Abstract

The growing electricity demand impels the expansion of generation capacity. For an effective and detailed planning, it is vital to know the supply capacity and the growth potential of a power plant technology. For the growth of a power generation technology, the electricity generated from it needs reinvestment for the construction of newer power plants, other than just meeting the demand. This paper proposes a framework employing dynamic energy analysis to examine the capacity expansion, growth potential and energy dynamics of six different technologies (solar PV, wind, hydro, nuclear, coal and gas). The power plant characteristics include lifetime, construction time, energy payback time and energy reinvestment factor. Energy payback time, relative to the lifetime of a power plant, is the primary constraint in capacity expansion. We analyze energy reinvestment strategies, affecting the growth rate, and determine its optimal value. The solar PV power plant has the least maximum growth potential of 15%, while gas power plant has the highest maximum growth potential of 124%. Relationships are developed to find the minimum time frame required to follow a self-sustainable path with optimal reinvestment for any technology. A case study is presented to reach the global demand capacity target for the year 2030 following a low-carbon-emission path.

Graphical abstract

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

The United Nations has estimated the world’s population to reach 11.2 billion by 2100 (UN, 2017). Expectedly, this population growth demands the expansion of power generation capacity to meet the electrical load demand in the future. Other than producing electricity, the electricity generation process is known to have negative impacts on the environment related to climate change and ecosystem (Khan 2019). Global warming has reached approximately 1 °C above pre-industrial levels in 2017 and is rapidly increasing at approximately 0.2 °C per decade (IPCC 2018). Fossil fuels are the primary sources of global carbon dioxide (CO2) emissions compared to renewable energy sources (NEA 2015). Global CO2 emissions from electricity generation increased to 45% between 2000 and 2015 due to the domination of the large share of fossil fuels in electricity generation (IEA 2017a, b). The average CO2 concentration in the atmosphere reached 417 parts per million (ppm) in 2020 (NOAA 2020) from 280 ppm in pre-industrial time (IEA 2017a, b) due to significant dependence on fossil fuel for the total primary energy supply. Its concentration is recommended to be below 350 ppm to avoid the negative impact of greenhouse gas (GHG) on human society and climate (Kenny et al. 2010). Renewable energy sources are sustainable, and their deployment has increased in recent years, but fossil fuels are still the predominant sources of energy in the world (Brockway et al. 2019). Sims et al. (2003) suggested some ways to minimize GHG emissions from electricity generation process such as preferring efficient fuel conversions (e.g., cogeneration), the transition from high to low carbon-intensive fossil fuel (e.g., the transition to gas from coal), implementing carbon sequestration and decarbonization technology, and deployment of nuclear and renewable-based power plants. Additionally, negative emission technologies have to be supplemented to reduce overall emissions (Pires 2019). To ensure the access of electricity to our future generations and cut down the GHG emissions, a significant focus is to be given to following a low carbon path of electricity generation. Limiting the global warming to 1.5 °C or less would require reaching net zero CO2 emissions by 2050 globally (IPCC 2018).

Sustainable energy is an energy which can meet today’s need without compromising the ability to meet the needs of our upcoming generation (Brundtland 1987). For this, the energy supply needs to be secure, affordable and environmentally friendly (Wang et al. 2019). Moreover, it is necessary to identify and deploy the power plants having higher energy delivering and growing potential, unlimited reserves, and lower GHG emissions. Kato et al. (1998) found out the CO2 emissions produced by residential photovoltaic (PV) technology were lower than the average CO2 emissions from utilities in Japan and suggested that frameless design and minimization of glass used in PV modules can decrease the energy payback time (EPBT) and CO2 emissions significantly. Alsema (2000) recommended that a grid-connected PV system in the long term can remarkably contribute to the reduction of CO2 emissions. Raadal et al. (2011) suggested having a strict standard method and requirements for life cycle assessment (LCA) study due to the wide variations in GHG emissions obtained by authors for the power plant based on the same technology. Peng et al. (2013) concluded that PV technologies are environmentally friendly and sustainable, and with the advancement in upcoming technologies, the PV system performance is expected to rise soon. Life cycle assessment study of a 1-MW PV power plant in China showed that its greenhouse gas production was 938.45 g CO2-eq./kWh lower than the traditional coal-fired power plant indicating PV as a benign technology to the environment compared to coal (Wu et al. 2017). Walmsley et al. (2017) analyzed the energy return on investment (EROI) and related GHG emissions of wind energy farms in New Zealand and compared them with the wind energy farms in Europe and America. Environmental impacts of power plants should not be limited only to GHG emissions but also need to consider acidification potential, photochemical ozone creation potential, eutrophication potential and human toxicity potential in the future LCA studies since the degree of these impacts was found to be different in nuclear-, wind- and hydro-based power plants (Siddiqui and Dincer 2017). An LCA study conducted by Xu et al. (2018) showed a better environmental performance of onshore wind over coal and gas power systems in China for most of the environmental impacts including global warming potential but followed with higher abiotic depletion elements and ozone layer depletion potential.

Hondo (2005) developed a model to find the GHG emissions per kWh of the electricity produced for nine different power generation technologies, which could help select less carbon-intensive technologies. The nuclear power plant needs to be deployed with the growth rate of 10.5% per year from 2010 to 2050 to replace the fossil fuel power plants, but this high growth rate will result in all the energy produced from nuclear power plants utilized for its new construction. Hence, nuclear power cannot be claimed to be an emission-free energy source (Pearce 2008). Solar PV, wind, hydro, and nuclear technologies have a negligible carbon footprint in comparison with oil-, gas- and coal-based power generation (Kessides and Wade 2011a). However, the power density (W/m2) of solar PV, wind and hydro is lower than coal, gas and nuclear power generation (Buceti 2014). The transition from fossil fuels to renewables is very challenging, mainly due to its lower power density and intermittent nature (Kessides and Wade 2011a). Harvesting renewable energy requires higher output energy production during its lifetime than the energy required during its design, manufacturing, installation, operation and decommissioning stages to forbid them from being an energy sink. The net energy analysis (NEA) is a method to evaluate power generation input and output energy in a quantitative way that can be followed to know the energy production potential of different types of power plants (Raugei 2019). Calculating the cumulative energy demand (CED) separately for construction, operation, and decommissioning stages helps to identify the higher energy-demanding stage and the impacts (e.g., global warming, eutrophication, abiotic depletion, acidification) associated with each stage (Buonocore et al. 2015). Huang et al. (2017) assessed the environmental performance and net energy analysis of offshore wind power systems by using LCA and various energy indicators like CED, EROI and EPBT. EROI and EPBT play a very important role in assessing the impact of energy systems on the economy (Cleveland et al. 1984; Hall et al 1986). They observed that the minimization in environmental impact and energy requirement is by 25% and 30%, respectively, when recyclable waste materials of the offshore wind power systems are reused. NEA and LCA, when combined, can give more insights regarding power generation and growth potential, which are very useful for policymakers (Jones et al. 2017).

LCA and NEA are handy tools to examine and compare the overall energy used and the environmental impacts at different stages in the overall life of any product or a system. Since the environmental impact due to GHG emissions from the electricity sector has become one of the major problems of this century, many researchers are working with the LCA approach to calculate the energy associated and the environmental impacts of power plants based on various technologies including solar PV, wind and coal. Life cycle energy analysis approach is useful to know the energy associated with the overall life of a power plant of any technology. Gibon et al. (2017) pointed out the shortcomings of LCA, asserting that it does not consider the consequences of fatal accidents, especially in nuclear power plants. Moreover, they found that carbon capture technology results in an increase in environmental impacts, other than GHG emissions. The static life cycle energy analysis expresses the results in terms of increasing energy demand and energy yield ratio. In contrast, the dynamic life cycle energy analysis is real time in nature as it considers the fundamental energy balance equation, which is a function of time (Mathur et al. 2004). Static analysis like carbon emission pinch analysis, with a single (Tan and Foo 2007) or multiple objectives (Krishna Priya and Bandyopadhyay 2017), may be able to help in determining the intended mix of various power plants. However, it fails to determine the ways to achieve it. Standard energy system analysis, based on LCA and NEA, is essentially static in nature. Different material and energy inputs and outputs are considered identical and typically; temporal changes are not accounted for. As LCA and NEA are not sufficient to know about the growth rate potential of energy technology, there is a need for dynamic energy analysis (Kessides and Wade 2011a), especially for the capacity expansion of electricity sector.

Power plants are in various stages of their life such as construction, generation and decommissioning. The total electricity production at any instant of time is dependent upon the overall installed capacity available at that time. To follow a low-emission pathway and meet the rising electricity demand, the electric power plants need to provide some of its electricity produced for the construction of newer power plants in addition to meeting the load demand. If the rate of construction of new power plants is lower, followed by higher rate decommissioning of old existing power plants, then the electricity generation capacity falls and may not be enough to meet the load demand. Growth rate of a power plant also plays an important role in reducing the emissions associated with the power plant (Pearce 2008). The transient behavior of different parameters are important for the appropriate capacity expansion of the electricity sector. This necessitates the need for the dynamic energy analysis.

Mathur et al. (2004) and Kessides and Wade (2011a) had presented the concept of power generation expansion where the operational power plants reinvest some amount of energy generated for the construction of new power plants while simulatenously providing electricity to consumers. As the growth of power plant is supported by the existing operational power plant, Mathur et al. (2004) and Kessides and Wade (2011a) studied the growth of the power plant using the concept of both static and dynamic energy analyses. Mathur et al. (2004) reported a lower growth rate potential of PV power plants and suggested the need for their promotion by some special schemes. Technologies requiring significant CED and longer EPBT relative to their lifetime are the significant constraints on the growth of the power plant (Mathur et al. 2004; Kessides and Wade 2011a). Similarly, Becerra-Lopez and Golding (2007) studied the capacity expansion of power generation system in Far West Texas. However, they followed the dynamic exergy analysis and concluded that renewable technologies have an enormous potential to meet the load demand of the future. It is essential to have a diversification of the energy sources to have a sustainable electricity generation in the future (Carley and Andrews 2012). Renewables like PV and wind being intermittent energy sources make energy storage vital and necessary to maintain the balance of electricity demand and supply. PV power generation has a higher energy cost and less energy storage affordability compared to wind power generation (Carbajales-Dale et al. 2014). Emmott et al. (2014) developed a model to assess GHG reduction potential with the growth of PV electricity generation following dynamic carbon mitigation analysis to understand how renewable energy contributes in the transition to low carbon path. The higher growth rate of PV technology to replace high carbon-intensive energy sources will initially require a significant carbon dioxide generation during construction and commissioning stage (i.e., higher carbon investment). It may take a long time to mitigate atmospheric carbon dioxide (Emmott et al. 2014).

Unlike the static modeling, a dynamic energy model (Barrett and Spataru 2015) includes the short time-step dynamics and points out the path to fulfil the energy demands in various sectors with a suitable energy technology over time (Capellán-Pérez et al. 2019). Static energy analysis cannot quantify the energy flow at a given instant of time. Dynamic life cycle energy analysis gives a basis to know about the power plant growth and electricity-producing potential of a power plant at any instant of time by linking the energy demand for construction, operation, and decommissioning happening at different locations at any instant of time. Many studies have been done to forecast the growth of different power plants. However, to the best of our knowledge, energy reinvestment strategies to vary the growth rate of a power plant and optimal energy reinvestment to transfer the maximum energy to meet the load demand are some interesting aspects, which have not been studied by researchers till date. Fulfilment of this research gap is the novelty of this work. The methodology used in this study is a dynamic assessment of an overall energy system using fundamental energy balance equations to derive the time-dependent solutions for installation and capacity undergoing construction. The obtained solution is then used to assess the growth potential of various power plants. Emphasis has been given to find the growth potential of the different power plants without considering cost constraints, environmental constraints and cross-subsidy.

Dynamic analysis of power sectors

The model for dynamic analysis of electrical power sectors is developed in this section considering the energy generation and utilization. Consider a power plant of technology \(i\) at time \(t\) with the installed capacity of \(P_{i} \left( t \right)\) and the capacity under construction of \(C_{i} \left( t \right)\). The lifetime, construction time, energy payback time and capacity factor of the power plant are represented by \(T_{i}\), \(\mu_{i}\), \(\tau_{i}\) and \(\varphi_{i}\), respectively.

Figure 1 depicts the energy flow path for a power plant to follow its capacity expansion. The energy obtained from the installed capacity \(P_{i} \left( t \right)\) of the power plant is used for the construction of a new power plant of the same technology, to meet load demand and to supply energy for decommissioning of the old power plant. In this paper, it is assumed that the energy generated from a power plant is reinvested for the growth of the power plant of the same technology. This assumption ensures no energy subsidy for the growth of a technology and can represent an independent indicator of overall sustainability assessment of the technology involved (Kessides and Wade 2011a). A fraction \(\beta_{i} \left( {0 \le \beta_{i} \le 1} \right)\) of the total energy produced from the power plant of technology \(i\) is provided for the construction of a new power plant of the same technology. The remaining fraction \(\left( {1 - \beta_{i} } \right)\) of total energy is delivered to meet the current load demand of \(D_{i} \left( t \right)\). In other words, if \(E_{i}\) is the total energy available after accounting for the energy required for decommissioning, then \(\beta_{i} E_{i}\) is the energy provided for the construction of new power plant of technology \(i\) and \(\left( {i - \beta_{i} } \right)E_{i}\) is the energy delivered to meet the load demand or demand capacity of \(D_{i} \left( t \right)\). \(\beta_{i}\) is the decision variable termed as energy reinvestment factor for the power plant of technology \(i\), based on which the growth rate \(\left( {\alpha_{i} } \right)\) increases or decreases.

It is assumed that the new power plant is commissioned immediately after the completion of its construction and an existing power plant is decommissioned immediately after their lifetime. The amount of energy required during construction and decommissioning of the power plant is uniformly distributed over the construction time and its lifetime, respectively. The capacity factor of the power plant accounts for the energy required for decommissioning the power plant. No resource constraints, cost constraints, environmental constraints and deficiency of land area to construct the power plants are considered.

Dynamic model

Writing the dynamic equation for the construction capacity of the power plant of technology \(i\):

In Eq. (1), \(C_{i} \left( {t + \delta t} \right)\) and Ci (t) represent the capacity of the power plant under construction of technology \(i\) going at time \(t + \delta t\) and t respectively. The second term on the right represents the new capacity of the power plant under construction of same technology undertaken at time \(\delta t\). The amount of energy utilized for the construction purpose at time \(\delta t\) is \(\beta_{i} \varphi_{i} P_{i} \left( t \right)\delta t\). The term \(\frac{\delta t}{{\mu_{i} }}C_{i } \left( t \right)q_{i}\) represents the part of energy given to the continuation of ongoing construction \(C_{i} \left( t \right)\). \(q_{i}\) is termed as emplacement energy, which is defined as the energy per unit of installed capacity (Kessides and Wade 2011a) and is related to the simple energy payback time, \(\tau_{i} = \frac{{q_{i} }}{{\varphi_{i} }}\). The third term \(\frac{\delta t}{{\mu_{i} }}C_{i } \left( t \right)\) represents the fraction of construction \(C_{i} \left( t \right)\) completed in \(\delta t\) time. Equation (1) can be simplified to the following dynamic equation for the construction capacity:

Similarly, writing the dynamic equation for an installed capacity of technology i (Kessides and Wade 2011a):

In Eq. (3), \(P_{i} \left( {t + \delta t} \right)\) and Pi(t) represents the installed capacity of the power plant of technology i at time \(t + \delta t\) and t respectively. The decommissioning capacity of power plant should be the power plant commissioned \(T_{i}\) years back. However, to formulate a differential equation, it is assumed to be proportional to the fraction of the operating power plant (Kessides and Wade 2011a). The second term on the right \(\frac{\delta t }{{T_{i} }} P_{i } \left( t \right)\) represents the fraction of \(P_{i} \left( t \right)\) decommissioned at time \(\delta t\). The third term \(\frac{\delta t}{{\mu_{i} }}C_{i } \left( t \right)\) represents the new capacity added in time \(\delta t\) . The dynamic equation for the installed capacity can be written as:

It should be noted that in deriving Eqs. (2) and (4), continuum condition of energy generation and power consumption is assumed. This is applicable as time-average values of different parameters are considered in the proposed framework. Due to these time-average values, distinctions between dispatchable and non-dispatchable power plants are avoided. The approximate solution of the differential Eqs. (2) and (4) is expressed as (see Supplementary Information for detailed derivation):

where \(\alpha_{i}\) is the growth rate of the technology \(i\) and \(P_{i0}\) is the initial installed capacity.

The total energy available from the installed power plant to meet the load demand or demand capacity is:

These differential equations are solved using numerical codes and analyzed to perform the dynamic analysis of the power plants.

Variation of growth rate with reinvestment factor

The growth rate of the technology \(i\) [Equation (S5)] can be rewritten as:

From Eq. (8), it can be observed that the growth rate of the power plant depends upon its construction time \(\left( {\mu_{i} } \right)\), lifetime \(\left( {T_{i} } \right)\), energy payback period \(\left( {\tau_{i} } \right)\) and energy reinvestment factor \(\left( {\beta_{i} } \right)\). Parameters \(T_{i}\), \(\mu_{i}\) and \(\tau_{i}\) can be known from life cycle energy analysis, while \(\beta_{i}\) is the control or decision variable. To ensure that the power plant is expanding exponentially with respect to time, we need to have the energy reinvestment factor at least higher than its threshold value \(\left( {\beta_{i} > \beta_{{i, {\text{thres}}}} } \right)\), in Eq. (8).

If the reinvestment factor is less than its threshold value \(\left( {\beta_{i} < \beta_{{i, {\text{thres}}}} } \right)\), then the generation capacity cannot grow with the progress of time. The installed capacity \(P_{i} \left( t \right)\) can grow exponentially for \(\beta_{i} > \beta_{{i, {\text{thres}}}}\), can remain stagnant for \(\beta_{i} = \beta_{{i, {\text{thres}}}}\), or can fall exponentially for \(\beta_{i} < \beta_{{i, {\text{thres}}}}\). Therefore, \(\beta_{i}\) can be regulated to either expand or suppress any technology depending upon the requirement.

Likewise, the maximum growth is possible only when energy reinvestment factor is equal to 1 in Eq. (8).

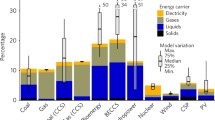

The growth potentials of various technologies at different energy reinvestment factors are graphically presented in Fig. 2 using the data of Table 1 in Eq. (8). The threshold reinvestment and the maximum growth rate, calculated using Eqs. (9) and (10), are presented in Table 2.

For the analysis carried out on six different power plant technologies in the world, as shown in Table 2, it can be inferred that solar PV power plant has the least potential to grow with a maximum growth rate of 15.1%. The highest threshold reinvestment of solar PV power plant points out higher energy demand for its new construction to maintain growth. Coal and gas power plants hold the highest possibilities to grow themselves by using output energy available from their existing power plants because of the lowest threshold reinvestment required than renewable power plants. The growth potential of the nuclear power plant is very high, significantly higher than that of renewable power plants and slightly lower than that of the non-renewable power plants. Therefore, without considering factors like a perceived risk to humankind, capital investments, waste disposal, etc., the nuclear power plant has the most significant growth potential among other low-carbon technologies.

Sensitivity analysis

Sensitivity analysis is instrumental in identifying the most dominant parameters that influence the change in results. Parameters in our study are energy payback time, construction time and lifetime. Table 3 shows the sensitivity analysis of these three parameters on the growth rate of solar PV power plant for some fixed energy reinvestment factors. We observe that the energy payback time is the highest, and the construction time is the least sensitive parameters. From Eq. (2), it may be observed that the rate of construction of new power plant increases with decreasing payback time, and thereby, it increases the growth rate. For 10% increase in the energy payback time, the growth rate is decreased by 13.62%, and for 10% decrease in the energy payback time, the growth rate is increased by 16.38% when. Variation in the lifetime has a substantial change in the growth rate as it impacted the rate of change in the operating power plant [Eq. (4)]. Increase in the construction time increases the rate of construction of new power plant (2) and reduces the rate of operating power plant (4). These two competing effects make the construction time least significant. It may be observed from Table 3 that the construction time does not have a significant impact in comparison with other parameters. Like solar PV, similar results are observed for other technologies, indicating energy payback time as the most sensitive parameter. Therefore, research focus should be directed toward reducing the energy payback time through energy-efficient construction technologies and efficient energy conversions.

Changes in operating and atmospheric conditions, variations in availability of renewable resources, fluctuations in demand of various energy services and the lack of complete understanding of the power plants cause parametric uncertainties. Sensitivity analysis plays an important role in identifying uncertainties associated with estimating different parameters associated with the proposed model. Effects of various probabilistic uncertainties such as variations in solar radiations (Arun et al. 2009) or wind velocities (Roy et al. 2010) can be understood and quantified through probabilistic-based modeling. In the proposed methodology, time-average values of these parameters are adopted and their influence on energy-sector modeling is neglected. On the other hand, epistemic uncertainties in parameters arise due to improper knowledge of operations of power plants. These epistemic uncertainties are important in appropriate planning for the future and may be accounted for either through interval arithmetic or through various scenario generations (Bandyopadhyay 2020). In the work, the later approach is adopted and discussed in the case study section.

Optimal energy reinvestment to have maximum demand capacity

As the demand capacity \(D_{i} \left( t \right)\) in Eq. (7) depends upon the controlled variable \(\left( {\beta_{i} } \right)\), a graph is plotted to see the nature of this variation for a given time of analysis, \(t = N\) (see Fig. 3). It can be noted that there exists an optimal energy reinvestment \(\left( {\beta_{{i, {\text{opt}}}} } \right)\) at which the maximum energy can be supplied to meet the demand. The growth rate corresponding to optimal energy reinvestment is termed as an optimal growth rate \(\left( {\alpha_{{i, {\text{opt}}}} } \right)\) and can be calculated for the corresponding \(\beta_{{i, {\text{opt}}}}\) using Eq. (8). Differentiating Eq. (7) and equating it to zero, \(\beta_{{i,{\text{ opt}}}}\) can be determined as a function of construction time \(\left( {\mu_{i} } \right)\), energy payback time \(\left( {\tau_{i} } \right)\), lifetime \(\left( {T_{i} } \right)\) and time of analysis \(\left( N \right)\).

Figure 4 shows the variation of the optimal reinvestment of solar PV technology as a function of time of analysis. Graphically, it can be observed that both the optimal energy reinvestment and the optimal growth rate are negative for initial few years, signifying that solar PV power plant cannot flourish in a short time range because of energy sink, which means energy supply is not enough to meet the load demand. Moreover, as the time is increasing both the optimal energy reinvestment and growth rate are rising and intersecting at the 4th year. It may be noted further that the optimal energy reinvestment is positive after ~4.4 years; however, the growth rate is still negative. It is because the growth rate of a power plant of any technology \(i\) is possible only if energy reinvestment is higher than the threshold energy reinvestment factor \(\left( {\beta_{{i, {\text{opt}}}} > \beta_{{i, {\text{thres}}}} } \right)\). This negative optimal energy reinvestment clinches that solar PV power plant cannot grow until \(\beta_{{i, {\text{opt}}}} > \beta_{{i, {\text{thres}}}}\) for which it needs to be subsidized. From Fig. 5, it can be noted that wind power plant requires less time to get its energy reinvestment paid off in comparison with the solar PV power plant.

The minimum time required to have \(\beta_{{i, {\text{opt}}}} = \beta_{{i, {\text{thres}}}}\) can be obtained from Eq. (11):

From Eq. (12), it can be observed that \(T_{{i,{\text{min}}}}^{^{\prime}}\) depends upon the construction time \(\left( {\mu_{i} } \right)\), the lifetime \(\left( {T_{i} } \right)\) and the energy payback time \(\left( {\tau_{i} } \right)\). The minimum time required for different power plants is presented in Table 4. It can be noted that gas power plants require the least time horizon and solar PV power plants require the longest time horizon for development. Similar to the previous observation, reduction in the energy payback time can help to flourish a technology in a short time frame. Low carbon technologies like nuclear and wind should be emphasized to decarbonize in a short period. However, solar PV and hydropower plants can help in decarbonizing over a longer time horizon.

Global energy analysis

According to Key World 2017 report (IEA 2017a, b), the primary source of electricity generation was still fossil fuel in 2015 with a share of 66.3% of total electricity production in the world, while in the same year renewables and nuclear shares were only 23.1% and 10.6%, respectively. As fossil fuels are the primary drivers of global warming and climate change, energy policy to increase the share renewable energy technology for energy consumption is considered as the primary path for sustainable development (Destek and Aslan 2017; Østergaard et al. 2020). Based on the life cycle of greenhouse gas emissions, fossil fuels are the most carbon-intensive energy sources (WNA 2011). Table 5 shows the lifecycle GHG emissions of various power plants. Low carbon intensity of renewable and nuclear technologies indicates them as a potential technology to decarbonize rising emission to achieve the objective of Paris agreement (2015) of keeping earth temperature below 2 °C (NEA 2015).

The proposed model is applied to determine a low carbon path to meet the global energy demand for a 17-year time frame, starting from 2013 and ending in 2030. The energy production from all the power plants is combined to satisfy the forecasted global demand. The energy reinvestment factor of each power plant is assumed to be constant over the given time frame of 17 years. To reduce GHG emission in 2030, the growth of non-renewable power plants is suppressed, and the growth of low-carbon power plants is encouraged. The installed capacity of various power plants in 2013 and 2030, provided in Fig. 6 (World Energy Outlook Special Report 2015), is used to determine the growth rate \(\left( {\alpha_{i} } \right)\) of technologies and is tabulated in Table 6. Based on these data, the global electricity demand is estimated to be 26,268.64 TWh in 2030. The energy reinvestment \(\left( {\beta_{i} } \right)\) corresponding to the growth rate \(\left( {\alpha_{i} } \right)\) of various power plants may be calculated as:

Global installed capacity and energy production: (a) in 2013 and (b) forecast for 2030 (World Energy Outlook Special Report 2015)

The energy reinvestment factors for different power plants are tabulated in Table 7 under Scenario-I, the base case scenario. Two additional renewable dominated scenarios are proposed to reduce the overall GHG emission compared to the base-case scenario. In these three scenarios, basic parameters are assumed to be constant over the 17-year time frame. An additional scenario is proposed and analyzed, considering dynamic parameters. It should be noted that annual energy-based planning is considered in this case study. We have inherently assumed that the combination of various power plants is sufficient to dispatch the required power demand.

It is observed that the reinvestment factor for a solar PV power plant for the base case (0.7398) is higher than the optimal reinvestment factor (0.6710), considering the time of analysis of 17 years. In the proposed scenarios, the optimal reinvestment factor for the solar PV power plant is considered to deliver the maximum energy to demand on the planning year. It may further be observed that, other than solar PV and hydro, all other power plants are capable of meeting the total load demand of 2030 alone. However, considering only one such power plant may not be advisable as the present analysis does not consider other important factors like capital investment, land requirement, water requirement, etc. In the proposed scenarios, reinvestment factors for the low-carbon technologies are increased from the base case scenario. Reinvestments of other three technologies, i.e., wind, hydro and nuclear, are increased by 10% and 20% in Scenario-II and Scenario-III, as shown in Table 7. Additionally, reinvestment for coal plants is suppressed completely, and reinvestment for the gas power plant is adjusted to satisfy the energy demand of 26,268.64 TWh in 2030. In these three scenarios, constant values of different parameters are assumed over the planning horizon. In Scenario-IV, some of the parameters are assumed to be dynamic to demonstrate the advantages of the proposed method. In summary, the following four scenarios are considered in this analysis:

-

Scenario-I: Base-case scenario with parameter values based on the World Energy Outlook Special Report (2015),

-

Scenario-II: Renewable scenario (optimal reinvestment for solar PV and 10% higher reinvestment for wind, hydro and nuclear),

-

Scenario-III: Aggressive renewable scenario (optimal reinvestment for solar PV and 20% higher reinvestment for wind, hydro and nuclear), and

-

Scenario-IV: Aggressive renewable with technological changes.

In Scenario-IV, the capacity factors of the power plants are updated based on the 2019 operating values (EIA 2020): 24.3% for solar PV; 34.3% for wind; 41.2% for hydro; 93.4% for nuclear; 47.5% for coal; and 37.8% for gas. The capacity factor for natural gas-based power plants is calculated based on the capacity-weighted capacity factors of combined-cycle power plants, gas-turbine power plants, steam-turbine power plants and internal combustion engines. Recent technological advances in PV and wind reduced the energy payback periods for these power plants significantly (Steffen et al. 2018). It is assumed that the energy payback periods for the PV and the wind power plants are going to be reduced annually by 5% and 3%, respectively. Contrary to renewable energy technologies, energy payback periods for fossil fuel-based power plants experienced an increase in its values in recent years (Hu et al. 2013). The energy payback periods for the coal and the gas-based power plants are assumed to be increased annually by 3% and 2%, respectively. Furthermore, to phase out coal-based power plants, it is assumed to reduce the life of these power plants annually by 10%. Reinvestment factors for this scenario are tabulated in Table 7. It may be noted that the reinvestment factor for wind is increased annually by 1%.

Energy supply to demand and the global installed capacity corresponding to all three scenarios are shown in Figs. 7 and 8. In Scenario-II and Scenario-III, the energy supplied to the load from coal power plant reduces by 33.4% (see Fig. 7) with a 33.8% reduction in installed capacity (see Fig. 8). As the coal power plants are further suppressed in Scenario-IV, energy supplied and installed capacity are reduced significantly by 66%. In Scenario-II and Scenario-III, there is an increase in demand met by the gas power plant to adjust energy deficiency from other four power plants. The demand met by the gas power plant, in Scenario-II and Scenario-III, is increased by 21.7% and 7.8% with a similar increase in installed capacity. However, due to significant growth in the renewables, the demand met by the gas power plants is reduced to 59%. In the base case, the overall energy supplied from fossil fuel power plants is expected to reduce from 70 to 55.6%. On the other hand, in proposed renewable scenarios, the energy supplied from fossil fuel power plants can further go down significantly (52% in Scenario-II, 48% in Scenario-III and 26% in Scenario-IV).

From the present 18.3% renewable share, all scenarios are expected to have significant contributions from the renewables (29.3% in the base case, 31.9% in the renewable scenario, 34.6% in the aggressive renewable scenario and 55.2% in the aggressive renewable with technological changes). Similarly, contributions from nuclear power plants are expected to increase. Increase in installed capacity for the proposed scenarios is expected due to lower capacity factors of the renewable power plants. It can be noted that although solar PV installed capacity and energy production are less in the proposed scenarios, it is supplying slightly higher energy than Scenario-I; compared to 1.13% in the base case, 1.16% energy is supplied in the Scenarios-II and III. In the case of Scenario-IV, contributions from solar PV plant increase to 5.5%.

The GHG emissions in all four scenarios are calculated by multiplying the total energy produced with the mean GHG emission rate. Table 8 indicates that the total GHG emissions, in the proposed scenarios, are lower than the base case. Compared to Scenario-I, GHG emission can be reduced by 13.5% and 17.9%, in Scenario-II and Scenario-III, respectively. With dynamic parameters, GHG emission can further be reduced by 49.5% in Scenario-IV. Based on the recommendations of IPCC (2018), Scenario-IV is closer to achieving net-zero CO2 emissions by 2050. As fossil fuel power plants dominate the GHG emission (about 95%), the overall reduction in GHG emission is achieved by increasing the share of low-carbon power plants. Additionally, it should be noted that the emission from solar PV power plants is reduced by 18.7% in Scenarios-II and III, compared to the base-case scenario, due to optimal reinvestment factor for this sector.

This study demonstrates that by adjusting the energy reinvestment factors, a significant reduction in GHG emission can be achieved. Various other scenarios may be created and studied by changing the energy reinvestment factors for various power plants. For example, if the perceived risk of the nuclear power plant is considered as a hindrance for the growth of these power plants, its energy reinvestment factor can be reduced. Through Scenario-IV, it has been demonstrated that the parameters can be varied over the planning horizon dynamically, and a lower GHG emission can be achieved.

Conclusion

The mathematical model used in this study provides a reasonable basis for drawing dynamic interpretations of the power plants of any technology. The result showed far-ranging maximum growth rates, 15.1% for solar PV and 124.34% for gas based power plant technology. Furthermore, the optimal energy reinvestment factor in meeting the maximum demand capacity highlighted that the renewable technology power plants, especially solar PV power plants, need a longer time frame than other power plant technologies to proliferate. Unlike the construction time and lifetime of the power plant technology, energy payback time is found to be the most sensitive parameter to vary growth rate, while construction time is found to be the least sensitive. The longer energy payback time of renewable technology relative to their life is the major constraint for their expansion as compared to non-renewable technology indicating the requirement of subsidization for their flourishment. This observation suggests that the current research should be directed toward reducing energy payback time for most renewable energy technologies.

Moreover, global energy status and case studies are giving us a basis to identify the path to increase less carbon-intensive renewable and nuclear technology power plant to meet future load demand by adjusting the energy reinvestment. It may be noted that the global average values are considered in this paper for the analysis of the global energy status and identifying low-carbon pathways. However, the proposed framework is generic and can be applied to specific locations or countries to identify the specific policies to achieve low-carbon pathways for that region. As demonstrated through Scenario-IV, the IPCC (2018) recommendations of reaching net-zero CO2 emissions by 2050 may be achieved.

This paper has tried to explain the single power plant energy dynamics by relaxing many inevitable constraints like resource availability, environmental emissions, infrastructure setting and cost for expansion. Adding these constraints in the present model would have reduced the energy reinvestment and corresponding growth rate of any power plant. The model assumes exponential growth with an upper limit on its construction capacity possible. The assumptions made in this study are to make our study easier and get an approximate model. Moreover, in the present world, there are many sources subsidizing the deployment of other technologies. This model can help select the power plant technology and know its energy-producing potential for energy planners and policymakers and can also be used as a foundation to develop a more complex mathematical model by considering more constraints and cross-subsidization. This work assumes the energy reinvestment is made only using the electricity generated. Factors like transportation of materials, requirement of fuels (gas/liquid), labor, etc., are not accounted for. Technical issues related to grid integration, grid stability, variations and uncertainties associated with renewables should be incorporated in the proposed framework. Additionally, grid-level storage can significantly influence the overall planning of the electricity sector. Future research is directed toward relaxing some of the above-mentioned limitations.

Abbreviations

- C(t):

-

Capacity of the power plant under construction (MW)

- D(t):

-

Demand capacity or load demand or energy provided to active consumers (MWh/y)

- E(t):

-

Total energy produced from a power plant (MWh)

- N :

-

Time of analysis at which the demand capacity is maximum (y)

- P(t):

-

Installed capacity of a power plant (MW)

- t :

-

Time instant (y)

- T :

-

Lifetime of a power plant (y)

- y :

-

Year

- β :

-

Energy reinvestment factor of a power plant i (value lies between 0 and 1)

- μ :

-

Construction time of a power plant (y)

- τ :

-

Energy payback time of a power plant (y)

- φ :

-

Capacity factor of a power plant

- α :

-

Growth rate of a power plant (y−1)

- i :

-

Technology type

- max:

-

Maximum

- min:

-

Minimum

- opt:

-

Optimal

- thres:

-

Threshold

- CED:

-

Cumulative energy demand

- EPBT:

-

Energy payback time

- EROI:

-

Energy return on investment

- GHG:

-

Greenhouse gas

- LCA:

-

Life cycle assessment

- NEA:

-

Net energy analysis

- PV:

-

Photovoltaic

References

Alsema EA (2000) Energy pay-back time and CO2 emissions of PV systems. Prog Photovoltaics Res Appl 8(1):17–25

Arun P, Banerjee R, Bandyopadhyay S (2009) Optimum sizing of photovoltaic battery systems incorporating uncertainty through design space approach. Sol Energy 83(7):1013–1025

Bandyopadhyay S (2020) Interval pinch analysis for resource conservation networks with epistemic uncertainties. Ind Eng Chem Res 59(30):13669–13681

Barrett, M., and Spataru, C. (2015, March). DyneMo: a dynamic energy model for the exploration of energy, society and environment. In: 2015 17th UKSim-AMSS International Conference on Modelling and Simulation (UKSim). IEEE, pp 255–260

Becerra-Lopez HR, Golding P (2007) Dynamic exergy analysis for capacity expansion of regional power-generation systems: case study of far West Texas. Energy 32(11):2167–2186

Brockway PE, Owen A, Brand-Correa LI, Hardt L (2019) Estimation of global final-stage energy-return-on-investment for fossil fuels with comparison to renewable energy sources. Nat Energy 4(7):612–621

Brundtland Commission (1987) World commission on environment and development. Our Common Future

Buceti G (2014) Sustainable power density in electricity generation. Manag Environ Qual Int J 25(1):5–18

Buonocore E, Vanoli L, Carotenuto A, Ulgiati S (2015) Integrating life cycle assessment and emergy synthesis for the evaluation of a dry steam geothermal power plant in Italy. Energy 86:476–487

Capellán-Pérez I, de Castro C, González LJM (2019) Dynamic Energy Return on Energy Investment (EROI) and material requirements in scenarios of global transition to renewable energies. Energy Strategy Rev 26:100399

Carbajales-Dale M, Barnhart CJ, Benson SM (2014) Can we afford storage? A dynamic net energy analysis of renewable electricity generation supported by energy storage. Energy Environ Sci 7(5):1538–1544

Carley S, Andrews RN (2012) Creating a sustainable US electricity sector: the question of scale. Policy Sci 45(2):97–121

Cleveland CJ, Costanza R, Hall CA, Kaufmann R (1984) Energy and the US economy: a biophysical perspective. Science 225(4665):890–897

Destek MA, Aslan A (2017) Renewable and non-renewable energy consumption and economic growth in emerging economies: evidence from bootstrap panel causality. Renew Energy 111:757–763

EIA (2020) Electric power monthly. The U.S. Energy Information Administration (EIA). www.eia.gov/electricity/monthly/current_month/october2020.pdf

Emmott CJM, Ekins-Daukes NJ, Nelson J (2014) Dynamic carbon mitigation analysis: the role of thin-film photovoltaics. Energy Environ Sci 7(6):1810–1818

Gibon T, Arvesen A, Hertwich EG (2017) Life cycle assessment demonstrates environmental co-benefits and trade-offs of low-carbon electricity supply options. Renew Sustain Energy Rev 76:1283–1290

Hall CA, Cleveland CJ, Kaufmann R (1986) Energy and resource quality: the ecology of the economic process. Wiley Interscience, New York

Hondo H (2005) Life cycle GHG emission analysis of power generation systems: Japanese case. Energy 30(11–12):2042–2056

Hu Y, Hall CA, Wang J, Feng L, Poisson A (2013) Energy Return on Investment (EROI) of China’s conventional fossil fuels: Historical and future trends. Energy 54:352–364

Huang YF, Gan XJ, Chiueh PT (2017) Life cycle assessment and net energy analysis of offshore wind power systems. Renew Energy 102:98–106

International Energy Agency (IEA) (2017a) Report on CO2 emissions from fuel combustion

International Energy Agency (IEA) (2017b) Report on key world energy statistics

IPCC (2018) Global warming of 1.5 °C. In: Masson-Delmotte V, Zhai P, Pörtner H-O, Roberts D, Skea J, Shukla PR, Pirani A, Moufouma-Okia W, Péan C, Pidcock R, Connors S, Matthews JBR, Chen Y, Zhou X, Gomis MI, Lonnoy E, Maycock T, Tignor M, Waterfield T (eds) An IPCC Special Report on the impacts of global warming of 1.5 °C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty

Jones C, Gilbert P, Raugei M, Mander S, Leccisi E (2017) An approach to prospective consequential life cycle assessment and net energy analysis of distributed electricity generation. Energy Policy 100:350–358

Kato K, Murata A, Sakuta K (1998) Energy payback time and life-cycle CO2 emission of residential PV power system with silicon PV module. Prog Photovoltaics Res Appl 6(2):105–115

Kenny R, Law C, Pearce JM (2010) Towards real energy economics: energy policy driven by life-cycle carbon emission. Energy Policy 38(4):1969–1978

Kessides IN, Wade DC (2011a) Towards a sustainable global energy supply infrastructure: net energy balance and density considerations. Energy Policy 39:5322–5334

Kessides IN, Wade DC (2011b) Deriving an improved dynamic EROI to provide better information for energy planners. Sustainability 3(12):2339–2357

Khan I (2019) Greenhouse gas emission accounting approaches in electricity generation systems: a review. Atmos Environ 200:131–141

Krishna Priya GS, Bandyopadhyay S (2017) Multi-objective pinch analysis for power system planning. Appl Energy 202:335–347

Mathur J, Bansal NK, Wagner HJ (2004) Dynamic energy analysis to assess maximum growth rates in developing generation capacity: case study of India. Energy Policy 32:281–287

Neumeyer C, Goldston R (2016) Dynamic EROI assessment of the IPCC 21st century electricity production scenario. Sustainability 8(5):421

National Oceanic and Atmospheric Administration (NOAA) (2020) Global Monitoring Division, https://www.esrl.noaa.gov/gmd/ccgg/trends/index.html. Accessed on 30 June 2020.

Nuclear Energy Agency (NEA) (2015) Report on nuclear energy: combating climate change

Østergaard PA, Duic N, Noorollahi Y, Mikulcic H, Kalogirou S (2020) Sustainable development using renewable energy technology. Renew Energy 146:2430–2437

Peng J, Lu L, Yang H (2013) Review on life cycle assessment of energy payback and greenhouse gas emission of solar photovoltaic systems. Renew Sustain Energy Rev 19:255–274

Pearce JM (2008) Thermodynamic limitations to nuclear energy deployment as a greenhouse gas mitigation technology. Int J Nuclear Govern Economy Ecol 2(1):113–130

Pires JCM (2019) Negative emissions technologies: a complementary solution for climate change mitigation. Sci Total Environ 672:502–514

Raadal HL, Gagnon L, Modahl IS, Hanssen OJ (2011) Life cycle greenhouse gas (GHG) emissions from the generation of wind and hydro power. Renew Sustain Energy Rev 15(7):3417–3422

Raugei M (2019) Net energy analysis must not compare apples and oranges. Nat Energy 4(2):86–88

Roy A, Kedare SB, Bandyopadhyay S (2010) Optimum sizing of wind-battery systems incorporating resource uncertainty. Appl Energy 87(8):2712–2727

Siddiqui O, Dincer I (2017) Comparative assessment of the environmental impacts of nuclear, wind and hydro-electric power plants in Ontario: a life cycle assessment. J Cleaner Prod 164:848–860

Sims RE, Rogner HH, Gregory K (2003) Carbon emission and mitigation cost comparisons between fossil fuel, nuclear and renewable energy resources for electricity generation. Energy Policy 31(13):1315–1326

Steffen B, Hischier D, Schmidt TS (2018) Historical and projected improvements in net energy performance of power generation technologies. Energy Environ Sci 11(12):3524–3530

Tan RR, Foo DCY (2007) Pinch analysis approach to carbon constrained energy sector planning. Energy 32(8):1422–1429

Voss A (2001) LCA and external costs in comparative assessment of electricity chains: decision support for sustainable electricity provision. https://doi.org/10.18419/opus-1547

Walmsley TG, Walmsley MR, Atkins MJ (2017) Energy Return on energy and carbon investment of wind energy farms: a case study of New Zealand. J Cleaner Prod 167:885–895

Wang Z, Xu G, Wang H, Ren J (2019) Distributed energy system for sustainability transition: a comprehensive assessment under uncertainties based on interval multi-criteria decision making method by coupling interval DEMATEL and interval VIKOR. Energy 169:750–761

Weißbach D, Ruprecht G, Huke A, Czerski K, Gottlieb S, Hussein A (2013) Energy intensities, EROIs (energy returned on invested), and energy payback times of electricity generating power plants. Energy 52:210–221

World Nuclear Association (2011) Comparison of life cycle greenhouse gas emissions of various electricity generation sources. Online report http://www.world-nuclear.org/our-association/publications/online-reports.aspx Last retrieved on 11 Mar 2018

World Population Prospects—Population Division United Nations. esa.un.org. Retrieved 15 Jun 2017

Wu P, Ma X, Ji J, Ma Y (2017) Review on life cycle assessment of greenhouse gas emission profit of solar photovoltaic systems. Energy Proc 105:1289–1294

Xu L, Pang M, Zhang L, Poganietz WR, Marathe SD (2018) Life cycle assessment of onshore wind power systems in China. Resour Conserv Recycl 132:361–368

World Energy Outlook Special Report (2015) Energy and Climate Change, IEA

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

On behalf of all authors, the corresponding author states that there is no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Pyakurel, M., Nawandar, K., Ramadesigan, V. et al. Capacity expansion of power plants using dynamic energy analysis. Clean Techn Environ Policy 23, 669–683 (2021). https://doi.org/10.1007/s10098-020-01995-9

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10098-020-01995-9