Abstract

The Chichilnisky criterion is an explicit social welfare function that satisfies compelling conditions of intergenerational equity. However, it is time inconsistent and has no optimal solution in the Ramsey model. By investigating stationary Markov equilibria in the game that generations with Chichilnisky preferences play, this paper shows how, nevertheless, this criterion can be practically implemented in the Ramsey model, leading to attractive consequences. The time-discounted utilitarian optimum is the unique equilibrium path with a high-productive initial stock, implying that the weight on the infinite future in the Chichilnisky criterion plays no role. However, this part of the Chichilnisky criterion may lead to more stock conservation than the time-discounted utilitarian optimum with a low-productive initial stock. Based on the notion of von Neumann–Morgenstern abstract stability, we obtain uniqueness by assuming that each generation coordinates on an almost best equilibrium and takes into account that future generations will do as well.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

In spite of the development that accumulated reproducible and human capital has lead to in the recent past, there are clear conflicts of interest between generations: the well-being of future generations might be undermined unless we take costly action today. Abating greenhouse gas emissions, which reduces future climate change, has attracted much attention (Stern 2007; Nordhaus 2008) and is a prime example of costly current action with long-term future benefits. Other conflicts with similar characteristics include preserving biodiversity (which ensures future resilience), exploiting soil and water resources with caution (which avoids future malnutrition and decease) and using antibiotics with care (which reduces future health problems).

These intergenerational conflicts raise the normative question: What should our generation as a collective do if the interests of all generations are considered from an impartial perspective? In line with Rawls’(1999) reflective equilibrium, to provide answers to this question we need both

-

axiom-based normative criteria of intergenerational equity,

-

growth models to explore the consequences of such normative criteria.

This ensures that criteria for intergenerational equity are judged both by the ethical conditions on which they build and by their consequences in specific technological environments (this approach is endorsed by, e.g., Koopmans 1967; Dasgupta and Heal 1979, p. 311; Atkinson 2001, p. 206).

In this paper, we follow this program by considering Chichilnisky’s (1996) sustainable preference in Ramsey’s (1928) model of economic growth. We consider Chichilnisky’s sustainable preference because it is a first and important attempt to find principles for balancing the interests of the present and the future. We consider Ramsey’s one-sector growth model because it is simple and versatile.

The Ramsey model, in which output depends on a one-dimensional stock k and is split between consumption c and stock accumulation \(\dot{k}\), is versatile because the stock can be interpreted in two ways. One possibility is to interpret the function that turns stock k into output \(c + \dot{k}\) as a net production function and k as an aggregate of accumulated reproducible and human capital. Then the initial rate of net productivity can be assumed to be high, and the question is to how much capital to accumulate. Another possibility is to interpret the function that turns k into \(c\,+\,\dot{k}\) as a natural growth function and k as an aggregate resource stock that indicates the status of the natural environment, including climatic conditions, biodiversity, soil and water resources and the efficiency of available medication. Then the initial rate of net productivity can be assumed to be low, and the question is how much resource to conserve.

Economists (see, e.g., Barro and Sala-i-Martin 2004) usually apply the time-discounted utilitarian (TDU) criterion, which seeks to maximize the time-discounted average of future utilities,

over all feasible paths. In this criterion, u is a utility function that turns consumption into transformed value (‘utility’). When the TDU criterion is applied to the Ramsey model, it leads to capital accumulation in the former interpretation, with a high-productive capital aggregate, but does not lead to resource conversation in the latter interpretation, with a low-productive resource aggregate.

From a normative point of view, one might argue that the TDU criterion is deficient as a matter of principle—in spite of Koopmans’s (1960) axiomatization—as it does not treat generations equally. The TDU criterion leads also to problematic consequences in the Ramsey model, as it does not support the intuition—supported by both utilitarian and egalitarian arguments in technological environments with positive net productivity (cf. Asheim et al. 2001)—that we should be willing to assist an infinite future if all future generations are worse off than us.

Alternatives like undiscounted utilitarianism and maximin treat generations equally. They entail that future generations are assisted if they are worse off than us, but provide very different answers to the question of our responsibility to save for the benefit of future generations that are better than us (see Asheim 2010, Sect. 4.3): According to undiscounted utilitarianism, the responsibility to save for the benefit of future generations that are better than us is essentially unlimited, while there is no such responsibility when maximin is applied. Hence, compared to the TDU criterion, undiscounted utilitarianism and maximin might be claimed to lead to more desirable consequences when the Ramsey model is interpreted as a model of resource conservation, but these criteria lead to extreme and perhaps undesirable consequences when the Ramsey model is interpreted as a model of capital accumulation.

Chichilnisky’s (1996) sustainable preference balances the interests of the present and the future by requiring that a criterion of intergenerational equity be neither a dictatorship of the present (also generations beyond any given T play a role) nor a dictatorship of the future (not only generations beyond any given T play a role). Chichilnisky (1996) makes the important observation that the TDU criterion is ruled out the by the former of these requirements, since under TDU, what happens beyond some finite future time does not play any role if two different consumption paths are strictly ranked. Criteria like the limit of the discounted average of utilities as the discount rate goes to zero and the long-run undiscounted average of utilities are ruled out by the latter of these requirements.

In addition, a sustainable preference has the properties of (1) being numerically represented by an explicit social welfare function and (2) satisfying the Strong Pareto principle (in the sense of being sensitive to the interests of each generation). The former of these requirement rules out undiscounted utilitarianism and lexicographic maximin, while the latter rules out ordinary maximin.

In the present paper, we apply the following particular version of a sustainable preference within the class of representations considered in Chichilnisky’s (1996) Theorems 1 and 2, but adapted to our continuous time framework:

This version can be used to rank consumption paths for which the limit of the discounted average of utilities exists when the discount rate \(\rho \) goes to zero. Converging consumption paths is a special case; in this case, the criterion ranks paths by a convex combination of the TDU value and limit of utility as time goes to infinity.

However, it is problematic to apply Chichilnisky’s criterion in the Ramsey model. These issues are discussed by Heal (1998) and they motivate the analyses of Figuières and Tidball (2012) and Ayong Le Kama et al. (2014). The problems that hinder application are twofold:

-

There is a generic problem of nonexistence in a class of technological environments that includes the Ramsey model. The reason is that the value of the first TDU part of the criterion is increased by the delaying the response to the second asymptotic part that captures the concern for the infinite future.

-

The criterion is time inconsistent, as the weight on any absolute time t in the TDU part increases when the time of evaluation is advanced, while the weight on the infinite future through the asymptotic part does not change.Footnote 1

Up to now, these problems have prevented an exploration of the consequences of Chichilnisky’s criterion in the Ramsey model. We take on this challenge and show how nevertheless the criterion can be practically implemented in the Ramsey model.Footnote 2

The problems of nonexistence and time inconsistency imply that searching for an optimal path when applying the Chichilnisky criterion in the Ramsey model is both futile and irrelevant. Consequently, this paper investigates stationary Markov equilibria in the game that generations with Chichilnisky preferences play in the Ramsey model. We show that the equilibrium path always coincides with the TDU optimum in the case of a high-productive initial stock, implying that the weight on the infinite future in the Chichilnisky criterion plays no role. However, we also show that this part of the Chichilnisky criterion may lead to more stock conservation than the time-discounted optimum in the case of a low-productive initial stock.

These consequences of the Chichilnisky criterion might be considered attractive as it supports the intuition that we should seek to assist future generations if they are worse off than us, while not having an unlimited obligation to save for their benefit if they turn out to be better off.

The paper is organized as follows. In Sect. 2, we introduce the Ramsey model and investigate TDU optimal paths when the stock is constrained to remain within restricted subintervals. This will serve as a building block for the analysis of stationary Markov equilibria when, in Sects. 3–7, applying the Chichilnisky criterion to the Ramsey model. In Sect. 3, we first establish that there does not exist an optimal path for the Chichilnisky criterion in the Ramsey model.

In Sect. 4, we consider one-attractor stationary Markov equilibrium strategies on subintervals and establish that the Chichilnisky criterion is outcome equivalent to the TDU criterion. In Sects. 5 and 6, we then show that this conclusion is changed when we consider multiple-attractor stationary Markov equilibrium strategies. To be precise: The Chichilnisky criterion is still outcome equivalent to the TDU optimum when the Ramsey model is interpreted as a model of capital accumulation with a high-productive initial stock. However, when the Ramsey model is interpreted as a model of resource conversation with a low-productive initial stock, equilibrium strategies provide a bridge from the near future—whose interests are taken into account by the TDU part of Chichilnisky’s criterion—to the infinite future—whose interests are protected by the asymptotic part of the criterion. The reason is that all generations understand that, in equilibrium, any exploitation of the stock for short-term gains will have consequences also for the infinite future. This result is related to Krusell and Smith’s (2003) demonstration of multiple Markov equilibria in the Ramsey model under quasi-geometric discounting.

In the penultimate Sect. 7, we address the problem of coordination: What if the first generation coordinates on an equilibrium strategy leading to an outcome that maximizes the value of the Chichilnisky criterion over all equilibrium strategies? What if the first generation takes into account that future generations will do so in turn? Our analysis, which is based on von Neumann–Morgenstern abstract stability (von Neumann and Morgenstern 1953, p. 40; Greenberg 1990, Chapter 4), demonstrates that uniqueness is obtained by assuming that each generation coordinates on an almost best equilibrium and takes into account that future generations will do as well. This uniqueness result allows us to perform comparative statics with respect to the discount rate \(\delta \) and the weight \(\alpha \) on the infinite future.

In the final Sect. 8, we offer concluding remarks by comparing our results in the context of the Chichilnisky criterion with other criteria that also support the intuition that we should seek to assist future generations if they are worse off than us, while not having an unlimited obligation to save for their benefit if they turn out to be better off. An “Appendix” contains the proofs of all lemmas.

2 TDU optimum in the Ramsey model

Denote by k the stock of an augmentable good. In the Ramsey model, instantaneous output f(k) is split between flow of consumption c and stock accumulation \(\dot{k}\).

To facilitate the analysis, let \(f : \mathbb {R}_+ \rightarrow \mathbb {R}_{+}\) be a continuously differentiable strictly increasing and strictly concave function satisfying \(f(0) = 0, \lim _{k \rightarrow 0^+}f'(k) = \infty \), and \(\lim _{k \rightarrow \infty }f'(k) = 0\). The analysis can also be adapted to the case where f has an interior maximum, due to depreciation (when f is interpreted as a net production function and k as a stock of a capital aggregate) or reduced natural regeneration for stocks exceeding the maximum sustainable yield (when f is interpreted as a natural growth function and k as a stock of a resource aggregate). Furthermore, let \(u : \mathbb {R}_{+} \rightarrow \mathbb {R}_{+}\) be a twice differentiable strictly increasing and strictly concave utility function satisfying \(u(0) = 0\) and \(\lim _{c \rightarrow 0^+}u'(c) = \infty \).

The technology can be described by the system:

Note that if k(t) is absolutely continuous on \([0, \infty )\), then \(c|_{(0,T)}(t) \in L^{1}\left( 0,T\right) \) for all \(T > 0\). Given \(k_{0} \ge 0\), a pair (k(t), c(t)) of stock and consumption paths defined for \(t \in [0,\infty )\), satisfying (1) and (2), with k(t) absolutely continuous, will be called feasible. The set of all feasible pairs will be denoted by \(A\left( k_{0}\right) \). If \(k_0 = 0\), then there is only one feasible path with (k(t), c(t)) being equal to (0, 0) at each point in time. So we will be concerned only with the non-trivial case where \(k_0 > 0\).

Define \(\mathbf {k}_{\infty } : \mathbb {R}_{++} \rightarrow \mathbb {R}_{++}\) by \(f'(\mathbf {k}_{\infty }(\delta )) = \delta \). It follows from the assumptions on f that \(\mathbf {k}_{\infty }\) is well-defined continuous and strictly decreasing function of \(\delta \).

Write \(\underline{k} := \mathbf {k}_{\infty }(\delta )\). The following result is classical:

Proposition 1

The unrestricted TDU problem:

has a unique solution \((k^{*}\left( t\right) , c^{*}\left( t\right) ) \) for every initial stock \(k_{0} > 0\) and yields a finite value for the integral. Both \(k^{*}(t)\) and \(c^{*}(t)\) are monotonic in t, and:

It follows as a corollary that the discounted average of the utilities derived from consumption, \(\delta \int _{0}^{\infty }e^{-\delta t}u(c(t))\hbox {d}t\), exists for every feasible path and all \(\delta > 0\) since \(\delta \int _0^Te^{-\delta t}u(c(t))\hbox {d}t\) is an non-decreasing function of T (as \(u(c(t)) \ge 0\) for all t) and has an upper bound.

To study the implications of the Chichilnisky criterion in the Ramsey problem, we need first to understand the restricted TDU problem. Fix \(k_0 > 0\), and let \(I \subseteq \mathbb {R}_{++}\) be an interval with positive measure satisfying that \(k_0 \in I\). The interval I may be unrestricted and coincide with \(\mathbb {R}_{++}\) or be an open, half-closed or closed subinterval of \(\mathbb {R}_{++}\) within which the stock k is constrained to remain.

Given \(k_{0} \in I\), a pair (k(t), c(t)) of stock and consumption paths defined for \(t \in [0,\infty )\) satisfying (1) and (2), with k(t) absolutely continuous and remaining in I for all \(t \in [0,\infty )\), will be called I-feasible. The set of all I-feasible pairs will be denoted by \(A\left( k_{0}, I \right) \). An I-feasible pair \((k^{*}(t), c^{*}(t))\) of stock and consumption paths defined for \(t \in [0,\infty )\) is I-optimal if, for any other I-feasible pair (k(t), c(t)), we have:

Since the TDU criterion is strictly concave, we obtain the following observation.

Lemma 1

If an I-optimum pair exists, then it is unique.

With any I-feasible pair (k(t), c(t)), we associate the path of present-value consumption prices \(p: [0, \infty ) \rightarrow \mathbb {R}_{++}\) defined by:

An I-feasible pair \((k^{*}(t),c^{*}(t))\) of stock and consumption paths defined on for \(t \in [0,\infty )\) will be called I -competitive if \(c^{*}\) is absolutely continuous, so that the associated present-value price path \(p^{*}(t)\) is differentiable almost everywhere, and, for almost all \(t \in [0, \infty ), k^{*}(t)\) satisfies profit maximization:Footnote 3

The pair \((k^{*}(t),c^{*}(t))\) satisfies the capital value transversality (CVT) condition if

We are now in a position to state a sufficient condition for optimality.

Lemma 2

If an I-feasible pair \((k^{*}(t), c^{*}(t))\) is I-competitive and satisfies the CVT condition, then \((k^{*}(t), c^{*}(t))\) is I-optimal.

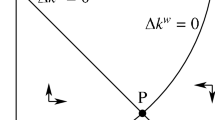

This provides us with three cases, illustrated in Fig. 1, where an I-optimal pair of stock and consumption paths exists and is unique. Note that uniqueness follows from Lemma 1.

-

(a)

If \(\underline{k} \in I, \underline{k} = \sup I \notin I\) or \(\underline{k} = \inf I \notin I\), then there exists a unique I-competitive pair (k(t), c(t)) satisfying the CVT condition. If \(k_{0}=\underline{k}\), we have \(k\left( t\right) =\underline{k}\) for all t. If \(k_{0} \ne \underline{k}\), then \(k\left( t\right) \) belongs to the interior of I for all \(t>0\), and converges to, but never reaches, \(\underline{k}\). Condition (3) is satisfied for all \(t \in [0, \infty )\), implying that net marginal productivity \(f'(k)\) equals the consumption interest rate \(-\dot{p}/p\). This leads to the Euler equation,

$$\begin{aligned} u''(c) \dot{c} = (\delta - f'(k)) u'(c), \end{aligned}$$and the Keynes–Ramsey rule,

$$\begin{aligned} f'(k) = \delta + \eta \tfrac{\dot{c}}{c}, \end{aligned}$$where \(\eta = - u''(c)c/u'(c)\).

-

(b)

If \(\underline{k} < \inf I \in I\), then there exists a unique I-competitive pair (k(t), c(t)) satisfying the CVT condition. The stock path reaches \(\min I\) in finite time T with \(\dot{k}(T) = 0\) and stays at \(\min I\), with \(c(t) = f(\min I)\), for \(t \ge T\). We have that \(f'(k) < -\dot{p}/p\) for \(t > T\), implying that the Euler equation is satisfied only in the interior phase, for \(0 < t < T\). Note that (3) is not satisfied for \(t = T\), as c and thus p are not differentiable at this point in time.

-

(c)

If \(\underline{k} > \sup I \in I\), then there exists a unique I-competitive pair (k(t), c(t)) satisfying the CVT condition. The stock path reaches \(\max I\) in finite time T with \(\dot{k}(T) = 0\), and stays at \(\max I\), with \(c(t) = f(\max I)\), for \(t \ge T\). We have that \(f'(k) > -\dot{p}/p\) for \(t > T\), implying that the Euler equation is satisfied only in the interior phase, for \(0 < t < T\). Note that (3) is not satisfied for \(t = T\), as c and thus p are not differentiable at this point in time.

We claim that in the remaining cases, that is, \(\underline{k} < \inf I\notin I\) or \(\underline{k} > \sup I \notin I\), there is no I-optimal pair. Indeed, suppose, for instance, \(\underline{k} > \sup I\notin I\). Set \(J=I\cup \left\{ \sup I\right\} \). Clearly, the set of I-feasible pairs \(A(k_0,I)\) is a subset of the set of J-feasible pairs \(A(k_0,J)\), so the maximum of the TDU criterion over all J-feasible pairs is at least as large as the supremum over all I-feasible pairs:

We know from case (c) above that the J-maximum is unique and is achieved by a pair \((k^{*}(t), c^{*}(t))\) where \(k^{*}(t)\) stays in I for \(0\le t < T\) and is equal to \(\sup I\) for \(t\ge T\). We approximate \((k^{*}(t), c^{*}(t))\) by a sequence of I-feasible pairs \((k_{n}(t), c_{n}(t))\) as follows. Denote by \(T_{n}\) the time when \(k^{*}(t) =\sup I-\frac{1}{n}\), and set:

with \(c_n\) being the associated consumption path. Clearly:

so \(\sup _{A\left( k_{0},I\right) }=\max _{A\left( k_{0},J\right) }\). On the other hand, the maximum on the right-hand side is achieved only at \((k^{*}(t), c^{*}(t))\), which does not belong to \(A\left( k_{0},I\right) \). So the supremum is not achieved. This establishes the converse of Lemma 2, namely:

Lemma 3

If an I-feasible pair \((k^{*}(t), c^{*}(t))\) is I-optimal, then \((k^{*}(t), c^{*}(t))\) is I-competitive and satisfies the CVT condition.

We summarize our results as follows:

Proposition 2

The restricted TDU problem:

has a unique solution \((k^{*}\left( t\right) , c^{*}\left( t\right) ) \) for every initial stock \(k_{0} \in I\) if and only if the interval \(I \subseteq \mathbb {R}_{++}\) satisfies \(\underline{k} \in I, \underline{k} = \sup I \notin I, \underline{k} = \inf I \notin I, \underline{k} > \sup I \in I\) or \(\underline{k} < \inf I \in I\). Both \(k^{*}(t)\) and \(c^{*}(t)\) are monotonic in t, and:

where

3 Chichilnisky criterion in the Ramsey model

Fix \(k_0 > 0\) and consider the class \(B(k_0)\) of feasible pairs of stock and consumption paths (k(t), c(t)) for which the limit

exists. Any feasible pair of stock and consumption paths for which consumption converges as time goes to infinity is in \(B(k_0)\), but as we will return to in Sect. 4, the set \(B(k_0)\) contains also pairs where consumption does not converge.

A pair \((k^{*}(t),c^{*}(t)) \in B(k_0)\) of stock and consumptions paths is Chichilnisky optimal (C-optimal) if

for any pair \((k(t),c(t)) \in B(k_0)\) of stock and consumption paths.

The Chichilnisky criterion (C-criterion), as given by (4), consists of a TDU part and a part that depends on the behavior of the consumption path at infinity. It is a special case of what Chichilnisky (1996) calls a sustainable preference. The C-criterion is clearly time inconsistent, as the weight on the elements in the consumption path in the TDU part is increased when the time of evaluation is advanced, while the weight on the asymptotic part is not affected when the time of evaluation is advanced. Furthermore, there is no optimal path in the Ramsey model, as established by the following result.

Proposition 3

There does not exist an optimal pair of stock and consumption paths for the C-criterion, as given by (4), when applied in the Ramsey model.

Proof

Step 1: A pair \((k(t),c(t)) \in B(k_0)\) satisfying that c(t) converges to \(f(\underline{k})\) is not C-optimal. Since f is strictly increasing, there is \(k' > \underline{k}\) with \(f(k') > f(\underline{k})\). By following the TDU-optimal stock path converging to \(\underline{k}\) for a sufficiently long time before the deviating to a stock path converging to some \(k'\) with associated consumption path converging to \(f(k')\), any pair \((k(t),c(t)) \in B(k_0)\) satisfying \(\lim _{t \rightarrow \infty } c(t) = f(\underline{k})\) can be improved, leading to a contradiction.

Step 2: A pair \((k(t),c(t)) \in B(k_0)\) satisfying that c(t) does not converge to \(f(\underline{k})\) is not C-optimal. Suppose that there is a Chichilnisky-optimal pair \((k(t),c(t)) \in B(k_0)\) where c(t) does not converge to \(f(\underline{k})\). By following the TDU-optimal stock path converging to \(\underline{k}\) for a sufficiently long time before deviating to a pair of paths of capital and consumption with the same limiting properties as (k(t), c(t)), the pair (k(t), c(t)) can be improved, leading to a contradiction. \(\square \)

In the supnorm topology, the C-criterion is continuous in the consumption paths. However, in this topology the set of feasible paths in the Ramsey model is not compact, even if consumption is restricted to remain within a compact interval. Hence, the Bolzano–Weierstrass Extreme Value Theorem cannot be invoked to establish existence of an optimal path.

The fact that the C-criterion is time inconsistent and does not have an optimal path in the Ramsey model implies that seeking an optimal path is both irrelevant and futile. For the rest of the paper, we therefore investigate stationary Markov equilibria in the game that generations with Chichilnisky preferences play in the Ramsey model.

4 One-attractor equilibrium strategies

In this section, we consider stationary Markov strategies on subintervals corresponding to basins of attraction. We show that such a one-attractor Markov strategy is continuous if it satisfies the equilibrium property stated in Definition 2 below. The analysis of these continuous equilibrium strategies prepares the ground for introducing discontinuous stationary Markov strategies in the subsequent sections.

Definition 1

A one-attractor stationary Markov strategy is a pair \((I, \sigma )\), where \(I \subseteq \mathbb {R}_{++}\) is an interval with positive measure and \(\sigma : I \rightarrow \mathbb {R}_{+}\) satisfies:

-

for any initial \(k_0 \in I\), there is a unique absolutely continuous solution \(\kappa (\cdot \,;k_0) : [0, \infty ) \rightarrow I\) to \(k(0) = k_0\) and \(\dot{k} = f(k) - \sigma (k)\) for \(t \in [0, \infty )\), so that the pair \((\kappa (t;k_0), \sigma (\kappa (t;k_0)))\) is I-feasible,

-

there is \(k_{\infty } \in I\), such that, for any initial \(k_0 \in I, \lim _{t \rightarrow \infty }\kappa (t;k_0) = k_{\infty }\), so that \(k_{\infty }\) is an attractor with I as the corresponding basin of attraction.

Since \(k_\infty \) is the unique attractor in I, it follows that the capital path, \(\kappa (t;k_0)\), from \(k_0 \in I\) as a function of t is constant if \(k_0 = k_\infty \), increasing on \([k_0, k_\infty )\) if \(k_0 < k_\infty \), and decreasing on \((k_\infty , k_0]\) if \(k_0 > k_\infty \). In particular:

-

If \(k_0 = k_\infty \), then \(\sigma (k_0) = f(k_0)\).

-

If \(k_0 < k_\infty \), then \(\sigma (k) < f(k)\) for all \(k \in [k_0, k_\infty )\).

-

If \(k_0 > k_\infty \), then \(\sigma (k) > f(k)\) for all \(k \in (k_\infty , k_0 \, ]\).

Furthermore, even though \(\sigma (\kappa (t;k_0))\) need not converge as \(t \rightarrow \infty \) (as consumption may shatter), \(\rho \int _0^{\infty } e^{-\rho t} u(\sigma (\kappa (t;k_0)))\) converges to \(u(f(k_\infty ))\) as \(\rho \rightarrow 0^+\). Hence, the associated value according to the C-criterion of \(\sigma \) for any \(k_0 \in I\) is given by:

We now introduce the concept of a stationary Markov equilibrium strategy on I: It is a strategy such that deviating on a short time interval is not profitable, provided that the stock k remains in I. The intuition is that the current generation takes the future behavioral rule as given, but is able to make a near-instantaneous deviation. To formalize this, let \((I,\sigma )\) be a strategy with solution converging to some \(k_{\infty }\). Take the initial stock \(k_0 \in I\) and a time \(\varDelta > 0\), and any control \(c(t) \ge 0, t \in [0, \varDelta )\). Extend it to a control \(c_{k_0, \varDelta }(t)\) on \([0, \infty )\) by:

We call \(c_{k_0, \varDelta } I\)-admissible if there is a unique absolutely continuous solution \(k : [0, \infty ) \rightarrow I\) to \(k(0) = k_0\) and \(\dot{k} = f(k) - c_{k_0, \varDelta }(t)\) for \(t \in [0, \infty )\), so that the pair \((k(t), c_{k_0, \varDelta }(t))\) is I-feasible.

Definition 2

A one-attractor stationary Markov strategy \((I, \sigma )\) is an equilibrium strategy if, for all \(k_0 \in I\), there exists \(\varDelta > 0\) such that, for every I-admissible \(c_{k_0, \varDelta }\),

Proposition 4

The pair \((I, \sigma )\) is an equilibrium strategy if and only if, for every \(k_0 \in I\), the solution \(\kappa (\cdot \, ;k_0) : [0, \infty ) \rightarrow I\) to \(k(0) = k_0\) and \(\dot{k} = f(k) - \sigma (k)\) for \(t \in [0, \infty )\) satisfies that \((\kappa (t;k_0), \sigma (\kappa (t;k_0))\) is I-optimal.

The proof makes use of the following lemma.

Lemma 4

If the pair \((I, \sigma )\) is an equilibrium strategy, then, for every \(k_0 \in I\), the solution \(\kappa (\cdot ;k_0) : [0, \infty ) \rightarrow I\) to \(k(0) = k_0\) and \(\dot{k} = f(k) - \sigma (k)\) for \(t \in [0, \infty )\) has the properties that \((\kappa (t;k_0), \sigma (\kappa (t;k_0))\) is I-competitive and satisfies the CVT condition.

Any I-admissible \(c_{k_0, \varDelta }(t)\) has the same limiting properties as \(\kappa (t;k_0)\) so that

This allows the proof of Lemma 4 to focus on the TDU part of the C-criterion.

Proof

(Proof of Proposition 4) Assume that, for every \(k_0 \in I\), the solution \(\kappa (t;k_0)\) satisfies that \((\kappa (t;k_0), \sigma (\kappa (t;k_0))\) is I-optimal. Then deviating from \(\kappa (t;k_0)\) on any bounded time interval cannot improve the TDU part of \(J(k_0, I, \sigma )\) and cannot influence the part that depends on the limit of the consumption path. Therefore, \((\kappa (t;k_0), \sigma (\kappa (t;k_0))\) is an equilibrium.

Conversely, assume that pair \((I, \sigma )\) is an equilibrium. By Lemma 4, for every \(k_0 \in I\), the solution \(\kappa (t ;k_0)\) has the properties that \((\kappa (t;k_0), \sigma (\kappa (t ;k_0)))\) is I-competitive and satisfies the CVT condition. By Lemma 2, \((\kappa (t;k_0), \sigma (\kappa (t; k_0)))\) is I-optimal. \(\square \)

Proposition 4 implies that, in the Ramsey model, if there is a single attractor on \(I = \mathbb {R}_{++}\), then the stationary Markov equilibrium strategy of the C-criterion yields the same outcome as the unrestricted TDU-optimal path, and moreover, the attractor equals \(\underline{k}\). This one-attractor equilibrium on \(\mathbb {R}_{++}\) will be denoted \(\left( \mathbb {R}_{++}, \sigma _{\underline{k}} \right) \).

Furthermore, for every \(k \in \mathbb {R}_{++} \backslash \{ \underline{k} \}\), if (1) \(k > \underline{k}\) and \(I = [k, \infty )\) or (2) \(k < \underline{k}\) and \(I = (0, k]\), then there is a unique one-attractor equilibrium on I. In these cases, the attractor equals k. Such one-attractor equilibria will be denoted \(\left( I, \sigma _k \right) \).

Propositions 2 and 4 imply that the class of one-attractor equilibrium strategies \((I, \sigma )\) can be divided into three subclasses (where the notation \(\sigma _k\) corresponds the one just introduced in the two previous paragraphs):Footnote 4

-

(a)

I satisfies that \(\underline{k} \in I\). Then, for any \(k_0 \in I \backslash \{\underline{k}\}\), the solution \(\kappa (t ;k_0)\)to \(k(0) = k_0\) and \(\dot{k} = f(k) - \sigma (k)\) for \(t \in [0, \infty )\) converges to, but never reaches, \(\underline{k}\), while, for \(k_0 = \underline{k}\), the stock equals \(\underline{k}\) for all t. In this case, \(\sigma = \sigma _{\underline{k}}|_{I}\).

-

(b)

I satisfies that \(\underline{k} < \inf I \in I\). Then, for any \(k_0 \in I\), the solution \(\kappa (t;k_0)\) to \(k(0) = k_0\) and \(\dot{k} = f(k) - \sigma (k)\) for \(t \in [0, \infty )\) reaches \(\inf I\) in finite time. In this case, \(\sigma = \sigma _{\min I}|_{I}\).

-

(c)

I satisfies that \(\underline{k} > \sup I \in I\). Then, for any \(k_0 \in I\), the solution \(\kappa (t;k_0)\) to \(k(0) = k_0\) and \(\dot{k} = f(k) - \sigma (k)\) for \(t \in [0, \infty )\) reaches \(\sup I\) in finite time. In this case, \(\sigma = \sigma _{\max I}|_{I}\).

The following section shows that additional possibilities arise when considering strategies with multiple attractors. We end this section with the following result.

Corollary 1

If the pair \((I, \sigma )\) is an equilibrium strategy, then for every \(k_0 \in {int}I\), we have:

5 Multiple-attractor equilibrium strategies

A multiple-attractor stationary Markov strategy combines a finite number of one-attractor stationary Markov strategies, to obtain a strategy defined on \(\mathbb {R}_{++}\).

Definition 3

A multiple-attractor stationary Markov strategy is a collection

where \(\{I_1, \ldots , I_n\}\) is a partition of the set of possible stock sizes \(\mathbb {R}_{++}\) and, for every \(i \in \{1, \ldots , n\}, (I_i, \sigma |_{I_i})\) is a one-attractor stationary Markov strategy.

Adopt the convention that the sets \(I_1, I_2\), ..., \(I_n\) are ordered in the sense that if \(i < j, k' \in I_i\) and \(k'' \in I_j\), then \(k' < k''\). Since, for every \(i \in \{1, \ldots , n\}, (I_i, \sigma |_{I_i})\) is a one-attractor stationary Markov strategy, we can define the associated value function \(V_{\sigma } : \mathbb {R}_{++} \rightarrow \mathbb {R}\) as follows: For every \(k > 0\),

where \(i \in \{1, \ldots , n\}\) satisfies that \(k \in I_i\).

When analyzing one-attractor equilibrium strategies for any interval \(I_i\), we have assumed that deviations that push the stock path outside \(I_i\) are not feasible. From interior points of \(I_i\) (with \(i < n\)), deviating toward \(I_j\) with \(j > i\) is indeed infeasible if the interval of time, \((0, \varDelta )\), during which the deviation takes place is sufficiently short, since consumption cannot be reduced below zero. However, even such near-instantaneous deviations can push the stock path into \(I_{i+1}\) from \(\max I_i\) (if the maximum exists) or into \(I_j\) with \(j < i\) from any point in \(I_i\) (provided that \(i > 1\)) since consumption is unbounded.

Consider \(c_{k_0, \varDelta }\) as defined in (5). We call \(c_{k_0, \varDelta }\) admissible if there is a unique absolutely continuous solution \(k : [0, \infty ) \rightarrow \mathbb {R}_{++}\) to \(k(0) = k_0\) and \(\dot{k} = f(k) - c_{k_0, \varDelta }(t)\) for \(t \in [0, \infty )\), so that the pair \((k(t), c_{k_0, \varDelta }(t))\) is feasible. Note that the solution k(t) is not required to remain in one particular element of the partition \(\{I_1, \ldots , I_n \}\).

Definition 4

A multiple-attractor stationary Markov strategy

is an equilibrium strategy if, for all \(k_0 > 0\), there exists \(\varDelta > 0\) such that, for every admissible \(c_{k_0, \varDelta }\),

If \(\sigma = \{(I_1, \sigma _1), \ldots , (I_n, \sigma _n)\}\) is a multiple-attractor equilibrium strategy, then it follows directly from Definitions 2 and 4 that, for every \(i \in \{1, \ldots , n \}, (I_i, \sigma _i)\) is a one-attractor equilibrium strategy. Furthermore, the value function \(V_{\sigma }\) must be upper semi-continuous. To see this, suppose that \(V_{\sigma }\) were not upper semi-continuous. That is, there would exist a point of discontinuity, k, such that the functional value of \(V_{\sigma }\) is strictly greater than \(V_{\sigma }(k)\) for arguments near k. Then there would be a profitable deviation at k for all \(\varDelta > 0\), contradicting that \(\sigma \) is a multiple-attractor equilibrium strategy. We have established the following characterization.

Lemma 5

If a multiple-attractor stationary Markov strategy

is an equilibrium, then

-

(i)

for every \(i \in \{1, \ldots , n \}, (I_i, \sigma |_{I_i})\) is a one-attractor equilibrium strategy, and

-

(ii)

the value function \(V_{\sigma } : \mathbb {R}_{++} \rightarrow \mathbb {R}\) is upper semi-continuous.

Let \(\sigma = \{(I_1, \sigma |_{I_1}), \ldots , (I_n, \sigma |_{I_n})\}\) be a multiple-attractor equilibrium strategy. By Lemma 5, for every \(i \in \{1, \ldots , n\}, (I_i, \sigma |_{I_i})\) is a one-attractor equilibrium strategy, and thus, by Proposition 4, \(J(\cdot , I, \sigma |_{I_i})\) is a continuous function on \(I_i\). Hence, it follows that \(V_{\sigma }\) is a piecewise continuous function. Furthermore, since for every \(i \in \{1, \dots , n\}, J(\cdot , I, \sigma |_{I_i})\) is a continuously differentiable function on the interior of \(I_i\), it follows that \(V_{\sigma }\) is a piecewise continuously differentiable function. Finally, every point of discontinuity is an extreme point of some interval \(I_i\).

It follows from cases (b) and (c) of Sect. 4 that \(V_{\sigma }\) is continuous from the left for \(k < \underline{k}\) and continuous from the right for \(k > \underline{k}\). Furthermore, case (a) of Sect. 4 implies that \(\underline{k}\) cannot be a point of discontinuity, as \(\underline{k}\) is interior in the interval \(I_i\) to which \(\underline{k}\) belongs.Footnote 5

Lemma 6

Let \(\sigma \) satisfy the conditions (i) and (ii) of Lemma 5. If k is a point of discontinuity of \(V_{\sigma } : \mathbb {R}_{++} \rightarrow \mathbb {R}\), then \(k > \underline{k}\).

It follows from Lemmas 5 and 6 that any point of discontinuity of \(V_{\sigma }\) must exceed \(\underline{k}\), ruling out case (c). This implies that there cannot be an extreme point of some interval \(I_i\) for \(k \le \underline{k}\).Footnote 6 Hence, for any multiple-attractor equilibrium strategy, \(\sigma = \{(I_1, \sigma |_{I_1}), \ldots , (I_n, \sigma |_{I_n})\}\), there is \(k > \underline{k}\), such that \(I_1 = (0, k)\) and \(\underline{k}\) is the attractor in \(I_1\) for the system \(\dot{k} = f(k) - \sigma |_{I_1}(k)\), where \(\sigma |_{I_1}\) is the restriction of \(\sigma _{\underline{k}}\) to \(I_1\). Therefore, for any initial stock \(k_0 \le \underline{k}\), the stock will converge toward \(\underline{k}\). However, if the initial stock \(k_0\) exceeds \(\underline{k}\) and there exists an interval \(I_i\) (with \(i>1\)) which contains \(k_0\), then there is a point of discontinuity \(k_\infty = \min I_i > \underline{k}\) such that the stock converges to \(k_\infty \). This is summarized in the following proposition.

Proposition 5

Let \(\sigma = \{(I_1, \sigma |_{I_1}), \ldots , (I_n, \sigma |_{I_n})\}\) be a multiple-attractor equilibrium strategy. Then \(I_1 \supset (0,\underline{k}]\) and, for all \(i > 1, I_i \subset (\underline{k}, \infty )\). Furthermore:

-

(a)

If \(k_0 \in I_1\), then \(k_{\infty } = \lim _{t \rightarrow \infty }\kappa (t,k_0) = \underline{k}\),

-

(b)

If \(k_0 \in I_i\) with \(i > 1\), then \(k_{\infty } = \lim _{t \rightarrow \infty }\kappa (t,k_0) = \min I_i > \underline{k}\),

where, for \(j \in \{1, \ldots , n\}\) with \(k_0 \in I_j, \kappa (\cdot ,k_0) : [0, \infty ) \rightarrow I_j\) is the solution to \(k(0) = k_0\) and \(\dot{k} = f(k) - \sigma |_{I_j}(k)\).

The former case corresponds to the interpretation of f as a net production function and k as a stock of a capital aggregate. In this interpretation, the initial capital stock \(k_0\) is high productive, and the question is to how much capital to accumulate. Proposition 5 implies that in a multiple-attractor equilibrium strategy, capital is accumulated as in the TDU-optimal path. Hence, the C-criterion leads to the same behavior as the TDU criterion, independently of which multiple-attractor equilibrium strategy the generations coordinate on.

The latter case corresponds to the interpretation of f as a natural growth function and k as a stock of a resource aggregate. In this interpretation, the initial resource stock \(k_0\) is low productive, and the question is how much resource to conserve. Proposition 5 implies that in a multiple-attractor equilibrium strategy, more resource might be conserved than in the TDU-optimal path. Hence, the C-criterion might lead to more conservation than the TDU criterion does, depending on which multiple-attractor equilibrium strategy the generations coordinate on.

6 The scope for resource conservation

The discussion and results of the previous section suggest that there are many multiple-attractor equilibrium strategies all satisfying the properties of Proposition 5. Even though \(\underline{k}\) is the smallest (positive) attractor, there may be one or more attractors that exceed \(\underline{k}\). In this section, we discuss what outcomes are consistent with some multiple-attractor equilibrium strategy, while the following section will be devoted to whether coordination on a best multiple-attractor equilibrium strategy can be used to identify a unique outcome for any initial stock.

For the study of the scope for resource conservation for the Ramsey model under the C-criterion, we first establish the converse of Lemma 5, leading to the following result.

Proposition 6

A multiple-attractor stationary Markov strategy

is an equilibrium if and only if

-

(i)

for every \(i \in \{1, \ldots , n \}, (I_i, \sigma |_{I_i})\) is a one-attractor equilibrium strategy, and

-

(ii)

the value function \(V_{\sigma } : \mathbb {R}_{++} \rightarrow \mathbb {R}\) is upper semi-continuous.

The necessity of (i) and (ii) follows from Lemma 5. To show the sufficiency of these two conditions, let \(\sigma = \{(I_1, \sigma |_{I_1}), \ldots , (I_n, \sigma |_{I_n})\}\) satisfy (i) and (ii). Since Proposition 5 relies on these conditions only, for all \(k_0 > 0\), the value \(V_\sigma (k_0)\) depends solely on \(k_\infty \) as determined by (a) and (b) of Proposition 5. This permits the following notation, given that \(\sigma = \{(I_1, \sigma |_{I_1}), \ldots , (I_n, \sigma |_{I_n})\}\) satisfies (i) and (ii):

-

(a)

If \(k_0 \in I_1\), then \(k_\infty = \underline{k}\) and

$$\begin{aligned} \upsilon _{k_\infty }(k_0) = J(k_0, I_1, \sigma _{\underline{k}}|_{I_1}) = V_\sigma (k_0). \end{aligned}$$ -

(b)

If \(k_0 \in I_i\) with \(i > 1\), then \(k_\infty = \min I_i > \underline{k}\) and

$$\begin{aligned} \upsilon _{k_\infty }(k_0) = J(k_0, I_i, \sigma _{\min {I_i}}|_{I_i}) = V_\sigma (k_0). \end{aligned}$$

Lemma 7

For \((k_\infty , k_0) \in [\underline{k}, \infty ) \times (k_\infty , \infty ), \tfrac{\partial }{\partial k_\infty } \upsilon '_{k_\infty }(k_0) > 0\).

Proof

(Proof of Proposition 6, sufficiency part) Assume that conditions (i) and (ii) are satisfied by \(\sigma = \{(I_1, \sigma |_{I_1}), \ldots , (I_n, \sigma |_{I_n})\}\). Consider \(k_0 \in I_i\).

By condition (i), there are no profitable deviation within \(I_i\). This completes the proof if \(n=1\). If \(n > 1\), then we have two cases to consider.

If \(i < n\), there is no feasible deviation to \(I_{i+1}\), ..., \(I_{n-1}, I_n\). The reason is that, by Lemmas 5 and 6 and footnote 5, it follows that \(\sup I_i = \min I_{i+1} \in I_{i+1}\) so that \(\sup I_i \notin I_i\). Therefore, since consumption cannot be reduced below zero, the stock cannot be pushed out of \(I_i\) into \(I_{i+1}\) during a near-instantaneous deviation.

If \(i > 1\), implying by Lemmas 5 and 6 and footnote 5 that \(k_0 > \underline{k}\), the stock can be pushed out of \(I_i\) into \(I_1, I_2\), ..., \(I_{i-1}\) also during a near-instantaneous deviation as consumption is unbounded. By Lemmas 5 and 6 and footnote 5, the stock path determined by \(k_0\) and \(\sigma |_{I_i}\) converges to \(\min I_i\), and a deviation from \(k_0\) to \(I_j, j\in \{1, \ldots , i-1\}\), during some interval \((0, \varDelta )\) with \(\varDelta > 0\) leads to a stock path converging to \(k_\infty := \underline{k}\) if \(j = 1\) and \(k_\infty := \min I_j\) if \(j > 1\). To establish that no such deviation is profitable, it is sufficient to show that

as the left-hand side is the maximal value associated with a stock path originating at \(k_0\) and converging to \(k_\infty \) and, by condition (i), the right-hand side is value associated with the stock path determined by \(k_0\) and \(\sigma |_{I_i}\). We have that

Condition (ii) implies that the terms of the second line are non-positive since at points of discontinuity, \(\min I_\ell \), the value \(V_\sigma \) jumps upwards from

(if \(\ell > 2\) and \(\upsilon _{k_\infty }(\min I_{\ell })\) if \(\ell = 2\)) to \(V_\sigma (\min I_{\ell }) = \upsilon _{\min I_{\ell }}(\min I_{\ell })\), while Lemma 7 implies that the terms of the third line are non-positive. \(\square \)

To determine the scope for resource conservation for the Ramsey model under the C-criterion, it will turn out to be sufficient to consider a class of strategies, \(\sigma ^\kappa \), with two attractors, \(\underline{k}\) and \(\kappa \) (\(> \underline{k}\)), where \(\sigma ^\kappa \) restricted to each of the two basins of attractions is a one-attractor equilibrium. It follows from Sect. 4 that this leads to basins of attractions being \((0,\kappa )\) and \([\kappa , \infty )\) and two one-attractor equilibrium strategies being \(\sigma _{\underline{k}}|_{(0,\kappa )}\) and \(\sigma _\kappa \) (using the notation introduced in Sect. 4):

Hence, for each \(\kappa > \underline{k}\), this two-attractor strategy consists of the unique one-attractor equilibrium strategy on \(\mathbb {R}_{++}\), but restricted to \((0,\kappa )\), coupled with the unique one-attractor equilibrium strategy on \([\kappa , \infty )\). Then

The two-attractor strategy \(\sigma ^\kappa \) is illustrated in Fig. 2.

Note that \(\sigma ^\kappa \) approaches the one-attractor equilibrium strategy \(\left( \mathbb {R}_{++}, \sigma _{\underline{k}} \right) \) as \(\kappa \downarrow \underline{k}\), since \(\sigma _\kappa \) approaches \(\sigma _{\underline{k}}|_{[\underline{k}, K)}\) as \(\kappa \downarrow \underline{k}\). Thus \(\upsilon _\kappa (k)\) is a continuous function of \(\kappa \) on \([\underline{k}, k]\). Lemma 7 means that the gradient of the value function for given stock size k increases with the point of discontinuity \(\kappa \). Furthermore, for all \(\kappa \in [\underline{k}, \infty ), \sigma _\kappa (\kappa ) = f(\kappa )\) so that

Finally, by Corollary 1:

since \(f'(\underline{k}) = \delta \) and \(\alpha > 0\). Hence, the gradient of \(\upsilon _{\underline{k}}(k)\) is smaller than the gradient of u(f(k)) when evaluated at \(\underline{k}\). And it remains smaller than the gradient of u(f(k)) for all \(k \in [\underline{k}, \bar{k}\,]\), where \(\bar{k} := \mathbf {k}_{\infty }\left( (1-\alpha )\delta \right) \), since \(\upsilon '_{\underline{k}}(k) < \upsilon '_{k}(k) = (1 - \alpha )\delta u'(\sigma _k(k)), \sigma _k(k) = f(k)\) and \((1 - \alpha )\delta = f'(\bar{k}) \le f'(k)\) for \(k \in (\underline{k}, \bar{k}\,]\), so that

for \(k \in (\underline{k}, \bar{k}\,]\). This implies that

is a non-empty closed set satisfying \(\min K = \underline{k}\) and \([\underline{k}, k\,] \subseteq K\) for some \(k > \bar{k}\).

By part (ii) of Proposition 6, \(\sigma ^\kappa \) is a two-attractor equilibrium strategy if and only \(\kappa \in K\). Figure 2 illustrates this case. Hence, any stock \(k \in K\) can be conserved if the initial stock \(k_0\) exceeds k. For the converse result, that a stock \(k > \underline{k}\) cannot be conserved if \(k \notin K\) even if the initial stock \(k_0\) exceeds k, we have to consider multiple-attractor equilibrium strategies with more than two attractors. Using Proposition 6, Lemma 7 and expressions (8) and (9), the converse result can also be established, showing that it is sufficient to consider two-attractor equilibrium strategies of the form (7) when analyzing the scope for resource conservation.

Combined with our previous results, this analysis shows that:

-

\(\max K\) is the maximum stock that can be conserved if K is bounded above and the initial stock \(k_0\) is at least as large as \(\max K\).

-

\(\max \{k \in K : k \le k_0 \}\) is the maximum stock that can be conserved if the initial stock \(k_0\) is as least as large as \(\underline{k}\) but not an upper bound for K, as the stock cannot be accumulated beyond \(k_0\) in an equilibrium strategy if \(k_0 \ge \underline{k}\). In particular, \(k_0\) is the maximal stock that can be conserved if \(k_0 \in [\underline{k}, \bar{k}]\), as \([\underline{k}, \bar{k}] \subset K\).

-

The stock accumulates to \(\underline{k}\) for any equilibrium strategy if the initial stock \(k_0\) is smaller than \(\underline{k}\).

7 Coordinating on an equilibrium strategy

Assume now that the generation at time 0 is endowed with the stock \(k_0\) and seeks to coordinate on an equilibrium strategy that leads to an outcome maximizing the value of the C-criterion. Of central interest for the analysis of this question is the stock \(\bar{k} = \mathbf {k}_{\infty }\left( (1-\alpha )\delta \right) \) defined by

The importance of the stock \(\bar{k}\) can been seen by observing that, by Corollary 1,

since \(\lim _{k \downarrow \kappa }\sigma _\kappa (k) = f(\kappa )\). The strict concavity of f gives the following consequences:

If \(\kappa > \bar{k}\), then \((1-\alpha )\delta > f'(\kappa )\) and the gradient of \(v_\kappa (k)\) is greater than the gradient of u(f(k)) (\(=f'(k)u'(f(k))\)) for k greater than but sufficiently near \(\kappa \). Therefore, if the initial stock \(k_0\) is larger than \(\bar{k}\), then there exists \(\kappa \in (\bar{k}, k_0)\) such that the increase in the TDU part of the C-criterion achieved by running down the stock to \(\kappa \)—and thus temporarily increasing consumption—more than compensates for the reduced value of asymptotic part of the criterion that such a rundown of the stock leads to.

On the other hand, if \(\kappa < \bar{k}\), then \((1-\alpha )\delta < f'(\kappa )\) and the gradient of \(v_\kappa (k)\) for k smaller than the gradient of u(f(k)) (\(=f'(k)u'(f(k))\)) for all k between \(\kappa \) and \(\bar{k}\). Therefore, if the initial stock \(k_0\) does not exceed \(\bar{k}\), then, for all \(\kappa \in (0, k_0)\), the increase in the TDU part of the C-criterion achieved by running down the stock to \(\kappa \) does not compensate for the reduced value of asymptotic part of the criterion that such a rundown of the stock leads to. Hence, if \(k_0 \in (\underline{k}, \bar{k}]\), then it pays to conserve the stock at \(k_0\), given that an equilibrium strategy does not allow the stock to be accumulated beyond \(k_0\) if \(k_0 > \underline{k}\), while if the initial stock \(k_0\) does not exceed \(\underline{k}\), then any equilibrium strategy leads to accumulation of the stock to \(\underline{k}\).

These results can be summarized as follows: Assume that the generation at time 0 has the stock \(k_0\) and coordinates a multiple-attractor equilibrium strategy \(\sigma \) designed to maximize the value of the C-criterion.

-

(1)

If \(k_0 \in (0, \underline{k}]\): All equilibrium strategies induce the same behavior as the TDU optimum, accumulating the stock to \(\underline{k}\). Accumulation beyond \(\underline{k}\) is not possible.

-

(2)

If \(k_0 \in (\underline{k}, \bar{k}]\): The value of the C-criterion is maximized by staying put, e.g., by choosing \(\sigma ^{k_0}\). It is not possible to accumulate, and not worthwhile to decrease the stock, given the trade-off between the two parts of the C-criterion.

-

(3)

If \(k_0 \in (\bar{k}, \infty )\): It is not worthwhile to stay put, as the increase in TDU part of the C-criterion achieved by running down the stock exceeds the cost in terms of a reduced value of the part depending on the infinite future. The path will converge to some \(k_{\infty } \ge \bar{k}\) satisfying \(k_{\infty } \in K\).Footnote 7

In case (3), convergence to some \(k_{\infty } > \bar{k}\) is not consistent with taking into account that future generations will coordinate on a best equilibrium strategy in turn, since they will not stay put at \(k_{\infty }\). However, due to the time inconsistency of the C-criterion, it might indeed be the case that initially the value of the C-criterion is maximized by choosing \(k_{\infty } > \bar{k}\). This will be optimal initially, but not later, as advancing the time of evaluation increases the weight on the elements in the TDU part of the C-criterion, while not affecting the weight on the asymptotic part.

To handle this kind of time inconsistency in the coordination on a preferred equilibrium, we present a modeling that is inspired by the analysis of renegotiation-proofness in repeated games. In particular, our formulation is based on von Neumann–Morgenstern abstract stability as revived by Greenberg (1990) and applied in, e.g., Asheim (1997), while maintaining the restriction to stationary Markov strategies.

Let \(\sigma = \{(I_1, \sigma |_{I_1}), \ldots , (I_n, \sigma |_{I_n})\}\) be a multiple-attractor equilibrium strategy. Say that \(k''\) can be reached from \(k'\) by \(\sigma \) if there exist \(i_1, \ldots , i_m\) such that

-

(a)

\(k'_1 := k' \in I_{i_1}\) and \(k''_m := k'' \in I_{i_m}\),

-

(b)

for all \(\ell \in \{ 1, \ldots , m-1\}, k'_{\ell +1} \in I_{i_{\ell +1}}\) can be accessed from \(k''_{\ell } \in I_{i_{\ell }}\) during a near-instantaneous deviation, and

-

(c)

for all \(\ell \in \{ 1, \ldots , m\}\), the solution \(\kappa (\cdot ;k'_\ell )\,:\,[0, \infty ) \rightarrow I_{i_\ell }\) to \(k(0) = k'_{\ell }\) and \(\dot{k} = f(k) - \sigma _{i_\ell }(k)\) for \(t \in [0, \infty )\) has the property that \(\kappa (\tau ;k'_\ell ) = k''_{\ell }\) for some \(\tau \ge 0\).

Hence, we consider stocks that can be reached by following \(\sigma \), but allowing for a finite number of near-instantaneous deviations.

The analysis of Sect. 5 leads to the following observation.

Lemma 8

Let \(\sigma = \{(I_1, \sigma |_{I_1}), \ldots , (I_n, \sigma |_{I_n})\}\) be a multiple-attractor equilibrium strategy.

-

(i)

If \(k' \in (0,\underline{k}]\), then \(k''\) can be reached from \(k'\) if and only if \(k'' \in (0, \underline{k}]\).

-

(ii)

If \(k' \in (\underline{k}, \infty )\), then \(k''\) can be reached from \(k'\) if and only if \(k'' \in (0, k']\).

Let \(\varSigma = \{\sigma = \{(I_1, \sigma |_{I_1}), \ldots , (I_n, \sigma |_{I_n})\} \mid \sigma \) is a multiple-attractor equilibrium strategy} denote the class of equilibrium strategies. Consider the set \(D = \mathbb {R}_{++} \times \varSigma \), and define the dominance relation \(\succ _{\varepsilon }\) on D, where \(\varepsilon \) is a positive real number:

We refer to \((D, \succ _{\varepsilon })\) as the \(\varepsilon \) -system for the Ramsey–Chichilnisky game.

Let A be a subset of D. The \(\varepsilon \) -dominion of \(A, \varDelta _{\varepsilon }(A)\) is defined as follows:

We say that the set A, where \(A \subseteq D\), is:

-

vNM internally \(\varepsilon \)-stable for the system \((D, \succ _{\varepsilon })\) if \(A \subseteq D \backslash \varDelta _{\varepsilon }(A)\),

-

vNM externally \(\varepsilon \)-stable for the system \((D, \succ _{\varepsilon })\) if \(A \supseteq D \backslash \varDelta _{\varepsilon }(A)\),

-

vNM \(\varepsilon \)-stable if \(A = D \backslash \varDelta _{\varepsilon }(A)\).

Hence, if a \(\varepsilon \)-stable set exists and is unique, then \(\varepsilon \)-stability uniquely divides D into a good set \(G_\varepsilon \) and a bad set \(B_\varepsilon = D \backslash G_\varepsilon \), where no element in \(G_\varepsilon \) is dominated by another element in \(G_\varepsilon \) and every element in \(B_\varepsilon \) is dominated by some element in \(G_\varepsilon \).

Consider any system \((D, \succ )\). It is well established that a stable set need not exist, and if it exists, it may not be unique. von Neumann and Morgenstern (1953) provide a sufficient condition for the existence of a unique stable set: Say that the dominance relation \(\succ \) is strictly acyclic if there does not exist an infinite sequence \(\{a_1, a_2, \ldots , a_j , \ldots \}\) of elements in D such that, for all \(j \in \mathbb {N}, a_{j+1} \succ a_j\).

Theorem 1

(von Neumann and Morgenstern 1953) Consider any system \((D, \succ )\). If the dominance relation \(\succ \) is strictly acyclic, then there exists a unique vNM stable set for the system \((D, \succ )\).

Lemma 9

Consider the \(\varepsilon \)-system \((D, \succ _{\varepsilon })\) for the Ramsey–Chichilnisky game, where \(\varepsilon \) is some positive number. Then \(\succ _{\varepsilon }\) is strictly acyclic.

Proposition 7

Consider the \(\varepsilon \)-system \((D, \succ _{\varepsilon })\) for the Ramsey–Chichilnisky game, where \(\varepsilon \) is some positive number. There exists a unique vNM \(\varepsilon \)-stable set, \(G_{\varepsilon }\), for the system \((D, \succ _{\varepsilon })\).

Proof

By vNM’s theorem, this follows from Lemma 9. \(\square \)

The following lemmas fully characterize the \(\varepsilon \)-stable set for \(k \in (0, \bar{k}\,]\) and partially characterize the \(\varepsilon \)-stable set for \(k \in (\bar{k}, \infty )\).

Lemma 10

If \(k \in (0, \underline{k}\,]\), then \((k, \sigma ) \in G_\varepsilon \) if and only if \((k, \sigma ) \in D\).

Lemma 11

If \(k \in (\underline{k}, \bar{k}\,]\), then \((k, \sigma ) \in G_\varepsilon \) if and only if \((k, \sigma ) \in D\) and \(u(f(k')) - V_\sigma (k') \le \varepsilon \) for all \(k' \in (\underline{k}, k]\).

Lemma 12

If \(k \in (\bar{k}, \infty )\), then \((k, \sigma ) \in G_\varepsilon \) only if \((k, \sigma ) \in D\) and \(v_{\bar{k}}(k') - V_\sigma (k') \le \varepsilon \) for all \(k' \in (\underline{k}, k]\).

These three characterization results allow us to prove the following result.

Proposition 8

For all \(\zeta > 0\) and \(k_0 \in (\underline{k}, \bar{k}\,]\), there exists \(\varepsilon > 0\) such that if \(\sigma \) satisfies that \((k_0, \sigma ) \in G_{\varepsilon }\), then the solution \(\kappa (\cdot ;k_0) : [0, \infty ) \rightarrow \mathbb {R}_{++}\) to \(k(0) = k_0\) and \(\dot{k} = f(k) - \sigma (k)\) for \(t \in [0, \infty )\) satisfies that \(k_{\infty } = \lim _{t \rightarrow \infty }\kappa (t;k_0) \in (k_0 - \zeta , k_0\,]\).

For all \(\zeta > 0\) and \(k_0 \in [\bar{k}+\zeta , \infty )\), there exists \(\varepsilon > 0\) such that if \(\sigma \) satisfies that \((k_0, \sigma ) \in G_{\varepsilon }\), then the solution \(\kappa (\cdot ;k_0) : [0, \infty ) \rightarrow \mathbb {R}_{++}\) to \(k(0) = k_0\) and \(\dot{k} = f(k) - \sigma (k)\) for \(t \in [0, \infty )\) satisfies that \(k_{\infty } = \lim _{t \rightarrow \infty }\kappa (t;k_0) \in [\, \bar{k}, \bar{k} + \zeta )\).

Proof

Part 1. We must show that, for all \(\zeta > 0\) and \(k \in (\underline{k}, \bar{k}\,]\), there exists \(\varepsilon > 0\) such that if \((k, \sigma ) \in G_{\varepsilon }\), then \(\sigma \) has a discontinuity in \((k - \zeta , k\,]\). By Lemma 7 and the definition of \(\bar{k}\), if \(\sigma \in \varSigma \) has no discontinuity in \((k - \zeta , k\,]\), then \(V_\sigma (k) \le v_{k - \zeta }(k) < u(f(k))\). By Lemma 11, \((k, \sigma ) \notin G_\varepsilon \) by choosing \(\varepsilon > 0\) sufficiently small.

Part 2. We must show that, for all \(\zeta > 0\) and \(k \in [\bar{k}+\zeta , \infty )\), there exists \(\varepsilon > 0\) such that if \((k, \sigma ) \in G_{\varepsilon }\), then \(\sigma \) has no discontinuity in \([\bar{k} + \zeta , \infty )\). By Lemmas 5 and 7 and the definition of \(\bar{k}\), if \(\sigma \in \varSigma \) has a discontinuity in \([\bar{k} + \zeta , \infty )\), then \(V_\sigma (\bar{k} + \zeta ) \le u(f(\bar{k} + \zeta )) < v_{\bar{k}}(\bar{k} + \zeta )\). By Lemma 12, \((k, \sigma ) \notin G_\varepsilon \) by choosing \(\varepsilon > 0\) sufficiently small. \(\square \)

The interpretation is that, in the limit, when \(\varepsilon \rightarrow 0, (k, \sigma ) \in G_{\varepsilon }\) implies that:

-

\(\sigma (k) = \sigma _{\underline{k}}(k)\) if \(k \in (0, \underline{k}]\): The stock is accumulated to \(\underline{k}\), corresponding to the TDU optimum.

-

\(\sigma (k) = \sigma _k(k)\) if \(k \in (\underline{k}, \bar{k}]\): The stock is conserved at k.

-

\(\sigma (k) = \sigma _{\bar{k}}(k)\) if \(k \in (\bar{k}, \infty )\): The stock is decumulated to \(\bar{k}\).

The strategy \(\sigma \) is illustrated in Fig. 3. This is essentially a uniqueness result, although the limiting strategy is not a multiple-attractor equilibrium strategy. Rather, as \(\varepsilon \rightarrow 0\), the points of discontinuity appear closer and closer, so that the outcome from any initial \(k_0 \in (\underline{k}, \bar{k}\,]\) approaches the path where the stock remains constant at \(k_0\). Hence, in the limit the intervals within \((\underline{k}, \bar{k}\,]\) are reduced to points, which contradicts Definitions 1 and 3.

The uniqueness result allows for comparative statics.

-

As \(\delta \rightarrow 0\) for fixed \(\alpha \in (0,1)\), the outcome for any \(k_0 > 0\) becomes identical with the TDU-optimal path, which in turn approaches the undiscounted utilitarian optimum (if it exists). Hence, the weight on the infinite future in the C-criterion plays no role.

-

As \(\alpha \rightarrow 1\) for fixed \(\delta > 0\), the outcome is the TDU optimum for \(k_0 \in (0, \underline{k}\,]\), while \(k_0\) is conserved if \(k_0 \in (\underline{k},\infty )\). Hence, increasing the weight on the infinite future in the C-criterion does not change the behavior for small \(k_0\), but ensures that resource conservation is the outcome any initial \(k_0 \in (\underline{k}, \infty )\).

8 Concluding remarks

We have shown that Markov equilibria, when the C-criterion is applied in the Ramsey model, support the intuition that we should seek to assist future generations if they are worse off than us, but not having an unlimited obligation to save for their benefit if they turn out to be better off.

This reinforces the results obtained by Asheim and Mitra (2010) and Zuber and Asheim (2012) for the criteria of sustainable discounted utilitarianism (SDU) and rank discounted utilitarianism (RDU), respectively. These criteria are also numerically representable, and they are neither a dictatorship of the present (also generations beyond any given T play a role) nor a dictatorship of the future (not only generations beyond any given T play a role). However, they do not satisfy the Strong Pareto principle and are thus not examples of sustainable preferences.

When applied to the Ramsey model, both SDU and RDU lead to capital accumulation (leading to outcomes that are identical to the TDU optimal path) when \(k_0 \in (0, \underline{k}]\), while \(k_0\) is conserved if \(k_0 \in (\underline{k},\infty )\). Moreover, these optimal paths are time consistent so that a game-theoretic analysis is not called for.

The problems of nonexistence and time inconsistency of the C-criterion arise because it combines a TDU part, treating the near future in advantageous manner, with a part that depends solely on the behavior of the consumption path at infinity. This does not by itself protect the interests of the far but finite future. Since almost every generation will live in the far but finite future, this is a potentially serious concern.

Our analysis of stationary Markov strategies in the Chichilisky-Ramsey model shows how equilibrium strategies indeed provide a bridge from the near future—whose interests are taken into account by the TDU part—to the infinite future—whose interests are protected by the asymptotic part of the C-criterion. The reason is that all generations understand that, in equilibrium, any exploitation of the stock for short-term gains will have consequences also for the infinite future.

Notes

Jackson and Yariv (2015) provide another perspective on the time inconsistency of the Chichilnisky criterion. They show that any Pareto-efficient and non-dictatorial aggregation of heterogeneous time preferences leads to time inconsistency. A sustainable preference is essentially a Pareto-efficient and non-dictatorial aggregation of positive and zero time preference.

It would be desirable to apply Chichilnisky’s criterion to more general models, e.g., with resources and risk. Given the complexity of doing so even in the Ramsey model, this is a task for future research. An application like Botzen et al. (2014) represents the future by the end period of the DICE model—not the infinite future—and does not address the problem of time inconsistency.

The first term, pf(k), is the value of net production, while the negative of the second term, \(- \dot{p}k = (-\dot{p}/p)pk\), is the cost of holding capital, with \(-\dot{p}/p\) being the consumption interest rate. Hence, \(pf(k) + \dot{p}k\) can be interpreted as profit. Note that (3) cannot be defined at time at which c and thus p is not differentiable.

The case where \(\underline{k} = \inf I \notin I\) or \(\underline{k} = \sup I \notin I\) does not correspond to an equilibrium since the I-optimal stock path converges to \(\underline{k}\) which is not in I (contradicting Definition 1). The case where \(\underline{k} < \inf I \notin I\) or \(\underline{k} > \sup I \notin I\) does not correspond to an equilibrium since it must generate an I-optimal pair (by Proposition 4) and there is no I-optimal pair in this case (by Propositions 2).

To see this, consider, e.g., the case where there is some \(i \in \{1, \ldots , n\}\) such that \(\underline{k} = \max I_i\). Since \(\{I_1, \ldots , I_n\}\) is a partition of \(\mathbb {R}_{++}\), there is \(j \in \{1, \ldots , n\}\) such that \(\underline{k} = \inf I_j \notin I_j\). However, as pointed out in footnote 4, this does not correspond to a one-attractor equilibrium strategy.

To see this, suppose that there is an extreme point \(k' \le \underline{k}\) of some interval \(I_i\). Footnote 5 implies that \(k' < \underline{k}\). By case (c) of Sect. 4, this implies that \(k' = \max I_i\). Since \(\{I_1, \ldots , I_n\}\) is a partition of the set \(\mathbb {R}_{++}\), there is \(j \in \{1, \ldots , n\}\) such that \(k' = \inf I_j \notin I_j\), where, for every \(k_0 \in I_j\), the solution \(\kappa (\cdot ,k_0) : [0, \infty ) \rightarrow I_j\) to \(k(0) = k_0\) and \(\dot{k} = f(k) - \sigma |_{I_j}(k)\) for \(t \in [0, \infty )\) has the property that \(k_{\infty } = \lim _{t \rightarrow \infty }\kappa (t,k_0)\) satisfies \(k_{\infty } = \max I_j < \underline{k}\) or \(k_{\infty } = \underline{k}\). Furthermore, if \(k_0 \in (k', k_{\infty })\), then \(\dot{\kappa }(t,k_0) > 0\) for all \(t \in (0, \infty )\), so that \(\sigma |_{I_j}(k) < f(k)\) for all \(k \in (k', k_{\infty })\). Therefore, Corollary 1 implies

$$\begin{aligned} V'_{\sigma }(k) = (1 - \alpha )\delta u'(\sigma |_{I_j}(k)) < (1 - \alpha ) f'(k) u'(f(k)) < u'(f(k)) f'(k) = \tfrac{\hbox {d}}{\hbox {d}k}[u\left( f(k)\right) ] \end{aligned}$$by the strict concavity of u since \(f'(k) > \delta \) for \(k \in (k', k_{\infty })\) and \(\alpha > 0\). Combining this observation with steps 1 and 2 of the proof of Lemma 6 contradicts that \(V_{\sigma }\) is continuous at \(k'\).

Since, as shown in Sect. 6, \([\underline{k},k] \subseteq K\) for some \(k > \bar{k}\), there are equilibrium strategies for which the stock converges to some \(k_{\infty } > \bar{k}\) for initial stocks \(k_0\) satisfying \(k_0 \in (\bar{k}, \infty )\).

This upper bound is constructed by maximizing the two parts of the C-criterion separately, taking into account that the stock cannot be accumulated beyond \(\hat{k}\) for any \(\hat{k} \ge \underline{k}\) and \(\sigma \in \varSigma \).

References

Asheim, G.B.: Individual and collective time-consistency. Rev. Econ. Stud. 64, 427–443 (1997)

Asheim, G.B.: Intergenerational equity. Ann. Rev. Econ. 2, 197–222 (2010)

Asheim, G.B., Buchholz, W., Tungodden, B.: Justifying sustainability. J. Environ. Econ. Manag. 41, 252–268 (2001)

Asheim, G.B., Mitra, T.: Sustainability and discounted utilitarianism in models of economic growth. Math. Soc. Sci. 59, 148–169 (2010)

Atkinson, A.B.: The strange disappearance of welfare economics. Kyklos 54, 193–206 (2001)

Ayong Le Kama, A., Ha-Hui, T., Le Van, C., Schubert, K.: A never-decisive and anonymous criterion for optimal growth models. Econ. Theory 55, 281–306 (2014)

Barro, R.J., Sala-i-Martin, X.I.: Economic Growth, 2nd edn. MIT Press, Cambridge (2004)

Botzen, W.J.W., van den Bergh, J.C.J.M., Chichilnisky, C.: Climate Policy Without Dictatorship of Any Generation: Comparing the Chichilnisky Criterion and Classical Utilitarianism in DICE. VU University Amsterdam, Mimeo (2014)

Chichilnisky, G.: An axiomatic approach to sustainable development. Soc. Choice Welf. 13, 231–257 (1996)

Dasgupta, P.S., Heal, G.M.: Economic Theory and Exhaustible Resources. Cambridge University Press, Cambridge (1979)

Ekeland, I., Long, Z., Zhou, Q.: A new class of problems in the calculus of variations. Reg Chaotic Dyn. 18, 558–589 (2013)

Figuières, C., Tidball, M.: Sustainable exploitation of a natural resource: a satisfying use of Chichilniskys criterion. Econ. Theory 49, 243–265 (2012)

Greenberg, J.: The Theory of Social Situations. Cambridge University Press, Cambridge (1990)

Heal, G.: Valuing the Future: Economic Theory and Sustainability. Columbia University Press, New York (1978)

Jackson, M.O., Yariv, L.: Collective dynamic choice: The necessity of time inconsistency. Am. Econ. J.: Microecon. 7, 150–178 (2015)

Koopmans, T.C.: Stationary ordinal utility and impatience. Econometrica 28, 287–309 (1960)

Koopmans, T.C.: Intertemporal distribution and optima1 aggregate economic growth. In: Ten Economic Studies in the Tradition of Irving Fisher, Wiley, New York (1967)

Krusell, P., Smith, A.A.: Consumption-savings decisions with quasi-geometric discounting. Econometrica 71, 365–375 (2003)

Nordhaus, W.D.: A Question of Balance: Weighing the Options on Global Warming Policies. Yale University Press, New Haven (2008)

Ramsey, F.P.: A mathematical theory of saving. Econ. J. 38, 543–559 (1928)

Rawls, J.: A Theory of Justice, Rev edn. The Belknap Press of the Harvard University Press, Cambridge (1999)

Stern, N.H.: The Stern Review of the Economics of Climate Change. Cambridge University Press, Cambridge (2007)

von Neumann, J., Morgenstern, O.: Theory of Games and Economic Behavior, 3rd edn. Princeton University Press, Princeton (1953)

Zuber, S., Asheim, G.B.: Justifying social discounting: the rank-discounted utilitarian approach. J. Econ. Theory 147, 1572–1601 (2012)

Author information

Authors and Affiliations

Corresponding author

Additional information

The paper builds on Ekeland et al. (2013) and has been circulated under the title “Generations playing a Chichilnisky game.” We are grateful for helpful discussions with Graciela Chichilnisky and Bård Harstad and useful comments received at SURED 2014, the 9th Tinbergen Institute Conference, the 11th ESWC, the 2nd FAERE conference and a seminar at Gothenburg University. Asheim’s research is part of the activities at the Centre for the Study of Equality, Social Organization, and Performance (ESOP) at the Department of Economics at the University. ESOP is supported by the Research Council of Norway through its Centres of Excellence funding scheme, project number 179552. Ekeland’s research has been supported by the Chaire de Développement Durable and the Laboratoire de Finance des Marchés de l’Énergie at the Université de Paris-Dauphine.

Appendix: Proofs

Appendix: Proofs

Proof

(Proof of Lemma 1) It is easily checked that the set of all I-feasible consumption paths is convex. Since u is strictly concave, the TDU criterion is strictly concave, and the maximum, if it exists, is unique. \(\square \)

Proof

(Proof of Lemma 2) Assume that the I-feasible pair \((k^{*}(t), c^{*}(t))\) is I-competitive and satisfies the CVT condition. For any other I-feasible pair (k(t), c(t)) we have, using the definition of \(p^{*}(t)\) and the concavity of u:

Hence, by Eq. (1) and the property that (3) holds for almost all t:

Integrating by parts the right-hand side, and using the fact that \(k\left( 0\right) =k_{0}=k^{*}\left( 0\right) \):

Letting \(T\rightarrow \infty \) (keeping in mind that limits exist) and using the CVT condition:

Hence, \((k^{*}(t), c^{*}(t))\) is I-optimal. \(\square \)

Proof

(Proof of Lemma 4) Assume that the pair \((I, \sigma )\) is a one-attractor stationary Markov equilibrium and fix an arbitrary \(k_0 \in I\), leading to a unique and absolutely continuous capital path, \(\kappa (t;k_0)\) converging to \(k_\infty \).

Step 1: \(\sigma \) is continuous. Let \(\tau _\infty (k_0)\) be the finite or infinite time at which \(k_\infty \) is reached. Since \(\sigma \) is Markovian, the capital path from \(k_0 \in I\) is constant if \(k_0 = k_\infty \), increasing on \([k_0, k_\infty )\) if \(k_0 < k_\infty \) and decreasing on \((k_\infty , k_0]\) if \(k_0 > k_\infty \).

Assume \(k_0 \ne k_\infty \). Let \(\tau (\cdot ;k_0)\) denote the inverse function of \(\kappa (\cdot ;k_0)\), defined on \([k_0, k_\infty )\) if \(k_0 < k_\infty \) and on \((k_\infty , k_0]\) if \(k_0 > k_\infty \). For fixed \((I, \sigma )\), write \(J(k_0, I, \sigma ) = (1-\alpha ) V(k_0) + \alpha \lim _{\rho \rightarrow 0^+} \left( \rho \int _0^{\infty } e^{-\rho t} u(\sigma (\kappa (t;k_0))) \hbox {d}t \right) \), so that \(V(k_0)\) is the value of the TDU part of the C-criterion when \(\sigma \) is followed from \(k_0\).

if \(k_0 < k_\infty \) and

if \(k_0 > k_\infty \). By means of this change of variable, we will show that \(\sigma \) must be continuous for all values of \(k_0\) if \(\sigma \) is an equilibrium strategy.

For values of \(k_0\) for which \(\sigma \) is continuous, we have that

Therefore, for values of \(k_0\) for which \(\sigma \) is continuous, it follows that

independently of whether \(k_0 < k_\infty \) or \(k_0 > k_\infty \).

Since \(\sigma \) is an equilibrium strategy, it follows that for all values of \(k_0\) for which \(\sigma \) is continuous,

by considering a deviation from \(\sigma \) in a sufficiently short time interval \((0, \varDelta )\). Since \(\sigma \) is an equilibrium strategy, it follows also that for all values of \(k_0\) for which \(\sigma \) is continuous,

since otherwise staying put at \(k_0\) for \(t \in (0, \varDelta )\) by choosing \(c(t) = f(k_\infty )\) would be a profitable deviation. Furthermore, Eqs. (11) and (12) imply that \(V(k_0) - u(\sigma (k_0)) > 0\) if \(k_0 < k_\infty \) and \(V(k_0) - u(\sigma (k_0)) < 0\) if \(k_0 > k_\infty \).

Suppose that \(\tilde{k}\) is a point of discontinuity of \(\sigma \). Write \(c^- = \lim _{k_0 \uparrow \tilde{k}}\sigma (k_0)\) and \(c^+ = \lim _{k_0 \downarrow \tilde{k}}\sigma (k_0)\). It follows from Eqs. (11) and (12) that

Since \(\tilde{k}\) is a point of discontinuity of \(\sigma \), we have that \(c^- \ne c^+\). However, if Eq. (13) is satisfied with strict inequality,Footnote 8 then the strict concavity of u implies that the equation

is solved by a unique \(\tilde{c}' < f(\tilde{k})\), corresponding to the case where \(\tilde{k} < k_\infty \) and a unique \(\tilde{c}'' > f(\tilde{k})\), corresponding to the case where \(\tilde{k} > k_\infty \). This contradicts that both (14) and (15) can be satisfied and proves that \(\sigma \) must be continuous for \(k_0 \ne k_\infty \).

It remains to be shown that \(\sigma \) is continuous at \(k_\infty \). With \(k_0 = k_\infty \), Eq. (13) is satisfied with equality. Furthermore, V is continuous at \(k_\infty \) as (i) \(\sigma (\kappa (t;k_0)) \rightarrow f(k_\infty )\) for all t as \(k_0 \rightarrow k_\infty \) in the case where \(\tau _\infty (k_0) = \infty \) for \(k_0 \ne k_\infty \), and (ii) \(\tau _\infty (k_0) \rightarrow 0^+\) as \(k_0 \rightarrow k_\infty \) otherwise. It follows from the strict concavity of u and the property that \(\sigma (k_0)\) solves (16) for \(\tilde{k} = k_0\) that \(\sigma (k_0)\) approaches \(f(k_\infty )\) continuously also in case (ii).

Step 2: \((\kappa (t;k_0), \sigma (\kappa (t;k_0)))\) satisfies Eq. (3) for almost all \(t \in [0, \infty )\). Since \((I, \sigma )\) is a one-attractor stationary Markov equilibrium, then there exists \(\varDelta > 0\) such that

for every I-admissible choice \(c_{k_0,\varDelta }\) where the solution \(k : [0, \infty ) \rightarrow I\) to \(k(0) = k_0\) and \(\dot{k} = f(k) - c_{k_0, \varDelta }(t)\) for \(t \in [0, \infty )\) satisfies that \(k(\varDelta ) = k_1 := \tau (\varDelta ,k_0)\), since then \(\sigma (\kappa (t,k_0)) = c_{k_0, \varDelta }(t)\) for \(t \in (\varDelta , \infty )\).

There exists a pair \(\hat{k} : [0, \varDelta ] \rightarrow I\) and \(\hat{c} : [0, \varDelta ] \rightarrow \mathbb {R}_{+}\) such that (i) \(\hat{c}\) is absolutely continuous, so that the associated present-value price path \(\hat{p}(t)\) defined \(\hat{p}(t) = e^{-\delta t}u'(\hat{c}(t))\) is differentiable almost everywhere, (ii) Eq. (3) is satisfied for almost all \(t \in [0, \varDelta ]\), and (iii) \(\hat{k}(0)=k_0\) and \(\hat{k}(\varDelta )=k_1\). By (10) and the strict concavity of the TDU criterion, we have that

if \((\kappa (t,k_0), \sigma (\kappa (t,k_0)))\) does not coincide with \((\hat{k}(t),\hat{c}(t))\) for \(t \in [0,\varDelta ]\), contradicting (17). Hence, the pair \((\kappa (t,k_0), \sigma (\kappa (t,k_0)))\) satisfies Eq. (3) for almost all \(t \in [0, \varDelta ]\). Since \(k_0 \in I\) is arbitrary, it follows that \((\kappa (t;k_0), \sigma (\kappa (t;k_0)))\) satisfies Eq. (3) for almost all \(t \in [0, \infty )\).

Step 3: \((\kappa (t;k_0), \sigma (\kappa (t;k_0))\) is I-competitive and satisfies the CVT condition. By Step 1, \(\sigma : I \rightarrow \mathbb {R}_{++}\) is continuous, so that, for every \(k_0 \in I\), the solution \(\kappa (t;k_0)\) has the properties that \(\sigma (\kappa (t;k_0))\) is an absolutely continuous function of t and, by Step 2, \((\kappa (t;k_0), \sigma (\kappa (t;k_0))\) satisfies Eq. (3) for almost all \(t \in [0, \infty )\). Moreover, by Definition 1, \((\kappa (t;k_0), \sigma (\kappa (t;k_0))\) is I-feasible, so that \((\kappa (t;k_0), \sigma (\kappa (t;k_0))\) is I-competitive. Finally, by Definition 1, \(\kappa (t;k_0)\) converges, implying that \((\kappa (t;k_0), \sigma (\kappa (t;k_0))\) satisfies the CVT condition. \(\square \)

Proof

(Proof of Corollary 1) Assume that the pair \((I, \sigma )\) is an equilibrium, and let \(k_0 \in \hbox {int}I\). Let \(V(k_0)\) be defined as in the proof of Lemma 4. We need to show that \(V'(k_0)\) exists and equals \(\delta u'(\sigma (k_0))\).

Case 1: \(k_0 \ne k_\infty \). The result follows from (12) of the proof of Lemma 4.