Abstract

The future consequences of climate change are highly uncertain and estimates of economic damages differ widely. Governments try to cope with these risks by investing in mitigation and adaptation measures. In contrast to most of the existing literature, we explicitly model the decision of risk averse governments on mitigation and adaptation policies. We also consider the interaction of the two strategies in presence of uncertainty. Mitigation efforts of a single country trigger crowding out as other countries will reduce their mitigation efforts. This may even lead to lower mitigation on the global scale. In contrast, a unilateral commitment to large adaptation efforts benefits the single country and can reduce the global risk from climate change at the expense of other countries.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Climate change is one of the major global challenges that has been on the policy agenda of the last two decades. The consensus view nowadays predicts a further increase in global temperature of 1 degree Centigrade up to almost 4 degrees Centigrade on average until the end of this century, if no measures are taken to reduce greenhouse gas (GHG) emissions (IPCC 2013). Prominent studies on the welfare effects of climate change come up with significant cost estimates for the global economy (see for example Aldy 2010; Tol 2009, 2014). But uncertainty about how the climate system works in detail, how climate change translates into economic effects and how the latter are affected by future technological change make solid predictions difficult. Our focus lies on the uncertain damages following climate change. This uncertainty is of special interest as it rapidly increases when the temperature hike exceeds the 3-degree-centigrade threshold. Estimates of the global welfare effects are negative on average and range from slight gains to losses of more than 10 percent of world GDP (Tol 2014, 2013; Aldy 2010). Even though the large uncertainty is frequently mentioned, the endogeneity of the distribution of climate risk is hardly ever taken into account when analyzing the effects of climate policy. The present paper reveals that the risk dimension of climate policy has major implications for the role of unilateral advances and thus for the non-cooperative climate policy game.

To cope with the potential welfare costs of climate change, two types of measures are at hand: mitigation and adaptation. Mitigation aims at damping climate change by reducing global GHG emissions, whereas adaptation limits the damages induced by climate change, e.g., by building higher dams or more stable buildings as a protection against extreme weather events).Footnote 1 The important distinction between the two is that mitigation efforts are contributions to a global public good (no one can be excluded from potential benefits) and adaptation is a private good with spatially limited effects.

Governments and politicians have tried to implement an international climate agreement to limit global GHG emissions with only moderate success so far. As an alternative, unilateral advances in mitigation are frequently advocated in the political sphere to increase global mitigation. The main argument in favor of such a strategy claims that advances in mitigation efforts will force other countries to imitate the unselfish behavior and thus lead to a more favorable scenario of climate change. Economists, in contrast, have frequently argued that unilateral measures of mitigation policy may not be very successful as they are simply crowded out by other players. In the absence of a global agreement or a (benevolent) world government, climate policy is set by individual countries in a non-cooperative setting. The reactions of all other players have to be taken into account when countries strategically set their climate policy.

This type of analysis is often carried out within the framework of a public goods game with private provision. The nature and comparative static properties of this game have been analyzed by Bergstrom et al. (1986). Hoel (1991) applied this framework to global environmental problems. His seminal analysis of unilateral action shows that a commitment to unilateral advances in mitigation changes the equilibrium outcome: the unilateral advances are partially crowded out due to the reduced equilibrium efforts of the other contributors.Footnote 2

Things are different with a strategic investment in adaptation measures. Zehaie (2009) finds that the unilateral commitment to more adaptation acts as a commitment to lower mitigation contributions in the future and forces other players to invest more in mitigation.Footnote 3 Ebert and Welsch (2012) show that unilateral improvements of adaptive capacity can have the same strategic effect on mitigation. Heuson (2015) analyze the use of adaptation and investment in the mitigation technology as commitment devices. They find that when both measures are used prior to mitigation, their strategic effects add up. The strategic investment in adaptation is especially harmful for total global mitigation when used by a large emitter as smaller emitters are simply not able to offset the decrease in mitigation (Farnham and Kennedy 2015).

None of the above contributions on strategic climate policy considers risk. And those contributions in the growing literature on climate change dealing with risk, rarely include uncertainty in the objective function of the decision maker. Ingham et al. (2007) regard uncertainty as a lack of knowledge and examine the effects of future learning on climate policy. Uncertainty has been incorporated into Integrated Assessment Models for instance by Tol and Yohe (2007) and by Bosello and Chen (2010). Kane and Shogren (2000) analyze climate policy as a choice of risk-taking without consideration of the strategic effects in the non-cooperative equilibrium. Bramoullé and Treich (2009) show that uncertainty increases mitigation efforts.Footnote 4 Tsur and Withagen (2013) focus on adaptation policies that can reduce the catastrophic damage of an abrupt but uncertain climate change. The contribution that is structurally closest to ours is Lohse et al. (2012). In an expected utility framework, they consider self-insurance (the sum of contributions reducing the size of the loss) and self-protection (the sum of contributions reducing the probability of a loss) as voluntary contributions to a public good and discuss the interaction of these strategies with market insurance. They point out that unilateral contributions to a global public good generate an income effect in the rest of the world. Depending on the attitude towards risk, the unilateral contribution may increase or decrease the contribution of the other countries beyond the usual crowding out mechanism. Thereby they uncover an important mechanism that is also driving the results in our framework. Assuming decreasing absolute risk aversion, unilateral contributions to the public good might lead to more than full crowding out and result in a lower global provision level (Lohse et al. (2012, Lemmas 2 and 3)).

We combine the approach of Lohse et al. (2012) with the strategic commitment to adaptation discussed by Zehaie (2009). The analysis proceeds in three steps. First, we derive the country specific optimal amount of mitigation given the mitigation efforts of all other countries (Sect. 2.1). Risk considerations cause an even more pronounced crowding out effect. Here we replicate the ’over-crowding out effect’ derived by Lohse et al. (2012) in a mean-variance-approach (Sect. 2.2). The unilateral advance of a single country in mitigation policy induces policy changes in the rest of the world such that global mitigation efforts may be reduced. Second, we derive the Nash equilibrium and characterize its properties, if all countries contribute to the global public good (Sect. 2.3). The equilibrium analysis confirms that unilateral advances away from the Nash equilibrium can lead to over-crowding out under certain conditions. Third—and most importantly—we consider adaptation as an alternative climate policy strategy (Sect. 3). Adaptation limits the local damages from climate change and is a substitute measure for mitigation. For didactic purposes, we first consider simultaneous decisions on adaptation and mitigation from the perspective of a single country (Sect. 3.1), before we turn to adaptation as a commitment device in a single country (Sect. 3.2) and in both countries (Sect. 3.3). The strategic use of adaptation is beneficial from the perspective of a single country not only because it reduces the risk from climate change, but also because it affects the behavior of other countries. The early commitment to large adaptation efforts acts as a credible promise that this country will exert low mitigation efforts in the future. This, in turn, forces the other countries to pursue more ambitious mitigation goals.

Summing up, the contribution of this paper to the literature is twofold. First, we derive new insights by bringing together two existing ideas: the strategic commitments to adaptation analysed by Zehaie (2009) and the risk dimension of climate policy as discussed in Lohse et al. (2012). The combination of these two aspects leads to a better understanding of strategic effects in climate policy as our analysis demonstrates. Our second contribution to the literature is more of a didactic nature. We demonstrate how the mean-variance approach can be used fruitfully to analyse risk-taking in long-term climate policies. For this purpose, we transfer the self-insurance approach with two states of nature to the mean-variance approach with a continuous distribution of damages. We are confident that the mean-variance approach can be extended in various directions relevant for climate economics.

2 Mitigation policy only

2.1 A country’s individually optimal choice

For the moment, we will focus on the climate policy of a single country or region and denote this country with index 1, whereas the rest of the world is labeled ’country 2’. In a strategic context, we treat country 2 as one single player for simplicity reasons.Footnote 5 Global emissions of greenhouse gases determine the well-being in the world as they are causal for climate change. Country 1 faces the risk of a stochastic net damage (loss) \(L_{1}\) from climate change with mean \(\bar{\mu }_1\) and standard deviation \(\bar{\sigma }_1\). This stochastic damage can be influenced by investing in mitigation policies. If country 1 invests \(m_{1}\) and the rest of the world invests \(m_{2}\) in mitigation, the effective damage becomes \(\alpha (m) \cdot L_{1}\) with \(m= m_{1} + m_{2}\). Hence, mitigation is a global public good, since the size of the public good depends on the contributions of all countries and all countries benefit independent of their individual contribution.

Some regularity assumptions about \(\alpha \) are as follows: we assume that the function \(\alpha \) is twice continuously differentiable, decreasing in additional mitigation, but at a decreasing rate [\(\alpha _{m}\le 0\) and \(\alpha _{mm}\ge 0\)], where the subscript denotes the derivative with respect to m. The first dollar spent on climate policy is highly productive \(\left[ \alpha _{m}(m=0)=-\infty \right] \). Beyond a certain threshold \(\bar{m}\), additional measures do not further reduce damages from climate change \(\left[ \alpha _{m}=0\right] \) for all \(m\ge \bar{m}\). Mitigation comes at a cost. We assume a twice continuously differentiable and convex cost function \(c(m_{1})\) with \(c_{m_1}\ge 0\), \(c_{m_1 m_1}>0\) and \(c(0)=c_{m_1}(0)=0\).

Let \(y_{1}\) be the initial wealth of country 1. The country can influence the size and riskiness of the stochastic final wealth \(V_{1}\) by choosing the appropriate mitigation measures:

Country 1 is populated by a representative risk averse individual that has preferences over the mean and the standard deviation of domestic wealth, represented by a twice continuously differentiable utility function \(U(\mu _{1},\sigma _{1})\), where \(\mu _{1}\) denotes the mean and \(\sigma _{1} \) the standard deviation of final wealth \(V_{1}\). The utility function has the usual properties \(U_{\mu }>0\), \(U_{\sigma }<0\), \(U_{\mu \mu }<0\), \(U_{\sigma \sigma }<0\) and \(U_{\mu \sigma } > 0\).Footnote 6

We can now analyze the climate policy of a single country that maximizes the utility of the representative citizen. For the moment, we take \(m_2\), the mitigation efforts in the rest of the world, as given and focus solely on country 1, which faces the following maximization problem:

Mitigation reduces the riskiness \([\sigma _1]\) of damages induced by climate change, but has an ambiguous effect on the expected wealth \([\mu _1]\). While the expected damage is reduced, mitigation is also associated with costs. Domestic climate policy has to balance these countervailing effects by choosing the country-specific optimal contribution to global mitigation efforts.

The first-order condition is

where \(\mu _{m_1}\) and \(\sigma _{m_1}\) are the derivatives of mean and standard deviation with respect to \(m_1\). The second-order condition is given by \(f_{m_1 m_1} \equiv \frac{\partial f_{m_1}}{\partial m_1} <0\), which requires that the cross-derivative \(U_{\mu \sigma }\) is not too strongly positive. By rearranging the FOC we obtain the first result of our analysis:

The left-hand side of Eq. (4) describes the marginal rate of substitution between expected wealth and risk. It tells us how much additional expected wealth is needed to compensate the representative individual for a slight increase in the standard deviation. The right-hand side captures the marginal rate of transformation. Country 1 has to give up some expected wealth through mitigation to reduce the risk of damages from climate change. In the optimum, the marginal rate of substitution and the marginal rate of transformation are equalized.

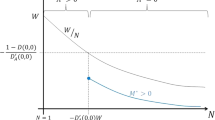

The outcome is illustrated in Fig. 1. The \(\mu _{1}(\sigma _{1})\)-curve describes the efficiency frontier of the opportunity set in country 1 for a given mitigation policy \(m_{2}\) in the rest of the world. All points beneath the curve are also feasible but inefficient; all points above are not attainable. The slope of this curve equals the marginal rate of transformation [see Eq. (4)]:

Without any investments (\(m_{1}=0\)), the economy is situated at point A. The first unit invested in mitigation is highly productive, whereas the marginal cost is zero. The slope of the efficiency frontier in A amounts to \(- \bar{\mu }_1/\bar{\sigma }_1\). Starting to invest in mitigation, the mean wealth increases and the standard deviation is reduced. When the productivity of further investments becomes sufficiently small (beyond point B), the reduced risk comes at the cost of a lower expected wealth. As the slope of the indifference curve \(\bar{U}\) corresponds to the marginal rate of substitution, the optimal climate policy for country 1 is reached when the indifference curve becomes tangent to the opportunity set (point C). Note that the position of the efficiency frontier changes when \(m_{2}\) varies. How changes in \(m_{2}\) affect the mitigation policy of country 1 is discussed in the next section.

2.2 Unilateral advances in mitigation policy

Unilateral advances in climate policies are frequently advocated by the media and environmental activists. Politics is pressured to go ahead with mitigation policies.Footnote 7 The main argument is that advances in climate policies will induce other countries to imitate this behavior and thus lead to a more favorable scenario of climate change. In this section, we analyze the consequences of unilateral advances in mitigation policy for global mitigation efforts and for global risk-taking. How does country 1 adjust its mitigation policy if country 2 exogenously increases expenditures on mitigation?Footnote 8 Again, using the FOC [Eq. (3)], we can evaluate the impact of changes in \(m_2\) on mitigation efforts in country 1. Differentiating yields the following comparative statics:

The relevant question here is whether country 1 will fully or partially crowd out the additional mitigation efforts of other countries. We can rewrite Eq. (6) as

see appendix 5.1. As \(f_{m_1 m_1}<0\) shows up in the numerator and denominator, the overall effect depends on the second and third term in the numerator denoted by A and B. If both terms sum up to zero, we have perfect crowding out \(\left[ \frac{d m_{1}}{dm_{2}}=-1\right] \). If \(A+B\) becomes negative, the reduction in mitigation effort of country 1 overcompensates the additional efforts of the other country \(\left[ \frac{dm_{1}}{dm_{2}}<-1\right] \); total mitigation efforts are reduced.

The sign of term A depends on the degree of absolute risk aversion captured by the term in square brackets. Note that \(\sigma _m <0\), \(U_\mu >0\) and \(c_{m_1}\ge 0\). For constant absolute risk aversion it becomes zero and for decreasing absolute risk aversion it becomes positive; see Appendix 5.2. Term B is always positive due to the convexity of the cost function.

Proposition 1

With constant or increasing absolute risk aversion, a unilateral increase in the mitigation effort of other countries is only partly crowded out by the reduced efforts of country 1. If, however, the absolute risk aversion is sufficiently decreasing, the increased mitigation efforts of other countries are more than crowded out.

The intuition for this result is as follows: The unilateral efforts of the other country shift up the opportunity set of country 1 (see Fig. 1). For each risk \(\sigma _1\), country 1 achieves a higher expected wealth as the costs of mitigation are now borne to a larger extent by the other country. In addition, the slope of the efficiency frontier changes. For each level of \(\sigma _1\), the slope of the efficiency curve is lower, since the marginal cost to achieve \(\sigma _1\) has fallen. Whether country 1 wants to select a lower or higher risk depends on the risk preferences. For constant absolute risk aversion, the slope of the indifference curve \(\bar{U}\) remains constant for a given level of \(\sigma _1\) (e.g., when moving upwards from C). If absolute risk aversion is strongly decreasing, the flattening of the indifference curve will be stronger than the flattening of the efficiency frontier. Then a tangency point to the north-east of C is chosen. In this case, country 1’s expected wealth increases but the risk has become larger too.

Under the plausible condition of decreasing absolute risk aversion, unilateral increases in mitigation efforts by a single country may be counterproductive. In contrast to the standard models of public good contributions (see, e.g., Hoel 1991), a unilateral increase in investment can be more than crowded out so that global mitigation even decreases. The explanation for this seemingly paradoxical result is the wealth effect created by the unilateral mitigation efforts. Proposition 1 replicates Lemmas 2 and 3 in Lohse et al. (2012), which were developed in an expected utility framework.Footnote 9

2.3 The non-cooperative equilibrium in mitigation

So far, we have focused on the decisions of a single country and its reactions to a policy change in the other country. We now turn to the equilibrium in which both countries’ choices are determined endogenously in a non-cooperative setting. Each region decides on its privately optimal mitigation level given the mitigation efforts of the other country. The Nash equilibrium of the mitigation game is then a vector of contributions \((m_{1}^{*},m_{2}^{*})\) where each \(m_{i}^{*}\) is the best response to \(m_{j}^{*}\) fulfilling Eq. (3) \([i,j=1,2; i\ne j]\).

Proposition 2

There is at least one stable interior equilibrium of mitigation efforts in pure strategies.

Proof

Consider the reaction functions \(m_{1}(m_{2})\) and \(m_{2}(m_{1})\). Each intersection of these reaction functions is a Nash equilibrium, denoted \((m_{1}^{*},m_{2}^{*})\). The reaction functions are continuous self-mappings on the closed and compact set \([0,\bar{m}]\). Hence, these functions intersect at least once. This proves that a Nash equilibrium exists. We can rule out \(m_{i}^{*}\ge \bar{m}\) for \(i\in \{1,2\}\) by the following reasoning: i’s utility is higher for \(m_{i}=\bar{m}\) than for \(m_{i}>\bar{m}\). Moreover, a marginal reduction in effort at \(m_{i}=\bar{m}\) increases \(i\,\)’s utility since this reduction has a positive first-order effect on \(\mu _{i}\), but a zero first-order effect on \(\sigma _{i}\). Hence, \(m_{i}(m_{j}=0)<\bar{m}\). This result, in turn, can be used to rule out \(m_{i}^{*}=0\). Consider a marginal increase in \(m_{i}\) at \(m_{i}=0\). As \(m_{j}^{*}<\bar{m}\), this increase has a strictly beneficial first-order effect on \(\sigma _{i}\) and a non-negative first-order effect on \(\mu _{i}\). This shows that at least one interior equilibrium exists. Further, by the same arguments, \(0<m_{i}(m_{j})<\bar{m}\) for all \(m_{j}\in [0,\bar{m}]\), and \(\lim _{m_{j}\rightarrow \bar{m}}m_{i}(m_{j})=0\). Accordingly, the curve \(m_{1}(m_{2})\) starts above \(m_{2}(0)\) and must, at some point, fall below \(m_{2}(m_{1})\) (see Fig. 2). Hence, at the intersection, the stability condition \(\frac{dm_{1}(m_{2})}{d m_{2}}\cdot \frac{dm_{2}(m_{1})}{dm_{1}}<1\) must be fulfilled. \(\square \)

Without further specifying the functional forms, it is impossible to decide whether the equilibrium is unique; see also Proposition 1 in Lohse et al. (2012), which also states that a Nash equilibrium with private (self-insurance) contributions exists but may not be unique. However, if there are \(2n+1\) equilibria, at least \(n+1\) of them must be stable. The reaction curves in Fig. 2 could intersect more than once. However, as the reaction curve of country 1 (\(m_{1}(m_{2})\)) originates on the vertical axis above country 2’s reaction curve (\(m_{2}(m_{1})\)) but terminates on the horizontal axis beneath it, there must be an uneven number of intersections, where every other intersection constitutes a stable equilibrium.

Proposition 3

Suppose that \((m_{1}^{*}, m_{2}^{*})\) is a stable Nash equilibrium. If there is an exogenous increase in \(m_{i}\), then

-

(i)

\(\frac{\partial m (m_{1}^{*}, m_{2}^{*})}{\partial m_{i}}>0\) if \(\left. \frac{dm_{j}}{dm_{i}}\right| _{(m_{i}^{*}, m_{j}^{*})}>-1\) and

-

(ii)

\(\frac{\partial m (m_{1}^{*}, m_{2}^{*})}{\partial m_{i}}<0\) if \(\left. \frac{dm_{j}}{dm_{i}}\right| _{(m_{i}^{*}, m_{j}^{*})}<-1\).

Hence, excessive crowding out can only occur with sufficiently steep reaction curves in the Nash equilibrium.

Proof

The left panel of Fig. 2 depicts the case with less than full crowding out (Case 1). All points with the same total mitigation effort (\(m^*=m^*_1 + m^*_2\)) are illustrated with the dashed line with slope \(-1\). Starting from the Nash equilibrium (A), a small exogenous increase in \(m_1\) would induce country 2 to reduce its mitigation efforts slightly; the new combination of mitigation efforts (B) is on country 2’s reaction curve. Point B is above the dashed line, if \(\frac{dm_{2}}{dm_{1}}>-1\). Total mitigation efforts are higher than in A; unilateral advances are not fully crowded out. However, as shown in the right panel of Fig. 2 (Case 2), more than full crowding out will occur if the reaction curve of country 2 is sufficiently steep \(\left[ \frac{dm_{2}}{dm_{1}}<-1 \right] \) so that it runs beneath the dashed line (\(m^*\)) to the right of the Nash equilibrium (A’). If country 1 now unilaterally increases its mitigation efforts by one unit, the new combination of mitigation efforts B’ is located beneath the dashed line. Here, global mitigation decreases when unilateral advances are made. \(\square \)

Proposition 3 shows that the seemingly paradoxical effect of over-crowding out can survive in the neighborhood of a Nash equilibrium. It requires that one country reacts very flexibly to changes in mitigation, whereas the other country has to react little. In the standard Bergstrom et al. (1986) framework of private provision of a public good, only partial crowding out (or full crowding out as a limiting case) is possible. Their assumption that the private and the public good are both ’normal’ implies that the reaction curves have slopes in the range [−1,0]. In our framework, due to risk and quite natural assumptions about risk preferences, generous unilateral commitment to reduce emissions by more than the equilibrium amount is costly for the country that makes this commitment and may even have a negative effect for the environment. Hence, uncertainty and risk aversion strengthen the policy arguments against generous commitments for unilateral emission reductions.

3 Adaptation as an additional instrument in climate policy

As we have just seen, unilateral advances in mitigation may not work in a non-cooperative setting. In the extreme case, the additional efforts of a single country are more than crowded out by the other country. If unilateral advances in mitigation do not work, maybe an alternative strategy using adaptation can help to improve global risk-taking. Adaptation comprises all measures that reduce the damages from climate change. Adaptation is often seen as a short- or medium-term measure against the threats from extreme weather events. The impact of many adaptation measures, however, lasts for many decades after implementation. Important examples of long-lasting adaptation measures include changes in the robustness standards of new infrastructure projects such as bridges, rail tracks, or the electricity grid and building restrictions for flood-prone areas. For adaptation measures to work as a commitment device, it is this long-term impact that brings about a change in the country’s mitigation incentives. These adaptation measures are precautionary, have a long-lasting impact on the vulnerability of a country and thereby lessen the country’s future incentives for mitigation efforts. It is this change in incentives together with the irreversibility of investments that matters and that makes adaptation a credible commitment device.

In a first step, we extend our model by allowing for adaptation as an additional instrument for domestic climate policy. For the purpose of clarity, we start out again with the partial equilibrium approach and focus solely on a single country, which uses adaptation in a non-strategic manner. In a second step, we allow one country to use adaptation as a strategic instrument. We analyze how the Nash equilibrium in mitigation contributions is affected when one country can commit to an adaptation policy before the mitigation game is played. In a third step, we finally discuss the Nash equilibrium when both countries strategically invest in adaptation measures.

3.1 A country’s individually optimal mix of adaptation and mitigation

We extend our base model to allow for adaptation efforts in addition to mitigation. If country 1 invests \(m_1\) in mitigation and \(a_1\) in adaptation, the effective damage from climate change becomes \(\alpha (a_1,m) \cdot L_1\) with \(m=m_1+m_2\). While mitigation is a global public good, adaptation is a private good. We assume that adaptation has the same qualitative impact on \(\alpha \) as mitigation, i.e. \(\alpha _{a_1} \le 0\) and \(\alpha _{{a_1} {a_1}}> 0\). The cost of adaptation is denoted by \(k(a_1)\) with \(k_{a_1}\ge 0\), \(k_{{a_1} {a_1}}>0\) and \(k(0)=k_{a_1}(0)=0\). Country 1 now faces a stochastic final wealth of

Maximizing utility \(U(\mu _1,\sigma _1)\) of the representative individual with respect to \(m_1\) and \(a_1\) yields

which leads to the optimality condition:

Hence, the marginal rate of substitution has to be equal to the marginal rate of transformation of both adaptation and mitigation.Footnote 10 Substituting the derivatives of \(\mu _1\) and \(\sigma _1\) and simplifying provides some insights into the optimal mix of adaptation and mitigation:

Country 1 should choose adaptation and mitigation in a way such that the marginal cost per unit of risk reduction is the same across the two policy instruments.

Proposition 4

From the point of view of a single country, climate policy is chosen optimally if (i) the marginal rate of substitution between \(\mu \) and \(\sigma \) equals its marginal rate of transformation and if (ii) the marginal cost of adaptation and mitigation per unit of risk reduction are equalized.

Adaptation creates only local benefits but it is nevertheless linked to the global mitigation efforts. As mitigation and adaptation are substitutes with respect to risk reduction, a country will also adjust its adaptation policy in the wake of additional mitigation efforts of the rest of the world. We discuss this strategic interaction between mitigation and adaptation in the next section.

3.2 Adaptation as a commitment device

If a country wants to induce other countries to change their contributions to the global public good ’mitigation’, it can pursue two strategies. The country may try and announce to depart from the Nash equilibrium levels, for instance, by keeping its mitigation efforts low. Should this announcement be credible, it changes other countries’ provision incentives. However, such an announcement is typically not time consistent and, therefore, not credible. If the other countries rightly anticipate that the country will not stick to this announcement but return to a choice that is an individually optimal reply in the equilibrium, they will also not depart from their Nash contributions. Therefore, announcements on mitigation efforts are not suitable as a commitment device. Alternatively, a country can invest in adaptation measures that have a long-lasting impact on the country’s cost of climate change and thereby reduce the vulnerability against extreme weather events. This lower climate cost lessens the country’s future incentives for mitigation efforts. Due to its irreversibility, adaptation of this type acts as a credible commitment device.

Many of the possible adaptation measures have a long-lasting impact on a country’s own climate cost. If these measures are taken early on as precautionary devices, they change the mitigation incentives in future years. This strategic aspect leads us to consider a two-stage game where country 1 first invests in adaptation and then both countries 1 and 2 play the contribution game with respect to mitigation efforts. The early commitment will influence the mitigation efforts of the other country in stage 2. We analyze whether country 1 has an incentive to use such a commitment strategy. We also discuss under which conditions global risks from climate change will be reduced.

We expand our model as a two-stage game as follows. In stage 1, country 1 commits to adaptation \(\bar{a}_1\). In stage 2, the mitigation game (\(m_1, m_2\)) is played as described in Sect. 2. Solving by backward induction, we start in stage 2, where each country i chooses its own contribution \(m_i\) for a given contribution of the other country and for a given level of adaptation of country 1 (\(\bar{a}_1\)).

Maximizing country 1’s utility \(U(\mu (\bar{a}_1, m_1+\bar{m}_2), \sigma (\bar{a}_1, m_1+\bar{m}_2))\) with respect to \(m_1\) yields the following first-order condition:

The interesting question is how country 1’s contribution varies with the previous commitment to the adaptation effort. Differentiating (15) with respect to \(\bar{a}_1\) and \(m_1\) yields:

As \(f_{m_1 m_1} < 0\), the reaction depends on the sign of \(f_{m_1 a_1}\), which tells us how the marginal utility of mitigation measures changes when adaptation efforts increase slightly. Even though one might argue that adaptation and mitigation are no perfect substitutes, it is quite plausible that there is some degree of substitutability, i.e., damages that can be avoided by further mitigation could also be reduced by strengthening adaptation efforts. In this case, we have \(f_{m_1 a_1} < 0\). An increase in adaptation in the first stage then decreases the mitigation efforts in the second stage. Alternatively, mitigation and adaptation could reinforce each other; then we have complements [\(f_{m_1 a_1} > 0\)]. Even though there is some debate about complementarity between mitigation and adaptation, this distinction refers to the cross effects on marginal costs rather than on damages as in our case; see Ingham et al. (2013) or Ingham et al. (2007).

As \(m_1\) varies with adaptation efforts, the entire contribution game will be affected by the commitment strategy. We analyze this effect by turning to stage 1 of the game. We maximize the utility \(U(\mu (a_1,m_1+m_2),\sigma (a_1,m_1+m_2))\) over \(a_1\), which yields:

Using the first-order condition (15), the expression simplifies to

The first term in square brackets describes the marginal utility from additional adaptation efforts neglecting the strategic effects; see Eq. (11). The second term captures the commitment effect of early adaptation. It measures the impact on marginal utility, when adaptation is slightly increased and the mitigation efforts of the other country are adjusted. Reading the second term from right to left helps to gain an economic intuition for the forces at work: If adaptation and mitigation are substitutes, an increase in adaptation reduces country 1’s future mitigation (\(\frac{\partial m_1}{\partial a_1}<0\)). The reduction in domestic mitigation efforts induces country 2 to spend more on mitigation (\(\frac{\partial m_2}{\partial m_1}<0\)).Footnote 11 Ceteris paribus this leads to higher mitigation, which in turn reduces damages (\(\frac{\partial \alpha }{\partial m}<0\)). As the marginal utility term is also negative, the strategic interaction creates an additional positive marginal benefit for country 1. Hence, we get the following result:

Proposition 5

If adaptation and mitigation are (imperfect) substitutes in limiting the damages from climate change (\(f_{m_1 a_1} < 0\)), a country can gain from an early commitment to large adaptation efforts. The commitment strategy induces other countries to increase their mitigation efforts.

Country 1 strategically overinvests in adaptation if adaptation and mitigation are substitutes. Here, overinvestment refers to a comparison with the country’s investment in adaptation in the absence of a strategic motive [cf. Eqs. (11) and (17)]. The high investments are a credible strategy as they are largely irreversible. In contrast, a commitment to low investments is rarely credible as there is always the opportunity of topping up. The commitment to the adaptation strategy forces country 2 to foster its mitigation efforts.

Figure 3 illustrates the commitment effect on the mitigation game. Depending on the equilibrium, the over-investment in adaptation can decrease (Case 1, left panel) or increase (Case 2, right panel) the global mitigation effort.Footnote 12 The commitment to early adaptation shifts the reaction curve of country 1 inwards. Country 2 then increases its mitigation efforts. The Nash equilibrium moves from point A (A’) to point C (C’). The dashed line in each panel describes the mitigation efforts \(m_1\) and \(m_2\) yielding the same global mitigation as in the Nash equilibrium A (A’). In the left panel (Case 1), the new Nash equilibrium C is below the dashed line. Hence, the selfish adaptation strategy leads to a lower global mitigation effort but it’s still benefitting country 1. In the right panel (Case 2), the new equilibrium C’ is located above the dashed line. The selfish adaptation strategy helps to reduce global risks from climate change. Clearly, the other country loses in terms of expected wealth as it has to make larger contributions to the global public good.

3.3 Both countries strategically invest in adaptation

As a final step of our analysis, we briefly investigate the scenario where both countries can strategically invest in adaptation, before the mitigation game is played. Solving the game backwards, we note that the first-order condition

for stage 2 is structurally equivalent to equation (15) in the previous section, though the level of adaptation \(\bar{a}_i\), which is set in stage 1, might differ. As adaptation is a private good, the outcome of the mitigation game depends only on the strategic setting of adaptation in the own country but not on adaptation in the other country. The adaptation choice in country j, however, exerts an indirect influence on country i’s policy as it changes the mitigation effort \(m_{j}\). As before an increase in adaptation in the first stage decreases mitigation efforts in the second stage. In the first stage, each country takes the adaptation efforts of the other country as given when it decides on \(a_{i}\). Using our results from the previous section [cf. Eq. (18)], the first-order condition in stage 1 of country i can be written as

The second term again captures the strategic motive to invest in adaptation. In Fig. 3, a strategic investment in adaptation by both countries would correspond to an inward shift of both reaction curves. In Case 1, total mitigation would clearly be lower than in the absence of any strategic adaptation (A). For Case 2, it is impossible to say whether strategic adaptation leads to higher or lower total mitigation without specifying the functional forms. The outcome depends on the relative magnitude of the shifts in the two reaction curves. From a global perspective, the strategic over-investment in adaptation is detrimental for two reasons. First, it may reduce the total mitigation effort (and certainly will in the symmetric case). Second, it distorts the cost-efficient mix of adaptation and mitigation within each country. From the perspective of an individual country, however, there is always an incentive to engage in strategic adaptation.

4 Conclusion

The proposed model allows to consider explicitly the dimension of uncertainty in climate policy. Uncertainty about the future damages from climate change and the risk aversion of decision makers have a crucial influence on national investments in mitigation and adaptation.

Our paper shows that the risk dimension may reinforce the crowding out problem of global mitigation efforts in the empirically relevant case of decreasing absolute risk aversion. Even though mitigation may be an efficient measure from a global perspective, unilateral advances in mitigation are ineffective in the absence of a benevolent global government. Unilateral advances work like a wealth transfer to the rest of the world. Making the rest of the world richer also marginally reduces the risk aversion. The mitigation efforts of the countries are reduced.

We have also shown that unilateral adaptation may be an attractive strategy if mitigation and adaptation are substitutes in climate policy. The early investment in adaptation of a country acts as a credible commitment to low mitigation efforts in the future and thus forces the other countries to pursue a more ambitious mitigation policy. This strategy may even foster global mitigation efforts.

Admittedly, this paper is only a first step towards the explicit consideration of risk-taking behavior in models of climate change. There are still many open questions that have to be answered in subsequent research. For instance, we have completely ignored the time dimension. As learning about the damaging effects of climate change will take place over time, countries may benefit from following a waiting strategy as seen in Ingham et al. (2007). Adaptation facilitates such a waiting strategy as it still allows a country to react to climate change even when it is too late for effective mitigation policies.

Notes

In an experimental setting, Sturm and Weimann (2008) confirm Hoel’s result, when countries decide simultaneously on the public good contribution. Numerous other extensions have been developed, e.g. Vicary (2009) modifies the model of non-cooperative mitigation policy to analyze asymmetries between countries.

There is a broad literature on further strategic aspects in general models of the private provision of public goods. For instance, countries may prefer to remain uninformed about their country-specific benefits from a public good (Morath 2010). This underinvestment helps them to credibly commit to a low level of public good contribution and to free ride on the other countries. Related to this, players may strategically abstain from purchasing insurance, even if it is offered for a fair premium, if they take part in a game of private provision of a public good later (Robledo 1999). For other forms of strategic behavior, see Konrad (1994), Ihori (1996), Buchholz et al. (1998) and Siqueira (2003).

For an experimental setting, see Hasson et al. (2010) who introduce uncertainty about climate change to test whether participants contribute more in high-vulnerability treatments.

This simplifies the analysis considerably and allows us to study the strategic context. Evidently it disregards the fact that some countries in the rest of the world may be in a corner solution.

As all distributions in the choice set belong to the same linear class, the mean-variance-approach is equivalent to the expected utility approach; see Meyer (1987) and Sinn (1989). The latter also contains a comprehensive treatment of the mean-variance-approach. Lohse et al. (2012) use the expected utility framework, which allows them to distinguish between self-insurance and self-protection. This distinction is most suitable with two states of the world (damage/no damage). As mitigation affects the entire distribution of damages, this distinction is of little practical relevance here. The mean-variance-approach has the advantage of dealing elegantly with continuous damage distributions.

National pledges as formulated in the Copenhagen Accord or the nationally determined contributions (NDC), which are part of the Paris Agreement, can also be interpreted as unilateral advances in mitigation. Crowding-out effects as reaction to national pledges have been studied, e.g., by Bosetti and Cian (2013).

In contrast to Hoel (1991), we do not explicitly model the benefit that is experienced by country 2 from the increase in mitigation efforts. We simply consider an exogenous deviation from the utility maximizing mitigation effort and focus on the impact on total mitigation. Hence, we abstract from the question why a country may want to depart from the Nash equilibrium (e.g., for political motives, warm-glow motives ...).

Note that the minor differences emerge due to the different settings. We have convex costs, whereas Lohse et al. (2012) employ a linear specification. In the mean-variance-approach, mitigation simultaneously shifts and squeezes the damage distribution whereas Lohse et al. (2012) distinguish two types of mitigation technologies (self-insurance and self-protection).

The second-order conditions are documented in Appendix 5.3.

To be precise, the sign depends on the absolute risk aversion and on the convexity of the cost function; see Sect. 2. We neglect the special cases, where extreme values of increasing absolute risk aversion and/or convex costs could make the reaction curve upward-sloping.

In Appendix 5.4, we derive the formal condition for partial crowding out and over-crowding out in the extended model with adaptation and mitigation.

References

Aldy JE (2010) Designing climate mitigation policy. J Econ Lit 48(4):903–934

Bergstrom T, Blume L, Varian H (1986) On the private provision of public goods. J Public Econ 29(1):25–49

Bosello F, Chen C (2010) Adapting and mitigating to climate change: balancing the choice under uncertainty, Fondazione Eni Enrico Mattei—Sustainable developement series 159—Technical report

Bosetti V, Cian ED (2013) A good opening: the key to make the most of unilateral climate action. Environ Resource Econ 56:255–276

Bramoullé Y, Treich N (2009) Can uncertainty alleviate the commons problem? J Eur Econ Assoc 7(5):1042–1067

Buchholz W, Nett L, Peters W (1998) The strategic advantage of being less skilled. Econ Lett 60(1):35–39

Ebert U, Welsch H (2012) Adaptation and mitigation in global pollution problems: economic impacts of productivity, sensitivity, and adaptive capacity. Environ Resource Econ 52:49–64

Fankhauser S, Smith JB, Tol RSJ (1999) Weathering climate change: some simple rules to guide adaptation decisions. Ecol Econ 30(1):67–78

Farnham M, Kennedy P (2015) Adapting to climate change: equilibrium welfare implications for large and small economies. Environ Resource Econ 61:345–363

Hasson R, Löfgren A, Visser M (2010) Climate change in a public goods game: investment decision in mitigation versus adaptation. Ecol Econ 70(2):331–338

Heuson C (2015) Investment and adaptation as commitment devices in climate politics. Environ Resource Econ 62(4):769–790

Hoel M (1991) Global environmental problems: the effects of unilateral actions taken by one country. J Environ Econ Manag 20(1):55–70

Ihori T (1996) International public goods and contribution productivity differentials. J Public Econ 61(1):139–154

Ingham A, Ma J, Ulph AM (2007) Climate change, mitigation and adaptation with uncertainty and learning. Energy Policy 35(11):5354–5369

Ingham A, Ma J, Ulph AM (2013) Can adaptation and mitigation be complements? Clim Change 120(1–2):39–53

Intergovernmental Panel on Climate Change (2013) Climate change 2013—the physical science basis: contribution of working group I to the fifth assessment report of the IPCC. Cambridge University Press, Cambridge

Kane S, Shogren JF (2000) Linking adaptation and mitigation in climate change policy. Clim Change 45(1):75–102

Konrad KA (1994) The strategic advantage of being poor: private and public provision of public goods. Economica 61(241):79–92

Lohse T, Robledo JR, Schmidt U (2012) Self-insurance and self-protection as public goods. J Risk Insur 79(1):57–76

Meyer J (1987) Two-moment decision models and expected utility maximization. Am Econ Rev 77(3):421–430

Morath F (2010) Strategic information acquisition and the mitigation of global warming. J Environ Econ Manag 59(2):206–217

Robledo JR (1999) Strategic risk taking when there is a public good to be provided privately. J Public Econ 71(3):403–414

Sinn H-W (1989) Economic decisions under uncertainty, 2nd edn. Physica-Verlag, Heidelberg

Siqueira K (2003) International externalities, strategic interaction, and domestic politics. J Environ Econ Manag 45(3):674–691

Sturm B, Weimann J (2008) Unilateral emission abatement: an experiment. In: Cherry T, Shogren J, Kroll S (eds) Environmental economics, experimental methods. Routledge, London, pp 157–183

Tol RSJ (2009) The economic effects of climate change. J Econ Perspect 23(2):29–51

Tol RSJ (2013) Targets for global climate policy: an overview. J Ecn Dyn Control 37(5):911–928

Tol RSJ (2014) Correction and update: the economic effects of climate change. J Econ Perspect 28(2):221–226

Tol RSJ, Yohe GW (2007) Infinite uncertainty, forgotten feedbacks, and cost-benefit analysis of climate policy. Clim Change 83(4):429–442

Tsur Y, Withagen C (2013) Preparing for catastrophic climate change. J Econ 110:225–239

Vicary S (2009) The voluntary provision of a public good in an international commons. Can J Econ 42(3):984–996

Zehaie F (2009) The timing and strategic role of self-protection. Environ Resour Econ 44(3):337–350

Acknowledgements

We thank Kjell Erik Lommerud, Alf Erling Risa, Sigve Tjøtta, Gaute Torsvik and Kjell Vaage an two anonymous reviewers for very helpful comments and suggestions. This research is funded by the German Federal Ministry of Education and Research (BMBF) within the funding priority ’Economics of Climate Change’ (Grant no. 01LA1106A).

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Reaction curve

The derivatives of Eq. (3) amount to

and

Note that Eqs. (A.21) and (A.22) have similar structures. Hence, we can write

Substituting in (6) leads to Eq. (7).

1.2 Absolute risk aversion

Let S be the slope of the indifference curve: [\(S\equiv \frac{d \mu _i}{d\sigma _i}|_{\bar{U}}=-\frac{U_{\sigma }}{U_{\mu }}\) with \(U_\mu >0\), \(U_\sigma <0\) and \(i=1,2\)]. Absolute risk aversion is decreasing (increasing) if the slope of the indifference curve decreases (increases) with \(\mu _i\) (see, for instance, Sinn 1989). Taking the derivative of S with respect to \(\mu _i\) yields

Hence, absolute risk aversion is

1.3 Second-order condition

The second-order conditions are

We can rewrite the second-order condition \(|D|>0\) as

with

and \(i,j=\{a,m\}\). The second-order condition is always fulfilled if we have

-

(A1)

\(A<0\)

-

(A2)

\(\alpha _{ii}-\alpha _{ij}>0\),

i.e. the cross-derivative \(U_{\mu \sigma }\) should not be too strongly positive and an increase in climate measure i reduces the marginal productivity \(\alpha _{i}\) more than an increase in measure j. The latter implies some degree of complementarity between adaptation and mitigation. In the case with perfect substitutability, we have \(\alpha _{ij}=0\).

1.4 Crowding out

The change of mitigation of country i as reaction on an increase of mitigation by country j is given by:

Taking the derivative of (12) with respect to \(m_{i}\) yields.

The corresponding derivative with respect to \(m_{j}\) is

As Eqs. (A.29) and (A.30) have similar structures, we can also write

Finally, using \(f_{a_i m_i}=f_{a_i m_j}=f_{m_i a_i}\), Eq. (A.28) can be rewritten as

A comparison with Eq. (7) immediately shows that the condition for over-crowding out is the same in the extended model as in our baseline model of Sect. 2.

Rights and permissions

About this article

Cite this article

Auerswald, H., Konrad, K.A. & Thum, M. Adaptation, mitigation and risk-taking in climate policy. J Econ 124, 269–287 (2018). https://doi.org/10.1007/s00712-017-0579-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00712-017-0579-8