Abstract

Stochastic dividend discount models (Hurley and Johnson in Financ Anal J 50–54. http://www.jstor.org/stable/4479761, 1994, J Portf Manag 27–31. doi:10.3905/jpm.1998.409658, 1998; Yao in J Portf Manag 99–103. doi:10.3905/jpm.1997.409618, 1997) present expressions for the expected value of stock prices when future dividends, periodically received by shareholders as a reward for their risky investment, evolve through time in a Markovian setting by the means of a discretely distributed random rate of growth. Such result extends and makes more flexible the classical textbook formula for stock prices known as Gordon model. This paper introduces a closed-form expression for the variance of random stock prices, determines how their variance is affected by the variance of the dividend rate of growth, establishes that, in this framework, the dividend process is non-stationary, and perform a simple econometric analysis applying real market data.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

To determine the theoretical price of a common stock, equity valuation has always relied on the dividend discount model (DDM). Such model (Williams 1938; Gordon and Shapiro 1956) determines the market value of a stock by discounting, at a suitable risk-adjusted rate, all future dividends a stock will pay to its owner. In the basic setting dividends are assumed to grow at a constant rate and the valuation formula has closed-form expression if this rate, as well as the discount one, is deterministic and constant through time.

Hurley and Johnson (1994, 1998) enhance DDM by allowing dividends to be random, following either an arithmetic or a geometric discrete-time stochastic evolution. Yao (1997) further contributes to this extension considering a trinomial evolution for future dividends and allowing the firm to go bankrupt.

More recently, Hurley (2013) imposes the growth rate of the stochastic dividend to be a continuous random variable with any given density function.

Under a theoretical point of view, this approach can be encompassed into a Markovian setting, as proved by Ghezzi and Piccardi (2003). D’Amico (2013), applying a more general semi-Markov chain, further generalizes their result.

So far, stochastic DDM have presented expressions for the expected value of random stock prices. Needless to say, for proper investment decisions a measure of risk should be taken into consideration. Mean-variance analysis is a standard, well established and largely applied framework for dealing with financial decisions under uncertainty. In modern portfolio theory stocks can be partially ranked according to the mean-variance principle: out of two stocks, one is preferred to the other if the expected value of its random return is greater and, at the same time, the variance is smaller.

This suggests that, for a sharper look into stochastic DDM, an expression for the variance of random stock prices is necessary as well as useful.

This motivates the result presented in this article, where a closed-form formula for the variance of random stock prices when their future dividends evolve according to a discrete stochastic process, is found.

The paper is organized as follows: Sect. 2 summarizes the previous results presented in existing literature while Sect. 3 carries a closed-form expression for the variance of stock prices. Section 4 is devoted to an econometric analysis of the stochastic DDM applied to real market data while Sect. 5 concludes.

2 A dividend model for stock pricing

In the deterministic setting, DDM allows to derive a closed-form expression for the price of a stock if the following hypotheses hold:

-

(a)

dividends per share evolve through time at the constant geometric rate \(g>-1\). This means that \(d_{j+1}=d_j \left( 1+g\right) \), being \(d_j\) the dividends per share at time \(j\). It also follows that \(d_j=d_0\left( 1+g\right) ^{j}, j = 1, 2, \ldots \), where \(d_0\) is the actual dividend;

-

(b)

companies are not subject to default; they will continue paying dividends forever, and

-

(c)

the discount rate \(k\), i.e. the return a rational investor requires to hold the stock, is constant and such that \(k>g\).

The market value at time \(0\) of the stock is

Hurley and Johnson (1998) propose an interesting extension to DDM assuming that the dividends’ growth rate is a discrete random variable with \(n\) possible outcomes

where \(-1<g_{1}< \cdots <g_n, q_{s}=P\left[ \tilde{g}=g_{s}\right] >0, s=1,\ldots , n\), and \(\sum _{s=1}^{n}q_{s}=1\). Given the current dividend per share \(d_0\), future dividends at time \(j, \tilde{d}_{j}\), are random variables themselves and follow the recursive condition \(\tilde{d}_{j+1}=\tilde{d}_{j} \left( 1+\tilde{g}\right) \).

The random price of the stock is, then, the sum of an infinite sequence of discounted random dividends

If hypotheses (b) and (c) above hold, Hurley and Johnson (1998) find that the expected value of \(\tilde{P}_{0}\) is

as long as \(k>E[\tilde{g}]\), being \(E[\tilde{g}] = \sum _{s=1}^{n}g_{s}q_{s}\) the expected value of \(\tilde{g}\).

It is worth noting that, in (3), the expected stock price depends only on \(E[\tilde{g}]\). No other moments of \(\tilde{g}\) affect \(E[\tilde{P}_0]\) so that, in particular, the variance of \(\tilde{g}\) has no effect on \(E[\tilde{P}_0]\). In other words, any choice of \(\tilde{g}\) with a given expected value will return, cœteris paribus, the same expected stock price, regardless of the distribution of \(\tilde{g}\).

3 Variance of stock prices

The result we present in this section is twofold: we obtain a closed-form expression for the variance of a random stock price \(Var[\tilde{P}_0]\) and we explicitly show how the variance of the random rate of growth and the expected value of the stock price affect its variance.

Recalling (2), the variance of \(\tilde{P}_{0}\) is

where the covariance between the stochastic dividend \(\tilde{d}_{j}\) at time \(j\) and the stochastic dividend \(\tilde{d}_{p}\) at time \(p\) comes from the standard expression

Determining \(E\left[ \tilde{d}_{j}\cdot \tilde{d}_{p}\right] \) requires the joint distribution of \(\tilde{d}_{j}\) and \(\tilde{d}_{p}\).

Assuming \(\tilde{g}\) is distributed as in (1), let

denote the possible outcomes of random dividend in \(j\) when it has grown, in \(j\) steps, \(s_{t}, 0 \le s_t \le j\) times at rate \(g_{t}, t=1, \ldots , n\) with \(s_{1} + \cdots + s_{n}=j\). It results that the probability that these outcomes occur is

where \(\left( {\begin{array}{c}j\\ s_{1}, \ldots , s_{n}\end{array}}\right) =\frac{j!}{s_{1}!\ldots s_{n}!}\) is the multinomial coefficient. The expected value of the random dividend in \(j\) isFootnote 1

being \(A=\left\{ a_{1}+\cdots +a_{n}=j\right\} \). If \(r_{t}\ge 0\) is the number of times dividend \(\tilde{d}_{p}\) has grown at rate \(g_{t}, t=1,\ldots ,n\), in \(p\ge j\) steps with \(r_{1}+\cdots +r_{n}=p\), to determine joint probabilities

it is firstly required to find conditional probability

To do this it is necessary to introduce auxiliary variables \(z_{t}\ge 0, t=1, \ldots , n\), that denote the number of times the random dividend grows at rate \(g_{t}\) from step \(j+1\) to step \(p\). The above probabilities can be strictly positive only if

-

(C1)

\(0 \le z_{t} \le p-j, t=1,..,n\),

-

(C2)

\(s_{t} + z_{t} \le r_{t}, t=1,..,n\), and

-

(C3)

\(z_{1}+\cdots +z_{n}=p-j\).

In all other cases, given \(\tilde{d}_{j}=d_{j}\left( s_{1},\ldots ,s_{n}\right) , \tilde{d}_{p}=d_{p}\left( r_{1},\ldots ,r_{n}\right) \) is an impossible event.

To justify condition (C1), it is sufficient to think that the random dividend can grow at the same rate \(g_t\) at most \(p-j\) times from step \(j+1\) to step \(p\). (C2) is required as dividend cannot overall grow at rate \(g_{t}\) more than \(r_{t}\) times in \(p\) steps. Finally, (C3) stems from the fact that from \(j+1\) to \(p\) random dividend grows, at some rate \(g_t\), exactly \(p-j\) times.

This being said, it is easy to see that the required conditional probability follows a multinomial distribution; this is so because once some dividend level is reached in \(j\), the subsequent ones will evolve at each step according again to \(\tilde{g}\). This allows to write

so that, recalling (4), it is possible to express the joint probability

The expression for the expected value of the product between \(\tilde{d}_{p}\) and \(\tilde{d}_{j}\) is (Appendix 1)

Recalling (5), the covariance between random dividends \(\tilde{d}_{j}\) and \(\tilde{d}_{p}\) is

so that the variance of random dividend \(\tilde{d}_{j}\) can be expressed as

Eventually, the covariance can be written in a more compact form as follows:

It is straightforward to see that all covariances between random dividends are strictly positive as, being \(g_t > -1, t=1, \ldots , n, 1 + E[\tilde{g}] > 0\).

An interesting feature to stress is that the dividends process, as defined here, is non-stationary. In fact, covariance between \(\tilde{d}_{j}\) and \(\tilde{d}_{p}\) depends not only on \(p-j\), the time number of time steps between the two dividends, but also explicitly on \(j\).

Further, correlation between \(\tilde{d}_{j}\) and \(\tilde{d}_{p}\) is

being \(\sigma \left[ \tilde{d}_j\right] \) the standard deviation of \(\tilde{d}_j\).

Finally (Appendix 2), the variance of \(\tilde{P}_{0}\)

is positive and finite when \(k>\dfrac{E\left[ \tilde{g}\right] +E\left[ \tilde{g}^{2}\right] }{1+E[\tilde{g}] }\). Appendix 3 shows that this condition encompasses inequality \(k>E[\tilde{g}]\), required for the convergence of (3). This means that when

the random stock price \(\tilde{P}_0\) has a positive expected value but no acceptable value for its variance. Formula (7) clearly expresses how the expected stock price and the variance of the rate of growth influence the variance of \(\tilde{P}_{0}\). As can be expected, the larger \(\text {Var}[\tilde{g}]\), the larger \(\text {Var}[\tilde{P}_0]\). Formula (7) also shows a linear link between \(\text {Var}[\tilde{P}_0]\) and \(E^2[\tilde{P}_0]\).

To conclude this section, we present a simple example. Assume that random future dividends of two stocks with the same current dividends per share \(d_0 = 2\) and discount rate \(k=0.05\) have the following binomial random rates of growth

The expected values of \(\tilde{g}_{1}\) and \(\tilde{g}_{2}\) are the same: \(E\left[ \tilde{g}_{1}\right] = E\left[ \tilde{g}_2\right] = 0.01\) so that the expected prices of the two stocks turn out being the same as, from (3),

Now, \(E\left[ \tilde{g}^2_{1}\right] = (-0.02)^2 \cdot 0.5 + 0.04^2 \cdot 0.5 = 0.001, E\left[ \tilde{g}^2_{2}\right] = (-0.08)^2 \cdot 0.5 + 0.1^2 \cdot 0.5 = 0.0082, Var\left[ \tilde{g}_{1}\right] = 0.001 - 0.01^2 = 0.0009\) and \(Var\left[ \tilde{g}_{2}\right] = 0.0082 - 0.01^2 = 0.0081\), nine times greater then \(Var\left[ \tilde{g}_{1}\right] \).

From (7) the two variances are:

and

where the latter is eleven times larger then the first.

4 An econometric application

In this section we perform an econometric analysis whose aim is to evaluate the relevance of the formula for the variance of stock prices when applied to real data. We exploit stock market data from the datasetFootnote 2 maintained by Prof. Robert J. Shiller, and consisting of S&P 500 index monthly stock prices, dividends and earnings starting January 1871. The 10-year Treasury constant maturity rate is also available in the dataset. The time series of dividends we analyze covers the period from December 1993 to December 2013. As monthly dividends are computed from quarterly data by linear interpolation, to avoid mis-specification we decide to consider quarterly data, so that we end up with \(T=80\) observations.

The objective is to provide an example of how the variance of stock price, determined by the model, changes depending on the definition of the random variable \(\tilde{g}\) that describes the behavior of the dividend growth rate. For sake of simplicity, we consider the binomial case: \(\tilde{g}\) has two outcomes. The analysis could be easily generalized into the multinomial case.

Our analysis develops as follows:

-

we compute the observed quarterly dividend growth rate for each period \(t=1, \ldots , 80\) as \(g_t = \log d_t - \log d_{t-1}\), where \(d_t\) is the observed dividend value at time \(t\). Data are summarized in Table 1;

-

for each threshold value \(a_{i} \in A\), we define as a “success” the case in which the observed growth rate \(g_t\) is less or equal then \(a_i\). Let \(\#a_i\) be the variable that counts the number of successes. We then estimate, by maximum likelihood, the probability of having a “success” as the frequency \(q_i = \frac{\#a_i}{T}\). This is done because the empirical frequency \(q_i\) is the maximum likelihood estimator of the probability in a binomial distribution. In other words, we define a dichotomic event (i.e. the growth rate is either greater or less than \(a_i\)) that allows to apply the binomial distribution to the unknown dynamics of \(\tilde{g}_{t}\). We also define \(A\) as the set containing the following thresholds:

$$\begin{aligned} A\!=\!\left\{ -0.05, -0.04, -0.03, -0.02, -0.01, 0, 0.01, 0.015, 0.02, 0.03, 0.04, 0.05 \right\} \end{aligned}$$ -

for each \(i=1,\ldots ,12\) we apply (3) taking as discount rate the rate obtained adding to the average yearly long-term interest rate in the analyzed period, \(0.0462\), an ad-hoc spread equal to \(0.02\) so that the yearly discount rate turns out being \(k=0.0662\). The initial dividend is \(d_0 = 12.58\). The random dividends growth rate is defined as:

-

if \(0<\#a_i<T\)

$$\begin{aligned} \tilde{g}_i = \left\{ \begin{array}{l} g_{1i} = \frac{\displaystyle \sum \nolimits _{t=1}^{T}g_t I_{\left\{ g_t \leqslant a_i \right\} }}{\#a_i} \quad \text {with probability}\quad q_{1i} = \frac{\#a_i}{T} \\ g_{2i} = \frac{\displaystyle \sum \nolimits _{t=1}^{T}g_t I_{\left\{ g_t > a_i \right\} }}{T-\#a_i} \quad \text {with probability} \quad q_{2i} = \frac{T - \#a_i}{T} \end{array} \right. \end{aligned}$$ -

if \(\#a_i = 0\),

$$\begin{aligned} g_{2i} = \frac{\displaystyle \sum \nolimits _{t=1}^{T}g_t}{T} \quad \text {with probability} \quad q_{2i} = 1; \end{aligned}$$ -

if \(\#a_i = T\),

$$\begin{aligned} g_{1i} = \frac{\displaystyle \sum \nolimits _{t=1}^{T}g_t}{T} \quad \text {with probability} \quad q_{1i} = 1. \end{aligned}$$

It results that, for all \(a_i\),

$$\begin{aligned} E\left[ \tilde{g}_i\right]&= \frac{\displaystyle \sum \nolimits _{t=1}^{T} g_t I_{\left\{ g_t \leqslant a_i \right\} }}{\#a_i} \cdot \frac{\#a_i}{T} + \frac{\displaystyle \sum \nolimits _{t=1}^{T}g_t I_{\left\{ g_t > a_i \right\} }}{T-\#a_i} \cdot \frac{T - \#a_i}{T} \\&= \frac{\displaystyle \sum \nolimits _{t=1}^{T}g_t I_{\left\{ g_t \leqslant a_i \right\} } + \displaystyle \sum \nolimits _{t=1}^{T} g_t I_{\left\{ g_t > a_i \right\} }}{T} = \frac{\displaystyle \sum \nolimits _{t=1}^{T}g_t}{T}. \end{aligned}$$ -

-

we finally compute, exploiting (7), \(\text {Var}[\tilde{P}_{0}]\) for each \(a_i \in A\).

With regards to the data, as

the expected stock price is

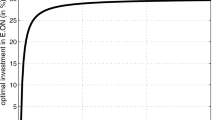

Computed variances are shown in Table 2. For each threshold \(a_{i}\) (columns 1 and 4), the frequency \(q_i\) that the growth rate is smaller than \(a_i\) (columns 2 and 5) and the standard deviation (columns 3 and 6) are reported.

Further, Fig. 1 depicts graphically the behavior of the standard deviation.

Some comments on the results are due. The standard deviation reaches a (rather flat) maximum around \(a = -0.01\) and remains relatively constant for smaller threshold values. As \(a\) grows, though, standard deviation decreases rapidly. It turns out that the behavior of the standard deviation is not symmetric with respect to the threshold’s absolute value. It is well known that the largest variance for a binomial random variable occurs when the probability of a success is \(0.5\). Our result shows that the largest variance is obtained when threshold \(a_i\) is chosen close to \(0\). This is indeed the case in which the a priori knowledge on the rate of growth of dividends is weak so that the two possible outcomes for \(\tilde{g}\) has to be trivially divided into ‘positive’ and ‘negative’.

5 Conclusions

In this article we have presented a closed-form expression for the variance of the price of a stock whose dividends evolve stochastically, according to a discrete-time multinomial scheme.

Such formula has to be intended as a necessary companion for the expected price of the stock; these two values should be used together to determine the convenience in buying, holding, or selling a stock, or to perform stock picking exploiting a mean-variance framework.

Recently, a lot of research has been focused on the so-called ‘Minimum Variance’ portfolios that carry some interesting features and, as pinpointed by Coqueret (2014), are not affected by estimation errors. If covariances between random stock prices were known, an optimal risk-minimizing portfolio, according to modern portfolio theory, could be derived in the DDM setting. To do this joint probabilities of random rates of growth of different stocks have to be derived.

As a final remark, it is very well known that variance is not a coherent risk measure, in the sense introduced by Artzner et al. (1999). Recently, Guégan and Tarrant (2012) show that as many as five risk measures are needed to have a full picture of complex risk structures. Using only variance in risk management and portfolio analysis has then to be cautious. Stochastic dividend discount models, determining explicitly the random behavior of all future dividends, are a well grounded stepping-stone for computing a coherent risk measure of a stock price, as, for instance, its expected shortfall.

The goals of determining risk measures for stock prices determined using a stochastic DDM and of performing a full portfolio analysis of two or more stocks combined together seem promising fields and are left for subsequent research.

Notes

\(\mathbf {1}_A\) is the indicator function. It is equal to \(1\) if event \(A\) is true and \(0\) otherwise.

References

Artzner, P., Delbaen, F., Eber, J.M., Heath, D.: Coherent measures of risk. Math Finance 9(3), 203–228 (1999). doi:10.1111/1467-9965.00068

Coqueret, G.: Diversified minimum-variance portfolios. Ann Finance (2014). doi:10.1007/s10436-014-0253-x

D’Amico, G.: A semi-Markov approach to the stock valuation problem. Ann Finance 9(4), 589–610 (2013). doi:10.1007/s10436-012-0206-1

Ghezzi, L.L., Piccardi, C.: Stock valuation along a Markov chain. Appl Math Comput 141, 385–393 (2003). doi:10.1016/S0096-3003(02)00263-1

Gordon, M.J., Shapiro, E.: Capital equipment analysis: the required rate of profit. Manag Sci 3, 102–110 (1956). doi:10.1287/mnsc.3.1.102

Guégan, D., Tarrant, W.: On the necessity of five risk measures. Ann Finance 8(4), 533–552 (2012). doi:10.1007/s10436-012-0205-2

Hurley, W.J.: Calculating first moments and confidence intervals for generalized stochastic dividend discount models. J Math Finance 3, 275–279 (2013). doi:10.4236/jmf.2013.32027

Hurley, W.J., Johnson, L.D.: A realistic dividend valuation model. Financ Anal J 50–54 (1994). http://www.jstor.org/stable/4479761

Hurley, W.J., Johnson, L.D.: Generalized Markov dividend discount model. J Portf Manag 27–31 (1998). doi:10.3905/jpm.1998.409658

Williams, J.B.: The Theory of Investment Value. Cambridge: Harvard University Press (1938)

Yao, Y.: A trinomial dividend valuation model. J Portf Manag 99–103 (1997). doi:10.3905/jpm.1997.409618

Acknowledgments

The authors would like to thank an anonymous referee for the useful comments to a previous version of this article.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix 1

Let conditions (C1), (C2) and (C3) hold. The inner sums in (6) return

where \(B=\left\{ z_1-s_1+\cdots +z_n-s_n = p-j\right\} \).

Letting, instead, \(C=\left\{ s_1+\cdots +s_n = j\right\} \), the outer sums become

Appendix 2

Recalling that, when \(-1<y<1, \sum _{u=1}^{+\infty } y^u = \frac{y}{1-y}\), the variance of \(\tilde{P}_{0}\), if \(E[\tilde{g}] < k\), is obtained as follows

Summing up the two fractions into brackets results a fraction whose numerator can be written as \(Var\left[ \tilde{g}\right] \left( 1+k\right) \) so that

Consider the first parenthesis in the denominator of the expression above. By summing and subtracting \(E^2[\tilde{g}]\) one gets

This means that

Finally, recalling once again (3), the variance can be expressed as

Appendix 3

From (8), for the convergence and positiveness of \(Var\left[ \tilde{P}_{0}\right] \) both

and \(k-E\left[ \tilde{g}\right] \) must be strictly positive. This is the case if

Inequality

is always true as, being equivalent to \(E\left[ \tilde{g}\right] +E\left[ \tilde{g}^{2}\right] >E\left[ \tilde{g}\right] +E^{2}\left[ \tilde{g}\right] \), it boils down to \(E\left[ \tilde{g}^{2}\right] -E^{2}[\tilde{g}] =Var\left[ \tilde{g}\right] > 0.\)

This implies that \(Var\left[ \tilde{P}_{0}\right] \) returns positive and finite values as long as

Rights and permissions

About this article

Cite this article

Agosto, A., Moretto, E. Variance matters (in stochastic dividend discount models). Ann Finance 11, 283–295 (2015). https://doi.org/10.1007/s10436-014-0257-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10436-014-0257-6

Keywords

- Equity valuation

- Stochastic dividend discount models

- Non-stationarity of stochastic dividend processes