Abstract

The rising level of long-term care (LTC) expenditures and their financing sources are likely to impact savings and capital accumulation and henceforth the pattern of growth. This paper studies how the joint interaction of the family, the market and the State influences capital accumulation and welfare in a society in which the assistance the children give to dependent parents is triggered by a family norm. We find that with a family norm in place, the dynamics of capital accumulation differ from those of a standard Diamond (Am Econ Rev 55:1126–1150, 1965) model with dependence. For instance, if the family help is sizeably more productive than other LTC financing sources, pay-as-you-go social insurance might be a complement to private insurance and foster capital accumulation.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

The purpose of this paper is to analyze the joint impact that alternative ways of financing long-term care (LTC) may have on capital accumulation. Such a question is relevant to assess the pattern of economic growth in a world where dependent elderly are becoming a significant fraction of the population.

LTC consists of nursing care (as opposed to health care) for people who depend on help to carry out daily activities such as eating, bathing, dressing, going to bed, getting up or using the toilet.Footnote 1 The demand for LTC is expected to increase. More than two out of five people aged 65 or older report having some type of functional limitation (sensory, physical, mental, self-care disability, or difficulty leaving home). In the EU, the share of the population aged 65+ will be more than double by 2050, while the share of the population aged 80+ will be more than triple.Footnote 2 Not only will the relative number of dependent elderly increase, but the cost may increase as well, due to the growing prices of services (the so-called Baumol disease).

On the supply side, the main provider of LTC is the family. Yet, in a context of weakening family ties, individuals may also rely on the market of private insurance and on social policy. Even though the role of the family dominates that of the State and of the market, the relative importance of these three sources of provision varies across countries and over time.Footnote 3

In the present paper, we acknowledge both the importance of LTC and the diversity of its financing sources in explaining capital accumulation and economic growth.Footnote 4 We use a two-period OLG model with risk of dependence to assess the influence of the various ways of financing LTC on capital accumulation. A casual look at the problem may lead one to think that LTC has the same effect as any other old age need, namely it calls for savings. In that respect, an increase in LTC needs can be expected to stimulate capital accumulation. This reasoning is surely correct as long as LTC is financed by savings or private insurance. It is incorrect if LTC services are provided by the State or the family. Intuitively, as long as social insurance and family solidarity operate according to a pay-as-you-go principle, each of these two financing sources depresses capital accumulation. We show that when different sources of LTC financing coexist, crowding out may lead to surprising results. The most interesting one is that if family help is taken into account, a pay-as-you-go social LTC insurance may be a complement to private insurance and it may foster capital accumulation.Footnote 5

Our model rests on three key assumptions. First, we assume that the main motive for children’s assistance is a family norm. This idea is pervasive in sociology and gerontology. As an example, Lowenstein and Daatland (2006) study the impact of filial norms on the exchange of intergenerational support between adult children and older parents across five European countries. The effect of filial norms on help provision by children is shown to be moderate but significant and variable across countries, appearing more prescriptive in the South than in the North.Footnote 6 The economic literature generally distinguishes three motives for children helping their dependent parents: altruism, quid pro quo exchange or family norms. Klimaviciute et al. (2015) use data from the Survey of Health, Ageing and Retirement in Europe (SHARE) to test the motives of informal caring in a number of European countries. Their main finding is that exchange dominates altruism and family norms, but that all three motives play a role in explaining informal long-term care. The literature also acknowledges the fact that intergenerational transfers may occur even in the absence of altruism motives or bargaining.Footnote 7 Zhang and Zhang (1998) consider a model with implicit contracts between generations, while in Fan (2001) intergenerational transfers occur because parents want to shape the type of their children. Stark (1995) and Cox and Stark (2005) propose the concept of “demonstration effect”: individuals help their parents in order to set an example to their children. Along this line, we consider a framework where intergenerational transfers are motivated by a norm that induces children to imitate their parents. While we choose to conceptualize the problem using a family norm, our model could be seen as an extreme version of a model with exchange or altruism. The child may help his dependent parent against the promise of being helped when old and dependent. Similarly, children’s help could be motivated by joy of giving ascending altruism.

Second, we focus on a particular type of assistance, consisting of an investment that children make before knowing whether their parents are dependent or not. This ex ante investment is made with the idea that it will be particularly useful if the parents become dependent. It may concern housing or children’s location and occupation choices. Also, children may build a house with facilities that are relevant for dependent people.

The third key assumption is that parents prefer their children’s help over other sources of LTC, at least to a certain level. The idea that parents prefer being taken care by their children rather than by unknown formal caregivers is standard.Footnote 8 It is sometimes used to explain why parents avoid purchasing private insurance.Footnote 9 In this paper, we assume that the dependent parents particularly value the effort and time that children put into earning the resources that they devote to filial help. For the early stages of dependence, this assumption seems to be particularly compelling. In more severe cases, such as heavy dementia, the role of children might be less valuable for the dependent parents.

Our analysis will focus not only on the steady state but also on the dynamics of capital accumulation along the equilibrium path. In our analysis, the role of the State is restricted to providing a social insurance without aiming at social optimality. Its role is thus quite passive, and our approach mainly positive. We first present what we call the benchmark model, that is, a model à la Diamond without family help but with the possibility for the individuals to purchase private LTC insurance. In such a setting, a pay-as-you-go social insurance scheme has a consistently depressive effect on capital accumulation. Also, there is no switch in the insurance behavior along the equilibrium path: individuals either always insure, or they never insure.

These two features do not hold any more when we introduce the family norm. The pay-as-you-go social insurance, when combined with the family norm, can surprisingly have an enhancing effect on capital accumulation. This is due to the fact that social insurance reduces family help; since family help is particularly valuable in case of dependence, individuals might react to its reduction by increasing savings and private insurance coverage. Thus, public insurance might actually be a complement to private insurance in the presence of a family norm. This sheds a new light on the debate, initiated by Brown and Finkelstein (2008), about the crowding out effect of social LTC coverage on private insurance.Footnote 10 Overall, the effect of the introduction of social LTC insurance on welfare is ambiguous and depends on its impact both on family help and on capital accumulation. Furthermore, we show that as the degree of family help increases or decreases over time, switches in insurance can appear; namely, along the dynamic path one can have first private insurance purchases and then no private insurance at all, or the other way around. Finally, we show that the strength of the family norm on assistance has a depressive effect on capital accumulation, and that the probability of dependence affects capital accumulation in a non-monotonic way.

Economists have hardly treated the relationship between LTC expenditures and capital accumulation. A notable exception is Kopecky and Koreshkova (2014), which calibrates a life cycle model with LTC expenditures.Footnote 11 Abstracting from family help and norms, the authors show that social LTC insurance discourages capital accumulation by crowding out precautionary savings. The literature on health investment, longevity and growth, is extensive, but has a different emphasis.Footnote 12 Work on social security (see, for instance, Zhang and Zhang 1998) and growth finds that unfunded pension schemes have a depressive effect on capital accumulation relative to fully funded pensions or savings. The results of this literature are different from ours in that it always finds that old age family arrangements have the same effect as pay-as-you-go pensions, except that they imply much larger incentive effects on either fertility or longevity.

The rest of the paper is organized as follows. In the next section, we present the model. In Sect. 3, we study the benchmark case without family norm. We allow for a family norm in Sect. 4, and we study how the parameters of the economy affect the dynamics and the steady state of capital accumulation. We conclude in Sect. 5. We present proofs and analytic developments in several technical appendices.

2 The economy

We consider an overlapping generations model where time is assumed to be discrete. All agents (individuals and firms) are price takers, and all markets are competitive. Individuals live two periods, and without loss of generality, the size of the population is assumed to be constant. An individual born in t supplies one unit of labor in the first period and receives the market wage \(w_{t}\). In the second period, he is retired and is dependent with probability \(p\in (0,1)\). In this case, he needs LTC.

2.1 The financing of LTC needs

LTC needs can be financed through different channels: the market, the State and the family.

2.1.1 The market

Individuals can use the market to provide for their LTC needs. First of all, they can self-insure through precautionary savings. By saving \(s_t\) in their young age, they receive \(R_{t+1}s_t\) in their old age, where \(R_{t+1}\) is the interest factor. Note that this way of financing LTC is not efficient, since ex post savings are too high if the individual is not dependent. Alternatively, individuals can purchase an amount \(i_{t}\ge 0\) of private LTC insurance in the first period. Then, they get an insurance allowance \(R_{t+1}i_{t}/p\) in case of dependence in the second period. We thus assume that the insurance contract is actuarially fair.Footnote 13 In the following, we will say that individuals insure whenever they purchase private LTC insurance. Of course, even if they do not insure, they might (partially) self-insure through precautionary savings.

2.1.2 The State

The government may provide social LTC insurance through a pay-as-you-go system, by setting a linear tax \(\tau \in [0,1)\) on the labor income of the young in order to finance a transfer to the dependent. Then, each dependent elderly born in t receives a transfer \(\tau w_{t+1}/p\). We thus assume no loading factor in social LTC insurance.

2.1.3 The family

The family can provide help to the dependent. In each period t, young individuals devote a fraction \(x_{t}\in [0,1-\tau ]\) of their income to their parent.Footnote 14 This fraction is chosen before children know whether or not their parents will be dependent.

The fraction of income devoted to parents depends on the past filial help behavior. Each individual observes the fraction \(Z_{t-1}=x_{t-1}+\tau \in [0,1)\) which his parent was willing to devote to his grandparent and the evolutionFootnote 15 of \(Z_{t}\) across time follows the process \(Z_{t}=\pi Z_{t-1}+\pi (1-\pi )\), where \(\pi \in [0,1]\) captures the intensity of transmission of the family norm. Thus, \(Z_{t}\) is increasing in \(Z_{t-1}\), and it is equal to 0 if the family norm is not transmitted (i.e., \(\pi =0\)) and equal to \(Z_{t-1}\) if the norm is perfectly transmitted (i.e., \(\pi =1\)). In other words, \(\pi \) can be viewed as the intensity of intergenerational imitation (or of transmission of the family norm). Since \(Z_{t}=x_{t}+\tau \), the evolution of the voluntary help \(x_t\) follows a linear process:

For a given history, the level of family help depends only on the parameter \(\pi \) and on the tax rate \(\tau \). This captures the presence of a norm that individuals cannot break, while abstracting from bargaining and altruistic concerns. This simplification allows us to focus on the interaction between the strength of family norms and public intervention in determining the pattern of capital accumulation. The (linear) reduced form in (1) is consistent with the “demonstration effect” developed by Stark (1995) and Cox and Stark (2005) who state that parents who desire being helped in the future have an incentive to make transfers to their own parents in order to instill appropriate preferences in their children.Footnote 16 They posit that the demonstration is not perfect by assuming that with probability \(\varpi \), a child will simply imitate his parent’s action, while with probability \(1-\varpi \), he will choose an action to maximize his expected utility, aware though that his own child may be an imitator. Applying this approach to our dynamic settings, we obtain a linear process for the evolution of family help.

Another feature of our specification is that the parents weight the help they receive from their children more than any other transfers (from savings, private and/or social insurance). Indeed, an individual does not merely value his child’s help as \(x_{t+1}w_{t+1}\), but as \(x_{t+1}^\sigma w_{t+1}\) with \(\sigma \in (0,1)\) measuring the importance of filial help for the parent. The lower \(\sigma \), the higher the evaluation of \(x_{t+1}\) is (with respect to the other sources of income) for the parent. This captures the fact that, at least in the early stage of dependence, the elderly prefer being taken care by relatives rather than by unknown caregivers (see Pauly 1990).Footnote 17 Since an increase in children’s help is less valuable if the help is already high, our formulation also takes into account the fact that the parent gets a psychological benefit from filial help, but might feel guilty to receive too much of it. In the limit, if the children devote all their income to their parents (i.e., \(x_{t+1}=1\)), the latter do not get any psychological gain from filial help and evaluate \(x_{t+1}w_{t+1}\) as a mere monetary transfer.

Since our goal is to analyze the role of family help in the presence of (potential) LTC needs, the family help is here most valuable for the parents in case of dependence. However, this help is not necessarily sunk: if the parent does not turn out to be dependent, he weights the family help by a parameter \(\gamma <1\).

2.2 The production process

In any period t, a single good is produced using two factors, capital \(K_t\) and labor \(L_t\). Production occurs according to a Cobb–Douglas technology \(AK_{t}^{\alpha }L_{t}^{1-\alpha }\) with \(A>0\) and \(\alpha \in (0,1)\).

2.2.1 Equilibrium prices

As markets are perfectly competitive, each factor is paid its marginal product. Assuming that capital fully depreciates after one period we obtain:

where \(k_t=K_t/L_t\) is the capital stock per worker in period t.

2.2.2 Intertemporal equilibrium

As the endowment of capital at each period is equal to the resources that were not consumed in the preceding period, the capital stock in period \(t+1\) is financed by precautionary saving \(s_{t}\) and private LTC insurance \(i_{t}\). Since the size of the population is constant, we have:

In other words, capital accumulation depends on optimal individual decisions.

2.3 The optimal individual behavior

In order to understand individual behavior, we first define individual welfare. We then solve the individual optimization program and study insurance decisions.

2.3.1 Individual welfare

In the first period, each young individual devotes a fraction \(x_{t}\) of his wage \(w_t\) to his elderly parent, and a fraction \(\tau \) to the government.Footnote 18 He devotes his remaining income to consumption \(c_t\), precautionary savings \(s_{t}\), and private LTC insurance \(i_{t}\). In the second period, he consumes \(R_{t+1}s_{t}\), receives the help from his child and, in the case of dependence, also receives the benefits of both the private and the social LTC insurance, respectively, \(R_{t+1}i_{t}/p\) and \(\tau w_{t+1}/p\).

The welfare \({\mathscr {W}}_t\) of an individual born in t is:

with \(\beta \in (0,1)\) is the psychological intertemporal discount factor and

The function H(.) corresponds to second-period utility and is given by:

if the individual is not dependent and otherwise by:

with \(\xi >0\) and \(D>0\). In this specification, \(H^{\text {dep}'}(\kappa )>H^{\text {not dep} '}(\kappa )\) captures the fact that dependent individuals have higher needs.Footnote 19 The parameter \(D>0\) measures the utility loss implied by dependence and is assumed to be high enough to ensure that \(H^{\text {dep}}(\kappa )<H^{\text {not dep}}(\kappa )\) for any feasible value of \(\kappa \).Footnote 20 As mentioned above, the individual does not attribute the same value to the voluntary transfer received from his child as to other means of financing LTC. In the following, for the sake of tractability, the instantaneous utility function u(.) is assumed to be logarithmic.

2.3.2 The optimization problem

From now on, we will use the indicator function \(\mathbb {1}\equiv \mathbb {1}_{\pi >\tau \ge 0}\) to encompass the benchmark case without family help where \(\mathbb {1}=0\) (i.e., \(\pi =\tau =0\) and \(\pi =0<\tau <1\)) and the case with family help where \(\mathbb {1}=1\) (i.e., \(\pi >\tau \ge 0\)).Footnote 21 Then, using (1) an individual born in t solves the following problem:

under the nonnegative constraints \(s_{t}\ge 0\) and \(i_{t}\ge 0\).

To avoid unrealistic corner solutions in which individuals do not self-insure through precautionary savings (and then rely exclusively on family help if they are not dependent), we will make the following assumption:

Assumption 1

\(\gamma <1/(1+\xi )\).

As it is shown in “Appendix 1,” Assumption 1 is sufficient (but not necessary) to have a positive \(s_t\). Intuitively, the weight \(\gamma \) of the family help is perceived by the parent as being low, which induces him to self-insure through precautionary savings.

Hence, the first-order condition (FOC) with respect to \(s_{t}\) is:

Note that without transfers from external sources (i.e., \(\tau =\pi =0\)), this FOC would not depend on \(R_{t+1}\).

2.3.3 Insurance behavior

The unconstrained solution for \(i_{t}\) could be negative, leading to a corner solution. Conversely, when individuals insure the FOC with respect to \(i_t\) is:

Then, we formally obtain the following optimal level for insurance (see “Insurance behavior depending on \(\delta \xi \) and \(\varepsilon (x_{t})\)” of Appendix):

with \(\delta =\alpha /(1-\alpha )\) and \(\varepsilon (x_t)=\tau /p+ \big [1-\gamma (1+\xi )\big ]\psi ^\sigma (x_{t})\mathbb {1}\).

Depending on the values of \(\tau \), p, \(\xi \), \(\gamma \), \(\sigma \), \(\pi \), and \(x_t\), \(\varepsilon (x_t)\) can take any values in \([0,+\infty )\), while \(\delta \xi \) can take any values in \((0,+\infty )\). This will lead to different dynamics of capital accumulation depending on the relative importance of sources of LTC financing.

3 Benchmark case: absence of family help

In order to understand the role of the family, we will first study an economy where the family help is not operative, i.e., individuals cannot directly help their elderly parents. We will denote this case with the subscript d, since it corresponds to the model of Diamond (1965), adapted to allow for dependence.

3.1 The market

First, consider the case where the government does not intervene, i.e., \(\tau =0\). Then, there are no intergenerational transfers, \(\varepsilon (x_{t})=0\), and individuals only provide for dependence in old age through precautionary savings or private LTC insurance. According to (6), individuals insure and this decision is independent of the capital stock. Based on Eqs. (2) to (6), the dynamics of capital accumulation are given by (see “Capital accumulation when \(\pi =0\)” of Appendix):

Intuitively, individuals always transfer a share \(A^{-1}\zeta _p/(1-\alpha )\) of their wage \(w_{t}\) to the second period using precautionary savings and private LTC insurance. According to (7), there exists a unique positive steady-state capital stock,

which is globally stable in \(\mathbb {R}_{+}^\star \), i.e., for all \(k_0\in \mathbb {R}_{+}^\star \), the optimal path \(\{k_t\}_{t\ge 0}\) converges monotonically to \(k_{d|_{\tau =0}}\).

Note that, in the case without dependence, we find the well-known dynamics of the standard Diamond’s model, i.e., \(k_{t+1}= \zeta _0 k_t^\alpha \) with \(\zeta _0=A(1-\alpha )\beta /(1+\beta )\). Compared to this standard model, we have introduced the probability of dependence. Since \(k_{d|_{\tau =0}}\) increases in p, the probability of dependence has a positive impact on capital accumulation (see “Comparative statics with respect to p when \(\pi =\tau =0\)” of Appendix). The higher the probability of dependence, the higher the savings and/or insurance coverage.

3.2 The market and the State

We now consider the case where the government intervenes through the social (unfunded) LTC insurance described in Sect. 2.1, i.e., \(\varepsilon (x_{t})=\tau /p\). Individuals take this into account when choosing how much private LTC insurance to purchase and how much to save. According to (6), they insure if and only if \(p\delta \xi >\tau \). Three remarks about this condition can be made. First, the decision to insure is invariant through time and is not affected by the capital stock. Second, if the tax rate is relatively high, individuals do not insure. The social LTC insurance crowds out the private LTC one. Third, individuals trade-off between the return of precautionary savings R and the one of private LTC insurance R / p. Thus, the higher p is, the higher the attractiveness of private LTC insurance.

According to Eqs. (2) to (6), the dynamics of capital accumulation can be described by (see “Capital accumulation when \(\pi =0\)” of Appendix):

with:

Since the sign of \(p\delta \xi -\tau \) is time independent, no switch in the insurance behavior is possible: individuals choose either to insure or not to insure in all periods. We can thus identify two regimes, characterized by the presence (or absence) of private LTC insurance along the optimal path \(\{k_t\}_{t\ge 0}\). The existence of these two different dynamics is due to the presence of the social LTC insurance. As we have shown above, the insurance behavior does not affect capital accumulation when the government does not intervene (i.e., \(\eta _d|_{\tau =0}=\mu _d|_{\tau =0}=\zeta _p\)).

According to (8), there exists a unique positive steady-state capital stock,

which is globally stable in \(\mathbb {R}_{+}^\star \), i.e., for all \(k_0\in \mathbb {R}_{+}^\star \), the optimal path \(\{k_t\}_{t\ge 0}\) converges monotonically to \(k_d\). Note that the steady state is such that \(k_d=\max \Big \{k_d^i,k_d^n\Big \}\), where the superscripts “n” and “i” denote “no insurance” and “insurance,” respectively.

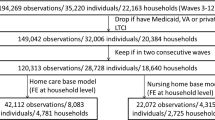

We can now look more closely at the effect of \(\tau \) on capital accumulation (see “Comparative statics with respect to \(\tau \) when \(\pi =0\)” of Appendix and Fig. 1).Footnote 22 The capital stocks \(k_d^i\) and \(k_d^n\) are both decreasing functions of \(\tau \). When the tax rate increases, the disposable income decreases and this income effect reduces savings and capital accumulation. Furthermore, individuals insure if and only if \(\tau <\tau _{a}=\min \{p\delta \xi ,1\}\). Intuitively, as \(\tau \) increases, individuals get more social LTC insurance, which discourages precautionary savings and private LTC insurance.

To conclude, our results are standard, and mirror Diamond’s model with the only difference that we introduced dependence and LTC insurances. They can be summarized as follows:

Proposition 1

Without family help, the capital stock \(k_{t}\) converges monotonically to \(k_d\). The steady-state capital stock decreases as the tax rate increases. The insurance behavior is time invariant. If the tax rate \(\tau \) and/or the probability \(1-p\) are sufficiently low (resp. high), individuals always insure (resp. never insure).

We will now study whether these results are robust to the introduction of the family.

4 The State, the market, and the family

We now consider the case where children can help their parents. As described previously, family help is triggered by a norm imposing that a certain fraction of the children’s earnings is devoted to the parents. In the following, we first characterize the dynamics of voluntary family help, then we turn to the dynamics of capital accumulation. Finally, we study the effect of the intensity of intergenerational imitation, the probability of dependence, and the tax rate on the steady-state capital stock.

4.1 The dynamics of family help

We here want to focus on the case where the family help is always operative. Henceforth, we restrict our study as follows.

Assumption 2

\(\tau <\pi \) and \(x_0<1-\tau \).

Assumption 2 ensures that \(x_{t}\in (0,1-\tau )\).Footnote 23 Then, the dynamics \(\{x_t\}_{t\ge 0}\) of family help described by (1) and represented in Fig. 2 converge monotonically to \({\widetilde{x}}=\pi -\tau \). Note that the fraction \(x_{t+1}\) is linear in \(x_{t}\), and nonlinear in \(\pi \). Indeed, given \(x_{t}\), \(x_{t+1}\) is a concave function of \(\pi \), increasing up to \({\bar{\pi }}_{t}=(1+x_{t}+\tau )/2\) and decreasing afterward. Then, the parameter \(\pi \in (\tau ,1]\) measures the intensity of imitation, but also its imperfection. This allows the individuals to devote a bigger or a smaller share with respect to the past generation. If \(\pi \in (\tau ,x_{t}+\tau )\), the imitation is weak and children transmit a smaller fraction than their parents did (i.e., \(x_{t+1}<x_{t}\)). If \(\pi \in (x_{t}+\tau ,1)\), the imitation is strong and children transmit a bigger fraction than their parents did (i.e., \(x_{t+1}>x_{t}\)). Finally, in the limit case where \(\pi =1\), imitation is perfect, and \(x_{t+1}=x_{t}\).

4.2 The global dynamics

4.2.1 Insurance behavior

According to (6), individuals insure if and only if \(\delta \xi >\varepsilon (x_{t})\). Here, it is important to emphasize that \(\varepsilon (x_{t})\) depends on \(x_{t}\) and is then time dependent. Thus, contrary to the benchmark case, changes in the insurance behavior over time are possible.

Assumption 1 ensures that \(\varepsilon (x_{t})\) increases in \(x_{t}\). Then, \(\varepsilon (x_{t})\) and \(\delta \xi \) cannot cross more than in one point denoted by \({\widehat{x}}\). Consequently, individuals insure for any \(x_t<{\widehat{x}}\) and do not insure for any \(x_t>{\widehat{x}}\). Since the dynamics of \(x_{t}\) are monotonic (increasing if \(x_{0}<{\widetilde{x}}\) and decreasing if \(x_{0}>{\widetilde{x}}\)) and independent of \(k_{t}\), two cases can arise. When \(\delta \xi \) is neither too high nor to low, \({\widehat{x}}\) belongs to \({\mathscr {I}}=\left[ \min \{x_{0},{\widetilde{x}}\},\max \{x_{0},{\widetilde{x}}\}\right] \). Then, there exists a unique period T after which the sign of the sequence \(\{x_t-{\widehat{x}}\}_{t\ge 0}\) changes. Individuals change their insurance behavior after period T. When \(\delta \xi \) is very high or very low, \({\widehat{x}}\) does not belong to \({\mathscr {I}}\) and individuals either never insure or always insure. Under Assumptions 1 and 2, one (and unique) switch in the insurance behavior is possible and we can thus distinguish four regimes characterized by the insurance behavior along the equilibrium path (see “Global dynamics: the different regimes” of Appendix). When \(\delta \xi \le \min \left\{ \varepsilon (x_{0}),\varepsilon ({\widetilde{x}})\right\} \), there is no insurance in any period (Regime I). When \(\delta \xi >\max \left\{ \varepsilon (x_{0}),\varepsilon ({\widetilde{x}})\right\} \), there is positive insurance in any period (Regime II). When \(\varepsilon ({\widetilde{x}})<\delta \xi \le \varepsilon (x_0)\), the dynamics display a switch from no insurance to insurance along the equilibrium path (Regime III). Finally, when \(\varepsilon (x_0)<\delta \xi \le \varepsilon ({\widetilde{x}})\), the dynamics display a switch from no insurance to insurance (Regime IV).

4.2.2 The dynamics of capital accumulation

The impact of the parameters of interest on the insurance behavior, described above, is independent qualitatively of the level of \(\gamma \). Thus, without loss of generality but for the sake of tractability, we illustrate the dynamics of capital accumulation when \(\gamma =0\). In this case, \(\varepsilon (x_t)=\tau /p+\psi ^\sigma (x_{t})\) can be interpreted as the transfer that an individual in \(t+1\) receives in the case of dependence from external sources (the State and his child). According to Eqs. (2) to (6), these dynamics are given by (see “Capital accumulation when \(i_t=0\)” and “Capital accumulation when \(i_t>0\)” of Appendix):

with:

Using \(\varepsilon ({\widetilde{x}})=\tau /p+(\pi -\tau )^\sigma \) and according to (9), there exists a unique positive steady-state capital stock,

Note that the steady-state capital stock is such that \({\widetilde{k}}=\max \left\{ {\widetilde{k}}^i,{\widetilde{k}}^n\right\} \).

The dynamics of \(\{k_t\}_{t\ge 0}\) are more complex with family help than in the benchmark case, because \(\eta (x_{t})\) and \(\mu (x_{t})\) depend on \(x_{t}\).

4.2.3 The global dynamics

According to (1) and (9), the dynamic system \((k_{t},x_{t})\) is described by:

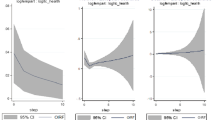

It is globally asymptotically stable and converges to a unique steady state: the pair \(({\widetilde{k}},{\widetilde{x}})\). We can thus distinguish the four regimes characterized by the insurance behavior along the equilibrium path evoked in the beginning of this section (see Fig. 3).Footnote 24

Global dynamics with family norm. a Regime I: \(\delta \xi \le \min \left\{ \varepsilon (x_{0}),\varepsilon ({\widetilde{x}})\right\} \). b Regime II: \(\delta \xi >\max \left\{ \varepsilon (x_{0}),\varepsilon ({\widetilde{x}})\right\} \). c Regime III: \(\varepsilon ({\widetilde{x}})<\delta \xi \le \varepsilon (x_0)\). d Regime IV: \(\varepsilon (x_0)<\delta \xi \le \varepsilon ({\widetilde{x}})\)

Our main results, established in “Appendix 3,” can be summarized as follows:

Proposition 2

The dynamic system \((k_{t},x_{t})\) is defined by (1) and (9). For all \((k_{0},x_{0})\in \mathbb {R}_{+}^\star \times \mathbb {R}_{+}\), this system is globally asymptotically stable and converges to \(({\widetilde{k}},{\widetilde{x}})\). The dynamics of capital accumulation are not necessarily monotonic.

Individuals always (resp. never) insure if \(\delta \xi \) is sufficiently high (resp. low). For intermediate values of \(\delta \xi \) and \(x_{0}<{\widetilde{x}}\) (resp. \(x_{0}>{\widetilde{x}}\)), individuals insure (resp. do not insure) up to a certain period and then decide not to insure (resp. insure). Thus, one (and unique) switch in the insurance behavior is possible.

Contrary to the benchmark case without family help, the dynamics of capital accumulation are not necessarily monotonic and might be characterized by switches in the insurance behavior. Intuitively, since the family help and the private LTC insurance are substitutes, the dynamics of family help affect the insurance behavior over time. If family help increases over time, individuals might reduce the purchase of private LTC insurance. After a certain period, the market for private LTC insurance completely disappears. To the contrary, if family help decreases over time, the market for private LTC insurance might emerge after a certain period.

4.3 Comparative statics

We now study the impact of the parameters of the economy on insurance behavior and long-run capital accumulation.

4.3.1 Insurance behavior

First of all, we can analyze how variations in \(\pi \), p, and \(\tau \) affect the insurance regime in the steady state (see “Insurance behavior according to \(\pi \), p and \(\tau \)” of Appendix). Since private LTC insurance occurs at the steady state if and only if \(\delta \xi >\varepsilon ({\widetilde{x}})\), it is sufficient to study how \(\varepsilon ({\widetilde{x}})\) varies with these parameters. As \(\varepsilon ({\widetilde{x}})\) is increasing in \(\pi \), there exists a threshold \(\pi _a\) such that individuals insure if and only if the degree of intergenerational imitation is lower than \(\pi _a\). When \(\tau >0\), the \(\varepsilon ({\widetilde{x}})\) is decreasing in p so that there exist a threshold \(p_a\) such that individuals insure if and only if the probability of dependence exceeds \(p_a\). When \(\tau =0\), the insurance regime does not depend on p. Finally, the derivative of \(\varepsilon ({\widetilde{x}})\) with respect to \(\tau \) has the sign of \({\underline{\tau }}-\tau \) with \({\underline{\tau }}=\pi -[p\sigma (1-\gamma (1+\xi ))]^{1/(1-\sigma )}\). If \(\pi <[p\sigma (1-\gamma (1+\xi ))]^{1/(1-\sigma )}\), then \(\varepsilon ({\widetilde{x}})\) always decreases in \(\tau \), and there exists a threshold \(\tau _b\) such that individuals insure if and only if the tax rate exceeds \(\tau _b\). If \(\pi \ge [p\sigma (1-\gamma (1+\xi ))]^{\sigma -1}\), there exist two thresholds, \(\tau _c\) and \(\tau _d\), such that insurance occurs if and only if the tax rate is lower than \(\tau _c\) or higher than \(\tau _d\).

It is worth noting that the impact of the parameters of interest on the insurance behavior, described above, is qualitatively independent of the level of \(\gamma \). Thus, without loss of generality and for the sake of tractability, in the following we illustrate the comparative statics on capital accumulation when \(\gamma =0\), i.e., when children’s help is productive only in case of parental dependence.

4.3.2 Intensity of intergenerational imitation

We now study the impact of \(\pi \), the intensity of imitation, on capital accumulation (see “Comparative statics with respect to \(\pi \) when \(\pi >\tau \ge 0\)” of Appendix and Fig. 4). As \(\pi \) increases from \(\tau \) to 1, \(\varepsilon ({\widetilde{x}})\) increases from \(\tau /p\) to \(\tau /p+(1-\tau )^\sigma \). Then, the steady-state capital stock \({\widetilde{k}}\) is \({\widetilde{k}}^{i}\) (and individuals insure) whenever \(\pi <\pi _{a}=\tau +\max \{0,\min \{(\delta \xi -\tau /p)^{1/\sigma },1-\tau \}\}\), and \({\widetilde{k}}^{n}\) (and individuals do not insure) if \(\pi \ge \pi _{a}\). Since \({\widetilde{k}}^{i}\) and \({\widetilde{k}}^{n}\), the steady-state capital stock \({\widetilde{k}}\) is always decreasing in \(\pi \in (\tau ,1]\).

Intuitively, if \(\pi \) increases, the fraction of income \({\widetilde{x}}\) devoted to elderly parents increases.Footnote 25 On the one hand, this reduces the disposable income in young age. On the other hand, this also increases the transfer that individuals expect from their children. These two effects lead to a reduction in precautionary saving and private LTC insurance and, consequently, in the capital stock.

4.3.3 Probability of dependence

The impact of p on capital accumulation is somehow more complex (see “Comparative statics with respect to p when \(\pi >\tau \ge 0\)” of Appendix). It depends on whether the government intervenes or not in providing social LTC insurance.

When the government does not intervene, \(\varepsilon ({\widetilde{x}})=\pi ^\sigma \) does not depend on p and two cases can be identified depending on the intensity of intergenerational imitation. When \(\pi \) is sufficiently high (i.e., \(\delta \xi \le \pi ^\sigma \)), the family help is so high that individuals decide not to insure. Note also that the steady-state capital stock \({\widetilde{k}}^{n}|_{\tau =0}\) decreases when p increases (see Fig. 5a). Intuitively, as the probability of dependence increases, it becomes less interesting to transfer consumption to the non-dependent state, while the LTC needs will be met by family help. When \(\pi \) is sufficiently low (i.e., \(\delta \xi >\pi ^\sigma \)), individuals decide to insure and the steady-state capital stock \({\widetilde{k}}^{i}|_{\tau =0}\) increases in p (see Fig. 5b). Intuitively, the higher the probability of dependence, the more individuals insure for old age, so that the capital stock increases.

Consider now the case where \(\tau >0\). As p increases from 0 to 1, the threshold \(\varepsilon ({\widetilde{x}})\) decreases from \(+\infty \) to \(\tau +(\pi -\tau )^\sigma \). Consequently, when \(\delta \xi \) is sufficiently low (i.e., \(\delta \xi \le \tau +(\pi -\tau )^\sigma \)) individuals decide not to insure and the steady-state capital stock \({\widetilde{k}}^{n}\) decreases (resp: increases) when p is lower (resp: higher) than a threshold \({\underline{p}}\in (0,1]\) defined in “Comparative statics with respect to p when \(\pi >\tau \ge 0\)” of Appendix (see Fig. 6a). Thus, we find that the relationship between the probability of dependence and capital accumulation can be non-monotonic. Intuitively, when p is sufficiently low, individuals fully rely on the social LTC insurance and family help. As the probability of dependence increases, it becomes less interesting to transfer consumption to the non-dependent state, while the government and the family help cover the dependent state. Thus, the capital stock \({\widetilde{k}}^{n}\) decreases. Conversely, when the probability p is high, the return of social insurance, \(\tau /p\), is very low, and individuals increase their own savings, so that the capital stock \({\widetilde{k}}^{n}\) increases.

When \(\delta \xi \) is sufficiently high (i.e., \(\delta \xi >\tau +(\pi -\tau )^\sigma \)) individuals decide not to insure when \(p\le p_a= \tau /[\delta \xi -(\pi -\tau )^\sigma ]\) and insure when \(p>p_a\). As \(0<{\underline{p}}<p_a<1\), the steady-state capital stock, \({\widetilde{k}}^{n}\), decreases when \(0< p<{\underline{p}}\) and increases when \({\underline{p}}<p<p_a\). Finally, the steady-state capital stock, \({\widetilde{k}}^{i}\), increases when \(p_a<p<1\) (see Fig. 6b). Note that the threshold \(p_a\) increases in \(\pi \): as the imitation becomes more intense, individuals insure for a smaller range of probabilities of dependence. This is a standard case of crowding out.

The social LTC insurance crowds out private LTC insurance, so that individuals insure only if \(\tau \) is low enough. The size of \(\tau \) also affects the impact of the probability of dependence on the insurance decision. To show this, let us compare the case where \(\tau =0\) and \(\tau >0\), limiting the analysis to the case where \(\pi \) is low enough (Figs. 5b, 6b): individuals always insure with no public intervention, while in the presence of social LTC insurance, individuals only insure as long as \(p>p_a\).

4.3.4 Tax rate

In order to inform policy makers about the optimal social LTC insurance, it is important to assess the impact of the tax rate on capital accumulation (see “Comparative statics with respect to \(\tau \) when \(\pi >\tau \ge 0\)” of Appendix). We can distinguish two cases depending on the value of \(\pi \), reminding that the derivative of \(\varepsilon ({\widetilde{x}})\) with respect to \(\tau \) has the sign of \({\underline{\tau }}-\tau \). As \(\gamma =0\), we have \({\underline{\tau }}=\pi -(p\sigma )^{1/(1-\sigma )}\).

When \(\pi \le (p\sigma )^{1/(1-\sigma )}\), as \(\tau \) increases from 0 to \(\pi \), the threshold \(\varepsilon ({\widetilde{x}})\) decreases from \(\pi ^\sigma \) to \(\pi /p\). Then, the steady-state capital stock \({\widetilde{k}}\) is \({\widetilde{k}}^{i}\) (and individuals insure) if \(\tau >\tau _{b}\), while it is \({\widetilde{k}}^{n}\) (and individuals do not insure) when \(\tau \le \tau _{b}\) with:

where \(\tau ^\star _b\in (0,\pi )\) is the unique root of the function \({\varLambda }(\tau )=\delta \xi -\varepsilon ({\widetilde{x}})\). Furthermore, an increase in the tax rate has always a positive impact on the steady-state capital stock (see Fig. 7a).

When \(\pi >(p\sigma )^{1/(1-\sigma )}\), \(\varepsilon ({\widetilde{x}})\) increases in \(\tau \) if \(\tau <{\underline{\tau }}\), and decreases if \(\tau >{\underline{\tau }}\). Then, the steady-state capital stock \({\widetilde{k}}\) is \({\widetilde{k}}^{i}\) (and individuals insure) if \(\tau \in [0,\tau _{c})\cup (\tau _{d},\pi ]\), while it is \({\widetilde{k}}^{n}\) (and individuals do not insure) if \(\tau \in [\tau _{c},\tau _{d}]\) with:

where \(\tau ^\star _c\in (0,{\underline{\tau }})\) and \(\tau ^\star _d\in ({\underline{\tau }},\pi )\) are the roots of function \({\varLambda }(\tau )\).

Since \({\widetilde{k}}^{i}\) and \({\widetilde{k}}^{n}\), the steady-state capital stock \({\widetilde{k}}\) is always decreasing up to \({\underline{\tau }}\) and then increasing afterward. However, Fig. 7b encompasses five parameters configurations in terms of insurance behavior. In two configurations, the steady-state insurance regime does not change as \(\tau \) varies. Indeed, individuals always (resp: never) insure when \(\tau _c=\tau _d={{\underline{\tau }}}\) (resp: \(\tau _c=0\) and \(\tau _d=\pi \)). In two other configurations, as \(\tau \) increases, only one change in the reference regime is possible. This is the case where \(0=\tau _c<\tau _d<\pi \) or \(0<\tau _c<\tau _d=\pi \). Finally, two changes exist when \(0<\tau _c<{{\underline{\tau }}}<\tau _d<\pi \).

Our comparative statics results are summarized in the following proposition.

Proposition 3

The steady-state capital stock is monotonically decreasing in the intensity of intergenerational imitation \(\pi \).

With no taxation, the steady-state capital stock decreases (resp. increases) in the probability of dependence p if the intensity of intergenerational imitation \(\pi \) is high (resp. low). With taxation, the steady-state capital stock decreases (resp. increases) in p if this parameter if low (resp. high).

The steady-state capital stock increases in the tax rate \(\tau \) if the intensity of intergenerational imitation \(\pi \) is relatively low or \(\tau \) is relatively high. If \(\pi \) is relatively high and \(\tau \) is relatively low, the steady-state capital stock decreases in \(\tau \).

The comparative statics with respect to \(\tau \) are surprising. In the absence of family help (see Fig. 1), the effect of the tax rate on the capital stock is negative. With family help, the intuition for Fig. 7 is to be found in the relative costs and returns of the family norm and of social LTC schemes. On the one hand, at the steady state, \(x+\tau =\pi \). This implies that, on the contribution side, the two schemes are perfect substitutes. On the other hand, the return of the social LTC contribution \(\tau w\) is constant and equal to 1 / p, while the return of xw decreases with x. As a consequence, when \(\tau \) is high, x is small and yields a return that can be higher than 1 / p. Thus, an increase in \(\tau \) causes a decrease in x, which in turn implies a decline in LTC expenditures. To compensate for such a decline, individuals increasingly turn to market sources of LTC financing, fostering capital accumulation. Of course, if \(\pi \) is relatively low, x is also relatively small and therefore might have a higher return than 1 / p for any level of \(\tau \). In this case, the steady-state capital stock always increases if the tax rate increases. This intuition also explains our finding that social and private LTC insurance can be complements: for sufficiently high levels of the tax, private LTC insurance may emerge as the tax level increases. This message is counterintuitive but important: in the presence of family support, individuals choose private LTC insurance if the pay-as-you-go social LTC insurance is generous enough; the more generous the latter, the higher the economic growth. Thus, the fact that an aging population leads the State to establish generous unfunded social LTC insurance may in some circumstances encourage individuals to ensure themselves privately and is therefore beneficial for growth. This is particularly true for societies where the family norm is not very strong.

To conclude, it is worth noting that if the dependent elderly do not perceive family help as more valuable than other sources of LTC financing (\(\sigma =1\)), an increase in public insurance always depresses capital accumulation.

4.4 Welfare implications

In the previous section, we have shown that introducing a social LTC insurance may not depress capital accumulation and growth. We now turn to characterizing the welfare implication of social LTC insurance. First, we will characterize the first best solution and compare it with the laissez-faire allocation (i.e., when the tax rate \(\tau =0\)). We will then analyze the impact on welfare of the introduction of a payroll tax \(\tau \) used to finance the social LTC insurance.

In the first best, the social planner allocates consumption levels, the family help x, and the capital stock k. We show in “First best allocation” of Appendix that the first best family help and capital stock are, respectively, \(x^{FB}=(p\sigma )^{\frac{1}{1-\sigma }}\) and \(k^{FB}=\Big [q\alpha A+q\alpha A(1-\alpha )(p\sigma )^{\frac{1}{1-\sigma }}( 1-\sigma )/\sigma \Big ]^{\frac{1}{1-\alpha }}\). Note that the steady-state \(k^{FB}\) is greater than the one defined by the modified golden rule, which is equal to \((q\alpha A)^{\frac{1}{1-\alpha }}\). This is due to the fact that, in an economy with family help, the social planner takes into account the positive impact of k on wages.

We can now compare the first best allocation with the laissez-faire one. For low levels of \(\pi \), the laissez-faire family norm (equal to \(\pi \)) is below its first best level, while the opposite is true for high levels of \(\pi \). Thus, in the laissez-faire, there may be over- or underprovision of family help. In “First best versus laissez-faire accumulation” of Appendix, we also show that the economy always displays underaccumulation of capital in the laissez-faire whenever \(\alpha \) is high enough. For lower levels of \(\alpha \), there always exists threshold \({\widehat{\pi }}\) such that the economy displays underaccumulation for \(\pi >{\widehat{\pi }}\), and overaccumulation for \(\pi <{\widehat{\pi }}\).

We can now turn to analyzing the effect of the introduction of social LTC insurance on welfare. To this purpose, we consider that the problem of the social planner is to maximize the steady-state welfare \(\widetilde{{\mathscr {W}}}\) with respect to the tax rate \(\tau \). The introduction of social insurance is desirable only if \(({\text {d}} \widetilde{{\mathscr {W}}}/{\text {d}}\tau ) |_{\tau =0}\) is positive. It can be shown that the sign of \(({\text {d}} \widetilde{{\mathscr {W}}}/{\text {d}}\tau ) |_{\tau =0}\) is ambiguous. Social LTC insurance always depresses family help, but can have a positive or a negative impact on the capital stock. The social planner has to take into account these two effects in order to evaluate the impact of social insurance on welfare (Table 1).

In order to illustrate the different scenarios, we ran some simulations. In line with the literature, we assume that \(\alpha =1/3\) and that the quarterly psychological discount factor is equal to 0.99. Thus, assuming that each period lasts 30 years, \(\beta =0.99^{120}=0.3\). We set \(A=20\) and the probability of dependence in old age equal to 0.5 (remember that we are interested in all forms of dependence, even the mildest ones). We set the preference parameter \(\xi \) at 0.3, implying that, under our logarithmic utility functions, individuals would need to consume 30% more in case of dependence in order to equalize the marginal utilities of consumption in the dependent and non-dependent state. We then consider two cases depending on the level of \(\sigma \). For low values of \(\pi \), individuals purchase insurance, and family help is below its first best level. As \(\pi \) increases, individuals stop purchasing LTC insurance, family help increases, and capital accumulation decreases. Overall, the desirability of the tax depends on the level of \(\pi \) in a non-monotonic way. If \(\pi \) is very low, introducing \(\tau \) helps to increase the capital stock (\(\partial k/\partial \tau |_{\tau =0}\) is positive and high). Then, the introduction of the tax is desirable. This is also the case when \(\pi \) is high. The tax depresses capital accumulation, but it reduces family help, which is overprovided. The second effect dominates. For intermediate values of \(\pi \), in our example the tax is not optimal, either because it depresses family help more than it increases the capital stock (case with \(\sigma =0.5\)), or because it depresses capital stock more than it reduces overprovided family help (case with \(\sigma =0.7\)).

5 Conclusion

In this paper, we have considered that LTC can be financed by four different channels: savings, private insurance, family help based on a norm, and an unfunded public scheme. Using a simple OLG model, we have obtained a number of interesting results concerning the implications of LTC financing and capital accumulation, both along the equilibrium path and on the stationary equilibrium.

In the benchmark case, namely without any family norm, the stock of capital evolves monotonically, either upward or downward. Individuals resort to private insurance when the loading factor is not too high. With the family norm, the evolution is no longer monotonic. Finally, there are plausible cases in which, along the equilibrium path, people switch their insurance behavior: they buy private insurance up to a certain period and then they stop doing it, or vice versa.

Turning to the steady states, we study the effects of three key parameters on capital accumulation and economic growth: the tax rate, the intensity of intergenerational imitation, and the probability of dependence. The relation between the payroll tax and the capital stock is expected to be negative. However, it may be positive when the family help is sizeably more productive that the other LTC financing sources. Since social insurance crowds out family help, individuals may compensate by increasing savings and private insurance. This result relies on the hypothesis that family help is perceived by the dependent elderly as more valuable than any other source of LTC financing, while public insurance crowds out family help one by one. This assumption is in line with the literature documenting a tension between parents and children concerning the optimal amount of family help. For instance, Barcyzk and Kredler (2014) show that dependent elderly favor home care subsidies, while their children favor nursing homes subsidies. The result is also consistent with recent findings by Costa-Font and Courbage (2014), suggesting that family help crowds out private insurance, but public insurance does not.

Not surprisingly, the intensity of intergenerational imitation has a depressive effect on capital accumulation. The probability of dependence has an effect on capital accumulation that depends on the prevalence of insurance. With private insurance, it is always positive; without private insurance, its sign is ambiguous. Private insurance arises for a range of intermediate values of p. The introduction of a family norm crowds out private insurance and reduces this range.

Even though our paper is basically positive, it has some interesting policy implications. In particular, it indicates that the intervention of the State in LTC financing may not discourage, but rather foster capital accumulation through saving and private insurance purchase and thus have a positive effect on growth. We also show that the introduction of a social LTC insurance may have a positive effect on welfare.

Some comments about the limitations of our approach are in order. First, to keep the model tractable, we abstracted from bargaining within the family or from altruism. In a model with altruism or exchange, family aid may not have a depressive effect on capital accumulation. Parents would use intergenerational transfers, bequests, or intervivos gift to compensate their children for undersaving. The gist of our paper is elsewhere. We show that, when combined, our two PAYG schemes (family norm and social insurance) may have a fostering effect on capital accumulation. This is a surprising effect given that taken separately, these two schemes have a depressing effect. The effects that we identify in our framework remain relevant as long as family help is motivated, at least in part, by a family norm.

Second, we take the family norm as given without any normative judgment. We also assume identical individuals. If people were to differ in the extent of the filial norm to which they are subject, we would end up with an unfair situation in which only those with children willing and able to take care of them would receive the care they need. In that case, there would be an additional role for the public sector (on this, see Stuifbergen and Delden 2011).

Notes

Source: European Commission (2013a).

For more details, see European Commission (2013b).

Brown and Finkelstein (2011) provide an overview of the economic and policy issues surrounding insuring LTC expenditure risk. They also discuss the likely impact of recent LTC public policy initiatives.

Family ties have been shown to matter for evaluating the impact of PAYG systems. For instance, Lambrecht et al. (2005) find that PAYG pensions may foster growth, in a model in which altruistic parents may affect their children’s income through education and bequests.

The crucial impact of social norms (family ties) in LTC financing is emphasized, among others, by Costa-Font (2010).

According to Pauly (1990), families rationally decide to forego the purchase of LTC insurance due to intrafamily moral hazard. Instead of purchasing insurance, parents will rely on the bequest motive to induce children to provide care. Under both complete and incomplete information, Jousten et al. (2005), Pestieau and Sato (2008), and Kuhn and Nuscheler (2011) study the optimal design of a LTC policy when children are heterogeneous with respect to the degree of altruism toward parents.

For a broader overview, see also Brown and Finkelstein (2011).

As we showed in an earlier draft, considering a loading factor on the insurance premium does not qualitatively modify the analysis.

The underlying assumption is that children are credit constrained.

This reduced form is in the spirit of the ones generally used in education models which consider that the dynamics of human capital accumulation follows a known (exogenous or endogenous) process.

For an application of this method to a model of LTC financing without capital accumulation, see Canta and Pestieau (2013).

There exist several stages of dependence that can be characterized by the dependent elderly’s ability to perform in different areas of cognition and functioning: orientation, memory, judgment, home and hobbies, personal care, and community.

We thus implicitly assume that a child’s help is subject to payroll taxation exactly like precautionary savings and private LTC insurance. The alternative, implying \(c_t = (1-\tau )(1-x_t)w_t-s_t-i_t\), would not have produced very different results.

The assumption that \(H^{\text {dep}'}(\kappa )>H^{\text {not dep}'}(\kappa )=u'(\kappa )\) may be disputed (see, for instance, Finkelstein et al. 2009, 2013), since some goods may substitute or complement good health. Our assumption remains reasonable up to a certain wealth level, and we implicitly assume in this paper that this wealth threshold is not reached.

Since we always obtain bounded steady-state solutions, the resources of the economy are always finite and consumption is bounded by a threshold \(\kappa _{max}\). Since \(H^{\text {dep}}(\kappa )<H^{\text {not dep}}(\kappa )=u(\kappa )\) for any \(\kappa <{\widetilde{\kappa }}=u^{-1}[D/\xi ]\), it is sufficient to assume that D is such that \(\kappa _{max}<{\widetilde{\kappa }}\).

If \(0<\pi <\tau \), family help may vanish along the equilibrium path. We thus rule out this case (see Assumption 2).

In all figures illustrating the comparative statics with respect to the steady-state capital stock k, we always assume that k varies in a convex way. However, depending on the cases and the values of the parameters, k may also vary in a concave way.

If \(\tau >\pi \), then there exists a date after which \(x_{t}=0\), and we would be in the case studied in Sect. 3. The case \(x_0>1-\tau \) has already been excluded because children are credit constrained.

In Fig. 3, \(g(x)=\eta (x)^{\frac{1}{1-\alpha }}\) whereas \(h(x)=\mu (x)^{\frac{1}{1-\alpha }}\).

Note that this is not necessarily the case along the equilibrium path since \(\partial x_t/\partial \pi \) is negative when \(\pi >(1+x_{t-1}+\tau )/2\).

Note that \(\lambda (p_a)= \delta (1+\xi )p_a\tau \), which, together with \(\lambda '(p)>0\), implies that \(p_a>{\underline{p}}\).

References

Barcyzk, D., Kredler, M.: Evaluating long term care policy options, taking the family seriously. Working paper (2014)

Brown, J.R., Finkelstein, A.: The interaction of public and private insurance: medicaid and the long-term care insurance market. Am. Econ. Rev. 98, 1083–1102 (2008)

Brown, J.R., Finkelstein, A.: Insuring long-term care in the US. J. Econ. Perspect. 25, 119–142 (2011)

Canta, C., Pestieau, P.: Long term care insurance and family norms. BE J. Econ. Anal. Pol. 14, 401–428 (2013)

Chakrabarti, A.: Endogenous fertility and growth in a model with old age support. Econ. Theory 13, 393–416 (1999)

Chen, Y.: Endogenous health investment, saving and growth. University of Olso, Health Economics Research Programme. Working paper 8 (2007)

Costa-Font, J.: Family ties and the crowding out of long-term care insurance. Oxf. Rev. Econ. Pol. 26, 691–712 (2010)

Costa-Font, J., Courbage, C.: Crowding out of long-term care Insurance: evidence from European Expectation Data. CESifo working paper 4910 (2014)

Cox, D., Stark, O.: On the demand for grandchildren: tied transfers and the demonstration effect. J. Public Econ. 89, 1665–1697 (2005)

Cremer, H., Pestieau, P., Ponthiere, G.: The economics of long-term care: a survey. Nord Econ Policy Rev 2, 107–148 (2012)

De Nardi, M., French, E., Jones, J.B.: Why do the elderly save? The role of medical expenses. J. Polit. Econ. 118, 37–75 (2010)

Diamond, P.: National debt in a neoclassical growth model. Am. Econ. Rev. 55, 1126–1150 (1965)

Ehrlich, I., Lui, F.: Intergenerational trade, longevity, and economic growth. J. Politi. Econ. 99, 1029–1059 (1991)

European Commission: the 2012 ageing report. Economic and Budgetary Projections for the 27 EU Member States (2010–2060) (2013a)

European Commission: long term care in aging society—challenges and policy options. Commission Staff Working Document (2013b)

Fan, C.S.: A model of intergenerational transfers. Econ. Theory 17, 399–418 (2001)

Finkelstein, A., Luttmer, E., Notowidigdo, M.: Approaches to estimating the health state dependence of the utility function. Am. Econ. Rev. 99, 116–121 (2009)

Finkelstein, A., Luttmer, E., Notowidigdo, M.: What good is wealth without health? The effect of health on the marginal utility of consumption. J. Eur. Econ. Assoc. 11, 221–258 (2013)

Fuster, L.: Effects of uncertain lifetime and annuity insurance on capital accumulation and growth. Econ. Theory 13, 429–445 (1999)

Gong, L., Li, H., Wang, D.: Health investment, physical capital accumulation, and economic growth. China Econ. Rev. 23, 1104–1119 (2012)

Hemmi, N., Tabata, K., Futagami, K.: The long-term care problem, precautionary saving, and economic growth. J. Macroecon. 29, 60–74 (2007)

Jousten, A., Lipszyc, B., Marchand, M., Pestieau, P.: Long term care insurance and optimal taxation for altruistic children. FinanzArchiv 61, 1–18 (2005)

Klimaviciute, J., Perelman, S., Pestieau, P., Schoenmaeckers, J.: Caring for elderly parents: Is it altruism, exchange or family norm? CREPP, Université de Liège. Working paper (2015)

Kopecky, K., Koreshkova, T.: The impact of medical and nursing home expenses on savings. Am. Econ. J. Macroecon. 6, 29–72 (2014)

Kuhn, M., Nuscheler, R.: Optimal public provision of nursing homes and the role of information. J. Health Econ. 30, 795–810 (2011)

Lambrecht, S., Michel, P., Vidal, J.-P.: Public pensions and growth. Eur. Econ. Rev. 49, 1261–1281 (2005)

Leroux, M.-L., Pestieau, P.: Social security and family support. Can. J. Econ. 47, 115–143 (2014)

Lowenstein, A., Daatland, S.: Filial norms and family support in a comparative cross-national context: evidence from the OASIS study. Ageing Soc. 26, 203–223 (2006)

Mellor, J.: Long-term care and nursing home coverage: Are adult children substitutes for insurance policies? J. Health Econ. 20, 527–547 (2001)

Pauly, M.V.: The rational non-purchase of long-term care insurance. J. Polit. Econ. 95, 153–168 (1990)

Pestieau, P., Sato, M.: Long-term care: the state, the market and the family. Economica 75, 435–454 (2008)

Siciliani, L.: The economics of long-term care. BE J. Econ. Anal. Pol. 14, 343–375 (2013)

Silverstein, M., Gans, D., Yang, F.: Intergenerational support to aging parents: the role of norms and needs. J. Fam. Issues 27, 1068–1084 (2006)

Stark, O.: Altruism and beyond. Cambridge University Press, Cambridge, UK (1995)

Stuifbergen, M., Van Delden, J.M.: Filial obligations to elderly parents: A duty to care? Med. Health Care Philos. 14, 63–71 (2011)

Zhang, J., Zhang, J.: Social security, intergenerational transfers, and endogenous growth. Can. J. Econ. 31, 1225–1241 (1998)

Author information

Authors and Affiliations

Corresponding author

Additional information

The authors would like to thank two anonymous referees, as well as participants and discussants at UQAM, University of Strasbourg, the Norwegian–German seminar in Public Economics 2013, the La Rochelle Economic Dynamics Days 2013, the Paris-SCOR meeting 2014 on Long Term Care, the Toulouse TIGER conference 2014, and the IIPF Conference 2014 and 2015 for useful comments and suggestions. The authors acknowledge financial support from the Chair Fondation du Risque/SCOR “Risk Market and Value Creation”.

Appendices

Appendix 1: Capital accumulation and insurance behavior

An agent born in t chooses \(s_t\) and \(i_t\) to maximize \({\mathscr {W}}_t\) under the constraints \(s_{t}\ge 0\) and \(i_{t}\ge 0\). After computations, the first-order condition with respect to \(s_{t}\) is given by (4), and, when \(i_t>0\), the first-order condition with respect to \(i_t\) is equivalent to (5).

1.1 Insurance behavior depending on \(\delta \xi \) and \(\varepsilon (x_{t})\)

Merging (4) and (5) to eliminate their first term leads to the following equation: \( i_{t}/p=\xi s_{t}-\varepsilon (x_{t})w_{t+1}/R_{t+1}\). As \(\delta w_{t+1}=k_{t+1}R_{t+1}\) and \(k_{t+1}=s_t+i_t\), the equation can be rewritten as \([\delta /p+\varepsilon (x_{t})]i_{t}=[\delta \xi - \varepsilon (x_{t})]s_{t}\). Then, agents purchase LTC insurance if and only if \(\delta \xi >\varepsilon (x_{t})\) and insurance behaviors are described by (6).

1.2 Capital accumulation when \(i_t=0\)

As \(\delta w_{t+1}=k_{t+1}R_{t+1}\) and \(k_{t+1}=s_t\), (4) is equivalent to \(-1/[(1-\tau -x_t\mathbb {1})w_{t}-k_{t+1}]+\delta \beta p(1+\xi )/\{[\delta +\tau /p+\psi ^\sigma (x_t) \mathbb {1}] k_{t+1}\}+\delta \beta (1-p)/\{[\delta +\gamma \psi ^\sigma (x_t) \mathbb {1}]k_{t+1}\}=0\). As \(w_t=A(1-\alpha )k_t^\alpha \), we obtain \(\{[\delta +\tau /p+\psi ^\sigma (x_t)\mathbb {1}] [\delta +\gamma \psi ^\sigma (x_t)\mathbb {1}]+\delta \beta p(1+\xi )[\delta +\gamma \psi ^\sigma (x_t)\mathbb {1}]+\delta \beta (1-p)[\delta +\tau /p+\psi ^\sigma (x_t) \mathbb {1})]\}k_{t+1}=A(1-\alpha )(1-\tau -x_t\mathbb {1})\{\delta \beta p(1+\xi )[\delta +\gamma \psi ^\sigma (x_t) \mathbb {1}]+\delta \beta (1-p)[\delta +\tau /p+\psi ^\sigma (x_t)] \mathbb {1})]\}k_t^\alpha \). Then, according to “Insurance behavior depending on \(\delta \xi \) and \(\varepsilon (x_{t})\)” of Appendix, \(k_{t+1}=\eta _d k_t^\alpha \) when \(\pi =0\) and \( \delta \xi \le \varepsilon (x_{t})\), whereas \(k_{t+1}=\eta (x_t) k_t^\alpha \) when \(\gamma =0\), \(\pi >\tau \ge 0\) and \( \delta \xi \le \varepsilon (x_{t})\).

1.3 Capital accumulation when \(i_t>0\)

As \(i_t>0\), we obtain from (6) that \([\delta /p+\varepsilon (x_{t})]i_t=[\delta \xi -\varepsilon (x_{t})]s_t\). Using (3), we then get \(i_t=p[\delta \xi -\varepsilon (x_{t})]k_{t+1}/[\delta (1+p\xi )]\) and \(s_{t}=[\delta +p\varepsilon (x_{t})]k_{t+1}/[\delta (1+p\xi )]\). Using these equations, we obtain \(\delta (1+p\xi )\{s_{t}+ i_{t}/p+[\tau /p+\psi ^\sigma (x_{t})\mathbb {1}]w_{t+1}/R_{t+1}\}=(1+\xi )k_{t+1}\{\delta +\tau +[p+(1-p)\gamma ]\psi ^\sigma (x_{t})\mathbb {1}\}\). Using (2) and (5) we get \(\beta \delta A(1-\alpha )(1+p\xi )(1-\tau -x_{t}\mathbb {1})k_t^\alpha =\{\delta [1+\beta (1+p\xi )]+\tau +[p+(1-p)\gamma ]\psi ^\sigma (x_{t})\mathbb {1}\}k_{t+1}\). Then, according to “Insurance behavior depending on \(\delta \xi \) and \(\varepsilon (x_{t})\)” of Appendix, \(k_{t+1}=\mu _d k_t^\alpha \) when \(\pi =0\) and \(\delta \xi >\varepsilon (x_{t})\), whereas \(k_{t+1}=\mu (x_t) k_t^\alpha \) when \(\gamma =0\), \(\pi >\tau \ge 0\) and \(\delta \xi >\varepsilon (x_{t})\).

Appendix 2: Results of Sect. 3 (\(\pi =0\))

1.1 Capital accumulation when \(\pi =0\)

According to “Capital accumulation when \(i_t=0\)” and “Capital accumulation when \(i_t>0\)” of Appendix, the dynamics are described by (8). Since the sign of \(p\delta \xi -\tau \) is time independent, no switch in the insurance behavior is possible. As \(k_{t+1}\) is an increasing and concave function of \(k_t\), the capital stock \(k_{t}\) converges monotonically to the unique positive steady-state \(k^{d}\). When \(\tau =0\), since \(\eta _d=\mu _d=\zeta _p\) and \(p\delta \xi >\tau \), individuals insure and the dynamics of capital accumulation \(k_{t+1}=\zeta _pk_t^\alpha \) converge to \(k_{d|_{\tau =0}}\).

1.2 Comparative statics with respect to p when \(\pi =\tau =0\)

As \(\partial \zeta _p/\partial p=A(1-\alpha )\beta \xi /[1+(1+p\xi )\beta ]^2\) is positive, \(k_{d|_{\tau =0}}=\zeta _p^\frac{1}{1-\alpha }\) increases in p.

1.3 Comparative statics with respect to \(\tau \) when \(\pi =0\)

As \(\partial \eta _d/\partial \tau =-A\alpha \beta (1-\alpha )^2p^2(1+\xi )(1-\tau )/\{\alpha p[1+(1+p\xi )\beta ]+(1-\alpha )[1+(1-p)\beta ]\tau \}^2-\eta _d/(1-\tau )\) is negative, \(k_d^n=\eta _d^\frac{1}{1-\alpha }\) decreases in \(\tau \). As the nominator of \(\mu _d\) decreases in \(\tau \) while the nominator increases, \(k_d^i=\mu _d^\frac{1}{1-\alpha }\) decreases in \(\tau \). Then, the capital stocks \(k_d^i\) and \(k_d^n\) are both decreasing functions of \(\tau \). Using “Insurance behavior depending on \(\delta \xi \) and \(\varepsilon (x_{t})\)” of Appendix, it is straightforward to show that individuals insure if and only if \(\tau <\tau _{a}=\min \{p\delta \xi ,1\}\). We thus obtain Fig. 1.

Appendix 3: Results of Sect. 4 (\(\pi >\tau \ge 0\))

According to “Capital accumulation when \(i_t=0\)” and “Capital accumulation when \(i_t>0\)” of Appendix, we obtain the two-dimensional dynamical system described by (1) and (9). Then, the existence and the uniqueness of the positive steady state, denoted (\({\widetilde{k}}, {\widetilde{x}}\)), are straightforward.

1.1 Dynamics of family help

The dynamics of \(x_t\), described by (1) and represented in Fig. 2, are straightforward and independent of k. Then, the locus \(x_{t+1}=x_t\) expressed as a function of k is a vertical line with abscissa \({\widetilde{x}}\) in the plan (x, k). To the left of this line, \(x_{t+1}-x_t>0\) and, for any \(k>0\), \(x_t\) converges toward \({\widetilde{x}}\). To the right of this line, \(x_{t+1}-x_t<0\) and, for any \(k>0\), \(x_t\) converges toward \({\widetilde{x}}\).

1.2 Local dynamics with no insurance

Assume that from a date \(\kappa \ge 0\), agents do not insure. The locus \(k_{t+1}-k_t=0\) as a function of x can be written as \(g(x)=\eta (x)^{\frac{1}{1-\alpha }}\). Let us define \(a(x)=\alpha [1+(1+p\xi )\beta ]+(1-\alpha )[1+(1-p)\beta ]\varepsilon (x)\). After computations we get \(\eta '(x)=-\eta (x)/(1-\tau -x)-\alpha A p \beta (1-\alpha )^2(1+\xi )(1-\tau -x)\varepsilon '(x)/a(x)^2\). Since \(1-\tau -x>0\), \(\eta (x)>0\), \(a(x)>0\), and \(\varepsilon '(x)=\sigma \pi \psi (x)^{\sigma -1}>0\), it is straightforward to show that \(\eta '(x)<0\) and \((1-\tau -x)\eta '(x)+\eta (x)<0\). After computations, we also get \(\eta ''(x)=-[(1-\tau -x)\eta '(x)+\eta (x)]/(1-\tau -x)^2-\alpha A p \beta (1-\alpha )^2(1+\xi )\{[\varepsilon ''(x)(1-\tau -x)-\varepsilon '(x)]a(x)-2a'(x)\varepsilon '(x)(1-\tau -x)\}/a(x)^3\). Since \(1-\tau -x>0\), \(a(x)>0\), \(\varepsilon '(x)>0\), \(a'(x)>0\), \((1-\tau -x)\eta '(x)+\eta (x)<0\), and \(\varepsilon ''(x)=-\sigma (1-\sigma )\pi ^2\psi (x)^{\sigma -2}<0\) it is possible to show that \(\eta ''(x)>0\).

As \(\eta (x)\) is a decreasing and convex function of x, g(x) is also a decreasing and convex function of x. The equation \(k_{t+1}=g(x)^{1-\alpha }k_t^\alpha \) can be rewritten as \(k_{t+1}-k_t=[(g(x)/k_t)^{1-\alpha }-1]k_t\). Thus, below the curve \(k_{t+1}=k_t\), for any \(x\in (0,1-\tau )\), \(k_t\) converges toward g(x). Above the curve \(k_{t+1}-k_t<0\), for any \(x\in (0,1-\tau )\), \(k_t\) converges toward g(x). Then, using “Dynamics of family help” of Appendix, the dynamics in the neighborhood of (\({\widetilde{k}}^n,{\widetilde{x}}\)) are described in Fig. 3a.

1.3 Local dynamics with insurance

Assume that from a date \(\kappa \ge 0\), agents insure. The locus \(k_{t+1}-k_t=0\) as a function of x can be written as \(h(x)=\mu (x)^{\frac{1}{1-\alpha }}\). Let us define \(b(x)=\alpha [1+(1+p\xi )\beta ]+(1-\alpha )p\varepsilon (x_{t})\). After computations, we get \(\mu '(x)=-[1/(1-\tau -x)+b'(x)/b(x)]\mu (x)\). Since \(\mu (x)>0\), \(b(x)>0\), and \(b'(x)=(1-\alpha )p\sigma \pi \psi (x)^{\sigma -1}>0\), it is straightforward to show that \(\mu '(x)<0\) and \(\mu '(x)+\mu (x)/(1-\tau -x)<0\). After computations, we also get \(\mu ''(x)=-[\mu '(x)+\mu (x)/(1-\tau -x)]/(1-\tau -x)-\mu '(x)b'(x)/b(x)-[b(x)b''(x)-b'(x)^2]\mu (x)/b(x)^2\). Since \(1-\tau -x>0\), \(b(x)>0\), \(b'(x)>0\), \(b''(x)=-(1-\alpha )p\sigma (1-\sigma )\pi ^2\psi (x)^{\sigma -2}<0\), \(\mu (x)>0\), \(\mu '(x)<0\), and \(\mu '(x)+\mu (x)/(1-\tau -x)<0\), it is possible to show that \(\mu ''(x)>0\).

Since \(\mu (x)\) is a decreasing and convex function of x, h(x), which represents \(k_{t+1}-k_t=0\), is also a decreasing and convex function of x. The equation \(k_{t+1}=h(x)^{1-\alpha }k_t^\alpha \) can be rewritten as \(k_{t+1}-k_t=[(h(x)/k_t)^{1-\alpha }-1]k_t\). Below the curve \(k_{t+1}=k_t\), for any \(x\in (0,1-\tau )\), \(k_t\) converges toward h(x). Above the curve, for any \(x\in (0,1-\tau )\), \(k_t\) converges toward h(x). Then, using “Dynamics of family help” of Appendix, the dynamics in the neighborhood of (\({\widetilde{k}}^i,{\widetilde{x}}\)) are described in Fig. 3b.

1.4 Global dynamics: the different regimes

First, note that \(\mu (x_{t})=\eta (x_{t})\) if and only if \(\delta \xi =\varepsilon (x_{t})\). Then, since \(\eta (x_{t})\) is decreasing in \(\xi \) while \(\mu (x_{t})\) increases in \(\xi \), \(\mu (x_{t})\gtreqqless \eta (x_{t})\) if and only if \(\delta \xi \gtreqqless \varepsilon (x_{t})\). Since \(\varepsilon (x)\) increases in x, g(x) and h(x) cannot cross in more than one point: the point \({\widehat{x}}\) such that \(\varepsilon ({\widehat{x}})=\delta \xi \). Consequently, individuals insure for any \(x_t<{\widehat{x}}\) and do not insure for any \(x_t>{\widehat{x}}\). Since the dynamics of \(x_{t}\) are monotonic (increasing if \(x_{0}<{\widetilde{x}}\) and decreasing if \(x_{0}>{\widetilde{x}}\)) and independent of \(k_{t}\), and using the fact that \(k_{t+1}=\max \{g(x_{t})^{1-\alpha },h(x_{t})^{1-\alpha }\} k_t^\alpha \), we can distinguish four types of dynamics. Regime I occurs when \(\delta \xi \le \min \{ \varepsilon (x_0),\varepsilon ({\widetilde{x}})\}\). As \(g(x)\ge h(x)\), agents do not insure and, according to “Local dynamics with no insurance” of Appendix, we obtain the dynamics of Fig. 3a. Regime II occurs when \(\delta \xi > \max \{\varepsilon (x_0),\varepsilon ({\widetilde{x}})\}\). As \(h(x)>g(x)\), agents insure and, according to “Local dynamics with insurance” of Appendix, we obtain the dynamics of Fig. 3b. Regime III occurs when \(\varepsilon ({\widetilde{x}})<\delta \xi \le \varepsilon (x_0)\). As long as \(t\le T=E\left[ \ln \left\{ \pi -\tau -{\widehat{x}}/(\pi -\tau -x_{0})\right\} /\ln (\pi -\tau )\right] +1\), \(x_{t}>{\widehat{x}}\) decreases and agents do not insure because \(h(x)\le g(x)\). When \(t>T\), \(x_{t}<{\widehat{x}}\), \(h(x)>g(x)\) and individuals insure. Then, according to “Dynamics of family help” and “Local dynamics with no insurance” of Appendix, we obtain the dynamics of Fig. 3c. Regime IV occurs when \(\varepsilon (x_0)<\delta \xi \le \varepsilon ({\widetilde{x}})\). As long as \(t<T'=E\left[ \ln \left\{ {\widehat{x}}-\pi +\tau /(x_{0}-\pi +\tau )\right\} /\ln (\pi -\tau )\right] +1\), \(x_{t}<{\widehat{x}}\) increases and agents insure because \(h(x)>g(x)\). When \(t\ge T'\), \(x_{t}>{\widehat{x}}\), \(h(x)\le g(x)\) and agents do not insure. Then, according to “Dynamics of family help” and “Local dynamics with insurance” of Appendix, we obtain the dynamics of Fig. 3d.

Appendix 4: Comparative statics (\(\pi >\tau \ge 0\))

1.1 Insurance behavior according to \(\pi \), p and \(\tau \)

By definition, we have \(\varepsilon ({\widetilde{x}})\equiv \tau /p+[1-\gamma (1+\xi )](\pi -\tau )^\sigma \). As \(\partial \varepsilon ({\widetilde{x}})/\partial \pi =[1-\gamma (1+\xi )]\sigma (\pi -\tau )^{\sigma -1}\), \(\varepsilon ({\widetilde{x}})\) is increasing in \(\pi \). As \(\partial \varepsilon ({\widetilde{x}})/\partial p=-\tau /p^2\), \(\varepsilon ({\widetilde{x}})\) is independent of p when \(\tau =0\) and decreasing in p when \(\tau >0\). As \(\partial \varepsilon ({\widetilde{x}})/\partial \tau =1/p-[1-\gamma (1+\xi )]\sigma (\pi -\tau )^{\sigma -1}\), \(\partial \varepsilon ({\widetilde{x}})/\partial \tau \) has the sign of \({\underline{\tau }}-\tau \) with \({\underline{\tau }}=\pi -[p\sigma (1-\gamma (1+\xi ))]^{1/(1-\sigma )}\). Then, \(\varepsilon ({\widetilde{x}})\) always decreases in \(\tau \) when \(\pi <[p\sigma (1-\gamma (1+\xi ))]^{1/(1-\sigma )}\) and is always increasing up to \({\underline{\tau }}\) and decreasing afterward when \(\pi \ge [p\sigma (1-\gamma (1+\xi ))]^{1/(1-\sigma )}\). According to these variations and since private LTC insurance is positive if and only if \(\delta \xi >\varepsilon ({\widetilde{x}})\), it is straightforward to prove the existence of the thresholds \(\pi _a\), \(p_a\), \(\tau _b\), \(\tau _c\), and \(\tau _d\) and, consequently, to obtain the results of the paragraph “Insurance behavior” in Section 4.3.

1.2 Comparative statics with respect to \(\pi \) when \(\pi >\tau \ge 0\)

Since \(\partial \eta ({\widetilde{x}})/\partial \pi =-\alpha A(1-\alpha )^2(1-\pi )\beta p (1+\xi )\sigma (\pi -\tau )^{\sigma -1}/\{\alpha [1+(1+p\xi )\beta ]+(1-\alpha )[1+(1-p)\beta ]\varepsilon ({\widetilde{x}})\}^2- \eta ({\widetilde{x}})/(1-\pi )\), then \(\partial \eta ({\widetilde{x}})/\partial \pi <0\). Since the nominator of \(\mu ({\widetilde{x}})\) decreases in \(\pi \) while the nominator increases, \(\partial \mu ({\widetilde{x}})/\partial \pi <0\). As \(\eta ({\widetilde{x}})\) and \(\mu ({\widetilde{x}})\) are decreasing functions of \(\pi \), \({\widetilde{k}}^{n}=\eta ({\widetilde{x}})^{\frac{1}{1-\alpha }}\) and \({\widetilde{k}}^{i}=\mu ({\widetilde{x}})^{\frac{1}{1-\alpha }}\) are also decreasing functions of \(\pi \). According to “Insurance behavior according to \(\pi \), p and \(\tau \)” of Appendix, we thus obtain Fig. 4.

1.3 Comparative statics with respect to p when \(\pi >\tau \ge 0\)

After computations, \(\partial \eta ({\widetilde{x}})/\partial p\) has the sign of \([\delta \xi -\varepsilon ({\widetilde{x}})][\alpha +(1-\alpha )\varepsilon ({\widetilde{x}})]+\alpha (1+\xi )\tau /p\), and \(\partial \mu ({\widetilde{x}})/\partial p\) has the sign of \([\delta \xi -\varepsilon ({\widetilde{x}})]+(1+p\xi )\tau /p\).

Consider the subcase where \(\tau =0\). If \(\delta \xi \le \varepsilon ({\widetilde{x}})=\pi ^\sigma \), then individuals do not insure and \(\partial \eta ({\widetilde{x}})/\partial p<0\). Then, \({\widetilde{k}}^{n}=\eta ({\widetilde{x}})^{\frac{1}{1-\alpha }}\) is decreasing in p. If \(\delta \xi >\pi ^\sigma \), individuals insure and \(\partial \mu ({\widetilde{x}})/\partial p>0\). Then, \({\widetilde{k}}^{i}=\mu ({\widetilde{x}})^{\frac{1}{1-\alpha }}\) is increasing in p. We thus obtain Fig. 5.