Abstract

We show that in finite settings with identical firms and consumers, asymmetric pure price equilibria with positive profits exist. We consider a price competition duopoly for a homogeneous product. Demand stems from a second-stage consumption game at posted prices, with consumers’ behavior impacted by negative network effects. We characterize equilibrium prices and demand. In all subgame-perfect pure price equilibria, both firms have positive profits, and in some, firms charge different prices.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Two classic examples of negative network effects are congestion and snob effects. A congested service, for example, might reduce the utility of consumption directly (e.g., noise, a bad seat) or indirectly (e.g., waiting, traffic). A snob effect might appear when there is a desire for exclusivity (e.g., fashion, luxury goods). However, network effects also appear under the scope of social influence, with the ever-increasing impact of the Internet, social networks, and platforms of user-generated content and rating, producing a tendency for higher relevance. We have more information on other’s choices, they constitute affirmation and identification, and there is an increased political awareness and statement in choices like consumption.

In this work, we aim to show that negative network effects are a source of price dispersion and, in particular, may mitigaete the effects of competition between firms, stabilizing pure price strategies.

In 1838 Cournot wrote ‘Every one has a vague idea of the effects of competition.’ In the effort to formalize this vague idea, and model the effects of competition, he considered two identical firms selling a homogeneous good, and assumed ‘the price is necessarily the same for each proprietor.’ A conclusion was: ‘the result of competition is to reduce prices’ (Cournot 1838, ch. VII). Bertrand objected to the idea that firms would compete in this setting, as ‘It would be in their interest to associate or, at least, to fix the common price’. The argument was: if firms engage in competition, then they would undercut their rival’s price, and there would be no limit to the resulting dynamics (Bertrand 1883). This was coined a paradox as it contradicted the expected outcome, the vague idea Cournot was formalizing (on the Cournot-Bertrand debate see Bornier 1992).

A reflex of how the paradox clashed with empirical knowledge and observation is the considerable amount of research into what aspects could be counteracting the price undercutting dynamics. In particular, what phenomena may avoid the downward spiral to zero profits and produce a positive profit stopping point (a pure equilibrium) below the monopoly price. There is, however, a second effect of the price undercutting dynamics. Consumers buying from the lower-priced firm, ceteris paribus, leads to price homogenization. The latter is not a less significant challenge, as Hopkins (2008) emphasizes ‘there is considerable empirical evidence that price dispersion is widespread and significant. Yet it has proven surprisingly difficult for economists to derive satisfactory models that support price dispersion as an equilibrium phenomenon.’

Tirole (1988) divides non-collusive solutions to the Bertrand paradox along two lines that relax assumptions in the classic setting, the Edgeworth approach and product differentiation (Hotelling’s approach). Under the former, pure price equilibria with positive profits for homogeneous settings exist if firms’ capacities are sufficiently small or if the cost functions induce decreasing marginal returns. Undercutting is countered through the cost function if, loosely speaking, serving more demand is costly. These solutions have the advantage of not requiring a priori heterogeneity to guarantee existence, but, with identical firms, they produce symmetric price strategies for firms with positive profit. Furthermore, the cases of increasing or constant marginal returns still pose a challenge (see Hoernig 2007; Baye and Kovenock 2008; Saporiti and Coloma 2010; Bagh 2010; Dastidar 2011).

The product/ consumer side approach (à la Hotelling) attacks the problem by removing the assumption of the lowest price capturing all consumers. The region where consumer indifference exists, the diagonal of equal prices, is extended and this counters undercutting by smoothing out the demand discontinuity. Essentially this is achieved by imposing restrictions on the distribution of consumer preferences which imply non-atomicity (thus excluding the case of homogeneous consumers) (see Caplin and Nalebuff 1991). There are other approaches, de Palma et al. (1985) show that if firms lack information regarding consumer tastes, sufficient heterogeneity ensures a pure price equilibrium. Allen and Thisse (1992) consider consumers with different price sensitivities. In general, approaches from the product/ consumer side can produce asymmetric equilibria. The drawback is that a sufficient degree of heterogeneity is necessary to guarantee pure price solutions above marginal costs.

A natural question emerges: is a priori heterogeneity a necessary condition to achieve asymmetric price equilibria? Does price competition push firms towards the same price? Burdett and Judd (1983) have answered this question using search costs. With identical firms, differences in consumer search behavior can support a continuous price distribution at equilibrium. However, with a finite set of firms using pure price strategies, Diamond (1971) paradox still holds: search costs lead to the monopoly price.

In the present work, we consider a finite setting and study how negative network effects produce a counter to both consequences of the price undercutting dynamics: the downward spiral and the price symmetry pull. Inspired by social psychology through the theories of planned behavior or reasoned action, we study how network effects impact the formation of behavioral intentions, which thus changes how demand responds to price. The study of external or nonfunctional aspects of consumption has a long tradition in economics. Notably, for example, in the seminal works of Rae, Veblen, or Leibenstein (see Leibenstein 1950, and references therein). A survey including consumer demand under network effects is, for example, (Shy 2011). Here, however, we do not examine network effects per se but the results of their existence, i.e., they are not studied on top of an already existing solution but will produce the pure price solution.

The model we consider is a two-stage game. The first stage is the classic setting: a pricing game between two identical firms selling a homogeneous good. Demand stems from the second stage: a consumption subgame where a finite set of indistinguishable consumers has to choose which firm to buy from while subject to network effects. The latter is determined by a unique parameter making the setting completely homogeneous. Consumers are allowed to use behavior strategies. For each pair of posted prices, we consider the partition of consumers according to whether they choose a pure or non-degenerate behavior strategy. A result in (Soeiro et al. 2014) shows that the sizes of blocks in this partition determine a selection from the equilibrium demand correspondence. For some behavior strategies, this partition is locally constant (the number of consumers in each block is the same). For these, the response to a price undercut is a change in the probability of consumers not in pure strategies, which induces locally continuous profit functions. The existence of locally constant partitions in the indifference region is sufficient to eliminate Bertrand’s paradox.

The approach can appear to be a mere shift of mixed strategies from firms to consumers. However, it carries a deeper assumption: the reaction to price undercuts is given by adjustments in the behavioral intention of some consumers, instead of a somewhat abrupt disruption of all consumption choices. It seems reasonable. Moreover, the resulting equilibrium set is much richer. We show that there are multiple subgame-perfect equilibria, all with positive profit for both firms, some with different prices. The price difference is an endogenously generated asymmetry: it is proportional to the network effect parameter according to the asymmetry in the partition’s block sizes. Equilibrium prices are also proportional to the network effect parameter (and the model reduces to the classic setting when the parameter is zero). A priori heterogeneity is thus not a necessary condition to produce asymmetric pure price equilibria with positive profits.

Naturally, there are drawbacks and differences to the literature on network effects in price competition. More precisely, we consider active demand expectation, i.e., players maximize expected payoffs, and expected demand is not determined a priori, which leads to multiple consumption equilibria, a potential drawback. What equilibrium will be played? We do not address this problem. Instead, we characterize all subgame-perfect equilibria, which is sufficient to prove existence and possible resulting prices. However, we show that no equilibrium is better or efficient. We further observe that multiplicity might be a tool when trying to account for variability. There are many reasons why some equilibria might be eliminated in some markets and not in others. For example, reservation prices might differ, different strategies might be chosen or expected due to previous information or behavior by firms or consumers. Especially in repeated competition, the partition of consumers in some given day might work as a focal point for the next. An interesting study would be the dynamic of these partitions over time (thus consumption) and how firms adjust to it.

The results in this work lie at the intersection of the three strands of literature reviewed before. Comparatively to solutions based on the cost function, negative network effects also produce pure price equilibria with positive profit for homogeneous settings. In particular, this could be useful when the cost function does not induce decreasing marginal returns. For affine cost functions, the results follow straightforwardly. The second advantage is that the solutions may be asymmetric. Such is possible because the technique is similar to the approach using product differentiation: extending the indifference region to eliminate the discontinuity. However, with network effects, this is generated endogenously by the consumers’ actions. Thus, asymmetric equilibria do not depend on some intrinsic product or consumer differences.

Concerning the price dispersion literature, we complement Burdett and Judd (1983) by showing that the result holds for the finite case of a duopoly where firms use pure price strategies, even in the absence of search costs. Furthermore, network effects produce asymmetries when search costs may suffer from Diamond’s paradox. In a context with increased use of online tools, this might be particularly interesting. Price dispersion has remained ‘persistant and significant’ (Hopkins 2008), and while search costs may reduce, network effects can be more prevalent. Finally, we observe that the present model simplicity lends itself to straightforward incorporation into any setting. In itself, the idea is very general: smoothing demand by allowing consumers to use behavior strategies in an interval created by network effects. It is a natural way to restore demand continuity and a simple effect to couple with other parameters or strategic variables. In fact, following the work and critique by Bos and Vermeulen (2020), one can use network effects as another alternative microeconomic foundation to deduce (locally) the general form linear demand.

The outline of the work is as follows. In the next section, we set up the model. In Section 3 stage equilibria are fully characterized, i.e., prices and consumption outcomes. In Section 4, necessary and sufficient conditions for a given strategy to be a subgame-perfect equilibrium are explicitly derived. We then show there are multiple classes of strategies satisfying these conditions, in particular asymmetric ones. Finally, we conclude in Section 5 by discussing a relation between profits and consumer welfare, the impact of an affine cost function, and an interpretation of a player as a group. We use \(\equiv\) for definitions.

2 Model

We consider two firms and a finite set \(\mathcal {I}\) of n consumers.Footnote 1 The game begins with a pricing stage, where firms act simultaneous and independently, followed by a consumption stage, where consumers act simultaneous and independently. In the first stage each firm sets a price \(p_j\), \(j=1,2\), determining the pair \(\mathbf {p}\equiv ( \ p_1, p_2)\in (\mathbb {R}_0^+)^2\). In the second stage each consumer \(i\in \mathcal {I}\) observes prices and chooses an action \(a^i \in \mathcal {A}\equiv \{1, 0\}\) representing choosing one of the two firms (\(a^i=1\) for firm 1). For each pair of prices the second stage is thus a standard simultaneous move game with a two-action set (which means consumption is mandatory).

Let \(\mathbf {a}\in \mathcal {A}^n\) denote an action profile for consumers and \((a^i, \mathbf {a}_{-i})\) the standard split in i’s action and remaining actions. The payoff of each consumer is determined by prices and an externality parameter \(\alpha \in \mathbb {R}^+\). In particular, if \(a^i=1\), that payoff isFootnote 2

and for \(a^i=0\) it is

We will allow consumers to use behavior strategies giving rise to expected payoffs and demand (see for example Fudenberg and Tirole 1991, p. 85), and we will fully characterize subgame-perfect equilibria.Footnote 3

2.1 Behavior strategies, expected payoffs and demand

A behavior strategy for consumer i specifies a probability distribution over \(\mathcal {A}\) at each \(\mathbf {p}\) (independent). For each \(i\in \mathcal {I}\) it defines points \((\sigma _1^i(\mathbf {p}), \sigma _2^i(\mathbf {p}))\), where \(\sigma _1^i(\mathbf {p})\equiv \sigma ^i(\mathbf {p}, 1)\equiv \sigma ^i(\mathbf {p})\) and \(\sigma _2^i(\mathbf {p})\equiv \sigma ^i(\mathbf {p}, 0)\equiv 1-\sigma ^i(\mathbf {p})\) represent, respectively, the probability of consumer i using the service provided by firm 1 or 2 at prices \(\mathbf {p}\). Behavior strategies are summarized in a consumption behavior \(\varvec{\sigma }: (\mathbb {R}_0^+)^2 \rightarrow [0,1]^{n}\) through the profile \(\varvec{\sigma }(\mathbf {p})\equiv (\sigma ^{i_1}(\mathbf {p}),\ldots , \sigma ^{i_n}(\mathbf {p}))\).

A strategy profile for the game is a pair denoted \((\mathbf {p}^*, \varvec{\sigma })\) formed by a pair of prices \(\mathbf {p}^*\) and a consumption behavior \(\varvec{\sigma }\). We will make use of the distinction between a strategy profile \((\mathbf {p}^*, \varvec{\sigma }(\mathbf {p}))\) and the outcome \((\mathbf {p}^*, \varvec{\sigma }(\mathbf {p}^*))\), though we will sometimes omit the dependence on \(\mathbf {p}\) when there is no ambiguity and simplifies notation. For example, behavior strategies are used to evaluate the profitability of firm’s price deviations, while outcomes determine payoffs. We will refer to \(\varvec{\sigma }(\mathbf {p}^*)\in [0,1]^{n}\) as a consumption outcome.

The expected payoff for consumers in a given outcome \((\mathbf {p},\varvec{\sigma })\) is the expected value of the aforementioned utility with respect to the consumption behavior, denoted \(u^i(\mathbf {p},\varvec{\sigma })\), that is,

This leads toFootnote 4

where,

The expected value for firm 1’s demand at \(\mathbf {p}\) with respect to \(\varvec{\sigma }\), is

For simplicity, we assume firms have no costs (briefly discussed in section 5). For each firm \(j=1,2\), this leads to the following expected demand and profit,

3 Stage equilibria

3.1 Consumption stage equilibria (2nd stage)

A consumption outcome \(\mathbf {q}\in [0,1]^{n}\) induces a partition of the consumers set according to whether they use a pure or non-degenerate behavior strategy. Let us denote these blocks by

Note that this determines outcome classes, which have the same partition, independently of player permutations.

In (Soeiro et al. 2014) it is shown that, for one-shot games, of which the consumption stage subgame is a particular case, non-degenerate behavior strategies are type- symmetric in equilibria when \(\alpha \ne 0\). Below, we adapt the result for our context. Let \(\Delta p \equiv p_1-p_2\) and let us define the following decision threshold function (the interpretation is a limit for the price difference which will establish price domains),

Theorem 1

In a Nash equilibrium \(\mathbf {q}\), for all \(i,j\in \mathcal {I}\), if \(i\ne j\) and \(0<q^i, q^j<1\), then \(q^i=q^j=q(\Delta p; l_1,m,l_2)\) where

The above result does not mean that each pair of prices uniquely determines demand based on second stage equilibria. Nevertheless, each partition \((l_1,m,l_2)\) with \(m>1\) has associated a unique Nash equilibrium expected demand value, and a price (difference) domain where \(0<q(\Delta p; l_1,m,l_2)<1\). If \(m=0\) then demand is also uniquely determined by \((l_1,m,l_2)\), it is \(l_1\) for firm 1 and \(l_2\) for firm 2. The only undefined case is where \(m=1\), in which demand (for firm 1) may take any value in \((l_1, l_1+1)\). Due to this property, we call \((l_1,m,l_2)\) a demand characterization of a given outcome (with a slight abuse due to the case \(m=1\), which will not be relevant for our results).

The price (difference) domain \(\mathcal {PD}(l_1^*, m^*, l_2^*)\) of a demand characterization is defined as the set of price differences \(\Delta p\) for which there is a second stage Nash equilibrium \(\mathbf {q}^*\) with demand characterization \(l_j(\mathbf {q}^*)=l_j^*\), for \(j=1,2\), and \(m(\mathbf {q}^*)=m^*\). Price domains are computed directly from applying the Nash equilibrium condition on expected payoffs.

Price domains for pure equilibria (\(m=0\)):

-

(i)

\(\mathcal {PD}(n,0, 0)=(-\infty , T(n)]\);

-

(ii)

\(\mathcal {PD}(l_1,0,n-l_1)=[T(l_1+1), T(l_1)]\), for \(l_1 \in \{1,\ldots , n-1\}\);

-

(iii)

\(\mathcal {PD}(0,0, n)=[T(1), +\infty )\).Footnote 5

Price domains for mixed equilibria (\(m\ge 1\)):

-

(iv)

\(\mathcal {PD}(l_1,1,n-l_1-1)=T(l_1+1)\);

-

(v)

\(\mathcal {PD}(l_1,m,l_2)= \left( T(l_1+m), T(l_1+1)\right)\) if \(m>1\).

Observe that \(T(l_1+k)=T(l_1)-2k\alpha\). Hence, price domains of non-monopolistic characterizations are contained in the interval (T(n), T(1)) which is partitioned into \(n-1\) intervals of size \(2\alpha\) by the thresholds \(T(n-1), \ldots , T(2)\). As \(T(l_1+1)<T(l_1)\), all these price domains are non-empty (or non-degenerate).

Given \((l_1,m,l_2)\) let us now define (in terms of firm 1) the following characterization preserving functions \(d_{(l_1,m,l_2)}: \mathcal {PD}(l_1^*, m^*, l_2^*) \rightarrow [l_1, l_1+m]\) given by

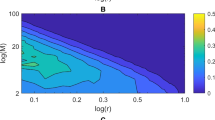

If \(\varvec{\sigma }(\mathbf {p})\) is a second stage Nash equilibrium for every \(\mathbf {p}\), then, for every \(\mathbf {p}\) there is \((l_1,m,l_2)\) such that \(D_1(\mathbf {p},\varvec{\sigma })=d_{(l_1,m,l_2)}(\Delta p)\). That is, the union of all preserving function images forms a correspondence of equilibrium demand and the triple \((l_1,m,l_2)\) determines a selection at \(\Delta p\). Let \(\mathcal {CD}(\Delta p) \equiv \{(l_1, m, l_2) : \Delta p \in \mathcal {PD}(l_1, m, l_2)\}\). Given \(\mathbf {p}^*\), the correspondence of equilibrium demand at \(\Delta p^*\) is \(\mathbf {ED}(\Delta p^*)\equiv \{d_{(l_1,m,l_2)}(\Delta p^*) : (l_1,m,l_2)\in \mathcal {CD}(\Delta p^*) \}\). An illustration is presented in Fig. 1.

A depiction with \(n=6\) for ease of visualization, and RGB colors in the range [0, 1] in the following way \((l_1/n, m/n, l_2/n)\). Summing up, the characterization of consumption equilibria can be done completely using the partition block sizes \(l_1, m, l_2\). The set of second stage Nash equilibria induces a correspondence of equilibrium demand formed by the union of horizontal (\(m=0\)), vertical (\(m=1\)) and oblique (\(m>1\)) line segments, each identified by \((l_1, m, l_2)\) and with a particular price domain. Given \(\Delta p\), a demand characterization \((l_1,m,l_2)\) determines a Nash equilibrium demand selection for \(\Delta p\)

3.2 Pricing stage equilibria (1st stage)

We are now able to characterize the candidates to subgame-perfect equilibria with positive profits for both firms.

Lemma 1

A strategy profile \((\mathbf {p}^*,\varvec{\sigma }^*)\) is a subgame-perfect equilibrium with positive profits for both firms only if there is \((l_1,m,l_2)\) with \(m>1\) and a neighbourhood \(V(\Delta p^*)\subset \mathcal {PD}(l_1,m,l_2)\) where for all \(\mathbf {p}\) such that \(p_1-p_2^* \in V(\Delta p^*)\) and \(p_1^*-p_2 \in V(\Delta p^*)\), we have

The main idea is that for both prices to be positive, there must be continuity in demand around the equilibrium point. Observe that the result does not apply to equilibria where at least one firm is with price equal to zero, i.e. these equilibria (both the Bertrand zero profit and monopolies) could exist and are not included in this Lemma. In the subsequent section, we will show they in fact do not exist.

Remark 1

Suppose we consider positive externalities. A consequence of Lemma 1 is that (when \(\alpha <0\)) equilibria with positive profits for both firms do not exist (price domains overlap, and there is a unique possibility, (0, n, 0), in which \(q_j(\Delta p)\) increases with price). As such, with positive externalities, in a subgame-perfect equilibrium, at least one firm has zero profits. Observe also that the case \(\alpha = 0\) is the classic Bertrand framework, without a sharing rule specification.

Proposition 1

A strategy profile \((\mathbf {p}^*,\varvec{\sigma }^*)\), where \(\varvec{\sigma }^*(\mathbf {p}^*)\) has demand characterization \((l_1,m,l_2)\), is a subgame-perfect equilibrium with positive profits for both firms only if, \(m>1\), and outcome prices are

In the above Lemma and Proposition, we have provided necessary conditions for positive profit equilibria. The proof of Lemma 1 follows by showing that, in the neighborhood of the equilibrium price difference, demand characterization must be constant except possibly at the equilibrium point. This leads to a locally continuous profit function, whose maximum is that of Proposition 1. Note that the latter defines price functions \(p_j^*(l_1, m, l_2;\alpha )\) for \(j=1,2\). We observe that higher prices are associated with fewer consumers using pure strategies. We will discuss how that translates into profits in Section 5.

4 Subgame-perfect equilibria

The necessary conditions established in Section 3.2, implicitly define a set of admissible strategies \((\mathbf {p}^*,\varvec{\sigma }^*)\) for which there is \((l_1^*, m^*, l_2^*)\) with \(m^*>1\) such that: (i) outcome prices are \(p_j^*(l_1^*, m^*, l_2^*)>0\) for \(j=1,2\); and (ii) for \(\mathbf {p}=( \ p_1,p_2^*)\) in some neighborhood \(V(\Delta p^*)\), \(D_1(\mathbf {p}, \varvec{\sigma }^*) = l_1^* +q(\Delta p; l_1^*, m^*, l_2^*)m^*\) (analogously for firm 2.). Observe that (i) and (ii) are completely determined by some \((l_1, m, l_2)\) (where \(m>1\)). As such, we can identify admissible outcomes by this triplet, and restrict our study to strategies that produce these outcomes. This induces an equivalence relation in the set of admissible strategies with respect to outcomes. We denote the strategy classes in this equivalence relation by \(\underline{(l_1,m,l_2)}\), and are interested in studying and distinguishing equilibria up to these classes.Footnote 6 The next Lemma states these are in fact the only classes for which an equilibrium exists.

Lemma 2

In all subgame-perfect equilibria prices and profits are positive.

Proof

Suppose, by contradiction, and wlg, there is a subgame-perfect equilibrium where \(p_1^*=0\). Note that for \(\Delta p^*< T(1)\) we have \(D_1>0\). As \(\Delta p^*=-p_2^*\le 0\) and \(T(1)>0\), there is \(\delta >0\) and \(0 < \epsilon \le p_2^*+\delta\) such that \(\epsilon -p_2^* < T(1)\), and thus \(D_1(\epsilon , p_2^*)>0\). In that case, if firm 1 changes to \(p_1=\epsilon\) it would have positive profits, which is absurd.

4.1 Existence

The price pairs obtained in Proposition 1 are local maxima by construction. Hence, the main issue for establishing existence is the study of incentives to higher price deviations. In particular, the study of demand induced by \(\varvec{\sigma }^*(\mathbf {p})\) outside a neighborhood of \(\Delta p^*\). This is particularly troublesome when there are multiple second-stage equilibria.Footnote 7 The price difference interval for which there are multiple second stage equilibria with different associated demand is (T(n), T(1)). For price differences outside this interval, demand is well defined: when \(\Delta p\le T(n)\) demand is \(D_1=n\) and for \(\Delta p\ge T(1)\) it is \(D_1=0\).

Recall that \(\mathcal {PD}(l_1,m,l_2)=(T(l_1+m),T(l_1+1)) \subseteq (T(n),T(1))\). Note that, in each class of admissible strategies, there is a subset of strategy profiles \((\mathbf {p}^*,\varvec{\sigma }^*)\in \underline{(l_1,m,l_2)}\) with \(\varvec{\sigma }^*\) inducing the following (deviation) demand,

where \(q^*( \ p_1)\equiv q( \ p_1-p_2^*;l_1, m, l_2)\), and \(f_L( \ p_1)\) and \(f_R( \ p_1)\) are determined by functions \(f_L : ( \ p_2^* +T(n), p_2^* +T(l_1+m)] \rightarrow [l_1+m, n)\) and \(f_R: [p_2^* +T(l_1+1), p_2^* +T(1)) \rightarrow (0, l_1+1]\) such that \(f_L( \ p_1), f_R( \ p_1)\in \mathbf {ED}( \ p_1 - p_2^*)\). These strategies extend demand behavior in the neighborhood of \(\Delta p^*\) as given by Lemma 1 to the whole domain \(\mathcal {PD}(l_1,m,l_2)=(T(l_1+m),T(l_1+1))\). For this reason we call them outcome extension strategies. Within each class \(\underline{(l_1,m,l_2)}\), outcome extension strategies differ only in the specification of both \(f_L\) and \(f_R\). Because \(p_1^*\) found in Proposition 1 is guaranteed as a profit maximum in the interval between \(p_2^*+T(l_1+m)\) and \(p_2^*+T(l_1+1)\) (in terms of firm 1), existence of an equilibrium in some class amounts to the study of whether there are specifications \(f_L, f_R\) which do not create incentives to deviate from \(p_1^*\). As these specifications are restricted to \(\mathbf {ED}( \ p_1 - p_2^*)\), three situations may occur: (i) no specifications create an incentive for deviation; (ii) some specifications create an incentive; (iii) all specifications create an incentive. Two simplistic examples of demand and profit induced by outcome extension strategies are depicted in Figs. 2 and 3.

The issue is the following: the specifications \(f_L\) and \(f_R\) determine a change in demand characterization, which produces either a jump or non-differentiable point in demand. The problem posed for equilibrium existence will be whether this provides incentives to a price deviation. We thus need to compare outcome profit with the one produced by different choices of \(f_L\) and \(f_R\).

Using Lemma 1 together with Proposition 1, we can compute the outcome profit for any given strategy profile \((\mathbf {p}^*,\varvec{\sigma }^*)\in \underline{(l_1,m,l_2)}\) (recall that all strategies in the same class produce the same outcome). Writing profit for firm 1, we get

Furthermore, the outcome price difference stemming from Proposition 1 is

where \(\Delta l\equiv l_1-l_2\). Given a demand characterization \((l_1,m,l_2)\), let us now define for some \(k\in \{0,n-3\}\) the following

Theorem 2

A subgame-perfect equilibrium belonging to a \(\underline{(l_1,m,l_2)}\) class with \(m>1\), exists if, and only if, \(\Delta p(\underline{l_1,m,l_2}) \in \mathcal {PD}(l_1,m,l_2)\), and

-

(i)

if \(l_1>0\), for every \(k\in \{0, \ldots , l_1-1\}\),

$$\Pi _1^*(\underline{l_1, m, l_2}) \ge P_1(k; (l_1, m, l_2))(k+1);$$ -

(ii)

if \(l_2>0\), for every \(k\in \{0, \ldots , l_2-1\}\),

$$\Pi _2^*(\underline{l_1,m,l_2}) \ge P_2(k; (l_1, m, l_2))(k+1).$$

The theorem says that it is sufficient to check for incentives at the finite set of prices \(P_j(k)\). In fact, the conditions could be improved upon, by checking only that point which produces the higher profit among all k (for each firm). This however overcomplexifies the proofs, having no impact in the main point of this work.

The idea behind condition (i) (and similarly for (ii)) is to ensure that, given \((l_1, m, l_2)\), for each \(p_1\) there are specifications \(f_L( \ p_1)\) and \(f_R( \ p_1)\) below the isoprofit function, so that it is possible to use an outcome extension strategy in \(\underline{(l_1,m,l_2)}\) to build a subgame-perfect equilibrium. Interestingly, the only actual deviation incentives for a firm are price increases. Demand for a price increase depends on the specification \(f_R\), which is necessary to determine demand in the interval \((T(l_1+1), T(1))\) (for firm 1, and when \(l_1>0\)). In the right-hand side of the inequalities are possible profits at \(P_j(k)\) where demand is bounded below by \(k+1\in \mathbf {ED}( \ p_1 - p_2^*)\). Figures 2 and 3 contain an ilustration of what condition (i) means geometrically.

Observe that the class \(\underline{(0, n, 0)}\) has a unique outcome extension strategy. No specifications are necessary because \(\mathcal {PD}(0, n, 0)=(T(n), T(1))\), i.e. it occupies the whole multiple equilibria domain. This class trivially satisfies both (i) and (ii) of Theorem 2. As \(\Delta p(\underline{0, n, 0})=0\) and \(0\in \mathcal {PD}(0, n, 0)\) (and we note that \(\Pi _j^*(\underline{0, n, 0})>0\)), we get the following corollary.

Corollary 1

A subgame-perfect equilibrium exists.

Having established existence, we now turn to the question of whether equilibria where firms charge different prices exist. When we refer to asymmetric equilibria, these are the equilibria that we have in mind. Recall that, for any given class \(\underline{(l_1,m,l_2)}\), where \(m>1\), the price difference is \(\Delta p^*=-\frac{2\alpha \Delta l}{3m}\). As such, for different prices we need to study classes where \(l_1 \ne l_2\), which is not the case of (0, n, 0) that established existence in Corollary 1.

Theorem 3

Multiple subgame-perfect equilibria where firms charge different prices and have positive profits exist if, and only if, \(n\ge 4\).

The proof is done by construction, showing that there are classes with \(\Delta l \ne 0\) which satisfy Theorem 2. The idea behind this result is that a sufficient number of consumers in non-degenerate strategies (m) is necessary so that losing them with a price increase provokes enough profit loss to cover the gain from a higher price paid by pure strategy consumers. Nevertheless, this sufficient number is low. From the previous results we know \(m\ge 2\) is a necessary condition, thus we need at least \(n\ge 3\), so we can use a third consumer to create the price asymmetry. However, in the case \(n=3\) the unique equilibria is \((\underline{0,3,0})\). The classes (1, 2, 0) and (0, 2, 1) do not satisfy Theorem 2.

Correspondences of equilibrium demand (top) and profit (bottom) for outcome extension strategies in \(\underline{(3,4,2)}\). For each \(p_1\) outside the interval \([p_2^*+T(l_1+m), p_2^*+T(l_1+1)]\) there are multiple choices for \(f_L( \ p_1), f_R( \ p_1)\in \mathbf {ED}( \ p_1 - p_2^*)\). These lead to different profit functions. The marked points correspond to \(P_1(k)\) in Theorem 2. When these are below isoprofit (in top figure), or equilibrium profit (in bottom figure) there is an equilibrium in the respective class. We used RGB colors as before

5 Profits, cost function and group interpretation

5.1 Profits

In Section 3.2 we observed that higher prices are associated with fewer consumers using pure strategies. Although demand characterizations do not induce an obvious outcome order in terms of profits, we can show that the class (0, n, 0) produces the highest profits for both firms.

Proposition 2

The equilibria with higher profits for both firms are in the class \(\underline{(0,n, 0)}\). Prices are \(p_1=p_2=\alpha (n-1)\) and profits are \(\Pi _1^*=\Pi _2^*=\alpha \frac{n(n-1)}{2}\).

The result might seem to point in a different direction than that of this work, but this is not so. Note that for \(\Delta p = 0\), which is the case in Proposition 2, there are multiple second stage equilibria. Namely, for every characterization such that \(T(l_1+m)<0<T(l_1+1)\) we have \(0\in \mathcal {PD}(l_1,m,l_2)\). In fact, this holds whenever \(l_j < \frac{n-1}{2}\), for \(j=1,2\) (derived directly from the threshold expression). This means that there are multiple second stage equilibria for prices \(\overline{p}_1=\overline{p}_2=\alpha (n-1)\). However, the best response of firm 1 to \(\overline{p}_2\) is \(\overline{p}_1-\frac{l_1}{m}\) (see proof of Proposition 1 for best reply function). Hence, the pair \((\overline{p}_1, \overline{p}_2)\) is an intersection of best responses only when \(l_1=l_2=0\), and different strategy classes would lead firms into an undercut dynamics. In terms of consumer welfare, we can see, for example, that given some \(0<l< \frac{n-1}{2}\), all classes of the form \(\underline{(l,n-2l,l)}\) are a consumption stage equilibrium for \(\Delta p =0\) and produce higher consumer welfare for \(\overline{\mathbf {p}}\) (see Remark 2 below). As such, if firms do not collude, there is no particular reason for \(\mathbf {\overline{p}}\) to be played a priori, because there is no reason to expect a strategy from the class \(\underline{(0,n, 0)}\) to be more likely than any other (whether consumers coordinate or not). That is, firms cannot force one particular second stage equilibrium by choosing the associated prices.

Remark 2

For a consumption behavior \(\varvec{\sigma }\) associated to a strategy profile \((\mathbf {p},\varvec{\sigma })\in \underline{(l_1,m,l_2)}\), define the (expected) consumer welfare at some price pair \(\mathbf {p}^*\) asFootnote 8

Let \((\mathbf {\overline{p}},\varvec{\sigma })\in \underline{(0,n, 0)}\) be a subgame-perfect equilibrium as in Proposition 2. Recall that \(\overline{p}=\alpha (n-1)\). Note that, \(q(\Delta \overline{p}; 0,n,0)=\frac{1}{2}\), and thus we get \(CW(0,n,0; \mathbf {\overline{p}})=-n\overline{p}-n\alpha \frac{n-1}{2}\). Now, observe that for any l such that \(0<l< \frac{n-1}{2}\), as \(\Delta \overline{p}=0\in \mathcal {PD}(l,n-2l, l)\), for any outcome extension strategy profile \((\mathbf {\overline{p}},\varvec{\sigma }')\in \underline{(l, n-2l, l)}\) we have \(D_1(\mathbf {\overline{p}},\varvec{\sigma }')\in \mathbf {ED}(\Delta \overline{p})\) (that is, \(\varvec{\sigma }'(\overline{p})\) is a second stage Nash equilibrium). Moreover, we also have \(q(\Delta \overline{p}; l,n-2l,l)=\frac{1}{2}\). Consumer welfare is,

From here, as \(2l+m=n\), we get \(CW(l, n-2l, l; \mathbf {\overline{p}})>CW(0,n,0; \mathbf {\overline{p}})\). These classes were chosen for simplicity. Not all selections are symmetric for \(\Delta p =0\).

5.2 Cost function and reservation price

Suppose we introduce a cost function with constant marginal cost c and a fixed cost F when \(D_j>0\), leading to a profit function \(\Pi _j^C\equiv ( \ p_j-c)D_j -F\). Equilibrium prices found in Proposition 1 would be up by the cost c, i.e. \(p_j^{C*} = c+p_j^*\). In particular, \(\Delta p\) and the characterization of second stage equilibria would be unaffected. The profit in equilibrium would thus only change by F, i.e. \(\Pi _j^{C*}=\Pi _j^*-F\). In the inequalities of Theorem 2, establishing necessary and sufficient conditions, the right-hand side are profits at \(P_j(k)\) when demand is \(k+1\). Note that, for example \(P_1(k)\) goes up by c too because it depends on \(p_2^*\). Therefore, both the right and left sides of inequalities change only by F. The Theorem is thus unaffected by introducing the cost function. Consequently, negative network effects may be used to solve existence in the case of affine cost functions.

Naturally, there are limits on F, and an argument to be made. Suppose firms decide whether to enter the market (i.e. produce/ serve demand) depending on F. If it is below the lower profit equilibrium, then firms would always decide to enter; if it is above the highest profit equilibrium, then firms would never enter; if it is somewhere in between, then it would depend on how firms evaluate the risk of one equilibrium with profit below F to happen. Recall that firms cannot force a second stage equilibrium by choosing the associated prices. We have not studied which is the lower profit equilibrium, as it goes beyond the scope of this work. Note, however, that the highest profit is in the class \(\underline{(0,n,0)}\), for which an equilibrium always exists. Nevertheless, the lowest profit is in the class \(\underline{(n-2,2,0)}\) (see proof of Proposition 2) for which an equilibrium does not exist (unless \(n=2\) and it is unique). So, for the lowest profit the argument is more involved as it requires a combination with Theorem 2 and the number of consumers. Furthermore, the decision of entering or not would depend on a risk assessment, which is an interesting line of research in itself.

Another impact of introducing a cost function would be seen if consumers had a reservation price \(p^R\). In that case, some equilibria where prices are higher would be eliminated. An equilibrium in some class \(\underline{(l_1, m, l_2)}\) would exist only if \(p^R - c \ge p_1^*(l_1, m, l_2)\). Observe that, as the highest equilibrium prices are in the class \(\underline{(0,n, 0)}\), this symmetric equilibrium would be the first to be eliminated, thus providing further motivation to study the other equilibria. In particular, this may help understand, and study, why some markets may be stable at a non-symmetrical pure price equilibrium, which in particular may be below the global optimum for firms.

5.3 Group interpretation

An alternative interpretation for the model would be to consider \(\mathcal {I}\) not as a set of n individual consumers, but as representing n groups. If it is merely an interpretation, say i is a group of friends deciding on a dinner venue (or a representative), naturally, results follow (although this means groups would have sensibly the same size and \(p_j\) could be seen as an average price paid per group). If each group consists of a continuum [0, 1] of individuals, and \(\sigma _j^i\) represents the fraction of those in group i who buy from firm j, then this requires a more careful discussion. Under this interpretation, consumers would be using pure strategies, thus equilibria would be computed using pure strategy payoffs and not expected utility. The payoff for each individual of group i of choosing firm j could be \(-p_j -\sum _{i'} \sigma _j^{i'}(\mathbf {p})\), and this would lead to a unique equilibrium with \(p_1^*=p_2^*=\alpha n\). As the only thing that matters is the aggregated value of demand, not the specific composition of strategies that determine it, we could collapse the second stage and follow an invariance approach in line with Carmona and Podczeck (2018). In our results, what precludes this approach is the use of expected payoff, which leads to a network effect \(\sum _{i'\ne i} \sigma _j^{i'}(\mathbf {p})\), where i doesn’t count. The multi-valued points in the resulting equilibrium demand correspondence are not essentially avoidable, as they are when limited to the diagonal of equal prices. More importantly, the demand response to a price deviation is not invariant, it depends on the aggregate’s composition (the demand characterization triplet). To use the group interpretation while maintaining the results, we could add an assumption that individuals of the same group do not have an impact on each other. This is a justifiable assumption. As an example think of two groups as smokers vs non-smokers, then negative network effects being inter-group and not intra-group, are a plausible model assumption. This type of effect is studied for example with crowding types (see for example Conley and Wooders, 1997). Under this interpretation, our results say that it would be necessary to have at least 4 groups to produce price asymmetries in equilibrium.

6 Conclusion

The modification we have made to the classic setting of two identical firms is simply introducing a negative network effect parameter \(\alpha\). The original framework corresponds to \(\alpha =0\), where demand was completely determined by \(\Delta p\), except at \(\Delta p=0\) where consumers were indifferent and demand correspondence multi-valued. Network effects extend multi-valued points in the correspondence to an interval of size \(2\alpha (n-1)\). Theorem 1, from our previous work, states that non-degenerate behavior strategies are symmetric, thus all these consumers must play with the same probability \(q\in (0,1)\), which leads to demand around the equilibrium point (for firm 1) being \(l_1 +mq\). This is the process of smoothing demand around the equilibrium point. Naturally, there are several possibilities for \(l_j\) and m. We then provide sufficient and necessary conditions for each of these possibilities to be a (global) subgame-perfect equilibrium and show some asymmetric consumer strategies that satisfy these conditions.

There is no particular assumption required to obtain the results, thus generalizations do not pose any particular problem. The only result which is not expectable to hold in more general settings is that of Proposition 5.1, the higher profit equilibrium being the symmetric one. This is a consequence of considering a simple and symmetric setting, and firms will likely be better at different equilibria if consumers have a preference or bias towards one firm, or if firms have different costs.

The reason we considered this simplistic setting was to be in line with the formalization of a vague idea, as Cournot alluded to. It is our general expectancy that the outcome of competition is supposed to differ from collusion, in particular, competition is expected to generate different price strategies (and positive profits). We have proposed a reason why that may be so. The main mechanism behind the result is that consumers react to price changes differently, by changing the probability of their choice if they’re using non-degenerate behavior strategies, and reacting only to higher price changes, if they’re using pure strategies. This is possible when there are negative network effects, and it seems natural. In practice, no firm realistically expects a disruption of consumption choices for every small price undercut.

Notes

In Section 5 we discuss the interpretation of \(\mathcal {I}\) representing n groups instead of individual consumers.

It’s possible to consider a benefit, \(b>0\), such that \(U^i_1\equiv b -p_1 -\alpha \sum _{i'\in \mathcal {I}} a^{i'}\) and similarly for choosing firm 2. In that case consumer payoffs would be positive, if b is sufficiently high. As we follow a von Neumann–Morgenstern approach to expected utility, and \(U_1-U_2\) would be the same, this would induce the exact same consumption equilibria and have no impact in results. For simplicity we consider \(b=0\). If we considered that consumers only buy a product when payoff is positive, then the subsequent analysis would carryover, with a dependence on b, but would require a 3 action strategy space for the consumption subgame.

Whether one considers i counts or not in the network effects summation has no impact on results.

There should be a \(-\alpha\) term added to the formula, but we have removed it as it has no impact on choices. It represents the fact that a consumer is always ‘with herself’, which could be assumed zero in the network effects presented in pure strategy payoffs.

Note that the threshold is constructed in terms of firm 1 for simplicity. After loosing all consumers, there’s no limit to price, thus T(0) has no meaning. We observe that there is no problem with infinite prices, since firms are not allowed to collude, and will have the incentive to deviate from a high price of the other firm.

Although associated to each demand characterization \((l_1,m,l_2)\) is a unique pair of outcome prices and demand, this does not mean there is a unique strategy leading up to that outcome, that’s why we partition strategies into classes that produce the same outcomes. Note this does not mean there cannot be equilibria from different classes with the same prices! However, these have different outcome demand (thus consumer behavior).

We will address invariance in Section 5

Consumer welfare being negative is an artifact of the simplification of considering utility as just the cost. As mentioned before, a consumption benefit parameter, equal for both firms, will have no impact on results and would make utility, and thus consumer welfare, positive.

References

Allen B, Thisse JF (1992) Price equilibria in pure strategies for homogeneous oligopoly. J Eco Manag Strat 1(1):63–81

Bagh A (2010) Pure strategy equilibria in bertrand games with discontinuous demand and asymmetric tie-breaking rules. Econ Lett 108(3):277–279

Baye MR, Kovenock D (2008) Bertrand competition. In The New Palgrave Dictionary of Economics. Palgrave Macmillan UK, pp. 1–7

Bertrand J (1883) Review of theorie mathematique de la richesse social par leon walras and recherches sur les principes de la theorie du richesses par augustin cournot. Journal des Savants 67:499–508

Bornier JMD (1992) Thecournot - bertrand debate: A historical perspective. History of Political Economy 24(3):623–656

Bos I, Vermeulen D (2020) On the microfoundation of linear oligopoly demand. The B.E. J Theo Eco

Burdett K, Judd KL (1983) Equilibrium price dispersion. Econometrica 51(4):955–969

Caplin A, Nalebuff B (1991) Aggregation and imperfect competition: On the existence of equilibrium. Econometrica 25–59(1):25

Carmona G, Podczeck K (2018) Invariance of the equilibrium set of games with an endogenous sharing rule. J Eco Theo 177:1–33

Conley JP, Wooders MH (1997) Equivalence of the core and competitive equilibrium in a tiebout economy with crowding types. J Urban Econ 41(3):421–440

Cournot A (1839) Researches into the Mathematical Principles of Wealth. The Macmilian Company, New York. Translation by Nathaniel Bacon 1897

Dastidar KG (2011) Existence of bertrand equilibrium revisited. Int J Econ Theo 7(4):331–350

de Palma A, Ginsburgh V, Papageorgiou YY, Thisse JF (1985) The principle of minimum differentiation holds under sufficient heterogeneity. Econometrica 53(4):767–781

Diamond PA (1971) A model of price adjustment. Journal of Economic Theory 3(2):156–168

Fudenberg D, Tirole J (1991) Game Theory. MIT Pres

Hoernig SH (2007) Bertrand games and sharing rules. Econ Theor 31(3):573–585

Hopkins E (2008) Price Dispersion. In: Macmillan Palgrave (ed) The New Palgrave Dictionary of Economics. Palgrave Macmillan UK, London, pp 1–4

Leibenstein H (1950) Bandwagon, snob, and veblen effects in the theory of consumers’ demand. Q J Econ 64(2):183–207

Saporiti A, Coloma G (2010) Bertrand competition in markets with fixed costs. The B.E. J Theo Eco 10:1

Shy O (2011) A Short Survey of Network Economics. Rev Ind Organ 38(2):119–149

Soeiro R, Mousa A, Oliveira TR, Pinto AA (2014) Dynamics of human decisions. J Dyna Games 1(1):121–151

Tirole J (1988) The theory of industrial organization. MIT Press, Cambridge, Mass. 1994 edition

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Proofs

Proofs

Let us define for ease of notation the function

1.1 Lemma 1

Proof

Let \((\mathbf {p}^*,\varvec{\sigma }^*)\) be a subgame-perfect equilibrium with positive profits for both firms, hence, where \(p_1^* \ne 0\ne p_2^*\). We will do the proof in terms of firm 1, firm 2 is analogous. Let us denote equilibrium outcome demand by \(D_1^*\equiv D_1(\mathbf {p}^*,\varvec{\sigma }^*(\mathbf {p}^*))\) and let \((l_1^*, m^*, l_2^*)\) be the outcome demand characterization. Note that \(D_1^* \in \mathbf {ED}(\Delta p^*)\), which is formed by the union of horizontal (\(m=0\)), vertical (\(m=1\)) and oblique (\(m>1\)) line segments. As both prices are positive and part of equilibrium, \(D_1^*\) must have the same right and left limit (a discontinuity would be an incentive for a small price change). Therefore, \(D_1^*\) is either located at a point whose neighborhood has constant demand characterization (deviation demand stays in the same segment), or at an intersection point (if it changes segment). Suppose demand stays in the same segment for an interval containing \(\Delta p^*\). Then, \(m^*\ne 1\), because for \(m=1\) the domain is a single point. But if \(m^*=0\) a price change would produce no change in demand for at least one of the firms. As such, \(m^*>1\), which means demand is on an oblique segment, given by \(Q_1(\Delta p; l_1,m,l_2)\). Suppose now that \(D_1^*\) lies at an intersection point, possibly leading to a change of demand characterization. Note that the slope of each line is (completely) determined by m (for obliques it is \(-\frac{m}{2\alpha (m-1)}\)). Furthermore, characterization preserving functions with the same m start at different points \(T(l_1+m)\) (note that \(l_1+m=n-l_2\) and n is fixed). Thus, different demand characterizations (line segments) which intersect, have different slopes. Furthermore, the number of possible demand characterizations is finite, hence, all the intersection points of these segments are isolated, that is, there is a neighborhood (of \(\Delta p\)), for which they are unique. As such, there is a neighborhood of \(\Delta p^*\) for which, at most, there is a unique change of demand characterization, in this case happening at \(\Delta p^*\). Seen that at \(D_1^*\) the right and left slope must be the same, this means that the demand characterization on the left and right of \(\Delta p^*\) must be the same. Therefore, there must be an interval containing \(\Delta p^*\) for which the demand characterization is constant, except possibly at \(\Delta p^*\). That is, there is \((l_1, m, l_2)\) such that in the neighbourhood of \(\Delta p^*\) demand is given by \(Q_1(\Delta p; l_1,m,l_2)\). But if \(\Delta p^*\) is an intersection point, although it may have a different demand characterization, demand value is the same, that is, \(D_1^*=Q_1(\Delta p^*; l_1,m,l_2)\). Note that in particular, this means the equilibrium must lie at an interior point of the price domain, as at the boundary there must be a change to a different demand characterization.

1.2 Proposition 1

Proof

The idea of this proof is to find the profit maximum for each demand characterization, which is produced by Lemma 1. Let \((\mathbf {p}^*,\varvec{\sigma }^*)\) be a subgame-perfect equilibrium with positive profits for both firms. For each demand characterization consider the function \(F_1\equiv F_1(l_1,m,l_2): ( \ p_2^*+T(l_1+m), p_2^*+T(l_1+1)) \rightarrow \mathbb {R}\), given by \(F_1( \ p_1)=p_1Q_1( \ p_1,p_2^*; l_1,m,l_2)\). According to Lemma 1 there is \((l_1,m, l_2)\) with \(m>1\) and a neighbourhood \(V(\Delta p^*) \in (T(l_1+m), T(l_1+1))\) such that, for \(p_1-p_2^* \in V(\Delta p^*)\) we have \(\Pi _1( \ p_1,p_2^*,\varvec{\sigma }^*( \ p_1, p_2^*))=F_1( \ p_1)\). Therefore (see equation 2 for \(Q_1\)),

Note that, as \(\Delta p^* \in (T(l_1+m), T(l_1+1))\), we have \(p_1^*<p_2^*+T(l_1+1)\), and as \(p_1^*>0\) by assumption, so is \(p_2^*+T(l_1+1)\). A first question is whether the underlying quadratic function maximum is interior to the domain of \(F_1\), or if it is outside and the maximum of \(F_1\) at the boundary of its domain. Suppose the maximum of \(F_1\) is \(p^M\) at the boundary. Then \(p^M-p_2^*=T(l_1+1)\) or \(p^M-p_2^*=T(l_1+1)\), which means \(\Delta p^*\) would not be an interior point of \((T(l_1+m), T(l_1+m))\). According to the last note on the proof of Lemma 1, \((\mathbf {p}^*,\varvec{\sigma }^*)\) cannot be a subgame-perfect equilibrium. This is a contradiction, hence the maximum of \(F_1\) must be interior. Using the first order condition, we get

Analougously we get

From here,

noting that \(T(l_1+m)=\alpha (n-2l_1-2m+1)\) and \(T(l_1+1)=\alpha (n-2l_1-1)\) (see equation 1) we get that

The fixed point, \(p_1^*=P_1( \ p_2( \ p_1^*))\) is

noting that \(l_1+l_2=n-m\), we get

From \(P_2( \ p_1^*)\) we get \(p_2^*\).

1.3 Theorem 2

Proof

Consider an outcome with demand characterization \((l_1^*, m^*, l_2^*)\) and prices \(\mathbf {p}^*=( \ p_1^*(l_1,m,l_2),p_2^*(l_1,m,l_2))\) where \(\Delta p^*\in \mathcal {PD}(l_1^*, m^*, l_2^*)\). These are necessary conditions on the outcome. The aim of this proof is to find sufficient and necessary conditions for existence of a strategy profile \((\mathbf {p}^*, \varvec{\sigma }^*)\) which is a subgame-perfect equilibrium and produces the above mentioned outcome.

We will do the analysis in terms of firm 1, firm 2 is analogous. It is helpful to keep in mind Fig. 4 throughout the proof.

Recall that non-monopolistic equilibrium demand exists only for \(p_1 \in [p_2^*+T(n), p_2^*+ T(1)]\), an interval which is partioned in \(n-1\) blocks of size \(2\alpha\) by the thresholds \(T(l_1)\) for each \(l_1\in \{2, 3, \ldots , n-1 \}\). At each threshold point, say \(p_1=p_2^*+T(l_1)\), the minimum and maximum value in \(\mathbf {ED}( \ p_1-p_2^*)\) are, respectively, \(l_1-1\) and \(l_1\). As such, (demand) values in \(\mathbf {ED}( \ p_1-p_2^*)\) are bounded above by the line \(\overline{d}_1( \ p_1)\equiv n-( \ p_1-( \ p_2^*+T(n)))/2\alpha\).

The outcome extension strategies in \((\underline{l_1^*, m^*, l_2^*})\) differ only in the specifications \(f_L\) and \(f_R\). Let us denote \(Q_1^*( \ p_1)\equiv Q_1( \ p_1-p_2^*; l_1^*, m^*, l_2^*)\), and \(\text {I}^*\equiv ( \ p_2^*+T(l_1^*+m^*), p_2^*+T(l_1^*+1))\). For all \(p_1 \in \text {I}^*\), any of the above outcome extension strategies induce \(D_1( \ p_1,p_2^*)=Q_1^*( \ p_1)\). Let \(\Pi _1^*\equiv \Pi _1(\underline{l_1^*, m^*, l_2^*})\). The isoprofit demand curve for firm 1, \(h_1( \ p_1; (\mathbf {p}^*,\varvec{\sigma }^*(\mathbf {p}^*)))=\Pi _1^*/p_1\), which we abbreviate to \(h_1( \ p_1)\), is tangent to \(Q_1^*( \ p_1)\) at \(p_1^*\). As \(Q^*_1\) is linear, \(h( \ p_1)\ge Q_1^*( \ p_1)\) for all \(p_1\in \text {I}^*\). The question is thus, are there specifications \(f_L\) and \(f_R\) for price deviations outside \(\text {I}^*\) that lead to demand continuations of \(Q_1^*\) below \(h_1\)?

Let \(tl\equiv p_2^*+T(l_1^*+m^*)\) and \(tr\equiv p_2^*+T(l_1^*+1)\), so that \(\text {I}^*=(tl,tr)\). Let us start with the case \(p_1\le tl\). Note that \(Q_1^*\) and \(\overline{d}_1\) are both linear and cross at \(Q_1^*(tl)=\overline{d}_1(tl)\). For \(p_1>tl\), we have \(Q_1^*( \ p_1)<\overline{d}_1( \ p_1)\) and for \(p_1< tl\), we have \(Q_1^*( \ p_1)>\overline{d}_1( \ p_1)\). As \(Q_1^*\le h_1\), then \(h_1\) crosses \(\overline{d}_1\) at a point \(p_1>tl\). As such, for \(p_1\le tl\), we obtain \(h_1( \ p_1)>\overline{d}_1( \ p_1)\). As for all possible choices of \(f_L\), it holds that \(f_L( \ p_1)\le \overline{d}_1( \ p_1)\), then, for all \(f_L\) we must have that \(f_L( \ p_1)<h_1( \ p_1)\) for all \(p_1\le tl\).

Let us now look at the case \(p_1 \ge tr\). When \(p_1>p_2^*+T(1)\), the unique equilibrium demand is \(D_1=0\), therefore, we need only look at the interval \([tr, p_2^*+T(1))\), which is partitioned into \(l_1^*-1\) blocks by thresholds \(T(l_1^*+1), T(l_1^*), T(l_1^*-1), \ldots , T(1)\). Note that, we must have \(m^*>1\) and thus, \(0\le l_1^*<n-2\).

Claim

In every interval (block) \([p_2^*+T(l_1+2), p_2^*+ T(l_1+1)]\), where \(l_1\in \{0, \ldots , n-2\}\), demand for firm 1 is bounded below by

where

Taking into account the above claim, we need only guarantee that \(h_1( \ p_1)\ge \underline{d_1}( \ p_1)\) for \(p_1 \in [p_2^*+T(l_1^*+1), p_2^*+T(1))\). Note that \(\underline{d_1}( \ p_1)\) is continuous (though not differentiable at \(P^I_1\)), thus, as \(Q_1\) decreases with price, it suffices to show that \(h_1( \ p_1^I(l_1))\ge \underline{d_1}( \ p_1^I(l_1))\) in the aforementioned blocks (intervals), i.e. for every \(l_1\in \{0, \ldots , l_1^*-1\}\). If this is the case, then at least the outcome extension strategy with specification \(f_R( \ p_1)=\underline{d_1}( \ p_1)\) has no incentives for firm 1 to deviate, and is part of an equilibrium. We have thus to show that for every \(l_1\in \{0, \ldots , l_1^*-1\}\), it holds that \(\Pi _1^* / P_1^I(l_1)\ge l_1+1\). As \(P_1^I(l_1)>p_1^*>0\), we can rewrite this as \(\Pi _1^* \ge P_1^I(l_1)(l_1+1)\).

Proof (Proof of Claim)

Recall that \(\mathbf {ED}\) is formed by the union of oblique line segments determined by \(Q_1\) for characterizations with \(m>1\), and horizontal and vertical segments for \(m=0\) and \(m=1\). In this proof, when mentioning lines/ segments we will be always referring to this equilibrium demand space. For \(m>1\), each \(Q_1\) segment is completely determined by \(l_1\) and m (note that \(l_2=n-l_1-m\)), with price domain \([p_2^*+T(l_1+m), p_2^*+T(l_1+1)]\). Consider now a block \(( \ p_2^*+T(l_1+2), p_2^*+T(l_1+1))\) for some \(l_1\in \{0, \ldots , n-2\}\). The minimum value of demand at \(p_1=p_2^*+T(l_1+2)\) is \(l_1+1\) and the maximum value at \(p_1=p_2^*+T(l_1+1)\) is \(l_1+1\). As such, all oblique lines whose domain contains this block, cross the horizontal line \(l_1+1\) (the unique non-oblique line in the mentioned interval). The first intersection happens at some point, call it \(p_1^I\), such that \(Q_1( \ p_1^I -p_2^*; l_1', m', l_2') =l_1+1\) for some characterization \((l_1', m', l_2')\). We will now show that this characterization is of a particular form determined by \(l_1\). Given a fixed \(\overline{l}_1\), for every possible value of \(m'\), i.e. \(1<m'\le n-\overline{l}_1\), the segments determined by \((\overline{l}_1, m', n-\overline{l}_1-m')\) intersect (end) at \(p_2^*+T(\overline{l}_1+1)\). The slope of lines determined by \(Q_1\) is \(-m'/[2\alpha (m'-1)]\), hence, among characterizations with \(\overline{l}_1\), the first to cross is of the form \((\overline{l}_1, n-\overline{l}_1, 0)\) (maximum \(m'\) for lowest slope because \(\alpha >0\)). As such, characterizations with \(l_2'=0\) are the candidates to originate the first crossing at \(p_1^I\). For all \(l'_1\), characterizations of the form \((l_1',n-l_1',0)\) intersect (start) at \(p_2^*+T(n)\). As such the first crossing is provided by the line which ends first, that is, where \(p_2^*+T(l_1'+1)\) is smallest (the steepest line is where \(l_1'\) is higher because \(m'=n-l_1'\)). Taking into account that it must contain the domain, (thus end after \(p_2^*+T(l_1+2)\)) we must have \(l_1'<l_1+1\), and so we get \(l_1'=l_1\). The first crossing in the interval \(( \ p_2^*+T(l_1+2), p_2^*+T(l_1+1))\) is thus determined by solving \(Q_1( \ p_1^I -p_2^*; l_1, n-l_1, 0) =l_1+1\), which is \(p_1^I=P_1^I(l_1)\). From \(p_2^*+T(l_1+1)\) to \(P_1^I(l_1)\) minimum demand is \(l_1+1\), then it follows \(Q_1( \ p_1-p_2^*; l_1, n-l_1, 0)\).

Ilustration for the proof of Theorem 2

1.4 Theorem 3

Proof

Consider the classes \(\underline{(l_1,m, 0)}\) where \(l_1\ge 1\) and \(m\ge 3l_1\). Note that, \(p_j(l_1,m, 0) >0\) for \(j=1,2\) and \(\Delta p^*\ne 0\). So these classes have positive and different prices. The proof follows by showing that for \(n\ge 4\) these classes exist and satisfy Theorem 2, hence a subgame-perfect equilibrium with positive profit always exists.

To show that the classes satisfy Theorem 2, we need to show that \(\Delta p^* \in \mathcal {PD}(l_1,m,0)\) and that conditions (i) and (ii) are satisfied.

For \(\Delta p^* \in \mathcal {PD}(l_1,m,0)\), we must show that \(T(l_1+m)<\Delta p^*<T(l_1+1)\). Observe that \(\Delta l =l_1\) and \(l_1+m=n\). Recall \(T(x)=\alpha (n-2x+1)\). We thus have to show that

Because \(l_1\ge 1\) and \(m>2l_1\), we have that \(l_1+m > 1 +2l_1\), hence, \(n-1>2l_1\), which means \(\alpha (n-1)>2\alpha l_1\) and the above holds.

Now for conditions (i) and (ii), note that (ii) is trivially satisfied when \(l_2=0\), thus we need only show condition (i), that is, we need to show that for all \(k\in \{0, \ldots , l_1-1\}\) we have

This is,

As \(2\alpha >0\), it can be removed. As \(k\in \{0,\ldots ,l_1-1\}\), we get that \(n-k>n-l_1=m\), thus the (new) right hand side is smaller than the following quadratic in \(k+1\),

with maximum at \(k+1=\dfrac{1}{2}\left( n-1-\dfrac{l_1}{3m}+\dfrac{1}{m}\right)\). Therefore it is enough to show that,

Note that \(m>1\), hence this can be rewritten as

and developped into

Thus,

which multiplied by 4 leads to

obtaining

and getting (note that \(n-l_1=m\))

Eliminating the term \(\frac{(l_1-3)^2}{m}\), which is positive, it suffices to show that

Recall that we are considering the classes with \(l_1\ge 1\), \(m\ge 3l_1\), and \(l_2=0\). The inequality \(15l_1^2\ge -6l_1+9\) holds for \(l_1\ge 1\). For the left one, as the left-hand side decreases with \(l_1\), the right-hand side increases, and the maximum for \(l_1\) is m/3, it is enough to show that \(6m^2-29m+18\ge 0\). This holds for \(m>4\). Therefore, for \(n\ge 6\) the proof is done. For \(n=4\) and \(n=5\), we observe that, respectively, the classes \(\underline{(1, 3, 0)}\) and \(\underline{(1, 4, 0)}\), are an equilibrium, which can be seen directly (in this cases \(k=0\)). That is, it holds that \(\Pi _1(\underline{1, 3, 0})\ge P_1(0, (1, 3, 0))\) and \(\Pi _1(\underline{1, 4, 0}) \ge P_1(0, (1, 4, 0))\).

1.5 Proposition 5.1

Proof

Let \(\mathbf {EL}\) be the set of classes \(\underline{(l_1, m, l_2)}\) that contain a subgame-perfect equilibrium with positive profits for both firms. We will show that for all \(L\in \mathbf {EL}\) we have \(\Pi _j^*(L)<\Pi _j^*(\underline{0, n, 0)}\). Fix \(m^*>1\). Consider two classes \(L, L' \in \mathbf {EL}\) such that \(L=\underline{(l_1, m^*, l_2)}\), \(L'=\underline{(l_1', m^*, l_2')}\) and, without loss of generality, suppose \(l_1<l_1'\). Then, by Equation 3 we have \(\Pi _1^*(L)>\Pi _1^*(L')\). Therefore, the highest profit for firm j is in a class with \(l_j=0\). We will now show that equilibrium profit for classes of the form \(\underline{(0, m, n-m)}\) is increasing in m for \(2\le m \le n\). For firm 2 the reasoning is analogous and concludes the proof. Note that, using Equation 3, equilibrium profit in these classes can be rewritten as a function of m

We now observe that

Let \(A\equiv m(3n-1)-2n\) and \(B=3n-1\). Then, we have,

As \(\Pi _1^*(\underline{0,m,n-m})>0\) then \(A\ne 0\), thus,

Noting \(A=Bm-2n\), we get

The solution is \(m=\frac{2n}{n+1}\) which is smaller than 2. Hence, there is no critical point for \(m>2\), which means \(\Pi _1^*(\underline{0,m,n-m})\) is monotonous in \(2\le m \le n\). As \(\Pi _1^*(\underline{0,2,n-2})\le \Pi _1^*(\underline{0,n,0})\) for \(n\ge 2\), then \(\Pi _1^*(\underline{0,n,0})\) is maximal.

About this article

Cite this article

Soeiro, R., Pinto, A.A. Negative network effects and asymmetric pure price equilibria. Port Econ J 22, 99–124 (2023). https://doi.org/10.1007/s10258-021-00199-3

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10258-021-00199-3