Abstract

In the light of global warming, this paper develops a framework to compare energy and transportation technologies in terms of cost-efficient GHG emission reduction. We conduct a simultaneous assessment of economic and environmental performances through life cycle costing and life cycle assessment. To calculate the GHG mitigation cost, we create reference systems within the base scenario. Further, we extend the concept of the mitigation cost, allowing (i) comparision of technologies given a limited investment resource, and (ii) evaluation of the direct impact of policy measures by means of the subsidized mitigation cost. The framework is illustrated with a case of solar photovoltaics (PV), grid powered battery electric vehicles (BEVs), and solar powered BEVs for a Belgian small and medium sized enterprise. The study’s conclusions are that the mitigation cost of solar PV is high, even though this is a mature technology. The emerging mass produced BEVs on the other hand are found to have a large potential for cost-efficient GHG mitigation as indicated by their low cost of mitigation. Finally, based on the subsidized mitigation cost, we conclude that the current financial stimuli for all three investigated technologies are excessive when compared to the CO2 market value under the EU Emission Trading Scheme.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

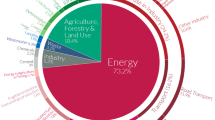

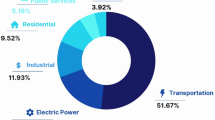

Aiming to mitigate climate change, the EU set targets to reduce greenhouse gas (GHG) emissions with at least 20 % by 2020 compared to 1990 levels (European Commission 2009a). In 2010, two sectors produced nearly two-thirds of global CO2 emissions; electricity and heat generation accounted for 41 % while transport produced 22 % (International Energy Agency 2012). Clean energy and transportation technologies are at hand to reduce polluting emissions, yet they often imply increased economic costs. Hence, there is a strong need to assess and compare clean energy and transportation (non-energy) technologies in terms of cost-efficient emission reduction. To this end, the economic costs and environmental impacts of clean technologies can be integrated into a mitigation assessment (Sathaye and Meyers 1995), and the technologies’ costs for mitigation can be calculated accordingly.

The GHG mitigation cost is defined by Lazarus et al. (1995) in the manual “Long range energy alternatives planning” (LEAP) system. LEAP is an integrated modeling tool that can be used to track energy consumption, production, and resource extraction in all sectors of an economy. It can be used to account for both energy and non-energy (including transportation) GHG emission sources and sinks. The LEAP system model is not used as such in this paper, although the reasoning behind the model has the same structure. Moreover, we conduct a comparative life cycle assessment (LCA) to assess the mitigation potential of the technologies and we use life cycle costing (LCC) to assess the economic costs. Additionally, in our framework we extend the traditional mitigation cost as described in LEAP in two ways: (i) In the light of rationing capital among competing investment opportunities (Lorie and Savage 1955), we allow comparing the mitigation cost of different technologies—i.e. energy, transportation (non-energy), or a combination of the former—given the constraint of a limited capital for investment; and (ii) As both energy (Badcock and Lenzen 2010) and transportation technologies (Delucchi and Murphy 2008) are generously subsidized, we assess the impact of policy by calculating the subsidized GHG mitigation cost, which accounts for all direct subsidies and taxes. The methodology is illustrated with a Belgian small and medium sized enterprise (SME). As a matter of fact, to pursue high environmental performance, economic, and social effectiveness of companies, including SMEs is the key goal of sustainable development (Laurinkeviciute and Stasiskiene 2011). The company aims to reduce GHG emissions at the source (i.e. source reduction) by substituting fossil based with clean technologies (Ingwersen et al. 2013). More specifically, they seek to evaluate the cost of emission reduction of solar photovoltaics, grid powered battery electric vehicles, and solar powered battery electric vehicles under budgetary limits.

In the following section (“Conceptual framework”), we discuss how the framework is conceptualized. The “Methodology” section provides a stepwise method to address the targeted objectives of the framework. In the section “Case study”, the proposed methodology is applied to a Belgian company. The paper ends with a “Conclusion” section, incorporating policy recommendations.

Conceptual framework

A schematic overview of the conceptual framework is provided in Fig. 1. A detailed explanation is given in the following subsections.

Cost-efficient emission reduction

To assess the cost of emission reduction, it is necessary to evaluate (i) the emission reduction potential; and (ii) the economic costs compared to the conventional (e.g. fossil based) alternative over the whole life cycle of the technologies. To this end, we make use of life cycle assessment and life cycle costing. Life cycle assessment or LCA is a tool to assess environmental impacts of complete life cycles of products or functions. In this framework, we use comparative LCA, i.e. the environmental impact of the clean technology is calculated and compared to the impact of a conventional technology. More specifically, we make use of attributional LCA—suited to describe the environmentally physical flows of a past, current, or future product system—rather than a consequential LCA, which is more appropriate for determining the emission impact of a change in consumption. The applied LCA methodology complies to the relevant ISO standards (14040-14044:2006). Life cycle costing or LCC is an assessment technique that takes into consideration all the cost factors relating to the asset during its operational life. The life cycle cost of an asset can, very often, be many times the initial purchase or investment cost (Woodward 1997). As any rational investor considers the life cycle cost rather than merely the cost of investment, it is important that policy makers are aware of the magnitude of lifetime costs since their final aim is to influence the investor’s choice.

Energy, transportation, and combined technologies

For each technology, we calculate the mitigation cost as defined by Lazarus et al. (1995) in the manual “Long range energy alternatives planning” (LEAP) system. To this end, both the LCA and the LCC must handle on the same functional unit. To compare energy and transportation technologies, we follow the LEAP approach that distinguishes “reference systems” (in which energy and non-energy technologies are separated) within the base scenario (which can contain both types). Among others, this approach is demonstrated by Kumar et al. (2003) who determined the GHG mitigation potential of biomass energy technologies in Vietnam. In the light of rationing capital among competing investment opportunities (Lorie and Savage 1955), we extend the mitigation cost as described in LEAP by comparing the mitigation cost of different technologies—i.e. energy, transportation (non-energy), or a combination of the former—given the constraint of a limited investment resource.

Impact of policy measures

Policy makers can make use of the mitigation cost to determine how much abatement can be achieved at a certain economic cost and to assess where policy intervention is needed in order to achieve certain emission reductions. Accordingly, the authors propose to include the impact of financial policy measures on the mitigation cost. Hence, we define the “subsidized mitigation cost” that takes into account all direct subsidies and/or taxes relating to a technology (or combination of technologies). Rather than predicting the economic cost of emission reduction to meet future CO2 targets—as demonstrated among others by Chen et al. (2013)—this analysis evaluates the current impact of policy on the economic cost of mitigation.

Methodology

To address the aims of the developed framework, a three-step methodology is worked out (Fig. 2). First, the base scenario and investment scenarios are defined. Second, the technology sizes within each scenario are calculated, given the constraint of a limited capital for investment. Then, the greenhouse gas mitigation cost of each technology including and excluding the impact of policy is determined. This is elaborated upon in the following subsections.

Base scenario and investment scenarios

For each technology that we want to assess, a reference technology or “reference system” needs to be defined. Indeed, without a reference it is impossible to calculate the mitigation cost. Then, the base scenario is composed of all the reference systems. Next, the investment scenarios can be defined by replacing the reference systems within the base scenario one by one with the according technology that needs to be assessed. If the combination of energy and transportation technologies is complementary, we additionally include in our framework the combination of the former.

Investment sizes, given a limited investment resource

To calculate the technology sizes, we refer to De Schepper et al. (2012) who developed a model to directly compare the economic payoff of individual complementary technologies with the economic payoff of their integrated combination under budgetary constraints. Given a limited amount of investment resources (I 0), the size of any individual technology \(\left( {{\text{size}}_{{N_{\text{i}} }} } \right)\) can be calculated according to Eq. 1, where the denominator \({\text{UC}}_{{N_{\text{i}} }} - {\text{UC}}_{{R_{\text{i}} }}\) represents the initial unit cost of technology N i directly compared to the initial unit cost of displaced technology R i. When the technology lifetimes are unequal, the roll-over-method (Boardman et al. 2011) is used; the project with the shorter lifetime is “rolled over” within the lifetime of the longer project: Given technology N s with short lifetime \(n_{{N_{\text{s}} }}\) that needs to be compared with technology N l with longer lifetime \(n_{{N_{\text{l}} }}\) \(\left( {n_{{N_{\text{l}} }} > n_{{N_{\text{s}} }} } \right)\), the number of times that project N s needs to be “rolled over” (z) is given in Eq. 1a. The calculation of the initial unit cost of investment in N s as compared to the investment in any displaced technology \(R_{\text{s}} \left( {{\text{UC}}_{{N_{\text{s}} }} - {\text{UC}}_{{R_{\text{s}} }} } \right)\) is then calculated according to Eq. 1b, by taking into account the real annual price evolution of the technologies (\(\dot{P}\)), and then discounting at discount rate r. The investment size of any joint combination of interdependent technologies is calculated by solving a system of equations as outlined in (2). The first equation indicates that the investment cost I 0 is composed of the initial unit cost of all technologies directly compared to the initial unit cost of the displaced technologies \(\left( {{\text{UC}}_{{N_{\text{i}} }} - {\text{UC}}_{{R_{\text{i}} }} } \right)\) multiplied by their size \(\left( {{\text{size}}_{{N_{\text{i}} }} = {\text{size}}_{{R_{\text{i}} }} } \right).\) The other equations represent the technical interrelationships among the different technologies within the integrated combination, which is characterized by a constant c i .

Technological and subsidized GHG mitigation cost

The mitigation cost of any investment scenario n is calculated using Eq. 3 by dividing the additional economic cost of each investment scenario n as compared to the base scenario b (Q n − Q b ) by the average annual emission reduction (GHG b − GHG n ) over the whole lifetime (Lazarus et al. 1995). The economic life cycle costs Q (including investment capital I 0, operation costs OC and maintenance costs MaC) of all investment scenarios and the base scenario throughout the lifetime of the technologies are calculated and annualized according to Eqs. 4 and 5. To calculate the GHG emission reduction, we use the professional LCA software SimaPro® (PRé consultants, Amersfoort, The Netherlands). We note that the mitigation cost as such is based solely on technological parameters, excluding any financial legislative parameters such as direct taxes or subsidies. We refer to this cost as “technological mitigation cost”.

To assess the influence of monetary incentives, we define in Eq. 6 the subsidized GHG mitigation cost. The latter is calculated by correcting the economic costs Q for the direct subsidies received and the direct taxes to be paid (SUBS). Taxes are considered as negative subsidies.

Case study

The case is based on a Belgian SME with a demand for both electricity and road transport. Currently, required demands are met by means of grid electricity and gasoline powered internal combustion engine vehicles or gasoline ICEVs. The vehicles have an average travel distance of 17,120 km/year. The company wants to assess the cost-efficient emission reduction of the following clean energy and transport technologies: (i) solar photovoltaics (PV); (ii) grid powered battery electric vehicles (BEVs); and (iii) solar powered BEVs (the combination of the former), given an initial capital for investment of €127,000. Economic data is summarized in Table 1. Data regarding the BEV is based on the Nissan Leaf; the ICEV referred to is the comparable gasoline powered Nissan Note Tekna auto 1.6 l. For each numerical value, a motivation and reference is listed. We assume that the lifetime of the project equals the lifetime of the “longest living” technology; that is solar PV with a lifetime of 25 years. Further we assume that the vehicles’ CO2 emissions are constant throughout the lifetime of the project.

Base scenario and investment scenarios

The scenarios are presented schematically in Fig. 3.

Investment sizes, given a limited investment resource

The investor has foreseen a budget of €127,000 that can potentially be invested in either one of the investment scenarios (Table 2, row 1). The calculations of the investment sizes are listed in row 2. In scenario 1, the ICEVs from the base scenario are used to meet transportation demands, and the capital is used to purchase PV panels. According to Eq. 1 as discussed in the section “Methodology”, we find that the size of the PV installation totals 57.37 kWp, which is sufficient to displace an average of 44,327 kWh/year of grid electricity in the base scenario. The latter is calculated as the average of the electricity generated by the solar panels annually. In scenario 2, the grid is used to meet electricity demands, and the gasoline ICEVs are replaced with grid powered BEVs for transport. The determination of the number of BEVs is more complicated, as the lifetime of the BEVs (5 years) differs from that of the PV installation (25 years). Hence, the investment in BEVs is rolled over 5 times within the longer PV lifetime (Eq. 1a). Following Eq. 1b, we find that the number of BEVs equals 6, meaning that the project starts with 6 BEVs that are replaced 5 times every 5 years. We assume that these 6 BEVs will replace an equal amount of ICEVs in the base scenario. Scenario 3 makes use of grid electricity and solar powered BEVs. The size of the latter combined technology given the budgetary limit of €127,000 is calculated by solving the system of equations as outlined in Eq. 2 which can be found in the section “Methodology”. The constant c in this case represents the power of solar panels needed to charge one BEV (kWp/vehicle), and is hence calculated by dividing the total electricity consumption of the BEV (kWh/vehicle) by the amount of electricity generated per unit of power of the solar panels (kWh/kWp). In this investment scenario, 4 BEVs are purchased (that are replaced 5 times every 5 years) accompanied with 15.38kWp of solar panels to power the vehicles. As the base scenario contains 6 ICEVs and the limited investment capital is sufficient to replace only 4 of them with BEVs; 2 ICEVs are kept in this scenario.

Technological and subsidized GHG mitigation cost

The calculation of the economic costs as well as the direct impact of policy can be found in Table 2, row 3. The life cycle inventory as modeled in SimaPro® is listed in Table 3. Unit processes are selected from the EcoInvent database, based on the best available match with the real projections at hand. The different scenarios are assessed for their impact on climate change (kg CO2-eq.) using the IPCC 2007 GWP 100a v1.02 single issue method. Regarding the electricity, the LCA takes into account the GHG emissions of the generation and the distribution phase. To assess the impact of the vehicles, we consider the impacts of (i) production and assembly, (ii) well-to-tank (WTT) (production and distribution of the energy carrier), and (iii) tank-to-wheel (TTW) (conversion from energy carrier to transport). Table 4 shows the CO2-eq. emissions per unit of the different processes used.

An overview of the economic costs, the GHG emissions and the mitigation costs is presented in Table 5. The first two rows summarize the economic costs excluding and including the impact of policy. From the investor’s point of view, scenario 2 (grid powered BEVs) is the most interesting option for investment, as it implies the lowest economic costs while receiving the highest amount of policy support. Scenario 1 (solar PV) on the other hand implies the highest costs. The third row shows total GHG emissions. In scenarios 1, 2, and 3, life cycle GHG emissions as compared to the base scenario are decreased with 24, 45, and 37 %. Hence, from a climate change viewpoint, the limited investment resources would obtain the best (worst) results when allocated to grid powered BEVs (solar PV). The final row shows the technological and the subsidized mitigation costs. In both cases, grid powered BEVs (scenario 2) are the most cost-efficient technology to reduce greenhouse gases. A negative mitigation cost—e.g. technological mitigation cost of grid BEVs in scenario 2—indicates that the alternative is an economic option regardless of any emission reduction (Sims et al. 2003) or hence, reducing greenhouse gases in this case leads to an economic gain. We note however that according to Weiss et al. (2012), the price of the Nissan LEAF is—just as the price of the Mitsubishi i-MiEV and the Citroën C-zero—substantially (i.e. about 41 %) lower than the price of an “average” BEV, due to the fact that the former are mass produced. This draws the attention to the importance of scale economies, reaching significant cost savings when producing large quantities. The subsidized mitigation cost indicates that all technologies are generously subsidized in Flanders, reaching values of about −300€ per ton CO2-eq. avoided. Finally, we note that the choice of the discount rate is important (Baumol 1968). Based on a Monte Carlo sensitivity analysis, we conclude that the discount rate in our analysis is not an important variable to determine the variability of the forecast variables, i.e. the technologies’ greenhouse gas mitigation costs.

Impact of policy measures including sensitivity analysis

The impact of policy measures on the mitigation cost is visualized in Fig. 4. The vertical axis shows the GHG mitigation cost; the horizontal axis reflects the additional amount of subsidies as compared to the base scenario. Where this additional amount of subsidization equals zero (the y-axis); one can find the technological GHG mitigation cost. The larger data points are projections of the current situation (June 2012) for Belgian SMEs, reflecting the subsidized mitigation cost. The horizontal line indicates the targeted market value of CO2 emissions according to the EU Emission Trading Scheme in 2020 (European Commission 2012). The solar PV technology for SMEs without any type of direct subsidization or taxes—even after a market presence of over 35 years (Nielsen et al. 2010)—largely exceeds the projected CO2 market value. Mass produced BEVs on the contrary approximately achieve this targeted value.

To verify the robustness of these results, a sensitivity analysis is performed. Accordingly, we simultaneously vary the investment resource, the travelled distance, and the generated electricity (as these are all interrelated). Moreover, we let the investment resource fluctuate with +20 and −20 %. The effect on the GHG mitigation cost is shown in Fig. 5. We see that the analysis is robust for a change in the aforementioned parameters, as the reciprocal ranking of the technologies is maintained.

Conclusion

We develop a framework to compare the cost-efficient emission reduction of clean energy and transport technologies and to evaluate the impact of policy, given limited investment resources. The analysis is static, intended to assess the current impact of policy on the mitigation cost. The prediction of future measures falls beyond the scope of this framework. While the framework approaches increased CO2 emissions as a mere monetary problem, we recognize that the overall impacts of global warming go well beyond this monetary valuation.

We illustrate the framework with a case of PV solar power, grid powered (mass produced) battery electric vehicles (BEVs), and solar powered (mass produced) BEVs for a Belgian SME. In terms of cost-efficient emission reduction, the company gains more by replacing petrol fueled vehicles with grid powered BEVs than with installing solar panels. The analysis is robust to changes in the amount of the limited investment capital, the amount of electricity generated and the amount of kilometers travelled, as indicated by the sensitivity analysis. The analysis only considers economic and environmental parameters. Particularly related to BEVs, there are other inconveniences—e.g. limited driving range, long charging times—that fall beyond the scope of this framework. The results are valid for Belgium, a rather cloudy region in Europe with a relatively low electricity intensity mix. Results differ with location, depending on the amount of solar irradiation and the electricity intensity mix. We studied a Belgian SME rather than a household. Knowing that households face electricity prices that are about twice as high, solar PV becomes the most cost-efficient technology to reduce emissions.

The current financial stimuli for these technologies are found to be generous. Moreover, the subsidized value of one ton carbon dioxide avoided by means of solar PV, grid powered BEVs, and solar powered BEVs equals more than ten times the market value of CO2 certificates under the EU Emissions Trading Scheme. Excessive subsidization might be temporarily justified for emerging technologies with a high potential for cost-efficient emission abatement, aiming to reward “early adopters” who pave the way for broader adoption, which in turn can lead to mass production and cost reductions. Finally, we point to the importance of a sound long-term incentive scheme to insure a stable environment for investors.

Abbreviations

- α (%/year):

-

Annual system performance deterioration rate

- β (kWh/kWp):

-

Irradiation factor

- BEV (number of vehicles):

-

Battery electric vehicle

- D t (km/year):

-

Annual travel distance

- (E)ID (%):

-

(Elevated) investment deduction

- Electr (kWh):

-

Electricity

- Fuse (l/100 km):

-

Fuel use

- Gasol (l):

-

Gasoline

- GCC (€/MWh):

-

Green current certificates

- GHG (CO2-eq.):

-

Greenhouse gas

- ICEV (number of vehicles):

-

Internal combustion engine vehicle

- INS (€):

-

Insurance cost

- I 0 (€):

-

Investment cost (capital)

- MaC (€):

-

Maintenance cost

- MC (€/ton avoided CO2-eq.):

-

Mitigation cost

- n (year):

-

Lifetime

- OC (€):

-

Operation cost

- \(\dot{P}\) (%/year):

-

Real annual price increase

- PV (kWp):

-

Photovoltaics

- Q (€):

-

Economic life cycle cost

- r (%):

-

Discount rate

- S/T (€):

-

Subsidies/taxes

- T n (€/year):

-

Annual traffic tax

- T 0 (€):

-

One off vehicle registration tax

- t r (%):

-

Tax rate

- UC (€):

-

Unit cost (excluding direct taxes and subsidies)

References

Badcock J, Lenzen M (2010) Subsidies for electricity-generating technologies: a review. Energy Policy 38(9):5038–5047. doi:10.1016/j.enpol.2010.04.031

Baumol WJ (1968) Social rate of discount. Am Econ Rev 58(4):788–802

Belgisch Staatsblad (2009) Programmawet 23.12.2009. www.ejustice.fgov.be. Accessed 12 Sept 2012

Belgische Petroleum Federatie (2012) Maximumprijzen. www.petrolfed.be. Accessed 02 Oct 2012

Boardman AE, Greenberg DH, Vining AR, Weimer DL (2011) Cost-benefit analysis: concepts and practice, 4th edn. Prentice Hall, Upper Saddle River

Chen L, Zhang H, Guo Y (2013) Estimating the economic cost of emission reduction in Chinese vehicle industry based on multi-objective programing. Clean Technol Environ Policy 15(4):727–734. doi:10.1007/s10098-012-0560-8

De Schepper E, Van Passel S, Lizin S (2012) SDEWES12-0485: Economic benefits of combined technologies: electric vehicles and PV solar power. Paper presented at the 7th conference on sustainable development of energy, water and environment systems, Ohrid, Macedonia

Delucchi MA, Murphy JJ (2008) How large are tax subsidies to motor-vehicle users in the US? Transp Policy 15(3):196–208. doi:10.1016/j.tranpol.2008.03.001

European Commission (2009a) Directive 2009/28/EC of the European Parliament and of the Council of 23 April 2009 on the promotion of the use of energy from renewable sources and amending and subsequently repealing directives 2001/77/EC and 2003/30/EC, Brussels, Belgium

European Commission (2009b) Part III: annexes to impact assessment guidelines, Brussels, Belgium

European Commission (2012) Commission staff working document—information provided on the functioning of the EU ETS, the volumes of GHG emission allowances auctioned and freely allocated and the impact of the surplus of allowances in the period up to 2020, Brussels, Belgium

European Union (2005–2011) Car price reports 2005–2011. http://ec.europa.eu. Accessed 12 Sept 2012

Eurostat (2012) Electricity prices for industrial consumers. http://epp.eurostat.ec.europa.eu/. Accessed 17 Oct 2012

EU Coalition - McKinsey (2010) A portfolio of power-trains for Europe: a fact-based analysis—the role of battery electric vehicles, plug-in hybrids and fuel cell electric vehicles, Brussels, Belgium

Federale Overheidsdienst Financiën (1992) Wetboek van de Inkomstenbelastingen 1992, Brussels, Belgium

Federale Overheidsdienst Financiën (2005–2011) Tarieven van de verkeersbelasting 2005–2011. http://koba.minfin.fgov.be. Accessed 02 Jun 2012

Federale Overheidsdienst Financiën (2011–2012) Tarieven van de verkeersbelasting 2011–2012. http://koba.minfin.fgov.be. Accessed 02 Jun 2012

Federale Overheidsdienst Financiën (2012) Aanvullende codes—Accijnzen en milieutaksen. http://tarweb.minfin.fgov.be. Accessed 18 Oct 2012

Ingwersen W, Garmestani A, Gonzalez M, Templeton J (2013) A systems perspective on responses to climate change. Clean Technol Environ Policy 1–12. doi:10.1007/s10098-012-0577-z

International Energy Agency (2012) CO2 emissions from fuel combustion—highlights, Paris, France

Kumar A, Bhattacharya SC, Pham HL (2003) Greenhouse gas mitigation potential of biomass energy technologies in Vietnam using the long range energy alternative planning system model. Energy 28(7):627–654. doi:10.1016/s0360-5442(02)00157-3

Laurinkeviciute A, Stasiskiene Z (2011) SMS for decision making of SMEs. Clean Technol Environ Policy 13(6):797–807. doi:10.1007/s10098-011-0349-1

Lazarus M, Heaps C, Raskin P (1995) Long range energy alternatives planning (LEAP) system. Reference manual. Boston Stockholm Environment Institute (SEI), Stockholm

Lorie JH, Savage LJ (1955) Three problems in rationing capital. J Bus 28(4):229–239

Nielsen TD, Cruickshank C, Foged S, Thorsen J, Krebs FC (2010) Business, market and intellectual property analysis of polymer solar cells. Sol Energy Mater Sol Cells 94(10):1553–1571. doi:10.1016/j.solmat.2010.04.074

Nissan (2012a) Algemene prijslijst België. www.nissan.be. Accessed 24 Oct 2012

Nissan (2012b) Nissan leaf. www.nissan.be. Accessed 24 Oct 2012

Nissan (2012c) Nissan note. www.nissan.be. Accessed 24 Oct 2012

Sathaye J, Meyers S (1995) Greenhouse gas mitigation assessment: a guidebook. Kluwer Academic Publishers, Dordrecht

Sims REH, Rogner H-H, Gregory K (2003) Carbon emission and mitigation cost comparisons between fossil fuel, nuclear and renewable energy resources for electricity generation. Energy Policy 31(13):1315–1326. doi:10.1016/s0301-4215(02)00192-1

Súri M, Huld TA, Dunlop ED, Ossenbrink HA (2007) Potential of solar electricity generation in the European Union member states and candidate countries. Sol Energy 81(10):1295–1305. doi:10.1016/j.solener.2006.12.007

Vlaams Energieagentschap (2012) Groene stroomcertificaten voor fotovoltaïsche zonnepanelen. www.energiesparen.be. Accessed 04 Jun 2012

Weiss M, Patel MK, Junginger M, Perujo A, Bonnel P, van Grootveld G (2012) On the electrification of road transport—learning rates and price forecasts for hybrid-electric and battery-electric vehicles. Energy Policy 48:374–393. doi:10.1016/j.enpol.2012.05.038

Woodward DG (1997) Life cycle costing—theory, information acquisition and application. Int J Proj Manage 15(6):335–344. doi:10.1016/s0263-7863(96)00089-0

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

De Schepper, E., Van Passel, S., Lizin, S. et al. Cost-efficient emission abatement of energy and transportation technologies: mitigation costs and policy impacts for Belgium. Clean Techn Environ Policy 16, 1107–1118 (2014). https://doi.org/10.1007/s10098-014-0713-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10098-014-0713-z