Abstract

This paper empirically examines the effect on couples’ labour supply of a universal at-birth cash benefit and a government subsidy equal to 50% of child care expenditure for working parents. The method is first to simulate the effects on labour supply over the adult lifecycle using a calibrated dynamic utility maximisation model of a representative couple, using data drawn from waves of a longitudinal survey for Australia. Then using the same data, the effect of family benefits and the child care subsidy on couples’ hours worked is econometrically estimated. The 50% child care subsidy was found to increase the average couple’s labour supply by the equivalent of 0.75 to 1 h per week whilst children are of pre-school age, and less on average over the couple’s working lifetime. The cash benefit changes were found to have a negligible effect on labour supply.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

This paper empirically examines the effects of a child care subsidy and universal, at-birth, cash family benefits on the hours worked by couples in Australia. A dynamic utility maximisation model of a representative couple is calibrated and econometrically estimated using longitudinal survey data. The motivation for this study is the Australian Government’s decision to significantly increase both child care subsidies and family benefits during the 2000–2010 decade.

An extensive range of studies show that monetary child care costs can significantly affect mothers’ labour supply (Blau and Robins 1989; Connelly 1992; Ribar 1995; Gornick et al. 1996; Powell 1997; Viitanen 2005; Blau and Tekin 2007; Baker et al. 2008; Lefebvre and Merrigan 2008; Herbst 2010; Simonsen 2010; Washbrook et al. 2011). However, there is variability in the sizes of effects found in different national contexts, and in some contexts the effects of monetary child care costs are insignificant (Jaumotte 2004; Del and Vuri 2007; Lundin et al. 2008). In Norway, the introduction of a “cash for childcare” subsidy to parents who do not use publicly subsidised child care, which in effect increases the relative price of external child care, has been found to reduce mothers’ labour supply (Schone 2004; Ronsen 2009). Sanchez-Mangas and Sanchez-Marcos (2008) found that in Spain the introduction of a benefit paid to working mothers but not specifically linked to child care use had a small but statistically significant effect on mothers’ labour force participation. Recent Australian studies have generally found that the effects of the cost of child care on a mother’s or couple’s employment are small and sometimes insignificant (Doiron and Kalb 2005; Rammohan and Whelan 2005; Rammohan and Whelan 2007; Kalb and Lee 2008). Wetzels (2005) also finds an insignificant effect of child care cost on female labour force participation in the Netherlands, a country in which, like Australia, a high percentage work on a part-time basis. Jaumotte’s macroeconomic analysis (2004) finds that higher public child care subsidies increase female labour force participation including full-time work, a pattern consistent with her review of the literature.

Universal, at-birth, cash transfer payments similar to Australia’s Baby Bonus have been introduced by only a few countries, including Norway, Italy, Poland, SpainFootnote 1 and, at a provincial level, Canada (McDonald 2006a; Gauthier 2007, 2010).Footnote 2 Whilst there is an extensive literature on the effects of such policies on fertility, empirical studies of the labour supply effects appear rare (McDonald 2006a, b; Gauthier 2007). Jaumotte (2004) finds a significant negative relationship between the value of child benefits and females’ rate of participation in part-time work, but an insignificant relationship with participation in full-time work. She concludes that child care subsidies are therefore preferred to child benefits from the point of view of raising female labour supply.

The model in this paper is applied to data for Australia where the government implemented major changes to family benefits in 2004 and 2005 (Daniels 2009; Parr and Guest 2011). In 2004, a universal, flat-rate cash payment to the parents of new born children, originally known as the ‘Maternity Payment’ (but following widespread media and popular misnomer renamed as the ‘Baby Bonus’Footnote 3), was introduced. At the same time, the amounts and eligibility for means-tested payments to the parents of dependent children (known as ‘Family Tax Benefits’) were increased (Australian Government 2004; Costello 2004). One of the questions motivating this paper is whether the ‘Baby Bonus’ precipitated changes in labour force participation. Also, in 2005 the Government introduced a substantial new subsidisation of child care expenditure, known as the Child Care Rebate. The initial rate was 30% of the gap between child care expenditure and the pre-existing, progressive Child Care Benefit up to an annual maximum amount of A$4,000 per child, with effect for expenses incurred over the 2004–05 financial year (Daniels 2009). In 2008, the incoming Labor Government increased the childcare rebate to 50% and the annual maximum amount per child to A$7,750. Eligibility for payment of the Child Care Rebate is conditional on a specified number of hours being spent working, studying, or training, and is not means-tested. The structure of the rebate delivers larger absolute amounts to those with higher incomes, to those with larger numbers of pre-school age, and to those who use more expensive child care (for example due to stronger child quality of life concerns). The Child Care Rebate has substantially reduced the out-of-pocket expenditures on child care to working parents across the income spectrum compared to those which prevailed before its introduction (Australian Government 2010; ABS 2011). There has also been a rapid inflation for child care. Thus, despite a 50% Child Care Rebate, the out-of-pocket cost of child care in September 2009 was only 20% below the level which prevailed 5 years earlier, before the introduction of the Rebate (ABS 2011).

Section 2 of this paper describes the data collection and details of the dynamic utility maximising model, the results of which are discussed in Section 3 (the calibration is described in the Appendix). The specification and results from the econometric estimation are discussed in Section 4. Section 4.3 presents the main conclusions.

2 Method and data

2.1 Data

The data used are from Waves 2–9 of the Household, Income and Labour Dynamics in Australia (HILDA) survey.Footnote 4 Wave 1 of this nationwide, longitudinal survey was conducted in 2001 and subsequent waves on an annual basis. Remote areas of the country were not sampled (Wooden and Watson 2007). A multi-stage, cluster sample design was used, and 13,969 men and women from 7,682 households and 488 census collection districts, which were stratified by State or Territory, and metropolitan or non-metropolitan, were successfully interviewed for Wave 1. The household response rate was 66% and the individual response rate 61%. The retention rate for individual panel members between Waves 1 and 5 was 74%. Data are collected annually on family formation and background, employment and unemployment history and status, and income. Modules of questions on other special topics have been added periodically to the core content (Watson and Wooden 2002a, b; Wooden and Watson 2007).

2.2 The dynamic utility maximisation model

Models where households choose both labour supply and fertility, including the number and spacing of children, by maximising a lifetime utility function have become well established. Early examples include Cigno (1983), Moffitt (1984), Happel et al. (1984), Hotz and Miller (1988), Cigno and Ermisch (1989), and Eckstein and Wolpin (1989); and more recently Del and Sauer (2009), Ueda (2008) and Sheran (2007). The models tend to differ on several dimensions: whether they are discrete time or continuous time, stochastic or deterministic, and whether the econometric estimation is of a structural or reduced form model. The optimising model in this paper is a discrete choice model somewhat in the vein of Sheran (2007). The contribution here is, first, the specification of the utility function and the calibration of parameters such that the baseline behaviour of the representative couple is consistent with observations from the HILDA data with respect to their birth sequence and parity-specific labour supply; second, the specification of parameters capturing the costs of children that are influenced by family policies such as a child care rebate and cash payments to families, and other parameters calibrated using HILDA data; third, a comparison of results from the simulation model with those from an econometric estimation.

A representative couple is the unit of analysis. There is no distinction between male and female labour supply or wages. This implicitly allows either or both partners to adjust labour supply in order to spend time in child rearing.Footnote 5 The couple derives utility over their working lifetime from discretionary consumption including that of their children, where discretionary consumption is defined as consumption above the minimum costs of children; their own leisure (including home production); and the number of children born to the couple. The couple’s intertemporal utility function is

where: i is the duration of the couple’s union which also defines the age of the couple since the union is assumed to occur when both parents are 25 years of age;Footnote 6

In Eq. 1 M i is the couple’s composite index of consumption and leisure and is given by

N j is a dichotomous variable (0, 1) indicating a birth (N j = 1) or no birth (N j = 0) at the couple’s age j; hence the child is of age i–j when the couple are aged i; γ j is an age-specific utility weight on a birth at the couple’s age j which captures the preference for births over the reproductive span, and γ j follows a bimodal distribution in order to generate the most common birth pattern according to HILDA data;Footnote 7 C i is the sum of the couple’s discretionary consumption at age i including their children’s consumption;

- S i :

-

is the couple’s joint leisure which includes time spent caring for children;

- ψ :

-

is the elasticity of substitution between consumption and leisure;

- μ :

-

is the preference for consumption relative to leisure;

- θ a,i :

-

represents an additional degree of preference for leisure which depends on the age of the youngest child of the couple at age i; 0 < θ a,i < 1 and \(\theta_{a,i}^\prime \left( a \right)<0\), hence θ a,i declines as the youngest child grows older;Footnote 8

- ρ :

-

is a pure rate of time preference.

The couple maximises Eq. 1 subject to their joint lifetime budget constraint

and a terminal wealth constraint: \(A_T =\bar{{A}}\).

A decision to work an extra hour when children are under the age of 6 is assumed to require paid child care expenditure, c, which is given by

where η is a parameter (0 < η < 1), w 0 is the hourly wage rate at the time of the union, and e is the proportion of child care expenditure rebated by the government.

The remaining variables and parameters are:

- N c,i :

-

the discrete number of children in child care when the couple are aged i;

- T :

-

the couple’s working lifetime which is assumed to be 40 years starting from the date of the couple’s union (time 0 in the plan, age 25), implying a retirement age of 65;

- w i :

-

the couple’s joint (after tax) wage rate per hour at age i;

- L i :

-

the couple’s joint labour supply where L = 1 − S i (discussed further below);

- Q i − j,n :

-

the minimum expenditure, other than child care expenditure, required to support a child of age i–j and birth order n;Footnote 9

- B i − j :

-

family benefits received for a child of age i–j, given as a proportion, δ of Q i − j,n

- A i :

-

the couple’s wealth at the end of age i;

- r :

-

the constant interest rate.

Children under the age of 6 are assumed to require longer hours of child care, which can be provided by either or both of the parents, through paid child care, or a combination of the two. Child care provided by the parents implies a reduction in their labour force participation, the cost of which is forgone wages equal to w i L i per child for the couple at age i. As the parents are assumed to earn a joint wage and have joint labour supply there is no distinction between which of the parents undertakes child care. Alternatively child care can be ‘outsourced’ at an expenditure per child of c.

The couple’s joint wage rate per unit of labour supply is given by their level of human capital. Human capital accumulates with work experience. Hence the wage rate is

where K 0 is their initial stock of human capital which depends on their natural talent, education and work experience prior to their union; and ε is a positive constant determining the rate at which human capital accumulates with labour supply. The couple’s income varies with both the number and timing of births because the time required to spend with the child implies less time in the labour force which reduces both contemporaneous income and human capital accumulation. For parents who have children under the age of 6, an increase in labour supply, ΔL i , implies a decision to outsource child care at the expenditure of cw 0(ΔL i ).

This is a partial equilibrium model, implying that the fiscal implications of government decisions that affect child care expenditure do not feed back to the couple’s lifetime budget via changes in either taxation or transfer payments. This is justified on the basis that the government budgetary cost of child care, including tax expenditures and subsidies to providers, is small and some of the financing mechanisms have only an indirect impact on couples’ lifetime budgets. Hence, as an approximation, the effect on couples’ lifetime budgets is assumed to be zero.

2.2.1 Solution procedure

Given T = 20 there are 220 = 1,048,576 possible birth sequences and therefore plans. In the initial calibration each of these plans is repeatedly simulated with trial values of the exogenous parameters in γ t until the utility maximising birth sequence corresponds with the median birth sequence according to Wave 9 of the HILDA data. The resulting values of the parameters in γ t are then adopted for all simulations of family policy parameters. According to the HILDA data, the median number of children born to coupled women who have most recently reached the end of their reproductive span is 2. The median time from start of a union to the first of the two births is 3.5 years and the median number of years between births is 3, which implies the birth sequence {0,0,0,1,0,0,1,0,...} where “0” indicating no birth in a year and “1” indicating a birth.Footnote 10 Hence, the baseline birth sequence is characterised by a birth occurring in the fourth year of the union and the seventh year of the union.

For a given birth sequence the couple maximises U by choosing consumption, C i , and leisure time, S i, subject to Eq. 3. This yields the following relation between consumption of goods and leisure:

where \(p_i =\left( {w_i -cN_{c,i} } \right)\) is the price of leisure. Solving Eq. 6 for S i and substituting into Eq. 2, yields

and repeating for C i yields

Defining P i as the minimum price that buys a unit of the consumption index, M i , we can write P i M i = C i + p i S i into which is substituted Eqs. 7 and 8, yielding

Now Eqs. 7 and 8 can be simplified using Eq. 9 to give:

To obtain the Euler equation, first use Eqs. 10 and 11 to substitute for C i and S i in the budget constraint Eq. 3, using S i = 1 − L i . Then maximise the utility function Eq. 1 with respect to M i,j subject to Eq. 3. This yields

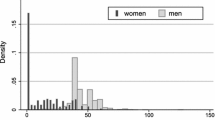

A trial value is chosen for M i for i = 1, then solved forward for M i for i = 1,...,T according to Eq. 12. For i = 1,...,h calculate C i and S i according to Eqs. 10 and 11. The value of terminal financial assets, A T is compared with the target value and M 1 is iterated until they are equal within a degree of tolerance. Parameter values and data are discussed in the Appendix. Figure 1 illustrates the lifetime path for the couple’s labour supply under the baseline parameter values and baseline childbirth sequence; it also illustrates the path in the case where there are no children.

2.2.2 Labour supply

The aim here is to investigate the impact on the couple’s labour supply of family policies given alternative exogenous fertility decisions. Family policies are simulated by varying the two child care expenditure parameters: η, and the rebate, e; and the family benefits parameter, δ. Child care parameters have both a substitution effect and an income effect on labour supply (L i ), whereas family benefits have only an income effect. The substitution effect of child care expenditures occurs through the price of leisure:\(p_i =\left( {w_i -cN_{c,i} } \right)\), where c is the child care parameter given by Eq. 4, capturing both η and e.

A potentially important assumption for simulations of labour supply responses, is the chosen value for ψ, the intratemporal elasticity of substitution between leisure and consumption. Typical values of this parameter in the literature are in the range 0.5 to 1.0. For example, Foertsch (2004), Auerbach and Kotlikoff (1987) and Altig et al. (2001) all use a value of 0.8 in their dynamic models. However a higher value of ψ is appropriate here because the model applies only to couples and is calibrated to the case where the couple has two children. Theory and empirical evidence suggests that labour supply elasticities for married couples (and women in particular) are considerably higher than for singles and childless couples (see surveys in Evers et al. 2008, and Blundell and MaCurdy 1999). For Australia, Scutella (2000) estimates that married women with two dependent children have labour supply elasticities that are higher than for other groups of married women; for example their uncompensated elasticities are 30% higher than for married women with no dependent children. Hence, the baseline value for ψ here is 1.2 and sensitivity analysis is reported for a value of 0.9.

In this model, the wage rate is endogenous through the effect of labour supply on accumulation of human capital which in turn determines the wage rate (Eq. 5). In such models the labour supply response depends on the discounted value of the marginal effect of current hours on all future wage rates and on the marginal utility of lifetime wealth (Shaw 1989). This, along with the existence of non-wage income, implies that the labour supply response to a change in child expenditure is highly non-linear; hence the need for numerical simulations.

3 Simulations and results

In addition to the base case birth sequence {0, 0, 0, 1, 0, 0, 1, 0, ...} there are three sequences for each of three completed fertility rates: one, two and three births. For each birth sequence there are four simulations: one for the base case parameter values and one for an alternative value of each of the three parameters: η, e and δ. The simulated values for η are 0.1 (base) and zero, for e are 0.5 (base) and zero, and for δ are 0.25 (base) and 0.5. The average labour supply is reported over the 40 year working life span and also for the period during which the couple has a child of child care age.

The results (Table 1) are described in detail below and are summarised as follows. Reducing child care expenditure through the two parameters η and e leads to higher labour supply: the substitution effect of a higher price of leisure dominates the income effect. This also has a dynamic effect that gives a small boost to labour supply lasting until children are well beyond child care age. This refers to the effect on future wages of higher labour supply while children are young (Eq. 5), which implies a persistently higher (albeit slightly) price of leisure throughout adult life. Labour supply therefore remains slightly higher throughout adult life as a result of lower child care expenditure. The effect is greater the higher the completed fertility rate and (albeit slightly) the earlier in the lifetime that children are born. Family benefits on the other hand have a smaller effect on lifetime labour supply because they have no effect on the price of leisure; again there is a dynamic effect through Eq. 5 but of relatively small magnitude.

Turning to the detail and taking first the base case birth sequence, the effect of reducing η from 0.1 to zero (or 10% of the couple’s wage income at the time of the union), is to raise labour supply by 2.1%Footnote 11 while the couple has a child under 6 and by 0.4% over the whole adult lifetime. These percentages can be converted to equivalent working hours. If we assume a 40 h working week, then a 2.1% increase in labour supply amounts to an average increase of approximately 1 h per week, and a 0.4% increase equates to about a quarter of an hour. The 2.1% increase while the couple has a child under 6 reflects the relative strength of the substitution effect of a higher price of leisure. The effect of the child care rebate (e) is simulated by reducing the rebate from 0.5 to zero. This raises paid child care costs which reduces the price of leisure and reduces net income. The net effect is a reduction in labour supply, both while children are under 6 (2.5%) and over the whole adult lifetime (0.4%). Again, these percentages equate to an average increase of about 1 h per week while children are under 6 and a quarter of an hour on average of the whole adult lifetime.

Family benefits (δ) do not directly affect the price of leisure and hence the primary effect on labour supply is an income effect. This could be expected to reduce labour supply over the whole adult lifetime since a given target wealth can be achieved with less labour. However there is a dynamic effect which again works through Eq. 5. As couples adjust to their higher net income by working less, they accumulate less human capital which affects their future wages leading to feedback income and substitution effects. The net impact on labour supply of all of these effects turn out to be relatively small. For example, for the baseline birth sequence a doubling of family benefits by increasing the value of δ from 0.25 to 0.5 increases labour supply by 0.04% while the youngest child is under 6 and decreases labour supply by 0.08% over the lifetime.

The corresponding results are given for other birth sequences in order to show the effect of the number of children requiring child care (N c,i ) and their ages. A greater number of children in child care implies that a change in a child care cost parameter has a bigger impact on the price of leisure. Compare for example the birth sequences for a completed fertility rate of 3 children with those for children (the bottom 3 birth sequences of Table 1). In all three of these birth sequences, the effect of reducing child care expenditure to zero is greater than in any of the sequences for a completed fertility of 2 children. Similarly, the reduction in the child care rebate has a bigger impact in the case of 3 children than for 2 children. The increased magnitudes are roughly proportional to the increase in the number of children. That is, a 50% increased completed fertility rate from 2 to 3 children implies approximately a 50% increase in the magnitude of the effects of the variation in the child care parameters, which accords with intuition.

The results are affected by the timing of births which is exogenous in this model. Several cases are simulated and reported (Table 1). The effect of child care expenditure on labour supply is very slightly greater the earlier that children are born in the couple’s lifetime. Consider for example the three simulations for one child. Reducing η from 0.1 to zero boosts lifetime labour supply by 0.01% more when the child is born in year 2 than in year 4 and again 0.01% more when the child is born in year 4 than in year 6. The earlier in the lifecycle that the boost to labour supply occurs, the greater the accumulated effect on future wages and hence the greater the accumulated substitution effect on labour supply (although it is emphasised that the magnitude of the effect is very small).

As discussed above, the magnitude of the labour supply response is potentially sensitive to the chosen value for ψ. The full set of simulations was run for ψ = 0.9 compared with the base value of 1.2. The results (given in Table 2) are as expected in that the signs of the responses are unaltered and the magnitudes are smaller, roughly commensurate with the reduction in the parameter value. For example, eliminating the child care rebate reduces labour supply during the period when children are under 6 by 1.95% compared with 2.45% in the base case; and over the whole adult lifetime by 0.35% compared with 0.43% in the base case. A doubling of the family benefits parameter, δ, from 0.25 to 0.5 has a similar negligible effect on labour supply as in the base case.

These simulations have calibrated the rather complex dynamic effects on labour supply, for alternative birth sequences, of child care expenditure when future wages depend on accumulated human capital through labour force experience. In summary, plausible reductions in child care expenditure, equivalent to a 50% child care rebate, increase labour supply in the order of an equivalent 1 h per week on average over a 40 h week, while children are aged under 6, and less on average over the working lifetime. Plausible changes in family benefits have a negligible effect on labour supply. These results are supported by the econometric estimation to which we now turn.

4 Econometric estimation

4.1 Model specification

The dependent variable is a continuous variable for the number of hours usually worked per week in all jobs by a couple. Multilevel regression models were used for the analysis (Liang and Zeger 1986; Goldstein 1995). The models have the form:

where the subscript i, j refers to the observation from Wave j (j = 2,...,9) for woman i; X k , is a vector of explanatory variables (discussed below); u i is a random effect for couple i; and Y i,j is the hours worked per week by couple i in year j. The estimated covariances of residuals for different observations from the same couple were allowed to vary according to the modulus of the difference in wave numbers.

The analysis was restricted to 19,136 observations on married or cohabiting opposite sex couples in which both partners are aged between 15 years and 64 years, taken from Waves 2–9 of HILDA. The data included 4,556 observations on couples with a youngest child under age five. The over 65s were excluded because they are past the current standard retirement age. Our primary focus is on the combined hours worked by couples. However, we also report results for hours worked by husbands and wives separately. For each dependent variable we present two models: (1) a model which includes a baselines effect for the Child Care Rebate and Childcare Price Index, as well as for the Baby Bonus and controls a range of characteristics for the couple and their children, and (2) a model which also fits interactions between the Child Care Rebate and Childcare Price Index and the wife’s and the husband’s education, as well as the other variables mentioned above. The former model shows the population-wide effect of the Child Care Rebate, whilst the second identifies the variability in this effect according to couple’s characteristics. The data were weighted to take account of differential non-response.

4.2 Choice of explanatory variables

The following groups of independent variables were motivated by the dynamic utility maximising model simulated above.

Family benefit and child care subsidy policies

The variable Baby Bonus indicates whether the youngest child was aged zero in a year following the introduction of the Baby Bonus. The Baby Bonus is captured in the utility maximising model through the family benefits parameter, δ. The variable Child Care Rebate (e in the utility maximising model) and Youngest Child Under Five was given the value 30 for years when the 30% rate of rebate was available (i.e. 2005 to 2007), 50 for years when the 50% rate was available (2008 to 2009), and zero for other years if the youngest child was aged under five. Since the Child Care Rebate could also encourage participation among couples with a youngest child of school age (through reducing the effective costs of before and after school care and vacation care) a similar variable—Child Care Rebate and Child Aged 5 to 14—was also included for couples with a youngest child in this age range.

Child care price index variables

In addition to the net cost of child care being affected by childcare subsidies, it is also affected by changes in the price of child care. To capture the effect of such changes we calculated an index of the price of child care before deduction of the Child Care Rebate using official Consumer Price Index figures (ABS 2011). This was scaled to give the price of child care in the first year of the period considered (i.e. 2002) a value of 100. The variable Index of Child Care Price and Youngest Child Under 5 was calculated by multiplying the values of the child care price index by an indicator variable for the youngest child being aged under five in age range. A similarly calculated variable Index of Child Care Price and Youngest Child 5 to 14 was calculated to test whether parental hours worked in this age range was affected by the price of child care.

Number and ages of children

Age of the youngest child resident in the couple’s home and the numbers of resident children in the 0 to 4, 5 to 14 and 15 to 24 age ranges are included.Footnote 12 The importance of children’s ages as determinants of parents’ labour supply is captured in the utility maximising model through the path of the parameter θ a,i which represents an additional degree of preference for leisure while children are young (as discussed above). This pattern has also been demonstrated in numerous studies both for Australia and internationally (Evans and Kelley 2008; Birch 2005; Kalb 2009). These variables will be related to the demand for parents’ time in child care (Ronsen and Sundstrom 2002).

Education-related variables

In Eq. 5, the couple’s joint wage rate depends on their initial stock of human capital as well as their labour force experience. Differences in attitudes to career-orientation, parental involvement with child development and the division of household labour may also vary with education (Evans and Kelley 2008; Craig 2006, 2007). For each partner the highest level of education was categorised into Bachelor’s degree or higher, diploma or certificate, completion of Year 12 (the final year of schooling in Australia) or for migrants the overseas equivalent, and Year 11 (or its overseas equivalent) or less. Binary variables indicating whether each partner was currently studying full time were also included.

Type and duration of union

In the utility maximising model no assumption is made about whether the couple are married or cohabitating. However, previous research has shown that cohabiting couples have more egalitarian attitudes to and divisions of household labour and paid work than married couples (Baxter 2005). It is also possible there are attitudinal differences towards gender roles between couples with differing types of union which may also be related to labour supply. Hence, a variable indicating whether the couple are married or cohabiting was included. And the duration of the union was also included to test whether couples’ hours worked varied with the length of time they have been together.Footnote 13

Age

The effect of the couple’s age is indirectly captured in the utility maximising model through the accumulation of human capital over time. In the estimation, linear and squared terms for age were included for each partner.

Interactions between child care subsidy policies and education-related variables

Since, in both absolute terms and as a percentage of income, the value of the Child Care Rebate will vary with couple’s wage and this in turn will depend on their stock of human capital, and because of differing child raising practices between parents with differing educations which may affect the responsiveness of couples’ labour supply to child care costs, we tested for interaction effects between education-related variables and the Child Care Rebate (Cigno 2001; Craig 2006, 2007; Blakemore et al. 2009).

Interactions between Child Care Price Index and Education-related variables

These were also fitted to test whether couples with different educational profiles differ in their responses to changes in child care prices.

4.3 Results

4.3.1 Trends in hours worked

Figure 2 shows that the mean hours worked per week for all couples aged 15–64 rose gradually between 2002 and 2008 and then decreased slightly in 2009. The hours worked by females in couples (henceforth we refer to male partners as “husbands” and female partners as “wives”) also generally increased up until 2008 before decreasing between 2008 and 2009. For “husbands” there is also a very slight increase in hours worked over time.

For couples whose youngest child is under five, the hours worked generally increased (Fig. 3). Between 2003 and 2008, the increase in hours worked was generally greater (in both absolute and percentage terms) among wives with a youngest child aged under 5 than among wives. Moreover, the reduction in hours worked between 2008 and 2009 was also noticeably less among those with one or more children under five. The mean hours worked by husbands with children under 5 is roughly three times that for females and has been decreasing gradually since 2004.

4.3.2 Effects of the child care rebate and the baby bonus on hours worked

The regression results reported in Table 3 indicate that the Child Care Rebate has produced a small but statistically significant increase in the hours worked by couples with a youngest child under 5. The predicted effect of the 30% Child Care Rebate is to increase the hours worked per couple by 0.42 h per week and the predicted effect of the 50% rebate to increase it by 0.75 h per week.Footnote 14 Note that this result is close in magnitude to the result from the simulations reported in Section 3, which amounted to 1 h per week. The increase is mainly due to statistically significant increases in the hours worked by the wives (0.54 h for a 30% rebate and 0.89 h for a 50% rebate). The effect of the rebate on the hours worked by the husband is small and not quite statistically significant at 10%. The sizes of effects for couples with a youngest child aged 5 to 14 are very small and not statistically significant.

Table 4 shows there is significant variability in the effect of the Child Care Rebate on couple’s hours worked between educational groups. The effect of the Rebate generally increases as the husband’s highest education increases, being significantly higher for couples in which the husband has a Bachelor’s degree of higher than for couples in which the husband has Year 11 education or less. This may be related to the regressive structure of the Rebate: it delivers larger amounts to couples with higher combined incomes. The increase in work hours is largely due to the wives of highly educated men working for significantly longer. Table 4 also shows the effect of the Child Care Rebate is greater among couples where the wife has a Certificate or Diploma as a highest level of education. This may be because the returns from working after deduction of work-related child care costs were raised above critical threshold levels for this group by the Rebate

Both in Tables 3 and 4 the effects of the Baby Bonus and the other changes which occurred simultaneously on couple’s hours, the wife’s hours, and the husband’s hours are not statistically significant. This result is also consistent with the simulation results in Section 3 where the Baby Bonus was found to have a negligible effect on labour supply.

4.3.3 Effects of other variables on hours worked

Over the 2002 to 2009 period the price of child care (excluding Child Care Rebate) almost doubled. Table 3 shows significant negative effects of the price of child care on the hours worked by couples with a youngest child aged under five. The effect on the wives hours worked is much larger than the effect on husbands hours worked. Table 4 shows the effect of higher child care prices is significantly greater on couples in which the husband has a Bachelor’s degree. This may reflect the greater part of child care costs that are payable by higher income couples after deduction of the progressively-levied Child Care Benefit. The effects of child care price on the hours worked by couples with a youngest child aged 5 to 14 are not significant.

The results also show that hours worked by a couple increase considerably as the wife’s education increases. This is because more educated wives work significantly more hours. The increase in hours worked as female education increases may reflect a ‘wage pull’ effect. However there may also be attitudinal differences between educational groups which affect the utility of leisure (Evans 1996; Craig 2006).

The effects of the husband’s education on couple’s hours worked are not significant. However the insignificant difference between the hours worked by couples in which the husband has a post school qualification, compared to those with Year 11 as the highest education, reflects a (near) zero sum in which the significantly higher hours worked by husbands is offset by their wives working fewer hours. Interestingly, after controlling for other variables including the wife’s education, the hours worked by couples in which the husband has at least a Bachelor’s degree are less than those for couples in which the husband has only Year 12 as the highest education. This is due to the wives of Bachelor’s or above educated men working fewer hours than their contemporaries with husbands educated to Year 12. It may be that a higher male education, and hence income, promotes role specialisation, with the female specialising more on home duties, or that with a higher male income the marginal utility of the female’s income and hence her incentive to work is reduced (Evans 1996).

Not surprisingly, being a student reduces the couple’s hours worked, and more so if the husband studies than if the wife does so. There is no significant evidence that one partner studying is associated with higher (or lower) hours worked by the other partner. The significant effects of both linear and squared terms for the ages of both partners show that hours worked generally increase as the ages of the couple increase but at a decreasing rate. The effect of the husband’s age is greater than the effect of the wife’s age.

Hours worked vary considerably according to the numbers of children by age. The predicted difference in hours worked between a couple with a given number of children and those for a couple with no children is obtained by summing the effects of the “age of youngest child”, “number of children 0 to 4”, “number aged 5 to 14” and “number aged 15–24”. As expected the numbers of hours a couple works are much lower when the youngest child is very young and also tend to decrease as the number of children in the family increases, particularly when the number in either the 5 to 14 or the 15 to 24 age range reaches three or more. These effects are largely due to the effects on the hours worked by the wife. Husbands with one child aged 5 to 14 work slightly longer hours than husbands without children in this age range. The differences in hours worked between cohabiting couples and married couples are not significant. The effects of duration of union also are not significant.

5 Conclusions

This study has examined the effect on couples’ labour supply of family policies, in particular cash benefits and child care subsidies. The simulations of the utility maximising model and the econometric estimations both indicate that a 50% reduction in child care expenditure would increase household labour supply of an equivalent 0.75 to 1 h per week on average. The small size of this effect is consistent with previous work for Australia which has shown the effects of child care expenditure on family or female labour supply are small and in some cases insignificant (Doiron and Kalb 2005; Rammohan and Whelan 2005, 2007; Kalb and Lee 2008). There are a number of possible explanations for the small effect: a shift from lower quality/lower price or informal to higher quality/higher price formal child care; inflexibility in the supply of child care places resulting from legally mandated minimum staff-to-child ratios in child care centres and requirements for staff qualifications; localised shortages in child care availability; first-come first-served child care place allocation practices; and barriers to labour force re-entry such as negative (potential) employer attitudes to employing mothers with young children. All of these factors would reduce the responsiveness of parents’ labour supply to the effective cost of child care (Blau and Robins 1989; Kalb 2009; Breunig et al. 2011). Our econometric estimations show the effect of the Child Care Rebate is greater for couples in which the husband is highly educated. This could reflect the regressive nature of the rebate.

The simulation model indicates that over the longer term the increase in hours worked resulting from the child care rebate should also have a dynamic effect that somewhat boosts future labour supply through the effect on future wages of higher labour supply when children are young. Although increased hours of child care in theory could be substituted for the leisure time of either partner, our econometric estimation shows that the increase in couples’ hours worked which has resulted from the increased subsidisation of child care has come entirely from the wives. This would reflect relatively few husbands being primary carers.

Family benefits do not directly affect the price of leisure and hence the primary effect on labour supply is an income effect. The result is a relatively small effect on labour supply, as found empirically here. The small size of the effect may be related to the modest size of the Baby Bonus and its payment at birth when most mothers would have a strong preference to be at home caring for their children, barring all but the most difficult financial circumstances.

Notes

Spain’s equivalent to the Baby Bonus, which was introduced in 2007, was discontinued at the end of 2010.

In several countries, for example Singapore and the Russian Federation, the term ‘Baby Bonus’ has been used to describe family benefits which structured differently from Australia’s universal, flat-rate, at birth ‘Baby Bonus’.

Henceforth, we refer to it as the Baby Bonus.

Wave 1 was not included because comparable data on hours worked were not available from this wave.

In Australia, for example, mothers still spend considerably less time in paid work and considerably more time on domestic work and looking after children than fathers, especially when the children are young (Craig and Sawrikar 2009). However, there is a trend toward fathers spending more time caring for children than in the past and some evidence fathers would like more opportunity to do so (Craig and Sawrikar 2009; Craig et al. 2010).

The Wave 9 HILDA data (for 2009) show the median ages at entry to union for couples with a female partner aged 45 to 54 and two children were 25.2 for females and 27.5 for males.

The bimodal distribution is given as the weighted sum of two normal distributions: \(\gamma_i =\frac{1}{\sigma \sqrt {2\pi } }\exp \left( {\frac{-\left( {i-\mu_1 } \right)^2}{2\sigma^2}} \right)+w\frac{1}{\sigma \sqrt {2\pi } }\exp \left( {\frac{-\left( {i-\mu_2 } \right)^2}{2\sigma^2}} \right)\) where w is a weight.

This reflects evidence from the time use literature which shows that younger children receive more of parents’ child care time than older children (Craig 2006, 2007; Craig and Sawrikar 2009) implying more parental time out of the labour force. It is assumed here that this reflects a parental preference to spend more time with younger children.

The cost of a child of a given age is assumed to decline with the number of children born (see Section 2).

The estimates are derived from the fertility histories of women aged 40–49 with 2 children who are currently either married or in an opposite sex cohabiting/de facto union, had not had a child before their current union and who (if married) had not been married prior to the start of their current union.

The percentage changes reported in Table 1 refer to percentage point change in LFP (not the proportional change).

The HILDA survey provides the age of the youngest child by individual years of age. Information on numbers of children by age is provided only by the broad age ranges (0 to 4, 5 to 14 and 15 to 24) here.

Non linearity in this effect was tested for by including the square of the union duration. However, the squared term was later removed after it was found to be insignificant.

Non linearity in this effect was tested for by including separate effects for a 30% rebate and a 50% rebate. However, since the estimated effect of the 50% rebate on hours worked by couples with a child under 5 was roughly 1.6 times that of a 30% rebate the more parsimonious linear variable was preferred.

References

Altig D, Auerbach AJ, Kotlikoff LJ, Smetters KA, Walliser J (2001) Simulating fundamental tax reform in the United States. Am Econ Rev 91(3):574–595

Auerbach AJ, Kotlikoff LJ (1987) Dynamic fiscal policy. Cambridge University Press, Cambridge

Australian Bureau of Statistics (2011) Consumer price index catalogue number 6401.0. Commonwealth of Australia, Canberra

Australian Government (2004) Budget 2004–05: more help for families. Commonwealth of Australia, Canberra. http://www.budget.gov.au/2004–05. Accessed 31 May 2011

Australian Government Department of Education, Employment and Workplace Relations Office of Early Childhood Education and Child Care (2010) State of child care in Australia. Commonwealth of Australia, Canberra. http://www.mychild.gov.au/documents/docs/StateChildCareAus.pdf. Accessed 10 Jan 2012

Baker M, Gruber J, Milligan K (2008) Universal child care, maternal labor supply, and family well-being. J Polit Econ 116(4):709–745

Baxter J (2005) To marry or not to marry: marital status and the household division of labor. J Fam Issues 26(3):300–321

Birch ER (2005) Studies of the labour supply of Australian women: what have we learned? Econ Rec 81(252):65–84

Blakemore T, Strazdins L, Gibbings J (2009) Measuring family socioeconomic position. Aust Soc Policy 8:121–168

Blau DM, Robins PK (1989) Fertility, employment, and child-care costs. Demography 26(2):287–299

Blau DM, Tekin E (2007) The determinants and consequences of child care subsidies for single mothers in the USA. J Popul Econ 20(4):719–741

Blundell R, MaCurdy T (1999) Labor supply: a review of alternative approaches. In: Ashenfelter OA, Card D (eds) Handbook of labor economics. Amsterdam, North Holland, pp 1559–1695

Breunig R, Weiss A, Yamauchi C, Gong X, Mercante J (2011) Child care availability, quality, and affordability: are local problems related to labour supply? Econ Rec 87(276):109–124

Cigno A (1983) Human capital and the time-profile of human fertility. Econ Lett 13(4):385–392

Cigno A (2001) Comparative advantage, observability, and the optimal tax treatment of families with children. Int Tax Public Financ 8(4):455–470

Cigno A, Ermisch J (1989) A microeconomic analysis of the timing of births. Eur Econ Rev 33(4):737–760

Connelly R (1992) The effect of child care costs on married women’s labor force participation. Rev Econ Stat 74(1):83–90

Costello P (2004) Budget speech 2004–05. Australian Government, Canberra. http://www.budget.gov.au/2004–05/speech/html/speech.htm. Accessed 9 June 2011

Craig L (2006) Parental education, time in paid work and time with children: an Australian time-diary analysis. Br J Sociol 57(4):553–575

Craig L (2007) How employed mothers in Australia find time for both market work and childcare. J Fam Econ Issues 28(1):69–87

Craig L, Sawrikar P (2009) Work and family: how does the (gender) balance change as children grow? Gend Work Organ 16(6):684–709

Craig L, Mullan K, Blaxland M (2010) Parenthood, policy and work–family time in Australia 1992–2006. Work Employ Soc 24(1):27–45

Daniels D (2009) Social security payments for people caring for children, 1912 to 2008: a chronology. Parliamentary Library, Parliament of Australia, Canberra. http://www.aph.gov.au/Library/pubs/BN/2008–09/children.htm. Accessed 10 April 2010

Del Boca D, Sauer RM (2009) Life cycle employment and fertility across institutional environments. Eur Econ Rev 53(3):274–292

Del Boca D, Vuri D (2007) The mismatch between employment and child care in Italy: the impact of rationing. J Popul Econ 20(4):805–832

Doiron D, Kalb G (2005) Demands for child care and household labour supply in Australia. Econ Rec 81(254):215–236

Eckstein Z, Wolpin KI (1989) Dynamic labour force participation of married women and endogenous work experience. Rev Econ Stud 56(3):375–390

Evans MDR (1996) Women’s labour force participation in Australia: recent research findings. J Popul Res 13(1):67–92

Evans MDR, Kelley J (2008) Trends in women’s labour force participation in Australia: 1984–2002. Soc Sci Res 37(1):287–310

Evers M, De Mooij R, Van Vuuren D (2008) The wage elasticity of labour supply: a synthesis of empirical estimates. De Economist 156(1):25–43

Foertsch T (2004) Macroeconomic impacts of stylized tax cuts in an intertemporal computable general equilibrium model. Congressional Budget Office Technical Paper Series, Washington, DC

Gauthier AH (2007) The impact of family policies on fertility in industrialized countries: a review of the literature. Popul Res Policy Rev 26(3):323–346

Gauthier AH (2010) Comparative family policy database, version 3 [computer file]. Netherlands Interdisciplinary Demographic Institute and Max Planck Institute for Demographic Research (distributors). http://www.demogr.mpg.de. Accessed 1 June 2010

Goldstein H (1995) Multilevel statistical models. Arnold, London

Gornick JC, Meyers MK, Ross KE (1996) Public policies and employment of mothers: a cross-national study. Luxembourg Income Study Working Paper No. 140

Gray M, Chapman B (2001) Foregone earnings from child rearing: changes between 1986 and 1997. Fam Matters 58:4–9

Happel SK, Hill JK, Low SA (1984) An economic analysis of the timing of childbirth. Popul Stud 38(2):299–311

Herbst CM (2010) The labor supply effects of child care costs and wages in the presence of subsidies and the earned income tax credit. Rev Econ Household 8(2):199–230

Hotz VJ, Miller RA (1988) An empirical analysis of life cycle fertility and female labor supply. Econometrica 56(1):91–118

Jaumotte F (2004) Labour force participation of women: empirical evidence on the role of policy and other determinants in OECD countries. OECD Economic Studies No 37 2003/2

Jorgenson DW, Yun KY (2001) Investment: lifting the burden: tax reform, the cost of capital and U.S. economic growth, vol 3. MIT Press, Cambridge, MA

Kalb G (2009) Children, labour supply and child care: challenges for empirical analysis. Aust Econ Rev 42(3):276–299

Kalb G, Lee WS (2008) Childcare use and parents’ labour supply in Australia. Aust Econ Pap 47(3):272–295

Lattimore R, Pobke C (2008) Recent trends in Australian fertility. Productivity Commission Staff Working Paper, Commonwealth of Australia, Canberra

Lefebvre P, Merrigan P (2008) Child-care policy and the labor supply of mothers with young children: a natural experiment from Canada. J Labor Econ 26(3):519–548

Li W, Yao R (2007) The life-cycle effects of house price changes. J Money Credit Bank 39(6):1375–1409

Liang KY, Zeger SL (1986) Longitudinal data analysis using generalized linear models. Biometrika 73(1):13–22

Lundin D, Mork E, Ockert B, (2008) How far can reduced childcare prices push female labour supply? Lab Econ 15(4):647–659

McDonald P (2006a) An assessment of policies that support having children from the perspectives of equity, efficiency and efficacy. Vienna Yearb Popul Res 2006:213–234

McDonald P (2006b) Low fertility and the state: the efficacy of policy. Popul Dev Rev 32(3):485–510

Moffitt R (1984) Profiles of fertility, labour supply, and wages of married women: a complete life-cycle model. Rev Econ Stud 51(2):263–278

Parr N, Guest R (2011) The contribution of increases in family benefits to Australia’s early 21st-century fertility increase: an empirical analysis. Demographic Res 25(6):215–244

Percival R, Harding A (2007) in Henman P, Percival R, Harding A, Gray M ‘Costs of children: research commissioned by the Ministerial Taskforce on Child Support’. Occasional Paper No. 18, Canberra, Australian Government Department of Families, Community Services and Indigenous Affairs

Powell LM (1997) The impact of child care costs on the labour supply of married mothers: evidence from Canada. Can J Econ 30(3):577–594

Rammohan A, Whelan S (2005) Child care and female employment decisions. Australian J Lab Econ 8(2):203–225

Rammohan A, Whelan S (2007) The impact of childcare costs on the full-time/part-time employment decisions of Australian mothers. Aust Econ Pap 46(2):152–169

Ribar DC (1995) A structural model of child care and the labor supply of married women. J Labor Econ 13(3):558–597

Ronsen M (2009) Long-term effects of cash for childcare on mothers’ labour supply. Labour 23(3):507–533

Ronsen M, Sundstrom M (2002) Family policy and after-birth employment among new mothers—a comparison of Finland, Norway and Sweden. Eur J Popul 18(2):121–152

Sanchez-Mangas R, Sanchez-Marcos V (2008) Balancing family and work: the effect of cash benefits for working mothers. Lab Econ 15(6):1127–1142

Scutella R (2000) Labour supply estimates for married women in Australia. Melbourne Institute of Applied Economic and Social Research, Working Paper No. 25/99, University of Melbourne

Shaw KL (1989) Life-cycle labor supply with human capital accumulation. Int Econ Rev 30(2):431–456

Sheran M (2007) The career and family choices of women: a dynamic analysis of labor force participation, schooling, marriage, and fertility decisions. Rev Econ Dyn 10(3):367–399

Schone P (2004) Labour supply effects of a cash-for-care subsidy. J Popul Econ 17(4):703–727

Simonsen M (2010) Price of high-quality daycare and female employment. Scand J Econ 112(3):570–594

Ueda A (2008) Dynamic model of childbearing and labor force participation of married women: empirical evidence from Korea and Japan. J Asian Econ 19(2):170–180

Viitanen TK (2005) Cost of childcare and female employment in the UK. Labour (Special Issue) 19(S1):149–170

Washbrook E, Ruhm CJ, Waldfogel J, Han WJ (2011) Public policies, women’s employment after childbearing, and child well-being. B E J Econ Anal Pol 11(1):1–48

Watson N, Wooden M (2002a) The household, income and labour dynamics in Australia (HILDA) survey: wave 1 survey methodology, HILDA project technical paper series no 1/02. http://www.melbourneinstitute.com/hilda. Accessed 18 Aug 2010

Watson N, Wooden M (2002b) Assessing the quality of the HILDA survey wave 1 data, HILDA project technical paper series no 4/02. http://www.melbourneinstitute.com/hilda. Accessed 18 Aug 2010

Wetzels C (2005) Supply and price of childcare and female labour force participation in the Netherlands. Labour 19(s1):171–209

Wooden M, Watson N (2007) The HILDA survey and its contribution to economic and social research (so far). Econ Rec 83(261):208–231

Acknowledgements

This research was supported by an Australian Research Council (ARC) Discovery Grant funding scheme (project number DP0984378). We gratefully acknowledge the research assistance provided by Amy Lo and Simon Massey. This paper uses unit record data from the Household, Income and Labour Dynamics in Australia (HILDA) survey. The HILDA Project was initiated and is funded by the Australian Government Department of Families, Housing, Community Services and Indigenous Affairs (FaHCSIA) and is managed by the Melbourne Institute of Applied Economic and Social Research (Melbourne Institute). The findings and views reported in this paper, however, are those of the authors and should not be attributed to either FaHCSIA or the Melbourne Institute.

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Alessandro Cigno

Appendix: Calibration and data

Appendix: Calibration and data

The base case values chosen for the parameters in Eqs. 1 to 5, are given in Table 5 and are chosen as follows. The preference for consumption relative to leisure, μ, is calibrated such that the optimal labour force participation (LFP) at the time of the union, in the case of no children, is equal to 0.6; hence L 1 = 0.8 and S 1 = 0.2 in that simulation. The value of μ is recalibrated for each birth sequence such that this initial LFP condition is met. The term θ a,i represents an additional degree of preference for leisure depending on the age of the youngest child of the couple at age i. The values of θ a,i are set in order that the joint labour time of the couple falls by approximately 30% in the first year following a birth, 15% in the second year, and 10% in the third year and so on. This broadly reflects HILDA data on couples’ median hours worked per week according to the age of the youngest child. The age-specific preference for children, γ i follows a bimodal distribution in order to generate the baseline birth sequence.

The child care expenditure parameter, η, is set equal to 0.1 in the baseline case, representing expenditure per child of 10% of the couple’s wage at the time of the union. The child care rebate is set at 0.5 (50%) in the baseline case. The parameter ε measures the rate at which the couple’s human capital increases with workforce experience. The value of ε was determined from Gray and Chapman (2001) who find that woman increase their annual after-tax earnings by between 1% and 4% per year from the age of 30 to 45, depending on the number of children they have. We have chosen a value of ε (0.01) reflecting the lower end of this range.

The cost of a child of age i–j and birth order n, Q i − j,n , is based on Percival and Harding (2007). They report figures for a child of a given age that vary depending on the work status of the parents, the level of child care and the number of children in the household. An average of their figures at each age is adopted here, resulting in the cost of the first born child being roughly 20% of household income when the child is aged 3 and increasing by 0.4% of income for each additional year of age of the child, reaching approximately 25% of income by age 14. The age-specific costs of second and subsequent children are assumed here to be 50% of the cost of the most recently born child. This is an approximation consistent with the figures reported in Percival and Harding (2007). It implies for example, that given the cost of the first born child at age 3 of 20% of household income, when the second child is age 3 the cost of that child is 0.5 of 20% (=10%) of household income, giving a total cost of the two children (aged 3 and 6) of 30%. Once the child reaches the age of 18, the cost of that child is reduced by 50% for each year thereafter. Hence, the cost of a 19-year-old child is 50% the cost of an 18-year-old, and the cost of a 20-year-old is 25% of the cost of an 18-year-old, and so on.

Family benefits per child of age i–j B i − j , are expressed as a proportion, δ, of the monetary costs of a child at age i–j. Lattimore and Pobke (2008) calculate the value of Australian Government family benefits to be about one quarter of the full private monetary costs of children. Hence δ = 0.25 in the base case.

Target wealth at the end of the planning period, A T , is set equal to five times the household income at the time of the union. This is based on HILDA Wave 9 data for median household financial assets for couples aged 60–69 who have children. Initial wealth, A 0, is zero.

The real interest rate, r, is both a borrowing and lending rate for simplicity. It is set at 3% which is a typical rate used in household life cycle models (Li and Yao 2007, for example). The rate of time preference, ρ, is also set at 3% which is also well within the range of values used in similar models and those estimated from data (for example Li and Yao 2007, use 4.5% while Jorgenson and Yun 2001, estimate a value of 2%).

Rights and permissions

About this article

Cite this article

Guest, R., Parr, N. Family policy and couples’ labour supply: an empirical assessment. J Popul Econ 26, 1631–1660 (2013). https://doi.org/10.1007/s00148-012-0421-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-012-0421-0