Abstract

It is well-known that reinsurance can be an effective risk management solution for financial institutions such as the insurance companies. The optimal reinsurance solution depends on a number of factors including the criterion of optimization and the premium principle adopted by the reinsurer. In this paper, we analyze the Value-at-Risk based optimal risk management solution using reinsurance under a class of premium principles that is monotonic and piecewise. The monotonic piecewise premium principles include not only those which preserve stop-loss ordering, but also the piecewise premium principles which are monotonic and constructed by concatenating a series of premium principles. By adopting the monotonic piecewise premium principle, our proposed optimal reinsurance model has a number of advantages. In particular, our model has the flexibility of allowing the reinsurer to use different risk loading factors for a given premium principle or use entirely different premium principles depending on the layers of risk. Our proposed model can also analyze the optimal reinsurance strategy in the context of multiple reinsurers that may use different premium principles (as attributed to the difference in risk attitude and/or imperfect information). Furthermore, by artfully imposing certain constraints on the ceded loss functions, the resulting model can be used to capture the reinsurer’s willingness and/or capacity to accept risk or to control counterparty risk from the perspective of the insurer. Under some technical assumptions, we derive explicitly the optimal form of the reinsurance strategies in all the above cases. In particular, we show that a truncated stop-loss reinsurance treaty or a limited stop-loss reinsurance treaty can be optimal depending on the constraint imposed on the retained and/or ceded loss functions. Some numerical examples are provided to further compare and contrast our proposed models to the existing models.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Reinsurance is one of the most traditional and long standing risk management solutions, particularly from an insurer’s point of view. Its strategic use not only leads to an effective risk mitigation, but it also enhances an insurer’s stability and profitability. Examples of the reinsurance contracts (or treaties) for which an insurer can transfer its risk to a reinsurer include quota-share reinsurance, stop-loss reinsurance, excess-of-loss reinsurance, surplus reinsurance, and so on. Because of the variety of these reinsurance treaties that exist in the marketplace, the insurers are therefore constantly seeking for better and more effective reinsurance strategies.

The quest for optimal risk management solution using reinsurance is an active area of research among academics, actuaries, and risk managers. In a typical formulation of an optimal reinsurance model, it involves at least the following three components. First is the criterion (i.e. objective) that determines the optimality of the reinsurance contracts. Second is the premium principle that specifies how the reinsurance premium is calculated. The third is the constraints, if any, that are imposed on the model. Examples of some typical constraints include the restriction on the structure of the reinsurance contracts and the reinsurance premium budget that an insurer could spend on reinsuring his risk via reinsurance. In this paper, we will also demonstrate that an ingenious specification of constraints could lead to an optimal reinsurance model with some desirable features, including controlling the credit risk of the reinsurer and the counterparty risk of the insurer. The pioneering work on optimal reinsurance is attributed to Borch (1960), Kahn (1961) and Arrow (1963). In particular, Borch (1960) showed that the stop-loss reinsurance is optimal in the sense of minimizing the variance of the insurer’s retained loss under the assumption of expected reinsurance premium principle. Confining to the expected reinsurance premium principle and the criterion of maximizing the expected utility of a risk-averse insurer’s terminal wealth, Arrow (1963) also established that stop-loss reinsurance is optimal.

The classical optimal reinsurance models have been generalized in a number of interesting directions, with particular emphasis on the three aspects of the optimal reinsurance models discussed above, i.e. more sophisticated criterion, more complex premium principles, and more involved constraints. Just to name a few, Young (1999), Kaluszka (2001, 2005) and Kaluszka and Okolewski (2008) addressed the optimal reinsurance strategy by considering other premium principles such as Wang’s premium principle, mean-variance premium principles, maximal possible claims principle, convex premium principles, etc. Cai and Tan (2007), Cai et al. (2008), Balbás et al. (2009), Chi and Tan (2011) and Tan et al. (2011) demonstrated that modern risk measures such as the Value-at-Risk (VaR) and the Conditional Value-at-Risk (CVaR) can be exploited in a reinsurance model for a viable risk management solution. More recently, Chi and Tan (2013) broadened the optimal reinsurance model by investigating the VaR and CVaR reinsurance models under a more general premium principle. They imposed some constraints on the ceded loss functions and assumed that the premium principle satisfies three basic axioms, namely distribution invariance, risk loading and stop-loss order preserving. See also Cheung et al. (2013) and Chi and Weng (2013).

While the existing results have studied the optimal reinsurance solutions under a standard premium or a particular class of premium principles, in this paper we propose a new class of premium principle which we denote as the monotonic piecewise premium principle and show that the resulting optimal reinsurance model involving this new class of premium principle is still tractable. By piecewise premium principle we mean a premium principle that can be constructed by either concatenating a series of different premium principles or using the same premium principle but with different parameter values.

There are many advantages to investigate the optimal reinsurance model under this new class of premium principle. First and foremost is that the proposed monotonic piecewise premium principle is able to capture the risk attitude of the reinsurer easily and intuitively. If risk were segmented into different layers so that a higher layer of risk refers to a greater risk exposure with a larger potential catastrophic loss, then a reinsurer typically has a different level of risk attitude on each of these layers. This implies that different layers of risk may be priced differently. More specifically, a reinsurer, in general, demands a higher risk premium (i.e. higher risk loading) on a risk in higher layers than a risk in lower layers. The proposed monotonic piecewise premium principle provides an elegant way of addressing the differentiate in risk attitude. For example, if a reinsurer prefers to consistently using an expected premium principle to price all layers of risk, then the differentiate in risk attitude can be reflected by attaching a higher risk loading parameter of the expected premium principle when pricing a higher layer of risk. The piecewise nature of the premium principle also provides a greater flexibility in modeling a reinsurer’s risk attitude by allowing the reinsurer to adopt different premium principles depending on the layers. For instance, the reinsurer may use the expected value premium principle when the claim is less than a certain threshold level, and Wang’s premium principle when the claim exceeds that threshold. Similarly, if the reinsurer uses principle of equivalent utility to price the contracts, the reinsurer may choose different parameters or even different utility functions on different layers and this again leads to premium principle that is piecewise.

A second advantage to investigate the optimal reinsurance under the proposed monotonic piecewise premium principle is that it can be used to analyze the optimal reinsurance in the context of multiple reinsurers. This is facilitated by the fact that the piecewise nature of pricing layers of risk can be viewed as being reinsured by different reinsurers. Each reinsurer is reinsuring one or more layers of risk using its premium principle.

A third advantage is that it is a much wider class of premium principles in that it encompasses the stop-loss preserving class of premium principle considered in Chi and Tan (2013). The stop-loss preserving premium principle includes the following eight classical premium principles: net, expected value, exponential, proportional hazard, principle of equivalent utility, Wang’s, Swiss, and Dutch. Moreover, the class we consider here also includes the premium principles which are monotonic and constructed by concatenating some combinations of the above eight premium principle.

Another contribution of the paper is to demonstrate that by meticulously imposing an appropriate constraint on an optimal reinsurance model, optimal reinsurance strategy with a certain desirable property can be obtained analytically. More specifically, we propose two variants of the optimal reinsurance models. The first model takes into consideration the reinsurers’ willingness to reinsure when designing the reinsurance contract. Many of the studies on optimal reinsurance implicitly assume that the reinsurers will accept any reinsurance contracts proposed by the insurance companies. This, however, may not be the case in practice. It is possible that the reinsurers are not willing to, or not allowed to due to concern with credit risk or constraint on risk capital requirement. This issue can be addressed by imposing a limit on the losses that can be ceded to the reinsurer.

The second model is motivated by the presence of the counterparty risk that the insurer is concerned with. In an ideal arrangement, losses that are ceded to the reinsurer become the obligation of the reinsurer and will be indemnified to the insurer. However there are situations where the reinsurer might be facing cash flow strained or financial distress that impact its ability to meet its obligation. When this arises, the insurer is responsible for the losses that are supposedly to have transferred to the reinsurer and hence ultimately bearing the counterparty risk. This suggests that when designing an optimal reinsurance strategy, insurer needs to take into consideration the counterparty risk. In this paper, we propose a new optimal reinsurance model that reflects counterparty risk.

The basic setup of our optimal reinsurance model is to seek an optimal reinsurance strategy that minimizes the VaR of the total exposed risk of an insurer given some budget constraint and under the monotonic piecewise reinsurance premium principles. The model description, including the definition of monotonic piecewise premium principle and the constraints on the ceded loss functions are described in Sect. 2. The use of VaR as a relevant measure of risk for the insurer is prompted by its popularity among banks and financial institutions for quantifying risk. Analytical reinsurance strategies for the basic reinsurance model as well as its variants are derived in Sect. 3. In particular, by requiring the retained loss function to be nondecreasing, this section demonstrates that the ceded loss function of the following form

where \(0\leqslant d\leqslant v\), \((x)_+ = \max \{x, 0\}\), and \(1\!\!1_D\) denotes the indicator function of an event \(D\), can be optimal. This ceded loss function is commonly known as the truncated stop-loss reinsurance treaty. The same type of ceded loss function is also shown to be optimal in the reinsurance models analyzed by Gajek and Zagrodny (2004), Kaluszka (2005), Kaluszka and Okolewski (2008), Bernard and Tian (2009) and Chi and Tan (2011). The truncated stop-loss reinsurance treaty has the peculiar property that once the loss amount exceeds a certain threshold \(v\), the reinsurer will have zero obligation to the insurer. In other words, there is no indemnification from the reinsurer to the insurer for any loss exceeding \(v\). From an insurer’s point of view, this risk management strategy seems counterintuitive and not desirable since there is no protection to the insurer when there is a catastrophic loss (or when loss exceeds \(v\)). From the reinsurer’s point of view, ceded loss function of this kind is also not desirable as it induces an insurer’s moral hazard. There is an incentive for the insurer to underreport its loss when the actual loss exceeds \(v\).

One simple solution of preventing the truncated stop-loss function being optimal is to impose the constraint that the ceded loss function is also nondecreasing, in addition to nondecreasing constraint on the retained loss function. This is exactly the motivation for Sect. 4 which demonstrates that with the added constraint, a limited stop-loss reinsurance treaty with the following structure

for some \(a\geqslant 0, b>0\), can be optimal. Note that the limited stop-loss treaty is similar to the standard stop-loss reinsurance except that it imposes an upper limit on the loss that a reinsurer is liable. Risk management with this type of property is more reasonable as it does not expose the reinsurer to unlimited risk exposure. There are other studies that have similarly shown that the above ceded loss function can be optimal. These include the works of Kaluszka and Okolewski (2008) and Gajek and Zagrodny (2004). Using the the criteria of maximizing either the expected utility or the stability of the cedent, the former authors established that (2) can be optimal for a fixed reinsurance premium calculated according to the maximal possible claims principle. Similarly the latter authors considered more general symmetric and even asymmetric risk measures and showed the optimality of (2).

By considering a particular form of a piecewise premium principle, Sect. 5 provides a detailed illustration on how the optimal form of the reinsurance treaties can be evaluated. Numerical examples are further given to compare and contrast our proposed models to the existing results. Sect. 6 concludes the paper.

2 Risk measure based reinsurance model

2.1 Model description

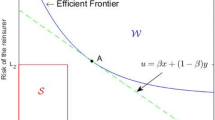

Let \(X\) be the claim random variable that an insurer is obligated to pay. Without any loss of generality, we assume that \(X\) is a non-negative random variable with cumulative distribution function (c.d.f.) \(F_X(x) = \mathbb {P}(X \leqslant x)\) and \(\mathbb {E}(X) < \infty \). In the absence of reinsurance the insurer’s risk exposure is \(X\). Let us now assume that the insurer is using reinsurance to cede part of his risk to a reinsurer. In this case, the claim \(X\) is divided into two parts, i.e. the ceded loss part, \(f(X)\), and the retained loss part, \(R_f(X)\). This means that \(X = f(X) + R_f(X)\) and that a reinsurance contract (or treaty) is uniquely determined by either the ceded loss function \(f(\cdot )\) or the retained risk function \(R_f(\cdot )\). Here we focus on the ceded loss function \(f(\cdot )\) to identify the reinsurance treaty. Under the reinsurance treaty \(f\), the reinsurer is obligated to pay \(f(X)\) to the insurer when a claim \(X\) arises. By transferring part of the risk to a reinsurer, the insurer incurs an additional cost in the form of reinsurance premium \(\varPi (f(X))\) that is payable to the reinsurer. Note that the reinsurance premium is a function of the ceded loss function \(f(\cdot )\) and the adopted premium principle. In the presence of reinsurance, the total risk exposure of the insurer is transformed from \(X\) to \(T_f(X)\) where \(T_f(X) =R_f(X) + \varPi (f(X))\). The transformed random variable \(T_f(X)\) captures the tradeoff between risk retaining and risk transferring. If the insurer is conservative and wishes to transfer most of the risk to a reinsurer, then the retained risk \(R_f(X)\) can be made small but at the expense of higher reinsurance premium \(\varPi (f(X))\). On the other hand, if the insurer has a much higher risk tolerance, then the cost of reinsurance \(\varPi (f(X))\) will be small but at the expense of higher retained risk \(R_f(X)\). Consequently the idea underlying the optimal reinsurance is to seek an optimal ceded function \(f(x)\) that balances the tradeoff between risk retaining and risk transferring.

A plausible risk measure based optimal reinsurance model [see for example Cai and Tan (2007) and Chi and Tan (2013)] can be formulated as

where \(\rho (\cdot )\) represents the risk measure that is adopted by the insurer, \(\varPi (\cdot )\) is the reinsurance premium principle, \(\pi _0\) is the maximum budget an insurer could spend on reinsurance premium, and \(\mathcal {L}\) is the admissible set of ceded loss functions. In this paper, we analyze the optimal reinsurance model by setting the risk measure \(\rho \) to the VaR. Despite its shortcomings such as lacking coherence property (see Artzner et al. (1999)), VaR remains prominent among financial institutions for quantifying risk [see Jorion (2006)]. Formally, VaR is defined as follows:

Definition 1

The VaR of a non-negative variable \(X\) at the confidence level \((1 - \alpha )\), where \(0 < \alpha < 1\), is defined as

The constant \(\alpha \), which is typically a small value such as 1 % or 5 %, reflects the the desired confidence level of the insurer. The optimal reinsurance model (3) under VaR criterion simplifies to

We now define the admissible set \(\mathcal {L}\). Here we consider the following two classes of \(\mathcal {L}\), which are labeled as \(\mathcal {L}_1\) and \(\mathcal {L}_2\), respectively:

There are some common characteristics among the above admissible sets \(\mathcal {L}_1\) and \(\mathcal {L}_2\). First, the loss that is ceded to a reinsurer is nonnegative and uniformly bounded by the risk itself. The latter restriction ensures that the claim amount paid by the reinsurer does not exceed the original claim. Second, the retained loss function is at least a nondecreasing function so that the insurer needs to bear a correspondingly higher claim for larger claim. Third, without loss of too much generality, for any reinsurance treaty \(f\), we assume that the retained loss function \(R_f(x)\) is a left continuous function with respect to \(x\). Fourth, the admissible set \(\mathcal {L}_1\) encompasses \(\mathcal {L}_2\); i.e. \(\mathcal {L}_2 \subsetneqq \mathcal {L}_1\). Some argue that the ceded loss function should be nondecreasing, similar to the retained loss function. Ensuring both ceded loss function and the retained loss function to be nondecreasing has the advantage of reducing the insurer’s moral hazard. It is for this reason that we also investigate the optimal reinsurance under the admissible class \(\mathcal {L}_2\). Chi and Tan (2013) similarly analyzed the optimal reinsurance under \(\mathcal {L}_2\) and stop-loss preserving class of premium principle. The above two admissible sets \(\mathcal {L}_1\) and \(\mathcal {L}_2\) represent the two basic constraints we impose on the ceded loss functions and the retained loss functions, as we will discuss in Sect. 3 and 4.

2.2 Piecewise premium principle

This subsection begins by first describing the well-known stop-loss order preserving premium principle. Then we formally define the proposed class of premium principle that is monotonic and piecewise. We conclude the subsection by presenting an example in order to contrast the difference between the proposed class of premium principle and the class of stop-loss order preserving premium principle.

In order to understand what we meant by a class of premium principle that is stop-loss order preserving, it is essential to first introduce the definition of stop-loss order between two risks. While there are several different but equivalent definitions of stop-loss order [see Hurlimann (1998)], here we just state the one which is based on Theorem 3.2.2 in Rolski et al. (1999).

Definition 2

Suppose \(X_1\) and \(X_2\) are two random variables with finite means. If

then we say that the random variable \(X_1\) is smaller than the random variable \(X_2\) in stop-loss order and we use the notation \(X_1 \leqslant _{sl} X_2\) to denote such ordering.

Using the above definition, the stop-loss order preserving property of the insurance premium principle is defined as follows:

Definition 3

Suppose \(\varPi (\cdot )\) is an insurance premium principle. If \(\varPi (X_1) \leqslant \varPi (X_2)\) for any random variables \(X_1\) and \(X_2\) as long as they satisfy \(X_1 \leqslant _{sl} X_2\), then we say that the insurance premium principle \(\varPi (\cdot )\) is stop-loss order preserving.

Now we introduce what we meant by a class of premium principle that is monotonic.

Definition 4

Given any two risks \(X\) and \(Y\) such that \(X(\omega ) \leqslant Y(\omega )\) for all possible outcomes \(\omega \), then \(\varPi (\cdot )\) is said to be a premium principle preserving monotonicity if \(\varPi (X) \leqslant \varPi (Y)\).

It should be emphasized that monotonicity is a mild condition on the premium principle. In particular, the class of monotonic premium principles includes the premium principles which preserve stop-loss ordering. The class of premium principles which preserves stop-loss ordering includes the following eight classical premium principles: net, expected value, exponential, proportional hazard, principle of equivalent utility, Wang’s, Swiss, and Dutch. It is also worth mentioning that monotonicity allows a premium principle to have a very flexible piecewise structure. The piecewise premium principle is defined as follows:

Definition 5

If there exist \(0 = a_0 < a_1 < \cdots <a_{n-1} < a_n = \infty \), \(a_i \in \mathbb {R}\), \(i = 0, 1, \ldots , n\) such that for any random variable \(X\), \(\varPi (X) = \sum _{i = 1}^{n} \varPi _{i}(X \cdot 1\!\!1_{X \in [a_{i - 1}, a_{i})})\), where \(1\!\!1\) denotes the indicator function and each \(\varPi _{i}(\cdot )\) is a specific premium principle, then we say that the premium principle \(\varPi (\cdot )\) is a piecewise premium principle. If additionally the piecewise premium principle satisfies the monotonicity property, then the resulting premium principle is both monotonic and piecewise.

Note that any arbitrary classical premium principle is a special case of the above piecewise premium principle. This follows by setting \(n=1\) in the above definition. For this reason we will mainly focus our analysis on the piecewise premium principle (i.e. \(n>1\)) instead of the ordinary premium principle. Furthermore, the monotonic piecewise premium principle encompasses the stop-loss order preserving premium principle so that the former premium principle is more general than the latter premium principle. In fact, the following example confirms that a premium principle can be monotonic and piecewise and yet does not preserve the stop-loss ordering.

Example 1

Using the notation in Definition 5, this example considers a monotonic piecewise premium principle with \(n=2\), \(a_1=10\), and \( \varPi _{i}, i=1, 2\) are expectation premium principles with risk loading factors \(\rho _1 = 0.1\) and \(\rho _2 = 0.5\), respectively. This implies that \( \varPi _{1}\) applies to the first layer of risk with loss amount less than 10 while \( \varPi _{2}\) applies to the remaining layer with loss amount exceeding or equal to 10. Hence the piecewise premium principle is constructed by concatenating two expectation premium principles with the following representation:

Note that the expectation premium principle is monotonic and preserves stop-loss order and that the premium principle (7) is a monotonic piecewise premium principle.

Let us now consider the following two loss random variables \(X_1\) and \(X_2\) such that \(X_1\) represents a deterministic loss of 10 in any scenario while \(X_2\) equals to 5 with probability of 80 % and uniformly distributed between 5 and 55 with probability of 20 %. It is easy to verify that both risks have the same expectations; i.e. \(\mathbb {E}\left[ X_1\right] = \mathbb {E}\left[ X_2\right] = 10\). Furthermore, the following analysis confirms that \(X_1 \leqslant _{sl} X_2\).

(i) If \(d \leqslant 5\), we have

(ii) If \(5 < d \leqslant 10\), we have

which is increasing with respect to \(d\) when \(5 < d \leqslant 10\). Therefore, it achieves its minimum when \(d = 5\), i.e.,

(iii) If \(d \geqslant 10\), it is clear that

Hence according to Definition 2, we have \(X_1 \leqslant _{sl} X_2\). On the other hand, the premium principle (7) is not stop-loss order preserving premium principle though it is a monotonic piecewise premium principle since \(\varPi (X_1) = 15\) and \(\varPi (X_2) = 13.34\).

3 Optimality of truncated stop-loss reinsurance treaties

By assuming the premium principle is monotonic (see Definition 4) and the ceded loss functions need not be non-decreasing [i.e. the admissible set of ceded loss functions is given by \(\mathcal {L}_1\) as defined in (5)], Sect. 3.1 shows that the truncated stop-loss reinsurance treaty (1) is optimal to the reinsurance model (4). The same subsection also demonstrates that the basic reinsurance model can be extended to analyzing the optimal reinsurance treaties under the multiple reinsurers when the premium principle is of the form piecewise as defined in Definition 5. Two interesting extensions of the optimal reinsurance models are discussed in Sect. 3.2 and 3.3. In particular, Sect. 3.2 investigates the reinsurance model (4) under the additional constraint that a limit is imposed on the reinsurance treaty while Sect. 3.3 examines a generalization of the reinsurance model (4) that incorporates counterparty risk. Interestingly, both variants of the optimal reinsurance models still confirm the optimality of the truncated stop-loss reinsurance treaties.

3.1 Without nondecreasing assumption on the ceded loss functions

In this subsection, we show that for the reinsurance model (4), the truncated stop-loss reinsurance strategy is optimal among all the strategies in \(\mathcal {L}_1\). To proceed, for any ceded loss function \(f\) from the set \(\mathcal {L}_1\), it is useful to consider the following function:

where \(v = \mathrm{VaR}_{\alpha }(X)\). Note that by construction, \(g_f\) is also an element in \(\mathcal {L}_1\). Clearly, if the ceded loss function of a reinsurance treaty takes the form \(g_f\), then the reinsurance treaty is a truncated stop-loss reinsurance treaty. The following theorem shows that if the reinsurance premium is monotonic, the truncated stop-loss reinsurance treaty is the optimal form among all the admissible treaties in \(\mathcal {L}_1\).

Theorem 1

Consider the reinsurance model (4) with admissible ceded loss functions \(\mathcal {L}_1\). Assume further that the reinsurance premium principle \(\varPi (\cdot )\) is a monotonic piecewise premium principle. Then, for any ceded loss function \(f\in \mathcal {L}_1\), we can construct the ceded loss function \(g_f\in \mathcal {L}_1\) using (8) such that \(g_f\) satisfies the following properties:

-

(a)

\(\varPi (f(X))\leqslant \pi _0\) implies \(\varPi (g_f(X))\leqslant \pi _0\). Equivalently, if the ceded loss function \(f\) satisfies the budget constraint, then the ceded loss function \(g_f\) will also satisfy the budget constraint;

-

(b)

\(\textit{VaR}_{\alpha }(T_{g_f}(X)) \leqslant \textit{VaR}_{\alpha }(T_{f}(X))\).

Proof

(a) We first claim that \(g_f(x) \leqslant f(x)\) for all \(x \geqslant 0\). In fact, for \(0 \leqslant x \leqslant v\), since \(f\in \mathcal {L}_1\), the retained loss function corresponding to \(f\) is nondecreasing, which implies that

Therefore,

and

Thus, \(g_{f}(x) \leqslant f(x), \forall ~x \geqslant 0\).

As a result, the monotonicity of the premium principle \(\varPi _i(\cdot )\) immediately implies that \(\varPi (g_f(X)) \leqslant \varPi (f(X))\), which is the desired result.

(b) The translation invariance property of VaR yields

where the second equality is due to an application of Theorem 1 in Dhaene et al. (2002) along with the left continuity and nondecreasing properties of \(R_f(x)\). This completes the proof.

\(\square \)

Remark 1

-

(a)

The above theorem indicates that the optimality of the truncated stop-loss reinsurance strategy is independent of the reinsurance premium principle. The truncated stop-loss reinsurance strategy is optimal among all the strategies in \(\mathcal {L}_1\) as long as the premium principle is monotonic. The actual specification of the parameter values of the optimal ceded loss function then depends on the premium principle.

-

(b)

If we denote \(d = v - f(v)\), then the truncated stop-loss function \(g_{f}\) defined in (8) can be succinctly represented as

$$\begin{aligned} g_{f}(x) = (x - d)_{+} 1\!\!1_{\{x \leqslant v\}}. \end{aligned}$$Furthermore, it follows from Theorem 1 that the VaR-based optimal reinsurance problem (4), with admissible set of ceded loss functions \(\mathcal {L}_1\), can equivalently be rewritten as

$$\begin{aligned} \begin{aligned} \displaystyle \left\{ \begin{array}{l@{\quad }l} \underset{0 \leqslant d \leqslant v}{\min } &{}\mathrm{VaR}_{\alpha }\left( X - (X - d)_{+} 1\!\!1_{\{X \leqslant v\}} + \varPi \left[ g_{f}(X)\right] \right) \\ \, \\ \text{ s.t. } &{} \varPi [g_f(X)]\equiv \varPi \left[ (X - d)_{+} 1\!\!1_{\{X \leqslant v\}} \right] \leqslant \pi _0. \end{array}\right. \end{aligned} \end{aligned}$$The above optimization problem reduces to

$$\begin{aligned} \displaystyle \left\{ \begin{array}{l@{\quad }l} \underset{0 \leqslant d \leqslant v}{\min } &{}d + \varPi \left[ g_{f}(X)\right] \\ \, \\ \text{ s.t. } &{} \varPi [g_f(X)]\equiv \varPi \left[ (X - d)_{+} 1\!\!1_{\{X \leqslant v\}} \right] \leqslant \pi _0, \end{array}\right. \end{aligned}$$(9)which is simply an optimization problem involving only one variable. Hence once the reinsurance premium principle is given, it is technically much easier to solve, as shown in the numerical examples in Sect. 5.

If there exist several reinsurers which adopt different premium principle in the market, then the insurance company will naturally take advantage of this when ceding its risk to the reinsurers. When determining the optimal reinsurance strategy, the insurance company will consider the existence of multiple reinsurers, and the premium principle is not so explicit as that in the case of single reinsurer. The following theorem deals with the case of multiple reinsurers.

Theorem 2

Assume that there are \(n\) reinsurers in the market and that reinsurer \(i\) adopts premium principle, \(\varPi _i(\cdot )\), for \(i = 1, 2, \ldots , n\). Each premium principle \(\varPi _i(\cdot )\) is a monotonic piecewise premium principle. We further assume that the insurance company will always seek the optimal way to cede his risk to the reinsurers in order to minimize the cost of reinsurance. Under the above assumptions, the premium that the insurance company pays associated with the ceded loss function \(f\) is given by

where \(\bigcup _{i = 1}^{n} A_i = \bigcup _{i = 1}^{n} A_i^f = [0, +\infty )\). And \(\{A_i^f\}_{i = 1}^{n}\) is the optimal partition associated with the ceded loss function \(f\) in the sense that it minimizes the premium paid by the insurance company.

Then, for any ceded loss function \(f\in \mathcal {L}_1\), we can construct the ceded loss function \(g_f\) according to (8), and \(g_f\) satisfies the following properties:

-

(a)

\(\varPi (f(X))\leqslant \pi _0\) implies \(\varPi (g_f(X))\leqslant \pi _0\). Equivalently, if the ceded loss function \(f\) satisfies the budget constraint, then the ceded loss function \(g_f\) will also satisfy the budget constraint;

-

(b)

\(\textit{VaR}_{\alpha }(T_{g_f}(X)) \leqslant \textit{VaR}_{\alpha }(T_{f}(X))\).

Proof

(a) From the proof of Theorem 1, we know that \(g_{f}(x) \leqslant f(x), \forall ~x \geqslant 0\). Therefore, for any set \(B\), we have

The monotonicity of the premium principle \(\varPi _i(\cdot )\) immediately implies that

We assume that \(\{A_i^f\}_{i = 1}^{n}\) is the optimal partition associated with the ceded loss function \(f\) in the sense that it minimizes the premium paid by the insurance company given a ceded loss \(f\). This means that the reinsurance premium is calculated by

We further denote that \(B_i^f = f^{-1}(A_i^f)\) as the inverse image of \(A_i^f\) under \(f\), then the premium associated with the ceded loss function \(f\) expressed in the above expression can be rewritten as

Analogously we have \(B_i^{g_f} = g_f^{-1}(A_i^{g_f})\), where \(\{A_i^{g_f}\}_{i = 1}^{n}\) is the optimal partition associated with the ceded loss function \(g_f\) and \(B_i^{g_f}\) is the inverse image of \(A_i^{g_f}\) under \(g_f\). Then

which is the required result.

The proof of part (b) is the same as that of Theorem 1 and hence is omitted. \(\square \)

Remark 2

-

(a)

The above theorem identifies the optimal form of the ceded loss function when there are multiple reinsurers in the market. The optimal form of the reinsurance strategies is also a truncated stop-loss type contract.

-

(b)

In this theorem, we do not need to assume that the premium principle \(\varPi (\cdot )\) to be monotonic, though it is a weak and reasonable assumption on the premium principle. We just need to impose the monotonic assumption on each \(\varPi _i(\cdot )\), which is the premium principle adopted by the \(i\)-th reinsurer.

-

(c)

It is worth mentioning that the overall retained loss function is nondecreasing. Therefore, the reinsurers will accept this treaty if they only require the retained loss functions to be nondecreasing for the concern of moral hazard.

-

(d)

It is imperative to distinguish the works of Asimit and Badescu (2013) and Chi and Meng (2012) from ours as they have similarly investigated the optimal reinsurance in the context of multiple reinsurers. The key difference lies in how the ceded losses are distributed to the reinsurers. Their formulations assume that the ceded losses are divisible in such a way that any loss is shared among the reinsurers while in our setup, the ceded losses are first divided into layers and then each reinsurer is responsible (entirely) for each layer of risk. Because the potential claim is assumed to be segmentable, their optimal reinsurance strategies and the corresponding minimal exposed risk may depend on the number of reinsurance companies in the market. Even if all the reinsurers are using the same premium principle, the number of reinsurers in the market may still affect insurer’s optimal strategy and the corresponding optimal exposed risk level. This phenomenon appears to be counterintuitive. In contrast, our proposed optimal strategy and the corresponding minimal exposed risk only depend on the premium principles adopted by the reinsurers and not on the number of reinsurers in the market.

-

(e)

Remark 1 for Theorem 1 is similarly applied to Theorem 2.

3.2 Exerting limit on the reinsurance treaties

In general, reinsurers do not wish to reinsure catastrophic claims unless they are appropriately compensated. Some reinsurers may raise the risk loading factor on higher layers of coverage, which has been dealt with by considering the monotonic piecewise premium principles in the last subsection. Some reinsurers may choose to impose a limit on the reinsurance treaties. Another reason for reinsurer to impose a limit on the reinsurance treaties may be due to regulatory constraint. In this subsection we will investigate an optimal reinsurance strategy under this motivation.

We suppose that the reinsurers are only willing to accept the reinsurance treaties subject to a limit. This implies that the maximal values of the ceded loss functions are bounded by a specified constant \(c_1\). Hence the admissible set of the ceded loss functions is revised to

Though the admissible set is different, we can still use the method similar to the last subsection to derive the optimal reinsurance strategies. This is summarized in the following corollary.

Corollary 1

Consider the reinsurance model (4) with admissible ceded loss functions \(\mathcal {L}_1'\) and monotonic piecewise reinsurance premium principle \(\varPi (\cdot )\). Then, for any ceded loss function \(f\in \mathcal {L}_1'\), we can construct the ceded loss function \(g_f\) using (8) with \(g_f\) satisfies the following properties:

-

(a)

\(g_f\in \mathcal {L}_1'\).

-

(b)

\(\varPi (f(X))\leqslant \pi _0\) implies \(\varPi (g_f(X))\leqslant \pi _0\). Equivalently, if the ceded loss function \(f\) satisfies the budget constraint, then the ceded loss function \(g_f\) will also satisfy the budget constraint;

-

(c)

\(\textit{VaR}_{\alpha }(T_{g_f}(X)) \leqslant \textit{VaR}_{\alpha }(T_{f}(X))\).

Proof

From the proof of Theorem 1 (a), we know that \(g_{f}(x) \leqslant f(x), \forall ~x \geqslant 0\). Therefore, \(f(x) \leqslant \min \{x, c_1\}\) implies that \(g_f(x) \leqslant \min \{x, c_1\}\). It is easy to verify that the retained loss function \(R_{g_f}\), which is associated with the ceded loss function \(g_f\), is nondecreasing and left continuous. Accordingly, we can conclude that \(g_f\in \mathcal {L}_1'\).

Since the construction of \(g_f\) is the same as that in Theorem 1, the proof of part (b) and (c) is exactly the same as that of Theorem 1 and hence is omitted. \(\square \)

Remark 3

-

(a)

The above corollary identifies an optimal form of the ceded loss function when there is a limit imposed on the reinsurance treaties. The optimal form of the reinsurance strategies is also a truncated stop-loss type contract.

-

(b)

Using the notation from Remark 1, we can express the ceded loss function \(g_f\) as follows

$$\begin{aligned} g_{f}(x) = (x - d)_{+}1\!\!1_{\{x \leqslant v\}}. \end{aligned}$$It is clear that \(\displaystyle \max _{x \geqslant 0}\{g_{f}(x)\} = v - d\). Therefore, we need the condition \(d \geqslant v - c_1\) to ensure that \(g_f(x)\) is bounded by the constant \(c_1\). This implies that we can simplify the optimization problem as follows

$$\begin{aligned} \displaystyle \left\{ \begin{array}{l@{\quad }l} \underset{\max \{0, v - c_1\} \leqslant d \leqslant v}{\min } &{}d + \varPi \left[ g_{f}(X)\right] \\ \, \\ \text{ s.t. } &{} \varPi [g_f(X)]\equiv \varPi \left[ (X - d)_{+}1\!\!1_{\{X \leqslant v\}}\right] \leqslant \pi _0. \end{array}\right. \end{aligned}$$(12)

3.3 In the presence of counterparty risk

In an ideal reinsurance arrangement, the reinsurer is liable for any claim as stipulated in the reinsurance treaty and hence any claim that is ceded will be reimbursed by the reinsurer. The insurer is only concerned with the residual part of the risk. While this is true in theory, in practice the use of reinsurance exposes the insurer to another type of risk known as the counterparty risk. The counterparty risk arises when the reinsurer is not able to meet its obligation for reasons such as the company is having cash flow strained or facing insolvency/bankruptcy. When this occurs, the insurer is ultimately responsible for the part of the risk that is supposedly ceded to the reinsurer. This suggests that in the design of optimal reinsurance strategy, the creditworthiness of the reinsurer is one of the critical factors that cannot be ignored. Yet the counterparty risk is often neglected in most formulations of the optimal reinsurance models. The objective of this subsection is to demonstrate that by artfully modifying some of the constraints of the reinsurance models, the counterparty risk could be integrated to the optimal reinsurance models that we have discussed so far.

We first assume that the actual claim that is ceded to the reinsurer is so large that when it exceeds a certain threshold, then the reinsurer is in financial stress and might not be able to meet its contractual obligation. In this case, the loss that is supposedly indemnified to the insurer will be defaulted. We propose to reduce the counterparty risk by ensuring that the probability of the reinsurer not meeting its obligation does not exceed a certain acceptable tolerance level of the insurer. If \(\bar{c}_1\) represents the threshold of the above reinsurer and \(0 \leqslant \beta \leqslant 1\) denotes the desired tolerance level of the insurer, then the above condition is translated to the probabilistic constraint \(\mathbb {P}(f(X) > \bar{c}_1) \leqslant \beta \). The parameter \(\beta \) is predetermined by the insurer and reflects the insurer’s risk tolerance towards counterparty risk. Clearly, the smaller the \(\beta \), the less exposure the insurer is to counterparty risk. In the extreme case where \(\beta =0\), the counterparty risk is completely eliminated since the ceded claim can never exceed the threshold \(\bar{c}_1\) and hence the counterparty risk will never be triggered.

The optimal reinsurance model (4) can easily be modified to reflect the above approach of controlling the counterparty risk. This is achieved by seeking an optimal reinsurance to the reinsurance model (4) with the admissible set of the ceded loss function revises to

As in the last subsection, we can still use the same technique to derive the optimal reinsurance strategies even though the admissible set is different. The results are summarized in the following corollary.

Corollary 2

Consider the reinsurance model (4) with admissible ceded loss functions \(\mathcal {L}_1''\) and monotonic piecewise reinsurance premium principle \(\varPi (\cdot )\). Then, for any ceded loss function \(f\in \mathcal {L}_1''\), we can construct the ceded loss function \(g_f\) using (8) and that \(g_f\) has the following properties:

-

(a)

\(g_f\in \mathcal {L}_1''\).

-

(b)

\(\varPi (f(X))\leqslant \pi _0\) implies \(\varPi (g_f(X))\leqslant \pi _0\). Equivalently, if the ceded loss function \(f\) satisfies the budget constraint, then the ceded loss function \(g_f\) will satisfy the budget constraint as well;

-

(c)

\(\textit{VaR}_{\alpha }(T_{g_f}(X)) \leqslant \textit{VaR}_{\alpha }(T_{f}(X))\).

Proof

From the proof of Theorem 1 (a), we know that \(g_{f}(x) \leqslant f(x), \forall ~x \geqslant 0\). Therefore, \(\mathbb {P}(f(X) > \bar{c}_1) \leqslant \beta \) implies that \(\mathbb {P}(g_f(X) > \bar{c}_1) \leqslant \beta \). It is easy to verify that the retained loss function \(R_{g_f}\), which is associated with the ceded loss function \(g_f\), is nondecreasing and left continuous. Accordingly, we conclude that \(g_f\in \mathcal {L}_1''\).

Since the construction of \(g_f\) is the same as that in Theorem 1, the proofs of part (b) and (c) are exactly the same as that of Theorem 1, hence are omitted here. \(\square \)

Remark 4

-

(a)

The above corollary identifies the optimal form of the ceded loss function which takes into consideration counterparty risk. The optimal form of the reinsurance strategies is also a truncated stop-loss type contract.

-

(b)

Using the notation in Remark 1, we can express the ceded loss function \(g_f\) as follows

$$\begin{aligned} g_{f}(x) = (x - d)_{+} 1\!\!1_{\{x \leqslant v\}}. \end{aligned}$$Therefore, \(\mathbb {P}(g_f(X) > \bar{c}_1) \leqslant \beta \) is equivalent to \(d > Q_1 - \bar{c}_1\) where \(Q_1 = \inf \{q \geqslant 0: \mathbb {P}(q < X \leqslant v) \leqslant \beta \}\). This implies that we can simplify the optimization problem as follows:

$$\begin{aligned} \displaystyle \left\{ \begin{array}{l@{\quad }l} \underset{\max \{0, Q_1 - \bar{c}_1\} \leqslant d \leqslant v}{\min } &{}d + \varPi \left[ g_{f}(X)\right] \\ \, \\ \text{ s.t. } &{} \varPi [g_f(X)]\equiv \varPi \left[ (X - d)_{+} 1\!\!1_{\{X \leqslant v\}}\right] \leqslant \pi _0. \end{array}\right. \end{aligned}$$(14) -

(c)

Note that the model we considered in the last subsection is a special case of the model in this subsection. This can be seen by setting \(\bar{c}_1 = c_1\) and \(\beta = 0\). Therefore, the optimal reinsurance model proposed in this subsection is more general and that it gives the insurer the additional flexibility of specifying its attitude on courterparty risk. The insurer’s attitude on counterparty risk is reflected by \(\bar{c}_1\) and \(\beta \). Note also that if we let \(\bar{c}_1 = + \infty \) or \(\beta = 1\), then the model in this subsection recovers the one in Sect. 3.1.

4 Optimality of limited stop-loss reinsurance treaties

In the last section, we study a few variations of the optimal reinsurance model (4). All these variants share the same constraint that the ceded loss functions do not need to be nondecreasing and that the truncated stop-loss reinsurance treaties are optimal. These results imply that the losses that are ceded to the reinsurer do not need to increase with losses. In fact when the losses increase to a critical level, the losses ceded will reduce drastically to zero and remain at zero thereafter. This raises a concern to the reinsurer as reinsurance treaty of this type potentially triggers insurer’s moral hazard. On the other hand, the truncated loss function is also not a desirable risk management strategy for the insurer since there is no protection when the loss exceeds a certain threshold level. For these reasons, both insurers and reinsurers often prefer reinsurance treaties with the property that the ceded losses are at least non-decreasing with losses. As a result, the objective of this section is to investigate the optimal ceded loss function \(f\) to the optimization problem (4) when the premium principle is monotonic and there is a monotonic assumption imposed on the ceded loss functions. In this case, the admissible set of the ceded loss function corresponds to \(\mathcal {L}_2\). Similarly, we will extend our results to the case of multiple reinsurers and investigate the optimal strategies if there is a limit on the reinsurance treaties or there exists counterparty risk. Our analysis reveals that the limited stop-loss treaty (2) can be optimal.

4.1 With nondecreasing assumption on the ceded loss functions

In this subsection, we assume the admissible set is \(\mathcal {L}_2\) as defined in (6). We will show that the so-called limited stop-loss reinsurance strategy (2) is optimal among all the strategies in \(\mathcal {L}_2\). We will employ the same technique used in the previous section to derive the optimal solutions over \(\mathcal {L}_2\). Analogously, for any ceded loss function \(f\) from set \(\mathcal {L}_2\) we construct the following function \(h_f\) which is also an element in \(\mathcal {L}_2\):

where as defined previously \(v = \mathrm{VaR}_{\alpha }(X)\).

It follows from the above representation that the reinsurance treaty with the ceded loss function \(h_f(X)\) is commonly known as a limited stop-loss reinsurance treaty. The following theorem shows that if the reinsurance premium principle is monotonic, then the limited stop-loss reinsurance treaty is the optimal form among all the admissible treaties in \(\mathcal {L}_2\).

Theorem 3

Consider the reinsurance model (4) with admissible ceded loss functions \(\mathcal {L}_2\). Assume the reinsurance premium principle \(\varPi (\cdot )\) is a monotonic piecewise premium principle. Then, for any ceded loss function \(f\in \mathcal {L}_2\), we can construct the ceded loss function \(h_f\in \mathcal {L}_2\) according to (15), and \(h_f\) satisfies the following properties:

-

(a)

\(\varPi (f(X))\leqslant \pi _0\) implies \(\varPi (h_f(X))\leqslant \pi _0\). Equivalently, if the ceded loss function \(f\) satisfies the budget constraint, then the ceded loss function \(h_f\) also satisfies the budget constraint;

-

(b)

\(\textit{VaR}_{\alpha }(T_{h_f}(X)) \leqslant \textit{VaR}_{\alpha }(T_{f}(X))\).

Proof

The proof is similar to that of Theorem 1.

(a). We first claim that \(g_f(x) \leqslant f(x)\) for all \(x \geqslant 0\). In fact, for \(0 \leqslant x \leqslant v\), since \(f\in \mathcal {L}_2\), the retained loss function corresponding to \(f\) is nondecreasing, which implies that

Therefore,

Since \(f\in \mathcal {L}_2\) is a nondecreasing function, we have

Thus, \(h_{f}(x) \leqslant f(x), \forall ~x \geqslant 0\).

As a result, the monotonicity of the premium principle \(\varPi _i(\cdot )\) immediately implies that \(\varPi (h_f(X)) \leqslant \varPi (f(X))\), which is the required result.

(b). The proof is parallel to proving part (b) of Theorem 1 and hence is omitted. \(\square \)

Remark 5

All the comments in Remark 1 for Theorem 1 are analogously applicable to the present case. In particular, we make the following remarks:

-

(a)

The above theorem indicates that the optimality of the limited stop-loss reinsurance strategy is independent of the reinsurance premium principle. The limited stop-loss reinsurance strategy is optimal among all the strategies in \(\mathcal {L}_2\) as long as the premium principle is monotonic.

-

(b)

By denoting \(d = v - f(v) \), the function \(h_f\) defined above can be rewritten as

$$\begin{aligned} h_f(x) = (x - d)_{+} - (x - v)_{+}. \end{aligned}$$Based on the results from Theorem 3, it is easy to see that the VaR-based reinsurance model (4) can be equivalently cast as

$$\begin{aligned} \begin{aligned} \displaystyle \left\{ \begin{array}{l@{\quad }l} \displaystyle \min _{0 \leqslant d \leqslant v} &{}\mathrm{VaR}_{\alpha }\left\{ X - (X - d)_{+} + (X - v)_{+} + \varPi \left[ h_f(X)\right] \right\} \\ \text{ s.t. } &{}\varPi \left[ h_f(X)\right] \equiv \varPi \left[ (X - d)_{+} - (X - v)_{+}\right] \leqslant \pi _0 . \end{array}\right. \end{aligned} \end{aligned}$$The above optimization problem can be simplified as follows

$$\begin{aligned} \left\{ \begin{array}{l@{\quad }l} \displaystyle \min _{0 \leqslant d \leqslant v} &{}d + \varPi \left[ h_f(X)\right] \\ \text{ s.t. } &{}\varPi \left[ h_f(X)\right] \equiv \varPi \left[ (X - d)_{+} - (X - v)_{+}\right] \leqslant \pi _0. \end{array}\right. \end{aligned}$$(16)The optimal reinsurance problem again reduces to an optimization problem of just a single variable.

Similar to the discussion in the last section, if there exist several reinsurers which adopt different premium principle in the market, then the insurance company will naturally take advantage of this when ceding its risk to the reinsurers. The following theorem, as a counterpart of Theorem 2, deals with the case of multiple reinsurance companies.

Theorem 4

Consider the reinsurance model (4) with admissible ceded loss functions \(\mathcal {L}_2\). Assume that there are \(n\) reinsurers in the market and each reinsurer \(i\) adopts premium principles \(\varPi _i(\cdot )\) for \(i = 1, 2, \ldots , n\). Every premium principle is a monotonic piecewise premium principle. We further assume that after the insurance company determined his ceded part, he will seek the optimal way to cede his risk to the reinsurers in order to minimize the cost of reinsurance. Under the above assumptions, the premium that the insurance company pays associated with the ceded loss function \(f\) is given by (10).

Then, for any ceded loss function \(f\in \mathcal {L}_2\), we can construct the ceded loss function \(h_f\) according to (15), and \(h_f\) satisfies the following properties:

-

(a)

\(\varPi (f(X))\leqslant \pi _0\) implies \(\varPi (h_f(X))\leqslant \pi _0\). Equivalently, if the ceded loss function \(f\) satisfies the budget constraint, then the ceded loss function \(g_f\) will also satisfy the budget constraint;

-

(b)

\(\textit{VaR}_{\alpha }(T_{h_f}(X)) \leqslant \textit{VaR}_{\alpha }(T_{f}(X))\).

Proof

The proof is parallel to Theorem 2 and hence is omitted. \(\square \)

Remark 6

All the comments in Remark 2 for Theorem 2 are analogously applicable here. We emphasize that the overall ceded loss function and retained loss function are both nondecreasing, though the ceded loss function with respect to the \(i\)-th reinsurer might not be. Therefore, the reinsurers will accept this treaty since there it reduces moral hazard.

4.2 Exerting limit on the reinsurance treaties

Similar to Sect. 3.2, here we study the optimal reinsurance strategies if there is a limit imposed on the reinsurance treaties. We suppose that the maximal values of the ceded loss functions are bounded by a specified constant \(c_2\) so that the admissible set of the ceded loss functions changes to

Using the technique similar to the last section, we obtain the following corollary. The proof is also similar and hence is omitted.

Corollary 3

Consider the reinsurance model (4) with admissible ceded loss functions \(\mathcal {L}_2\) and monotonic piecewise reinsurance premium principle \(\varPi (\cdot )\). Then, for any ceded loss function \(f\in \mathcal {L}_2'\), we can construct the ceded loss function \(h_f\) using (15) and \(h_f\) satisfies the following properties:

-

(a)

\(h_f\in \mathcal {L}_2'\).

-

(b)

\(\varPi (f(X))\leqslant \pi _0\) implies \(\varPi (h_f(X))\leqslant \pi _0\). Equivalently, if the ceded loss function \(f\) satisfies the budget constraint, then the ceded loss function \(h_f\) also satisfies the budget constraint;

-

(c)

\(\textit{VaR}_{\alpha }(T_{h_f}(X)) \leqslant \textit{VaR}_{\alpha }(T_{f}(X))\).

Remark 7

All the comments in Remark 3 of Corollary 1 are analogously applicable here. In particular, using the notation in Remark 5, the ceded loss function \(h_f\) can be expressed as

Since \(\displaystyle \max _{x \geqslant 0}\{h_{f}(x)\} = v - d\), \(h_f(x)\) is bounded by the constant \(c_2\) is equivalent to \(d \geqslant v - c_2\). Therefore, the optimization problem can be reformulated as follows

4.3 In the presence of courterparty risk

As in Sect. 3.3, we model the counterpary risk by seeking an optimal ceded loss function such that the probability that the ceded part exceeds the threshold \(\bar{c}_2\), which is \(\mathbb {P}(f(X) > \bar{c}_2)\), is bounded by a predetermined parameter \(\beta \). In this case, the admissible set of the ceded loss function is given by

where \(0 \leqslant \beta \leqslant 1\) is a predetermined parameter chosen by the insurance company.

Using the same technique, the following corollary gives the optimal reinsurance strategy that reflects the counterparty risk. The proof is again omitted due to the similarity.

Corollary 4

Consider the reinsurance model (4) with admissible ceded loss functions \(\mathcal {L}_2\) and monotonic piecewise reinsurance premium principle \(\varPi (\cdot )\). Then, for any ceded loss function \(f\in \mathcal {L}_2''\), we can construct the ceded loss function \(h_f\) according to (15), and \(h_f\) satisfies the following properties:

-

(a)

\(h_f\in \mathcal {L}_2''\).

-

(b)

\(\varPi (f(X))\leqslant \pi _0\) implies \(\varPi (h_f(X))\leqslant \pi _0\). Equivalently, if the ceded loss function \(f\) satisfies the budget constraint, then the ceded loss function \(h_f\) also satisfies the budget constraint;

-

(c)

\(\textit{VaR}_{\alpha }(T_{h_f}(X)) \leqslant \textit{VaR}_{\alpha }(T_{f}(X))\).

Remark 8

All the comments in Remark 4 for Corollary 2 are analogously applicable here. In particular, using the notation in Remark 5, the ceded loss function \(h_f\) can be expressed as

Therefore, \(\mathbb {P}(h_f(X) > \bar{c}_2) \leqslant \beta \) is equivalent to \(d > Q_2 - \bar{c}_1\) where \(Q_2 = \mathrm{VaR}_{\max \{\alpha , \beta \}}(X)\). Hence we can simplify the optimization problem as follows

5 Illustrations

The objective of this section is to illustrate how the results obtained in the last two sections can be used to determine the optimal ceded loss functions by assuming the monotonic piecewise expected value premium principle with the following representation:

where \(X\) is any random variable, \(a\), \(\rho _1\) and \(\rho _2\) are fixed constants with \(\rho _2 \geqslant \rho _1\). We note that the expected value premium principle is the simplest premium principle and it has been widely studied due to its tractability. The drawback of this premium principle is that the risk attitude of the reinsurer is assumed to be invariant to risk. This is inconsistent with practice since reinsurer often demands a higher level of compensation for larger risk. This issue is alleviated by using an expected value premium principle that is monotonic and piecewise since in this case, the higher layer of risk is penalized with a larger loading factor.

Using the monotonic piecewise expected value premium principle (21), Sect. 5.1 first derives the general expressions of the optimal ceded loss functions in term of parameters \(a\), \(\rho _1\) and \(\rho _2\). By considering a specified set of numerical values, Sect. 5.2 then calculates explicitly the optimal ceded loss function. The optimal ceded loss functions are compared and contrast to some existing results.

We emphasize that while we have consistently used the piecewise expected value premium principle in our illustrations, the optimal reinsurance strategies under other piecewise premium principles, such as principle of equivalent utility but with piecewise parameter values, piecewise with expected premium principle and Wang’s premium principle, piecewise with Dutch premium principle and Wang’s premium principle, and so forth, can be calculated in a similar fashion.

5.1 Piecewise expected value premium principle

The general optimal ceded loss functions, in term of parameters \(a\), \(\rho _1\) and \(\rho _2\), are derived in the following two subsections for the optimal reinsurance models that we have analyzed in the last two sections. The first subsection assumes that the ceded loss functions need not be nondecreasing while the second subsection imposes the monotonic constraint on the ceded loss functions.

5.1.1 VaR-minimization among \(\mathcal {L}_1\)

According to Theorem 1, the optimal ceded loss function is of the following form

where \(0 \leqslant d_1 < v\) and \(d_1\) is yet to be determined. Recall that \(v = \mathrm{VaR}_{\alpha }(X)\). It follows from (9) that the VaR of the insurer’s total exposed risk corresponding to the ceded loss function \(f_1\) can be expressed as

Now we will determine the optimal retention level \(d_1\) under the assumed premium principle (21). Since the calculation of the reinsurance premium depends on the relationship between the ceded loss function and the constant \(a\), we need to consider the following two different cases:

Case (i): \(d_1 > v - a\)

In this case, we have the inequality \(f_1(x) \leqslant v - d_1 < a\). Accordingly, the reinsurance premium can be calculated as

where \(\bar{F}_X(x) = 1 - F_X(x)\) is the complementary cumulative distribution function, which is also called survival function, of the random variable \(X\). Therefore, the corresponding VaR of the insurer’s total exposed risk is given by

Taking derivatives of the above expression of VaR with respect to \(d_1\) yields

If \(\frac{1}{1 + \rho _1} + \bar{F}_X(v) < 1\) and by denoting \(\gamma _1 = \bar{F}_X^{-1}\left( \frac{1}{1 + \rho _1} + \bar{F}_X(v)\right) \), then it is obvious that \(\gamma _1 < v\) and that

If \(\frac{1}{1 + \rho _1} + \bar{F}_X(v) \geqslant 1\), we set \(\gamma _1 = 0\).

Clearly, the reinsurance premium \(\varPi \left[ (X - d_1)_{+} 1\!\!1_{\{X \leqslant v\}}\right] \) decreases with the retention level \(d_1\). We introduce a constant \(\bar{\gamma }_1\) to reflect the minimum admissible retention level induced by the budget constraint. If \(\varPi \left[ X 1\!\!1_{\{X \leqslant v\}}\right] \leqslant \pi _0\), then we set \(\bar{\gamma }_1 = 0\); otherwise we assume that the constant \(\bar{\gamma }_1\) solves the equation \(\varPi \left[ (X - \bar{\gamma }_1)_{+} 1\!\!1_{\{X \leqslant v\}}\right] = \pi _0\). Therefore, \(\varPi \left[ (X - d_1)_{+} 1\!\!1_{\{X \leqslant v\}}\right] \leqslant \pi _0\) if and only if \(d_1 \geqslant \bar{\gamma }_1\). Now we can express the optimal ceded loss function \(f_1(x)\) explicitly as follows

where \((v - a)^{+}\) means the number which is larger than \((v - a)\) but infinitely close to \((v - a)\). The corresponding minimum VaR of the insurer’s total exposed risk is

Case (ii): \(d_1 \leqslant v - a\)

In this case, the reinsurance premium is calculated by

where \((v - a)^{-}\) means the number which is less than \((v - a)\) but infinitely close to \((v - a)\). Obviously, if the function \(\bar{F}_X(x)\) is continuous at \(x = a + d_1\), then the above expression can further be simplified. However, we allow the function \(\bar{F}_X(x)\) to be not continuous. The corresponding VaR of the insurer’s total exposed risk is given by

Therefore, the optimization problem in this case can be written as

Once the constants \(a, \rho _1, \rho _2\) and the distribution of the claim \(X\) are given, it is relatively easy to solve the above optimization problem. After solving the above optimization problem, we just need to compare the corresponding minimal VaR of the insurer’s total exposed risk from cases (i) and (ii) to finalize the optimal reinsurance strategy.

5.1.2 VaR-minimization among \(\mathcal {L}_2\)

According to Theorem 3, the optimal ceded loss function is of the following form

where \(0 \leqslant d_2 < v\) and \(d_2\) has yet to be determined. It follows from (16) that the VaR of the insurer’s total exposed risk corresponding to the ceded loss function \(f_2\) can be expressed as

Now we will determine the optimal retention level \(d_2\) under the assumed premium principle (21). As before, we need to consider the following two cases:

Case (i): \(d_2 > v - a\)

In this case, we have the inequality \(f_2(x) \leqslant v - d_2 < a\). Accordingly, the premium paid by the insurer can be calculated as

Therefore, the corresponding VaR of the insurer’s total exposed risk can be expressed as

Taking derivatives of the above expression of VaR with respect to \(d_2\) yields

Let \(\gamma _2 = \bar{F}_X^{-1}\left( \frac{1}{1 + \rho _1}\right) \), then it is easy to verify that

Clearly, the reinsurance premium \(\varPi \left[ \min \{(X - d_2)_{+}, v - d_2\}\right] \) is decreasing with respect to the retention level \(d_2\). We introduce a constant \(\bar{\gamma }_2\) to reflect the minimum admissible retention level due to the budget constraint. If \(\varPi \left[ \min \{X, v\}\right] \leqslant \pi _0\), then we set \(\bar{\gamma }_2 = 0\); otherwise we assume that the constant \(\bar{\gamma }_2\) solves the equation \(\varPi \left[ \min \{(X - \gamma _2)_{+}, v - \gamma _2\}\right] = \pi _0\). Therefore, \(\varPi \left[ \min \{(X - d_2)_{+}, v - d_2\}\right] \leqslant \pi _0\) if and only if \(d_2 \geqslant \bar{\gamma }_2\). Now we can express the optimal ceded loss function \(f_2(x)\) explicitly as follows

The corresponding minimum VaR of the insurer’s total exposed risk is

Case (ii): \(d_2 \leqslant v - a\)

In this case, the reinsurance premium is calculated by

Similarly, we allow the function \(\bar{F}_X(x)\) to be not continuous. The corresponding VaR of the insurer’s total exposed risk can be expressed as

Therefore, the optimization problem becomes

As in the previous subsection, once the constants \(a, \rho _1, \rho _2\) and the distribution of the claim \(X\) are given, the above optimization problems can be solved explicitly. The optimal reinsurance strategy is then given by the one that has the lower minimal VaR of the insurer’s total exposed risk.

Remark 9

-

(a)

While we have derived the optimal ceded loss functions by concatenating two expected value premium principles. If the piecewise premium principle is constructed from \(n\) expected value premium principles, similar steps apply although the derivation is more tedious and lengthy.

-

(b)

In Chi and Tan (2011), they obtained the optimal reinsurance strategies among the admissible set \(\mathcal {L}_1\) and \(\mathcal {L}_2\) with the assumptions that there is no budget constraint and the premium principle is expected value premium principle. In this subsection, we demonstrate how to obtain the optimal reinsurance strategies among \(\mathcal {L}_1\) and \(\mathcal {L}_2\) when the premium principle is piecewise expected value premium principle, which is more general than the expected value premium principle. By setting \(a = \infty \) (or equivalently \(\rho _1 = \rho _2\)) and removing the budget constraint, then our results collapse to Chi and Tan (2011).

-

(c)

For the cases of exerting limit on the ceded loss functions and imposing the courterparty risk constraint, the optimal reinsurance strategies can be calculated similarly. Therefore, we will not discuss these cases in the example in details. However, we will present the numerical results for these cases in the following subsection.

5.2 Numerical examples

In this subsection, we calculate explicitly the optimal ceded loss functions by considering a specified example. In particular, we assume the insurer faces a potential risk that follows the exponential distribution with mean 10 and the insurer is seeking reinsurance to reinsurer its risk. We further assume the reinsurance budget is 5, the confidence levels of the VaR is 95 %, and the reinsurance premium principle is the piecewise premium principle (21) with parameter values \(a=10\), \(\rho _1=0.1\) and \(\rho _2 = 0.5\). This implies that when the claim is less than 10, the risk loading factor is 10 %. When the claim is larger than 10, the risk loading increases to 50 %.

With the above setup, we now utilize the analysis in the last subsection to calculate the optimal reinsurance strategies for the VaR when the admissible set of the ceded loss functions are given by \(\mathcal {L}_1\) and \(\mathcal {L}_2\) respectively. We will also calculate the optimal reinsurance strategies when there is a limit imposed on the ceded loss and when there exists counterparty risk. These results are compared and contrast to the existing results when there is no budget constraint.

(a) VaR minimization among \(\underline{\mathcal {L}_{1}}\):

Using the given parameter values, the optimal ceded loss function in case (i) is found to be \((X - 19.9573)_{+}1\!\!1_{\{X \leqslant 29.9573\}}\) with a non-binding budget constraint. Similarly, the optimal ceded loss function in case (ii) is \((X - 6.1539)_{+}1\!\!1_{\{X \leqslant 29.9573\}}\) and the budget constraint is binding. By comparing the VaR of these two cases, we conclude that the optimal ceded loss function is given by \((X - 6.1539)_{+}1\!\!1_{\{X \leqslant 29.9573\}}\) with the corresponding VaR value 11.1539.

When there is no budget constraint, the optimal ceded loss function is determined to be \((X - 2.6007)_{+} 1\!\!1_{\{X \leqslant 29.9573\}}\) with the corresponding VaR value 10.5490.

Following the same procedure, we also calculate the optimal ceded loss function when there is a limit on the ceded loss functions or there is a counterparty risk constraint.

-

When there is a limit constraint, say \(20\), on the ceded loss functions, the optimal ceded loss function is \((X - 9.9573)_{+} 1\!\!1_{\{X \leqslant 29.9573\}}\), and the corresponding VaR value is 12.8586.

-

When there is counterparty risk constraint, i.e. \(\mathbb {P}(f(X) > 10) \leqslant 10\,\%\), the optimal ceded loss function is \((X - 8.9712)_{+} 1\!\!1_{\{X \leqslant 29.9573\}}\) and the corresponding VaR value is 12.3324.

If the premium principle is the classical expected premium principle with risk loading factor \(\rho = 0.1\) and there is no budget constraint, the optimal ceded loss function is easily obtained to be \((X - 0.4177)_{+} 1\!\!1_{\{X \leqslant 29.9573\}}\). If the risk loading factor changes \(\rho = 0.5\), then the optimal ceded loss function is \((X - 3.3314)_{+} 1\!\!1_{\{X \leqslant 29.9573\}}\).

Table 1 summarizes the optimal reinsurance strategies in \(\mathcal {L}_1\) for the various variants of the optimal reinsurance models. Depending on the imposed constraints, the resulting optimal value of VaR of the insurer will be affected accordingly.

(b) VaR minimization among \(\underline{\mathcal {L}_{2}}\):

Similar calculations can be repeated for the optimal reinsurance strategies among \(\mathcal {L}_2\). The results are depicted in Table 2.

6 Conclusion

In this paper, we investigate the VaR-based optimal reinsurance strategies under the monotonic piecewise premium principle. We consider several different admissible sets of the ceded loss functions. In the general model, we show that the truncated stop-loss or the limited stop-loss reinsurance strategy is optimal depending on whether the ceded loss functions are required to be nondecreasing. In both cases, we extend our results to the case of multiple reinsurers. Moreover, we also consider the cases of exerting a limit on the reinsurance treaties or existing courterparty risk constraint. We also use the piecewise expected value premium principle as an example to demonstrate how to apply our results to solve the optimal reinsurance problem. A numerical example is provided to highlight our results.

References

Arrow, K. J. (1963). Uncertainty and the welfare economics of medical care. American Economic Review, 53(5), 941–973.

Artzner, P., Delbaen, F., Eber, J., & Heath, D. (1999). Coherent measures of Risk. Mathematical Finance, 9(3), 203–228.

Asimit, V. A., & Badescu, A. (2013). Optimal risk transfer with multiple reinsurers. Insurance: Mathematics and Economics, 53(1), 252–265.

Balbás, A., Balbás, B., & Heras, A. (2009). Optimal reinsurance with general risk measures. Insurance: Mathematics and Economics, 44(3), 374–384.

Bernard, C., & Tian, W. (2009). Optimal reinsurance arrangements under tail risk measures. The Journal of Risk and Insurance, 76(3), 709–725.

Borch, K. (1960). An attempt to determine the optimum amount of stop loss reinsurance. In Transactions of the 16th International Congress of Actuaries, vol. I (pp. 597–610). Brussels.

Cai, J., & Tan, K. S. (2007). Optimal retention for a stop-Loss reinsurance under the VaR and CTE risk measures. ASTIN Bulletin, 37(1), 93–112.

Cai, J., Tan, K. S., Weng, C., & Zhang, Y. (2008). Optimal reinsurance under VaR and CTE risk measures. Insurance: Mathematics and Economics, 43, 185–196.

Cheung, K. C., Sung, K. C. J., & Yam, S. C. P. (2013). Risk-minimizing reinsurance protection for multivariate risks. Journal of Risk and Insurance. doi:10.1111/j.1539-6975.2012.01501.x.

Chi, Y., & Meng, H. (2013). Optimal reinsurance arrangements in the presence of two reinsurers. Scandinavian Actuarial Journal.

Chi, Y., & Tan, K. S. (2011). Optimal reinsurance under VaR and CVaR risk measures: a simplied approach. ASTIN Bulletin, 41(2), 487–509.

Chi, Y., & Tan, K. S. (2013). Optimal reinsurance with general premium principles. Insurance:Mathematics and Economics, 52(2), 180–189.

Chi, Y., & Weng, C. (2013). Optimal reinsurance subject to Vajda condition. Insurance:Mathematics and Economics, 53(1), 179–189.

Dhaene, J., Denuit, M., Goovaerts, M. J., Kaas, R., & Vyncke, D. (2002). The concept of comonotonicity in actuarial science and finance: theory. Insurance: Mathematics and Economics, 31(1), 3–33.

Gajek, L., & Zagrodny, D. (2004a). Optimal reinsurance under general risk measures. Insurance: Mathematics and Economics, 34(2), 227–240.

Gajek, L., & Zagrodny, D. (2004b). Reinsurance arrangements maximizing insurer’s survival probability. The Journal of Risk and Insurance, 71(3), 421–435.

Hurlimann, W. (1998). On stop-loss order and the distortion pricing principle. ASTIN Bulletin, 28(1), 119–134.

Jorion, P. (2006). Value at Risk: The New Benchmark for Managing Financial Risk (3rd ed.): McGraw-Hill.

Kahn, P. M. (1961). Some remarks on a recent paper by Borch. ASTIN Bulletin, 1(5), 265–272.

Kaluszka, M. (2001). Optimal reinsurance under mean-variance premium principles. Insurance: Mathematics and Economics, 28(1), 61–67.

Kaluszka, M. (2005). Optimal reinsurance under convex principles of premium calculation. Insurance: Mathematics and Economics, 36(3), 375–398.

Kaluszka, M., & Okolewski, A. (2008). An extension of Arrow’s result on optimal reinsurance contract. Journal of Risk and Insurance, 75(2), 275–288.

Rolski, T., Schmidli, H., Schmidt, V., & Teugels, J. (1999). Stochastic Processes for Insurance and Finance: John Wiley and Sons.

Tan, K. S., Weng, C., & Zhang, Y. (2011). Optimality of general reinsurance contracts under CTE risk measure. Insurance: Mathematics and Economics, 49(2), 175–187.

Young, V. R. (1999). Optimal reinsurance under Wang’s premium principles. Insurance: Mathematics and Economics, 25(2), 109–122.

Acknowledgments

Cong thanks the funding support from the Waterloo Research institute in Insurance, Securities and Quantitative finance (WatRISQ). Tan acknowledges research funding from the MOE Project of Key Research Institute of Humanities and Social Sciences at Universities(No. 11JJD790004), the Natural Sciences and Engineering Research Council of Canada and the Society of Actuaries Centers of Actuarial Excellence Research Grant.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Cong, J., Tan, K.S. Optimal VaR-based risk management with reinsurance. Ann Oper Res 237, 177–202 (2016). https://doi.org/10.1007/s10479-014-1584-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-014-1584-8