Abstract

Storage systems can be deployed on varying scales by different stakeholders. The stakeholders in grid-tied scenarios include residential, industrial or commercial consumers, distribution network operators, or transmission system network operators. For the purposes of this study, the distribution network operator has been selected as the primary beneficiary of the storage system. This study examines the economic benefits of investing in storage systems for distribution network operators. The consideration for time-of-use (ToU) rates, as they influence the operation of the storage system and in turn, the profit obtainable from a storage-in-distribution-network system, is considered. The economic analysis of the payback period for the investment in storage systems when the storage system provides energy arbitrage services only has been analysed under the ToU tariff schemes. For the distribution network operator owning a storage system, the payback period, when storage systems are incorporated into the network, ranges from 83 to 5 years when there is an increase in variation of consumer tariffs from 1 to 10% of the present electricity costs. Sensitivity analysis for other storage technology options is also considered and presented.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

1 Introduction

Recent upgrades to national grids and environmental concerns in many countries have seen an inclusion of renewable energy sources in national energy mixes. This inclusion has further led to the deployment of energy storage systems to handle intermittency of renewable energy sources, especially solar and wind sources. Other than intermittency, storage has also played a huge role in providing black-start services during grid outages [1], providing additional reliability and flexibility [2] and maintaining grid voltage by supplying reactive power to the system [3]. There is also a growing potential for energy storage systems in modern grid networks due to evolving energy demands in transportation and heating [1].

Storage systems have varying characteristics and constraints which make some more suitable than others in providing a particular service to a network. These may include the ability to charge and discharge rapidly to handle spikes and surges in demand and supply, or a high energy density to provide power during blackouts. The differing constraints which affect their suitability for a particular location also include requiring large volumes of water, the need for a large space for storage tanks or high capital costs. In this regard, a hybrid of two or more types of energy storage systems can be used to deliver a wider range of services required by the consumer [4]. In addition, having more than one type of storage in the network also helps to improve reliability, as the failure of one storage system would be handled by the second system, without interrupting normal system operation [1].

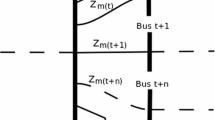

As the storage system owner (SSO), the distribution network operator (DNO), as shown in Fig. 1, invests resources into the design, building, operation and maintenance of a storage system. Apart from providing technical services to the consumers, the distribution network storage system owner’s (DN-SSO) aim is to make maximum profit via energy trading and other services. The choice to act as a power supplier to the consumer to augment grid supply must also be balanced with acting as a consumer to the central grid operator while ensuring that customers’ demands are met at all times [20]. While in operation, the degradation of the storage system must also be factored into the objective function to account for reduced efficiency after going through a number of charge–discharge cycles.

The practical problem that motivates this paper stems from: How can a DNO obtain maximum value from the inclusion of energy storage systems as part of its network infrastructure? In addition, a range of energy storage technologies abounds; which one is the most promising for the DNO to operate?

The rest of the paper is organised as follows: a detailed literature review of energy storage systems and related literature is presented in Sect. 2. This is followed by the formulation of the mathematical model describing the system in Sect. 3. Section 4 presents the results and some cost analysis of variations in the network operating conditions. The study is concluded in Sect. 5.

2 Literature Review

Storage systems may be deployed within a network by a range of stakeholders, each having their own interests and expected benefits. These stakeholders include these three categories:

-

1.

The consumer—residential, commercial and industrial consumers

-

2.

The distribution network operator (DNO) as the storage system owner (DN-SSO)

-

The storage system owner (depending on grid supply only)

-

The storage system owner (depending on grid and owned-PV/wind power)

-

-

3.

The transmission network operator [21]

The residential, commercial or industrial consumer seeks to make use of storage systems to provide power when there is a grid outage or when grid prices are high. An intelligent grid management system would take advantage of low grid prices to charge the storage system and run dispatchable electrical loads within the network. With these consumers, the ESS can provide reliable power during outages and replace back-up generators [3]. The DN-SSO invests in storage systems for technical, economical and environmental reasons—handling voltage fluctuations, energy arbitrage, peak shaving or reducing GHG emissions [5, 6]. The DNO can go further to include solar or wind power supply within the network to optimise the services offered by the installed storage system in their network. The transmission network invests in storage for network upgrade deferral, voltage regulation and improvements in transient stability [2].

A distribution network’s operation was optimised to maximise profit when energy storage systems and distributed generation were incorporated in it [7]. The results of the study revealed that coordinated planning of the storage and distributed generation yielded increases in profits of 42, 37 and 59%, when distributed generation only, energy storage only and distributed generation-energy storage, respectively, were considered.

Based on the possible benefits of the storage system to different stakeholders [2], who sometimes have opposing interests, the optimisation of storage system operation must be done with consideration of its effect on the remunerability, which may vary for each stakeholder [8] and also depends on the incentive scheme being used [9]. For instance, under a ToU tariff scheme, a residential consumer seeks to minimise buying from the distribution network operator at peak periods and obtain maximum remuneration to make his storage investments profitable. A distribution network operator on the other hand seeks to buy from the utility so that even when the customer demands reach peak periods, the high customer demands can be met while seeking to maximise remuneration [22,23,24].

Similarly, it is important to consider who the primary beneficiaries of the storage system’s required function would be [8] in considering storage type, site and size to be deployed, as this affects the return on investment. In sizing a storage system performing energy arbitrage services in a distribution network, there needs to be a compromise between the invested capital and incomes realised from energy arbitrage [10]. When providing peak shaving services, high power and high energy capabilities of the storage system are required.

In an ideal situation when the beneficiaries do not have conflicting interests, one storage can serve multiple functions within the network and gain revenue for multiple services provided. However, this may not be a common case as the storage’s performance in carrying out one function might be limited by other functions. One way to overcome this challenge is the inclusion of multiple storage systems within a network to obtain maximal functionality of the particular storage systems in the network [4]. Summarily, the objective of optimising storage system allocation involves a trade-off among the capital invested in the storage system, the services that the storage system can provide and the choice of storage technologies that can be considered [2].

Reviewed literature has considered the profitability of energy storage systems providing different services for a distribution network. As storage systems require consideration of both power and energy constraints unlike other conventional assets in a network [11], our work seeks to consider in detail the influence of the preceding time interval on profitability of the system. Therefore, while other works are limited to power demand constraints, which do not consider power demand or supply in the preceding time interval within the horizon, we have included time-dependent energy-related constraints in this study to give a more realistic approach to the operation of storage systems within a distribution network.

3 Methodology

A modified form of the IEEE 5-bus network [12] is used in this study. Buses 1–4 are selected as buses with residential consumers, while Bus 5 is selected as the bus for industrial consumers. The storage service considered in this study is the provision of energy arbitrage services.

Due to the huge variety of demand profiles available, peak demand, which is generally assumed for the demand profile, is not sufficient for proving the contribution of energy storage systems within a network [11]. Thus, in this study, the load profile is based on the IEEE 5-bus system peak demands (see Table 1), but modified to suit residential consumers at some buses and industrial consumers at one bus. The residential load profile framework from Eskom [13] is scaled to match the peak demand of the IEEE 5-bus data at each bus for every hour within a day. Similarly, the industrial load profile of [14] is used at Bus 5 and is scaled to match the IEEE 5-bus data. Thus, the demand at every hour comprises residential loads on Buses 2–4 and industrial loads on Bus 5. The resulting hourly load profile at all buses is presented in Fig. 2 below:

The objective of the model is to maximise profits from the sale of electricity to residential and industrial consumers, while considering degradation of the energy storage systems as shown in Eq. 1:

Maximise

The profit due from the storage system under the ToU is defined in Eq. 2. Pdem(i, t) and Pgrid(i, t) represent the power demand from the consumer and power supplied by the grid respetively, ToU(i, t) are the electricity prices under time of use rates and Cmunic is the cost of purchasing electricity from the central grid. μS1 and μS2 are the storage degradation costs for storage systems 1 and 2. The power discharged from storage systems 1 and 2 are represented by PS1D(i, t) and PS2D(i, t) respectively. Equations 3 and 4 define the sales of electricity to consumers, ConSP(i, t) which is a product of the power demanded by the consumers, Pdem(i, t), and the time of use tariffs, ToU(i, t). The cost of grid electricity (GridCP(i, t)) purchased is shown in Eq. 4.

The constraints guiding the operations of system components in the distribution network are as shown in Eqs. 5– 9b below. Equation 5 depicts the power balance at buses within the day, where the balance of power within the network involves power generation and supply balancing out. The limits of the grid power supply are presented in Eq. 6, and the state of charge of the storage systems is presented in 7a and 7b.

These states of charge (SOC) of the energy storage systems are maintained between the highest and lowest SOCs, to avoid possible overcharging or over discharging, as defined in 8a and 8b.

Simultaneous charging and discharging of the storage systems are prevented as shown in Eqs. 9a and 9b:

Other data used in the model include the electricity tariffs of CityPower consumers as shown in Table 2 [15].

4 Results

The model is run with the data presented in the tables above using the CPLEX solver of the Advanced Interactive Multidimensional Modeling Software (AIMMS). The system daily profit with and without storage systems installed in the network is obtained from the simulation results. These results show the profit from buying electricity from the central utility at Municflex rates (CMunic ($/MWh) of R583, (equivalent to $38.33/MWh) was compared with when storage was included in the system. The HESS storage configuration considered in this analysis is a lithium-ion and lead–acid battery hybrid.

Without storage systems, a daily profit from sales of electricity under the ToU tariff system was realised as $267,265. In this case, as there is no storage, all power obtained from the grid is immediately sold to the consumer at the ToU rates. It should be noted that this is not the actual profit generated by the distribution network, as other expenses such as network demand charges, transmission network charges, environmental levies and administrative charges are also borne by the distribution network operator daily and would reduce this value. However, for the purposes of this study, it is assumed that this is the profit received daily.

In comparison, when storage systems are included in the network, it was observed that:

On a superficial level, this simply implies that the inclusion of a storage system is not profitable to the distribution network operator under the existing conditions. However, a detailed analysis of some influencing factors presented below will give another perspective.

4.1 Sensitivity Analysis I—Increasing ToU Tariffs

As current electricity ToU tariffs (shown in Table 2) were used in the first cost analysis, a consideration for a 1–10% increase in tariff paid by the consumer shows the daily savings due to the inclusion of storage systems (Table 3):

Payback Period

The payback period is an economic analysis tool used to assess the time it would take to recover the capital costs invested in an energy storage system [16]. A simple payback period is used in this study and is described in Eq. 10 as [17]:

For a storage system to be deemed as profitable, the best scenario would be to have a payback period less than its lifetime [16]. Thus, from preceding results, the annual savings and payback periods at slightly increased consumer tariffs from 1 to 10% of the current consumer ToU tariff are presented in Table 4:

From the results presented in Table 4, the most beneficial tariff for the customer is the one in which there is at least 10% increment in the current time-of-use tariff rates, due to the lifetime of the storage used (lithium-ion and lead–acid HESS).

4.2 Sensitivity Analysis II—Comparison of Different Storage Technologies

Each storage type has particular characteristics associated with it. These include the roundtrip efficiency, power density, energy density, lifetime, response time, technology maturity, storage duration, etc. [18]. The technically viable energy storage system options for distribution networks include batteries, hydrogen fuel cell (HFC) systems, flywheel energy storage systems, supercapacitors and superconducting magnetic energy storage systems [18]. The charging and discharging efficiencies of the energy storage systems are assumed to have the same value [19].

A compromise between the cost and performance using the data provided in Table 5 is used to compare some of these technologies.

For this study, another HESS considered is the lithium-ion battery-hydrogen fuel cell hybrid. The payback period with this HESS is presented in Table 6.

The results from Table 6 show that under the existing ToU tariffs scheme, the lithium-ion battery hydrogen fuel cell HESS only becomes profitable when there is at least a 1% increase in the current tariff regime. In addition, it can be seen that the payback period, when there is a 10% increase in the current tariff, is 6.76 years.

5 Conclusion

The profitability of inclusion of energy storage systems when providing energy arbitrage services within a distribution network is influenced by a number of factors—the technology type, the capacity, existing tariff rates, lifetime of the storage technology, etc. A few of these factors have been analysed in this study to highlight the influence they have on the payback period of storage systems within a network under the time-of-use tariff. This analysis would assist distribution network operators in choice of storage technologies that can be deployed to ensure that the investment on storage systems is profitable. Further work on this study will include the profit analysis when the storage system is providing other services such as peak shaving, voltage regulation, etc., concurrent with energy arbitraging.

References

Brandon NP, Edge JS, Aunedi M, Barbour ER, Bruce PG, Chakrabarti BK, Esterle T et al (n.d.) UK research needs in grid scale energy storage technologies. http://energysuperstore.org/wp-content/uploads/2016/04/IMPJ4129_White_Paper_UK-Research-Needs-in-Grid-Scale-Energy-Storage-Technologies_WEB.pdf

Lorente JL, Liu XA Best R, Morrow DJ (2018) Energy storage allocation in power networks—a state-of-the-art review. In: Proceedings of 2018 53rd International University Power Engineering Conference UPEC 2018, pp 1–6

Wong LA, Ramachandaramurthy VK, Taylor P, Ekanayake JB, Walker SL, Padmanaban S (2019) Review on the optimal placement, sizing and control of an energy storage system in the distribution network. J Energy Stor 21:489–504

Gbadegesin AO, Sun Y, Nwulu NI (2019) Techno-economic analysis of storage degradation effect on levelised cost of hybrid energy storage systems. Sustain Energy Technol Assess 36:100

Das CK, Bass O, Kothapalli G et al (2018) Overview of energy storage systems in distribution networks: placement, sizing, operation, and power quality. Renew Sustain Energy Rev 91:1205–1230

Bozchalui MC, Sharma R (2014) Operation strategies for energy storage systems in distribution networks. In: IEEE Power and Energy Society General Meeting, vol 2014

Saboori H, Hemmati R (2017) Maximizing DISCO profit in active distribution networks by optimal planning of energy storage systems and distributed generators. Renew Sustain Energy Rev 71:365–372

Hartmann B, Vokony I, Sorés P, Táczi I (2019) Service aspect assessment of energy storage under the ownership of distribution system operators. J Energy Storage (25)

Gbadamosi SL, Nwulu NI, Sun Y (2018) Multi-objective optimization for composite generation and transmission expansion planning considering offshore wind power and feed in tariffs. IET Renew Power Gen 12(14):1687–1697

Chen C, Que B, Zhou Z et al (2018) Cost-benefit analysis of distributed energy storage in distribution grids with renewables. In: 2018 international conference on power system technology: powercon 2018

Konstantelos IG, Strbac G (2018) Capacity value of energy storage in distribution networks. J. Energy Storage 18:389–401

‘APPENDIX 1 IEEE 5-BUS SYSTEM DATA’. [Online]. Available https://shodhganga.inflibnet.ac.in/bitstream/10603/26549/14/14_appendix.pdf

Eskom, ‘Eskom Homeflex’. Available at http://www.eskom.co.za/ CustomerCare/TariffsAndCharges/Documents/Eskom%20Booklet.pdf

Paudyal S, Cañizares CA, Bhattacharya K (2015) Optimal operation of industrial energy hubs in smart grids. IEEE Trans Smart Grid 6(2):684–694

CityPower, ‘Schedule of Approved Electricity Tariffs for FY2019/20’. [Online]. Available: https://www.citypower.co.za/ReportsandDocuments/ScheduleofApprovedTariffs.1920.pdf

Fong G, Moreira R, Strbac G (2017) Economic analysis of energy storage business models. IEEE Manchester Power Tech

Grantham A, Pudney P, Ward LA et al (2017) The viability of electrical energy storage for low-energy households. Sol Energy 155:1216–1224

Alhamali A, Farrag ME, Bevan G, Hepburn DM (2017) Review of Energy Storage Systems in electric grid and their potential in distribution networks. In: 2016 18th international middle-east power systems conference, MEPCON 2016—proceedings, pp 546–551

Fedjaev J, Amamra SA, Francois B (2016) Linear programming based optimization tool for day ahead energy management of a lithium-ion battery for an industrial microgrid. In: Proceedings IEEE international power electronics and motion control conference PEM, pp 406–411

Nwulu NI, Agboola PO (2012) Modelling and predicting electricity consumption using artificial neural networks. In: Proceedings of the 11th international conference on environmental and electrical engineering (EEEIC2012), Venice, Italy, 18–25 May 2012

Musasa K, Nwulu NI, Gitau MN, Bansal RC (2017) Review on DC collection grids for offshore wind farms with HVDC transmission system. IET Power Electr 10:2104–2115

Damisa U, Nwulu NI, Sun Y (2018) Microgrid energy and reserve management incorporating prosumer behind the-meter resources. IET Renew Power Gener 12(8):910–919

Fahrioglu M, Nwulu NI (2012) Investigating a ranking of loads in avoiding potential power system outages. J Electr Rev (Przeglad Elektrotechniczny) Warsaw, Poland 88(11a):239–242

Nwulu NI, Fahrioglu M (2011) A neural network model for optimal demand management contract design. In: Proceedings of the 10th international conference on environmental and electrical engineering (EEEIC2011), Rome, Italy, 8–11 May 2011

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Singapore Pte Ltd.

About this paper

Cite this paper

Gbadegesin, A.O., Sun, Y., Nwulu, N. (2020). Cost Analysis of Hybrid Energy Storage System Benefits to Distribution Network Operators. In: Emamian, S.S., Awang, M., Yusof, F. (eds) Advances in Manufacturing Engineering. Lecture Notes in Mechanical Engineering. Springer, Singapore. https://doi.org/10.1007/978-981-15-5753-8_61

Download citation

DOI: https://doi.org/10.1007/978-981-15-5753-8_61

Published:

Publisher Name: Springer, Singapore

Print ISBN: 978-981-15-5752-1

Online ISBN: 978-981-15-5753-8

eBook Packages: EngineeringEngineering (R0)