Abstract

Over the last few years water scarcity and pollution have been rapidly growing at both regional and global level. This has generated in many cases increasing intersectoral competition over the use of a limited amount of water resources. To examine the dynamics that such competition may generate in the economy, the present paper proposes a simple dynamic evolutionary model in which two sectors (A and B) compete for the use of water and studies the impact of water pricing on the dynamics of the two sectors in the presence of a population of interacting economic agents characterized by imitative behaviors. As it emerges from the model, when water is underpriced a self-enforcing process may be observed driving the economy towards a Pareto-dominated equilibrium. In such equilibrium the economy fully specializes in sector A, characterized by the highest negative impact on the water resource, at the expenses of sector B. The paper shows that a policy of fine tuning that increases water price through the endogenous water pricing mechanism examined in the model can inhibit the convergence of the economy to such an equilibrium point and can progressively shift the system towards the less water-consuming sector. Finally, assuming a Leontief production function and performing numerical simulations, it is shown how a change in water price can affect the dynamics of the model, and that the same results hold also in a more general, three-sector context.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Water scarcity and pollution problems have been widely debated by scholars, public opinion and policy-makers for the vast and sometimes dramatic consequences that they cause.

Lack of water prevents irrigation and agricultural production in many world areas, including many Mediterranean countries (in particular, all Northern African countries in the Mediterranean area), several Asian countries and the Middle East (United Nations Development Programme 2006).

More than 16 % of the world population is water stressed, namely, it has no access to drinkable water. Sub-Saharan Africa contains most water stressed countries in the world, but water stress is rapidly increasing also in other highly-populated countries such as China and India (United Nations Development Programme 2006). Water scarcity is one of the reasons underlying the increase in food prices observed in the last few years (Trostle 2008), which hits mainly the poorest sectors of the population. Furthermore, water pollution damages human health causing hepatitis, cholera, dysentery and typhoid fever. These diseases are responsible for about 88 % of total diseases among individuals aged under 15, particularly in the developing countries where 95 % of water is untreated. It has been estimated that more than 3.4 million deaths per year are due to diseases deriving from lack of safe water, sanitation and hygiene-related causes, and that 99 % of all deaths occur in developing countries (World Health Organization (WHO) 2008).

The crucial role of water problems for food prices and health explains the increasing attention recently devoted to the “water-food-energy” nexus that is gaining central stage in the academic and political debate (Hoff 2011; World Economic Forum 2011; Rasul and Sharma 2015), particularly as this issue is strictly related to the theme of the 2015 EXPO edition dedicated to problems encountered in feeding the planet. The vital role of water for a healthy and sustainable development of human society has been recently emphasized also by Pope Francis in his Encyclical “Laudato si”’ (Pope Francis 2015), which has attracted large attention by public opinion and the media worldwide.

Despite the vast interest in water scarcity and pollution problems described above, opinions diverge on how to solve them. Among the various economic instruments that have been proposed for this purpose, a particularly important role has been played by water tradable permits (WTP), namely, emission or consumption trading schemes that have been implemented in several world areas to limit water scarcity and pollution. Their functioning is akin to that of the air cap-and-trade systems: the regulation authority establishes a maximum amount of water that can be used (or water pollution that can be discharged) in a certain ecosystem. It then attributes to local actors a given number of tradable rights to consume (or pollute) the water basin and can intervene on the market by setting a price cap or floor and through a fine-tuning policy that modifies the total amount of permits according to the new scientific evidence on the evolution of the water problems at stake.

This paper intends to investigate how the introduction of a water pricing mechanism (like the one underlying WTP) can affect the evolution of the economic system when different economic sectors compete for the use of a limited amount of water resources. For this purpose, first the simplest possible case with two sectors having different impacts on the (common) water resources is considered, and then the analysis is extended to show that the same results hold when the number of sectors is larger than two. To examine this issue, the rest of the paper is structured as follows. Section 2 reviews the related literature, Section 3 describes the set up of the analytical model, Sections 4 shows the dynamic regimes deriving from the model. Section 5 performs some numerical simulations assuming a production function a la Leontief that can capture the essential role that water can play in many production processes being a non-substitutable input. Section 6 extends the analysis to the case with three sectors, showing with numerical simulations that previous results hold also in a more complex context. Finally, Section 7 contains some concluding remarks.

2 Related Literature

The application of WTP to manage water resources is the object of growing attention in the literature (see Borghesi 2013; Fisher-Vanden and Olmstead 2013; for reviews of the studies in this field). Water tradable permits were implemented long ago mainly in Australia and in many States of the USA, but implementation experiences have been pursued also in some developing countries including Chile, Mexico and India.Footnote 1 More precisely, one can distinguish two kinds of water trading schemes: (i) tradable water pollution rights (TWPR) and (ii) tradable water abstraction rights (TWAR). In the former case the regulation authority sets a maximum amount of water pollution, whereas in the latter it establishes a water consumption cap.

Some applications turned out to be successful in addressing water consumption and pollution problems. This is, for instance, the case of Australia where TWAPR and TWPR were established from the 1990s along the Hunter River in the New South Wales region, and in the Murray-Darling Basin, the main Australian area of agricultural production and the biggest Australian water reserve suppling four states and the country’s major urban centres (e.g. Brisbane, Sydney, Melbourne, Canberra and Adelaide). In both areas the local authorities fixed a telematic register. In the Hunter River two computerised centres were created for trading water permits, which work in a similar vein and have similar size of the financial stock exchange that is present in the major Australian cities (The Economist 2003). In the Murray-Darling basin, the system of online trading is monitored on a daily basis by a stakeholder committee (Kraemer et al. 2004). In both cases, the application of WTP was very successful: the number of violations of the maximum limits of discharge progressively decreased as well as the salinity problem which characterized both Australian basins. Also in the USA the implementation of TWAR and TWPR accomplished some remarkable success. For instance, important environmental results were achieved in terms of the volume of water being restored (112 millions of cubic meters in 2007 alone, cf. Garrick et al. 2009) in the Columbia Basin (that encompasses the US states of Oregon, Washington, Montana and small portions of Nevada, Utah and Wyoming). Moreover, the application of TWAR in many Western states led to an increase in the flow of the main rivers, with the number of transactions being very high in California, where the water scarcity problem has become particularly severe due to demographic growth and long periods of drought (Landry 1998; Pincetl and Hogue 2015).

In many other cases, however, the WTP schemes turned out to be non-active or inefficient (cf. Borghesi 2013). Many studies have tried to identify which factors determine the success or failure of WTP. Among them, particular attention has been devoted to the government’s capacity to monitor the market (Woodward et al. 2002; Dai et al. 2008; Fisher-Vanden and Olmstead 2013; Borghesi 2014), the degree of competition of the market (Hahn 1984; Hagem and Weskog 1998), the degree of uncertainty on the functioning of the market (Bjornlund and McKay 2002), the participation and involvement of the stakeholders (Jarvie and Solomon 1998). While these factors are common to both TWAR and TWPR, other studies identify some more idiosyncratic drivers for the positive or negative outcome of water markets that are specific to each kind of WTP. For instance, a crucial condition for a well-functioning system of TWPR is the regulator’s ability to determine the flow of discharges from non-point sources, such as agricultural and urban wastes. Non-point sources are difficult to monitor since they are widespread and have no clearly defined entry points, but their inclusion in the trading programme is very important since it increases the heterogeneity of the abatement costs across the various sources, which improves the working of the system (cfr. Shortle and Horan 2001; Collentine 2006; Prabodanie et al. 2010). Similarly, in the case of TWAR a crucial role is played by the variability of rainfall and therefore of water supply that depends on exogenous factors such as climate and geographic conditions. This sometimes extreme variability may hinder the definition of property rights and the functioning of the system.Footnote 2 Most contributions in the literature discuss the pros and cons of WTP providing a detailed analysis of specific case-studies (e.g. Bjornlund and McKay 2002; Garrick et al. 2009; Hearne and Easter 1997; Horan et al. 2002; Tisdell 2001; Dionisio Perez Blanco 2015). Differently from that strand of the literature, the present paper intends to investigate the possible consequences of applying a WTP-like pricing mechanism to water problems through a theoretical two-sector model. More precisely, this contribution intends to examine what may happen in the case of two (or more) sectors competing for the consumption of a scarce resource like water. Different sectors are assumed to have different impact (in terms of consumption and/or pollution) on water resources. To provide an example, one can think of agriculture and industry as the two competing sectors or, alternatively, biological agriculture and livestock farming that have very different water consumption levels, the latter being much more water-consuming than the former. While the model presented in the next section is purely theoretical, its insights have obvious implications for many real-world situation in which different sectors rely on a limited amount of water resources for their production activities.Footnote 3

The literature provides many examples in which two or more sectors compete for scarce water resources, possibly leading to a structural change in the composition of the economy. For instance, as (Woodhouse 2003, p.1073) pointed out, in the Kimana swamp in Kenya “the pastoralist livestock system is now subject to competition from agriculture as streams are diverted for irrigated vegetable production” to supply Nairobi and Mombasa, as well as from the increasing commercial tourism since the area is an attractive camping site providing unique wildlife viewing. In Ethiopia massive water use by foreign direct investments in other sectors have strongly reduced agro-pastoralists activities due to the lack of remaining available water (Makki 2012; Abbink 2011). Similarly, in Peru the use of water in the mining sector (particularly in the Conga Mining Project) has severely damaged the agricultural sector, causing “destruction and transformation of four high-altitude lagoons, two to supply water to the mine and two for deposition of mine waste” (Franks et al. 2014, p.7578).Footnote 4 More generally, intensification of water use from other sectors has changed agricultural production in several world areas, causing heavy productivity loss of the land which may lead local agents to abandon their agricultural activities and/or to move away from the area (see Woodhouse 2003 on this issue for a detailed description of several interesting case studies).

The model described below aims at providing a useful theoretical framework to examine how intersectoral water competition as the one emerging in these case-studies may alter the dynamics of the economic system, possibly leading to polarization/specialization of the economic activity in one sector at the cost of the other(s). For this purpose, this article sets forth an evolutionary model in which agents are characterized by bounded rationality and imitative behaviors. A similar theoretical framework has been recently adopted by Antoci et al. (2015) to study the impact of a system of tradable permits (no matter whether air or water permits) on the diffusion of environment-preserving technological innovations in the presence of firms’ strategic behaviors. Differently from that work, this contribution adopts a more aggregate approach that investigates sector dynamics rather than single firms’ choices.

3 Set Up of the Model

Let us consider an economy with two productive sectors, sector A and sector B. The economy is populated by a continuum of economic agents. The size of the population of economic agents is constant and represented by the positive parameter \(\overline {N}\); the variable x(t) indicates the share of the population working in sector A at time t (so 1 ≥ x(t) ≥ 0, and 1 − x(t) indicates the share of the population working in sector B).

The production activity of each economic agent working in sector A (sector B) depends on the flow W A (respectively W B ) of available water resource at time t:

where \(x\overline {N}\) and \((1-x)\overline {N}\) represent, respectively, the sub-populations of agents working in sectors A and B. Parameter \( \overline {W}_{A}\) (\(\overline {W}_{B}\)) measures the flow of water resource to which an agent operating in sector A (respectively, B) would have access in an economy populated by only one agent (the values of \(\overline {W}_{A}\) and \(\overline {W}_{B}\) may be affected by the availability of dams, canalizations etc. and may be, at least in principle, different in the two sectors). The parameters α and β can be interpreted as measures of the negative externalities generated by the production activities of agents working in sectors A and B, respectively, on the water endowment \(\overline {W}_{A}\) of each agent working in sector A. Analogously, the parameters γ and δ can be interpreted as measures of the negative externalities generated by the production activities of sectors A and B, respectively, on the water endowment \( \overline {W}_{B}\) of each agent working in sector B. Let us assume that α > β > 0 and γ > δ > 0, that is, the negative impacts of sector A on the flows \(\overline {W}_{A}\) and \(\overline {W}_{B}\) are higher than those of sector B; that is, the activity of sector A (B) is relatively more water consuming (preserving).Footnote 5

The payoff function of an economic agent operating in sector A (sector B , respectively) is assumed to be a strictly increasing function of available water resources:

with derivatives satisfying the conditions: \(\frac {d{\Pi }_{A}(W_{A})}{dW_{A}} >0\) and \(\frac {d{\Pi }_{B}(W_{B})}{dW_{B}}>0\).

Finally, the pricing mechanism for water-use permits is modelled as follows. In each instant of time t, the price p w that agents have to pay for their water consumption is assumed to be determined by the public administration according to the following rule:

where \(\overline {p}\geq 0\) and μ ≥ 0 are parameters. Notice that, if μ > 0, then the price p w is endogenously determined: it increases if the share x of the agents working in the more impacting sector A increases. According to such mechanism, the payoffs of agents operating in sector A and in sector B become respectively:

where α + γ > β + δ. The time evolution of the share x is assumed to be described by the well-known replicator equation (see Weibull 1995):Footnote 6

where \(\overset {\cdot } {x}\) indicates the time derivative of x(t). As it will be shown below, if the price p w is low enough, then a self-reinforcing process of expansion of sector A (at the expenses of sector B) may occur driving the economy towards Pareto-dominated equilibrium points. An increase in the price p w of water-use permits can inhibit the convergence of the economy to such equilibrium points.

4 Dynamic Regimes

Notice that the pure population states x = 0 (where all agents are working in sector B) and x = 1 (where all agents are working in sector A) are always equilibrium points according to the replicator Eq. 6. The other equilibrium points, when existing, correspond to the states \(\overline {x}\in (0,1)\) satisfying the equation:

In such equilibrium points, sectors A and B coexist.

According to Eqs. 1 and 2, the flows W A (x) and W B (x) are strictly decreasing in the share x of agents working in sector A. Therefore, an increase in x generates a reduction in the water availability in both sectors. In this context, one can distinguish two possible scenarios depending on whether the payoff \(\widetilde {\Pi }_{A}(x)\) decreases more or less rapidly than the payoff \(\widetilde {\Pi }_{B}(x)\) as the share x increases. The case in which \(\widetilde {\Pi }_{A}(x)\) and \(\widetilde {\Pi }_{B}(x)\) decrease at the same rate will be omitted here since in that case the agents’ decision trivially depends on the initial position of the graphs of \(\widetilde {\Pi }_{A}(x)\) and \(\widetilde { {\Pi }}_{B}(x)\).

Notice that, ceteris paribus, an increase in \(p_{w}=\overline {p}+\mu x \overline {N}\) generates a reduction in the payoff differential \(\widetilde { {\Pi }}_{A}(x)-\widetilde {\Pi }_{B}(x)\) (see Eq. 6); that is, it reduces the relative performance of agents operating in sector A with respect to agents operating in sector B. In particular: 1) an increase in \( \overline {p}\) (for a given value of μ) generates a downward shift of the graph of \(\widetilde {\Pi }_{A}(x)-\widetilde {\Pi }_{B}(x)\), without modifying its slope (and the slopes of \(\widetilde {\Pi } _{A}(x)\) and \( \widetilde {\Pi }_{B}(x)\)); 2) an increase in μ (for a given value of \( \overline {p}\)) generates a downward shift of the graph of \(\widetilde {\Pi }_{A}(x)-\widetilde {\Pi }_{B}(x)\), as well as a decrease in its slope (that is, as x increases, the negative effect on \(\widetilde {\Pi }_{A}(x)\) becomes relatively higher than the effect on \(\widetilde {\Pi }_{B}\)). Therefore, an increase in μ can lead the economy to shift between the two scenarios described in the next subsections, namely, from Scenario 1 to Scenario 2. If, instead, only \(\overline {p}\) increases, no change of scenario can occur and the economy will stay in the initial scenario.

4.1 Scenario 1: The Payoff in Sector A Decreases Less Rapidly than in Sector B

In this scenario, the slope of the graph of \(\widetilde {\Pi }_{A}(x)\) is higher than the slope of the graph of \(\widetilde {\Pi }_{B}(x)\).Footnote 7 Three possible cases can be distinguished according to the relative position of the graphs of \(\widetilde {\Pi }_{A}(x)\) and \(\widetilde {\Pi }_{B}(x)\): (i) the graph of \(\widetilde {\Pi }_{A}(x)\) lies above that of \(\widetilde { {\Pi }}_{B}(x)\) for every x ∈ [0, 1] (see Fig. 1), (ii) the graph of \(\widetilde {\Pi }_{A}(x)\) lies below that of \(\widetilde {\Pi }_{B}(x)\) for every x ∈ [0, 1] (Fig. 2) or (iii) the graph of \( \widetilde {\Pi }_{A}(x)\) lies below that of \(\widetilde {\Pi }_{B}(x)\) for \(x< \overline {x}\), while the opposite holds for \(x>\overline {x}\) , where \( \overline {x}\) ∈ (0, 1) (Fig. 3).

In the first case, the payoff of working in sector A is always higher than that of working in B, and the economy approaches the equilibrium point x = 1 (where it specializes in the production of the sector A) whatever is the initial share x(0) > 0 of agents that decide to operate in A. In case (ii) the opposite applies, and the economy approaches the equilibrium point x = 0 (where it gets specialized in the production of the sector B) whatever is the initial share x(0) < 1 of agents that decide to operate in A. If the two extreme cases (i) and (ii) described above do not apply and the graphs of \(\widetilde {\Pi }_{A}(x)\) and \(\widetilde {\Pi }_{B}(x)\) cross for \(\overline {x}\) ∈ (0, 1) (Fig. 3), then a bi-stable regime emerges from the model (see the arrows in Fig. 3): if the initial share x(0) is less than the threshold level \(\overline {x}\), then the economy approaches the equilibrium point x = 0 (where all individuals operate in B); vice-versa, if x(0) is higher than \(\overline {x}\), then the economy approaches the equilibrium point x = 1 (where all individuals operate in A ). If x(0) is just equal to \(\overline {x}\), then working in the two sectors provide the same payoff and no individual will have any incentive to modify her choice (\(\overline {x}\) is an equilibrium point).

Observe that if x = 0, that is, if every agent works in sector B, her payoff will be:

while if x = 1 (namely, everyone works in sector A) it is equal to:

As Figs. 2 and 3 show, in the cases (ii) and (iii) above it is always: \( \widetilde {\Pi }_{B}(0)>\widetilde {\Pi }_{A}(1)\). In other words, the agents are always better-off if they all work in sector B rather than if they all work in sector A. However, in the context (iii) (Fig. 3), the dynamics of the model may lead the agents to operate the opposite choice (i.e. they all work in sector A), which will make everyone worse-off. In fact, if the initial share x(0) is above the threshold level \(\overline {x}\), working in sector A is individually perceived as the best strategy in response to the others’ choices (i.e. \(\widetilde {\Pi }_{A}(x)>\widetilde {\Pi }_{B}(x)\) for \(x>\overline {x}\)). As the choice of working in sector A spreads among the population of agents, however, the whole community ends up in a socially undesirable outcome since the agents’ payoff in x = 1 is lower than in x = 0. In this case, the choice of working in A gives origin to an undesirable social convention that represents a stable Nash equilibrium of the economy. Any departure from this equilibrium thus requires an external intervention in order to coordinate the individuals’ choices. As a matter of fact, no agent has an incentive to work in the less impacting sector B if the others do not do the same.

A similar outcome may also occur in the context (i), where the graph of \( \widetilde {\Pi }_{A}(x)\) lies always above that of \(\widetilde {\Pi }_{B}(x)\), so that everyone wants to work in sector A, whatever the value of x(0) is. As Fig. 1 shows, although \(\widetilde {\Pi }_{A}(x)>\widetilde {\Pi }_{B}(x) \) for every x ∈ (0, 1)), it is still possible to have \(\widetilde { {\Pi }}_{B}(0)>\widetilde {\Pi }_{A}(1)\), that is, the payoff of each agent in the equilibrium x = 0 may be higher than in the equilibrium x = 1. Even in this case, therefore, the selection process of agents’ choices may lead the economy to converge to the equilibrium x = 1 although the payoff level in x = 1 is lower than in x = 0 (which, in the context of case (i), is an unstable equilibrium point, see Fig. 1).

The classification of dynamic regimes that can be observed in Scenario 1 is summarized by the following proposition:

Proposition 1

In the scenario in which the payoff of sector A decreases less rapidly than that of sector B (Figs. 1–3), the replicator Eq. 6 can lead to the following possible dynamic regimes:

-

1)

If \(\widetilde {\Pi }_{A}(0)\geq \widetilde {\Pi }_{B}(0)\) then the graph of π A (x) lies always above the graph of π B (x), in the interval [0, 1]. In this case whatever the initial distribution of strategies x(0) ∈ (0, 1), x will always converge to the equilibrium point x=1, where the economy becomes totally specialized in sector A while sector B disappears (see Fig. 1).

-

2)

If \(\widetilde {\Pi }_{A}(1)\leq \widetilde {\Pi }_{B}(1)\) then the graph of π A (x) lies always below the graph of π B (x), in the interval [0, 1]. It follows that in this case whatever the initial distribution of strategies x(0) ∈ (0, 1), x will always converge to the equilibrium point x = 0, where the economy becomes fully specialized in sector B while sector A disappears (see Fig. 2).

-

3)

If \(\widetilde {\Pi }_{A}(0)<\widetilde {\Pi }_{B}(0)\) and \(\widetilde {\Pi }_{A}(1)>\widetilde {\Pi }_{B}(1)\) then there exists \(\overline {x}\in (0,1)\) such that \({\Pi }_{A}(\overline {x})={\Pi }_{B}(\overline {x})\) . In this case, if \( x(0)<\overline {x}\) , the economy approaches the equilibrium point x = 0 (where all individuals operate in B); vice-versa, if \(x(0)>\overline {x}\) , the economy approaches the equilibrium point x = 1 (where all individuals operate in A) (see Fig. 3).

As to the comparison of the payoffs in the equilibria of dynamic regimes illustrated in Figs. 1–3 the following result applies:

Proposition 2

In cases 2 and 3 of Proposition (1), it is always: \(\widetilde { {\Pi }}_{B}(0)>\widetilde {\Pi }_{A}(1)\) . That is, the agents are always better-off if they all work in sector B rather than if they all work in sector A. A similar outcome may also occur in case 1, where the equilibrium point x = 0 is not stable.

4.2 Scenario 2: the Payoff in Sector A Decreases more Rapidly than in Sector B

Let us now suppose that the negative impact due to an increase in the share x is relatively higher on the payoff of the agents working in sector A than of those working in sector B, and consequently the slope of the graph of \(\widetilde {\Pi }_{B}(x)\) is higher than that of the graph of \( \widetilde {\Pi }_{A}(x)\). In this case, the reduction of the available water flow, provoked by the increase of the share of agents working in sector A, affects sector A relatively more than sector B. As in Scenario 1, even in this case three possible sub-cases can be distinguished according to the relative position of the decreasing curves \(\widetilde {\Pi }_{A}(x)\) and \( \widetilde {\Pi }_{B}(x)\). If \(\widetilde {\Pi }_{A}(x)\) decreases more rapidly than \(\widetilde {\Pi }_{B}(x)\), but its graph always remains above \( \widetilde {\Pi }_{B}(x)\) in the interval [0, 1], then x will tend to the equilibrium point x = 1 (see the arrows in Fig. 4). Once again, however, it is still possible (though it is not necessarily the case) that in x = 1 the payoff of each agent is lower than on the equilibrium x = 0 (as it occurs in Fig. 4).

If, on the contrary, the graph of \(\widetilde {\Pi }_{A}(x)\) lies always below that of \(\widetilde {\Pi }_{B}(x)\) in the interval [0, 1], and the former falls more steeply than the latter when x increases (Fig. 5), then all agents will prefer to work in sector B and the economy converges to the equilibrium x = 0, where agents’ payoff is higher than in x = 1.

Finally, if the graphs of \(\widetilde {\Pi }_{A}(x)\) and \(\widetilde {\Pi }_{B}(x)\) cross, for \(x=\overline {x}\) ∈ (0, 1) (Fig. 6), it is \(\widetilde { {\Pi }}_{A}(x)>\widetilde {\Pi }_{B}(x)\) for \(x<\overline {x}\) and \(\widetilde { {\Pi }} _{A}(x)<\widetilde {\Pi }_{B}(x)\) for \(x>\overline {x}\). That is, if the number of agents that decide to work in sector A is sufficiently low, working in A is the best strategy for each agent and the share x of agents that make this choice will increase. If, on the contrary, the number of individuals that work in A becomes “too high” (above the threshold level \(\overline {x}\)), it is preferable to work in sector B rather than in A. Differently from what happened under Scenario 1, in this case (Fig. 6) the share x will tend to the equilibrium point \(\overline {x}\) whatever the initial share x(0) of agents working in sector A, so that \(\overline {x}\) represents a stable Nash equilibrium of the economy. Notice that since \(\overline {x}\) ∈ (0, 1) , at the equilibrium point \(\overline {x}\) one can observe heterogeneous choices within the population (some agents decide to go work in sector A and others to work in sector B) and the distribution \(\overline {x}\) of the choices among the agents tends to remain constant over time (the equilibrium \(\overline {x}\) being stable). As Fig. 6 shows, it is:

In other words, although everyone would be better-off in the equilibrium point x = 0, where the economy is specialized in sector B, the dynamics that emerge from the choice adoption process leads away from x = 0 towards the stable equilibrium \(\overline {x}\).

The classification of dynamic regimes that can be observed in Scenario 2 is summarized by the following proposition:

Proposition 3

In the scenario in which the payoff of sector A decreases more rapidly than that of sector B (Figs. 4–6), the replicator Eq. (6) can lead to the following possible dynamic regimes:

-

1)

If \(\widetilde {\Pi }_{A}(1)\geq \widetilde {\Pi }_{B}(1)\) then the graph of π A (x) lies always above the graph of π B (x) in the interval [0, 1]. In this case whatever the initial distribution of strategies x(0) ∈ (0, 1), x will always converge to the equilibrium point x = 1, where the economy becomes totally specialized in sector A (see Fig. 4).

-

2)

If \(\widetilde {\Pi }_{A}(0)\leq \widetilde {\Pi }_{B}(0)\) then the graph of π A (x) lies always below the graph of π B (x) in the interval [0, 1]. It follows that whatever the initial distribution of strategies x(0) ∈ (0, 1), x will always converge to the equilibrium point x = 0, where the economy becomes totally specialized in sector B (see Fig. 5).

-

3)

If \(\widetilde {\Pi }_{A}(0)>\widetilde {\Pi }_{B}(0)\) and \(\widetilde {\Pi }_{A}(1)<\widetilde {\Pi }_{B}(1)\) then there exists \(\overline {x}\in (0,1)\) such that \({\Pi }_{A}(\overline {x})={\Pi }_{B}(\overline {x})\) . In this case x will tend to the equilibrium point \(\overline {x}\) whatever the initial share x(0) ∈ (0, 1) (see Fig. 6). In \(\overline {x}\) , both sectors A and B coexist in the economy.

As to the comparison of the payoffs in the equilibria of dynamic regimes illustrated in Figs. 4–6 the following result applies:

Proposition 4

In case 2 of Proposition (3), it is always: \(\widetilde {\Pi }_{B}(0)>\widetilde {\Pi }_{A}(1)\) . That is, the agents are always better-off if they all work in sector B rather than if they all work in sector A. A similar outcome may also occur in case 1, where the equilibrium point x=0 is not stable. Finally, in case 3, it is always \(\widetilde {\Pi }_{B}(0)>\widetilde {\Pi } _{A}(\overline {x})=\widetilde {\Pi }_{B}(\overline {x})\) ; namely, although everyone would be better-off in the equilibrium point x=0, where the economy is specialized in sector B, the economy converge to the stable equilibrium \(\overline {x}\) , where both sectors coexist.

5 Numerical Simulations

In this section, a specific example of the payoff functions \(\widetilde {\Pi }_{A}(W_{A})\) and \(\widetilde {\Pi } _{B}(W_{B})\) is illustrated. Let us assume that the production process of the economic agents operating in sectors A and B are respectively described by the following Leontief production functions:

where L A and L B represent the labour inputs employed by each agent operating in sectors A and B, respectively, and a, b, c, d are productivity parameters. The underlying reason for adopting a Leontief production function is that it reflects the limited substitution possibilities among key inputs in agricultural production so that water scarcity often turns out to be a limiting factor in the production process. Let the parameter \(\overline {L}\) indicate the labour force endowment that is available in the economy. The (exogenously determined) value of \(\overline {L}\) is assumed to be high enough, so that labour is never the “scarce” input. Under such assumption, given the water inputs W A and W B , the values of L A and L B are determined by the following equations:

from which:

Consequently, the outputs of each agent operating in sectors A and B are given by:

To determine the profit functions (payoff functions) of each agent, the following assumptions are made: 1) The prices of the outputs produced in sectors A and B are exogenously determined (small open economy assumption) and, for simplicity, set equal to unity. 2) The unitary cost w of labour (wage) is exogenously determined (w is assumed to be a strictly positive parameter).

Recalling that α + γ and β + δ measure the negative impacts on water availability due to the two sub-populations of agents operating in sector A and in sector B, respectively, from the assumptions above it follows that profits are given by:

where \(p_{w}=\overline {p}+\mu x\overline {N}\) is the price of water.

It is easy to check that, when p W is low enough, then all the dynamic regimes described in Figs. 1–6 can be obtained by varying the values of the other parameters. Furthermore, in the context μ = 0 (the price of water is constant), Scenario 1 occurs if:

where γ − δ > 0 and α−β > 0 by assumption, while \(1- \frac {w}{d}\geq 0\) and \(1-\frac {w}{b}\geq 0\) if and only if agents earn positive profits in the more favourable context p W = 0.Footnote 8 Scenario 2 occurs if the opposite of (7) is satisfied.

Notice that the parameters on the left side of (7) measure the water consumption of the two sectors, while the parameters on the right side represent the productivity of labour and water, and the wage rate.

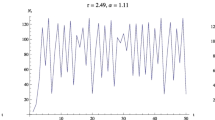

Using numerical simulations it is possible to show how an increase in the values of parameters μ and \(\overline {p}\) can affect the dynamics of the economy, ceteris paribusFootnote 9 (see Figs. 7 and 8). The blue region in Fig. 7 indicates the parameters values \((\mu , \overline {p})\) giving rise to the bistable dynamic regime illustrated in Fig. 3 (where the economy may converge to the Pareto dominated equilibrium x = 1). The yellow region in Fig. 7 indicates the values \((\mu ,\overline {p})\) for which the dynamic regime illustrated in Fig. 2 is observed (where the Pareto efficient equilibrium x = 0 is globally attractive). Notice that the latter regime can be obtained by increasing μ and/or \(\overline {p}\). In other words, by increasing one or both these components of the water price the economy can shift from the undesirable specialization in the highly water-consuming sector A to the Pareto dominant specialization in the less water-consuming sector B.

The effect of an increase in parameters μ and \(\overline {p}\). The blue region indicates the parameters values \((\mu , \overline {p})\) giving rise to the bistable dynamic regime in Fig. 3. The yellow region indicates the values \((\mu ,\overline {p})\) for which the dynamic regime illustrated in Fig. 2 is observed

Figure 8 shows a surface embedded in the three-dimensional space \((\mu , \overline {p},x)\). The value of x on the vertical axis corresponds to that of the repulsive interior equilibrium \(\overset {\_}{x}\) in the bi-stable regime illustrated in Fig. 3. It indicates, therefore, the threshold level of x that separates the basin of attraction of the Pareto dominant equilibrium x = 0 from that of the Pareto dominated equilibrium x = 1. The higher the value of x along the vertical axis of Fig. 8, the larger the size of the basin of attraction of the Pareto dominant equilibrium x = 0. Notice that if such threshold level equals 1 (i.e. \(\overset {\_}{x}=1\) in Fig. 3), then the basin of attraction of x = 0 is the whole set x ∈ [0, 1), so that the economy shifts from the bistable regime of Fig. 3 to the case described in Fig. 2 in which the Pareto dominant equilibrium x = 0 is globally attractive. It follows that the plateau (i.e the flat portion) of the region illustrated in Fig. 8 (where the threshold level is x = 1) corresponds to the pairs \((\mu ,\overline {p})\) giving rise to the regime illustrated in Fig. 2. Instead, in correspondence of the non-flat portion of the surface, the bistable regime in Fig. 3 is observed. As the figure shows, an increase in \(\overline {p}\) and/or μ tends to progressively enhance the basin of attraction of x = 0 until the latter becomes globally attractive (along the plateau).

The analysis developed in this section and in the previous one shows that multiple Pareto ranked equilibria may arise when water price is endogenous (p W being an increasing function of the share of the population working in sector A). The main goal of public administration should be to fix the values of the parameters \(\overline {p}\) and μ in order to satisfy the following condition:

As a matter of fact, such condition ensures the convergence of the economy to the equilibrium point x = 0 in all the cases in which the payoff in x = 0 is higher than in the other equilibrium points. Consider, for instance, case 3 in Proposition 1. Starting from the payoff configuration:

according to which the bistable regime in Fig. 3 occurs if \(\overline {p} =\mu =0\) , the public administration has to fix \(\overline {p}\) and μ so as to satisfy the following conditions:

In fact, if condition (9) is satisfied, the graph of \(\widetilde {\Pi }_{A}(x)\) will always be below that of \(\widetilde {\Pi }_{B}(x)\) for any value of x in the interval (0, 1). Stated differently, by properly setting the parameters \(\overline {p}\) and μ the government can shift and tilt the graph of \(\widetilde {\Pi } _{A}(x)\) so that working in the water-consuming sector A becomes eventually less profitable than working in the water-preserving sector B. It follows that whatever the initial value of x(0) the system will eventually converge to the equilibrium point x = 0 in which none will work in the more water-consuming sector A and production will totally shift towards the more water-preserving sector B. As emphasized before, this does not require to price water consumption only in the more water-consuming sector, but to price such consumption differently between sectors A and B to account for the different negative impact of the two sectors.

Notice that the term \(\overline {p}\) can be interpreted as the price floor of water-use permits, that is, a lower bound that the government may decide to introduce in the market in order to make sure that the price for water use does not fall below what is regarded as excessively low (i.e. socially undesirable). In other words, by increasing the exogenous component \( \overline {p}\) (the price floor, which is independent of the activity level of sector A) the regulator can induce a progressive shift towards the sector that is naturally more water-preserving and/or that invested in lower impact technologies. The same applies to a policy of fine-tuning on the endogenous price component μ which captures the reactivity of permits price to an increase in the production (and therefore also in the permits’ demand) of the most impacting sector A.

6 A more General Setting: A Three-Sectors Economy

This section intends to show that the results obtained in the two-sector economy described above can be easily extended to a more complex setting with n sectors (n ≥ 3). Indeed, in reality many sectors compete for water resources such as industry, agriculture, urban and environmental services. In particular, the case with three sectors will be examined here as this is the maximum dimension that allows to illustrate the present results in graphical terms. Let us consider, therefore, a context in which three sectors are present: A, B and C. Agents in sectors A and B face the Leontief production functions introduced in the preceding section; agents operating in sector C have the following production technology:

where W C and L C represent, respectively, water and labour inputs. As for sectors A and B, the labour input L C is obtained solving the equation:

from which:

The output is therefore given by:

Let us represent the state of the agents’ population with the vector \(\mathbf {x}=\left (x_{1},x_{2},x_{3}\right ) \in R^{3}\), where x 1, x 2 and x 3 represent the shares of agents operating in sectors A, B and C, respectively. Thus the vector \(\mathbf {x}=\left (x_{1},x_{2},x_{3}\right ) \) belongs to the unitary simplex, illustrated in Figs. 9, 10 and 11 in that it satisfies the following conditions:

Water inputs W A (x), W B (x), and W C (x) are given by:

According to the restrictions imposed on parameters measuring the impacts on water availability, sectors A and C have the highest and the lowest impact, respectively.

Profits are given by:

Finally, taking into account the impact of the three sectors on water resources, the mechanism determining the price p W of water resources is assumed to be:

According to such mechanism, the price p W reaches its highest value when x 1 = 1 (all agents operate in the most impacting sector A) and its lowest value when x 1 = x 2 = 0 (all agents operate in the least impacting sector C).

Following Taylor and Yonker (1978), we assume that the time derivatives \( \dot {x}_{i}=dx_{i}/dt\) of the shares x 1, x 2 and x 3 are given by the well known replicator equations (see also Weibull 1995):

where:

represents the population-wide average payoff. According to dynamics (11), strategies performing better than the average \(\overline {\Pi } (\mathbf {x)}\) spread in the population at the expense of less performing ones. Dynamics (11) could be completely analysed by means of the classification proposed by Bomze (1983) for replicator equations. However, due to space constraints, in this paper the analysis will be limited to numerical simulations.

Let us note that the states \(e_{1}=\left (x_{1},x_{2},x_{3}\right ) =\left (1,0,0\right ) \), \(e_{2}=\left (x_{1},x_{2},x_{3}\right ) =\left (0,1,0\right ) \) , and \(e_{3}=\left (x_{1},x_{2},x_{3}\right ) =\left (0,0,1\right ) \) in which only one strategy (working in sector A, in sector B, in sector C, respectively) is adopted by the agents are always equilibrium points under replicator dynamics (11). In Figs. 9–11, attractive equilibrium points are indicated by full dots, repulsive ones by empty dots, while saddle points by drowning their stable and unstable branches. The numerical simulation illustrated in Fig. 9 Footnote 10 shows for a three-sector economy the phase portrait of a dynamic regime analogous to the bistable regime illustrated in Fig. 3 that was obtained in the context with only two sectors. All the vertices of the unitary simplex (e 1, e 2 and e 3) are locally attractive equilibria. If the economy starts from an initial distribution \(\left [ x_{1}(0),x_{2}(0),x_{3}(0)\right ] \) of strategies that is sufficiently close to e 1 (respectively, to e 2 and e 3), then it will eventually converge to the equilibrium e 1 (respectively, to e 2 and e 3). Consequently, the dynamics illustrated in Fig. 9 is path-dependent. Furthermore, under the parameters specification used to generate the simulation in Fig. 9, the equilibrium e 1 is Pareto dominated by e 2, which in turn is Pareto dominated by e 3. This implies that e 1 and e 2 are poverty traps for the economy: if the initial distribution of strategies \(\left [ x_{1}(0),x_{2}(0),x_{3}(0)\right ] \) belongs to the basins of attraction of e 1 and e 2 (in pink and yellow, respectively), then a self-reinforcing process drives the economy towards a Pareto dominated equilibrium.

Figure 9 is obtained by setting \(\overline {p}=0.21\) and μ = σ = 0, in the pricing Eq. (10). Figure 10 shows the dynamic regime which is observed by increasing, ceteris paribus, the values of μ and σ (μ = 0.2, σ = 0.1). In such a context, the poverty trap e 1 is no more attractive, while e 2 and e 3 remain attractive. Finally, the dynamic regime in Fig. 11 is obtained via a further increase in μ and σ (μ = 0.9, σ = 0.8). Notice that the Pareto dominant equilibrium e 3 becomes globally attracting: starting from any initial distribution of strategies \(\left [ x_{1}(0),x_{2}(0),x_{3}(0)\right ] \) with x 3(0) > 0 (i.e. a strictly positive share of agents initially works in sector C so that the others can possibly imitate their strategy), the economy will eventually converge to e 3 in which everyone ends up working in the least water-consuming sector C.

7 Conclusions

Water scarcity and pollution are certainly among the main challenges mankind has to face nowadays. Water is not only a basic need for human health and well-being, but also a primary requirement for the production activities underlying the economic development of modern societies. These features have generated a heated debate both among scholars and in the public opinion on how to reduce water consumption. To get a deeper understanding on this issue, the present work investigates water problems from a non conventional perspective with respect to the extant literature. In fact, differently from previous theoretical literature on water consumption and pollution problems, this contribution examines the impact of an endogenous water-pricing mechanism on the dynamics of the economic system in the presence of a population of interacting economic agents characterized by imitative behaviors. Furthermore, the model proposed here analyzes the environmental (water-related) and economic dynamics that emerge when two sectors compete for water consumption since their production activities both depend on a limited stock of water resources at disposal. As the model shows, when water is underpriced there exists a self-enforcing adoption process driving the economy towards a Pareto-dominated equilibrium: the economy fully specializes in the sector characterized by the highest negative impact on the water resource, at the expenses of the other sector(s). A relatively low water price, therefore, may end up locking-in the economy in a system that is totally dominated by the most polluting sector.

A proper intervention on the endogenous water pricing mechanism, however, can inhibit the convergence of the economy to a similar Pareto-dominated equilibrium. As shown in the paper, this can be obtained by increasing the exogenous and/or the endogenous price component (indicated in the paper as \( \overline {p}\) and μ, respectively). To provide an example from real world applications of a similar mechanism, an increase in the price floor in a water permits system (corresponding to a rise of \(\overline {p}\) in the model) can be a suitable instrument to drive the economic system away from the most polluting sectors and to induce the adoption of water-saving technologies as well as a change in the composition of the economic system.

This is certainly not to say that water tradable permits are the panacea of all water problems. Like any other market, WTP may undergo several implementation problems that often emerge when economic theory is confronted with practical application and everyday reality. However, a proper implementation of this mechanism can help societies overcome some of the increasing water problems experienced in the last decades and can shift the economy away from the specialization in “dirty” sectors. The latter look more appealing in the short-run for their lower production costs with respect to cleaner sectors which invest in water-preserving technologies; however, their impact on water resources may end up preventing the continuation of economic development in the long-run. Using water markets to properly price water use can alter the relative costs of the two sectors and thus promote the diffusion of water-preserving technologies through the imitative behaviours that often characterize our societies and that have been analytically described in this work.

Notes

The first WTP markets date back to 1979 in Chile and to the early 1980s’ in some States of the USA (Idaho, Wisconsin, Colorado). In Australia water consumption permits were introduced in 1989 in the Murray-Darling Basin. The Australian regulator then decided to extend the application of water markets and implemented also a a system of water pollution permits in the same basin three years later. See Borghesi (2013) for a discussion of these applications.

See Borghesi (2013) for an in-depth discussion of the factors of success/failures of WTP that distinguishes between general issues that are common to both TWPR and TWAR and application problems that are specific to each of them.

The latter contribute to pollute water therefore both water consumption and water pollution problems can be simultaneously taken into account in the model.

See also Bebbington and Williams (2008) for a discussion of the conflicts between the mining companies and the local community in the Yanacocha gold mine site in Northern Peru.

As pointed out before, the model can be easily adapted to examine water pollution rather than consumption problems. If so, the terms \(\overline {W}_{i}\) (i = A, B) can be interpreted as measures of water quality (rather than quantity), while the parameters α, β, γ, δ measure the effect that the polluting activities of sectors A and B have on water quality. In what follows, however, we will generally refer to water consumption rather than pollution problems as the former have more immediate and evident consequences on the production capacity of the economic sectors.

The same results on dynamics, in this one-dimensional context, would be obtained under every sign-preserving adoption dynamics (see Weibull 1995) according to which: \(\overset {\cdot } {x}\gtreqless 0\) if \(\widetilde {\Pi }_{A}(x)\gtreqless \widetilde {\Pi }_{B}(x)\) for every x ∈ (0, 1).

The slope of the graphs \(\widetilde {\Pi }_{i}(x)\) (i = A, B) are equal to \( \frac {d\widetilde {\Pi }_{A}(x)}{dx}=\frac {d{\Pi }_{A}\left [ W_{A}(x)\right ]} { dW_{A}}(\beta -\alpha )\overline {N}-\mu (\alpha +\gamma )\overline {N}\) and \( \frac {d\widetilde {\Pi }_{B}(x)}{dx}=\frac {d{\Pi }_{B}\left [ W_{B}(x)\right ]} { dW_{B}}(\delta -\gamma )\overline {N}-\mu (\beta +\delta )\overline {N}\). In what follows the slope of the graph of \(\widetilde {\Pi }_{A}(x)\) is said to be lower (respectively higher) than that of the graph of \(\widetilde {\Pi } _{B}(x)\), if \(\frac {d\widetilde {\Pi }_{A}(x)}{dx}<\frac {d\widetilde {\Pi }_{B}(x)}{dx}\) (respectively \(\frac {d\widetilde {\Pi }_{A}(x)}{dx}>\frac {d \widetilde {\Pi }_{B}(x)}{dx}\)) ∀x ∈ (0, 1). Notice that, if μ = 0 , the slopes of the graphs of \({\Pi }_{A}\left [ W_{A}(x)\right ] \) and \({\Pi }_{B}\left [ W_{B}(x)\right ] \) coincide with those of the graphs of \( \widetilde {\Pi }_{A}(x)\) and \(\widetilde {\Pi }_{B}(x)\), respectively.

Although a zero-price scenario is admittedly less frequent, one can find specific examples in which water is free. Think, for instance, of common-pool water resources in some African countries that are freely available to the inhabitants of the surrounding villages, causing women to walk long distances to get the available water and provoking well-known free-riding problems. As pointed out above, however, all dynamic regimes of Figs. 1–6 apply even if water price is strictly positive but sufficiently low.

This simulation is obtained setting:

α = 0.83, β = 0.2, γ = 0.94, δ = 0.41, ε = 0.1, ζ = 0.21, η = 0.7, 𝜃 = 0.41, λ = 0.01, μ = 0 , σ = 0,\(\overline {W}_{A}=10\), \(\overline {W}_{B}=6\), \(\overline {W}_{C}=3\), \(\overline {p}=0.21\), w = 0.8, a = 1, b = 1, c = 1.5, d = 1, e = 2.7 , f = 1.

References

Abbink J (2011) Land to foreigners: economic, legal, and socio-cultural aspects of new land acquisition schemes in Ethiopia. J Contemp Afr Stud 29(4):513–535

Antoci A, Borghesi S, Sodini M (2015) Emission trading systems and technological innovation: a random matching model. In: Semmler W, Bernard L (eds) The Handbook of the Macroeconomics of Climate Change. Oxford University Press, pp 376–397

Bebbington A, Williams M (2008) Water and mining conflicts in Peru. Mt Res Dev 28(3/4):190–195

Bomze L (1983) Lotka-Volterra equations and replicator dynamics: a two-dimensional classification. Biol Cybern 48:201–211

Borghesi S (2013) Water tradable permits: a review of theoretical and case studies. J Environ Plan Manag 57(9):1305–1332

Borghesi S (2014) Water conservation and management: common sense for a common resource?. In: Castellucci L (ed) Government and the Environment. The Role of the Modern State in the Face of Global Challenges, 116-131, Routledge

Bjornlund H, McKay J (2002) Aspects of water markets from developing countries: experience from Australia, Chile and USA. Environ Dev Econ 7:769–795

Collentine D (2006) Composite market design for a transferable discharge permit system. J Environ Plan Manag 49(6):929–946

Dai TS, Gu BY, Zhao WH (2008). In: 4th international conference study on the market power in water rights market, wireless communications, networking and mobile computing

Dionisio Perez Blanco C (2015) Water charging and water saving in agriculture. In: Insights from a revealed preference model in a Mediterranean basin’, Paper presented at the third GGKP’s Annual Conference, 29-30 January, 2015, Venice

Fisher-Vanden K, Olmstead S (2013) Moving pollution trading from air to water: potential, problems, and prognosis. J Econ Perspect 27(1):147–172

Pope Francis (2015) Laudato si’: encyclical Letter on care for our common home. Libreria Editrice Vaticana, Rome

Franks DM, Davis R, Bebbington AJ, Ali SH, Kemp D, Scurrah M (2014) Conflict translates environmental and social risk into business costs. PNAS 111(21):7576–7581

Garrick D, Siebentritt MA, Aylward B, Bauer CJ, Purkey A (2009) Water markets and freshwater ecosystem services: policy reform and implementation in the Columbia and Murray-Darling basins. Ecol Econ 69:366–379

Hagem C, Westkog H (1998) The design of a dynamic tradeable quota system under market imperfections. J Environ Econ Manag 36(1):89–107

Hahn RW (1984) Market power and transferable property rights. Q J Econ 99(4):753–765

Hearne RR, Easter WK (1997) The economic and financial gains from water markets in Chile. Agric Econ 15(3):187–199

Hoff H (2011) Understanding the Nexus. Background Paper for the Bonn 2011 Conference: The Water, Energy and Food Security Nexus. Stockholm, Sweden

Horan RD, Shortle JS, Abler DG (2002) Point-nonpoint nutrient trading in the Susquehanna river basin. Water Resources Research 38(5):8–1-8-12

Jarvie M, Solomon B (1998) Point-non point effluent trading in watersheds: a review and critique. Environ Impact Assess Rev 18(2):135–157

Kraemer A, Kampa E, Interviews E (2004) The Role of Tradable Permits in Water Pollution Control. Brussels: Ecologic, Institute for International and European Environmental Policy

Landry C (1998) Market Transfer of Water for Environmental Protection in the Western United States. Water Policy 1(5):457–469

Makki F (2012) Power and property: commercialization, enclosures, and the transformation of agrarian relations in Ethiopia. J Peasant Stud 39(1):81–104

Pincetl S, Hogue TS (2015) California’s new normal? Recurring drought: addressing winners and losers, local environment. Int J Justice Sustainability 20(7):850–854

Prabodanie RAR, Raffensperger JF, Mike MW (2010) A pollution offset system for trading non-point source water pollution permits. Environ Resour Econ 45:499–515

Rasul G, Sharma B (2015) The nexus approach to water–energy–food security: an option for adaptation to climate change. Climate Policy, forthcoming. doi:10.1080/14693062.2015.1029865

Shortle JS, Horan RD (2001) The economics of non-point pollution control. J Econ Surv 15(3):255–289

Taylor P, Yonker L (1978) Evolutionary stable strategies and game dynamics. Math Biosci 40:145–56

The Economist (2003) Priceless: a survey of water. The Economist 19:3–16

Tisdell JG (2001) The environmental impact of water markets: an Australian case-study. J Environ Manag 62(1):113–120

Trostle R (2008) Global Agricultural Supply and Demand: Factors Contributing to the Recent Increase in Food Commodity Prices. A Report from the Economic Research Service. United States Department of Agriculture

United Nations Development Programme (2006) Human Development Report 2006: Beyond Scarcity–Power, Poverty and the Global Water Crisis. Basingstoke, United Kingdom: Palgrave Macmillan

Weibull JW (1995) Evolutionary Game Theory. The MIT Press, Cambridge (MA)

World Economic Forum (2011) Water security: water-food-energy-climate nexus. The World Economic Forum Water Initiative. Edited by Dominic Waughray. Washington D.C., USA. Island Press

World Health Organization (WHO) (2008) Safer water, better health: costs, benefits, and sustainability of interventions to protect and promote health. Geneva: World Health Organization

Woodhouse P (2003) African enclosures: a default mode of development. World Dev 31(10):1705–1720

Woodward RT, Kaiser R, Aaron-Maire W (2002) The structures and practise of water-quality trading markets. J Am Water Resour Assoc 38(4):967–979

Acknowledgments

The authors would like to thank two anonymous referees and seminar participants to the Fourth Annual Conference of IAERE (Italian Association of Environmental and Resource Economists, Bologna, 2016) and to the Workshop ”European Water Utility Management: Promoting Efficiency, Innovation and Knowledge in the Water Industry”, 2015 held at University of Pisa (Italy) for helpful comments and suggestions on a preliminary version of the paper. The usual disclaimer applies.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Antoci, A., Borghesi, S. & Sodini, M. Water Resource Use and Competition in an Evolutionary Model. Water Resour Manage 31, 2523–2543 (2017). https://doi.org/10.1007/s11269-016-1391-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11269-016-1391-x