Abstract

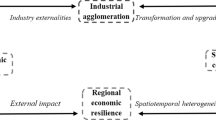

This paper discusses the relationship between regional resilience and industrial variety from an evolutionary perspective. Using a panel dataset containing information on 285 cities at prefectural and higher levels in China, this paper introduces a spatial econometric model to explain how regional resilience is affected by industrial variety with interregional industrial linkages. I find that industrial variety plays a positive role in regional resilience and this role spills over through industrial linkages bridging regions. Due to the interregional linkages, regions can have greater resilience by utilizing industries of other regions. The effect of industrial variety on regional resilience depends on the position of a region in the network of industrial linkages. This effect is also limited by the types of industrial linkages.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The concept of regional resilience has been developed from the fields of physical sciences, ecological sciences, and complex adaptive systems theory and has been considered as engineering resilience, ecological resilience, and adaptive resilience, respectively (Martin 2011; Martin and Sunley 2015). Engineering resilience and ecological resilience are based on the equilibrium theory, focusing on the ability of a system to return or move to a stable equilibrium state. These types of resilience emphasize the response to disturbances, and that is, the region’s short-term capacity to resist shocks and recover from shocks. They are suitable for studies about external acute shocks including natural disasters, financial crises, terrorist events, and other discrete turbulent events. However, regions also face internal and prolonged shocks that are called chronic slow-burn, occurring with economic transformation (Pendall et al. 2010). The resilience conceptions based on equilibrium theory cannot represent chronic slow-burn, so a resilience conception from a dynamic and evolutionary perspective is needed. Compared to engineering resilience and ecological resilience, adaptive resilience in the evolutionary framework extends the connotation of regional resilience and pays more attention to a region’s ability to develop new growth paths and reconfigure the socio-economic structure in the long run (Christopherson et al. 2010; Simmie and Martin 2010).

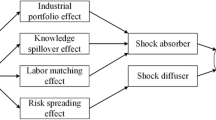

Based on an evolutionary perspective, the relationship between regional resilience and industrial variety is studied from both short-term and long-term perspectives. In terms of the short-term ability to accommodate shocks, the literature finds that regions with diversified industries have the ability to spread risks and accommodate sector-specific shocks (Boschma 2015; Montgomery 1994) and the relatedness between these industries help to stabilize employment (Diodato and Weterings 2015; Neffke and Henning 2013). As for the long-term ability to sustainably develop new growth paths, industrial variety provides the potential for knowledge recombination, and the cross-fertilization of knowledge prevents lock-in (Cattani 2006; Desrochers 2001; Glaeser et al. 1992). Especially, knowledge recombination based on inter-industry learning is easier to occur in regions with a portfolio of related industries and such regions have a higher probability of continuously attracting related industries (Neffke et al. 2011). In other words, no matter in the short term or long term, industrial variety contributes to regional resilience and related variety plays a larger role than unrelated variety.

It is undeniable that industrial variety is conducive to greater regional resilience. The larger role of related variety, however, might be reconsidered because of the increasing industrial linkages between regions. Geographical boundaries are broken by interregional linkages and the interactions between industries of different regions become flexible (Monge and Contractor 2003), so nowadays the findings concerning the relatedness of diversified industries within a region are very likely to be different from the previous studies that regard inter-industry interaction as an intra-regional activity. Local industries establish contact with external industries through interregional industrial linkages, and then the industrial relatedness across regions can make up for the lack of industrial relatedness within a region. The interregional linkages enable regions to mitigate the impact of short-term shocks by stabilizing employment structure with assistance from external industries (Boschma and Iammarino 2009), and enable regions to generate new growth paths in the long run by the gatekeeper industries absorbing external industrial information carried in the interregional linkages (Giuliani and Bell 2005; Graf 2010; Morrison 2008). Therefore, considering the spatial structure of interregional linkages, this paper aims to explore the impact and spillover effects of industrial variety on regional resilience.

This paper contributes to this line of research by introducing a spatial econometric model with a spatial weight matrix reflected by the interregional industrial linkages. The empirical analysis is based on the evidence from China. After the global financial crisis in 2008, both theoretical studies (Boschma 2015; Cowell 2013; Crespo et al. 2013; Martin 2011; Modica and Reggiani 2015) and empirical studies (Cainelli et al. 2019b; Cellini and Torrisi 2014; Ezcurra and Rios 2019) on regional resilience have rapidly grown in European regions. Regional resilience research in China has risen in recent years and lags far behind Europe (Hu and Yang 2019; Shi et al. 2021; Tan et al. 2020; Wang and Wei 2021). This nascent research field plays an important role in China’s development. From a short-term perspective, the Covid-19 pandemic has dealt a heavy blow to China’s economy and the negative impacts have lasted for several years. The improvement of regional resilience helps create new growth paths to cope with the impacts of the Covid-19 and possible shocks in the future. From a long-term perspective, China's persistent regional imbalances are also closely related to regional resilience. For example, northeastern industrial cities and western resource cities have single industrial structures, imperfect market mechanisms, and limited natural resources, leading to a low level of regional resilience. These cities are affected strongly by the various external shocks and their economic growth might even become weaker without the shocks. In contrast, the highly resilient cities in the Yangtze River Delta and Pearl River Delta continuously optimize and upgrade their industrial structures. They are able to effectively respond to shocks and maintain high economic growth. Therefore, the research focusing on China’s cities is valuable. Based on the data of 285 cities at prefectural and higher levels in China, this paper confirmed the positive role of industrial variety in the improvement of resilience. Both related variety and unrelated variety significantly promote regional resilience and exert spillover effects. This paper also investigates the moderating effects, finding that the position of a region in the network of industrial linkages affects the impact of industrial variety on regional resilience. Additionally, the types of industrial linkages affect spillover effects. Manufacturing industrial linkages contribute to spillover effects regardless of related variety and unrelated variety, while not all service industrial linkages have spillover effects.

The rest of this paper is organized as follows. The next section reviews the literature about regional resilience and industrial variety and comments on the relationship between regional resilience and related variety. Section 3 presents the econometric approaches, including the spatial econometric model, the data for variables, and the spatial weights matrix of industrial linkages. Section 4 examines the role of industrial variety in regional resilience, under the background that regions are increasingly bridged by interregional industrial linkages. Finally, Sect. 5 concludes.

2 Literature review

2.1 Regional resilience in specialized regions and diversified regions

There have been studies about the different regional resilience levels between specialized regions and diversified regions. One analysis concerns how industrial variety spreads risks and weakens the negative impacts of shocks. This line of research focuses on the different reactions of specialized regions and diversified regions facing economic shocks and what leads to these reactions. Specialized regions are dominated by a small number of industries that are highly embedded in the regions with strong backward linkages (McCann and Ortega-Argilés, 2015). This leads to short-term benefits of rapid economic growth, but these regions become vulnerable and volatile. When downturns in specialized industries take place, these regions have to deal with chronic unemployment with out-migration (Dissart 2003; Gilchrist and St. Louis 1991). On the contrary, diversified regions house a range of industries and the fluctuations of degrees of timing and intensity in such industries vary (Davies and Tonts 2010; Malizia and Ke 1993). According to portfolio theory, product diversification reduces risk by placing bets on more than one horse (Montgomery 1994). Diversified regions have the ability to accommodate sector-specific shocks and keep higher economic stability. Even though some industries are hit a deadly blow, other industries lower the negative impact on the local economy as a whole (Boschma 2015).

Developing new growth paths through knowledge recombination has also been an important theme in the literature. From the evolutional perspective, regional resilience not only represents the ability to resist shocks and recover from shocks but also stands for the ability to renew new growth paths (Martin 2011). In this regard, diversified regions also overshadow specialized regions. Industries in specialized regions share a similar knowledge base and the dominant industries determine the growth path of specialized regions. These regions tend to lock in. The functional lock-ins, cognitive lock-ins, and political lock-ins make them difficult to develop redundancy and variety (Grabher 1993; Hassink 2005; Nooteboom 2000). They can hardly branch into a new industry, as there are few recombination options with little variety between existing knowledge fields (Boschma 2015). Specialized regions need the infusion of new industries from other regions to achieve the revitalization and enhancement of their industrial base (Martin and Sunley 2006). Even in this case, however, these regions might lose the opportunity to develop growth paths that lay beyond the existing ones because of myopia and sunk costs (Malmberg and Maskell 1997; Maskell and Malmberg 1999). By contrast, diversified regions are more likely to recombine knowledge and technologies to develop new growth paths according to Jacobs externalities (Desrochers and Leppälä, 2011; Jacobs 1969). Innovative activities inevitably lead to the diversification and complexity of a region, and the diversified region injectes insights and adaptations into economic life, providing the best setting for innovative behaviors (Jacobs 1985). Knowledge recombination results from the redeployment of existing knowledge into a new environment, including putting the existing knowledge to new use and incorporating fresh knowledge into the existing knowledge (Cattani 2006; Desrochers 2001). Knowledge recombination tends to occur in diversified regions. The diversified context increases the possibilities of developing new growth paths through the cross-fertilization of knowledge across various industries (Glaeser et al. 1992).

2.2 The role of related variety and unrelated variety

As Frenken et al. (2007) distinguished between related variety and unrelated variety, economic geographers have been aware of the relatedness between industries when industrial diversity influences regional resilience. The concept of related variety amounts to saying that in a region with a high number of industries, some industries are more related than others and these industries generate more Jacobs externalities. Compared to regions with unrelated variety, regions with a portfolio of related industries provide more opportunities for inter-industry learning and thus more potential for technology and knowledge recombination across industries. Each industry contributes to the supportive local technological environment and in return draws from the local pool of related technology and knowledge. In this context, related variety is continuously enhanced, because industries that share knowledge and technology with a range of related industries tend not to exit their present region, and regions with such local environment have a higher probability of attracting industries that are technologically related to the preexisting industries rather than industries whose technologies are unrelated to the local technological pool (Neffke et al. 2011).

Apart from enlarging externalities, related variety also promotes regional resilience by stabilizing employment. Diodato and Weterings (2015) considered regions that rapidly reabsorbed the excess labor into the job market after economic shocks to be more resilient, as the negative impact of downturns on employment in these regions is limited. If an industry is strongly hit, the laid-off workers need to switch jobs in another industry or another region. The higher share of interregional labor mobility means a lower resilience because the shocked regions are unable to achieve a quick recovery and reabsorb the laid-off workers, while resilient regions that reabsorb workers with the inter-industry labor mobility consist of related industries. Related variety enhances inter-industry labor matching (Neffke and Henning 2013). Regions with a local supply of related industries are beneficial for the redundant employees to change jobs in industries that require knowledge and skills associated with what they have acquired in their previous work. The inter-industry reabsorption of labor prevents the massive outflow of high-skilled workers and protects the labor structure after economic shocks.

Although previous literature has reached a consensus that related variety plays a larger role in regional resilience, the relevant discussions are based on the premise that the regions are relatively closed. The increasing interregional linkages change this situation. The interregional linkages that carry technology and knowledge counterbalance the sectoral lock-in in a region, and thus, inter-industry learning is not limited to the regional boundaries (Boschma and Iammarino 2009; Camagni 1991). The local industries that are connected with industries of other regions act as gatekeepers, absorbing and disseminating external knowledge, technology, and experience. External industrial information carried in the linkages is spread through gatekeepers, so as to prevent the region from being locked (Giuliani and Bell 2005; Graf 2010; Morrison 2008). In this case, regions absorb external industrial technology and knowledge contained in the interregional linkages to develop new growth paths or build new growth paths referring to other regions’ paths. In addition, the interregional industrial linkages also avoid the labor outflow caused by industry impact. When a specific industry in a particular region is hit, other regions can help to relieve the downward pressure on this industry through industrial linkages including investment, trade, technological alliances, etc. (Boschma and Iammarino 2009). Thus, the labor structure is stabilized. In summary, regional resilience benefits from interregional industrial linkages.

Therefore, this paper argues that the industrial variety of regions that are connected by industrial linkages favors the resilience of each other. Because industrial linkages bridge related industries in different regions, the intra-regional relatedness of industries is not necessary and importance should be attached to both related variety and unrelated variety.

2.3 Research on China’s regional resilience

The resilience of China’s cities has kept increasing, but shows a significant spatial correlation (Shi et al. 2021). The highest values of resilience are concentrated in the most developed cities and their surroundings. To weaken the imbalanced distribution and promote the resilience of all cities, the factors that influence regional resilience need to be paid attention to. Wang and Wei (2021) studied the response of China’s regional economies to the 2008 subprime crisis, and found regional resilience was affected by industrial diversity, human capital stock, trade openness, and financial liberalization. Hu et al. (2022) took the case of old industrial cities in Northeast China to examine the regional resilience against the Covid-19 pandemic and the 2008 financial crisis. They found that the factors that shaped regional resilience include industrial structure, variety, innovation, specialization, openness, and state agency. Additionally, population shrinkage plays different a negative role in regional resilience (Sun et al. 2023). High-speed railway promotes economic resilience along the lines and this impact spills over to neighboring cities (Li et al. 2023). In the digital era, smart city promotion (Zhou et al. 2021), digital inclusive finance (Du et al. 2023), and Internet development (Shi et al. 2024) all contribute to China’s regional resilience.

Among all the factors mentioned above, industrial structure plays a key role in the improvement of China’s regional resilience. Tan et al. (2020) used the evidence from resource-based cities in China to explore the impact of industrial structure on regional resilience. Their results indicated that industrial diversification benefited economic resilience, while the impact of industrial specialization was the opposite. This is consistent with the results from European cities. Furthermore, regional resilience is linked to the institutional changes in industrial path development. Cities that achieve endogenously based layering and conversion are able to renew their paths and create new paths. These cities show higher resilience to deal with different crises. By contrast, cities that are trapped in exogenously induced institutional thickening show lower resilience and are more difficult to complete economic renewal after shocks (Hu and Yang 2019).

To enrich the literature concerning the relationship between industrial variety and regional resilience, and to expand the research of China’s regional resilience based on an industrial perspective, this paper uses the data of China’s city to analyze the role of industrial variety on regional resilience, considering the impact of interregional industrial linkages.

3 Econometric approach

3.1 Model

Anselin (2013) finds that spatial data are naturally spatial dependent and spatial autocorrelated. Considering the increasing relatedness of interregional industrial structures, I take the spatial autoregressive model (SLX model) to examine the spatial characteristics of the relationship between industrial variety and regional resilience.

The model can be expressed as:

where \(\text{RES}={({\text{RES}}_{1}, \cdots ,{\text{RES}}_{n})}^{T}\) is a proxy for regional resilience. \(\text{RV}={(\text{RV}, \cdots ,{\text{RV}}_{n})}^{T}\) and \(\text{UV}={(\text{UV}, \cdots ,{\text{UV}}_{n})}^{T}\) represent related and unrelated variety, respectively. \(W\) is a \(285\times 285\) spatial weights matrix with non-negative elements that indicates how the 285 regions selected are related in terms of industry. The value of \(\beta \) reflects how local related and unrelated variety affect resilience, and \(\rho \) reflects the impacts of related and unrelated variety of other cities. \(Control\) stands for vectors of control variables. \(\varepsilon \) is a disturbance vector.

3.2 Variables

3.2.1 Regional resilience

The dependent variable depends on the national gross domestic product, due to the importance of economic performance in regional resilience (Crescenzi et al. 2016; Martin 2011). Referring to the widely used measure of regional resilience (Doran and Fingleton 2016; Ezcurra and Rios 2019; Fingleton et al. 2012; Giannakis and Bruggeman 2017; Lagravinese 2015; Martin et al. 2016), the dependent variable is calculated as follows:

where \(\Delta {\text{GDP}}_{it}\) represents the growth rate of the gross domestic product in region \(i\) in year \(t\), and \(\Delta {\text{GDP}}_{t}\) represents the growth rate of the national gross domestic product in year \(t\).

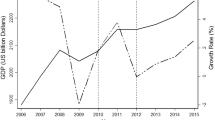

The data of the national gross domestic product are drawn from the China City Statistical Yearbook. From 2004 to 2019, the gross domestic product of the selected 285 cities at the prefectural and higher levels in China increased from 16,291.3 billion yuan to 94,522.2 billion yuan. After a period of rapid growth in the first decade of the twenty-first century, the growth rate of the national gross domestic product gradually fell back to a stable line.

3.2.2 Industrial variety

Frenken et al. (2007) initially proposed the measurement of related variety and unrelated variety to measure the relatedness of industries. This measurement reflects the similarity between different industries in a region and is widely used in the studies of evolutionary economic geography (Boschma and Iammarino 2009; Boschma et al. 2012; Cainelli et al. 2019a). I calculate related and unrelated variety based on the International Patent Classification, referring to Rocchetta and Mina (2019). I select all six-digit IPC subclasses \(i\) under a three-digit IPC subclass \({I}_{g}\), where \(g=1, 2, \dots , G\). The three-digit shares \({P}_{g}\) can be derived by summing all the six-digit shares \({p}_{i}\) belonging to a three-digit subclass:

Related variety is represented as the weighted sum of entropy within each three-digit IPC classification:

where

Unrelated variety is represented as the entropy at the three-digit level:

The IPC data are obtained from the China National Intellectual Property Administration spanning a period from 2004 to 2019. The related variety and unrelated variety of each city are calculated based on 3,514,341 pieces of city-subclass information.

3.2.3 Control variables

Considering the impact of economic structure (Lagravinese 2015), control variables include structural characteristics, such as the share of industrial output (\(\text{gdp}2\text{p}\)) and the share of industrial employment (\(\text{emp}2\text{p}\)). In addition, an active innovation and education environment is beneficial to the integration of knowledge and the creation of new growth paths, so the number of applied invention patents (\(\text{patent}\)) and the number of universities (\(\text{uni}\)) are introduced to control the influence of innovation on regional resilience (Bristow and Healy 2018; Rocchetta and Mina 2019). Foreign direct investment is used to control the level of openness, population density (\(\text{popdensity}\)) is used to control the influence of agglomeration economies (Frenken et al. 2007), and the strength of the interregional transportation network (\(\text{transdegree}\)) is used to control the influence of transportation. Values of VIF are under 10.

3.3 Spatial weights matrix

Investment is a typical channel for industrial linkages, transferring capital, knowledge, technology, market information, labor, and management experience between invested and investing regions. Regional industries are upgraded by learning and imitation (Boschma and Iammarino 2009; Rojec and Knell 2018). I take the investment data from the Industrial and Commercial Enterprise Registration Database spanning from 2004 to 2019 to construct the spatial weights matrix of interregional industrial linkages. As shown in Fig. 1, the industrial linkages between regions in China reflected by interregional investment display an upward trend.

Figure 2 displays the network of industrial linkages in China. The lines represent the average investment of each pair of regions in the 16 years. The number of interregional investments is divided into five parts according to the natural breaks (Jenks). Due to a large amount of data, the lowest part is hidden to improve clarity and visibility. From the linkages shown in Fig. 2, higher industrial linkages can be found between developed regions. Firstly, these industrial linkages increase as the economic development levels of the dyad cities improve. Specifically, the highest linkages take place between the Capital Beijing, and regions such as Shanghai, Shenzhen, Chongqing, Tianjin, and Ningbo (darkest and thickest lines on the map) that have the top development levels. Secondly, regions in eastern China are more industrially related to each other. It is obvious in Fig. 2 that the lines are more concentrated in eastern China; namely, the eastern cities have more industrial linkages with other cities. On the contrary, the western cities have fewer interregional industrial linkages. Thirdly, the industrial linkages show a radial pattern. The majority of the stronger industrial linkages are connected with the Capital Beijing. The Yangtze River Delta and the Pearl River Delta are also important radiation points of industrial linkages. The three most prosperous areas in China deeply influence the form of the network of industrial linkages.

The linkages between every two regions form a network. The network of industrial linkages can be expressed as a 285 × 285 matrix. The values between every two cities in the sixteen years are taken the average, which mitigates the bias of using data of a single year (Benner and Waldfogel 2008). Since the industrial linkage network is regarded as an undirected network, I take the average of interregional investments between every two cities and construct a symmetrical matrix.

4 Empirical findings

4.1 Baseline results

Table 1 presents the baseline results of the impact of related variety and unrelated variety on regional resilience. To measure the spillover effects, the estimations can be decomposed into direct and indirect effects (LeSage and Pace 2009). The direct effects measure how regional resilience responds to its related and unrelated variety; the indirect effects arising from interregional industrial linkages reflect spatial spillover effects cumulated over all regions. As reported in Column (1) and (3), the estimated coefficients of both related variety and unrelated variety are positive and statistically significant (p < 0.05). This means that higher levels of industrial variety within a region are associated with higher levels of regional resilience regardless of the relatedness of industrial variety. These results are consistent with the existing literature that more diversified regions have greater regional resilience (Boschma 2015; Desrochers and Leppälä, 2011). Furthermore, as can be observed in Column (2) and Column (4), the indirect effects in the SLX model are significant, indicating the level of resistance of a region is also related to the industrial variety in regions that are connected by industrial linkages. Diversified industrial composition contributes to the regional resilience of both local and industrial-associated regions, regardless of the relatedness or unrelatedness of the industries within a region.

4.2 Robustness tests

Table 2 shows the results of robustness checks. Column (1) and Column (2) represent the results of replacing the dependent variable. GDP and GDP per capita represent the size and level of economic output, respectively, so I use GDP per capita to calculate a new regional resilience variable as the dependent variable. In Column (3) and Column (4), the independent variables are recalculated. Here the relatedness between industries is measured with all six-digit IPC subclasses falling under four-digit IPC subclasses, and thus related variety and unrelated variety are calculated based on the new categories of relatedness. Column (5) and Column (6) represent the relationship between the regional resilience in period \(t\) and the related variety and unrelated variety in period \(t-1\). In order to avoid possible endogenous errors caused by mutual causation, the lagged variables of related and unrelated variety are introduced as instrumental variables. The robust tests show positive and significant results that related variety and unrelated variety are beneficial to the resistance ability of both local regions and other regions that have industrial linkages. The baseline results are robust.

4.3 Moderating effects of network position

The impacts of industrial variety on the resilience of a particular region are affected by the position of this region in the network of industrial linkages. The entrenched position of a region enables it to have more industrial linkages with other regions and make better use of industrial resources in other regions. I posit that regions that are located in the core positions of the network of industrial linkages are able to make better use of the diverse industries of other regions to achieve greater regional resilience. The moderating models are shown below:

The degree centrality is used to represent the positions of the industrial network. Regions are regarded as nodes and the industrial linkages between them are regarded as edges in the network. Referring to Opsahl (Opsahl et al. 2010), the degree centrality is calculated by combining the degree of nodes and the weight of edges:

where \({d}_{i}\) is the degree of node \(i\) and \({s}_{i}\) is the sum of the weights of all edges connected with node \(i\). The network of industrial linkages consists of 285 nodes and the data of edges are reflected by interregional investment data from the Industrial and Commercial Enterprise Registration Database. The industrial linkages are considered undirected, taking the average investment amounts between pairs of regions as the weights of network edges.

As shown in Table 3, the moderating effects are positive and statistically significant. In terms of both related and unrelated variety, the core position in the industrial network enlarges the role of industrial variety in regional resilience. The spillover effects reflected by the indirect effects are also enlarged. Strengthening the industrial relationships with other regions and enhancing the positions in the industrial network help regions reach greater regional resilience and promote the industrial-associated regions’ resilience.

4.4 Different types of industrial linkages

As shown in Table 4, a region’s related variety and unrelated variety are beneficial to promote other regions’ resilience through manufacturing industrial linkages. The strong linkages of manufacturing industries directly provide multiple opportunities for firms in different regions to collaborate and learn from each other. Knowledge, technologies, and labor flow over regions. These regions keep recombining different technologies, optimize their industrial structures, and subsequently become more resistant. By contrast, linkages of service industries do not directly affect knowledge recombination and industrial restructuring, but contribute to an active environment for them. The interaction between unrelated industries is more difficult than that between related ones. Not all service industrial linkages play a significant role in the spillover effects. As shown in Table 5, IT service and scientific service show statistically significant spillover impacts. The rapid development of IT industries and the active scientific environment within a region is helpful for inter-industry activities. The IT service linkages and scientific service linkages between regions help these regions break the limitation of geographical distance, promoting the establishment of cross-border firms, institutions and other platforms. This accelerates the dissemination of industrial knowledge, technologies, experience, and labor. Thus, a region’s diversified industries are easier to be utilized by their connected regions to create new growth paths and resist shocks. Interestingly, the financial service linkages are more important for the resilience promoted by unrelated variety. Financial integration leads to the interaction and interpenetration of financial activities in different regions. The integrated and proactive financial environment provides these regions with more opportunities to re-allocate their resources. Division and cooperation develop in unrelated industries in these regions, promoting technological innovation and the development of the real economy. Other types of service industrial linkages have little spatial impact.

5 Conclusions

Using the panel data of the 285 cities at prefectural and higher levels in China spanning the period from 2004 to 2019, this paper uses a spatial econometric model to explore the impact of industrial variety on regional resilience. The main findings and corresponding policy implications are shown below:

Firstly, industrial variety favors regional resilience, consistent with the existing literature (Boschma 2015; Desrochers and Leppälä, 2011). However, this paper has some new arguments on the roles of related variety and unrelated variety. Previous studies pay attention to the intra-regional industrial activities and find a larger role of related variety on regional resilience because inter-industry activities are easier to take place between related industries (Neffke et al. 2011). Due to the increase of interregional industrial linkages, inter-industry activities are not limited to the related industries within a particular region. Instead, industrial interactions and cooperation across regions are on the increase. Industries utilize the resources from external industries that are related to them to improve the level of resilience. Thus, the role of relatedness within a region is weakened. Both related variety and unrelated variety are important for regional resilience.

Secondly, the role of industrial variety in regional resilience has spillover effects. Industrial variety not only has a direct effect on local resilience but also has an indirect effect to influence the resilience of other regions. Based on this finding, interregional industrial linkages should be attached with more importance.

Thirdly, regions are located in different positions in the industrial network, which makes a difference in the relationship between industrial variety and regional resilience. If a region lies in the core position, its resilience is more dependent on industrial variety. Additionally, the spillover effects of the industrial variety of a core region are stronger than those of a periphery region.

Fourthly, different types of industrial linkages differ in their roles in spillover effects. The spatial effects of both related variety and unrelated variety in regional resilience are significantly affected by manufacturing industrial linkages. By contrast, only specific types of service industrial linkages are useful for the spillover effects.

These findings raise some potentially important policy implications. The analysis suggests that improving industrial variety may contribute to increasing the level of regional resilience. Accordingly, policymakers should avoid path dependence, but continuously introduce new industries and guide regions to develop diversified industrial bases. Moreover, it is important to recall the spillover effects caused by industrial linkages. Policymakers should keep strengthening the interregional industrial linkages, including industrial investment and industrial cooperation. The local governments can provide subsidies and tax incentives for interregional industrial investment, establish interregional industrial cooperation platforms and technological alliances to weaken the administrative barriers, and develop an integrated market that is conducive to the interregional circulation of industrial resources.

References

Anselin L (2013) Spatial econometrics: methods and models. Springer Science & Business Media, New York

Benner M, Waldfogel J (2008) Close to you? Bias and precision in patent-based measures of technological proximity. Res Policy 37(9):1556–1567

Boschma R (2015) Towards an evolutionary perspective on regional resilience. Reg Stud 49(5):733–751

Boschma R, Iammarino S (2009) Related variety, trade linkages, and regional growth in Italy. Econ Geogr 85(3):289–311

Boschma R, Minondo A, Navarro M (2012) Related variety and regional growth in Spain. Pap Reg Sci 91(2):241–256

Bristow G, Healy A (2018) Innovation and regional economic resilience: an exploratory analysis. Ann Reg Sci 60(2):265–284

Cainelli G, Ganau R, Modica M (2019a) Does related variety affect regional resilience? New evidence from Italy. Ann Reg Sci 62(3):657–680

Cainelli G, Ganau R, Modica M (2019b) Industrial relatedness and regional resilience in the European Union. Pap Reg Sci 98(2):755–778

Camagni R (1991) Innovation networks: spatial perspectives. Belhaven-Pinter, Mississippi

Cattani G (2006) Technological pre-adaptation, speciation, and emergence of new technologies: how Corning invented and developed fiber optics. Ind Corp Chang 15(2):285–318

Cellini R, Torrisi G (2014) Regional resilience in Italy: a very long-run analysis. Reg Stud 48(11):1779–1796

Christopherson S, Michie J, Tyler P (2010) Regional resilience: theoretical and empirical perspectives. Camb J Reg Econ Soc 3(1):3–10

Cowell MM (2013) Bounce back or move on: Regional resilience and economic development planning. Cities 30:212–222

Crescenzi R, Luca D, Milio S (2016) The geography of the economic crisis in Europe: national macroeconomic conditions, regional structural factors and short-term economic performance. Camb J Reg Econ Soc 9(1):13–32

Crespo J, Suire R, Vicente J (2013) Lock-in or lock-out? How structural properties of knowledge networks affect regional resilience. J Econ Geogr 14(1):199–219

Davies A, Tonts M (2010) Economic diversity and regional socioeconomic performance: an empirical analysis of the western Australian grain belt. Geogr Res 48(3):223–234

Desrochers P (2001) Local diversity, human creativity, and technological innovation. Growth Change 32(3):369–394

Desrochers P, Leppälä S (2011) Opening up the ‘Jacobs Spillovers’ black box: local diversity, creativity and the processes underlying new combinations. J Econ Geogr 11(5):843–863

Diodato D, Weterings ABR (2015) The resilience of regional labour markets to economic shocks: exploring the role of interactions among firms and workers. J Econ Geogr 15(4):723–742

Dissart JC (2003) Regional economic diversity and regional economic stability: research results and agenda. Int Reg Sci Rev 26(4):423–446

Doran J, Fingleton B (2016) Employment resilience in Europe and the 2008 economic crisis: insights from micro-level data. Reg Stud 50(4):644–656

Du Y, Wang Q, Zhou J (2023) How does digital inclusive finance affect economic resilience: evidence from 285 cities in China. Int Rev Financ Anal 88:102709

Ezcurra R, Rios V (2019) Quality of government and regional resilience in the European Union. Evidence from the Great Recession. Pap Reg Sci 98(3):1267–1290

Fingleton B, Garretsen H, Martin R (2012) Recessionary shocks and regional employment: evidence on the resilience of U.K. regions. J Reg Sci 52(1):109–133

Frenken K, Van Oort F, Verburg T (2007) Related variety, unrelated variety and regional economic growth. Reg Stud 41(5):685–697

Giannakis E, Bruggeman A (2017) Economic crisis and regional resilience: evidence from Greece. Pap Reg Sci 96(3):451–476

Gilchrist DA, St. Louis LV (1991) Directions for diversification with an application to Saskatchewan. J Reg Sci 31(3):273–289

Giuliani E, Bell M (2005) The micro-determinants of meso-level learning and innovation: evidence from a Chilean wine cluster. Res Policy 34(1):47–68

Glaeser EL, Kallal HD, Scheinkman JA, Shleifer A (1992) Growth in Cities. J Polit Econ 100(6):1126–1152

Grabher G (1993) The weakness of strong ties: the lock-in of regional development in the Ruhr area. pp. 255–277

Graf H (2010) Gatekeepers in regional networks of innovators. Camb J Econ 35(1):173–198

Hassink R (2005) How to unlock regional economies from path dependency? From learning region to learning cluster. Eur Plan Stud 13(4):521–535

Hu X, Yang C (2019) Institutional change and divergent economic resilience: path development of two resource-depleted cities in China. Urban Studies 56(16):3466–3485

Hu X, Li L, Dong K (2022) What matters for regional economic resilience amid COVID-19? Evidence from cities in Northeast China. Cities 120:103440

Jacobs J (1969) The economy of cities. Vintage, New York

Jacobs J (1985) Cities and the wealth of nations: principles of economic life. Vintage, New York

Lagravinese R (2015) Economic crisis and rising gaps North–South: evidence from the Italian regions. Camb J Reg Econ Soc 8(2):331–342

LeSage J, Pace RK (2009) Introduction to spatial econometrics. Chapman and Hall/CRC, Boca Raton

Li R, Xu M, Zhou H (2023) Impact of high-speed rail operation on urban economic resilience: Evidence from local and spillover perspectives in China. Cities 141:104498

Malizia EE, Ke S (1993) The influence of economic diversity on unemployment and stability. J Reg Sci 33(2):221–235

Malmberg A, Maskell P (1997) Towards an explanation of regional specialization and industry agglomeration. Eur Plan Stud 5(1):25–41

Martin R (2011) Regional economic resilience, hysteresis and recessionary shocks. J Econ Geogr 12(1):1–32

Martin R, Sunley P (2006) Path dependence and regional economic evolution. J Econ Geogr 6(4):395–437

Martin R, Sunley P (2015) On the notion of regional economic resilience: conceptualization and explanation. J Econ Geogr 15(1):1–42

Martin R, Sunley P, Gardiner B, Tyler P (2016) How regions react to recessions: resilience and the role of economic structure. Reg Stud 50(4):561–585

Maskell P, Malmberg A (1999) Localised learning and industrial competitiveness. Camb J Econ 23(2):167–185

McCann P, Ortega-Argilés R (2015) Smart specialization, regional growth and applications to European Union cohesion policy. Reg Stud 49(8):1291–1302

Modica M, Reggiani A (2015) Spatial economic resilience: overview and perspectives. Netw Spat Econ 15(2):211–233

Monge PR, Contractor NS (2003) Theories of communication networks. Oxford University Press, Oxford

Montgomery CA (1994) Corporate diversificaton. J Econ Perspect 8(3):163–178

Morrison A (2008) Gatekeepers of knowledge within industrial districts: who they are how they interact. Reg Stud 42(6):817–835

Neffke F, Henning M (2013) Skill relatedness and firm diversification. Strateg Manag J 34(3):297–316

Neffke F, Henning M, Boschma R (2011) How Do regions diversify over time? Industry relatedness and the development of new growth paths in regions. Econ Geogr 87(3):237–265

Nooteboom B (2000) Learning and innovation in organizations and economies. OUP Oxford, Oxford

Opsahl T, Agneessens F, Skvoretz J (2010) Node centrality in weighted networks: generalizing degree and shortest paths. Soc Netw 32(3):245–251

Pendall R, Foster KA, Cowell M (2010) Resilience and regions: building understanding of the metaphor. Camb J Reg Econ Soc 3(1):71–84

Rocchetta S, Mina A (2019) Technological coherence and the adaptive resilience of regional economies. Reg Stud 53(10):1421–1434

Rojec M, Knell M (2018) Why is there a lack of evidence on knowledge spillovers from foreign direct investment? J Econ Surv 32(3):579–612

Shi T, Qiao Y, Zhou Q (2021) Spatiotemporal evolution and spatial relevance of urban resilience: evidence from cities of China. Growth Chang 52(4):2364–2390

Shi F, Zheng Y, Liu X (2024) Does internet development affect urban economic resilience? New evidence from China. Appl Econ 56(26):3117–3132

Simmie J, Martin R (2010) The economic resilience of regions: towards an evolutionary approach. Camb J Reg Econ Soc 3(1):27–43

Sun Y, Wang Y, Zhou X, Chen W (2023) Are shrinking populations stifling urban resilience? Evidence from 111 resource-based cities in China. Cities 141:104458

Tan J, Hu X, Hassink R, Ni J (2020) Industrial structure or agency: What affects regional economic resilience? Evidence from resource-based cities in China. Cities 106:102906

Wang Z, Wei W (2021) Regional economic resilience in China: measurement and determinants. Reg Stud 55(7):1228–1239

Zhou Q, Zhu M, Qiao Y, Zhang X, Chen J (2021) Achieving resilience through smart cities? Evidence from China. Habitat Int 111:102348

Funding

The study was funded by China Scholarship Council, CSC202306010248.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.