Abstract

Although earthquakes are large idiosyncratic shocks for affected regions, little is known of their impact on economic activity. Seismic events are rare, the data are crude (the Richter scale measures the magnitude, but says nothing of the associated damages), and counterfactuals are often entirely absent. Using a geophysical methodology devised to gauge seismic damages (the so-called Mercalli scale), we study the evolution of output and employment following seismic events in 95 Italian provinces from 1986 to 2011 for a total of 22 earthquakes. Our identification strategy relies on ideal counterfactuals: ex ante identical neighboring provinces that only differ ex post in terms of damages. We show that following an earthquake, the observed contraction of output and employment is generally small or even negligible. In some cases, the net effect on output and employment can be positive because the stimulus from the reconstruction activities more than compensate for the destruction of physical capital. Finally, we show that the effects on economic activity are nonpersistent, do not spill over from the epicentral region to the neighbors, and tend to be reabsorbed within 2 years from the event.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

What is the behavior of economic activity following a seismic event? Major recent episodes, such as the 2011 ‘Tohoku’ earthquake in Japan or the 2010 event in Haiti, have revitalized the policy and academic debates around this question in both, advanced economies and developing countries. While most of the research in social and natural sciences has been devoted to increasing the ability to predict such events, the knowledge about their impact on economic activity is still limited. On the one hand, theory offers conflicting predictions according to the model;Footnote 1 thus, the aforementioned research question remains empirical. On the other hand, earlier empirical papers have run in substantial identification issues, limiting the ability to identify the effect. Our contribution is to suggest an innovative identification strategy to estimate the causal effect of seismic events on economic activity both, on impact and in the medium term.

Despite the vastly different identification strategies employed by previous contributions (reviewed below) three main empirical challenges have emerged. First, seismic events are large idiosyncratic shocks at the local level, but tend to be negligible in aggregated terms, especially in advanced economies. Thus, employing national data tends to bias downwardly the estimates of their impact on economic activity. Second, seismic events are rare and counterfactuals are often entirely absent. Finally, while the moment-magnitude (measured by the Richter scale) is strictly exogenous to business cycle fluctuations, it is only weakly correlated to the severity and extension of the generated damages which instead vary according to a large number of factors, including the deepness of the epicenter, the type of seismic waves (undulatory vs. sussultory), and the vulnerability of civil structures.

In this paper we contribute to the ongoing debate by suggesting an identification strategy based on a geophysical methodology devised to gauge seismic damages—the so-called Mercalli scale. Our unique dataset covers 95 Italian provincesFootnote 2 over the period 1986–2011 for a total of 22 seismic events and provides an ideal setting to address the aforementioned empirical issues. While the literature focuses almost exclusively on the effects at the aggregate level, we call the attention to the local dimension which offers an ideal ground for identification. Also, because the Richter scale is only weakly correlated to the associated damagesFootnote 3 (see Sect. 2 for details), we rely on the so-called Mercalli scale ranks, a geophysical methodology devised to classify seismic damages on twelve notches from ‘instrumental’ (I) to ‘catastrophic’ (XII). The Mercalli scale, which is based on a narrative description of the severity of the damages, is used as a proxy of the capital stock loss suffered at the local level.

In our empirical investigation we consider two alternative dependent variables, the rate of change of provincial output and the employment rate. We identify the impact of seismic events using as a regressor either a strictly exogenous dummy variable (for all provinces reporting at least one municipality above Mercalli III) or the provincial Mercalli ranks (either the maximum or the average of the ranks assigned to the municipalities in each province). Nonlinearities in output (and employment) behavior are captured by including the square of the Mercalli rank as a regressor. Possible endogeneity issues of Mercalli ranks are addressed by running instrumental variables regressions using the geophysical characteristics of each event (the moment-magnitude and the distance of each province from the epicenter) as strictly exogenous instruments.

Our results, robust to a large set of checks, lead to three main conclusions. First, we provide evidence that the negative shock generated by seismic events does not necessarily result in persistent output (or employment) losses. Using data at annual frequency most of the point estimates in our regressions exhibit a negative sign, but the standard errors are large in all models making the coefficients insignificantly different from zero. In other words, while the use of annual data does not allow to appreciate the dynamics across quarters, the negative impact on output and employment seems to be reabsorbed with a year from the seismic event with no significant losses in the medium term. Also, we show that in some regressions (especially when considering employment as dependent variable), the point estimates are positive, suggesting that seismic shocks can even stimulate economic activity (typically by increasing private and public investment). In a complementary paper (Trezzi and Porcelli 2014), we show that the behavior of economic activity following a seismic shock is driven by two factors that tend to net each other out. On the one hand, the destruction of physical capital generated by the quake tends to depress economic activity; on the other hand, the reconstruction activities—typically financed by public grants—tend to boost local economic activity. Secondly, we obtain the same results when focusing only on the epicentral provinces which typically report the highest and most extended damages. In other words, our evidence holds at ‘any level of damages,’ including for the most devastating events. Furthermore, Italian provinces show a peculiar ‘insular’ aspect as the negative spillover effects from the epicentral province to the neighbors are tested to be negligible. Finally, our results are checked against ideal counterfactuals: contiguous provinces ex ante identical that differ ex post according to the Mercalli rank. The graphical evidence emerging from the counterfactuals largely confirms our results.

Our study contributes to a literature which is still in its infancy given the identification issuesFootnote 4. Recent papers have debated regarding the impact of seismic events on output dynamics, but no consensus has emerged so far. Some authors argue that earthquakes (and more in general natural disasters) are setbacks for economic growth (Barro and i Martin 2003; Raddatz 2009). Along these lines Toya and Skidmore (2007) and Noy (2009) suggest that most of the cross section standard deviation of output behavior can be explained by specific observables. Countries with a higher literacy rate, better institutions, higher per capita income, higher degree of openness to trade, and higher levels of government spending are better able to withstand seismic shocks (Noy 2009).Footnote 5 In contrast to this strand of the literature, other contributions (Albala-Bertrand 1993; Caselli and Malhotra 2004; Skidmore and Toya 2002; Barone and Mocetti 2014) find mild or even positive effects on growth. Cavallo et al. (2013) argue that only extremely large events have a negative effect on output in both, the short run and long run, but only if they are followed by political instability, while Loayza et al. (2012) find that they might activate a creative destruction process even in the short run.Footnote 6 Finally, the rest of the paper is organized as follows. Section 2 explains our identification strategy and introduces the reader to the Mercalli scale. Section 3 presents our empirical models. Section 4 explains the characteristics of our dataset. Section 5 shows our baseline results and robustness checks. Finally, Sect. 6 concludes.

2 The Richter and Mercalli scales: identifying the impact of quakes

In 1935, the American physicist Charles Francis Richter, at the California Institute of Technology, in partnership with Beno Gutenberg developed a methodology to quantify the energy released during an earthquake. Richter and Gutenberg created a base-10 logarithmic scale, which is now known as ‘Richter moment-magnitude scale’ (or simply ‘Richter scale’). The magnitude is based on the ‘seismic moment’ of the earthquake which is equal to the rigidity of the Earth multiplied by the average amount of slip on the fault and the size of the area that slipped. An earthquake ranked at 6.0 on the Richter scale has a ‘shaking amplitude’ 10 times higher than the one that measures 5.0 and corresponds to a release of energy 31.6 times larger. Nowadays, the magnitude is recorded using an instrument called ‘seismograph.’

However, before the invention of seismographs, another scale was developed to categorize earthquakes. In 1783, two Italian architects (Pompeo Schiantarelli and Ignazio Stile) suggested a rudimentary scale to classify the damages generated by the devastating event of that year that stroke in the southern part of the peninsula. The scale underwent several revisions over time and is now known as ‘Mercalli scale,’ from the Italian vulcanologist Giuseppe Mercalli who modified it in 1908. The scale is defined on twelve notches ranging from level I (instrumental) to level XII (catastrophic). The twelve levels are used to categorize the effects of a seismic event on the Earth’s surface, human beings, objects of nature, and civil structures. As an example, we report the definition of level VI (strong) of the scale, while those of the remaining levels are given in “Appendix”.

Level VI: “People - Felt by all. People and animals alarmed. Many run outside. Difficulty experienced in walking steadily. Fittings - Objects fall from shelves. Pictures fall from walls. Some furniture moved on smooth floors, some unsecured free-standing fireplaces moved. Glassware and crockery broken. Very unstable furniture overturned. Small church and school bells ring. Appliances move on bench or table tops. Filing cabinets or ‘easy glide’ drawers may open (or shut). Structures - Slight damage to buildings type I.Footnote 7 Some stucco or cement plaster falls. Windows type I broken.Footnote 8 Damage to a few weak domestic chimneys, some may fall. Environment - Trees and bushes shake, or are heard to rustle. Loose material may be dislodged from sloping ground, e.g. existing slides, talus slopes, shingle slides”.

The ‘macroseismic intensity’ (meaning the destructive power) of an earthquake is not entirely determined by its magnitude. While every earthquake has only one magnitude (recorded at the epicenter), the damages and therefore the Mercalli ranks vary greatly from place to place. In general terms, the negative effects differ across municipalities according to the distance from the epicenter, the degree of urbanization rate, and the structural properties of the buildings. Using the National Institute of Geophysics and Volcanology (INGV) database, Fig. 1 shows the correlation between the moment-magnitude and the maximum Mercalli rank registered in all recorded episodes in history (3,176 events in total). We also plot the best fit of the data with the 95% confidence intervals. As expected, there exists a positive correlation between the two variables.Footnote 9 On average, if the magnitude of the earthquake increases by one level of the Richter scale, the severity of the damages measured by the maximum Mercalli rank increases by 1.92 levels of the Mercalli scale. However, the same magnitude can be associated with significantly different levels of damages across episodes. For instance, a 6.0 event on the Richter scale generates damages between level VI (‘strong’) and level X (‘intense’) of the Mercalli scale.

Nowadays, following a well-established practice, in the aftermath of an event specialists from the Civil Protection Department (CPD)Footnote 10 survey the epicentral region and rank the affected municipalities using the Mercalli scale. As an example, Fig. 2 shows the map of the largest earthquake in our dataset: the 1997 ‘Appennino umbro-marchigiano’ event.

The 1997 earthquake affected 869 municipalities (and sub-municipalities) located in 24 provinces in the center part of the country. Our definition of ‘affected municipality’ includes all municipalities above level III of the Mercalli scale (below Mercalli III the quake is not felt by human beings, but only recorded by seismographs). The moment-magnitude of the event was 5.87 on the Richter scale, and the maximum Mercalli rank (IX) was registered in the sub-municipality of ‘Collecurti’ in the province of ‘Macerata.’ Most of the other highest Mercalli ranks were recorded in municipalities located in the provinces of ‘Perugia’ and ‘Terni’ both in the ‘Umbria’ region. The cross-sectional heterogeneity of damages across provinces visible in Fig. 2 is at the core of our identification strategy explained in Sect. 3.

3 The empirical model

We identify the impact of earthquakes on economic activity by regressing the rate of growth of provincial output on a variable capturing the presence of an earthquake in year t in province p. Seismic events are assumed to be strictly exogenous. In our baseline we specify six models, the first one of which is expressed by

where \(Y_{{p,t}}=\frac{y_{{p,t}}-y_{{p,t}-1}}{y_{{p,t}-1}}\), \(y_{{p},t}\) is per capitaGDP in province p in year t, \(\alpha _{p}\) and \(\gamma _{t}\) are provincial and time fixed effects, respectively, \(\varvec{\theta ^{'}}\) is a vector of coefficients, \(\mathbf {X}_{{p,t}}\) contains a set of controls, and \(\varepsilon _{{p,t}}\) is an idiosyncratic shock. The coefficient of interest is \({\beta }\). The variable \(\textit{Earthquake}_{{p,t}}\) is a dummy taking the value of ‘1’ if province p reported at least one municipality with a Mercalli rank higher than III in year t. This assumption maximizes the number of positive entries in the dummy since we consider as ‘affected’ two levels (III and IV) which are not associated with damages to civil structures. However, our choice ensures that potential negative spillover effects are captured by the model (for instance, people might commute from/to neighboring provinces which we consider as ‘affected’ if sufficiently close to the epicenter). Finally, assuming that the output loss is inversely correlated to the distance from the epicenter (and positively to the Mercalli ranks) from this model we estimate an upper bound of \({\beta }\) since we include in the dummy \(\textit{Earthquake}_{{p,t}}\) provinces reporting lower damages being located farer away from the epicentral region.

As a second approach we replace \(\textit{Earthquake}_{{p,t}}\) with a dummy \(({Epicenter}_{{p,t}})\) that takes the value of ‘1’ only for the epicentral province in each event, the province where the epicenter was located by INGV. This second approach is more restrictive and reduces the number of ‘affected’ provinces to the number of earthquakes in the dataset (22 in total). From this model we estimate a lower bound of \(\beta \), our prior being that the closer the province to the epicenter, the higher the output loss.

Third, in order to account for cross-sectional variations in damages across provinces and seismic events we modify model (1) by replacing the dummy \(\textit{Earthquake}_{{p,t}}\) with the Mercalli rank \(({Mercalli}_{{p,t}})\) of province p in year t. Formally,

where \(\zeta _{{p,t}}\) is an error term. As a measure of damages we consider the maximum Mercalli rank among all municipalities in the province; in robustness checks, we employ the weighted average using the population as a weight and show that our results are fully robust to this assumption.Footnote 11 Also, in order to account for possible nonlinearities of output behavior with respect to the severity of the damages we add the square of \({Mercalli}_{{p,t}}\) as a regressor.

In the last two models we use an instrumental variable approach. An endogeneity bias in our estimates might arise if the Mercalli ranks are correlated to output dynamics—for instance if richer provinces have buildings ex ante less vulnerable to seismic shocks. Our strategy is to run model (2) instrumenting \({Mercalli}_{{p,t}}\) using the strictly exogenous geophysical characteristics of the events. As a first approach we create a municipal-specific indicator \(({Intensity}_{i,t})\) that proxies the local ‘macroseismic intensity’ of the event, meaning the destructive power at the micro (municipal)-level. This measure interacts with two exogenous variables: the moment-magnitude and the inverse of the distance of each municipality from the epicenter. Aggregation at the provincial level is done by taking the unweighted average and using it as a strictly exogenous instrument. Formally, the Intensity in province p in year t is defined as

where \(N_{p}\) is the number of municipalities in province p. Ceteris paribus, the higher the magnitude (or the lower the distance from the epicenter), the higher the ‘intensity’ of the event in province p. As a second approach we use three separate instruments: the magnitude of the event (Magnitude), the inverse of the distanceFootnote 12 from the epicenter (1 / Distance), and its square \((1/{Distance}^{2})\). The strict exogeneity of the instruments is ensured by the nature of the variables, being determined only by the geophysical characteristics of the earthquake. Every regression is run twice: the first time allowing for a constant term and time fixed effects only; the second time adding all controls (see “Appendix B” for details on control variables). Finally, to study the dynamic impact of seismic events on economic activity we allow the lags of the main regressor. Model (1) is modified as follows:

The variable Earthquake is then replaced with Mercalli to consider the heterogeneity of damages across provinces. The regressions are run 6 times, progressively adding lags and controls.

4 Data

Our dataset is a balanced panel of 95 provinces observed over the period 1986–2011 at yearly frequency for a total of 2470 observations.Footnote 13 As a measure of provincial output we use the estimates released by the Italian National Institute of Statistics (ISTAT) of the real per capita value added.Footnote 14 As an alternative dependent variable we consider the rate of employment of the population aged 15–64 years released by ISTAT for the period 2004–2011 (760 observations in total). All geophysical data are released by the Italian National Institute of Geophysics and Volcanology (INGV). We consider 22 earthquakes, the first one of which is the 1987 ‘Reggiano’ episode and the last one is the 2009 ‘Aquilano’ event (see Table 4 in section “Appendix C” for details). Geophysical data are provided at the micro-municipal level of disaggregation, and they cover the following information: the date of the event, the moment-magnitude (measured by the Richter scale), the geographical coordinates of the epicenter, and the Mercalli ranks of each municipality. Out of 2470 entries the dummy \(\textit{Earthquake}_{{p,t}}\) contains 245 positive values. No provinces were affected by two events in the same calendar year. If an earthquake strikes in the last two months of the year we attribute it to the next calendar year. Our results are insensitive to this choice. A summary of the descriptive statistics is reported in section “Appendix C”. Aggregation of municipal data at the provincial level is performed by taking the unweighted averageFootnote 15 of all observations within the same province. Finally, all complementary data (control variables) come from ISTAT. Section “Appendix B” reports the list and the definitions of these variables.

5 Results

The results of our baseline are reported in Tables 1 and 2 for output and employment, respectively. The first eight columns in each table reflect the models described in Sect. 3. The last four columns of Tables 1 and 2 refer to the instrumental variables approach. For completeness, we show both stages of the 2SLS procedure. (The first stage is denoted with an \(`f'\).) As already mentioned, the regressions using output as a dependent variable are run on the entire sample (2470 observations), while the regressions on employment are run on 760 observations including three seismic events [’Appennino Lucano’ (2004), ’Lago di Garda’ (2004), and ’Aquilano’ (2009)]. Table 3 extends the baseline results presented in Tables 1 and 2, showing the dynamic results—meaning the results of the regressions which add up to three lags of the main regressors. The number of observations decreases to 2185 as the models progressively allow for lags.

The main evidence emerging from our baseline is that the coefficient of interest \(({\hat{\beta }})\) is not significant at 5% level in any model. Only in Table 3 few coefficients are significant at 10% level. Concentrating on Table 1, the point estimate of column (2c) implies an output loss of around half of a percentage point in the same year of the event. While the point estimates are virtually all negative, the associated standard errors are high, making the coefficients not significant. Only in model 2 of Table 2 the coefficient of Epicenter is highly significant (with a positive sign); however, when controlling for other observables the significance disappears. Table 3 shows that this result extends to the dynamic impact since no coefficient is significantly different from zero at 5% level.Footnote 16 This result is less surprising for model 1 because the definition of ‘affected province’ includes observations more distant from the epicenter, with a lower Intensity and Mercalli ranks. However, our main evidence holds for the epicentral provinces which typically report more severe and extended damages. Our results also suggest that local economies may be ‘insular’ in their response to earthquakes offsetting the potential negative spillover effects induced by large negative supply shocks at the local level. Furthermore, when the variables Earthquake and Epicenter are replaced with our measure of damages (Mercalli) we obtain the same results of models 1 and 2: The estimated coefficients remain insignificantly different from zero for both variables, Mercalli and \(Mercalli^{2}\). In contrast to a common belief, earthquakes do not display a significant impact neither on (local) output growth nor on employment, ‘at all levels of damages severity.’

Finally, the instrumental variables regressions confirm the previous evidence. The coefficient of Mercalli remains in line with the fixed effects estimates excluding a potential endogeneity bias. The first stages of the 2SLS reveal that most of the cross-sectional variation across Mercalli ranks is explained by the exogenous characteristics of the events: the moment Magnitude and the Distance from the epicenter. Column 5f reports the results by regressing the variable Mercalli on the synthetic measure of macroseismic Intensity using OLS. The estimated coefficient is highly significant, and the positive sign is in line with the prior: ceteris paribus, the higher the Intensity, the higher the Mercalli ranks. On average, increasing the Intensity of a province by one unit increases the corresponding Mercalli rank by almost two notches. The same evidence emerges from column 6f that reports the results of regressing Mercalli on Magnitude, the inverse of the Distance, and its square. All regressors are significant at 1% level and the \(R^{2}\) suggest that virtually all variation is explained by the exogenous regressors. The validity of our IV analysis is confirmedFootnote 17 by the tests reported in the last two lines of each table. In particular, the first stage of F test confirms that Intensity, Magnitude, the inverse of Distance and its square are indeed good instruments since the statistics are always above the corresponding critical values.Footnote 18 Also, the Sargan–Hansen test of overidentifying restrictionsFootnote 19 is never rejected (Figs. 3, 4, 5, 6).Footnote 20

5.1 Counterfactual analysis

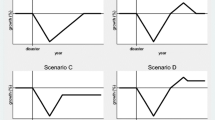

As a complementary exercise, we provide counterfactual analysis based on the major event in our dataset (the 1997 ‘Appennino umbro-marchigiano’ quake). The graphical intuition/check is based on ideal counterfactuals: neighboring provinces ex ante identical that differ ex post in terms of damages. Figure 7 plots the evolution of output for the provinces of ‘Perugia’ and ‘Roma.’ The vertical line indicates the year of the earthquake. The two provinces exhibit an identical output behavior before the event, but while the province of ‘Perugia’ was extensively affected by the earthquake (54 municipalities out of 59Footnote 21 involving 96.2% of the population had a Mercalli rank equal to or above V with a maximum Mercalli rank of VII–VIII), in the province of ‘Roma’ only marginal damages were registered (8 municipalities for a total of 1.3% of the provincial population had a Mercalli rank equal to or above V, and only two of them were ranked at VIFootnote 22). Output does not deviate from trend the year of the event or in the following years, confirming our general results (Figs. 8, 9, 10, 11, 12).

5.2 Robustness checks

We verify our baseline results against three alternative specifications. As a first check we eliminate from the sample the events with a Magnitude below 5.75 (the mean plus one standard deviation). In this way the variables Earthquake, Epicenter, Mercalli, and \(Mercalli^{2}\) assume positive values only for the ‘big’ quakes and zero otherwise. Tables 6 and 7 show the results of these regressions for output and employment, respectively. The evidence largely confirms the baseline since the standard errors remain significantly high. However, two differences emerge with respect to the baseline. The point estimates of the coefficients of Earthquake and Epicenter are higher than the baseline (respectively, around six and four times higher), but the high standard errors make us interpret these results with caution. Moreover, the coefficients of Mercalli and \(Mercalli^{2}\) (as shown in Table 7) are significant although the sign of Mercalli is positive. This evidence suggests that employment in provinces reporting more severe damages might even be stimulated presumably as a result of the reconstruction activities which typically follows the event. According to our estimates, one level increase in the average Mercalli rank in an affected province increases employment by around 0.3%.

Next, we check whether our baseline results are influenced by the way we aggregate the observations at the municipal level. In our baseline scenario the regressors are constructed by taking the unweighted average of the municipal observations within the same province. In this second check we construct the same regressors as in the baseline, but we take the weighted average of municipal observations using the population as a weight. The variables Earthquake and Epicenter become continuous variables bounded between 0 and 1 representing the share of the population affected by the event and the corresponding share in the epicentral province, respectively. On the other hand, the variable Mercalli becomes a measure of the damages accounting for their extension. The same weighting scheme applies to the instruments used in models 5 and 6. Tables 8 and 9 present the results of this robustness check for output and employment, respectively. Despite the different weighting schemes, the magnitude and significance of all coefficients are comparable to the baseline. Standard errors remain high, the first stages of the instrumental variables regressions remain highly correlated to the damages, and no significant impact of earthquakes is found in any model.

Moreover, we check whether the baseline evidence is influenced by our classification of ‘affected municipality.’ In our baseline we consider as ‘affected’ every municipality classified above Mercalli III. Because structural damages to buildings are reported only above the fifth level of the scale in this check we build new regressors starting from this different assumption at the municipal level. Virtually identical results are obtained by weighting the observations using the population as a weight. Tables 10 and 11 present the results of this robustness check. Column 2 (and 2c) replicates the baseline since the definition of the dummy Earthquake remains the same. All coefficients remain insignificantly different from zero, and in the fixed effects estimates the sign is always positive. Overall, the evidence largely confirms the baseline results.

Finally, we run the baseline models using as a dependent variable averages of the output and employment growth 2 years before and 2 years after the event. Final results, available on request, are in line with the baseline results.

6 Conclusion

In this paper we contribute to the ongoing debate on the effects of seismic events on economic activity by suggesting an identification strategy based on a geophysical methodology devised to gauge seismic damages—the so-called Mercalli scale. Our strategy is based on the so-called Mercalli scale ranks (a methodology gauged to classify seismic damages) and provides an ideal setting to address the main empirical issues encountered so far in the applied literature. We show that the impact of seismic shocks on output and employment is generally small and it can even be positive. As we notice in a complementary paper (Trezzi and Porcelli 2014), the behavior of economic activity following a seismic shock is driven by two factors that tend to net each other out. On the one hand, the destruction of physical capital generated by the quake tends to depress economic activity; on the other hand, the reconstruction activities—typically financed by public grants—tend to boost local economic activity. In this paper we also show that the effects on economic activity are nonpersistent, do not spill over from the epicentral region to the neighbors, and tend to be reabsorbed within a year from the event, including after the most devastating earthquakes. While this paper sheds new light on the applied literature investigating the casual effect of natural events on economic activity, we think that more research is needed to understand other important dimensions, for instance the sectoral responses of output and employment, the effectiveness of countercyclical policies, or the reaction of the housing market to seismic shocks.

Notes

See Cavallo et al. (2010) for an excellent review on this point.

Italy is one of the most seismic countries in the world being located in between the Eurasian and the African plate. Statistically, the country experiences a significant earthquake every 4 and a half years. Thanks to a long history of records the National Institute of Geophysics and Volcanology (INGV) provides the information on all recorded episodes.

The correlation between the moment-magnitude and the severity (and extension) of the damages is zero across provinces affected by the same event because there is only one magnitude for each earthquake measured at the epicenter, while the damages vary greatly across provinces.

For a paper on the frontier on how to identify the effects on business dynamics generated by floods.

In this paper, differences in social capital across provinces are captured by the provincial fixed effect given their persistency over time. Although we control for this factor, the analysis of its direct impact goes beyond the scope of this paper and we reserve to investigate this aspect in more detail in future research.

For the definition of ‘Building Type I’ see “Appendix”.

For the definition of ‘Window Type I’ see “Appendix”.

The \(R^{2}\) of the regression is 0.81.

The Department of Civil Protection is a structure of the Prime Minister’s Office which coordinates and directs the national service of civil protection. When a national emergency is declared, it coordinates the relief on the entire national territory following natural disasters or catastrophes. In this case, the council of ministers declares the ‘state of emergency’ by issuing a law by decree and identifies the actions to be undertaken.

The implicit assumption is that—conditional on Mercalli ranks—the damages are uniformly distributed across types of buildings (especially ‘productive’ vs. ‘nonproductive’). For privacy issues the details about the damages reported by each affected building are not publicly available. However, partial information is available for the 2009 ‘Aquilano’ event. For this earthquake, the distribution of damages severity across types of buildings is indeed uniform. Furthermore, disruption to economic activity might arise even if productive buildings are not directly affected. (Roads might be damaged, Internet connection might be interrupted, etc.)

The distance is calculated as an unweighted average of the distance of each municipality in the province from the epicenter.

Although we have been able to construct the longest time series of provincial GDP growth available at the moment for Italy, the panel structure still contains a large N and a small T. Therefore, typical asymptotic properties of fixed effect panel data model estimators (such as within-the-group) applies in this case.

For the period 1986–1995 we use the estimates released by the statistical office of the ‘Taglicarne Institute’ as in Acconcia et al. (2011).

On average a province is composed by 73 municipalities.

Allowing for more lags in the model does not change our results.

The same evidence applies to robustness checks.

Stock–Yogo weak ID test critical values for single endogenous regressor are between 22 and 5 according to the maximal IV size.

In our models the joint null hypothesis is that the instruments are valid, i.e., uncorrelated with the error term.

Under the null, the Sargan–Hansen test statistic is distributed as Chi-squared in the number of (\(L-K\)) overidentifying restrictions, where \(L=\) instruments and \(K=\) endogenous regressors. A rejection casts doubt on the validity of the instruments.

The five municipalities below level V were Bastia Umbra, Fratta Todina, Monte Castello di Vibio, Paciano, and Scheggia e Pascelupo.

The list of municipalities in the province of Rome involved in the 1997 event is as follows (Mercalli ranks and population in brackets): Ciciliano (V—1,105), Mentana (V—34,326), Montelibretti (V—4,881), Nemi (VI—1,702), Ponzano Romano (V—1,013), Riano (V—6,148), Riofreddo (VI—770), and Roccagiovine (V—293).

References

Acconcia A, Corsetti G, Simonelli S (2011) Mafia and public spending: evidence on the fiscal multiplier from a quasi-experiment. CEPR discussion papers 8305, C.E.P.R. discussion papers. http://ideas.repec.org/p/cpr/ceprdp/8305.html

Albala-Bertrand JM (1993) Natural disaster situations and growth: a macroeconomic model for sudden disaster impacts. World Dev 21(9):1417–1434. http://ideas.repec.org/a/eee/wdevel/v21y1993i9p1417-1434.html

Barone G, Mocetti S (2014) Natural disasters, growth and institutions: a tale of two earthquakes. Temi di discussione (economic working papers) 949, Bank of Italy, Economic Research and International Relations Area. http://ideas.repec.org/p/bdi/wptemi/td_949_14.html

Barro RJ, Sala i Martin X (2003) Economic growth, 2nd edn. Volume 1 of MIT Press books. The MIT Press. http://ideas.repec.org/b/mtp/titles/0262025531.html

Caselli F, Malhotra P (2004) Natural disasters and growth: from thought experiment to natural experiment. Mimeo, New York

Cavallo E, Noy I (2009) The economics of natural disasters: a survey. Research Department Publications 4649, Inter-American Development Bank, Research Department. http://ideas.repec.org/p/idb/wpaper/4649.html

Cavallo E, Galiani S, Noy I, Pantano J (2010) Catastrophic natural disasters and economic growth. Research Department Publications 4671, Inter-American Development Bank, Research Department. http://ideas.repec.org/p/idb/wpaper/4671.html

Cavallo E, Galiani S, Noy I, Pantano J (2013) Catastrophic natural disasters and economic growth. Rev Econ Stat 95(5):1549–1561. http://ideas.repec.org/a/tpr/restat/v95y2013i5p1549-1561.html

Hochrainer S (2009) Assessing the macroeconomic impacts of natural disasters: are there any? Policy research working paper series 4968, The World Bank. http://ideas.repec.org/p/wbk/wbrwps/4968.html

Loayza NV, Olaberria E, Rigolini J, Christiaensen L (2012) Natural disasters and growth: going beyond the averages. World Dev 40(7):1317–1336. http://ideas.repec.org/a/eee/wdevel/v40y2012i7p1317-1336.html

Noy I (2009) The macroeconomic consequences of disasters. J Dev Econ 88(2):221–231. http://ideas.repec.org/a/eee/deveco/v88y2009i2p221-231.html

Raddatz C (2009) The wrath of god: macroeconomic costs of natural disasters. Policy research working paper series 5039, The World Bank. http://ideas.repec.org/p/wbk/wbrwps/5039.html

Skidmore M, Toya H (2002) Do natural disasters promote long-run growth? Econ Inq 40(4):25. http://ideas.repec.org/a/oup/ecinqu/v40y2002i4p664-687.html

Toya H, Skidmore M (2007) Economic development and the impacts of natural disasters. Econ Lett 94(1):20–25. http://ideas.repec.org/a/eee/ecolet/v94y2007i1p20-25.html

Trezzi R, Porcelli F (2014) Reconstruction multipliers, Finance and economics discussion series 2014-79, Board of governors of the federal reserve system (US), revised Jan 2016. https://ideas.repec.org/p/fip/fedgf/2014-79.html

Author information

Authors and Affiliations

Corresponding author

Additional information

We are grateful to Giancarlo Corsetti, Pontus Rendahl, Massimiliano Stucchi, and to the participants of the presentations at the University of Cambridge, at University of Exeter, and at University of Ferrara, for helpful comments and suggestions. We are also particularly grateful to the Italian National Institute of Geophysics and Volcanology (INGV) for providing the requested data. All errors and omissions remain ours. First draft: September 2014. This version: May 2017. Disclaimer: The views expressed in this paper are those of the authors and do not necessarily reflect those of the Board of Governors of the Federal Reserve System and SOSE SpA.

Appendices

Appendix A: The Mercalli scale—definitions

-

I Instrumental People: Not felt except by a very few people under exceptionally favourable circumstances.

-

II Weak People: Felt by persons at rest, on upper floors or favourably placed.

-

III Slight People: Felt indoors, hanging objects may swing, vibration similar to passing of light trucks, duration may be estimated, may not be recognised as an earthquake.

-

IV Moderate People: Generally noticed indoors but not outside. Light sleepers may be awakened. Vibration may be likened to the passing of heavy traffic, or to the jolt of a heavy object falling or striking the building. Fittings: Doors and windows rattle. Glassware and crockery rattle. Liquids in open vessels may be slightly disturbed. Standing motorcars may rock. Structures: Walls and frames of buildings, and partitions and suspended ceilings in commercial buildings, may be heard to creak.

-

V Rather strong People: Generally felt outside, and by almost everyone indoors. Most sleepers awakened. A few people alarmed. Fittings: Small unstable objects are displaced or upset. Some glassware and crockery may be broken. Hanging pictures knock against the wall. Open doors may swing. Cupboard doors secured by magnetic catches may open. Pendulum clocks stop, start, or change rate. Structures: Some windows Type I cracked. A few earthenware toilet fixtures cracked.

-

VI Strong People: Felt by all. People and animals alarmed. Many run outside. Difficulty experienced in walking steadily. Fittings: Objects fall from shelves. Pictures fall from walls. Some furniture moved on smooth floors, some unsecured free-standing fireplaces moved. Glassware and crockery broken. Very unstable furniture overturned. Small church and school bells ring. Appliances move on bench or table tops. Filing cabinets or “easy glide” drawers may open (or shut). Structures: Slight damage to Buildings Type I. Some stucco or cement plaster falls. Windows Type I broken. Damage to a few weak domestic chimneys, some may fall. Environment: Trees and bushes shake, or are heard to rustle. Loose material may be dislodged from sloping ground, e.g. existing slides, talus slopes, shingle slides.

-

VII Very Strong People: General alarm. Difficulty experienced in standing. Noticed by motorcar drivers who may stop. Fittings: Large bells ring. Furniture moves on smooth floors, may move on carpeted floors. Substantial damage to fragile contents of buildings. Structures: Unreinforced stone and brick walls cracked. Buildings Type I cracked with some minor masonry falls. A few instances of damage to Buildings Type II. Unbraced parapets, unbraced brick gables, and architectural ornaments fall. Roofing tiles, especially ridge tiles may be dislodged. Many unreinforced domestic chimneys damaged, often falling from roof-line. Water tanks Type I burst. A few instances of damage to brick veneers and plaster or cement-based linings. Unrestrained water cylinders (water tanks Type II) may move and leak. Some windows Type II cracked. Suspended ceilings damaged. Environment: Water made turbid by stirred up mud. Small slides such as falls of sand and gravel banks, and small rock-falls from steep slopes and cuttings. Instances of settlement of unconsolidated or wet, or weak soils. Some fine cracks appear in sloping ground. A few instances of liquefaction (i.e. small water and sand ejections).

-

VIII Destructive People: Alarm may approach panic. Steering of motorcars greatly affected. Structures: Buildings Type I heavily damaged, some collapse. Buildings Type II damaged, some with partial collapse. Buildings Type III damaged in some cases. A few instances of damage to Structures Type IV. Monuments and pre-1976 elevated tanks and factory stacks twisted or brought down. Some pre-1965 infill masonry panels damaged. A few post-1980 brick veneers damaged. Decayed timber piles of houses damaged. Houses not secured to foundations may move. Most unreinforced domestic chimneys damaged, some below roof-line, many brought down. Environment: Cracks appear on steep slopes and in wet ground. Small to moderate slides in roadside cuttings and unsupported excavations. Small water and sand ejections and localised lateral spreading adjacent to streams, canals, lakes, etc.

-

IX Violent Structures: Many Buildings Type I destroyed. Buildings Type II heavily damaged, some collapse. Buildings Type III damaged, some with partial collapse. Structures Type IV damaged in some cases, some with flexible frames seriously damaged. Damage or permanent distortion to some Structures Type V. Houses not secured to foundations shifted off. Brick veneers fall and expose frames. Environment: Cracking of ground conspicuous. Landsliding general on steep slopes. Liquefaction effects intensified and more widespread, with large lateral spreading and flow sliding adjacent to streams, canals, lakes, etc.

-

X Intense Structures: Most Buildings Type I destroyed. Many Buildings Type II destroyed. Buildings Type III heavily damaged, some collapse. Structures Type IV damaged, some with partial collapse. Structures Type V moderately damaged, but few partial collapses. A few instances of damage to Structures Type VI. Some well-built timber buildings moderately damaged (excluding damage from falling chimneys). Environment: Landsliding very widespread in susceptible terrain, with very large rock masses displaced on steep slopes. Landslide dams may be formed. Liquefaction effects widespread and severe.

-

XI Extreme Structures: Most Buildings Type II destroyed. Many Buildings Type III destroyed. Structures Type IV heavily damaged, some collapse. Structures Type V damaged, some with partial collapse. Structures Type VI suffer minor damage, a few moderately damaged.

-

XII Catastrophic Structures: Most Buildings Type III destroyed. Structures Type IV heavily damaged, some collapse. Structures Type V damaged, some with partial collapse. Structures Type VI suffer minor damage, a few moderately damaged.

Construction types.Buildings Type I: Buildings with low standard of workmanship, poor mortar, or constructed of weak materials like mud brick or rammed earth. Soft story structures (e.g., shops) made of masonry, weak reinforced concrete, or composite materials (e.g., some walls timber, some brick) not well tied together. Masonry buildings otherwise conforming to buildings Types I to III, but also having heavy unreinforced masonry towers. (Buildings constructed entirely of timber must be of extremely low quality and are Type I.). Buildings Type II: Buildings of ordinary workmanship, with mortar of average quality. No extreme weakness, such as inadequate bonding of the corners, but neither designed nor reinforced to resist lateral forces. Such buildings not having heavy unreinforced masonry towers. Buildings Type III: Reinforced masonry or concrete buildings of good workmanship and with sound mortar, but not formally designed to resist earthquake forces. Structures Type IV: Buildings and bridges designed and built to resist earthquakes to normal use standards, i.e., no special collapse- or damage-limiting measures taken (mid-1930s to c. 1970 for concrete and to c. 1980 for other materials). Structures Type V: Buildings and bridges, designed and built to normal use standards, i.e., no special damage-limiting measures taken, other than code requirements, dating from since c. 1970 for concrete and c. 1980 for other materials. Structures Type VI: Structures, dating from c. 1980, with well-defined foundation behavior, which have been specially designed for minimal damage, e.g., seismically isolated emergency facilities, some structures with dangerous or high contents, or new-generation low-damage structures. Windows.Type I: Large display windows, especially shop windows. Type II: Ordinary sash or casement windows. Water tanks.Type I: External, stand-mounted, corrugated iron tanks. Type II: Domestic hot-water cylinders unrestrained except by supply and delivery pipes.

Appendix B: List and definition of control variables

Population: total number of residents at 31 December of each year. Source: ISTAT. Population65: share of population older than 65 years resident at 31 December of each year. Source: ISTAT.Population85: share of population older than 85 years resident at 31 December of each year. Source: ISTAT. Index of young dependency: ratio between the number of people younger than 14 years and people in working age (14–65 years old) at 31 December of each year. Source: ISTAT. Index of senior dependency: ratio between the number of people older than 65 years and people in working age (14–65 years old) at 31 December of each year. Source: ISTAT.

Appendix C: Summary statistics

Appendix D: Robustness checks—tables

See Tables 6, 7, 8, 9, 10, 11.

Rights and permissions

About this article

Cite this article

Porcelli, F., Trezzi, R. The impact of earthquakes on economic activity: evidence from Italy. Empir Econ 56, 1167–1206 (2019). https://doi.org/10.1007/s00181-017-1384-5

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-017-1384-5