Abstract

This article analyses Bangladesh export–import data to quantify historically generated e-waste from four types of discarded electronic devices (mobile phones, TVs, tablets, and computers/laptops) and uses the trends to predict the generation of e-waste from these devices up to 2030. From this data, together with estimated redundancy rates, printed circuit board (PCB) masses, metal content, and value based on characterisation of indicative samples, the potential value of e-waste was evaluated. Through processing the PCBs in Bangladesh, metals including Cu, Ag, Au, Pd, and Sn worth more than US$2.4 billion till 2020 could be recovered. This value could reach US$7 billion when forecasted to 2030. The potential value varies mainly with the fluctuating metal prices in the international market.

Access provided by Autonomous University of Puebla. Download conference paper PDF

Similar content being viewed by others

Keywords

Introduction

Electronic waste (e-waste) encompasses the various units of antiquated electronic and electrical equipment (EEE) which have either lost their proper functionality or their appeal to the user with the arrival of new upgraded products. In 2019, worldwide e-waste generation was estimated to be 53.6 million metric tonnes (Mt), of which only around 17% was adequately collected and recycled [1]. This is projected to rise to 70.4 Mt by the year 2030. An opportunity for urban mining through secondary resource recovery has been created since these electronic items are gradually and continuously being added to the e-waste stream. This could have a strong impact on the economy, especially of countries with no natural mineral resources and related industries to produce primary metals. E-waste contains several base metals (Cu, Zn, Sn, Ni, and Fe), precious metals (Ag, Au, Pt, and Pd), rare earths (Y, Ce, and Nd), and critical metals (Ga, In, Co, Li, and Ta) [2,3,4,5]. The sustainable recovery of these metals could provide economic benefits, decrease environmental hazards, and reduce the environmental footprint caused by mining by supplying metals for further manufacturing. A good understanding of the e-waste generation in different countries and regions requires proper estimation of the resources available and an assessment in terms of potential market value. This can lead to tailored processing routes designed to extract valuable materials considering the socio-economic situation of the country. Several articles have been published in recent years which estimated the e-waste generation for different countries and their potential value [6,7,8].

Bangladesh is a densely populated country in South Asia having around 170 million people. With its growing population and economy, in recent times, the use of EEE has increased rapidly. A few articles have been published on the Bangladesh e-waste scenario, surveys, policies, legal frameworks, and possible environmental impacts, etc. [9,10,11]; however, there is lack of quantitative data which could give a good estimate of the total e-waste generation within the country and the potential value that could be recovered. This kind of estimation encourages business entrepreneurs to invest and governments to formulate favourable policies for investors, stakeholders, and public–private partnership in this arena. Recently, the Department of Environment (DoE) in collaboration with the Centre for Environmental and Resource Management (CERM) published a report that shows the informal recycling of e-waste countrywide [12]. Another report for Bangladesh was previously published by Environment and Social Development Organization (ESDO). Although they reported a wide variety of e-waste categories and provided a sense of the huge stockpiling of e-waste, the data was not strong enough to support the conclusion of 2.7 Mt e-waste generation in Bangladesh annually [13]. Almost 90% of the total e-waste of Bangladesh was shown to come from ship breaking yards by assuming the number of obsolete ships coming into the shore every year and assuming they were full of e-waste. This is unlikely to be the actual scenario, and the data currently lacks a rigorous breakdown of the types of e-waste resources.

Methodology

This study uses trade data (export, import, re-import, and re-export) from the UN COMTRADE database [14]. The annual quantity of the selected electronic products was obtained from the database for harmonised system (HS) codes of the selected products and predicted until 2030 using a statistical extrapolation. The total amount of electronic products entering the Bangladesh market were assumed to be used internally, and the products would be gradually added to the e-waste stream at the end of their useful life. The Weibull distribution function was used to calculate the dynamic lifespan of individual electronic items and hence the proportion of generated e-waste [15]. To estimate the potential metals that are available for recovery from the e-waste, only the PCB portion of the e-waste was considered. The market value of the major and valuable metals was used to calculate potential revenue from the processing of these wastes. A more detailed description of the aforementioned is given in the subsequent sections.

Estimating Put-on-Market (POM) Products

Four types of electronics (mobile phones, TVs, tablets, and computers/laptops) that are used in Bangladesh and have a much higher growth in use were selected for this study. The import data was obtained from the UN COMTRADE database for individual products ranging from 1992 to 2019 [14]. The base data was chosen as 2000 to 2019 and then predicted until 2030. Estimation of the POM electronics, in tonnes, was calculated using the following equation:

Bangladesh does not primarily manufacture electronics and hence does not export to other countries. In recent times however, some companies are assembling electronics such as mobile phones and televisions locally although accurate statistics for this kind of domestic production is limited. Therefore, to simplify the calculation, the domestic production and export were considered as zero. Thus, for Bangladesh, the equation becomes

The HS codes for PC-Desktop used were HS-847141, HS-847149 and HS-847150. To get the sales data for Laptop/Tablets, it was HS-847130, and for TV sales data the HS codes were HS-852810, HS-852812, HS-852813, and HS-852820. However, the UN COMTRADE database does not report the mobile phone sales data before 2007 although Bangladesh started using mobile phones from 1997 when the first telecom company Grameenphone started business in Bangladesh [16]. Consequently, mobile phone subscriber data was taken from the Bangladesh Telecommunication Regulatory Commission (BTRC) website as the basis for mobile phone POM data. BTRC publishes monthly total subscriber data for the preceding 90 days period. In this regard, the unique subscriber penetration data was obtained as per the (Global System for Mobile Communications) GSMA report [17] to calculate the number of mobile phones (assuming every user has at least one mobile phone throughout their subscription period). To estimate the POM of the different electronic items, the number of units data obtained from the UN COMTRADE database was used. The weight data was also available but with less consistency. Therefore, the numbers were converted to weight by multiplying the data by the average unit weight of the individual items described in earlier research [6, 18].

Product Lifespan of Selected Electronics

The lifespan of electronic goods is considered as the period an electronic device/product remains in the service of its user. Generally, different electronic products have different lifetimes, and these are not always straightforward to predict since it depends on multiple factors including the product quality, type of electronics, consumer’s choice, emergence of new technology/features, income of individuals, and the socio-economic situation of the country. For example, mobile phones have shorter lifespans compared to televisions or other large household appliances such as washing machines. There are arguments that the product lifespan should be higher in developed countries compared to the developing/underdeveloped countries and vice versa. One argument is that developed countries can afford and purchase higher quality products, and thus, the durability of the electronics should be higher compared to that of developing or lower income countries. Another argument is that in relatively lower income countries, consumers use products with much care and reuse, refurbishing to maximize the lifetime of a product, while consumers in developed nations usually do not reuse to such an extent. These scenarios can lead to an underestimation or overestimation of the total POM data; however in general, the method described in this article is relatively accurate for estimating POM and subsequent e-waste generation [6, 19].

The Weibull probability distribution function is a tool that has been used by many researchers to estimate the proportion of POM electronics being added to the waste stream within the broad lifespan of the product [6, 8]. This probability analysis tool is widely used in manufacturing lines to statistically measure probability of failure for a particular batch of product. It was also found to be effective in examining the behaviour of electronic products [18, 19]. The Weibull probability density function (PDF) is expressed by following:

where f(t) is the probability density function indicating the failure rate. The shape factor (α) and scale factor (β) are the two parameters that can be empirically obtained for a particular product. This study adapts the shape factor and scale factor values derived for the four types of electronic products from a previously reported study [19] (Table 1). These values were empirically obtained for each product based on data from European and non-EU countries.

Estimation of E-waste Generation from the Discarded Electronics

E-waste generated from the four electronic product types was calculated using the Weibull distribution function and the annual POM data using the following formula [19]:

Here, E-waste generated (y) is the quantity of e-waste generated in the year; t0 is the initial year of sale of the product; POM (t) refers to the electronics entered the market (in tonnes) in a historical year t, ahead of the year y, and L(t, y) is the Weibull probability density function (Eq. 3) indicating the lifespan distribution for the batch of products sold per year (t).

Results and Discussion

POM Electronics and E-waste Generation

The mass of e-waste generation for each type was calculated by multiplying the number of units with the unit weight. The average weight of TVs was taken as 11.19 kg/unit and 15.2 kg/unit for Desktop-PCs, 3.2 kg/unit of Laptop/Tablets [19], and for mobile phones it was 0.1 kg/unit [6]. Figure 1 shows the annual POM for Mobile phones, Laptop/Tablets and Desktop-PCs follows a gradual incremental trend annually whereas the POM trend for TVs, while increasing overall from 2000 to 2019, between 2003 and 2013 there was a relative fall in the POM observed. The POM data was predicted until 2030 using the best fitted trend except for the TV data where it was difficult to fit a predictive trend. Hence, a 3% annual increment was considered to predict the future POM for TVs until 2030. This was based on the fact that e-waste has a growth rate of 3–5 wt.% for all over the world [2]. The lowest value of the range was therefore chosen as a conservative estimate.

The product lifespan profile of the electronics is shown in Fig. 2. This distribution function shows the gradual decay of a product after it enters the consumer market. The lifespan of mobile phones is the shortest, while TVs have the highest lifespan. Most of the mobile phones finish their usability within 4–5 years with some proportion having a higher lifespan. The sharp peak of the PDF for mobile phones at 4 years indicates the higher failure rate of mobile phones around this time, with very few having a higher lifetime. Laptop/Tablets have a relatively higher period of usability compared to mobile phones, and Desktop-PCs are more likely to serve for extended periods compared to mobile phones and Laptop/Tablets. Although having a relatively shorter lifespan from TVs, both distribution functions are similar having a relative blunt peak compared to mobile phones and or Laptop/Tablets. Note that while the calculation of e-waste generation depends on the Weibull function for the individual product type, the failure rate is less sensitive than the POM data of the electronics [19].

Generation of E-waste from Discarded Electronics

The generation of e-waste from the four different electronics from the year 2000 to 2030 is shown in Fig. 3a. Overall, the total annual e-waste generation increases with time from around 2.7 kt in 2000 to 25 kt in 2030. Although TVs dominate e-waste in the early years, mobile phones gradually become the highest contributor. The e-waste generation from Desktop-PCs and Laptops/Tablets increased with time as the accessibility of these devices increased. Nonetheless, the volume of e-waste coming from Desktop-PCs and Laptops/Tablets was smaller compared to that of mobile phones and TVs.

The mobile phone market has a saturation which is related to the number of subscribers and the total population, and for Bangladesh, it is near to this point as indicated by the subscriber data [20, 21]. Once this point is reached, the e-waste coming from mobile phones would become constant. However, the consumption of other electronics can continue to grow in coming years. In 2019, the generated e-waste by the four types of electronics was around 13 kt. The total e-waste generated in Bangladesh in 2019 was estimated as 199 kt with a per capita generation of 1.2 kg [1]. Clearly these four items make up only a very small proportion of the total e-waste generation in the country; however, they carry a significant value in terms of materials and their potential utility and price. Cumulative generation of e-waste from the selected EoL electronic devices is shown in Fig. 3b. While the current volume of e-waste resulting from these devices is more than 150 kt, it is predicted to rise to 350 kt by 2030.

For this study, the proportion of PCBs in the electronics was obtained from data reported in the literature. For mobile phones, the PCB was 30% of the total weight [3], while for Desktop-PCs, Laptops/Tablets, and TVs, the value was about 12% of total mass [18]. The total potential PCB contents from the individual electronics are shown in Fig. 4. The data indicates that by 2020 the annual waste PCB generation was close to 3 kt while it was predicted to rise to above 5 kt by 2030. Moreover, until 2006, TVs were the major electronics contributing to waste PCB generation. Later, waste generation from mobile phones and Desktop-PCs gradually increased with time. After 2010, the highest waste PCBs come from mobile phones followed by TVs and Desktop-PCs. The metal contents for PCBs from different electronic products were obtained from Oguchi et al. 2011 (Table 2).

Estimation of Potentially Recoverable Embedded Metals

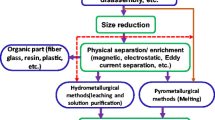

Metals, plastics, and ceramics components of the electronic products could potentially be recovered from PCBs once they have finished their service by disassembly and dismantling. However, PCBs are complex composites consisting of various metals including precious metals, rare earths, and base metals [4, 5]. To recover the materials within the PCBs, some physical and/or chemical processing is required. In this study, only the PCB portion of e-waste was considered to estimate the embedded metals that are either high in concentration or high in value. Among the base metals, Cu and Sn were estimated, while from the precious metals, Au, Ag, and Pd were estimated. Figure 5 shows the base metals and precious metal content of Bangladesh e-waste from 2000 till 2030. The data indicates that PCB e-waste generated in the year 2020 could provide around 7 kt of Cu, 764 t of Sn, 62 t of Ag, 25 t of Au, and 5 t of Pd. The amount will increase every year and is predicted to be close to 19 kt Cu, 2 kt Sn, 180 t Ag, 72 t Au, and 15 t of Pd in 2030.

Revenue Potential and Sensitivity

Reprocessing of the e-waste materials to recover valuable materials will generate revenue that could offset the processing cost. The potential value for the individual metals and the total potential revenue are plotted in Fig. 6. The current metal price was taken from the LME website and shown in Table 3 [22]. It is seen that the total potential of the e-waste for Bangladesh is close to US$3 billion dollars at present, while it is predicted to reach US$7 billion by 2030. Gold being the highest contributor could contribute around US$4 billion, while Pd is the second highest followed by Cu. This study shows that more than 82% of the total value comes from the precious metals while slightly above 7% comes from Cu. It was reported that precious metals (Au, Ag, and Pd) contribute almost 85% of waste PCBs and 93% in case of mobile phone PCBs [5]. Since Au is the major contributor and its price fluctuates with the volatility of world’s economy, the potential revenue is highly sensitive to the gold price.

Limitation of the Present Study

This article described the POM and subsequent e-waste generation scenario of Bangladesh for the first time considering four types of electronics that are the fastest growing and most widely used in the country. There are, however, some limitations of the research with regard to the assumptions and estimation that were used.

-

Most of the data was taken from UN COMTRADE database which is a reliable source of worldwide export–import data. Still, there may be some unreported electronics that entered Bangladesh market through informal routes. Some companies have recently started manufacturing and assembling mobile phones, televisions, and household electronics in Bangladesh. The data for locally manufactured products is not available and hence not included in this estimation.

-

The number of individual electronics was multiplied by the average unit weight of the individual device to obtain the POM in weight. That could bring a variation in the estimated weight of the total POM and the generated e-waste.

-

Based on the historical data, the future POM was predicted until 2030 using best fitted trends. These trends may not apply in coming years being highly dependent on the country’s financial and political situation.

-

To estimate the dynamic generation of e-waste from the selected electronics, the Weibull distribution function was used. For this, the α & β values were taken from the literature lifespan data based on a European-based study. The actual lifespan could be slightly different as the lifespan changes with evolution of the technology and manufacturing year. For example, Mairizal et al. showed that the overall lifespan for mobile phones decreased with time compared to the earlier versions of mobile phones in Indonesia [8].

-

The metal content of PCBs and the proportion of PCBs for the selected electronics was taken from the literature. These values could vary according to country, quality of the products, and usage periods.

-

To calculate the potential value of embedded materials, the recent price of metals was taken into consideration. The market price of metals, especially precious metals, varies largely with time and other factors (economic and political stability). For example, the gold price increased recently in response to market volatility due to the COVID-19 global pandemic. The values in the current study are predicted until 2030; however, during the intervening, there may be a significant change in the metal market (for any or all of the metals examined). Thus, the expected revenue could be higher or lower.

-

Complete recovery of the embedded metal portion of Cu, Sn, Ag, Au, and Pd was assumed in order to estimate the available metals and their potential economic value. However, it is unlikely that complete recovery of the metals could be achieved. Lower recoveries would decrease the metal yield and the subsequent revenue. On the other hand, some metals (Fe, Al, Zn, Pb, etc.) have been omitted from calculating the potential value. Depending on the recycling route, some of these metals could also be recovered, thereby increasing the total revenue.

-

Moreover, this study considers only the PCB portion of the e-waste generated from the selected electronics which constitutes a small portion of the total mass. Other parts of the electronic devices such as body, casings, and wirings contain several materials that could also be recovered easily without any complex metallurgical/chemical processing and add value to the potential recovered materials.

Conclusion

This article analyses the export–import data of Bangladesh for TVs, Desktop-PCs, Laptop/Tablets, and mobile phone subscriber data to estimate the generation of total e-waste and the potential value of the embedded materials. The estimate indicates that about 7,000 t Cu, 764 t of Sn, 62 t of Ag, 25 t of Au, and 5 t of Pd would be available to recover from the generated waste PCBs by 2020. With a growth by 2030, this is predicted to be 19,000 t Cu, 2,000 t Sn, 180 t Ag, 72 t Au, and 15 t Pd. The potential value that could be recovered is currently close to US$2.4 billion and around US$7 billion by 2030. This value is sensitive to the market value of precious metals, especially gold and palladium. Despite the unavoidable limitations of this study, it gives a reasonable indication of the high potential of e-waste recycling industries in Bangladesh that could encourage entrepreneurs to consider investing in this sector.

References

Forti V, Balde CP, Kuehr R, Bel G (2020) The global e-waste monitor 2020: quantities, flows and the circular economy potential. https://collections.unu.edu/view/UNU:7737. Accessed 26 March 2021

Cucchiella F, D’Adamo I, Koh SL, Rosa P (2015) Recycling of WEEEs: an economic assessment of present and future e-waste streams. Renewable Sustain Energy Rev 51:263–272

Oguchi M, Murakami S, Sakanakura H, Kida A, Kameya T (2011) A preliminary categorization of end-of-life electrical and electronic equipment as secondary metal resources. Waste Manage 31:2150–2160

Islam MK, Haque N, Somerville MA (2021) Characterisation and techno-economics of a process to recover value from e-waste materials. In: TMS 2021 150th annual meeting & exhibition supplemental proceedings, pp 995–1006

Khaliq A, Rhamdhani MA, Brooks G, Masood S (2014) Metal extraction processes for electronic waste and existing industrial routes: a review and Australian perspective. Resources 3(1):152–179

Islam MT, Huda N (2019) E-waste in Australia: generation estimation and untapped material recovery and revenue potential. J Cleaner Prod 237:117787

Koshta N, Patra S, Singh SP (2021) Estimation of e-waste at micro level for reverse logistics: a case of Delhi. J Cleaner Prod 314:128063

Mairizal AQ, Sembada AY, Tse KM, Rhamdhani MA (2021) Electronic waste generation, economic values, distribution map, and possible recycling system in Indonesia. J Cleaner Prod 293:126096

Islam MT, Abdullah AB, Shahir SA, Kalam MA, Masjuki HH, Shumon R, Rashid MH (2016) A public survey on knowledge, awareness, attitude and willingness to pay for WEEE management: case study in Bangladesh. J Cleaner Prod 137:728–740

Rahman MA (2017) E-waste management: A study on legal framework and institutional preparedness in Bangladesh. Cost Manage 45:28–35

Alam M, Bahauddin K (2015) Electronic waste in Bangladesh: evaluating the situation, legislation and policy and way forward with strategy and approach. Present Environ Sustain Dev 1:81–102

Report on assessment of generation of e-waste, its impacts on environment and resource recovery potential in Bangladesh. https://doe.portal.gov.bd/publications/research. Accessed 09 July 2021

Hossain S, Sulatan S, Shahnaz F, Akram AB, Nesa M, Happell J (2010) E-waste: Bangladesh situation. Study report by environment and social development organization, Dhaka. Bangladesh

UN COMTRADE database 2021. https://COMTRADE.un.org/data/. Accessed 03 June 2021

Weibull W (1951) A statistical distribution function of wide applicability. J Appl Mech 18(3):293–297

Grameenphone. https://www.grameenphone.com/about/discover-gp/about-grameenphone/our-story. Accessed 12 July 2021

Country overview: Bangladesh Mobile industry driving growth and enabling digital inclusion. https://www.gsma.com/mobilefordevelopment/resources/bangladesh-mobile-industry-driving-growth-and-enabling-digital-inclusion/. Accessed 12 July 2021

Parajuly K, Habib K, Liu G (2017) Waste electrical and electronic equipment (WEEE) in Denmark: flows, quantities and management. Resour Conserv Recycl 123:85–92

Forti V, Baldé K, Kuehr R (2018) E-waste statistics: guidelines on classifications, reporting and indicators. http://collections.unu.edu/eserv/UNU:6477/RZ_EWaste_Guidelines_LoRes.pdf. Accessed 20 July 2021

BTRC 2021. http://www.btrc.gov.bd/telco/mobile. Accessed 07 July 2021

Statista 2021. https://www.statista.com/statistics/497091/number-of-mobile-cellular-subscriptions-in-bangladesh/. Accessed 07 July 2021

LME 2021. https://www.lme.com/en-GB. Accessed 24 July 2021

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Minerals, Metals & Materials Society

About this paper

Cite this paper

Islam, M.K., Haque, N., Somerville, M., Pownceby, M.I., Bhargava, S., Tardio, J. (2022). Estimation of the Generation and Value Recovery from E-waste Printed Circuit Boards: Bangladesh Case Study. In: Lazou, A., Daehn, K., Fleuriault, C., Gökelma, M., Olivetti, E., Meskers, C. (eds) REWAS 2022: Developing Tomorrow’s Technical Cycles (Volume I). The Minerals, Metals & Materials Series. Springer, Cham. https://doi.org/10.1007/978-3-030-92563-5_11

Download citation

DOI: https://doi.org/10.1007/978-3-030-92563-5_11

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-92562-8

Online ISBN: 978-3-030-92563-5

eBook Packages: Chemistry and Materials ScienceChemistry and Material Science (R0)