Abstract

Although private long-term care insurance (LTCI) is often discussed as a potential solution to the need for long-term care financing in the U.S., there is little empirical evidence on the economic consequences of having LTCI. We use U.S. Health and Retirement Study data to examine how LTCI affects key financial outcomes of insured individuals. Using an instrumental variable approach to account for the endogeneity of LTCI purchase, we find that LTCI leads to consistently positive effects on assets, consistently negative effects on Medicaid and Food Stamp enrolment and parent–child financial transfers, and ambiguous effects on out-of-pocket medical payments. These results suggest that although private LTCI does not entirely protect insured individuals against large medical expenditure, it improves the general financial well-being of insured individuals, potentially by reducing Medicaid-related disincentives to asset accumulation, motivating individuals to save more and reduce intergenerational wealth transfers.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

Introduction

Long-term care (LTC) expenditure has become one of the largest financial risks faced by elderly people and their families in the U.S. (Brown and Finkelstein 2007) Although LTC is expensive,Footnote 1 coverage for LTC under public insurance schemes is limited—MedicareFootnote 2 covers only post-acute care up to 100 days, and MedicaidFootnote 3 covers only individuals who have spent down most of their assets.Footnote 4 On the other hand, only 13% of individuals aged 65 years and older have private long-term care insurance (LTCI) (Congressional Budget Office 2013). As a result, LTC financing in the U.S. relies heavily on out-of-pocket expenditure by individuals and their families until they spend down their assets and qualify for Medicaid. The high cost of formal LTC might also limit an individual’s choice of service: more than two-thirds of the most disabled seniors receive solely informal care, which might be inappropriate for individuals who need intensive services (Thompson 2004).

To reduce individuals’ financial burden and curb government spending on LTC, policymakers have often considered private LTCI as one solution, and have implemented various programmes to stimulate the demand for private LTCI in the U.S.Footnote 5 Private LTCI markets also exist in other countries such as France, Germany, the United Kingdom, and Canada, often as a supplement to public programmes. Purchase of private LTCI may not be broadly appealing to consumers for a variety of reasons, including the typical structure of the policies themselves, which usually limit benefits to a set dollar amount per day for a limited number of years (Brown and Finkelstein 2007). Individuals generally purchase policies several decades before needing care because their risk—and the corresponding price—is lower at that point, and they are able to lock in the lower rate. However, individuals in their fifties and sixties often have competing demands in terms of spending on children and their own parents, and might not see the policies as a valuable priority at that time in their lives (Sperber et al. 2014). As a result, many individuals explicitly or implicitly rely on Medicaid for their future LTC needs (Brown and Finkelstein 2004), despite the associated requirement of spending down assets to qualify. Furthermore, reliance on Medicaid might, in turn, dampen incentives to accumulate assets, as qualifying for Medicaid coverage entails strict asset limits.

From a policy perspective, the desirability of expanding private LTCI in the U.S. is often taken as self-evident. Although financial protection is arguably the primary purpose of any health insurance (Zeckhauser 1970), and LTCI can play an important role in financial planning for the elderly, there is little empirical evidence for economic consequences of having LTCI. Prior literature in this area has mainly examined the influences of LTCI on health services utilisation and informal caregiver outcomes. Therefore, to evaluate private LTCI policies and inform policymakers of the potential costs and benefits of extending LTCI coverage requires an understanding of how LTCI affects key financial outcomes for older adults. In this paper, we study the effects of having private LTCI on the financial well-being of insured individuals, and explore the potential mechanisms behind these effects. Specifically, we study two types of financial outcomes: individuals’ assets, and (as extreme outcomes) their safety net programme status (participation in Medicaid and Food StampFootnote 6). We also study two potential explanatory mechanisms that are available in the data—out-of-pocket medical expenditure and intergenerational wealth transfers.

Our study extends the literature by examining (for the first time, to our knowledge) how LTCI affects the financial well-being of insured individuals, and considers the mechanisms behind these effects. We use an instrumental variable (IV) approach to account for potential endogeneity and reverse causality of owning LTCI. Our results suggest that LTCI increases the assets of policyholders and reduces their likelihood of enrolling in safety net programmes. One likely mechanism is that LTCI counters disincentives to personal savings inherent in Medicaid policies and reduces the necessity for parent–child financial transfers to spend down assets. Thus, LTCI might serve as an effective financial management tool. However, LTCI might not be sufficient to protect the insured against large out-of-pocket medical expenditure. Public policies designed to encourage private LTCI purchase should consider additional savings associated with reduced safety net programme enrolment and increased personal savings as potential social gains.

Background and conceptual framework

LTC financing in the U.S.

Since Medicare does not cover most LTC, and not many seniors have private LTCI, Medicaid is becoming one of the most important potential alternative sources of LTC financing for elderly people in the U.S. However, Medicaid LTC rules require individuals to exhaust any assets above Medicaid qualifying levels in order to be eligible. This potentially leaves their community-dwelling spouse and joint assets at risk. As a result, Medicaid creates incentives for reducing personal savings and spending down/shielding assets (Bassett 2007; Centers for Medicare and Medicaid Services 2008; Greenhalgh-Stanley 2015; Gruber and Yelowitz 1999; Hubbard et al. 1995; Waidmann and Liu 2006). For example, older adults may strategically invest in Medicaid-exempt assets (e.g., primary home, car, and personal items) and transfer assets (e.g., money, gifts, and home ownership) to their relatives and friends to accelerate Medicaid qualification. They can still retain a right to live in their home for the rest of their lives by claiming the home as their “life estate”.Footnote 7 Furthermore, the institutionalised spouse may divorce the community-dwelling spouse, with the couple splitting their assets in favour of the spouse who is well in order to avoid impoverishment.

How does LTCI affect financial outcomes?

LTCI premiums lower the disposable income that can be devoted to savings and therefore have a direct negative impact on wealth. LTCI might also influence the financial well-being of insured individuals through several indirect mechanisms:

LTCI may affect policyholders’ savings motives

The risk of living a long life and having large out-of-pocket medical expenditure is a major driver of precautionary savings for many older adults (De Nardi et al. 2010; Kopecky and Koreshkova 2014). Therefore, as LTCI pays at least partially for LTC, which potentially represents a large proportion of out-of-pocket expenditure for seniors, it may dampen the incentives for precautionary savings. The dampening of the precautionary savings motive may be mitigated by the fact that LTCI is almost always partial insurance, and consumers may decide to purchase a policy not just to smooth income but also to enable consumption of higher-quality or more preferred LTC options. At the same time, in the presence of an asset-tested social protection programme (e.g., Medicaid), LTCI may instead encourage individuals to save; that is, as LTCI reduces the need for Medicaid, it would also remove the disincentives for asset accumulation inherent in Medicaid LTC rules. Furthermore, because LTCI insures bequests (Pauly 1990), having LTCI may also encourage savings for bequests. Overall, we would expect insured individuals to have more savings and make fewer intergenerational asset transfers.

LTCI may affect policyholders’ out-of-pocket LTC expenditure, with the resulting changes in disposable income affecting savings and assets

On the one hand, LTCI reduces the effective price of LTC to the insured by offering (usually partial) coverage. On the other hand, LTCI might stimulate additional demand for LTC, defined as care that would not be demanded if paid for completely out-of-pocket (i.e., ex post moral hazard) (McGuire 2011). The additional demand may take the form of care in more desirable settings, as Medicaid has historically restricted care to nursing homes, and nursing homes that cater to Medicaid recipients tend to be of lower quality (Mor et al. 2004). In contrast, LTCI may enable recipients to receive care in alternative or higher-quality settings which may cost more. Empirical studies find that insured individuals are more likely to receive formal LTC and/or care in a desirable (sometimes, more expensive) setting because their choice sets have been expanded due to the availability of the insurance payoff (Konetzka et al. 2017; Li and Jensen 2011). Overall, whether LTCI increases or decreases out-of-pocket LTC payments (and correspondingly reduces or increases savings and wealth) depends on whether the decrease in effective price offsets the increase in quantity caused by the moral hazard effect, which must be determined empirically.

LTCI may affect asset transfers

The exchange motive theory of inter vivos transfers suggests that parents may use asset transfers to invoke attention from children (Norton and Van Houtven 2006). In that case, we would expect insured individuals to make fewer asset transfers to children since they rely less on informal care.

In summary, a number of considerations mean that LTCI creates competing effects for enrollees with respect to out-of-pocket LTC expenditure, wealth accumulation and intergenerational asset transfers. We follow prior literature in anticipating that LTCI’s effect on savings motives will dominate, with enrolment leading to greater wealth accumulation and fewer intergenerational asset transfers. We make no a priori hypotheses about the net effect of LTCI on out-of-pocket LTC or health care expenditure.

Methods

Data and sample

Our primary source of data is the Health and Retirement Study (HRS), a longitudinal study that surveys a national representative sample of Americans over the age of 50 and their spouses every 2 years. It is the only publicly available data set that includes consistently worded questions on LTCI in the U.S. It is also the role model for a growing number of longitudinal ageing studies around the world, such as the China Health and Retirement Longitudinal Study (CHARLS), the English Longitudinal Study of Ageing (ELSA), and the Survey of Health, Ageing and Retirement in Europe (SHARE). We use the RAND imputed HRS data file in conjunction with the original HRS data for most variables and use the Cross-Wave Geographic Information (detail) file to match respondents to area-level information (RAND Center for the Study of Aging 2014). In addition, we collect county-level nursing home bed supply from the Area Health Resource File (AHRF) and collect state tax policies from the literature (Goda 2010), supplemented with manual searches of state tax return forms. We use data from waves 3 to 10 (1996–2010) for our analyses because the LTCI questions in waves 1 and 2 are inconsistent and subject to substantial measurement error (Finkelstein and McGarry 2006).

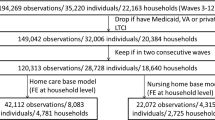

For our main specification, we use an observation-level pooled sample from waves 3 to 10, and account for the multiple observations of the same individuals by clustering our standard errors at the household level. We exclude individuals who (1) have VA coverage status (as they have no motivation to purchase LTCI),Footnote 8 (2) are younger than 50 (e.g., younger spouses of the target cohorts), (3) do not file taxes (as they would not be affected by our IV), (4) have negative total assets, financial assets, or are in the bottom quartile of the income distribution (as they would not find LTCI affordable and would have low opportunity costs to enrol in Medicaid), and (5) have more than USD 1 million in total assets (as they would be more likely to self-insure than to buy LTCI) (Brown and Finkelstein 2004). These exclusions enable us to focus on respondents who are more likely to purchase LTCI. Our final sample includes 63,171 eligible observations of 20,119 individuals and 12,594 households. For parent–child financial transfer models, we also exclude individuals who have no children.

Variables

Dependent variables

We study two types of financial outcome measures: those that directly measure an individual’s general financial well-being and those that explain the potential mechanisms of the change in the insured’s financial well-being.

Household non-housing financial assets and total assets Footnote 9

We use the dollar amount of RAND-imputed self-reported household non-housing financial assets and total assets as measures of an individual’s general financial well-being.Footnote 10 Since all asset measures are reported in nominal dollars, we inflate them to 2010 dollars using the CPI-U. The measurement error due to imputation and self-report may bias results if it is correlated with an individual’s LTCI ownership. We address this concern using an IV approach.

Medicaid and Food Stamp enrolment

We construct dichotomous variables for programme enrolment using HRS questions that ask directly about Medicaid and Food Stamp coverage at any time since the previous wave.

Large total out-of-pocket medical expenditure

We use total out-of-pocket medical costs in preference to out-of-pocket LTC costs as our dependent variables because: (1) HRS does not have consistent measures for out-of-pocket nursing home costs and out-of-pocket home care costs, (2) LTC costs are the largest component of total out-of-pocket medical costs, and (3) total out-of-pocket medical costs more directly relate to elderly people’s financial security. We use RAND-imputed self-reported total out-of-pocket medical expenditure in our analysis.Footnote 11 We inflate out-of-pocket expenditure to 2010 dollars using the CPI-U. To study whether LTCI protects households from catastrophic medical expenditure, we define our two out-of-pocket variables dichotomously, indicating whether the respondent’s total out-of-pocket payments for healthcare exceed USD 10,000 or USD 25,000.Footnote 12

Parent–child financial transfers

We define the financial transfer variable dichotomously using a question from HRS that asks directly about the presence of any parent–child financial transfers totalling USD 500 or more since the previous wave.

Treatment variable

We define a dichotomous variable for LTCI ownership using a question in HRS that asks whether the respondent currently has LTCI.Footnote 13 Respondents who indicate that they have LTCI are then asked about the coverage for specific LTC services.Footnote 14 In our main specifications, LTCI purchase is defined as answering “yes” to the LTCI ownership question, regardless of the answers to the follow-up coverage question.

Control variables

We also control for (or in some cases, stratify by) a rich set of variables available in the HRS that might be related to both LTCI holding and financial outcomes. Specifically, we control for respondents’ age, gender, race, ethnicity, education, employment status, marital status, number of children, health insurance coverage, number of diagnosed chronic conditions,Footnote 15 number of limitations in activities of daily living (ADLs), self-rated health status, county-level number of nursing home beds per thousand 65-year-olds (proxy for LTC service availability), life insurance coverage (proxy for risk aversion). We also use state and year fixed effects to account for general time trends in individuals’ financial well-being due to macroeconomic cycles, and for unobserved state characteristics such as time-invariant health-related policies.

Empirical strategy

Instrumental variables design

The key challenges of identifying the causal relationship between LTCI and financial outcomes are addressing the potential endogeneity of owning LTCI and the potential reverse causality issue. A prior study finds the existence of both preference- and risk-based selection in the LTCI market (Finkelstein and McGarry 2006); that is, individuals are more likely to purchase LTCI if they have private information that they are high risk and/or if they have a strong taste for insurance. Therefore, LTCI ownership may be endogenous, since individual risk and preference may be correlated with individual wealth. Another concern is that some of our outcomes (wealth, out-of-pocket spending) could reversely induce LTCI purchase (i.e., reverse causality).

We use an IV approach to address the potential endogeneity and reverse causality issues. A valid IV should predict one’s LTCI ownership but should not affect one’s financial outcomes through pathways other than altering LTCI status. When validity assumptions are met, the IV approach mimics the random assignment process and leads to plausibly unbiased estimates (Angrist et al. 1996). Adapted from prior studies (Coe et al. 2015; Goda 2010), our instrument is a dichotomous variable indicating the availability of any state tax subsidies for LTCI purchase in a specific year.

First, we test the IV strength assumption: state subsidies for the purchase of LTCI predict the propensity to purchase or retain LTCI. As shown in Appendix Table 4, there is great variation in tax policies over state and time. In 1996, among the 41 states and the District of Columbia that levied a broad-based personal income tax,Footnote 16 only three states offered tax deductions, and one state offered both tax deduction and tax credit for LTCI purchase. By 2010, 15 states and the District of Columbia offered tax deductions, eight states offered tax credits, and two states offered both tax deductions and tax credits for LTCI purchase. Regression results of our first-stage IV model show that state tax incentives lead to a 1.9 percentage point increase in LTCI ownership (Appendix Table 5), which is similar to the 2.7 percentage point increase found in the Goda (2010) study using a wealthier sample. With a first-stage F statistic of 13.0 in the base model, our IV meets the strength requirement.

Next, we discuss the exclusion restriction: state subsidies are not directly related to the individual-level financial outcomes or any unmeasured confounders. Although our instrument is a state-level variable, which is less likely to be confounded by individual-level unobserved confounders (e.g., risk aversion and unmeasured health), some potential threats to IV exogeneity should be considered. The main concern is that states might change Medicaid policies and/or income tax policies around the same time that the LTCI tax subsidies are enacted, which may lead to a change in wealth, independent of the effect through LTCI. However, we think the policy endogeneity is not a concern for our IV: Goda (2010) finds that the implementation of state LTCI tax subsidies was unrelated to changes in Medicaid eligibility or age ratios (which are related to rating regulations). We also find that the state tax treatments of income from Social Security benefits and pensions (two major sources of income for older adults) were very stable between 1998 and 2010.Footnote 17 In addition, we check the timing of state policies that may affect caregivers’ income (although these policies are less likely to affect the financial well-being of elderly people, and are therefore less likely to be a confounder). One important policy is the state expansion of the federal Family Medical Leave Act (FMLA). We find that only two states (California and New Jersey) offered paid family leave to allow qualified employees to care for a sick parent during our study period. Further, none of the states offered income tax credit to family caregivers during our study period. Another potential concern is that the IV may be correlated with formal LTC supply in the local market, which may further affect individuals’ LTC expenditure and financial well-being. Therefore, we control for county-level number of nursing home beds per thousand 65-year-olds as proxy for formal LTC supply. Finally, although it is unlikely that seniors will choose where to live and move solely based on state tax subsidies for LTCI purchase, we test the robustness of results excluding individuals who moved between waves. Overall, consistent with prior work, it is conceptually plausible to consider our IV to be exogenous.

Empirically, although the assumption that the IV itself is uncorrelated with the error term cannot be tested in an exactly identified model such as ours (same number of instrumental variables and endogenous explanatory variables), we conduct an “IV balance check” to test the correlation between the IV and each of the independent variables while controlling for the other independent variables, as the exogeneity requirement is conditional (Appendix Table 6). Intuitively, this table highlights whether an observed confounder (e.g., education) would be correlated with the IV and lead to IV endogeneity if it were unobservable and not controlled for. Although statistically significant differences between the two groups exist in age and nursing home supply, the differences in all the other observed characteristics are not statistically significant at the 0.10 level. These results show that the IV approach has greatly improved sample balance in observed characteristics/confounders (compared to those shown in Table 1), which also suggests a good balance in unobserved characteristics/confounders and provides support for the validity of the IV. We include these balance check variables (including both balanced and imbalanced variables) in our regressions for additional control.

Another indirect IV exogeneity test is to check if individuals who do not have LTCI face the same change in dependent variables at the time of tax policy change as people who have LTCI. If the IV is exogenous, the tax IV alone, without changing LTCI ownership, should not affect wealth outcomes. Therefore, we should expect the tax IV to be uncorrelated with the wealth outcomes among individuals who do not have LTCI. Appendix Table 7 presents regression results of the influence of tax IV on financial outcomes among individuals who do not have LTCI. We find a much smaller effect for total assets, and no significant effect for other outcomes (compared to the effects in Table 2). Our results suggest that although the IV may be correlated with some unobservables (e.g., other policies), it has greatly improved the endogeneity issue, since those unobservables cannot explain most of our results.

Instrumental variable models

Because we have a binary treatment variable and, in some models, binary dependent variables, we use two-stage residual inclusion (2SRI) methods (Terza et al. 2008).

We predict an individual’s LTCI status using the following first-stage model:

where LTCIit represents whether individual i has LTCI at time t, IVit is the instrumental variable for individual i at time t, Xit is a vector of controls for individual-level characteristics. Yeart and Stateit represent year and state fixed effects, and \(\varepsilon_{it}\) is the error term. We then calculate the response residuals \(\hat{r}_{it}\) from the first-stage model, which are the difference between the predicted probabilities and observed LTCI values.Footnote 18 These residuals are included in the second-stage model below as additional regressors to produce the correct adjustment for potential endogeneity in the outcome equation:

where Yit is an outcome measure for individual i at time t, and the other variables are the same as in Eq. (1). We use the ordinary linear regression model for linear dependent variables and the logistic regression model for binary dependent variables.

We account for the multiple observations of the same individuals by clustering our standard errors at the household level, and perform a bootstrap procedure for both stages, with 500 iterations to modify standard errors (Efron 1981).

Our main models estimate the concurrent effects of owning LTCI on wealth outcomes across the sample (although the LTCI policy might have been purchased recently or many years prior). We also construct numerous alternative specifications to test the robustness of our results. First, to target those more likely to be affected by LTCI, we run our models on those who have ever exhibited a potential need for LTC.Footnote 19 Second, we examine longer-run effects and measure outcomes 4 years after holding LTCI. Third, the IV exogeneity may be violated if individuals choose where to live based on states’ LTCI subsidies. Therefore, we test the robustness of results excluding individuals who moved from another state 2 years before holding LTCI to test the IV exogeneity. Fourth, although the IV approach should correct for potential measurement error in our endogenous treatment variable, we also test an alternative measure of LTCI holding that is defined as individuals who reported having LTCI and were also able to answer the follow-up LTCI coverage question.Footnote 20 This follow-up question helps us to confirm individuals’ LTCI status. Finally, we run a generalised estimating equation (GEE) model as a robustness check. The likelihood of our binary outcomes is analysed using a logit link function with a binomial distribution.

Results

Descriptive statistics

Table 1 provides descriptive statistics for our sample.Footnote 21 Overall, by construction, our sample has higher education levels, income, and assets than average Americans of a similar age. In addition, there are significant differences between respondents with and without LTCI regarding their socio-economic status, county-level LTC supply, family structure, uninsurance rates, health, and risk preferences, which underscore the potential endogeneity of LTCI and the necessity of using the IV approach.

Regression results

Tables 2 and 3 present regression results of the impact of LTCI coverage on financial outcomes. Our conceptual framework predicts that LTCI leads to increased savings. In line with this hypothesis, we find consistently higher financial assets and total assets for insured individuals using our base models, and the magnitudes of the effects are substantial. Specifically, we find LTCI ownership leads to a USD 38,049 increase in household financial assets (on a mean of USD 92,244) and a USD 70,338 increase in household total assets (on a mean of USD 329,506).Footnote 22 These represent a sizable 41% increase in financial assets and a 21% increase in total assets. Furthermore, we see similar effects among less healthy individuals who need LTC, suggesting that both healthy and less healthy individuals are affected by the Medicaid-related saving disincentives. The effects on assets 4 years after holding LTCI are even greater, consistent with year-over-year effects on asset accumulation. In addition, the increase in total assets in the long run is primarily driven by the increase in financial assets. Lastly, IV robustness tests using the alternative definition of LTCI status and excluding those who moved between waves also produce similar results.

We further decompose the USD 70,338 increase in household total assets in the base model into various types of assets (Appendix Table 8). Besides the USD 38,049 increase in household financial assets, LTCI also leads to a USD 25,450 significant increase in Individual Retirement Account (IRA)/Keogh pension plan values (on a mean of USD 49,479), and a USD 13,063 significant increase in primary residence values (on a mean of USD 134,666). Our results suggest that LTCI has a greater impact on “liquid assets” (e.g., IRA/Keogh and financial assets) than on housing assets. This is also consistent with our conceptual framework: because Medicaid does not consider an individual’s primary residence as a countable asset, it has a greater negative impact on liquid asset accumulation. As a result, LTCI has a greater positive impact on liquid asset accumulation.

Next, we examine the impact of LTCI on safety net programme enrolment. We find that LTCI reduces the insured’s likelihood of enrolling in Medicaid and the Food Stamp programmes, although the marginal effects are not statistically significant in the Medicaid model. The small effects are as expected—since people who are more likely to use safety net programmes are poorer and are less affected by the saving disincentives in Medicaid, and they are also less affected by LTCI, which removes these disincentives. The lack of significance/statistical power in our results might also be due in part to low prevalence rates of these outcomes in our sample. We find a much greater effect on Medicaid enrolment 4 years later, suggesting larger long-run effects, consistent with the greater long-run asset effects. The IV estimates from other sensitivity models are generally consistent with those of our base specifications. Overall, our findings on safety net programmes are consistent with those on assets, suggesting that LTCI is effective as a financial management tool to improve the overall economic well-being of insured individuals.

Finally, we explore the potential explanatory mechanisms of the financial impact. Our IV results reveal a negative relationship between LTCI and having out-of-pocket payments of USD 10,000 and upwards, and a positive relationship between LTCI and out-of-pocket payments of USD 25,000 and upwards, but no consistent pattern, and neither effect is statistically significant.Footnote 23 The IV estimates of the long-run models are larger and more positive, but IV estimates of the other sensitivity models are somewhat noisy and insignificant. As noted earlier, one potential explanation for the lack of significant change in total out-of-pocket expenditure may be the moral hazard effect; that is, although insured individuals pay only a portion of the total LTC costs, they may use more or more expensive LTC services. Another explanation may be an income effect—since insured individuals have more assets, they may also have a stronger demand for all types of health services. Last, but not least, changes in LTC costs and utilisation may also affect utilisation and costs of other types of health services. For example, receiving LTC may enable recognition of problems and reminders of screenings that lead to greater use (and higher costs) of outpatient routine or acute care. Overall, our findings suggest that private LTCI does not entirely protect insured individuals against large out-of-pocket medical expenditure, and changes in out-of-pocket payments are unlikely to explain the increase in wealth.

Our findings on parent–child financial transfers support our hypotheses with respect to Medicaid-related wealth accumulation incentives. The IV results of our base models imply that LTCI induces a significant 6.6 percentage point reduction in the probability of giving financial transfers to children (on a mean of 43.6%). This negative effect is not observed in the 4-year model. One potential explanation for this long-run effect is the income effect—since insured individuals have more assets in the long run, they may also be more likely to transfer assets. It is worth noting that the effects of LTCI on transfers, while not in comparable units to the effects on assets, are modest in magnitude. This suggests that our finding of increased assets is only partly explained by the change in parent–child financial transfers, and a more direct change in savings behaviour is still likely.

Conclusions

Although policymakers often consider private LTCI to be a potential solution to LTC financing in the U.S., no prior empirical study has focused on economic consequences caused by holding LTCI. In this paper, we estimate the effects LTCI has on individuals’ wealth, and then explore the potential explanatory mechanisms of these effects. Our results are consistent with the existence of Medicaid serving as a disincentive to asset accumulation (with an associated incentive to transfer/hide assets). Individuals with LTCI face fewer incentives to spend down their assets, and are therefore expected to accumulate more assets and reduce asset transfers. We also find evidence that LTCI reduces insured individuals’ likelihood of enrolling in safety net programmes.

The effects on out-of-pocket payments are inconclusive and small in magnitude. The lack of effect suggests that typical LTCI policies still leave policyholders with part of the financial risk. Furthermore, although our analysis is not a direct assessment of moral hazard, our results are consistent with the existence of a moral hazard effect. The potentially increased LTC use induced by moral hazard may be welfare increasing and desirable among lower-income people or people with higher risk who might underuse formal LTC without insurance (Nyman 2003; Pauly 1968). In addition, increased use of formal LTC might relieve the burden on informal caregivers in the form of time, effort, forgone wages, and other economic costs, which might further improve insured individuals’ financial outcomes, and increase their social welfare. Coe et al. (2015) find that LTCI coverage induces less informal caregiving.

From a policy perspective, our study indirectly informs policymakers about whether the social gains from a tax subsidy for LTCI premiums would outweigh the cost of the tax subsidy in the U.S. Using simulations, Goda (2010) estimates that each dollar of state tax subsidy for LTCI premiums produces approximately USD 0.84 in Medicaid savings, and the return is more for individuals with moderate wealth, and less for individuals with very high or very low wealth. However, her calculation does not take into account social gains from increased savings among LTCI policyholders or reduced utilisation of other safety net programmes (e.g., Food Stamp) that we find in our study. We therefore expect a higher return than what she estimated if we take into account these desired effects.

One caveat of our study is that our sample is limited to individuals with moderate wealth, and we can estimate only local average treatment effects (LATEs) for subpopulation groups that are induced by our IV to change LTCI status (i.e., the compliers) (Imbens and Angrist 1994); that is, we can only estimate the treatment effects among individuals who have LTCI because they live in a state that offers tax subsidies for LTCI purchase and would not have LTCI otherwise. Further, since tax subsidies could encourage the compliers to buy more expensive and comprehensive LTCI (i.e., they could impact the intensive margin), the effects we estimate might not apply to purchase of policies more generally. However, making these sample restrictions and using the IV approach are necessary for identification, and allow us to focus on seniors who are more likely to respond to tax subsidies.

It is worth noting that older adults often get LTCI through a financial advisor as part of a financial planning package; that is, when they are offered an LTCI policy, they are also offered some savings and investment plans. As a result, people who have LTCI may also have more investment options and knowledge. This mechanism may also explain the large asset accumulation effects we observed, although it suggests a limitation of our study—we cannot disentangle the impact of LTCI and the potential impact of financial advice if they are received together, driven by the inducement of LTCI tax incentives.

Overall, our findings on the effects of LTCI on financial outcomes have several key implications. One is that current LTCI policy design might be insufficient to protect policyholders against large medical expenditure. However, it might improve the general financial well-being of insured individuals by encouraging them to save more and reduce asset transfers. Public policies designed to encourage LTCI purchase to cover LTC services should consider additional savings associated with reduced safety net programme enrolment and increased personal savings. Although our findings are based on the LTCI market in the U.S. and may not be fully generalisable, they may also have implications for other countries with private LTCI markets in the presence of means-tested safety net programmes.

Notes

In 2014, the average monthly cost was USD 6000 for nursing home care and USD 4000 for home-based care in the U.S. (Genworth Financial 2014).

Medicare is a national health insurance programme administered by the U.S. federal government. It provides health insurance for individuals aged 65 and older, younger adults with certain disability status, and individuals with end-stage renal diseases or amyotrophic lateral sclerosis.

Medicaid is a joint federal and state programme that provides health insurance to people with limited income and resources.

In most states, an individual can keep USD 2000 in countable assets, and married couples who are still living in the same household can keep USD 3000 in countable assets.

For example, the federal government and some state governments offer tax subsidies for LTCI premiums, and the Partnership for LTC programme allows LTCI policyholders to keep more assets when they turn to Medicaid after their private policy benefits have been exhausted.

The Food Stamp Program (or Supplemental Nutrition Assistance Program) is a federal programme that provides food purchasing assistance for low-income Americans.

However, gifts or transfers made within 60 months prior to Medicaid application might be subject to penalties under the Deficit Reduction Act of 2005. Elderly people who plan to rely on Medicaid would need to start this process years before they need Medicaid.

The HRS question is “Are you currently covered by TRI-CARE, CHAMPUS, CHAMP-VA, or any other military health care plan?”

Non-housing financial assets are defined as the net value of stocks—mutual funds, investment trusts, bank accounts, certificates of deposit, Treasury bills, government bonds, bonds, and bond funds—less debt. Total assets are defined as the net value of non-housing financial assets—housing, real estate, vehicles, businesses, and Individual Retirement Account (IRA) /Keogh pension plan—less home loans.

Respondents are asked to report their household-level asset ownership and values. Those who do not provide an exact amount are then asked unfolding bracket questions. RAND imputes a consistent measure of wealth across all waves using bracketed responses and imputation models if an exact amount is not reported. See the RAND HRS Data Version N for a detailed description of the imputation method (RAND Center for the Study of Aging 2014).

Respondents are asked to report their individual-level spending on hospitals, nursing homes, doctors, dentists, outpatient surgery, prescription drugs, home-based care, and special facilities since the previous wave. For individuals who do not provide an exact value, RAND imputes a consistent measure of out-of-pocket medical expenditure across all waves using bracketed responses and imputation models. See the RAND HRS Data Version N for a detailed description of the imputation method (RAND Center for the Study of Aging 2014).

One of the main purposes of having LTCI is arguably to reduce the likelihood of having catastrophic out-of-pocket medical expenditure, defined as endangering the family's ability to maintain its customary standard of living. In our study, we directly measure the likelihood of having very large out-of-pocket medical expenditure. Given the average household income of USD 75,627 among our sample, USD 10,000 and USD 25,000 represent about 13% and 33% of the average household income, respectively.

Respondents are asked: “Not including government programs, do you now have any insurance which specifically pays any part of long-term care, such as personal or medical care in the home or in a nursing home?”.

Respondents are asked: “Does this plan cover care in a nursing home facility only, personal or long-term care at home, or both in-home and nursing home care?”

Number of diagnosed chronic conditions out of a list of 8 conditions, including hypertension, diabetes, cancer, lung diseases, heart problems, stroke, psychiatric problems, and arthritis.

AK, FL, NV, SD, TX, WA, and WY did not have an income tax, and NH and TN collected income tax only on interest and dividend income.

In 1998, among the 41 states and the District of Columbia that levied a broad-based personal income tax, 26 states and the District of Columbia provided a full exclusion for income from Social Security, and 10 states provided a full exclusion for income from pensions. As of 2010, only the State of Wisconsin had changed its tax policies and started to offer full exclusion for Social Security income in 2008 (Baer 2001; Edwards and Wallace 2004; McNichol 2006; Penner 2000; Snell 2011; Snell and Waisanen 2009).

2SRI IV estimates based on varying forms of residuals may be different (Basu and Coe 2017). We include the most commonly used response residuals in our 2SRI models.

Defined as individuals who need help with ADL/IADL, who have been diagnosed with memory-related diseases, and who have bad self-reported memory.

We drop individuals who indicated having LTCI but were not able to answer the coverage question.

Among the 63,171 observations that meet our inclusion restrictions, 1199 observations have missing LTCI status and are not used in our analyses. Table 1 shows statistics for the 61,972 observations that have non-missing LTCI status.

We also assess the effects on financial assets and total assets using a wealthier sample, and we find larger effects. This suggests that the large treatment effects are driven by wealthier individuals, which is consistent with spend-down theory.

Because many LTCI policies have an elimination period, usually 30 to 100 days, during which the policyholders still have to pay their LTC out-of-pocket, we also use a higher out-of-pocket threshold, USD 50,000. We still find no significant effect.

References

Angrist, J.D., G.W. Imbens, and D.B. Rubin. 1996. Identification of causal effects using instrumental variables. Journal of the American Statistical Association 91 (434): 444–455. https://doi.org/10.2307/2291629.

Baer, D. 2001. State taxation of social security and pensions in 2000. Washington, D.C.: AARP Public Policy Institute.

Bassett, W.F. 2007. Medicaid’s nursing home coverage and asset transfers. Public Finance Review 35 (3): 414–439. https://doi.org/10.1177/1091142106293944.

Basu, A., and N.B. Coe. 2017. 2SLS vs 2SRI: Appropriate methods for rare outcomes and/or rare exposures. Health Economics. https://doi.org/10.1002/hec.3490.

Brown, J.R., and A. Finkelstein. 2004. The interaction of public and private insurance: Medicaid and the long-term care insurance market. Working Paper No. 10989. National Bureau of Economic Research. Retrieved from http://www.nber.org/papers/w10989.

Brown, J.R., and A. Finkelstein. 2007. Why is the market for long-term care insurance so small? Journal of Public Economics 91 (10): 1967–1991.

Centers for Medicare and Medicaid Services. 2008. Transfer of assets in the Medicaid program. MD: Baltimore.

Coe, N.B., G.S. Goda, and C.H. Van Houtven. 2015. Family spillovers of long-term care insurance. Working Paper No. 21483. National Bureau of Economic Research. Retrieved from http://www.nber.org/papers/w21483.

Congressional Budget Office. 2013. Rising demand for long-term services and supports for elderly people. Washington, DC: Congressional Budget Office.

De Nardi, M., E. French, and J.B. Jones. 2010. Why do the elderly save? The role of medical expenses. Journal of Political Economy 118 (1): 39–75. https://doi.org/10.1086/651674.

Edwards, B., and S. Wallace. 2004. State income tax treatment of the elderly. Public Budgeting & Finance 24 (2): 1–20. https://doi.org/10.1111/j.0275-1100.2004.02402001.x.

Efron, B. 1981. Nonparametric estimates of standard error: The jackknife, the bootstrap and other methods. Biometrika 68 (3): 589–599. https://doi.org/10.2307/2335441.

Finkelstein, A., and K. McGarry. 2006. Multiple dimensions of private information: Evidence from the long-term care insurance market. American Economic Review 96 (4): 938–958. https://doi.org/10.1257/aer.96.4.938.

Genworth Financial. 2014. 2014 Cost of care survey. VA: Richmond.

Goda, G.S. 2010. The impact of state tax subsidies for private long-term care insurance on coverage and Medicaid expenditures. Working Paper No. 16406. National Bureau of Economic Research. Retrieved from http://www.nber.org/papers/w16406.

Greenhalgh-Stanley, N. 2015. Are the elderly responsive in their savings behavior to changes in asset limits for Medicaid? Public Finance Review 43 (3): 324–346.

Gruber, J., and A. Yelowitz. 1999. Public health insurance and private savings. Journal of Political Economy 107 (6): 1249–1274.

Hubbard, R.G., J. Skinner, and S.P. Zeldes. 1995. Precautionary saving and social insurance. Journal of Political Economy 103 (2): 360–399.

Imbens, G.W., and J.D. Angrist. 1994. Identification and estimation of local average treatment effects. Econometrica 62 (2): 467–475. https://doi.org/10.2307/2951620.

Konetzka, R.T., D. He, J. Dong, M.J. Guo, and J.A. Nyman. 2017. Moral hazard and long-term care insurance. Working Paper.

Kopecky, K.A., and T. Koreshkova. 2014. The impact of medical and nursing home expenses on savings. American Economic Journal: Macroeconomics 6 (3): 29–72. https://doi.org/10.1257/mac.6.3.29.

Li, Y., and G.A. Jensen. 2011. The impact of private long-term care insurance on the use of long-term care. Inquiry: The Journal of Medical Care Organization, Provision and Financing 48 (1): 34–50.

McGuire, T.G. 2011. Demand for health insurance. In Handbook of Health Economics, vol. 2, ed. Mark V. Pauly, Thomas G. McGuire, and Pedro P. Barros, 317–396. New York: Elsevier.

McNichol, E.C. 2006. Revisiting state tax preferences for seniors. Washington, D.C.: Center on Budget and Policy Priorities.

Mor, V., J. Zinn, J. Angelelli, J.M. Teno, and S.C. Miller. 2004. Driven to tiers: Socioeconomic and racial disparities in the quality of nursing home care. The Milbank Quarterly 82 (2): 227–256. https://doi.org/10.1111/j.0887-378X.2004.00309.x.

Norton, E.C., and C.H. Van Houtven. 2006. Inter-vivos transfers and exchange. Southern Economic Journal 73 (1): 157–172. https://doi.org/10.2307/20111880.

Nyman, J.A. 2003. The theory of demand for health insurance. Stanford, CA: Stanford University Press.

Pauly, M.V. 1968. The economics of moral hazard: Comment. The American Economic Review 58 (3): 531–537.

Pauly, M.V. 1990. The rational nonpurchase of long-term-care insurance. Journal of Political Economy 98 (1): 153–168.

Penner, R.G. 2000. Tax benefits for the elderly. Occasional Paper No. 5. Washington, D.C.: The Urban Institute.

RAND Center for the Study of Aging. 2014. RAND HRS longitudinal data file 2014 (V2), supported by NIA and SSA. Retrieved September 2, 2015, from http://www.rand.org/labor/aging/dataprod/hrs-data.html.

Snell, R. 2011. State personal income taxes on pensions and retirement income: Tax year 2010. Denver, CO: National Conference of State Legislatures.

Snell, R., and B. Waisanen. 2009. State personal income taxes on pensions and retirement income: Tax year 2008. Denver, CO: National Conference of State Legislatures.

Sperber, N.R., C.I. Voils, N.B. Coe, R.T. Konetzka, J. Boles, and C.H. Van Houtven. 2014. How can adult children influence parents’ long-term care insurance purchase decisions? The Gerontologist 57 (2): 292–299. https://doi.org/10.1093/geront/gnu082.

Terza, J.V., A. Basu, and P.J. Rathouz. 2008. Two-stage residual inclusion estimation: Addressing endogeneity in health econometric modeling. Journal of Health Economics 27 (3): 531–543. https://doi.org/10.1016/j.jhealeco.2007.09.009.

Thompson, L. 2004. Long-term care: Support for family caregivers (Issue Brief). Georgetown University.

Waidmann, T., and K. Liu. 2006. Asset transfer and nursing home use: Empirical evidence and policy significance. Washington, DC Kaiser Family Foundation. Retrieved from http://kff.org/medicaid/issue-brief/asset-transfer-and-nursing-home-use-empirical/.

Zeckhauser, R. 1970. Medical insurance: A case study of the tradeoff between risk spreading and appropriate incentives. Journal of Economic Theory 2 (1): 10–26. https://doi.org/10.1016/0022-0531(70)90010-4.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

Rights and permissions

About this article

Cite this article

Dong, J., Smieliauskas, F. & Konetzka, R.T. Effects of long-term care insurance on financial well-being. Geneva Pap Risk Insur Issues Pract 44, 277–302 (2019). https://doi.org/10.1057/s41288-018-00113-7

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1057/s41288-018-00113-7