Abstract

We study the effect of appending regular, wholesale prices with a conventional, single price-break point quantity discount offered by a supplier to multiple retailers engaged in a Cournot–Nash competition. It is commonly observed in real-life supply chains that the retail price does not drop at once to the extent of the wholesale price discount. We capture this inertia with an evolutionary analysis which assumes that not every retailer immediately adopts a discounting strategy. We find that evolutionary dynamics then might alter the expected final outcome of the competition and show that the supplier will not be able to induce simultaneously both perfect coordination and perfect competition regardless of the type of retailers he is dealing with. Moreover, though the profits the supply chain gains are highest when the supplier perfectly coordinates it, we show that the retailers retain a non-zero profit margin in such a case. As a result, the supplier will not necessarily want to coordinate the supply chain, preferring instead to gain the same amount of profit from the perfect competition between the retailers attracted by the discount.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Discounting is a very popular and efficient tool that many firms widely use to improve sales and reduce operating costs thereby increasing the firm’s profit as well as the overall profit of the supply chain. In supply chain coordination literature, the main focus is on constructing and designing wholesale pricing strategies to improve the manufacturer’s payoff with the ultimate aim of achieving perfect coordination of the whole supply chain, i.e., optimizing profits system-wide. Various approaches to discounting have been suggested based on: order-quantity discount schemes (Weng 1995; Chen et al. 2001; Wang and Wang 2005; Zhou and Li 2007; Cai et al. 2009; Sinha and Sarmah 2010a, b); annual volume discount approaches (Viswanathan and Wang 2003; Qin et al. 2007); and franchise fees (Weng 1995; Qin et al. 2007). Specifically, Sarmah et al. (2006) extensively review supply chain coordination with discounting in an economic order quantity (EOQ) framework. The idea of this operational approach is to encourage a buyer to order the items in quantities larger than his EOQ by offering a price discount. Chen et al. (2001) and Wang (2003) show that perfect coordination is achieved via a common discount policy based on combining volume and quantity discounts. Weng (1995) finds that combining quantity discounts and franchise fees ensures full coordination, but a quantity discount alone is insufficient.

Single-vendor/multiple-buyer supply chain coordination models are particularly interesting in real life applications with respect to quantity/price discount policies. These models have shown that the vendor can maximize the system profit by offering common discount policy (Chen et al. 2001; Ingene and Parry 1995; Kim and Hwang 1988; Moorthy 1987). Most of the models are characterized by either a single, (Hwang and Kim 1986) or continuous/infinite price break schedules (Abad 1988; Lal and Staelin 1984; Rosenblatt and Lee 1985). Wang (2002) develops a single-vendor and multi-buyer discount pricing model with several price breaks. In a similar setting, the quantity discounts that Wang and Wang (2005) suggest fail to fully coordinate the channel but they do improve the profits of the supplier and the retailers. The coordinating efficiency of multiple pricing schedules (and thereby multiple breakpoints) is explored by Sinha and Sarmah (2010a, b) with a single-vendor/multi-buyer discount pricing model. While implementing continuous quantity/price discount schedules with an infinite number of price breaks does not have much practical significance (Munson and Rosenblatt 1998), the vast majority of the discount schemes proposed to date in the literature are all-unit quantity discounts with a single price break (Sarmah et al. 2006). The reason for this marketing approach is that it is both a common practice in industry and straightforward to implement for manufacturers working with multiple retailers and constrained by law to offer the same discount opportunities to each retailer.

In this paper we take a different perspective on the discounting that a single supplier offers to multiple retailers. We assume that the supplier’s goal is to simply offer to all his retailers a classical, single price-break point discount that will maximize his profits but possibly not impose losses on the retailers. Clearly, from time to time almost every firm offers such a wholesale discount scheme to improve its profits. Instead of designing a coordinating discounting scheme, we study, in terms of Cournot–Nash interactions, an evolutionary process of what happens to retailer orders when a supplier who sells his goods at a regular wholesale price offers a discount.

The common assumption in supply chain literature is that all retailers participating in the distribution channel are symmetric, i.e., they make their decisions simultaneously and identically based on a one-time interaction (see, for example, Chen et al. 2001; Bernstein et al. 2008; Oliveira et al. 2013). Consequently, depending on channel parameters, either all firms constitute equilibrium or none. In the current research we relax this strong assumption by allowing multiple interactions while retaining the symmetric parameters of the retailers to focus on the evolutionary perspective on competition and coordination. Indeed, in real life retailers do not necessarily respond simultaneously to a change in a supplier’s policy. This is manifested by inertia in decreasing retail prices observed in the distribution channel in response to lowered wholesale prices (Xia and Li 2010; Cosguner et al. 2014). Then, if some retailers have already adopted a new supplier’s offer while others still operate according to the standard contract, the result of competition may differ from that based on the classical assumption. In particular, given a proportion of firms who have adopted a discounted offer, it is not necessarily beneficial for a retailer who just completed her standard contract to accept the new offer. Moreover, even if it is beneficial, there can be a critical proportion of those who have already accepted the offer beyond which this retailer is better off by sticking to the standard contract. That is, the channel is characterized by a dynamic process rather than a simultaneous, one-time move. To understand the dynamics of repeated contractual interactions between a supplier and multiple retailers, we employ the basic evolutionary game model (see, for example, McKenzie 2009). The evolutionary game theory recognizes that not all of the entire population of the firms will immediately “defect” and become “mutants” by ordering a greater quantity at the discounted price. Furthermore, unlike the “quick” defectors accepting the discount, the other retailers may either persist in ordering the same quantity for some time (we refer to them as to ordinary retailers) since the regular offer remains available, or they can avoid the discount by optimally adjusting their orders in response to changes in the channel due to the dynamics induced by the defectors. We show the presence of two phenomena: that ordinary retailing may be more beneficial under some conditions and that “smarter” adjusting retailers may be worse off than the ordinary retailers. In other words, by not requiring the retailers to change their contract policy simultaneously and allowing for repeated interactions we obtain a much wider, non-intuitive, operational picture and observe many outcomes otherwise overlooked.

It is important to note that though discounting is an effective way to drive sales, discounts can lead the customers to ask themselves why they can’t get that discounted price some other time. Furthermore, if they recently paid full price for a product that is now on sale, they may feel cheated. This may also negatively affect the consumer’s product evaluation (Blattberg and Neslin 1990), expected discount level along with product’s profitability (Krishna 1991) as well as the consumer’s internal reference price and thereby perceived savings (Grewal et al. 1998). This is why it is imperative for the firm to give a good reason for a discount along with specific rules (Kennedy and Marrs 2011). Volume discounts considered in this paper are an example of this. They make sense in the mind of the buyer who expects that the more they buy, the cheaper things will get. Therefore customers are generally not skeptical if they encounter this type of discount. There are also negative impacts on the supply chain when offering discounts in an uncertain environment. In particular, when the demand for products is stochastic, information transferred in the form of “orders” between supply chain members tends to be distorted resulting in the bullwhip effect. One possible cause of the bullwhip effect under demand uncertainty is shown to be price promotions (Lee et al. 1997). In the present paper, we consider a stable distribution channel by adopting the classical, deterministic Cournot–Nash approach. This implies that we assume full information transparency among supply chain members (and therefore no bullwhip effect) to focus on the evolving competition and coordination outcomes caused by discounting.

We present the model and some preliminaries in Sect. 2, which is followed by formalizing in Sect. 3 the wholesale price contract details and possible retailer strategies. Sections 4, 5 and 6 discuss two-level wholesale price contracts in the presence, respectively, of: ordinary retailers, adjusting retailers and both types of retailers at the same time. In these three sections, we assume a proportion of the corresponding retailers is given along with the channel parameters and determine the range of discount values that the supplier can offer to improve his profits as well as the conditions under which the retailers will accept/reject the discounted offer. In Sect. 7 we study the results of the evolutionary process and show when repeated interactions between the retailers and the supplier will lead to a perfect competition, i.e., when the supplier will be able to maximize his profits. In particular, when the population of the retailers is sufficiently large and the number of defecting retailers increases, a perfect competition can develop between them. Any further defection (more retailers adopting the discounting strategy), however, may cause losses for both ordinary and defecting retailers. In terms of standard static analysis, no retailer would choose the discounting strategy at all from the very beginning. From an evolutionary standpoint, however, this only indicates that ordinary retailers who choose to purchase discounted product quantities when the competition between the defectors is already perfect, will observe losses and consequently stop ordering the product.

On the whole, we find that the supplier will not be able to simultaneously pursue both perfect coordination and perfect competition with two-level, quantity discounting regardless of the type of retailers he is dealing with. Moreover, with only ordinary retailers present in the channel, it is possible to choose which option to follow.

2 The model and preliminaries

Consider a monopolistic supply chain involving a supplier who sells a product to N symmetric firms (retailers) engaged in a Nash–Cournot competition. That is, the retailers compete on the number of products \(q_{i}\), \(i=1,\ldots ,N\) they sell. Price P (or inverse demand) is a commonly known, downward function in the total number of products \(Q=\sum \nolimits _{i=1}^N {q_i }\) flooding the channel, \(P=a-{ bQ}\). The supplier offers either a standard wholesale price contract to the firms that is based on a regular wholesale price \(w=w^{s}\) per product unit or a promotional contract based on a two-level price (single price-break point). One is regular \(w=w^{s}\) for buying less than a threshold level \(q^{d}\) of product units and the other is discounted, \(w^{d}<w^{s}\), for buying \(q^{d}\) or more units of the product. Accordingly, the retailer’s transfer payment is

We assume the parties incur no other costs than the transfer payment by each retailer to the supplier. This assumption, while not affecting our results, helps to avoid large expressions thereby improving the exposition. Main notations used in this paper are summarized in Table 1.

Given a supplier’s offer, Cournot horizontal competition implies that every retailer \(i, i=1,\ldots ,N\) independently responds by making a simultaneous decision \(q_{i}\ge 0\) to maximize her profit \(J_{ri}\):

subject to the retailer’s sustainability

The supplier, on the other hand, maximizes his profit:

The described model fits the Stackelberg game where the supplier is a leader who offers a specific form of the transfer payment and the retailers are followers responding simultaneously with Nash–Cournot equilibrium order quantities. We contrast the outcome of this game with a system-wide optimal profit, J, found by maximizing the supply chain’s total profit

Consider first the classical, wholesale price contract \(T(q_i ,w^{s},w^{d},q^d )= w^{s}q_{i}\) characterized by a wholesale price, \(w^{s}\), independent of order quantity \(q_{i}\).

Wholesale price contract

Equation (2) transforms into \(J_{ri}^s =q_i \left( {a-b\sum \nolimits _{i=1}^N {q_i -w^{s}} } \right) \). Consequently, given symmetric conditions, the Nash–Cournot response found by maximizing \(J_{ri}^s \) is

Substituting (6) into (4) we observe concavity of the supplier’s profit function and applying the first order optimality condition, we find the Stackelberg wholesale price

which implies Stackelberg total output \(Q^{s}=\frac{a}{2b}\frac{N}{N+1}\) and retail price \(P^{s}=\frac{a}{2}\frac{N+2}{N+1}\). That is, the ith retailer profit is

The supplier, on the other hand, earns

and the supply chain’s profit is

Accordingly, \({\mathop {\lim }\limits _{N\rightarrow \infty }} P^{s}={\mathop {\lim }\limits _{N\rightarrow \infty }} \frac{a}{2}\frac{N+2}{N+1}=\frac{a}{2}=w^{s}\), which corresponds to the Cournot theorem. That is, as the number of the competing firms tends to infinity, the price, \(P^{s}\), converges to the marginal cost (which in our case is \(w^{s})\) thereby leading to a perfectly competitive market. Furthermore, maximizing the channel’s total profit (5), we find the system-wide optimal quantity, price and profit, respectively

Consequently, the Stackelberg extension to the Cournot theorem in terms of supply chain entails the following: as the number of the horizontally competing retailers tends to infinity,

-

the competition between the retailers becomes perfect, i.e., the retail price converges to the retailer’s marginal cost while the supplier, whose wholesale price does not change, extracts the entire supply chain profit;

-

the supply chain profit converges to the system-wide optimal one, i.e., the supply chain becomes perfectly coordinated.

Note that the supply chain coordination methods are mostly based on a supplier giving up part of his profit margin by reducing the wholesale price to increase the quantity sold (e.g., two-part tariff, revenue sharing and other quantity discounting contracts). In the channel that we consider, the retailers give up their profit margin as their numbers increase while the supplier’s wholesale price remains unchanged. The two-part tariff, for example, which is extensively discussed in literature, is based on a reduced wholesale price and a fixed transfer payment to the supplier to offset his reduced margin. In terms of our formulation, when \(N=1\) (no horizontal competition), the supplier would need to completely give up his margin, \(w^{s}=0\), to eliminate vertical competition and to have the supply channel profit equal to the system-wide optimal one. The fixed transfer payment then can enable the supplier to extract the surplus that the retailer gains with the contract, but not the entire channel’s profit as with the standard wholesale price contract when N tends to infinity. This is because the retailer would not agree to a two-part tariff contract unless she earns not less than with the standard wholesale price contract. As the horizontal competition exacerbates, the supplier needs to concede less in regard to his wholesale price with a two-part tariff contract. In particular, the same two-part tariff for N competing firms would imply that the supplier makes the total order quantity equal to the system-wide optimal one, \(Q=\frac{a}{2b}\) (see (8)), by setting with respect to (6):

i.e., \(w=\frac{N-1}{N}\frac{a}{2}>\)0, but not w=0 when there is only one retailer. Accordingly, the greater the number of competing retailers, the smaller the discount \(1-\frac{N-1}{N}=\frac{1}{N}\) of the regular wholesale price \(w^{s}=\frac{a}{2}\) the supplier can offer. The number of competing firms is, however, never infinite. Therefore, although the two-part tariff enables the channel to gain system-wide maximal profits under a finite number of participating firms, similar to the Cournot theorem result, it does not lead to a perfect competition between the retailers. In this paper we show that unlike the two-part tariff, a two-level wholesale price contract may lead to a perfect competition even if the number of competing retailers is finite.

3 Two-level wholesale price contract and possible retailer strategies

Let the supplier offer a two-level wholesale price contract. One level is standard \(w^{s}\) for buying less than \(q^{d}\) of an item and the other is discounted, \(w^{d}\), for buying \(q^{d}\) or more of the item. A retailer can respond to such an offer with three different strategies. One involves ignoring the discount by ordering the same quantity (6), i.e.,

This is a typical response to the regular offer. It is a standard strategy and we refer to the firms exercising this strategy as ordinary retailers. Another strategy entails avoiding the discount as well, but the order is adjusted in light of changes in the channel due to the dynamics induced by those accepting the discount, \(w^{d}\). We refer to such behavior as an adjustment strategy and to the retailer who chooses this strategy as an adjusting retailer. The strategy of ordering at least \(q^{d}>q^{s}\) units at price \(w^{d}\) is referred to as a discounting strategy. Our goal is to study the evolutionary process due to offering a new (lower) wholesale price to the retailers. Invoking the terminology of the evolutionary games, the retailers who switch strategies, from standard/adjustment to discounting, will be referred to as mutants or defectors. The common assumption of the evolutionary analysis is that the original strategy does not change when mutants appear with a new strategy. That is, the retailers who used to order the standard quantity, \(q^{s}\), in response to the regular offer \(w^{s}=a\)/2 may either continue to do so for some time regardless of what the others do (regular retailers) or even adjust the order to account for market changes while still not accepting the new discounted offer (adjusting retailers). Such inertia or resistance to a quick change is frequently observed in the retail industry as discussed in the Introduction. An important consequence of this inertial behavior is that depending on the proportion of those who have adopted the change right away, it may not become optimal for the others to adopt it as well, thereby justifying the resistance to change. In the next section, we study the interaction between the ordinary retailers employing the standard strategy and those who buy discounted products.

4 Two-level wholesale price contract and ordinary retailing

Let p be the proportion of the retailers using a strategy of signing a standard wholesale contract and 1-p be the proportion of those going for the discounted offer. Then pN and (\(1-p)N \) will be the number of ordinary and defecting retailers, respectively. We now consider a two-fold symmetric equilibrium with respect to two possible contracts, \(q_i =q^{s}\)for pN ordinary retailers and \(q_i =q^{d}\) for the other (\(1-p)N\) retailers. Accordingly, the total order is

Substituting (10) and (11) into (4) and denoting the offered discount from price \(w^{s}\) by \(1-\alpha \), \(0<\alpha <1\), i.e., \(w^{d}=\alpha w^{s}=\alpha \frac{a}{2}\), the supplier’s objective function becomes

where the first term represents the supplier’s profit from the ordinary retailers using the standard strategy while the second term determines the profit from the retailers choosing the discounting strategy. Clearly, the supplier is interested in his profit to grow when the retailers defect, i.e., optimization (12) is subject to \(\frac{\partial J_s }{\partial p}<0\). We observe from (12) that both p and \(q^{d}\) linearly affect the supplier’s profit. Therefore, by rearranging the terms of the objective \(J_{s}\) in (12) with respect to p, so that, \(J_s =p\alpha \frac{a}{2}N(\frac{a}{2b\alpha }\frac{1}{N+1}-q^{d})+\alpha \frac{a}{2}Nq^{d}\), we find that if \(q^{d}>\frac{a}{2b\alpha (N+1)}>q^{s}=\frac{a}{2b(N+1)}\), then the more retailers who defect by choosing the discounting strategy, the greater the supplier’s profit, \(\frac{\partial J_s }{\partial p}<0\). Furthermore, it is easy to see \(\frac{\partial J_s }{\partial q^{d}}>0\). Therefore by choosing,

the supplier ensures increased profits by offering any discount \(\alpha \) while parameter \({\varepsilon }>1\) determines the extent the supplier intends to extract the profit from the channel. The maximal \(\varepsilon \) and thereby optimal \(q^{d}\) then can be found by requiring the retailer’s sustainability, i.e., from constraint (3) which implies the retailer’s order is identical to the supplier’s break point.

Taking into account (13), the objective function from Eq. (12) transforms into

which is greater than the supplier’s standard profit \(\frac{a^{2}N}{4b(N+1)}\) for \(p<\)1 as summarized below.

Proposition 1

Let the supplier offer to ordinary retailers a two-level wholesale price contract with standard \(w^{s}=\frac{a}{2}\) and discounted \(w^{d}=\alpha w^{s}\) prices. If the minimal order quantity, \(q^{d}\), for purchasing at the discounted price,\(w^{d}\), is determined by (13), then

-

the higher \(\varepsilon \) and/or discount \(1-\alpha \), the larger the order quantity \(q^{d}\);

-

the larger the proportion of the firms, \(1-p\), utilizing the discount, the higher the total order, Q(p), and the greater the supplier’s profit from his quantity discount. \(\square \)

This result corresponds to a typical discounting policy which is intended to induce retailers to order more. For this policy to work, the retailers must have a chance to improve their profits. That is, given a specific distribution {p, 1-p}, the retailer’s profit with the standard strategy, \(J_{ri}^{s}=q^{s}\)(a − bQ(\(p)-w^{s})\), should not exceed that with the discounting strategy, \(J_{ri}^{d}=q^{d}\)(a − bQ(\(p)-w^{d})\) subject to \(J_{ri}^{d}\ge \)0, \(J_{ri}^{s}\ge \)0. We denote the difference between these profits as \(\delta \)(\(p)=J_{ri}^{d}-^{ }J_{ri}^{s}\) and next study when \(\delta \)(\(p)\ge \) 0 with respect to constraint (3).

Substituting the order quantity of the standard (10) and discounting (13) contracts, we have

Differentiating (14) with respect to p we find

Accordingly, the greater the number of defecting retailers, the smaller the advantage \(\delta \) of the discounting strategy over the standard one. From (15) we conclude that if \(\delta \)(0)\(\ge 0\), which, with respect to (14), holds if

then the profit advantage of the discounting strategy is retained for any p including when the entire population of retailers, N, defects.

Condition (16) breaks up into two cases:

and

Consider first condition (17). Since \(\alpha<\)1 and \(\varepsilon>\)1, expression \(\varepsilon \alpha +\alpha -2\varepsilon \) is always negative and thus (17) ensures that (16) always holds. On the other hand, if (18) holds, then condition (16) readily results in

Since \(\delta \)(1)\(>0\), when (19) does not hold so that, \(\delta \)(0)\(<0\), there will be a critical proportion \(p_{cr}\) determined by equating (14) to zero

such that if the number of defecting retailers increases beyond this proportion, the discounting strategy will no longer have an advantage over the standard one, \(\delta \)(\(p)<0\) for \(p<p_{cr}<1\). Furthermore, if \(p_{cr}\ge 1\), i.e., \(N\ge \frac{\alpha (\varepsilon \alpha +\alpha -2\varepsilon )}{3\varepsilon \alpha -\varepsilon ^{2}-\varepsilon \alpha ^{2}-\alpha ^{2}+(\varepsilon -\alpha )^{2}}=\frac{\alpha (\varepsilon \alpha +\alpha -2\varepsilon )}{\varepsilon (5\alpha -\alpha ^{2})}\), then \(\delta \)(\(p)<0\) always holds.

Proposition 2

Let the supplier offer to ordinary retailers a two-level wholesale price contract with standard \(w^{s}=\frac{a}{2}\) and discounted \(w^{d}=\alpha w^{s}\) prices along with a minimal order quantity, \(q^{d}\), determined by (13). If either (17) or (18) along with \(N<\frac{\alpha (\varepsilon \alpha +\alpha -2\varepsilon )}{3\varepsilon \alpha -\varepsilon ^{2}-\varepsilon \alpha ^{2}-\alpha ^{2}}\) holds, then \(\delta \)(\(p)>0\), i.e., the retailers using the discounting strategy always have a higher profit (or lower loss) than those employing the standard strategy regardless of their ratio p to the total population of retailing firms. The advantage, however, declines as the number of defectors aggravates, \(\frac{\partial \delta (p)}{\partial p}>0\). Otherwise, if (17) does not hold and \(N>\frac{\alpha (\varepsilon \alpha +\alpha -2\varepsilon )}{3\varepsilon \alpha -\varepsilon ^{2}-\varepsilon \alpha ^{2}-\alpha ^{2}}\), then there exists a critical proportion \(p_{cr}\), determined by (20) such that \(\delta \)(\(p)>0\) for \(p>p_{cr}\), \(\delta \)(\(p_{cr})=0\) and \(\delta \)(\(p)<0\) for \(p<p_{cr}\). \(\square \)

Next, recalling the sustainability constraint (3), we need for the ordinary retailers, \(P \ge w^{s}\), or with respect to (10), (11) and (13), \(a\ge \frac{pNa}{N+1}+\frac{\varepsilon (1-p)Na}{\alpha (N+1)}\), which reduces to

Condition (21) implies that if the supplier chooses the discount parameters, \(\varepsilon \) and \(\alpha \), so that

the advantage of the discounting strategy remains for any proportion \(1-p\) of the defecting retailers and the retail price exceeds the retailer’s marginal cost, \(P \ge w^{s}>w^{d}\). Otherwise there will be a critical number of defectors \(1-p_{cr}^{s}\) (determined by assuming equality for condition (21))

for which the competition between the retailers using the standard strategy will become perfect, \(P=w^{s}\). Any defection resulting in an increase of \(1-p_{cr}^{s}\) will induce losses to the remaining ordinary retailers. It should be noted that perfect competition does not necessarily imply perfect coordination of the channel. By comparing the total quantity \(Q=\frac{1}{2}\frac{aN(p\alpha +\varepsilon (1-p))}{b(N+1)\alpha }\), with the system-wide optimal quantity \(Q*=\frac{a}{2b}\), we find that when p is equal to that determined by (23), channel coordination becomes perfect. That is to say, if \(p=p_{cr}^{s}\), then we observe both perfect competition between the ordinary retailers (but not between those going for the discount) and perfect coordination of the channel. It is also readily observed that when \(N=\frac{\alpha }{\varepsilon -\alpha }\), we have \(p_{cr}^s =0\), thereby leading to perfect coordination when all ordinary retailers defect. Clearly, the lower the discount \(1-\alpha \), (the bigger \(\alpha =\frac{N\varepsilon }{N+1}<1)\) the greater the profit that the supplier can extract from the system-wide optimal channel’s profit.

Similarly, the sustainability constraint (3) for the retailers exercising the discounting strategy is \(P \ge w^{d}\), or

which always holds if

If (25) does not hold, then there will be one more critical number of defectors \(1-p_{cr}^{d}\), \(p_{cr}^d <p_{cr}^s \)

for which the competition, this time between the defectors, will become perfect while the ordinary retailers will sustain losses. The total quantity sold in such a case, \(Q=\frac{a}{2b}(2-\alpha )\), is greater than the system-wide optimal, \(Q*=\frac{a}{2b}\) and therefore the retail price is lower than the system-wide optimal one. Any defection beyond that number, \(p_{cr}^d \), will imply all retailers sustain losses.

We summarize these findings as follows.

Proposition 3

Let the supplier offer to ordinary retailers a two-level wholesale price contract with standard \(w^{s}=\frac{a}{2}\) and discounted \(w^{d}=\alpha w^{s}\) prices along with the minimal order quantity, \(q^{d}\), determined by (13).

-

If \(N\le \frac{\alpha }{\varepsilon -\alpha }\), then both the standard and discounting strategies are profitable for the retailers regardless of the proportion p. If \(N=\frac{\alpha }{\varepsilon -\alpha }\), the supply chain coordination (but not the competition) is perfect (\(p_{cr}^{s}=0\)) when all retailers defect, \(p=0\).

-

If \(\frac{\alpha }{\varepsilon -\alpha }<N<\frac{(2-\alpha )\alpha }{\varepsilon -(2-\alpha )\alpha }\), then \(J_{ri}^{d}>\)0 for any p; \(J_{ri}^{s}>0\) for \( p_{cr}^{s}<p \le 1\), \(J_{ri}^{s}=0\) for \(p=p_{cr}^{s}\) and \(J_{ri}^{s}<0\) for \(0 \le p<p_{cr}^{s}\). In other words, there is a critical proportion of ordinary retailers \(p_{cr}^{s}\) determined by (23) for which the supply chain coordination and the competition between the retailers using the standard strategy becomes perfect. Any defection resulting in an increase of \(1-p\), implies losses by the remaining ordinary retailers.

-

If \(N\ge \frac{(2-\alpha )\alpha }{\varepsilon -(2-\alpha )\alpha }\), then \(J_{ri}^{s}<0\) for any p; \(J_{ri}^{d}>0\) for \( p_{cr}^{d}<p\le 1\), \(J_{ri}^{d}=0\) for \(p=p_{cr}^{d}\) and \(J_{ri}^{d}<0\) for 0\( \le p<p_{cr}^{d}\). That is, there exists a critical proportion \(p_{cr}^{d}\) determined by (26) for which the competition between the retailers using the discounting strategy becomes perfect. Any defection resulting in an increase of \(1-p\), implies losses for both ordinary and defecting retailers. When \(N=\frac{(2-\alpha )\alpha }{\varepsilon -(2-\alpha )\alpha }\), \(p_{cr}^{d}=0\) and the competition is perfect when all retailers defect. \(\square \)

From

and Propositions 2 and 3, it follows, that when (18) holds, and \(\frac{(2-\alpha )\alpha }{\varepsilon -(2-\alpha )\alpha }<N<\frac{\alpha (\varepsilon \alpha +\alpha -2\varepsilon )}{3\varepsilon \alpha -\varepsilon ^{2}-\varepsilon \alpha ^{2}-\alpha ^{2}}\), the retailers choosing the discounting strategy are better off, but both standard and discounting strategies may induce losses. In addition, if \(N>\frac{\alpha (\varepsilon \alpha +\alpha -2\varepsilon )}{3\varepsilon \alpha -\varepsilon ^{2}-\varepsilon \alpha ^{2}-\alpha ^{2}}\), all retailers may not only incur losses but the discounting strategy is no longer advantageous over the standard one. On the other hand, if (17) holds, the discounting is always advantageous while \(N>\frac{(2-\alpha )\alpha }{\varepsilon -(2-\alpha )\alpha }\) may still imply losses regardless of the strategy chosen.

Finally, we note that, for example in case of (22), the retail price

gradually decreases toward the minimal level of \(P=a-\frac{a}{2}\frac{N \varepsilon }{(N+1)\alpha }\ge w^{s}\) as the number of defectors grows, i.e, when \(p\rightarrow 0\). As discussed in the introduction, this effect reflects the inertia in decreasing retail prices in the distribution channel in response to a discounted wholesale price.

5 Two-level wholesale price contract and adjusting retailers

We assume now that the retailers observe a decrease in the price of the products and hence an increase in the total product flow induced by discounted offers. Based on such an observation, the retailers decide to adjust their standard orders. That is, in response to the standard offer, \(w^{s}=\frac{a}{2}\), an e proportion of the retailers order \(q^{a}\) products to maximize their profit \(J_{ri}^{a}\). Then, the total quantity of the ordered products is \(Q=e{Nq}^{a}+(1-e)Nq ^{d}\) and differentiating the retailer’s profit function we have

which leads to

From (28) we observe that unlike standard order (1), which is always positive, the adjusting strategy results in a feasible order quantity \(q^{a} \ge 0\), only if \(a\ge 2b(1-e)Nq^{d}\), which holds for any e when

Accordingly, the supplier’s profit is

where the first term represents the supplier’s profit from the adjusting retailers and the other term determines the profit from the retailers choosing the discounting strategy. Differentiating (29) with respect to e we have

Consequently, when \(N+\alpha \ge (1-\alpha )(Ne+2)eN\), we find that for any e, if

then \(\frac{\partial J_s }{\partial e}<0\) and therefore the greater the number of the retailers employing the discounting strategy, the larger the supplier’s profit. Furthermore, since the supplier’s profit depends linearly on \(q^{d}\), we straightforwardly obtain that \(\frac{\partial J_s }{\partial q^{d}}>0\), if \(eN-\alpha eN- \alpha <0\), otherwise if \(eN-\alpha eN- \alpha >0\), \(\frac{\partial J_s }{\partial q^{d}}<0\). Accordingly, if \(\alpha \le \frac{N}{1+N}\), there exists,\( p_{cr}^{a}\),

such that \(\frac{\partial J_s }{\partial q^{d}}=0\). From the feasibility of (28) and (31), i.e., \(\frac{a}{2b(N+\alpha )}\le q^{d}\le \frac{a}{2bN}\), when \(N+\alpha \ge (1-\alpha )(Ne+2)eN\) (which always holds if \(\alpha \ge \frac{N}{1+N})\), we conclude that depending on the sign of \(\frac{\partial J_s }{\partial q^{d}}\), \(q^{d}\), which maximizes the supplier’s profit is switched from its lower bound, \(\frac{a}{2b(N+\alpha )}\), to its upper bound, \(\frac{a}{2bN}\). One option for the supplier is to keep \(q^{d}\) at the lower bound, \(q^{d}=\frac{a}{2b(N+\alpha )}\) (regardless of e). Then, when all retailers choose the discounting strategy, the supplier’s profit is equal to \(\alpha \frac{a^{2}}{4b}\frac{N}{N+\alpha }\). This choice converges to the supplier’s profit of \(\frac{N}{1+N}\frac{a^{2}}{4b}\) when \(\alpha \) tends to one, which is identical to what occurs when only the standard wholesale price contract is offered without any discounts. We therefore conclude as follows.

Proposition 4

Let the supplier offer to adjusting retailers a two-level wholesale price contract with standard \(w^{s}=\frac{a}{2}\) and discounted \(w^{d}=\alpha w^{s}\) prices.

-

If \(\alpha >\frac{N}{1+N}\), then \(q^{d}=\frac{a}{2bN}\) maximizes the supplier’s profit and ensures that the larger the proportion of the firms, \(1-e\), exercising the discounting strategy, the greater the supplier’s profit.

-

If \(q^{d}=\frac{a}{2b(N+\alpha )}\), the supplier’s profit from discounting is lower than that from the standard contract. \(\square \)

Proposition 4 implies that if the supplier offers a discount so that,\(\alpha >\frac{N}{1+N}\) and

he improves his profit compared what occurs under the standard strategy. Note that

as required by any quantity discount contract. Furthermore, when all retailers choose discounting strategy (33), the supplier’s profit is equal to \(\alpha \frac{a^{2}}{4b}\). Accordingly, the lower the discount, \(1-\alpha \), (the greater \(\alpha )\), the closer the supplier’s profit \(\alpha \frac{a^{2}}{4b}\) to the system-wide optimal one (8), \(J^{*}=\frac{a^{2}}{4b}\), and, hence, the closer the supplier is to extracting the entire profits of the channel. This with respect to \(\alpha <1\), however, also entails that he will not be able to obtain all the profits of the channel.

We next verify that the retailers will defect in response to the offered discount (33) which is possible if the retailers’ profits from the adjusting strategy, \(J_{ri}^{a}=q^{a}(a-bQ(e)-w^{s})\), do not exceed those obtained with the discount strategy, \(J_{ri}^{d}=q^{d}(a-bQ(e)-w^{d})\) subject to (3), i.e., \(\delta \)(\(e)=J_{ri}^{d}-^{ }J_{ri}^{a}\ge 0\).

Substituting the order quantity of the adjusting retailers (28) and of the defectors (33) into \(\delta \)(e) we have

From (35) we observe that \(\delta \)(\(e)>0\) for \(e\ge 0\). Moreover, the retail price

is always positive and greater than the wholesale price. Note, that both the retail price (36) and the corresponding total order quantity, \(Q=\frac{a}{2b}\frac{(eN-e+1)}{eN+1}\), converge to the system-wide optimal price P* and quantity Q*, respectively when all retailers defect, \(e=0\). We summarize these results in the following proposition.

Proposition 5

Let the supplier offer to adjusting retailers a two-level wholesale price contract with standard \(w^{s}=\frac{a}{2}\) and discounted \(w^{d}=\alpha w^{s}\) prices along with the minimal order quantity, \(q^{d}\), determined by (33).

-

The retailers choosing the discounting strategy are always better off than those employing the adjusting strategy, \(\delta \)(\(e)>0\).

-

The more the defectors, the lower the retail price and the greater the total product quantity sold which converge to the system-wide optimal price P* and total product quantity Q* when all retailers defect, \(e=0\).

-

The competition between the retailers is never perfect. \(\square \)

6 Two-level wholesale price contract and two types of retailers

We assume now that the population of the retailers consists of both p ordinary and e adjusting retailers. Then, the total quantity of the products is \(Q=p{Nq}^{s}+e{Nq}^{a}+(1-p-e){Nq}^{d}\). Differentiating the adjusting retailer’s profit function \(J_{ri}^{a}=(a-bQ-w^{s})q^{a}\) and accounting for the assumption that the retailers of the same type are symmetric, we have

This order is feasible \(q^{a}\ge 0\), if \(a\ge 2bN[q^{d}(1-p-e)+pq^{s}]\), which, with respect to (10), transforms into

Differentiating the supplier’s profit, \(J_s =w^{s}N(pq^{s}+eq^{a})+\alpha w^{s}(1-p-e)Nq^{d}\), with respect to \(q^{d}\) and accounting for (10) and (37), we have

which is positive if

Since \(J_{s}\) depends linearly on \(q^{d}\), if (40) holds the supplier is interested in increasing \(q^{d}\), i.e., in offering a quantity discount if, of course, his profit will grow when more retailers accept the discount, i.e.,\(\frac{\partial J_s }{\partial p}<0\) and \(\frac{\partial J_s }{\partial e}<0\). Since this result is similar to that obtained in the previous section, we next consider \(q^{d}=\frac{a}{2bN}\). Then

which is negative, if

Furthermore, if there are no adjusting retailers, \(e=0\), then the condition ensuring that the supplier benefits from offering the discount to the ordinary retailers is \(\alpha >\frac{N}{N+1}\). It is easy to see that condition (42) is stronger than (40) since \(\frac{N(eN+e+1)}{N(eN+e+1)+1}>\frac{eN}{eN+1}\). Furthermore, \(\frac{\partial J_s }{\partial e}=\frac{a^{2}}{4b(eN+1)^{2}(N+1)}\left( (1-\alpha )eN(eN^{2}+eN+2N+2)+pN-\alpha N-\alpha \right) \), which is negative if

Since

condition (42) is stronger than (43) (which in turn is stronger than (40)). Then, if discount \(\alpha \) satisfies (42), the supplier profits by offering a discount with \(q^{d}\) determined by (33). Based on (42) we next introduce the critical proportion of the adjusting retailers,

and express (43) via p explicitly,

to arrive at the following result.

Proposition 6

Let the supplier offer a two-level wholesale price contract with standard \(w^{s}=\frac{a}{2}\) and discounted \(w^{d}=\alpha w^{s}\) prices, \(\alpha >\frac{N}{N+1}\) and \(q^{d}=\frac{a}{2bN}\).

-

If \(\frac{N\alpha +\alpha -N}{N(N+1)(1-\alpha )}\ge 1\), then the supplier always profits from both types of retailers by offering a discount, \(\alpha >\frac{N}{N+1}\).

-

If \(\frac{N\alpha +\alpha -N}{N(N+1)(1-\alpha )}<1\), then there exists 0\(<e_{cr}^{a}<\)1, so that when \(e<e_{cr}^{a}\), the supplier profits from ordinary retailers going for the discount; otherwise, if \(e \ge e_{cr}^{a}\), the supplier does not profit from them.

-

the supplier profits from adjusting retailers choosing the discount contract only if \(p<\alpha (N+1)-eN(N+1)(eN+2)(1-\alpha )\). \(\square \)

This proposition implies that the supplier can only profit from either or both of the two types of retailers depending on the discount he offers and the proportion of each type of retailer in the overall retailing population. The lower the proportion of adjusting retailers and/or the discount, the higher the likelihood the supplier will profit from both types of retailers accepting the discount conditions being offered. Similar to the findings of the previous section, the presence of the adjusting retailers implies that if the retailers order the discounted products, the supplier’s profits tend to the system-wide optimal one when \(\alpha \) increases.

We next verify that the retailers will defect in response to the discount. For that we denote \(\delta \)\(_{1}=J_{ri}^{d}-^{ }J_{ri}^{a}\) , \(\delta \)\(_{2}=J_{ri}^{d}-^{ }J_{ri}^{s}\) and \(\delta \)\(_{3}=J_{ri}^{s}-^{ }J_{ri}^{a}\).

Substituting the corresponding order quantities into the retailers’ profits we have

which are all always positive. This implies that the retailers profit from the discounted offer. In addition, the ordinary retailers are better off than the adjusting ones who reduce their order quantity \(q^{s}-q^{a}>0\) to account for an increasing flow of the discounted products. This is to say, less information or less adaptiveness, is advantageous in such a case. Moreover, the retail price is always positive and greater than the standard wholesale price \(w^{s}\):

Accordingly, even when all retailers defect, \(e=p=0\), and therefore \(P-w^{s}=0\), those who buy discounted products still have a non-zero margin P-\(\alpha \)w\(^{s}>\)0 as \(\alpha <1\). Again, the retail price and the corresponding total order quantity, \(Q=\frac{a}{2b}\frac{(eN^{2}+N+1-p-e)}{(N+1)(eN+1)}\), converge to the system-wide optimal price P* and quantity Q*, respectively when all retailers defect, \(p=0\), \(e=0\), which implies perfect coordination of the channel. We summarize these results as follows.

Proposition 7

Let the supplier offer retailers a two-level wholesale price contract with standard \(w^{s}=\frac{a}{2}\) and discounted \(w^{d}=\alpha w^{s}\)prices along with the minimal order quantity, \(q^{d}\), determined by (33).

-

The retailers choosing the discounting strategy are always better off than those employing the adjusting as well as standard strategy, \(\delta \)\(_{1}(p,e)>0\) and \(\delta \)\(_{2}(p,e)>0\).

-

The retailers employing the standard strategy are better off than those employing the adjusting strategy, \(\delta \)\(_{3}(p,e)>0\).

-

The competition between the retailers is never perfect. \(\square \)

7 Evolution of the retailers’ strategies

In this section we study how the population of retailers evolves, assuming they repeatedly order products from the supplier based on the three strategies discussed above. Recall that we represent the state of the population by the proportion of those following the standard strategy, p, adjusting strategy, e, and of those following the discounting strategy (defectors), \(r=1-p-e\). Then, with respect to the terminology of evolutionary game theory, the state dynamics is due to the average fitness of “cooperators”, \(J_{r}^{s}=J_{ri}^{s}\), \(J_{r}^{a}=J_{ri}^{a}\), and defectors, \(J_{r}^{d}=J_{ri}^{d}\). Accordingly, denote the average fitness of the population by \(\bar{{J}}\),

when the retailers implement the adjusting, standard and discounting strategies. Next assume that the proportion of the population following the cooperation and defecting strategies in the next generation is related to the proportion of the population following these strategies in the current generation. That is, \(p=p(t)\), \(e=e(t)\) and \(r=r(t)\) and the replicator dynamics are (Taylor and Jonker 1978; Zeeman 1979):

Using our notations from the previous sections, we then can conclude when two of the three strategies are employed, that if, for example, \(\delta (p)=J_r^d -J_r^s >0\), then \(J_r^s<\bar{{J}}<J_r^d \) and, hence, \(\frac{dp}{dt}<0\), \(\frac{dr}{dt}>0\), i.e., the proportion of the population choosing the standard strategy decreases while those buying for the discounted price increases.

Ordinary retailing

We start off by analyzing the evolution of the ordinary retailers when there are no adjusting ones. According to Proposition 2, if condition (17) holds, then \(\delta \)(\(p)>0\) and thereby \(\frac{dp}{dt}<0\), \(\frac{dr}{dt}>0\). This implies that all ordinary retailers using the standard strategy will eventually defect. According to Proposition 3, however, the defection can continue as long as \(N<\frac{(2-\alpha )\alpha }{\varepsilon -(2-\alpha )\alpha }\), that is, as long as the defectors are sustainable. When \(N>\frac{(2-\alpha )\alpha }{\varepsilon -(2-\alpha )\alpha }\), the defectors sustain losses for \(p<p_{cr}^{d}\), while the ordinary retailers sustain losses even earlier for \(p<p_{cr}^{s}\), \(p_{cr}^{s}>p_{cr}^{d}\). Consequently, when state p evolves to be \(p<p_{cr}^{s}\), the ordinary retailers can still defect, thereby overcoming their losses. But once \(p=p_{cr}^{d}\), further defection will not make the ordinary retailers sustainable. Naturally, these retailers will stop purchasing the product from the supplier, \(\frac{dp}{dt}=0\), and thereby \(\frac{dr}{dt}=0\) for \( p=p_{cr}^{d}\). This implies the number of the retailers participating in the supply chain will reduce to \(N=\frac{(2-\alpha )\alpha }{\varepsilon -(2-\alpha )\alpha }\). We summarize these results in the following proposition.

Proposition 8

Let either (17) or (18) along with \(N<\frac{\alpha (\varepsilon \alpha +\alpha -2\varepsilon )}{3\varepsilon \alpha -\varepsilon ^{2}-\varepsilon \alpha ^{2}-\alpha ^{2}}\)hold and the supplier offers to the ordinary retailers a two-level wholesale price contract with standard \(w^{s}=\frac{a}{2}\) and discounted \(w^{d}=\alpha w^{s}\) prices along with the minimal order quantity, \(q^{d}\), determined by (13).

-

If \(N<\frac{(2-\alpha )\alpha }{\varepsilon -(2-\alpha )\alpha }\), then \(\frac{dp}{dt}<0\), \(\frac{dr}{dt}>0\) for any p, i.e., all retailers using the standard strategy defect and the discounting strategy becomes evolutionarily stable and the standard strategy extinct. Neither competition nor coordination is perfect in this case.

-

If \(N\ge \frac{(2-\alpha )\alpha }{\varepsilon -(2-\alpha )\alpha }\), then \(\frac{dp}{dt}<0\), \(\frac{dr}{dt}>0\) for \(p_{cr}^{d}<p\le \)1 and \(\frac{dp}{dt}=0\), \(\frac{dr}{dt}=0\) for \( p=p_{cr}^{d}, \)i.e, the ordinary retailers become extinct. Furthermore, the overall population of the retailers eventually reduces to \(1-p_{cr}^{d}\), i.e., to \(N=\frac{(2-\alpha )\alpha }{\varepsilon -(2-\alpha )\alpha }\). The others, \(p_{cr}^{d}\), stop purchasing the product from the supplier. The competition is then perfect but not the coordination. \(\square \)

Note that a static analysis would imply that when \(N>\frac{(2-\alpha )\alpha }{\varepsilon -(2-\alpha )\alpha }\), the retailers incur losses when choosing discounting and thus would refrain from this strategy. The evolution, however, entails that some of them leave the channel while the others choose the discounting strategy and the competition will become perfect. With respect to Proposition 3, we also conclude that if \(N<\frac{\alpha }{\varepsilon -\alpha }\), the evolution will be characterized by a the retail price that is higher than the system-wide optimal price and a total order quantity that is lower than the system-wide optimal one. When \(N=\frac{\alpha }{\varepsilon -\alpha }\), the evolution will result in perfect coordination (but not perfect competition). On the other hand, when \(N>\frac{\alpha }{\varepsilon -\alpha }\), the evolution passes through a state of perfect coordination, but does not stop there. It will entail the retail price becoming lower and the order quantity greater than the system-wide optimal price and quantity respectively. Finally, since \(\frac{(2-\alpha )\alpha }{\varepsilon -(2-\alpha )\alpha }>\frac{\alpha }{\varepsilon -\alpha }\), it is not possible to attain simultaneously both perfect coordination and perfect competition since the latter is observed when \(N\ge \frac{(2-\alpha )\alpha }{\varepsilon -(2-\alpha )\alpha }\). This is to say, unless \(N=\frac{\alpha }{\varepsilon -\alpha }\), the evolution may result in zero profit margin for the retailers exercising the discounting strategy (and the extinct standard strategy), but not in the maximal profit of the entire channel. Interestingly, if we compare the supplier’s profit when all ordinary retailers defect and \(N=\frac{\alpha }{\varepsilon -\alpha }\) (ensuring perfect coordination and thereby maximal profit of the entire channel) with the case of \(N=\frac{(2-\alpha )\alpha }{\varepsilon -(2-\alpha )\alpha }\)(ensuring perfect competition), we find the same expression \(J_s =\frac{a^{2}}{4b}\frac{N}{N+1}\varepsilon \). Moreover, it is straightforward to determine that in both cases, \(\varepsilon <\frac{N+1}{N}\). That is, although the overall supply chain profit is higher in the former case due to the perfect coordination, the retailers keep a non-zero profit margin, which is zero in the latter case due to the perfect competition. As a result, the supplier extracts the same profit from the channel in both cases and is thus indifferent whether or not perfect coordination or perfect competition is achieved.

Proposition 9

Let \(N>\frac{\alpha (\varepsilon \alpha +\alpha -2\varepsilon )}{3\varepsilon \alpha -\varepsilon ^{2}-\varepsilon \alpha ^{2}-\alpha ^{2}}\), (18) hold and the supplier offers to ordinary retailers a two-level wholesale price contract with standard \(w^{s}=\frac{a}{2}\) and discounted \(w^{d}=\alpha w^{s}\) prices along with the minimal order quantity, \(q^{d}\), determined by (13). If \(N<\frac{\alpha (\varepsilon \alpha +\alpha -2\varepsilon )}{\varepsilon (5\alpha -\alpha ^{2})}\), then \(\frac{dp}{dt}>0\), \(\frac{dr}{dt}<0\) for \(p<p_{cr}\); \(\frac{dp}{dt}<0\), \(\frac{dr}{dt}>0\) for \(p>p_{cr}\); and \(\frac{dp}{dt}=0\), \(\frac{dr}{dt}=0\) for \( p=p_{cr}\), i.e, there will be \(p_{cr}\) ordinary retailers and \(1-p_{cr}\) mutants using discounting strategy. Otherwise, if \(N\ge \frac{\alpha (\varepsilon \alpha +\alpha -2\varepsilon )}{\varepsilon (5\alpha -\alpha ^{2})}\), then \(\frac{dp}{dt}>0\), \(\frac{dr}{dt}<0\) and any mutants become extinct, i.e., the standard strategy is evolutionary stable. \(\square \)

Adjusting retailers

We next analyze the evolutionary process of the adjusting retailers when there are no ordinary ones. Our conclusion is straightforwardly obtained from Proposition 5.

Proposition 10

Let the supplier offer to the adjusting retailers a two-level wholesale price contract with standard \(w^{s}=\frac{a}{2}\) and discounted \(w^{d}=\alpha w^{s}\) prices along with the minimal order quantity, \(q^{d}\), determined by (33). Then \(\frac{de}{dt}<0\), \(\frac{dr}{dt}>0\) for anye, i.e., retailers defect to buy discounted products. \(\square \)

In addition, we find from Propositions 5 and 10 that this time the evolution results in perfect supply chain coordination, but not in perfect competition between the retailers.

Two types of retailers

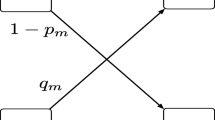

Based on Proposition 7, we straightforwardly conclude that \(J_r^a <\bar{{J}}\)and the number of adjusting retailers always decreases \(\frac{de}{dt}<0\), the number of those going for the discount always increases\(\frac{dr}{dt}>0\) as \(J_r^d >\bar{{J}}\), while the number of the ordinary retailers \(\frac{de}{dt}<0\) may either increase or decrease depending on the initial distribution {p, e, r}. However, the decreasing number of adjusting retailers unavoidably leads to \(J_r^s <\bar{{J}}\) and, thus, \(\frac{de}{dt}<0\) as summarized below and is illustrated in Fig. 1.

Proposition 11

Let the supplier offer to the retailers a two-level wholesale price contract with standard \(w^{s}=\frac{a}{2}\) and discounted \(w^{d}=\alpha w^{s}\) prices along with the minimal order quantity, \(q^{d}\), determined by (33). Then all retailers eventually defect to buy discounted products. \(\square \)

Note that according to Lemma 7, in the presence of the two types of retailers, the supplier does not necessarily immediately profit from offering a discount unless \(\frac{N\alpha +\alpha -N}{N(N+1)(1-\alpha )}\ge 1\). However, as the number of defectors increases, the supplier starts making a profit. We also conclude that the supplier will not be able to simultaneously pursue both perfect coordination and perfect competition with classical, two-level, quantity discounting regardless of the type of retailers he is dealing with.

8 Conclusions

Given a wholesale price contract, in terms of a supply chain with a single supplier and multiple retailers, Cournot competition implies that as the number of horizontally competing retailers tends to infinity, the competition between retailers becomes perfect. At the same time, the supplier’s wholesale price does not change and the supply chain profit converges to the system-wide optimal one. We find that a classical, single price-break point quantity discount may induce perfect competition between retailers even when their numbers are finite. We discuss three possible strategies a retailer may use when a discount is offered: (i) order more at the discounted wholesale price; (ii) order the same standard quantity at the same regular price (ordinary retailers); and (iii) buy at the regular price but adjust the order quantity (adjusting retailers).

We find that there is always a quantity discount such that the supplier profits when offering this discount to the ordinary retailers: the larger the proportion of the firms utilizing the discount, the higher the total order and the greater the supplier’s profit. For the retailers, however, the discounting strategy is not necessarily advantageous over the standard one especially when there is a high number of retailers in the channel. In particular, if the population of retailers is sufficiently small, the retailers using the discounting strategy are better off than those employing the standard strategy regardless of the proportion of the defectors in the total population of the firms. The advantage, however, reduces as the number of the defectors aggravates. As a result, for a critical proportion of ordinary retailers the competition between the retailers using the discounting strategy may become perfect, but not the coordination. Any further defection then would imply losses for both ordinary and defecting retailers. In terms of standard, static analysis, this implies that no ordinary retailer would choose the discounting strategy at all. Evolutionarily, however, this only implies that the ordinary retailers who choose to purchase the product at the discounted price, when the competition between the defectors is already perfect, will observe losses and consequently will stop ordering the product. The remaining retailers will retain the discounting strategy and therefore perfectly compete. The evolutionary inertia in dropping the retail prices and thus resulting in a delay in the final outcome of perfect competition then adds revenues to the retailers who eventually end-up with a zero profit margin.

Unlike the ordinary retailers, the adjusting retailers align their order based on the observed channel dynamics. We find that in this case the supplier profits from offering a very limited discount. On the other hand, the retailers choosing the discounting strategy are always better off than those employing the adjusting strategy. The more the defectors, the lower the retail price and the greater the total product quantity sold which converge to the system-wide optimal price and quantity respectively when all adjusting retailers defect. This perfect coordination is, however, not associated with the perfect competition between the retailers.

When the supply chain involves both ordinary and adjusting retailers, the outcome is more complex. Specifically, the supplier profit from either type of retailers or both depending on the discount he offers and the proportion of each type of retailers in the overall population of retailers. The lower the proportion of the adjusting retailers and/or the discount, the higher the likelihood the supplier will profit from both types of retailers accepting the discount conditions that have been offered. The competition between the retailers then does not become perfect and the retailers choosing the discounting strategy are better off than those employing the adjusting and standard strategies. Of the two strategies, however, the latter is more advantageous than the former. That is, we show the presence of two phenomena: that ordinary retailing may be more beneficial under some conditions and that “smarter” adjusting retailers may be worse off than the ordinary retailers. Overall we conclude that the supplier will not be able to pursue simultaneously both perfect coordination and perfect competition with the classical single price-break point quantity discounting regardless of the type of retailers he is dealing with. Importantly, with only ordinary retailers present in the channel, it is possible to choose which option to pursue—perfect coordination or perfect competition. Clearly the overall supply chain profits are highest under perfect coordination, but we show that when this occurs the retailers keep a non-zero profit margin preventing the supplier from extracting the entire profit. This margin is zero when the competition is perfect and therefore the supplier extracts the entire profits of the channel. However, in such a case the overall chain profit is lower. As a result, we find that the supplier extracts the same profit from the channel in both cases and is thus indifferent as to whether perfect coordination or perfect competition is achieved. This implies the suppliers will not necessarily want to coordinate the supply chain vis a vis the ordinary retailers alone. By the same token, the supplier’s decision when offering a discount is affected by the type of retailer he is dealing with rather than by a desire to improve the coordination or competition in the channel.

It is commonly observed in real-life supply chains that the retail price does not drop at once to the extent of the wholesale price discount. This phenomenon is also sustained with the evolutionary analysis which shows that it may take time for the supplier to start extracting higher profits from the supply chain by offering discounts. The outcome is due to the inert management of the wholesale contracts by the retailers which can play a positive role enabling the retailers to compensate for declining over time profits.

Finally, we used a common and limiting assumption that appears in the supply chain literature that all retailers participating in the distribution channel are symmetric. Further generalization by assuming non-symmetric parameters for the retailers as well as accounting for various types of uncertainty are challenging tasks and therefore important directions for future research.

References

Abad PL (1988) Joint price and lot-size determination when the supplier offers incremental quantity discounts. J Oper Res Soc 39:603–607

Bernstein F, Song JS, Zheng X (2008) Bricks-and-mortar vs. clicks-and-mortar: an equilibrium analysis. Eur J Oper Res 187(3):671–690

Blattberg RC, Neslin SA (1990) Sales promotion concepts, methods, and strategies. Prentice Hall, New Jersey

Cai GS, Zhang Z, Zhang M (2009) Game theoretical perspectives on dual-channel supply chain competition with price discounts and pricing schemes. Int J Prod Econ 117(1):80–96

Chen FR, Federgruen A, Zheng YS (2001) Coordination mechanisms for a distribution system with one supplier and multiple retailers. Manag Sci 47(5):693–708

Cosguner K, Chan TY, Seetharaman S (2014) Dynamic pricing in a distribution channel in the presence of switching costs. SSRN: http://ssrn.com/abstract=2488622 or http://dx.doi.org/10.2139/ssrn.2488622

Grewal D, Krishnan A, Baker J, Borin N (1998) The effect of store name, brand name and price discounts on consumers’ evaluations and purchase intentions. J Retail 74(3):331–352

Hwang H, Kim KH (1986) Supplier’s discount policy with a single price break point. Eng Costs Prod Econ 10(4):279–286

Ingene CA, Parry ME (1995) Channel coordination when retailers compete. Mark Sci 14(4):360–377

Kennedy DS, Marrs J (2011) No B.S. price strategy: the ultimate no holds barred kick Butt take no prisoner guide to profits, power, and prosperity. Entrepreneur Press, Irvine

Kim KH, Hwang H (1988) An incremental discount-pricing schedule with multiple customers and single price break. Eur J Oper Res 35:71–79

Krishna A (1991) Effect of dealing patterns on consumer perceptions of deal frequency and willingness to pay. J Mark Res 28:441–451

Lal R, Staelin R (1984) An approach for developing an optimal discount pricing policy. Manag Sci 30(12):1524–1539

Lee HL, Padmanabhan V, Whang S (1997) Information distortion in a supply chain: the bullwhip effect. Manag Sci 43(4):546–558

McKenzie JA (2009) Evolutionary game theory, stanford encyclopedia of philosophy. http://plato.stanford.edu/entries/game-evolutionary/

Moorthy KS (1987) Managing channel profits: comments. Mark Sci 6:375–379

Munson CL, Rosenblatt MJ (1998) Theories and realities of quantity discounts: an exploratory study. Prod Oper Manag 7(4):352–359

Oliveira FS, Ruiz C, Conejo AJ (2013) Contract design and supply chain coordination in the electricity industry. Eur J Oper Res 227(3):527–537

Qin YY, Tang HW, Guo CH (2007) Channel coordination and volume discounts with price-sensitive demand. Int J Prod Econ 105(1):43–53

Rosenblatt MJ, Lee HL (1985) Improving profitability with quantity discounts under fixed demand. IIE Trans 17(4):388–395

Sarmah SP, Acharya D, Goyal SK (2006) Buyer vendor coordination models in supply chain management. Eur J Oper Res 175(1):1–15

Sinha S, Sarmah SP (2010a) Single-vendor multibuyer discount pricing model: an evolutionary computation based approach. Int J Oper Res 8(1):1–19

Sinha S, Sarmah SP (2010b) Single-vendor multi-buyer discount pricing model under stochastic demand environment. Comput Ind Eng 59(4):945–953

Taylor PD, Jonker LB (1978) Evolutionary stable strategies and game dynamics. Math Biosci 40:145–156

Viswanathan S, Wang QN (2003) Discount pricing decisions in distribution channels with price-sensitive demand. Eur J Oper Res 149(3):571–587

Wang Q (2002) Determination of suppliers’ optimal quantity discount schedules with heterogeneous buyers. Naval Res Logist 49(1):46–59

Wang Q (2004) Coordinating independent buyers with integer-ratio time coordination and quantity discounts. Naval Res Logistics 51(3):316–331. doi:10.1002/nav.10117

Wang Q, Wang R (2005) Quantity discount pricing policies for heterogeneous retailers with price sensitive demand. Naval Res Logist 52(7):645–658

Weng Z (1995) Channel coordination and quantity discounts. Manag Sci 41(9):1509–1522

Xia T, Li X (2010) Consumption inertia and asymmetric price transmission. J Agric Resour Econ 35(2):209–227

Zeeman EC (1980) Population dynamics from game theory. In: Nitecki ZH, Robinson CR (eds) Global theory of dynamical systems (Evanston, 1979), Lecture Notes in Mathematics, vol 819. Springer, Berlin, pp 471–497

Zhou Y, Li D-H (2007) Coordinating order quantity decisions in the supply chain contract under random demand. Appl Math Model 31:1029–1038

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Kogan, K. Discounting revisited: evolutionary perspectives on competition and coordination in a supply chain with multiple retailers. Cent Eur J Oper Res 27, 69–92 (2019). https://doi.org/10.1007/s10100-017-0490-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10100-017-0490-y