Abstract

Models dealing with cross-border acquisitions versus greenfield investment usually assume that the entry of a foreign firm into a market has effects on the outputs of all domestic firms in that market, but exit or entry of local firms is not considered. The purpose of this paper is to re-examine the acquisition versus greenfield versus exporting question under fixed versus free entry assumptions for local firms. Our finding is that greenfield entry and exporting options are more attractive relative to acquisition when the local market structure adjusts to foreign entry through local entry or exit than when it is fixed. With respect to welfare in the host economy, existing theory models and policy discussions maintain that the effects of greenfield versus acquisition entry differ substantially. We show that under free entry and exit, there is no difference between the two for consumer surplus, but acquisition improves welfare a little through rent extraction by the local acquired firm. Thus the existing conventional wisdom may be leading to inappropriate policy choices by host governments.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

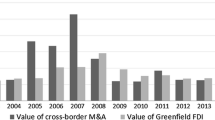

Analyses of cross-border acquisitions versus greenfield investments are motivated by the relatively large volume of mergers and acquisitions (M&A) in total world flows of foreign direct investment (FDI). Even in developing countries, where we might expect entry of foreign firms by greenfield investments to dominate, about one-third of FDI inflows were by M&A by the late 1990s. For the world as a whole, the value of cross M&A activity was about four-fifths of total FDI flows (World Investment Report 2000). Thus international trade and finance economists have been keen to understand the factors driving the choice of entry mode by foreign multinational firms. There have been a fair number of papers written about cross-border acquisitions versus greenfield investments, and some include a third option for a foreign firm such as exporting. These models vary considerably in their structure and assumptions, presumably largely because the modelers have different underlying questions in mind.

Our approach to this question comes indirectly from what is known as the strategic-trade-policy literature, a largely normative literature that considered the effects of trade and industrial policy in an environment of increasing returns to scale and imperfect competition. One thing that turned out to be crucial in determining the sign as well as the magnitude of optimal policies is whether or not there is free entry and exit of firms in response to the policy (Venables 1985; Horstmann and Markusen 1986; Markusen and Venables 1988).

In our reading of the literature on greenfield versus acquisitions in the international context, we have not seen a model which allows for the entry or exit of domestic firms (other than the target of course) in response to the entry of a foreign multinational into the country. Footnote 1 This is a concern both because of the big difference between fixed and free-entry approaches in the strategic-trade-policy literature just mentioned, and because some of the policy literature take a very strong position based on the fixed-firm case. Here is a quote from the World Investment Report 2000 Cross Border Mergers and Acquisitions and Development (2000, pp. xxvi–xxvii).

Under normal circumstances (i.e., in the absence of crises or systemic changes) and especially when cross-border M&As and greenfield investments are real alternatives, greenfield FDI is more useful to developing countries than cross-border M&As... And when M&As involve competing firms, there are, of course, the possible negative impacts on market concentration and competition, which can persist beyond the entry phase The most important policy instrument, however, is competition policy. The principal reason is that M&As can pose threats to competition, both at the time of entry and subsequently.

In our model with free entry and exit (but similar to traditional models in other dimensions), we show that this view is incorrect. Aggregate domestic output and price is ex post the same under either greenfield or acquisition implying that consumer surplus is the same. Even more, we show that an acquisition may improve domestic welfare because part of the acquisition rents accrue to the local seller. A greenfield investment, however, will not change welfare at all in our model.Footnote 2 Thus policies favoring greenfield as suggested by the World Investment Report, may be distortionary and inappropriate.

Perhaps the closest discussion to our model is a short section in Navaretti and Venables (2004, chapter 3, written by Venables). They use a standard large-group monopolistic competition model and inquire as to the effect of the entry of a foreign multinational, either by switching from exports or by entirely new supply.Footnote 3 In either case, the entry can be by greenfield or by M&A, though there is no definition and no discussion about the acquisition process or price. Assume that the foreign firm is “new”, not a switcher from exporting. A central case assumes that the foreign multinational produces with the same marginal cost as local firms. Thus if the foreign firm enters by “greenfield” it will simply displace one domestic firm in the monopolistic-competition equilibrium, and if it enters by “M&A” it takes over one firm which leaves the profits of the remaining firms at zero. There is no observational difference between greenfield and M&A: in either case, ex post there is one foreign firm and (n − 1) domestic firms. A similar equivalence occurs if entry is switching from exports. They do not solve for an equilibrium under the assumption of a fixed number of firms and thus do not compare it to the free entry/exit case which is the principal focus of our paper.Footnote 4

The purpose of this paper is to provide a model which endogenizes market entry of local firms and in which firms interact strategically.Footnote 5 We build a partial-equilibrium model of a single industry in a single host country, with an outside foreign firm that is initially exporting to the country.Footnote 6 There are zero profits earned by multiple host-country firms initially. Then the multinational is allowed to directly enter either by making a greenfield investment in a new plant, or by acquiring one local firm. This is analyzed both under the assumption that the number of other host-country firms is held fixed, or that the number adjusts such that zero-profits are maintained. Acquisition is modelled as a Nash bargaining game between the multinational and one firm, but we include the special case where all of the bargaining weight goes to the multinational (who makes take-it-or-leave-it offers) so that the multinational firm captures all of the surplus. The multinational’s outside option is exporting and the local firm’s outside option is then (continued) zero profits.

Entry of the foreign firm (switching from exporting) by acquisition has the effect of driving up the product price in the host country under the fixed market structure (import supply disappears), but drives down the price when entering via greenfield (there is one more firm, with a marginal cost less than under exporting). Allowing the number of (zero-profit) domestic firms to adjust means that there will be entry under acquisition but exit under greenfield. Relative to the fixed-market structure, free entry and exit make acquisition less attractive relative to either greenfield or to exporting.

The effects of the alternative market-structure assumptions on the profits of the entering multinational are interesting. Use the fixed assumption as a benchmark and now introduce free entry and exit. If the firm chose greenfield under the former or switches from exporting to greenfield, its profits will increase with entry, whereas if it initially chose acquisition the situation is a bit more complex. If the multinational continues to choose acquisition or switches to exporting it must be worse off. But if it switches to greenfield, it can be either better or worse off: free entry reduces the profits from acquisition but increases the profits from greenfield. If that latter profit level “jumps over” acquisition profits sufficiently that greenfield profits are now higher than the initial acquisition profits, then the multinational is better off.

The remainder of the paper is organized as follows. Section 2 sets up the general model and develops an important invariance result for an endogenous market structure. Section 3 specifies the model further and discusses the foreign entry option both for a fixed and an endogenous market structure. Section 4 presents the implications of parameter changes, and Section 5 concludes.

2 The model

We consider a single country, labeled Home. Within this country, local firms do not export to other markets but serve their local market only. There is free market entry, and local firms have to carry a fixed cost of size F upon entry. After they have entered the market, they produce with a constant marginal cost c. Let n denote the number of local firms. Additionally, there is a foreign firm denoted by the subscript 0. This firm is a multinational firm which is already active in other markets and does not have to carry any entry cost. We will not yet discuss the type of activity carried out by this firm, i.e., whether this firm will serve the market through an acquisition, a greenfield investment or by exports, but we will rather consider how a change in the foreign firm’s activity level will affect the Home market.

Preferences of consumers in Home can be represented by a quasi-linear utility function which gives rise to an inverse demand function p(z) where z denotes aggregate production for the Home market. Let x i denote the individual output of a local firm, and x 0 is the output of the foreign firm. As common in Cournot models of this type, we assume strategic substitutability in the sense of Bulow et al. (1985) such that p′(z) + p′′(z)x < 0, ∀ x ∈ ]0, z]. Aggregate production is determined by

The local firm behavior is given by the first-order condition

Ignoring the integer constraint allows us to determine the number of local firms entering the market by the zero profit condition

We now consider how any change in the activity of the multinational firm will change individual production levels, aggregate production and market entry. For this purpose, we treat x 0 as an exogenous variable and consider how x i , z and n change with x 0. Total differentiation yields

and

Equation (5) proves our first proposition.

Proposition 1

If the market structure is endogenous, any change in the foreign firm’s output level

-

1. does not change aggregate production,

-

2. does not change the size of active local firms,

-

3. but implies only market entry or exit.

Proposition 1 is a very strong result which demonstrates that the local industry will adjust to multinational activities only by market entry or market exit. Furthermore, consumers are not affected at all because aggregate supply stays constant. Proposition 1 is a very general result which holds true for any multinational activities, including those we will consider in the next section.Footnote 7 Lemma 1 summarizes this implication for the different modes of multinational activities.

Lemma 1

If the market structure is endogenous, any acquisition, any greenfield investment or any export will not change aggregate production and individual production levels of local firms but only the number of active local firms.

This result is not inconsistent with empirical findings. The increase in x 0 which we will endogenize in the following section may originate from trade and/or investment liberalization.Footnote 8 For example, Gu et al. (2003) show that the Canada-U.S. Free Trade Agreement had no significant effect on Canadian firm size but on firm turnover as measured by the exit rate of manufacturing firms (see also Head and Ries 1999). Hence, tariff reductions and an increase in import competition did not change the scale of active firms, but made some firms leave the market, as predicted by Proposition 1.

3 Acquisitions and greenfield investment with endogenous market structure

In this section, we employ a more specific model in order to discuss the role of endogenous market structures on the type of market entry. Demand in Home is given by p = a − bX, and c* denotes the marginal cost of the foreign firm. In the case of exports, the foreign firm has to carry a trade cost of size t per unit of exports. If c* + t > c, the market share of an exporting firm will be lower than that of a local firm. Furthermore, c* < c guarantees that the foreign firm’s marginal costs are lower and it will have a higher market share if it enters the market by a greenfield investment. For future convenience, we introduce γ ≡ c* + t − c, which is the difference in marginal costs between an exporting and a local firm (and which can be negative). We assume that \(\gamma < \sqrt{b F}\) which guarantees that at least exports are worthwhile.Footnote 9 Furthermore, we assume that \(a -c > \sqrt{b F}\); this condition guarantees that the market is sufficiently profitable even if only local firms are active. The term \(\pi (\Uppi)\) will denote the profit of the local (foreign) firm.

The setup of our analysis is as follows. Prior to possible FDI, the foreign firm could only enter the domestic market via exports. Potentially active local firms correctly anticipate the behavior of the foreign firm and decide to enter or not to enter the market. Correctly anticipating output behavior, local firms enter the domestic market until the profit of each local firm is equal to zero. We label this scenario as the trade regime and use it as the benchmark for our analysis. Each firm maximizes its profits which gives rise to the first-order conditions of a local firm and an export firm, respectively:

x (x*) denotes the output of a local (export) firm. Since local firms are symmetric, aggregate output X is equal to n x + x*. Using symmetry and solving for outputs yields the maximized profits

The trade regime is denoted by the subscript T. Local firms will enter the market until their profits are equal to zero which allows us to determine the equilibrium number of local firms:

The foreign firm correctly anticipates the behavior of local rivals both in terms of their number and their outputs. Using (8) for \(\Uppi_T\) in (7) determines the foreign profits in equilibrium:

Now assume that the foreign firm is also allowed to acquire a local firm or to make a greenfield investment. We assume that acquiring a local firm implies using its technology whereas a greenfield investment implies that the foreign firm transfers its technology to the host country.Footnote 10 Hence, an acquired firm will continue to be run with marginal costs of size c, but a greenfield investment will enable the foreign firm to serve the domestic market by marginal costs of c*.

We know from Proposition 1 that aggregate output will not change with the activity level of the foreign firm when market structure is endogenous. From our specific assumptions in this section, we thus know that aggregate output will be equal to

in equilibrium under free entry, irrespective of the mode of entry of the multinational. Note that aggregate output decreases with F and c, but increases with b.

We will now consider the incentives to export, to acquire a firm or to make a greenfield investment under two different assumptions about the market structures. In the short run, local firms may not be able to enter or leave the market after FDI has become possible. In this case, the number of active local firms is fixed to the endogenously derived number of firms under the trade regime. In the long run, however, local firms will leave (enter) the market if profits are negative (positive), and in that case the number of active local firms is determined such that local profits are equal to zero. The sequence of moves is given by Box 1.Footnote 11

3.1 Greenfield investment

In the case of a greenfield investment, the foreign firm will produce by a lower marginal cost but has to carry a fixed cost of size G. We can see from the first-order conditions for local firms and the foreign firm, i.e.,

that the foreign firm is now more aggressive in the local market (x* now denotes the output of the multinational firm). For a fixed market structure, the output of the multinational firm will increase and the output of all local firms will decline:

However, aggregate output will unambiguously increase if no entry and exit occurs because local firms will produce less if and only if the price has declined. The foreign firm’s profits from greenfield are equal to

If no entry or exit of local firms occurs, the number of active firms is equal to n T (see Eq. 8) which yields an equilibrium foreign profit level of

The bar denotes the fixed market structure.

What will happen if local firms are allowed to enter or leave the market? The increase in aggregate output and the decline in individual output will unambiguously decrease profits of local firms in the case of a fixed market structure. Given that their profits have been equal to zero under the trade regime, greenfield investment will induce market exit of some local firms. If the foreign firm enters via greenfield, the profit of each local firm is equal to

which is zero in equilibrium for an endogenous market structure. From (15), we can determine the number of local firms

The foreign firm will correctly anticipate that the number of active local firms will decline to n G and that its profit will thus be equal to

The star denotes the endogenous market structure. Comparing (14) and (17) shows that \(\Uppi^*_G > \bar{\Uppi}_G\) because the exit of local firms increases foreign profits. Our results are summarized by

Proposition 2

For a fixed market structure, greenfield investment implies an increase in aggregate output and a decrease in both output and profit of each local firm. If the market structure is endogenous, greenfield investment implies market exit, and greenfield profits are larger for the multinational compared to a fixed market structure.

3.2 Acquisition

In the case of a fixed market structure, any acquisition will imply that two formerly independent firms will merge in a new entity such that, ceteris paribus, the number of all active firms goes down by one. After an acquisition, the foreign firm will have gained complete corporate control over the potential local entrant. The foreign firm cannot change local production costs but can manage entry more efficient which now warrants a fixed cost of size A with \(0 \leq A < F\).Footnote 12 Let us consider an acquisition as a process after which the foreign firm becomes a local firm so that n is now the number of firms including the new entity formed by the foreign and a local firm. If an acquisition takes place, outputs and net operating profits of each firm, including the acquired firm, are respectively equal to

At the beginning of the game or “period”, we assume that the foreign firm must choose among exporting, greenfield, or an attempt to acquire a domestic firm. If the foreign firm chooses to attempt an acquisition and it fails, we assume that it reverts to exporting and that it cannot choose greenfield at that point. In other words, we rule out the possibility that the foreign firm can threaten greenfield in a negotiation. Allowing for this adds some messy complications without changing our basic story.Footnote 13 As for the acquisition price, we assume that both parties enter a negotiation process the outcome of which can be modelled as a Nash bargaining process. In order to allow for asymmetric bargaining power, we assume that the Nash product, denoted by \(\Upomega\), is equal to

where M denotes the merger profits without fixed cost, and q is the acquisition price. The parameter α, α ∈ [0, 1], gives the bargaining power of the foreign firm. The outside option for the foreign firm is to continue serving the market by exports (which yields profits \(\Uppi_T\)), whereas the local firm’s outside option is to compete against all other local firms and the foreign exporting firm which yields zero profits both under a fixed and an endogenous market structure. The merger is profitable if \(M > A + \Uppi_T\). According to the Nash bargaining solution, the acquisition price q will be equal to \((1 - \alpha)(M - A - \Uppi_T)\) so foreign acquisition profits will be equal to

This profit increases linearly with M. In the case of a fixed market structure, local firms do not enter or leave the market and n is equal to n T . In this case, merger profits and foreign profits are respectively equal to

Why does \(\bar{M}\) decline with t via γ? A large trade cost implies a large number of local firms in the trade regime, so the foreign firm will buy a small-sized firm which is less attractive. For a fixed market structure, the acquisition of a local firm will decrease aggregate output and thus the price in the Home market increases. Both effects will unambiguously increase profits of local firms, and since each local firm made zero profits before, an acquisition will induce market entry.Footnote 14 In the case of an endogenous market structure, the number of local firms is determined by π A = F according to Eq. (18) so that

From (22), it follows that merger profits are equal to the entry cost of a local firm if the market structure is determined endogenously. With M* = F, the foreign acquisition profits read

Clearly, as \(\sqrt{b F} > \gamma\), merger profits and hence also foreign acquisition profits are lower compared to a fixed market structure, i.e., \(\bar{M} > M^*\) (cf. equations (21) and (23)). These results are summarized by

Proposition 3

For a fixed market structure, an acquisition implies a decrease in aggregate output and an increase in both output and profit of each local firm. If the market structure is endogenous, an acquisition implies market entry, and acquisition profits are smaller for the multinational compared to a fixed market structure.

When comparing the acquisition option with trade, we arrive at a clear result.

Lemma 2

IfA = 0 and γ > 0, an acquisition will always dominate trade.

Proof

For the case of an endogenous market structure \(\Uppi_A^* = \alpha F + (1 - \alpha)\Uppi_T > \Uppi_T = (\sqrt{b F} - \gamma)^2/b \Leftrightarrow b F > (\sqrt{b F} - \gamma)^2 \Leftrightarrow \gamma > 0\) if A = 0. Furthermore, \(\bar{M} > M^*\) so that the acquisition is even more profitable in the case of a fixed market structure. \(\square\)

The reason is straightforward:

with a small fixed cost after an acquisition, the foreign firm is able to take over a local firm very cheaply, as this firm is making zero profits under the trade regime anyway. Furthermore, γ > 0 implies that local production by an acquired firm is less costly than exporting.

4 Discussion

In this section, we will illustrate our results graphically, and we will discuss how parameter changes will affect the relative profitabilities of our FDI option with and without endogenous market structures. There are quite a few parameters in our model, and we will choose two important ones to illustrate some of our results. Figures 1, 2, 3, 4 and 5 plot equilibrium regimes with G (greenfield fixed costs) on the vertical axis and t (exporting trade costs) on the horizontal axis. These figures are from numerical simulations over a grid of values to give an idea about scale, but all of the qualitative effects shown in the figures are valid independently of the specific values of other parameters held constant. At each point in the Figures, the number of domestic firms is set endogenously to give them zero profits under the exporting regime. This number is then held fixed in Figs. 1 and 4, while it is allowed to adjust in Figs. 2 and 5 if the foreign firm chooses an option other than exporting.

Figures 1, 2 and 3 use the bargaining parameter α = 0.5, while Figs. 4 and 5 use α = 1. The latter is included because it is plausible to suppose that the foreign firm might be able to make a series of all-or-nothing offers until someone accepts, giving all rents to the foreign firm. As should be clear from (20) and (23), this is equivalent to setting α = 1.

Consider Fig. 1 and a middle level of G (e.g., 0.75 in the Figure). At very low trade costs, the foreign firm chooses exporting. As trade costs rise, at some point the firm switches to acquisition. This level of trade costs is independent of G as shown in the Fig. (see Eq. 21). As trade costs continue to rise, this erodes the foreign firms profits in the acquisition game, because the firm’s outside option becomes poorer. Thus at some higher level of trade costs, the firm switches to greenfield. The boundary between acquisition and greenfield is upward sloping because an increase in t reduces acquisition profits as just noted and this must be matched by an increase in G which reduces greenfield profits. The boundary between exporting and greenfield is positively sloped because an increase in t that reduces exporting profits must be matched by an increase in G which will reduce greenfield profits.Footnote 15

Now suppose that we permit entry or exit in response to the foreign firm’s choices in Fig. 1. How will this alter the firm’s choice is shown in Fig. 2. Consider a point on the boundary between exporting and acquisition in Fig. 1. Acquisition will lead to local entry under free entry/exit as we have shown, which leads to lower profits under acquisition, and hence the foreign firm will now strictly prefer exporting at the old boundary: the boundary between exporting and acquisition shifts right as shown in Fig. 2. Second, consider a point on the boundary between exporting and greenfield in Fig. 1. Greenfield will now lead to local exit when entry/exit is allowed and so profits improve under that option: the boundary between exporting and acquisition shifts up as shown in Fig. 2. Third, consider a point on the boundary between acquisition and greenfield in Fig. 1. Allowing entry reduces the profits from acquisition (local entry) and increases the profits from greenfield (local exit) and so greenfield becomes strictly preferred and the boundary between acquisition and greenfield shifts up as shown in Fig. 2.

Figure 3 shows the change in the foreign firm’s profits when entry/exit are allowed relative to holding the number of local firms fixed. Many of the results have already been touched on: there is no change if the foreign firm chose exports before and after the entry/exit is allowed (region 1) because of the calibration procedure; profits fall if the firm switches from acquisition to exports after entry/exit (region 2) or chooses acquisition before and after entry/exit (region 3); profits increase if the foreign firm switches to greenfield from exporting (region 4) or chooses greenfield before and after entry/exit (region 5).

The more complex region is the one in which the firm chooses acquisition initially and then switches to greenfield after entry/exit is permitted (region 6). This is composed of two sub-regions. Region 6.1 has an upper boundary which is the new boundary between acquisition and greenfield shown in Fig. 2. The introduction of entry/exit leads to entry under acquisition, which is chosen initially, leading to a fall in profits. The foreign firm switches to greenfield in region 6.1, recouping some of its loss but not enough to get back to its initial profit level under no entry. Region 6.2 has a lower boundary which is the initial boundary between acquisition and greenfield in Fig. 1. While the firm (marginally) prefers acquisition in this region initially, the introduction of entry/exit means that it can force exit and increase its profits by switching to greenfield and its profits increase from allowing entry/exit in region 6.2.

Figures 4 and 5 perform the same experiments as Figs. 1 and 2, respectively, but setting the foreign firm’s bargaining weight at one, α = 1. As we just noted, this is equivalent to a situation where the firm can make all-or-nothing offers to competing domestic firms and hence can extract all gains. The only boundary affected is that between acquisition and greenfield. This boundary shifts down because the foreign firms profits will be higher with acquisition and unchanged under greenfield in both the no entry and free entry regimes. This boundary also flattens out. The trade cost is irrelevant to the choice between acquisition and greenfield under entry (Fig. 5, Eq. 23), and only of small, indirect importance under no entry/exit (Fig. 4, Eq. 21—recall that t is an element of γ).Footnote 16 The profit effects of entry under α = 1 are qualitatively the same as in Fig. 3, so we omit a figure corresponding to Fig. 3 for the α = 1 case.

Briefly, we can note some comparative-statics results with respect to other parameters. The following results refer to the borders in Figs. 1 and 2. These results can be shown analytically (see Appendix). Consider first an increase in F, the fixed cost for a local firm. An increase in F reduces the equilibrium number of local firms in the benchmark (under foreign exporting), with those firms being larger and having higher markups. Aggregate output is lower and the equilibrium price is higher (see Eq. 10). The largest impact is on greenfield profits. Basically, the marginal cost advantage of switching from either exporting or acquisition to greenfield is amplified when the initial price (under exporting) is higher, as is the case when F is higher.Footnote 17

A decrease in b is an increase in the market size (essentially adding more identical consumers, keeping the demand intercept on the p axis constant and flatting out the slope of the inverse demand curve). Aggregate output increases, and this favors greenfield relative to both acquisition and exporting. A larger market gives the foreign firm a larger incentive to switch from higher marginal cost exports or acquisition to lower marginal cost greenfield. This result is well known in the literature on horizontal investments under both no and free/entry assumptions: the larger market makes it optimal to bear a fixed cost (G) to switch to a lower marginal-cost option (Markusen 2002). It is interesting to note that this market-size effect is generally not present in large-group monopolistic-competition models (Markusen and Venables 2000, Navaretti and Venables 2004): with a constant markup, the number of firms expands in strict proportion to market size, and hence does not create an incentive to switch to foreign production.

Finally, consider a decrease in c, the marginal cost of host-country firms and the marginal cost for the foreign firm under the acquisition option. A lower c also increases aggregate output (see Eq. 10), but improves the attractiveness of acquisition over either exporting or greenfield and expands the acquisition region in Figs. 1, 2, 3, 4 and 5 on both borders. Recall that we assumed that c > c*, otherwise the foreign firm would never choose greenfield. We could think of a fall in c as a convergence between the foreign country and the local economy in terms of technical sophistication. The implication that it is more common for entering firms to choose acquisition when entering another advanced economy and more common to choose greenfield in or exporting to a developing country is confirmed by some empirical evidence. The World Investment Report (2000, p. 117) quoted earlier, reports that cross-border M&As as a percentage of total FDI inflows in 1997–1999 was about 80% for foreign investments into Western Europe and the United States, 60% for investments into Latin America, about 35% for investments into Africa and Central and Eastern Europe, and 20% for foreign investments into developing Asia. Roughly speaking, the share of M&A in total inward investments rises with the level of per capita income of the host country, much as our model predicts.

With respect to the prediction of our model that foreign production (either through greenfield or acquisition) will be preferred as c converges to c* (the host is more developed), there is a good deal of evidence that foreign affiliates are chosen relative to exporting for more advanced economies (Markusen 2002; Navaretti and Venables 2004).

5 Concluding remarks

As noted in the introduction of the paper, there are many papers that are at least partially interested in issues about greenfield versus acquisition FDI and those two choices versus exporting. These models generally differ substantially from one another and are designed to address rather different questions. We have long felt that one gap in the literature is that authors always assume that the choice of entry mode by a foreign multinational does not lead to any change in the number of local firms (other than of course an acquired firm switching ownership). When we think about the importance of the assumption of fixed firm numbers versus free entry/exit in the strategic trade-policy literature, we feel that this omission may be quite important. In contrast to the existing M&A literature, we should also note that many if not most of the mainstream theoretical literature on multinationals assume free entry and exit of firms in response to any changes in the underlying environment. Thus the theoretical M&A literature stands in sharp contrast to much of the other theoretical literature on multinationals (Markusen and Venables 2000; Markusen 2002; Navaretti and Venables 2004).

Our principal finding may seem rather obvious ex post: allowing adjustment in the number of domestic firms following the entry of a foreign multinational (either a new supplier or a foreign firm switching from exporting) leads to exit if the foreign firm chooses greenfield and to entry if the foreign firm chooses acquisition. Greenfield becomes more attractive relative to either exporting or to acquisition, and acquisition becomes less attractive relative to exporting if entry/exit is allowed relative to the standard no entry/exit assumption.

Other results are somewhat less obvious and we should bear in mind that we are using a partial-equilibrium model. First, we show that under any demand curvature, the adjustments of local firm numbers under free/entry exit imply that the mode of entry by the multinational does not affect aggregate output or the output per firm of the (adjusted number of) domestic firms. Regardless of whichever of the three options the multinational chooses, domestic firm numbers adjust so that total output and output per local firm is constant. An implication of this is that the mode of entry does not have important welfare effects on the local economy, except for some rent extraction in the case of acquisition. This contrasts to the no-entry no-exit mainstream literature, where the choice of mode does have significant local welfare consequences.

Second, we show that the effects on the foreign entrant’s profits of allowing local entry and exit relative to no entry/exit can go either way. Some cases are straightforward: a foreign firm preferring acquisition with and without entry is made worse off by allowing local adjustment via entry while a foreign firm preferring greenfield without entry must be made better off by allowing local adjustment. Other cases are more subtle. We noted two empirical implications of our model, which are that acquisition should be more common in more developed host-country markets where the cost difference between the foreign and host firms is smaller, and exporting should be less common (relative to either foreign production option) under the same circumstances. The former receives strong confirmation in the World Investment Report (2000) and the latter in Markusen (2002) and Navaretti and Venables (2004).

While our paper is theoretical, it may have important policy implications insofar as it calls into question the conventional wisdom contained in (strong worded) policy conclusions and recommendations such as those found in the World Investment Report (2000) quoted earlier. In particular, we find no effects of greenfield versus acquisition on domestic prices which could be thought of as a measure of competition effects. As we noted, this theoretical result is consistent with the empirical results of Gu et al. (2003) and Head and Ries (1999) on a rather different question. Indeed, acquisition can weakly dominate in our model due to rent sharing with the target firm. Governments that implement policies that bias firm choices toward greenfield and discourage acquisition may want to consider a re-evaluation.

Notes

For example, Bjorvatn (2004) discusses the choice of entry to a foreign market in a simple Cournot setup, whereas Müller (2007) does a similar exercise in a Hotelling setup. For similar models using a fixed market structure, see Eicher and Kang (2005) and Mattoo et al. (2004). Other models discuss international mergers as a way to overcome information asymmetries (see Qiu and Zhou 2006) or the possibility of merger waves when firms differ substantially across countries and industries (see Neary 2007). Also these models do not consider entry or exit of non-target firms. Bertrand and Zitouna (2006) consider exit, but only in a Cournot duopoly.

There is also a substantial empirical literature both on the role of M&A and economic integration (see for example Hijzen et al. 2008) and on the determinants of different FDI modes (see for example Basile 2004; Raff et al. 2008). This literature shows that market concentration matters, but cannot consider the change in market structure triggered by foreign market entry.

Models of monopolistic competition and firm heterogeneity have identified which type of firms chose which entry type; see Helpman et al. (2004). Nocke and Yeaple (2007) show that the type of entry depends on the source of heterogeneity. If firms differ in their mobile capabilities, the most efficient firms go for a greenfield investment; if firms differ in their immobile capabilities, the least efficient active firms acquire local firms. Our analysis does not assume any heterogeneity across firms (except between the multinational and the local firms), because we want to focus on exit or entry of local firms as a response to a strategic investment of the multinational firm.

Our comment here is not a criticism. Navaretti and Venables (2004, pp. 67–68) are not really interested in greenfield versus acquisition; their discussion is more of an aside and not related to the broader focus of the chapter. A similar ex post equivalence of greenfield and acquisition occurs in the free-entry models in Markusen (2002).

Haller (2009) considers the impact on a local duopolistic industry in which firms differ and can reduce costs by R&D.

We consider a single multinational firm entering a market in which several local firms are active. See Norbäck and Persson (2007, 2008) for models in which several multinationals potentially enter a market, and in which they may compete among each other for the acquisition of a single domestic firm. Horn and Persson (2001) consider both international and national mergers at the same time.

Stähler and Upmann (2008) develop a similar result for unilateral market entry regulation in an integrated market.

In fact, it could be even the increase in combined output by several foreign firms.

If \(\sqrt{b F}\,<\,\gamma\), local entry cost is low and consequently the local market is crowded by local firms such that the average cost of a local firm is less than c* + t.

Our results would not change substantially if we allowed the acquired firm to operate with lower marginal costs.

Note that we allow the foreign firm only to export if sales negotiations fail. Allowing greenfield as an outside option would require to allow the local firm to pay the foreign firm as to avoid market entry via greenfield. See the discussion in subsection 3.2.

Empirically, there may be more than just an entry cost. For example, Görg (2000) finds that an acquisition warrants some product and process adaptation costs.

In order to facilitate an easy comparison of the three options under both no and free entry, we calibrate the model initially such that domestic firms just break even. The problem with allowing the foreign firm to threaten greenfield if negotiations are not successful is that, with a fixed number of firms, this implies negative profits for all existing domestic firms including the target as the outside option if negotiations fail. So the local target firm even has an incentive to compensate the foreign firm for not doing a greenfield investment. Then you may ask why a local firm would want to start negotiating with the foreign firm if it would be better off if any other local firm did that. While intriguing, this does that seem to enrich our basic story. If we restrict the foreign firm to reverting to exporting as its outside option, then a failed negotiation leaves the domestic firms continuing to earn zero profits under both no entry and free entry, thus facilitating an easy and clear comparison between the two entry assumptions.

The Appendix proves that the behavior of the boundaries in the G-t-space holds in general for an endogenous market structure. This behavior is also quite intuitive for a fixed market structure. Note, however, that changes in t also change the benchmark equilibrium (trade regime).

Trade cost t only affects acquisition profits indirectly when the firm captures all rents, and this is due to the calibration procedure. As noted earlier, as we move through the parameter space in these figures, the initial number of local firms is adjusted to maintain zero profits. As t increases, so do the initial number of local firms that leaves profits at zero. Acquisition profits fall the larger the (fixed) number of local firms in the market (Eq. 21) as do greenfield profits (Eq. 14—though this is not obvious by inspection), but the latter fall by less in our simulations. Thus the acquisition - greenfield boundary in Fig. 4 has a small positive slope.

See Appendix for a general proof.

References

Basile, R. (2004). Acquisition versus greenfield investment: The location of foreign manufacturers in Italy. Regional Science and Urban Economics, 34(1), 3–25.

Bertrand, O., & Zitouna, H. (2006). Trade liberalization and industrial restructuring: The role of cross-border mergers and acquisitions. Journal of Economics and Management Strategy, 15(2), 479–515.

Bjorvatn, K. (2004). Economic integration and the profitability of cross-border mergers and acquisitions. European Economic Review, 48(6), 1211–1226.

Bulow, J. I., Geanakoplos, J. D., & Klemperer, P. D. (1985). Multimarket oligopoly: Strategic substitutes and complements. Journal of Political Economy, 93(3), 488–511.

Eicher, T., & Kang, J. W. (2005). Trade, foreign direct investment or acquisition: Optimal entry modes for multinationals. Journal of Development Economics, 77(1), 207–228.

Görg, H. (2000). Analyzing foreign market entry: The choice between greenfield investment and acquisitions. Journal of Economic Studies, 27(3), 165–181.

Gu, W., Sawchuk, G., & Rennison, L. W. (2003). The effect of tariff reductions on firm size and firm turnover in Canadian manufacturing. Review of World Economics/Weltwirtschaftliches Archiv, 139(3), 440–459.

Haller, S. A. (2009). The impact of multinational entry on domestic market structure and investment. International Review of Economics and Finance 18(1), 52–62.

Head, K., & Ries, J. (1999). Rationalization effects of tariff reductions. Journal of International Economics, 47(2), 295–320

Helpman, E., Melitz, M., & Yeaple, S. (2004). Exports versus FDI with heterogeneous firms. American Economic Review, 94(1), 300–316.

Hijzen, A., Görg, H., & Manchin, M. (2008). Cross-border mergers and acquisitions and the role of trade costs. European Economic Review 52(5), 849–866.

Horn, H., & Persson, L. (2001). The equilibrium ownership of an international oligopoly. Journal of International Economics, 53(2), 307–333.

Horstmann, I. J., & Markusen, J. R. (1986). Up the average cost curve: Inefficient entry and the new protectionism. Journal of International Economics, 20(3–4), 225–247.

Markusen, J. R. (2002). Multinational firms and the theory of international trade. Cambridge: MIT Press.

Markusen, J. R., & Venables, A. J. (1988). Trade policy with increasing returns and imperfect competition: Contradictory results from competing assumptions. Journal of International Economics, 24(3–4), 299–316.

Markusen, J. R., & Venables, A. J. (2000). The theory of endowment, intra-industry, and multinational trade. Journal of International Economics, 52(2), 209–234.

Mattoo, A., Olarreanga, M., & Saggi, K. (2004). Model of foreign entry, technology transfer, and FDI policy. Journal of Development Economics, 75(1), 95–111.

Müller, T. (2007). Analyzing modes of foreign entry: Greenfield investment versus acquisition. Review of International Economics, 15(1), 93–111.

Navaretti, G. B., & Venables, A. J. (2004). Multinational firms in the world economy. Princeton: Princeton University Press.

Neary, P. (2007). Cross-border mergers as instruments of comparative advantage. Review of Economic Studies, 74(4), 1229–1257.

Nocke, V. & Yeaple, S. (2007). Cross-border mergers and acquisitions vs. greenfield foreign direct investment: The role of firm heterogeneity. Journal of International Economics, 72(2), 336–365.

Norbäck, P.-J., & Persson, L. (2007). Investment liberalization—Why a restrictive cross-border merger policy can be counterproductive. Journal of International Economics, 72(2), 366–380.

Norbäck, P.-J., & Persson, L. (2008). Globalization and profitability of cross-border mergers & acquisitions. Economic Theory 35 (2), 241–266.

Perry, M. K., & Porter, R. H. (1985). Oligopoly and the incentive for horizontal merger. American Economic Review, 75 (1), 219–227.

Qiu, L., & Zhou, W. (2006). Product differentiation, asymmetric information and international mergers. Journal of International Economics, 68(1), 38–58.

Raff, H., Ryan, M., & Stähler, F. (2008). Firm productivity and the foreign-market entry decision (Economics Working Paper 2008-02). University of Kiel.

Salant, S. W., Switzer, S., & Reynolds, R. J. (1983). Losses from horizontal merger: The effects of an exogenous change in industry structure on Cournot–Nash equilibrium. Quarterly Journal of Economics, 98(2), 185–199.

Stähler, F., & Upmann, T. (2008). Market entry regulation and international competition. Review of International Economics, 16(4), 611–626.

Venables, A. J. (1985). Trade and trade policy with imperfect competition—The case of identical products and free entry. Journal of International Economics, 19(1–2), 1–19.

World Investment Report. (2000). Cross-border mergers and acquisitions and development. New York: UNCTAD.

Acknowledgments

We are grateful to an anonymous referee for useful suggestions.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Result 1 proves that the boundaries between the foreign entry options as displayed by the figures hold in general.

Result 1

If the market structure is endogenous,

-

1.

a trade cost level\(\bar{t}\)exists such that acquisition profits and trade profits coincide,

-

2.

a greenfield investment (trade) is more profitable for low (high) levels ofGif\(t \leq \bar{t}\),

-

3.

greenfield investment (an acquisition) is more profitable for low (high) levels ofGif\(t \geq \bar{t}\).

Proof

Let \(\hat{G}\) denote the greenfield fixed cost for which \(\Uppi_T = \Uppi_G^*\):

Furthermore, \(\hat{G}(t = 0) = 0\) so that \(\hat{G}\) is an increasing, concave function of t, starting at the origin. Let \(\bar{G}\) denote the greenfield cost fixed cost for which \(\Uppi_A^* = \Uppi_G^*\):

Furthermore, \(\bar{G}(t = 0) = \alpha[(\sqrt{b F} + c - c^*)^2/b - (F - A)] > 0\), because \((\sqrt{b F} + c - c^*)^2/b > F\), so that \(\bar{G}\) is an increasing, concave function of t, starting at a positive level. Comparing (24) and (25), we find that

which shows that the slope of \(\hat{G}\) in the G–t–space is larger than the slope of \(\bar{G}\) for any identical t. Hence, if they cross in the G–t–space, they will intersect only once. Let us denote the trade cost level where they intersect by \(\bar{t}\). At this intersection, by definition \(\Uppi_A^* = \Uppi_T\) so that \(\Uppi_T(\bar{t}) = F - A\). Since \(\Uppi_T\) does not depend on G, \(\Uppi_A^* <(>) \Uppi_T\) if \(t <(>) \bar{t}\). \(\square\)

Result 2 demonstrates the change in foreign profits with the local firm’s fixed cost F for an endogenous market structure.

Result 2

If the market structure is endogenous, an increase inFleads to the largest profit increase for greenfield investment, followed by acquisition and trade.

Proof

\(\square\)

Result 3 demonstrates the change in the boundaries with the parameters F, b and c for an endogenous market structure. Note that an increase in \(\hat{G} (\bar{G})\) makes greenfield relatively more attractive compared to trade (an acquisition).

Result 3

If the market structure is endogenous, an increase inFincreases both\(\hat{G}\)and\(\bar{G}\), and increase inbdecreases both\(\hat{G}\)and\(\bar{G}\), and an increase incincreases both\(\hat{G}\)and\(\bar{G}\).

Proof

\(\square\)

About this article

Cite this article

Markusen, J., Stähler, F. Endogenous market structure and foreign market entry. Rev World Econ 147, 195–215 (2011). https://doi.org/10.1007/s10290-010-0085-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10290-010-0085-3