Abstract

This article investigates a second-degree discrimination scheme where an online platform sells a two-version service to consumers involved in a random network. In particular, consumers choose between purchasing a premium or a free version of the service. The premium version is sold at a price and enables higher network externalities than the free version. The free version includes advertising about some product—unrelated to the service. Under the assumptions that (a) advertising rotates clockwise the inverse demand of the advertised product and (b) the platform receives a fixed portion of the revenue from the sales of the advertised product, I explore (1) how the random network, and the market conditions for the advertised product, relate to the optimal pricing of the service, and (2) the welfare implications for the platform and the consumers. Hazard rate functions are crucial for optimal pricing, and first-order stochastic dominance of the degree distribution characterizes the welfare implications. The model provides foundations for empirical analysis on degree distributions and hazard rate functions underlying complex social networks.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The last decade has witnessed a proliferation of a particular form of (quality) discrimination implemented by platforms that offer online services (web search engines, entertainment, news, sports tracking, communication, social interaction, market matching, product review, health evaluation, traffic monitoring, weather forecast, online gaming) to consumers involved in social networks. In these situations, some sort of discrimination is attractive to platforms because the targeted networks tend to feature positive externalities: the usage of the service is more beneficial to a consumer if her neighbors (e.g., family, friends, co-workers, users of the same service or of other related services) are using it as well. Given such network externalities, it is conceivable that the platform could extract a substantial amount of consumer surplus by offering individualized prices as a function of the consumer’s position in the network.Footnote 1 In practice, however, first-degree discrimination is hard to implement in complex social networks.Footnote 2 Instead, since the technology available to provide their services can be used also as a channel to advertise other products—in principle, unrelated to the service—a widely established pattern is a second-degree discrimination policy where platforms offer a two-version bundle of their services. The bundle consists of a premium version, which can be purchased at a price, and of a free version, which include ads of some other products.Footnote 3 In addition, the bundle is usually designed in a way such that the premium version allows consumers to enjoy the network externalities to a larger extent than the free version, a feature that will be referred to as externality premium in this paper.Footnote 4 The platform receives then a compensation, which is usually based on the amount of ads served or on the profits from the advertising activity. This nowadays ubiquitous business practice is commonly referred to as versioning in the business literature.

Whereas the incentives for perfect price discrimination in social networks are now fairly well understood by economists, second-degree discrimination through versioning with advertising has received little formal study. Understanding the simple economics of this type of second-degree discrimination is the goal of this article. The essential features and main implications of the model are outlined as follows.

1. The social network To overcome the difficulties of dealing with complex networks, the platform is assumed to rely on the empirical regularities that exhibit most social networks.Footnote 5 Considering random networks allows for a tractable framework in many environments. In particular, based on random networks, this article explores how (a) the degree distribution of the network and (b) the impact of advertising on the profitability of the advertised product affect (1) the incentives of the platform to pursue versioning with advertising, (2) the platform’s optimal pricing strategy, (3) the platform’s optimal profits, and (4) consumer surplus.

Random networks are usually best interpreted from a dynamic perspective where the underlying degree distribution determines how the average neighborhood size evolves over time. The role of the random network in the platform’s optimal pricing can be pinpointed by the degree distribution that generates the network and by its associated hazard rate function. On the one hand, through the incentives provided to consumers by the network externalities, the shape of the degree distribution directly determines the demands of both versions of the service. Other things equal, because of the externality premium, consumers with relatively large neighborhoods (or that expect to have relatively large neighborhoods in the future, for dynamic interpretations of the model) prefer the premium version rather than the free one. As a consequence, the demand of the premium version is positively related to the probability that the network generates relatively large neighborhoods. On the other hand, the hazard rate function of the random network characterizes the price-elasticity of the demand for the premium version of the service and, through this channel, is crucial to determine whether or not increasing the service price raises the profits from the service sales.

2. The role of advertising Following Lewis and Sappington (1994), and Johnson and Myatt (2006), the analysis considers that advertising helps consumers to improve their knowledge of their true underlying preferences for the product. In particular, as in Johnson and Myatt (2006), advertising is assumed to rotate clockwise the inverse demand of the product.Footnote 6 While this assumption does not place strong restrictions, it encompasses models of signaling advertisingFootnote 7 and models where advertising lowers the price-elasticity of the demand, as captured by Assumption 3.

Advertising influences (only) free version adopters’ opinions about the advertised product and, through the induced perturbations on the product’s demand, this affects the revenue from its sales as well. In short—when the platform’s profits are positively related to the revenue from the advertised product’s sales—the key trade-off that the platform faces is whether to rely on the profits from the sales of the premium version of the service or from its advertising activity through the free version.Footnote 8

In the proposed setup, there is no price discrimination on the advertised product, and the network externalities affect only the usage of the service but not the consumption of the advertised product.

3. Compensation contracts One assumption is important to restrict attention to the addressed research questions and helps enormously to make the analysis tractable. The real-world contracts that regulate the compensation received by platforms from their advertising activities are diverse and complex. It is hard to obtain a clear and unified specification of how such compensations enter in practice the platforms’ profit functions. While some platforms receive a fixed compensation, others receive a compensation based either on the amount of ads provided or on the revenue from the sales of the advertised product. Even further, some platforms are able to offer personalized ads of the product based on how each consumer uses the service and receive their compensations based on the targeted consumers’ characteristics.Footnote 9 Notably, though, some platforms are in fact—at least to some degree—integrated with the company that sells the advertised product.Footnote 10 Since the main goal of this paper is to study the relationship between the platform and the consumers, the analysis abstracts from the plausible relationships that may exist between the platform and the company whose product is advertised. Using a reduced form, both companies are modeled as being integrated and acting as a single monopolist that offers both commodities, the online service bundle and the advertised product. Yet, the crucial ingredient that this assumption seeks to capture is that the platform benefits when the impact of its advertising activity is positive on the product’s sales, which seems a conceivable relationship in many environments.

4. Main results When the market conditions for the advertised product leads to relatively low optimal prices of the advertised product, Proposition 1 shows that the platform prefers to offer only the premium version rather than pursuing versioning. For interior optimal prices where the platform optimally serves both versions of the service, the pricing strategy depends crucially on the hazard rate function of the degree distribution (Lemma 1). Proposition 2 studies the relation between the optimal pricing strategies for the service and the advertised product. For increasing hazard rates of the degree distribution, the optimal prices of the service and of the advertised product always move in the same direction, whereas decreasing hazard rates with sufficiently high slope (in absolute value) are required for optimal prices to move in opposite directions. Under the stronger assumption that advertising reduces the price-elasticity of the advertised product (Assumption 3), Corollary 1 provides a clear-cut condition on the hazard rate function of the degree distribution under which the optimal prices of the service and the product move in the same direction.

Application of the classical first-order stochastic dominance notion to the degree distribution of the random network characterizes completely the model’s welfare implications. First-order stochastic dominance over the degree distribution follows if and only if the network that dominates yields higher optimal profits to the platform (Proposition 4) and lower values of consumer surplus (Proposition 5). Other welfare insights follow by comparing consumer surplus in situations where the platform optimally pursues versioning to others where it optimally serves only the premium or the free version. Interestingly, consumer surplus is always lower when the platform pursues versioning, compared to the cases where it serves only the premium version (Proposition 6).

The empirical literature on social networks suggests that most large but relatively sparse social networks adjust to the pattern of scale-free networks, which are governed by power law degree distributions and thus feature decreasing hazard rates.Footnote 11 In contrast, other recent empirical studies have documented that relatively dense and well-connected networks tend to diverge from the scale-free/power law pattern and adjust rather to the exponential degree distribution pattern, which features constant hazard rate functions.Footnote 12 Motivated by the existing empirical studies, the model developed here is therefore applied to both the power law degree distribution and the exponential degree distribution (in Sect. 5). The application of the model to the power law degree distribution provides a closed form that relates key optimal pricing features in a neat way to the parameter of the distribution. As for the application to the exponential degree distribution, the optimal price of the service always increases in the difference of optimal profits (with and without advertising) from the product’s sales. Interestingly, the shapes of the hazard rate functions of both degree distributions lead to that the optimal prices of the service and the product always move in the same direction, so that a rise in the price of the service always makes consumers worse off. Also, by studying how the condition provided in Proposition 3 works for both degree distributions, it follows that if the platform finds optimal to set relatively high prices of the service, this may lead ultimately to the provision of only the free version of the service. Finally, comparison of the two applications delivers the insight that, when advertising becomes more attractive in the sense that it increases the positive impact of advertising on the profits from the product’ sales, the platform has more incentives to rely on its advertising activity under power law distributions, relative to the cases of social networks generated by exponential distributions. These findings seem to be consistent with the casual observation that most online platforms that sell their services to large and relatively sparse Internet-based networks (such as the networks of Google or Twitter users) tend to offer only free versions of their services, with attached ads, whereas platforms serving to well-connected Application-based networks (such as the networks of users of most exercise and health tracking applications) are relatively opting more for offering both versions of their services. The model is also consistent with the observation that platforms that in practice operate in networks with high externality premiums offer only the premium versions of their services (such as Whatsapp—for some smart devices—or Tinder).

Lastly, given the generality of the inverse demand functions and of the degree distributions considered, this article does not explore conditions that guarantee that optimal prices are interior or unique. The optimal prices explored in the two main applications, though, are interior and (under very mild conditions) unique.

1.1 Literature connections

To the best of my knowledge, this is the first paper that explores second-degree discrimination in social networks by means of a two-version service bundle where one of the versions offers advertising. The current paper is nonetheless profoundly influenced by several fields of research in economics. At a general level, this article is related to the prolific literature, initiated by Farrell and Saloner (1985), and Katz and Shapiro (1985), that explores the effects of network externalities on economic decisions and to the classical second-degree discrimination analysis of Mussa and Rosen (1978), and Maskin and Riley (1984), wherein a monopolist offers a menu of different qualities of a single product.

The approach pursued here to advertising owes much to the notion of informative advertising developed by Lewis and Sappington (1994), and Johnson and Myatt (2006). Regarding the assumed role of advertising, there is also a deep connection with the structure of the endogenous information decision problem explored by Amir and Lazzati (2016) in the context of (common value) Bayesian supermodular games proposed by Van-Zandt and Vives (2007).Footnote 13 As in supermodular structures, consumers’ demand decisions and valuations of the advertised product are complements in the current article. Given this, as Johnson and Myatt (2006) shows, the assumption that the inverse demand of the advertised product rotates clockwise implies that the platform optimally wishes to provide either fully informative or totally non-informative advertising. Although their motivation is quite different, Amir and Lazzati (2016) consider an information structure that is convex in the supermodular order, which is conceptually similar to the assumption on demand rotation effects induced by higher advertising informative quality.

The technical side of the paper is related to the voluminous literature on random networks that started with the influential work of Erdös and Renyi (1959). The notion of random networks used in the article meets the assumptions of the canonical configuration model, which was proposed by Bender and Canfield (1978), and subsequently applied by a number of articles in the social networks area.Footnote 14 The article’s interpretations of the role of the hazard rate function of the network degree distribution rely heavily on the micro-founded model provided recently by Shin (2016). Using a dynamic benchmark, Shin (2016) provides a full characterization result wherein increasing hazard rates arise if an only if nodes are less (or equally) likely to engage in new links as their degrees increase.

Although less closely related, the current article also complements the recent works on optimal targeting and advertising strategies through local word-of-mouth communication, which have been investigated by a number of articles since the seminal contributions of Ellison and Fudenberg (1995), and Bala and Goyal (1998).Footnote 15 The current article departs from those contributions in two respects. First, the novel form of second-degree discrimination with advertising here proposed is not present in those works. Secondly, the current model does not consider that the information about the advertised product flows through the network depending on how consumers are linked. While information is transmitted publicly to all free version adopters, the only role of the network is to provide consumers with the incentives for their purchasing decisions, depending on the size of the externality premium.

The paper’s questions are, to some extent, related to the motivation followed by Eliaz and Spiegler (2017) who explore a model where a platform targets consumers that are involved in a network and offers them personalized ads. The platform receives then compensations from the firms whose products are advertised, which are based on the characteristics of the targeted consumers. Their analysis focuses on proposing incentive-compatibility mechanisms that fully extract the surplus of the firms.

Finally, Gramstad (2016) has recently addressed questions similar to the ones explored here by considering a monopolist that allows consumers to choose from a menu of differentiated products in the presence of local externalities. While Gramstad (2016) explores the role of the network structure in optimal pricing when consumers may choose between different versions of a product, as the current article does, there are important differences between both approaches. The main one is that a mechanism such as advertising, which influences consumers’ valuations, is absent in Gramstad (2016)’s analysis. In addition, the size of the network externality in the model proposed here depends only on the version chosen by the consumer herself and not on the versions chosen by her neighbors. The model presented here considers a single market for a (two-version) service, whereas Gramstad (2016) focuses more on segmented markets along the network.

The rest of the article is organized as follows. Section 2 lays out the model, and Sect. 3 describes the model’s main results on the platform’s optimal pricing policy. Section 4 explores the role of the degree distribution that underlines the social network in the platform’s optimal profits and in consumer surplus under the proposed scheme of versioning with advertising. Section 5 provides the main applications of the model, and Sect. 6 concludes. The proofs omitted in the text are relegated to the Appendix.

2 The model

There is a unit mass of consumers, indexed by \(i \in [0,1]\), that can purchase two unrelated commodities, a two-version online service and a consumption product. The two-version service is provided at no cost by a platform, and it consists of a premium version and a free version. The consumption product is offered by a monopolist that produces \(z \ge 0\) units, at a marginal cost \(c>0\), and sets a price \(p \ge 0\) for each unit. The monopolist does not price discriminate and, thus, the price p is common to all consumers. Each consumer has a unit demand for the service and I will use exchangeably the expressions “purchase” or “adopt” a version of the service. I will refer to the policy where the platform finds optimal to serve both versions of the service as versioning.Footnote 16 Through versioning, the platform follows a second-degree discrimination policy where the consumers self-select themselves to adopt one version or the other. Premium version adopters pay a price \(q \ge 0\) for each unit of the service. Free version adopters pay nothing for the service, but, attached to the service, they receive ads about the consumption product. Premium version adopters do not receive ads. Throughout the article, the notation \(a=0\) or \(a=1\) will indicate, respectively, that ads about the product are either absent or present.

As a compensation from its advertising activity, the platform is assumed to receive a fixed fraction \(\alpha \in (0,1]\) of the profits from the product’s sales.Footnote 17 Although in many real-world situations, it is hard for platforms to make their compensations from advertising contingent on the revenue that their ads generate, this assumption can be seen as capturing a reduced form of a simple relationship where successful advertising increases the platform’s compensation.Footnote 18

A consumer is willing to pay up to \(\omega \) for a single unit of the product and up to \(\theta \) for a single unit of the service. Conditional on receiving an advertising level \(a \in \left\{ 0,1\right\} \), the valuation for the product \(\omega \) is drawn from a distribution \(F_{a}(\omega )\), with support on some interval \((\underline{\omega },\overline{\omega }) \subseteq \mathbb {R}_{+}\) and density \(f_{a}(\omega )\). The valuations of the product are independent across consumers. The valuation of the service \(\theta \) is randomly drawn from some real interval \((\underline{\theta }, \overline{\theta }) \subseteq \mathbb {R}_{++}\), with \(\underline{\theta }>0\).Footnote 19 The valuations of the service are independent across consumers as well. The two commodities are totally unrelated, and therefore, the valuations \(\omega \) and \(\theta \) are assumed to be independent from each other.

The market conditions for the advertised product are therefore fully described in the model by the distributions of valuations \(\left\{ F_{0}(\omega ), F_{1}(\omega )\right\} \) and by the cost parameter c. Such market conditions are primitives that determine how advertising impacts the profitability of the advertised product’s sales.

2.1 The network and consumer preferences

The consumers are embedded in an (exogenous) complex social network.Footnote 20 The network allows consumers to interact locally with respect to their consumptions (only) of the service. The consumption of the service exhibits a local (positive) network effect: a consumer’s utility from (any version of) the service increases as her neighbors increase their consumptions. These externalities capture the idea that the total utility from using the service is positively related to the number of neighbors who are using it.Footnote 21 The size of the externality that accrues to each service adopter depends on the version that she chooses but not on the versions chosen by her neighbors.

The network is assumed to be stochastically generated to capture its complexity and the uncertainty that the platform and the consumers may have about its architecture, as well as to allow for dynamic interpretations where the network evolves over time. The platform and the consumers are uncertain about the specific architecture of the network, but they commonly know the stochastic process that generates it. There is a set \([\underline{n},\overline{n}] \subseteq \mathbb {R}_{+}\) of possible neighborhood sizes, or degrees in the social network.Footnote 22 Let \(n_{i} \in [\underline{n},\overline{n}]\) denote a possible degree for consumer i. The degree distribution of the social network is given by a twice continuously differentiable distribution \(H_{s}(n)\), with a strictly positive density \(h_{s}(n)\) over the support \([\underline{n},\overline{n}]\). The parameter \(s \in [\overline{s},\underline{s}]\) indexes a family of degree distributions.

Let \(x_{i}\) be the probability that consumer i buys the premium version of the service and let \(x_{s}(q)\) be the fraction of premium version adopters at price q, conditioned on the degree distribution \(H_{s}(n)\). Also, in consonance with earlier notation, let \(z_{i}\) denote consumer i’s consumption of the product. By assuming that each consumer adopts one of the versions of the service, it trivially follows that the average consumption of some version of the service across the neighbors of each given consumer equals one.Footnote 23 Therefore, in the proposed model, the number \(n_{i}\)—quite conveniently—gives us the average consumption of the service of consumer i’s neighbors (conditioned on consumer i having degree \(n_{i}\)). In addition to these considerations, the preference specification in (1) below makes use of the degree independence assumption in order to guarantee that the only relevant information about the network for each consumer is her degree.Footnote 24 The expected utility of a consumer i, conditioned on having degree \(n_{i}\), is then specified as

The expression in (1) captures the presence of local (positive) network externalities. A consumer’s utility raises by an amount of 1, when she adopts the free version of the service, or by an amount \(1+\beta \), when she adopts the premium version, for each unit of the service consumed by her neighbors, regardless of the version that the neighbors adopt. I assume that \(\beta >0\), which can be viewed formally as a single crossing condition for the two types of service adopters. The term \(\beta \) describes the presence of an externality premium. As indicated in the Introduction, this seems to be the consistent with most real-world online services where the premium version allows consumers to enjoy the network externalities to a greater extent compared to the free version.

From the preference specification in (1), it follows that the fraction of consumers that purchase the premium version of the service at price q, conditional on the degree distribution \(H_{s}(n)\), is given by

For price q, let \(n(q)\equiv {q}/{\beta }\) be the cutoff degree such that \(x_{i}=0\) if \(n_{i} \le n(q)\), whereas \(x_{i}=1\) if \(n_{i} > n(q)\). From the expression in (2) above, we observe that the fraction of consumers that purchase the premium version naturally decreases in its price q. Note that all consumers purchase the free version of the service (i.e., \(x_{s}(q)=0\)) when its price satisfies \(q \ge \overline{q}\), where the upper bound \(\overline{q}\) on the service price is given by \(\overline{q}\equiv \beta \overline{n}\). Given this implication, since we are interested in considering prices for the service in the range \(q \in (\underline{\theta },\overline{\theta })\) of the consumers’ valuations, the analysis will naturally assume that \(\overline{\theta } \ge \overline{q}\) (or, equivalently, that \(\overline{\theta } \ge \beta \overline{n}\)).

Hazard rate analysis, which has traditionally been used to account for “survival rates” in epidemiology and finance, is useful in the proposed framework to capture key features of how the random network evolves in dynamic interpretations of the model. The hazard rate function of the random network with distribution degree \(H_{s}(n)\) is the function on \([\underline{n},\overline{n}]\) defined as

For dynamic interpretations where the network evolves over time, the function \(r_{s}(n)\) gives us the probability that a randomly selected consumer has approximately n neighbors in a subsequent period,Footnote 25 conditioned on her current neighborhood size being no less than n.

Notably, the sensitivity of the demand \(x_{s}(q)\) of the premium version of the service with respect to its price depends on the externality premium \(\beta \) and on the random process that generates the network. In particular, the price-elasticity of the demand \(x_{s}(q)\) is characterized by the hazard rate that underlines the random network. Algebraically, the price-elasticity \(\epsilon _{s}(q)\equiv -q{x^{\prime }_{s}(q)}/{x_{s}(q)} \) of the demand \(x_{s}(q)\) equals

Consequently, the main insights into the platform’s optimal pricing in the proposed setup are deeply related to the hazard rate of the degree distribution.

2.2 Advertising the product

Leaving aside strategic or dynamic issues, the literature on advertising has traditionally considered three types of ads: persuasive, complementary, and informative ads [e.g., Bagwell (2007) or Renault (2015)]. Persuasive and complementary ads change the consumer’s preferences for the advertised product.Footnote 26 On the other hand, informative advertising influences the consumers’ knowledge, or perceptions, of the product features.Footnote 27

This article considers that ads are informative and that they improve the consumers’ knowledge of their own tastes for the product. More specifically, building on the micro-foundations provided by Johnson and Myatt (2006), I assume that advertising rotates clockwise the distribution of the product valuations or, equivalently, the inverse demand of the product. At price p, conditional on receiving an advertising level \(a \in \left\{ 0,1\right\} \), a fraction \(z_{a}(p)=\mathbb {P}(\omega \ge p\, | \, a)=1-F_{a}(p)\) of consumers purchase the product. Therefore, \(P_{a}(z_{a})=F^{-1}_{a}(1-z_{a})\) gives us the inverse demand function of the consumers that receive advertising level a. The following assumption describes how the consumers’ valuations (or, equivalently, the inverse demand curve) are influenced by advertising in this model.

Assumption 1

(Rotation Effects of AdvertisingFootnote 28) There exists a single \(\omega ^{R} \in (\underline{\omega },\overline{\omega })\) such that

Equivalently, there exists a single \(z^{R} \in (0,1)\) such that

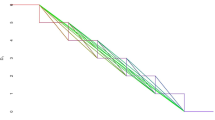

Under Assumption 1 above, advertising rotates clockwise the distribution of valuations (or, equivalently, the inverse demand function) in a way such that both functions cross exactly once. In intuitive terms, this article assumes that advertising makes the distribution of valuations “more disperse” or “more heterogenous”. Figures 1, 2, and 3 illustrate how advertising is assumed to affect distributions of valuations and, accordingly, demands in the proposed setup.

The condition stated in Assumption 1 does not place strong restrictions on the role of advertising and allows for a very flexible class of implications. By improving the consumers’ information about their valuations of the product, advertising may persuade some consumers to purchase the product while discouraging others. In particular, both increases in the variance of the valuations and reductions in the price-elasticity of the product are particular cases captured by Assumption 1. The density function \(f_{a}(\omega )\) under advertising (\(a=1\)) reflects more dispersion of the product valuations than without advertising (\(a=0\)). The relation between \(F_{0}(\omega )\) and \(F_{1}(\omega )\) imposed by Assumption 1 is a bit more general than second-order stochastic dominance as it does not require mean-preserving.Footnote 29

2.3 Profit functions

Let \(\pi _{a}(\omega ) \equiv (\omega -c)[1-F_{a}(\omega )]\) (or, equivalently, \(\pi _{a}(p) \equiv (p-c)z_{a}(p)\)) be the profits from the product’s sales for a level of advertising \(a \in \left\{ 0,1\right\} \). Because advertising affects (some of) the consumers’ willingness to pay for the product, the profits from the product’s sales depend on the fraction \(x_{s}(q)\) of premium version adopters. Given a degree distribution \(H_{s}(n)\) and a price q for the service, the monopolist wishes to set a price \(p^{*}_{s}\) for the product so as to maximize the profits from the product’s sales

Price discrimination is not allowed for the advertised product so that, as mentioned earlier, all consumers face a common price p, regardless of the version of the service that they adopt.Footnote 30 Let \(\Delta (p) : (\underline{\omega },\overline{\omega }) \rightarrow \mathbb {R}\) be the function that specifies the difference

in profits from the product’s sales when advertising is present with respect to the situation without advertising, for each price of the product p. The function \(\Delta (p)\) is therefore a primitive of the model: its shape describes the market conditions for the product and, in particular, specifies how advertising affects the profitability of the product’s sales at each price p.

This article will restrict attention to the fairly general class of inverse demand functions such that the profit functions \(\pi _{a}(p)\), for \(a \in \left\{ 0,1\right\} \), and \(\pi \big (p,q\big )\) have a unique interior maximum, for each given price q of the service. In addition, to make the problem of discrimination through versioning interesting we need to assume that advertising indeed allows the monopolist to achieve higher profits than in the absence of it.Footnote 31 The following assumption will be maintained throughout the article.

Assumption 2

For the advertising levels \(a \in \left\{ 0,1\right\} \), given a price of the service \(q \in (\underline{\theta },\overline{\theta })\), the distributions \(F_{a}(\omega )\) of consumer valuations (or, equivalently, the demand inverse functions \(z_{a}(p)\)) of the product are such that:

-

(i)

each profit function \(\pi _{a}(\omega )\) has a unique interior maximum \(\omega ^{*}_{a} \in (\underline{\omega },\overline{\omega })\) for \(a \in \left\{ 0,1\right\} \), the profit function \(\pi \big (p,q\big )\) has a unique interior maximum \(p^{*}_{s} \in (\underline{\omega },\overline{\omega })\), and

-

(ii)

given the unique interior maxima \(\omega ^{*}_{0}\) and \(\omega ^{*}_{1}\), the condition \(\pi _{1}(\omega ^{*}_{1})>\pi _{0}(\omega ^{*}_{0})\) is satisfied.

Given an optimal price \(p^{*}_{s}\) of the product, the objective of the platform is then to choose a price \(q^{*}_{s}\) for the service so as to maximize its profits

Formally, the optimal choices \((p^{*}_{s},q^{*}_{s})\) correspond to a subgame perfect Nash equilibrium of the (perfect information) game where the monopolist chooses first the price of the product and then the platform selects a price for the service. Existence of equilibrium is guaranteed because the profits specified in (4) and (5) are continuous functions on compact convex sets. Interestingly, using backwards induction, the optimal choices of both prices are determined by solving the platform’s decision problem \(\max _{(p,q) \in \mathbb {R}^{2}_{+}} {\varPi }(p,q)\). Provided that \(\alpha >0\), the monopolist and the platform have common interests with respect to the choice of the price p of the advertised product. Analytically, the monopolist’s decision can then be ignored since the platform is the player that optimally chooses both prices \(p^{*}_{s}\) and \(q^{*}_{s}\).Footnote 32 Using the expression in (5) for the platform’s profits, we can write the value function of the platform’s problem as

The value function \({\varPi }^{*}(s)\) will be our key expression to explore the how the degree distribution of the social network affects the platform’s optimal profits.

3 Optimal pricing

A rise in the price q of the service has two effects on the platform’s profits. First, higher prices naturally increase the revenue for each unit sold of (the premium version of) the service. Secondly, as more consumers purchase the free version, the advertising activity of the consumption product increases. More advertising could lead to an increase in the revenue from the product’s sales, which benefits the platform through the compensation that it receives from the product’s sales. In short, the platform must solve the dilemma of whether making its profits from the sales of the premium version of the service or from its advertising activity through the free version. The conflict between these two effects is captured by the term \(q-\alpha \Delta (p)\) in the optimal profits specified in (6). The final implications on the platform’s profits are, in principle, ambiguous. On the one hand, they depend on the shape of the inverse demand functions of the product (\(z_{a}(p)\)) and on the production cost (c); in other words, they depend on the market conditions of the product. Notably, in the current benchmark, the final effects on the platform’s profits also rely substantially on the network that connects the consumers (\(H_{s}(n)\)), and on the externality premium that it enables (\(\beta \)).

3.1 “Only premium version” as optimal decision

The first result on optimal pricing deals with an interesting class of optimal corner choices. Proposition 1 establishes that the platform prefers to provide only the premium version of the service, rather than discriminate through versioning, for relatively low prices of the product. A direct implication of Assumption 1 on the role of advertising is that the profit functions \(\pi _{0}(p)\) and \(\pi _{1}(p)\) cross exactly once, at the rotation valuation \(p=\omega ^{R}\). Assumption 1 directly implies that, for each given valuation \(\omega \),

In other words, \(\pi _{0}(p)>\pi _{1}(p)\) if and only if \(p< \omega ^{R}\). Therefore, \(\Delta (p^{*}_{s})<0\) for optimal prices of the product \(p^{*}_{s} \in (\underline{\omega },\omega ^{R})\). Then, by using the expression in (5) for the platform’s profits, it follows that the platform’s optimal choice entails \(x^{*}_{s}=1\). Under the fairly general role of advertising imposed by Assumption 1, the profits from the product’s sales under advertising are lower than without advertising for relatively low prices of the product. In these cases, the platform prefers to offer only the premium version of the service. On the other hand, for optimal prices of the product \(p^{*}_{s} \in (\omega ^{R},\overline{\omega })\), we have that \(\Delta (p^{*}_{s})>0\). From the form of the profits of the platform described by (5), we observe that providing both versions of the service is optimal only if \(p^{*}_{s} >\omega ^{R}\). The result in Proposition 1 follows directly from the previous arguments.

Proposition 1

Consider a random social network with degree distribution \(H_{s}(n)\). Under Assumptions 1 and 2, the platform optimally chooses to provide only the premium version of the service when the price of the product is relatively low, i.e., for each \(p^{*}_{s} \in (\underline{\omega },\omega ^{R})\).

The platform may find optimal to pursue a discrimination policy through versioning only for prices of the product higher than \(\omega ^{R}\). The result in Proposition 1 above only requires that advertising rotates the inverse demand around some price higher than the lowest valuation \(\underline{\omega }\) (Assumption 1). In other words, offering only the premium version is the platform’s optimal choice for relatively low prices of the advertised product if one simply considers that advertising raises the dispersion of the product’s valuations.

Figure 4 displays a situation where the proportion of premium version adopters \(x_{s}\) is not optimal for the platform to pursue versioning. Here, the platform “best-replies” by offering only the premium version. On the other hand, Figure 5 displays a situation where the platform prefers to pursue versioning for the proportion \(x_{s}\) of premium version adopters.

3.2 Versioning as optimal decision

The model’s implications on discrimination through versioning are obtained when attention is restricted to interior optimal choices \(x_{s}(q^{*}_{s}) \in (0,1)\).Footnote 33 Lemma 1 gives us the necessary and sufficient conditions for interior optimal prices. Moreover, Lemma 1 provides also the key condition that ensures that the platform optimally pursues versioning rather than serve only the free version of the service.

A caveat of the model to conduct comparative statics exercises is in order here. Despite the sufficient condition provided by Proposition 1, the structure of the model is not appropriate to compare in general situations where the platform pursues versioning with others where it offers only the premium version. Since \(\underline{\theta }>0\), by construction all consumers prefer at least the free version rather than no purchasing any version of the service whatsoever. This enables us to compare the case where the platform serves only the free version and, accordingly, all consumers adopt the free version, with other situations where the platform offers both versions. However, the model’s assumptions do not guarantee that all consumers would purchase the premium version if this were the only version offered in the market. The fraction of consumers that would purchase the service if only the premium version were served, which can be denoted as \(\tilde{x}_{s}(q)\), would depend only on the relation between the valuation \(\theta \) and the service price q. In the current model, such a fraction of consumers \(\tilde{x}_{s}(q)\) would be different from the fraction of premium version adopters \(x_{s}(q)\) under versioning. For this reason, the comparison between the associated profits to the platform would not be appropriate.

Lemma 1

Let Assumptions 1 and 2 hold. Consider a random social network with degree distribution \(H_{s}(n)\) and suppose that \(p^{*}_{s} \in (\omega ^{R},\overline{\omega })\) is an optimal price of the consumption product. Then, if the interior service price \(q^{*}_{s} \in \left( \underline{\theta }, \overline{\theta } \right) \) corresponds to an optimal choice by the platform, the following first-order condition must be satisfied:

If, in addition to condition (7), the interior service price \(q^{*}_{s}\) satisfies the second-order condition

then it corresponds to an optimal choice by the platform. Moreover, the platform optimally chooses an interior optimal price \(q^{*}_{s}\) rather than serve only the free version of the service if the condition

is satisfied.

The result provided by Lemma 1 is central to the analysis of the platform’s optimal pricing decisions when it offers both versions of the service. In particular, condition (7) provides an intuitive interpretation of the platform’s incentives to choose its optimal (interior) prices for the service: the marginal revenue from the premium version sales, \(q^{*}_{s}\), must be equal to the increase of revenue from the product’s sales derived by switching from no advertising to advertising, \(\alpha \Delta (p^{*}_{s})\), plus the term \(\beta /r_{s}\big (n(q^{*}_{s})\big )\) which specifies the inverse of the price-elasticity of the demand \(x_{s}(q)\) of the premium version of the service. At the optimal pricing strategy, the term \(\beta /r_{s}\big (n(q^{*}_{s})\big )\) gives us the marginal utility to consumers due to the externality gain induced by switching from the free to the premium version, normalized by the conditional probability that the cutoff degree \(n(q^{*}_{s})\) in the social network is maintained. In short, the platform’s optimal price of the service \(q^{*}_{s}\) depends additively on the change in the profits induced by advertising and on the network features. Such network features are summarized by the externality premium \(\beta \) and the conditional probability \(r_{s}(n)\) that the degree of a randomly chosen consumer increases as the network grows.

Proposition 1 showed that, for optimal prices of the advertised product \(p^{*}_{s}\) such that \(\Delta (p^{*}_{s})<0\), the platform always chooses to provide only the premium version of its service. For optimal prices \(p^{*}_{s}\) such that \(\Delta (p^{*}_{s})>0\), the equilibrium condition in (7) allows us to obtain insights as to how the shape of the hazard rate function influences the relationship between the difference of profits \(\Delta (p^{*}_{s})\) and the optimal price of the service \(q^{*}_{s}\). Suppose that, starting from certain optimal prices \(p^{*}_{s}\) and \(q^{*}_{s}\), the difference in profits \(\Delta (p_{s})\) increases (for prices \(p_{s}\) around the equilibrium price \(p^{*}_{s}\)). Other things equal, we observe from the expression in (7) that, in order to get back again to satisfy the equilibrium condition, the platform needs to change \(q^{*}_{s}\) so as to increase the difference \(\rho _{s}(q_{s}) \equiv q_{s}-\frac{\beta }{r_{s}(q_{s}/\beta )}\). Now, compare a situation where the hazard rate is decreasing (in a sufficiently large subset of \([\underline{n},\overline{n}]\) that contains \(q^{*}_{s}/\beta \)) with another where it increases. For decreasing hazard rates, an increase of \(q_{s}\) becomes (to a lower or higher extent) offset by the induced increase in \(\frac{\beta }{r_{s}(q_{s}/\beta )}\). In particular, if \(r_{s}(\cdot )\) is decreasing, then any increase induced in \(\rho _{s}(q_{s})\) by a certain increase \(\Delta q_{s}\) is lower than the increase induced by the same change \(\Delta q_{s}\) in situations where \(r_{s}(\cdot )\) is instead increasing. Furthermore, for sufficiently decreasing hazard functions \(r_{s}(\cdot )\), \(\rho _{s}(q_{s})\) can even be decreasing in the price \(q_{s}\). As a consequence, in order to re-establish the condition in (7), for those cases where the difference \(\rho _{s}(q_{s})\) is increasing in \(q_{s}\), the optimal price \(q^{*}_{s}\) needs to increase more under decreasing hazard rates relative to situations with increasing hazard rates. On the other hand, if the hazard rate that underlines the social network is negative and sufficiently high (in absolute value) so that the difference \(\rho _{s}(q_{s})\) decreases in \(q_{s}\), then the platform needs to lower its optimal price \(q^{*}_{s}\) to meet the required equilibrium condition. The qualitative implications in this respect are therefore very sensitive to the particular form of the hazard rate function. Specifically, under the assumptions of the model, we have

Therefore, for decreasing hazard rates, increases in the difference of profits \(\Delta (p^{*}_{s})\) lead to decreases in the optimal price \(q^{*}_{s}\) and, therefore, to a lower proportion of free version adopters if the hazard rate further satisfies the inequality \(\left| r^{\prime }_{s}(n(q_{s}))\right| > \left[ r_{s}(n(q_{s}))\right] ^{2}\).Footnote 34 When a decreasing hazard rate does not satisfy such a condition, then the induced increase in the optimal price \(q^{*}_{s}\) is higher relative to each situation where the social network exhibits increasing hazard rates. As a consequence, the proportion of free version adopters increases relatively more.

The final condition provided by Lemma 1 tells about the incentives of the platform to actually pursue versioning rather than serve only the free version of the service. Because the difference of profits \(\pi _{1}(\omega ^{*}_{1})-\pi _{1}(p^{*}_{s})\) is bounded, we observe from the requirement in (9) that, under the conditions specified in (7) and (8), the platform prefers to pursue versioning rather than serve only the free version of the service for sufficiently high values of the externality premium \(\beta \). This is very intuitive because higher values of the externality premium make more attractive the premium version.

Application of the implicit function theorem to the first-order condition in (7) of Lemma 1 allows us to study the relation between local changes in the optimal interior prices of the product and the service. Suppose that, starting from some interior optimal pair \((p^{*}_{s},q^{*}_{s})\), the price of the service increases locally. Then, Proposition 2 can be used to obtain testable implications as to whether the monopolist will “best-reply” by either increasing or decreasing the price of the product.

Proposition 2

Consider a random social network with degree distribution \(H_{s}(n)\) and suppose that \(p^{*}_{s} \in (\omega ^{R},\overline{\omega })\) and \(q^{*}_{s} \in \left( \underline{\theta }, \overline{\theta } \right) \) are interior optimal prices of the consumption product and the service. Suppose that the optimal price of the service \(q^{*}_{s}\) increases locally. Under Assumptions 1 and 2, it follows that

Moreover, if \(q^{*}_{s}\) corresponds to an interior optimal choice, then it must be the case that \(\pi ^{\prime }_{0}(p^{*}_{s})<0\) and, in addition, either (a) \(\pi ^{\prime }_{1}(p^{*}_{s})>0\), or (b) \(\pi ^{\prime }_{1}(p^{*}_{s})<\pi ^{\prime }_{0}(p^{*}_{s})\).

To obtain unambiguous implications from Proposition 2, we must study the relation existing between the slopes of the functions \(\pi ^{\prime }_{0}(p^{*}_{s})\) and \(\pi ^{\prime }_{1}(p^{*}_{s})\), for each optimal price \(p^{*}_{s} \in (\omega ^{R},\overline{\omega })\). Assumption 1, though, is too general so as to place such relevant restrictions on the slopes of the profit functions. Assumption 3 imposes further structure on the role of advertising by considering that advertising decreases the price-elasticity of the product demand.Footnote 35 Let \(\varepsilon _{a}(p)\equiv -{p z^{\prime }_{a}(p)}/{z_{a}(p)}\) be the price-elasticity of the product demand under advertising level \(a\in \left\{ 0,1\right\} \).

Assumption 3

(Decreasing Elasticity) For each \(p \in (\underline{\omega },\overline{\omega })\), advertising lowers the price-elasticity of the product demand, \(\varepsilon _{1}(p)<\varepsilon _{0}(p)\).

Using the definition of price-elasticity of the product demand and the expression of the profits from the sales of the product under advertisement level a, we can write

By Assumption 1, it follows that \(z_{0}(p^{*}_{s})< z_{1}(p^{*}_{s})\) for each \(p^{*}_{s} \in (\omega ^{R},\overline{\omega })\). Then, if we further impose Assumption 3, it follows from the expression in (11) that \(\pi ^{\prime }_{0}(p^{*}_{s})<\pi ^{\prime }_{1}(p^{*}_{s})\). This relation gives us the case (a) of Proposition 2 if, in addition, we have \(\pi ^{\prime }_{1}(p^{*}_{s})>0\). From the expression in (11), we obtain that the slope of the profit function \(\pi _{1}(p)\) is positive at price \(p^{*}_{s}\) if and only if \(\varepsilon _{1}(p^{*}_{s})<p^{*}_{s}/(p^{*}_{s}-c)\). These arguments yield the following corollary to Proposition 2.

Corollary 1

Consider a random social network with degree distribution \(H_{s}(n)\) and suppose that \(p^{*}_{s} \in (\omega ^{R},\overline{\omega })\) and \(q^{*}_{s} \in \left( \underline{\theta }, \overline{\theta } \right) \) are interior optimal prices of the consumption product and the service such that \(\varepsilon _{1}(p^{*}_{s})<p^{*}_{s}/(p^{*}_{s}-c)\). Suppose that the optimal price of the service \(q^{*}_{s}\) increases locally. Under Assumptions 2 and 3, it follows that

When advertising lowers the price-elasticity of the product demand—and such price-elasticity is sufficiently low under advertising—optimal prices move in opposite directions only if the hazard rate of the degree distribution is decreasing around the cutoff degree \(n(q^{*}_{s})\) at the optimal price. In addition, the corresponding (negative) slope of the hazard rate must be sufficiently high (in absolute value).

The hazard rate \(r_{s}(n)\) of the degree distribution provides an interesting measure when we interpret the social network as a collection of consumers’ degrees that evolve dynamically according to some stochastic law. Suppose that, up to a certain period t, there are no neighborhoods in the social network of size less than some minimum level \(\widehat{n}\). Then, \(r_{s}(\widehat{n})\) can be interpreted as the odds that, in the subsequent period \(t+1\), consumers have a number of links approximately equal to such a former minimum value \(\widehat{n}\). Using this dynamic interpretation, increasing hazard rates indicate that if the average neighborhood size increases over time, then it becomes very likely to have a reversal in this growing tendency because at \(t+1\) the consumers tend to have a number of neighbors around the minimum value \(\widehat{n}\), which was already achieved in the previous period t. Decreasing hazard rates imply higher probabilities that consumers have degrees in the future that diverge from the current minimum degree, thus making it more likely that the network maintains its minimum neighborhood size as it grows.

Those dynamic interpretations have recently received quite appealing formal microeconomic foundations by Shin (2016). Under the assumptions of the canonical configuration model to formalize how the random graph is generated,Footnote 36 Shin (2016) (Proposition 2) shows that increasing hazard rates follow if and only if a node is less likely to form additional new links as her degree increases. On the other hand, with decreasing hazard rates, the degree of a randomly chosen node becomes arbitrarily large as the average neighborhood size increases (Shin 2016, Proposition 3). Thus, by combining the result in Corollary 1 with the insights provided by Shin (2016) (Proposition 2), we obtain the implication that if the network evolves in a way such that a node is less likely to form additional new links as her degree increases, then necessarily optimal prices move in the same direction. On the other hand, the random network must evolve in a way such that a node becomes very likely to form new links as her degree increases for optimal prices to move in opposite directions.

The final part of this section explores a class of optimal corner choices where the platform prefers to offer only the free version of the service. Proposition 3 provides a sufficient condition under which the platform prefers to offer only the free version of the service.

Proposition 3

Consider a random social network with degree distribution \(H_{s}(n)\). Under Assumptions 1 and 2, the platform finds optimal to provide only the free version of the service if the following condition holds

where \(q^{\mathrm {pm}}_{s}\) is the (interior) optimal price that the platform sets for the service when it provides only the premium version.

The sufficient condition provided by Proposition 3 unveils an interesting mechanism that may lead the platform to ultimately provide only the free version of the service. We observe from the expression of the platform’s profits given by (5) that the platform benefits from relying relatively more on the free version of the service when the market features of the product makes the advertising activity sufficiently profitable. This is very intuitive. Through this channel, the platform therefore has incentives to raise the price of the service so as to increase the proportion of free version adopters. Suppose that the network structure and the externality premium lead to that the profits from the premium version sales always increase in its price. The type of situations identified by Proposition 3 is then based on the attainment of corner solutions where the premium version becomes so expensive that all consumers are driven to choose the free version. This is in turn supported as the platform’s optimal choice at equilibrium because it becomes more profitable for the platform to rely on the revenue from its advertising activity.

Although the sufficient condition stated in Proposition 3 can formally be satisfied under a broad class of degree distributions—regardless of whether their hazard rates increase or decrease—it is satisfied relatively easer for increasing hazard rates.Footnote 37 Yet, despite the analytical implication of Proposition 3, it should be emphasized that the available empirical evidence suggests that increasing hazard rates rarely govern the kind of large social networks which are usually targeted by online platforms. In contrast—though there are no empirical studies/findings on this regard—casual observation tells us that the kind of relatively small social networks formed by the set of consumers who have a particular interest in a given “reviewed and rated” good/service are extremely well-connected and, therefore, seem to adjust to increasing hazard rates. For such social networks, following a dynamic interpretation of their degree distributions, one would expect that the degree of any given consumer hardly grows as time evolves. Examples of such social networks are the networks of consumers who use the review and rating services—for a given good/service in which they are interested—served online by platforms such as Yelp or Foursquare. The consumers in these networks are linked to anyone else in the network—everyone can observe the reviews of all other users. Notably, platforms such as Yelp and Foursquare offer in practice only the free version of their services, with advertising.

Going back to the implications that stem from condition 7 of Lemma 1 for interior optimal prices, suppose that the difference in profits \(\Delta (p^{*}_{s})\) increases around the optimal price \(p^{*}_{s}\). This is naturally interpreted in the proposed setup as having a change in the conditions of the market for the advertised product so that advertising makes more profitable the sales of the product—for prices sufficiently close to \(p^{*}_{s}\). Then, let us recall that decreasing hazard rates with slopes that satisfy \(\left| r^{\prime }_{s}(n(q_{s}))\right| \le \left[ r_{s}(n(q_{s}))\right] ^{2}\)—in other words, decreasing hazard rate functions with not very steep slopes—imply higher proportions of free version adopters, relative to situations with increasing hazard rates. In fact, as the key applications of Sect. 5 show, the implication that higher prices of the service can facilitate that the platform ultimately offers only the free version can also follow under degree distributions with decreasing or constant hazard rates.

4 Welfare analysis

This section explores the role of the social network on the optimal profits of the platform and on consumer surplus under the explored second-degree discrimination scheme.

4.1 Optimal profits of the platform

Lemma 1 provides a straight-forward proof of the key result of Proposition 4, which establishes that first-order stochastic dominance over the degree distribution of the social network follows if and only if the dominating random network yields higher optimal profits—provided that attention is restricted to interior optimal prices. The following definition states the classical notion of first-order stochastic dominance in terms of local changes in the distributions.

Definition 1

The family of degree distributions \(\left\{ H_{s}(n)\right\} \) is ordered by first-order stochastically dominance (FOSD-ordered) if, for each given \(n \in [\underline{n},\overline{n}]\), we have \(\partial H_{s}(n) / \partial s<0\).

The proof of Proposition 4 follows from two basic observations. First, let us recall from (2) that, for a given price q, the fraction of premium version adopters is \(x_{s}(q)=1-H_{s}\big (n(q) \big )\) so that \(\partial x_{s}(q) / \partial s=-\partial H_{s}\big (n(q) \big ) /\partial s\). It then follows that \(\partial x_{s}(q) / \partial s>0\) if and only if the family of degree distributions \(\left\{ H_{s}\right\} \) is FOSD-ordered. Secondly, given the previous observation, we note from the expression for the value function of the platform’s problem in (6) that \(\partial {\varPi }^{*}(s) / \partial s >0\) if and only if \(q-\alpha \Delta (p) >0\). Therefore, from Lemma 1, we observe that the inequality above is guaranteed when we restrict attention to interior optimal prices \((p^{*}_{s},q^{*}_{s})\) because we have that \(\beta /r_{s}\big (n(q^{*}_{s}) \big )>0\).

Proposition 4

Suppose that the family of degree distributions \(\left\{ H_{s}(n)\right\} \) gives rise to interior optimal prices \(p^{*}_{s} \in (\omega ^{R},\overline{\omega })\) and \(q^{*}_{s} \in \left( \underline{\theta }, \overline{\theta } \right) \). Then, the platform’s optimal profits \({\varPi }^{*}(s)\) are strictly increasing in \(s \in [\underline{s},\overline{s}]\) if and only if \(\left\{ H_{s}(n)\right\} \) is FOSD-ordered.

Consider two degree distributions \(H_{s}(n)\) and \(H_{s^{\prime }}(n)\) such that \(H_{s}(n)\)FOSD\(H_{s^{\prime }}(n)\). Then, for a dynamic interpretation of random networks where the average neighborhood size increases over time, the probability \(\mathbb {P}(n > m \, |\, s)\) is higher than \(\mathbb {P}(n > m \, | \, s^{\prime })\). When m raises as the network grows over time, consumers are more likely to raise the number of their future neighbors under \(H_{s}(n)\) than under \(H_{s^{\prime }}(n)\). Therefore, because of the externality premium \(\beta \), consumers value in average the premium version of the service relatively more under \(H_{s}(n)\) than under \(H_{s^{\prime }}(n)\). This raises the platform’s revenue from the service sales without affecting any of the fundamentals of the revenue from the advertising activity. In short, the degree distribution \(H_{s}(n)\) gives the platform more flexibility in its discrimination problem, which allows for higher optimal profits, relative to the optimal profits attainable under the distribution \(H_{s^{\prime }}(n)\).

4.2 Consumer surplus

In the current setting, consumer surplus at prices (p, q) is given by the expression

The following lemma derives a useful expression for the consumer surplus.

Lemma 2

Under the preference specification in (1), consumer surplus at prices (p, q) can be written as

An immediate insight follows from the form of the consumer surplus obtained in (12). For a given pair of prices (p, q), it follows from (12) that

In the expression above, we have \(\big [ 1+z_{0}(p)-z_{1}(p) \big ]>0\) for each \(p \in (\omega ^{R},\overline{\omega })\) because \(z_{1}(p) \in [0,1]\) by construction. On the other hand, recall from (2) that the fraction of premium version adopters is \(x_{s}(q)=1-H_{s}\big (n(q) \big )\) so that \(\partial x_{s}(q) / \partial s=-\partial H_{s}\big (n(q) \big ) /\partial s\). It then follows that \(\partial x_{s}(q) / \partial s>0\) if and only if the family of degree distributions \(\left\{ H_{s}(n)\right\} \) is FOSD-ordered. These implications remain valid for any interior optimal prices that satisfy the first-order condition (7) obtained in Lemma 1. The previous arguments provide a proof of the intuitive result in Proposition 5. In the current benchmark, FOSD always decreases consumer surplus when we restrict attention to interior optimal prices—at the optimal prices selected by the platform.

Proposition 5

Suppose that the family of degree distributions \(\left\{ H_{s}(n)\right\} \) gives rise to interior optimal prices \(p^{*}_{s} \in (\omega ^{R},\overline{\omega })\) and \(q^{*}_{s} \in \left( \underline{\theta }, \overline{\theta } \right) \). Then, consumer surplus at such optimal prices \(\mathrm{CS}(p^{*}_{s},q^{*}_{s})\) is strictly decreasing in \(s \in [\underline{s},\overline{s}]\) if and only if \(\left\{ H_{s}(n)\right\} \) is FOSD-ordered.

The result provided by Proposition 5 gives us a welfare implication that naturally complements the one obtained in Proposition 4. First-order stochastic dominance of the degree distribution that generates the random network leads to higher optimal profits for the platform and to lower consumer surplus values for the optimal prices set by the platform.

Proposition 1 established that relatively low optimal prices of the product induce the platform to offer only the premium version, whereas it may be profitable to pursue versioning for higher optimal prices of the product. Proposition 6 shows that consumer surplus is always lower when the platform pursues versioning with advertising compared to the cases where it optimally serves only the premium version of the service. In a nutshell, when the market conditions of the advertised product make it profitable for the platform to rely (at least to some extent) on advertising, consumers are worse off.

Proposition 6

Consider two random social networks with degree distributions \(H_{s}(n)\) and \(H_{s^{\prime }}(n)\) that induce, respectively, optimal prices \(p^{*}_{s}\) and \(p^{*}_{s^{\prime }}\) of the product. Let Assumptions 1 and 2 hold. Suppose that \(p^{*}_{s}<\omega ^{R}\) so that the platform optimally chooses to serve only the premium version of the service and that \(p^{*}_{s^{\prime }}>\omega ^{R}\) is a price of the product such that the platform optimally chooses to serve both versions of the service, \(x_{s^{\prime }}(q^{*}_{s^{\prime }}) \in (0,1)\), for an optimal price of the service \(q^{*}_{s^{\prime }}\). Then, consumer surplus when the platform offers only the premium version exceeds consumer surplus under versioning, that is, \(\mathrm{CS}(p^{*}_{s})>\mathrm{CS}(p^{*}_{s^{\prime }},q^{*}_{s^{\prime }})\).

The comparison between different levels of consumer surplus for the cases of versioning and serving only the free version of the service is more ambiguous. Versioning with advertising allows higher consumer surplus than serving only the free version either if it entails a lower price for product or if the proportion of premium version adopters under versioning is sufficiently low.

Proposition 7

Consider two random social networks with degree distributions \(H_{s}(n)\) and \(H_{s^{\prime }}(n)\) that induce, respectively, optimal prices \(p^{*}_{s}>\omega ^{R}\) and \(p^{*}_{s^{\prime }}>\omega ^{R}\) of the product. Let Assumptions 1 and 2 hold. Suppose that \(p^{*}_{s}\) induces the platform to optimally serve only the free version of the service and that \(p^{*}_{s^{\prime }}\) induces the platform to optimally serve both versions of the service, \(x_{s^{\prime }}(q^{*}_{s^{\prime }}) \in (0,1)\), for an optimal price of the service \(q^{*}_{s^{\prime }}\). Then, consumer surplus when the platform offers both versions of the services exceeds consumer surplus when it serves only the free version of the service, \(\mathrm{CS}(p^{*}_{s^{\prime }},q^{*}_{s^{\prime }})>\mathrm{CS}(p^{*}_{s})\), either if (a) \(p^{*}_{s^{\prime }}<p^{*}_{s}\), or (b) \(p^{*}_{s^{\prime }}>p^{*}_{s}\) and, at the same time, the proportion of premium version adopters satisfies

Both conditions (a) and (b) in Proposition 7 are rather intuitive. Versioning allows for higher consumer surplus if either it leads to lower prices of the product or if it is associated with a relatively high proportion of free version adopters.

The final part of this section explores how changes in optimal prices affect consumer welfare. Suppose that, for a random social network with degree distribution \(H_{s}(n)\), there exists a unique pair \((p^{*}_{s},q^{*}_{s})\) of interior optimal prices. Then, let \(\text {CS}(s)=\text {CS}(p^{*}_{s},q^{*}_{s})\) denote the consumer surplus associated with the degree distribution \(H_{s}(n)\) at such optimal prices. Suppose now that, starting from the pair \((p^{*}_{s},q^{*}_{s})\) of interior optimal prices, the price of the service \(q^{*}_{s}\) increases locally. Then, using the expression for the consumer surplus in (12), we obtain

Since \(z^{\prime }_{a}(p^{*}_{s})<0\) for each \(a \in \left\{ 0,1\right\} \), \(x^{\prime }_{s}(q^{*}_{s})<0\), and \(1+z_{0}(p^{*}_{s})-z_{1}(p^{*}_{s}) >0\), we observe from the expression in (13) that an increase in the price of the service may increase consumer surplus only if it induces a sufficiently high decrease \(\partial p^{*}_{s}/ \partial q^{*}_{s}<0\) in the price of the product. Intuitively, consumer welfare could only increase upon a rise in the price of the service if a higher proportion of consumers that receive ads leads the monopolist to optimally decrease the price of the product. By using the insight provided by expression (10) in Proposition 2, Proposition 8 gives us the required condition on the induced change \(\partial p^{*}_{s}/ \partial q^{*}_{s}\) under which a rise in the price of the service is welfare improving for consumers.

Proposition 8

Consider a random social network with degree distribution \(H_{s}(n)\) and suppose that there exists a unique pair \((p^{*}_{s},q^{*}_{s})\) of interior optimal prices. Under Assumptions 1 and 2, a local increase in the price \(q^{*}_{s}\) of the service increases consumer surplus \(\mathrm{CS}(s)\) if and only if the condition

is satisfied, where

for each pair \((p^{*}_{s},q^{*}_{s})\) of interior optimal prices.

Obviously, when an increase in the price of the service induces a rise in the price of the product, both changes in prices have a negative impact on consumer welfare. An increase in the price of the service could be welfare improving for consumers only if it triggers a reduction in the price of the product. Furthermore, the size of such a price reduction must be sufficiently high. Proposition 8 gives us the requirement on the magnitude that the induced reduction in the price of the product must satisfy. When advertising reduces the price-elasticity of the product demand (Assumption 3), and the induced price-elasticity is sufficiently low under advertising, a rise of the service price can induce a welfare improvement only if the hazard rate is (at least locally) decreasing and, in addition, it satisfies \(\left| r^{\prime }_{s}(n(q^{*}_{s}))\right| >\big [r_{s}(n(q^{*}_{s}))\big ]^{2}\).

5 Model’s applications

This section presents two applications of the model to degree distributions which typically match well the data available on many complex social networks. While there is no conclusive evidence as to which degree distributions describe best specific real-world networks, many empirical studies suggest that most complex social networks are fairly well captured by either scale-free/power law patterns or by exponential degree distributions (see, e.g., Barabási and Albert 1999; Clauset et al. 2009; Stephen and Toubia 2009; Ugander et al. 2011). In both applications provided in this section, the sufficient condition provided by Proposition 3 leads to that, if the platform finds profitable to raise the price of the service, then this facilitates that it will ultimately find optimal to provide only the free version of the service.Footnote 38 Yet, random networks generated by power law distributions provide more incentives to the platform to rely on its advertising activity (and, therefore, on the free version of its service), relative to networks generated by exponential distributions.

5.1 Power law degree distribution

Empirical evidence suggests that most real-world Internet-based social networks are scale-free. Thus, if we consider that such networks are randomly generated, then the corresponding degree distribution must follow a power law. Also, power law degree distributions are particularly suitable to model the formation of networks that follow a preferential attachment pattern. For a degree support \([\underline{n},+\,\infty )\), with \(\underline{n}>0\) a power law degree distribution with parameter\(\sigma >1\) is given by

Most empirical estimates propose values for the parameter \(\sigma \) that lie in the interval (2, 3). The corresponding hazard rate function is \(r_{s}(n)=(\sigma -1)/n\), which decreases in n. Following the insights provided by Shin (2016) (Proposition 3), the degree of a randomly chosen consumer becomes arbitrarily large as the average degree of the network increases. The result provided by Lemma 1 leads to that interior optimal prices \(q^{*}_{s}\) of the service must satisfy the condition

As for the second-order condition stated in (8) of Lemma 1, we have

Therefore, we obtain that

and

so that the second-order requirement in (8) translates into \(2(\sigma -1)>\sigma \) for the power law degree distribution. Such a requirement is satisfied for \(\sigma >2\).

Notably, the optimal price of the service does not depend on the size of the externality premium in the scale-free network pattern. For \(\sigma >2\), it follows that the optimal price of the service increases in the difference \(\Delta (p^{*}_{s})\) between the optimal profits (with and without advertising) from the product’s sales. As to the relation between the optimal prices of the product and the service, notice that

Therefore, the result in Proposition 2 leads to that, for \(\sigma >2\), the optimal prices of both commodities move in the same direction (\(\partial p^{*}_{s}/ \partial q^{*}_{s}>0\)) if and only if \(\pi ^{\prime }_{1}(p^{*}_{s})>\pi ^{\prime }_{0}(p^{*}_{s})\). If, in addition, we make use of the stronger Assumption 3 on the effect of advertising on the price-elasticity of the product, Corollary 1 indicates that \(\partial p^{*}_{s}/ \partial q^{*}_{s}>0\) for \(\sigma >2\) because, for those parameter values, we have

Thus, a rise in the price of the service always reduces consumer welfare for random networks that are generated by a power law degree distribution with parameter \(\sigma >2\). We observe that the model’s predictions on optimal pricing depend crucially on whether the parameter value \(\sigma \) exceeds or not 2.

Finally, by using the result of Proposition 3, it follows that the platform prefers to offer only the free version of the service if the sufficient condition

is satisfied. Therefore, as the right-hand side of the expression above is decreasing in \(q^{\mathrm {pm}}_{s}\) for any parameter value \(\sigma >1\), higher optimal prices \(q^{\mathrm {pm}}_{s}\) makes it easier for the sufficient condition provided by Proposition 3 to hold.

5.2 Exponential degree distribution

A typical degree distribution with constant hazard rate function is the exponential degree distribution. For a degree support \([0,+\,\infty )\), an exponential degree distribution with parameter\(\sigma >0\) is given by

The corresponding hazard rate function is \(r_{s}(n)=1/\sigma \). The result provided by Lemma 1 leads to that interior optimal prices \(q^{*}_{s}\) of the service satisfy the condition

As for the second-order condition stated in (8), notice that \(h_{s}(n)=(1/\sigma )e^{-n/\sigma }\) and \(h^{\prime }_{s}(n)=-(1/\sigma ^{2})e^{-n/\sigma }\). Therefore, we obtain that

and

so that the second-order requirement in (8) is automatically satisfied.

We obtain that the optimal price of the service increases in the difference of optimal profits \(\Delta (p^{*}_{s})\) from the product’s sales. In addition, the optimal price of the service increases with the size of the externality premium \(\beta \). Under Assumption 3 on the effect of advertising on the price-elasticity of the product, Corollary 1 indicates that \(\partial p^{*}_{s}/ \partial q^{*}_{s}>0\) for low values of the price-elasticity of \(z_{1}(p)\) because

A rise in the price of the service always reduces consumer welfare for random networks that are generated by an exponential degree distribution.

Finally, by using the result of Proposition 3, it follows that the platform prefers to offer only the free version of the service if the sufficient condition

is satisfied. Thus, as the right-hand size of the expression above decreases in \(q^{\mathrm {pm}}_{s}\), higher optimal prices \(q^{\mathrm {pm}}_{s}\) facilitate that the sufficient condition provided by Proposition 3 holds.

5.3 Comparative implications

The two applications explored in the previous subsection allow us to obtain some insights into how these two prominent degree distributions influence comparatively the increases in free version adopters caused by an increase in the difference of profits \(\Delta (p^{*}_{s})\)—intuitively, when market conditions change so that the positive impact of advertising on the profitability of the advertised product raises—(around some initial equilibrium price \(p^{*}_{s}\)). In consonance with earlier notation, let \(\rho _{\mathrm {pl}}(q_{s})\) and \(\rho _{\mathrm {exp}}(q_{s})\) be the functions that yield the value \(q_{s}-\frac{\beta }{r_{s}(n(q_{s}))}\), respectively, under the power law and the exponential distribution. In the above applications, we have obtained that

so that, regardless of the value of parameter \(\sigma >1\), it follows that \(0<\rho ^{\prime }_{\mathrm {pl}}(q_{s})<\rho ^{\prime }_{\mathrm {exp}}(q_{s})\) for each \(q_{s}\). Therefore, we obtain that the power law distribution induces increases in the equilibrium price \(q^{*}_{s}\) which are always higher than the ones derived under the exponential distribution. As a consequence, upon changes in the market conditions for the advertised good that make the advertising activity more profitable, the model suggests that power law distributions lead to higher increases in the price of the premium version—and, therefore, to higher proportions of free version adopters—compared to exponential distributions. This, in turn, makes easer that the sufficient condition provided by Proposition 3 be satisfied under power law distributions, relative to exponential distributions. The message conveyed therefore is that power law distributions facilitate that the platform relies relatively more on its advertising activity—and ultimately may lead it to offer only the free version of its service—, compared to cases of social networks described by exponential distributions.

Ideally, one would like to work with a theoretical framework that maps directly into sharp real-world detailed implications. In the environment explored in this paper, however, this goal is hard to achieve because of two reasons. First, the problem analyzed requires to bring into the model a very diverse array of elements—the influence of advertising in consumers’ opinions, the role of compensation contracts, the impact of the network architecture, and the effects of network externalities—making it complex. Secondly, the absence of conclusive empirical evidence (beyond casual or anecdotical observation) as to how real-world platforms choose their versioning policies,Footnote 39 makes it hard to identify clearly how platforms are in practice choosing their discrimination policies based on primitives.Footnote 40