Abstract

To pursue the high environmental performance, economic and social effectiveness of the companies, including small and medium enterprises (SMEs), is the key goal of the sustainable development concept. Sustainable development is based on preventive management principles, and their application in SMEs has become an important issue for enhancing competitiveness. Unfortunately, most of the sustainable development-related research is focused on large companies rather than SMEs, especially in the industrial sector. The importance of SMEs often remains unnoticed. Besides, SMEs themselves often have inadequate knowledge about their environmental and social impacts and management, and apply voluntary preventive measures less frequently than large companies. To make sustainable decisions and to improve the environmental performance, economic and social effectiveness of SMEs, an integrated sustainable management system (SMS) based on financial analysis is necessary, oriented to strategic sustainability goals, not requiring significant financial and human resources. Integration of sustainability management accounting and composite sustainable development index methodologies forms the basis of SMS for SMEs decision making. SMS was applied in three pilot SMEs (small-scale wood parquet, medium-scale wood pallets, medium-scale beverage producing companies). In this article, an extensive analysis of a small-scale wood parquet manufacturing company’s case is presented. The application of SMS enabled to identify key sustainability problems and to find solutions to improve the companies’ sustainability performance. SMS application resulted in reduced input materials consumption and the reduction of sustainability costs.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Development of small and medium enterprises (SMEs) is one of the priorities of the EU and Lithuanian policy. SMEs play a key role in implementing the Lisbon Strategy aims to encourage the development of innovation, partnership, competitiveness and employment. It is stressed in Long-term Strategy for Development of Lithuanian Economy to 2015 that “small and medium enterprises are one of the key factors of economic growth, with substantial impact on the overall development of the Lithuanian economy, job creation and social stability, and therefore its development is one of Lithuania’s most important economic policies” (Government of the Republic of Lithuania 2002). In Lithuania, as in other EU countries, more than 99% of all the operating companies are classified as SMEs, creating about 60% of the total value added, and employing more than 70% of the total workforce. Although the impact of individual small and medium-sized enterprises on the environment may be minimal, the total emissions of SMEs in the EU account for 70% of the total industrial pollution.

SMEs are the basis of socio-economic well-being and ensure continuous employment. An increased number of SMEs gives impetus to the economic growth through intensified competition. Permanent change is the essential feature of SMEs. Due to constantly changing business environment, companies, wishing to survive and continue their activities, must be flexible, dynamic and open. Only an adequate response to environmental changes and the anticipation of these changes may ensure the continuity of business (Lithuanian Department of Statistics 2007), therefore, competing for the market, companies are forced to seek new solutions and niches.

Under competitive conditions, in order to improve their performance and to sustain and expand the market, SMEs should inevitably follow the sustainable and long-term development principles (Ministry of Economy 2007) and to apply integrated measures to increase SME sustainability—economic, environmental and social performance.

Issues of SMEs sustainability

At the beginning of 2010, in Lithuania there were 63,840 companies functioning, of which 63,447 (99.4%) were small and medium-sized enterprises. That number accounted for 75% of micro-enterprises, 20% were small enterprises and only 5% were medium. Most micro-enterprises operate in the services sector. SMEs dominate in wholesale and retail trade (21,417 companies at the beginning of 2010), real estate, rental activities (13,035 companies at the beginning of 2010), manufacturing (6,830 companies at the beginning of 2010) as well as construction, transport and storage sectors.

The highest value-added is also created by wholesale and retail trade, manufacturing and real estate activities in the SME sector. In 2005–2008, SMEs value added increased steadily, faster growth occurred in 2005–2006 (32% compared with the last year). The highest added value of small and medium-sized enterprises sector is created by medium-sized enterprises (50–249 employees), with a slight lag behind small businesses (9–49 employees), the added value created by micro-enterprises (1–9 employees) is the lowest, although there is the largest number of micro-enterprises in SMEs sector. SMEs create about 60% of value added of all the companies operating in Lithuania.

In 2006–2010, around 70% of all employees in Lithuania were employed in SMEs, and staff costs accounted for about 60% of all Lithuanian companies’ staff costs. In 2008, small and medium-sized companies’ export accounted for 47% of all the Lithuanian companies’ export, import accounted for 53%. The largest share of export and import in the SME sector is related to medium-sized businesses.

Manufacturing is the most important Lithuanian economy sector creating value added (22%), it provides a major share (60%) of the country’s export (Ministry of Economy 2009). SMEs represent around 97% in the total number of manufacturing companies. In 2010, SMEs represented the number of 6,830 enterprises in the total 7,004 manufacturing enterprises. More than half of these enterprises were micro-sized companies, 33% were small and 12% were medium-sized enterprises. In 2005–2008, the SMEs’ value added accounted for about 60% of all the value created by manufacturing enterprises.

In 2007–2008, manufacturing SMEs export accounted for about 55% of all the manufacturing industry export, the import accounted for about 58%, manufacturing industry small and medium-sized enterprises were employing 70% of all employees in manufacturing industries.

In the manufacturing sector, SMEs dominate in wood and wood and cork product, paper and paper product manufacturing industry (in 2010—1,353), textiles (870), food and beverage industry (811) and furniture industry (775). The biggest added value is also created by food and beverage, textiles, wood, cork and their products, furniture manufacturing industry, paper and paper product manufacturing.

Most of sustainable development-related research focuses on large companies rather than SMEs, especially in the industrial sector. The importance of SMEs often remains unnoticed for several reasons. The first—environmental impacts of large firms are more visible. It is easier to see, measure, interpret and evaluate the impact of large enterprises. The second reason—the nature and structure of the SME sector. Most of these enterprises are very small, as well as their impact on the environment. Their individual, for example, waste generation and energy consumption levels may be very low. In addition, many small and medium-sized enterprises (particularly in well-developed countries) are operating in the service sector, and have no obvious “polluting” industrial practices. Therefore, at first sight, it seems that SMEs are causing little or no impact on the environment (Labonne 2006). However, this assumption is not correct—like large enterprises, SMEs have a significant impact on the environment, but the maximum impact may be caused not by the activity of individual companies (with the exceptions), but by the total number of SME’s operating in all sectors. In the study performed in United Kingdom, it is stated that 60% of carbon dioxide emissions of the total national economic activity are generated by SMEs and the conclusions are presented about the need to increase energy efficiency and reduce emissions of SMEs. A study in the Netherlands stressed that SMEs generate about 50% of all commercial and industrial waste. These studies only confirm the fact that small and medium business has a significant impact on the environment (European Commission 2007).

Thus, the impact on the environment of individual SMEs may be minimal, especially if it is a service sector micro-enterprise, but it should be noted, that, since SMEs sector involves enterprises of different sizes, in many aspects (also related to the impact on the environment) a medium-sized enterprise is more comparable with a large company than a small or micro-sized one, especially in the manufacturing sector. Therefore, the biggest environmental impact is caused by SMEs in the following manufacturing sectors: metal manufacturing, textile, plastics, wood and furniture manufacturing, publishing, electronics, food and beverage industry as well as chemicals and chemical products manufacturing SMEs.

The problem is that SMEs often have inadequate knowledge about their environmental impact and management in this area, and are not familiar with the environmental legislation and obligations assigned to them (European Commission 2007). This often results in the situation, when SME does not implement any practical measures to reduce the environmental impact.

Necessity of sustainable management system for SMEs

Abundant scientific literature concerning the development of sustainable management, efficiency and innovation, is more focused on large companies and the industry level, but not on the SME sector (Labonne 2006). SMEs develop preventive voluntary environmental improvement programs significantly less than large companies, less frequently adapt environmental policies, carry out environmental audits, or implement other sustainable development and environmental performance evaluation and improvement measures.

However, in Lithuania there is an increasing number of small and medium sized industrial enterprises implementing measures of sustainable industrial development, even though most companies are limited to Cleaner Production and Environmental Management System (EMS), “EMAS-Easy” and the Quality Management Systems tools. Application of other measures, such as product-oriented measures of sustainable industrial development, sustainability cost accounting and sustainability reporting tools, capable of increasing the company’s economic efficiency, environmental and social performance, is only in the initial stage (Jasch and Stasiškienė 2005).

The last decade has seen an increased pressure to broaden the accountability of large and also small and medium companies beyond economic performance, to shareholders, and sustainability performance to all stakeholders. The concept of business or corporate sustainability has therefore grown in recognition and importance. Business sustainability can be defined as “adopting business strategies and activities that meet the needs of the enterprise and its stakeholders today while protecting, sustaining and enhancing the human and natural resources that will be needed in the future”. Business sustainability entails the incorporation of the objectives of sustainable development, namely social equity, economic efficiency and environmental performance, into a company’s operational practices. Companies that compete globally are increasingly required to commit to and report on the overall sustainability performances of operational initiatives (Labuschagne et al. 2005). The key sustainable development decision-making promoting factors in SMEs are as follows:

-

pursuit of competitive advantage

-

supply chain pressure

-

legal requirements and obligations

-

international standards

-

demand of voluntary reporting (Ranganathan 1998)

The methodologies used for the measurement of sustainability (involving the sustainability of environmental, social and economic domains, both individually and in various combinations) are still evolving (Stasiškienė and Šliogerienė 2009). They include indicators, indices, benchmarks, audits, cost accounting, as well as assessment and reporting systems.

Profit is the key driving force of business activity. Regardless of what goals or ideals uphold company executives and other employees, the survival of the business and positive economic indicators are the fundamental principles of any profit-making enterprise (Ministry of Economy 2008). For most companies to have an interest in sustainable development, there needs to be an expected financial benefit (Jasch and Lavicka 2005). In order to make the right decisions in the company, the main task is to ensure that all relevant costs are taken into account (United Nations Division for Sustainable Development 2001).

Economic and financial indicators are the well-understood business “language”, which, if expressing sustainable development aspects of the company, would allow it to achieve promising results. Therefore, there is a need of relatively simple, easily adapting, flexible sustainable management system for SMEs, expressing sustainable development aspects (economic, environmental and social) through financial indicators.

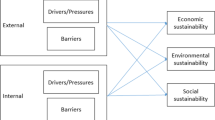

Sustainable management system for SMEs

Sustainability management accounting (SMA) and composite sustainable development index—I CSD (Krajnc and Glavič) methodologies were chosen as very promising tools for sustainable decision making in SMEs. The integration of these methodologies makes the basis of a sustainable management system for SMEs (see Fig. 1).

Stages of SMS

SMA is the most evolved form of environmental management accounting (EMA). EMA is a joint evaluation method, enabling to increase material efficiency, decrease environmental impacts and risks, and reduce environmental costs due to the financial accounting and cost accounting data transmission (Stasiškienė and Staniškis 2006). The evaluation method combines the company’s financial data with physical data (United Nations Division for Sustainable Development 2001) (Bennett et al. 2002).

EMA information encourages the search for more efficient approaches of energy and materials use, allows to monitor and to manage effectively the generation of pollutants (Stasiškienė and Staniškis 2006). Due to EMA, environmental costs are more accurately identified, evaluated, distributed and controlled, and more detailed information is provided, necessary to assess environmental performance and to prepare the report (Rikhardsson et al. 2005). In this way, the company improves the internal decision-making process and its image in the eyes of stakeholders (customers, employees, government, etc.).

The cost categories, evaluating, when using EMA are:

-

Emission and waste treatment cost;

-

Prevention and environmental management cost;

-

Material purchase value of non product output;

-

Processing costs of non product output;

-

Environmental earnings.

Material purchase value of non product output is the specific category of costs that are not evaluated by other methods. The non product output, i.e., material turned into emissions and waste, is the indicator of inefficient production. The material purchase cost of wasted materials is the most important environmental cost factor, accounting for 40–90% of total environmental costs, depending on the value of raw materials and the labour intensity of the sector (Bennett et al. 2003).

SMA is the enlargement of EMA, incorporating costs of social performance—treatment of undesired effects, prevention and sustainability management cost and sustainability earnings. Health and Safety are two very important social cost aspects in SMEs. Training and education also constitute a significant social cost factor. Human rights and Diversity and opportunity do not make up any significant costs in Lithuanian SMEs, as well as Society and Product Responsibility costs (Jasch and Lavicka 2005) The main benefits are more accurate data and better arguments for investment appraisal or performance indicators as well as improved consistency of information and management systems that should help them to improve their environmental, social and economic performance (Jasch and Lavicka 2005). The two major cost drives are the purchase costs of non-product output and the costs related to lost working days because of sick leave and accidents and the overtime pay to make up for these lost working days. The cost assessment scheme allows one to better understand the relationships between costs for treatment of undesired effects due to unimplemented protection measures and lost material purchase value in comparison to the prevention costs (Jasch and Stasiškienė 2005).

Sustainability management accounting allows the company to identify the key sustainable development problems in it, based on financial indicators. Depending on the available information, comparative analysis of non-product output with the technological norms or Best Available Technologies (BAT) are carried out, with the purpose to assure the relevance and validity of the problems.

With regard to the company key issues, identified when implementing SMA, sustainability performance indicators are selected.

These indicators are the quantification of the current company’s sustainability problems to promote decision-making and enabling the company to monitor periodically the changes in this field. However, these indicators do not reflect the overall enterprise sustainability, since it includes only problematic aspects. Perhaps for the company’s internal decision-making these performance indicators would be sufficient, but in order to determine the effectiveness of the overall sustainable development, particularly to provide sustainability reports, a larger set of indicators is necessary. For this purpose, composite sustainable development index methodology is integrated into the sustainability decision making model.

The main purpose of I CSD is communication with stakeholders and sustainability reporting level raising (Krajnc and Glavič 2004). The composite sustainable development index calculation methodology consists of several stages:

-

Selection of indicators

-

Normalization of indicators

-

Weighing of indicators (using analytic hierarchy process (AHP))

-

Calculation of sub-indices

-

Combining sub-indices into I CSD

For SMEs, it is suggested to use 5–15 indicators from each economic, social and environmental indicator group. The main problem of aggregating indicators into the I CSD is the fact that indicators may be expressed in different units. One way of solving this problem could be normalization of indicators. One of the possible options for normalization of indicators could be normalization of each indicator i by dividing its value in time t with its target value determined by realistic assessment of unexploited potentials of the company (Krajnc and Glavič 2004). Another step requires pair-wise comparisons (weighing) to be made between each pair of indicators. The comparisons are made by posing the question which of the two indicators i and j is more important with respect to the SD of the company, respectively. The intensity of preference is expressed on a factor scale from 1 to 9.

Sustainability sub-indices are calculated using Formula (1) (Krajnc and Glavič 2004):

where I S,j is the sustainability sub-index for a group of indicators (economic, j = 1, environmental, j = 2, social, j = 3), W ji is the weight of indicator i for the group of sustainability indicators j and reflects the importance of this indicator in the sustainability assessment of the company. The sustainability sub-indices are combined into the composite sustainable development index I CSD using Formula (2) (Krajnc and Glavič 2004):

Once the fundamental issues of sustainable development are defined and the comprehensive indicator system is developed, the next important step of the sustainable development decision-making model is taken—the search for alternatives and their economic evaluation. In search for alternatives to solve the problem, it is useful to rely on the BAT information.

Economic evaluation can be performed by using the following profitability indicators:

-

Payback Period (PP)

-

Net present value (NPV)

-

Internal rate of return (IRR)

PP is the simplest and most approximate investment evaluation method, used mainly in small and medium-sized enterprises. This means the ratio of investment and the resulting annual savings. The PPis calculated according to the formula:

where K is investment and R is annual net income.

NPV is widely used as an economic project viability assessment method. By calculating the NPV, the value of money decrease over time is measured. The assessment of monetary value decline is very important when evaluating long-term projects. Decline in value of money over time is also called discount (Kopustinskas et al. 2007). Frequently the discount is considered as the prevailing interest-rate offered by sound banks at the time, also considering the inflation rate. NPV is calculated according to the formula:

where CF0…CF n are cash flows from the initial investment to the last cash flows and i is discount rate.

On the basis of NPV, the following decision-making rule is considered:

-

the investment would add value to the company and the project may be accepted, if NPV > 0,

-

the investment would subtract value from the company, the project should be rejected, if NPV < 0,

-

the investment would neither gain nor lose value for the company, if NPV = 0.

In some cases, for the investing company it is difficult to assess the cost of capital for the investment, i.e., there are several credit sources, loan terms are not clear, and so on. In such cases, it is impossible to calculate NPV, and the company often uses the IRR instead. (Kopustinskas et al. 2007). IRR is the discount rate at which NPV is equal to zero. IRR is calculated according to the formula:

After the economic evaluation of the alternatives, sensitivity analysis may be performed. Sensitivity analysis is performed by varying the initial assumptions and observing the changes in the NPV and other criteria. The investment would be risky if the cost issue in a small change leads to significant changes in the criteria. The essence of the sensitivity analysis is the basic variable change, when the others remain stable (Biezma and San Cristóbal 2005). Sensitivity analysis is needed to evaluate the risks of the investment project. Sensitivity analysis is a tool for testing the robustness of findings to inherent uncertainties and the need for assumptions. The idea is to simply replace unknown or uncertain parameters with alternative values drawn from a plausible distribution (Kotchen 2010). Sensitivity analysis includes the following steps:

-

Selection of a key indicator, e.g., the parameter which is the target of sensitivity analysis. Such indicators may be an IRR and/or NPV;

-

Choice of variables which would clarify the key indicator, in particular, the parameters whose values may vary in a wide range.

-

Calculation of the key indicator for a given range of parameters.

-

The last stage of the sustainable management system is decision making, e.g., implementation of the selected alternative or alternatives, taking into account the economic evaluation of alternatives, risk assessment, e.g., sensitivity analysis, and the results of composite sustainable development index methodology; and also reporting.

SMS application in SMEs

The sustainable management system was applied to the small-scale wood parquet, medium-scale wood pallets and medium-scale beverage producing Lithuanian companies (see Table 1). In this article an extensive analysis of a small-scale wood parquet manufacturing company’s case is presented.

Results of sustainability management accounting in wood parquet manufacturing company (see Table 2):

-

Total sustainability costs of the wood manufacturing company amounted to 137,450 euro in 2008, of which 126,850 euro (92%) were environmental costs and 10,600 euro (8%) were social costs.

-

Before the application of SMA, only environmental taxes were considered as environmental costs in the company—they accounted for only 1% of the total real environmental costs. The total social costs were evaluated approximately 5 times higher than the company considered before.

-

In 2008, the company paid 5,780 euro for the treatment of undesired effects, 19,450 euro for the prevention and sustainability management, and the material purchase value of non product output amounted to 112,220 euro.

-

Distribution of environmental costs under the cost categories in the wood manufacturing company:

-

Treatment of undesired effects—4%.

-

Prevention and sustainability management—8%.

-

Material purchase value of non product output—88%.

-

-

Distribution of social costs under the cost categories in the wood manufacturing company:

-

Treatment of undesired effects—10%

-

Prevention and sustainability management—90%.

-

Higher prevention costs result in lower treatment of undesired effects costs and particularly—lower material purchase value of non product output in the case of environmental costs. It can be concluded that the company did not give sufficient attention to the prevention of harming the environment in 2008.

-

Environmental air and climate costs amounted to 104,646 euro (76%) in 2008, waste water costs—1,375 euro (1%), waste costs—12,466 euro (9%), soil and groundwater costs—9,040 euro (6%). Social health costs amounted to 1,350 euro (1%), safety costs—9,500 euro (7%).

-

With the reference to SMA results and the comparison with BAT, the company’s key sustainable development problem was identified as large heat and electric energy consumption (0.79 and 0.83 kWh/m3, respectively), due to the non-optimized combustion process in the company’s boiler-house and non-efficient heat energy supply management inside the company. In wood pallets producing company key sustainable development problem also was identified as large heat and electric energy consumption (0.67 and 1.15 kWh/m3, respectively), since the company operate vertical technique for pallets production and the conveyor is not used.

When calculating the composite sustainable index in the parquet producing company, to avoid the huge time-consuming amount of data, the limit was set for 5–15 sustainability indicators in each sustainable development perspective. In our case, the main indicators (5 economic, 12 environmental and 8 social) were chosen (see Table 3).

The indicators were weighed (using AHP) and normalized to calculate economic, environmental, social sub-indices and finally the composite sustainable index. The results of the three pilot companies are presented in Table 4.

The closer the index value to 1, the higher is the company efficiency in the field of sustainable development. In the case of the Lithuanian parquet producing company, the composite sustainable index value is 0.508. It should be noted, however, that the value of the environmental sub-index is lower in comparison with the economic and social sub-indices. The application of SMA in the company also proved that the situation of social performance is better compared to the environmental performance.

Once the key sustainability problem is identified and comprehensive indicator system developed, another important step of the sustainable management system must be performed—identification of alternatives and their economic evaluation. In our case, three main alternatives were selected and analysed with the help of economic evaluation and sensitivity analysis:

-

(1)

modernization of the boiler-house

-

(2)

boiler optimization

-

(3)

installation of a condensing economizer

Installation of a condensing economizer was recognized as the most promising alternative. The detailed process of the economic evaluation and sensitivity analysis of this alternative is presented below.

The investment of 36,700 euro for the implementation of the item—a condensing economizer, is necessary. Table 5 presents annual savings in the case of the alternative implementation. After the installation of a condensing economizer in the small-scale wood manufacturing company, electric energy consumption, compared to other inputs, would be reduced significantly (12,360 euro per year).

Calculation of the payback period:

-

PP = K/R

-

PP = 37,700/11,857 = 3.2 years

Since the PP is more than 3 years, it is advisable to calculate the NPV:

where CF0…CF n are cash flows from the initial investment to the last cash flows and i is discount rate.

In the case of 10% discount rate, NPV (see Table 6) is satisfactory to consider the investment choice.

IRR is calculated according to the formula:

At that point, where NPV is equal to zero, the discount rate is equal to IRR. In our case, IRR is equal to 0.11 or 11%.

For the sensitivity analysis, NPV is chosen as a key indicator and wood sawdust costs are chosen as a key variable, when other variables remain stable. Electric energy costs are also a potential variable, but, since electric energy costs tend to grow, in our case it would have only a positive impact. Therefore, in this situation the electric energy variable is not considered.

Three variations of wood sawdust costs were chosen: pessimistic (10% growth), realistic (7% growth) and optimistic (5% growth).

Table 7 presents the influence of the variable (sawdust market prices) to the key indicator NPV. In our case, before the sensitivity analysis, NPV amounted to 885 euro. After the sensitivity analysis, in the case of all the three variations, NPV remained positive. Therefore, the alternative was accepted.

Conclusions

-

1.

SMEs are seeking for a relatively simple, easily adapting, flexible sustainable management system, expressing sustainable development aspects through financial indicators. Sustainability management accounting and composite sustainable development index methodologies fill this gap, being very promising tools for sustainable decision making in SMEs.

-

2.

Applying SMS in three pilot companies, it was identified that total sustainability costs amount to 90–92% of the environmental costs and 8–10% of social costs. Although part of prevention costs in the case of social dimension was 80–90%, in the case of the environmental dimension it amounted only to 7–12%. Since the investment in preventive measures significantly reduces the costs of treatment of undesired effects and also material non product output, it can be concluded that companies do not give sufficient attention to the prevention of harming the environment.

-

3.

In all the three pilot companies, the main identified sustainability problems, based on financial indicators, are related with the non product output, which amounted to 54–82% of the total sustainability costs. In the cases of wood manufacturing companies, non product output resulted mainly from high electrical and heat energy consumption (55–70% of sustainability costs). In the case of the beverage company, non product output also resulted from high electrical and heat energy consumption (22–42% of sustainability costs) and water consumption (8% of sustainability costs).

-

4.

The composite sustainable development index of the wood parquet manufacturing company is 0.508, wood pallets company is 0.517 and beverage company is 0.562. It shows that the companies are about in the midway of implementing sustainable development goals. In all the three cases, the key issue and the problematic area is the environmental performance with the sub-index values of 42–48%. The composite sustainable development index supports the results of SMA and may also be used for reporting purposes.

-

5.

Application of the sustainable management system enables us to identify the key sustainability problems and to find solutions to improve the company’s sustainability performance. In the wood parquet manufacturing company, after performing the economic evaluation and the sensitivity analysis, a decision was made to implement the condensing economizer alternative to solve the identified sustainability problems. Heat energy consumption decreased by 15%, electrical energy by 19% and sustainability costs by 12%. In the case of the wood pallet producing company, the interoperabil conveyor alternative was chosen. Heat energy consumption decreased by 18%, electrical energy by 18% sustainability costs by 15%. In the case of the beverage company, the heat recuperation system and water reuse system alternatives were chosen. Heat energy consumption decreased by 17%, electrical energy by 18%, water consumption by 20% and sustainability costs by 17%.

-

6.

SME sector demonstrates lower efficiency and productivity, lower compliance with environmental requirements and usually lower knowledge, human and financial resources, compared to large enterprises. The sustainable management system, integrating adaptable preventive methods, supports SMEs to overcome those issues, ensures continuous improvement and helps to become more sustainable and competitive.

Abbreviations

- AHP:

-

Analytic hierarchy process

- BAT:

-

Best available technologies

- EMA:

-

Environmental management accounting

- EMS:

-

Environmental management system

- ICSD:

-

Composite sustainable development index

- IRR:

-

Internal rate of return

- NPV:

-

Net present value

- PP:

-

Payback period

- SD:

-

Sustainable development

- SMA:

-

Sustainability management accounting

- SMEs:

-

Small and medium enterprises

- SMS:

-

Sustainable management system

References

Bennett M, Bouma JJ, Wolters T (2002) Environmental management accounting: informational and institutional developments. Kluwer Academic Publishers, Netherlands

Bennett M, Rikhardsson PM, Schaltegger S (2003) Environmental management accounting—purpose and progress. Kluwer Academic Publishers, Netherlands

Biezma MV, San Cristóbal JR (2005) Investment criteria for the selection of cogeneration plants—a state of the art review. Appl Therm Eng 26(5-6):583–588

European Commission (2007) Small, clean and competitive. Executive summary of the impact assessment

Government of the Republic of Lithuania (2002) Long-term strategy for development of Lithuanian Economy to 2015, Resolution No. 853, Vilnius

Jasch C, Lavicka A (2005) Pilot project on sustainability management accounting with the Styrian automobile cluster. J Clean Prod 14(14):1214–1227

Jasch C, Stasiškienė Ž (2005) From environmental management accounting to sustainability management accounting. Environ Res Eng Manag, ISSN 1392-1649, 4(34):77–88

Kopustinskas V, Alzbutas R, Augutis J (2007) Statistical methods of uncertainty and sensitivity analysis for mathematical model output. Energetics 53(3):10–15

Kotchen MJ (2010) Cost-benefit analysis. In: Schneider S (ed) Encyclopedia of climate and weather, 2nd edn. Oxford University Press, Oxford

Krajnc D, Glavič P (2004) A model for integrated assessment of sustainable development. Resour Conserv Recycling 43(2):189–208

Labonne J (2006) A comparative analysis of the environmental management, performance and innovation of SMEs and larger firms based on the OECD database. Final report. CL Conceil, France

Labuschagne C, Brent AC, van Erck RPG (2005) Assessing the sustainability performances of industries. J Clean Prod 13(4):373–385

Lithuanian Department of Statistics (2007) SME business success factors 2006, Study, Vilnius

Ministry of Economy of the Republic of Lithuania (2007) Business social initiatives analysis: benefits, costs, impact on business and society. Report of applied scientific research, Vilnius

Ministry of Economy of the Republic of Lithuania (2008) Corporate sustainable industrial development (including the assessment of greenhouse gas emissions) effectiveness system and methodology development. Report of applied scientific research, Vilnius

Ministry of Economy of the Republic of Lithuania (2009) Plan for stimulation of economy, Vilnius

Ranganathan J (1998) Sustainability rulers: measuring corporate environmental and social performance. World Resources Institute, Washington, DC

Rikhardsson PM, Bennett M, Bouma JJ, Schaltegger S (2005) Implementing environmental management accounting: status and challenges. Springer, NY

Stasiškienė Ž, Šliogerienė J (2009) Sustainability assessment for corporate management of energy production and supply companies for Lithuania. Int J Strateg Prop Manag 13(1):71–81 (ISSN1648-715X)

Stasiškienė Ž, Staniškis JK (2006) Environmental management accounting in Lithuania: exploratory study of current practices, opportunities and strategic intents. J Clean Prod, ISSN 0959-6526, 14(14):1252–1261

United Nations Division for Sustainable Development (2001) Environmental management accounting procedures and principles. United Nations, NY

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Laurinkevičiūtė, A., Stasiškienė, Ž. SMS for decision making of SMEs. Clean Techn Environ Policy 13, 797–807 (2011). https://doi.org/10.1007/s10098-011-0349-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10098-011-0349-1