Abstract

We develop an overlapping generations model with leveraged investment in speculative asset bubbles. Financial intermediaries use borrowed funds to speculate on a risky asset bubble, which promises high returns as long as it does not collapse. They can, however, default on their debt and shift the losses to lenders when the bubble collapses. This risk shifting leads to welfare-reducing (or “toxic”) rational asset bubbles. We then analyze a set of often discussed policy interventions: pricking bubbles, macroprudential regulations, and leverage restriction.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Financial crises tend to follow dramatic booms in asset prices and their collapses (Reinhart and Rogoff 2009), especially when the booms are driven by debt financing (Minsky 2008; Kindleberger and Aliber 2011; Jordà et al., forthcoming). The global financial crisis of 2007–2009 that began in the USA is an illustration of such a phenomenon in which financial intermediaries are left relatively unchecked to use borrowed funds to invest in risky assets such as real estate and the associated subprime mortgage-backed securities (Reinhart and Rogoff 2009; Rajan 2011; Stiglitz 2012). The role played by the combination of credit and speculation in the build-up to the crisis in the USA has also been documented by Angelides et al. (2011), Mian and Sufi (2011), and Barlevy and Fisher (2012).

In this paper, we analyze the booms and busts of asset bubbles—assets whose prices are inflated beyond their fundamental values—and their implications to welfare and policy. We develop a tractable rational bubble model that features an interplay of debt financing and speculation on risky asset bubbles. Our starting point is an overlapping generations model pioneered by Samuelson (1958), Diamond (1965), and Tirole (1985), in which an aggregate shortage of storage leads to the emergence of bubbles—assets which pay no dividend but have positive value. To this, we add two ingredients, both of which are relevant to the recent US housing bubble episode: (i) leveraged bubble investment: Bubble investment is financed by borrowing, and (ii) defaultable debt: Borrowers raise funds via a standard debt contract. These ingredients lead to risk shifting: Borrowers shift the risk of a bubble to lenders by defaulting on the debt if the bubble collapses. To manifest this idea in the simplest possible way, we assume that households cannot directly invest in the financial market; instead, they lend to financial intermediaries (“bankers”), who then use the borrowed money either to invest in physical capital or to speculate on a bubble asset that has an exogenous risk of collapse. However, credit markets are incomplete: Bankers’ borrowing is in the form of a non-contingent standard debt contract and is defaultable. This setup of financial intermediation is similar to that used by Allen and Gale (2000) and Barlevy (2012) and allows us to model leveraged bubble investment with default risk in a tractable manner.

As a result of bankers’ risk shifting, welfare-reducing asset bubbles (or “toxic asset bubbles”) emerge when the risk of bubble collapse is high enough. Intuitively, because bankers do not fully internalize the consequence of the collapse of a bubble, they have an incentive to chase higher returns from a risky asset bubble. This leveraged speculation leads to bubble equilibria in which social welfare is worse than in a bubble-less equilibrium. The existence of toxic rational asset bubbles due to leveraged speculation is our first contribution.

Next, we analyze a set of policies that have often been discussed among scholars and policymakers. In the first step, we consider a case in which a policymaker can observe bubbles and bubble investment. In this case, an ex-post unanticipated policy that pricks a bubble can improve welfare if it is combined with a redistribution from the non-bubble holders to the bubble holders. This policy is equivalent to using tax revenue from non-bubble holders for purchasing a toxic asset bubble in order to remove it from the market. Next, we consider two types of ex-ante anticipated policy: macroprudential policy that taxes bubble speculation and a macroprudential banking regulation that places a constraint on the share of a risky asset in bankers’ balance sheets. For each policy, our analysis shows that the riskier a bubble, the stricter is the optimal policy, i.e., the higher is the optimal tax or the tighter is the optimal constraint on bankers. In addition, both policies can eliminate toxic asset bubbles. However, these policies have a drawback in practicality: They hinge on the strong assumption that the policymaker can observe bubbles and bubble investment. We thus consider a case in which the policymaker can neither observe bubbles nor bubble investment. In this case, a leverage restriction on bankers, i.e., a constraint on the debt-to-equity ratio, can prevent toxic asset bubbles, although with a trade-off of reducing overall financial intermediation. The analyses of these bubble policies are our second contribution.

Related literature. Our paper is related to a large literature on rational bubbles. Much of the literature has focused on a positive analysis of bubbles. In particular, a common theme in this literature is that rational bubbles emerge to reduce some inefficiency in the financial market, such as an aggregate shortage of assets for storage as in the classic framework in Tirole (1985), or a credit market imperfection, as in the recent work by Miao and Wang (2012, 2015b), Martin and Ventura (2012), Farhi and Tirole (2012), Hirano and Yanagawa (2014), Ikeda and Phan (2014), and Zhao (2015).

Regarding policy analyses that are related to our paper, Saint-Paul (1992), Grossman and Yanagawa (1993), and King and Ferguson (1993) show that, in the presence of externality in capital accumulation, the emergence of bubbles on an unproductive asset would inefficiently divert resources from investment, and thus, there is room for regulating bubbles. Similarly, Hirano et al. (2015) show that taxing oversized bubbles is optimal because they marginally crowd out productive investment. Caballero and Krishnamurthy (2006) show in a small open economy framework that bubbles can marginally crowd out domestic savings and cause a shortage of liquid international assets. Finally, Miao et al. (2014) show that bubbles can crowd in investment excessively rather than crowding it out. While these papers highlight a potential inefficiency of rational bubbles through their negative externality on aggregate productive investment, our paper highlights a different source of inefficiency: bankers’ risk shifting due to debt financing. More broadly, our paper is related to an emerging literature on macroprudential policies.Footnote 1

Outside the rational bubble literature, our paper benefits from an insight from Allen and Gorton (1993), Allen and Gale (2000), and Barlevy (2012), who show how risk shifting pushes the price of a risky asset above its fundamental value in a two- or three-period model without rational bubbles. We further develop this insight into an overlapping generations model with rational bubbles. Likewise, Doblas-Madrid and Lansing (2014)Footnote 2 embeds risk shifting in a model that follows Abreu and Brunnermeier (2003)’s framework. This framework is different from the rational bubble framework in many aspects, one of which is heterogeneous information as a main driving force of bubbles. By contrast, our model does not feature asymmetric information and provides a more tractable environment for policy analyses.

Finally, it is worth mentioning the limitations of an overlapping generations model, although it provides a tractable framework for policy analyses and thus has been widely adopted by the rational bubble literature. In such a model, the traditional interpretation of a period as twenty or thirty years is not appropriate for analyzing standard business cycle fluctuations. Instead, we adopt the convention in the financial friction literature such as Bernanke and Gertler (1989), interpret the entry and exit of finite-lived agents in our model as representing the entry and exit of investors or firms from the credit market, and interpret a period as the length of a typical financial contract such as a loan contract. However, the finite horizon setting still assumes away potentially interesting forward-looking behaviors of agents with an infinite horizon. Recent developments in the literature using an infinite horizon model include Kocherlakota (2009), Hirano and Yanagawa (2014), Miao and Wang (2012, 2014, 2015a, b), Miao et al. (2013a, b, 2014). Among them, Miao and Wang (2012, 2014, 2015b) develop a novel framework of stock price bubbles, while Miao and Wang (2015a) develop a model of bubbles in the value of banks and Miao et al. (2014) develop a model of housing bubbles. Finally, Miao et al. (2013b) provide the first dynamic stochastic general equilibrium (DSGE) model of bubbles, which can be estimated by Bayesian methods. For a survey of the recent bubble literature in an infinite horizon model and its differences from an overlapping generations model, see Miao (2014).

The plan for the rest of the paper is as follows. Section 2 provides the useful benchmark model with no risk shifting. Section 3 introduces our main model. Section 4 provides robustness checks. Section 5 conducts policy analyses. Section 6 concludes. All proofs are in the “Appendix.”

2 Benchmark model with no risk shifting

This section provides the benchmark model with no financial intermediation and thus no risk shifting. Time is discrete, denoted by \(t=0,1,2,\ldots \). There are overlapping generations of households. Each household lives for two periods, young and old ages, and each generation has a constant unit population. For simplicity, we assume households are risk neutral and consume only in old age. Households have no initial asset and supply one unit of labor inelastically to firms when they are young.

There is a constant unit population of competitive firms. A representative firm produces output \(Y_{t}\) by combining capital \(K_{t}\) and labor \(L_{t}\) according to the Cobb–Douglas production function: \(Y_{t}=K_{t}^{\alpha }(A_{t}L_{t})^{1-\alpha }\) with \(0<\alpha <1\). The labor-augmenting productivity \(A_{t}\equiv g^{t}\) grows at a constant exogenous rate of \(g\ge 1\). For simplicity, we assume capital depreciates completely after one period. We also assume:

As will be shown later in this section, this condition corresponds to the classic dynamic inefficiency condition in Tirole (1985), which guarantees the existence of bubble equilibria.

Let \(R_{t}^{k}\) and \(W_{t}\) denote the rental rate of capital and the wage rate, respectively. For each variable \(X_{t}\), denote \(x_{t}\) as the detrended variable: \(x_{t}\equiv X_{t}/A_{t}\) (for example, \(w_{t}\equiv W_{t}/A_{t}\)). Firms’ profit maximization and the labor market-clearing condition (\(L_{t}=1\)) yield standard marginal pricing for factor prices:

We now introduce a bubble. As in Tirole (1985), consider an asset in fixed unit supply that pays no dividend in any period. Thus, the only reason any agent purchases the asset is because he or she expects to be able to sell it later. The asset is called a bubble if its price is positive. Following Weil (1987), we model a stochastic bubble by assuming that in each period, the bubble bursts (i.e., the price permanently collapses to zero) with an exogenous and constant probability \(\lambda \in [0,1)\). Formally, the price process \(\{\tilde{P}_{t}\}_{t\ge 0}\) of a bubble satisfies: if \(\tilde{P}_{t}=P_{t}>0\),

where \(P_{t}\) denotes the price of the bubble conditional on the event that the bubble has not bursted. In addition, once a bubble is collapsed, it will never emerge in the future: \(\Pr (\tilde{P}_{t+1}=0\vert \tilde{P}_{t}=0)=1.\)

There are two cases to be considered: a case in which a bubble persists and another case in which a bubble bursts. First, consider the former case, i.e., \(\tilde{P}_{t}=P_{t}>0\). Each young household directly chooses a savings portfolio consisting of capital \(K_{t+1}\ge 0\) and bubble \(b_{t}\ge 0\) to maximize the expected consumption in old age, \(E_{t}[C_{t+1}(\tilde{P}_{t+1})]\), subject to budget constraints in young and old ages, \(\tilde{P}_{t}b_{t}+K_{t+1}=W_{t}\) and \(C_{t+1}(\tilde{P}_{t+1})=\tilde{P}_{t+1}b_{t}+R_{t+1}^{k}K_{t+1}\), respectively. Given \(\tilde{P_{t}}=P_{t}>0\), the first-order conditions of the problem imply a no-arbitrage condition: \(R_{t+1}^{k}=(1-\lambda )P_{t+1}/P_{t}.\) Detrending the condition yields:

This condition implies that households are indifferent between investing in the capital stock or in the bubble asset. The detrended budget constraint for young households and the consumption in old age in period t are written, respectively, as:

Next, consider a case in which a bubble has bursted, i.e., \(\tilde{P}_{t}=0\). Then the household’s problem is trivial, and each young household simply saves all of the wage income \(W_{t}\) into capital investment so that \(K_{t+1}=W_{t}\). The equilibrium dynamics is summarized by the following two equations:

We are now in a position to define equilibria.

Definition 1

(Equilibria with no risk shifting)

-

1.

Given an initial capital stock \(k_{0}>0\), a no-bubble equilibrium consists of allocation \(\{k_{t+1},c_{t}\}_{t=0}^{\infty }\) and prices \(\{R_{t+1}^{k},w_{t}\}_{t=0}^{\infty }\) that satisfy (2), (3), (8) and (9). A no-bubble steady state consists of allocations \(\{k_{nb},c_{nb}\}\) and prices \(\{R_{nb}^{k},w_{nb}\}\) that satisfy the same conditions but without time subscript t.

-

2.

Given an initial capital stock \(k_{0}>0\), an initial bubble price \(p_{0}>0\), and a stochastic process for a bubble asset (4), a stochastic bubble equilibrium with self-investment consists of allocations \(\{k_{t+1}(\tilde{p}_{t}),c_{t}(\tilde{p}_{t})\}_{t=0}^{\infty }\) and prices \(\{R_{t}^{k}(\tilde{p}_{t}),w_{t}(\tilde{p}_{t}),\tilde{p}_{t}\}_{t=0}^{\infty }\) such that (i) conditions (2) and (3) are satisfied; (ii) if \(\tilde{p}_{t}=p_{t}>0\), then conditions (5), (6), and (7) are satisfied; (iii) if \(\tilde{p}_{t}=0\), then conditions (8) and (9) are satisfied. A stochastic bubble steady state with self-investment consists of allocations \(\{k_\mathrm{self},c_\mathrm{self}\}\) and prices \(\{R_\mathrm{self}^{k},w_\mathrm{self},p_\mathrm{self}\}\) that satisfy the conditions (i) and (ii) of a bubble equilibrium with self-investment where time subscript t is removed.

As in the rational bubble literature, there are two types of bubbles: asymptotic bubbles and transitory bubbles. Given \(p_{0}>0\), an asymptotic bubble is such that the limit of the price of the unburst bubble is positive, i.e., \(\lim _{t\rightarrow \infty }p_{t}>0\). A transitory bubble is such that the price of the unburst bubble converges to zero, i.e., \(\lim _{t\rightarrow \infty }p_{t}=0\). As in the standard bubble literature, we focus on asymptotic bubble equilibria.

The following Lemma states the conditions under which bubble equilibria exist, and shows the uniqueness of an asymptotic bubble equilibrium. Because an asymptotic bubble equilibrium coincides with a stochastic bubble steady state if an initial capital stock is given by \(k_{0}=k_\mathrm{self}\), we define social welfare as the expected utility in a stochastic bubble steady state.

Lemma 1

(Existence of equilibria with no risk shifting)

-

1.

There is a unique no-bubble equilibrium for each initial \(k_{0}>0\). In steady state, capital and prices are given by: \(k_{nb}=[(1-\alpha )/g]^{\frac{1}{1-\alpha }},\) \(R_{nb}^{k}=\alpha g/(1-\alpha )\), and \(w_{nb}=(1-\alpha )k_{nb}^{\alpha }.\) Consumption (welfare) is given by \(c_{nb}=\alpha [(1-\alpha )/g]^{\frac{\alpha }{1-\alpha }}.\)

-

2.

There exist bubble equilibria if and only if dynamic inefficiency condition (1) holds, and the risk of bursting \(\lambda \) is not too large: \(\lambda <\underline{\lambda }\equiv (1-2\alpha )/(1-\alpha ).\)

-

3.

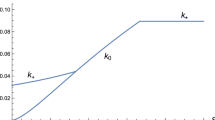

When bubbles exist, there is a unique asymptotic equilibrium. In stochastic bubble steady state, capital and prices are given by: \(k_\mathrm{self}=\{\alpha /[(1-\lambda )g]\}^{\frac{1}{1-\alpha }},\) \(R_\mathrm{self}^{k}=(1-\lambda )g\), \(w_\mathrm{self}=(1-\alpha )k_\mathrm{self}^{\alpha }\), and \(p_\mathrm{self}=[1-\alpha -\alpha /(1-\lambda )]k_\mathrm{self}^{\alpha }\). The expected consumption (welfare) is given by:

$$\begin{aligned} c_\mathrm{self}^{e}= & {} \left( 1-\lambda \right) \underbrace{\left( 1-\frac{\alpha }{1-\lambda }\right) k_\mathrm{self}^{\alpha }}_{{c\mathrm{if}~ \mathrm{bubble}~\mathrm{persists}}}+\lambda \underbrace{R_\mathrm{self}^{k}k_\mathrm{self}}_{{c\mathrm{if}~\mathrm{bubble}~\mathrm{collapses}}}\\= & {} (1-\lambda )(1-\alpha )\left[ \frac{\alpha }{(1-\lambda )g}\right] ^{\frac{\alpha }{1-\alpha }}. \end{aligned}$$

We then have the following benchmark result regarding welfare:

Lemma 2

In the economy with self-investment, a bubble improves welfare: \(c_\mathrm{self}^{e}>c_{nb}\).

Lemma 2 restates the standard result in the rational bubble literature that bubbles improve welfare. Intuitively, a bubble improves welfare since it mitigates the shortage of storage that generates inefficiency in the financial market. In the next section, we overturn this result by extending the benchmark model to incorporate imperfect financial intermediation.

3 Model of bubbles with risk shifting

3.1 Bubbles with risk shifting

We now introduce risk shifting to the benchmark model. In this model, young households cannot directly invest in capital or a bubble asset. Instead, they put their savings in financial intermediaries (“bankers”) who invest on their behalves. Figure 1 summarizes this setup. The setup captures the fact that in practice most households do not directly manage their wealth and delegate wealth management to financial intermediaries. Similar to households, bankers exist for two periods, and in each period, the population of new bankers is unity. We assume that households lend to bankers through a standard debt contract as in Jensen and Meckling (1976), Stiglitz and Weiss (1981), Allen and Gorton (1993) and Allen and Gale (2000).Footnote 3 In particular, new bankers offer a non-contingent debt contract to young households at the interest rate \(R_{t+1}^{d}\), take deposits of young households, \(D_{t}\), and use the deposits to invest in capital and a bubble asset. However, bankers have an option to default on their debt obligation. If a bank defaults (i.e., declares bankruptcy), all of its assets are seized and distributed equally to its depositors. Each new banker in period t chooses its portfolio to maximize the expected profit in period \(t+1\):

subject to \(D_{t}=\tilde{P}_{t}b_{t}+K_{t+1}\). Profit function \(\varPi _{t+1}(\tilde{P}_{t+1})\) captures the nature of a standard debt contract: If the return on investment, \(\tilde{P}_{t+1}b_{t}+R_{t+1}^{k}K_{t+1}\), is smaller than the amount owed plus interest, \(R_{t+1}^{k}D_{t}\), then a bank defaults on its debt and households seize all of the bank’s assets. As a consequence, bankers do not fully internalize the downside risk of its investment, causing an agency problem. Household consumption in old age is given by:

Bankers’ optimization problem is solved by guessing and verifying that bankers default on their promised payment if and only if the bubble bursts. Given this guess, their expected profit is given by:

Profit maximization yields the following no-arbitrage conditions: \(R_{t+1}^{d}=R_{t+1}^{k}\) and \(P_{t+1}/P_{t}=R_{t+1}^{k}\). Detrending the later condition yields:

Compared with the benchmark model presented in the previous section, the only difference between the no-arbitrage conditions regarding the choice of a bubble asset, (5) and (13), lies in the absence of the probability of bubble bursting \(\lambda \) in (13). This is the manifestation of risk shifting in this model: Because bankers can default and avoid negative profit when the bubble bursts, they focus only on the high return when the bubble sustains and ignore the loss when the bubble bursts. As a consequence, bankers shift the bubble’s risk of bursting to households, and the households’ consumption drops when the bubble bursts as shown in (11).

The no-arbitrage conditions imply that competitive bankers earn zero profit even when the bubble does not burst. On the other hand, each bank’s profit would be negative if the bank repaid their debt after the bubble bursted: \(\varPi _{t+1}(\tilde{P}_{t+1}=0)=R_{t+1}^{k}K_{t+1}-R_{t+1}^{d}(P_{t}b_{t}+K_{t+1})=-R_{t+1}^{k}P_{t}b_{t}<0.\) Therefore, bankers default when the bubble bursts, as previously guessed.

We now define a stochastic bubble equilibrium with risk shifting and a stochastic bubble steady state with risk shifting in the same manner as in Definition 1, except that the no-arbitrage condition (13) replaces that in the benchmark model (5), and the deposit amount and the deposit interest rate are given by \(d_{t}=w_{t}\) and \(R_{t+1}^{d}=R_{t+1}^{k}\), respectively. As in the previous section, we focus on an asymptotic bubble equilibrium and its stochastic steady state. Note that a no-bubble equilibrium in this model is the same as that in the benchmark model.

The following Proposition summarizes the properties of the bubble equilibria with risk shifting:

Proposition 3

(Bubble equilibria with risk shifting)

-

1.

The bubble equilibria exist if and only if condition (1) holds, irrespective of the bubble’s risk of bursting \(\lambda \).

-

2.

In the stochastic bubble steady state, capital and prices are given by: \(k_{b}=(\alpha /g)^{\frac{1}{1-\alpha }},\) \(R_{b}^{k}=R_{b}^{d}=g\), \(w_{b}=(1-\alpha )k_{b}^{\alpha },\) and \(p_{b}=(1-2\alpha )k_{b}^{\alpha }\). The expected steady-state consumption (welfare) is given by:

$$\begin{aligned} c_{b}^{e}=(1-\lambda )\underbrace{(1-\alpha )\left( \frac{\alpha }{g}\right) ^{\frac{\alpha }{1-\alpha }}}_{{c \mathrm{if}\mathrm{bubble} \mathrm{persists}}}+\,\,\lambda \underbrace{\alpha \left( \frac{\alpha }{g}\right) ^{\frac{\alpha }{1-\alpha }}}_{{c\mathrm{if bubble collapses}}}. \end{aligned}$$

Intuitively, because bankers ignore the risk of bubble burst due to their debt financing, bankers’ no-arbitrage condition (13) does not involve the bubble’s probability of bursting \(\lambda \). As a consequence, unlike in the benchmark model, \(\lambda \) does not affect the existence condition of bubble equilibria.

The fact that the bankers ignore the risk of bubble burst and shift the risk to households have an interesting implication for the size of bubble, as stated in the following corollary.

Corollary 4

The size of the bubble in the stochastic bubble steady state with risk shifting is larger than that with no risk shifting:

Intuitively, risk shifting induces bankers to chase the high upside return from the risky bubble and leads to a high demand for the bubble asset, which inflates the size of the bubble.

3.2 Toxic asset bubbles

Now we are in a position to analyze the welfare implications of bubbles. Recall from Proposition 3 that the expected consumption in the bubble steady state with risk shifting is

where \(c_{b}\) is the consumption if the bubble persists and \(c_{b}^{L}\) is the consumption if the bubble collapses. On the one hand, assumption (1) implies that \(c_{b}\) is higher than \(c_{b}^{L}\). Indeed, \(c_{b}\) is the first-best steady-state consumption level in this economy.Footnote 4 On the other hand, assumption (1) implies that \(c_{b}^{L}\) is lower than the consumption in the no-bubble steady state, \(c_{nb}\). Hence, from Eq. (14), the expected consumption in the bubble steady state is lower than that in the no-bubble steady state, \(c_{b}^{e}<c_{nb}\), if and only if the probability of bubble burst \(\lambda \) is higher than \(\bar{\lambda }\), where:

which is the solution to equation \((1-\overline{\lambda })c_{b}+\overline{\lambda }c_{b}^{L}=c_{nb}\). Assumption (1) ensures \(0<\overline{\lambda }<1\); for example, \(\overline{\lambda }=0.379\) when \(\alpha =0.4\). Thus, with risk shifting, there exist equilibria with excessively risky bubbles that reduce welfare, that is, an asymptotic bubble equilibria with \(c_{b}^{e}<c_{nb}\).

In the economy with self-investment, however, no welfare-reducing bubbles exist. To see this, recall that the existence of bubble equilibria with self-investment requires \(\lambda \) to be lower than \(\underline{\lambda }\) (Lemma 1). But assumption (1) implies \(\overline{\lambda }>\underline{\lambda }.\) Thus, there do not exist self-investment equilibria with bubbles whose risk is larger than \(\overline{\lambda }\).

Intuitively, in the self-investment economy, agents fully internalize the risk of a bubble, as shown in no-arbitrage condition (5), and thereby a bubble is welfare improving. However, when bankers can shift risks to households, they do not internalize the risk of a bubble and only care about the high return when the bubble grows, as shown in no-arbitrage condition (13). This equation implies that bankers behave as if the bubble would last forever. Ironically, households enjoy the first-best consumption if the bubble does not burst. Yet, the consumption drops sharply when the bubble collapses, because bankers default on their debt and avoid the loss caused by the bubble burst. Hence, regardless of the bubble’s risk, there exist bubble equilibria. In particular, there exist bubble equilibria with toxic bubbles.

Throughout the rest of the paper, we call a bubble “toxic” if its risk of bursting satisfies \(\lambda >\overline{\lambda }\). The analysis above shows that welfare with bubble is smaller than welfare with no bubble if and only if the bubble is toxic. The following proposition summarizes the results regarding toxic asset bubbles:

Proposition 5

(Toxic asset bubbles)

-

1.

In the economy with risk shifting, there exist equilibria with toxic bubbles, i.e., bubbles with \(\lambda >\overline{\lambda }\). Such bubbles reduce welfare in steady state: \(c_{b}^{e}<c_{nb}\).

-

2.

In the economy with self-investment, equilibria with toxic bubbles do not exist.

4 Robustness checks

This section shows that our results are robust to alternative assumptions.

4.1 n-period overlapping generations

For tractability, we have adopted the standard two-period overlapping generation setup as in the classic Samuelson–Diamond–Tirole framework. Indeed, our main results are robust to generations with longer horizons. “n-period overlapping generations” in Appendix extends the model to an environment in which each household lives for n-periods, having lifetime utility \(E_{t}(c_{1,t}+\beta c_{2,t+1}+\cdots +\beta ^{n-1}c_{n,t+n-1})\), and saves a fraction s of its wealth in each of the first \(n-1\) periods of their life.

4.2 Risk-averse households in old age

This subsection allows old households to be risk averse instead of being risk neutral. Our result is in fact strengthened if old households are risk averse: A toxic bubble reduces social welfare even more when old households are risk averse. Suppose households’ utility of consumption in old age is \(u(c_{t})\), where \(u(\cdot )\) is strictly increasing and strictly concave. We still maintain the simplifying assumptions that households do not consume in young age and bankers are risk neutral. It is straightforward to show that both the bubble steady state with financial intermediation and the no-bubble steady state are not affected by households’ risk aversion. In particular, the existence condition for bubbles under risk shifting is the same dynamic inefficiency condition (1). Thus, Proposition 3 continues to hold. However, not surprisingly, the threshold \(\overline{\lambda }\) for toxic bubble risk in Proposition 5 is lowered, i.e., a risky bubble is more likely to be toxic, due to risk aversion. This threshold is defined implicitly by the following equation: \((1-\overline{\lambda })u(c_{b})+\overline{\lambda }u(c_{b}^{L})=u(c_{nb})\). Because the consumption in the stochastic bubble steady state drops sharply in the case of bubble burst, the more risk averse are the households in old age, the larger is the loss from the bubble burst, and the smaller is \(\overline{\lambda }\). As numerical examples with \(u(c)=c^{1-\sigma }/(1-\sigma )\), the thresholds are \(\bar{\lambda }=0.33\) when \(\sigma =1\) and \(\bar{\lambda }=0.25\) when \(\sigma =3\), both of which are smaller than 0.38 in the case of linear utility.

4.3 Risk-averse households in both periods of life

Now suppose households are risk averse and consume in young age as well. The expected lifetime utility of a generation born in period t is given by \(\log (C_{t}^{y})+\beta E_{t}\log (C_{t+1}^{o})\) where \(C_{t}^{y}\) is consumption in young age and \(C_{t+1}^{o}\) is consumption in old age. The existence condition for bubbles under risk shifting in Proposition 3 becomes \(\alpha <\beta /(1+2\beta )\) which corresponds to a dynamic inefficiency condition in this environment, and is again independent of the risk of bubble burst. “Risk-averse households in both periods of life” in Appendix derives this result and shows that Proposition 5 is robust to this extension, with a different threshold \(\overline{\lambda }\) for toxic bubbles. As a numerical example, the threshold is \(\bar{\lambda }=0.14\) when \(\alpha =0.3\) and \(\beta =1\).Footnote 5

4.4 Varying bubble risk \(\lambda \)

We have maintained the assumption that the risk of bubble burst \(\lambda \) is constant. However, the size of a bubble could affect the risk of bubble burst (Filardo 2009). This possibility can be taken into account by assuming that \(\lambda \) is a function of the size of a bubble. That is, if a bubble has not bursted in \(t-1\), then the probability of bubble burst in period t is \(\lambda (P_{t})\), where \(\lambda (P)\) is an exogenous function that is increasing in P. However, agents do not internalize the effect of their actions on the aggregate size of the bubble \(P_{t}\) because they are infinitesimal. Thus, not surprisingly, Proposition 3 and Proposition 5 still apply.Footnote 6

4.5 Aggregate shocks

So far we have assumed no aggregate shocks. Assume instead that \(A_{t}=a_{t}g^{t}\), where \(a_{t}\) is identically and independently distributed on \([\underline{a},\overline{a}]\subset (0,\infty )\) over time with its mean normalized to one. In addition, to introduce bankers’ net worth in a simple way, assume that bankers work in the first period of their lives as households do; in the first period of their lives, each banker supplies \(\epsilon \) units of labor inelastically and each household supplies \(1-\epsilon \) units of labor inelastically. Thus, each banker’s net worth is \(\epsilon W_{t}\). Assume the fluctuations in \(a_{t}\) is sufficiently small relative to the net worth of bankers, so that a negative productivity shock is not enough to cause bankers to default when the bubble persists, and a positive productivity shock is not enough to prevent bankers from defaulting when the bubble bursts. This assumption captures the idea that it is the collapses of bubbles that trigger crises rather than regular business cycle fluctuations. “Aggregate shocks” in Appendix shows that Propositions 3 and 5 are robust to this extension with an aggregate shock.

5 Policy analysis

We have shown how toxic bubbles can emerge in an economy with risk shifting. This market failure warrants policy interventions. The model presented in Sect. 3 provides a tractable framework for policy analyses. In this section, we explore three sets of policy that are often discussed among scholars and policymakers: ex-post bubble pricking, ex-ante tax or restriction on bubble investment, and ex-ante leverage restriction. The first two sets of policy assume that the government can observe bubbles and bubble investment. The last policy assumes that the government can neither observe bubbles nor bubble investment.

5.1 Pricking a bubble

An important policy question is whether it is optimal for the government to “prick” a bubble when it already exists. Our model can provide an answer to this question.

Suppose that the economy is in the stochastic bubble steady state with risk shifting, and consider an ex-post unanticipated policy that makes the bubble collapse in period T.Footnote 7 Because bubbles are assumed not to re-emerge, it follows that from period T onward, the economy converges to the steady state with no bubble. For \(t\ge T\), the transitional dynamics of consumption and capital follow the dynamics of the no-bubble equilibrium: \(k_{t+1}=[(1-\alpha )/g]k_{t}^{\alpha }\) and \(c_{t}=\alpha k_{t}^{\alpha }\) for all \(t\ge T\), and \(k_{T}=k_{b}\). Because of the transitional dynamics, instead of looking at steady-state expected utility as social welfare, we look at the expected utility of each generation, starting with the generation born in period \(T-1\). If the bubble is sufficiently risky, then pricking the bubble in period T can improve the expected utility of all generations born in periods \(t\ge T\). At the same time, however, pricking the bubble obviously hurts the current bubble holders, i.e., the old households in period T, as their consumption drops below the level they enjoyed in the bubble period: \(c_{T}=\alpha k_{b}^{\alpha }<c_{b}^{e}\). We formalize this result in the first part of Proposition 6 below.

A natural question then emerges: Is there a policy that improves the expected utility of all generations? The answer is yes. Such a policy combines pricking the bubble with a one-time redistribution in the same period. The redistribution is implemented by a lump-sum tax on young households who benefit from the pricking and a lump-sum transfer to old households who are hurt by the pricking. Note that this policy is equivalent to a policy where the government uses revenues from taxing the current young households to purchase the bubble from the current old households, in order to remove the “toxic asset” from the financial market. We formalize this result in the second part of the following proposition:

Proposition 6

(Pricking bubble) Consider the bubble steady state with risk shifting.

-

1.

If the bubble is sufficiently risky:

$$\begin{aligned} \lambda >\check{\lambda }\equiv \frac{1-\alpha }{1-2\alpha }\left[ 1-\left( \frac{\alpha }{1-\alpha }\right) ^{1-\alpha }\right] \in \left( \overline{\lambda },1\right) , \end{aligned}$$(16)then an unanticipated policy that pricks the existing bubble improves the expected utility for all generations except for the current old generation (who holds the bubble).

-

2.

If the bubble is sufficiently risky:

$$\begin{aligned} \lambda \ge \hat{\lambda }\equiv \frac{1-\alpha }{2-\alpha }\left[ \frac{\left( \frac{1-\alpha }{\alpha }\right) ^{1-\alpha }-\frac{\alpha }{1-\alpha }}{1+\left( \frac{1-\alpha }{\alpha }\right) ^{1-\alpha }}\right] \in (\check{\lambda },1), \end{aligned}$$then an unanticipated policy that pricks the existing bubble, combined with a one-time lump-sum redistribution of \(\theta =\alpha k_{b}^{\alpha }-c_{b}^{e}\) from the current young households’ wage income to the current old households, is a Pareto improvement.

As a numerical illustration, if \(\alpha =0.4\), then the thresholds are \(\check{\lambda }=0.648\) and \(\hat{\lambda }=0.802\). For simplicity, we have considered lump-sum taxation. If we instead consider a distortionary tax such as a labor income tax with an endogenous labor decision, the threshold of bubble risk that warrants bubble pricking would increase, as taxation has a distortionary cost.

5.2 Regulation on speculation

The next two subsections analyze two ex-ante policies respectively. First, as in Hirano and Yanagawa (2014), we consider macroprudential policy that imposes a tax \(\tau \) per units of bubble speculation. The tax revenue is transferred in a lump-sum manner to the current old for consumption. Suppose that the government can observe the bubble’s risk \(\lambda \) and set the tax \(\tau \) as a function of \(\lambda \). Then, the optimization problem of bankers is given by:

The government chooses \(\tau \) in period \(t=0\) to maximize the expected utility in the stochastic bubble steady state with risk shifting. The tractability of the model allows us to find a closed-form solution to this problem. The following proposition summarizes this result:

Proposition 7

The optimal macroprudential tax on bubble speculation is:

Note that the optimal tax is increasing in the bubble’s risk \(\lambda \), as one would expect. In particular, if the bubble becomes too risky, then the optimal tax policy is to shut down the market for bubble completely, i.e., to make \(p_{t}=0\) by imposing the highest tax of \(\tau ^{*}=(1-2\alpha )/(1-\alpha )\). Interestingly, the optimal tax is positive even if the bubble’s risk is small so that the bubble is not toxic. This feature has to do with Corollary 4 that shows \(p_{b}>p_\mathrm{self}\). The optimal tax addresses the inflated asset bubble caused by the banks’ risk shifting.

Next, we consider a macroprudential banking regulation that limits bankers’ holding of the bubble asset:

where \(0\le \kappa \le 1\) is a required bubble–capital ratio set by the government in period \(t=0\). The optimization problem of bankers is then:

subject to constraint (17). The government chooses \(\kappa \) in period \(t=0\) to maximize the expected utility in the stochastic bubble steady state with risk shifting. Again, the parsimonious model allows us to find a closed-form solution for the optimal regulation. The following proposition summarizes our finding:

Proposition 8

The optimal regulation on a bubble–capital ratio is given by:

Note that the optimal regulation \(\kappa ^{*}\) is decreasing in the bubble’s risk \(\lambda \), so that the optimal regulation becomes tighter as the bubble’s risk becomes higher. In addition, if the bubble is too risky, then the optimal regulation completely shuts down the bubble market by setting \(\kappa ^{*}=0\). As in the case of the optimal tax, when the bubble’s risk is positive, the optimal regulation in the form of constraint (17) is always binding so that the regulation restricts the bubble investment to address the inflated bubble caused by the banks’ risk shifting.

5.3 Leverage restriction

All of the policy exercises above make the strong assumption that the government can perfectly observe bubbles and target bubble investment. In this subsection, we relax this assumption and consider a case in which the government can observe neither bubbles nor bubble investment. Here we consider the often discussed policy of leverage restriction.Footnote 8

Consider a modified version of the model presented in Sect. 3. In this model, the government can impose a limit on bankers’ leverage, which is defined as the ratio of debt over net worth. To introduce bankers’ net worth, we use the setup used in Sect. 4.5 such that each banker is endowed with \(\epsilon \) units of time, works and earns \(\epsilon W_{t}\) and uses the wage income as the net worth. The government imposes the following constraint on leverage:

where the left-hand side is the leverage of the banking sector, and \(\phi >0\) is the restriction chosen by the government.

In practice, there is a trade-off associated with leverage restriction. On the one hand, it reduces the banking sector’s risk taking. On the other hand, it reduces useful financial intermediation, as the financial system is usually more efficient than households at investing. To introduce this trade-off in a simple manner, we maintain the assumption that households cannot directly invest in the bubble asset, but relax the assumption that households cannot directly invest in capital. Instead, we assume that households can invest in capital, but they are less productive than bankers at doing so. In particular, while each banker can turn one unit of the consumption good into one unit of capital, each household can turn one unit of the consumption good into only \(1-\xi <1\) units of capital.

The optimization problem of a representative bank is:

subject to \(\tilde{P_{t}}b_{t}+K_{t+1}^{b}=\epsilon W_{t}+D_{t}\) and \(D_{t}\le \phi \,\epsilon W_{t}\), where \(K_{t+1}^{b}\) denotes the amount of capital invested by the bank. We focus on the case of binding leverage restriction so that it puts a limit on bank borrowing that can be used for investing in the bubble asset. Thus, if the leverage restriction is tight enough, bankers do not have enough funds at hand to support bubbles. The tight restriction, however, comes at a cost. It reduces bank intermediation and increases unproductive capital investment by households. Then, which is better in terms of welfare, a bubble equilibrium without a leverage restriction or a bubble-less equilibrium with a tight leverage restriction? If the bubble is sufficiently risky, then a tight leverage restriction improves welfare. The following result formalizes this intuition:

Proposition 9

In an asymptotic bubble equilibrium, the price of the bubble asset is given by \(p_{b}=\{[1-\xi (1-\epsilon (1+\phi ))](1-\alpha )-\alpha \}(\alpha /g)^{\frac{\alpha }{1-\alpha }}\) and is increasing in \(\phi \). If a leverage restriction is sufficiently stringent such that \(\phi \le \frac{\frac{\alpha }{1-\alpha }-(1-\xi )}{\epsilon \xi }-1\), then there is no bubble equilibrium. Furthermore, if the bubble is sufficiently risky:

then preventing bubbles by setting leverage restriction \(\phi \le \frac{\frac{\alpha }{1-\alpha }-(1-\xi )}{\epsilon \xi }-1\) improves welfare.

Proposition 9 implies that the government can eliminate toxic bubbles if it sets a sufficiently tight leverage restriction. It is straightforward to show that this result is robust when there are small aggregate shocks, as in the robustness check in Sect. 4.5.

6 Concluding remarks

We have developed an overlapping generations model of welfare-reducing asset bubbles in a general equilibrium with financial intermediation. The model features leveraged bubble investment and defaultable debt within a standard rational bubble framework. Because debt is defaultable, leveraged borrowers do not fully internalize the downside risk of bubble investment and are thus willing to speculate on excessively risky bubbles that give high upside returns. Our setup with limited-liability bankers as borrowers provides a simple and intuitive illustration of this mechanism.

For tractability, we have abstracted away from the expansionary (or crowd-in) effect of bubbles on investment and output, which is now well known thanks to many recent papers such as Martin and Ventura (2011, 2012), Farhi and Tirole (2012), Ikeda and Phan (2014), and Miao and Wang (2015b). Introducing the expansionary effect of bubbles would lead to two opposing effects of bubbles on welfare. On the one hand, as these papers point out, bubbles improve the efficiency of the allocation of resources in the economy as long as they persist. On the other hand, as our paper points out, if bubble investment is leveraged, bubbles can generate excessive volatility in the economy due to their risk of bursting. Our goal is to illustrate the latter effect in the clearest possible model, and a full analysis of the two opposing effects of bubbles is left for future work.

In concluding the paper, we find it useful to relate our paper to the US housing bubble episode in the 2000s. In the boom phase, more households with low income purchased houses with loans made by financial intermediaries. The intermediaries, in turn, financed their lending by securitizing the mortgage loans as mortgage-backed securities (MBS) and selling the securities to others. The MBS rating was high overall, and newly supplied MBS met an increase in demand for safe assets by intermediaries such as institutional investors and mutual funds. While such securities were traded many times, it was ultimately the financial sector that held the most of the securities. The financial sector as a whole made mortgage lending, generated MBS, and financed the lending collateralized by the securities from households and foreign investors (Rajan 2011; Stiglitz 2012). Given this narrative, actual financial intermediaries had an aspect of risk shifting similar to bankers in our model. The fact that most of MBS were treated as safe assets in spite of their default risk implied that the financial sector mis-priced the risk, helped fuel the credit-driven housing boom and aggravated the bust in housing prices. While our model is so stylized that it abstracts from a housing sector, securitization, and collateralization, it sheds light on how risk shifting can play an important role in facilitating the risky US housing bubble episode in the 2000s. For the literature on housing bubbles, see the empirical work of Mian and Sufi (2014), the theoretical work of Zhao (2015), Bengui and Phan (2015) and references therein.

In summary, our model provides a tractable framework in which excessively risky bubbles that reduce welfare can emerge and policy interventions are warranted. In the hindsight of the financial crisis of 2007–2009, the economic profession has paid significant attention to the normative question of how to address booms and busts in asset prices. This paper aims to be a small building block toward that greater project.

Notes

See Galati and Moessner (2013) for a review of the literature.

For a related near-rational bubble model of bubbles in equity price, see Lansing (2012).

“Microfoundation for standard debt contract” in Appendix provides a microfoundation for this assumption by using costly state verification, as in Townsend (1979).

Formally, following Diamond (1965), we consider a benevolent planner who allocates consumption and capital investment to maximize steady-state consumption, subject to resource constraint \(c+gk=f(k)\). The optimization problem is: \(\max _{k\ge 0}f(k)-gk\). The solution, which is known as the “golden rule,” is \(k_\mathrm{gold}=(\alpha /g)^{\frac{1}{1-\alpha }}=k_{b}\) and \(c_\mathrm{gold}=c_{b}\).

If \(\alpha =0.4\) instead as in the previous numerical examples, bubbles do not exist because the existence condition in this case is \(\alpha <1/3\).

The equilibrium quantities \(k_{b},R_{b}^{k},w_{b},p_{b}\) in Proposition 3 are unaffected, while the expected consumption is slightly different and given by:

$$\begin{aligned} c_{b,t}^{e}=[1-\lambda (p_{b}k_{b}^{\alpha }g^{t})](1-\alpha )\left( \frac{\alpha }{g}\right) ^{\frac{\alpha }{1-\alpha }}+\lambda (p_{b}k_{b}^{\alpha }g^{t})\alpha \left( \frac{\alpha }{g}\right) ^{\frac{\alpha }{1-\alpha }}. \end{aligned}$$The condition for toxic bubbles, \(\lambda >\bar{\lambda }\), is equivalent to \(p_{b}k_{b}^{\alpha }g^{t}>\lambda ^{(-1)}(\bar{\lambda })\), where \(\lambda ^{(-1)}(x)\) is the inverse function of \(\lambda (x)\).

Such a bubble pricking policy includes outright banning the trading of the bubble asset and a tax on trading the bubble asset. For the latter policy, see Proposition 7, which shows that high tax effectively eliminates bubble equilibria.

See, e.g., Shin (2011) on Basel III framework.

References

Abreu, D., Brunnermeier, M.K.: Bubbles and crashes. Econometrica 71(1), 173–204 (2003)

Allen, F., Gale, D.: Bubbles and crises. Econ. J. 110(460), 236–255 (2000)

Allen, F., Gorton, G.: Churning bubbles. Rev. Econ. Stud. 60(4), 813–836 (1993)

Angelides, P., Thomas, B., et al.: The financial crisis inquiry report: final report of the national commission on the causes of the financial and economic crisis in the United States (Revised Corrected Copy). Government Printing Office (2011)

Barlevy, G.: Rethinking Theoretical Models of Bubbles. New Perspectives on Asset Price Bubbles (2012)

Barlevy, G., Fisher, J.: Mortgage Choices and Housing Speculation. FRB of Chicago Working Paper (2012)

Bengui, J., Phan, T.: Inequality, financial frictions and asset bubbles. Working paper (2015)

Bernanke, B., Gertler, M.: Agency costs, net worth, and business fluctuations. Am. Econ. Rev. 79, 14–31 (1989)

Caballero, R.J., Krishnamurthy, A.: Bubbles and capital flow volatility: causes and risk management. J. Monet. Econ. 53(1), 35–53 (2006)

Diamond, P.A.: National debt in a neoclassical growth model. Am. Econ. Rev. 55(5), 1126–1150 (1965)

Doblas-Madrid, A., Lansing, K.: Credit-Fuelled Bubbles. Working paper (2014)

Farhi, E., Tirole, J.: Bubbly liquidity. Rev. Econ. Stud. 79(2), 678–706 (2012)

Filardo, A.: Household debt, monetary policy and financial stability: still searching for a unifying model. In: Bank for International Settlements (ed.), Household Debt: Implications for Monetary Policy and Financial Stability, pp. 31-50. BIS papers no. 46 (2009)

Galati, G., Moessner, R.: Macroprudential policy—a literature review. J. Econ. Surv. 27(5), 846–878 (2013)

Grossman, G.M., Yanagawa, N.: Asset bubbles and endogenous growth. J. Monet. Econ. 31(1), 3–19 (1993)

Hirano, T., Yanagawa, N.: Asset bubbles, endogenous growth, and financial frictions. Working paper (2014)

Hirano, T., Inaba, M., Yanagawa, N.: Asset bubbles and bailout. J. Monet. Econ. (2015, forthcoming)

Ikeda, D., Phan, T.: Asset bubbles and global imbalances. Working paper (2014)

Jensen, M.C., Meckling, W.H.: Theory of the firm: Managerial behavior, agency costs and ownership structure. J. Financ. Econ. 3(4), 305–360 (1976)

Jordà, Ò., Schularick, M., Taylor, A.M.: Leveraged bubbles. J. Monet. Econ. (forthcoming)

Kindleberger, C.P., Aliber, R.Z.: Manias, panics and crashes: a history of financial crises. Palgrave Macmillan, New York (2011)

King, I., Ferguson, D.: Dynamic inefficiency, endogenous growth, and ponzi games. J. Monet. Econ. 32(1), 79–104 (1993)

Kocherlakota, N.: Bursting bubbles: consequences and cures. Unpublished manuscript, Federal Reserve Bank of Minneapolis (2009)

Lansing, K.J.: Speculative growth, overreaction, and the welfare cost of technology-driven bubbles. J. Econ. Behav. Organ. 83(3), 461–483 (2012)

Martin, A., Ventura, J.: Theoretical notes on bubbles and the current crisis. IMF Econ. Rev. 59(1), 6–40 (2011)

Martin, A., Ventura, J.: Economic growth with bubbles. Am. Econ. Rev. 102(6), 3033–3058 (2012)

Mian, A., Sufi, A.: House prices, home equity-based borrowing, and the us household leverage crisis. Am. Econ. Rev. 101(5), 2132–56 (2011)

Mian, A., Sufi, A.: House of Debt: How They (and You) Caused the Great Recession, and How We Can Prevent It from Happening Again. University of Chicago Press, Chicago (2014)

Miao, J.: Introduction to economic theory of bubbles. J. Math. Econ. 53, 130–136 (2014)

Miao, J., Wang, P.: Bubbles and total factor productivity. Am. Econ. Rev. 102(3), 82–87 (2012)

Miao, J., Wang, P.: Sectoral bubbles, misallocation, and endogenous growth. J. Math. Econ. 53, 153–163 (2014)

Miao, J., Wang, P.: Banking bubbles and financial crises. J. Econ. Theory 157, 763–792 (2015a)

Miao, J., Wang, P.: Bubbles and credit constraints. Working paper (2015b)

Miao, J., Wang, P., Xu, L.: Stock market bubbles and unemployment. Working paper (2013a)

Miao, J., Wang, P., Xu, Z.: A Bayesian DSGE model of stock market bubbles and business cycles. Working paper (2013b)

Miao, J., Wang, P., Zhou, J.: Housing bubbles and policy analysis. Working paper (2014)

Minsky, H.P.: Stabilizing an Unstable Economy, vol. 1. McGraw-Hill, New York (2008)

Rajan, R.G.: Fault Lines: How Hidden Fractures Still Threaten the World Economy. Princeton University Press, Princeton (2011)

Reinhart, C.M., Rogoff, K.: This Time is Different: Eight Centuries of Financial Folly. Princeton University Press, Princeton (2009)

Saint-Paul, G.: Fiscal policy in an endogenous growth model. Q. J. Econ. 107(4), 1243–1259 (1992)

Samuelson, P.A.: An exact consumption-loan model of interest with or without the social contrivance of money. J. Polit. Econ. 66(6), 467–482 (1958)

Shin, H.S.: Macroprudential policies beyond Basel III. BIS Pap. 1, 5 (2011)

Stiglitz, J.E.: The Price of Inequality: How Today’s Divided Society Endangers our Future. W. W. Norton, New York (2012)

Stiglitz, J.E., Weiss, A.: Credit rationing in markets with imperfect information. Am. Econ. Rev. 71(3), 393–410 (1981)

Tirole, J.: Asset bubbles and overlapping generations. Econometrica 53(6), 1499–1528 (1985)

Townsend, R.M.: Optimal contracts and competitive markets with costly state verification. J. Econ. Theory 21(2), 265–293 (1979)

Weil, P.: Confidence and the real value of money in an overlapping generations economy. Q. J. Econ. 102(1), 1–22 (1987)

Zhao, B.: Rational housing bubble. Econ. Theory 60(1), 141–201 (2015)

Acknowledgments

We thank Jianjun Miao and an anonymous referee for useful comments. We wish to thank our colleagues Gadi Barlevy, Bob Barsky, Craig Burnside, Jeff Campbell, Bill Keech, and Tomohiro Hirano for their suggestions. We also thank the seminar and workshop participants at Duke University, the Federal Reserve Bank of Chicago, the Bank of Japan, the University of Tokyo, the University of Montreal, the Asia Pacific Conference on Economic Dynamics, and the 7th Annual Workshops of the Asian Research Network for their helpful comments. The views expressed in this paper are those of the authors. They should not be interpreted as reflecting the views of the Bank of Japan.

Author information

Authors and Affiliations

Corresponding author

Appendix

Appendix

1.1 Proofs

1.1.1 Proof of Lemma 1

First, in the no-bubble economy, the law of motion for capital is given by \(k_{t+1}=[(1-\alpha )/g]k_{t}^{\alpha }\) and consumption is given by \(c_{t}=\alpha k_{t}^{\alpha }.\) These equations imply the no-bubble steady-state values in part 1 of Lemma 1.

Next, we show the existence of bubble equilibria. Given \(k_{0}>0\), Eqs. (3), (5), and (6) imply the following equilibrium dynamics for \(k_{t+1}\) and \(p_{t}\):

Let \(p_{t}^{*}\) denote a bubble–output ratio: \(p_{t}^{*}\equiv p_{t}/k_{t}^{\alpha }\). Then, combining these two equations, we obtain the law of motion for \(p_{t}^{*}\):

Suppose that condition (1) does not hold. Then, the law of motion for \(p_{t}^{*}\) implies that for any \(\lambda \in [0,1), p^{*}<0\) in steady state, and this cannot be an equilibrium. This shows the necessity of condition (1) for the existence of bubble equilibria. Next, suppose that condition (1) holds. Then, the law of motion for \(p_{t}^{*}\) implies that as long as \(\lambda \) is less than \(\underline{\lambda }\equiv \frac{1-2\alpha }{1-\alpha }\), there exists a unique stochastic steady state \(p_\mathrm{self}^{*}>0,\) given by:

The law of motion also implies that \((p_{t+1}^{*}/p_{t}^{*})\vert _{p_{t}^{*}>p_\mathrm{self}^{*}}>1\) and \(0<(p_{t+1}^{*}/p_{t}^{*})\vert _{p_{t}^{*}<p_\mathrm{self}^{*}}<1\). Thus, any initial bubble that satisfies \(0<p_{0}^{*}\le p_\mathrm{self}^{*}\) constitutes an equilibrium. In particular, an initial bubble \(0<p_{0}^{*}<p_\mathrm{self}^{*}\) is a transitory bubble as it converges to zero (as long as it does not collapse), and an initial bubble \(p_{0}^{*}=p_\mathrm{self}^{*}\) constitutes an asymptotic bubble as it remains at \(p_{t}^{*}=p_\mathrm{self}^{*}\) (as long as it does not collapse). For \(p_{0}^{*}>p_\mathrm{self}^{*}, p_{t}^{*}\) diverges to infinity (as long as it does not collapse), which cannot be an equilibrium. This shows the sufficiency of condition (1) for the existence of bubbles. This also shows that a asymptotic bubble equilibrium is unique and coincides with the stochastic bubble steady state.

The allocation and prices in the stochastic bubble steady state are calculated as follows. From (3) and (5), the return on capital is given by \(R_\mathrm{self}^{k}=\left( 1-\lambda \right) g\). From (3), the capital stock is given by \(k_\mathrm{self}=\left\{ \alpha /\left[ \left( 1-\lambda \right) g\right] \right\} ^{\frac{1}{1-\alpha }}.\) Because the bubble–output ratio is \(p_\mathrm{self}^{*}=1-\alpha -\alpha /\left( 1-\lambda \right) \), the bubble is given by \(p_\mathrm{self}=p_\mathrm{self}^{*}k_\mathrm{self}=\left[ 1-\alpha -\alpha /\left( 1-\lambda \right) \right] k_\mathrm{self}.\) With \(k_\mathrm{self}\) and \(p_\mathrm{self}\) at hand, the wage and the consumptions are given by (2) and (6), respectively. Finally, the expected consumption \(c_\mathrm{self}^{e}\) is given by \(c_\mathrm{self}^{e}=(1-\lambda )p_\mathrm{self}+R_\mathrm{self}^{k}k_\mathrm{self}\) because the consumption in the next period is \(p_\mathrm{self}+R_\mathrm{self}^{k}k_\mathrm{self}\) if the bubble sustains, while it is \(R_\mathrm{self}^{k}k_\mathrm{self}\) if the bubble bursts. The exact expression for \(c_\mathrm{self}^{e}\) is obtained after substituting out \(p_\mathrm{self}\) and \(k_\mathrm{self}\):

1.1.2 Proof of Lemma 2

The existence condition, \(\lambda <\underline{\lambda }\equiv (1-2\alpha )/(1-\alpha )\), implies:

1.1.3 Proof of Proposition 3

The bubble steady state exists if and only if \(p_{b}=(1-\alpha )(k_{b})^{\alpha }-gk_{b}>0\). The arbitrage condition (13) implies \(R_{b}^{k}=g\). From (3), the capital stock is given by \(k_{b}=(\alpha /g)^{1/(1-\alpha )}\). Substituting the expression for \(k_{b}\) into the condition of \(p_{b}>0\) yields the result: \(p_{b}>0\) if and only if \(\alpha <1/2\), which is the dynamic inefficiency condition (1). Because the consumption in the next period is \(p_{b}+R_{b}^{k}k_{b}\) if the bubble sustains, while it is \(R_{b}^{k}k_{b}\) if the bubble bursts, the expected consumption is given by:

1.1.4 Proof of Corollary 4

Immediate from Lemma 1 and Proposition 3.

1.1.5 Proof of Proposition 5

First, we show \(c_{b}^{e}<c_{nb}\) if and only if \(\lambda >\bar{\lambda }\). From Eq. (14) and part 1 of Lemma 1, we know that:

Thus, \(c_{b}^{e}/c_{nb}<1\) if and only if \(\lambda >\bar{\lambda }\), where \(\bar{\lambda }\) is given by (15). The threshold \(\bar{\lambda }\) satisfies \(0<\overline{\lambda }<1\):

where assumption (1) has been used in deriving the above inequalities.

Next, we shall show that \(\bar{\lambda }\) is greater than \(\underline{\lambda }\). The difference between \(\bar{\lambda }\) and \(\underline{\lambda }\) is:

The denominator is positive because of assumption (1: \(\alpha <1/2\)). The numerator is:

Let us denote \(\delta \equiv \alpha /(1-\alpha )\). Because \(0<\alpha <1/2\), we have \(0<\delta <1\). The above expression now can be written as

The strict inequality follows from \(\delta ^{1-\delta }<1\) because \(0<\delta <1\). Therefore, \(\bar{\lambda }-\underline{\lambda }>0\).

1.1.6 Proof of Proposition 6

The expected utility of households born in period T (in which the bubble collapses) is given by \(c_{T+1}=\alpha k_{T+1}^{\alpha }\), where \(k_{T+1}=[\left( 1-\alpha \right) /g]k_{b}^{\alpha }\). Note that \(c_{T+1}\) can be expressed as \(c_{T+1}=\alpha (c_\mathrm{gold}/g)^{\alpha }\), while \(c_{b}^{e}\) is expressed as \(c_{b}^{e}=\left[ 1-\lambda +\lambda \alpha / \left( 1-\alpha \right) \right] c_\mathrm{gold}\), where \(c_\mathrm{gold}\) is the first-best (golden rule) consumption defined in Footnote 4. On the other hand, the expected utility of households born in period \(t>T\) comes from the dynamics in the no-bubble equilibrium. Their expected utility is greater than that of the generation born in period T, because from period T onward, the economy converges from the post-collapse levels of capital and consumption to the levels in the no-bubble steady state. Hence, the expected utility of households who are born in periods \(t\ge T\) is greater than the expected utility in the bubble steady state \(c_{b}^{e}\) if and only if condition 16 holds. This proves the first part of the Proposition.

Next, consider the second part of the Proposition. Old households (the generation born in period \(T-1\)) are not hurt by the policy if and only if the consumption when the bubble is pricked is equal or greater than that when the bubble is sustained: \(c_{T}=\alpha k_{b}^{\alpha }+\theta \ge c_{b}^{e}\). Setting \(\theta \) such that the old households are indifferent between the two events, \(c_{T}=c_{b}^{e}\), yields \(\theta =\alpha k_{b}^{\alpha }-c_{b}^{e}\). With such a transfer, the net income of young households in period T changes to \(w_{T}-\theta \) when a bubble is pricked. The young households’ welfare is given by its consumption in the next period, or, \(c_{T+1}=\alpha (w_{T}-\theta )^{\alpha }\). Solving \(c_{T+1}\ge c_{b}^{e}\) for \(\lambda \) yields the following condition:

It is straightforward to algebraically verify that the threshold \(\hat{\lambda }\) is greater than \(\check{\lambda }\).

1.1.7 Proof of Proposition 7

In a stochastic bubble equilibrium with bubble speculation tax \(\tau \), the first-order conditions of bankers imply the following no-arbitrage condition:

Hence, in stochastic bubble steady state:

Thus, the capital stock in stochastic bubble steady state is:

The resource constraint in steady state is the same as before:

Hence,

Thus, \(p>0\) if and only if \((\frac{1-\alpha }{\alpha })(1-\tau )-1>0\), or

In other words, there can be a stochastic bubble steady state if and only if \(\tau <\frac{1-2\alpha }{1-\alpha }.\)

Recall that all bubble tax in each period is redistributed to old households. Then, the expected consumption in the stochastic bubble steady state is given by

Substituting values for k and p into this equation, we obtain:

By taking the first-order condition with respect to \(\tau \), we find that the local optimum is:

Combining (18) and (19), we conclude that the optimal bubble tax is:

1.1.8 Proof of Proposition 8

We assume that bankers default if the bubble bursts and then later verify that this is the case in equilibrium. Then, the Lagrangian associated with bankers’ optimization problem can be written as:

where \(\mu _{t}\ge 0\) is the Lagrange multiplier associated with constraint (17). The first-order conditions are:

These conditions imply:

Equation (20) implies that \(R_{t+1}^{k}\le R_{t+1}^{d}\). Hence, when the bubble bursts, the profit if bankers do not default is:

Therefore, it is in fact optimal for bankers to default if the bubble bursts. Equation (21) implies that in the stochastic bubble steady state:

Therefore, equations that determine the stochastic bubble steady state are:

We assume that \(\kappa \) is sufficiently small so that the constraint is binding (otherwise, the regulation has no effect on welfare). Then, the Lagrange multiplier in the stochastic bubble steady state is:

Thus, the constraint is strictly binding, i.e., \(\mu >0\), when \(\kappa <(1-2\alpha )/\alpha \). The steady-state bubble is:

Thus, \(p>0\) if and only if:

or equivalently:

or \(\kappa >0\), which is always true. Hence, given that the regulation constraint is binding, there is always a stochastic bubble steady state.

Welfare, or the expected consumption in the stochastic bubble steady state, is:

From the first-order condition with respect to \(\kappa \), we find that the local optimum is:

Note that \(\kappa <(1-2\alpha )/\alpha \) when \(\lambda >0\) so that the optimal regulation is always binding if the risk of bubble burst is positive. Also, Eq. (22) implies \(\kappa <0\) when \(\lambda =1\). Therefore, the optimal regulation is:

1.1.9 Proof of Proposition 9 and Welfare Implications

We focus on a case in which a bank defaults when a bubble bursts. Because the leverage restriction is binding, the flow budget constraint of the bank implies \(p_{t}+gk_{t+1}^{b}=(1+\phi )\epsilon (1-\alpha )k_{t}^{\alpha }\), where the variables are detrended and \(b_{t}=1\) is imposed. The aggregate capital is given by \(k_{t+1}=k_{t+1}^{b}+k_{t+1}^{w},\) where \(k_{t+1}^{w}\) is the amount of detrended capital invested by the household in period t. The household has \((1-\epsilon )w_{t}\), lends \(\phi \epsilon w_{t}\) to the bank, and invests the remaining amount \([1-\epsilon (1+\phi )]w_{t}\) in capital, where \(\epsilon (1+\phi )<1\) is assumed. Because the household incurs the cost \(\xi \) per unit of capital investment, \(k_{t+1}^{w}\) is given by \(gk_{t+1}^{w}=(1-\xi )[1-\epsilon (1+\phi )]w_{t}.\) Thus, the capital invested by the bank is given by \(k_{t+1}^{b}=k_{t+1}-k_{t+1}^{w}=k_{t+1}-g^{-1}(1-\xi )[1-\epsilon (1+\phi )](1-\alpha )k_{t}^{\alpha }.\) Substituting this expression into the flow budget constraint yields:

In an asymptotic bubble equilibrium, \(R_{b}^{k}=g\), \(k_{b}=(\alpha /g)^{\frac{1}{1-\alpha }},\) and \(p_{b}=\{[1-\xi (1-\epsilon (1+\phi ))](1-\alpha )-\alpha \}k_{b}^{\alpha }.\) Thus, \(p_{b}>0\) if and only if the leverage restriction is not tight enough to satisfy:

When the bubble persists, the households consume \(R_{b}^{k}[1-\epsilon -\xi (1-\epsilon (1+\phi ))]w_{b}/g.\) When the bubble bursts, the household consumes \(R_{b}^{k}k_{b}\). Thus, the expected consumption is given by:

In the bubble-less equilibrium, the law of motion for capital is given by

In steady state, \(k_{nb}=\{[1-\xi (1-\epsilon (1+\phi ))](1-\alpha )/g\}^{\frac{1}{1-\alpha }}.\) The consumption is given by:

Thus, the bubble is toxic, i.e., \(c_{b}^{e}<c_{nb}\) if and only if

Suppose that a regulator sets a leverage restriction so that a bubble does not emerge. Then, the welfare in the bubble-less steady state is greater than the welfare in the asymptotic bubble equilibrium in which there is no leverage restriction if and only if

as desired.

1.2 Extensions and robustness checks

This appendix provides the details of the series of robustness check exercises in Sect. 4.

1.2.1 n-period overlapping generations

Assume each household lives for n periods. The expected lifetime utility of a household born in period t is:

With linear utility, the savings decision is either indeterminate or at a corner solution. To avoid this, we adopt an assumption in the classic Solow growth model that households save an exogenous fraction s of their wealth and consume the remaining fraction in each period of their life, except for the last period in which they consume everything. Also, for simplicity, we assume that each household, with its size given by \(1/(n-1)\), supplies one unit of labor inelastically in each of the earlier \(n-1\) periods of their life and does not work in the last period of their life. The aggregate labor is 1 and wage rate earned by each household in period t is \(W_{t}/(n-1)\). Thus, the aggregate savings in each period is:

These aggregate savings are deposited in bankers, whose optimization problem is as in Sect. 3 in the main text. In equilibrium, the no-arbitrage condition of bankers is the same as Eq. (13). The steady-state bubble is:

while the capital stock is given by \(k_{b}=(\alpha /g)^{1/(1-\alpha )}\). Hence, \(p_{b}>0\) if and only if \(s(1-\alpha )>\alpha \), which is the dynamic inefficiency condition in this environment. This existence condition of bubbles is again independent of the risk of bursting of the bubble. Thus, the intuition that risk shifting enables the existence of excessively risky bubbles applies. The rest of the arguments about toxic asset bubbles similar to those in Propositions 3 and 5 apply.

1.2.2 Risk-averse households in both periods of life

Assume lifetime utility of a household is \(\log (C_{t}^{y})+\beta E_{t}\log (C_{t+1}^{o})\). Young households decide how much of their wage income \(W_{t}\) to save and how much to consume. Let \(S_{t}\) denote an individual household’s savings, and let \(\overline{S}_{t}\) denote the aggregate economy’s savings. Households deposit their savings with bankers, who then invest in a portfolio consisting of capital and bubbles. As in the main text, when a bank defaults, all of its assets are seized and distributed equally among its depositors. Hence, the optimal saving decision of a young household in period t solves:

subject to:

Thus, the equilibrium \(S_{t}\) solves:

The solution is \(S_{t}=\frac{\beta }{1+\beta }W_{t}\). Hence, the steady-state bubble is given by

while the capital stock is given by \(k_{b}=(\alpha /g)^{1/(1-\alpha )}\). Thus, \(p_{b}>0\) if and only if

which is the dynamic inefficiency condition in this environment. This existence condition of bubbles is again independent of the risk of bursting of the bubble, as in Proposition 3. The rest of the arguments follows through. The expected lifetime utility (welfare) is given by:

In the bubble-less equilibrium, the equilibrium dynamics with log–log preferences are:

Thus, the steady-state capital stock and marginal product of capital are:

and thus, the lifetime utility in steady state is:

Hence, the expected lifetime utility is worse in the bubble steady state if and only if:

Algebraic manipulations show that this inequality is equivalent to \(\lambda >\overline{\lambda }\) where \(\overline{\lambda }\equiv 1-\frac{1+\beta }{\beta }\frac{\alpha }{1-\alpha }>0\). In summary, Propositions 3 and 5 are robust when households have log–log preferences.

1.2.3 Aggregate shocks

A representative household works and earns \((1-\epsilon )W_{t}\) in the first period of their lives. A representative banker works and earns \(\epsilon W_{t}\) in the first period of their lives and combines it with borrowing from households to invest in capital and an bubble asset. With aggregate TFP shocks, the marginal product of capital is \(R_{t+1}^{k}=A_{t+1}\alpha K_{t+1}^{\alpha -1}\). Since \(E_{t}(A_{t+1})=E_{t}(a_{t+1})g^{t+1}=g^{t+1}\) and the banker is risk neutral, the portfolio problem of the banker is essentially unchanged from (10). Apply the same guess and verify method as in the main text: We guess that a banker defaults if and only if the bubble bursts. Then, the portfolio optimization problem is the same as (12). Thus, we have the same set of first-order conditions. In an asymptotic bubble equilibrium, the bank defaults when a bubble bursts if and only if \(R_{b}^{k}gk_{b}-R_{b}^{d}d_{b}<0\) for all \(a_{t+1}\), i.e., \(\bar{a}<1+\frac{p_{b}-\epsilon w_{b}}{gk_{b}}=\frac{(1-\alpha )(1-\epsilon )}{gk_{b}^{1-\alpha }}\). The bank does not default when a bubble persists if and only if \(R_{b}^{k}(gk_{b}+p_{b})-R_{b}^{d}d_{b}\ge 0,\) i.e., \(\underline{a}\ge 1-\frac{\epsilon w_{b}}{gk_{b}}=1-\frac{\epsilon (1-\alpha )}{gk_{b}^{1-\alpha }}.\) Then the rest of the arguments in the proofs of Propositions 3 and 5 carry through in a straightforward manner.

1.3 Microfoundation for standard debt contract

We provide a microfoundation of a debt contract assumed in the main text. The microfoundation is standard and is based on asymmetric information and costly state verification à la Townsend (1979). In this setting, the environment of bankers remains the same. In a bubble equilibrium, the bankers invest in both capital and a bubble asset. Bankers return is high or low depending on the event of bubble burst. The environment of a households sector differs from that in the main text. In particular, households do not observe bankers ex-post return without a cost. The households can observe the return only when they conduct costly auditing. No stochastic auditing is allowed. In addition, the households cannot make a contract which specifies the portfolio of capital and a bubble asset. The assumption of asymmetric information implies that the households do not observe the event of bubble burst when they receive the return.

In the model, there are only two states: h and l, where h denotes a high return (when a bubble sustains) and l denotes a low return (when a bubble bursts). The households do not observe the state without conducting costly auditing, but they know the probability of low return, \(\lambda \,\). Without loss of generality, we restrict our attention to a truth-telling contract in which bankers truthfully reveal the state \(s\in \left\{ h,l\right\} \). In this setting, the households decide three objects which depend on state s. First, they make an auditing decision, \(\delta \left( s\right) \in \left\{ 0,1\right\} \), where 0 indicates no auditing and 1 indicates auditing. Second, they choose the amount of repayment from bankers per unit of deposit when they audited bankers, \(R_{a}^{k}\left( s\right) \). Third, they choose the amount of repayment from bankers per unit of deposit when they did not audit bankers, \(r\left( s\right) \). The households’ objective is to maximize the expected repayment per unit of deposit:

where \(\epsilon >0\) denotes the auditing cost per unit of loan. Bankers are competitive and protected by a limited-liability law. The resulting participation constraints of bankers are: For \(s\in \left\{ h,l\right\} \)

where the left-hand side in each inequality denotes the profit of bankers per unit of deposit in case of no-monitoring and monitoring, respectively. Two incentive constraints are required to make bankers reveal a state truthfully. First, if the households do not audit bankers in the both states, the repayment has to be the same:

Otherwise, bankers will always report a state with lower repayment. Second, if the households audit bankers in a low state but not in a high state, the repayment in a low state is equal or less than that in a high state:

Otherwise, bankers would report a high state and pay less when they are in a low state.

A contact that maximizes the return received by the households has two features. First, the households audit only when bankers report a low state: \(\delta (h)=0\) and \(\delta (l)=1\). This auditing is enough to prevent bankers to fake a state. If bankers in a high state faked to be in a low state, the households would audit bankers and confiscate all bankers’ assets. Thus, bankers have no incentive to fake when they are in a high state. If the households did not audit when bankers report a low state, bankers in a high state would fake to be in a low state and thus the households return would be lower. Auditing in a high state as well would not change the repayment, but the return would be low because of an additional auditing cost. Second, the participation constraints (24) are binding: \(r(s)=s\) if \(\delta (s)=0\) and \(R_{a}^{k}(s)=s\) if \(\delta (s)=1\). Otherwise, the households can increase the return by raising the repayment.

From (23) the households expected return under the contract is given by

So far, the returns, h and l, have been taken as given. In the model presented in the main text, h and l are endogenously determined by bankers portfolio choice. In particular, in the model, h and l are corresponding to:

By assumption, the households cannot write a contract which depends on bankers portfolio choice between capital and a bubble asset, \(\{K_{t+1},b_{t}\}\). The households arrange the contact so as to make bankers to choose the portfolio to maximize (27). Under the contract such that the households confiscate all bankers assets in case of auditing, however, bankers do not take into account the earning in a low state. Thus, the households arrange the contract to maximize bankers earning in a high state. Given that bankers are competitive, one way to maximize h is to offer a debt contract with interest rate \(R_{t+1}^{d}\). The resulting financial arrangement is exactly the same as in the main text except the presence of auditing costs \(\epsilon \). The model in the main text corresponds to a limiting case where \(\epsilon \rightarrow 0\).

Rights and permissions

About this article

Cite this article

Ikeda, D., Phan, T. Toxic asset bubbles. Econ Theory 61, 241–271 (2016). https://doi.org/10.1007/s00199-015-0928-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-015-0928-1