Abstract

The application of a livelihood asset-based approach to adaptation policy targeting is presented through the creation of maps highlighting the spatial contrasts of access to various types of livelihood assets utilizing primary household data. Thus, the livelihood maps provide policy-makers with a tool to quickly identify areas with limited access to certain types of assets, making the latter less able to react to a changing level of climate-related risks. In the case of Bhutan, distinct spatial patterns of asset endowments is identified using five different asset indicators drawing attention to the fact that some areas facing increased level of climate-related risks lack access to productive and human capital, while other areas facing a similar situation have relatively insufficient access to financial assets. This again shows that any non-targeted policy aiming at improving households’ risk-management capacities through asset-building would have quite diverse results even among closely located districts in Bhutan. Finally, relevant policy options concerning the various dimensions of asset holdings are discussed so as to identify options that may benefit poor and vulnerable no matter if the expected outcomes of a changing climate are realized or not.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The Intergovernmental Panel on Climate Change (IPCC) states that projected changes in the frequencies and intensities of extreme climate events are expected to have mostly adverse effects on natural as well as human systems (IPCC 2007a). These projected changes will have serious consequences for household welfare outcomes such as food security and poverty in rural areas due to increased crop failures, loss of livelihoods, and yield declines (Food and Agriculture Organisation of the United Nations 2008). The projected changes include increased warm spells and heat waves, resulting in droughts, increases in heavy precipitation events in most areas, and an increase in intense tropical cyclone activity (IPCC 2007a). In that sense, it is crucial to understand how people living in disaster-prone areas are adapting to and coping with such changes and how they are affected when the shock occurs. Just as importantly, it is essential to recognize how people facing these climate-related risks can be assisted in the most efficient way.

Given the expected adverse impacts of climate change, the convergence of multiple stressors such as civil unrest, economic or financial instability, and spreading diseases provides a critical challenge for communities throughout the developing world facing increased levels of climate-related risks, especially if the resources needed to facilitate adaptation efforts are lacking (Fields 2005). In the field of poverty alleviation, minimizing the leakage of resources to the non-poor is a key to maximizing the impact given limited funds, and one way to minimize such leakage is through proper targeting (Fujii 2008). For example, spatial targeting may have potentially large impacts on policy efficiency, as household welfare is commonly unevenly distributed across regions or districts in developing countries. Linking this with climate change adaptation, significant gains could be made if adaptation policies target households with a low potential or chance of adapting to the changing levels of risk. Thus, there is a need for proper targeting tools when it comes to distributing the limited amount of resources allocated for climate change adaptation policies.

This study looks at how a livelihood asset-based approach may be applied in order to provide a tool for targeting adaptation policies so as to disburse the efforts to the most vulnerable. The starting point is the asset-based approaches that are commonly applied to analyses of household welfare. The paper argues that a similar approach is suitable for discussing households’ abilities to adapt and react to climate-related risks. In order to provide an example of the practical application of such a framework, the case of Bhutan is presented through various maps highlighting the spatial contrasts in households’ asset holdings. Based on these, relevant policy options for improving households’ potentials for adaptation are identified and discussed.

The rest of this paper is structured in the following way. Section two describes asset-based approaches to household welfare analysis, while section three describes the case study used and the methodology. Section four presents the results, while section five discusses them. Finally, section six provides a conclusion.

Asset-based approaches relevant to household welfare outcomes and climate change risk management

Sen (1981) introduced the concept of entitlements or capabilities, where people with access to a sufficient range of assets have the “freedom” to act in the face of adverse situations. In that sense, Sen was one of the first to define household well-being as being multidimensional and closely interlinked with access to assets and associated livelihood strategies (Moser 2006). Linking this to adaptation to and the management of climate-related risks, people need access to a range of assets and entitlements in order to be able to adapt to changes in climate-related risks by, for example, adjusting their livelihood strategies. Based on Sen’s thoughts, among others, various asset-based approaches to livelihoods and household welfare have evolved since then, all underlining the value of having stable access to and control of assets in order to ensure household well-being when faced with adverse situations such as climate-related risks.

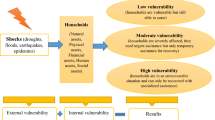

One strand within this literature has been work on the sustainable livelihoods approach (SLA), which is centred on people and their skills, status, and possessions (Department for International Development (DFID) 1999). The focus is on how they are able to use these assets to improve their overall quality of life, acknowledging that no single asset on its own is able to yield the self-desired outcomes in terms of, for example, reduced vulnerability or improved food security. The SLA shows how households navigate in a so-called vulnerability context in which the external environment among other things affects the returns to household assets in form of price changes, natural hazards, and the like (Devereux 2001). In this context, households employ their available assets in order to obtain positive livelihood outcomes through various livelihood strategies. Thus, the main focus of the SLA is to ensure that people have adequate access to the various assets they need to fulfil their individual potential, thus showing that livelihood assets may be grouped into several sub-groups, each covering an important aspect of livelihood asset holdings.

Another approach is the social risk management (SRM) framework put forward by the World Bank. The emphasis here is to increase the risk-management capacity for each household so that the maximum possible welfare loss is minimized, together with the probability of a loss in consumption below a given threshold (Holzmann and Jorgensen 2000). The framework is centred around the “risk-vulnerability chain,” where risks are reduced through ex-ante management strategies such as reduction (e.g. livelihood diversification) and compensation (savings and insurance), as well as ex-post responses or coping strategies (e.g. increased labour supply, asset sales, and credit) (Siegel et al. 2003). The risk-management strategies available to each individual household are then used to maximize the household’s well-being outcomes. The availability of potential risk-management strategies is determined by household access to relevant livelihood assets.

Finally, an asset-based approach to poverty dynamics has recently been explored, arguing that insufficient returns from productive assets are a key driver of chronic poverty. The reason is that households in developing countries often rely on asset liquidation as a coping strategy to maintain their consumption levels following an adverse welfare shock. Thus, households often tend to maintain secure and easily sellable asset portfolios, facing low expected returns as a consequence. Such a strategy could give rise to a poverty trap, from which households are able unable to escape due to their inability to sustain their income-generating asset base (Carter and Barrett 2006). Acknowledging the existence of such poverty traps and the inter-linkages between short-term coping and potential losses in long-term productivity and adaptation are important for climate change adaptation, especially as the adverse impacts of climate change accumulate over time (Yamin et al. 2005).

Asset-based approaches to development are not new, but many of these have primarily been linked to general poverty alleviation. But as all these approaches acknowledge that assets are not only inputs to certain livelihood strategies, but also grant households the ability to be and to act, the link to adaptation should be pretty straightforward (Bebbington 1999). The SRM approach has been used to identify so-called “no-regrets” or “pro-poor” approaches to climate change adaptation by arguing that adaptation basically consists of risk-management strategies based on households’ access to assets through which they can tackle the risks associated with a changing climate (Heltberg et al. 2009).Footnote 1 Thus, the asset portfolios of households and communities are key drivers in both reducing risks and coping with and adapting to increased levels of risk (Moser and Satterthwaite 2008). Furthermore, the multidimensional approach of SLA also makes it possible to explore how the different aspects of climate change may affect people’s assets, as well as their livelihood strategies and hence their welfare outcomes (Verner 2010). Thus, adaptation is seen as an integrated part of households’ overall risk management, as households in developing countries face many other risks not related to climate.

The idea of this study is to show how a livelihood asset-based framework can be used to highlight households’ potential for adaptation to climate-related risks when such potential is defined as being determined by sufficient access to livelihood assets. The results are presented through detailed asset maps showing household access to various categories of assets utilizing primary household data. Such maps have the potential to present clearly existing spatial heterogeneity in asset portfolios, providing an obvious tool for adaptation policy targeting if they are linked together with, for example, perceived climate-related risks.

This study proposes to use asset holdings on the household level in order measure household resilience on the district or community level. Using household-level data makes it possible to include a much higher number of asset-related variables in order to capture the true variation in asset holdings on the household level. To my knowledge, this approach has not been tried before when it comes to disaggregated mapping of livelihood assets on the country level. Moreover, linking actual climate-related risks with disaggregated livelihood asset maps is also an approach to adaptation policy targeting that has not been explored thoroughly.

Data and methodology

In order to show how livelihood asset-based maps can be used for policy targeting, the case of Bhutan was chosen due to the availability of data and the country’s location, which exposes it to several climate-related risks. The analysis is based on the Bhutan Living Standard Survey (BLSS) from 2007 conducted by the National Statistics Bureau (NSB) of Bhutan and contains spatially disaggregated and detailed household data. The nation-wide survey was conducted from March to May 2007, covering a national representative sample of nearly 10,000 households. The BLSS for 2007 collected information on assets, housing, education, and the like, and the survey was made representative down to the district level (dzongzhags). The high level of detail makes it suitable for creating asset-based measures on a disaggregated spatial level, in this case the district level. This level of aggregation is chosen due to two reasons. First and foremost, the BLSS data are, as mentioned above, only representative at the district level making further disaggregation difficult. Secondly, the size of Bhutan itself makes it less appealing to further disaggregate the analysis, as targeting on such a disaggregated level would be unfeasible.Footnote 2

The mapping of welfare outcomes at highly detailed levels has been employed frequently recently through the use of small area estimation methods. However, most studies have focused on uni-dimensional outcomes such as incomes, consumption, or nutritional intake (see Elbers et al. 2003; Minot et al. 2006; Benson 2006, for examples). But while uni-dimensional approaches may fail to explore the underlying causes of the low welfare outcomes, multidimensional approaches are able to provide more immediate pointers to the corresponding welfare policy options (Erenstein et al. 2010). Thus, this study looks at how multidimensional asset-based maps can contribute if the risks of climate change are to be reduced by improving households’ asset portfolios. And in any case, disaggregated targeting is able to enhance the efficiency of many welfare-related interventions and to reduce leakage by focusing efforts on smaller homogenous population groups (Bigman and Srinivasan 2002).

In line with both SLA and SRM, assets are divided into relevant categories so as to generate multidimensional maps presenting the contrasts in asset portfolios across Bhutan. Each indicator needs to be comparable across geographical areas (districts in this case), and, given that each asset category encompasses several types of assets, a method for summarizing asset holdings within each category is needed. Thus, this study introduces the Sahn–Stifel method, which uses factor analysis to find a single common factor that explains the covariance of a vector of assets by assuming that these assets reflect a common latent “wealth” variable that is impossible to measure directly (Sahn and Stifel 2000).Footnote 3 Thus, the aim is to identify common factors that are the source of more than one variable, and then keep the common factor that accounts for a larger part of the variation of the included variables (Perge 2010). The factor loadings from this common factor then represent data-driven weights on the assets within each category (Barrett et al. 2006). In that sense, the Sahn–Stifel method will allow us to create a data-driven index for each asset category based upon a series of asset variables.

More formally, the asset index takes the following form:

where AI i is the asset index estimated for the i households in the sample being a function of their J different assets and their associated estimated weights. It is assumed that the ownership of the different assets is explained by the so-called common latent “wealth” variable as well as a unique element, whose variance is uncorrelated across assets (Sahn and Stifel 2000). So, each weight is given by:

where c i is the common factor that needs to be estimated. The estimation derives a matrix of factor loadings reflecting the relationship between assets and the common factor; and the common factor can be obtained from this matrix (Perge 2010):

The weights for each of the asset categories are then estimated using the normalized factor scoring coefficients. Thus, a household’s score is the sum of its weighted normalized responses within each category:

Thus, if ownership of one type of asset is a good proxy for ownership of other assets, it would receive a positive coefficient. The size of the coefficient indicates if the specific type of asset conveys more or less information about the other assets.

In practice, data for each asset category are pooled together across districts so as to ensure that the data-driven index weights from the factor analysis are consistent. The indices are then compiled on the district level, resulting in estimates of district-level asset portfolios within each category, and are mapped using ArcView in order to present contrasts in asset endowments across districts.

Such a multidimensional mapping approach has only been used in a very few studies to date. Erenstein et al. (2010) explored asset holdings in three regions in India, but they relied on district-level data in order to construct the various dimensions of asset holdings, thereby including relatively few variables for each indicator. If the included variables capture the true variation in the asset holdings at the specified spatial level, this does not impose any problems. On the other hand, having too few variables may also imply selection bias if the included variables are not able to mimic the true variation in livelihood asset holdings. If this is the case, any data-driven weights within a given indicator are biased. Furthermore, utilizing household-level primary data to measure the sub-components limits the issues of having to combine data collected at different times and/or spatial scales (Hahn et al. 2009).

An aggregate indexing approach also presents difficulties in incorporating the variations between study populations, as sub-components are averaged into one major index score (Vincent 2007). But by disaggregating the analysis into a range of livelihood asset indicators, it is much easier to explore the variations in sub-categories, thus making spatial contrasts in asset holdings more visible. Multidimensional livelihood asset maps thus provide a means for spatially disaggregating the root causes of a given welfare outcome such as the ability to adapt to a changing climate.Footnote 4 A few more studies have also used approaches to poverty mapping similar to the India study (Kristjanson et al. 2005; Baud et al. 2008; Fujii 2008). Finally, the Alkire Foster method has also been used in estimating multidimensional poverty. This method relies on deriving the combination of deprivations that a household is experiencing by sorting them into a given number of dimensions (Alkire and Foster 2009; Alkire and Santos 2010). However, this study refrains from considering people either poor or non-poor and instead focuses on measuring the individual household’s capacity and potential in dealing with risks. By aggregating these measurements to a relevant spatial level (in this case district level), it is then possible to indicate where larger groups of households lacking access to certain kinds of assets or entitlements are located.

Results

All household assets are grouped into categories, each relevant for a distinct part of a households’ livelihood asset portfolios. Five categories were identified based on both SLA and SRM. Descriptive statistics for these are found in Table 1.

Comparing the asset categories in Table 1 with the suggested groups from SRM and SLA, categories relating to natural and social capital are lacking due to insufficient data, although the “agricultural productive capital” category covers some of the natural capital dimension through the ownership of various types of land.Footnote 5 Moreover, the traditional physical capital category is split into two categories, one covering wealth-related assets such as dwelling quality and durables, the other capturing agricultural productive capital, thus making it easier to explore the reasons behind a low risk-management capacity.

The factor loadings from the first common factor found on the far right column of Table 1 present the data-driven weights that the various asset indices rely on. One possible disadvantage of using many variables within each category is that the factor analysis could capture some spurious correlations manifested by counter-intuitive weights. However, the factor loadings associated with all five asset indicators have the expected signs and are used as weights for the indices.Footnote 6 However, the location capital indicator has an inverse scale compared to the others, meaning that a high value equals low access to this type of capital.

The factor loadings are used to estimate the district-level asset holdings by the five indicators. The estimated indicators are mapped and presented in Figs. 1, 2, 3, 4, and 5. The inverse scale of the location capital indicator is taken into account, meaning that dark colours always equal the lowest ranking districts.Footnote 7

The livelihood asset maps show significant contrasts in the asset portfolios between the districts. It should, however, be noted that the indicators do not distinguish between households living in urban and rural areas, which explains some of the heterogeneity in the indicators. For example, Thimphu district ranks as the worst district when it comes to agricultural productive asset holdings, mainly due to the large urban population in this district.

The physical capital indicator shows low physical capital bases in the central as well as the north-eastern districts of Bhutan. This fits well with community-level rural poverty rates, as some of the highest rates are found in communities within these districts (World Bank 2010). The main divergence between poverty rates and physical capital holdings is that the northernmost district, Gasa, ranks as one of the worst districts using the physical capital indicator, while it is also found among the three districts with the lowest poverty rates (National Statistics Bureau 2007). Another study of multidimensional poverty in Bhutan also confirms the discrepancy between actual poverty rate and entitlements in Gasa, which is probably due to the very sparse population in this mountainous area causing (Santos and Ura 2008).

Human capital endowments are also quite divergent spatially, following the same pattern as the physical capital holdings. Not surprisingly, Thimphu ranks as the best educated district, being the home of the capital and the major urban centre in Bhutan. The lowest ranking districts in terms of human capital correlate quite well with the physical capital holdings, except that the central districts of Daga and Chirang rank higher in terms of human capital.

The location capital indicator captures how well households are integrated into the existing infrastructure, measured by the travelling time to various important services such as health care and food markets. Lack of location capital, for example, limits households’ options in obtaining credit or selling products, especially in times of stress, making them more vulnerable to risks, as it would be difficult for them to obtain direct help due to this lack of integration. Not surprisingly, Gasa ranks as the worst region due to the large impassable areas in the mountains.

The spatial pattern of financial capital access is quite similar to the location capital indicator, as the south-eastern part of the country seems to be the region where most households fail to have sufficient access to credit. Surprisingly, Thimphu also shows a lack of access to financial capital. One reason could be the naturally low holdings of small ruminants in the capital district of Bhutan due to the urban character of the district.Footnote 8 Thus, the estimate of the financial capital indicator was done again with the ruminant variable removed, but the alternative specification did not change the ranking of Thimphu.

Finally, the agricultural productive capital indicator highlights that it is mainly the south-western and north-eastern parts of Bhutan that lack access to agricultural productive, if one ignores Thimphu. Again, this fits well with overall poverty prevalence in the country, as some of the highest community-level poverty rates are to be found in these areas.Footnote 9

Discussion

Given the spatial heterogeneity in asset holdings, it should now be clear that an asset-based, non-targeted policy intervention in Bhutan would have very diverse results in terms of expected welfare outcomes. Thus, any policy intervention in the country that aims to improve households’ livelihood asset bases so as to increase their risk-management capacities would have to take the heterogeneity in asset endowments into account. Failing to do so would hamper the efficiency of the given intervention. However, some policy interventions that are aimed at specific livelihoods are perhaps not suitable in all geographical settings. For example, it could prove to be very costly to improve road access in highly mountainous region such as Gasa District, despite the lack of location capital. Finally, factors such as population densities should be taken into account when using livelihood asset maps for policy targeting so as to direct relevant interventions to as large a proportion of the people in need as possible.

If the livelihood maps are to be used to target policies aimed at improving households’ abilities to adapt to climate-related changes, it is necessary to identify the perceived climate-related risks first.Footnote 10 Bhutan faces numerous climate-related risks identified in its National Disaster Risk Management Framework, most of them related to the mountainous nature of the country (Ministry of Home and Cultural Affairs (MoHCA) 2006). The risks are primarily related to floods, wildfires, landslides, and Glacier Lake Outburst Floods (GLOFs). IPCC climate projections for the South Asia sub-continental region, of which Bhutan is part of, predict increases in average temperatures, especially at higher altitudes, and greater precipitation despite an expected decrease during the dry season. However, there is no conclusive indication of changes in the occurrence of extreme weather events (IPCC 2007b). Climate data from Bhutan show an increasing trend in precipitation variability over the past decade, while average temperatures also have been higher than the mean from 1990 to 2003 (National Environment Commission 2009). As regards extreme weather events, twelve have been identified for the period 1993 to 2005, with floods being the most common (Danish International Development Assistance 2008).

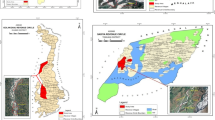

In this case, GLOF-related risks are selected in order to narrow the analysis, especially spatially. However, the focus on GLOFs is highly relevant, as they serve as one of the most immediate and severe consequences of climate change in the Himalayan region, partly due their large potential for damage (Namgyel 2003).

Figure 6 shows the locations of the areas that are most threatened by GLOFs. The western GLOF areas are those with the highest estimated threats, as the Po Chu basin alone holds one-third of the so-called dangerous lakes. GLOFs not only pose a great risk for households living in the basins, they also threaten industrial infrastructure such as hydropower projects, which contribute significantly to the country’s export earnings.

Major GLOF areas in Bhutan Source: based on Mool et al. (2001)

The expected GLOF-affected areas cover six to seven districts consisting of all districts in the north except Tashi Yangtse (the easternmost district). Looking at the livelihood asset portfolios of these areas, it is obvious that they face diverse challenges, making policy targeting highly relevant. The easternmost districts have limited access to physical and human capital, while the more central districts primarily have problems accessing financial capital. This implies that the aim of potential livelihood support programs should be adapted to the given district-level context that they are implemented in so as to ensure efficiency.

Adaptation policy examples using a livelihood asset-based approach

Previously, there has been a general lack of connection between general development plans in form of, for example, Poverty Reduction Strategy Papers and a country’s adaptation policies (Hardee and Mutunga 2010). But by employing an asset-based framework to improve the potential of households to cope with and adapt to a changing climate, the link between adaptation policies and, for example, general poverty alleviation should be clearer. Such integration would also be useful in moving beyond the ‘technical’ domain that climate change adaptation efforts are sometimes isolated within (Moser and Satterthwaite 2008).

Using the identified asset categories, it is now possible to identify relevant adaptation policy options and relate to the case of Bhutan’s GLOF areas:

Physical capital

The physical capital category does not focus on any direct productive means, as the category covers mostly durable goods and dwelling quality. Such assets do not generate any income themselves and are for the most part not related directly to livelihoods. On the other hand, they play an important role in risk management, as they are linked to both ex-ante, but especially ex-post risk management. Thus, following risky events, physical assets can be drawn down or sold in order to make up for losses generated by the risky event, as seen in, for example, Latin America following Hurricane Mitch in 1998 (Carter et al. 2007). The physical capability of household members is naturally also a key driver for adaptation to any given changes in the surrounding natural as well as economic environment, making the quality of sanitary conditions a key indicator of vulnerability to climatic variability (Brooks et al. 2005). Finally, some aspects of physical capital could actually provide direct protection from climate-related risks, such as using specifically reinforced buildings as shelters during storms or floods.

Policy interventions for this type of capital could focus on reducing the risk sensitivity of households by improving the protection of the physical assets beforehand. One example would be to improve the building standards and sanitary conditions of household dwellings, enabling them to better withstand a realization of a risky event.

If the aim is to limit asset liquidation following a risky event, implementing well-targeted safety nets is an option for limiting the losses of the affected households. Such safety nets need to be in place before realization and would benefit from contingency plans for scaling up given the severity of the shock. The design could involve direct cash transfers, work programmes to ensure labour demand and other in-kind transfers, and could be either conditional or unconditional. Previous experiences have shown that existing safety nets are able to protect affected households by, for example, providing temporary employment in shock-affected regions through the reconstruction of damaged infrastructure (Grosh et al. 2008). All in all, it is vital that a country possesses the capacity to deliver transfers or work programmes when needed so as to limit the impact of any adverse shock (Heltberg 2007). In non-emergency contexts, safety nets are also an option to reduce risk adversity by encouraging diversification into riskier activities with potentially higher returns (Devereux 2001).

In our GLOF case, Gasa and Lhuntsi are clearly lacking access to proper physical assets, while Wangdi Phodrang and Bumthang seem to be better off. A further investigation shows that another driver for the low physical asset bases in both Gasa and Lhuntsi is lack of proper sanitary conditions. And given the nature of GLOFs, this could pose a serious constraint for household adaptation both ex-ante and ex-post due to the associated health risk. Especially following a flood-related event, health problems could exacerbate, if the sanitary conditions are of poor quality (for example, through water-borne diseases) thereby severely constraining households’ risk-management abilities.

Human capital

Human capital is an important aspect of building resilience to climate-related events, for example, through increasing households’ returns from their labour (Moser and Satterthwaite 2008). Higher educational levels and awareness also encourage the more efficient management of natural resources, which is vital for the sustainability of many rural livelihoods (Osman-Elasha et al. 2006).

Health-related issues are also a part of human capital, and it is clear that illness and insufficient health services can impose barriers for households in fulfilling their welfare potential due to both the immediate loss in earnings through inability to work, but also potentially through contingent coping strategies (for example, selling productive assets to replace lost income). Thus, overall health status is found to be a key driver in fulfilling the potential of households to manage risks from climate-related events (Brooks et al. 2005).

One widely used instrument available for improving households’ human capital is conditional cash transfers (CCTs), where households receive cash on the premise that they will use health, education, or other services that are considered to be of public interest. The basic CCT pays out cash or in-kind support for school attendance, but other schemes such as postponing some of the transfers by making them conditional on graduation or tertiary enrolment have also be tried (Barrera-Osorio et al. 2008).Footnote 11 CCTs could increase household resilience to climate-related risky events ex-ante by helping children being immunized, proper nourished, and better educated. At the same time, they also raise the general awareness of service providers and community support systems. However, CCTs associated with schooling and health are relatively poorly at delivering emergency support ex-post due to more complex administration and difficulties in scaling up (Fajth and Vinay 2010). Finally, efficiency gains from CCTs can be obtained by calibrating transfers for increased participation, as well as by reducing leakage through targeting those cases where conditionality will most likely imply a change in behaviour (De Janvry and Sadoulet 2004).

The eastern region of Bhutan encompasses districts with some of the lowest human capital bases in the country making these districts prime targets for interventions aimed at improving households’ access to, for example, education.

Location capital

Location capital relates to the physical infrastructure that controls accessibility to markets and health care, thus determining whether households are effectively cut off from market integration. Thus, lack of location capital limits their options in obtaining credit or selling products, thus hindering them in realizing their adaptive potential. On the other hand, proper infrastructure ensures that households are able to engage in livelihoods depending on market access, which again could diversify their income, and this limits their vulnerability to specific shocks. In that sense, vulnerability to climate change is linked to levels of socio-economic development where limited rural infrastructure is an indicator of regions associated with high vulnerability (Gbetibouo et al. 2010). Moreover, proper infrastructure is also associated with ex-post risk management of a major aggregate shock, as insufficient infrastructure creates isolated localities (due to, for example, collapsing roads and bridges), but also through failures of traditional communication networks that are essential for adequately attending to the needs of the isolated population (Debels et al. 2009). Also, proper access to extension services has also shown to be a significant factor in describing households’ perception of and adaptation to climate change (Gbetibouo 2009). Finally, a well-functioning physical infrastructure is a prerequisite for household risk management, for example, if emergency aid is needed. Moreover, proper communication networks such radio networks are essential to integrate any remote population group, both before and after a given climate-related shock.

Obviously, Gasa lacks proper infrastructure, but changes in elevation throughout the district makes a better physical integration with the rest of the country a significant challenge. But well-functioning physical infrastructure is a prerequisite for household risk management, for example, if emergency aid is needed. And given that Gasa encompass the most dangerous glacial lakes, the construction and improvement of infrastructure related to, for example, transport in the district should be implemented taking these risks into consideration by ensuring that it is able withstand future weather events.

Financial capital

Access to financial services, whether formal or informal, may be used to smooth consumption and manage risks, as well as to engage in new income-generating activities and build up vital assets. Many rural households across the world lack access to formal credit institutions and therefore have to rely on informal services that often prove to be less stable and secure. Informal financial instruments are usually restricted to the village level (borrowing from friends and relatives), making them suitable to managing idiosyncratic risks, while they risk failing when tackling covariate shocks, as these affect all households within the community (Alderman and Haque 2007). Thus, a lack of access to credit is associated with a low potential to adapt to climate-related risks, emphasizing the role of formal credit as a catalyst for livelihood support and enhancement through its abilities to tackle all kinds of risks (Eakin and Bojórquez-Tapia 2008; Hammill et al. 2008; Gbetibouo 2009).

One instrument has been the implementation of microfinance, which aims to provide small loans without collateral to households excluded from the formal financial sector (Morduch 1999). While previous subsidized credit schemes failed to deliver financial support, the more recent attempts in, for example, Bangladesh have been more successful at reaching the poor (Amin et al. 2003). In that sense, microcredit is basically an ex-ante risk-management option, as it builds household resilience through the diversification of livelihoods and assets.

Interestingly, access to financial capital has a distinct spatial distribution compared to, for example, physical or human capital in the GLOF-related areas, meaning that Wangdi Phodrang and Bumthang rank as the worse districts. Below one-fourth of the households in Lhuntsi have access to formal credit and instead rely on informal arrangements, shown by the fact that more than 85 per cent of households within the districts have the option of borrowing from friends and relatives. In Wangdi Phodrang, around 40 per cent of household have access to formal credit, but only one-third of the households have access to informal credit. This indicates that the challenges in the two districts are quite different, as Lhuntsi would tend to benefit solely from interventions focusing on providing formal credit, while Wangdi Phodrang could also benefit from arrangements building upon already existing informal arrangements.

Agricultural productive capital

Naturally, access to agricultural productive capital is the income-generating foundation of many rural livelihoods and thus also a key driver for adaptation. For example, small landholdings could be a barrier to crop diversification, making small landholders vulnerable to climatic stress (Gbetibouo et al. 2010). On the other hand, income diversification by complementing crop income with, for example, livestock income increases risk-management capacity, although it might not be sufficient to tackle specific climate-related shocks (Eakin and Bojórques-Tapia 2008). And, according to the asset poverty literature, households that are unable to sustain a decent welfare level through their productive capital portfolio are caught a downward spiral, further deteriorating their asset pools, as attempts are made to maintain consumption through unsustainable responses (for example, reducing consumption, selling remaining productive assets, withdrawing children from school, etc.) (Carter and Barrett 2006; Barrett 2007).

One option for protecting productive assets is the introduction of index-based insurance schemes that initiate payments to affected households when, for example, precipitation is below or above a certain threshold at which asset holdings will be threatened, whether through direct losses or distress sales (see, for example, Barnett et al. 2008). Such index-based insurance schemes may overcome obstacles related to moral hazard, timely payouts, or administrative costs associated with field evaluation, which may arise when implementing more traditional insurance schemes. And just like safety nets, index-based insurance schemes could reduce household risk adversity and fuel a transition towards livelihoods associated with higher risks and gains (Alderman and Hague 2007). However, targeting the most vulnerable households has so far also been a challenge for pilot projects concerned with index-based insurance, as the vulnerable households seem to have the highest price elasticity of demand, despite their potentially high welfare gains from the insurance (Chantarat et al. 2009).

In relation to our case, Bumthang is one of the well-endowed districts in Bhutan when it comes to agricultural productive assets. The main reason is the access to dryland, as households in Bumthang have access to more than 4 acres of dryland primarily used for maize, while the national average is around 1.3 acres of dryland per household. At the same time, Bumthang also has one of the highest average livestock holdings per household indicating that households within this district are quite diversified. Gasa, on the other hand, is having a much more one-dimensional asset portfolio, as households primarily rely on livestock. This makes them much less diversified, and they could be at risk from aggregate shocks that adversely affect the livestock herds in this area. Finally, Lhuntsi is located in a zone having very modest access to agricultural productive assets limiting households’ risk-management capacities within the district.

Limitations of multidimensional asset-based indicators and their associated maps

First and foremost, it should be emphasized that many policy options relevant for GLOF risk management focus on the reduction of risk exposure in a broader perspective, for example, by lowering the water levels of threatening glacier lakes (MoHCA 2006). Due to the multidimensional aspects of the livelihood asset maps, it is not straightforward to apply them to such broad interventions, for which, for example, a single composite indicator of overall vulnerability more suitable. In that sense, the multidimensional approach also lacks direct measurement of payoffs among different policy options, as the maps only present the heterogeneity in asset holdings, thereby locating the areas where the specific asset groups are sparsely distributed. But again, if one wants to explore estimated returns of holdings of various assets, the analysis would need to focus on a single measurable welfare outcome such as poverty or expenditure, which again could be an imperfect proxy for welfare (Lang et al. 2010).

Another possibility is to complement the livelihood asset maps with a single aggregate asset index capturing the overall status of asset holdings. However, it is problematic to pool all asset groups together, as various significant factors emerge from the factor analysis due to correlation within the various asset groups, thus making it difficult to defend a single aggregate asset index. Another possibility would be to take a reduced-form asset approach where only the most important assets from each livelihood asset group are taken into account. Studies comparing asset trajectories over time and across countries especially have utilized a reduced-form asset index (see Sahn and Stifel 2000; Booysen et al. 2008 for a few examples). But such an approach is bound to rely on a high degree of subjectivity regarding the inclusion of sub-components, thus making it less appealing.

The masking of extreme values by focusing on an aggregated spatial level should also be taken into consideration when employing an asset-based approach similar to the one suggested in this study. For example, pockets of poverty could be hidden within wealthy districts and should not be ignored. It is, however, reasonable to retain an aggregated focus when looking at households’ abilities to withstand and adapt to adverse risks, as a household typically depends not only on its own resources, but also on the resources of those who are likely to come to its aid (Tache and Sjaastad 2010). In rare cases, however, an increase in the risk-management abilities at household level through asset accumulation could also imply negative consequences for the risk-management ability of the community as whole. For example, a significant increase in livestock holdings would benefit the individual households, but the increased number of livestock could also lead environmental degradation making the positive effect of increased asset holdings smaller. Such issues of scale are also important to acknowledge, but are difficult to account for empirical.

The link between livelihood assets and welfare outcomes is perhaps also not so straight forward, despite the close correlation between, for example, livelihood assets and absolute poverty (Erenstein et al. 2010). Focusing solely on assets implies the possibility of ignoring the underlying drivers and modifiers that, together with livelihood assets, enable households to fulfil their welfare potential through, for example, adapting to changing levels of risks. Therefore, the insights drawn from livelihood asset maps should be linked with any knowledge of how these assets are adapted to create pathways of prosperity, acknowledging, for example, the dynamic roles of farmers’ livelihood systems (Dixon et al. 2007).

Finally, the maps presented in this study only provide a snapshot of the spatial contrasts in asset holdings: they cannot capture any changes over time. Thus, asset-based maps lack the ability to represent asset dynamics unless they are updated over time. Maps generated for sequential periods in time would, on the other hand, be able to illustrate the spatial dynamics of the individual asset types, together with their relative contributions and linkages to welfare outcomes (Erenstein et al. 2010).

Conclusions

The application of a livelihood asset-based approach to adaptation policy targeting has been presented through the creation of maps highlighting the spatial contrasts of access to various types of livelihood assets utilizing primary household data. In that sense, it provides a multidimensional and coherent approach to priority-setting and targeting when it comes to improving households’ access to livelihood assets, which are seen as the main determinants of household-level risk-management capacity. The main advantage of the methodology presented in this study is that it is easily adapted to any given spatial scale and is only limited by the detail level of the data provided. This implies that it is possible to conduct a policy targeting analysis from district-level and down to dwelling-level scale given the specific needs.

The livelihood maps provide a tool for policy-makers to identify areas with limited access to certain types of assets, making the latter less able to react to a changing level of climate-related risks. Such insights enhance the targeting, prioritization, and efficiency of a given welfare-related policy intervention by, for example, limiting the leakage of aid. In the case of Bhutan, distinct spatial patterns of asset endowments were shown using five different asset indicators. Attention was drawn, for example, to the fact that some areas facing GLOFs lacked access to productive and human capital, while other areas facing similar risks had relatively insufficient access to financial assets. This again implies that any non-targeted policy aimed at improving households’ risk-management capacities through asset-building would have quite diverse results even among closely located districts.

Policy options relevant for each group of livelihood assets have also been identified, focusing on those options that would aid the poor and vulnerable in dealing with potentially increased levels of climate-related risks, but also when it comes to achieving more general welfare outcomes such as escaping poverty. Thus, the examples presented in this study are meant to be policy options that benefit households, no matter what the realized outcomes of climate change. This should be seen as a complement to a narrower policy focus where adaptation measures are taken to improve the adaptive potential of a specific sector or ecosystem (for example, the construction of new infrastructure or coastal management).

The development of a livelihood asset-based approach to adaptation policy could be further improved by exploring the impact of having sufficient access to livelihood assets when it comes especially to gradual changes in the climatic environment, but also in connection with more sudden events such as GLOFs. Thus, implementing a dimension of time in the asset-based measures could further improve knowledge of how access to livelihood assets influences a household’s ability to fulfil its welfare potential, given increasing levels of climate-related risks. A further disaggregation beyond the district level would also be appealing, but high data requirements would make this approach difficult to implement on a wide scale, especially if it were to rely solely on primary household-level data.

Notes

The terms “no-regrets” and “pro-poor” should be seen as a way to identify policy options that would be beneficial to the poor and vulnerable, no matter what the uncertain future consequences of a changing climate.

Bhutan is 47,000 km2 large and has around 700,000 citizens. Hence, 20 districts are quite disaggregated.

Principal component analysis (PCA) has also been used to compile the necessary indicators regarding asset-based maps (Erenstein et al. 2010). While the assumptions behind factor analysis and PCA differ, the end result, that is, the inter-district ranking of asset holdings, is virtually the same. Factor analysis was finally chosen primarily due to its more relaxed assumptions regarding correlation structure.

Small area estimations of, for example, poverty are suitable for identifying local pockets of poverty, but it is more difficult to highlight the possible differences between two poor areas by focusing solely on a single welfare outcome.

Natural capital usually covers soil quality, rainfall and the like (and such factors can be difficult to allocate to specific households), while social capital is normally proxied by membership of community-level organisations or cooperatives and similar networks.

The factor loadings were taken from the first factor. For all the indicators except human capital, the eigenvalue of the first factor confirmed that the first factor loading captured the most significant part of the variation. For the human capital indicator, the second set of factor loadings was also considered due to the high eigenvalue, but it was decided to use only the first factor, as this was the only intuitively appealing one.

The categories are determined using natural jenks, meaning that within each group the average deviation from the mean is minimized, while the deviation from the other groups is maximized.

Ruminants are included to capture easily sellable assets in terms of goats and the like.

It is not surprising that ownership of physical and agricultural productive assets correlates well with the estimated community-level poverty rates, as these rely heavily on exactly the same variables.

In this case, identifying the perceived climate-related risks is mostly linked to identifying the areas in Bhutan that are most likely to be affected by changing levels of climate-related risks.

As a matter of fact, changing the timing of payments does not change primary enrolment rates, but it does a positive effect on the secondary and tertiary levels.

References

Alderman H, Haque T (2007) Insurance against covariate shocks: the role of index-based insurance in social protection in low-income countries of Africa. African Human Development Series, World Bank Working Paper no. 95, Washington, DC, World Bank

Alkire S, Foster J (2009) Counting and multidimensional poverty measurement. Oxford Poverty & Human Development Initiative (OPHI) Working Paper no. 32, Oxford Department of International Development, University of Oxford

Alkire S, Santos ME (2010) Multidimensional poverty index: research brief. Oxford poverty & human development initiative. Oxford Department of International Development, University of Oxford, Oxford

Amin S, Rai AS, Topa G (2003) Does microcredit reach the poor and vulnerable? Evidence from northern Bangladesh. J Dev Econ 70:59–82. doi:10.1016/S0304-3878(02)00087-1

Barnett B, Barrett CB, Skees J (2008) Poverty traps and index-based risk transfer products. World Dev 36:1766–1785. doi:10.1016/j.worlddev.2007.10.016

Barrera-Osorio F, Bertrand M, Lindin L, Perez-Calle F (2008) Conditional cash transfers in education: design features, peer and sibling effects. Evidence from a randomized experiment in Colombia. Policy Research Working Paper 4580, The World Bank, Washington, DC

Barrett CB (2007) Poverty traps and resource dynamics in smallholder agrarian systems. In: Delink R, Ruijs A (eds), Economics of poverty, environment and natural-resource use. Wageningen UR Frontier Series 25, Springer, The Netherlands

Barrett CB, Marenya PP, McPeak J, Minten B, Murithi F, Oluoch-Kosura W, Place F, Randrianarisoa JC, Rasambainarivo J, Wangila J (2006) Welfare dynamics in rural Kenya and Madagascar. J Dev Stud 42:248–277. doi:10.1080/00220380500405394

Baud I, Sridharan N, Pfeffer K (2008) Mapping urban poverty for local governance in an Indian mega-city: the case of Delhi. Urban Stud 45:1385–1412. doi:10.1177/0042098008090679

Bebbington A (1999) Capitals and capabilities: a framework for analyzing peasant viability, rural livelihoods and poverty. World Dev 27:2021–2044. doi:10.1016/S0305-750X(99)00104-7

Benson T (2006) Insights from poverty maps for development and food relief program targeting: an application to Malawi. Food and Consumption Division Discussion Paper 205, International Food Policy Research Institute (IFPRI), Washington, DC

Bigman D, Srinivasan PV (2002) Geographical targeting of poverty alleviation programs: methodology and applications in rural India. J Policy Model 24:237–255. doi:10.1016/S0161-8938(02)00108-4

Booysen F, Van Der Berg S, Burger R, Von Maltitz M, Du Rand G (2008) Using an asset index to assess trends in poverty in seven Sub-Saharan African countries. World Dev 36(6):1113–1130. doi:10.1016/j.worlddev.2007.10.008

Brooks N, Adger WN, Kelly PM (2005) The determinants of vulnerability and adaptive capacity at the national level and the implications for adaptation. Global Environ Chang 15:151–163. doi:10.1016/j.gloenvcha.2004.12.006

Carter MR, Barrett CB (2006) The economics of poverty traps and persistent poverty: an asset-based approach. J Dev Stud 42:178–199. doi:10.1080/00220380500405261

Carter MR, Little P, Mogues T, Negatu W (2007) Poverty traps and natural disasters in Ethiopia and Honduras. World Dev 35:835–856. doi:10.1016/j.worlddev.2006.09.010

Chantarat S, Mude AG, Barrett CB (2009) Willingness to pay for index based livestock insurance: results from a field experiment in Northern Kenya. Mimeo (available at http://www.ilri.org/ibli/images/stories/Chantarat_et_al__WTP2009.pdf)

Danish International Development Assistance (Danida) (2008) Climate change screening of Danish development cooperation with Bhutan. Ministry of Foreign Affairs of Denmark

De Janvry A, Sadoulet E (2004) Conditional cash transfer programs: are they really magic bullets? University of California at Berkeley, Mimeo

Debels P, Szlafstein C, Aldunce P, Neri C, Carvajal Y, Quintero-Angel M, Celis A, Bezanilla A, Martínez D (2009) IUPA: a tool for the evaluation of the general usefulness of practices for adaptation to climate change and variability. Nat Hazards 50:211–233. doi:10.1007/s11069-008-9333-4

Devereux S (2001) Livelihood insecurity and social protection: a re-emerging issue in rural development. Dev Policy Rev 19:507–519. doi:10.1111/1467-7679.00148

DFID (1999) Sustainable livelihoods guidance sheets. DFID, London

Dixon J, Hellin J, Erenstein O, Kosina P (2007) U-impact pathway for diagnosis and impact assessment of crop improvement. J Agric Sci 145:195–206. doi:10.1017/S0021859607007046

Eakin H, Bojórquez-Tapia LA (2008) Insights into the composition of household vulnerability from multicriteria decision analysis. Glob Environ Chang 18:112–127. doi:10.1016/j.gloenvcha.2007.09.001

Elbers C, Lanjouw JO, Lanjouw P (2003) Micro-level estimation of poverty and inequality. Econometrica 71:355–364. doi:10.1111/1468-0262.00399

Erenstein O, Hellin J, Chandna P (2010) Poverty mapping based on livelihood assets: a meso-level application in the Indo-Gangetic Plains, India. Appl Geogr 30:112–125. doi:10.1016/j.apgeog.2009.05.001

Fajth G, Vinay C (2010) Conditional cash transfers: a global perspective. mdg insights—issue 1. UNDG Policy Network for MDGs

Fields S (2005) Why Africa’s climate change burden is greater. Environ Health Perspect 113:A534–A537

Food and Agriculture Organisation of the United Nations (FAO) (2008) Climate change and food security: a framework document. FAO, Rome

Fujii T (2008) How well can we target aid with rapidly collected Data? Empirical results for poverty mapping from Cambodia. World Dev 36:1830–1842. doi:10.1016/j.worlddev.2007.10.013

Gbetitouo G (2009) Understanding farmer’s perceptions and adaptations to climate change and variability: the case of the Limpopo Basin, South Africa. IFPRI Discussion Paper 00849, IFPRI, Washington, DC

Gbetitouo G, Ringler C, Hassan R (2010) Vulnerability of the South African farming sector to climate change and variability: an indicator approach. Nat Resour Forum 34:175–187. doi:10.1111/j.1477-8947.2010.01302.x

Grosh M, Del Ninno C, Tesliuc E, Ouergi A (2008) For protection and promotion: the design and implementation of effective safety nets. The World Bank, Washington, DC

Hahn MB, Riederer AM, Foster SO (2009) The livelihood vulnerability index: a pragmatic approach to assessing risks from climate variability and change—a case study in Mozambique. Glob Environ Chang 19:74–88. doi:10.1016/j.gloenvcha.2008.11.002

Hammill A, Matthew R, McCarter E (2008) Microfinance and climate change adaptation. IDS Bull-I Dev Stud 39:113–122. Doi:10.1111/j.1759-5436.2008.tb00484.x

Hardee K, Mutunga C (2010) Strengthening the link between climate change adaptation and national development plans: lessons from the case of population in National Adaptation Programmes of Action (NAPAs). Mitig Adapt Strateg Glob Change 15:113–126. doi:10.1007/s11027-009-9208-3

Heltberg R (2007) Helping South Asia cope better with natural disasters: the role of social protection. Dev Policy Rev 25:681–698. doi:10.1111/j.1467-7679.2007.00392.x

Heltberg R, Siegel PB, Jorgensen SL (2009) Addressing human vulnerability to climate change: toward a ‘no-regrets’ approach. Glob Environ Chang 19:89–99. doi:10.1016/j.gloenvcha.2008.11.003

Holzmann R, Jorgensen S (2000) Social risk management: a new conceptual framework for social protection, and beyond. Social Protection Discussion Paper no. 0006, The World Bank, Washington, DC

IPCC (2007a) Climate change 2007: impacts, adaptation and vulnerability. In: Parry M, Canziana O, Palutikof P, van der Linden P, Hanson C (eds) Contribution of working group II to the fourth assessment report. Cambridge University Press, Cambridge, UK

IPCC (2007b) Climate change 2007: the physical science basis. In: Solomon S, Qin M, Manning M, Chen Z, Marquis M, Averyt K, Tignor M, Miller H (eds) Contribution of working group I to the fourth assessment report of the IPCC. Cambridge University Press, Cambridge, UK

Kristjanson P, Radeny M, Baltenweck I, Ogutu J, Notenbaert A (2005) Livelihood mapping and poverty correlates at a meso-level in Kenya. Food Policy 30:568–583. doi:10.1016/j.foodpol.2005.10.002

Lang C, Barrett CB, Naschold F (2010) Targeting maps: an asset-based approach to geographic targeting. Cornell University, Mimeo

Ministry of Home and Cultural Affairs (2006) National disaster risk management framework: reducing disaster risks for a safe and happy Bhutan. Disaster Management Division, Ministry of Home and Cultural Affairs. Thimphu, Bhutan

Minot N, Baulch B, Epprecht M (2006) Poverty and inequality in Vietnam: spatial patterns and geographic determinants. IFPRI Research Report No. 148, IFPRI, Washington, DC

Mool PK, Wangda D, Bajracharya SR, Kunzang K, Gurung DR, Joshi SP (2001) Inventory of glaciers, glacial lakes, and glacial lake outburst floods: monitoring and early warning systems in the Hindu Kush-Himalayan region – Bhutan. Kathmandu, ICIMOD

Morduch J (1999) The microfinance promise. J Econ Lit 37:1569–1614. doi:10.1257/jel.37.4.1569

Moser C (2006) Asset-based approaches to poverty reduction in a globalized context: an introduction to asset accumulation policy and summary of workshop findings. Brookings Institution, Washington

Moser C, Satterthwaite D (2008) Towards pro-poor adaptation to climate change in the urban centres of low- and middle-income countries. Human settlements discussion paper series. Climate change and cities discussion paper 3. IIED

Namgyel T (2003) Country presentation on Bhutan. Paper presented at UNFCCC expert workshop on local coping strategies and technologies for adaptation to climate change, October 2003, New Delhi, India

National Environment Commission (2009) Strategizing climate change for Bhutan. Royal Government of Bhutan

National Statistics Bureau (2007) Poverty analysis report 2007. Royal Government of Bhutan

Osman-Elasha B, Goutbi N, Spanger-Siegfried E, Dougherty B, Hanafi A, Zakieldeen S, Sanjak A, Atti H, Elhassan H (2006) Adaptation strategies to increase human resilience against climate variability and change: lessons from the arid regions of Sudan. AIACC working paper no. 42, AIACC project

Perge E (2010) Testing a poverty trap mechanism with Tsimane’ panel data. Chronic poverty research center working paper No. 158, Chronic Poverty Research Centre, University of Sussex

Sahn D, Stifel D (2000) Poverty comparisons over time and across countries in Africa. World Dev 28:2123–2155. doi:10.1016/S0305-750X(00)00075-9

Santos ME, Ura K (2008) Multidimensional poverty in Bhutan: estimates and policy implications. OPHI working paper no. 14, Oxford poverty and human development initiative, Oxford University

Sen A (1981) Poverty and famines: an essay on entitlement and deprivation, Oxford University Press, Oxford

Siegel PB, Alwang J, Jorgensen S (2003) Rediscovering vulnerability through a risk chain: views from different disciplines. Q J Int Agric 42:351–370

Tache B, Sjaastad E (2010) Pastoralists’ conceptions of poverty: an analysis of traditional and conventional indicator from Borana, Ethiopia. World Dev 38:1168–1178. doi:10.1016/j.worlddev.2010.01.001

Verner D (2010) Introduction. In: Verner D (ed) Reducing poverty, protecting livelihoods, and building assets in a changing climate. The World Bank, Washington, DC

Vincent K (2007) Uncertainty in adaptive capacity and the importance of scale. Glob Environ Chang 17:12–24. doi:10.1016/j.gloenvcha.2006.11.009

World Bank (2010) Bhutan economic update, April, 2010. The World Bank, Washington, DC

Yamin F, Rahman A, Huq S (2005) Vulnerability, adaptation and climate disasters: a conceptual overview. IDS Bull-I Dev Stud 36:1–14. doi:10.1111/j.1759-5436.2005.tb00231.x

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Jakobsen, K. Livelihood asset maps: a multidimensional approach to measuring risk-management capacity and adaptation policy targeting—a case study in Bhutan. Reg Environ Change 13, 219–233 (2013). https://doi.org/10.1007/s10113-012-0320-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10113-012-0320-7