Abstract

Risk premia are related to price probability ratios or for continuous time pure jump processes the ratios of jump arrival rates under the pricing and physical measures. The variance gamma model is employed to synthesize densities with risk premia seen as the ratio of the three parameters. The premia are shown to be mean reverting, predictable, focused on crashes at shorter horizons and rallies at the longer horizon. Predicted premia may be used to adjust physical parameters to develop option prices based on time series data.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Option markets provide us with a rich source of data on the risk neutral or pricing distribution of asset returns. Time series data on returns may be employed to estimate the corresponding physical return distribution. It is also well recognized that the two are not the same. In fact the mean return under the pricing distribution must, by spot forward arbitrage, be the interest rate in the absence of intermediate incomes. On the other hand, under the physical distribution we get the mean rate of return on the asset. The latter generally exceeds the interest rate to reflect risk compensation. The two can be very different and Bollerslev and Todorov (2011) document the sharp differences in the probability of tail events under the two distributions. Bakshi et al. (2010) show that their ratio is generally U shaped.

The objective of this paper is to develop procedures enabling one to relate the two distributions with a view towards making it possible to go from one to the other. For this purpose we estimate both distributions in the same parameteric class and study the relationship between the respective parameters. We do this daily from January 2010 to January 2015, for 45 stocks in the top 50 stocks of the S&P 500 index. The analysis is carried out for each of seven return horizons from a month, and a quarter to one and a half years in steps of a quarter.

For the choice of a return distribution we recognize that many independent shocks affect returns over the large intervals of time being considered. Such an observation suggests the use of limit distributions of independent but possibly not identically distributed effects. The entire class of such limit distributions were characterized by Lévy (1937) and Khintchine (1938) as the self decomposable distributions that are a subclass of the infinitely divisible distributions. For a more recent proof of this proposition we cite Sato (1999). It is instructive to note that the Merton (1976) jump diffusion model is not self decomposable and is hence not a limit law. In fact [see Sato (1999)] a self decomposable law must have an arrival rate of jumps that when multiplied by the absolute value of the jump size, decreases with the jump size for positive jumps and increases with the jump size for negative jumps. In particular, the integral of jump arrival rates near zero is infinite and all limit laws have infinitely many jumps in any interval or are processes of infinite activity as described in Carr et al. (2002).

A particularly simple and tractable self decomposable law is the variance gamma distribution [Madan and Seneta (1990), Madan et al. (1998)]. The arrival rate of jumps when inflated by the absolute value of the jump size for this model is a negative exponential for positive jumps and an exponential for negative moves and hence the self decomposability. The distribution has three parameters and adequately fits risk neutral and physical returns. The original parameterization in Madan et al. (1998) was obtained as Brownian motion with drift \(\theta \) and volatility \( \sigma \) time changed by a gamma process with unit mean rate and variance rate \(\nu .\) Volatility is calibrated by \(\sigma ,\) while \(\theta \) provides access to skewness and \(\nu \) gives kurtosis. A high variance rate for the time change leads to many large and small time changes and hence the heavy tails and the peakedness associated with kurtosis.

The variance gamma was reparameterized in Carr et al. (2002) in terms of its Lévy measure with parameters C, G and M. The parameter C scales an overall jump arrival rate while G calibrates the exponential rate of increase for negative moves and M calibrates the rate of exponential decrease for positive moves. A small value for G coupled with a high value for M yields more negative moves and a left skewed distribution. We estimate all risk neutral and physical distributions in the variance gamma class with the (C, G, M) parameterization. The physical parameters are denoted C, G, M with the risk neutral counterparts being \( \widetilde{C},\) \(\widetilde{G}\) and \(\widetilde{M}.\)

In relating the two probabilities we employ the concept of risk premia. Risk is characterized by describing the probabilities with which different mutually exclusive and exhaustive sets of events occur. In addition to the probability of events, in developed financial markets, there are also prices of events possibly observed through the market price of securities paying unity on the occurence of the event and zero otherwise. These prices are also known as the Arrow Debreu prices of events [Arrow (1953), Debreu (1959)].

For any event, denoted by A, let p(A) be the event probability while q(A) is the event price in the forward market delivered at event resolution. The expected return of the security paying unity on event occurrence is given by

This expected return is positive when p(A) exceeds q(A) and negative otherwise. In general when events are hurtful to market participants the prices will exceed probabilities and rates of return are negative as people are willing to pay a premium to ensure against their occurrence. The structure of risk premia in markets is described by the ratios of price to probability and events have risk premia depending on whether q(A) exceeds p(A) or not. However, though there is an interpretation here in terms of expected rates of return on particular securities the fundamental entity is the ratio of price to probability that in continuous time will be transformed to the ratios of event arrival rates under the two measures. The latter is just a relativity of a description of the instantaneous risk with no direct connection to any particular expected rate of return. Risk premia are just price probability ratios.

In continuous time the probabilities of events like a jump in the price of an asset are proportional to the arrival rates for the different jump sizes. Risk premia are then given by the ratio of risk neutral arrival rates to their physical counterparts. Given that the relevant distributions vary with the investment horizon and the arrival rates of jumps vary with the jump sizes the risk premia to be extracted from a joint analysis of time series data and option prices vary jointly with jump size and horizon.

We note that holding a risky asset exposes the holder to instantaneous moves of different sizes in the price of an asset. By way of contrast however, if price paths are continuous with no jumps in asset prices then there are no instantaneous risks and both risks and rewards are only experienced over time. Rates of return are earned over periods of time. These rates of return are compensation for covariation risk between asset returns and the factors driving the ratio of price price to probability (Cochrane (2005)). The covariations also occur over time and risk premia at a point of time are given by the relevant covariation number, lacking both, the variation by jump size and the investment horizon.

For jump sizes x, and return horizon h there are in principle risk premia \(\lambda (x,h)\) measured by the ratio of arrival rates for jump sizes x as embedded in the ratio of risk neutral and physical arrival rates seen in the two densities for returns over the time horizon h. We employ our parsimonious parametric model for these arrival rates to construct just three risk premia at each horizon. We term these premia to be the level, up and down premia as given by the ratios

An added benefit of working with risk represented by jump arrival rate functions for different jump sizes is that risk premia are described in terms of relative arrival rates, risk neutral to physical, that describe the risk. We work purely with centered or driftless variates and given the well known difficulties of estimating drifts it is a benefit to describe risk premia directly in terms of the risk itself with no reference to drift. This occurs as pure jump processes experience risk at each instant via jump arrival rates and at the level of the instant there are no drifts to speak off. The theory of continuous processes removed instantaneous risk by assumption and was left with risk reward relations over time via drift and covariations.

The three risk premia are estimated daily for each of the 45 stocks and 6 maturities. We report on the predictability and mean reversion observed in the risk premia and note that one may transform physical to risk neutral densities on multiplying estimated physical parameters in the (C, G, M) format by the appropriate risk premia. The result allows for the construction of option prices from purely time series data and a judgement on three risk premia for which we provide a number of observations. Option prices may be viewed as exaggerated if the implied risk premia are way out of line with historical observations on such premia. Recognizing, nonetheless, that markets can stay exaggerated for long times.

We observe the risk premia to be mean reverting as seen univariately or in terms of a first order three dimensional vector autoregression. They also satisfy some degree of predictability. Downside premia fall with the return horizon while upside premia rise with the length of the return horizon. The longer horizon is thereby more focused on rallies while the short term is focused on crashes. The downside premium moves in opposite directions to the level and up side premium, though the level and upside premiums move positively with the downside premium.

The outline of the rest of the paper is as follows. Section 2 presents the details of the variance gamma model as it is employed in the analysis of this paper. Details for the risk neutral estimation are presented in Sect. 3. Section 4 takes up the estimation of the physical return distribution at arbitrary horizons. Section 5 presents aggregate results on the estimated risk premia. Predictability and mean reversion in risk premia are taken up in Sect. 6. Section 7 addresses the structure of dynamic responses in risk premia. Results on constructing option prices based on the physical return distribution parameters and predicted risk premia are presented in Sect. 8. Section 9 develops the equations for mean returns from those for the two densities. Section 10 relates these equations for mean returns to a more classical formulation like the Ross (1976), arbitrage pricing theory. Section 11 concludes.

2 The variance gamma model as a density synthesizer

The variance gamma model was introduced in the symmetric case in Madan and Seneta (1990) and generalized to allow for skewness in Madan et al. (1998). In this formulation it has three parameters \(\sigma ,\nu ,\theta \) and a variance gamma random variable X may be constructed from a standard normal variate Z and a gamma variate g with unit mean and variance \(\nu \) as

The characteristic function is given by

The density is infinitely divisible and all the components are variance gamma distributed. The Lévy density or arrival rates k(x) of jumps x is given by

The parameters C, G, M introduced in Carr et al. (2002) are related to \(\sigma ,\nu ,\theta \) by

The inverse map is given by

The density has a closed form in the (C, G, M) format presented in Carr and Madan (2014) and given by

where \(K_{\nu }(x)\) is the modified Bessel function.

We observe that as |x|k(x) is a negative exponential for positive x and an exponential for negative x the variance gamma law is self decomposable and thus is a limit law (Sato (1999)). In this regard we may note that as the negative exponential function is among the simpler decreasing positive functions defined on the half line the variance gamma law is a relatively simple example of a self decomposable law. It is therefore a limit law capable of calibrating the skewness and kurtosis of a distribution, beyond just the volatility. Given the observed variations in these entities we employ it as a return density synthesizer with parameters easily interpretable in terms of the embedded jump arrival rate function. One may further note that an exponential decay for arrival rates is necessary if one is to employ the model to describe log price relatives of continuously compounded returns, thereby requiring the existence of exponential moments.

3 Risk neutral densities at arbitrary maturities

The estimation of risk premia require both an estimation of the pricing density and the physical return density at each investment horizon. We wish to develop procedures permitting such estimation at all arbitrary horizons that are not necessarily restricted to traded option maturities. It is therefore useful to be able to calibrate option prices simultaneously across all traded maturities with models that will deliver risk neutral densities at all intermediate maturities as well. Lévy process models have this ability but unfortunately as noted in Carr et al. (2007) they are unable to fit option prices across the maturity dimension. This is because all Lévy process models by virtue of their identically and independently distributed increments have skewness and excess kurtosis falling like the reciprocal of the square root of maturity and maturity respectively. One may observe, model free, in market data that such decreases do not occur. These observations led Carr et al. (2007) to propose and investigate the Sato process associated with a self decomposable law at unit time. The marginal distributions for the Sato process are obtained on scaling the unit time distribution by a power of the time horizon variable. They found the scaling coefficient to be near a half. Sato (1991) showed the existence of an additive process with independent by time inhomogeneous increments consistent with these scaled marginal distributions. Carr et al. (2007) report on the calibration performance of a large number of Sato processes associated with a variety of different self decomposable laws at unit time. They also reported that the Sato process associated with the variance gamma law at unit time was among the better performing models. Here we estimate the risk neutral law across all strikes and maturities simultaneously using the model VGSSD or the Sato process associated with the variance gamma law at unit time. This is a four parameter model with parameters \(\sigma ,\nu ,\theta ,\gamma \) with the log price relative at horizon t, X(t) related to the unit time log price relative by

By the scaling property the distribution at all maturities is variance gamma with parameters \((\sigma t^{\gamma },\nu ,\theta t^{\gamma })\) where \( (\sigma ,\nu ,\theta )\) are the unit time parameters. We may then transform to (C, G, M) format at each maturity to get a variance gamma risk neutral density for each maturity.

The specific risk neutral stock price model for maturity t is given by

where r(t), q(t) are the continuously compounded interest rate and dividend yield for the maturity t and \(\omega (t)\) is the convexity correction to get the right forward. More exactly

The calibrations were done using the Fast Fourier Transform (FFT) technology introduced in Carr and Madan (1999).

4 Physical return densities at arbitrary horizons

One may employ data on daily returns to estimate a variety of models for the daily return distribution. But our interest is in the distribution of returns over longer horizons matching or between two traded option maturities. Non overlapping and relevant data at such long horizons is just not available. One possibility is to treat H days as H independent copies of a single day and to then form H successive convolutions to get to the H day distribution. However, as already noted, such a strategy leads to a fast reduction in skewness and excess kurtosis. Another alternative is to just scale the daily return distribution by a power of the horizon H. In this case skewness and excess kurtosis remain constant at any longer horizon.

Eberlein and Madan (2010) conducted a study of nonoverlapping 10 and 20 day returns to observe that both skewness and excess kurtosis fall with the return horizon, but not as fast they do for i.i.d. increments. They proposed a mixture model exploiting the characteristic decomposition of a self decomposable random variable. For every self decomposable random variable X and any constant \(c<1\) there exists an independent random variable denoted \( X^{(c)}\) such that

The principles of i.i.d. and scaling were combined by taking H independent copies of cX and adding them up and scaling \(X^{(c)}\) by a power of the horizon. This gave a model for the H day returns as

where \((cX)_{H}\) is the sum of H independent copies of cX or the Lé vy process cX taken at time H. The random variable \(X_{H}\) can easily be simulated and it has an easily derived characteristic function that may be used to build the density or the distribution function by Fourier inversion. Eberlein and Madan (2010) show that for \(c<1\) the speed at which skewness and excess kurtosis fall may be slowed down. They also estimate the parameters \(c,\gamma \) with a view to modeling 10 and 20 day target return distributions and show in this case that optimal median values for \( c,\gamma \) were 1 / 2 for both. Here we go to the longer horizon using the setting \(c=\gamma =1/2.\)

We come back to the variance gamma class at the longer horizon by fitting a variance gamma distribution to a sample drawn from the distribution of \( X_{H}.\) In this way we obtain physical variance gamma parameters for each return horizon.

In estimating the parameters of the variance gamma model for daily return data and then again for the simulated long horizon retrun data we follow Madan (2014) and employ digital moment estimation as a more robust approach employing bounded moments. We minimize the root mean square percentage error between the observed and theoretical moments. The theoretical tail probabilities of centered variance gamma variates on the left and the right are obtained on integrating with respect to the closed form for the density.

5 The risk premia

The data employed consisted of time series data on 45 stocks in the top 50 as on February 28 2015. The data covered 1349 days from January 4 2010 to March 5 2015. In addition we employed for each of the 45 stocks, data on the prices of all traded options each day with a moneyness range of \(33\,\%\) out of the money relative to the forward for maturities ranging from under a month to two and half years. Three risk premia are computed for each of 45 stocks, one each of 1349 days, at each of 6 maturities ranging from a quarter to a year and a half at steps of a quarter. The total number of cases for each of the three premia are \(364{,}230=45*1349*6\).

Risk neutral estimates for each maturity one each day and for each stock are obtained from the calibration of the Sato process based on the variance gamma law at unit time. The physical parameters for daily returns are obtained from 600 immediately prior returns. The density for the specific return horizon is obtained by combining shaving the self decomposable daily return by a half and running it as an i.i.d. process to the horizon coupled with scaling the independent component by the square root of the horizon. The long horizon return is then approximated using digital moment estimation by its own variance gamma law. The premia are given by the ratios of parameters in the (C, G, M) format.

5.1 Aggregate distributions

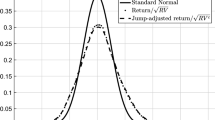

We first report the distribution of the three premia across names, days and maturities. Outliers defined as observations in the top and bottom qunitiles, and nans were replaced by zeros. Nonnumeric premia may arise when a parameter is estimated in the time series data at zero. This may occur as a consequence of a bad starting value. Instead of finding these values and redoing the estimation in these cases, we merely deleted the cases as we had sufficiently many cases where this did not occur. The proportion of nonzero premia in the three cases of level, down and up were 0.9554, 0.9130 and 0.9460 respectively. For the remaining cases we present in Fig. 1 the distributions on deleting the top and bottom quintiles.

5.2 Response of premia to the return horizon

We report here on the behavior of the three risk premia with respect to the return horizon. We regressed the three premia across names, days and maturities on a constant term and dummy variables for the five maturities exceeding a quarter. The correlation coefficients are low as expected but the t-statistics are significant.

The coefficients and t-statistics are as follows.

Coefficients and associated t-statistics | ||||||

|---|---|---|---|---|---|---|

Maturity | L | t-stat | D | t-stat | U | t-stat |

Constant | 0.8037 | 439.85 | 1.1644 | 2343.04 | 0.9166 | 1921.27 |

0.5 | \(-\)0.0307 | \(-\)11.87 | \(-\)0.0184 | \(-\)26.41 | 0.0266 | 41.23 |

0.75 | \(-\)0.0374 | \(-\)14.44 | \(-\)0.0287 | \(-\)41.25 | 0.0426 | 66.58 |

1.0 | \(-\)0.0347 | \(-\)13.36 | \(-\)0.0347 | \(-\)49.88 | 0.0545 | 85.46 |

1.25 | \(-\)0.0258 | \(-\)9.87 | \(-\)0.0439 | \(-\)62.99 | 0.0582 | 91.26 |

1.5 | \(-\)0.0132 | \(-\)5.05 | \(-\)0.0503 | \(-\)72.08 | 0.0610 | 95.83 |

We observe that the level and down premia fall with maturity while the up premium rises. The down premia fall consistently, the up premia rise consistently, while the level premia fall and then rise. This suggests that over the longer term the concern is with rallying markets while over the shorter term the concern is with market crashes. This premium structure is in line with the observation that over the longer term markets are expected to rise and hence sudden up moves are more critical and to be charged for, though in the interim one may get a rough ride and seek compensation for sudden down moves that are less of an issue over the longer horizon. The level premium aggregates across all move sizes and is less directional. It may be viewed as a charge for quadratic variation that is eventually expected to rise with the horizon. However, in the shorter term it may be charged for substantially at the lower end like a quarter with a slight downward adjustment at six and nine months before rising again.

5.3 Mean reversion in premia

For each of the 45 names and six maturities we performed a robust regression of the premia across the 1349 days on a constant term and its lagged value. The equation is

The equilibrium value is given by

and the rate of convergence to equilibrium is the coefficient b as in the absence of shocks

We present in Tables the quantiles across names for the convergence rates and equilibrium values by maturity for all three premia.

Level premia convergence rate quantiles | ||||||

|---|---|---|---|---|---|---|

Quantile | Maturity | |||||

.25 | .5 | .75 | 1 | 1.25 | 1.5 | |

5 | 0.4997 | 0.5092 | 0.4637 | 0.4769 | 0.5186 | 0.4119 |

10 | 0.7401 | 0.7236 | 0.6936 | 0.7206 | 0.6956 | 0.7149 |

25 | 0.8072 | 0.8053 | 0.8067 | 0.8044 | 0.8246 | 0.8173 |

50 | 0.9022 | 0.8942 | 0.8846 | 0.8632 | 0.8763 | 0.8708 |

75 | 0.9249 | 0.9214 | 0.9173 | 0.9139 | 0.9118 | 0.9171 |

90 | 0.9408 | 0.9444 | 0.9374 | 0.9339 | 0.9304 | 0.9279 |

95 | 0.9475 | 0.9487 | 0.9521 | 0.9501 | 0.9533 | 0.9474 |

Level premia equilibrium level quantiles | ||||||

|---|---|---|---|---|---|---|

Quantile | Maturity | |||||

.25 | .5 | .75 | 1 | 1.25 | 1.5 | |

5 | 0.2799 | 0.2451 | 0.2306 | 0.2320 | 0.2382 | 0.2093 |

10 | 0.3939 | 0.3700 | 0.3549 | 0.3475 | 0.3357 | 0.3346 |

25 | 0.5210 | 0.4810 | 0.4712 | 0.4667 | 0.4897 | 0.4903 |

50 | 0.7284 | 0.6957 | 0.6834 | 0.6973 | 0.7008 | 0.7498 |

75 | 0.8318 | 0.8228 | 0.8202 | 0.8297 | 0.8715 | 0.9185 |

90 | 1.0742 | 1.0189 | 1.0182 | 1.0519 | 1.2025 | 1.2932 |

95 | 1.1465 | 1.1078 | 1.1659 | 1.2233 | 1.2793 | 1.4147 |

Down premia convergence rate quantiles | ||||||

|---|---|---|---|---|---|---|

Quantile | Maturity | |||||

.25 | .5 | .75 | 1 | 1.25 | 1.5 | |

5 | \(-\)0.0014 | \(-\)0.0019 | \(-\)0.0013 | \(-\)0.0001 | \(-\)0.0015 | \(-\)0.0011 |

10 | \(-\)0.0014 | \(-\)0.0010 | 0 | 0 | 0 | \(-\)0.0001 |

25 | \(-\)0.0001 | 0.0003 | 0.0025 | 0.0072 | 0.0016 | 0.0028 |

50 | 0.0367 | 0.1257 | 0.1732 | 0.1288 | 0.2558 | 0.1126 |

75 | 0.7380 | 0.7024 | 0.7298 | 0.4623 | 0.7380 | 0.6061 |

90 | 0.8952 | 0.9021 | 0.9167 | 0.8165 | 0.9395 | 0.8877 |

95 | 0.9120 | 0.9357 | 0.9512 | 0.8912 | 0.9815 | 0.9352 |

Down premia equilibrium level quantiles | ||||||

|---|---|---|---|---|---|---|

Quantile | Maturity | |||||

.25 | .5 | .75 | 1 | 1.25 | 1.5 | |

5 | 0.7667 | 0.7495 | 0.7289 | 0.7694 | 0.7554 | 0.7639 |

10 | 1.0578 | 1.0556 | 1.0331 | 1.0531 | 1.0291 | 1.0365 |

25 | 1.0731 | 1.0732 | 1.0704 | 1.0700 | 1.0651 | 1.0596 |

50 | 1.1148 | 1.1123 | 1.1047 | 1.1039 | 1.0914 | 1.0842 |

75 | 1.1823 | 1.1651 | 1.1516 | 1.1490 | 1.1429 | 1.1316 |

90 | 1.2098 | 1.2054 | 1.1883 | 1.1776 | 1.1643 | 1.1442 |

95 | 1.2491 | 1.2184 | 1.2057 | 1.1878 | 1.1842 | 1.1632 |

Up premia convergence rate quantiles | ||||||

|---|---|---|---|---|---|---|

Quantile | Maturity | |||||

.25 | .5 | .75 | 1 | 1.25 | 1.5 | |

5 | 0.0017 | 0.0073 | 0.0078 | 0.0283 | 0.1388 | 0.1044 |

10 | 0.0132 | 0.0500 | 0.0569 | 0.0987 | 0.3208 | 0.3394 |

25 | 0.1032 | 0.2836 | 0.4288 | 0.4986 | 0.6031 | 0.7187 |

50 | 0.6372 | 0.8173 | 0.8369 | 0.8150 | 0.8499 | 0.8472 |

75 | 0.8561 | 0.8901 | 0.9099 | 0.8703 | 0.9139 | 0.9239 |

90 | 0.9208 | 0.9327 | 0.9425 | 0.9202 | 0.9566 | 0.9597 |

95 | 0.9528 | 0.9632 | 0.9718 | 0.9322 | 0.9719 | 0.9749 |

Up premia equilibrium level quantiles | ||||||

|---|---|---|---|---|---|---|

Quantile | Maturity | |||||

.25 | .5 | .75 | 1 | 1.25 | 1.5 | |

5 | 0.5718 | 0.6370 | 0.6628 | 0.6808 | 0.6806 | 0.6862 |

10 | 0.8046 | 0.8633 | 0.8945 | 0.9145 | 0.9097 | 0.9159 |

25 | 0.8177 | 0.8836 | 0.9069 | 0.9303 | 0.9296 | 0.9341 |

50 | 0.8635 | 0.9175 | 0.9396 | 0.9537 | 0.9541 | 0.9573 |

75 | 0.9129 | 0.9586 | 0.9719 | 0.9875 | 0.9887 | 0.9889 |

90 | 0.9887 | 1.0193 | 1.0276 | 1.0392 | 1.0268 | 1.0216 |

95 | 1.0262 | 1.0520 | 1.0673 | 1.0708 | 1.0612 | 1.0550 |

We observe, focusing attention on the rows related to the median that the level premium reverts relatively slowly but with a speed that increases with the horizon. The down premia are fast reverting while the up premia are intermediate but slow down with an increase in the return horizon. The equilibrium levels for the level premia is around 0.7, while it is near 1.1 for the down premium and 0.95 for the up premium.

The speed of convergence of down premia reinforces our earlier observation about short term rough rides being charged for. However, over the longer term it is quadratic variation and up moves that are the issue and the premia move slowly as they reflect long term considerations that must be allowed for and charged for in risk neutralization. The interquartile range for the equilibrium up premia contracts somewhat while it is maintained for the down and level premia. This may reflect a greater level of market confidence in the charges for up moves, while those for down moves and quadratic variation generally are dispersed. Testing hypotheses in these directions are a subject matter for future research.

6 Predictability and multivariate mean reversion of risk premia

This section reports on a more general analysis of risk premia predictability and their mean reversion properties. Specifically we treat the three premia as a vector in a first order vector auto regression driven by the level of the current physical arrival rates. The economic logic of the formulation is that premia are risk charges for exposure to unhedgeable surprise movements and hence they should respond dynamically to innovations in the physical reality as reflected by movements observed in the parameters for the physical distributions. If the resulting dynamics is explosive with no convergence then markets are in equilibrium possibly arbitrary in the activity of pricing risks. Efficient and competitive markets should reflect stable equilibria and dynamics for their pricing activities.

Let \(\pi _{t}\) denote the vector of the three premia at time t for a specific return horizon, and \(x_{t}\) the level of the contemporaneous physical parameters for the same return horizon. The vector autoregression is given by

There are seven coefficients to be estimated for each of three premia at each of seven return horizons for each of the 45 stocks. By way of predictability we report the root mean square of each regression. By way of multivariate mean reversion we report the three roots of the characteristic polynomial associated with matrix of lagged dependent variables. For some parsimony in reporting we report results just for the quarterly and annual horizon. With respect to predictability and mean reversion we then have six \( R^{2\prime }s\) and six roots, three each for each of two return horizons, for each stock. These are presented in two tables, one for the \(R^{2\prime }s \) (Table 1) and one for the roots (Table 2). We observe fairly high levels for the root mean square error especially for the Up and Down premia with slightly lower level for the level premia. The eigen values are all below unity indicating the consistent presence of mean reversion in the premia (Table 2).

With a view to understanding how the risk premia respond to each other we present the average \(t-statistics\) across all stocks at the quarterly return horizon. The results are similar at other horizons.

Average t-statistics | |||

|---|---|---|---|

Variable | Level | Down | Up |

Constant | 14.87 | 13.67 | 43.52 |

Level lagged | 25.03 | \(-\)6.19 | \(-\)22.08 |

Down lagged | 5.49 | 34.48 | 20.92 |

Up lagged | \(-\)6.31 | \(-\)2.99 | 84.67 |

C physical | \(-\)5.01 | \(-\)4.19 | \(-\)10.04 |

G physical | 0.40 | \(-\)3.11 | 7.92 |

M physical | \(-\)4.66 | \(-\)0.97 | \(-\)23.47 |

We observe that all premia react strongly and positively to their lagged values in what we know to be a mean reverting way. The level premium moves up with the down premium and down with the up premium. The down premium moves down with both the level premium and the up premium. The up premium moves down with the level premium but up with the down premium. One may say that the up premium has momentum with the down premium but the down premium moves opposite to the up premium. The level premium has momentum with the down premium but moves opposite to the up premium. The down premium moves opposite to both the other premia.

It is reasonable that up and down premia fall when the level premia rises as the letter provides across the board risk coverage. On the other hand when the down premium rises the dynamic response for both the level and up premia is to rise. This possibly reflects an interpretation of increased uncertainty across the board with the crash fear embedded in down premia. In contrast an increase in the up premium is probably more focused on a rally with consequent falls in the level and down premia.

The fact that premia respond dynamically to movements in the physical structure of return distributions addresses favorably the physics of finance or the econmic logic embedded in risk neutralization. The risk charges embodied in risk neutralization are by and large the insurance premia that markets must charge for risk exposures that cannot be hedged away by dynamic trading. For pure jump processes these exposures are always present and must be charged for. However, they are competitive charges determined by equilibrating markets and so reflect movements in real risk exposures that dissipate to equilibrium levels in the absence of shocks to the system. Hence the strong levels of reversion displayed in the eigenvalues of the associated dynamical systems. For eigenvalues at or below .9 the effects are essentially dissolved by a quarter.

7 Construction of option prices based on physical parameters and predicted premia

We may use the prediction equations for risk premia to risk neutralize an estimated physical law. Figure 2 presents such a construction for options on AAPL for January 26, 2015 for the maturity 0.97. We observe in this case that the downside puts are being overpriced in the market while the upside calls are underpriced. In this circumstance one would consider buying the upside calls and selling the downside puts.

Such an analysis could be conducted for each stock, each day, each maturity and each strike. The strikes could be represented by moneyness relative to the forward but the structure of maturities varies with the stocks involved and here we have interpolated premia from our prespecified maturities to the actual maturity for the stock involved on the specific day being considered. Our purpose in this section was just to illustrate one such construction. At this point we do not anticipate any statistical hypothesis to be tested nor have we designed a procedure appropriate for the test of such a specific hypothesis.

Alternatively, one might consider trading the under and over pricing along with the profitability of such a trade. However, it is not clear when such positions are to be unwound and given the wide spreads on out-of-the-money options, trading at mid quotes is in any case questionable.

Designing and implementing trading strategies around such procedures is an extensive exercise of its own that goes well beyond the objectives of this paper. The same may be said about the formulation, design and implementation of statistical hypothesis tests based on such procedures. We are merely taking a small step in the direction of linking physical and risk neutral densities via risk premia embedded by jump size and horizon.

8 Back to mean returns

We may develop the equation for mean returns on the stock directly in terms of the two densities. Suppose we have estimated the physical and risk risk neutral densities in the variance gamma class for horizon h by \(\widetilde{ p}(S), \widetilde{q}(S)\) respectively. Let X denote a variance gamma random variable with density in C, G, M format as

Denote the normalizing constant by

and the unnormalized density by

whereby

We may write

where

By definition of risk neutrality we must have in the absence of dividends for time horizon h that

Let the risk neutral variate X have density q(X) with physical density p(X). We may also write

Let the risk neutral parameters be \(C^{\prime },G^{\prime },M^{\prime }\) with physical counterparts C, G, M. The above equation yields

We now observe that

The equality (4) now reads

We may rewrite as

which yields that

We next observe that

This is the risk neutral expectation of \(\exp (x)\) which we define as \(\exp (-\omega ^{\prime }).\) Hence

It follows that

or that

In fact we may write for any physical density for X that

This will always yield

and hence that

We determine \(\omega ^{\prime }(h)\) directly from the option surface. If we let

we have that

or that

Now

or that

It follows that

We know that

So we get that

8.1 Sample computations of annualized mean returns

We present in Table 3 average values of mean returns computed for each stock and each return horizon across all the days for which premia were computed. The mean returns are computed as per equation (5) and they are then annualized for comparison across return horizons. No interest rate is subtracted.

We observe that the annualized mean returns fall with the return horizon. The mean returns are made up of compensation for risk embedded in risk premia for surprise moves. We have observed that level and down premia fall with the horizon while the up premium rises. The results here are consistent with the view that level and down premia dominate the construction of mean returns reflected in charges for quadratic variation and market crashes. The up premium is paid by those who are short and focused on market rallies and this is generally a less prominent side of the market for premia.

The mean returns are by and large positive but there are cases when they appear to be substantially negative, in particular, for CVX, ORCL and MA at all horizons. In general the risk neutral distribution is fitted quite well by models for the option price. The physical distribution was fitted on the assumption of independently and identically distributed returns. To the extent this assumption is called into question on actual data the physical parameters may be impacted by outliers leading to large physical convexity corrections and associated negative premia and mean returns.

9 Relation to the Ross arbitrage pricing theory

The focus of attention here is return on the asset over a horizon h and we begin by writing for any single stock price that

with

One may also define the h period return as

In the context of the Ross (1976) arbitrage pricing theory framework for h period returns we would reach the conclusion

for factor exposures \(\beta \) and market prices of factor risk \(\lambda .\) This structure assumes that

and the risk of u is not priced.

Suppose there is a joint physical density y(F, u) satisfying independence of F and u with

The physical density for R(h) is then

On the other hand we would have

where \(\widetilde{g}\) is the risk neutral distribution for F.

The physical expectation of F is zero but risk neutrally we have

or that

It follows that

or that

There are then horizon specific market prices of risk, mean rates of return and factor exposures with mean rates of return simultaneously given by the Ross (1976) APT and the difference in the risk neutral and physical convexity corrections for X. We just do not see the factor decomposition in the computation via convexity corrections. They are just different ways of arriving at the mean returns. It is a more complex task to formulate a factor model, its physical and risk neutral joint densities and their potential consistency with quoted option prices across numerous underlying assets.

10 Conclusion

Risk premia though classically seen in terms of expected excess returns are related to price probability ratios. For continuous time pure jump processes this reduces to the ratio of arrival rates of jump sizes under the pricing and the physical measure. There is in general a two dimensional continuum of risk premia depending on the return horizon and the size of jumps. Using the variance gamma model as a density synthesizer risk premia in option markets are reduced to the ratio of the three parameters evaluated under both measures for each return horizon. The premia are shown to be mean reverting, predictable, focused on crashes at shorter horizons and rallies at the longer horizon. Predicted premia may be used to adjust physical parameters to develop option prices based on time series data. One thus has access to mechanisms for risk neutralizing physical return distributions.

References

Arrow, K.J.: The role of securities in the optimal allocation of risk bearing. As translated and reprinted 1964. Rev Econ Stud 31, 91–96 (1953)

Bakshi, G., Madan, D.B., Panayotov, G.: Returns of claims on the upside and the viability of U shaped pricing kernels. J Financ Econ 97, 130–154 (2010)

Bollerslev, T., Todorov, V.: Tails, fears and risk premia. J Financ 66, 2165–2211 (2011)

Carr, P., Madan, D.B.: Joint Modeling of VIX and SPX options at a single and common maturity with risk management applications. IIE Trans 46, 1125–1131 (2014)

Carr, P., Madan, D.: Option valuation using the fast Fourier transform. J Comput Financ 2, 61–73 (1999)

Carr, P., Geman, H., Madan, D., Yor, M.: The fine structure of asset returns: an empirical investigation. J Bus 75(2), 305–332 (2002)

Carr, P., Geman, H., Madan, D.B., Yor, M.: Self-decomposability and option pricing. Math Financ 17, 31–57 (2007)

Cochrane, J.: Asset Pricing. Princeton University Press, Princeton (2005)

Debreu, G.: Theory of Value: An Axiomatic Analysis of Economic Equilibrium. Yale University Press, New Haven (1959)

Eberlein, E., Madan, D. B.: The distribution of returns at longer horizons. In Recent advances in financial engineering: proceedings of the KIER-TMU International workshop on financial engineering 2010, eds., Masaaki Kijima, Chiaki Hara, Yukio Muromachi, Hidetaka Nakaoka and Katsumasa Nishide, World Scientific, Singapore (2010)

Khintchine, A. Y.: Limit laws of sums of independent random variables. ONTI, Moscow, (Russian) (1938)

Lévy, P.: Théorie de l’Addition des Variables Alé atoires. Gauthier-Villars, Paris (1937)

Madan, D.B.: Estimating Parametric Models of Probability Distributions. Methodol Comput Appl Probab (2014). doi:10.1007/s11009-014-9409-4

Madan, D., Carr, P., Chang, E.: The variance gamma process and option pricing. Eur Finance Rev 2, 79–105 (1998)

Madan, D., Seneta, E.: The variance gamma (VG) model for share market returns. J Bus 63, 511–524 (1990)

Merton, R.C.: Option pricing when underlying returns are discontinuous. J Financ Econ 3, 125–144 (1976)

Ross, S.A.: The arbitrage theory of capital asset pricing. J Econ Theory 13, 341–360 (1976)

Sato, K.: Self similar processes with independent increments. Probab Theory Relat Fields 89, 285–300 (1991)

Sato, K.: Lévy processes and Infinitely Divisible Distributions. Cambridge Uinversity Press, Cambridge (1999)

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank J.J. Vicente Alvarez for his encouragement of this project. Thanks are also due to King Wang for numerous discussions on this subject matter. Errors remain my sole responsibility.

Rights and permissions

About this article

Cite this article

Madan, D.B. Risk premia in option markets. Ann Finance 12, 71–94 (2016). https://doi.org/10.1007/s10436-016-0273-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-016-0273-9