that is solved (vertical axis), given the initial guess of the carbon price that is used by each method (horizontal axis) when calling the Python “scipy.optimize.fsolve” routine. We see that while the Naïve Method and our Iterative Method are robust to the initial guesses of carbon price, the Direct Method is largely unstable and leading to multiple solutions. The Naïve Method underestimates the carbon price, and only our Iterative Method is bound to find the desired solution of $23. Panels 2 and 3 show the corresponding carbon intensity and GDP outcomes. We see that the Naïve Method fails to achieve the intensity target and that the Direct Method cannot guarantee the lowest GDP loss when achieving the carbon intensity target. Only our Iterative Method is bound to find the cost-minimizing carbon price. Panel 4 shows the CPU time that is required by each method to solve for the policy solution. We see that the Naïve Method is the fastest, but it fails to solve the emissions intensity target. The Direct Method is roughly five times faster than our Iterative Method. However, the speed comes at the cost of not guaranteeing to find the cost-minimizing carbon price. If there exists only one solution to the emissions intensity target, it is arguable that the Direct Method is more efficient. But in the presence of multiple solutions (as in our illustrative example), more computational time will be required to vary the initial guess and to explore all possible policy solutions. In this sense, our Iterative Method is more cost-effective.

As a caveat, the simulation does appear that it is most efficient to use the Direct Method with an initial guess for the carbon price that is close to zero. But this is only particular to curvature of the simplified numerical example. This reduced-form model is smooth enough to facilitate local convergence from zero to the cost-minimizing carbon price of $23. In reality, however, energy economic models are often of large scale, incorporating complex, nonlinear and discontinuous dynamics of the economic and energy system, such as technological breakthrough, and price oscillations. Therefore a similar pattern of local convergence may not be expected. Moreover, a low initial guess for the carbon price that is close to zero tends to cost significantly more time to solve using the Direct Method. This could emerge as a major problem for large-scale energy economic models.

5.4 Policy implications

In order to mitigate carbon emissions while allowing for continued economic growth and development, developing countries such as China and India have committed to reduce their emissions intensities. This increases the complexity of modeling climate change policies because an intensity target can be possibly met by a range of emissions and output combinations. In our numerical example, a given emissions intensity target could be satisfied with a range of emissions and output combinations. Using different methods of simulation will lead to different estimates of the carbon price ranging from $20 to over $50. This will result in differences in projected abatement costs at the magnitude of trillion $. The wide spread of simulation results reflect the large empirical uncertainties in climate policy implementation as previously commented by Pearson (2012). These uncertainties pose a substantial challenge for the government and the independent agencies charged with implementation.

Coping with uncertainties, the intention for China and India to use the emissions intensity target is to increase flexibility and allow for continued growth and development. In this regard, the policy application of our algorithm is tremendous because it allows policymakers to explore the flexibility and to maximize the growth potential under a mitigation target. The algorithm has proved to be an effective tool in finding the policy solution that achieves the target at minimum economic cost. In other words, policy recommendations that are based on simulation using the algorithm will ensure that the abatement done within a given country would be done at minimum cost. This will help to resolve uncertainties related to the economic cost of mitigation policies, firming the evidence base on which the particulars of national climate policy are formulated. Alleviating developing economies’ concerns about limits to growth, in turn, will facilitate the progress of international climate change negotiations.

One the other hand, in practice, if the policy in place (e.g. an existing carbon tax) is to be evaluated by certain simulation model, our algorithm can serve as a tool for assessment as to whether the current policy is on the trajectory that leads to the cost-minimizing solution—if not, the algorithm then points to a potential policy correction that can adjust to achieve the intensity target at the lowest cost given the current status. That said, the algorithm should not be overvalued due to its numerical essence. It is a tool based on simulation models; and the policy value of the algorithm is also limited to such models.

6 Conclusion

The algorithm presented in this paper provides a simple but non-trivial solution to the complex problem of modelling climate policy commitments specified in terms of an emissions intensity target. In practice, a variety of GDP and emission levels may satisfy an emissions intensity target and may be reached with a range of policy instruments. The algorithm addresses the issue from two asspects. First, it proposes a sensible criterion for selecting one particular combination of emissions and GDP: one that minimizes the economic loss, as measured by the deviation in GDP from a BAU projection in the absence of policy. Second, it provides a unique solution to the problem that satisfies this criteria under some fairly general asssumptions about an economic/energy model.

In the existing literature, there are three approaches dealing with the emissions intensity target in energy economic models. Using a stylised simulation model to compare the numerical performances of the three methods, we find that the Naïve Method fails to solve the emissions target. While the Direct Method works to solve the problem, it does not guarantee to find the cost-minimizing carbon price. In the presence of multiple solutions, our Iterative Method is the only one to provide a unique and coherent solution that is consistent with emissions intensity target while minimizing the GDP loss with reference to the BAU projection. Overall, it suggests that our proposed algorithm is an attractive solution to the problem.

Notes

See e.g., Lu et al. (2013) for a thorough literature and policy review.

In economic modelling, closure is the decision of which variables are exogenous and which are endogenous.

See http://www.gams.com.

Please see Table 1 on page 1166 and Figure 2 on page 1168 of Lu et al. (2013) for a derivation of this using the EIA International Energy Statistics.

This is more than three times of the carbon tax in Australia from July 2012 to June 2014 or about ten times of the current EU Allowance price.

This target is derived in Table 1 on page 1166 and Figure 2 on page 1168 of Lu et al. (2013) using the EIA International Energy Statistics.

These carbon prices are within range found by Lu et al. (2013).

The source codes of the script are available on request.

References

Ellerman, A., & Sue Wing, I. (2003). Absolute versus intensity-based emission caps. Climate Policy, 3(S2), S7–S20.

Govindaraju, C., & Tang, C. (2013). The dynamic links between \(\text{ CO }_{2}\) emissions, economic growth and coal consumption in China and India. Applied Energy, 104, 310–318.

Hübler, M., Löschel, A., & Voigt, S. (2014). Designing an emissions trading scheme for China—An up-to-date climate policy assessment. Energy Policy, 75, 57–72.

Jotzo, F., & Pezzey, J. (2007). Optimal intensity targets for greenhouse gas emissions trading under uncertainty. Environmental & Resource Economics, 38, 259–284.

Liao, H., & Cao, H. (2013). How does carbon dioxide emission change with the economic development? Statistical experiences from 132 countries. Global Environmental Change, 23(5), 1073–1082.

Lu, Y., Stegman, A., & Cai, Y. (2013). Emissions intensity targeting: From China’s 12th Five Year Plan to its Copenhagen commitment. Energy Policy, 61, 1164–1177.

Lv, W., Hong, X., & Fang, K. (2012). Chinese regional energy efficiency change and its determinants analysis: Malmquist index and Tobit model. Annals of Operations Research. doi:10.1007/s10479-012-1094-5.

Marschinski, R., & Edenhofer, O. (2010). Revisiting the case for intensity targets: Better incentives and less uncertainty for developing countries. Energy Policy, 38, 5048–5058.

McKibbin, W., Morris, A., Wilcoxen, P., & Cai, Y. (2009). Consequences of alternative U.S. cap-and-trade policies: Controlling both emissions and costs. Climate and Energy Economics Discussion Paper. The Brookings Institution.

McKibbin, W., Morris, A., & Wilcoxen, P. (2011). Comparing climate commitments: A model-based analysis of the Copenhagen Accord. Climate Change Economics, 2, 79–103.

McKibbin, W., Morris, A., Wilcoxen, P., & Cai, Y. (2015). Carbon taxes and U.S. fiscal reform. National Tax Journal, 68(1), 139–156.

Newell, R. G., & Pizer, W. A. (2008). Indexed regulation. Journal of Environmental Economics and Management, 56(3), 221–233.

Parry, I., & Bento, A. (2000). Tax deductions, environmental policy, and the “double dividend” hypothesis. Journal of Environmental Economics and Management, 39, 67–96.

Parry, I., Williams, R., & Goulder, L. (1999). When can carbon abatement policies increase welfare? The fundamental role of distorted factor markets. Journal of Environmental Economics and Management, 37, 52–84.

Pearson, D. (2012). Empirical uncertainties in climate policy implementation. The Australian Economic Review, 45, 114–124.

Quirion, P. (2005). Does uncertainty justify intensity emission caps? Resource and Energy Economics, 27, 343–353.

Tian, H., & Whalley, J. (2009). Level versus equivalent intensity carbon mitigation commitments. NBER Working Paper No. 15370.

United Nations Framework Convention on Climate Change. (2010). Copenhagen Accord. https://unfccc.int/meetings/copenhagen_dec_2009/items/5262.php. Accessed 17 Oct 2014

Wang, K., Zhang, X., Wei, Y. M., & Yu, S. (2013). Regional allocation of \(\text{ CO }_{2}\) emissions allowance over provinces in China by 2020. Energy Policy, 54, 214–229.

Wu, J., Song, M., & Yang, L. (2014). Advances in energy and environmental issues in China: Theory, models, and applications. Annals of Operations Research. doi:10.1007/s10479-014-1528-3.

Yang, L., & Yang, T. (2012). Energy consumption and economic growth from perspective of spatial heterogeneity: Statistical analysis based on variable coefficient model. Annals of Operations Research. doi:10.1007/s10479-012-1095-4.

Yi, W., Zou, L., Guo, J., Wang, K., & Wei, Y. (2011). How can China reach its \(\text{ CO }_{2}\) intensity reduction targets by 2020? A regional allocation based on equity and development. Energy Policy, 39, 2407–2415.

Zhang, D., Rausch, S., Karplus, V. J., & Zhang, X. (2013). Quantifying regional economic impacts of \(\text{ CO }_{2}\) intensity targets in China. Energy Economics, 40, 687–701.

Zhu, Z., Liao, H., Cao, H., Wang, L., Wei, Y., & Yan, J. (2014). The differences of carbon intensity reduction rate across 89 countries in recent three decades. Applied Energy, 113, 808–815.

Author information

Authors and Affiliations

Corresponding authors

Additional information

This study was undertaken while Yiyong Cai worked with the Australian National University.

Appendix: Algorithm properties

Appendix: Algorithm properties

In this appendix, we will show how our Iterative Method works to find that achieves the emissions intensity target while minimizing the economic cost. For future reference, let us define the auxiliary function \(\hat{{E}}\) such that \(\hat{{E}}(\tau )=\varepsilon \times G(\tau )\), and note that a policy solution exists where \(\hat{{E}}(\tau )=\varepsilon \times G(\tau )=E(\tau )\). As the auxilary function \(\hat{{E}}\) only differes from G by a scaler, \(\hat{{E}}\) has the same properties as G does. In other words, Assumption 3 is equivalent to

Assumption 5

The auxilary function \(\hat{{E}}\) is continuous. It satisfies: (1) \(\hat{{E}}(\tau )>\hat{{E}}(\tau _m )\) for all \(\tau \in [0,\tau _m )\) ; and (2) \(\hat{{E}}\) is weakly decreasing on \([\tau _m ,\infty )\).

Similarly, Assumption 4 is equivalent to

Assumption 6

\(E(0)>\hat{{E}}(0).\)

Figure 6 contains examples where Assumptions 1, 2, 5 and 6 are satisfied and Fig. 7 contains examples where at least one of the assumptions are violated. More specifically, in Fig. 6, Example a corresponds to the scenario where only one policy solution to the emissions intensity target exists; Example b corrresponds to the scenario where there are two solutions; Example c corresponds to the scenario in which the rebound effects discussed above are prominent and the carbon price is sufficiently low. It shall be shown that the algorithm works for all three examples. In contrast, in Fig. 7, Example a violates Assumption 1 as there is no policy solution to the emissions intensity target; Example b violates Assumption 5 which unrealistically states that the carbon price will continue to increase GDP over quite a wide range; and Example c violates Assumption 6 because the BAU emission intensity is lower than the target and thus no mitigation is needed.

Our proposed algorithm is characterised by the following properties:

Property 1

For any \(k\ge 0\) and \(0\le \tau _k <\tau _m ,\, \tau _{k+1} \ge \tau _k\).

Proof

Suppose for a contradiction that \(\tau _{k+1} <\tau _k \). Then by Assumption 2,

Since \(E(0)>\hat{{E}}(0)\), if \(\hat{{E}}(\tau _k )>E(\tau _k )\), then by continuity there exists \(\tau _a \in [0,\tau _m )\) such that \(E(\tau _a )=\hat{{E}}(\tau _a )\), contradicting the definition of \(\tau _m \); if \(\hat{{E}}(\tau _k )=E(\tau _k )\), then \(\tau _k \) is a solution and by definition of \(\tau _m \) we have \(\tau _k \ge \tau _m \), again a contradiction. \(\square \)

Property 2

For any \(k\ge 0 \) and \(0\le \tau _k <\tau _m,\,\tau _{k+1} \le \tau _m\).

Proof

Suppose for a contradiction that \(\tau _{k+1} >\tau _m \). Then by Assumptions 2 and 5,

which is a contradiction. \(\square \)

Property 3

Let \(\tau _0 =0\). The sequence \((\tau _k )\) converges to \(\tau _m\).

Proof

This follows readily from Properties 1 and 2, and the Monotone Convergence Theorem. \(\square \)

Altogether, Properties 1 – 3 ensures that our proposed algorithm will solve for \(\tau _m \). By Assumption 3, \(G(\tau _m )\) is the highest possible GDP outcome that is compatible with the emissions intensity target. In other words, the economic loss, as measured by the deviation in GDP from the BAU projection, is minimized.

Rights and permissions

About this article

Cite this article

Cai, Y., Lu, Y., Stegman, A. et al. Simulating emissions intensity targets with energy economic models: algorithm and application. Ann Oper Res 255, 141–155 (2017). https://doi.org/10.1007/s10479-015-1927-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-015-1927-0