Abstract

Empirical evidence has found a correlation between Energy Performance (EPC) rankings and housing prices. Though, little attention has been devoted to research the spatial implications of EPC marginal prices. This paper attempts to fill this gap using a geographical-weighted-regression, departing from listing prices for Barcelona. The results suggest the existence of a premium equivalent to 1.7% for each EPC ranking, which nearly double the previous reported evidence in this city. Also, the impact shows a non-stationary distribution across urban space. As a matter of fact, the higher the impact, the lower the price of apartments and their quality. The apartments portraying the larger impact are located in peripheral areas inhabited by medium and low-income population. So, the equity of less wealthy population witnesses the largest brown discount.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

In Europe, buildings are responsible for 40% of energy consumption and 38% of CO2 emissions (Arcipowska et al. 2014), implying economic, geopolitical and environmental concerns. So, in 2002 the European Commission addressed the Energy Performance of Buildings Directive (EPBD)-2002/91/EC-; its main instrument to improve the energy performance of buildings is the Energy Performance Certificate (EPC). This certificate informs potential users about the performance of property to be transacted. As a result, consumers might capitalize into a market premium the benefits of efficient premises such as energy savings and environment conservation. The growing evidence, reviewed in the next section, confirms the existence of a market premium for efficient buildings; nonetheless, none of them explore whether it is stationary across the space.

In Spain, the late transposition of EPBD has made it mandatory to include an EPC in the property market only since 1st June 2013. So, the studies exploring the hedonic agenda of EPC rankings are scarce but enough to confirm a small premium for efficient buildings. Nonetheless, this finding cannot hold in the future due to the increases of energy costs: in 2015, Spanish households’ energy expenditure was 361 euros/year while for EU 28 it was 327 euro (Eurostat 2016). For that reason, in this paper, (1) the existing evidence is revisited in order to analyze whether EPC marginal price has recently increased, and (2) it is explored whether EPC impact over prices is homogenous across the urban space; and finally, (3) in the case of non-stationarity we identify the urban, social and property attributes correlated to such variation. In doing so apartments’ listing prices for Metropolitan Barcelona are analyzed using conventional and geographical/locally weighted regressions. Results suggest that: EPC price impact has increased in relation to previous research; while EPC marginal prices are non-stationary, they are correlated with socioeconomic and housing attributes.

The remainder of the paper is organized as follows. First, a brief literature review is offered; second, the methodology, study area and data are described; next, the results are analyzed; finally, in the concluding section the findings are discussed within the framework of public policy.

2 Brief Literature Review

Table 1 details a selection of case studies researching the impact of EPC rankings on housing prices. All of them use the hedonic approach and are based on transaction or listing prices; most of them consider EPC ranks as categorical measures of energy efficiency and report marginal prices in terms of semi-elasticities. It is worth saying that while most of the studies report a positive correlation between prices and energy efficiency, in some cases this relation is reversed. This latter is the case of Oxford in the study of Bio Intelligence Service et al. (2013) and is produced by a poor control of location variables. For this reason, in this paper large efforts have been made in order to take into consideration the large quantity of attributes influencing prices. Also, it is evident that the impact is larger in the selling market than in the leasing one.

The very different hedonic agendas found across the EU respond to differences in: climate, income, energy/housing prices and, perhaps, environmental concerns. In general, the studies made in Spain do report a relatively small impact in relation to northern countries. Nevertheless, such studies require to be revisited since both of them were produced using data just after the EPBD transposition came into force. With the exception of the work of Chegut et al. (2014) that has found a “gentrification” process for the London offices certified under the BREEAM scheme, none of the studies have researched the spatial implications of EPC impact as it is done in this paper as next explained.

3 Study Area, Data and Methodology

3.1 Study Area

Barcelona metropolitan area (AMB) is selected as a study case. In order to identify the limits of this agglomeration the travel-to-work method based on interaction value (Roca et al. 2009) has been used. Such approach also allows to detect subcentres, which is relevant since accessibility to centralities might impact on prices. As a result, the functional AMB is formed by 184 municipalities comprising 3,759 km2 and 5.22 million inhabitants (Fig. 1).

3.2 Methodology

After having delimited the study area, the methodology comprises 5 steps:

-

(1)

First, an ordinary-least-square (OLS) hedonic model has been calibrated in order to identify the marginal price of EPC ranking.

-

(2)

Second, the same model has been re-calibrated eliminating the EPC ranking as an independent variable, but maintaining all the remaining significant attributes. The residuals of such model have been saved.

-

(3)

Third, the residuals of the aforementioned model have been used as a dependent variable in a Geographical Weighted Regression (GWR) using solely the EPC ranking as the independent variable. This procedure enormously contributes to save computing resources.

-

(4)

Fourth, using the Monte Carlo test, it has been investigated whether the coefficient for EPC ranking depicts a non-stationary variation across the metropolis.

-

(5)

Finally, those statistically significant local coefficients for EPC rankings have been used to identify their correlation with socioeconomic and housing attributes.

3.2.1 Ordinary-Least-Square Model

In the literature there is little advice on the functional form that hedonic models shall adopt (Can 1992; Sheppard 1999; Malpezzi 2003; Epple et al. 2018). Nonetheless, the semi-log function has been intensively used in the context of property analysis. Marmolejo and Gonzalez (2009) summarized the advantages of semi-log function: (i) it helps to normalize the price and residual distributions which is fundamental for OLS analysis; (ii) the resulting coefficients are semi-elasticities (i.e. coefficients express marginal price variation in percent terms) so, the used form is:

where: the logarithm of price P of an apartment i depends on a set of variables related to: AS architectural structural attributes; EA environmental and accessibility attributes; and S socio-economic attributes while ε is the error.

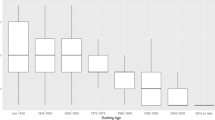

In the AS dimension, there are covariates and factors related to physical structural features (e.g.: area and dwelling’s quality) and facilities (e.g.: lift, heating or air-conditioner). The construction year is correlated with energy efficiency, since in Spain there have been at least two construction codes with implications on thermal isolation. So, older houses, especially those constructed before 1981, exhibit a lower performance compared to those constructed after 2007 where advanced techniques and criterions for energy efficiency are applied. This As-dimension also includes the EPC rank.

The EA dimension includes environmental and accessibility indicators, such as noise pollution, next-to-sea location, employment density, accessibility to highways and train stations as well as distances to centralities.

In the S dimension, education level and income are key factors. It includes the percentage of residents holding a university degree living around each of the analyzed apartments. In order to depict a wider picture of the socio-economic structure of the city, a Principal Component Analysis (PCA) has been computed departing from the professional positions (e.g. managers, clerks, blue collar workers, etc.). The resulting principal-components represent proxies for high, medium and low-income population. Socioeconomic indicators are relevant for price formation and “green-market-premiums” since income and education are correlated with purchasing power, social prestige and environmental concerns (Banfi et al. 2008; Himmelberg et al. 2005).

3.2.2 Geographically-Weighted-Regression Model

Since the primary interest is to study the possible variation of EPC rank marginal price, a GWR has been used. This approach has many advantages: (i) it considers the impact of independent variables in a more flexible way, (ii) it resolves autocorrelation issues, and (iii) represents a “soft window” approach to submarket identification.

The GWR adjusts as many regressions as there are observations. In these regressions, the further away the observations are from the pivotal point, the less weight (i.e. importance) they have in the estimation of the B coefficients (one different for each regression). The weighting matrix is calculated as follows:

where w is the weighting space matrix, i is the pivotal point of the regression, j is each of the N observations included in the local regression and h is the distance from the Nth j point (Charlton et al. 2005). When the density of the observations is not constant throughout the space, it is advisable to use an adaptive kernel, making it possible to relax the geometry of the analysis area, which may not be isotropic from point i.

As it has been said, the dependent variable in the GWR-Model are the residuals of model I (after removing the EPC ranking as explanatory variable) and the only independent variable in the GWR-Model is the EPC ranking.

3.3 Data

Selling listing prices for apartments is the primary source of information. Such information has been retrieved from Habitaclia, one of the leading web-based property listings in Catalonia. The original dataset comprises 40,844 flats and includes architectonic, structural attributes as well as geo-locations. Data refers to April 2016, it is to say, almost 3 years after the RD 235/2013 made it mandatory to include EPC ranking in real estate advertising. Despite such obligation, in the sample only 15.28% of the listings does include EPC rankings.

In order to control all the location attributes that might influence prices (i.e. environmental quality, accessibility and socioeconomic structure of neighborhoods) a comprehensive GIS has been built departing from the data-sources detailed in Table 2.

All the contextual information has been incorporated into each of the analyzed dwellings using a spatial query departing from a buffer of 300 meters of radius around each of the dwellings. In order to eliminate outliers a twofold approach has been used: (i) first, all the cases with price values located beyond ±2 Std. Dev from the average price have been removed, (ii) second, the remaining of the cases have been depurated using the Mahalanobis Distance. This latter procedure allows to remove the cases whose price is not explained by the covariates but rather by other unmeasured aspects, such as landscaping or specific decorations (Li 2005). The depurated sample includes 5,497 cases.

Table 2 shows the statistical description of sample´s attributes. The average values are: 217,205 Euro; 86.8 m2; and 1.36 bathrooms. Regarding the facilities of condominium, 10% of apartments are equipped with swimming pool and 67% have a lift; 46% of the listed apartments have air conditioners and 68% are equipped with heating systems. In terms of quality of finishes/equipment, 34% of the advertisings claim for high-quality kitchens and 6% have chimneys; meanwhile 12% have a terrace larger than 20 m2. The presence of terraces and balconies in very dense and hot Mediterranean cities is very appreciated by consumers.

The average construction/full-refurbishment year is 1972, 70% of the sample has been constructed before 1981 when non-thermal isolation was required by law, 22% between such year and 2007 when the more restrictive technical building code (CTE) was approved, the remaining 7% was built after that year, implying a better compliance with energy efficiency criteria. Regarding EPC ranking the average class is 2.73, where the most efficient class in Spain is A = 7 and the worst is G = 1, only 16% of the sample is ranked as class A, B or C. All in all, it depicts a housing stock where thermal energy efficiency has a large room for improvement.

Figure 2 shows the average EPC ranking for municipalities containing more than 25Footnote 1 apartments. Interestingly, the coastal southern area, in the Garraf County, depicts a relative low energy efficiency benchmark. This zone comprises a relatively diverse typology of municipalities ranging from metropolitan subcentres, such as Vilanova, to more touristic cities such as Castelldefels and Sitges. In the interstitial municipalities of such poles, an important number of sprawling developments emerged during the second part of the 20th Century, most of them of low quality. This same trend of low-quality houses, in a lesser extent, is also located in some suburbs located at the Pre-littoral mountain range in the Maresme Coast and around Montseny area. On the contrary, Barcelona and some of the nearest municipalities that have concentrated the development of recently completed homes do exhibit a better average performance. The uneven distribution of energy efficient apartments along the city reinforces the need to explore the spatial implications on price formation.

4 Results

4.1 The Impact of EPC Ranking on Housing Prices

Using similar information from November 2014, Marmolejo-Duarte (2016) reported that each of the EPC ranks increases 0.85% the price of flats in Barcelona, while in our model (OLS-Model 1 in Fig. 3), such premium increases up to 1.7%. Implying that 15 months after the first results reported in Barcelona the importance of EPC ranking has almost doubled. Nonetheless, according to beta coefficients (calibrated using standardized values), in relation to other attributes energy efficiency remains one of the less important.

The apartments’ AS, AE & S attributes statistically significant at 99% of confidence explain almost 80% of the price variation.

-

In the architectonic structural dimension (AS) the most important attribute is the built area, the introduction of the squared area with a negative coefficient suggests the existence of diminishing returns in price formation (i.e. the larger the flat, the lower the marginal price increment). The presence of a lift and a swimming pool are the next attributes to enter in this dimension, implying an increase of 10.9 and 16.4% respectively in listing prices. Near in importance is the presence of a large terrace, which contributes to increase prices in 14.5%. It is worth saying that large terraces tend to be preset in penthouses (àtics in Catalan) enjoying natural light, privileged views and quietness. So, their presence might be proxying for a privileged house situation. The interaction coefficient for the attribute “level * lift” reveals that high stories do increase the price of apartments only if they are lift serviced. The presence of air conditioner and heating increase prices 8.6 and 8.4% respectively signaling the importance of thermal comfort in a context where, despite the climate benignancy, buildings in general are poorly isolated.

-

In the (EA) dimension employment density is the most important variable. Such density has been intensively used as an indicator of centrality in urban studies. Dense employment means ease of interaction, increased urban accessibility and presence of services. Accessibility to CBD is also an important variable; the semi-elasticity of this attribute suggests that each kilometer that the apartment is separated from the municipality of Barcelona the price decreases 0.3%. Nonetheless, distance to functional subcentres does not necessarily follow that rationale, since the positive sign suggest that prices increase 1.3% for each km that such distance increases. This latter finding is coherent with the fact that dynamic property markets have been located far from historical subcentres. The positive sign of distance to highways imply different things. On the one hand, metropolitan-highways are located in peripheral areas, so being far from such areas imply centrality; on the other hand, such infrastructures produce noise and car emissions. The third covariate in importance is the proximity to sea which increases 22.5% prices. The positive sign of noise annoyance requires an explanation. In this case noise annoyance refers to the proportion of households that declared in the Census that environmental noise is a problem in their neighborhood. Although, environmental noise is basically produced by cars, it is also produced by services such as shops, schools and mainly leisure activities happening both in private and public spaces. For that reason, it proxies for well-serviced zones where open-air activities occur.

-

Finally, in the (S) social dimension the model highlights the percentage of people holding a university degree as the most import locative variable. This attribute is related both to income and social perception of the space, since well-educated population tend to have relatively high salaries at the time that it is seen as a desirable source of positive externalities. In this dimension also enters the principal-component related to low medium-low income population, comprised by clerks and even qualified blue-collar working population, despite the fact they do not hold a university degree they have an acceptable income.

Model 2 is specified in the same manner than Model 1, except that EPC ranking has been deliberately excluded as an independent variable. As it can be seen, most of the covariates and factors maintain both their relative importance and semi-elasticity (the maximal variation in semi-elasticity terms is 0.6%). Nonetheless, the adjusted R2 slightly falls in relation to Model 1, confirming that EPC ranking does play a role in price formation. The residuals of Model 2 have been used in the GWR model next explained.

4.2 Does EPC Ranking has a Stationary Impact on Residential Prices?

As discussed prior, in order to analyze whether EPC ranking has a stationary impact on price formation, a GWR model has been implemented. According to conclusions of Fotheringham et al. (2003) and Brunsdon et al. (1998), the lower the AIC, the higher the adjustment of the model, although an extremely small AIC signals an overfitting issue (Guo et al. 2008). Considering this warning, in this study the optimal bandwidth band is bounded by 200–300 m following a cross-verification process.

Significance of the spatial variability in GWR estimation can be examined more formally by conducting a Monte Carlo Test (see Hope 1968) and its results indicate non-stationary spatial impacts, if p-value is found to be less than 0.05.

According to Table 3, GWR-model exhibits an R2 suggesting that 17% of the variance of residuals of Model 2 can be explained by the EPC ranking when spatial flexibility is allowed. This variable appears as significant at 99% of confidence and, as expected, it is positive in all the quartiles, although some cases have a negative unexpected sign (i.e. the lower the energy efficiency measured by means EPC ranking, the higher the price). Furthermore, according to the Monte Carlo Test, the impact of EPC ranking on prices is not stationary across the space. Figure 4 depicts the spatial distribution of EPC local-coefficients from the GWR analysis. The colors represent the importance of EPC rank according to such coefficient. As it can be seen dwellings with negative energy impact on housing prices locate mainly in three areas: (1) southern AMB (in municipalities such as Sitges, Calafell, El Vendrell, etc.); (2) middle-northern AMB (mainly Llinars del Valles); and (3) middle and northern Barcelona. Municipalities with green color are the most positive sensitive area and located in subcentres of AMB (mainly Terrassa and Sabadell) and Sant Marti District in Barcelona.

4.3 Relationship between EPC Ranking Variation and Urban, Social and Housing Attributes

So far, the results suggest that there is a non-stationary impact of EPC ranking on price formation. Although most of the cases result into a positive expected sign there are some exceptions where local-coefficients for EPC rank have resulted with a reversed sign. In order to explore this situation, and more generally, the trends on EPC rank variation the cases: (1) have been selected if the local coefficient for EPC rank is statistically significant at 90% of confidence, (2) the selected cases have been clustered in 4 groups. Group 1 clusters all the local negative coefficientsFootnote 2 (138 cases), Group 2, 3, and 4, roughly have the same quantity of positive cases following a tercile criteria (471 cases each one). As a result, only 1,550 cases are analyzed (see Fig. 5).

From the spatial distribution (Fig. 5), it seems that larger positive impacts of EPC ranking locate in three areas: (1) the largest subcentres, such as Terrassa and Sabadell; (2) the northern Maresme coastal area, such as Canet de Mar and Arenys de Mar; (3) some districts in Barcelona. Conversely, Group 1 cases exhibiting a negative impact concentrate in Sitges.

Figure 6 contains the average value for each of the AS, EA, and S attributes of the analyzed subsample for each of the four groups. According to Fig. 6 the following conclusions can be drawn:

-

There is a clear (inverse) correlation between the impact of EPC ranking price and quality of apartments. Namely the higher the impact, the lower the unitary price, built area, quality of kitchen, number of bathrooms, presence of condominium facilities such as swimming pool. Less clear is the relationship with the presence of terrace, construction year or heating.

-

Also, there is a correlation with locative factors. The larger the EPC ranking impact, the smaller the proximity to train (suburban train and subway) and metro stations, the higher the proximity to metropolitan-highways (located in peripheral locations), and smaller the annoyance of noisy (well serviced) zones.

-

Finally, in the (S) social dimension, the larger the impact, the smaller the proportion of well-educated population, and the fewer the presence of high-income population.

On the other hand, the areas where the local-coefficient for EPC ranking is reversed have: relatively new dwellings, depicting the largest average price, with state-of-the-art qualities and facilities, located next to the sea and decidedly populated by the wealthy population. It seems, therefore, that in this coastal submarket the energy performance in buildings is not the main priority for households, producing, in that way, an erratic outcome. At the same time, the larger impact of EPC rakings is located in areas of poor-quality housing inhabited by low income population. In such areas, oriented towards tourism, the proximity to sea, and amenities such as swimming pool, are the main drivers of prices irrespectively the energy efficiency of housing.

5 Conclusions

Several hedonic pricing studies have explored the impacts of mandatory EPC labels on dwellings’ price among the European Union (EU). However, the majority of them investigates areas with temperate oceanic climate (Bio Intelligence Service et al. 2013; Brounen and Kok 2011; Fuerst et al. 2015; Hyland et al. 2013), while in Mediterranean climates the evidence on EPC market premiums for efficient housing is scarcer. In Spain the seminal evidence reported by De Ayala et al. (2016) and Marmolejo-Duarte (2016) shows a very small impact of EPC ranking on selling prices. Nonetheless, the reactivation of the national real estate market, after the 2007–2015 crisis, and mainly the impressive increase in the price of utilities claims for revisiting such conclusions. This paper helps to fill that gap by studying the recent hedonic agenda of EPC rankings in Barcelona, one of the largest urban agglomerations in the EU. In doing so, listing information of selling apartments is analyzed using a hedonic approach. The results of the OLS model suggest that each EPC rank increases 1.7% the selling price of apartments; that’s almost the double in relation to previous findings (Marmolejo-Duarte 2016). Thus, the first conclusion of the study reported here is the increase in importance of EPC ranking in a relatively short period of time. However, compared to results of other climatic zones, the G-A class improvement is still modest: as said, in Barcelona price increase is 10.2%, whereas in Ireland it is 19.9%, in the Netherlands is 15% and in England 12% as reported in Table 1.

In general, the reviewed studies have found the impact of EPC ranking to be larger in the selling market in relation to the leasing one, and larger in cheap, small and rural located houses, perhaps because such dwellings are targeted to people with family budgets more sensitive to energy savings. Nonetheless, none EPC study has researched the spatial implications of energy efficiency marginal price. An exception is the work of Chegut et al. (2014) that reports a “gentrification” (sic) process for the London office market. According to these authors, in such scenario a new BREEAM certified building exhibits a marginal market premium lower than the previous certified neighboring office building, implying in that way a spatial competence. In Barcelona, Marmolejo-Duarte (2016) also reports that EPC ranking only becomes statistically significant when location control variables are introduced into models, suggesting a kind of spatial dependence that must be extensively explored. For that reason, the second objective of this research is to explore whether EPC ranking agenda is stationary across the city. In order to investigate such item, a geographical weighted regression model has been implemented. For the sake of simplicity, the process has consisted in regressing the residuals of OLS hedonic model in which EPC ranking has not been introduced. The results, refrained by Monte Carlo Test, suggest that EPC ranking coefficients are not the same across the metropolis of Barcelona. On the contrary, there are deep variations: as a matter of fact, in a selected pocket of the metropolis the sign of the local-coefficients is reversed. Looking closer this erratic “residential submarket”, it can be noticed that it is formed by state-of-the-art, relatively new coastal group of dwellings (including the “exclusive” Sitges area), located precisely in a zone inhabited by wealthy population. So, what is clear is that, in this area, energy efficiency is not a priority in relation to other residential and locational attributes (for example in Sitges, dwellings facing the extremely expensive waterfront were constructed when compliance with isolation requirements was scarce), making the coefficient for local EPC ranking appear as erratic.

The deeper analysis of local EPC ranking coefficient undercovers more serious menaces coming from the price formation in relation to energy efficiency. It seems there is a clear correlation between the importance of EPC rank on price formation to the quality, location and socioeconomic conditions. The larger the impact of EPC ranking on property prices, the lower the quality, less central and less wealthy the neighborhood where dwellings are located. It is to say, the areas depicting the worst of the architectonic conditions of apartments inhabited by the less wealthy population are those where EPC rankings have a larger impact on housing prices. This finding has enormous implications for public policy from the social cohesion perspective, since precisely low-income areas are inhabited by less educated population with large barriers to find economic resources leading to housing retrofit. So, a pretty well intended environmental policy, such as energy labels coming from the EPBD might have negative unexpected social consequences. By increasing the negative impact of low energy efficiency, an important brown discount appears, undervaluing the main asset of poor population. There are some possible explanations for this finding. On the one hand, there is the fact that low quality energy efficiency conditions imply a larger impact of low-income family budgets coming from energy bills. On the other hand, we see the fact that in low quality market segments most of the amenities and facilities such as lift, air conditioning & heating systems, large terraces or even swimming pool are absent. Therefore, in absence of quality differentiating attributes, EPC energy ranking may play an incorrect quality differencing role (Marmolejo-Duarte and Chen 2019a). For that reason, it is necessary to review the strategies regarding the communication strategy of the EPC scheme, as well as, the implications of efficient homes over household’s budgets and the environment. As well to construct robust indicators of architectonic quality in order to better isolate the impact of energy efficiency on housing prices.

Notes

- 1.

25 is the average of apartments by municipality no considering the municipality of Barcelona.

- 2.

In order to double check the results of the GWR model, a specific OLS model has been implemented only with the 138 cases where the local GWR coefficient is negative. In this latter OLS model the variable to explain is the residuals from MOD 2, and the unique explaining variable is the EPC rank. The resulting OLS coefficient is negative and equivalent to −0.055 (sig = 0.01) which is almost the same than the average of the GWR local coefficients. These results endorse the findings reported here.

References

Arcipowska A, Anagnostopoulos F, Mariottini F et al (2014) Energy performance certificates across the EU. A Mapping of National Approaches: 60

Banfi S, Farsi M, Filippini M et al (2008) Willingness to pay for energy-saving measures in residential buildings. Energy Econ 30:503–516. https://doi.org/10.1016/j.eneco.2006.06.001

Bio Intelligence Service, Lyon R, IEEP (2013) Energy performance certificates in buildings and their impact on transaction prices and rents in selected EU countries. In: Final report prepared for European Commission (DG Energy): Paris, France, 19 April 2013

Bottero M, Bravi M (2014) Valutaziones dei benefici conessi al riasparmio energetico degli edifice: un approccio econométrico. Ambiente e Sicurezza: 15–24

Brounen D, Kok N (2011) On the economics of energy labels in the housing market. J Environ Econ Manag 62:166–179. https://doi.org/10.1016/j.jeem.2010.11.006

Brunsdon C, Fotheringham S, Charlton M (1998) Geographically weighted regression. J Roy Stat Soc D-Sta 47:431–443. http://www.jstor.org/stable/2988625?origin=JSTOR-pdf

Can A (1992) Specification and estimation of hedonic housing price models. Reg Sci Urban Econ 22:453–474. https://doi.org/10.1016/0166-0462(92)90039-4

Charlton M, Fotheringham S, Brunsdon C (2005) Geographically weighted regression. In: ESRC National Centre for Research Methods, University of Leeds, Leeds

Chegut A, Eichholtz P, Kok N (2014) Supply, demand and the value of green buildings. Urban Stud 51:22–43. https://doi.org/10.1177/2F0042098013484526

De Ayala A, Galarraga I, Spadaro JV (2016) The price of energy efficiency in the Spanish housing market. Energy Policy 94:16–24. https://doi.org/10.1016/j.enpol.2016.03.032

Epple D, Quintero L, Sieg H (2018) A new approach to estimating hedonic equilibrium models for metropolitan housing markets. Johns Hopkins Carey Business School Research Paper No. 18–12. https://doi.org/10.2139/ssrn.3216207

Eurostat-European Commission (2016) Energy transport and environment indicators. Luxembourg

Fotheringham AS, Brunsdon C, Charlton M (2003) Geographically weighted regression: the analysis of spatially varying relationships. Wiley/University of Newcastle, West Atrium/UK

Fregonara E, Rolando D, Semeraro P (2017) Energy performance certificates in the Turin real estate market. J Eur Real Estate Res 10:149–169. https://doi.org/10.1108/JERER-05-2016-0022

Fuerst F, McAllister P, Nanda A et al (2015) Does energy efficiency matter to home-buyers? An investigation of EPC ratings and transaction prices in England. Energy Econ 48:145–156. https://doi.org/10.1016/j.eneco.2014.12.012

Guo L, Ma Z, Zhang L (2008) Comparison of bandwidth selection in application of geographically weighted regression: a case study. Can J Forest Res 38:2526–2534. https://doi.org/10.1139/X08-091

Himmelberg C, Mayer C, Sinai T (2005) Assessing high houses prices: bubbles, fundamentals and misperceptions. J Econ Perspect 19:67–92. https://doi.org/10.1257/089533005775196769

Hope AC (1968) A simplified Monte Carlo significance test procedure. J R Stat Soc B: 582–598. https://www.jstor.org/stable/2984263

Hyland M, Lyons RC, Lyons S (2013) The value of domestic building energy efficiency—evidence from Ireland. Energy Econ 40:943–952. https://doi.org/10.1016/j.eneco.2013.07.020

Li F, Norrbin S, Rasmussen D et al (2005) Hedonic regression models when unmeasured quality differences are present. In: Florida State University, Tallahassee, FL

Malpezzi S (2003) Hedonic pricing models: a selective and applied review. Housing Economics and Public Policy: 67–89. https://doi.org/10.1002/9780470690680.ch5

Marmolejo-Duarte C (2016) La incidencia de la calificación energética sobre los valores residenciales: un análisis para el mercado plurifamiliar en Barcelona. Inf Constr 68:156–168. https://doi.org/10.3989/ic.16.053

Marmolejo-Duarte C, Chen A (2019a) The uneven price impact of energy efficiency ratings on housing segments. Implications for public policy and private markets. Sustainability 11:372. https://doi.org/10.3390/su11020372

Marmolejo-Duarte C, Chen A (2019b) La incidencia de las etiquetas energéticas EPC en el mercado plurifamiliar español: un análisis para Barcelona, Valencia y Alicante. Ciudad y Territorio Estudios Territoriales, Vol. (LI), 199. https://upcommons.upc.edu/bitstream/handle/2117/133075/CyTET%20199_Marmolejo-Chen.pdf?sequence=1&isAllowed=y

Marmolejo-Duarte C, González-Tamez C (2009) Does noise have a stationary impact on residential values? J Eur Real Estate Res 2:259–279. https://doi.org/10.1108/17539260910999992

Roca-Cladera J, Marmolejo-Duarte C, Moix M (2009) Urban structure and polycentrism: towards a redefinition of the sub-centre concept. Urban Stud 46:2841–2868. https://doi.org/10.1177/2F0042098009346329

Sheppard S (1999) Hedonic analysis of housing markets. Handb Reg Urban Econ 3:1595–1635. https://doi.org/10.1016/S1574-0080(99)80010-8

Acknowledgements

This paper has been produced in the framework of EnerVALOR project (MINECO FEDER BIA2015-63606-R) leaded by the first author, as well as in the doctoral dissertation of the second author. The authors wish to thank Habitaclia for allowing to use both of the datasets analyzed in this paper, also Rolando Biere and Camilo Echavarria for their support gathering the information used, and to James Macdonald for the final proofreading of this piece.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Marmolejo-Duarte, C., Chen, A., Bravi, M. (2020). Spatial Implications of EPC Rankings Over Residential Prices. In: Mondini, G., Oppio, A., Stanghellini, S., Bottero, M., Abastante, F. (eds) Values and Functions for Future Cities. Green Energy and Technology. Springer, Cham. https://doi.org/10.1007/978-3-030-23786-8_4

Download citation

DOI: https://doi.org/10.1007/978-3-030-23786-8_4

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-23784-4

Online ISBN: 978-3-030-23786-8

eBook Packages: EnergyEnergy (R0)