Abstract

We examine supply chain contracts for two competing supply chains selling a substitutable product, each consisting of one manufacturer and one retailer. Both manufacturers are Stackelberg leaders and the retailers are followers. Manufacturers in two competing supply chains may choose different contracts, either a wholesale price contract in which the retailer’s demand forecasting information is not shared, or a revenue-sharing contract in which the retailer’s demand forecasting information is shared. Under supply chain competition and demand uncertainty, we identify which contract is more advantageous for each supply chain, and under what circumstances.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

With the rapid development of technology, the new generations of some products, such as iPods and cell phones, are marketed in and updated quickly. As new generations of products or new substitutable products are introduced quickly, retailers prefer to maintain low inventory. Product suppliers, however, prefer to encourage their retailers to order more product when an order is placed. Although the wholesale price contract is still widely used in practice, some supply chain coordination mechanisms have been studied to induce the retailer to order to the amount of the products as if the supplier and the retailer operate in an integrated supply chain, in order to mitigate “double marginalization” (Spengler 1950). Coordination of supply chains has also been intensively studied by practitioners and researchers (see, e.g., Lee and Rhee 2010; Wang and Liu 2007). A sound coordination mechanism can benefit all parties in the supply chain. Some coordination mechanisms that have been studied include, for example, returns policies (Pasternack 1985; Yao et al. 2005), two-part tariff contracts (Corbett and Tang 1999), quantity discount contracts (Tsay 1999; Li and Liu 2006), and revenue-sharing contracts (Cachon and Lariviere 2005; Giannoccaro and Pontrandolfo 2004, 2009). Tsay et al. (2003), Lariviere (2003), and Arshinder and Deshmukh (2008) provide comprehensive reviews on the performance of various types of contracts. A revenue-sharing contract, in which retailers pay a royalty fee on sales to the supplier, has been extensively studied in the literature. Cachon and Lariviere (2005) theoretically analyze the strengths and limitations of a revenue-sharing contract and demonstrate that such a contract can coordinate the supply chain.

The revenue-sharing contract has been applied as an important approach in many industries in the presence of brand competition among firms. James (1999) investigates a VCD rental industry with a manufacturer and competing retailers. He finds that the manufacturer would like to weaken the price competition among its downstream retailers and encourage larger orders. A higher wholesale price can weaken the price competition but does not encourage increased ordering. A study on the revenue-sharing contract illustrates that a lower wholesale price can create an incentive for more product to be ordered. Gerchak and Wang (2004) discuss a single supply chain assembling parts and find that a revenue-sharing contract can achieve supply chain coordination and thus improve the revenue of all parties. Cachon and Lariviere (2005) examine the application of the revenue-sharing contract in the rental industry. By comparing to the buyback contract and the quantity flexibility contract, they find that a revenue-sharing contract can achieve supply chain coordination in the newsvendor problem with a price-dependent demand, while the buyback contract and the quantity flexibility contract cannot. Since first applied in the rental industries in the 1990s, revenue-sharing has been widely applied to online marketplaces. For example, Youtube contracts revenue-sharing agreements with companies that advertise on its website.

Most studies on supply chain coordination through revenue-sharing contracts have focused on single supply chains. The competition among firms, however, has evolved to competition among supply chains. Barnes (2006) argues that “This has led companies to take advantage of this specialization to outsource parts of their operations to appropriate countries. This increased collaboration—with technology as the catalyst—means that instead of companies competing against companies, by 2010 supply chains will be competing against supply chains.” Although industries have certain common perspectives on chain-to-chain competition, not much theoretical research has been conducted in the literature.

The concept of chain-to-chain competition was first proposed in marketing research. McGuire and Staelin (1983) investigate a vertical structure with two manufacturers and two exclusive retailers. With a deterministic linear demand function, they find that for highly substitutable products, a decentralized distribution system strategically avoids price competition among manufacturers. Coughlan (1985) extends this research to the electrical industry. Moorthy (1988) links the interaction between a decentralized channel structure and a downstream vertically integrated structure. None of these studies, however, include demand uncertainty and contracting issues. Atkins and Zhao (2003) internalize the degree of competition and examine equilibrium structures for price and service competition in a supply chain. Wu and Chen (2003) propose a chain-to-chain competition model and analyze the equilibrium structures for competing supply chains considering inventory and returns policies in a newsvendor setting. They do not include pricing issues. None of them consider contracts issues. Ha and Tong (2008) study the impact of the linear price contract and the menu contract on decisions on whether or not to share information under chain-to-chain quantity competition. They focus on the role and the value of sharing information under these two contracts, and examine when the manufacturers should invest in acquiring information. Differing from Ha and Tong (2008), by comparing two manufacturers’ contracts, the wholesale price contract without sharing retailers’ demand forecasting information (decentralized supply chain) and the revenue sharing contract with sharing retailers’ demand forecasting information (vertically integrated supply chain), we investigate under what conditions vertical integration (alliance) performs better and under what conditions decentralized supply chain performs better, in the presence of chain-to-chain competition.

Precise demand information is critical in making sound pricing and ordering decisions when retailers face demand uncertainty. Demand information is usually the retailer’s private information. Technological advances in IT make information sharing easy to implement. For example, some suppliers, such as P&G, obtain demand forecasting or sales data from their retailers (such as, Wal-Mart), through a Vendor Managed Inventory (VMI) program or Continuous Replenishment Programs (CRP). Large manufacturers, like Campbell Soup and VF Corporation, get forecasts/sales data from the retailers to improve their production and distribution planning. Our paper is related to the literature on information sharing in the supply chain. Raju and Roy (2000) investigate the value of information on two firms that sell substitutable products in a market. Ryu et al. (2009) evaluate the supply chain performance of two different types of information-sharing methods, the planned demand transferring method (PDTM), and the forecasted demand distributing method (FDDM). They analyze supply chain performance for both methods in terms of throughput, inventory level, and service level. Chen (2003) provides an excellent review of the literature. In our paper, we will examine when sharing the retailer’s demand forecasting information through a revenue-sharing contract is more advantageous, as compared to the case of no information sharing through a wholesale price contract under supply chain competition.

The remainder of this paper is organized as follows. Section 2 describes the forecasting model. Section 3 analyzes supply chain competition under sharing/not sharing the retailer’s demand information for cases of revenue-sharing and wholesale price contracts. Section 4 examines and compares the supply chain contracts under supply chain competition and discusses the implementation of two manufacturers’ contracts. We conclude remarks in Sect. 5. The proofs are given in the Appendix.

2 Forecasting model

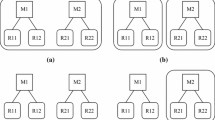

We consider two supply chains compete in a common market facing demand uncertainty, each consisting of one manufacturer who sells a substitutable product to one retailer. Both manufacturers are Stackelberg leaders and the retailers are followers in the two competing supply chains. To make ordering and pricing decisions, each retailer forecasts the demand independently. In practice, when two competing supply chains differentiate significantly, usually, the smaller supply chain imitates and follows the pricing strategies that are implemented in the leading supply chain. It is very interesting to examine the interaction in decisions between two competing supply chains when they are competitive in terms of the size of manufacturers as well as retailers, the experience of supplying and selling the product, and the knowledge of manufacturers in producing the product. In this paper, we consider such case by assuming that the two competing supply chains are identical, except that manufacturers may offer different contracts: either a wholesale price contract without sharing the retailer’s demand forecasting information, or a revenue-sharing contract with sharing the retailer’s demand forecasting information. When a wholesale price contract is selected, the manufacturer will not share the retailer’s demand forecasting information. Each manufacturer and retailer make decisions independently and the supply chain is decentralized. When a revenue-sharing contract is selected, the manufacturer will share the retailer’s demand forecasting information and the supply chain is integrated.

We define the decision-making sequence as follows: in stage 1, the manufacturer in each supply chain decides which contract will be offered, the wholesale price contract or a revenue-sharing contract. In stage 2, if a revenue-sharing contract is chosen and accepted by the retailer, the retailer will share its forecast information on demand with its manufacturer. The supply chain should set the retail price based on the retailer’s forecast on demand considering the other retailer’s forecast on demand since two supply chains sell the substitutable product. The manufacturer and the retailer also should negotiate their corresponding revenue shares; if a wholesale price contract is chosen and accepted by the retailer, the retailer will not share its forecast information on demand with its manufacturer. The manufacturer should decide the wholesale price based on its prior knowledge of the retailer’s demand and its anticipation of retailer’s reaction. The retailer should decide the retail price and order quantity based on its demand forecast considering the other retailer’s demand forecast. The manufacturers, the retailers, and the supply chains are indexed by i=1,2. The retailers compete in a market with linear demand functions. The inverse demand functions for two chains are:

where a>0 and 0 ≤r<1. p i and q i are the retail price and the selling quantity for the retailer i, respectively. r reflects the degree of the product substitution between two supply chains. Following the assumption of Raju and Roy (2000) and Yao et al. (2005), the intercept of the demand functions, a, is assumed to be normally distributed. a=a 0+e, where a 0 is the expected value of a and e is a normal distribution with mean 0 and variance v. The random part results from different values that the customer perceives and accepts the product. We assume that a 0 (the prior) is known by both manufacturers and retailers in both supply chains. The corresponding demand functions are:

Following Raju and Roy (2000) and Vives (1984), we assume that each retailer independently forecasts a as f i (i=1,2), where f i is a random variable due to forecasting error. Since we assume that two supply chains have the experience in selling the product, the forecasting errors by two retailers are constrained by the dispersion of a, the variance v. Thus, to simplify the calculation, we introduce \(\sqrt{v}\) in the forecasting model:

where following Raju and Roy (2000) and Vives (1984), ε i is a bivariate normal distribution, independent of a, with mean 0 and variance s i . Equation (3) gives that the larger dispersion of a, the larger the forecasting error. Equation (3) also eliminates the case that there is still forecasting error when the uncertainty of a is absent (the case v=0). ε 1 and ε 2 are independent. Since the two supply chains are identical, we assume that s 1=s 2=s. That is, forecast f 1 by retailer 1 has the same level of precision as f 2 by retailer 2.

Similar to Raju and Roy (2000) and Vives (1984), with simple calculation, the expected value of a, given the average (the prior, a 0), and the forecast f i , can be expressed as:

where t=1/(1+s) for t∈(0,1], is a measure of forecasting precision: t=1 indicates perfect forecasts while t→0 indicates increasingly poor forecasts.

As shown in Vives (1984), the conditional expectation of one retailer’s forecast f j given the other retailer’s forecast f i :

With the assumption that ε i are independent, we have:

From (2), the expected demands conditioned on retailers’ forecasting information become,

With (4) and (5), (7) implies that p 1 is the function of f 1 and p 2 is the function of f 2. Without loss of generality and affecting our insights in this paper, we normalize the production cost of each manufacturer to zero (from (1), we see that with the production cost c that is lower than the wholesale price, all the results will remain valid with a replaced by a−c).

3 Contracts under supply chain competition

In stage 1, when the manufacturer in each chain decides which contract is offered and the retailer decides whether or not to accept the contract, these decisions create three scenarios for two competing chains: both manufactures offer a wholesale price contract without sharing of retailers’ demand forecasting information (WW case), both manufacturers offer a revenue-sharing contract and share retailers’ demand forecasting information (RR case), and one supply chain in which the manufacturer offers a revenue-sharing contract competes with the other supply chain in which the manufacturer offers a wholesale price contract (RW case). We then examine under what conditions both manufacturers and retailers would prefer an integrated supply chain through a revenue sharing contract in Sect. 4. The expected profits of the retailer i, the manufacturer i, and the entire supply chain i are denoted by R i , M i , and T i , i=1,2, respectively. We assume that the reservation profits of both retailers are zero.

3.1 WW case: a wholesale price contract without information sharing in both supply chains

We first investigate the case of the two competing supply chains in which both manufacturers offer a wholesale price contract to their retailers and each retailer will not share its demand forecasting information with its manufacturer. The manufacturer i decides the wholesale price (w i ) and announces this price to the retailer i, who then sets the retail price (p i ).

With (7), the retailer i’s expected profit maximization problem given w i is:

Without knowing the retailer’s forecast on q i , from (2), the manufacturer i anticipates Eq i =[a 0(1−r)−Ep j +rEp i ]/(1−r 2), where i=1,2 and j=3−i. The expected profit maximization problem is:

For easy of exposition, in this paper, we use the abbreviated forms, ER i and ET i to present E(R i |f i ) and E(T i |f i ), respectively. With (8) and (9), denoting the case in which two manufacturers offer a wholesale price contract with a superscript WW, we have Proposition 1:

Proposition 1

There exists a unique symmetric price equilibrium for wholesale price \([w_{i}^{\mathit{WW}}]\) and retail price \([p_{i}^{\mathit{WW}}]\), where \(w_{i}^{\mathit{WW}}\) is given by (10) and \(p_{i}^{\mathit{WW}}\) is given by (11), i=1,2,

Equation (10) suggests that when both manufacturers offer a wholesale price contract without sharing their retailers’ information on forecasting demand, each manufacturer should cut the wholesale price \([w_{i}^{\mathit{WW}}]\) as the degree of substitution (r) increases \((\partial w_{i}^{\mathit{WW}} / \partial r < 0)\). The increase of r intensifies the price competition between manufacturers. From (11), with 0<t≤1 and 0≤r<1, we note that \(p_{i}^{\mathit{WW}}\) increase linearly with (f i −a 0). When f i =a 0, indicating the case of no demand uncertainty, the retailer i should set the retail price at 3a 0(1−r)/(4−3r), which decreases as r increases. This implies when the demand is deterministic, an increasing r also intensifies the price competition between retailers. Further, in the presence of demand uncertainty, if the retailer i forecasts the demand (f i ) is higher than the prior (a 0), it should increase the price while should decrease the price if f i <a 0. \(\partial p_{i}^{\mathit{WW}} / \partial r > 0\) requires a 0−f 1<3a 0(2−rt)2/[t(4−3r)2(2−t)], implying that when the retailer i pessimistically forecasts (f i <a 0) demand and the difference between a 0 and f i is less than 3a 0(2−rt)2/[t(4−3r)2(2−t)], the retailer should raise the price as r increases. Also, \(\partial p_{i}^{\mathit{WW}} / \partial t > 0\) if f i >a 0 while \(\partial p_{i}^{\mathit{WW}} / \partial t < 0\) if f i <a 0, implying that when retailers have an optimistic demand forecast, as the forecasting precision (t) increases, they should raise the prices, which weakens the price competition between retailers; if retailers’ demand forecast is pessimistic, however, as t increases, the retailers should lower the prices, which will result in intensifying price competition between two retailers.

With Eqs. (8)–(10), the expected profits of the retailers, conditional on their forecasts, as well as the expected profits of the manufacturers, are as follows

The result in (12) shows that as the forecast becomes more precise (t increases), the retailers’ expected profits increase. In addition, given a certain level of forecasting precision (t), if both manufacturers decide to offer a wholesale price contract without sharing of the retailers’ demand forecasting information, the retailers are more profitable as demand uncertainty increases (increasing v). This suggests that as demand uncertainty increases, the value of the retailer’s demand forecasting information increases. Without sharing retailers’ demand forecasting information, manufacturers’ profits decreases with \(r ( \frac{\partial EM_{i}^{\mathit{WW}}}{\partial r} = - \frac{4a_{0}^{2}[(1 - 2r)^{2} + r(1 - r)]}{(4 - 3r)^{3}(1 + r)^{2}} < 0 )\) because an increasing r intensifies the competition between manufacturers (\(\partial w_{i}^{\mathit{WW}} / \partial r < 0\)).

3.2 RR case: a revenue sharing contract with information sharing in both supply chains

We now discuss the case in which both supply chains are integrated through revenue-sharing contracts with sharing the retailers’ demand forecasting information. Each integrated supply chain is to set retail price (p i ) to maximize the chain-wide profit (T i ). With (7), the expected profits of supply chains are:

Denoting the case in which each manufacturer offers a revenue sharing contract with a superscript RR, with (14), we summarize the results in Proposition 2:

Proposition 2

There exists a unique retail price equilibrium \([p_{i}^{\mathit{RR}}]\) for both chains. \(p_{i}^{\mathit{RR}}\) is given by (15), where i=1,2,

For a given f i , comparing (15) to (11) gives \(p_{i}^{\mathit{WW}} > p_{i}^{\mathit{RR}}\). This suggests that the case that both manufacturers offer a revenue sharing contract intensifies the competition among retailers as compared to the case that both manufacturers offer a wholesale price contract.

With (14) and (15), the expected profits of the two supply chains are:

When each manufacturer offers a revenue sharing contract to split the chain-wide profit given in (16), it should negotiate a revenue share with its retailer. We denote that the retailer’s revenue share is θ and the manufacturer’s revenue share is (1−θ). We assume that the cost that the manufacturer acquires the retailer’s demand forecasting information is considered as a factor into the manufacturer’s negotiation of a revenue share with its retailer. Therefore, the manufacturer’s revenue share (1−θ) depends on not only the bargaining power of the manufacturer but also the cost of acquiring the retailer’s demand forecasting information. Generally, the stronger the bargaining power of the manufacturer, the higher the manufacturer’s revenue share; the higher the acquiring cost, the lower the manufacturer’s revenue share. Therefore, the expected profits of the manufacturers and the retailers are:

Comparing (17) and (18) to (12) and (13), we find that the retailers’ risk profit \(\frac{(1 - r)tv}{(1 + r)(2 - rt)^{2}}\) in (12) is shared by the manufacturers through a revenue-sharing contract where the manufacturers have a (1−θ) portion of the entire supply chain’s profits.

3.3 RW case: a wholesale price contract in one supply chain and a revenue sharing contract in the other supply chain

Without loss of generality, we assume that supply chain 1 offers a revenue-sharing contact to its retailer 1 while supply chain 2 offers a wholesale price contract to its retailer 2. We denote the case with a superscript RW. The expected profit in the vertically integrated supply chain 1 is:

The expected profits of the manufacturer and the retailer in supply chain 2 are:

With (19), (20), and (21), we summarize the results in Proposition 3:

Proposition 3

There exists a unique price equilibrium for wholesale price \([w_{2}^{\mathit{RW}}]\) and retail price \([p_{2}^{\mathit{RW}}]\) for supply chain 2, and retail price \([p_{1}^{\mathit{RW}}]\) for supply chain 1 given by (22),

Comparing \(w_{2}^{\mathit{RW}}\) in (22) to \(w_{2}^{\mathit{WW}}\) in (10), \(p_{1}^{\mathit{RW}}\) and \(p_{2}^{\mathit{RW}}\) in (22) to \(p_{i}^{\mathit{WW}}\) in (11) (i=1,2), we can conclude that \(w_{2}^{\mathit{RW}}<w_{2}^{\mathit{WW}}\), \(p_{1}^{\mathit{RW}}< p_{i}^{\mathit{WW}}\), and \(p_{2}^{\mathit{RW}}<p_{i}^{\mathit{WW}}\). When two decentralized supply chains compete, if supply chain 1 moves first to coordinate its supply chain and share the retailer’s demand forecasting information through a revenue-sharing contract, the manufacturer in supply chain 2 should cut its wholesale price; also, both retailers should cut their retail prices, which will intensify the price competition between two retailers.

The results in (22) show that when two retailers have close demand forecasts (f 1≈f 2), retailer 2 in a decentralized supply chain sets a higher price than that of retailer 1 in a vertically integrated supply chain 1, to offset the risk of the demand uncertainty it fully assumes in supply chain 2.

With (19) and (20), the expected chain-wide profit of the integrated supply chain 1 is:

With a revenue-sharing contract, the expected profits of manufacturer 1 and retailer 1 are:

With Eqs. (20)–(22), the expected profits of manufacturer 2 and retailer 2 are:

4 Analysis and comparison of contracts under supply chain competition

In the present research, the important management issue is when it makes economic sense for a supply chain to be coordinated by sharing the retailer’s demand forecasting information through a revenue-sharing contract, under supply chain competition. In a supply chain, only when both the manufacturer and the retailer are better off will a contract be offered and accepted. Our analysis will focus on the impact of various contracts in one supply chain on the contracts of the other (competing) supply chain. To easily compare the expected profits of manufacturers and retailers under manufacturers’ two contracts in the presence of supply chain competition, we first identify several boundary values, as follows.

-

a.

Letting θ 1 be the boundary value of \(EM_{i}^{\mathit{RR}} = EM_{i}^{\mathit{WW}}\), (13) and (17) give:

$$ \theta_{1} = 1 - \frac{2a_{0}^{2}(2 - r)^{2}(2 - rt)^{2}}{(4 - 3r)^{2}[(2 - rt)^{2}a_{0}^{2} + (2 - r)^{2}tv]}. $$(28) -

b.

Letting θ 2 be the boundary value of \(EM_{2}^{\mathit{RR}} = EM_{2}^{\mathit{RW}}\), (17) and (26) give:

$$ \theta_{2} = 1 - \frac{2a_{0}^{2}(4 - r^{2})^{2}(2 - rt)^{2}}{(8 - 3r^{2})^{2}[(2 - rt)^{2}a_{0}^{2} + (2 - r)^{2}tv]}. $$(29) -

c.

Letting θ 3 be the boundary value of \(EM_{1}^{\mathit{WW}} = EM_{1}^{\mathit{RW}}\), (13) and (26) give:

$$ \theta_{3} = 1 - \frac{2a_{0}^{2}(8 - 3r^{2})^{2}(2 - rt)^{2}}{(4 - 3r)^{2}[(4 + 3r)^{2}(2 - rt)^{2}a_{0}^{2} + (8 - 3r^{2})^{2}tv]}. $$(30) -

d.

Letting θ 4 be the boundary value of \(ER_{i}^{\mathit{RR}} = ER_{i}^{\mathit{WW}}\), (12) and (18) give:

$$ \theta_{4} = 1 - \frac{4a_{0}^{2}(3 - 2r)(1 - r)(2 - rt)^{2}}{(4 - 3r)^{2}[(2 - rt)^{2}a_{0}^{2} + (2 - r)^{2}tv]}. $$(31) -

e.

Letting θ 5 be the boundary value of \(ER_{2}^{\mathit{RR}} = ER_{2}^{\mathit{RW}}\), (18) and (27) give:

$$ \theta_{5} = 1 - \frac{8a_{0}^{2}(3 - r^{2})(2 - r^{2})(2 - rt)^{2}}{(8 - 3r^{2})^{2}[(2 - rt)^{2}a_{0}^{2} + (2 - r)^{2}tv]}. $$(32) -

f.

Letting θ 6 be the boundary value of \(ER_{1}^{\mathit{WW}} = ER_{1}^{\mathit{RW}}\), (12) and (27) give:

$$ \theta_{6} = 1 - \frac{24a_{0}^{2}(2 - r^{2})(4 - 3r^{2})(2 - rt)^{2}}{(4 - 3r)^{2}[(4 + 3r)^{2}(2 - rt)^{2}a_{0}^{2} + (8 - 3r^{2})^{2}tv]}. $$(33)

We now investigate the impact of manufacturers’ contracts under supply chain competition.

4.1 Comparing the impact of contracts under chain-to-chain competition

Comparing \(EM_{i}^{\mathit{RR}}\) to \(EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RR}}\) to \(ER_{i}^{\mathit{WW}}\), we find:

Proposition 4

If currently, both supply chains are decentralized with manufacturers’ wholesale price contracts, when 0<r<0.4226, if retailers can negotiate a revenue share in the range θ 4<θ<θ 1, both manufacturers and retailers in the two competing supply chains have an incentive to adopt a revenue-sharing contract with sharing retailers’ demand forecasting information, since \(EM_{i}^{\mathit{RR}} > EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RR}} > ER_{i}^{\mathit{WW}}\); otherwise, either manufacturers or retailers, or both, in the two competing supply chains, have no incentive to offer or accept a revenue-sharing contract. A wholesale price contract without sharing of retailers’ demand forecasting information is the better strategy for both supply chains if 0.4226<r<1 and θ 1<θ<θ 4, where θ 1 and θ 4 are given in (28) and (31), respectively.

Proposition 4 implies that if manufacturers observe that the degree of substitution (r) is below 0.4226 and if they can accept a revenue share (θ) in the range (θ 4,θ 1) for their retailers, collaboration between the two supply chains to move together to adopt a revenue-sharing contract sharing retailers’ demand forecasting information is a win-win strategy for both supply chains; otherwise a wholesale price contract without sharing of retailers’ demand forecasting information is a better strategy for either manufacturers or retailers, or both. When 0.4226<r<1 and θ 1<θ<θ 4, a wholesale price contract is preferred by both manufacturers and retailers in both supply chains.

When 0 < r<0.4226, ∂(θ 1−θ 4)/∂r<0, suggesting that the higher degree of substitution (r) results in a smaller (θ 1−θ 4). r can also be viewed as the degree of horizontal competition between retailers [see (1)]. The intensification of horizontal competition between retailers shrinks the space of coordinating the supply chain through a revenue-sharing contract in both supply chains. That is, as r increases, the value of vertical integration through a revenue-sharing contract decreases, and the range (θ 4,θ 1) of retailer’s share (θ) in a revenue-sharing contract shrinks until the range disappears. We summarize these results in Corollary 1.

Corollary 1

As the horizontal competition between retailers is intensified (measured by the increasing r), the value of coordination of the two supply chains and sharing the retailers’ demand forecasting information shrinks. It finally disappears at r=0.4226, where \(EM_{i}^{\mathit{RR}} = EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RR}} = ER_{i}^{\mathit{WW}}\).

Corollary 1 suggests that if two competing supply chains are decentralized and the degree of product substitution is not sufficiently high (0<r<0.4226), as r increases, there is less room for negotiating a revenue share (θ) for retailers under a revenue-sharing contract to achieve supply chain coordination and ensure increased profit for both the manufacturer and the retailer as compared to the case that both manufacturers offer wholesale price contracts without sharing retailers’ demand forecasting information.

When 0<r<0.4226, we summarize the impact of v and t on the retailers’ revenue share (θ) and the negotiating room (θ 1−θ 4) in Corollary 2.

Corollary 2

When 0<r<0.4226, if retailers have a higher forecasting precision (t) or if the variance of demand (v) is higher, the retailers can possibly negotiate a higher revenue share (θ). In addition, as t or v increases, the room (θ 1−θ 4) for negotiating a higher θ shrinks.

Corollary 2 suggests that with a higher forecasting precision (t) or when the demand uncertainty is higher (v is larger), retailers have stronger bargaining power to negotiate a higher revenue share (θ) if supply chains adopt a revenue-sharing contract, because retailers’ demand forecasting information becomes valuable in term of enhancing chain-wide profits.

We summarize our findings in Proposition 5 by comparing \(EM_{i}^{\mathit{RW}}\) to \(EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RW}}\) to \(ER_{i}^{\mathit{WW}}\).

Proposition 5

When 0<r<0.7507, if manufacturers in both competing supply chains are currently offering a wholesale price contract and if retailer 1 can negotiate a revenue share in the range θ 6<θ<θ 3, supply chain 1 has an incentive to move first to sign a revenue-sharing contract and share retailer 1’s demand forecasting information. This results in a loss in the profits of the manufacturer and the retailer in supply chain 2, because both \(EM_{1}^{\mathit{RW}} > EM_{1}^{\mathit{WW}}\) and \(ER_{1}^{\mathit{RW}} > ER_{1}^{\mathit{WW}}\), while both \(EM_{2}^{\mathit{RW}} < EM_{2}^{\mathit{WW}}\) and \(ER_{2}^{\mathit{RW}} < ER_{2}^{\mathit{WW}}\); otherwise, either manufacturer 1 or retailer 1, or both, have no incentive to offer or accept a revenue-sharing contract. A wholesale price contract is preferred by both supply chains if 0.7507<r<1 and θ 3<θ<θ 6, where θ 3 and θ 6 are given in (30) and (33), respectively.

Proposition 5 raises a cautionary note for the managers of the retailer and the manufacturer in supply chain 2. If they observe that their competitor is moving to a revenue-sharing contract and r is in the range (0,0.7507), they should reevaluate their current contract that is implemented. This was the case for Blockbuster; when Blockbuster first moved to accept a revenue-sharing contract with its suppliers in 1998, its competitors started to worry about the impact of this practice on their own businesses.

Propositions 4 and 5 suggest that if both supply chains are decentralized, when 0<r<0.4226 and if retailers’ revenue share in the range θ 4<θ<θ 1 can be accepted by manufactures, collaboration between the two competing supply chains to move together to adopt a revenue-sharing contract sharing retailers’ demand forecasting information is a win-win strategy for both supply chains. When 0.4226<r<0.7505, if a revenue share of the retailer 1 in the range θ 6<θ<θ 3 can be accepted by the manufacturer 1, supply chain 1 has an incentive to move first to sign a revenue-sharing contract that hurts the profits of the manufacturer and the retailer in supply chain 2.

Similar to Corollary 1, we find that as r increases within the range (0<r<0.7505), the value of coordinating supply chain 1 through a revenue-sharing contract decreases, because the range (θ 6,θ 3) for the retailer to negotiate a revenue share (θ) shrinks. The range (θ 6,θ 3) disappears at r=0.7507.

Propositions 4 and 5 also suggest:

Corollary 3

When 0<r<0.4226, if retailers can negotiate a revenue share (θ) in the range θ 4<θ<θ 1, both manufacturers and retailers in the two competing supply chains prefer a revenue-sharing contract with sharing retailers’ demand forecasting information; when 0.7507<r<1 and θ 3<θ<θ 6, both manufacturers and retailers in the two competing supply chains prefer a wholesale-price contract without sharing retailers’ demand forecasting information.

Without considering demand uncertainty, McGuire and Staelin (1983) obtain the similar results with different ranges of r as we presented in Propositions 4 and 5. In their work, when 0<r<0.708 (instead of 0<r<0.4226 in our paper), manufacturers prefer an integrated supply chain while prefer a decentralized supply chain with a wholesale-price contract if 0.931<r<1 (instead of 0.7507<r<1 in our paper). They show that as the degree of substitution (r) increases, the equilibrium retail prices [1/(2−r)] in the integrated supply chain increase. The result is counter-intuitive. The result is Different from their result, we show that as r increases, the equilibrium retail prices [(1−r)/(2−r)] in the integrated supply chain decrease. Our result makes more economic sense since the increasing degree of substitution (r) intensifies the price competition between retailers, suggesting that r in our demand model well reflects the degree of competition between two chains.

We conclude the results in Proposition 6 by comparing \(EM_{i}^{\mathit{RW}}\) to \(EM_{i}^{\mathit{RR}}\) and \(ER_{i}^{\mathit{RW}}\) to \(ER_{i}^{\mathit{RR}}\).

Proposition 6

If supply chain 1, which is currently adopting a revenue-sharing contract, competes with supply chain 2, which has a wholesale price contract, supply chain 2 is motivated to sign a revenue-sharing contract to compete with supply chain 1 if 0<r<0.9194 and if retailer 2 can negotiate a revenue share in the range θ 5<θ<θ 2 because \(EM_{2}^{\mathit{RR}} >\nobreak EM_{2}^{\mathit{RW}}\) and \(ER_{2}^{\mathit{RR}} > ER_{2}^{\mathit{RW}}\). This action will result in a loss in profits for both the manufacturer and the retailer in supply chain 1; otherwise, supply chain 2 prefers a wholesale price contract and has no incentive to sign a revenue-sharing contract if 0.9194<r<1 and θ 2<θ<θ 5, where θ 2 and θ 5 are given in (29) and (32), respectively.

Proposition 6 raises a cautionary note for the management of manufacturer 1 and retailer 1. Manufacturer 1 and retailer 1 should be aware that supply chain 2 is more likely to move from a wholesale price contract to a revenue-sharing contract, if the degree of substitution (r) is smaller than 0.9194 and a profit loss is expected for manufacturer 1 and retailer 1 as the result of such action. If the degree of substitution (r) is extremely high (>0.9194), however, manufacturer 1 and retailer 1 may not be worried, because either manufacturer 2, or retailer 2, or both have not incentive to sign a revenue-sharing contract. In addition, if supply chain 2 signs a revenue-sharing contract, the range (θ 5,θ 2) for retailer 2’s share (θ) shrinks as r increases. The range (θ 5,θ 2) disappears at r=0.9194. For the management in supply chain 2, if two initially competing supply chains adopt a wholesale price contract and if the management observes supply chain 1 moving to sign a revenue-sharing contract, signing in a revenue-sharing contract is a good strategy for supply chain 2 if 0<r<0.9194 and if a revenue share for retailer 2 in the range (θ 5,θ 2) can be accepted by manufacturer 2.

Comparing the boundary values θ j , j=1,2,…,6, we have Corollary 3 as follows:

Corollary 4

θ 2>θ 3>θ 1, θ 4>θ 5, and θ 4>θ 6.

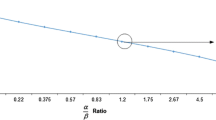

The relationship of θ j , j=1,2,…,6 is illustrated in Fig. 1 for 0<r<0.4226.

We note that in Fig. 1, there are two possible cases, either θ 5≥θ 6 or θ 5<θ 6. With Propositions 4, 5, and 6, Corollary 3, and Fig. 1, we can easily conclude that when 0<r<0.4226, the range (θ 4,θ 1)⊂(θ 5,θ 2) and the range (θ 4,θ 1)⊂(θ 6,θ 3).

To illustrate the results we have discussed, we use a numerical study and set a 0=1, v=0.2, and s=1. s=1 gives t=0.5. The results, including θ j , j=1,2,…,6 are shown in Fig. 2.

Figure 2 shows that in the shaded region I (i.e., the range θ 4<θ<θ 1), the manufacturers and the retailers in both supply chains would prefer a revenue-sharing contract with sharing retailers’ demand forecasting information. As r increases, the range shrinks. In the shaded region II which is the range (θ 3,θ 6), the manufacturers and the retailers in both supply chains would prefer a wholesale price contract without sharing retailers’ demand forecasting information.

r=0 is a special case, in which each supply chain is a monopoly in the marketplace. The manufacturer and the retailer in each supply chain will prefer a revenue-sharing contract with sharing retailer’s demand forecasting information, if the retailer can negotiate a revenue share in the range (θ 4,θ 1).

4.2 The impact of v

We now discuss two special cases of Corollary 2 as follows:

Corollary 5

When 0<r<0.4226,

-

(1)

if v→∞, we have θ 1→1 and θ 4→1,

-

(2)

if v=0 (no demand uncertainty case), if retailers can negotiate a revenue share in the range \(\frac{(2 - r)^{2}}{(4 - 3r)^{2}} < \theta < \frac{7r^{2} - 16r + 8}{(4 - 3r)^{2}}\), a revenue-sharing contract is preferred by two competing chains.

When r=0, if v=0, we have 0.25<θ<0.5.

Corollary 5 suggests that when demand variance (v) is extremely high, i.e., v→∞, and when product substitution is not high (r<0.426), the retailer will gain a major share (approaching 1) for having the advantage of obtaining demand forecasting information because such information becomes important and may be costly as v is extremely high. It also suggests that when demand is deterministic (v=0) and the degree of substitution (r) is not high (0<r<0.4226), there exists a retailer’s revenue share range, \(\frac{(2 - r)^{2}}{(4 - 3r)^{2}} < \theta < \frac{7r^{2} - 16r + 8}{(4 - 3r)^{2}}\), such that both competing supply chains will prefer a revenue-sharing contract. However, in the absence of product substitution between the two supply chains (r=0, the case that each supply chain is a monopoly) and in the absence of demand uncertainty (v=0), if the retailer can negotiate a revenue share in the range (0.25,0.5), both the manufacturer and the retailer will prefer a revenue-sharing contract as compared to a wholesale price contract.

We now use a numerical study to illustrate the impact of v. We set a 0=1, r=0.1, and s=1 in this example. s=1 gives t=0.5. The results are shown in Fig. 3.

Figure 3 shows that as v increases, the range of retailer’s revenue share (θ 4<θ<θ 1) shrinks, and both θ 1 and θ 4 increase, as labeled (region I).

4.3 Contracts and supply chain integration in the presence of chain-to-chain competition

Propositions 4 and 5 show that in the presence of chain-to-chain competition, only when the degree of product substitution is not high (0<r<0.4226), there exists a range of retailers’ revenue share (θ 4<θ<θ 1) such that supply chain vertical integration through a revenue sharing contract with sharing retailers’ demand forecasting information performs better than the decentralized supply chain with a wholesale contract without sharing retailers’ demand forecasting information.

As competition between retailers (horizontal competition) intensifies (i.e., r is increasing), the completion among manufacturers is intensified in the decentralized supply chain with a wholesale contract without sharing retailers’ demand forecasting information (discussed in Sect. 3.1). The manufactures should lower wholesale prices which encourage retailers order more products. Therefore, the advantage of supply chain vertical integration through a revenue sharing contract with sharing retailers’ demand forecasting information disappears and the decentralized supply chain with a wholesale contract without sharing retailers’ demand forecasting information is preferred by both manufacturers and retailers in two supply chains.

The above findings are very interesting. Gerchak and Wang (2004) study a problem in which a retailer/assembler who is a newsvendor facing uncertain demand is supplied by multiple component suppliers. They find that a revenue sharing contract cannot coordinate the supply chain while a revenue-plus-surplus-subsidy incentive scheme can coordinate supply chain. They also consider a wholesale-price in combination with buyback scheme that can coordinate the supply chain in their paper. When the supply chain faces chain-to-chain competition, we can expect that a revenue-plus-surplus-subsidy incentive scheme and a wholesale-price in combination with buybacks scheme might be still a good option for the supply chain if the degree of price competition between two chains is not intensive. This might be because the improvement of the supply chain efficiency through a coordination scheme is higher than the negative impact of price competition among supply chains on the supply chain efficiency. However, a simple wholesale price scheme might be a good option if the degree of price competition between two chains is intensive. Our results imply that the coordination schemes without considering chain-to-chain competition need to be carefully evaluated in the presence of chain-to-chain competition.

4.4 The implementation of contracts

In this paper, two contracts (the wholesale price and the revenue sharing contracts) are considered by manufacturers in the presence of chain-to-chain competition. When a wholesale price contact offered in two supply chains, supply chains are decentralized while supply chains are vertically integrated if a revenue sharing contracts is offered. Cachon (2003) points out that “the contract designer may actually prefer to offer a simple contract.” The wholesale price contract is still widely used in practice due to its simplicity in terms of implementation. In a wholesale price contract, the manufacturer sells its products with a posted wholesale price per unit to its retailer.

For a revenue sharing contract, the manufacturer will set a wholesale price below production cost if manufacturer and retailer agree to share the total revenue of the supply chain. Some researches pointed out that it might be difficult to implement a revenue sharing contract because the manufacturer (or product supplier) has to monitor sales and price of the product. Cachon and Lariviere (2005), however, pointed out: “almost all … stores have systems of computers and bar codes to track each (sale), so it should not be difficult for suppliers to monitor and verify revenues.” As the Stackelberg leaders in supply chains discussed in this paper, manufacturers have significant market power to do so although such monitoring increases the costs to manufacturers. In this paper, since when manufacturers offer a revenue sharing contract, to become a vertical alliance, the retailers should share their demand forecasting information with their manufacturers. With sharing retailers’ demand forecasting information, manufacturers can infer retailers’ sales and pricing information without monitoring.

5 Conclusions

Under the framework of supply chain competition and demand uncertainty, we investigate which contracts are more advantageous for each supply chain, and when. Two supply chain contracts are discussed: the wholesale price contract without sharing the retailer’s demand forecasting information and the revenue-sharing contract with sharing the retailer’s demand forecasting information. We show that when the degree of substitution is not high and the retailer can negotiate a revenue share in a range, both manufacturers and retailers in the two supply chains prefer a revenue-sharing contract that coordinates the supply chains and sharing retailer’s demand forecasting information, as compared to the case in which both supply chains adopt a wholesale price contract without sharing retailers’ demand forecasting information; otherwise, a wholesale price contract without sharing retailers’ demand forecasting information is preferred by either manufacturers, or retailers, or both in the two supply chains. We also show when a supply chain has an incentive to move to a revenue-sharing contract or stay with a wholesale price contract and what is the impact of such action by a supply chain on its competing supply chain. Furthermore, we demonstrate the impact of demand uncertainty and retailers’ forecasting precision on decisions of the manufacturers and retailers in two competing supply chains.

This paper sheds light on contracting under supply chain competition. We focus on two symmetric supply chains and assume that the two retailers’ forecasting abilities are at same level. This could be the case in a product market that is mature and very competitive, but the case of asymmetrically competing supply chains might be also interesting. Another possible extension could consider competition among multiple supply chains. We can examine how the competition affects pricing and contracting among the manufacturer and the retailer. We also can examine how the asymmetric production costs among manufacturers will affect equilibriums in multiple competing supply chains. Whether the main results derived from this paper can be applied for multiple competing supply chains need to be carefully examined. Also, we use linear demand functions in this paper. Although the linear demand function has been extensively used in the literature, it would be desirable to investigate whether the derived results, insights, and implications hold generally for other demand functions. Despite these assumptions, we believe that we have addressed an important issue in the area of chain-to-chain competition.

References

Arshinder, K. A., & Deshmukh, S. G. (2008). Supply chain coordination: perspectives, empirical studies and research directions. Int J Prod Econ, 115, 316–335.

Atkins, D., & Zhao, X. (2003). Supply chain structure under price and service competition. Working paper. Sauder School of Business, University of British Columbia.

Barnes, D. (2006). Competing supply chains are the future. Financial Times (November 8).

Cachon, G. P. (2003). Handbooks in operations research and management science: supply chain management. In Supply chain coordination with contracts. Amsterdam: North-Holland.

Cachon, G. P., & Lariviere, M. A. (2005). Supply chain coordination with revenue-sharing contracts: strengths and limitations. Manag Sci, 51, 30–44.

Chen, F. (2003). Information sharing and supply chain coordination. In A. G. de Kok & S. C. Graves (Eds.), Handbooks in operations research and management science (Vol. 11, pp. 341–421). Amsterdam: Elsevier.

Corbett, J., & Tang, C. (1999). Designing supply contracts: contract type and information asymmetric. In S. Tayur, R. Ganeshan, & M. Magazine (Eds.), Quantitative models for supply chain management. Dordrecht: Kluwer.

Coughlan, A. T. (1985). Competition and cooperation in marketing channel choice: theory and application. Mark Sci, 4, 110–129.

Gerchak, Y., & Wang, Y. (2004). Revenue-sharing vs. wholesale-price contracts in assembly systems with random demand. Prod Oper Manag, 1, 23–31.

Giannoccaro, I., & Pontrandolfo, P. (2004). Supply chain coordination by revenue sharing contracts. Int J Prod Econ, 89, 131–139.

Giannoccaro, I., & Pontrandolfo, P. (2009). Negotiation of the revenue sharing contract: an agent-based systems approach. Int J Prod Econ, 122, 558–566.

Ha, A., & Tong, S. (2008). Contracting and information sharing under supply chain competition. Manag Sci, 4, 701–715.

James, D., Jr. (1999). Revenue-sharing, demand uncertainty, and vertical control of competitions. Working paper. Northwestern University, Kellogg Graduate School of Management.

Lariviere, M. A. (2003). Supply chain contracting and coordination with stochastic demand. In S. Tayur, R. Ganeshan, & M. Magazine (Eds.), Quantitative models for supply chain management (pp. 233–268). Dordrecht: Kluwer.

Lee, C. H., & Rhee, B. (2010). Coordination contracts in the presence of positive inventory financing costs. Int J Prod Econ, 124, 331–339.

Li, J., & Liu, L. (2006). Supply chain coordination with quantity discount policy. Int J Prod Econ, 101, 89–98.

McGuire, T., & Staelin, W. R. (1983). An industry equilibrium analysis of downstream vertical integration. Mark Sci, 2, 161–191.

Moorthy, K. S. (1988). Decentralization in channels. Mark Sci, 7, 335–355.

Pasternack, B. A. (1985). Optimal pricing and returns policies for perishable commodities. Mark Sci, 4, 166–176.

Raju, J., & Roy, A. (2000). Market information and firm performance. Manag Sci, 46, 1075–1084.

Ryu, S., Tsukishima, T., & Onari, H. (2009). A study on evaluation of demand information-sharing methods in supply chain. Int J Prod Econ, 120, 162–175.

Spengler, J. (1950). Vertical integration and antitrust policy. J Polit Econ, 50, 347–352.

Tsay, A. (1999). Quantity-flexibility contract and supplier-customer incentives. Manag Sci, 45, 1339–1358.

Tsay, A., Nahmias, S., & Agrawal, N. (2003). Modeling supply chain contracts: a review. In S. Tayur, R. Ganeshan, & M. Magazine (Eds.), Quantitative models for supply chain management (pp. 299–336). Dordrecht: Kluwer (Chap. 10).

Vives, X. (1984). Duopoly information equilibrium: Cournot and Bertrand. J Econ Theory, 34, 71–94.

Wang, X., & Liu, L. (2007). Coordination in a retailer-led supply chain through option contract. Int J Prod Econ, 110, 115–127.

Wu, Q., & Chen, H. (2003). Chain-chain competition under demand uncertainty. Working paper. The University of British Columbia.

Yao, D., Yue, X., & Wang, X. (2005). The impact of information sharing on a return policy with the addition of a direct channel. Int J Prod Econ, 97, 196–209.

Acknowledgements

The authors gratefully acknowledge the support grants from the National Natural Science Foundation of China (NSFC), #70772070 and #70932005, and from the Natural Sciences and Engineering Research Council of Canada.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Proof of Proposition 1

For a given w i , with (7), the second order conditions of (8) and (9) show that there exist a unique optimal w i and p i . Taking partial derivative of (8) and (9) w.r.t. p i and w i , respectively. Setting these first order conditions to be 0:

where j=3−i.

With (A.1) and (A.2), we can obtain:

□

Proof of Proposition 2

With (7) and (14), it is to prove that there exists a unique optimal p i . Taking partial derivative of (14) w.r.t. p i and setting these two first order conditions to be 0. Thus, the vertical Stackelberg equilibriums of retail prices are:

Solving two equations in (A.3), we have

□

Proof of Proposition 3

For supply chain, the second order conditions are necessary and sufficient for the unique optimal p i (i=1,2) and w 2. The equilibrium of prices are:

Solving (A.4), (A.5), and (A.6), we have

□

Proof of Proposition 4

With 0<r<1 and 0<t<1, (A.7) gives that when θ<θ 1, \(EM_{i}^{\mathit{RR}} > EM_{i}^{\mathit{WW}}\) while \(EM_{i}^{\mathit{RR}} < EM_{i}^{\mathit{WW}}\) if θ>θ 1.

Equation (A.8) gives that when θ>θ 4, \(ER_{i}^{\mathit{RR}} > ER_{i}^{\mathit{WW}}\) while \(ER_{i}^{\mathit{RR}} < ER_{i}^{\mathit{WW}}\) if θ<θ 4. Further,

Equation (A.9) gives that when θ 1>θ 4 if 0<r<0.4226 while θ 1<θ 4 if 0.4226<r<1. Therefore, when 0<r<0.4226 and θ 4<θ<θ 1, \(EM_{i}^{\mathit{RR}} > EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RR}} > ER_{i}^{\mathit{WW}}\), implying both manufacturers and retailers in the two competing supply chains have an incentive to adopt a revenue-sharing contract with sharing retailers’ demand forecasting information; otherwise, there are two cases:

Case I

If 0<r<0.4226 and θ 1>θ 4,

-

a.

when θ>θ 1, \(EM_{i}^{\mathit{RR}} < EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RR}} > ER_{i}^{\mathit{WW}}\), manufacturers will not offer a revenue-sharing contract;

-

b.

when θ<θ 4, \(EM_{i}^{\mathit{RR}} > EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RR}} < ER_{i}^{\mathit{WW}}\), retailers will not accept a revenue-sharing contract.

Case II

If 0.4226 < r<1 and θ 1<θ 4,

-

a.

when θ>θ 4, \(EM_{i}^{\mathit{RR}} < EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RR}} > ER_{i}^{\mathit{WW}}\), manufacturers will not offer a revenue-sharing contract;

-

b.

when θ<θ 1, \(EM_{i}^{\mathit{RR}} > EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RR}} < ER_{i}^{\mathit{WW}}\), retailers will not accept a revenue-sharing contract;

-

c.

when \(\theta_{1} < \theta < \theta_{4}, EM_{i}^{\mathit{RR}} < EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RR}} < ER_{i}^{\mathit{WW}}\), both manufacturers and retailers have no incentive to move to adopt a revenue-sharing contract.

Cases I and II indicate that under those conditions, a wholesale price contract is preferred by either manufacturers, or retailers, or both. □

Proof of Corollary 1

With

Thus, the value of coordination of the two supply chains shrinks. In addition, from (A.9) in the proof of Proposition 4, we have that r=0.4226 gives θ 1−θ 4=0. From (A.7) and (A.8), we can conclude that the value of coordination of the two supply chains finally disappears at r=0.4226, where \(EM_{i}^{\mathit{RR}} = EM_{i}^{\mathit{WW}}\) and \(ER_{i}^{\mathit{RR}} = ER_{i}^{\mathit{WW}}\). □

Proof of Corollary 2

This means that the retailers’ revenue share (θ) can start with a higher value (∂θ 1/∂v>0 and ∂θ 1/∂t>0) and it is possible for the retailers to negotiate a higher revenue share (∂θ 4/∂v>0 and ∂θ 4/∂t>0) as v and t increase. In addition,

Equations (A.10) and (A.11) give that when 0<r<0.4226, both ∂(θ 1−θ 4)/∂v<0 and ∂(θ 1−θ 4)/∂t<0. Thus, as t and v increase, the room (θ 1−θ 4) for negotiating a higher θ shrinks. □

Proof of Proposition 5

This yields that when θ<θ 3 , we have \(EM_{1}^{\mathit{RW}} > EM_{1}^{\mathit{WW}}\) while \(EM_{1}^{\mathit{RW}} < EM_{1}^{\mathit{WW}}\) when θ>θ 3.

which yields that when θ>θ 6, we have \(ER_{1}^{\mathit{RW}} > ER_{1}^{\mathit{WW}}\) while \(ER_{1}^{\mathit{RW}} < ER_{1}^{\mathit{WW}}\) when θ<θ 6.

Also,

gives that when 0<r<0.7507,θ 3>θ 6 while 0.7507<r<1, θ 3<θ 6.

Further, from (12), (13), (26), and (27), we have:

Therefore, when 0<r<0.7507 and θ 6<θ<θ 3, \(EM_{1}^{\mathit{RW}} > EM_{1}^{\mathit{WW}}\) and \(ER_{1}^{\mathit{RW}} > ER_{1}^{\mathit{WW}}, EM_{2}^{\mathit{RW}} < EM_{2}^{\mathit{WW}}\) and \(ER_{2}^{\mathit{RW}} < ER_{2}^{\mathit{WW}}\). Therefore, if both competing supply chains currently are offering a wholesale price contract and if the retailer 1 can negotiate a revenue share in the range θ 6<θ<θ 3, supply chain 1 has an incentive to move first to sign a revenue-sharing contract that hurts the profits of the manufacturer and the retailer in supply chain 2; otherwise, there are two cases:

Case I

If 0<r<0.7507 and θ 3>θ 6,

-

a.

when θ>θ 3, \(EM_{1}^{\mathit{RW}} < EM_{1}^{\mathit{WW}}\) and \(ER_{1}^{\mathit{RW}} > ER_{1}^{\mathit{WW}}\), manufacturer 1 will not offer a revenue-sharing contract;

-

b.

when θ<θ 6, \(EM_{1}^{\mathit{RW}} > EM_{1}^{\mathit{WW}}\) and \(ER_{1}^{\mathit{RW}} < ER_{1}^{\mathit{WW}}\), retailer 1 will not accept a revenue-sharing contract.

Case II

If 0.7507 < r<1 and θ 3<θ 6,

-

a.

when θ>θ 6, \(EM_{1}^{\mathit{RW}} < EM_{1}^{\mathit{WW}}\) and \(ER_{1}^{\mathit{RW}} > ER_{1}^{\mathit{WW}}\), manufacturer 1 will not offer a revenue-sharing contract;

-

b.

when \(\theta < \theta_{3}, EM_{1}^{\mathit{RW}} > EM_{1}^{\mathit{WW}}\) and \(ER_{1}^{\mathit{RW}} < ER_{1}^{\mathit{WW}}\), retailer 1 will not accept a revenue-sharing contract;

-

c.

when θ 3<θ<θ 6, \(EM_{1}^{\mathit{RW}} < EM_{1}^{\mathit{WW}}\) and \(ER_{1}^{\mathit{RW}} < ER_{1}^{\mathit{WW}}\), both manufacturer 1 and retailer 1 have no incentive to move to adopt a revenue-sharing contract.

With (A.12) and (A.13), Cases I and II indicate that under those conditions, a wholesale price contract is preferred by either manufacturers, or retailers, or both in two competing supply chains. □

Proof of Proposition 6

gives that when \(\theta < \theta_{2}, EM_{2}^{\mathit{RR}} > EM_{2}^{\mathit{RW}}\) while \(EM_{2}^{\mathit{RR}} < EM_{2}^{\mathit{RW}}\) when θ>θ 2.

gives that when θ>θ 5, \(ER_{2}^{\mathit{RR}} > ER_{2}^{\mathit{RW}}\) while \(ER_{2}^{\mathit{RR}} < ER_{2}^{\mathit{RW}}\) if θ<θ 5.

Also,

gives that when 0<r<0.9194, θ 2>θ 5; otherwise, θ 2<θ 5. Also, (17), (18), (24), and (25) give:

Therefore, when 0<r<0.9194 and θ 5<θ<θ 2, \(EM_{2}^{\mathit{RR}} > EM_{2}^{\mathit{RW}}\), \(ER_{2}^{\mathit{RR}} > ER_{2}^{\mathit{RW}}\), \(EM_{1}^{\mathit{RR}} < EM_{1}^{\mathit{RW}}\), and \(ER_{1}^{\mathit{RR}} < ER_{1}^{\mathit{RW}}\). That is, if supply chain 1, which is currently adopting a revenue-sharing contract, competes with supply chain 2, which has a wholesale price contract, supply chain 2 is motivated to sign a revenue-sharing contract to compete with supply chain 1. Such action will result in a loss in profits for both the manufacturer and the retailer in supply chain 1 [(A.14) and (A.15)]; otherwise, there are two cases.

Case I

If 0<r<0.9194 and θ 2>θ 5,

-

a.

when θ>θ 2, \(EM_{2}^{\mathit{RR}} < EM_{2}^{\mathit{RW}}\) and \(ER_{2}^{\mathit{RR}} > ER_{2}^{\mathit{RW}}\), manufacturer 2 will not offer a revenue-sharing contract;

-

b.

when θ<θ 5, \(EM_{2}^{\mathit{RR}} > EM_{2}^{\mathit{RW}}\) and \(ER_{2}^{\mathit{RR}} < ER_{2}^{\mathit{RW}}\), retailer 2 will not accept a revenue-sharing contract.

Case II

If 0.9194<r<1 and θ 2<θ 5,

-

a.

when \(\theta > \theta_{5}, EM_{2}^{\mathit{RR}} < EM_{2}^{\mathit{RW}}\) and \(ER_{2}^{\mathit{RR}} > ER_{2}^{\mathit{RW}}\), manufacturer 2 will not offer a revenue-sharing contract;

-

b.

when θ<θ 2, \(EM_{2}^{\mathit{RR}} > EM_{2}^{\mathit{RW}}\) and \(ER_{2}^{\mathit{RR}} < ER_{2}^{\mathit{RW}}\), retailer 2 will not accept a revenue-sharing contract;

-

c.

when θ 2<θ<θ 5, \(EM_{2}^{\mathit{RR}} < EM_{2}^{\mathit{RW}}\) and \(ER_{2}^{\mathit{RR}} < ER_{2}^{\mathit{RW}}\), both manufacturer 2 and retailer 2 have no incentive to move to adopt a revenue-sharing contract.

With (A.14) and (A.15), Cases I and II indicate that under above conditions, either manufacturer 2, or retailer 2, or both, prefer a wholesale price contract and has no incentive to sign a revenue-sharing contract. □

Proof of Corollary 4

which gives θ 2>θ 3.

□

Proof of Corollary 5

Rights and permissions

About this article

Cite this article

Ai, X., Chen, J. & Ma, J. Contracting with demand uncertainty under supply chain competition. Ann Oper Res 201, 17–38 (2012). https://doi.org/10.1007/s10479-012-1227-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-012-1227-x