Abstract

Denmark has the highest proportion of wind power in the world. Wind power provided a world record of 39.1% of the total annual Danish electricity consumption in 2014 with as much as 51.7% in Western Denmark. Many would argue that the present power markets are not designed for such high shares of wind power production and that it would be hard to get good and stable prices. However, analyses in this chapter show that the Nordic power market works, extreme events have been few, and the current infrastructure and market organization has been able to handle the amount of wind power installed so far. It is found that geographical bidding areas for the wholesale electricity market reflect external transmission constraints caused by wind power. The analyses in this chapter use hourly data from West Denmark—which has the highest share of wind energy in Denmark and which is a separate price area at the Nordic power exchange. Data have been collected from the last ten years and periods with extreme wind conditions are used as case studies to illustrate the robustness of our findings.

Access provided by CONRICYT-eBooks. Download chapter PDF

Similar content being viewed by others

1 Introduction

Denmark is one of the Nordic countries that have set up ambitious long-term targets of carbon neutral energy systems with a fossile free electricity sector. To reach the ambitious energy and climate goals of carbon neutral energy systems in the Nordic countries, a large share of variable renewable energy sources will be deployed, especially wind power, in addition to other traditional storable renewable energy sources such as biomass and hydropower. In 2020, it is assumed that 50% of the yearly electricity generation will come from wind energy (ENS [1]). And in 2035, the political goal is to have 100% renewable energy based electricity generation in Denmark, which includes a high share of wind energy. By nature, the temporal supply of wind power is highly variable because it is determined by weather conditions, it is uncertain due to forecasting errors, and it is location specific as the primary energy carrier cannot be transported like coal or biomass (Borenstein [2], Hirth et al. [3]).

Such properties imply major integration and interfacing challenges of wind power with the energy system. Previously, the challenges related to variability has been studied by Lamont [4], Borenstein [5], Joskow [6], Nicolosi [7], Holttinen et al. [8], and Hirth [9]. Wind power will affect balancing costs as a consequence of forecasting errors (Smith et al. [10], Holttinen et al. [8], and Hirth [9]), and increase the costs of distribution and transmission networks (Brown and Rowlands [11], Lewis [12], and Hamidi et al. [13]).

In addition, wind power may influence the costs of firm reserve capacity and lower utilization rates and cause more cycling and ramping of traditional plants (Ueckerdt and Hirth [14]). At high wind power penetration rates, the overall integration costs could be substantial (Ueckerdt and Hirth [14], Hirth et al. [3], and IEA [15]). Consequently, cost effective integration of wind power has become a pressing challenge in the energy sector.

In liberalized markets with perfect competition (Olsen and Skytte [16], Skytte [17]), it is assumed that power supplier submit their bids at the power markets at marginal cost. However, wind power generation, as well as hydro power and photovoltaic, have no fuel cost and can be assumed to have almost zero marginal costs; all current costs are fixed costs that depends on non-negative generation. Whereas most thermal power generation (e.g., biomass or natural gas fired power plants) have fuel costs and can thereby submit bids at the power market at marginal cost that are higher than zero.

The zero marginal cost in addition to the variable supply of wind power may imply that negative prices occur at the power market. Negative prices are a signal from the market that there is excess production. Production in these hours means that you have to pay to “sell” your production. For example in hours with lower electricity demand than wind power generation (Nicolosi [7]).

Therefore, many would argue that the present power markets are not designed for high shares of wind power production and that it would be hard to get good and stable electricity prices (Skytte and Ropenus [18,19,20]). However, so far the Nordic power market has shown relatively stable prices, extreme events have been few, and the current infrastructure and market organization has been able to handle the amount of wind power installed. The reasoning behind this may be found in the technology mix and in the design of the Nordic power market. Jacobsen and Zvingilaite [21] and Grohnheit et al. [22] discuss this for the years 2006–2008 and for 2004–2010.

The share of wind has increased a lot during the last years. In this chapter, we analyze the market data up to 2014 from the Nordic power exchange Nord Pool with respect to wind power data, in order to see which influence wind power has. We take departure in the Western part of Denmark, which is the area with the highest share of wind power. In Sect. 4.2, we describe the design of the Nordic power market. The prices observed in Western Denmark are discussed and analyzed in Sect. 4.3. Section 4.4 looks at extreme hours, and finally Sects. 4.5 and 4.6 discuss perspectives and findings.

1.1 Wind Energy in Denmark

Denmark as a wind energy country is a nation that many others are looking to in order to discover sustainable energy solutions for the future. Denmark is a pioneer within wind energy. In the 1950s Johannes Juul, a Danish engineer, made a number of experimental turbines. It was Juul who was the first to connect a wind turbine with an (asynchronous) AC generator to the electrical grid, and around 1956 Juul built the stable three-bladed wind turbine, the Gedser wind turbine, which today underlies the Danish wind turbine design and has become a global standard. The Gedser wind turbine was in operation for many years and gave confidence in the technology.

After the energy crises in the 1970s wind turbines became popular. The first two wind turbines were connected to the power grid in 1976, and from 1978 the sales of serial produced wind turbines started. In the 1980s and 1990s many single turbines were deployed in Denmark. This resulted in many small turbines but with a low total share of the total domestic power consumption. From 1996 the number and installed capacity increased a lot.

Electricity in Denmark is divided into two geographical markets (east and west of the Great Belt), each with strong connection to the neighbor markets. The Western part of Denmark has had the largest deployment and has therefore the largest share of wind power.

In 2004, wind power provided 23.4% of the electricity consumption in Western Denmark (on a national level the share was 18.8% of the total Danish electricity consumption). Ten years later in 2014, the figure had risen to 51.7% in Western Denmark and to 39.1% on a national level of the domestic electricity consumption [23]. This is a new world record.

On a monthly basis the share was much greater in some months. Only in January 2014 the proportion was 61.4 percent at the national level. On an hourly basis wind power provided more than 100% of the Danish power consumption in several hours of the year—leading to export to the surrounding countries.

Today, total wind energy capacity in Denmark is almost 5,000 MW with nearly 1,300 MW (2014) located offshore.

Thus, wind power has a significant impact not only on the hourly price on the day-ahead spot market, but also the intraday or real-time markets. The impact of the volatility of wind power is reduced by market-driven trade.

Wind energy is traded at the Nordic power market in addition to receiving either feed-in premium (Denmark) or green certificates (Norway-Sweden). Jensen and Skytte [24, 25], Morthorst et al. [26], and Skytte [27] discuss the interactions between the power and green certificate markets.

2 The Nordic Power Market

Denmark is part of the Nordic power market. The common Nordic power market dates back to 1971 and was originally designed to balance out variations in precipitation and water inflow to hydro power stations. From 1993 it became a market place open for all generators and consumers of electricity in Norway, and expanded to the other Nordic countries in the following years (Amundsen and Bergman [28]). It was developed to exploit beneficial interaction between hydro power and large thermal plants, conventional coal power and nuclear power plants. This showed to be very effective. In wet precipitation years, the flexible conventional power plants in Denmark and Finland were dispatched and the excess generation from the Norwegian and Swedish hydro power plants were exported to Denmark and Finland (and later on also to other countries in Northern Europe). In dry precipitation years, Norway and Sweden imported power.

Simultaneously with the liberalization of the energy markets, a market based system (Nord Pool) was introduced and even small power suppliers were allowed to trade, making a very liquid market with reliable prices. The Nordic power exchange, Nord Pool (from March 2010 within Nasdaq OMX Commodities), is now covering Denmark, Norway, Sweden and Finland and parts of Germany and the Baltics (Skytte [17]). Since 1999 and 2000 the two parts of Denmark (West and East) have been bidding areas with separate prices at Nord Pool.

Nord Pool operates a day-ahead spot market with regional hourly prices (Elspot), an intraday market with continuous power trading up to one hour prior to delivery (Elbas – Electricity Balance Adjustment Service), a Regulating power market and a financial market for the following days, weeks, months and annual contracts up to five years. The participants in the markets are power producers, distributors, industries and brokers. Nord Pool Spot AS acts as counterpart in all contracts and all trades are physically settled with respective Transmission System Operators (TSO)s.Footnote 1

Deviations between planned supply and demand in real time must then be covered by balancing power at the regulating power market. Thus, the fundamental reason for having a balancing market is uncertainty about supply and demand. Regulating power is production capacity or consumption offered by the market players to the balance responsible TSO during the actual day of operation. Skytte [29] revealed the pattern of the prices on the Nordic regulating power market. The level of the regulating power price depends on the level of the corresponding spot price and the amount of regulation needed. Compared to the spot price there is a premium of readiness which is independent of the amount of regulating power but depended of the corresponding spot price.

On the day-ahead market a “system price” is calculated covering the whole area of Nord Pool assuming no network constraints. In hours when congestion occurs on interconnections between bidding areas, Finland, Sweden, Norway (divided in two or more areas), and Denmark (east and west) separate day-ahead area prices are calculated on the basis of the bids from each area. It means that congestion is managed by price differences resulting from these implicit auctions (market splitting) on the interconnectors to Norway, Sweden and between eastern Denmark and Germany (KONTEK). Explicit auctions are used on the interconnector between Western Denmark and Germany. The spot market bids are stated before noon for next day’s operation (12–36 h before delivery).

3 Area Prices in Western Denmark 2004–2014

Detailed market data from all the markets and price areas per hour are available since 2000.Footnote 2 For Western Denmark the minimum hourly demand in all the years between 2004 and 2014 was about 1.3 GW, and the maximum wind production varied between 2.2 and 3.9 GW (see Table 4.1). The installed capacities and transmission capacities were nearly the same in all the years from 2004 to 2009, although a large number of small wind turbines were replaced by larger units in on-shore wind parks. Wind production in 2007 was higher than the previous and following years. New off-shore windparks in 2009 and 2010 have lead to higher wind production in 2010 than in 2007.

The years 2004, 2006 and 2010 were dry years in Norway and Sweden, leading to import from Denmark, while 2005 and 2007–2009 have been more wet years with export to Denmark and further to Germany. In all the years except 2010 there were exports to Germany, largest in wet years with large import from the north.

Strong interconnections between Western Denmark and other regions (up to 1.7 GW for export to Northern Germany with very similar conditions for wind power, and 1.7 GW transmission capacity to Norway and Sweden with little wind capacity and large hydro storage capability) will reduce the number of events with consecutive hours with high prices due to lack of generation from wind.

Until August 2010, there was no connection between Western and Eastern Denmark, because the thermal capacity of the two systems is very similar, with only small potential gains from trade. This is changed by the larger wind capacity. The capacity on the new HVDC link is 590 MW. After the start of permanent operation more than 90% of the transfer went from west to east during the rest of 2010.

3.1 Prices in Western Denmark 2004–2014

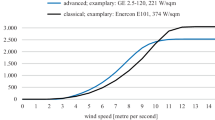

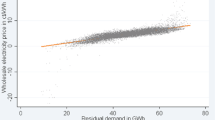

Both electricity consumption and wind power supply affect the electricity prices. This can be illustrated by looking at the simple average of hourly prices per year. The simple average of hourly prices—with equal weight to all hours during the year—is slightly lower than the average weighted by total production or consumption, because the larger consumption leads to higher prices on an hourly basis, and total production follows the demand. The average price weighted by wind production is lower than other prices (see Fig. 4.1).

The lower average price weighted by wind production is due to the fact that wind power supply does not follow the hourly demand for electricity. However, the wind generation per week or month is higher in the cold months where the demand is also high. This implies that, on an hourly basis day-ahead prices are negatively correlated with wind production to the extend that the weather forecast for strong wind sometimes can be read from the Nord Pool area prices, whereas there is little correlation between wind production and electricity demand.

3.2 Seasonal Variation of Demand and Wind Production

On a seasonal basis—measured on average monthly prices for the years 2004 to 2014—there is no systematic seasonal variation in electricity prices, but Fig. 4.2 clearly shows that both electricity demand and wind power generation are larger during winter months than during summer months, although the wind power production in each month is very different from year to year, while the annual variation in monthly consumption is much smaller. In particular, the monthly wind power generation was large in January 2005, 2007, 2008, and especially in January 2014 compared to the other monthly data.

2014 was a “normal” average wind year. However it was very windy during the first few months and with very little wind during the summer. For the month of January 2014, the share of the total electricity demand was over 83% for Western Denmark. The month of lowest wind power share was July at 28%.

With the Danish climate the demand for air conditioning during the summer is small. In neighboring Norway the seasonal correlation between wind and demand is even greater due to colder weather and widespread use of electric heating. Thus the increasing amount of wind power will add to the capacity of the hydro reservoirs as seasonal storages for electricity, depending on the management of the existing reservoirs. There may even be a much larger potential for short-term storages by pumping from lower reservoirs to higher. This process of using this potential has not yet started.

The possibility of hydro storage in neighboring countries reduces the variation in hourly prices, but the effect varies among the years, depending on the precipitation and inflow to the storages, and variation in the production from wind increases the variation in prices. In wet years the average price in the Danish area is low and the effect of varying production from wind is limited, while in dry years both the average price and the variation in hourly prices due to wind are high.

3.3 International Trade

The area price of Western Denmark is normally between the Nord Pool System price and the price on EEX (European Electricity Exchange, EEX—now EPEX Spot—covering Germany), except for the dry years 2006 and 2010, where prices on all these markets were relatively high. The much higher prices in 2008 are reflecting the much higher EUA (CO2 allowances) prices in 2008 than the almost zero price level for 2007. Figure 4.3 compares the average hourly prices in the five years from north (Nord Pool system price) to south (EEX).

Figure 4.4 shows the number of hours with differences between the area price for Western Denmark and the Nord Pool system price. In all years the area price in Western Denmark was within the interval of ±10 €/MWh from the Nord Pool system price in most of the time (between 73 and 97% in most years, but with only 52% in 2008 and 56% in 2005). Of these hours the area price was identical to the Nord Pool system price in 29% of the hours in 2005 and only 4% in 2008 and 2014. In the remaining hours prices in Western Denmark were different due to transmission constraints. The number of hours with extreme price below 5 €/MWh were negligible with around 1% of the hours, except for 2007 and 2014 which had prices below 5 €/MWh in 2% of the hours. Likewise for prices above 100 €/MWh, except for 2008, which was found in 2% of the hours.

The year 2009 was a “normal” hydrological year in Norway and Sweden. The average Nord Pool system price and the area price of Western Denmark were the same, although the hourly prices were identical in only 14% of the hours. In the wet years 2005, 2007 and 2008 the annual average prices on the EEX were between 13 and 24 €/MWh higher than the Nord Pool prices, while in the remaining years the average EEX prices were between 6 €/MWh above and 8 €/MWh below the Nord Pool System prices.

The regional price differences are reflected in the trade pattern between Western Denmark and the neighboring regions. In all the years, Western Denmark was a net exporter of electricity, ranging from 0.6 TWh in the wet year 2005 to 4.5 TWh in the dry year 2006. The annual variations in wind power are reflected in thermal generation rather than traded volumes.

4 Extreme Hours

As noted in Table 4.1 there is a large difference between the minimum load and the maximum wind power generation on an hourly basis. Therefore, one could expect extreme prices (low or negative) in the hours where both the demand load is low and the wind generation is high.

As noted in Fig. 4.2, the winter 2013–2014 was very windy. For 21 December 2013, the wind share of the electricity consumption was 138% in Western Denmark, and for 2 h the share was 178%.

Table 4.2 shows that the number of hours with area prices, below 5 €/MWh or above 100 €/MWh, is quite small, and the number of such extreme hours have decreased since 2007 or 2008. These criteria were used to identify extreme prices. The maximum number of occurrences in a single year is just below 200. Other extremes are chosen for high and low wind. These are less than 1% of the hourly demand (low wind) and more than 100% of the demand (high wind) in the current hour. The number of annual occurrences of “low wind” (<10%) was between 260 and 381, and between 20 and 1225 for “high wind” (>100%). The selected “extreme” hours were used for an analysis focusing on consecutive hours and prices for up-regulation and down-regulation on the balancing market. The tool for this analysis is the filter feature in an Excel database with the hourly observations of market data.

Observations of hourly wind production are not stochastically independent. They follow the pattern of meteorological data. It means that extreme events occur over several hours or days. They are predictable some days before. This is both reflected in the spot and in the regulating power price at Nord Pool. Table 4.2 shows that there are a number of hours with negative down-regulation prices. These negative prices are due to high start and stop costs of decentralized CHP generation in Denmark. The annual number of these events range from 34 in 2005 to 267 in 2010. Also down-regulation by using electricity in electric boilers in district heating systems may lead to negative prices for down-regulation. The price for up-regulation is always equal to or higher than the day-ahead price (Skytte [29]). In one year, 2008, up-regulation prices were more than 100 €/MWh higher than the day-ahead price in nearly 600 h and above 200 MWh higher in 120 h. In all other years the number of these events were much lower.

In the short term negative prices on the spot market are considered as the most important additional measure to address the challenge of the large amount of intermittent generation. Negative price bids were introduced on the German EEX spot market in 2008, and from October 2009 a negative price floor at \(-200\) €/MWh was introduced by Nord Pool. This is significant mainly for Denmark. In the remaining 2009, there were 27 h in Western Denmark with zero prices and 8 consecutive hours with negative prices between 33 and 120 €/MWh. Starting from October 2008, there were 15 h with negative prices in Germany in 2008 and 71 h in 2009. The average of negative prices was \(-41\) €/MWh. In 2010 there were 12 h with small negative values in both Denmark and Germany.

5 Perspective for Other Regions

Geographically Western Denmark is a small area, some 300 km north-south and less east-west. Congestion in the transmission or distribution network within this area is usually unimportant. On the other hand, the impact of capacity constraints to neighboring bidding areas can be analyzed using available data. Some of the results found in this analysis may be valid for other regions.

In most regions of Europe, existing bidding areas follow national boundaries. This may not be efficient in large countries with a large penetration of wind power in windy areas and bottlenecks in the transmission system. Splitting national markets into bidding areas that reflect these constraints have been practiced in the Nordic region for more than two decades. This leads to prices that reflect the expected amount of supply of wind power in each area, among other variables influencing the energy dispatch. To get the right price signals for generators and consumers, it is becoming increasingly important that the geographical bidding areas for the day-ahead market reflect the pattern of wind variations and transmission constraints.

Market splitting into areas prices will also lead to more transparency concerning the need for new transmission capacity. Large and frequent price differences between neighboring price areas clearly indicate the need for new transmission lines.

The Netherlands is similar to Western Denmark in area, climate, international connections, wind power and cogeneration volumes, but the electricity system is six times larger. This indicates that this type of market splitting is very unlikely to be useful within the Netherlands. In the UK the situation is quite different. There is already an imbalance between the location of generating capacity in the north and population centres in the south. So a large amount of wind power mainly in the north will add to the imbalance.

Some regions in Germany and Spain may have larger shares of wind power than Western Denmark, but so far, these regions are not identified as bidding areas in the electricity markets.

6 Findings and Final Comments

The current infrastructure and market organization in Western Denmark and within the Nordic power market is able to handle the current amount of wind power at more than 50% of the regional consumption in Western Denmark. The most important features to handle the variability and unpredictability of wind power in this region are the international transmission lines and the large amount of Hydropower and of CHP systems with heat storages within the region.

The analysis emphasizes the role of the market design and the accumulation of experience to be gained over many years. The long tradition and the design of the Nordic power market (Nord Pool) that was original designed to balance out variations in precipitation and water inflow to the hydro power stations, have implied a very flexible power system with a high share of energy flexibility on a yearly basis offered by thermal plants.

The last decades’ increasing deployment of variable renewable energy, especially wind power calls for another kind of flexibility in the system, namely power (effect) flexibility on the short term basis. The observations for Western Denmark in this chapter have shown that the Nordic power market is able to provide this kind of flexibility.

It was shown that the variations in hydro power (between dry, normal and wet precipitation years) are affecting the price level on a monthly basis. Whereas there is only a very small correlation between the amounts of wind power generated and the monthly prices. In addition, the water inflow to the hydro reservoirs is largest in the summer where the electricity demand is low. Whereas, it is normally more windy in the cold months than in the summer which imply that on average wind power generation follows the electricity demand.

On an hourly basis, the prices do correlate with the wind generation. However, the analysis for 2004–2014 shows that there have been relative few hours with extreme prices or consecutive hours with no wind or maximum wind. Even during the worst storm in ten years, when most of the wind capacity was cut off due to high wind speed, prices on the balancing market were not abnormal.

This illustrates how well wind and hydro power play together in the Nordic area. Hydro power generation is very variable on a yearly level. Whereas, the yearly wind power generation is much more predictable. The opposite is true at the short term (e.g. at the day-ahead market) where wind power is the variable generation and hydro power can be controlled according to the filling of the water reservoirs.

This synergy implies that on the one hand, hydropower can supply short-term power flexibility that facilitates the integration of wind power in the system. On the other hand, wind power can substitute hydro power in windy periods and thereby release more hydro power capacity that can be used to supply short-term power flexibility or be transmitted to neighboring countries. This is in benefits for all. Hydro power helps lowering the system integration costs of wind which increases the value of wind. Wind helps increasing the value of hydro power bye releasing capacity that can be used in high price periods.

Much further penetration of wind power will require additional measures. With the planed expansion of wind power at the Northern European power market in the future, it is doubtful if the electricity market by itself can generate enough flexibility. The Nordic system is able to handle the present amount of wind energy. But the hydro power capacity is limited and with the continuous growth of wind power deployment, it may not be enough in the future.

Therefore, for the future development we will have to look for the potentials of getting flexibility from other energy sectors at low costs. In particular demand response, stronger coupling to other energy markets (heat, gas and transport), and use of new technologies, e.g. electricity storages or electric vehicles, (Lund et al. [30]). The need for more flexibility to counteract variations from wind integration may also require improved system and market operation (IEA [15, 31]).

Finally, the most general recommendation is that bidding areas for the wholesale market should reflect external congestions caused by wind. This will lead to price differences between neighboring areas for a significant number of hours during the year as an incentive for trade that will benefit both. Western Denmark happens to be “born” as such bidding area.

Notes

- 1.

http://www.nordpoolspot.com/ (accessed on December 2017).

- 2.

http://energinet.dk/EN/Sider/default.aspx (accessed on December 2017).

References

Energistyrelsen, ENS 2012, Energiaftalen 22. marts 2012. https://ens.dk/. Accessed 26 Feb 2017

Borenstein, S.: The private and public economics of renewable electricity generation. J. Econ. Perspect. 26(1), 67–92 (2012)

Hirth, L., Ueckerdt, F., Edenhofer, O.: Integration costs revisited - an economic framework for wind and solar variability. Renew. Energy 24, 925–939 (2015)

Lamont, A.: Assessing the long-term system value of intermittent electric generation technologies. Energy Econ. 30(3), 1208–1231 (2008)

Borenstein, S.: The market value and cost of solar photovoltaic electricity production. CSEM Working Paper 176, University of California Energy Institute, Berkeley, California (2008)

Joskow, P.: Comparing the costs of intermittent and dispatchable electricity generation technologies. Am. Econ. Rev.: Pap. Proc. 100(3), 238–241 (2011)

Nicolosi, M.: The economics of renewable electricity market integration. An empirical and model-based analysis of regulatory frameworks and their impacts on the power market. Ph.D. dissertation, University of Cologne (2012)

Holttinen, H., Meibom, P., Orths, A., Lange, B., O’Malley, M., Tande, J.O., Estanqueiro, A., Gomez, E., Sder, L., Strbac, G., Charles Smith, J., van Hulle, F.: Impacts of large amounts of wind power on design and operation of power systems. Wind Energy 14(2), 179–192 (2011)

Hirth, L.: The market value of variable renewables: the effect of solar wind power variability on their relative price. Energy Econ. 38, 218–236 (2013)

Smith, C., Milligan, M., DeMeo, E., Parsons, B.: Utility wind integration and operating impact state of the art. IEEE Trans. Power Syst. 22(3), 900–908 (2007)

Brown, S., Rowlands, I.: Nodal pricing in Ontario, Canada: implications for solar PV electricity. Renew. Energy 34(1), 170–178 (2009)

Lewis, G.: Estimating the value of wind energy using electricity locational marginal pricing. Energy Policy 38(7), 3221–3231 (2010)

Hamidi, V., Li, F., Yao, L.: Value of wind power at different locations in the grid. IEEE Trans. Power Deliv. 26(2), 526–537 (2011)

Ueckerdt, F., Hirth, L., Luderera, G., Edenhofera, O.: System LCOE: what are the costs of variable renewables? Energy 63, 61–75 (2013)

International Energy Agency (IEA): The power of transformation: wind, sun and the economics of flexible power systems. OECD/IEA, Paris, France (2014)

Olsen, O.J., Skytte, K.: Competition and market power in Northern Europe. In: Glachant, J.-M., Finon, D. (eds.) Competition in European Electricity Markets, pp. 169–193. Edward Elgar Publishing Inc., Cheltenham (2003)

Skytte, K.: Fluctuating renewable energy on the power exchange. In: MacKerron, G., Pearson, P. (eds.) The International Energy Experience. Markets, Regulation and the Environment, pp. 219–231. Imperial College Press, London (2000)

Skytte, K., Ropenus, S.: Assessment and recommendations. Overcoming in short-term grid system regulatory and other barriers to distributed generation. Deliverable report D2, DG-GRID Project, Contract no. EIE/04/015/S07.38553 (2006)

Donkelaar, M., Maly, M., Skytte, K., Ropenus, S., Frias, P., Gomez, T.: Economic, policy and regulatory barriers and solutions for integrating more DER in electricity supply. Annual report, SOLID-DER Project, European Commission (2007)

Ropenus, S., Skytte, K.: Regulatory review and barriers for the electricity supply system for distributed generation in the EU-15. Int. J. Distrib. Energy Resour. 3(3), 243–257 (2007)

Jacobsen, H., Zvingilaite, E.: Reducing the market impact of large shares of intermittent energy in Denmark. Energy Policy 38(7), 3403–3413 (2010)

Grohnheit, P.E., Andersen, F., Larsen, H.: Area price and demand response in a market with 25% wind power. Energy Policy 39(12), 8051–8061 (2011)

Energinet.dk. https://en.energinet.dk. Accessed 26 Feb 2017

Jensen, S.G., Skytte, K.: Interactions between the power and green certificate markets. Energy Policy 30(5), 425–435 (2002)

Jensen, S.G., Skytte, K.: Simultaneous attainment of energy goals by means of green certificates and emission permits. Energy Policy 31(1), 63–71 (2003)

Morthorst, P.E.: Green certificates and emission trading. Energy Policy 31(1), 1–2 (2003)

Skytte, K.: Interplay between environmental regulation and power markets. EUI-RSCAS Working Papers, RSCAS no. 2006/04, European University Institute (EUI), Robert Schuman Centre for Advanced Studies (RSCAS) (2006)

Amundsen, E.S., Bergman, L.: Provision of operating reserve capacity: principles and practices on the Nordic electricity market. In: Competition and Regulation in Network Industries, vol. 2(1), pp. 73–98. Intersentia (2007)

Skytte, K.: The regulating power market on the Nordic power exchange Nord Pool: an econometric analysis. Energy Econ. 21, 295–308 (1999)

Lund, P., Lindgren, J., Mikkola, J., Salpakari, J.: Review of energy system flexibility measures to enable high levels of variable renewable energy. Renew. Sustain. Energy Rev. 45, 785–807 (2015)

International Energy Agency (IEA) and Nordic Energy Reserach (NORDEN): Nordic Energy Technology Perspectives. IEA/NORDEN, Oslo, Sweeden (2013)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2018 Springer International Publishing AG

About this chapter

Cite this chapter

Skytte, K., Grohnheit, P.E. (2018). Market Prices in a Power Market with More Than 50% Wind Power. In: Lopes, F., Coelho, H. (eds) Electricity Markets with Increasing Levels of Renewable Generation: Structure, Operation, Agent-based Simulation, and Emerging Designs. Studies in Systems, Decision and Control, vol 144. Springer, Cham. https://doi.org/10.1007/978-3-319-74263-2_4

Download citation

DOI: https://doi.org/10.1007/978-3-319-74263-2_4

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-319-74261-8

Online ISBN: 978-3-319-74263-2

eBook Packages: EngineeringEngineering (R0)