Abstract

This paper studies the firm size distribution arising from an endogenous growth model of quality ladders with expanding variety. The probability distribution function of a given cohort is a Poisson distribution that converges asymptotically to a normal of log size. However, due to firm entry propelled by horizontal R&D, the total distribution—i.e., when the entire population of firms is considered—is a mixture of overlapping Poisson distributions which is systematically right skewed and exhibits a fatter upper tail than the normal distribution of log size. Our theoretical results qualitatively match the empirical evidence found both for the cohort and the total distribution, and which has been presented as a challenge for theory to explain. Moreover, by obtaining a total distribution with a gradually increasing average over a long time span, the model is able to address complementary empirical evidence that points to a total distribution subtly evolving over time.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Empirical evidence clearly shows that the firm size distribution (FSD) is highly right-skewed, with the skewness apparently being driven by idiosyncratic stochastic processes of firm growth (e.g., Sutton 1997). Although the precise shape of the distribution is a subject of debate, empirical studies suggest that it is more right skewed (Sutton 1997; Cabral and Mata 2003; Bottazzi et al. 2007, among many others) and exhibits a fatter upper tail (e.g., Axtell 2001; Gaffeo et al. 2003; Growiec et al. 2008) than the lognormal distribution, which was originally used as a model for the highly skewed FSD (Gibrat 1931).

On the theoretical side, recent papers have made an important contribution to this literature by studying the interplay between economic growth, innovative activity and skewed firm size distributions (Thompson 2001; Klette and Kortum 2004; Segerstrom 2007), thus formally accommodating the early Schumpeterian view that linked market structure and the pace of innovation. In these models, monopolistic competition prevails and the underlying stochastic process of firm growth is a Poisson process of quality ladders (vertical R&D). This process for innovation then leads to persistent heterogeneity of size across firms along the balanced-growth path (BGP). Segerstrom (2007) shows how a model of quality ladders without intersectoral spillovers generates a skewed FSD, with size being proportional to firm quality. However, in this model the distribution is (asymptotically) lognormal. Klette and Kortum (2004) build a quality-ladders model of multi-product firms where each firm’s product space is time-varying but the overall product space is constant. Firm size, measured as the number of products per firm, follows a logarithmic series distribution. Thompson (2001) uses a model where quality ladders displaying intersectoral spillovers are combined with variety expansion (horizontal R&D). A mixed Gamma distribution of firm size is derived, with size being proportional to relative firm quality. Both the logarithmic and the mixed Gamma distributions are more skewed and have heavier upper tails than the lognormal.Footnote 1

In our paper, an alternative model of monopolistic competition that combines the quality-ladder with the expanding-variety mechanism is considered, such that a right-skewed, fat-tailed FSD is analytically derived from the interaction of those two mechanisms along the BGP. Klette and Kortum (2004), as well as Segerstrom (2007), focus on a single direction of innovative activity and thus are not able to grasp the link between the properties of the FSD and the well-known fact that economic growth occurs both along an extensive (introduction of new goods) and an intensive margin (increase in good quality) (e.g., Freeman and Soete 1997; Klepper 1996). This shortcoming is apparently overcome by Thompson (2001). However, the way horizontal entry is modelled in his model—horizontal innovations do not change the distribution of relative quality because, by assumption, the distribution of relative quality among entrants at any date is identical to the distribution across existing varieties at that date—implies that there is no direct impact of firm entry on the size distribution; indeed, it is only necessary to take the vertical innovation process into account when deriving the FSD (for a similar modelling approach, see Howitt 1999).

In contrast, our paper explicitly analyses the impact of successive cohorts of firms (indeed of varieties) entering the market in the shape of the FSD, in order to capture the link between a richer dynamic environment of innovation and market structure. As in Segerstrom (2007) (see also, e.g., Barro and Sala-i-Martin 2004, ch. 7), there are no intersectoral spillovers in vertical R&D and size is linear in firm quality; firm size is thus measured as technological-knowledge stock per firm, which relates closely to production (sales) per firm. Hence the FSD of a given cohort is a Poisson distribution that converges asymptotically to a normal of log size (i.e., a lognormal of size). However, due to firm entry propelled by horizontal R&D (e.g., Barro and Sala-i-Martin 2004, ch. 6), the total FSD—i.e., the FSD when the entire population of firms (varieties) is considered—is a mixture of overlapping Poisson distributions of log size that is systematically right skewed. This feature allows us to accommodate the empirical evidence reported by Cabral and Mata (2003) and Cabral (2007), according to which the FSD of a given cohort is significantly right-skewed at birth but evolving over time toward a lognormal distribution of size, whereas the total FSD is “fairly stable” and skewed to the right vis-à-vis the lognormal. This evidence has been presented as a challenge for theory to explain (Klepper and Thompson 2006).Footnote 2 Furthermore, our model predicts a total FSD with an upper tail that is systematically fatter than in the case of the normal distribution, which is also in accord with the empirical evidence mentioned earlier. In particular, we show that an (inverse) power-law scaling behaviour may emerge in the upper tail.Footnote 3

In our model (potential) entrants perform either vertical R&D, by which they increase the quality of an existing variety and hence substitute the incumbent (creative-destruction effect), or horizontal R&D, by which they create a new variety (e.g., Howitt 1999; Segerstrom 2000; Strulik 2007). Size upon entry rises over time due to spillovers from incumbents to entrants in both vertical and horizontal R&D. However, firms entering along the vertical margin are more efficient, and thus larger, than the incumbent in a given industry, while firms entering along the horizontal margin, by benefiting from an imperfect imitation effect, are less efficient, and thus smaller, than the incumbent average size across industries. Therefore, we capture in a simple manner the empirical evidence that suggests there is significant variation in the relative efficiency of new firms (e.g., Dunne et al. 1988; Audretsch 1995; Geroski 1995).

Due to the otherwise simple structure of our model, firm exit exists only in the vertical direction and as part of the mechanism (creative destruction) by which monopolist size grows over time in a given industry.Footnote 4 Thus, in order to derive the FSD, we keep track of the quality level in an arbitrary industry, irrespective of the fact that the monopolist’s identity in that industry is changing over time. Moreover, since we focus on the symmetric BGP equilibrium, the Poisson arrival rates are constant across industries and over time, implying that the growth rate of size is also constant across industries and over time. One unfortunate side effect of our approach is then that the growth rate of size (both in terms of expected value and variance) is independent of age and size, which is a counterfactual result (see, e.g., Klette and Kortum 2004).

Outside the endogenous growth literature, horizontal entry plays a major role in shaping the total FSD in many models. A recent paper with an entry mechanism close to ours is Luttmer (2007). The author emphasises horizontal entry by linking the expected productivity and size of a potential entrant to the productivity and size of incumbents, such that the size of entrants is a constant fraction of the average size of incumbents. Luttmer studies a dynamic monopolistic-competitive model of entry and exit, where incumbent firms become more productive at an idiosyncratic exogenous stochastic rate, while potential entrants can pay an entry cost to select a random incumbent firm and then—due to imperfect imitation—adopt a scaled-down version of its technology. A stationary FSD is analytically derived with support given by relative productivity per firm and with a Pareto upper tail, which is fatter than the lognormal upper tail.Footnote 5

Horizontal entry is pivotal in generating an asymmetric fat-tailed FSD in yet a different strand of the literature, dedicated to studying statistical models of firm dynamics.Footnote 6 For example, Growiec et al. (2008) develop a statistical model where the FSD is a lognormal distribution multiplied by a “stretching factor” which increases with the number of firms entering the market; the FSD is then shown to have a Pareto upper tail. For a very small number of firms, the “stretching factor” becomes negligible and the distribution is close to a lognormal. In turn, the submarkets model by Klepper and Thompson (2006) predicts that, in the steady state, for firms of any age, the distribution of the number of submarkets in which they participate is Poisson, but the mean is strictly increasing in age. There is also a corresponding steady-state distribution of the sizes of these firms, such that the distribution of firms of a given age is positively skewed and has a Poisson upper tail. The older the cohort, the greater the mean and variance and the smaller the skewness of the corresponding FSD. These predicted properties of the FSD are similar to those in our model and (qualitatively) match those found by Cabral and Mata (2003) for the FSD of a cohort of firms.

We derive a total FSD that is not stationary, since its average is not constant over time. This contrasts with the steady-state distributions derived in the literature (e.g., Thompson 2001; Klette and Kortum 2004; Klepper and Thompson 2006; Luttmer 2007, and many others). Our result for the average of firm (log) size, whose positive growth along the BGP reflects the endogenous growth of quality in our model, is in accordance with the empirical evidence for firm size measured as sales per firm (e.g., Jovanovic 1993).Footnote 7 On the other hand, the variance of the distribution displays a non-monotonic behaviour over time. In fact, our results show that when the number of cohorts is still relatively small, the variance quickly increases over time; however, the number of cohorts has a dampening effect on the behaviour of the variance, such that the variance stabilises as the number of cohorts becomes sufficiently large.

Overall, this implies that if we consider the variance adjusted by the average firm size and compute the coefficient of variation, we find a monotonically decreasing time path whatever the number of cohorts. Thus, it is clear that our FSD is not stationary, even if we consider normalised firm sizes.Footnote 8 To sum up, although we are able to obtain a stable total FSD in terms of skewness and upper-tail weight, in line with the empirical evidence presented by Cabral and Mata (2003) and others, our theoretical result is also able to address complementary empirical evidence that points to a FSD subtly evolving over time.

The fact that the FSD is derived within a general equilibrium model of endogenous growth allows us to derive interesting policy implications. Since the properties of the FSD can be directly related to the underlying firm dynamics arising from systematic innovative activity, we are able to study the effect of R&D subsidies and other forms of industrial policy on economic growth and on market structure, e.g., measured by concentration. In particular, our model allows us to study separately the effects of subsidies to vertical and horizontal R&D. In the literature, the importance of distinguishing between subsidies has been emphasised by Peretto (1998), although in quite a different analytical setup that analyses an equilibrium which is symmetric with respect to firm size; hence, concentration is trivially measured as the reciprocal of the number of firms. Laincz (2009) studies the impact of R&D subsidies on concentration within a model where firms are heterogeneous with respect to size; however, only vertical R&D is considered. Finally, Thompson (2001) performs comparative statics by focusing on changes in the parameters related to both vertical and horizontal R&D and the analysis of size distribution is akin to ours; however, the author does not explicitly address the effect of R&D subsidies on growth and concentration.

Our comparative-statics results depend upon the source of the change in the general equilibrium, such that the effect of R&D subsidies and targeted industrial policies is either growth- and concentration-enhancing or growth-neutral and concentration-reducing. In general, our predictions confirm the qualitative results in the papers cited above, while extending them to a framework where vertical and horizontal R&D explicitly interact in order to produce a non-degenerate FSD.

The remainder of the paper has the following structure. In the next two sections, we present the model, giving a detailed account of the production, price and R&D decisions, and derive the dynamic general equilibrium and the BGP. In Section 4, we analyse the FSD that results from the interaction between the expanding variety and the quality-ladders mechanism along the BGP. In Section 5, we focus on the impact of policy, namely R&D subsidies, on economic growth and market structure. Section 6 presents some concluding remarks.

2 Model

We explore a dynamic general equilibrium model of a closed economy where a single competitively-produced final good can be used in consumption, production of intermediate goods, and R&D. The final good is produced by a (large) number of firms each using labour and a continuum of intermediate inputs indexed by ω ∈ [0, N]. The economy is populated by fixed infinitely-lived households who inelastically supply labour to final-good firms. In turn, families make consumption decisions and invest in firms’ equity.

Potential entrants can devote resources either to horizontal or to vertical R&D. Horizontal R&D increases the number of intermediate-good industries N, while vertical R&D increases the quality of the good of an existing industry, indexed by j(ω). Quality level j(ω) translates into productivity of the final producer from using the good produced by industry ω, λ j(ω), where λ > 1 is a parameter measuring the size of each quality upgrade. By improving on the current best quality j, a successful R&D firm will introduce the leading-edge quality j(ω) + 1 and hence render inefficient the existing input supplied by the producer of ω. Therefore, the successful innovator will become a monopolist in ω. However, this monopoly is temporary, because a new successful innovator will eventually substitute the incumbent.

2.1 Households

The economy is populated by a fixed number of infinitely-lived households who consume and collect income from investments in financial assets (equity) and from labour. Households inelastically supply labour to final-good firms; thus, total labour supply, L, is exogenous and constant. We assume consumers have perfect foresight concerning the aggregate rate of technological change over time,Footnote 9 and choose the path of final-good aggregate consumption \(\left\{ C(t),t\geq0\right\} \) to maximise the discounted lifetime utility

where ρ > 0 is the subjective discount rate and θ > 0 is the inverse of the intertemporal elasticity of substitution, subject to the flow budget constraint

where a denotes households’ real financial assets holdings, r the equilibrium market real interest rate and w the real labour wage. The initial level of wealth a(0) is given, whereas the non-Ponzi games condition \(\textrm{li}\textrm{m}_{t\rightarrow\infty}a(t)e^{-\int_{0}^{t}r(s)ds}\geq0\) holds. The optimal path of consumption satisfies the well-known differential Euler equation

as well as the transversality condition \(\underset{t\rightarrow\infty}{\lim}e^{-\rho t}C(t)^{-\theta}a(t)=0\).

2.2 Production and price decisions

The final-good firm has a constant-returns-to-scale technology using labour and a continuum of intermediate goods with measure N and individual quality level j, both changing over time t, which is well-known from ch. 6 and 7 Barro and Sala-i-Martin (2004)

where L is the labour input and 1 − α is the labour share in production, λ is the size of each quality upgrade, and \(\lambda^{j\left(\omega,t\right)}\cdot X(\omega,t)\) is the input of intermediate good ω measured in efficiency units at time t.Footnote 10 That is, we integrate the final-producer technology that is considered in variety-expansion and quality-ladders models (Barro and Sala-i-Martin 2004, ch. 6 and 7, respectively).

Final producers are price-takers in all the markets in which they participate. They take wages, w(t), and input prices P(ω, t) as given and sell their output at a price equal to unity. From the profit maximisation conditions, we determine the aggregate demand of intermediate good ω as

The intermediate-good sector consists of a continuum N(t) of industries. There is monopolistic competition if we consider the whole sector: the monopolist in industry ω fixes the price P(ω, t) but faces the isoelastic demand curve (Eq. 5). We assume that the intermediate good is non-durable and entails a unit marginal cost of production, in terms of the final good, whose price is taken as given. The profit maximising price in industry ω is a constant markup over marginal cost P(ω,t) ≡ P = 1/α > 1,Footnote 11 which implies the aggregate quantity produced of ω

Using the results above we get the profit accrued by the monopolist in ω

where \(\tilde{\pi}\equiv\left(1/\alpha-1\right)\cdot\alpha^{\frac{2}{1-\alpha}}\).

Substituting Eq. 6 in Eq. 4 yields the aggregate output

where

is the intermediate-input aggregate quality index, which measures the technological-knowledge level of the economy, since, by assumption, there are no intersectoral spillovers. Total resources devoted to intermediate input production are also a linear function of Q(t)

as are total profits

2.3 R&D

We take the simplifying assumptions that both vertical and horizontal R&D are performed by (potential) entrants, and that successful R&D leads to the set-up of a new firm in either an existing or in a new industry (e.g., Howitt 1999; Segerstrom 2000; Strulik 2007). Moreover, there is perfect competition among entrants and free entry in R&D business.

As in the standard model of quality ladders, vertical R&D constitutes the search for new designs that lead to a higher quality of existing intermediate goods. Each new design is granted a patent and thus a successful innovator retains exclusive rights over the use of his/her good. By improving on the current top quality level j(ω, t), a successful R&D firm earns monopoly profits from selling the leading-edge input of j(ω, t) + 1 quality to final-good firms. A successful innovation will instantaneously increase the quality index in ω from \(q(\omega,t)=q(j{\kern1.5pt})\equiv\lambda^{\frac{\alpha}{1-\alpha}j(\omega,t)}\) to \(q^{+}(\omega,t)=q(j+1)=\lambda^{\frac{\alpha}{1-\alpha}}q(\omega,t)\). In equilibrium, lower qualities of ω are priced out of business.

Let \(I_{i}\left(j\right)\) denote the Poisson arrival rate of vertical innovations (vertical-innovation rate) by potential entrant i in industry ω when the highest quality is j. Rate \(I_{i}\left(j\right)\) is independently distributed across firms, across industries and over time, and depends on the flow of resources \(R_{vi}\left(j\right)\) committed by entrants at time t. As in, e.g., ch. 7 Barro and Sala-i-Martin (2004), \(I_{i}\left(j\right)\) features constant returns in R&D expenditures, \(I_{i}\left(j\right)=R_{vi}\left(j\right)\cdot\Psi\left(j\right)\), where \(\Psi\left(j\right)\) is the R&D productivity factor, which is assumed to be homogeneous across i in ω. We assume

where ζ > 0 is a constant flow fixed cost. With Eq. 12, we wish to capture the idea that the larger the scale of expected production of a firm, L · q(j + 1), is (see Eq. 6), the larger the costs necessary to discover and develop the associated technology will be: e.g., construction of prototypes and samples, new assembly lines and training of workers. These assumptions guarantee that spending in R&D increases at the same rate as output, delivering a BGP without scale effects, in line with the last generation of quality-ladders models (e.g., Barro and Sala-i-Martin 2004).Footnote 12 Also, differently from Howitt (1999) and others, we assume that there are no intersectoral spillovers in vertical R&D (e.g., Segerstrom 2007; Etro 2008). Aggregating across i in ω, we get R v (j) = ∑ i R vi (j) and I(j) = ∑ i I i (j), and thus

As the terminal date of each monopoly arrives as a Poisson process with frequency I(j) per (infinitesimal) increment of time, the present value of a monopolist’s profits is a random variable. Let V(j) denote the expected value of an incumbent firm with current quality level j(ω, t),Footnote 13 such that \(V(j{\kern1.5pt})=\pi(j{\kern1.5pt})\int_{t}^{\infty}e^{-\int_{t}^{s}\left(r(v)+I(j(v))\right)dv}ds\), where π(j), given by Eq. 7, is constant in-between innovations. We antecipate that, along the BGP, r and I are constants; hence, we can further write

On the other hand, free-entry prevails in vertical R&D such that the condition \(I(j{\kern1.5pt})\cdot V\left(j+1\right)=R_{v}(j{\kern1.5pt})\) holds, which implies that

By substituting Eq. 14 into Eq. 15 and using Eq. 7 to simplify, we get the arbitrage equation facing a vertical innovator

According to Eq. 16, the rates of entry are symmetric across industries, I(j) = I.

Variety expansion arises from R&D aimed at creating a new intermediate good. Again, innovation is performed by a potential entrant, which means that, because there is free entry, the new good is produced by a new firm. Under perfect competition among R&D firms and constant returns to scale at the firm level, instantaneous entry is obtained as \(\overset{.}{N}_{e}(t)=1/\eta\cdot R_{ne}\left(t\right)\), where \(\overset{.}{N}_{e}(t)\) is the contribution to the instantaneous flow of new varieties by R&D firm e at a cost of η units of the final good and \(R_{ne}\left(t\right)\) is the flow of resources devoted to horizontal R&D by innovator e at time t. The cost η is assumed to be symmetric, with η ≡ η(t) = ϕN(t)β, where ϕ and β are positive constants (e.g., Evans et al. 1998; Barro and Sala-i-Martin 2004, ch. 6). That is, the cost of setting up a new variety (cost of horizontal entry) is increasing in the number of existing varieties, N; the scale of the economy induces a negative externality in the form of a barrier to entry because it becomes costlier to introduce new varieties in large growing economies. Then, R n = ∑ e R ne and \(\overset{.}{N}(t)=\sum_{e}\overset{.}{N}_{e}(t)\), implying

Next, consider the average of the quality index for the existing varieties

We assume that the horizontal innovator enters with quality level mμ q (t), where m is a positive constant; i.e., there is a spillover from incumbents to potential entrants. However, while, e.g., Howitt (1999) and Thompson (2001) consider m = 1, we posit \(m\in\left(0,1\right)\). The fact that firms enter with a scaled-down version of the average quality level of existing varieties, for instance due to imperfect imitation of incumbents’ technology (e.g., Luttmer 2007; Poschke 2009),Footnote 14 implies that firms entering along the horizontal margin are less efficient, and thus smaller (see Eq. 6), than the incumbent average size across industries. This assumption captures the empirical observation that new firms start, on average, with small market shares relative to incumbents (Dunne et al. 1988; Geroski 1995; McCloughan 1995). In contrast, as explained above, firms entering along the vertical margin are more efficient, and thus larger, than the incumbent in a given industry; this introduces significant variation in the relative efficiency of new firms in our model, which is also in line with the empirical evidence (e.g., Audretsch 1995; Geroski 1995).

As the horizontal innovator’s monopoly power will be also terminated by the arrival of a successful vertical innovator in the future, the benefits from entry are given by \(V(\mu_{q})=\mu_{\pi}(t)\int_{t}^{\infty}e^{-\int_{t}^{s}\left[r\left(\nu\right)+I\left(\mu_{q}(\nu)\right)\right]d\nu}ds\), where \(\mu_{\pi}=\tilde{\pi}Lm\mu_{q}\) (see Eq. 7). Analogously to V(j) in Eq. 14, we then have

The free-entry condition is \(\dot{N}\cdot V(\mu_{q})=R_{n}\), which simplifies to

Substituting Eq. 19 into Eq. 20, yields the arbitrage equation facing a horizontal innovator

Finally, no-arbitrage in the capital market requires that the two types of investment—vertical and horizontal R&D—yield equal rates of return; otherwise, one type of investment dominates the other and a corner solution obtains. Thus, if we equate the effective rate of return r + I for both types of entry by considering Eqs. 16 and 21, we get the inter-R&D arbitrage condition

This condition is one of the key ingredients of the model. It equates the cost of vertical R&D, ζ, to the (effective) cost of horizontal R&D, η/(Lmμ q ). Furthermore, by rewriting Eq. 22 as \(\tilde{\pi}/\zeta=\left(\tilde{\pi}Lm/\phi\right)\cdot Q/N^{\beta+1}\), we see that the inter-R&D arbitrage condition defines a unique intersection between the two (effective) rates of return in the space (N, r + I), for a given level of technological knowledge, Q. It can then be shown that, whatever the value of the positive constants ζ, ϕ, m and L, an interior solution obtains with simultaneous vertical and horizontal R&D as a stable equilibrium for the capital market:Footnote 15 to the left of the equilibrium (when the number of varieties, N, is too small for a given Q), the rate of return to horizontal R&D is higher than the rate of return to vertical R&D, funds are reallocated from vertical to horizontal R&D such that N increases relatively to Q, and the market moves back to the intersection point; to the right of the equilibrium (N is too large for a given Q), the opposite movement is observed (see, e.g., Peretto 1998, for a similar analysis).

3 Balanced-growth path

The aggregate financial wealth held by all households is \(a(t)=\int_{0}^{N(t)}V(\omega,t)d\omega\), which, from the arbitrage condition between vertical and horizontal entry, yields a(t) = η(t) · N(t). Taking time derivatives and comparing with Eq. 2, we get an expression for the aggregate flow budget constraint which is equivalent to the product market equilibrium condition (see Gil et al. 2010)

The dynamic general equilibrium is defined by the allocation {X(ω, t), ω ∈ [0, N(t)], t ≥ 0} , by the prices \(\left\{ p(\omega,t),\omega\in[0,N(t)],t\ge0\right\} \) and by the aggregate paths \(\left\{C(t),N(t),Q(t),I(t),r(t),t\geq0\right\} \), such that: (i) consumers, final-good firms and intermediate-good firms solve their problems; (ii) vertical, horizontal and inter-R&D arbitrage conditions are met; and (iii) markets clear.

We now derive and characterise the BGP. Let \(g_{y}\equiv\dot{y}/y\) represent the growth rate of variable y(t). Along the BGP, the aggregate resource constraint (Eq. 23) is satisfied with Y, X, C, R v and R n growing at the same constant rate. By considering Eq. 8 and by time-differentiating Eq. 22 with η(t) = ϕN(t)β, the following necessary conditions for the existence of a BGP are derived: (i) g C = g Q = g; (ii) g I = 0; and (iii) g Q /g N = (β + 1), g N ≠ 0. Observe that g is the long-run aggregate growth rate and that g Q and g N are monotonically related.

If we assume that the number of industries, N, is large enough to treat Q as time-differentiable and non-stochastic, then we can time-differentiate Eq. 18 to get \(\dot{Q}(t)=\int_{0}^{N(t)}\dot{q}(\omega,t)d\omega+q(N,t)\dot{N}(t)\). After some algebraic manipulation of the latter, we can write, for I > 0,

Next, solve Eq. 3 with respect to r and note that, along the BGP, g C = g Q = g, to get r = ρ + θg. The latter, combined with g = (β + 1) · g N , Eqs. 24 and 16, yields

where \(\delta\equiv\left(\tilde{\pi}/\zeta-\rho\right)/\theta\). Observe that \(\underset{\beta\rightarrow\infty}{\textrm{lim}}g=g_{\rm no-entry}\) and that g, g N , I > 0 require δ > 0. Since, from Eq. 3, \(g=g_{C}=\left(r-\rho\right)/\theta\), then r > ρ must occur; this condition also guarantees g N > 0.Footnote 16 Thus, under a sufficiently productive technology, our model predicts a BGP with constant positive g and g N , where the former exceeds the latter by an amount corresponding to the growth of intermediate-good quality, driven by vertical innovation; to verify this, just check Eq. 24 and solve to get \(\dot{Q}/Q-\dot{N}/N=I\left(\lambda^{\frac{\alpha}{1-\alpha}}-1\right)\), which is positive if I > 0. This implies that the consumption growth rate equals the growth rate of the number of varieties plus the growth rate of intermediate-good quality, in line with the view that industrial growth proceeds both along an intensive and an extensive margin (e.g., Peretto 1998; Howitt 1999; Thompson 2001).

The number of firms along the BGP is also of interest. Given Eq. 22 and our assumption of η(t) = ϕN(t)β, we find

Observe that m and ϕ have no growth effects, i.e., no impact on the BGP values of the growth rates, g and g N , and the Poisson rate, I (see Eqs. 25–27), but have a level effect, by influencing the number of firms, N, along the BGP.

4 Firm size distribution

This section is concerned with the properties of the firm size distribution (FSD) in the intermediate-good sector that results from the interaction between the expanding variety and the quality-ladder mechanism along the BGP, bearing in mind that both the rate of variety expansion, g N , and the Poisson (quality-ladders) rate, I, are constant across industries and over time (see Eqs. 26 and 27).

With firm size measured as production (or sales) per firm, X(ω, t), Eq. 6 then implies that size is proportional to the quality index \(q(\omega,t)=q(j{\kern1.5pt})\equiv\lambda^{\frac{\alpha}{1-\alpha}j(\omega,t)}\). On the other hand, recall that the intermediate-good sector consists of a continuum N of industries, each one comprising a monopolist that will eventually be replaced by a new successful innovator in the vertical direction. Due to the assumption of perfect spillovers from incumbents to entrants in vertical R&D, firms in each existing industry enter at a size proportional to q(j + 1), i.e., immediately above the size, proportional to q(j), of the incumbent they have just replaced. Therefore, in order to derive the FSD, we will keep track of an arbitrary j corresponding to a monopolist with quality index q(j) in a given industry ω, irrespective of the fact that the monopolist’s identity is changing over time.

4.1 Firm size distribution of a given cohort

First, we consider the FSD for a given cohort c of varieties, i.e., for the measure of firms that enter at time t = t c and become monopolists in new industries producing new varieties indexed by \(\omega_{c}\in\left]N_{t_{c}-\epsilon},N_{t_{c}}\right]\), where ϵ > 0 is the time span between consecutive cohorts and N t = 0 if t < 0; since these monopolists will eventually be replaced by new successful innovators in the vertical direction, we are tracking the FSD for a specified set of goods, but not for the same firms over time. Under continuous time, and since \(g_{N}=\dot{N}/N\) is an instantaneous growth rate, then \(\lim\nolimits_{\epsilon\rightarrow0}\left(N_{t_{c}}-N_{t_{c}-\epsilon}\right)/\epsilon=Ng_{N}\), which is positive provided N and g N are positive.

As an initial condition, we assume that j = j c ≥ 0 for all industries ω c at t = t c . Then Eq. 6 implies that all of these industry monopolists start off with the same size at time t = t c . Since the same vertical innovation rate I prevails in all industries and is constant over time, the distribution of an arbitrary j is Poisson with parameter I(t − t c ). The mean of this distribution is I(t − t c ) and the variance is also I(t − t c ), so both the mean and the variance of j increase over t.

A well-known property of the Poisson distribution with parameter Λ is that it converges to a normal distribution with mean Λ and variance Λ as this parameter converges to infinity. Thus, for sufficiently large t − t c , the distribution of j becomes approximately normal with mean I(t − t c ) and variance I(t − t c ). Now, Eq. 6 implies that \(\textrm{ln}X=\textrm{ln}B+k\cdot j\), where \(B\equiv L\alpha^{\frac{2}{1-\alpha}}>0\) and \(k\equiv\left[\alpha/(1-\alpha)\right]\textrm{ln}\lambda>0\) are constants. Then, \(\textrm{ln}X\) is approximately normally distributed with mean \(\textrm{ln}B+kI(t-t_{c})\) and variance \(k^{2}I(t-t_{c})\). Thus, the distribution of firm size X is approximately lognormal when t − t c is large. A direct corollary is that, as regards a given cohort, both the average and the variance of size increase monotonically over time.

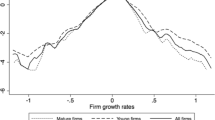

This result allows us to accommodate the important evidence reported by Cabral and Mata (2003) and Cabral (2007), according to which the FSD of a given cohort is significantly right-skewed at birth—in our case, corresponding to a Poisson distribution of log size—but evolving over time toward a normal distribution of log size (i.e., a lognormal of size). Figure 1 depicts the FSD of a given cohort by considering the probability function of log size over time (see also Table 1).Footnote 17

The firm-size distribution (FSD) of a given cohort as depicted by the probability function of log size over time (computation with the baseline parameter values): the cohort FSD is significantly right-skewed at birth, corresponding to a Poisson distribution, but evolves over time toward a normal distribution of log size (i.e., a lognormal of size)

4.2 Total firm size distribution

4.2.1 Derivation

Now, we focus on the total FSD, i.e., the FSD when the entire set of varieties is considered. We show that the FSD is an overlapping mixture of Poisson distributions which is systematically right skewed and exhibits a fatter upper tail than the normal distribution for log size.

Consider again a given cohort of varieties, born at time t c and produced by monopolists in new industries indexed by \(\omega_{c}\in\left]N_{t_{c}-\epsilon},N_{t_{c}}\right]\). For ease of exposition and without loss of generality, let us assume ϵ = 1 such that the measure of a given cohort can be represented by the discrete increment \(\Delta_{t_{c}}=N_{t_{c}}-N_{t_{c}-1}\), where c, t ∈ ℕ. Let \(\bar{q}_{t}\) denote the average of the quality index \(q\equiv\lambda^{\frac{\alpha}{1-\alpha}j}\) at time t and \(\bar{j}_{t}\) the level of j implicit in \(\bar{q}_{t}\). Also, let

In order to derive the distribution of z in Eq. 30, we heuristically analyse the evolution of the successive cohorts over time, which can then be described by the following steps:Footnote 18

-

1.

At instant t c = 0, cohort c = 0 is born, such that \(\Delta_{0}=N_{0},\,\bar{j}_{0}=0,\,\bar{q}_{0}=1\), and:

-

a.

The quality level of the firms belonging to the cohort c = 0 (Δ0) evolves following \(P_{o}(It)+\bar{j}_{0}\) over [0,t[;

-

b.

The average quality index for all pre-existent cohorts at t = 1 (Δ0) is given by

$$ \bar{q}_{1}=\lambda^{\frac{\alpha}{1-\alpha}(I+\bar{j}_{0})}=\lambda^{\frac{\alpha}{1-\alpha}I}.$$

-

a.

-

2.

At instant t c = 1, cohort c = 1 is born, such that \(N_{1}=N_{0}e^{g_{N}}\), \(\Delta_{1}=N_{1}-N_{0}=N_{0}(e^{g_{N}}-1)\), \(\bar{q}_{1}=\lambda^{\frac{\alpha}{1-\alpha}(I+\bar{j}_{0})}=\lambda^{\frac{\alpha}{1-\alpha}I}\), and:

-

a.

The quality level of the firms belonging to the cohort c = 1 (Δ1) evolves following \(P_{o}(I(t-1))+\bar{j}_{1}\) over [1, t[, such that \(\bar{j}_{1}\) solves \(\lambda^{\frac{\alpha}{1-\alpha}\bar{j}_{1}}=1+m(\bar{q}_{1}-1)\).Footnote 19 Thus, \(\bar{j}_{1}=\ln\left(1+m(\bar{q}_{1}-1)\right)/k,\, m\in\left(0,1\right)\);

-

b.

The average quality index for all pre-existing cohorts at t = 2 (Δ0 + Δ1) is given by

$$ \begin{array}{rll} \bar{q}_{2} & = & \frac{\Delta_{0}\lambda^{\frac{\alpha}{1-\alpha}(2I+\bar{j}_{0})}+\Delta_{1}\lambda^{\frac{\alpha}{1-\alpha}(I+\bar{j}_{1})}}{N_{1}}\\ & = & \lambda^{\frac{\alpha}{1-\alpha}I}e^{-g_{N}}\left(\bar{q}_{1}+(e^{g_{N}}-1)\lambda^{\frac{\alpha}{1-\alpha}\bar{j}_{1}}\right).\end{array}$$

-

a.

-

3.

At instant t c = 2, cohort c = 2 is born, such that \(N_{2}=N_{0}e^{2g_{N}}=N_{1}e^{g_{N}}\), \(\Delta_{2}=N_{2}-N_{1}=N_{1}(e^{g_{N}}-1)\), \(\bar{q}_{2}=\lambda^{\frac{\alpha}{1-\alpha}I}e^{-g_{N}}\left(\bar{q}_{1}+(e^{g_{N}}-1)\lambda^{\frac{\alpha}{1-\alpha}\bar{j}_{1}}\right)\), and:

-

a.

The quality level of the firms belonging to the cohort c = 2 (Δ2) evolves following \(P_{o}(I(t-2))+\bar{j}_{2}\) over [2,t[, such that \(\bar{j}_{2}\) solves \(\lambda^{\frac{\alpha}{1-\alpha}\bar{j}_{2}}=1+m(\bar{q}_{2}-1)\). Thus, \(\bar{j}_{2}=\ln\left(1+m(\bar{q}_{2}-1)\right)/k\);

-

b.

The average quality index for all pre-existing cohorts at t = 3 (Δ0 + Δ1 + Δ2) is given by

$$ \begin{array}{rll} \bar{q}_{3} & = & \frac{\Delta_{0}\lambda^{\frac{\alpha}{1-\alpha}(3I+\bar{j}_{0})}+\Delta_{1}\lambda^{\frac{\alpha}{1-\alpha}(2I+\bar{j}_{1})}+\Delta_{2}\lambda^{\frac{\alpha}{1-\alpha}(I+\bar{j}_{2})}}{N_{2}}\\ & = & \lambda^{\frac{\alpha}{1-\alpha}I}e^{-g_{N}}\left(\bar{q}_{2}+(e^{g_{N}}-1)\lambda^{\frac{\alpha}{1-\alpha}\bar{j}_{2}}\right).\end{array}$$

-

a.

-

4.

Finally, at instant t c = t − 1, cohort c = t − 1 is born, such that \(N_{t-1}=N_{0}e^{(t-1)g_{N}}=N_{t-2}e^{g_{N}}\),\(\Delta_{t-1}=N_{t-1}-N_{t-2}=N_{t-2}(e^{g_{N}}-1)\), and:

-

a.

The quality level of the firms belonging to the cohort c = t − 1 (Δ t − 1) evolves following \(P_{o}(I(t-t_{c}))+\bar{j}_{t-1}\) over [t c ,t[, such that \(\bar{j}_{t-1}\) solves \(\lambda^{\frac{\alpha}{1-\alpha}\bar{j}_{t-1}}=1+m(\bar{q}_{t-1}-1)\), which implies \(\bar{j}_{t-1}=\ln\left(1+m(\bar{q}_{t-1}-1)\right)/k\);

-

b.

The average quality index for all pre-existing cohorts at t (Δ0 + Δ1 + ... + Δ t − 1) is given by

$$ \bar{q}_{t}=\lambda^{\frac{\alpha}{1-\alpha}I}e^{-g_{N}}\left(\bar{q}_{t-1}+(e^{g_{N}}-1)\lambda^{\frac{\alpha}{1-\alpha}\bar{j}_{t-1}}\right),t\geqslant2.$$

-

a.

Then, at instant t ≥ 1, the distribution of z is a mixture of overlapping Poisson distributions with the following cumulative distribution function (cdf)

where \(u=\left(z-\ln(1+m(\bar{q}_{i}-1))\right)/k\), \(N_{t}=N_{0}e^{g_{N}t}\), Δ0 = N 0, \(\Delta_{i}=N_{0}\left(e^{g_{N}}-1\right)e^{g_{N}(i-1)}\) for i ≥ 1, and \(F_{P_{o}(I\left(t-i\right))}\left(u\right)\) denotes the cdf of the Poisson distribution with parameter \(I\left(t-i\right)\) evaluated at u.

The distribution in Eq. 31 reflects the systematic horizontal entry along the BGP. As one can see, the total FSD is a direct function of the technological parameters α, λ (through k) and m, and an indirect function of the remaining structural parameters of the model, through their influence on the endogenous variables g N and I (see Eqs. 26 and 27). In contrast, the distribution does not depend on the size of the first cohort, N 0, which is predetermined in the model.

Moreover, considering that R&D expenditures per firm are also proportional to the quality index \(q(j{\kern1.5pt})\equiv\lambda^{\frac{\alpha}{1-\alpha}j(\omega,t)}\) (to see this, solve Eq. 13 in order to R v ), we conclude that the distribution of R&D expenditure is also given by Eq. 31. Then, R&D intensity (defined by the ratio of R&D expenditure to sales) is constant across firms, which implies that the model predicts R&D intensity is independent of firm size. This matches one of the stylised facts that have emerged from recent empirical studies using firm-level data (see Klette and Kortum 2004, and also Segerstrom 2007).

4.2.2 Properties

The sth moment of the variable z, \(E\left(z^{s}\right)\), with cdf in Eq. 31, is given by

where s = 0, 1, 2, ..., f t (z) is the probability function of log size z, and \(f_{P_{o}(I(t-i))}(u)\) is the probability function of the Poisson distribution with parameter \(I\left(t-i\right)\) evaluated at u. Since it is not possible to obtain an analytical expression of the sum of the series in Eq. 32, we proceed with our analysis by computing approximate numerical results.

To do so, we calibrate the model with the following baseline parameter values: β = 2.4, ϕ = 1, ζ = 0.7, λ = 2.5, ρ = 0.02, θ = 1.5, α = 0.4, L = 1, and m = 0.4. Since they have no impact on the FSD, ϕ and L are normalised to unity; in particular, the latter implies that all aggregate magnitudes can be interpreted as per capita magnitudes. Given that along the BGP g Q − g N = βg N , we calibrate β by computing the ratio between the growth rate of the average firm size and the growth rate of the number of firms we have found in the empirical data.Footnote 20 The value for m follows from the empirical evidence reported by Geroski (1995) and McCloughan (1995) (see more references therein), according to which the average size of entrants ranges, respectively, between 33 and 50%, and between 25 and 66% of the average size of incumbents; thus, we chose roughly the mid-point value for m. The values for θ, ρ and α are set in line with the standard literature (see, e.g., Barro and Sala-i-Martin 2004). The values of the remaining parameters, ζ and λ, are chosen in order to calibrate the BGP aggregate growth rate, g, around 3.5 percent/year, corresponding to the average growth rate of World GDP in 1992–2007. Then, the implied values for g N and I are, respectively, 1.0 and 2.9%/year. The latter then means that the model predicts an average lifetime of a design of 34 years, which is within the range of values considered in the empirical literature (see Strulik 2007). Moreover, the implied value for the real interest rate is 7.2%, in line with the empirical value for the long-run average real return on the stock market, and which should be taken as the equilibrium rate of return to R&D, as argued by Jones and Williams (2000). Nonetheless, extensive sensitivity analysis has shown that the results presented hereafter are robust, in qualitative terms, to changes in the underlying parameters (see Section 5 and the Appendix).

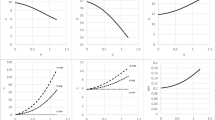

In Table 2 and Fig. 2, we characterise the FSD by considering the probability function of log size f t (z) for an increasing number of cohorts over time, while we let the parameters of the model take their baseline values throughout the analysis. The skewness and the tail-weight coefficients compare the FSD, in Eq. 31, with a normal distribution of log size with the same average and variance.Footnote 21 The interpretation of their values is as follows: if the skewness coefficient is above (below) zero, then the FSD is right (left) skewed (this coefficient for the normal distribution is zero); if the upper (lower) tail coefficient is above unity, the FSD has an upper (lower) tail heavier than the upper (lower) tail of the normal distribution. As already explained, since we are only able to compute approximate numerical results, small variations in the coefficients, especially if they do not show persistence in direction (i.e., upwards or downwards), should be interpreted with due caution. The same applies to changes in the average, E(z), in the variance, V(z), and thus in the variation coefficient, \(\gamma_{z}=\sqrt{V(z)}/E(z)\).

The total firm-size distribution (FSD) as depicted by the probability function of log size f t (z) for an increasing number of cohorts/periods of time (computation with the baseline parameter values): the FSD is systematically right skewed and exhibits a fatter upper tail than the normal distribution of log size

Firstly, we find that the average of (log) size is not constant over time. The average increases monotonically, as would be expected since sales per firm, X(ω,t), and hence \(\textrm{ln}X(\omega,t)\), are propelled by the endogenous growth of quality (see Eq. 6), which is positive along the BGP. An upward trend in average sales per firm over the long run is reported by, e.g., Jovanovic (1993). In turn, the variance displays a non-monotonic pattern over time: a rapid increase in the variance, when the number of cohorts is still relatively small, is eventually followed by a decrease when the number of cohorts rises to a certain threshold, and by a stabilisation thereafter (the latter is defined numerically within a given tolerance error term—in light of the results presented in Table 2, the order of this tolerance error term is of two decimal figures). This behaviour reflects the stabilising effect of the number of cohorts on the variance. That is, as shown in Section 4.1, for a given cohort, both the average and the variance of size increase monotonically over time (see Table 1). The fact that the number of cohorts increases exponentially at rate g N , combined with size upon horizontal entry rising over time in tandem with average size of existing firms due to the (imperfect) spillovers from incumbents to entrants, implies that a stabilisation in the dispersion of firm size will eventually set in when the entire population of firms is considered.Footnote 22

Secondly, the skewness and the upper-tail weight coefficients are systematically above zero and one, respectively, i.e., the skewness is larger and the upper tail is fatter than those observed with the normal distribution of log size, to which the FSD of a single cohort converges. Moreover, the coefficients become roughly stable for a sufficiently large number of cohorts (in the numerical exercise presented in Table 2, for around t > 1,000, again within a tolerance error term with a order of two decimal figures). The mechanism behind these results is similar to the one that explains the effect of the number of cohorts on the variance, as described above.Footnote 23 Thus, our theoretical predictions qualitatively address the evidence for total FSD in, e.g., Cabral and Mata (2003) and Bottazzi et al. (2007), as regards skewness, and in Gaffeo et al. (2003) and Growiec et al. (2008), as regards upper-tail weight. On the other hand, the lower tail is less heavy than the normal lower tail for a relatively small number of cohorts, but stabilises around the tail weight of the normal distribution over time.

Finally, by considering Eq. 31 with support changed from z to q ≡ e z, we obtain the cdf of size, F t (q). Then, we are also able to show that an (inverse) power law scaling behaviour emerges in the upper tail as the number of cohorts increases. Figure 3 depicts the tail cdf 1 − F(q) in a log-log scale, with an OLS regression line that informs us on the goodness of fit to a power law distribution. The slope of the regression line corresponds (in modulus) to the estimate of the power law coefficient.Footnote 24 For the baseline parameters, the estimates of the power-law coefficient stabilise at 0.83, which is within the range of empirical estimates obtained by Gaffeo et al. (2003) when firm size is measured by sales. However, as further noted in Section 5, for any given number of cohorts, our estimates are somewhat sensitive to shifts in the parameters of the model, despite the fact that the goodness of fit, measured by the R 2 (square of the correlation coefficient) remains very high.

Log-log plot of the tail of the cdf of size, 1 − F(q), for a different number of cohorts/periods of time (computation with the baseline parameter values): an (inverse) power law scaling behaviour emerges in the upper tail as the number of cohorts increases; the estimates of the power-law coefficient stabilise at 0.83, which is within the range of empirical estimates found in the literature

To sum up, a stable FSD arises with respect to the variance, the skewness and the upper-tail behaviour, which is in accord with the empirical properties of the FSD emphasised in the literature when the entire population of firms is considered. Nevertheless, since not all the moments of the distribution are stationary, not even asymptotically, then the total FSD is not stationary. Furthermore, the fact that the coefficient of variation decreases monotonically over time makes it clear that the FSD is not stationary even if we consider normalised firm sizes—i.e., firm sizes divided by the average firm size.

5 Comparative statics and policy implications for growth and market structure

Since the properties of the FSD cannot be derived analytically, a sensitivity analysis was conducted in order to access the robustness of our results. We tested for a wide range of parameter values and concluded that the skewness and the upper-tail weight coefficients presented in Table 2, whose values are systematically above zero and one, respectively, are robust to changes in all parameters (see the Appendix). That is, we always obtain a FSD that is right-skewed and has a fatter upper tail than the normal of log size. In contrast, the weight of the lower tail is sensitive to changes in β, m, λ and α, such that the lower-tail weight coefficient oscillates between values below and above unity. Also, the slope of the distribution in the log-log scale is somewhat sensitive to changes in the parameters of the model (an illustration of the impact of changes in β , ζ and m can be seen in Fig. 5).

From the point of view of the policy implications of our model, the impact of changes in the technological parameters β, ζ, m and ϕ is of special interest, in as much as these changes may be induced by the government by granting R&D subsidies and/or conducting other forms of industrial policy.Footnote 25 As far as R&D subsidies are concerned, we focus on the separate effects of those targeted at vertical R&D—which can be seen as pertaining to process innovation and incremental product innovation—and those targeted at horizontal R&D—pertaining to radical product innovation. The importance of analysing the impact of R&D subsidies separated this way has been convincingly emphasised by Peretto (1998).

We explore the fact that the properties of the FSD can be directly related to the firm dynamics arising from systematic innovative activity, in order to analyse the simultaneous impact of policy on economic growth and market structure, characterised by the number of firms, the average firm size and market concentration. As regards the latter, we use the well-known Herfindahl index as a measure.Footnote 26 Bearing in mind that the market share of the incumbent in industry ω with quality level j(ω, t), measured at the aggregate level, is given by X(j)/X = q(j)/Q, we have

where γ q denotes the coefficient of variation of \(q\equiv\lambda^{\frac{\alpha}{1-\alpha}j}\). As noted by Laincz (2009), the expression in Eq. 33 allows us to separate two effects on concentration: the first term captures the impact of the number of firms on concentration if all firms have equal market shares (if this is the case, the concentration measure is 1/N, which is the minimum level of concentration given N firms in the market), while the second term shows how the dispersion of market shares contributes to concentration, for a given number of firms. Concentration, as measured by the Herfindahl index, declines with a ceteris paribus increase in Q(t), through the BGP value of N(t) (see Eq. 29). Since Q(t) grows at the constant rate g > 0 along the BGP, we focus on changes in concentration conditional on Q(t).

As expected, the comparative-statics results depend upon the source of the change in the general equilibrium. For the purpose of illustration, in Table 3 and Fig. 4 we consider four different scenarios, besides the baseline (scenario A), each of which corresponding to a deviation from the baseline value of one of the technological parameters β, ζ, m and ϕ. Figure 4 depicts the probability function of log size, f t (z), for each scenario, while Table 3 displays the properties of the distribution and the corresponding values for the economic growth rate, g, the growth rate of the number of firms, g N , the Poisson rate, I, the number of firms, N, and the Herfindahl index (see also Fig. 5).

The total FSD under different scenarios for selected parameters (in log size), with t = 2,000. Scenario A: baseline parameter values. Scenario B: industrial policy aimed to reduce the negative externality from the existing varieties, amounting to a decrease in β. Scenario C: subsidy to vertical R&D, amounting to a decrease in ζ. Scenario D: industrial policy aimed to promote the positive spillovers from incumbents to horizontal entrants, amounting to an increase in m. Note: the FSD for scenario E (subsidy to horizontal R&D, amounting to a decrease in ϕ) is the same as for scenario A, hence it is not shown

Log-log plot of the tail of the cdf of size, 1 − F(q), for selected parameters, with t = 2,000. Scenario A: baseline parameter values. Scenario B: industrial policy aimed to reduce the negative externality from the existing varieties, amounting to a decrease in β. Scenario C: subsidy to vertical R&D, amounting to a decrease in ζ. Scenario D: industrial policy aimed to promote the positive spillovers from incumbents to horizontal entrants, amounting to an increase in m. The tail of the cdf for scenario E (subsidy to horizontal R&D, amounting to a decrease in ϕ) is the same as for scenario A (baseline), hence it is not shown

Let us consider first a subsidy to vertical R&D, which amounts to a decrease in the fixed flow cost of vertical entry, ζ (scenario C). This induces a reduction in the number of firms, N, for a given Q, such that the initial decrease in ζ is matched by an increase in average quality (see Eq. 22). The reduction in ζ also increases the effective rate of return I + r (see Eq. 16), which secures the larger resources allocated to investment (vertical and horizontal R&D) at the expense of present consumption (and hence granting a larger consumption growth—see the impact of ζ on Eq. 3). This, in turn, implies an increase in both the growth rate of the number of firms, g N , and the Poisson arrival rate, I, from which follows an increase in average firm size E(z) and a decrease in the coefficient of variation γ z ; however, in our numerical illustration, the latter translates into an increase in the coefficient of variation γ q .Footnote 27 Thus, concentration measured by Eq. 33 increases through both the number and the dispersion component, i.e., subsidies to vertical R&D stretch the FSD such that firm sizes are more spread out with fewer firms. Overall, there is a positive impact on economic growth, g, on concentration and on average firm size. Observe that the impact of ζ on the FSD, and hence on γ q , is only indirect through the effect of ζ on g N and I.

In contrast, by lowering the fixed flow cost of horizontal entry, ϕ, a subsidy to horizontal R&D has level effects only (scenario E): it increases the number of firms, such that the initial decrease in ϕ is matched by a decrease in average quality; however, since there is no impact of ϕ on the effective rate of return, both vertical and horizontal R&D are left unchanged (a higher number of firms with a smaller ϕ implies that the same amount of horizontal R&D sustains a given growth rate of the number of firms) and hence there is no effect on growth along either the vertical or the horizontal margin. Thereby, there is no impact on average firm size (despite the increase in the number of firms) and on the coefficient of variation (both γ z and γ q ). That is, there is no change in the FSD, and thus concentration decreases only through the number component. Overall, there is no impact on either economic growth or average firm size, but a negative impact on concentration.

An industrial policy aimed at reducing the negative externality induced by the number of existing varieties (barrier to horizontal entry) acts by decreasing the elasticity of the horizontal entry cost, β (scenario B). This implies an increase in the number of firms, in a similar fashion to a subsidy to horizontal R&D, while also having no impact on the effective rate of return. However, because a change in β alters the balance between the growth rate of the number of firms and the growth rate of quality (recall, from the necessary conditions for the existence of a BGP, that g Q /g N = (β + 1)), there will be a shift of resources from vertical R&D to horizontal R&D, and hence an increase in the growth rate of the number of firms and decrease in the Poisson arrival rate. A fall in average firm size and an increase in the coefficient of variation (both γ z and γ q ) then follow. Although the final result on concentration is a priori ambiguous, our numerical results show an increase in concentration as the number component is dominated by the dispersion component in Eq. 33. Overall, there is a positive impact on economic growth and on concentration, and a negative impact on average firm size. Observe that, similarly to ζ, the impact of β on the FSD is only indirect, through the effect of β on g N and I.

On the other side of the coin, an industrial policy aimed at promoting the positive spillovers from incumbents to horizontal entrants, by increasing the degree of imperfect imitation by horizontal entrants, m, (scenario D) raises the number of firms while having no impact on the effective rate of return. Since there is also no effect on the relationship between the growth rate of the number of firms and the growth rate of quality, then a change in m has only level effects, similarly to a subsidy to horizontal R&D. However, m has a direct impact on the FSD, such that the average firm size increases (despite the increase in the number of firms) and the coefficient of variation (both γ z and γ q ) decreases. Thus, concentration falls through both the number and the dispersion component. Overall, the impact is null on economic growth, negative on concentration and positive on average firm size.

Finally, policy intervention that increases m may also induce a FSD with a fat lower tail, as shown in Table 3. Fat lower tails have been apparently overlooked by the literature on firm size but have been reported by empirical studies on income and city size distributions (see Reed 2002, 2003).

To sum up, the effect of R&D subsidies and targeted industrial policies is either: (i) growth- and concentration-enhancing or (ii) growth-neutral and concentration-reducing. In particular, subsidies to vertical R&D belong to (i), while subsidies to horizontal R&D fit into (ii). Comparing with the literature, Laincz (2009), who considers subsidies to R&D only along the vertical direction, also obtains a positive relationship between growth and concentration as in (i). In contrast, Peretto (1998) considers both vertical and horizontal R&D but his measure of concentration is the reciprocal of the number of firms (i.e., equivalent to the first term in Eq. 33), since the author confines his analysis to an equilibrium which is symmetric with respect to firm size. Peretto’s model predicts a positive relationship between growth and concentration as follows: subsidies to vertical R&D are growth- and concentration-enhancing, while subsidies to horizontal R&D are growth- and concentration-reducing.

Thus, we extend Laincz’s and Peretto’s results as regards the effect of subsidies to vertical and horizontal R&D on concentration and growth to a setup with a non-degenerate FSD that exhibits the desired (qualitative) empirical properties. In particular, the contrast between Peretto’s results as regards the effect of subsidies to horizontal R&D on concentration and our prediction of a null impact of this type of subsidies on growth directly reflects the lack of relationship between growth and the flow fixed entry cost ϕ. Intuitively, the latter stems from the dominant effect exerted by the vertical-innovation mechanism over the horizontal-entry dynamics. Indeed, given the postulated horizontal entry technology and the lab-equipment R&D specification,Footnote 28 a BGP with positive (net) entry occurs ultimately because entrants expect incumbency value to grow propelled by quality-enhancing R&D. In contrast, Peretto (1998) assumes that R&D is knowledge-driven. In this case, the choice between vertical and horizontal R&D implies a division of labour between the two types of R&D. Since the total labour level is determined exogenously, horizontal entry occurs at the same rate as population growth along the BGP. Under this framework, a subsidy to horizontal R&D competes away scarce resources from vertical R&D and ultimately implies a fall in the growth rate.

However, one cannot conclude from the results described above that the relationship between concentration and growth is only either positive or null in our model. Indeed, it can be shown that changes in the preferences parameters ρ and θ imply a change of growth and concentration in opposite directions (not shown in Table 3). Thus, we confirm the ambiguity of the sign of the growth-concentration relationship emphasised by Thompson (2001) and others (see Thompson for several references to the related empirical literature).

Also noteworthy is the ambiguity of the sign of the relationship between economic growth and average firm size predicted by our model (see g and E(z) in Table 3). Although recent empirical work has found a positive relationship between average firm size and growth at the aggregate level, the majority of the empirical literature still gives little support for this view (see Pagano and Schivardi 2003).

In contrast, our model predicts an unequivocal relationship between economic size, measured by population size L, and both the number of firms and concentration: see the positive impact of L on Eq. 26 and, thereby, the negative impact on Eq. 33 (due to the removal of scale effects in our model, L has no impact on the FSD and hence on γ q ). This matches one of the robust stylised facts that emerges from international comparisons of manufacturing industrial structures: large countries tend to have a larger number of firms and lower concentration rates than small countries (see, e.g., Sherer and Ross 1990). One of the most important theoretical results in Peretto (1998) makes a similar prediction, which we herein extend to a framework where the FSD is non-degenerate.

6 Concluding remarks

With this paper, our goal has been to show how a simple model of endogenous growth with simultaneous vertical and horizontal R&D is able to account for several observed features of the FSD. We thereby establish a connection between endogenous growth theory and findings from firm-level studies of firm dynamics and innovation.

In particular, we have derived a highly-skewed fat-tailed FSD within a model where the only source of firm heterogeneity is the Poisson process of quality ladders (vertical R&D). In contrast, Thompson (2001) and Klette and Kortum (2004) combine the Poisson process with other stochastic features in order to introduce other dimensions of (exogenous) firm heterogeneity in their models. Our theoretical results qualitatively match the empirical evidence found both for the cohort and the total distribution, and still not addressed by the literature on endogenous growth and firm dynamics.

The simplicity of our stochastic structure, however, comes at the expense of empirically adequate predictions relating to firm age and exit dynamics. In particular, future work should seek to extend the present model in order to include elements that capture (i) exit probabilities that are decreasing in firm size and age,Footnote 29 and (ii) growth rates of size (both in terms of expected value and variance) decreasing in size and age among surviving firms, which are well-known empirical features of firm dynamics (see, e.g., Klette and Kortum 2004).

Another possible extension of our model would be to allow both incumbents and entrants to perform R&D (e.g., Segerstrom 2007), although this would imply a more complicated setup. This feature may be essential for further evaluating the impact of R&D subsidies, which, as emphasised by Mansfield (1986), are in reality often explicitly designed to act on the marginal expenditures of incumbents that do R&D.

Notes

Along a somewhat different line, the endogenous growth R&D models by Aghion et al. (2001) and Laincz (2009) allow for the derivation of a non-degenerate cross-section distribution of market structures, i.e., a distribution of firm sizes as measured by market shares within each industry, taken across all industries.

As their own explanation, Cabral and Mata (2003) consider the “small-firms selection” argument based on a theoretical model where financing constraints are especially relevant for small young firms. However, according to the recent empirical results by Angelini and Generale (2008), financial constraints are not the main determinant of FSD evolution, especially in financially developed economies. In a very recent paper, Gallegati and Palestrini (2010) build a statistical model without entry that explicitly addresses Cabral and Mata’s findings with respect to the FSD of a cohort of firms. Gallegati and Palestrini give an alternative explanation based on a “sample selection bias” argument, according to which a cohort of surviving firms may have a positive average rate of growth, which breaks the assumptions needed to “escape” the lognormal result (in particular, the assumptions needed in order to have an asymptotic Pareto FSD).

Although Cabral and Mata (2003) and Cabral (2007) analyse the evidence on FSD with size measured as employment per firm, a number of recent papers address the sensitivity of the FSD to different measures of size (employment, sales, capital and value added). Empirical results for sales per firm are obtained by Axtell (2001) and Gaffeo et al. (2003) (with respect to the tails weight), Bottazzi et al. (2007) (skewness) and Huynh et al. (2010) (evolution of cohort FSD). The evidence is qualitatively similar to that obtained when employment is the measure of firm size.

In fact, differently from the standard expanding-variety literature, we allow for entry as well as exit also along the horizontal direction. However, the structure of the model and, in particular, the assumption of an R&D lab-equipment specification, imply that positive (net) entry prevails along the BGP.

See de Wit (2005) for an extensive literature review of statistical models of firm dynamics.

In contrast, Thompson (2001) predicts that firm size, measured as sales per firm, is stationary along the BGP.

The focus on normalised firm size—i.e., firm size divided by its average—in order to analyse the shape of the steady-state FSD when size is non-stationary has been conducted by, e.g., Rossi-Hansberg and Wright (2007).

As we will see below, the uncertainty in R&D at the industry level creates jumpiness in microeconomic outcomes. However, as the probabilities of successful R&D across industries are independent and there is a continuum of industries, this jumpiness is not transmitted to macroeconomic variables.

In equilibrium, only the top quality of each ω is produced and used; thus, X(j, ω, t) = X(ω, t). Henceforth, we only use all arguments (j, ω, t) if they are useful for expositional convenience.

We assume that innovations are drastic, i.e., 1/α < λ, such that existing monopolies do not need to limit price and can instead charge the unconstrained monopoly price.

We assume that entrants are risk-neutral and, thus, only care about the expected value of the firm.

As noted by Poschke (2009), one possible explanation is that potential entrants cannot copy incumbents perfectly due to tacitness of knowledge embodied in these firms. However, the entry mechanism can be interpreted in other ways besides imitation. For instance, one can consider incumbents’ productivity as an indicator of knowledge in the economy. If entrants can draw on that, either as a spillover or because it is embodied in the production facilities they acquire upon entry, then they benefit from incumbents’ productivity.

If we consider the capital market equilibrium represented in the space (N, r + I), a graph can be drawn with, e.g., the number of varieties, N, on the horizontal axis (conditional on Q) and the effective rate of return, r + I, on the vertical axis. Then, Eq. 16 defines a horizontal line, while Eq. 21 is always downward-sloping in N (for a given Q), hence crossing Eq. 16 from above whatever the value of the positive constants ζ, ϕ, m and L.

Also, considering a(t) = η(t) · N(t) and Eq. 22, we re-write the transversality condition as

$$ \underset{t\rightarrow\infty}{\textrm{lim}}e^{-\rho t}C(t)^{-\theta}\zeta\cdot L\cdot Q(t)=\underset{t\rightarrow\infty}{\textrm{lim}}e^{-\rho t}\left(\frac{C(t)}{Q(t)}\right)^{-\theta}\zeta\cdot L\cdot\left(\hat{Q}e^{gt}\right)^{1-\theta}=0$$(28)where \(Q=\hat{Q}e^{gt}\) and \(\hat{Q}\) denotes detrended Q. Thus, the transversality condition implies ρ > (1 − θ)g; i.e., r > g, since \(g=\left(r-\rho\right)/\theta\). This condition also guarantees that attainable utility is bounded, i.e., the integral (Eq. 1) converges to infinity.

Bearing in mind that simultaneous vertical and horizontal R&D is a stable equilibrium in the capital market (see Section 2.3), we assume throughout the simulation exercise that the number of firms, N, at time t satisfies the inter-R&D arbitrage condition (22) given the level of technological knowledge, Q, also at t, for t ≥ 0. That is, we assume that Eq. 22 holds for the first cohort, when N = N 0 (and Q = Q 0); subsequently, as new cohorts enter the market, the assumption that N grows in tandem with Q at the constant rate g N = g Q /(1 + β) (see Eqs. 24 and 26) ensures that condition (22) continues to hold along the BGP. Thus, whatever the number of cohorts considered in each step of the simulation exercise, the corresponding N is implied by Q such that a BGP equilibrium with simultaneous vertical and horizontal R&D always holds as determined by Eq. 22.

Observe that, for all t, \(1+m(\bar{q}_{t}-1)\approx m\bar{q}_{t}\) for \(\bar{q}_{t}\) large enough, where m ∈ (0, 1) denotes the degree of imperfect imitation by horizontal entrants (see Section 2.3). However, since \(1+m(\bar{q}_{t}-1)>1\) provided \(\bar{q}_{t}\geq1\), we can compute \(\ln\left(1+m(\bar{q}_{t}-1)\right)\) as a positive number for any arbitrarily small (non-negative) value of m and \(\bar{q}_{t}\). This is not the case for \(\ln\left(m\bar{q}_{t}\right)\), because \(m\bar{q}_{t}\) may take values below unity.

The data concerns 23 European countries in the period 1995–2005 and is available from the Eurostat on-line database (link at http://epp.eurostat.ec.europa.eu).

We consider the Fisher skewness coefficient of a distribution F, which is given by \(\mu_{3}/\mu_{2}^{3},\) where μ s denotes the s-th central moment of F. As regards the tail weight, we consider modified versions of the tail-weight coefficient defined in Hoaglin et al. (1983). Thus, the right-tail weight is given by \(\left(\frac{F^{-1}(0.99)-F^{-1}(0.5)}{F^{-1}(0.75)-F^{-1}(0.5)}\right)\left(\frac{\Phi^{-1}(0.99)-\Phi^{-1}(0.5)}{\Phi^{-1}(0.75)-\Phi^{-1}(0.5)}\right)^{-1}\) and the left-tail weight is given by \(\left(\frac{F^{-1}(0.5)-F^{-1}(0.01)}{F^{-1}(0.5)-F^{-1}(0.25)}\right)\left(\frac{\Phi^{-1}(0.5)-\Phi^{-1}(0.01)}{\Phi^{-1}(0.5)-\Phi^{-1}(0.25)}\right)^{-1},\) where F − 1 and Φ − 1 denote the inverse cdf of F and of the standard Normal, Φ, respectively.

A similar result follows if, instead of considering that a given cohort of entrants introduces new varieties with the quality level concentrated at a given point of mass (given by m times the average quality level of extant varieties), we assume that the quality level of those new varieties follows a non-degenerate distribution, provided this distribution has a smaller variance than the distribution of the quality level of the extant varieties.

At a given instant of time, due to the co-existence of different cohorts, not all firms have had the same time to grow, while the population of firms itself continuously grows. Such behaviour of firm entry and growth resembles the well-known Yule process, whose limiting distribution exhibits a heavy upper tail and was used by Simon (1955) as a model for various skewed empirical distributions, including the city size distribution (see de Wit 2005).

In the empirical literature, the goodness of fit of the data to a power law (strict Pareto) \(F(x)=1-\left(a/x\right)^{p},x\geq a,p>0\), is usually determined by means of the OLS regression \(\textrm{ln}(1-F(x))=b-p\,\textrm{ln}x\), \(b=p\,\textrm{ln}a\), where x stands for firm size and F is the corresponding empirical cdf. In our case, we fit the line \(\textrm{ln}(1-F(x))=b-p\,\textrm{ln}x\), where x ≡ q, to the log-log plot of the theoretical tail of the cdf generated by Eq. 31 with support changed from z to q.

We study the effect of subsidies by considering that the government budget is always balanced and that changes in subsidies are exactly matched by changes of opposite sign in nondistortionary taxes (e.g., lump-sum taxes on consumption).

Given that q ≡ e z, the change of support from z to q brings about an increase in the variance that exceeds the increase in the average of the FSD (indeed, as shown in Table 3, γ z < 1 while γ q > 1). Since \(V(z)=E(z^{2})-\left(E(z)\right)^{2}\) and \(V(q)=E(e^{2z})-\left(E(e^{z})\right)^{2}\), this behaviour must be due to the fact that the effect of the change of support on the second moment of the distribution dominates the effect on (the quadratic of) the first moment. If this dominance is strong enough, then a shift in a given parameter with respect to the baseline that affects the coefficient of variation may imply that \(\gamma_{z}/\gamma_{z}^{base}<1\) and \(\gamma_{q}/\gamma_{q}^{base}>1\), where γ base denotes the coefficient of variation corresponding to the baseline scenario. This is the case as regards the change in ζ analysed in Table 3.

Using Rivera-Batiz and Romer (1991)’s terminology, the assumption that the homogeneous final good is the R&D input means that one adopts the “lab-equipment” version of R&D, instead of the “knowledge-driven” specification, in which labour is ultimately the only input.

See Thompson (2001) on the difficulty of introducing horizontal (net) exit in this class of endogenous growth models.

The numerical computation of the lower tail-weight coefficient is not possible if one cannot compute the lower quantiles, in particular, the quantiles of probability 0.01 and of probability 0.25.

The only practical consequence of having a very low level for economic growth is that a quite larger number of periods/cohorts, T, is required in order to obtain a total FSD with stabilised variance, skewness and tails weight.

References

Aghion P, Harris C, Howitt P, Vickers J (2001) Competition, imitation and growth with step-by-step innovation. Rev Econ Stud 68:467–492

Angelini P, Generale A (2008) On the evolution of firm size distributions. Am Econ Rev 98(1):426–438

Audretsch DB (1995) Innovation and industry evolution. MIT Press, Cambridge

Axtell RL (2001) Zipf distribution of U.S. firm sizes. Science 293:1818–1820

Barro R, Sala-i-Martin X (2004) Economic growth, 2nd edn. MIT Press, Cambridge

Bottazzi G, Cefis E, Dosi G, Secchi A (2007) Invariances and diversities in the patterns of industrial evolution: some evidence from italian manufacturing industries. Small Bus Econ 29:137–159

Cabral L (2007) Small firms in portugal: a selective survey of stylized facts, economic analysis, and policy implications. Port Econ J 6:65–88

Cabral L, Mata J (2003) On the evolution of the firm size distribution: facts and theory. Am Econ Rev 93(4):1075–1090

de Wit G (2005) Firm size distributions. An overview of steady-state distributions resulting from firm dynamics models. Int J Ind Organ 23:423–450

Dunne T, Roberts M, Samuelson M (1988) Patterns of entry and exit in U.S. manufacturing. Rand J Econ 19:495–515

Etro F (2008) Growth leaders. J Macroecon 30:1148–1172

Evans GW, Honkapohja SM, Romer P (1998) Growth cycles. Am Econ Rev 88:495–515

Freeman C, Soete L (1997) The economics of industrial innovation. MIT Press, Cambridge

Gabler A, Licandro O (2008) Endogenous growth through selection and imitation. Mimeo

Gaffeo E, Gallegati M, Palestrini A (2003) On the size distribution of firms: additional evidence from the G7 countries. Physica A 324:117–123

Gallegati M, Palestrini A (2010) The complex behavior of firms’ size dynamics. J Econ Behav Organ 75:69–76

Geroski P (1995) What do we know about entry? Int J Ind Organ 13:421–440

Gibrat R (1931) Les Inegalités Économiques; Applications: aux Inégalités des Richesses, à la Concentration des Entreprises, aux Populations des Villes, aux Statistiques des Familles, etc., d’une Loi Nouvelle, la Loi de L’Effet Proportionnel. Paris: Librairie du Recueil Sirey

Gil PM, Brito P, Afonso O (2010) Growth and firm dynamics with horizontal and vertical R&D. FEP Work Pap 356:1–29

Growiec J, Pammolli F, Riccaboni M, Stanley HE (2008) On the size distribution of business firms. Econ Lett 98:207–212

Hoaglin DM, Mosteller F, Tukey JW (1983) Understanding robust and exploratory data analysis. Wiley, New York

Howitt P (1999) Steady endogenous growth with population and R&D inputs growing. J Polit Econ 107(4):715–730

Huynh KP, Jacho-Chavez DT, Petrunia RJ, Voia M (2010) Evolution of firm distributions through the lens of functional principal components analysis. Mimeo

Jones CI, Williams JC (2000) Too much of a good thing? the economics of investment in R&D. J Econ Growth 5:65–85

Jovanovic B (1993) The diversification of production. Brookings Pap Econ Act Microecon 1:197–247

Klepper S (1996) Entry, exit, growth, and innovation over the product life cycle. Am Econ Rev 86(3):562–583

Klepper S, Thompson P (2006) Submarkets and the evolution of market structure. Rand J Econ 37(4):861–886

Klette J, Kortum S (2004) Innovating firms and aggregate innovation. J Polit Econ 112(5):986–1018