Abstract

Over the last 10 years or so a mathematical theory of bubbles has emerged, in the spirit of a martingale theory based on an absence of arbitrage, as opposed to an equilibrium theory. This paper attempts to explain the major developments of the theory as it currently stands, including equities, options, forwards and futures, and foreign exchange. It also presents the recent development of a theory of bubble detection. Critiques of the theory are presented, and a defense is offered. Alternative theories, especially for bubble detection, are sketched.

Recurrent speculative insanity and the associated financial deprivation and larger devastation are, I am persuaded, inherent in the system. Perhaps it is better that this be recognized and accepted.

–John Kenneth Galbraith, A Short History of Financial Euphoria, Forward to the 1993 Edition, p. viii.

Supported in part by NSF grant DMS-0906995.

The author wishes to thank the hospitality of the Courant Institute of Mathematical Sciences, of NYU, as well as INRIA at Sophia Antipolis, for their hospitality during the writing of this paper.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

These keywords were added by machine and not by the authors. This process is experimental and the keywords may be updated as the learning algorithm improves.

1 Introduction

The economic phenomenon that the popular media refers to as a financial bubble has been with us for a long time. A short adumbration of some economy wide bubbles would include the following major events (see [55] for a comprehensive history of bubbles through the ages):

-

The bubble known as Tulipmania which occurred in Amsterdam in the seventeenth century (circa 1630s) is the first documented bubble of the modern era. Some merchants had excessive wealth due to Holland’s role in shipping and world commerce, and as tulips became a fad, some rare and complicated bulbs obtained through hybrid techniques led to massive speculation in the prices of bulbs. One bulb in particular came to be worth the price of two buggies with horses, the then equivalent of two automobiles. As often happens with economy wide bubbles, when the bubble burst the economy of Holland went into a tailspin.

-

In the eighteenth century, John Law advised the Banque Royale (Paris, 1716–1720) to finance the crown’s war debts by selling off notes giving rights to the gold yet to be discovered in the Louisiana territories. When no gold was found, the bubble collapsed, leading to an economic catastrophe, and helped to create the French distrust of banks which lasted almost 100 years.

-

Not to be outdone by the French, the South Sea Company of London (1711–1720) sold the rights to the gold pillaged from the Inca and Aztec civilizations in South America, neglecting the detail that the Spanish controlled such trade and had command of the high seas at the time. As this was realized by the British public, the bubble collapsed.

-

The real king of bubbles, however, is the United States. A list of nineteenth, twentieth and now even twenty-first century bubbles would include the following, detailing only the crashes:

-

The 1816 crash due to real estate speculation.

-

With the construction of the spectacular Erie Canal connecting New York to Chicago through inland waterways, “irrational exuberance” (in the words of Alan Greenspan) led to the Crash of 1837.

-

Not having the learned its lesson in 1837, irrational exuberance due to the construction of the railroad system within the U.S. led to The Panic of 1873.

-

The Wall Street panic of October, 1907, where the market fell by 50 %, helped to solidify the fame of J.P. Morgan, who (as legend has it) stepped into the frayFootnote 1 and ended the panic by announcing he would buy everything. It also had some good effects, as its aftermath created the atmosphere that led to the creation and development of the Federal Reserve in 1913, via the Glass–Owen bill.Footnote 2

-

And of course the mother of all bubbles began with Florida land speculation as people would buy swamp land that was touted as beautiful waterfront property; this then segued into massive stock market speculation, ending with The Great Crash of 1929.

-

There was no runaway speculation in the US markets, nor major panics, in the 1940s and 1950s. But it began again with minor stock market crashes in the 1960s and 1980s.

-

The marvel of “junk bond financing” led to the fame of Michael Milken, the movie Wall Street and the stock market crash of 1987.

-

While it did not occur in the U.S., we need to mention the Japanese housing bubble, circa 1970–1989, which upon bursting led to Japan’s “lost decade,” one of a stagnant economy and “zombie” banks.

-

Back to the U.S. next, where speculation due to the commercial promise of the internet led to the “dot com” crash, from March 11th, 2000 to October 9th, 2002. Many of the internet dot-coms were listed on the Nasdaq Composite index, and it lost 78 % of its value as it fell from 5,046.86 to 1,114.11; a truly dramatic crash.

-

Finally, we are all familiar with the recent US housing bubble tied to subprime mortgages, and the creation of many three letter acronym financial products, such as ABS, CDO, CDS, and even CDO2. It is worth noting that the crash of 2007/2008, along with the one of 1929, escaped the economic borders of North America and thrust much of the world into economic depression.

-

It is of intrinsic interest to investigate the causes of financial bubbles, and there is a wealth of often insightful economic literature on the subject. This is not the purpose of this paper, which is rather to analyze prices and to try to determine if or if not a bubble is occurring, regardless of how it came about. For those with an understandable interest in the causes of bubbles, the author can recommend the little book of J.K. Galbraith [55], where Galbraith makes the case that speculation on a grand scale occurs when there is a new, or perceived as new, technological breakthrough (such as trade with the new world, the building of canals, the advent of railroads, junk bond financing, the internet, etc.) and that this can result in over enthusiasm and uncontrolled speculation. The more modern analysis of economists suggest that varied opinions among investors and short sales constraints can create financial bubbles (see for example [26, 41, 118, 138], just as a sampling). And recently, the interesting paper of Hong, Scheinkman, and Xiong [67] agrees with the conclusions of Galbraith, but takes the analysis further, beyond an explanation of simple overreaction on the part of investors to news. Hong et al. focus on the relations between investors and their advisers, the latter being classified into two types, “tech savvies” and “old fogies.” They discuss how reputation incentives create an upward bias among the recommendations of the tech savvy investors, which are taken at face value by those investors who are naïve. For an interpretation of how the recent housing bubble arose, one can consult [129]. Other interesting references are [19, 49, 139, 153, 154, 158].

To mathematically model a bubble, we start small, and consider an individual stock, rather than a sector (such as the technology sector), or an entire economy. If there is a bubble in the price of the stock, then the price is too high, relative to what one should pay for the stock. This seems intuitively obvious. But what is not obvious is: What then is the correct price of the stock? We assume such a stock is traded on an established exchange, and the theory of rational markets tells us that the price of the stock reflects exactly what the stock is worth, since if it were overvalued, people would sell it, and if it were undervalued, people would buy it. Such a theory eliminates the possibility of bubbles, and if we believe bubbles do in fact occur, we are forced not to accept this idea wholesale. Therefore we need a fair value for the stock.

This raises the question: Why does one buy a stock in the first place? Your brother-in-law might have a start-up and want you to participate by buying some stock in his company. This may be a bad investment, but good for your marriage. We will simplify life by assuming one buys stocks based only on their perceived investment potential. Moreover we will further simplify by assuming when one buys a stock, one is not speculating, and tries to pay a fair price for a long term investment, to the point where whether or not the stock goes up or down in the short run is irrelevant, and the only issue that matters is the future cash flow of the company. Nevertheless there is more of a risk in buying stocks than there is in banking money (especially when the deposits are insured by the government), so one can expect a rate of return with stocks that is higher than that of bank deposits, at least in the long run.Footnote 3 This return premium for taking an extra risk to buy stocks is known as “the market price of risk.”

So the compelling question we must first answer is: How do we determine what we call a fundamental price for a stock?

1.1 Organization

After the introduction, we first explain in Sect. 2 how to model the fundamental price of a risky asset. Since the fundamental price is expressed as a conditional expectation of future cash flows, with the conditional expectation being taken under the risk neutral measure, it is more easily explained in a complete market, since then the risk neutral measure is unique. We can then define a bubble as the difference between the market price of the risky asset in question, and the fundamental price. When the risky asset is simply a stock price, then the bubbles are always nonnegative. In Sect. 3 we establish the relationship between strict local martingalesFootnote 4 and bubbles, and give a theorem classifying bubbles into three types. In Sect. 4 we give examples of mathematical models of financial bubbles by exhibiting a method of generating strict local martingales as solutions of a certain kind of stochastic differential equation. This is based on a theorem of Mijatovic and Urysov [116], and we provide a detailed proof of the theorem (Corollary 5 of Sect. 4 in this paper). Special attention is given to the inverse Bessel process. We also present results on strict local martingales in Heston type models with stochastic volatility that go beyond the framework of Corollary 5, and we discuss the multidimensional case. We end by giving a criterion to determine whether or not the system is a strict local martingale through the use of Hellinger Processes.

In Sects. 5 and 6 we consider incomplete markets arising from a risky asset price process \(S = (S_{t})_{t\geq 0}\). Since incomplete markets have an infinite number of risk neutral measures, and since the fundamental price is defined using “the” risk neutral measure within the framework of complete markets, this is a bit of a thorny issue. Hence we review the method of letting the market choose the risk neutral measure originally proposed in [73] (see also [141, 142]), which works essentially by artificially completing the market through the use of call option prices. Once the risk neutral measure is chosen and temporarily fixed, the analysis proceeds analogously to the complete market case, with one important exception. The exception is that we allow the market choice of the risk neutral measure to change at random times, in a type of regime shift. This basically assumes the market is fickle, and while it always prices options in internally consistent ways (since otherwise there would be arbitrage), it can change this pricing from time to time, which actually represents a change in the selection of the risk neutral measure, from the infinite number of them compatible with the underlying risky asset price S. This method keeps the coefficients of the underlying stochastic differential equation unchanged, but we could equally and instead introduce a regime change where we change the underlying SDEs; this too may alter the structure of risk neutral measures, or it may not, depending on how dramatic is the change.

In Sect. 7 we consider what happens with calls and puts in the presence of bubbles. There are some surprising results, such as the loss of put-call parity (!) when bubbles are present, and that Merton’s “No Early Exercise” theorem for American calls no longer need hold, a fact first observed (to our knowledge) by Heston et al. [63] and by Cox and Hobson [30]. An analysis of the behavior of options in the presence of bubbles can be found in [122]. We then introduce the concept, originally due to Merton in 1973 [114] but refined mathematically successively in [88, 89], and finally in [131], and known as No Dominance. This extra assumption restores put call parity. Section 8 is devoted to a study of bubbles in foreign exchange, which is related to inflation. Here negative bubbles can occur, and Sect. 9 covers forwards and futures. Section 10 covers the controversial topic of trying to identify (in real time) when a given risky asset (such as a stock) is undergoing bubble pricing. This seems to be a question of great current interest, as the quotes given in this paragraph seem to indicate. Indeed, the quotations are from none other than Ben Bernanke (Chairman of the U.S. Federal Reserve system), William Dudley (President of the New York Federal Reserve), Charles Evans (President of the Chicago Federal Reserve), and Donald Kohn, Federal Reserve Board Vice Chairman.

Finally, in Sect. 11 we attempt to defend the local martingale approach to the study of bubbles from its critics. These criticisms seem to revolve around the use of strict local martingales, and the (technically mistaken) belief that they exist only in continuous time. Jacod and Shiryaev, in a 1998 paper [75], clarify the relationship between local martingales and generalized martingales in discrete time, and give necessary and sufficient conditions for a local martingale to be a martingale in discrete time. It is true that when a finite horizon price process in discrete time is nonnegative (such as a stock price) then as a consequence of the results of Jacod and Shiryaev, a nonnegative discrete time local martingale is indeed a martingale. So in this sense, when modeling stock prices (as we often are doing in this paper), it is indeed true that strict local martingale models do not exist for discrete time. But we argue in Sect. 11, as we have in [86], that this is just another reason of several that discrete time models are in fact inadequate to understand the full range of ideas required for a profound understanding of financial models.

We also discuss in Sect. 11 two of the leading alternative approaches to the study of bubbles, the first associated with P.C.B. Phillips and his co-authors, and the second associated with Didier Sornette and his co-authors. The key difference between these alternative approaches (of Phillips et al. and Sornette et al.) with the one presented here, is that both alternative approaches make assumptions (albeit very different ones) on the drift that leads to bubbles (under their understanding of what constitutes a bubble), whereas in our presentation the key assumptions related to bubbles revolve around the diffusive part of the model.

2 The Fundamental Price in a Complete Market

We begin with a complete probability space \((\Omega ,\mathcal{F},P)\) and a filtration \(\mathbb{F} = (\mathcal{F}_{t})_{t\geq 0}\) satisfying the “usual hypotheses.”Footnote 5 We let \(r = (r_{t})_{t\geq 0}\) be at least progressively measurable, and it denotes the instantaneous default-free spot interest rate, and

is then the time t value of a money market account. We work on a time interval \([0,{T}^{\star }]\) where \({T}^{\star }\) can be a finite fixed time T, or it can be ∞. We find that it is more interesting to consider a compact time interval (the finite horizon case, where \({T}^{\star } = T < \infty \)), but for now let us consider the general case. Next we let τ be the lifetime of the risky asset (or stock, to be specific), where τ is a stopping time, and \(\tau \leq {T}^{\star }\). τ can occur due to bankruptcy, to a buyout of the company by another company, to a merger, to being broken up by antitrust laws, etc.Footnote 6

Next we let \(D = (D_{t})_{0\leq t<\tau } \geq 0\) be the dividend process, and we assume it is a semimartingale. We let \(S = (S_{t})_{0\leq t<\tau }\) be nonnegative and denote the price process of the risky asset (again, we are thinking of a stock price here), and again, we are assuming it is a semimartingale. Since S has càdlàg paths,Footnote 7 it represents the price process ex cash flow. By ex cash flow we mean that the price at time t is after all dividends have been paid, including the time t dividend. But now we have to be a little more careful, since while the assumption that S is a semimartingale on the stochastic interval [0. τ) is necessary to exclude arbitrage opportunities, it is not sufficient. (See for example [83, 98, 127, 130]). That is, only a subclass of semimartingales exclude arbitrage opportunities. Let \(\Delta \in \mathcal{F}_{\tau }\) be the time τ terminal payoff or liquidation value of the asset. We assume that \(\Delta \geq 0\).

Finally, we let W be the wealth process associated with the market price of the risky asset plus accumulated cash flows:

Note that all cash flows are invested in the money market account.

It is standard (and desirable) to have a market which excludes arbitrage opportunities. There are different mathematical formulations of an arbitrage opportunity, but if one formulates them the right way then one has the validity of the first fundamental theorem of asset pricing: namely that the absence of arbitrage is mathematically equivalent to the existence of another probability measure Q, with the same null sets, that turns the price process into a martingale, or more generally a local martingale.Footnote 8 The correct formulation for the absence of arbitrage to hold and for the first fundamental theorem to hold in full generality was established by Delbaen and Schachermayer [34, 35]. (See alternatively [127].) If is called No Free Lunch with Vanishing Risk and if often referred to by its acronym NFLVR. Note that it need not be applied directly to the price process S but can be assumed as a hypothesis relative to any risky asset in question. In our case we want to assume that NFLVR holds for the wealth process defined in (2).

Henceforth, we assume NFLVR holds (and hence there are no arbitrage opportunities) which implies there exists at least one probability measure Q, with the same null sets as P (we write Q ∼ P), such that under Q we have that W is a local martingale. We make two more assumptions, both of which will be weakened later:

-

1.

The equivalent probability measure Q is unique (and hence the market is complete; see e.g. [83] and Sect. 5).

-

2.

The random variable \(W_{t} = \mathbf{1}_{\{t<\tau \}}S_{t} + B_{t}\int _{0}^{t\wedge \tau } \frac{1} {B_{u}}\mathit{dD}_{u} + \frac{B_{t}} {B_{\tau }} \Delta \mathbf{1}_{\{\tau \leq t\}}\) is assumed to be in L 1(dQ) for each t, \(0 \leq t \leq {T}^{\star }\).

The (now assumed to be) unique equivalent probability measure Q is often called a risk neutral measure, or the Equivalent Local Martingale Measure, sometimes abbreviated with the acronym ELMM. The term “risk neutral” comes from equilibrium theory. While individual people are risk averse when trading with their own money (and this is often mathematically modeled using utility functions), and perhaps people trading large sums with other people’s money are much less risk adverse, nevertheless the market in the whole is assumed to have risk aversion. By changing from the underlying probability P to an ELMM Q, we have an artificial transformation that generates risk neutral pricing in the market.Footnote 9 We use this risk neutral measure to give the market’s fundamental value for the risky asset; this should be the best guess for the future discounted cash flows, given one’s knowledge at the present time. If we take conditional expectations in (2) and rearrange the terms, this translates into:

The superscript \(\star \) will be used systematically to denote fundamental values.

Definition 1.

We define β t by

the difference between the market price and the fundamental price. (In a well functioning market, this difference is 0.) The process β is called a bubble.

3 Characterization of Bubbles

Our first observation is that we always must have \(S_{t} \geq S_{t}^{\star }\), t ≥ 0. This is of course equivalent to saying that the bubble β has the property β t ≥ 0 for all t, i.e., bubbles are always nonnegative.Footnote 10 This is an important point, so even though it is quite simple, we formalize it as a theorem. For simplicity we consider only the case where the stock pays no dividends, and the spot interest rate is 0. Note that it is only for simplicity, and an analogous result holds if the spot rate is not 0, and also if dividends are paid. If the spot rate is not 0, one needs to discount the final term. In the case of futures however, it matters whether or not the interest rates are deterministic, or random. We treat this is Sect. 9. For dividends, there are details to keep track of (for example when the stock is ex dividend, etc.), but the ideas are the same.

Theorem 1.

Let S be the nonnegative price process of a stock and assume S pays no dividends. Moreover assume the spot interest rate is constant and equal to 0. Let Q be a risk neutral measure under which S is a local martingale (and hence a supermartingale). Let \({S}^{\star }\) be the fundamental value of the stock calculated under Q, and let \(\beta _{t} = S_{t} - S_{t}^{\star }\) . Then β ≥ 0.

Proof.

Under these simplifying hypotheses of no dividends and 0 interest, the fundamental value of the stock is nothing more than

Since under Q the process S is a supermartingale, we have

and since \(S_{\tau } = \Delta 1_{\{\tau \leq {T}^{\star }\}}\), combining (4) and (5) gives the result. □

We can classify bubbles into three types, as shown in the following theorem, which was originally proved in [88]. For this theorem, we assume fixed a risk neutral measure Q under which both S and W are local martingales.

Theorem 2.

If in an asset’s price there exists a bubble \(\beta = (\beta _{t})_{t\geq 0}\) that is not identically zero, then we have three and only three possibilities:

-

1.

β t is a local martingale (which could be a uniformly integrable martingale) if \(\mathbb{P}(\tau = \infty ) > 0\) .

-

2.

β t is a local martingale but not a uniformly integrable martingale if τ is unbounded, but with \(\mathbb{P}(\tau < \infty ) = 1\) .

-

3.

β t is a strict \(\mathbb{Q}\) -local martingale, if τ is a bounded stopping time.

Proof.

Fix Q equivalent to P such that W is a local martingale under Q. Note that W t is a closable supermartingale, so there exists \(W_{\infty }\in {L}^{1}(\mathit{dQ})\) such that W t → W ∞ almost surely. Also, since S is a nonnegative local martingale under the risk neutral measure, \(\lim _{t\rightarrow \infty }S_{t} = S_{\infty }\) exists a.s. (cf., e.g., [128, Theorem 10, p. 8]). The fundamental wealth process is one’s best guess of future wealth, given today’s knowledge: \(W_{t}^{{\ast}} = E_{Q}(W_{\infty }\vert \mathcal{F}_{t})\). Note that analogously, \(W_{\infty }^{{\ast}}\) exists, and \(W_{\infty } = W_{\infty }^{{\ast}}\). Let

Then β t ′ is a (non-negative) local martingale since it is a difference of a local martingale and a uniformly integrable martingale. It is simple to check that

By the definition of wealth processes and (6), (7):

If τ < T for \(T \in \mathbb{R}_{+}\), then S ∞ = 0. A bubble \(\beta _{t} =\beta _{t}^{\prime} = 0\) for t ≥ τ and in particular β T = 0. If β t is a martingale,

It follows that β ⋅ is a strict local martingale. This proves (1). For (2) assume that β t is uniformly integrable martingale. Then by Doob’s optional sampling theorem, for any stopping time τ 0 ≤ τ,

and since β is optional, it follows from (for example) the section theorems of P.A. Meyer (see for example [39]) that β = 0 on [0, τ]. Therefore the bubble does not exist. For (3), \(E_{Q}[S_{\infty }\vert \mathcal{F}_{t}]\) is a uniformly integrable martingale and the claim holds. □

As indicated, there are three types of bubbles that can be present in an asset’s price. Type 1 bubbles occur when the asset has infinite life with a payoff at {τ = ∞}. Type 2 bubbles occur when the asset’s life is finite, but unbounded. Type 3 bubbles are for assets whose lives are bounded.

Of the three types of bubbles, the most interesting are those on a compact time interval, [0, T]. In this case we are dealing exclusively with Type 3 bubbles, and as seen in Theorem 2 we have that β will be a strict local martingale. Since \({S}^{\star }\) is a true martingale, and \(\beta = S - {S}^{\star }\), we have that β being a strict local martingale is equivalent to the price process S being a strict local martingale. Indeed, we see that:

Corollary 1.

We have a bubble on [0,T] if and only if the price process S is a strict local martingale.

For the important special case of a bounded horizon (that is, we are working on a compact time interval, [0, T]), we can summarize as follows:

Theorem 3.

Any non-zero asset price bubble β on [0,T] is a strict Q-local martingale with the following properties:

-

1.

β ≥ 0,

-

2.

β τ = 0,

-

3.

if β t = 0 then β u = 0 for all u ≥ t, and

-

4.

if no cash flows, then

$$\displaystyle{ S_{t} = E_{Q}\left (\left .\frac{S_{T}} {B_{T}}\right \vert \mathcal{F}_{t}\right )B_{t} +\beta _{t} - E_{Q}\left (\left . \frac{\beta _{T}} {B_{T}}\right \vert \mathcal{F}_{t}\right )B_{t} }$$for any \(\ t \leq T \leq \tau \leq {T}^{\star }\) .

This theorem states that the asset price bubble β is a strict Q- local martingale. Condition (1) states that bubbles are always non-negative, i.e. the market price can never be less than the fundamental value. Condition (2) states that the bubble must burst on or before τ. Condition (3) states that if the bubble ever bursts before the asset’s maturity, then it can never start again. Alternatively stated, condition (3) states that in the context of our model, bubbles must either exist at the start of the model, or they never will exist. And, if they exist and burst, then they cannot start again. Requiring bubbles to exist since the beginning of the modeling period is clearly a weak spot of the theory; fortunately this can be resolved within the context of incomplete markets, which allow for the concept of bubble birth. For this reason complete market models are ill suited to the study of bubbles, at least using our models of them. We will return to this subject in Sect. 6.

4 Examples of Bubbles

Of course it is of interest to know if such phenomena as bubbles occur, both in reality and in our models. We deal with our models first. Because we are working on a compact time interval, the fundamental value \({S}^{\star }\) will be a martingale as soon as \(\Delta \in {L}^{1}(\mathit{dQ})\), assuming no dividends and zero interest rate. In the presence of dividends and interest rates, other assumptions on integrability with respect to a given risk neutral measure enter the picture. Therefore the existence of a bubble becomes equivalent to the stock price process being a local martingale, which is not a martingale. (The space of all local martingales includes martingales as a subspace.) However it is easy to generate local martingales. Let us make the reasonable assumption that S follows a stochastic differential equation with a unique strong solution of the rather general form

where B is standard Brownian motion. Since Brownian motion has martingale representation, it generates complete markets (see, e.g., [83]). Therefore in this Brownian paradigm there is only one risk neutral measure Q. Under mild hypotheses on σ and b, including that σ never vanishes, (11) under Q becomes

and we have that S is a strict local martingale if and only if

for some ε > 0. This (and much more) is proved in detail in the papers [101, 116]. The idea goes back to Delbaen and Shirakawa [38]; see also [69]. However this is also easy to prove directly, using Feller’s test for explosions. We have the following results, which are based on remarks made to us by Dmitry Kramkov [102]. Theorem 4 is classic:

Theorem 4.

Let S be a nonnegative Q local martingale with S 0 = 1. Then S is a true martingale if and only if there exists a probability measure R, with R ≪ Q, and \(\frac{\mathit{dR}} {\mathit{dQ}}\vert _{\mathcal{F}_{t}} = S_{t}\) ; otherwise S is a strict local martingale.

The intuition behind why Theorem 4 is true, is that S has to have an expectation constant in time (and equal to one) in order to be a true martingale. Since it is nonnegative, this turns out also to be sufficient. If the expectation decreases with time, then R would be a sub probability measure, but not a true probability measure: some “mass would escape to ∞.”

Following Jacod and Shiryaev [76, pp. 166ff], for a stopping time ν we let P ν denote the restriction of P to the sigma algebra \(\mathcal{F}_{\nu }\), and we define R ≪ loc Q if there exists a sequence of stopping times τ n of stopping times such that \(\tau _{n} \nearrow \infty \) a.s. and \(R_{\tau _{n}} \ll P_{\tau _{n}}\) for each n. With the hypotheses of Theorem 4 one has automatically that R ≪ loc Q. Indeed, we have a true martingale when R ≪ Q without the “local” caveat. Using Feller’s test for explosions for one dimensional diffusions (see [97, 109] as in the recent treatment in [117]), we find the criterion of Mijatovic and Urusov [116, Corollary 4.3].

Theorem 5.

Let B be a Q Brownian motion and let S be of the form

Then S is a martingale if and only if

where σ(x) = xa(x).

Proof.

By Girsanov’s theorem, (14), under R becomes

for an R Brownian motion β. Mijatovic and Urusov show (though they are not the first to do something like this) that S is a true martingale if and only if \(\int _{0}^{t}a{(S_{s})}^{2}\mathit{ds} < \infty \) a.s. (dQ). This implies S cannot explode. To use Feller’s test to see if S explodes, we use the notation of Karatzas and Shreve [97]. Simple calculations show that in this case their scale function p is given by \(p(x) = -\frac{1} {x} + C\), and their speed measure m is

Finally their function \(v(x) =\int _{ c}^{x}\left (p(x) - p(y)\right )m(\mathit{dy})\) equals

and since in the second integral we have \(\frac{y} {x} < 1\) we get that \(v(+\infty ) = +\infty \) if and only if \(\int _{c}^{\infty }{ \frac{y} {\sigma }^{2}(y)}\mathit{dy} = +\infty \). Taking σ(x) = xa(x) means in this context

Therefore we see that by Feller’s test S does not explode if and only if \(\int _{1}^{\infty } \frac{1} {xa{(x)}^{2}} \mathit{dx} = +\infty \), and we are done. □

We end this discussion by noting that we do not really need to use Feller’s test, but could have instead used the local time-space formula of stochastic calculus (see for example [128]). Namely we have that

where \(L_{T}^{x}\) is the local time in x at time T of S. Since for almost all ω we have \(x\mapsto L_{T}^{x}(\omega )\) is a continuous function of x that vanishes off a compact set, and if the function a never vanishes, we can conclude \(0 <\epsilon (\omega ) \leq L_{T}^{x}(\omega ) < K(\omega ) < \infty \) and once again we can deduce the result. This approach is developed in detail in [116].

Of course one can ask for examples of bubbles coming from the markets. For economy wide bubbles there are many, as we mentioned in the introduction. In the case of individual assets, we detail examples in Sect. 10 later in this paper. A recent paper of X. Li, M. Lipkin, and R. Sowers [106] has shown a way in which bubbles can arise as a consequence of short squeezes related to bankruptcy stocks. There are of course many more examples, as a simple Google Scholar search will exhibit. Strict local martingales have received attention in the mathematical literature irrespective of their connection to models of financial bubbles. See for example [46, 137, 146].

4.1 Simulations for the Inverse Bessel Process

The inverse Bessel process is perhaps the most famous (or infamous) strict local martingale. It goes back at least to the renowned 1963 paper of Johnson and Helms [93] who gave it to provide an example of a nonnegative supermartingale which is uniformly integrable but is not of “Class D”, the class proposed by P.A. Meyer when he solved Doob’s decomposition conjecture, by showing it did not hold in full generality, but that it did nevertheless hold for supermartingales of Class D (the theorem is now known as the Doob–Meyer Decomposition Theorem of Supermartingales). The construction of Johnson and Helms is now classical: Let W be a standard three dimensional Brownian motion starting from the point (1, 0, 0). Let \(u(p) = 1/r\), where \(r =\parallel p \parallel \), the Euclidean distance of \(p \in {\mathbb{R}}^{3}\) to the origin. Define a process X by X t = u(W t ) for t ≥ 0. That is,

Then X is a uniformly integrable nonnegative process, with finite values a.s. because W never hits the origin with probability 1, and Itô’s formula shows that X is a local martingale, because u is the Newtonian potential and therefore a harmonic function for Brownian motion in \({\mathbb{R}}^{3}\). However simple calculations show that \(t\mapsto E(X_{t})\) is not constant (these calculations are given in detail in the little book of Chung and Williams [29]) and indeed E(X 0) = 1 while lim t → ∞ E(X t ) = 0. An alternate representation for the inverse Bessel process is as a solution to a stochastic differential equation of the form

where B is a standard one dimensional Brownian motion, and therefore since (16) is of the form of Corollary 5, we know from the Mijatovic–Urysov theorem that X is a strict local martingale. Nevertheless, it is easier to simulate paths of X using the representation given in (15), so it is nice to have both methods of representing X. One can see the two representations [(15) and (16)] of X are equivalent by applying Itô’s formula to the X given in (15).

To show that the inverse Bessel process has paths that can behave as if they are paths of a stock price with bubbles, we have the following simulationsFootnote 11 (Fig. 1).

Note that a roughly half of the simulations of the sample paths of the inverse Bessel could reasonably represent a history of the price of a stock that underwent bubble pricing. For clarity, we isolate one of these paths in Fig. 2:

4.2 Simulations for Stochastic Differential Equations

It is nice to go beyond the canonical case of the inverse Bessel process, and to consider other simple models of local martingales, to see if their simulations agree with one’s expectations for a model of a bubble price process. The theory tells us that they should, but one can always ask: Do simulations back up the theory? In this respect we are grateful to Jing Guo, who (at our request) simulated solutions of SDEs of the form

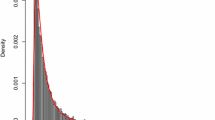

for various values of α, with of course α > 0 always. One of his observations is that as α grows, the bubble peaks get more peaked: that is, they both get higher, and they also get narrower. Figure 3 below illustrates what happens, with a graph of the average of 24 paths, for α = 0. 3:

Note that we have not included the drift in the models used for these pictures, and yet certainly in practice there is a drift, as far as the data is concerned. (The dynamics under the risk neutral measure removes the drift, but the data should reflect the dynamics under the objective measure, not the risk neutral measure.) When a drift is present, it should diminish the future peaks that the simulations show occur after the initial primary peak, but we are not including here even more simulations in order to illustrate that.

4.3 The Case of Stochastic Volatility

While the examples provided by equations of type (11) form a wide and useful class of equations, several examples that include stochastic volatility already exist in the literature. They provide examples of strict local martingales (and hence bubbles on a compact time interval [0, T]) for models with stochastic volatility.

Theorem 6 (Sin).

Assume there are no cash flows on the underlying asset, B is as in (2), that (W 1 ,W 2 ) is a standard two dimensional Brownian motion, and let \((S_{t},v_{t})\) satisfy

under the risk neutral measure Q where S 0 = x, v 0 = 1, α > 0, ρ ≥ 0, b > 0, a 1 , σ 1 , a 2 , σ 2 are constants. Then, \(\frac{S_{t}} {B_{t}}\) is a strict local martingale under Q if and only if \(a_{1}\sigma _{1} + a_{2}\sigma _{2} > 0\) .

For another example in this vein the reader can consult the work of B. Jourdain [94]. Also, L. Andersen and V. Piterbarg [3], of Bank of America and Barclay’s Capital respectively, consider a class of stochastic volatility models of the form

where \(({W}^{1},{W}^{2})\) is a two dimensional Brownian motion with correlation coefficient ρ.

Note that this is a generalization of the model of Sin above, and adds the feature that the correlation coefficient of the noise processes plays an important role. Anderson and Piterbarg in [3] are not trying to determine if a process is in a bubble or not, but rather their main thrust is to determine if extensions of what is known as the Heston model, a simple model using stochastic volatility, are reasonable in a financial context or not; they find that it depends on a range of parameters. And almost in passing, they discover a characterization of when the model forms a true martingale, or is a strict local martingale. This inter alia provides a simple test to determine if a process in their context is a strict local martingale, or a true martingale. They establish the following result, among many others.

Theorem 7 (Andersen–Piterbarg).

For the model (17) above, if \(p \leq \frac{1} {2}\) or \(p > \frac{3} {2}\) then X is a true martingale, and if \(\frac{3} {2} > p > \frac{1} {2}\) , X is a true martingale for ρ ≤ 0 and it is a strict local martingale for ρ > 0. For the case \(p = \frac{3} {2}\) , X is a true martingale for \(\rho \leq { \frac{1} {2}\epsilon \lambda }^{-1}\) , and X is a strict local martingale for \(\rho >{ \frac{1} {2}\epsilon \lambda }^{-1}\)

Perhaps the most definitive result already existing in the literature is that of P.L. Lions and M. Musiela [107]. Indeed, in their interesting paper they prove the results in Theorem 8 and in the more general result Theorem 9.

Theorem 8 (Lions–Musiela).

Let \(Z_{t} =\rho W_{t} + \sqrt{1 {-\rho }^{2}}B_{t}\) where \((W_{t},B_{t})\) is a standard two dimensional Brownian motion, and let (F,σ) solve

with

Suppose in addition that the following condition holds

then \(E(F_{t}\vert \ln F_{t}\vert ) < \infty ,E(\sup _{0\leq s\leq t}\vert F_{s}\vert ) < \infty \) for all t ≥ 0 and F t is an integrable nonnegative martingale. On the other hand, if the following holds:

for some smooth, positive, increasing function ϕ such that \(\int _{\epsilon }^{\infty }\frac{1} {\phi (\xi )}d\xi < \infty \) , for all ε > 0, then F t is a strict local martingale, and we have \(E(F_{t}) < F_{0}\) for all t > 0.

We observe that in the special case that b = 0 and μ(ξ) = αξ with α > 0, then (23) is equivalent to ρ ≤ 0, while (24) is equivalent to ρ > 0 (take ϕ(ξ) = ξ 2). Therefore we see that the correlation coefficient ρ plays an important role in determining whether or not the process \((F_{t})_{t\geq 0}\) is a strict local martingale.

Lions and Musiela go on to consider a more general case than that of Theorem 8. Instead of (18) and (19), they consider the equations

and again they want conditions under which F t is a martingale, and conditions under which F t is a strict local martingale. Their reasons for such an analysis are again not really related to bubble detection, but instead address the important issue as to whether or not certain stochastic volatility models are “well posed or not.” As with Anderson and Piterbarg, in Theorem 7, they provide, inter alia, a parametric framework for detecting whether or not a process is a martingale or a local martingale, based an a range of parameter values. We have the following theorem:

Theorem 9 (Lions–Musiela).

With \((F_{t})_{t\geq 0}\) given by (25) and (26) , and W and Z given as in Theorem 8,

-

1.

If ρ > 0 and if γ + δ > 1, we assume that b satisfies

$$\displaystyle{ \limsup _{\xi \rightarrow \infty }\frac{b(\xi ) {+\rho \alpha \xi }^{\gamma +\delta }} {\xi } < \infty . }$$(27)Then \((F_{t})_{t\geq 0}\) is an integrable nonnegative martingale and

$$\displaystyle{E(F_{t}\vert \ln F_{t}\vert ) < \infty ,\quad E(\sup _{0\leq s\leq t}\vert F_{s}\vert ) < \infty \quad \text{ for all }t \geq 0.}$$ -

2.

If ρ > 0,γ + δ > 1 and b satisfies

$$\displaystyle{ \liminf _{\xi \rightarrow \infty }\frac{b(\xi ){_{\rho }\alpha \xi }^{\gamma +\delta }} {\phi (\xi )} > 0 }$$(28)for some smooth, positive, increasing function ϕ such that \(\int _{\epsilon }^{\infty }\frac{1} {\phi (\xi )}d\xi < \infty \) , then \((F_{t})_{t\geq 0}\) is a strict local martingale (and not a true martingale), and we have \(E(F_{t}) < E(F_{0})\) for all t > 0.

4.4 Removal of Drift in the Multidimensional Case, and Strict Local Martingales

The multidimensional case is intrinsically interesting, since it is easy to imagine contagion within bubbles. The most obvious case might be that instead of an individual stock undergoing bubble pricing, the phenomenon might apply to an entire financial sector, such as technology stocks, automotive stocks, telecommunications, etc. Therefore it is interesting to understand some examples of multidimensional bubbles.

Since we know from the one dimensional case that strict local martingales are more likely if the coefficient σ increases quickly to ∞, we assume that σ is only locally Lipchitz. This guarantees existence and uniqueness of solutions up to an explosion time ξ, which can be ∞ but need not be in general. Let J = (0, ∞) and J i be the ith copy of J, and let \(I = \Pi _{i=1}^{d}J_{i}\), a subset of \({\mathbb{R}}^{d}\). We let

where μ and σ are locally Lipschitz functions. We let W denote a d dimensional Brownian motion, and then our stochastic differential equation takes the usual form

We make the hypotheses that the solution process Slives in the positive orthant.

The simplest case is to assume the square matrix σ is invertible. Then we can find a vector δ such that \(\sigma \times \delta = -\mu\). We also assume that δ is locally bounded. Our candidate Radon Nikodym process will as usual be an exponential local martingale:

where we set Z t = 0 on {t ≥ ξ}.

We assume that \(\int _{0}^{\xi \wedge t} \parallel \delta (S_{s}) {\parallel }^{2}\mathit{ds} < \infty \) on the event {t < ξ}, so that Z is well defined. Z is of course a nonnegative local martingale (since it solves a multidimensional exponential equation, with driving term being a continuous stochastic integral), hence (by Fatou’s Lemma) a supermartingale, and since the time horizon T is fixed, we have

Note that since we are in a multidimensional Brownian paradigm, by (for example) the Kunita–Watanabe version of the martingale representation theorem, we know that all local martingales have continuous paths, and cannot therefore jump to 0, even at the time T. (See for example [128, Theorem 43, p. 188].)

We next use a technique present in the book by Karatzas and Shreve [97, Exercise 5.38, p. 352] for one dimension, and developed in much more generality and for multiple dimensions in Cheridito et al. [27]. We repeat it here since for our case, the argument is perhaps easier to follow than the more general one treated in [27]. We let

the first exit time from the solid \({[ \frac{1} {n},n]}^{d}\). Note that τ n ↗ ↗ ξ as n → ∞, where τ n < ξ for each n. We next modify μ and σ, calling the new coefficients μ n and σ n , where μ n and σ n agree with μ and σ on \({[ \frac{1} {n},n]}^{d}\), and also are globally Lipschitz, and σ n is also invertible. We then have that there exists a unique, everywhere defined, and nonnegative solution S n of the auxiliary equation

where B is again a Brownian motion. Next we define δ n such that \(\sigma _{n} \times \delta _{n} = -\mu _{n}\), and define

which is well defined globally since L n is a local martingale with

and hence \([{L}^{n},{L}^{n}]_{t} \in {L}^{1}\) and L n is actually a (true) square integrable martingale. However by Novikov’s criterion (see for example [128]) we also have that the stochastic (also known as the Doléans–Dade) exponential \(\mathcal{E}({L}^{n})\) is a martingale. We let

and again, D n is a (nonnegative) martingale, so there is no problem in asserting the limit above exists. D n so defined is a supermartingale, by Fatou’s Lemma. We next relate it to the process Z defined in (31). For n ≥ m we have \(D_{t}^{n} = D_{t}^{m}\text{ for }t \leq \tau _{m}\), and hence for t < ξ we define \(D_{t} =\lim D_{t}^{n} \geq 0\), as n → ∞. Note that D t > 0 on {t < ξ} ∩ { D 0 > 0}. Finally, for t < ξ we have \(D_{t} = D_{0} \frac{Z_{t}} {Z_{0}}\). All this is preamble to defining a sequence of new measures:

Using Girsanov’s theorem we have that \(W_{t}^{n} = W_{t} +\int _{ 0}^{t\wedge \tau _{n}}\delta (S_{s}^{n})\mathit{ds}\) is a Q n Brownian motion up to τ n , giving rise to the SDE system (up to time τ n ):

and using the uniqueness in law of the solutions we have that the Q n measures are compatible and give an über measure Q with \({Q}^{n} = Q\vert _{\mathcal{F}_{\tau _{n}}}\) for each n, with

Theorem 10.

With Z,Q, as defined above, and ξ the explosion time of S, we have

Proof.

Let \(A \in \mathcal{F}_{T}\). Recalling that D = Z a.s. on the event {T < ξ}, we have:

again by the monotone convergence theorem. The theorem follows by taking \(A = \Omega \). □

Corollary 2.

Let S be as given in (30) and Z be as given in (31) . With the notation and assumptions of Theorem 10, if S does not explode under Q, then Z is a true martingale. If S does not explode under P, then Z is a martingale if and only if S does not explode under Q.

Proof.

Let us first assume that S does not explode under Q. But Z is a martingale if and only if E(Z T ) = 1, and this happens if and only if Q(ξ > T) = 1. Next we suppose that S does not explode under P. Then Z is a supermartingale, so \(E_{P}(Z_{T}) \leq 1\). Therefore if S does not explode under Q, we have \(E_{P}(Z_{T}1_{\{\xi >T\}}) = 1\). However since \(E_{P}(Z_{T}) \leq 1\), and Z T = 0 on {T ≥ ξ} a.s., we deduce the result. □

Why do we care whether or not Z is a martingale or only a local martingale? We know that the solution S of (30) is nonnegative and let us suppose it does not explode under P. We know that under a risk neutral measure the drift disappears and S is always a vector of at least local martingales, and it is a vector of martingales if and only if S does not explode in each of every component, and as we have seen by Corollary 2, this is tied to whether or not Z is a martingale. This is nice to know, but it is not much help in analyzing whether or not a given system is a martingale or a strict local martingale, the key property for telling whether or not we have a financial bubble.

We next give a criterion to determine whether or not the system is a strict local martingale through the use of Hellinger Processes. We use freely results about Hellinger Processes from the book of Jacod and Shiryaev [76]. First we note that if Q and P are two probabilities, we can define \(R = \frac{P+Q} {2}\) and then P ≪ R and Q ≪ R. We let \(X = \frac{\mathit{dP}} {\mathit{dR}}\) and \(Y = \frac{\mathit{dQ}} {\mathit{dR}}\), with X = (X t ) t ≥ 0 and Y = (Y t ) t ≥ 0 being their respective martingale versions, through projections onto the filtration. We set \(U_{t} = \frac{X_{t}} {Y _{t}}\), and define

While we do not reproduce the proof here, Younes Kchia has shown (2011, private communication):

Theorem 11.

Let the process Z be given as in (31) , the process α be as given in (34) , and the probability Q be as given in (33) . We then have that Z is a true martingale if and only if \(Q(h(\frac{1} {2})_{T} < \infty ) = 1\) and Q(sup 0≤t≤T α t < ∞) = 1. Here \(h(\frac{1} {2})_{T}\) is the Hellinger process of order \(\frac{1} {2}\) between P and Q.

We note that in the case considered above, if all processes are continuous and using \(R = \frac{P+Q} {2}\), we have

(See for example [76, p. 236].) We also note that these are much less practical conditions to check than those we have in the one dimensional case. We will see later that the one dimensional case presents its own formidable problems if we want to check if a condition such as (13) holds, in order to determine whether or not S is a strict local martingale.

For more ways to generate strict local martingales, as well as a study of their asymptotic behaviors, we refer the interested reader to [122]. Related papers involving strict local martingales include [11, 15, 30, 50, 96, 108], as well as the recent book [124].

5 Incomplete Markets: Choosing a Risk Neutral Measure

When we consider incomplete markets we immediately have a problem: How do we choose a risk neutral measure so that we can well define the fundamental value of a risky asset? The Second Fundamental Theorem of Finance states that a market is incomplete if and only if there exists an infinite number of equivalent risk neutral measures (see, e.g., [37], or [83]), so the question is not a trivial one. Many different methods have been proposed to solve this question, including (with sample references) indifference pricing (see for example the volume edited by R. Carmona [20]), choosing a risk neutral measure by choosing one that minimizes the entropy (or alternatively the “distance”) between the objective measure and the class of risk neutral measures (see for example the excellent paper of Grandits and Rheinlander [60]), by minimizing the variance of certain terms in the semimartingale decomposition, known as choosing the minimal variance measure (see for example Föllmer–Schweizer [53], or the subsequent results of Monat and Stricker [119]). Each of these methods works but they all give the uneasy feeling of arbitrariness, whose main value is a canonical procedure to choose a risk neutral measure. Instead, and as an alternative, we will sketch here a procedure due to Jacod and this author [73], which gives conditions under which it is apparent that the market has itself chosen a unique risk neutral measure. A similar approach (with a similar result) was taken in Schweizer and Wissel [141, 142], albeit in a more restrictive case (i.e., restricted to the Brownian paradigm). When sufficient conditions hold for the uniqueness of a risk neutral measure compatible with all market prices, it seems intuitively reasonable to use that risk neutral measure for pricing purposes, since it is the one the market itself is using.

The basic idea of the article [73] is to take an inherently incomplete market, and to complete it artificially by including option prices. This is accomplished by modeling the market price S of our risky asset together with a family of traded options. In this way, the options can in theory “complete” the market, rendering the choice of a compatible risk neutral measure unique. This idea is not new with [73], and its beginnings can be traced to the late 1990s, with the works of Dengler and Jarrow [40], Dupire [43], Derman and Kani [102], and also Schönbucher [140]. Note that if one ignores the options, the model depending only on the risky asset price remains incomplete, with an infinite choice of risk neutral measures, and we call this set \(\mathbb{Q}_{S}\). Therefore if the option prices change, for whatever reason, they could become compatible with a different choice of risk neutral measure in \(\mathbb{Q}_{S}\), and it is this flexibility that allows us to include bubble birth in our model, in the incomplete case.

We assume the following model for the stock price X. First, in the continuous case we suppose that

In the general case, when there are jumps, we suppose that

Here we are using established notation for stochastic integrals with respect to Brownian motions W i and random measure μ, or compensated random measure μ − ν, see for example the book of Jacod and Shiryaev [76]. We assume also that ν factors: ν(dt, dx) = dtF(dx). The index set I is assumed finite. In (36) X 0 > 0 is non-random and the coefficients a, σ i and ψ are such that the integrals and sums above make sense: that is, a and σ i are predictable and ψ is \(\tilde{\mathcal{P}}\)-measurable, and

for all t. (We use \(\tilde{\mathcal{P}}\) to denote the product σ algebra \(\mathcal{P}\otimes \mathcal{R}\) on \(\Omega \times \mathbb{R}_{+} \times \mathbb{R}\).)

Of course these coefficients should also be such that X t > 0: this amounts to saying that they factor as \(a_{t} = X_{t-}\bar{a}_{t}\) and \(\sigma _{t}^{i} = X_{t-}\bar{\sigma }_{t}^{i}\) and \(\psi (t,x) = X_{t-}\bar{\psi }(t,x)\) with \(\bar{\psi }> -1\) identically, with \(\bar{a}{,\bar{\sigma }}^{i}\) and \(\bar{\psi }\) satisfying (37), but it is more convenient to use the form (36). Note that this represents the most general semimartingale driven by μ and the W i’s that has a chance to satisfy the hypotheses NFLVR (No Free Lunch with Vanishing Risk) of Delbaen and Schachermayer.

For options, we consider a fixed pay-off function g on (0, ∞) which is nonnegative and convex, and we denote by P(T) t the price at time t ∈ [0, T] of the option with pay-off g(X T ) at expiration date T. We also assume that g is not affine, otherwise P(T) t = g(X t ) and we are in a trivial situation.

We denote by \(\mathcal{T}\) the set of expiration dates T corresponding to tradable options (always with the same given pay-off function g), and by \(T_{\star }\) the time horizon up to when trading may take place. Even when \(T_{\star } < \infty \), there might be options with expiration date \(T > T_{\star }\), so we need to specify the model up to infinity.

In practice \(\mathcal{T}\) is a finite set, although perhaps quite large. For the mathematical analysis it is much more convenient to take \(\mathcal{T}\) to be an interval, or perhaps a countable set which is dense in an interval. We consider the case where \(T_{\star } < \infty \) and \(\mathcal{T} = [T_{0},\infty )\), with \(T_{0} > T_{\star }\).

Apart from the fact that P(T) T = g(X T ), the prices P(T) t are so far unspecified, and the idea is to model them on the basis of the same W i and μ, rather than with X. However, since these are option prices, they should have some internal compatibility properties.

Indeed, if the option prices were derived in the customary way, we would have a measure \(\mathbb{Q}\) which is equivalent to \(\mathbb{P}\), and under which X is a martingale and g(X T ) is \(\mathbb{Q}\)-integrable and \(P(T)_{t} = \mathbb{E}_{\mathbb{Q}}(g(X_{T})\vert \mathcal{F}_{t})\) for t ≤ T. Then of course P(T) is a \(\mathbb{Q}\)-martingale indexed by [0, T]. But we can also look at how P(T) t varies as a function of the expiration date T, on the interval [t, ∞). That is, we are taking the non customary step of fixing t, and considering P(T) t as a process where T varies. Since X is a quasi-left continuous martingale and g is convex, then \(T\mapsto g(X_{T})\) is a quasi-left continuous submartingale relative to \(\mathbb{Q}\), and this implies that \(T\mapsto P(T)_{t}\) is non-decreasing and continuous for T ≥ t. Observe that this property holds \(\mathbb{Q}\)-almost surely, hence \(\mathbb{P}\)-almost surely as well because \(\mathbb{P}\) and \(\mathbb{Q}\) are equivalent.

Remark 12.

We wish to emphasize that, for example in the case of European call options, the usual theory calls for \(P(T)_{t} = \mathbb{E}_{{\mathbb{Q}}^{\star }}((X_{T} - K)_{+}\vert \mathcal{F}_{t})\) for some risk neutral measure \({Q}^{\star }\). We do not make this assumption here. Indeed, the previous paragraph is simply motivation for us to assume a priori that \(T\mapsto P(T)_{t}\) is non-decreasing and continuous. This seems completely reasonable from the viewpoint of practice, where (in the absence of dividends or interest rate changes and anomalies) it is always observed that \(T\mapsto P(T)_{t}\) is nondecreasing. In the language of practitioners, if it were not it would imply a “negative pricing of the calendar,” which makes no economic sense Lipkin, American stock exchange, 2007, private communication. Nevertheless we warn the reader that there are pathological examples where this assumption does not hold: for example if X is the reciprocal of a three dimensional Bessel process starting at X 0 = 1, then X is a local martingale for its natural filtration, but \(T\mapsto P(T)_{0}\) is not increasing, since P(0)0 = 0, P(T)0 > 0 for T ∈ (0, ∞), but lim T → ∞ P(T)0 = 0, hence \(T\mapsto P(T)_{0}\) cannot be increasing for T ≥ 0. Thus our assumption \(T\mapsto P(T)_{t}\) is increasing in T rules out the possibility of the market being governed by such price processes. This is an important exception, since the inverse Bessel process is the classic example of a strict local martingale, going back to the paper of Johnson and Helms [93]. The inverse Bessel process is of course a canonical example of a strict local martingale, fitting into the theory of when there are bubbles, so it would seem that this particular theory is excluding precisely the case where there are bubbles in call options, a topic treated in Sect. 7. Note however that in the proofs presented in [73], the assumption that \(T\mapsto P(T)_{t}\) is increasing in T is not essential, and could be replaced simply with \(T\mapsto P(T)_{t}\) is absolutely continuous as a function of T. This change allows us to apply this theory to the more general case where bubbles in option prices are included.

We write

In this case, the inverse Bessel process and other local martingales are included. The function f has the representation

We further assume that the process P(T 0) is given for \(t \leq T_{\star }\) by

in the continuous case, and in the general case by

where the above coefficients are predictable and satisfy

a.s., and further the (non-random) initial condition P(T 0)0 and these coefficients are such that we have identically

Finally we assume that we have \(\int _{T_{0}}^{T}\chi (s)_{T_{\star }}\mathit{ds} < \infty \) a.s. for all T > T 0, where

An example of the type of results obtained in [73] is when trading takes place up to time \(T_{\star }\), and the expiration dates of the options are all T ≥ T 0, where \(T_{0} > T_{\star }\). We denote \(\mathcal{M}_{\text{loc}}(T_{\star },T_{0})\) the collection of risk neutral measures for X that are compatible with the option structure so that no arbitrage opportunities exist. The following result is shown in [73]:

Theorem 13.

Consider a \((T_{\star },T_{0})\) partial fair model such that the set \(\mathcal{M}_{\text{loc}}(T_{\star },T_{0})\) is not empty. Then this set is a singleton if and only if, for a good version of the coefficients of the model, we have the following property: the system of linear equations

where \(((\beta _{i}),y) \in \Upsilon ^{\prime}(\omega ,s)\) , has for its only solution β i = 0 and y = 0 up to a Lebesgue-null set.

A consequence is that we see when conditions such as those in Theorem 13 above are met, the market prices for the options have uniquely determined a risk neutral measure. Also, should the market change its collective mind about the pricing of options, it could still choose a unique risk neutral measure, but a new one. Such phenomena have been noticed by economists, and it is referred to colloquially as the sun spot theory, since occasionally the sun gets sun spots, and they appear to happen randomly and without explanation (see for example [7, 22]).

6 Incomplete Markets: Bubble Birth

We use the idea of the previous section to extend our model of the economy to allow for the possibility of bubble “birth” after the model starts. A modification involves the market exhibiting different local martingale measures across time. We note that this is different from the usual paradigm of choosing an initial equivalent local martingale measure, and remaining with it fixed as our choice for all time, but we will see it is not that different from the standard notion of regime change. Indeed, shifting local martingale measures corresponds to regime shifts in the underlying economy (in any of the economy’s endowments, beliefs, risk aversion, institutional structures, or technologies). For pedagogical reasons we choose a simple and intuitive structure consistent with this extension.

To begin this extension, we need to define the regime shifting process. Let \((\sigma _{i})_{i\geq 0}\) denote an increasing sequence of random times with σ 0 = 0. The random times \((\sigma _{i})_{i\geq 0}\) represent the times of regime shifts in the economy. It is important that these times σ i be totally inaccessible stopping times. (See for example [128] for definitions and properties of totally inaccessible stopping times.) For if they were to be predictable, traders could see the regime shifts coming and develop arbitrage strategies around the shifts.Footnote 12 If we are working within a minimal Brownian paradigm, then there are no totally inaccessible stopping times, so we would need to consider a larger space that supports such times.

We let \(({Y }^{i})_{i\geq 0}\) be a sequence of random variables characterizing the state of the economy at those times (the particular regime’s characteristics) such that \(({Y }^{i})_{i\geq 0}\) and (σ) i ≥ 0 are independent of each other. Moreover, we further assume that both \(({Y }^{i})_{i\geq 0}\) and (σ) i ≥ 0 are also independent of the underlying filtration \(\mathbb{F}\) to which the price process S is adapted.

Define two stochastic processes \((N_{t})_{t\geq 0}\) and (Y t ) t ≥ 0 by

N t counts the number of regime shifts up to and including time t, while Y t identifies the characteristics of the regime at time t. Let \(\mathbb{H}\) be a natural filtration generated by N and Y and define the enlarged filtration \(\mathbb{G} = \mathbb{F} \vee \mathbb{H}\) (for example see [128] or [120] for a discussion of some of the general theory of filtration enlargement). By the definition of \(\mathbb{G}\), \((\sigma _{i})_{i\geq 0}\) is an increasing sequence of \(\mathbb{G}\) stopping times.

Since N and Y are independent of \(\mathbb{F}\), every \((Q, \mathbb{F})\)-local martingale is also a \((Q, \mathbb{G})\)-local martingale. By this independence, changing the distribution of N and/or Y does not affect the martingale property of the wealth process W. To discuss a collection of ELMMs, however, it is prudent to work on a finite horizon ([0, T]), and not on the infinite half line [0, ∞). Therefore, we do not speak of the mathematically appealing set of ELMMs defined on \(\mathcal{G}_{\infty }\), but rather we fix a (non random) horizon time T < ∞ and speak of the ELMMs defines on \(\mathcal{G}_{T}\), and that is a priori larger than the set of ELMMs defined on \(\mathcal{F}_{T}\). We are not concerned with this enlarged set of ELMMs. We will, instead, focus our attention on the \(\mathcal{F}_{T}\) ELMMs and sometimes write \(\mathcal{M}_{\mathit{loc}}^{\mathbb{F}}(W)\) to recognize explicitly this restriction. With respect to this restricted set, given the Radon Nikodym derivative \(Z_{T} = \frac{\mathit{dQ}} {dP}\vert _{\mathcal{F}_{T}}\), we define its density process by \(Z_{t} = E[Z_{T}\vert \mathcal{F}_{t}]\). Of course, Z is an \(\mathbb{F}\)-adapted process. Note that this construction implies that the distribution of Y and N is invariant with respect to a change of ELMMs in \(\mathcal{M}_{\mathit{loc}}^{\mathbb{F}}(W)\).

We will henceforth always be working in this section on the finite horizon case [0, T] with the non random timeTchosen a priori and fixed. We will no longer make special mention of this implicit assumption.

The independence of the filtration \(\mathbb{H}\) from \(\mathbb{F}\) gives this increased randomness in our economy the interpretation of being extrinsic uncertainty. It is well known that extrinsic uncertainty can affect economic equilibrium as in the sunspot equilibrium of Cass and Shell [7, 22]. This form of our information enlargement, however, is not essential to our arguments. It could be relaxed, making both N and Y pairwise dependent, and dependent on the original filtration \(\mathbb{F}\) as well. This generalization would allow bubble birth to depend on intrinsic uncertainty (see Froot and Obstfeld [54] for a related discussion of intrinsic uncertainty). However, this generalization requires a significant extension in the mathematical complexity of the notation and proofs, so we leave it aside.

We are now ready to discuss the fundamental price of a risky asset in the incomplete market context. Of course to do this, we need to select a risk neutral measure from an infinite selection of possibilities. We do this with the aid of Theorem 13. Because the unique measure specified in Theorem 13 can change as the regime shifts, so too might the fundamental value of the asset. Since the selection of the risk neutral measure affects the fundamental value, and this can change as the regime shifts, we can have the birth of price bubbles. More formally, we let the local martingale measure in our extended economy depend on the state of the economy at time t as represented by the original filtration \((\mathcal{F}_{t})_{t\geq 0}\), the state variable(s) Y t , and the number of regime shifts N t that have occurred. Suppose N t = i. Denote \({Q}^{i} \in \mathcal{M}_{\mathit{loc}}(W)\) as the ELMM “selected by the market” at time t given Y i.

As in the complete market case, the fundamental price of an asset (or portfolio) represents the asset’s expected discounted cash flows.

Definition 2 (Fundamental Price).

Let \(\phi \in \Phi \) be an asset with maturity ν and payoff \((\Delta ,{\Xi }^{\nu })\). The fundamental price \(\Lambda _{t}^{\star }(\phi )\) of asset ϕ is defined by

\(\forall t \in [0,\infty )\) where \(\Lambda _{\infty }^{\star }(\phi ) = 0\).

In particular the fundamental price of the risky asset \(S_{t}^{\star }\) is given by

To understand this definition, let us focus on the risky asset’s fundamental price. At any time t < τ, given that we are in the ith regime {σ i ≤ t < σ i + 1}, the right side of expression (49) simplifies to:

Given the market’s choice of the ELMM is \({Q}^{i} \in \mathcal{M}_{\mathit{loc}}^{\mathbb{F}}(W)\) at time t, we see that the fundamental price equals its expected future cash flows. Note that the payoff of the asset at infinity, X τ 1 {τ = ∞}, does not contribute to the fundamental price. This reflects the fact that agents cannot consume the payoff X τ 1 {τ = ∞}. Furthermore note that at time τ, the fundamental price \(S_{\tau }^{\star } = 0\). We emphasize that a fundamental price is not necessarily the same as the market price S t . Under NFLVR the market price S t equals the arbitrage-free price,Footnote 13 but this need not equal the fundamental price \(S_{t}^{\star }\).

For notational simplicity, we can alternatively rewrite the fundamental price in terms of an equivalent probability measure, indexed by time t, that is not a local martingale measure because of this time dependence.

Theorem 14.

There exists an equivalent probability measure \({Q}^{t\star }\) such that

Proof.

Let \({Z}^{i} \in \mathcal{F}_{T}\) be a Radon Nykodym derivative of Q i with respect to P and \(Z_{t}^{i} = E[{Z}^{i}\vert \mathcal{F}_{t}]\). Define

Then \(Z_{T}^{t{\ast}} > 0\) almost surely and

Therefore we can define an equivalent measure Q t ∗ on \(\mathcal{F}_{T}\) by \({\mathit{dQ}}^{t{\ast}} = Z_{T}^{t{\ast}}\mathit{dP}\). The Radon Nykodim density \(Z_{t}^{t{\ast}}\) on \(\mathcal{G}_{t}\) is

Then

and observing that

we can continue:

□

We call \({Q}^{t\star }\) the valuation measure at t, and the collection of valuation measures \(({Q}^{t\star })_{t\geq 0}\) the valuation system.

In our new model with regime change, there is no single risk neutral measure generating fundamental values across time. The valuation measures \({Q}^{s\star }\) and \({Q}^{t\star }\) at times s < t are usually two different measures, and neither is an ELMM. The \(\star \) superscript is used to emphasize that \({Q}^{t\star }\) is the measure chosen by the market, and the superscript t is used to indicate that it is selected at time t. In the i th regime {σ i ≤ t < σ i + 1}, the valuation measure coincides with \({Q}^{i} \in \mathcal{M}_{\mathit{loc}}^{\mathbb{F}}(W).\) Since \({Q}^{t\star }\) is a family of ELMMs and not one that is fixed, \({Q}^{t\star }\notin \mathcal{M}_{\mathit{loc}}^{\mathbb{F}}(W)\) in general, unless the system is static.Footnote 14

Given the definition of an asset’s fundamental price, we can now define the fundamental wealth process.

For subsequent usage, we see that the fundamental wealth process of the risky asset is given by

Then,

\(\forall t \in [0,\infty )\) and \(\ W_{\infty }^{\star } =\int _{ 0}^{\tau }\mathit{dD}_{u} + X_{\tau }\mathbf{1}_{\{\tau <T\}}\).

Alternatively, we can rewrite \(W_{t}^{\star }\) by

In general, the choice of a particular ELMM affects fundamental values. But, for a certain class of ELMMs, when τ < ∞ the fundamental values are invariant. This invariant class is characterized in the following lemma. We let \(\mathcal{M}_{\mathit{UI}}(W)\) denote the collection of equivalent measures that render W a uniformly integrable martingale. In contrast, \(\mathcal{M}_{\mathit{NUI}}(W)\) denotes those equivalent measures that render W at least a sigma martingale, but not a uniformly integrable martingale.

Lemma 1.

Suppose τ < T almost surely. In the i th regime {σ i ≤ t < σ i+1 }, if the market chooses \({Q}^{i} \in \mathcal{M}_{\mathit{UI}}^{\mathbb{F}}(W)\) , then the fundamental price of the risky asset \(S_{t}^{\star }\) and fundamental wealth \(W_{t}^{\star }\) do not depend on the choice of the measure Q i almost surely.

Proof.

Fix \({Q}^{{\ast}},{R}^{{\ast}}\in \mathcal{M}_{\mathit{UI}}^{\mathbb{F}}(W)\). τ < T implies that \(W_{T} = W_{T}^{{\ast}}\). Let \(W_{t}^{{Q}^{{\ast}} }\) and \(W_{t}^{{R}^{{\ast}} }\) be the fundamental prices on \(\{\sigma _{i} \leq t <\sigma _{i+1}\}\) when \({Q}^{i} = {Q}^{{\ast}}\) and R ∗ respectively. Since W is uniformly integrable martingale under Q ∗ and R ∗ ,

The difference of \(W_{t}^{{Q}^{{\ast}} }\) and \(S_{t}^{{Q}^{{\ast}} }\) does not depend on the choice of measure. Therefore \(W_{t}^{{Q}^{{\ast}} } = W_{t}^{{R}^{{\ast}} }\) implies \(S_{t}^{{Q}^{{\ast}} } = S_{t}^{{R}^{{\ast}} }\) on \(\{\sigma _{i} \leq t <\sigma _{i+1}\}\). □

This lemma applies to the risky asset only. If the measure shifts from \({Q}^{i} \in \mathcal{M}_{\mathit{UI}}^{\mathbb{F}}(W)\) to \({R}^{i} \in \mathcal{M}_{\mathit{UI}}^{\mathbb{F}}(W)\), then the fundamental price of other assets can in fact change.

The next lemma describes the relationship between the fundamental prices of the risky asset when two measures are involved, one being a measure \({R}^{\star } \in \mathcal{M}_{\text{NUI}}^{\mathbb{F}}(W)\).

Lemma 2.

Suppose τ < T. In the i th regime {σ i ≤ t < σ i+1 }, consider the case where \({Q}^{i} \in \mathcal{M}_{\mathit{UI}}(W)\) and \({R}^{i} \in \mathcal{M}_{\mathit{NUI}}(W)\) . Then,

That is, the fundamental price based on a uniformly integrable martingale measure is greater than that based on a non-uniformly integrable martingale measure.

Proof.

Pick \({Q}^{{\ast}}\in \mathcal{M}_{\text{UI}}(W)\) and \({R}^{{\ast}}\in \mathcal{M}_{\mathit{NUI}}(W)\). Since τ < T almost surely, \(W_{T} = W_{T}^{{\ast}}\). Under R ∗ , W is not a uniformly integrable non-negative martingale and \(W_{t} \geq E_{{R}^{{\ast}}}[W_{T}\vert \mathcal{M}_{t}]\). Therefore

□

We can now finally define what me mean by a price bubble in an incomplete market. As is standard in the economics literature,

Definition 3 (Bubble).

An asset price bubble β for S is defined by

Recall that S t is the market price and \(S_{t}^{\star }\) is the fundamental value of the asset. Hence, a price bubble is defined as the difference in these two quantities. Within a fixed regime, the theory simplifies to a complete market case where there is only one risk neutral measure, since the measure chosen by the market is fixed. Thus we have:

Theorem 15.

Within a fixed regime, S admits a unique (up to an evanescent set) decomposition

where \(\beta = (\beta _{t})_{t\geq 0}\) is a càdlàg local martingale and

-

1.

β 1 is a càdlàg non-negative uniformly integrable martingale with \(\beta _{t}^{1} \rightarrow X_{\infty }\) almost surely,

-

2.

β 2 is a càdlàg non-negative non-uniformly integrable martingale with \(\beta _{t}^{2} \rightarrow 0\) almost surely,

-

3.

β 3 is a càdlàg non-negative supermartingale (and strict local martingale) such that \(E\beta _{t}^{3} \rightarrow 0\) and \(\beta _{t}^{3} \rightarrow 0\) almost surely. That is, β 3 is a potential.

Furthermore, \(({S}^{\star } {+\beta }^{1} {+\beta }^{2})\) is the greatest submartingale bounded above by W.

As in the previous Theorem 2, β 1, β 2, β 3 correspond to the type 1, 2 and 3 bubbles, respectively. First, for type 1 bubbles with infinite maturity, we see that the β 1 bubble component converges to the asset’s value at time ∞, X ∞ . This time ∞ value X ∞ can be thought of as analogous to fiat money, embedded as part of the asset’s price process. Indeed, it is a residual value to an asset that pays zero dividends for all finite times. Second, this decomposition also shows that for finite maturity assets, τ < ∞, the critical threshold is that of uniform integrability. This is due to the fact that when τ < ∞n, the β 2, β 3 bubble components converge to 0 almost surely, while they need not converge in L 1. Finally, the β 3 bubble components are strict local martingales, and not martingales.

As a direct consequence of this theorem, we obtain the following corollary.

Corollary 3.

Within a fixed regime, any asset price bubble β has the following properties:

-

1.

β ≥ 0,

-

2.

β τ 1 {τ<∞} = 0,

-

3.

if β t = 0 then β u = 0 for all u ≥ t, and

-

4.

\(S_{t} = E_{{Q}^{\star }}\left [\left .S_{T}\right \vert \mathcal{F}_{t}\right ] +\beta _{ t}^{3} - E_{{Q}^{\star }}\left [\left .\beta _{T}^{3}\right \vert \mathcal{F}_{t}\right ]\) for any t ≤ T ≤τ.

As in the complete market case, we still have that bubbles must be nonnegative, even without regard to the regime being fixed or not:

Theorem 16.

Bubbles are nonnegative. That is, if β denotes a bubble, then β t ≥ 0 for all t ≥ 0.

Proof.

Fix t ≥ 0. On {σ i ≤ t < σ i + 1}, the market chooses Q i as a valuation measure and the fundamental price \(S_{t}^{{\ast}}\) is given by

where \(S_{t}^{\star i}\) denotes a fundamental price with valuation measure \({Q}^{i} \in \mathcal{M}_{\mathit{loc}}(W)\) and

and

By Corollary 3, \(\beta _{i} = S - {S}^{\star i} \geq 0\) for each i and hence β ∗ ≥ 0. □

The next example illustrates how we can model bubble birth.

Example 1.

Suppose that the measure chosen by the market shifts at time σ 0 from \(Q \in \mathcal{M}_{\text{UI}}(W)\) to \(R \in \mathcal{M}_{\text{NUI}}(W)\). To avoid ambiguity, we denote a fundamental price based on valuation measures Q and R by \({W}^{Q\star }\) and \({W}^{R\star }\), respectively. By Lemma 2, we can choose Q, R and σ such that the difference of fundamental prices based on these two measures,

is strictly positive with positive probability. Then, the fundamental price and the bubble are given by

And, a bubble is born at time σ 0.

As shown in Lemma 1, a switch from one measure Q to another measure Q ′ such that \(Q,{Q}^{{\prime}}\in \mathcal{M}_{\text{UI}}(W)\) does not change the value of \({W}^{\star }\). Therefore, if a bubble does not exist under Q, it also does not exist under Q ′. Bubble birth occurs only when a valuation measure changes from a uniformly integrable martingale \(Q \in \mathcal{M}_{\text{UI}}(W)\) to a non-uniformly integrable martingale \(R \in \mathcal{M}_{\text{NUI}}(W)\).

Remark 17.

The reader may well wonder if it is even possible that such a phenomenon happens: that there exists a framework with a process X that is a uniformly integrable martingale under one probability, and is a non uniformly integrable martingale under an equivalent martingale measure. The answer is yes, and it is provided in the work of Delbean and Schachermayer [36]. See alternatively [14].

We next wish to mention an alternative idea to treat the concept of bubble birth, although it complicates the model. It is often believed that bubbles arise due to “easy money,” when speculators have access to large pools of funds to invest. This is reflected in the market by its having a high degree of liquidity. Therefore it seems reasonable to try to combine the ideas of high liquidity and bubbles to see if the former can help us understand the birth of the latter. A first mathematical attempt in this direction is attempted in the research paper of R. Jarrow et al. [90]. See also the Ph.D. thesis of A. Roch [133].

In Jarrow et al. [90, 135] the authors combine ideas for bubble birth with mathematical models of liquidity issues presented for example in the work of Çetin et al. [23, 24] and Blais and Protter [16]. See also [136]. The idea, loosely put, is to use a liquidity risk model developed in [133, 134] for highly liquid stocks with a supply curve identified in [16], in order to gain insight into how liquidity can affect bubble births and bubble bursts. Instead of an instant return to the price takers’ general asset price, in this model each trade engenders a short exponential decay of its return time; in times of high liquidity these decays can overlap one upon the other, thereby mounting and artificially raising the price above its fundamental value. Whether or not this happens depends on whether or not key parameter values reach certain ranges.