Abstract

Given that little attention has been paid to the multiple and even conflicting roles of related variety and unrelated variety in shaping regional economic resilience, this study develops a framework that incorporates the industrial portfolio effect, the risk spreading effect, the labor matching effect, and the knowledge spillover effect to analyze the relationship between industrial diversity and economic resilience. Based on the developed framework, spatial econometric models are then employed to analyze the impacts of related variety and unrelated variety on economic resilience in U.S. Metropolitan Statistical Areas (MSAs) after the Great Recession. The empirical results from the estimation of the spatial Durbin error models show that a high level of related variety tends to undermine MSAs’ capacity to adapt to external shocks with respect to the 1-year period 2009–2010, the 3-years period 2009–2012, and the 5-years period 2009–2014, suggesting that due to the risk spreading effect, related variety acts as a shock diffuser in response to the crisis. By comparison, the role of unrelated variety as a shock absorber is significant in terms of direct effect, and the spatial spillovers of unrelated variety on economic resilience cannot be ignored with respect to the 3-years period 2009–2012 and the 5-years period 2009–2014.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

For a long time, economic geographers, regional scientists, and policy makers have focused on industrial structure and regional economic development in terms of specialization and diversity. The question that whether regions benefit more from being industrially specialized or being diversified was originally raised by the seminal work of Glaeser et al. (1992). Conventional wisdom and Marshall-Arrow-Romer (MAR) externalities hypothesize that knowledge spillovers occur within a single industry (Watson and Deller 2017), but Jacobs (1969) indicated that these spillovers take place across different industries. To examine this question extensively, Beaudry and Schiffauerova (2009) overviewed empirical studies on the effects of MAR and Jacobs externalities on regional economic development and found that the corresponding results are mixed: many studies have found evidence for the MAR hypothesis, whereas a substantial share of studies have confirmed the role of Jacobs externalities. To this end, the simplistic division of specialization and diversification seems to fail to capture the various effects of industrial structure on economic development.

To reconcile the tension between specialization and diversity, Frenken et al. (2007) hence introduced the concepts of related variety (RV) and unrelated variety (UV) and studied their effects respectively. On the one hand, related variety can impact regional economic performance in the knowledge spillover effect. This is because industrial diversity is the precondition for knowledge spillovers only when variety is related with similar knowledge bases across different industries or with cognitive proximity (Nooteboom 2000). Such cross-fertilization of inter-industry knowledge may give rise to Schumpeterian new combinations and innovation. Thus, related variety is supposed to benefit the economic performance of firms and regions (Frenken et al. 2007; Content and Frenken 2016; Xiao et al. 2018; Whittle and Kogler 2020). In relation to regional economic resilience, it is argued that related variety can act as a shock absorber and has the potential to provide opportunities for collective learning and inter-industry knowledge spillovers, which speeds up the recovery process from sector-specific shocks (Neffke and Henning 2013; Boschma 2015; Diodato and Weterings 2015; Sedita et al. 2017; Cainelli et al. 2019).

On the other hand, unrelated variety can also work as a shock absorber and reduces external risks for regional economies because of the industrial portfolio effect (Conroy 1975; Jackson 1984; Frenken et al. 2007; Watson and Deller 2017; Hu et al. 2022). If local industries are disconnected in terms of input–output linkages, the economic risk of one industry cannot spread to other industries through interindustry flows and damage only parts of the economy. Furthermore, Boschma (2015) and Whittle and Kogler (2020) claimed that when the effect of industrial variety as shock-absorber is manifest, local industries should be disconnected also in cognitive terms. As such, the decline in one sector will not affect the learning opportunities to other sectors in an industrially diversified region.

In addition to the well-known knowledge spillover and industrial portfolio effects, another two strands of literature might deepen our understanding on the relationship between industrial diversity and economic resilience and motivate our study. First, recent insights argued that related variety can work as a shock-diffuser when local industries are closely related (Antonietti et al. 2015; He et al. 2021). This is because regions with high levels of related variety can be vulnerable to external shocks. The economic risk of one industry can easily spread to other related industries and even damage the whole economy because of the risk-spreading effect. Second, some studies in labor economics suggested that the labor matching effect can impact economic performance (Boschma 2015). More specifically, from a micro perspective, workers who lose their jobs in economic shocks can easily find new jobs in skill-related industries (Neffke et al. 2018; Holm et al. 2017; Eriksson et al. 2016). By comparison, without large concentration of local industries related to the pre-displacement industries, redundant workers have to change industries, or move to other regions, or both, all of which will result in human capital destruction or reallocation and adversely influence economic resilience.

In this regard, the research goals of this study are two-fold. First, given that economic resilience is widely discussed in economic development and regional policy literature since the Great Recession in the late 2000s (Martin et al. 2016; Boschma 2015) on the one hand, and that considerable work has concentrated on related variety and unrelated variety by evolutionary economic geographers in the past decade (Boschma 2017) on the other hand, this study aims to link the diversity and resilience literature and develop a framework to incorporate different effects of industrial diversity on economic resilience, including the industrial portfolio effect, the knowledge spillover effect, the labor matching effect, and the risk spreading effect. Second, because the Great Recession and the recent COVID-19 pandemic provide natural experiments to explore the relationship between industrial diversity and economic resilience (Hu et al. 2022; Watson and Deller 2017), this study further examines the diversity-resilience relationship among 359 Metropolitan Statistical Areas (MSAs) in the contiguous U.S. with respect to the Great Recession and, among these effects, explores which effect dominates the relationship. Our empirical results mainly suggest that regions with many related industries tend to be less resilient to external shocks and related variety mainly acts as a shock-diffuser, whereas unrelated variety acts as a shock-absorber.

The contributions of this study can be summarized in the following perspectives. First, in examining various effects of industrial diversity on economic resilience (Brown and Greenbaum 2017; Cainelli et al. 2019; Doran and Fingleton 2018; He et al. 2021), this study emphasizes that (1) the net impact of related variety can be jointly determined by the risk spreading effect, the labor matching effect, and the knowledge spillover effect, and (2) both related variety and unrelated variety can absorb the negative influences of external shocks because of the knowledge spillover effect, the labor matching effect, and the industrial portfolio effect. Second, to provide a more accurate picture of the diversity-resilience relationship, we follow Cainelli et al. (2019) and Giannakis and Mamuneas (2022) to explicitly consider the role of space through the estimation of Spatial Durbin error models (SDEM) that account for local spatial spillovers and unobserved spatial dependence (Lacombe et al. 2014). The empirical results of our SDEM indicate that the spatial spillovers of unrelated variety on economic resilience cannot be ignored. Third, since the influences of industrial diversity on resilience may vary with the length of study period (Cainelli et al. 2019; Xiao et al. 2018), the temporal dimension of economic resilience is evaluated over three post-crisis periods that incorporate the full recovery process (i.e., the short-term 1-year period 2009–2010, the mid-term 3-years period 2009–2012, and the mid-term 5-years period 2009–2014), which is suitable to examine the different roles and effects of industrial diversity on economic resilience.

The remainder of this study is organized as follows. Section 2 reviews the existing literature on industrial diversity and regional economic resilience and summarizes four effects within the diversity-resilience relationship. Then, the methodological details are provided in Sect. 3. After that, Sects. 4 and 5 present the results of the descriptive statistics and spatial regression analysis. The final section concludes the main findings, presents the policy implications, and discusses the future research directions of this study.

2 Literature review

The concept of resilience originally comes from physics and represents the ability of recovering from external shocks. Especially after the Great Recession, how regions react to different crises have attracted attention from economic geographers, regional scientists, and urban researchers. Several academic journals, such as Cambridge Journal of Regions, Economy and Society (2010), Papers in Regional Science (2017) and the Annals of Regional Science (2018), have published special issues or sections on the state art of economic resilience research. Up to date, three general research topics can be identified, including the concepts, measurements, and determinants of economic resilience.

To begin with, regional economic resilience can be defined conceptually in a variety of approaches, including engineering resilience, ecological resilience, and evolutionary resilience (Boschma 2015). The engineering approach defines resilience as the ability of a return to the preexisting equilibrium point, whereas ecological resilience denotes returning to a new steady-state without changing its structure, identity, or function (Holling 1973). More recently, evolutionary resilience is defined as continuously adaption to changing conditions (Simmie and Martin 2010). It is generally hypothesized that shocks or disturbances are the basis for these resilience definitions and two broad types of disturbances are identified: one is slow-burning disturbances like climate change and resource depletion (Hu and Yang 2019; Tan et al. 2020), while the other type is short-term shocks, such as an economic crisis, an industry closure, a pandemic, and a natural disaster (Cainelli et al. 2019; Holm et al. 2017; Eriksson et al. 2016; Hu et al. 2022).

Next, due to the conceptually multifaced nature of economic resilience, measuring resilience in practice becomes challenging. Although there is no consensus on how to measure resilience, one stream of research adopts basic economic performance indicators to reveal shock responses; for instance, Brown and Greenbaum (2017) used unemployment rate and Rocchetta and Mina (2019) used employment growth rate. By comparison, others have established more composite indexes to assess economic resilience (Angulo et al. 2018; Lagravinese 2015; Martin et al. 2016). Han and Goetz (2019), for example, used input–output accounts to predict U.S. county-level economic resilience. Martin (2016) suggested that resilience can be measured as the ratio between the observed change in regional employment or output to the corresponding change in the country as a whole. Many empirical studies like Tan et al. (2020) and Hu et al. (2022) employed Martin’s (2016) index because of limited data requirement. Additionally, a series of papers explores different dimensions of economic resilience. Balland et al. (2015) examined the technological resilience of U.S. cities in terms of vulnerability, crisis intensity, and duration. Martin (2012) suggested that regional economic resilience can be viewed in the perspectives of resistance, recovery, reorientation, and renewal.

Finally, why regions differ in the performance of economic resilience is a crucial question. As a response, recent scholars have explored specific factors that explain the variation of economic resilience both theoretically and empirically, such as industrial structure (Martin 2016), location (Annoni et al. 2019), innovation (Bristow and Healy 2018), specialization (Cuadrado-Roura and Maroto 2016), and industrial relatedness (Xiao et al. 2018). Among these factors, industrial structure is generally considered as the key determinant of regional resilience by a number of authors (Boschma 2015; Martin et al. 2016). Based on this consensus, Martin and Sunley (2015) further suggested that the influences of industrial structure on resilience can be viewed in terms of diversity, modularity, related variety, diversified specialization, and the like, whereas this study focuses on industrial diversity (including both related variety and unrelated variety). For our focus, Table 1 summarizes recent articles on this topic and the current literature generally offers several categories of effects regarding the diversity-resilience relationship as follows.

First, the industrial portfolio effect views the combination of unrelated industries as a portfolio that protects a region from shocks. Unrelated variety therefore acts as a shock absorber with respect to economic downturns (Attaran 1986; Brown and Greenbaum 2017; Doran and Fingleton 2018; Hu et al. 2022). In this context, it is risky to make the economy of one region highly dependent on a limited number of industries, because specialized regions might suffer severely from shocks in demand. By contrast, industrially diversified regions may experience mild unemployment and even neutralize the negative effects of shocks. In other words, the strategy of “do not put all your eggs in one basket” can boost regional resilience. In fact, this strand of literature can be traced back to the Great Depression in the early 1930s when scholars found the key role of industrial diversity in resisting the crisis (Attaran 1986; Conroy 1975; Jackson 1984) and recent research work by Brown and Greenbaum (2017), Chen (2019), and Deller and Watson (2016) takes this direction. By employing different modeling methods like multilevel linear regression and spatial econometric methods, most of these studies have confirmed that unrelated variety has a positive impact on regional resilience.

Second, the knowledge spillover effect concerns the role of related variety as a shock absorber. Schumpeter and his followers attribute knowledge spillovers to the recombination of existing knowledge (Fleming 2001; Schumpeter 1934), and Jacobs (1969) further suggested that industrial diversity contributes to knowledge spillovers. However, Jacobs’ opinion has been questioned because of its unclear nature (Beaudry and Schiffauerova 2009; Content and Frenken 2016; Porter 2003). Based on the idea of cognitive distance (Nooteboom 2000), Frenken et al. (2007) stressed that knowledge spillovers occur only between industries with cognitive proximity, which has been referred to as related variety. For example, it is difficult for automobile manufactures to learn from dairy product companies. The cognitive distance between industries should be neither too great in that they have nothing to communicate nor too small as there is nothing to be learned (Boschma 2015). Under such optimal cognitive distances, knowledge spillovers result in the emergence of new industries and products, which enhances economic resilience especially in the post-crisis era (Cainelli et al. 2019; Rocchetta and Mina 2019; Xiao 2018). The knowledge spillovers effect has been supported by empirical evidence from numerous studies in different countries and at different geographical scales. For example, Diodato and Weterings (2015) discovered that input–output linkages, connectivity, and skill relatedness can jointly contribute to the resilience of Dutch labor markets. Sedita et al. (2017) confirmed the positive effect of related variety on economic resilience through linear regression models among local labor markets in Italy. In a similar vein, Cainelli et al. (2019) employed spatial econometric techniques and found that (1) related variety acted as a short-run shock absorber with respect to the Great Recession and (2) spatial spillovers exist within the variety-resilience relationship in the case of Italian labor markets.

Third, the risk spreading effect assumes that while relatedness contributes to regional economic resilience, the empirical fact cannot exclude that under some circumstance, related variety from the demand side can possibly work as a shock diffuser in response to a crisis (He et al. 2021). In essence, the industrial portfolio effect and the risk spreading effect share a same mechanism but with inverse effects depending on the industry mix. If local economies are characterized by high levels of unrelated variety, economic risks cannot be easily transferred to other industries. By comparison, regions with high levels of related variety usually have the risk spreading effect. From a theoretical perspective, industrial relatedness reduces modularity and increases the spreading risk across related subsets of sectors (Martin and Sunley 2015; Content and Frenken 2016). This is especially prevalent in resource-based economies where relatedness might lead to regional lock-in and reduce the capacity to react a crisis due to diversifying in new activities that are closely related to the old techno-industrial base (Rodríguez-Pose and Wilkie 2019). When economic shocks invade, economic risks spread to the whole economy easily and there is no cushion against such shocks. He et al. (2021) further argued that the net impact of related variety depends not only on the knowledge spillover effect on the supply side, but also on the risk-spreading effect on the demand side.

Fourth, in addition to the effects mentioned above, the labor matching effect received less attention in economic resilience research. However, a large and growing literature in labor economics connects skill relatedness to workers who lose their jobs in establishment closures (Neffke et al. 2018; Holm et al. 2017; Eriksson et al. 2016). The empirical evidence suggests that when local industries are skill related, related variety is expected to enhance labor matching and speed up the recovery from specific shocks. This is because the redundant works can easily find new jobs in skill-related industries to avoid the destruction or reallocation of human capital (Diodato and Weterings 2015). Comparing with the knowledge spillover effect, the labor matching effect emphasizes the use of excessive labor resources rather than the creation of new knowledge. The knowledge spillover effect and the labor matching effect are expected to contribute to economic resilience, but it is difficult to distinguish which effect is actual at work.

To sum up, the above literature review suggests that the influences of industrial diversity on regional economic resilience have not been systematically studied and most of existing studies only cover parts of these effects. Building on the works of Cainelli et al. (2019), He et al. (2021), Neffke et al. (2018), and Marin and Sunley (2015), we propose a framework to understand the relationship between related variety, unrelated variety, and economic resilience in terms of the risk spreading effect, the knowledge spillover effect, the labor matching effect, and the industrial portfolio effect (See Figure 1). Based on this framework, our study then investigates the diversity-resilience relationship in U.S. MSAs after the Great Recession and scrutinizes the roles of industrial diversity in regional economic resilience. The next section introduces the methodology.

3 Methodology

3.1 Measuring regional economic resilience

The empirical study aims to evaluate the relationship between industrial diversity and regional economic resilience after the Great Recession. To fulfil this aim, the corresponding spatial units are the MSAs in the continental U.S. This is because MSAs are functional—rather than administrative—regions that are defined based on population density and commuting flows and thus can be considered as functionally meaningful economic entities (Cainelli et al. 2019; Chen 2019; Doran and Fingleton 2018).

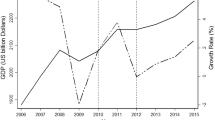

Following Doran and Fingleton (2018) and Cainelli et al. (2019), the resilience index is constructed for three post-crisis periods, i.e. the one-year period 2009–2010, the three-year period 2009–2012, and the five-year period 2009–2014. As shown in Fig. 2, the U.S. unemployment rate reaches its peak in 2009 and returns to the pre-crisis level in 2014. Similarly, the GDP growth rate is negative in 2009 and gradually comes back to normal after that. Since we focus on the short- and mid-term recovery aspects of economic resilience in the post-crisis era, we limit the study period from 2009 to 2014 and evaluate the influence of industrial diversity on economic resilience in one-, three-, and five-year post-crisis periods.

Although the existing literature has proposed several measures to quantify economic resilience like unemployment rate and GDP growth rate, this study adopts the sensitivity index developed by Martin et al. (2016) to measure economic resilience and use country-level employment data from the Bureau of Economic Analysis (BEA). The sensitivity index is chosen not only because of limited data requirement and computational ease, but also because of its popularity in previous literature and policy discussion between national and local trends (Martin et al. 2016; Cainelli et al. 2019; Hu et al. 2022). According to Martin et al. (2016), this index compares the difference between expected employment change to the actual change. The expected employment change in region r during k periods can be written as:

where \(E_{ir}^{t}\) is the employment value in industry i in region r in starting time t, the base year; and \(g_{N}^{t + k}\) is the change rate of national employment during k periods.

Then, the region’s economic resilience can be expressed as:

where \(\Delta E_{r}^{{{\text{Recovery}}}}\) is the actual recovery value of region r from time t to t + k. By definition, a positive value of \(Resilience_{r}\) indicates that the region is resilient to recession in respect to the national economy, and non-resilient if the value is negative.

3.2 Measuring related and unrelated variety

As reviewed by previous studies, there as numerous approaches to measure industrial diversity, such as the entropy index, the Herfindahl–Hirschman Index, and national average. In this analysis, the entropy index is employed because of its decomposable nature in measuring related variety and unrelated variety (Attaran 1986; Frenken et al. 2007). Meanwhile, although relatedness can be measured based on industrial classification standards, the probability of co-occurrence, input–output relationships, and others (Content and Frenken 2016; Whittle and Kogler 2020), this study makes full use of the work of the Harvard cluster mapping program by Porter (2003) and Delgado et al. (2016) and determines sectors within the same economic cluster as industrially related. Conceptually, Porter (1998) defines economic clusters as geographical concentration of linked industries. Based on this definition, Porter (2003) used an ex post indicator, the local correlation of employment across industries, to identify clusters of related industries. In Porter’s (2003, p.562) words, “if computer hardware employment is nearly always associated geographically with software employment, this provides a strong indication of locational linkages.” As a result, Porter identified 29 clusters in the context of U.S. After that, Delgado et al. (2016) extended Porter’s (2003) method by considering co-location patterns of employment and establishments, input–output relations, and similarity in occupation structure and consequently identified 51 economic clusters in the U.S., where each cluster includes several five-digit North American Industrial Classification Systems (NAICS) sectors. As a useful tool to analyze industrial structure in addition to standard industrial classification systems especially in the U.S., the cluster approach has been widely used to measure industrial relatedness in the existing literature (Boschma et al. 2012; Chen 2020; Hidalgo 2021).

As for the data source, all the variety variables are calculated based on County Business Patterns (CBP), which annually reports two- to six-digit level NAICS employment data for different levels of geographical areas like states, counties, and zip code areas. Because of confidentiality reasons, CBP uses data ranges for the actual number of jobs for small sectors and areas, which limits the usefulness of the data. However, values to replace these data ranges were estimated through Isserman and Westervelt’s (2006) method in the Upjohn Institute’s “WholeData” version of CBP.

Total variety is the entropy calculated between five-digit level NAICS sectors:

where \(p_{i}\) denotes the share of each five-digit sector in total employment. Larger values of the index indicate greater levels of diversity, while lower levels display a more specialized economy. Similarly, the calculation of unrelated variety is the entropy calculated among economic clusters identified by Delgado et al. (2016) as follows.

where \(p_{g}\) denotes the share of each cluster in total employment. Larger values of this index indicate a greater level of diversity between economic clusters, whereas lower levels hint at a more specialized economy. Related variety, by comparison, can be calculated as follows.

where every five-digit sector falls exclusively under an economic cluster. Because of the decomposable nature of the entropy index (Frenken et al. 2007; Attaran 1986), total variety equals to the sum of unrelated variety and the weighted sum of related variety.

3.3 Empirical model

To examine the relationship between industrial variety and economic resilience, the following empirical model is specified.

where the dependent variable is regional economic resilience and the independent variables include two industrial diversity measures (including both related variety and unrelated variety) and a set of control variables that capture the industrial, demographic, and social features of regions (See Table 2). Note that due to data completeness, accuracy and availability, the dependent variables are measured from 2009 to 2014, the related and unrelated variety variables are measured in 2010, and the control variables are mainly from the Census, County Business Patterns, and Bureau of Economic Analysis for the year 2010.

Most of these control variables are self-explanatory and have been widely used in the regional economic growth and convergence literature (Watson and Deller 2017; Cainelli et al. 2019; Chen 2019). The percentage of employment in goods production industries, for example, is highly associated with economic performance because during economic recessions. This is because customers are less willing to purchase durable goods like automobiles and furniture (Jackson 1984). Similarly, population size is usually used to measure the size of MSAs. Following Frenken et al. (2007) and Sedita et al. (2017), this variable has been regarded as a proxy for externalities related to urbanization. Regions with large population often house universities, industries, and organizations and therefore may better react and adjust to the impacts of an economic crisis (Cainelli et al. 2019). The share of population older than 25 with at least a bachelor’s degree is used to capture the educational effects in economic resilience (Giannakis and Mamuneas 2022). In addition, several geographic dummy variables (Northeast, Midwest, and South) are included to consider the potential socio-economic and institutional differences that might affect economic resilience among Census regions.

3.4 Modeling method

Although Eq. 6 can be estimated using an ordinary least squares (OLS) estimator, existing studies (e.g., Bishop and Gripaios 2010; Chen 2019; Trendle 2006; Watson and Deller 2017) suggest that spatial interactions across analytical units cannot be ignored within the diversity-performance relationship. In other words, the resilience of regions might depend not only on their own features, but also on characteristics of neighboring regions. One of the early works that used spatial regression models to study the empirical relationship between industrial diversity and economic performance is Trendle (2006), whom used the spatial autoregressive model (SAR) and the spatial error model (SEM) and confirmed the existence of spatial spillovers within the relationship. Compared to Trendle (2006), later work—such as Bishop and Gripaios (2010), Watson and Deller (2017), and Chen (2019)—applied various spatial econometric models to account for the spatial spillover effects with the diversity-performance relationship. In our case, because MSAs are not isolated and the spatial dependence may impact the resilience performance of neighboring regions, standard econometric techniques like the OLS may be misleading and the spatial econometric models are considered.

The spatial econometrics literature provides various spatial models—such as the spatial error model and spatial autoregressive model—to include different forms of spatial dependence. As from LeSage (2014), these spatial models mainly fall into two categories, including (1) local spatial spillovers that affect immediate neighbors only; and (2) global spatial spillovers that affect not only immediate neighbors but also the neighbors of the immediate neighbors, and so on. LeSage (2014) further suggested that endogenous interaction and feedback effects are not present in local spillovers, whereas these effects are present in global spillovers. Following this line of reasoning, three spatial models are considered and each model reflects a different type of spatial spillover mechanism as follows.

First, the spatially lagged X (SLX) model allows for local spillovers and can be formally specified as:

where y is the dependent variable; X is an array of independent variables; W is the spatial weight matrix that denotes the spatial relationship between regions; γ denotes the spatial parameter of the spatially lagged explanatory variables; and ε is the error term. Note that the WX term represents a weighted average of surrounding values of the independent variables and captures the influence of neighboring values of the independent variables on the dependent variable (i.e., local spillovers). From a technical standpoint, the spatial weight term W can be specified in a variety of approaches like distance- and contiguity-based ones. Based on LeGallo and Ertur (2003), this study uses the spatial weight matrix with eight nearest neighbors (KNN with k = 8) because it enables each region to have the same number of neighbors and avoid a situation where disconnected regions have zero neighbors. Despite that the spatial regression results are insensitive to the choice of the spatial weight matrix if the spatial model is specified correctly (LeSage 2014), alternative spatial weights—such as KNN spatial weights with k = 7 and 9—are also examined in the Appendix for robustness check.

Second, the spatial Durbin error model (SDEM) considers local spatial spillovers, which can be specified as follows:

where ρ denotes the spatial error parameter. When comparing with the SLX, the SDEM further considers the residual spatial autocorrelation in the error process (LeSage and Pace 2009). As such, the SDEM allows for assessing “the global diffusion of the shocks to the model disturbances” (LeSage 2014).

Third, the spatial Durbin model (SDM) allows for global spatial spillovers with the following form:

where β denotes the estimated coefficients of the independent variables; ρ denotes the spatial parameter of the spatially lagged dependent variables; γ denotes the estimated coefficients of the spatially lagged independent variables.

A key question concerns which spatial model is the most appropriate one. LeSage (2014) suggested that before taking statistical tests, one needs to determine the spatial spillovers to be a local or global specification; for instance, if the theoretical aspects of the modeling point to local spillovers, there is no need for statistical tests for global spillovers. However, it seems that theories might not be certain about the choice of global versus local spillovers in our case. Statistical tests are therefore employed. In fact, existing work on spatial econometrics provides a plethora of statistical tests for model specifications. For example, the (robust) Lagrange Multiplier statistics test whether spatial lags of the dependent variable should be included in the model (Anselin et al. 1996). Similarly, Wald or likelihood ratio tests are used to test whether the SDM can be simplified into the SEM or SAR (Elhorst 2014). Nevertheless, one shortcoming of these statistical tests is that it is difficult to make clear conclusions using the two-way comparisons of SDM versus SLX, SDEM versus SDM, and SDEM versus SLX specifications (LeSage 2014; Lacombe et al. 2014). To overcome this shortcoming, we employ a Bayesian approach for model comparison among the SLX, SDM and SDEM (LeSage 2014). The result of this approach directly returns the most appropriate model based on the comparison of the log-marginal likelihood values across different spatial models. The technical details about this Bayesian model comparison approach can be found in LeSage (2015) and LeSage and Pace (2009).

4 Descriptive statistics

Table 3 reports the descriptive statistics. Because all the variance inflation factor (VIF) values are less than 5, collinearity is not a serious concern in the model estimations. As for the dependent variables, the comparison between one-year, three-year, and five-year resilience demonstrates that the range and standard deviation of the resilience variable decrease significantly when extending the study period. Similarly, the boxplot in Fig. 3 also suggests that the distribution of economic resilience become less dispersed in longer study period. This can possibly be explained by the diminishing impacts of the economic crisis as the national and local economies recover. Then, the means of three resilience variables are negative, which suggests that 359 MSAs on average are non-resilient. The skewness values are 0.583, 1.553, and 1.198 respectively, indicating that all the resilience variables are right skewed.

Figure 4 maps the spatial distributions of resilient regions with positive values of \(Resilienc{e}_{r}\) and non-resilient regions with negative values of \(Resilienc{e}_{r}\) for all the three periods. When comparing these maps, it is evident that some large cities like New York and Orlando keep resilient in all three study periods and suffer less from the crisis. By comparison, some MSAs in the Midwest seem to economically resilient in the 2009–2010 period, but become non-resilience in longer study periods.

Figure 5 displays the scatterplot between related variety and unrelated variety with a linear trend line. The general trend is that related variety moves in the same direction with unrelated variety. In other words, MSAs with a higher degree of related variety tend to have a higher degree of unrelated variety. This finding can be associated with a large area effect. Large cities can have both high levels of related variety and unrelated variety in the form of diversified specializations (Martin and Sunley 2015; Chen 2020), but small regions cannot be industrial diversified. To further explore this point, Fig. 6 maps the spatial distribution of the related and unrelated variety indexes. Large areas like New York, Los Angeles and Chicago metro areas tend to have both high levels of related and unrelated variety, whereas some MSAs in the Midwest states tends to have both low levels of variety.

Figure 7 displays the scatterplots between diversity and resilience variables as well as the corresponding linear trend lines. These preliminary results reflect that the general relationship between related variety and resilience is negative in Fig. 7a, whereas that relationship become positive in Fig. 7b, c. In other words. MSAs with a higher degree of related variety tend to have less resilient economic performance from 2009 to 2010, but tend to have more resilient economic performance in three-year and five-year study periods. In a similar vein, the relationship between unrelated variety and resilience is negative in Fig. 7d, suggesting that the unrelated variety variable move in the opposite direction from the one-year economic resilience. By comparison, Figs. 7e, f show that as the unrelated variety variable increase, economic resilience slightly increases in longer study periods.

5 Empirical results

Table 4 reports the log-marginal likelihood values and posterior model probabilities for the SLX, SDM, and SDEM of different study periods. Comparison of these values and probabilities overwhelmingly suggest that the SDEM should be used, which leads to important implications regarding the diversity-resilience relationship. On one hand, although we have included several independent variables that may impact economic resilience, there are unobserved factors that “vary over space systematically, resulting in residual spatial error correlation” (Lacombe et al. 2014). In other words, unobserved factors produce shocks that impact the resilience of neighboring regions, as well as of neighbors to the neighboring regions, and so on. To this end, it is necessary to include regional dummy variables to capture the impacts of unobserved factors. On the other hand, economic resilience can be affected by the features of immediate neighboring regions as illustrated by the significant coefficients of the spatially lagged independent variables WX. And because of this, the SDEM has the advantage that interpretation of the direct and indirect effects is straightforward. Namely, the direct effects correspond to the model parameter β in Eq. 8 and reflect the changes of each explanatory variable on own-MSA economic resilience. By comparison, the indirect effects correspond to the model parameter γ and reflect the changes of each explanatory variable in neighboring MSAs on own-MSA economic resilience.

Table 5 reports the results of the maximum likelihood estimation of the SDEM specification for the three periods: Models 1–3 for the one-year resilience period 2009–2010, Models 4–6 for the three-year resilience period 2009–2012, and Models 7–9 for the five-year resilience period 2009–2014. The coefficient of the spatial error parameter ρ in both models are statistically significant, which confirms that the SDEM rather than SLX should be used.

As for the related variety variable, although the estimated indirect effect is negligible, the direct effect is significant in Models 3, 6, and 9 (i.e., models that include the full set of independent variables). Unlike the scatterplots and linear trend lines in Fig. 7, the control variables and potential spatial effects are considered and the corresponding results show that related variety is negatively associated with regional economic resilience over both periods, indicating that MSAs with a high level of related variety tend to be weak in response to the economic crisis. This is inconsistent with Cainelli et al. (2019) and Sedita et al. (2017), both of whom found that regions with high levels of related variety tend to have higher capacity in neutralizing the intensity of the external shock. As such, the effect of related variety as shock-absorber is not manifest, but its shock-diffuser role is evident in the case of U.S. MSAs after the Great Recession. In terms of magnitude, the effect of related variety is weaker over a longer time horizon when comparing Models 3, 6, and 9. In other words, the negative effect of related variety on economic resilience takes some time to diminish.

Looking at the estimated direct and indirect effects of unrelated variety tells a different story. On one hand, focusing on the direct effect, although the estimated coefficient of the unrelated variety variable is insignificant with respect to the one-year resilience period 2009–2010 in Model 3, the significant and positive sign of unrelated variety in Models 6 and 9 suggests that unrelated variety has a positive effect on regional economic resilience. This is in line with the work of Brown et al. (2017) and Hu et al. (2022), who found that unrelated variety act as a shock-absorber with respect to economic crises because of the portfolio effect. As for the magnitude of coefficients, the direct effect is 3.523 in Model 6 and that effect is 2.333 in Model 9. The comparison between Models 6 and 9 indicates that the effect of unrelated variety on resilience is stronger in the case of the three-year period resilience capacity. On the other hand, the estimated indirect or spatial spillover effects are also worth attention. The coefficient of the spatially lagged unrelated variety variable is negative and significant in the cases of the three-year and five-year resilience. The interpretation is that a high level of unrelated industrial variety in neighboring MSAs undermines the own-MSA resilience over longer time periods. As for the magnitude of coefficients, the indirect effect is 6.855 in Model 6 and 4.613 in Model 9.

Taken together, the estimated direct and indirect effects of unrelated variety are all significant in Models 6 and 9. The interpretation is that a high level of unrelated variety seems to strengthen the own-MSA resilience as indicated by the industrial portfolio effect, but to undermine the neighboring-MSA resilience, which seems to suggest a competition or backwash effect among MSAs (Kopczewska et al. 2017; Cainelli et al. 2019; Santos et al. 2023). Based on Kao and Bera (2016), the competition effect can be understood as an outflow of resources from one region to neighboring regions and adversely impacts the overall economic resilience. Comparing with positive spatial spillover effects, the prevalence of negative spatial spillovers is not uncommon and suggests competition between regions exceeds cooperation. We further quantify the total effects which can be measured as the sum of the direct and indirect effects (Lacombe et al. 2014). By definition, the total effects measure how a change in the unrelated variety variable affects economic resilience inclusive of the own MSA and surrounding MSA spatial spillover effects. The “net” outcome is that unrelated variety is negatively associated with economic resilience as a whole. In this regard, the competition effect not only outperforms the cooperation effect, but also neutralizes and even overturns the direct effect of unrelated variety on regional economic resilience.

We further check the robustness of the regression results. First, we used alternative spatial weight matrices (k nearest neighbors with k = 7 and 9) to model the relationship between industrial variety and economic resilience. Second, employment growth rate is directly employed to measure economic resilience. Since these results are not significantly different from Table 5, we move these estimation results to the Appendix (Tables 6–8).

6 Discussion and conclusions

This study has attempted to develop a theoretical framework to incorporate the risk spreading effect, the industrial portfolio effect, the labor matching effect, and the knowledge spillover effect in the relationship between industrial diversity and economic resilience. Through the developed framework, this study further examines the roles of related variety and unrelated variety in shaping regional economic resilience among 359 U.S. Metropolitan Statistical Areas after the Great Recession across three study periods. We have several key findings with their discussion as follows. The first one concerns with the direct effects of related variety and unrelated variety: MSAs with higher levels of related variety are more severely impacted by the crisis over all the three post-crisis periods, whereas unrelated variety has a positive effect on the five- and three-year resilience. The underlying theoretical implications are two-fold. On one hand, the empirical evidence seems to support the portfolio hypothesis that regions with higher levels of unrelated variety tend to have more resilient economic performance. On the other hand, it is the risk spreading effect—rather than the knowledge spillover effect or the labor matching effect—that dominates the relationship between related variety and resilience in this analysis. Therefore, researchers should consider the industrial portfolio effect, the risk spreading effect, the labor matching effect, and the knowledge spillover effect and their conflicting roles as a shock-diffuser or a shock-absorber altogether, as illustrated in the theoretical framework and empirical evidence, when exploring the relationship between industrial diversity on economic resilience.

Second, the indirect effects of related variety are negligible, but these effects of unrelated variety are statistically significant in longer periods. In terms of three- and five-year resilience, the negative spatial spillovers indicate that unrelated variety of neighboring MSAs tend to undermine the own-MSA resilience. This can possibly be explained by the competition effect rather than the cooperation effect (Cainelli et al. 2019). When combining the direct and indirect effects of unrelated variety together, the overall result is that unrelated variety is negatively associated with overall economic resilience. In other words, the dominant competition effect between regions undermines not only the cooperation effect but also the direct effect of unrelated variety on economic resilience.

Third, given that other work has explored the short- and long-run effects of industrial diversity (Cainelli et al. 2019) or compared the capacity before and after economic crises (Doran and Fingleton 2018; Tan et al. 2020), this study accounts for the full recovery period and compare the modeling results in three periods in terms of one-year, three-year, and five-year resilience. The empirical results suggest that in short-run and mid-term study periods, the roles of industrial diversity might not always be consistent.

The results of this study may provide two important policy impactions. First, our findings emphasize the diverse effects of related variety and unrelated variety on regional economic resilience. Because of these effects, related variety can act either as a shock-absorber or as a shock-diffuser in the post-crisis era. To this end, although many scholars and policy-makers advocate smart specialization strategies that aim to develop new growth paths for regions based on related diversification, policy practitioners should be cautious about the potential risk spreading effect of related variety, which is not limited to resource-based economies or lagging regions. Second, the empirical results also suggest the coexistence of positive direct and negative indirect effects of unrelated variety in respect to regional resilience. These spatial spillovers might come from the competition from neighboring regions. In this regard, public policies that aim at diversifying unrelated activities to promote regional resilience should consider not only the own effect but also the indirect effect from or to neighboring regions. A joint effort to simultaneously leverage the positive impacts of unrelated variety and offset its negative impacts is needed between regions and their neighbors.

Future research should consider such directions. First, while this study focuses exclusively on U.S. Metropolitan Statistical Areas, the relationship between related variety, unrelated variety, and regional economic resilience can be examined in other socio-economic and institutional contexts. For example, it is interesting to examine the multiple roles of industrial diversity in regional economic development in emerging economies, which might provide additional insights with regard to the diversity-performance relationship (Tan et al. 2020). Second, given that related variety and unrelated variety are two dimensions of industrial structure and regional capability, future studies should explore other dimensions—such as modularity and robustness (Martin et al. 2016) as well as economic complexity (Hane-Weijman et al. 2022; Hidalgo and Hausmann 2009)—and their impacts on regional economic development to uncover the underlying mechanisms. Third, Boschma (2015) mentioned related variety as shock-absorber when the local industries are skill-related, whereas this study defines relatedness mainly from a technological perspective based on economic clusters (Porter 2003). Scholars can compare technological relatedness and skill relatedness in terms of related variety (Neffke and Henning 2013; Whittle and Kogler 2020; Wixe and Anderson 2017), which might expand our understanding of related variety in the knowledge spillover effect and the labor matching effect with respect to economic crises.

References

Angulo AM, Mur J, Trívez FJ (2018) Measuring resilience to economic shocks: an application to Spain. Ann Reg Sci 2(60):349–374. https://doi.org/10.1007/s00168-017-0815-8

Annoni P, de Dominicis L, Khabirpour N (2019) Location matters: a spatial econometric analysis of regional resilience in the European union. Growth Change 50(3):824–855. https://doi.org/10.1111/grow.12311

Anselin L, Bera AK, Florax R, Yoon MJ (1996) Simple diagnostic tests for spatial dependence. Reg Sci Urban Econ 26(1):77–104. https://doi.org/10.1016/0166-0462(95)02111-6

Antonietti R, Cainelli G, Stefania M, Tomasini S (2015) Banks related variety and firms’ investments. Lett Spat Resour Sci 8(1):89–99. https://doi.org/10.1007/s12076-014-0130-2

Attaran M (1986) Industrial diversity and economic performance in U.S. areas. Ann Reg Sci 20(2):44–54

Balland P, Rigby D, Boschma R (2015) The technological resilience of US cities. Camb J Reg Econ Soc 8(2):167–184. https://doi.org/10.1093/cjres/rsv007

Beaudry C, Schiffauerova A (2009) Who’s right, Marshall or Jacobs? The localization versus urbanization debate. Res Policy 38(2):318–337. https://doi.org/10.1016/j.respol.2008.11.010

Bishop P, Gripaios P (2010) Spatial externalities, relatedness and sector employment growth in Great Britain. Reg Stud 44(4):443–454. https://doi.org/10.1080/00343400802508810

Boschma R (2015) Towards an evolutionary perspective on regional resilience. Reg Stud 49(5):733–751. https://doi.org/10.1080/00343404.2014.959481

Boschma R (2017) Relatedness as driver of regional diversification: a research agenda. Reg Stud 51(3):351–364. https://doi.org/10.1080/00343404.2016.1254767

Boschma R, Minondo A, Navarro M (2012) Related variety and regional growth in Spain. Pap Reg Sci 2(91):241–256. https://doi.org/10.1111/j.1435-5957.2011.00387.x

Bristow G, Healy A (2018) Innovation and regional economic resilience: an exploratory analysis. Ann Reg Sci 60(2):265–284. https://doi.org/10.1007/s00168-017-0841-6

Brown L, Greenbaum RT (2017) The role of industrial diversity in economic resilience: an empirical examination across 35 years. Urban Stud 6(54):1366–1374. https://doi.org/10.1177/004209801562487

Cainelli G, Ganau R, Modica M (2019) Does related variety affect regional resilience? New evidence from Italy. Ann Reg Sci 62(3):657–680. https://doi.org/10.1007/s00168-019-00911-4

Chen J (2019) Geographical scale, industrial diversity, and regional economic stability. Growth Change 50(2):609–633. https://doi.org/10.1111/grow.12287

Chen J (2020) The impact of cluster diversity on economic performance in U.S. Metropolitan statistical areas. Econ Dev Qtly 34(1):46–63

Conroy M (1975) The Concept and measurement of regional industrial diversification. South Econ J 41(3):492–505. https://doi.org/10.2307/1056160

Content J, Frenken K (2016) Related variety and economic development: a literature review. Eur Plan Stud 24(12):2097–2112. https://doi.org/10.1080/09654313.2016.1246517

Cuadrado-Roura JR, Maroto A (2016) Unbalanced regional resilience to the economic crisis in Spain: a tale of specialisation and productivity. Camb J Reg Econ Soc 1(9):153–178. https://doi.org/10.1093/cjres/rsv034

Delgado M, Porter ME, Stern S (2016) Defining clusters of related industries. J Econ Geogr 16(1):1–38. https://doi.org/10.1093/jeg/lbv017

Deller SC, Watson P (2016) Did regional economic diversity influence the effects of the Great Recession? Econ Inq 54(4):1824–1838. https://doi.org/10.1111/ecin.12323

Di Caro P (2015) Recessions, recoveries and regional resilience: evidence on Italy. Camb J Reg Econ Soc 8(2):273–291. https://doi.org/10.1093/cjres/rsu029

Diodato D, Weterings ABR (2015) The resilience of regional labour markets to economic shocks: Exploring the role of interactions among firms and workers. J Econ Geogr 15(4):723–742. https://doi.org/10.1093/jeg/lbu030

Doran J, Fingleton B (2018) US Metropolitan area resilience: Insights from dynamic spatial panel estimation. Environ Plann A 1(50):111–132. https://doi.org/10.1177/0308518X1773606

Elhorst JP (2014) Matlab software for spatial panels. Int Regional Sci Rev 37(3):389–405. https://doi.org/10.1177/0160017612452429

Eriksson RH, Henning M, Otto A (2016) Industrial and geographical mobility of workers during industry decline: the Swedish and German shipbuilding industries 1970–2000. Geoforum 75:87–98. https://doi.org/10.1016/j.geoforum.2016.06.020

Fleming L (2001) Recombinant uncertainty in technological search. Manage Sci 47(1):117–132. https://doi.org/10.1287/mnsc.47.1.117.10671

Frenken K, Van Oort F, Verburg T (2007) Related variety, unrelated variety and regional economic growth. Reg Stud 5(41):685–697. https://doi.org/10.1080/00343400601120296

Giannakis E, Mamuneas TP (2022) Labour productivity and regional labour markets resilience in Europe. Ann Reg Sci 68(3):69–712. https://doi.org/10.1007/s00168-021-01100-y

Glaeser EL, Kallal HD, Scheinkman JA, Shleifer A (1992) Growth in cities. J Polit Econ 100(6):1126–1152. https://doi.org/10.1086/261856

Han Y, Goetz SJ (2019) Predicting US county economic resilience from industry input-output accounts. Appl Econ 51(19):2019–2028. https://doi.org/10.1080/00036846.2018.1539806

Hane-Weijman E, Eriksson RH, Rigby D (2022) How do occupational relatedness and complexity condition employment dynamics in periods of growth and recession? Reg Stud 7(56):1176–1189. https://doi.org/10.1080/00343404.2021.1984420

He C, Chen T, Zhu S (2021) Do not put eggs in one basket: related variety and export resilience in the post-crisis era. Ind Corp Chang 30(6):1655–1676. https://doi.org/10.1093/icc/dtab044

Hidalgo C (2021) Economic complexity theory and applications. Natl Rev Phys 3(2):92–113. https://doi.org/10.1038/s42254-020-00275-1

Hidalgo CA, Hausmann R (2009) The building blocks of economic complexity. P Natl Acad Sci USA 106(26):10570–10575. https://doi.org/10.1073/pnas.0900943106

Holling CS (1973) Resilience and stability of ecological systems. Annu Rev Ecol Evol S 4(1):1–23

Holm JR, Østergaard CR, Olesen TR (2017) Destruction and reallocation of skills following large company closures. J Reg Sci 57(2):245–265. https://doi.org/10.1111/jors.12302

Hu X, Yang C (2019) Institutional change and divergent economic resilience: path development of two resource-depleted cities in China. Urban Stud 56(16):3466–3485. https://doi.org/10.1177/0042098018817223

Hu X, Li L, Dong K (2022) What matters for regional economic resilience amid COVID-19? Evidence from cities in Northeast China. Cities 120:103440

Hundt C, Holtermann L (2020) The role of national settings in the economic resilience of regions—evidence from recessionary shocks in Europe from 1990 to 2014. Growth Change 51(1):180–206. https://doi.org/10.1111/grow.12356

Isserman A, Westervelt J (2006) 1.5 million missing numbers: overcoming employment suppression in County Business Patterns data. Int Regional Sci Rev 29(3):311–335. https://doi.org/10.1177/0160017606290359

Jackson R (1984) An evaluation of alternative measures of regional industrial diversification. Reg Stud 18(2):103–112. https://doi.org/10.1080/09595238400185101

Jacobs J (1969) The economy of cities. Random House, New York, NY

Kao SYH, Bera AK (2016) Spatial regression: the curious case of negative spatial dependence. Working Paper, University of Illinois at Urbana-Champaign

Kitsos A, Bishop P (2018) Economic resilience in Great Britain: the crisis impact and its determining factors for local authority districts. Ann Reg Sci 60(2):329–347. https://doi.org/10.1007/s00168-016-0797-y

Kopczewska K, Kudła J, Walczyk K (2017) Strategy of spatial panel estimation: spatial Spillovers between taxation and economic growth. Appl Spat Anal Policy 10(1):77–102. https://doi.org/10.1007/s12061-015-9170-2

Lacombe DJ, Holloway GJ, Shaughnessy TM (2014) Bayesian estimation of the spatial Durbin error model with an application to voter turnout in the 2004 presidential election. Int Regional Sci Rev 37(3):298–327. https://doi.org/10.1177/0160017612452133

Lagravinese R (2015) Economic crisis and rising gaps North-South: evidence from the Italian regions. Camb J Reg Econ Soc 8(2):331–342. https://doi.org/10.1093/cjres/rsv006

Le Gallo J, Ertur C (2003) Exploratory spatial data analysis of the distribution of regional per capita GDP in Europe, 1980–1995. Pap Reg Sci 82(2):175–201. https://doi.org/10.1111/j.1435-5597.2003.tb00010.x

LeSage JP (2014) What regional scientists need to know about spatial econometrics. Rev Reg Stud 44:13–32

LeSage JP (2015) Software for Bayesian cross section and panel spatial model comparison. J Geogr Syst 17(4):297–310. https://doi.org/10.1007/s10109-015-0217-3

LeSage JP, Pace RK (2009) Introduction to Spatial Econometrics. CRC Press, Boca Raton, FL

Martin R (2012) Regional economic resilience, hysteresis and recessionary shocks. J Econ Geogr 12(1):1–32. https://doi.org/10.1093/jeg/lbr019

Martin R, Sunley P (2015) On the notion of regional economic resilience: conceptualization and explanation. J Econ Geogr 15(1):1–42. https://doi.org/10.1093/jeg/lbu015

Martin R, Sunley P, Gardiner B, Tyler P (2016) How regions react to recessions: resilience and the role of economic structure. Reg Stud 50(4):561–585. https://doi.org/10.1080/00343404.2015.1136410

Neffke F, Henning M (2013) Skill relatedness and firm diversification. Strat Manage J 34(3):297–316. https://doi.org/10.1002/smj.2014

Neffke FM, Otto A, Hidalgo C (2018) The mobility of displaced workers: how the local industry mix affects job search. J Urban Econ 108:124–140. https://doi.org/10.1016/j.jue.2018.09.006

Nooteboom B (2000) Learning by interaction: absorptive capacity, cognitive distance and governance. J Manag Gov 4(1):69–92. https://doi.org/10.1023/A:1009941416749

Porter M (2003) The economic performance of regions. Reg Stud 37(6–7):549–578. https://doi.org/10.1080/0034340032000108688

Rocchetta S, Mina A (2019) Technological coherence and the adaptive resilience of regional economies. Reg Stud 53(10):1421–1434. https://doi.org/10.1080/00343404.2019.1577552

Rodríguez Pose A, Wilkie C (2019) Innovating in less developed regions: what drives patenting in the lagging regions of Europe and North America. Growth Change 50(1):4–37. https://doi.org/10.1111/grow.12280

Santos A, Edwards J, Neto P (2023) Does Smart Specialisation improve any innovation subsidy effect on regional productivity? Port Case Eur Plan Stud 31(4):758–779. https://doi.org/10.1080/09654313.2022.2073787

Schumpeter J (1934) The Theory of Economic Development. Harvard University Press, Cambridge, MA

Sedita SR, De Noni I, Pilotti L (2017) Out of the crisis: an empirical investigation of place-specific determinants of economic resilience. Eur Plan Stud 25(2):155–180. https://doi.org/10.1080/09654313.2016.1261804

Simmie J, Martin R (2010) The economic resilience of regions: towards an evolutionary approach. Camb J Reg Econ Soc 1(3):27–43. https://doi.org/10.1093/cjres/rsp029

Tan J, Lo K, Qiu F, Zhang X, Zhao H (2020) Regional economic resilience of resource-based cities and influential factors during economic crises in China. Growth Change 51(1):362–381. https://doi.org/10.1111/grow.12352

Trendle B (2006) Regional economic instability: the role of industrial diversification and spatial spillovers. Ann Reg Sci 40(4):767–778. https://doi.org/10.1007/s00168-005-0055-1

Watson P, Deller SC (2017) Economic diversity, unemployment and the Great Recession. Q Rev Econ Finance 64:1–11. https://doi.org/10.1016/j.qref.2016.12.003

Whittle A, Kogler DF (2020) Related to what? Reviewing the literature on technological relatedness: where we are now and where can we go? Pap Reg Sci 99(1):97–113. https://doi.org/10.1111/pirs.12481

Wixe S, Andersson M (2017) Which types of relatedness matter in regional growth? Industry, occupation and education. Reg Stud 51(4):523–536. https://doi.org/10.1080/00343404.2015.1112369

Xiao J, Boschma R, Andersson M (2018) Industrial diversification in Europe: the differentiated role of relatedness. Econ Geogr 94(5):514–549. https://doi.org/10.1080/00130095.2018.1444989

Funding

This work was supported by the Natural Science Foundation of China (Grant numbers 42001136 and 42071170).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Chen, J., Li, X. & Zhu, Y. Shock absorber and shock diffuser: the multiple roles of industrial diversity in shaping regional economic resilience after the Great Recession. Ann Reg Sci 72, 1015–1045 (2024). https://doi.org/10.1007/s00168-023-01233-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00168-023-01233-2