Abstract

We examine the long-run effects of the pay-as-you-go (PAYG) social security scheme on fertility and welfare of individuals in an overlapping generations model, assuming that child-care services are available in the market. We show that the impact of a tax increase on fertility depends on the relative magnitudes of the standard intergenerational redistribution effect through the social security system, the (implicit) subsidy effect through tax-exemption of child rearing at home, and the price effect through changes in the relative price of market child care, and that if parental child-rearing time is inelastic, a tax cut could bring about a Pareto-improving allocation.

Similar content being viewed by others

Explore related subjects

Discover the latest articles, news and stories from top researchers in related subjects.Avoid common mistakes on your manuscript.

1 Introduction

Declining fertility and increasing life expectancy are two of the commonly observed features in most developed countries. As is well recognized, both could cause serious problems for the sustainability of social security systems financed on a pay-as-you-go (PAYG) basis. In particular, declining fertility reduces the number in the labor force in the future, which could in turn reduce contributions to their social security systems. On the other hand, decreases in parental child-rearing time, especially those of mothers, increase the labor supply of that generation and thereby their social security contributions. Such recognition has raised considerable public concern over this issue, leading many researchers to examine the feasibility and sustainability of public pension systems in such economies with declining fertility and/or increasing life expectancy (e.g., Zhang et al. 2001; Yakita 2001; Groezen et al. 2003). Most of the literature, however, has assumed that child rearing requires parental time as an essential input regardless of material costs, i.e., increasing child-rearing time necessarily increases the number of children (e.g., Galor and Weil 1996). It has been suggested that with higher wage rates due to economic growth, mothers may buy child care in the market (known as bought-in child care), supplying labor to the market instead of spending their own time on child rearing within the home (e.g., Blau and Robins 1988; Martinez and Iza 2004). In this study, we investigate the effects of a PAYG social security scheme, financed by payroll taxes, on the labor supply, fertility, and welfare of individuals, taking into account the availability of child care outside the home.

Recent empirical studies by Ahn and Mira (2002), for example, show that the cross-country correlation of the total fertility rate and the female labor force participation rate in Organization for Economic Cooperation and Development (OECD) countries was negative in the 1970s but turned positive after the late 1980s. Rindfuss et al. (2003) and Apps and Rees (2004) confirmed a positive association between fertility and the female labor supply in 1990 in the panel data of OECD countries but a negative relationship between them in 1970.Footnote 1 Martinez and Iza (2004) also showed a positive relationship between the total fertility rates and female labor force participation in the USA for the period 1980–2000. Using a simple theoretical framework, Apps and Rees (2004) explained the positive relationship between fertility and the female labor supply, assuming the availability of child care services outside the home and its substitutability for parental child care within the home. In their model, as an increase in the female wage rate increases the opportunity cost of child rearing, child-rearing time tends to be reduced. However, the resulting increase in the labor supply raises the wage income of individuals, which makes it possible to purchase more child care services in the market. Therefore, a higher female wage rate may increase both the fertility rate and their labor supply, resulting in a positive relationship between them. However, problems concerning social security were not examined by Apps and Rees (2004).

We consider a small open economy populated by overlapping generations with a PAYG social security scheme financed by a payroll tax on the working generation. For our purpose, we assume that individuals do not have bequest motives and that they derive utility from having children, not from their children’s utility, as proposed by Eckstein and Wolpin (1985). Section 2 presents an analytical framework and derives a stationary equilibrium.

Section 3 examines the effects of payroll tax changes on the stationary levels of fertility, bought-in-the-market child care (which is called market child care in the following), and parental child-rearing time. In formalizing the availability of child care outside the home, we follow Becker (1965), Balestrino et al. (2002, 2003), and Apps and Rees (2004), whose implicit assumption is that the price of market child care moves with the price of market goods in one-to-one fashion. An increase in the payroll tax rate means a decline in the after-tax wage rate and thereby induces individuals, especially mothers, to increase parental child-rearing time, thus reducing the labor supply. However, when individuals can substitute parental child care with market child care, the increased parental child-rearing time does not necessarily result in an increase in the number of children, as shown in Apps and Rees (2004). At the same time, in our model, changes in the labor supply and fertility affect intergenerational income distribution through the social security scheme. Although increased parental child-rearing time tends to reduce tax revenue and hence social security benefits, the increased tax rate raises the fertility rate if the standard effect of social security on the steady-state income is sufficiently great. The reduced after-tax wage rate also decreases the cost of children by making the price of market child care higher relative to the cost of parental child rearing, thereby exerting a positive effect on fertility. However, the purchase of market child care increases only when the demand for children as consumption goods is sufficiently great.

A welfare analysis is provided in Section 4. Not only do we examine the long-run welfare effects of a payroll tax change but also, in contrast to previous studies, we demonstrate the possibility that a payroll tax rate cut alone is intergenerationally Pareto-improving. Section 5 concludes the paper.

2 Model

We consider a small open economy populated by overlapping generations who live through three periods: childhood, working, and retirement. Individuals are assumed to be identical except for their ages, raise their children in the second working period, and have no bequest motives. We refer to a generation having children in period t as generation t. In this study, we abstract from gender differences in the model to focus on the social security effects on fertility, and we call the basic unit of our analysis simply “an individual.” The production technology is assumed to be governed by a standard, neoclassical constant-returns-to-scale production function. For simplicity, we assume that the level of the world interest rate remains constant over time. Then, the capital labor ratio and wage rate are also constant.Footnote 2

2.1 Individuals

Each individual derives utility both from the number of children and from material consumption in the second and third periods of life. The lifetime utility function of an individual of generation t is expressed as

where c t and d t+1 denote consumption in the second and third periods of life, respectively, γ(>0) represents the preference for children, and ρ∈(0,1) is the discount factor.

Following Balestrino et al. (2002, 2003), we assume that children are “goods,” which can only be produced at home by combining parental time and goods purchased from the market as inputs of production, both of which are essential to production. As children cannot be traded on the market, individuals could not specialize in domestic production, while they can specialize in market work (see Balestrino et al. 2003). Following Apps and Rees (2004), we call the goods “child care outside the home.”Footnote 3 Let the fertility function be specified as follows:Footnote 4

where x t denotes market child care and z t is parental child-rearing time.Footnote 5

Assuming the time endowment of an individual during a working period to be 1, the budget constraint in that period is given by

where s t is the savings for consumption in the retirement period, τ is the rate of payroll tax, and w is the wage rate. The budget constraint in the retirement period is written as

where r denotes the interest factor, and P t+1 is the pension benefit paid in period t + 1. Combining Eqs. 3 and 4 leads to the individual’s lifetime budget constraint:

The individual chooses consumption in the second and third periods together with the number of children so as to maximize lifetime utility (Eq. 1) subject to the fertility function (Eq. 2) and lifetime budget constraint (Eq. 5). The first-order conditions for the optimum are given by

with Eqs. 2 and 5. Equation 6, which is a standard condition, states that individuals choose consumption so as to equate the marginal rates of substitution between consumption in the second and third periods of life, \( {d_{{t + 1}} } \mathord{\left/ {\vphantom {{d_{{t + 1}} } {\rho c_{{t + 1}} }}} \right. \kern-\nulldelimiterspace} {\rho c_{{t + 1}} } \), with the rate of interest, r. Equation 7 can be rewritten as \( {{\left( {\beta n_{t} } \right)}} \mathord{\left/ {\vphantom {{{\left( {\beta n_{t} } \right)}} {x_{t} = {n_{t} } \mathord{\left/ {\vphantom {{n_{t} } {{\left( {\gamma c_{t} } \right)}}}} \right. \kern-\nulldelimiterspace} {{\left( {\gamma c_{t} } \right)}}}}} \right. \kern-\nulldelimiterspace} {x_{t} = {n_{t} } \mathord{\left/ {\vphantom {{n_{t} } {{\left( {\gamma c_{t} } \right)}}}} \right. \kern-\nulldelimiterspace} {{\left( {\gamma c_{t} } \right)}}} \), which denotes that individuals choose consumption in the working period and the purchase of child care services in the market to equate the marginal rate of substitution between consumption and offspring, n t /(γc t ), with the marginal rate of transformation, (βn t )/x t . Equation 8, which expresses an efficiency condition for raising a given number of children, states that the marginal rate of technical substitution between market child care and parental child-rearing time, (1 − β)x t /βz t , must be equal to the relative price of the inputs, (1 − τ)w.

Making use of the first-order conditions we have

Then, substituting Eqs. 9 and 10 into 2, we have

where \(p \equiv \frac{1}{{\theta \beta }}{\left[ {\frac{\beta }{{1 - \beta }}{\left( {1 - \tau } \right)}w} \right]}^{{1 - \beta }} \) is the “cost” per child.Footnote 6

Letting N t denote the population of generation t, the population evolves according to \( N_{{t + 1}} = n_{t} N_{t} \).

2.2 Government

We assume that the government administers a PAYG public pension scheme financed by a payroll tax on the labor income of working adults with a flat rate, τ. Assuming that the budget of the public pension program balances in each period, old-age pension benefits are constrained by \( {\left( {1 - z_{{t + 1}} } \right)}w\tau N_{{t + 1}} = P_{{t + 1}} N_{t} \) or, in per capita terms,

2.3 Stationary-state equilibrium

We assume that individuals have perfect foresight not only into future interest rates and pension benefits but also into the time allocation decisions on child rearing made by the next generation.Footnote 7 Inserting P t+1 from Eq. 13 into Eqs. 10 and 12, we have

Eliminating n t from Eqs.14 and 15 and rearranging terms, we obtain the dynamics of our model described by the following equation for z t :

(for the derivation, see Appendix B).

The stationary child-rearing time, \( z_{t} = z_{{t + 1}} = z \), is given as the solution to the following equation:

We can easily verify that a positive stationary state always exists and is unique. Linearizing Eq. 16 around the stationary equilibrium, it follows that

The condition for local stability is given by

which is assumed to hold in the following discussion.

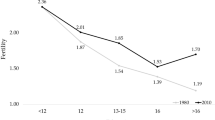

The stationary state equilibrium E is illustrated in Fig. 1. Curves NN and ZZ plot combinations (z,n), satisfying Eqs. 14 and 15, respectively. We can easily see that when τ > 0, the curve NN is upward sloping, and the curve ZZ is downward sloping. Figure 1 assumes that r is small enough that the stationary equilibrium is above curve \( n = r \mathord{\left/ {\vphantom {r {{\left( {1 - z} \right)}}}} \right. \kern-\nulldelimiterspace} {{\left( {1 - z} \right)}} \). When the economy does not have a social security system, i.e., when τ = 0, the number of children an individual has and the child-rearing time are constants and given as \( {\left( {\frac{{\gamma {\left( {1 - \beta } \right)}}} {{1 + \gamma + \rho }},\frac{\gamma } {{1 + \gamma + \rho }}\frac{w} {p}} \right)} \), which is labeled S in Fig. 1.Footnote 8 Although the constancy without a social security system comes from the small openness rather than the specifications of functions, our purpose in the present study is to examine the effects of changes in the size of a PAYG social security system on fertility and welfare.

3 Change in social security tax rate

In this section, we examine the effects of a change in the size of the PAYG social security system on child-rearing time, the purchase of child care services, and the fertility rate. The effects of an increase in the tax rate on curves NN and ZZ are given as

respectively. As the stationary fertility rate is

from Eq. 14, \( {z > \gamma {\left( {1 - \beta } \right)}} \mathord{\left/ {\vphantom {{z > \gamma {\left( {1 - \beta } \right)}} {{\left( {1 + \gamma + \rho } \right)}}}} \right. \kern-\nulldelimiterspace} {{\left( {1 + \gamma + \rho } \right)}} \) must hold to be n > 0. We assume that this condition is satisfied in the following. Therefore, Eq. 20 has a positive sign. An increase in the tax rate shifts the curve NN rightward.

Now we turn to the curve ZZ. In view of Eq. 15, \( p - \frac{\gamma } {{1 + \gamma + \rho }}\frac{{{\left( {1 - z} \right)}\tau w}} {r} > 0 \) must hold for n > 0, and hence, the denominator of Eq. 21 is positive. The sign of the numerator of Eq. 21 can be seen as follows. Using the concept of full income, Eq. 15 shows that the demand for children depends on the price, p, and full income, \( I \equiv {\left( {1 - \tau } \right)}w + \frac{{{\left( {1 - z} \right)}\tau wn}} {r} \), both of which are affected by the tax rate. An increase in the tax rate reduces the price, lowering the opportunity costs of child rearing, i.e., \( {dp} \mathord{\left/ {\vphantom {{dp} {d\tau }}} \right. \kern-\nulldelimiterspace} {d\tau } = - p{\left( {1 - \beta } \right)}{\left( {1 - \tau } \right)}^{{ - 1}} < 0 \). The effect on full income is given as \( \frac{{dI}} {{d\tau }} = {\left[ {w{\left( {\frac{n} {r} - 1} \right)} - \frac{{znw}} {r}} \right]} \): The first term is the redistribution effects through the social security system and the second is subsidies on child rearing of the next generation in the sense that the child-rearing (opportunity) costs are tax-exempt. The latter lowers full income, while the effect of the former on full income depends on the relative magnitudes of the interest rate and the population growth rate, as pointed out in the literature. The numerator of Eq. 21 is the sum of these three effects. Not only when the effect of redistribution from the working generation to the retired is negative (n < r) but also as long as the subsidy effect overwhelms the redistribution effect, even if positive (n > r); i.e., as long as \( {n < r} \mathord{\left/ {\vphantom {{n < r} {{\left( {1 - z} \right)}}}} \right. \kern-\nulldelimiterspace} {{\left( {1 - z} \right)}} \)), the change in full income is negative. In this case, the sign of the numerator of Eq. 21 depends on the relative magnitudes of the negative effect through full income and the positive effect through the price change. When the latter positive effect dominates, the curve ZZ shifts upward, while when the former negative effect is overwhelming, the curve shifts downward. However, when \( {n \geqslant r} \mathord{\left/ {\vphantom {{n \geqslant r} {{\left( {1 - z} \right)}}}} \right. \kern-\nulldelimiterspace} {{\left( {1 - z} \right)}} \), the effect through full income is positive. Together with the positive effect through the price change, this makes Eq. 21 positive. In this case, the curve ZZ definitely shifts upward.

To analyze the effect of a tax rate change on fertility and parental child-rearing time, we see the relation between the curve NN, given by Eq. 22, and the following curve:

If there is an intersection between the two curves, we have \( z = \frac{{\gamma {\left( {1 - \beta } \right)}}} {{1 + \gamma + \rho }}\frac{1} {{1 - \tau }} \) at the intersection point. When τ is sufficiently small, the value of z at the intersection approaches the lower limit of z, \( \underline{z} = {\gamma {\left( {1 - \beta } \right)}} \mathord{\left/ {\vphantom {{\gamma {\left( {1 - \beta } \right)}} {{\left( {1 + \gamma + \rho } \right)}}}} \right. \kern-\nulldelimiterspace} {{\left( {1 + \gamma + \rho } \right)}} \). In this situation, it is plausible that the stationary equilibrium lies above the curve (Eq. 23), and the curve ZZ shifts upward largely with an increase in the tax rate. Therefore, when τ is sufficiently small, the upward shift of the curve ZZ will be relatively greater than the rightward shift of the curve NN. In this case, an increase in the tax rate increases the fertility rate. In contrast, when τ is great, the stationary equilibrium lies below the curve (Eq. 23), and therefore, with an increase in the tax rate, the curve ZZ may move upward only slightly or even shift downward.Footnote 9 Furthermore, as the numerator of Eq. 20 is rewritten as \( z + \frac{{\gamma {\left( {1 - \beta } \right)}}} {{1 + \gamma + \rho }}\frac{{1 - z}} {r}{\left( {n - \frac{r} {{1 - z}}} \right)} \), the greater β is, the larger the rightward shift of the curve NN is when \( {n < r} \mathord{\left/ {\vphantom {{n < r} {{\left( {1 - z} \right)}}}} \right. \kern-\nulldelimiterspace} {{\left( {1 - z} \right)}} \). A rightward shift of NN curve means that parents substitute parental child-rearing time for the market child care to have a given number of children, reducing after-tax wage income. Therefore, the fertility rate falls when β is sufficiently great, while it may rise if β is sufficiently small and/or the curve ZZ moves upward sufficiently. In either case, however, parental child-rearing time increases. As a smaller β means a greater elasticity of fertility with respect to parental child-rearing time, the increase in parental child-rearing time tends to increase the fertility rate largely when β is sufficiently small, whereas the positive effect of the increased parental child-rearing time will be small if β is great.

As can be seen from Eq. 9, the purchases of child care outside the home depend on the full income of individuals, which in turn decreases with parental child-rearing time of the next generation. The increased child-rearing time due to a tax increase tends to reduce the purchase of child care, which is substitutable for parental child-rearing time. When τ is sufficiently small and the stationary equilibrium is above the curve (Eq. 23), an increase in the tax rate not only raises full income but also increases the purchases of child care outside the home when the fertility rate rises. If the positive (full) income effect overwhelms the negative substitution effect of the increased parental child-rearing time, the purchases of child care will be increased. This situation corresponds to the case where the curve NN moves only slightly and the curve ZZ shifts upward largely when the tax rate is raised. In this case, an increase in parental child-rearing time will be relatively small, and an increase in the purchase of child care may be great. In contrast, when τ is great and therefore the stationary equilibrium lies below the curve (Eq. 23), an increase in the tax rate and the induced decline in the fertility rate tend to decrease full income. Together with the negative substitution effect of the increased parental child-rearing time, the decreased full income reduces the purchase of child care outside the home. This is the case when the curve NN moves rightward largely and when the curve ZZ moves upward only slightly or shifts downward. In this case, parental child-rearing time increases largely, and the purchase of child care decreases.

Formally, we may state the above results in the form of the following propositions:

Proposition 1

\( \frac{{dz}} {{d\tau }} > 0 \)

Proof

By differentiating Eq. 17 with respect to τ, we can see that

which is positive.

Proposition 2

Define \( \eta = \frac{\tau } {z}\frac{{dz}} {{d\tau }} \):

-

(1)

If \( \eta > \frac{\tau } {{1 - \tau }} \), then \( \frac{{dx}} {{d\tau }} > 0 \) and \( \frac{{dn}} {{d\tau }} > 0 \).

-

(2)

If \( \frac{\tau } {{1 - \tau }} > \eta > \frac{{\beta \tau }} {{1 - \tau }} \), then \( \frac{{dx}} {{d\tau }} < 0 \) and \( \frac{{dn}} {{d\tau }} > 0 \).

-

(3)

If \( \frac{{\beta \tau }} {{1 - \tau }} > \eta \), then \( \frac{{dx}} {{d\tau }} < 0 \) and \( \frac{{dn}} {{d\tau }} < 0 \).

Proof

Making use of Eqs. 14 and 15, we have

From Eqs. 25 and 26, the results follow immediately.

The intuitions are as follows. An increase in the payroll tax rate increases parental child-rearing time through a decline in the opportunity cost of child rearing within the home. When τ is sufficiently small relative to the tax-rate elasticity of child-rearing time, the tax increase raises full income through intergenerational income redistribution and increases the purchase of child care and the number of children through the income effect (case 1). In contrast, when τ is relatively high, a decline of income due to the increased child-rearing time in addition to the tax increase decreases the purchase of child care, and thereby, the number of children if the contribution of market child care to the fertility function, β, is sufficiently great (case 3). However, if β is not so great, the fertility rate may increase because of the increased parental child-rearing time, although the purchase of child care decreases (case 2). In both cases 2 and 3, the lifetime full income declines, which in turn reduces the purchases of market child care, while the tax increase causes parents to increase parental child-rearing time, thereby reducing the labor supply. It should be noted that the fertility rate may rise or decline, depending on the relative effects of the tax elasticity of parental child rearing, η, and the market child-care services elasticity of fertility, β.Footnote 10

4 Welfare effects

This section examines the welfare effects of a change in the size of the PAYG social security system. From Eqs. 2, 6, 7, 10, and 12, the utility of an individual of generation t is given by

where \( \Gamma \equiv \ln {\left[ {\theta ^{\gamma } {\left( {\frac{w} {{{\left( {1 - \beta } \right)}\gamma }}} \right)}{\left( {\frac{{\beta w}} {{{\left( {1 - \beta } \right)}}}} \right)}^{{\gamma \beta }} {\left( {\frac{{\rho rw}} {{{\left( {1 - \beta } \right)}\gamma }}} \right)}^{\rho } } \right]} \). The stationary level of an individual’s utility is given by

where z is the stationary state when the tax rate is equal to τ. Differentiating Eq. 28 with respect to τ, we have

Thus, we obtain the following Proposition:

Proposition 3

-

(1)

If \( \eta > \frac{{1 + \gamma \beta + \rho }} {{1 + \gamma + \rho }}\frac{\tau } {{1 - \tau }} \) is satisfied, then \( \frac{{du}} {{d\tau }} > 0 \) holds.

-

(2)

If \( \eta < \frac{{1 + \gamma \beta + \rho }} {{1 + \gamma + \rho }}\frac{\tau } {{1 - \tau }} \) is satisfied, then \( \frac{{du}} {{d\tau }} < 0 \) holds.

The intuitional explanation is as follows. When η is sufficiently small enough to satisfy the condition in (2) of Proposition 3, the increase in parental child-rearing time will be small and the fertility rate will decline or rise only slightly. In this case, as the tax rate is relatively high, the tax increase reduces the lifetime full income, as is shown in Proposition 2. Therefore, the negative effect of the lower full income on utility will be dominating even if the fertility rate rises. In contrast, when η is relatively great as in case 1 of Proposition 3, the increased parental child care tends to raise the fertility rate, which affects utility positively. The increased fertility also tends to affect the full income positively through intergenerational income transfers. In this case, as the tax rate is relatively low, the negative effect of the tax increase will be more than offset by the positive effect of higher fertility.

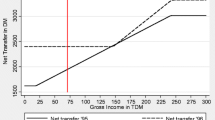

We can see that there is an optimal tax rate such that \( {du} \mathord{\left/ {\vphantom {{du} {d\tau }}} \right. \kern-\nulldelimiterspace} {d\tau } = 0 \). However, as η is a function of τ, we cannot solve the optimal tax rate explicitly nor rule out the multiplicity of the optimal tax rate. As condition \( 1 > \frac{{1 + \gamma \beta + \rho }} {{1 + \gamma + \rho }} > \beta \) always holds, and taking into account Propositions 2 and 3 above, we have four cases involving long-term changes in the individual’s purchase of market child care, the fertility rate, and the utility level of a representative individual. These results are summarized in Table 1.

In Proposition 3, we are concerned with comparative statics of stationary state utility levels and not with the transition paths between the steady states. Although it is difficult to provide definitive general policy recommendations, we can show the possibility for Pareto improvement. Assuming that the economy is initially on a stationary state path with tax rate τ I , we then consider that the tax rate is unexpectedly changed to τ N in period T. Generation T is taxed at rate τ N , and the retired generation T − 1 receives pension benefits corresponding to that tax rate. Identifying the initial stationary-state values before the policy change with asterisks (e.g., n* and z*), we have \( n* = \theta {\left( {\frac{\beta } {{1 - \beta }}{\left( {1 - \tau _{I} } \right)}w} \right)}^{\beta } z* \).

Now, we consider the utility level of generation T − 1. As the first-period consumption, c*, and the number of children, n*, were determined before the tax rate change, they are not altered by the policy impact. However, the second-period consumption in period T is affected, as the pension benefit is changed both directly by the tax rate change and indirectly by the change in the child-rearing behavior of generation T. The time devoted to child rearing by generation T must satisfy the following condition:

Setting τ = τ I and z = z* in Eq. 17, subtracting it from Eq. 30 and rearranging terms, it follows that

The pension benefit in period T is given as \( P_{T} = {\left( {1 - z_{T} } \right)}\tau _{N} wn* \), where the fertility rate n* is predetermined, while the stationary level of pension benefits with τ = τ I is \( P* = {\left( {1 - z*} \right)}\tau _{I} wn* \). Therefore, from Eq. 31, we can see that \( P*\begin{array}{*{20}c} { > } \\ { < } \\ \end{array} P_{T} \) as \( \tau _{I} \begin{array}{*{20}c} { < } \\ { > } \\ \end{array} \tau _{N} \), i.e., pension benefits increase with a reduction in the tax rate. This is because individuals augment the labor supply via a higher after-tax wage rate, thus reducing parental child rearing. As their savings were determined in the previous period, the consumption in retirement of generation T − 1, \( d_{T} = rs_{{T - 1}} + P_{T} \), increases with the tax cut.Footnote 11 Therefore, the only possibility for Pareto improvement lies in the case of a tax cut when \( \eta < \frac{{1 + \gamma \beta + \rho }} {{1 + \gamma + \rho }}\frac{\tau } {{1 - \tau }} \), although there is no guarantee that such a tax cut generally leads to a Pareto improvement allocation. However, we can show that if the choice of parental child-rearing time is not too elastic with respect to the tax rate, a contraction of the PAYG social security scheme will make all current and future generations better off.Footnote 12

Proposition 4

If \( \eta < \frac{{1 + \gamma \beta + \rho }} {{1 + \gamma + \rho }}\frac{\tau } {{1 - \tau }} \), a tax cut may lead to a Pareto-improving intertemporal allocation.

The intuition is simple. As parental child-rearing time is not reduced largely by a tax cut, the fertility rate may not decline largely and may even rise. In this case, the tax cut may increase the full income of the initial generation, whose tax rate is cut, through intergenerational transfers. As under the assumption of stability, parental child-rearing time and hence the lifetime utility converges fluctuation-wise to the new and higher steady state level [see (2) of Proposition 3], all generations will be better off with a tax cut under the condition of Proposition 4 (see Appendix C for a numerical example of a Pareto improvement).

This result is in contrast to that in previous studies such as those by Breyer (1989) and Groezen et al. (2003). Breyer (1989) showed that a decrease in the size of the PAYG social security system is not Pareto-improving when fertility is exogenous, while Groezen et al. (2003), assuming away parental child-rearing time, showed that merely reducing the tax does not allow for a Pareto improvement even with endogenous fertility. Our result shows the possibility of Pareto improvement of a PAYG payroll tax cut when there is a child care market, which is substitutable for parental child rearing within the home. It should be noted that as the long-term fertility rate may increase or decrease in this case (as illustrated in Table 1), the fertility rate on the transition path may be higher or lower than the rate before the policy change. Notably, if it is Pareto-improving in the case 3 of Proposition 2, a tax cut increases both the fertility rate and the labor supply in the market, making all current and future generations better off.

5 Concluding remarks

We have examined the long-run effects of a PAYG social security scheme on the labor supply, fertility, and welfare. An increase in the social security tax rate increases parental child-rearing time, as it reduces the opportunity cost. It means that the tax increase reduces the labor supply of individuals. The impact of a tax increase on fertility depends on the relative magnitudes of the following three effects: the standard intergenerational redistribution effect from the working generation to the retired generation through the social security system, the (implicit) subsidy effect through tax-exemption of child rearing at home, and the price effect through changes in the relative price of market child care. The redistribution effect depends on the difference between the real interest rate and the population growth rate. The subsidy effect tends to reduce the number of children as consumption goods, as it reduces the full income of working generations. The price effect makes the fertility rate higher through declines in the opportunity cost of parental child rearing when market child care is produced by using market goods. Thus, when the population growth rate is sufficiently high, the intergenerational redistribution effect is great enough to dominate the subsidy effect and increase full income. The positive income effect together with the price effect raises the fertility rate. In this case, the purchases of market child care will be increased. In contrast, when the fertility rate at the policy change is low, an increase in the tax rate reduces full income. If the negative income effect overwhelms the positive price effect, the fertility rate will be lower. In this case, the purchase of market child care will be decreased.

Welfare changes of various generations caused by a tax increase are ambiguous, as the transition to a stationary state is not monotonic. However, we show that if the tax rate and/or the contribution of market child care are sufficiently large and the change in the labor supply of the generation working at the policy change is sufficiently small, a reduction in the tax rate may bring about a Pareto improvement.

Three points should be mentioned: First, child care outside the home may require labor as well as goods as inputs. As shown in Appendix A, assuming identical individuals, an increase in the tax rate lowers the price of children, as in the case without labor inputs. However, this consideration will be more important when labor employed in the child care production outside the home is different from that in goods production, as assumed in Martinez and Iza (2004). In this case, the uniform tax rate cum lump-sum benefits pension scheme would involve intragenerational as well as intergenerational income redistribution. Second, we have assumed that individuals in each generation are identical. If individual endowments of labor are varied, effects of a change in the size of a social security system are different from individual to individual. In this case, consideration of income distribution within each generation will be important and necessary. Third, we have not considered a kind of externality generated by a PAYG social security asserted, for example, by Cigno (1993) and Sinn (1998). PAYG social security may be insurance against those not having children, while parents may not take into account the externality of having children on future output. However, these interesting issues in the presence of market child care must be left to future research.

Notes

Kögel (2004) casts doubt on the positive relationship because of possibly unmeasured factors specific to each country.

We assume that the capital/labor ratio is greater than the foreign debt per worker in the steady state.

The child care outside the home here could be day nurseries/preschools and day-care centers (the so-called organized child care) as well as services of baby-sitters at a child’s home, as suggested in Becker (1965).

As our focus is on the effects of social security on fertility choice in cases where child care services outside the home are available, we employ the Cobb–Douglas specification for the function, which is suggested as an example in Apps and Rees (2004).

We may assume instead that market child care is produced by employing market labor as well as market goods. Even if market child care is produced in a more labor intensive technology, the price effect of fertility with respect to a tax will not be reversed. See Appendix A. In contrast, Martinez and Iza (2004), assuming unskilled child-care services outside the home, showed that the increases in female mean wages could generate the positive relationship between fertility rates and female labor force participation rates, which was observed in the USA during the last two decades. However, we assume away heterogeneity of parents in this paper.

Defining the cost of child rearing as \( C_{t} = {\left( {1 - \tau } \right)}wz_{t} + x_{t} \), we have \( C_{t} = \frac{1} {{\theta \beta }}{\left( {\frac{\beta } {{1 - \beta }}{\left( {1 - \tau } \right)}w} \right)}^{{1 - \beta }} n_{t} = pn_{t} \).

Breyer and Straub (1993) assumed the perfect foresight of individuals into the next generation’s labor supply.

The fertility rate when τ = 0, equal to \( \frac{\gamma } {{1 + \gamma + \rho }}\frac{w} {p} \), may be greater than, equal to, or smaller than the world rate of interest.

The intercept of the curve ZZ with the vertical axis moves upward with a tax increase when n ≥ r, while it may shift downward when n < r.

Appendix C gives a numerical example for a set of plausible parameter values.

It should be noted that the positive relationship between the tax rate and the benefit level occurs at the time of policy change. It is natural to assume that a tax increase leads to an increase in tax revenue over the long run, too.

Further details are available from the authors upon request.

References

Ahn N, Mira P (2002) A note on the changing relationship between fertility and female employment rates in developed countries. J Popul Econ 15:667–682

Apps P, Rees R (2004) Fertility, taxation and family policy. Scand J Econ 106:745–763

Balestrino A, Cigno A, Pettini A (2002) Endogenous fertility and the design of family taxation. Int Tax Public Financ 9:175–193

Balestrino A, Cigno A, Pettini A (2003) Doing wonders with an egg: optimal re-distribution when households differ in market and non-market abilities. J Public Econ Theory 5:479–498

Becker GS (1965) A theory of the allocation of time. Econ J 75:493–517

Blau D, Robins PK (1988) Child-care costs and family labor supply. Rev Econ Stat 70:374–381

Breyer F (1989) On the intergenerational Pareto efficiency of pay-as-you-go financed pension systems. J Inst Theor Econ 145:643–658

Breyer F, Straub M (1993) Welfare effects of unfunded pension systems when labor supply is endogenous. J Public Econ 50:77–91

Cigno A (1993) Intergenerational transfers without altruism: family, market and state. Eur J Polit Econ 9:505–518

Eckstein Z, Wolpin KI (1985) Endogenous fertility and optimal population size. J Public Econ 27:93–106

Galor O, Weil DN (1996) The gender gap, fertility and growth. Am Econ Rev 86:374–387

Groezen B van, Leers T, Meijdam L (2003) Social security and endogenous fertility: pensions and child allowances as Siamese twins. J Public Econ 87:233–251

Kögel T (2004) Did the association between fertility and female employment within OECD countries really change its sign? J Popul Econ 17:45–65

Martinez DF, Iza A (2004) Skill premium effects on fertility and female labor force supply. J Popul Econ 17:1–16

Rindfuss R, Guzzo KB, Morgan SP (2003) The changing institutional context of low fertility. Popul Res Policy Rev 22:411–438

Sinn HW (1998) The pay-as-you-go pension system as fertility insurance and an enforcement device. J Public Econ 88:1335–1357

Yakita A (2001) Uncertain lifetime, fertility and social security. J Popul Econ 14:635–640

Zhang J, Zhang J, Lee R (2001) Mortality decline and long-run economic growth. J Public Econ 80:485–507

Acknowledgments

The authors wish to thank Murray C. Kemp and seminar participants at the Nagoya Macroeconomics Workshop for their comments. They are also indebted to two anonymous referees and to the editor, Alessandro Cigno, for their helpful comments and suggestions. This research is financially supported by the Postal Life Insurance Foundation of Japan. The second author also acknowledges financial support from the Japan Society for the Promotion of Science (Grant no. 18530127).

Author information

Authors and Affiliations

Corresponding author

Additional information

Responsible editor: Alessandro Cigno

Appendices

Appendix A

1.1 Market child care produced with labor and goods

Assume that the production function of market child care is written as

where m t is market goods purchased and l xt is labor employed, and that individuals decide how much market child care is produced by employing goods and labor. The budget constraint becomes

where m t + wl xt is the spending for the market child care. Labor of individuals, 1 − z t , is employed either in production of market child care, l xt , or in goods production, 1 − z t − l xt . The wage rates in both production sectors are the same by arbitrage. Assuming that Eq. 2 holds as in the text, the optimal demand plans are obtained in a similar way as in the text:

Making use of the budget equation, we have

In this case, defining the cost of child rearing as

we have

from which we obtain \( {dp} \mathord{\left/ {\vphantom {{dp} {d\tau }}} \right. \kern-\nulldelimiterspace} {d\tau } = { - p{\left( {1 - \beta } \right)}} \mathord{\left/ {\vphantom {{ - p{\left( {1 - \beta } \right)}} {{\left( {1 - \tau } \right)} < 0}}} \right. \kern-\nulldelimiterspace} {{\left( {1 - \tau } \right)} < 0} \). Therefore, assuming labor as well as goods as inputs in the market-child-care production does not alter our result essentially.

Appendix B

1.1 Derivation of dynamic equation (Eq. 16)

Combining Eqs. 14 and 15 (or Eqs. 10 and 12), we have

Substituting Eq. 37 into Eq. 14, we obtain

Dividing both sides of Eq. 38 by z t and rearranging them, we have the dynamic Eq. 16.

Appendix C

1.1 Numerical example

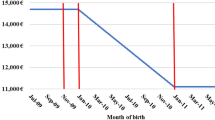

We show a numerical example, assuming parameter values of the model as follows: \( \beta = 0.3;\quad \theta = 30;\quad \gamma = 0.1;\quad \rho = 0.3{\left[ { \approx {\left( {1 + 0.05} \right)}^{{ - 24}} } \right]};\quad r = 2.033{\left[ { \approx {\left( {1 + 0.03} \right)}^{{24}} } \right]}; \) and w = 1.5.

One period is considered to consist of 25 years. These parameters are set so as to have the annual growth rate of population equal to about 1.5%, i.e., about 43% per period, at the tax rate of 20%. The steady state values of variables at various tax rates are presented in Table 2.

The results can be summarized as follows: (1) As Proposition 1 predicts, the child-rearing time is increasing with the tax rate; (2) at the tax rates from 0.05 to 0.35, as the condition of (2) of Proposition 2 holds, the fertility rate increases with the tax rate, but the purchases of the market child care decrease because of declining disposable income; (3) at even higher tax rates, as the tax-rate elasticity of child-rearing time becomes greater and the condition of (1) of Proposition 2 comes to be satisfied, the purchases of the market child care come to be increasing with the tax rate. In this situation, the market child care is purchased with the lowered disposable income. This reflects the fact that parents try to have many children to raise the social security benefits when retired; (4) as the weight on the utility from having children is relatively low in this example, the fertility rate rises with the tax increase.

The last column of Table 2 indicates the steady state welfare change at each tax rate. At the tax rates from 0.05 to 0.3, the tax increase diminishes the steady state welfare of individuals, while at the tax rates above 0.35 (up to 0.8, although this is not shown in the table), the tax increase improves the steady state welfare. It should be noted that the situation implied in the third column of Table 1 holds at tax rate 0.35.

Finally, to explain the mechanism of a Pareto improvement, we consider a tax cut of 0.01 from 82.5%. Suppose that the economy is initially at the steady state, then that the government cuts the tax rate by 0.01% in period 0. The time paths of the child-rearing time of individuals and the utility level of each generation are depicted in Fig. 2a,b, respectively. Although the initial tax rate is not plausible, we can see the mechanism of the Pareto improvement. As explained in the text, generation −1, retired in period 0, obtains a windfall of extra benefits because of the increased labor supply of generation 0.

The simulation analysis of this simple model does not generate plausible values of endogenous variables for the economy. It is partly because some other factors than those taken into account in this study affect the dynamics of the model. However, the conclusion of our study holds at least qualitatively.

Rights and permissions

About this article

Cite this article

Hirazawa, M., Yakita, A. Fertility, child care outside the home, and pay-as-you-go social security. J Popul Econ 22, 565–583 (2009). https://doi.org/10.1007/s00148-007-0153-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00148-007-0153-8