Abstract

We present a unified approach for partial information optimal investment and consumption problems in a non-Markovian Itô process market. The stochastic local mean rate of return and the Wiener process cannot be observed by the agent, whereas the path-dependent volatility, the path-dependent interest rate and the asset prices can be observed. The main assumption is that the asset price volatility is a nonanticipative functional of the asset price trajectory. The utility functions are general and satisfy standard conditions. First, we show that the corresponding full information market is complete and in this setting we solve the problem using standard methods. Second, we transform the original partial information problem into a corresponding full information problem using filtering theory, and show that it follows that the market is observationally complete in the sense that any contingent claim adapted to the observable filtration is replicable. Using the solutions of the full information problem we then easily derive solutions to the original partial information problem.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The optimal investment and consumption problem is a fundamental object of study in financial mathematics. In this paper we consider a financial market living on a stochastic basis \({\left( {\Omega ,{{\mathcal {F}}},P,\underline{\mathcal {F}}} \right) }\) carrying an n-dimensional asset price process S modeled as a non-Markovian Itô process. The (augmented) filtration generated by the asset prices \(\underline{{\mathcal {F}}}^S\) formalizes the information set of an agent. The local mean rate of return process \(\alpha \) and the driving Wiener process W are not assumed to be adapted to \(\underline{{\mathcal {F}}}^S\) and the agent can therefore generally not observe these processes and the information is thus partial. The asset price volatility is, however, without loss of generality adapted to \(\underline{{\mathcal {F}}}^S\). The market also carries an observable interest rate process r adapted to \(\underline{{\mathcal {F}}}^S\). The main assumption is that the volatility of S, denoted by \(\sigma (S)\), is a regular nonanticipative functional of the asset price trajectory. The market is shown to be observationally complete Footnote 1 in the sense that any contingent claim adapted to the observable filtration \(\underline{{\mathcal {F}}}^S\) is replicable, and for this we need the assumption that \(\sigma (S)\) is a regular nonanticipative functional.

For a fixed time interval and fixed initial wealth the agent faces the problem of optimizing expected utility of a continuous consumption stream and terminal wealth. The utility functions are general and satisfy standard conditions. This is a stochastic optimal control problem under partial information and the purpose of this paper is to characterize the agent’s optimal consumption and optimal portfolio weights processes, as well as the resulting optimal wealth process. We also study logarithmic and power utility in two examples. We tackle the problem in two steps.

First, we solve the corresponding full information problem, which we obtain by assuming that the large filtration \(\underline{{\mathcal {F}}}\) coincides with the observable filtration \(\underline{{\mathcal {F}}}^S\). Optimal investment and consumption problems with full information are typically studied using the dynamic programming approach or the martingale approach. In the dynamic programming approach solutions are typically presented in the form of non-linear infinite-dimensional partial differential equations called Hamilton–Jacobi–Bellman equations. This approach typically relies on the assumption that processes are Markovian. In the martingale approach optimization is performed \(\omega \) by \(\omega \). Solutions are typically presented in the form of characterizations of the process dynamics of optimal wealth, optimal consumption and the optimal portfolio. This approach typically relies on market completeness. Under the assumption of full information we show that our market is complete, and since it is also non-Markovian we use the martingale approach. The optimal investment and consumption problem was first studied in Merton (1969, 1971), where the dynamic programming approach was used. The martingale approach was developed in Pliska (1986) and Karatzas et al. (1987). The literature on the optimal investment and consumption problem is considerable, see Chapter 3 in Karatzas and Shreve (1998) for an excellent survey.

Second, we transform the original partial information problem into a corresponding full information problem using the filtering theory separation principle, also known as the principle of separation of estimation and control. We express the originally only partially observable dynamics of the asset prices in terms of fully observable dynamics of the same type as in the full information problem using a filter estimate of the unobservable process \(\alpha \) and the innovations process, and show that it follows that the market is observationally complete. Using the solutions of the full information problem we then easily derive solutions to the original partial information problem.

Using the filtering theory separation principle in this type of two step approach is a well-known technique in the literature of optimal investment and consumption under partial information, see e.g. Lakner (1995), Putschögl and Sass (2008), Sass and Wunderlich (2010) and Björk et al. (2010).

One strand of the literature on partial information optimal investment and consumption focuses on the problem from a general perspective, i.e. with the aim of studying a financial market which is as general as possible while still obtaining interesting results. The present paper belongs to this strand. Much of the general theory of optimal investment and consumption under partial information was developed in Lakner (1995). That is where the notions of full and partial information were introduced. Using filtering theory and martingale methods the paper studies partial information optimal investment and partial information optimal consumption separately. Asset prices follow an Itô process with unobservable stochastic local mean rate of return and volatility of a similar type as in the present paper. The risk free interest rate is assumed to be zero. An explicit expression for the optimal consumption process is derived and the optimal portfolio process is implicitly characterized. Moreover, explicit solutions for logarithmic and power utility are obtained under more restrictive assumptions on the asset price dynamics. Putschögl and Sass (2008) study partial information optimal investment and consumption using Malliavin calculus and present explicit expressions for the optimal consumption process as well as the optimal portfolio process involving Malliavin derivatives. Asset prices follow an Itô process with unobservable stochastic local mean rate of return and constant volatility. The interest rate is constant. The special case of power utility is studied in an example. The use of Malliavin calculus and in particular the Clark–Ocone theorem in order to obtain explicit expressions for optimal quantities, such as the optimal portfolio, which generally can otherwise only be implicitly characterized, is also seen in Lakner (1998), where optimal investment for a similar asset price model is studied. Björk et al. (2010) study optimal investment in a setting similar to the one in the present paper. The Markovian special case and power and logarithmic utility are also studied in detail.

The other, much larger, strand of the literature studies optimal investment and consumption under partial information in more specific financial models. It should be noted that many of these papers also add to the general theory. There are two main types of partial information asset price models for which reasonably explicit expressions for the optimal quantities may be found using filtering theory. In the first one, the unobservable local mean rate of return is modeled as the solution of a linear SDE and the Kalman filter is used. In the second one, which is known as the hidden Markov model (HMM), the unobservable local mean rate of return is modeled as a function of the current state of a continuous-time Markov chain with a finite number of states. The corresponding filter is known as the Wonham filter or the HMM filter. In both of these models it is necessary to impose a restrictive structure on the asset price volatility in order to obtain explicit solutions.

The Kalman filter is used to study optimal investment and consumption under partial information in Dothan and Feldman (1986), Lakner (1998) and Putschögl and Sass (2008). The HMM filter is used in Elliott and Rishel (1994), Honda (2003), Sass and Haussmann (2004), Bäuerle and Rieder (2005) and Hahn et al. (2007).

Sass (2007) studies the problem under convex constraints on the portfolio strategy in an Itô process model where the volatility depends on the current state of the asset price return process. Sass and Wunderlich (2010) study a similar model under joint budget constraints and shortfall risk constraints.

Callegaro et al. (2006), Bäuerle and Rieder (2007) and Frey et al. (2012) study the problem in jump process models.

The main contribution of the present paper is a unified approach for partial information optimal investment and consumption problems in observationally complete non-Markovian Itô process markets with stochastic unobservable local mean rates of return, path-dependent volatility and path-dependent interest rates. We extend the general results of Björk et al. (2010) by giving the agent the possibility of continuous consumption. However, more important, we show that our market is (observationally) complete and we also clarify the fact that one must make restrictive assumptions regarding the asset price volatility for this to be the case. We extend the general results of Lakner (1995) in that our interest rate is path-dependent rather than zero. This extension is not trivial. In Lakner (1995) the filtration generated by the asset prices coincides with the filtration generated by the Wiener process under the risk-neutral measure. This is because asset prices have no drift under the risk-neutral measure, since the interest rate is zero. This implies that the standard martingale representation theorem can be directly used to prove that the market is complete. We extend the general results (not related to Malliavin calculus) of Putschögl and Sass (2008), mainly due to their assumption of constant volatility and constant interest rate. This extension is not trivial for reasons similar to the ones mentioned in relation to Lakner (1995).

For the corresponding full information problem we shed some light on the solutions for the special case of power utility. Specifically, we note that the price process of a certain financial derivative turns up as an ingredient in the solution for power utility. We also generalize the probability measure \(Q^0\) studied in Björk et al. (2010).

The rest of this paper is structured as follows. In Sect. 2 we present general results which form the mathematical foundation of the paper. In Sect. 3 we introduce the financial market and formulate the problem which we study in the paper. In Sect. 4 we solve the problem in the special case of full information. By solving the problem we mean that we characterize the agent’s optimal consumption and optimal portfolio weights processes, as well as the resulting optimal wealth process. The problem is solved for general utility functions satisfying standard conditions. We also study logarithmic and power utility as examples. In Sect. 5 we transform the original partial information problem into a corresponding full information problem. Using the solutions of the full information problem we derive solutions to the original partial information problem.

2 Two martingale representation results

In order to show that the financial market in this paper is observationally complete we need two martingale representation results. The results are not fundamentally new but they are usually not presented in this way. Much of the general theory directly related to these results was developed in the seminal paper of Fujisaki et al. (1972) and the references therein, and can be found in e.g. Kallianpur (1980) and Liptser and Shiryayev (2001). This section is to be considered an independent part of the paper.

Consider a stochastic basis \({\left( {\Omega ,{\mathcal {F}},P,\underline{{\mathcal {F}}}} \right) }\) satisfying the usual conditions, where \(\underline{{\mathcal {F}}} = \left\{ {{\mathcal {F}}_t} \right\} _{0\le t \le T}\) for some fixed terminal time T. The basis carries an n-dimensional Wiener process denoted by W. For any process \(\xi \) we use the notation that the augmented filtration generated by \(\xi \) is denoted by \(\underline{{\mathcal {F}}}^\xi \). First we need two results from the theory of stochastic differential equations (Proposition 2.3).

Definition 2.1

Let \((C_T,{\mathcal {B}}_T)\) be the measurable space of continuous functions x on [0, T] where, for all \(t \in [0,T], {\mathcal B}_t\) is the \(\sigma \)-algebra \(\sigma (x\,{:}\,x_s, 0\le s \le t)\). The t-indexed \(n \times n\)-dimensional functional \(\beta _t\,{:}\,C_T \rightarrow {\mathcal {R}}^{n,n}\) is said to be nonanticipative if it is \({\mathcal {B}}_t\)-measurable for all \(t \in [0,T]\).

Definition 2.2

Let \(\eta _t(x)\) be a nonanticipative functional. \(\eta _t(x)\) is said to be regular if it satisfies the following Lipschitz and growth conditions, where \(||\eta ||^2 = \sum \eta _{ij}^2\),

for all \(t \in [0,T]\) and continuous functions x and y on [0, T], where \(L_1\) and \(L_2\) are constants and \(K_t\) is a nondecreasing right-continuous function with \(K_t \in [0,1]\).

Proposition 2.3

Let \(\eta _t(x)\) and \(\beta _t(x)\) be regular nonanticipative functionals. Then the SDE

has a unique strong solution \(\xi \). Moreover, if \(\beta _t(x)\) is invertible (for all t and x) then \(\underline{{\mathcal {F}}}^\xi = \underline{{\mathcal {F}}}^W\).

Proofs of the two results in Proposition 2.3 can be found in e.g. Kallianpur (1980) and Liptser and Shiryayev (2001).Footnote 2

In the rest of this section we will study an equation of the type

where \(\beta _t(x)\) is an invertible (for all t and x) regular nonanticipative functional and \(\gamma \) is an \(\underline{{\mathcal {F}}}\)-progressively measurable process. We need the following regularity.

Assumption 2.4

\(\int _0^T||\beta _t^{-1}(\xi )\gamma _t||^2{ dt}\,{<}\,\infty \) a.s. and the local martingale \(\tilde{L}_t\,{\equiv }\, e^{-\int _0^t(\beta (\xi )_s^{-1}\gamma _s)'{} { dW}_s -\frac{1}{2}\int _0^t||\beta (\xi )_s^{-1}\gamma _s||^2{ ds}}\) is a martingale.Footnote 3

We are now ready to present the first main result of this section.

Proposition 2.5

Let the process \(\xi \) satisfy the equation

where \(\beta _t(x)\) is an invertible (for all t and x) regular nonanticipative functional and \(\gamma \) is an \(\underline{{\mathcal {F}}}^\xi \)-progressively measurable process.Footnote 4 Let Y be any \(\underline{{\mathcal {F}}}^\xi \)-martingale. Then there exists an \(\underline{{\mathcal {F}}}^\xi \)-progressively measurable process \(a_t\) such that

for all t, where \(\int _0^T||a_s||^2{ ds}\,{<}\,\infty \) a.s.

Proof

The proof is for the one-dimensional case and the extension is trivial. The Girsanov theorem implies that if we change the probability measure, on \(\underline{{\mathcal {F}}}\), using the likelihood process \(\tilde{L}\), and denote the resulting equivalent measure by \(\tilde{P}\), then

is \(\underline{{\mathcal {F}}}\)-Wiener under \(\tilde{P}\) (the second part of Assumption 2.4 implies that we can use the Girsanov theorem). This implies that

From Proposition 2.3 and (4) it follows that \(\underline{{\mathcal {F}}}^\xi = \underline{{\mathcal {F}}}^{\tilde{W}}\) and we can therefore use the standard martingale representation theorem (see e.g. Chapter 1 of Karatzas and Shreve 1998) to prove that any \(\underline{{\mathcal {F}}}^\xi \)-martingale under \(\tilde{P}\), denote it by \(\tilde{Y}\), can be written as

\(\tilde{P}\)-a.s., for some \(\underline{{\mathcal {F}}}^{\tilde{W}}\)-progressively measurable process \(\tilde{a}\) (satisfying \(\int _0^T||\tilde{a}_s||^2{ ds} < \infty \tilde{P}\)-a.s.) and hence by (3)

\(\tilde{P}\)-a.s. Now let Y be an \(\underline{{\mathcal {F}}}^\xi \)-martingale under P. Abstract Bayes’ theorem then implies that \(\tilde{Y} \equiv \frac{Y}{\tilde{L}}\) is an \(\underline{{\mathcal {F}}}^\xi \)-martingale under \(\tilde{P}\) and by (5) it follows that (use Itô’s formula)

Hence Y is of the claimed form, with \(a_t = \tilde{L}_t\tilde{a}_t- Y_t(\beta _t(\xi )^{-1}\gamma _t)\) (recall that P and \(\tilde{P}\) are equivalent).

Moreover, \(\int _0^T||a_s||^2{ ds} = \int _0^T||\tilde{L}_s\tilde{a}_s- Y_s(\beta _s(\xi )^{-1}\gamma _s)||^2{ ds} < \infty \) a.s. follows from \(\int _0^T||\tilde{a}_s||^2{ ds} < \infty \) \(\tilde{P}\)-a.s., continuity of the trajectories of Y and \(\tilde{L}\) and the first part of Assumption 2.4. \(\square \)

In order to present the second main result of this section, Corollary 2.11, we need the following definition and result from filtering theory. The additional regularity of Assumption 2.7 is also needed.Footnote 5

Definition 2.6

Denote the filter estimate process, with respect to the filtration \(\underline{{\mathcal {F}}}^\xi \), for any process Y by \(\hat{Y}\), where Y is assumed to be a measurable process satisfying \(\int _0^TE\left[ {||Y_t||^2} \right] {} { dt} < \infty \). Define the process \(\hat{Y}\) as the \(\underline{{\mathcal {F}}}^\xi \)-progressively measurable modification of \(E_{{\mathcal {F}}^\xi _t}\left[ {Y_t} \right] , \forall t \in [0,T]\).

Assumption 2.7

\(\int _0^TE\left[ {||\beta _t^{-1}(\xi )\gamma _t||^2} \right] {} { dt} < \infty \).

Lemma 2.8

Let the process \(\xi \) satisfy the equation

where \(\beta _t(x)\) is an invertible (for all t and x) regular nonanticipative functional and \(\gamma \) is an \(\underline{{\mathcal {F}}}\)-progressively measurable process. The process \(\bar{W}\) defined by

is then \(\underline{{\mathcal {F}}}^\xi \)-Wiener.

Remark 2.9

\(\bar{W}\) is referred to as an innovations process.

Lemma 2.8 is a slight modification of a well-known result in filtering theory. To see this note that if we rewrite (6) as

then we are effectively in the setting of Fujisaki et al. (1972), where we find the result that the process \(\bar{W}\) defined by

is \(\underline{{\mathcal {F}}}^\xi \)-Wiener (here we rely on Assumption 2.7). \(\beta _t(\xi )^{-1}\) is adapted to \(\underline{{\mathcal {F}}}^\xi \) and Lemma 2.8 follows directly. Now rewrite (7) as

and note that \(\xi \) in (8) is exactly the same process as \(\xi \) in (6). The only difference is that (8) is the \(\underline{{\mathcal {F}}}^\xi \)-semimartingale representation of \(\xi \) while (6) is the \(\underline{{\mathcal {F}}}\)-semimartingale representation of \(\xi \). Using this, the following result follows directly from Proposition 2.5. First, however, we need regularity for (8) corresponding to Assumption 2.4.

Assumption 2.10

The local martingale (with respect to \(\underline{{\mathcal {F}}}^\xi \)) \(e^{-\int _0^t(\beta (\xi )_s^{-1}\hat{\gamma }_s)'d\bar{W}_s-\frac{1}{2}\int _0^t||\beta (\xi )_s^{-1}\hat{\gamma }_s||^2{ ds}}\) is an \(\underline{{\mathcal {F}}}^\xi \)-martingale.

Regularity corresponding to the other part of Assumption 2.4 can be shown to follow from Assumption 2.7.

Corollary 2.11

Let the process \(\xi \) satisfy the equation

where \(\beta _t(x)\) is an invertible (for all t and x) regular nonanticipative functional and \(\gamma \) is an \(\underline{{\mathcal {F}}}\)-progressively measurable process. Let Y be any \(\underline{{\mathcal {F}}}^\xi \)-martingale. Then there exists an \(\underline{{\mathcal {F}}}^\xi \)-progressively measurable process \(a_t\) such that

for all t, where \(\bar{W}\) given by (7) is \(\underline{{\mathcal {F}}}^\xi \)-Wiener and \(\int _0^T||a_s||^2{ ds} < \infty \) a.s.

3 The financial market and problem formulation

Consider an arbitrage free continuous time financial market living on a stochastic basis \({\left( {\Omega ,{\mathcal {F}},P,\underline{\mathcal {F}}} \right) }\) satisfying the usual conditions, where P is the objective probability measure and \(\underline{{\mathcal {F}}} = \left\{ {{\mathcal {F}}_t} \right\} _{0\le t \le T}\) for some fixed terminal time T which we interpret as the investment horizon of the agent. The market has the following components.

-

n asset price processes \(S^i\), for \(i =1,\ldots ,n\), with dynamics given by

$$\begin{aligned} { dS}_{t}^i = \alpha _t^iS_t^i{ dt} + \sigma _t^i(S)S_t^i{ dW}_t^i, \quad S_0^i \in {\mathcal {R}}^{++} \end{aligned}$$which we describe in the more convenient vector form

$$\begin{aligned} { dS}_{t} = D(S_t)\alpha _t{ dt} + D(S_t)\sigma _{t}(S){ dW}_{t} \end{aligned}$$(9)where

-

\(\alpha \) is an \(\underline{{\mathcal {F}}}\)-progressively measurable n-dimensional process satisfying \(\int _0^T||\alpha _t||{ dt}<\infty \) a.s.

-

W is an n-dimensional \(\underline{{\mathcal {F}}}\)-Wiener process

-

\(D(S_t)\) is the \(n \times n\) diagonal matrix with the vector \(S_t\) as main diagonal

-

\(\sigma _t(\cdot )\) is an \(n \times n\)-dimensional nonanticipative functional such that \(D(x)\sigma _t(x)\) is regular and invertible (for all t and x) and \(\int _0^T||\sigma _t(S)||^2{ dt}<\infty \) a.s.

-

-

A bank account process B which for the \(\underline{{\mathcal {F}}}^S\)-progressively measurable process r (interpreted as the instantaneous short rate), satisfying \(\int _0^T|r_t|{ dt}<\infty \) a.s., evolves according to \({ dB}_t = r_tB_t{ dt}, B_0 = 1\).

We will now describe the setup of the optimal investment and consumption problem in more detail. This setup and also the optimization procedure of the full information version of our problem (in Sect. 4) is very much inspired from the one largely developed in Karatzas et al. (1987) and described in Karatzas and Shreve (1998), where the important difference is that we have adjusted their (full information) setup to our partial information setup.Footnote 6

The market inhabits an agent with initial wealth \(x_0 \ge 0\), a time-dependent consumption utility function \(U_1(t,\cdot )\), and a (bequest) utility function \(U_2(\cdot )\) for terminal wealth. The utility functions satisfy the standard conditions of Assumption 4.10. Based on the information generated by the asset prices, formalized as the filtration \(\underline{{\mathcal {F}}}^S\), the agent makes decisions about consumption and investments.

Definition 3.1

A consumption process is an \(\underline{{\mathcal {F}}}^S\)-progressively measurable nonnegative process \(c_t\) satisfying \(\int _0^Tc_t{ dt}< \infty \) a.s.

Definition 3.2

Let the amount of capital invested in each risky asset be given by the n-dimensional process \(\pi _t\) and in the bank account by the process \(\pi ^0_t\), which are both \(\underline{{\mathcal {F}}}^S\)-progressively measurable such that \(\int _0^T |\pi ^0_t + \pi _t\mathbf{1}||r_t|{ dt} <\infty , \int _0^T |\pi _t(\alpha _t -r_t\mathbf{1})|{ dt} <\infty \) and \(\int _0^T ||\pi _t\sigma _t(S)||^2{ dt} <\infty \) a.s.Footnote 7 For a given \(c_t\) the corresponding wealth process is

with \(x_0 \ge 0\). The corresponding portfolio weights process is \(u_t \equiv \pi _t/ X_t\). The portfolio weights process is said to be self-financing ifFootnote 8 \(X_t = \pi ^0_t + \pi _t\mathbf{1}\) \(\forall t \in [0,T]\) and tame if the discounted wealth process \(X_tB_t^{-1}\) is bounded from below by a real constant that does not depend on t (but possibly on the process \(\pi _t\)) a.s. Moreover, we denote the wealth process corresponding to any \(c_t\) and \(u_t\) by \(X^{u,c}_t\).

The interpretation of a self-financing portfolio weights process is that the wealth of an agent with this portfolio weights process is equal to the cumulative gains earned from investment minus cumulative consumption plus initial wealth. The concept of a tame portfolio is introduced as these do not allow doubling strategies, see Karatzas and Shreve (1998, Chapter 1).

Definition 3.3

We call the pair \((u_t,c_t)\) a consumption and portfolio weights process. For a fixed \(x_0 \ge 0, (u_t,c_t)\) is said to be admissible if \(u_t\) is self-financing and tame (given \(c_t\)) and if the corresponding wealth process satisfies \(X^{u,c}_t \ge 0\) for all \(t \in [0,T]\) a.s.

In the following all portfolio weights processes are assumed to be admissible. In the rest of the paper we will mainly study the optimal investment and consumption problem under partial information presented in Problem 1. The information is partial because the agent needs her consumption and portfolio weights process \((u_t,c_t)\) to be adapted to \(\underline{{\mathcal {F}}}^S\), while the local mean rate of return process \(\alpha \) and the Wiener process W are not generally adapted to \(\underline{{\mathcal {F}}}^S\).

Problem 1

Given initial wealth \(x_0 \ge 0\) and utility functions \(U_1(t,\cdot )\) and \(U_2(\cdot )\) an agent wants to maximize the functional

over the set of admissible consumption and portfolio weights processes \((u_t,c_t)\) (which need to be adapted to \(\underline{{\mathcal {F}}}^S\)). Our task is to characterize the optimal consumption process, denoted by \(\bar{c}_t^*\), the optimal portfolio weights process, denoted by \(\bar{u}^*_t\), and the optimal wealth process, denoted by \(\bar{X}_t^*\).

4 The full information problem

In this section, we will study Problem 1 under the assumption that the agent has full information and we therefore let the large filtration coincide with the observable filtration, see Assumption 4.1. In Sect. 5 we will study the partial information problem we set out to study and consequently we will in that section drop Assumption 4.1 and show that the original partial information problem can be transformed into a full information problem of the type studied in this section.

Assumption 4.1

\(\underline{{\mathcal {F}}} = \underline{{\mathcal {F}}}^S\).Footnote 9

Remark 4.2

We use the notation that a bar over a quantity indicates that this is a quantity in the original partial information setting, i.e. without Assumption 4.1, and that the same quantity without the bar is with this assumption. For example, \(\bar{c}_t^*\) denotes the optimal consumption process under partial information, i.e. without Assumption 4.1, whereas \(c_t^*\) denotes the optimal consumption process under full information, i.e. with Assumption 4.1.

In the rest of this section we will write \(\underline{{\mathcal {F}}}\) and not \(\underline{{\mathcal {F}}}^S\) even though they by assumption coincide. The reason is that we in Sect. 5 will study the filtration \(\underline{{\mathcal {F}}}^S\) (without assuming that \(\underline{{\mathcal {F}}} = \underline{{\mathcal {F}}}^S\)) and we must make the distinction clear.

Consider the market price of risk process \(\vartheta _t\), which is an \(\underline{{\mathcal {F}}}\)-progressively measurable modification such that \(\vartheta _t = \sigma _t^{-1}(S)(\alpha _t-r_t\mathbf{1})\) a.s.

Assumption 4.3

The local martingales \(L_t \equiv e^{-\int _0^t\vartheta _s'{ dW}_s-\frac{1}{2}\int _0^t||\vartheta _s||^2{ ds}}\) and \(\tilde{L}_t\,{\equiv }\,e^{-\int _0^t(\sigma _s^{-1}(S)\alpha _s)'{ dW}_s-\frac{1}{2}\int _0^t||\sigma _s^{-1}(S)\alpha _s||^2{ ds}}\) are martingales. \(\int _0^T||\vartheta _t||^2{ dt}\,{<}\,\infty \) a.s. and \(\int _0^T||\sigma _t^{-1}(S)\alpha _t||^2{ dt}\,{<}\,\infty \) a.s.

We will now show that the full information market is complete and that a unique risk-neutral probability measure exits.

Definition 4.4

The market is said to be complete if every \({\mathcal {F}}_T\)-measurable and integrable contingent claim \(\zeta \), with \(\zeta B_T^{-1}\) a.s. bounded from below, can be replicated by an admissible portfolio strategy. A contingent claim is said to be integrable if \(E[\zeta B_T^{-1}L_T]<\infty \).Footnote 10

Proposition 4.5

-

There exists a unique equivalent risk-neutral probability measure Q, which is given by \(\frac{{ dQ}}{{ dP}} = L_T\) on \({\mathcal {F}}_T\) for

$$\begin{aligned} { dL}_t = -\vartheta _t'L_t{ dW}_t, \quad L_0 = 1. \end{aligned}$$(10) -

The process \(W^Q\) defined by \({ dW}^Q_t = \vartheta _t{ dt} + { dW}_t\) is \(\underline{{\mathcal {F}}}\)-Wiener under Q.

-

The process \(\tilde{W}\) defined by \(d\tilde{W}_t = \sigma _t^{-1}(S)\alpha _t{ dt} + { dW}_t\) is \(\underline{{\mathcal {F}}}\)-Wiener under the equivalent probability measure \(\tilde{Q}\), given by \(\frac{d\tilde{Q}}{{ dP}} = \tilde{L}_T\) on \({\mathcal {F}}_T\). Moreover, S has no drift under \(\tilde{Q}\) and \(\underline{{\mathcal {F}}} = \underline{{\mathcal {F}}}^{\tilde{W}}\).

-

The market is complete.

Proof

The second result and first part of the third result follow directly from the Girsanov theorem since \(L_t\) and \(\tilde{L}_t\) are a likelihood processes (see Assumption 4.3). We can therefore write the process S given by (9) as

which implies that \(\vartheta _t = \sigma _t^{-1}(S)(\alpha _t-r_t\mathbf{1})\) gives us a risk-neutral measure. For any probability measure equivalent to P the corresponding likelihood process is an \(\underline{{\mathcal {F}}}\)-martingale under P and by Proposition 2.5 (regularity is given in Assumption 4.3) we therefore know that any such likelihood process could be written on the same form as (10) giving another expression of the same type as (11). This implies that \(\vartheta _t\) determines the risk-neutral measure uniquely, which is the first result. Simple calculations show that S has no drift under \(\tilde{Q}\), and the last part of the third result follows from Proposition 2.3. The last part of the third result implies that we can use standard results about Wiener driven markets and the fourth result follows, see e.g. Karatzas and Shreve (1998, Chapter 1) (a slight modification of the proofs of these results is needed: instead of referring to the standard martingale representation theorem one must refer to a more general result such as Proposition 2.5). \(\square \)

Remark 4.6

The quadratic variation of S is without loss of generality adapted to \(\underline{{\mathcal {F}}}^S\) and it therefore follows that the asset price volatility would be a functional of the trajectory of S even if we did not assume this. Generally, however, this volatility functional would not be regular or even nonanticipative, see e.g. Liptser and Shiryayev (2001, Chapter 4). If the volatility functional would not be nonanticipative and regular we would not be able to prove that the market is complete, as Propositions 2.3 and 2.5 rely on this.

The market has been shown to be complete under the assumption of full information and we can therefore use the standard approach for solving the optimization problem. We follow Karatzas and Shreve (1998), where proofs of results analogous to the results in the rest of this section can be found.

The next result, Lemma 4.9, can be interpreted as saying roughly the following: for any contingent claim maturing at T there is an admissible consumption and portfolio weights process such that the corresponding wealth will coincide with the contingent claim at T, assuming that the initial wealth is large enough. The following definition and regularity condition are needed.

Definition 4.7

The stochastic discount factor M is defined by \(M_t = B_t^{-1}L_t\) for all \(t \in [0,T]\).

Assumption 4.8

\(E\left[ {\int _0^TM_t{ dt} + M_T} \right] < \infty \).

Lemma 4.9

Let initial wealth \(x_0 \ge 0\) be given, let \(c_t\) be a consumption process and let \(\zeta \) be some nonnegative \({\mathcal {F}}_T\)-measurable random variable such that

Then there exists an admissible consumption and portfolio weights process \((u_t,c_t)\) such that final wealth \(X^{u,c}_T = \zeta \).Footnote 11

Proposition 4.12 will reveal that optimal investment and consumption is directly related to the inverse of marginal utility and we must therefore introduce (generalized) inverse functions of the derivatives of the utility functions. This will be done in Assumption 4.10, where we will also specify the standard conditions that the utility functions satisfy.

Assumption 4.10

\(U_2\,{:}\,{\mathcal {R}} \rightarrow [-\infty ,\infty )\) and \(U_1\,{:}\,[0,T] \times {\mathcal {R}} \rightarrow [-\infty ,\infty )\).

\(U_2\) is concave, nondecreasing and upper semicontinuous and the half-line \(dom(U_2) \equiv \left\{ {x \in {\mathcal {R}}; U_2(x)> - \infty } \right\} \) is a nonempty subset of \([0,\infty )\). The derivative \(U_2'\) is continuous, positive and strictly decreasing on the interior of \(dom(U_2)\) and \(U_2'(\infty ) = 0\) (we use the notation \(U_2'(\infty ) = \lim _{x \rightarrow \infty }U_2'(x)\)). \(U_1\) satisfies the same conditions for each t.

\(\underline{c}_t \equiv \inf \left\{ {c \in {\mathcal {R}}; U_1(t,c)> - \infty } \right\} \) is a continuous function of t with values in \([0,\infty )\).

\(U_1\) and \(U_1'\) (the derivative is taken with respect to consumption) are continuous on \(\left\{ {(t,c) \in [0,T] \times (0,\infty ); c > \underline{c}_t} \right\} \).

For fixed \(t \in [0,T]\), the function \(I_1(t,\cdot ):(0,\infty ] \mathop {\rightarrow }\limits ^{onto} [\underline{c}_t,\infty )\) defined by

is strictly decreasing on \((0, \lim _{c \searrow \underline{c}_t }U'_1(t,c))\), equal to \(\underline{c}_t\) on \([\lim _{c \searrow \underline{c}_t }U'_1(t,c),\infty ]\) and continuous on \((0,\infty ]\).

For \(\underline{x} \equiv \inf \left\{ {x\in {\mathcal {R}}; U_2(x) > - \infty } \right\} \), the function \(I_2:(0,\infty ] \rightarrow [\underline{x},\infty )\) defined by

satisfies the analogous conditions.

The following regularity condition is needed.

Assumption 4.11

\({\mathcal {X}}(y){\equiv }E\left[ {\int _0^TM_tI_1(t, y M_t){ dt} \!+\! M_TI_2(y M_T)} \right] {<}\infty , \forall y\,{\in }\,(0, \infty ).\)

The full information solution to Problem 1 for the general utility functions of Assumption 4.10 is presented in the following proposition.

Proposition 4.12

(Optimal investment and consumption under full information) Let \(x_0 \in ({\mathcal {X}}(\infty ),\infty )\). The optimal wealth process

where \(\lambda \) is determined by

The optimal consumption process

The optimal portfolio weights process

where \(\sigma _{X^*}(t)\) is the volatility of the optimal wealth process \(X^*_t\).

In the rest of this section we will study the examples of power and logarithmic utility. Proposition 4.12 is used repeatedly.

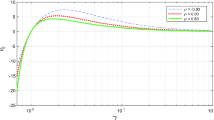

4.1 Example 1: Power utility under full information

Let \(U_1(t,c_t) = \frac{c_t^\gamma }{\gamma }\) and \(U_2(X_T) = \frac{X_T^\gamma }{\gamma }\) with \(\gamma <1, \gamma \ne 0\). To simplify the calculations we introduce the notation \(\beta = \frac{\gamma }{1-\gamma }\). Simple calculations show that \(c_t^* = (\lambda M_t)^{\frac{1}{\gamma -1}}\) and \(X_T^* = (\lambda M_T)^{\frac{1}{\gamma -1}}\), and that \(\lambda \) is given by

with \(H_0\) defined through the last equality. This implies that \(c_t^* = \frac{x_0}{H_0}M_t^{\frac{1}{\gamma -1}}, X_T^* = \frac{x_0}{H_0}M_T^{\frac{1}{\gamma -1}}\) and \({\mathcal {X}}(\infty )=0\).

We now introduce a process H, with \(H_0\) as starting value, which we will use to characterize the solution \(c^*_t,X^*_t\) and \(u^*_t\). The process H is a generalization of the process H studied in Björk et al. (2010). The process H of the present paper differs from the process H of Björk et al. (2010) because of the agent’s possibility of consumption.

Definition 4.13

Define the process H by \(H_t = E_{{\mathcal {F}}_t}\left[ {\int _t^T\left[ {\frac{M_s}{M_t}} \right] ^{-\beta }{} { ds} + \left[ {\frac{M_T}{M_t}} \right] ^{-\beta }} \right] \) for all \(t \in [0,T]\).

The optimal wealth process is then

Lemma 4.14

The process H can be written in the following Itô process form

for some processes \(\mu _H(t)\) and \(\sigma _H(t)\).

Proof

Use the definition of H and rewrite it as

The expected values in this expression are both martingales so they are by Proposition 2.5 driven by W. From the definition of M it follows that also \(M_t^{\beta }\) is driven by W. The result follows from Itô’s formula and the obvious fact that H is strictly positive.

\(\square \)

From the results above, the definition of \(M_t\) and Itô’s formula it follows that

This implies that \(\sigma _{X^*}(t) = {\frac{-\vartheta _t'}{\gamma -1}} + \sigma _H(t)\), so that \(u^*_t = \left[ {{\frac{-\vartheta _t'}{\gamma -1}} + \sigma _H(t)} \right] \sigma ^{-1}_t(S)\). The process H in Björk et al. (2010) is in that paper investigated by means of a probability measure \(Q^0\). In the following remark we perform a similar investigation of our process H under a probability measure \(Q^0\) which is a generalization of the probability measure in Björk et al. (2010).

Remark 4.15

Consider the likelihood process (assume in this example that it is a martingale) \(L_t^0 = e^{\int _0^t\beta \vartheta _s'{} { dW}_s -\frac{1}{2}\int _0^t\beta ^2||\vartheta _s||^2{ ds}}\) and the measure \(Q^0\) given by \(\frac{dQ^0}{{ dP}} = L_T^0\) on \({\mathcal {F}}_T\). Now use that \(M_t^{-\beta } = B_t^\beta L_t^{-\beta } = B_t^\beta L_t^0e^{\frac{1}{2}\int _0^t \frac{\beta }{1-\gamma }||\vartheta _s||^2{ ds}}\) to see that the process H has the representation

We now introduce a process \(\Pi \) which we use to characterize the solution (\(c^*_t,X^*_t\) and \(u^*_t\)) in a novel fashion.

Definition 4.16

Let \(\Pi \) be the price process of a derivative with dividend process \(M_t^{-(\beta +1)}\) and derivative payoff \(M_T^{-(\beta +1)}\) at time T, i.e. let

In the following lemma we investigate the dynamics of \(\Pi \), the connection between the volatilities of \(\Pi \) and H, and we also characterize the drift of the process H using the dynamics of the process \(\Pi \).

Lemma 4.17

The process \(\Pi \) can be written in the following Itô process form

for some process \(\sigma _\Pi \) and \(\mu _\Pi (t)= r_t - \frac{M_t^{-(\beta +1)}}{\Pi _t} + \sigma _\Pi (t)\vartheta _t\). The volatility and the drift of the process H are characterized by \(\sigma _H(t) = \sigma _\Pi (t) - (\beta +1)\vartheta _t'\) and

Moreover \(H_0 = \Pi _0\).

Proof

By definition it directly follows that \(H_tM_t^{-\beta -1} = \Pi _t\). Thus the dynamics of \(\Pi \) is clearly of the claimed form. Basic arbitrage theory implies that the return rate of a financial derivative with a dividend process is the risk free rate minus the dividend yield rate under the risk-neutral measure. This, together with Definition 4.16 and the Girsanov theorem gives the expression for \(\mu _\Pi \). The solutions of \(M_t\) and \(\Pi _t\) imply that

and Itô’s formula then gives the second last result. The last result is trivial. \(\square \)

The solution for power utility is presented in the following proposition. The proof consists of basic manipulations of the results above.

Proposition 4.18

(Power utility under full information) Let \(x_0 \in (0,\infty )\). The optimal wealth process

The optimal consumption process

The optimal portfolio weights process

4.2 Example 2: Logarithmic utility under full information

Let \(U_1(t,c_t) = ln(c_t)\) and \(U_2(X_T) = ln(X_T)\). Simple calculations show that \(c_t^* = (\lambda M_t)^{-1}, X_T^* = (\lambda M_T)^{-1}\), and that \(\lambda =(T + 1)/x_0\). This implies that \(c_t^* = \frac{x_0}{M_t(T+1)}, X_T^* = \frac{x_0}{M_T(T+1)}\) and \({\mathcal {X}}(\infty )=0\). The optimal wealth process is consequently given by

This implies (use Itô’s formula) that \(\sigma _{X^*}(t) = \vartheta '_t\) and hence that the optimal portfolio weights process \(u^*_t = \vartheta '_t\sigma ^{-1}_t(S)\).

Remark 4.19

The results on optimal consumption for logarithmic utility in the present paper are contained in the more general results of Korn and Seifried (2013) who study optimal consumption under logarithmic utility in a general semimartingale setting. Their general setting allows for partial information and other concepts such as ambiguity, nonlinear wealth dynamics and trading constraints.

5 The partial information problem

In this section we will study the partial information optimization problem we originally set out to study. We therefore drop Assumption 4.1 so that \(\underline{{\mathcal {F}}}^S \subseteq \underline{{\mathcal {F}}}\) where the inclusion generally is strict. We allow some repetition and restate the problem, although omitting some details. The asset price dynamics are given by

\(D(S_t)\) is the \(n \times n\) diagonal matrix with the vector \(S_t\) as main diagonal and \(D(S_t)\sigma _{t}(S)\) is an invertible regular nonanticipative functional. The process \(\alpha \) and the Wiener process W are generally not adapted to the observable filtration \(\underline{{\mathcal {F}}}^S\). The instantaneous short rate r is adapted to \(\underline{{\mathcal {F}}}^S\). The task is to maximize

over the set of admissible consumption and portfolio weights processes \((u_t,c_t)\) (which need to be adapted to \(\underline{{\mathcal {F}}}^S\)), where \(X_T^{u,c}\) is wealth at the terminal time T, and to characterize the resulting optimal consumption process \(\bar{c}_t^*\), optimal portfolio weights process \(\bar{u}^*_t\) and optimal wealth process \(\bar{X}_t^*\) (recall that the bar indicates a quantity under partial information).

We solve this partial information problem by transforming it to a corresponding full information problem of the type studied in Sect. 4. The main tool for this transformation is a projection of the dynamics of the process S in (12) (which is only partially observable) to the observable filtration \(\underline{{\mathcal {F}}}^S\). This type of approach is standard in the literature of partial information optimal investment and consumption, see Sect. 1. We need the following regularity in order to use the filtering theory of Sect. 2.

Assumption 5.1

\(\int _0^TE\left[ {||\sigma _t^{-1}(S)\alpha _t||^2} \right] {} { dt} < \infty \).

Let \(\hat{\alpha }\) denote the filter estimate process of the process \(\alpha \) with respect to the observable filtration \(\underline{{\mathcal {F}}}^S\) (see Definition 2.6 for details). Lemma 2.8 implies that the process \(\bar{W}\) defined by

is \(\underline{{\mathcal {F}}}^S\)-Wiener. Rewrite (13) as

and note that S in (14) is exactly the same process as S in (12).

Now consider the optimization problem stated in the beginning of this section, but instead of (12) describing the dynamics of the asset prices S let (14) do so. Moreover, consider the financial market as living on the filtration \({\left( {\Omega ,{\mathcal {F}},P,\underline{\mathcal {F}}^S} \right) }\), instead of \({\left( {\Omega ,{\mathcal {F}},P,\underline{\mathcal {F}}} \right) }\). In other words the filtration that we now consider is the observable filtration \(\underline{\mathcal {F}}^S\), and not the larger filtration \(\underline{\mathcal {F}}\). It is then clear that we have transformed the partial information problem to a corresponding full information problem. We can therefore modify the relevant full information results of Sect. 4 to corresponding results of the original partial information problem. The rest of this section is devoted to these corresponding results.Footnote 12

The partial information setting unique equivalent risk-neutral measure \(\bar{Q}\) is given by \(\frac{d\bar{Q}}{{ dP}} = \bar{L}_T\) on \({\mathcal {F}}^S_T\) for \(d\bar{L}_t = -\bar{\vartheta }_t'\bar{L}_td\bar{W}_t, \bar{L}_0 = 1\), where \(\bar{\vartheta }_t = \sigma _t^{-1}(S)(\hat{\alpha }_t-r_t\mathbf{1})\) (defined in the same way as \(\vartheta _t\) in Sect. 4). The partial information setting stochastic discount factor is \(\bar{M}_t \equiv B_t^{-1}\bar{L}_t\). The necessary regularity conditions are collected in the following assumptions.

Assumption 5.2

The local martingale (with respect to \(\underline{\mathcal {F}}^S\)) \(\bar{L}_t\) is an \(\underline{\mathcal {F}}^S\)-martingale. The same holds for \(\bar{\tilde{L}}_t \equiv e^{-\int _0^t(\sigma _s^{-1}(S)\hat{\alpha }_s)'d\bar{W}_s-\frac{1}{2}\int _0^t||\sigma _s^{-1}(S)\hat{\alpha }_s||^2{ ds}}\). Moreover, \(\int _0^T||\bar{\vartheta }_t||^2{ dt} < \infty \) a.s.Footnote 13

Assumption 5.3

\(E\left[ {\int _0^T\bar{M}_t{ dt} + \bar{M}_T} \right] < \infty \) and \(\bar{{\mathcal {X}}}(y) \equiv E\Bigl [\int _0^T\bar{M}_tI_1(t, y \bar{M}_t){ dt} + \bar{M}_TI_2(y \bar{M}_T)\Bigr ]<\infty , \forall y \in (0, \infty )\).

The results of Sect. 4 are based on the assumption that the stochastic basis \({\left( {\Omega ,{{\mathcal {F}}},P,\underline{\mathcal {F}}} \right) }\) satisfies the usual conditions. We therefore need the following result.

Lemma 5.4

Let the measure \(\bar{\tilde{Q}}\) be defined by \(\frac{d\bar{\tilde{Q}}}{{ dP}} = \bar{\tilde{L}}_T\) on \({\mathcal {F}}^S_T\) so that the process \(\bar{\tilde{W}}\) defined by \(d\bar{\tilde{W}}_t = \sigma _t^{-1}(S)\hat{\alpha }_t{ dt} + d\bar{W}_t\) is \(\underline{\mathcal {F}}^S\)-Wiener under \(\bar{\tilde{Q}}\).

Then the observable filtration \(\underline{\mathcal {F}}^S = \underline{\mathcal {F}}^{\bar{\tilde{W}}}\). Moreover, the stochastic basis \({\left( {\Omega ,{\mathcal {F}},P,\underline{\mathcal {F}}^S} \right) }\) satisfies the usual conditions.

Proof

The Girsanov theorem says that \(\bar{\tilde{W}}\) is an \(\underline{\mathcal {F}}^S\)-Wiener process under \(\bar{\tilde{Q}}\) (use Assumption 5.2). Simple calculations show that S has no drift under this measure and the equality of the filtrations follows from Proposition 2.3 [see also (4) in the proof of Proposition 2.5]. The stochastic basis \({\left( {\Omega ,{\mathcal {F}},P,\underline{\mathcal {F}}} \right) }\) satisfies the usual conditions by assumption and since \(\underline{\mathcal {F}}^S\), by definition, is an augmented filtration we only need to check that \(\underline{\mathcal {F}}^S\) is right-continuous. The augmented filtration generated by a Wiener process is right-continuous, see e.g. Karatzas and Shreve (1998). \(\square \)

The following result follows directly from the above and Proposition 4.5.

Corollary 5.5

The market is observationally complete in the sense that every \({\mathcal {F}}^S_T\)-measurable contingent claim \(\zeta \), with \(\zeta B_T^{-1}\) a.s. bounded from below and \(E[\zeta B_T^{-1}\bar{L}_T]<\infty \), can be replicated by an admissible portfolio strategy.

Remark 5.6

The approach described in the present paper does not rely on any particular utility function assumptions or on any particular optimization approach. Rather, it is a unified approach for studying partial information optimization problems in observationally complete non-Markovian Itô process markets with path-dependent volatility and path-dependent interest rates.

Obtaining a solution for Problem 1 is now just a matter of adding a bar to the relevant quantities in the full information solution (Proposition 4.12).

Theorem 5.7

(Optimal investment and consumption under partial information) Let \(x_0 \in (\bar{{\mathcal {X}}}(\infty ),\infty )\). The optimal wealth process

where \(\bar{\lambda }\) is determined by

The optimal consumption process

The optimal portfolio weights process

where \(\sigma _{\bar{X}^*}(t)\) is the volatility of the optimal wealth process \(\bar{X}^*_t\).

The results in the examples of power and logarithmic utility under full information in Sect. 4 can also easily be transformed into corresponding partial information results by adding bars to the relevant quantities. We present the partial information logarithmic utility results. The power utility results are just as easily transformed.

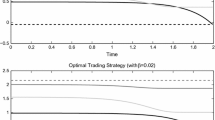

5.1 Example 3: Logarithmic utility under partial information

The optimal wealth process \(\bar{X}_t^* = \frac{x_0}{\bar{M}_t}\frac{T+1-t}{T+1}\), the optimal consumption process \(\bar{c}_t^* = \frac{x_0}{\bar{M}_t(T+1)}\), and the optimal portfolio weights process \(\bar{u}^*_t = \bar{\vartheta }'_t\sigma ^{-1}_t(S)\).

Notes

The term complete with respect to \(\underline{\mathcal {F}}^S\) is also used, see e.g. Hahn et al. (2007).

The proof of the first part of the proposition is found in Kallianpur (1980, Theorem 5.1.2) and in Liptser and Shiryayev (2001, Theorem 4.6). The proof of the second part is easiest found in Kallianpur (1980, Section 5.2) but the reasoning can also be found in the proof of Theorem 5.16 and Theorem 5.17 in Liptser and Shiryayev (2001). Regarding Definition 2.2: several different Lipschitz and growth conditions guaranteeing the existence of a unique strong solution are used in the literature (see e.g. Kallianpur 1980 or Liptser and Shiryayev 2001, or, for less general stochastic differential equations, Karatzas and Shreve 1991 or Øksendal 2003). Similar remarks apply to Definition 2.1.

Here \('\) denotes transposition. However, \('\) will sometimes denote the derivative. What is meant should be clear from the context.

Note that we in this proposition restrict the process \(\gamma \) to be \(\underline{{\mathcal {F}}}^\xi \)-progressively measurable, rather than just \(\underline{{\mathcal {F}}}\)-progressively measurable.

See e.g. Fujisaki et al. (1972), Kallianpur (1980, Chapter 8) or Liptser and Shiryayev (2001, Chapter 8) for similar results and definitions, and also justifications of the definitions. Recall (for a given filtration) that a progressively measurable process is adapted and measurable, that a process which is measurable and adapted has a progressively measurable modification, and that an adapted process with every sample path right-continuous or left-continuous is progressively measurable, see Karatzas and Shreve (1991, Chapter 1).

Karatzas and Shreve (1998) also have a slightly different setup in other respects. For example, they analyze the portfolio process \(\pi _t\) rather than our portfolio weights process \(u_t\), see Definition 3.2. The filtration of their market is moreover generated by the Wiener process driving the asset prices. The proofs of Karatzas and Shreve (1998) can easily be modified to our setup and are not included.

\(\mathbf{1}\) is an n-dimensional vector with each element equal to 1.

Thus \((1-u_t\mathbf{1})\) represents the weight in the bank account \(B_t\).

For further details see e.g. Karatzas and Shreve (1998).

Corollary 2.11 is a more formal version of this reasoning.

\(\int _0^T||\sigma _t^{-1}(S)\hat{\alpha }_t||^2{ dt} < \infty \) a.s. can be shown to follow from Assumption 5.1.

References

Bäuerle N, Rieder U (2005) Portfolio optimization with unobservable Markov-modulated drift process. J Appl Probab 42(2):362–378

Bäuerle N, Rieder U (2007) Portfolio optimization with jumps and unobservable intensity process. Math Finance 17(2):205–224

Björk T, Davis MH, Landén C (2010) Optimal investment under partial information. Math Methods Oper Res 71(2):371–399

Callegaro G, Di Masi G, Runggaldier W (2006) Portfolio optimization in discontinuous markets under incomplete information. Asia Pac Financ Mark 13(4):373–394

Dothan MU, Feldman D (1986) Equilibrium interest rates and multiperiod bonds in a partially observable economy. J Finance 41(2):369–382

Elliott RJ, Rishel RW (1994) Estimating the implicit interest rate of a risky asset. Stoch Process Appl 49(2):199–206

Frey R, Gabih A, Wunderlich R (2012) Portfolio optimization under partial information with expert opinions. Int J Theor Appl Finance 15(1):1–18

Fujisaki M, Kallianpur G, Kunita H (1972) Stochastic differential equations for the non linear filtering problem. Osaka J Math 9(1):19–40

Hahn M, Putschögl W, Sass J (2007) Portfolio optimization with non-constant volatility and partial information. Braz J Probab Stat 21(1):27–61

Honda T (2003) Optimal portfolio choice for unobservable and regime-switching mean returns. J Econ Dyn Control 28(1):45–78

Kallianpur G (1980) Stochastic filtering theory. Springer, Berlin

Karatzas I, Shreve SE (1991) Brownian motion and stochastic calculus. Springer, Berlin

Karatzas I, Shreve SE (1998) Methods of mathematical finance. Springer, Berlin

Karatzas I, Lehoczky JP, Shreve SE (1987) Optimal portfolio and consumption decisions for a “small investor” on a finite horizon. SIAM J Control Optim 25(6):1557–1586

Korn R, Seifried FT (2013) A concise characterization of optimal consumption with logarithmic preferences. Int J Theor Appl Finance 16(06):1–7

Lakner P (1995) Utility maximization with partial information. Stoch Process Appl 56(2):247–273

Lakner P (1998) Optimal trading strategy for an investor: the case of partial information. Stoch Process Appl 76(1):77–97

Liptser RS, Shiryayev AN (2001) Statistics of random processes: I. General theory. Springer, Berlin

Merton RC (1969) Lifetime portfolio selection under uncertainty: the continuous-time case. Rev Econ Stat 51(3):247–257

Merton RC (1971) Optimum consumption and portfolio rules in a continuous-time model. J Econ Theory 3(4):373–413

Øksendal B (2003) Stochastic differential equations. Springer, Berlin

Pliska SR (1986) A stochastic calculus model of continuous trading: optimal portfolios. Math Oper Res 11(2):371–382

Putschögl W, Sass J (2008) Optimal consumption and investment under partial information. Decis Econ Finan 31(2):137–170

Rogers L, Williams D (1987) Diffusions, Markov processes and Martingales, vol 2. Wiley, London

Sass J (2007) Utility maximization with convex constraints and partial information. Acta Appl Math 97:221–238

Sass J, Haussmann U (2004) Optimizing the terminal wealth under partial information: the drift process as a continuous time Markov chain. Finance Stochast 8(4):553–577

Sass J, Wunderlich R (2010) Optimal portfolio policies under bounded expected loss and partial information. Math Methods Oper Res 72(1):25–61

Author information

Authors and Affiliations

Corresponding author

Additional information

Financial support from the Tom Hedelius and Jan Wallander Foundation and The Fund Carl Silfvén is gratefully acknowledged. The author is also grateful to Professor Tomas Björk for helpful comments on this paper.

Rights and permissions

About this article

Cite this article

Lindensjö, K. Optimal investment and consumption under partial information. Math Meth Oper Res 83, 87–107 (2016). https://doi.org/10.1007/s00186-015-0521-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00186-015-0521-1