Abstract

This paper investigates how market participants form risk perspectives through a sequence of information shocks. Guided by a theoretical Bayesian learning model, we exploit a natural experiment afforded by the fracking boom in Pennsylvania in the late-2000s. We empirically examine whether familiarity with historical conventional gas explorations affects the willingness to pay for houses near fracking wells. We find the local real estate market is very efficient with participants rapidly collecting and processing market–relevant new information. We also find that participants discount historical events and rely on current information to estimate the risk of a change in market conditions.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

Since the last quarter of 2007, over 80,000 fracking wells were drilled in populated neighborhoods throughout the United States. According to a 2013 Wall Street Journal article, “More than 15.3 million Americans—roughly 1 out of every 20 people living in the U.S.—now live within a mile of a fracking well.”Footnote 1 However, the net economic impact of fracking for natural gas on local real estate markets is uncertain. For example, despite the potential environmental and health risks, fracking can generate significant economic activity, including job creation and income growth (Cunningham et al. 2020). Alternatively, since the fracking process involves injecting water, sand, and toxic chemicals into underground geological formations to release natural gas, it may impose severe environmental and health risks that eventually drive down nearby house prices (Muehlenbachs et al. 2015; Balthrop and Hawley 2017). The uncertainties associated with fracking provide a natural experiment to study how market participants perceive investment risks.

Contrary to previous studies that focus on how a specific risk factor affects individual houses, we use prior experiences with conventional drilling activities as identification to focus on the potential heterogeneous price effects of fracking.

According to classical asset pricing theory, the price of an investment is determined by its expected return. Investors rely on both historical data as well as new information to assess risk. For instance, Malmendier and Nagel (2011,2015) document that investors who experienced the Great Recession are less willing to enter the stock market compared to investors who learned about the Great Depression from textbooks. Ling et al. (2018) and Nicolosi et al. (2009) report that individuals improve their investment strategies based on feedback from their past trading performance. Meanwhile, Agarwal et al. (2008) reveal that individuals tend to discount older information when new information becomes available. While the literature clearly shows that investors and households process current information, it is unclear how the degree of familiarity with information alters its value. For example, if all investors experience a negative information shock event but some investors have prior experience with such a shock, then it is possible that those with prior experience may discount the current shock’s severity. We exploit a particular feature of fracking in Pennsylvania to explore how prior experience with information events impact asset prices.

In this study, we test whether being familiar with risks associated with a known technology (in this case, conventional drilling) impacts the perceived risk of a new technology (fracking). In essence, we test how past experience alters the perception or value of new information. However, testing this effect is challenging for a number of reasons. First, very few regions experience formative events, such as severe disasters or significant macroeconomic downturns, more than once. For example, Davis (2004) investigates a sudden increase in the number of leukemia cases in a county that resulted in a decrease in local house prices. However, since the cancer cluster only occurred once, he is unable to examine the value effect of repeated shocks. Second, although repeated events such as earthquakes, floods, and droughts also affect house prices, such natural disasters are driven by local geographic or climate characteristics. As a result, analysis of house price movements following natural disasters do not provide rich insights about cross–sectional variations.

We exploit a natural experiment afforded by the fracking boom in Pennsylvania in the late 2000s to overcome the empirical obstacles raised above. Pennsylvania provides a unique setting because it experienced two gas–induced house price booms. The first started in the 19th Century and was driven by the discovery and exploration of conventional natural gas. The second started in the late 2000s as a result of the technical advancement in hydraulic fracking, a method used to explore natural gas from rock formations.

While the boom in shale-gas extraction reached many areas of the country, Pennsylvania serves as an especially useful laboratory for exploring the effects of fracking activity on housing markets. Unlike many of the other fracking booms, which occurred in largely rural or desolate areas, the boom in Pennsylvania impacted many urban areas providing a meaningful experimental setting to explore pricing effects. More importantly, the fracking boom in Pennsylvania was largely unanticipated as it was driven by technological improvements in shale–extraction techniques.

As seen in Figs. 1 and 2, the locations of fracking wells in Pennsylvania are mainly determined by the richness of the shale gas resource (Cunningham et al. 2020). Uniquely to Pennsylvania, an earlier state–court decision (Dunham and Shortt v. Kirkpatrick, 1882) stipulated that a general sale of mineral rights, such as those that occurred in the 19th Century due to coal mining, does not include rights to oil and gas. This decision, now referred to as “Dunham’s Rule”, and recently affirmed in Butler v. Charles Powers Estate, 2013, means that most current homeowners in Pennsylvania retain ownership of the natural gas beneath their land. As a result, home owners are in a position to benefit from natural gas exploration.

Demonstration of four types of regions by drilling experiences. We focus on four types of locations in this study: (1) Regions affected by conventional and unconventional drillings (the “dual explorations” regions), (2) Regions only affected by conventional drillings (the “conventional-drilling” regions), (3) Regions affected by only unconventional drillings (the “unconventional fracking” regions), and (4) Regions affected by neither (the “no exploration” regions)

Another feature of the Pennsylvania housing market is that it mainly consisted of local buyers after the fracking boom. Our data shows that fracking did not drastically increase the local population, the number of purchase mortgages in the area, or the total number of home sales. Although the fracking boom created many jobs for both local residents and transient workers, a 2014 news article summarized that non-local workers live in temporary housing provided by drilling companies instead of buying houses.Footnote 2Gallagher and Persky (2020) document that people living in old manufacturing belt states, such as Pennsylvania, are strongly attached to their hometowns and less likely to move. Similarly, Cunningham et al. (2020) also find that fracking did not cause local homeowners to sell, nor did it attract outside investors into the area.

We utilize a general Bayesian learning framework to motivate our difference-in-difference-in-difference analysis employing monthly Zip Code level house price indexes in Pennsylvania from 2004 to 2012. To achieve identification, we rely on the natural distribution of conventional and fracking wells in Pennsylvania. Furthermore, as fracking only became feasible and profitable in the late 2000s, homes in the unconventional fracking regions are not subject to any pre-2006 drilling risks. Finally, we use incidents of fracking accidents, which are public information, as exogenous shocks to explore how households update their beliefs about fracking risks.

Our empirical results show that fracking is positively correlated with local house prices. Among neighborhoods that are exposed to fracking, houses in dual-exploration regions do not show additional price premium after the shale gas boom compared to houses in the fracking-only regions. In other words, houses in areas having conventional drilling wells sold for less than similar property in areas that never experienced drilling activities. This finding suggests that despite the public fear of fracking-related environmental risks, house price dynamics reflect realized fracking risks instead of perceived threats.

While we show that accidents lower house prices, we also show that the marginal impact diminishes over time. We find that it only takes two to three months for house prices to adjust to their previous levels if no additional accidents occur. This finding, which is consistent with findings of Gallagher (2014) and Hansen et al. (2006), suggests that buyers discount old information and rely on the most recent information to determine asset valuations.

Review of Literature

Economists have long been interested in understanding the role of information in investors’ decision–making processes and the elements that affect an individual’s treatment of information (Grossman and Stiglitz 1976; Admati 1985; Hansen et al. 2006; Van Nieuwerburgh and Veldkamp 2009; Malmendier and Nagel 2011; Agarwal et al. 2008; Gallagher 2014). Specifically, these studies show that the source of information, the degree of relevance, and the duration since the last occurrence all affect the way people process information. For example, Gallagher (2014) finds that individuals value firsthand experiences over secondhand information and Van Nieuwerburgh and Veldkamp (2009) show that individuals pay more attention to information that is more relevant to their short–term goal or current situation. Although Kahneman and Tversky (2013) and Kai-Ineman and Tversky (1979) document that people ignore information about low–probability events, Malmendier and Nagel (2011) document that early-life experiences may cause people to overvalue information while Gallagher (2014) and Agarwal et al. (2008) show that information shocks make quick but short-lived impacts on people’s risk preferences.

Another strand of literature documents that information affects property prices by altering people’s risk anticipation (Kiel and McClain 1995; Kiel and Williams 2007; Leggett and Bockstael 2000; Hansen et al. 2006; Klaiber and Gopalakrishnan 2012; Muehlenbachs et al. 2012). Since individuals process information differently, the price effect of a particular piece of information may vary across different real estate assets. For example, Kiel and Williams (2007) identify attributes that cause heterogeneous price effects of an environmental hazard on nearby properties. They find that houses in areas with fewer blue–collar workers are more likely to experience negative price effects, suggesting that residents’ characteristics are crucial in predicting both scale and duration of the information shock following a disaster. Additionally, Kousky (2010) examines whether a severe flood causes buyers to update their assessment of flood risks for houses in a flood zone. By monitoring price fluctuations across houses that are exposed to different levels of flood risks, Kousky (2010) documents a significant link between people’s anticipation of flood disasters and real estate values. Furthermore, he finds that the price differentials across properties cannot be solely explained by the underlying flood risk, which is consistent with findings of (Kiel and Williams 2007).

Our work is broadly related to the extant research that examines informational efficiencies of the real estate market. For example, Dumm et al. (2018) report that new information about sinkhole proximity and density have a negative effect on house prices. Pope (2008a, 2008b) report that airport noise and flood zone disclosures reduce real estate prices by 2.9 and 4.0 percent, respectively. Clapp et al. (2008) shows that buyers quickly incorporate information about changes in demographic attributes in the local school district and adjust their willingness to pay accordingly. Gatzlaff et al. (2018) examine the price effects of hurricane mitigation features and find both disclosed and undisclosed mitigation systems positively increase in sale prices. Pope (2008c) studies the negative price impact of home buyers’ fear for sex offenders, and documents that house prices drastically drop and then rebound as soon as a sex offender moves in and out of a neighborhood, respectively.

Empirical Methodology

We employ a general Bayesian learning framework to model the risk formation processes of housing market participants. These models are commonly used to explain immediate and longstanding responses to information shocks. The standard Bayesian learning model assumes that individuals treat all available information equally when making probability forecasts about an uncertain event (Viscusi 1991, Viscusi 1992 Nicolosi et al. 2009) while the discounted Bayesian model assumes people put less weight on past information (Agarwal et al. 2009; Kohlhase 1991; Gallagher 2014)).

To begin, we denote the probability that an adverse incident occurs in month t for a given fracking wellhead in Zip Code i as pt,i, which follows the distribution \({\beta } \sim ({\alpha }_{i},{\beta }_{i})\). In this framework, αi and βi are fixed parameters that are determined by Zip Code i’s past experience with drilling. As suggested by (Malmendier and Nagel 2011), neighborhoods that are familiar with drilling have greater αi compared to neighborhoods that have not experienced any drilling activity. Each month, individuals observe whether a fracking accident is reported in the neighborhood and use this information to update their risk anticipation. Thus, the updated expectation of drilling risk at t + 1 in Zip Code i is given as:Footnote 3

where

yi,k denotes fracking violations reported in Zip Code i for month k and St,i is the discounted sum of prior incidents in Zip Code i. δi is the discount parameter (δ ∈ [0,1]) such that δi = 0 indicates that individuals completely disregard past information while δi = 1 indicates that they equally weight all prior information as in a standard Bayesian model. Thus, our model accounts for heterogeneous discounting behavior across regions.

Our identification strategy relies on the distribution of conventional and fracking wells across Pennsylvania. Figure 1 shows this distribution and clearly reveals four geographical areas: (A) Regions affected by conventional and unconventional drilling (the “dual explorations” regions), (B) Regions only affected by conventional drilling and not in the Marcellus Shale area (the “conventional-drilling” regions), (C) Regions affected by only unconventional drilling (the “fracking-only” regions), and (D) Regions affected by neither (the “no drilling” regions). Since fracking only became feasible and profitable in Pennsylvania in the late 2000s, property in the unconventional fracking regions are not subject to pre–2006 drilling risk.

Based on our geographic identification strategy, we implement the following difference–in-difference–in–difference model to test changes in house prices before and after the fracking boom:

The dependent variable ΔPi,t is the monthly percentage change of house prices in Zip Code i at time t, i.e. ln \(\left (\frac {HPI_{t}}{HPI_{t-1}}\right )\). CONVi is a binary indicator variable that takes the value 1 if Zip Code i had prior experience with conventional drilling and 0 otherwise. FRACKi is a binary variable that equals to 1 if there is at least one fracking well location i, and 0 otherwise. The binary variable POST2006i,t is set to 1 if the house price was observed between 2007 and 2012, when extracting shale gas became feasible and profitable. The interaction (FRACKi × CONVi) indicates locations in the dual–exploration area. Holding all else constant, a positive and significant coefficient for the triple interaction term (λ7) would indicate that dual–explorations areas experience greater house price increases compared to houses in the fracking only area. Xi,t are vectors of demographic control characteristics, CountyY ear is a vector of year and county fixed-effects that removes conditions that might affect price of all houses sold in a county in a calendar year. Standard errors εc,t are double clustered at the county and year levels.

To explore how older information about fracking accidents may affect prices, we estimate the following equation using the post-fracking boom sub-sample in areas with at least one fracking well:

where ACCIDENTi,k is a binary variable variable indicating an environmental related fracking accident reported in Zip Code i at time k. A large gap between t and k indicates that ACCIDENTi,k is an older information. Xi,t are vectors of demographic control characteristics at the Zip Code level, and Y eart and Countyi are county and year fixed-effects that remove time-varying conditions that might affect price of all houses sold in a location in a specific year. Standard errors ε are clustered at the county and levels using two-way clusters.

Data and Descriptive Statistics

The analysis relies on two key data sets. The first is data on single family residential indexes in Pennsylvania. The second is data on monthly drilling permits over the relevant time frame of our study. In this section, we describe each source of data in preparation for our empirical analysis.

CoreLogic Home Price Index (HPI)

We employ Zip Code level Home Price Indexes (HPI) provided by CoreLogic for the period covering 2004 to 2012. The CoreLogic HPI is a repeat-sales index created with monthly sales prices of single-family, detached homes following Shiller (1991). This repeat–sale methodology tracks increases and decreases in transaction prices for properties that have been sold at least twice, thereby providing an accurate “constant-quality” view of pricing trends. The Corelogic HPI tracks over two hundred Zip Codes in Pennsylvania, representing roughly 55% of the housing stock in the state.Footnote 4

We matched our real estate data with the IRS’s Statistics of Income (SOI) database to obtain Zip Code level annual incomes. Our final matched observations represent Pennsylvania house prices in designated Metropolitan Statistical Areas (MSA) excluding Philadelphia or Pittsburgh metropolitan areas due to their high densities and strict fracking regulation.

Drilling Permit and Drilling Accidents

We collected data about gas exploration activities from the Pennsylvania Department of Environmental Protection (PA DEP), which provides monthly reports on permitting, drilling, and compliance activities. The PA DEP monthly report provides complete permit data for both conventional wells and fracking wells from 1975 to 2015 including a unique well identification (API), the well’s longitude and latitude, the well type (conventional/fracking), and the drilling permit issuance date. In addition, the PA DEP well compliance report provides information about drilling accidents at the well level.

Historically, all the natural gas wells in Pennsylvania were conventional. A conventional well is defined as a single vertical well shaft drilled to extract gas from a reservoir, usually at a shallow depth. Fracking, a technique enabling efficient and profitable gas exploration from the Marcellus Shale, became economically viable in Pennsylvania in the late–2000.

Figure 3 compares the number of permits issued by the PA EPA for the two types of wells. The first commercial fracking permit was issued in October 2007. By 2008, the number of unconventional drilling (fracking) wells surpassed conventional wells. Based on this figure and Cunningham et al. (2020), we define January 2007 as the beginning year of the Fracking boom.

Number of gas permits issued in PA by drilling type. This figure displays the annual counts of gas wells permitted in PA from 1998 to 2014. The blue traces counts of conventional wells and the orange line displays counts of fracking wells. The underlying data were obtained from the Pennsylvania Department of Environmental Protection. This figure show 2007 was the beginning of the fracking boom in PA

The PA DEP also provides timely reports on fracking accidents including the accident date and location, as well as a description of the nature of the incident. The PA DEP define a serious environmental-related drilling accidents as incidents that release hazardous substances in the air, water, soil, and food.

For each permit and incident, we use the longitude and latitude attributes to compute its corresponding Zip Code using a Geographic Information System software (ArcGIS). Next, we match the permit data with the HPI data based on Zip Codes. The matched data provides monthly house price index information and drilling history information of 187 Zip Codes in 26 counties in Pennsylvania from 2004 to 2012.

Descriptive Statistics

Table 1 shows the summary statistics of our main research data. Panel A shows the mean and standard deviation for the whole sample period (2004 to 2012). Panel B and Panel C report the variable summary statistics of two sub-samples defined by the 2007 fracking boom, respectively.

Panel A shows that the median monthly change in house prices (Δ HPI Month) for the whole sample period is 0.08%. The median population per Zip Code is 25 thousand, the median AGI in the sample is 62.31 thousand dollars.

Panel B of Table 1 reports the variable distributions of the before fracking sub-sample data from 2004 to 2006. The median AGI in the early period is 58.48 thousand dollars. In this period, fracking was not profitable in Pennsylvania, and therefore, the median number of fracking wells per Zip Code is 0.02. Those fracking wells we observe in this sub-period are research and testing wells at the early exploration stage. Many conventional wells were drilled in Pennsylvania during this early period, and the median count of conventional wells per Zip Code is 8.52.

Panel C reports the variable distributions of the sub–sample drawn from 2007 to 2012. Since fracking became profitable in Pennsylvania after 2006, the number of fracking wells increased drastically between 2007 and 2012. We also see an increase in conventional drilling wells in the same period, but the level of growth is not as prevalent as it is for fracking wells. The median income from royalties also increased from 10.63 thousand dollars before the fracking boom to 13.41 thousand dollars.

Table 2 Panel A and Panel B report the descriptive statistics of our data broken down by drilling regions before and after the fracking boom, respectively. Before the fracking boom, the monthly change in the house prices is the highest in areas without either conventional drilling or fracking (0.7%), followed by the conventional drilling only areas (0.27%) and the dual-exploration areas (0.22%). The fracking-only areas have the least amount of growth (0.12%). After the fracking boom, the monthly change in the house prices in all regions became negative due to the sub-prime crisis that coincided with the fracking. The areas without any drilling activities had the most severe monthly decline of -0.22%, followed by the monthly decline in house princes in conventional drilling only areas (-0.1%). The dual-exploration regions had the least drop in house prices after the fracking boom (-0.03%).

Empirical Results

House Prices and Fracking Activities

In this section, we explore the general impact of fracking on nearby house prices. We first empirically test whether the number of fracking wells is positively associated with real estate prices after the fracking boom using data from both fracking and non-fracking areas. We divide the sample into tertiles by the number of fracking permits by the end of the study period. Table 3 displays the covariate estimates. The dependent variable is the monthly percentage change in the Zip Code level house price index (Δ HPI Month). FRACK1, FRACK2, and FRACK3 are dummy variables that indicate the extensiveness of the ex-post fracking activities in the corresponding Zip Code, POST2006 is a dummy variable for observations after the fracking boom, and POST2006×FRACK1, POST2006×FRACK2, and POST2006×FRACK3 are the year-tier interaction terms. Table 1 Column (1) is the baseline specification including only the county and year fixed effects. Column(2) adds controls for the Zip Code level local population, Column(3) introduces controls for the Zip Code level median AGI, and Column(4) adds controls for the Zip Code level annual percentage growth of newly originated purchase mortgages. The unreported covariates are county and individual year fixed effects. Standard errors are calculated using two-way clustering by county–year.

Across columns, the results indicate that the number of fracking wells is positively correlated with real estate values, but the relationship is nonlinear. The monthly house price appreciation in Zip Codes with the lowest tertile of permits (Tier 1 fracking areas) after the fracking boom is 0.65% higher than it is in the non-fracking areas; the house price growth in Zip Codes with the medium tertile of permits (Tier 2 fracking areas) after the fracking boom is 0.7% higher, and the monthly house price appreciation in the Tier 3 fracking areas is 0.5% higher. All of the coefficient estimates are significant at the 1% level.

These findings reveal the economically significant net impact of fracking on the local real estate growth: the annual net increase of a house in Tier 1 regions is $1,813; a house in Tier 2 fracking regions will receive an additional $4,572 in return; a house in Tier 3 regions will receive another $4,800 in return.Footnote 5

Conventional Drilling History and Fracking Impact

Thus far, we have documented a positive effect of fracking on house prices. In this section, we investigate how experience with unconventional drilling affects the price impact of fracking on nearby houses.

Figure 4 plots the median monthly change in HPI by the four geographical areas defined in “Empirical Methodology” and shows that houses in fracking-only Zip Codes experienced a different volatility pattern starting in 2007 compared to the other three regions. Houses in fracking only Zip Codes experience a moderate but noticeable price increase after the 2007 house price meltdown/fracking boom until 2010. Meanwhile, declines and high volatility were seen in the other three regions.

Percentage change in HPI by regions (2004 to 2012). This figure plots the median percentage change in Zip Code level HPI by four regions based on their exposure to conventional drilling and fracking. The vertical line marks the beginning of the fracking boom. This figure shows house prices in fracking only areas experienced moderate growths immediately following the fracking boom. In contrast, houses in none fracking regions declined in price triggered by the subprime crisis. House prices in dual-exploration regions also declined during the financial crisis but at a smaller degree compared to non-fracking regions. Consistent with findings by Cunningham et al. (2020), the positive price impacts of fracking were offset by the adverse price impact of the subprime crisis

Table 4 displays the coefficient estimates for Eq. 2. The dependent variable is the monthly percentage change in house prices. Column (1) reports results from a baseline difference–in–difference–in–difference specification in which we control for local drilling characteristics together with year and county fixed effects. In Columns (2)-(4), we gradually include local characteristics controls, Ln(population), Ln(AGI), and the annual growth of newly originated mortgage (purchase), respectively. Standard errors are calculated using two-way clustering by county and year.

Column (1) shows that houses in fracking-only areas experienced a 0.75% increase in monthly return after the fracking boom (POST2006×FRACK). This is consistent with findings in the previous subsection, suggesting that houses in the fracking region increased in value after the fracking boom. However, returns in dual-exploration Zip Codes in the Post-2006 market are 0.63% lower (POST2006×FRACK ×CONV). These coefficients are statistically significant at the 1% level, implying regions having experience with drilling before the fracking boom were less optimistic about the fracking benefits.

Columns (2) and (3) control for the county and Zip Code level characteristics to exclude the possibility that results shown in Column (1) were driven by differences in local population and income between fracking-only areas and dual-exploration areas. The consistent covariates displayed across Columns (1)-Column (3) imply that such differences do not drive the real estate return gap between dual-exploration regions and fracking-only regions.

Since the fracking boom coincided with the 2007 subprime crisis, areas may differ in the level of investment attention based on drilling exposure before the fracking boom, and thus may experience different price trends when the real estate bubble burst. Thus, to control for the potential effect of “overheatedness” of the local housing market, we also include in Column (4), a variable that accounts for the percentage growth of newly originated mortgages:

Numbert is the number of new purchase mortgages originated in a Zip Code in year t, and Numbert− 1 is the number of new purchase mortgages originated in the same Zip Code in year t − 1. We find that the inclusion of “overheatedness” slightly decreased the magnitude of the POST2006-interactions. The triple interaction coefficient estimate changed from -0.623 in Column (3) to -0.609 in Column (4), the POST2006×FRACK coefficient changed from 0.747 in Column (3) to 0.742 in Column (4), and the POST2006×CONV coefficient changed from 0.550 in Column (3) to 0.539 in Column (4). Our findings indicate that although “overheatedness” contributed to the differences in house price movements after the fracking boom across regions, most of the price differences between houses in the dual-exploration areas and those in the fracking-only regions are driven by their exposure to different types of drilling technology.

Panel B of Table 4 replicates the model specification in Column (4) Panel A by replacing the dependent variable with quarterly house price changes, semi-annual price changes, and annual price changes to address the low R2 of the monthly house price return specification. The results displayed in this panel indicate an increase in the R2 values. The magnitude of the triple-interaction coefficient estimate remains consistent with the monthly model as we reduce the frequency of our dependent variable. Thus, we conclude that the R2 is low due to the high volatility of monthly zip code level returns while our independent controls are measured in an annual frequency. This is a common phenomenon found in monthly frequency data; for example, mortgage studies where the dependent variable is monthly mortgage performance status and the mortgage characteristics controls are measured at loan origination. However, since the error term is randomly distributed on either side of the mean, the low R2 does not affect the accuracy of the estimated effect.

Table 5 further investigates whether fracking imposes heterogeneous impacts on the income levels for residents in dual-exploration regions and fracking-only regions. The triple-difference model in this table corresponds to that used in Column (1) Panel A. We replace the dependent variable in each column with a Zip Code level annual per capita income variable reported to the IRS. The results show fracking does not lead to a statistically significant difference in the adjusted gross income or wage and salaries for residents in dual-exploration regions compared to those in fracking-only regions. However, individuals in dual-exploration regions report an additional $1,000 income from royalty payments after the fracking boom compared to those in the fracking-only regions. Despite the homogeneous wage and salaries and the lower realized royalty income compared to dual-exploration regions, houses in fracking-only areas still appreciated at a higher rate.

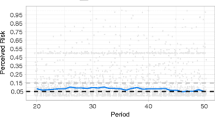

Our findings so far suggest that market participants’ overestimation of the fracking benefits and underestimation of the risks are possible causes of the additional real estate growth in the fracking-only regions. If that is the case, the real estate return gap between the fracking-only region and the dual-exploration should gradually disappear over time as fracking-only area investors gain experience with living near drilling wells. To test this hypothesis, we ran a series of regressions with the dual-exploration interaction term (FRACK×CONV) interacted with a calendar-year dummy (YEAR) after the fracking boom. The dependent variable is the monthly percentage change in house prices (Δ HPI Month). In each regression, we include individual county and year fixed effects as well as Zip Code level income controls. Figure 5 illustrates the time-varying coefficient estimates of the triple-interaction terms (FRACK×CONV ×YEAR). Our findings are consistent with the hypothesis that the negative coefficient of POST2006×FRACK ×CONV was driven by the early years of the fracking boom. The marginal impact of being in a dual-exploration region in 2007, corresponding to the beginning of the fracking boom, is -0.53%, and is between -0.38% and -0.48% in 2008 and 2009. Starting from 2010, three years into the fracking boom, real estate returns in dual-exploration regions are statistically identical to those in the fracking-only areas.

Event study: dual exploration effect over time (2007 to 2012). This figure plots the time varying coefficient estimates of the dual exploration interaction term (FRACK×CONV) interacted with calendar year dummies (YEAR). The dependent variable is the monthly percentage change in house prices (Δ HPI Month). Standard errors are calculated using two-way clustering by county-year. All specifications include individual county and year fixed effects as well as Zip Code level income controls

To summarize, in this section, we show at the beginning of the fracking boom, home prices in the dual-exploration regions reflected benefits and risks of fracking compared to house prices in fracking-only Zip Codes. Residents in fracking-only regions gradually learn about fracking risks such that three years into the fracking boom, the real estate return premium in those areas disappear. These findings are consistent with Nicolosi et al. (2009), which suggests that investors constantly learn about the market and use the new knowledge to improve their investment strategy. Our findings are robust to controlling for characteristics differences at the Zip Code level.

Time–Varying Impact of Fracking Accidents

In this section, we focus on a sub-sample of fracking Zip Codes from 2008 to 2012 and examine how residents update their anticipation about fracking risks based on recently reported local fracking accidents.Footnote 6

Figure 6 provides a visual demonstration of the local real estate market trend following environmental-related fracking accidents, i.e., drilling accidents that release hazardous substances in the air, water, soil, and food. All of these accidents were serious incidents that may lead to long-term environmental consequences to the local residents.Footnote 7 If market participants do not discount old information, these accidents should have a long term impact on the local housing market. We find that the local housing market experiences an immediate decline in prices following fracking accidents in the same Zip Code. However, prices recovered three months after the accidents.

Monthly percentage change in HPI vs. Fracking accident. This figure provides a visual demonstration of the local real estate market trend following environmental-related fracking accidents, i.e., drilling accidents that release hazardous substances in the air, water, soil, and food. The local housing market experiences an immediate decline in prices following fracking accidents in the same Zip Code. However, the loss triggered by accidents will recover shortly after the accidents

Table 6 reports analysis results of whether the price impact of fracking accidents diminishes over time. The dependent variable is the monthly change in house prices (Δ HPI Month). Accidentt−N (0 ≤ N ≤ 4) are binary variables indicting whether a severe fracking accident happened in a Zip Code N months before the observation time t. For instance, Accidentt− 1 = 1 means at least one severe fracking accident was reported in the same Zip Code one month ago. We also control for Zip Code level royalty income, Ln(population), and mortgage growth.Footnote 8

Columns (1)-(5) report the results from the estimations that include the accident lag dummies one by one. Column (1) shows that fracking accidents happened within a month lead to a 0.72% drop in real estate prices. This effect is statistically significant at the 5% level. Column (5) shows that fracking accidents that occurred three months ago are positively and statistically significantly correlated with real estate growth in the current month. In Column (6), we control for all of the accident lag variables in one specification (Accidentt−N (0 ≤ N ≤ 4)), and the estimated lagged accident impact for a specific lag-months are comparable to those reported in Column (1)-(5) in both magnitudes and statistical significance levels. Overall, the negative impact of past fracking accidents diminishes quickly: fracking accidents impose immediate negative prince effects on the local housing market. However, such a negative price shock on local housing prices recovers within three months.Footnote 9

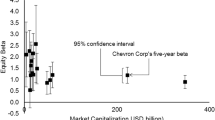

Figure 7 illustrates the duration of price impacts from past fracking accidents using the model presented in Column (3) of Table 6. Because this model controls for income, the coefficient estimates represent the real estate price impact, excluding any direct benefits from fracking. We plot the coefficient estimates for past fracking accident dummies (Accident t-0 – Accident t-4) as well as their 95% confidence intervals. This figure shows that the market immediately responds to accidents that had severe adverse environmental and safety consequences. However, after one month, the marginal impact of past fracking accidents diminishes, and the statistical power disappears. Interestingly, fracking accidents that happened three months ago are associated with a positive and statistically significant impact on local real estate returns.

Time–varying effect of fracking accident. This figure displays the price impacts of past fracking accidents using the model presented in Column(3) of Table 6. The dependent variable is the monthly percentage change in house prices (Δ HPI Month). We plot the coefficient estimates for past fracking accident dummies (Accident t-0 – Accident t-4). The dependent variable is the monthly percentage change in house prices (Δ HPI Month). Standard errors are calculated using two-way clustering by county-year. All specifications include individual county and year fixed effects as well as the Zip Code level royalty income

The findings imply that house prices adjust to their previous levels a few months after the accident. Therefore, we conclude that buyers rely on the most recent information to form beliefs about fracking risks. This finding is supported by Gallagher (2014), who finds that more recent information has an immediate but short-lived impact. Furthermore, we find house prices adjust to their previous levels if no additional accidents are reported within three months. This finding is supported by Hansen et al. (2006), who find that houses located near gas pipelines experience a sharp decrease in price following an explosion, but the price effect of such accidents disappears within six months.

Robustness: Placebo Validations

In “Conventional Drilling History and Fracking Impact”, we argue that the negative and statistically significant triple interaction effect (POST2006×FRACK ×CONV) is a result of perceived anticipation about fracking risks. In this subsection, we implement several robustness exercises to address the possible concerns that our main findings might have been driven by non-parallel trends in the data. Specifically, we perform several placebo exercises where we estimate our primary specifications on several alternative data sets and change the beginning of the fracking boom to alternative dates.

Table 7 displays the placebo test results. The model specifications in this section correspond to those in Column (1) and Column (4) in Table 4 except that we randomly changed the beginning of the fracking boom and the data sample periods. Columns (1)-(2) display results using an alternative sample of PA house price indexes from a time (January 2001 and December 2003) that predates the fracking boom and does not overlap with the 2004–2012 sample period.Footnote 10 The triple placebo interaction term (POST2001×FRACK×CONV) is weakly statistically significant and the triple interaction term (POST2002×FRACK×CONV) is statistically insignificant. In Columns (3)-(4), we employ the Pennsylvania house price index sample from January 2004 to December 2006 and reset the beginning of the fracking boom to January 2006. The triple interaction term (POST2005×FRACK×CONV) remains statistically insignificant with and without controlling for local characteristics in the model. Similarly, in Columns (5)-(6), we employ real estate prices sample from January 2004 to December 2012 and reset the beginning of the fracking boom to January 2011. The triple interaction term (POST2010×FRACK×CONV) remains statistically insignificant with and without controlling for local characteristics in the model. The statistically insignificant results show that the effects of the fracking boom were capitalized into prices during the first few years of the fracking boom (2007 to 2010), and no new information is present as of 2011.

Taken together, we provide empirical evidence showing that our model specifications satisfy the parallel trend assumptions and the negative and statistically significant triple interaction effect (POST2006×FRACK ×CONV) is consistent with market participants’ perceptions about fracking risks.

Conclusion

This paper uses a natural experiment arising from the fracking boom in 2007 to shed light on how market participants respond to information. As fracking wells spread across the U.S, real estate investors have expressed great concern about the market uncertainties caused by the fracking boom.

We find that the real estate market is very efficient in incorporating the potential benefits from fracking despite concerns surrounding the environmental consequences. At the beginning of the fracking boom, households in the fracking-only regions responded more positively to the potential benefits of fracking benefits compared to those in dual-exploration regions. Knowledge about conventional drilling helps participants in dual-exploration areas quickly update beliefs about the fracking risks and benefits. As a result, the initial level of real estate appreciation was higher in the fracking-only regions than those in the dual-exploration regions.

We also show that expectations about fracking risks are heavily influenced by whether a fracking accident took place in the current month, but this effect dissipates quickly. This finding suggests that market participants place greater emphasis on recent information and discount old information.

Notes

Gold, Russell and Tom McGinty, “Energy Boom Puts Wells in America’s Backyards” The Wall Street Journal, October 25, 2013.

“Fracking: So where’s the economic boom that was promised?” https://www.dispatch.com/article/20140128/NEWS/301289852

See Viscusi et al. (1997) for a more general discussion of the Bayesian learning model.

Although there are approximately 1700 Zip Codes tabulation areas in PA as of 2018, approximately 55% of the housing stock in PA are in those 200 Zip Codes. “2010 Census of Population and Housing” https://www.census.gov/prod/cen2010/cph-2-40.pdf.

We report the annualized gain as the monthly gain multiplied by twelve months. Monthly gains are estimated by taking the sum of the corresponding base term coefficients, the interaction term coefficients, and multiplying the net return by the median house price in our data ($209,800).

The median sale prices in this sample is 158.89 thousand dollars.

For example, one of the accidents has the following description in the DEP report: “The well erupted late Tuesday, sending thousands of gallons of chemical-laced and highly saline water spilling from the drill site, heading over containment berms, racing toward a tributary of a popular trout-fishing stream and forcing seven families nearby to temporarily evacuate their homes.”

Conventional selection criteria (AIC, HBIC, and SBIC) suggest that the most appropriate number of lag months is zero. Standard errors are calculated using two-way clustering by county–year.

We also tested several alternative models control for county-level household income, the count of fracking wells in a Zip Code, the AGI and Wage and Salary Income. None of those additional specifications drastically altering the results reported in the current Table 6. Results from the alternative specifications are available upon request.

The model specifications used to produce Column (1)-(2) corresponds to those in Column (1) Table 4 because local characteristics data at the Zip Code level are not available for this period.

References

Admati, A.R. (1985). Information in financial markets: the rational expectations approach. Graduate School of Business, Stanford University.

Agarwal, S., Driscoll, J.C., Gabaix, X., & Laibson, D. (2008). Learning in the credit card market.

Agarwal, S., Driscoll, J.C., Gabaix, X., & Laibson, D. (2009). The age of reason: Financial decisions over the life cycle and implications for regulation. Brookings Papers on Economic Activity, 2009(2), 51–117.

Balthrop, A.T., & Hawley, Z. (2017). I can hear my neighbors’ fracking: The effect of natural gas production on housing values in tarrant county, tx. Energy Economics, 61, 351–362.

Clapp, J.M., Nanda, A., & Ross, S.L. (2008). Which school attributes matter? the influence of school district performance and demographic composition on property values. Journal of urban Economics, 63(2), 451–466.

Cunningham, C., Gerardi, K., & Shen, L. (2020). The double trigger for mortgage default. Evidence from the fracking boom. Management Science. forthcoming.

Davis, L.W. (2004). The effect of health risk on housing values: Evidence from a cancer cluster. American Economic Review, 94(5), 1693–1704.

Dumm, R.E., Sirmans, G.S., & Smersh, G.T. (2018). Sinkholes and residential property prices: Presence, proximity, and density. Journal of Real Estate Research, 40(1), 41–68.

Gallagher, J. (2014). Learning about an infrequent event: evidence from flood insurance take-up in the united states. American Economic Journal: Applied Economics, 206–233.

Gallagher, R.M., & Persky, J. (2020). Heterogeneity of birth-state effects on internal migration. Journal of Regional Science.

Gatzlaff, D., McCullough, K., Medders, L., & Nyce, C.M. (2018). The impact of hurricane mitigation features and inspection information on house prices. The Journal of Real Estate Finance and Economics, 57(4), 566–591.

Grossman, S.J., & Stiglitz, J.E. (1976). Information and competitive price systems. The American Economic Review, 246–253.

Hansen, J.L., Benson, E.D., & Hagen, D.A. (2006). Environmental hazards and residential property values: Evidence from a major pipeline event. Land Economics, 82(4), 529–541.

Kahneman, D., & Tversky, A. (2013). Prospect theory: An analysis of decision under risk. In Handbook of the fundamentals of financial decision making: Part I. World Scientific (pp. 99–127).

Kai-Ineman, D., & Tversky, A. (1979). Prospect theory: An analysis of decision under risk. Econometrica, 47(2), 363–391.

Kiel, K.A., & McClain, K.T. (1995). The effect of an incinerator siting on housing appreciation rates. Journal of Urban Economics, 37(3), 311–323.

Kiel, K.A., & Williams, M. (2007). The impact of superfund sites on local property values: Are all sites the same? Journal of urban Economics, 61(1), 170–192.

Klaiber, H.A., & Gopalakrishnan, S. (2012). The impact of shale exploration on housing values in pennsylvania.

Kohlhase, J.E. (1991). The impact of toxic waste sites on housing values. Journal of urban Economics, 30(1), 1–26.

Kousky, C. (2010). Learning from extreme events: Risk perceptions after the flood. Land Economics, 86(3), 395–422.

Leggett, C.G., & Bockstael, N.E. (2000). Evidence of the effects of water quality on residential land prices. Journal of Environmental Economics and Management, 39(2), 121–144.

Ling, D.C., Lu, Y., & Ray, S. (2018). How do personal real estate transactions affect productivity and risk taking? evidence from professional asset managers. Real Estate Economics.

Malmendier, U., & Nagel, S. (2011). Depression babies: do macroeconomic experiences affect risk taking? The Quarterly Journal of Economics, 126(1), 373–416.

Malmendier, U., & Nagel, S. (2015). Learning from inflation experiences. The Quarterly Journal of Economics, 131(1), 53–87.

Muehlenbachs, L., Spiller, E., & Timmins, C. (2012). Shale gas development and property values. Differences across drinking water sources.

Muehlenbachs, L., Spiller, E., & Timmins, C. (2015). The housing market impacts of shale gas development. American Economic Review, 105 (12), 3633–59.

Nicolosi, G., Peng, L., & Zhu, N. (2009). Do individual investors learn from their trading experience? Journal of Financial Markets, 12(2), 317–336.

Pope, J.C. (2008a). Buyer information and the hedonic: the impact of a seller disclosure on the implicit price for airport noise. Journal of Urban Economics, 63(2), 498–516.

Pope, J.C. (2008b). Do seller disclosures affect property values? buyer information and the hedonic model. Land Economics, 84(4), 551–572.

Pope, J.C. (2008c). Fear of crime and housing prices: Household reactions to sex offender registries. Journal of Urban Economics, 64(3), 601–614.

Shiller, R.J. (1991). Arithmetic repeat sales price estimators. Journal of Housing Economics, 1(1), 110–126.

Van Nieuwerburgh, S., & Veldkamp, L. (2009). Information immobility and the home bias puzzle. The Journal of Finance, 64(3), 1187–1215.

Viscusi, W., Hakes, J., & Carlin, A. (1997). Measures of mortality risks. Journal of Risk and Uncertainty, 14(3), 213–233.

Viscusi, W.K. (1991). Age variations in risk perceptions and smoking decisions. The Review of Economics and Statistics, 577–588.

Viscusi, W.K. (1992). Fatal tradeoffs. Public and private responsibilities for risk. New York: Oxford University Press.

Acknowledgements

We thank Kun Bi, Chris Cunningham, Kris Gerardi, and seminar participants at the 2020 FSU-UF-UCF Real Estate Symposium, the Pennsylvania State University, the American Real Estate Society’s 33rd Annual Meeting, the 2016 Southern Finance Association annual meeting, and the 2018 Energy and Commodity Finance Conference for their helpful comments and discussions. We sincerely thank the helpful comments made by our anonymous referees. Special thanks to Gary Frederick for providing background information about the PA real estate market during the study period. All errors are our own.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Ambrose, B.W., Shen, L. Past Experiences and Investment Decisions: Evidence from Real Estate Markets. J Real Estate Finan Econ 66, 300–326 (2023). https://doi.org/10.1007/s11146-021-09844-2

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-021-09844-2