Abstract

The marine oil industry in the Gulf of Mexico (GoM) began in 1938 with the construction of the first oil well platform built in 4 meters of water, a mile off the Louisiana coast. The Mexican marine oil industry began in the 1950s with exploration and low-level production off the city of Tampico in the state of Tamaulipas. The discovery of the massive Cantarell oil field off Campeche in 1976 led to rapid expansion of the Mexican industry, surpassing US production of GoM-derived oil. Total annual oil production from the GoM peaked in 2003 at 1.6 billion barrels, but has since declined to about 1.2 billion barrels. Production at the Cantarell field peaked in 2004 and has since declined by 90%. Both the US and Mexican oil industries have focused more recently on deepwater plays to support production. The US oil production by lease depth showed a steady offshore migration through the 1990s but a dramatic rise in ultra-deep (e.g., ≥1500 m water depth) production beginning in the 2000s. In 2017, 52% of US oil production was from ultra-deep wells. Beginning in 2013, Mexico liberalized its policies to allow international cooperative ventures for exploration and production, particularly focusing on deepwater sources. Several large discoveries off Mexico since 2015 portend higher offshore production in the 2020s when these fields come online. In the US GoM, marine-derived natural gas production has declined by 79% since 1997, to about 1 trillion ft3 in 2017, reflecting rapid increases in land-based gas sources from hydraulic fracturing, which are less expensive to produce that marine-derived gas. Over the next decade, shallow-water sources of oil and gas in the US GoM will be phased out or reduced in importance as additional ultra-deep sources are developed. In the US GoM these include plays in depths to 3000 m and potentially deeper off Mexico. Ultra-deep sources occurring in the “Golden Triangle” between West Africa, Brazil, and the GoM will likely dominate global ultra-deepwater production, but other frontier regions will doubtlessly be explored. The inherent risks of catastrophic well blowouts at extreme depths will increase as the productivity of oil facilities increases exponentially with water depth.

Access provided by Autonomous University of Puebla. Download chapter PDF

Similar content being viewed by others

Keywords

1 Introduction

This book considers the potential impacts and responses to another large-scale, deepwater oil spill occurring in the Gulf of Mexico (GoM; Fig. 2.1) or elsewhere in the world. We synthesize many published research studies and especially focus on scientific investigations conducted during and after the Deepwater Horizon accident (Lubchenco et al. 2012). While the focus of the book is on factors controlling the fate, distribution, and ecological consequences of such spills, equally important considerations are where and under what circumstances such a deepwater blowout might again occur. Using the eight-decade history of marine oil and gas exploration and production from the GoM, including documentation from the USA and Mexico, we review the history and trends in spatial distribution, production, utilization, and management of the Gulf’s oil industries. We also provide global perspectives on deepwater oil development and thus where in the world deep spill responses are most likely to be necessary.

Geographic distribution of offshore oil and gas infrastructure facilities (yellow circles) in the Gulf of Mexico (GoM), 2017. (Data are from BOEM and PEMEX) . Also illustrated are the exclusive economic zone (EEZ ) boundaries between the USA, Mexico, and Cuba, as well as the US Congressional moratorium boundary on new oil and gas drilling (applicable until 2022). The locations of the Ixtoc 1 and Deepwater Horizon (DWH) oil blowouts are plotted as black triangles

2 History of Oil Development and Production in the Gulf of Mexico

Marine oil and gas development in the GoM was initiated in 1938 with the construction of a 320 × 180 ft wooden deck from which a drilling derrick sank a well in 4 m (14 ft) of water. The initial Superior-Pure State No. 1 well was located about a mile offshore of Creole, Louisiana (AOGHS 2018; Duncan et al. 2018). It successfully produced oil but was destroyed by a hurricane in 1940, then subsequently rebuilt, and put back into production. In 1947 Kerr-McGee drilled the first marine oil well out of sight of land in 6 m of water 10 miles from shore. This well would eventually yield 1.4 million stock tank barrels (=42 gallons, defined at sea level pressure) and 307 million ft3 of natural gas (AOGHS 2018). By the end of 1949, there were 11 oil and natural gas fields in the northern GoM (AOGHS 2018). A critical management issue resolved in the 1940s and early 1950s was the ownership of so-called tidelands (Austin et al. 2008), finally investing the authority to sell leases and regulate the offshore industry extensive of state territorial waters, in the federal government, through the Outer Continental Shelf (OCS ) Lands Act of 1953. The OCSLA defines the OCS as all submerged lands lying seaward of state coastal waters which are now under the US jurisdiction (Austin et al. 2008). The OCSLA thus substantially predated the establishment of the 200 nm exclusive economic zone (EEZ) by the USA in 1980 (Fig. 2.1), which asserted control over a wider variety of natural resources.

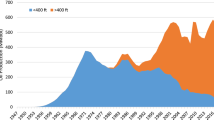

Between the 1940s and the 1970s, the US oil industry in the GoM gradually evolved to mid-continental shelf depths (Table 2.1) as technology advanced and larger plays of higher producing oil and gas were discovered. Annual oil production increased between the 1940s and 1970s from about 7 million barrels per year (MBPY ) in the 1950s to about 290 MBPY in the 1970s (Table 2.1; Fig. 2.2). Throughout this period, the technology for exploratory drilling evolved but was primarily based on derricks fixed to the ocean bottom or so-called “jack-up” rigs, consisting of a platform the legs of which could be systematically lowered to the sea bottom to support drilling operations, but subsequently jacked up and moved to other locations. These types of MODUs (Mobile Offshore Drilling Units) are appropriate for water depths to about 200 m. During the 1970s to the early 1990s, total oil production was stable, but the maximum depths of wells increased to about 700 m in the 1980s and 1300 m in the 1990s. This necessitated the development of drilling apparatus not fixed to the sea bottom but rather tethered by anchoring systems or dynamically positioned with the platforms floating at the surface (see Nixon et al. 2016 for a timeline of technology developments in offshore exploration and production equipment). The discovery and later production from the deepwater Cognac field by Shell Exploration and Production Company in 1975 was the first platform to exceed 300 m water depth and ushered in a new era of engineering development for deep tethered drilling and production systems. These deepwater technologies have included:

Cumulative decadal oil production (Table 2.1) by maximum lease depth in US waters of the GoM, 1948–2017. (Data are derived from the Bureau of Ocean Energy Management (BOEM): https://www.data.boem.gov/)

Semi-submersible platforms

Floating and semi-submersible platforms that can be moved, have buoyancy tanks, and are anchored to the seafloor. Their positions over well drilling or production operations are maintained through mooring systems or dynamic positioning (DP) technologies based on global positioning systems (GPS). The maximum depth of semi-submersibles is about 3000 m water depth.

Drill ships

Vessels with drilling capabilities used primarily for exploration of new oil fields or specific wells. As with semisubmersible platforms, positions over the well are maintained with anchoring systems and DP. Maximum depths of drill ships can be ~3700 m.

Compliant towers

These production platforms are modifications of shallow-water systems that consist instead of thinner, flexible towers and affixed to a traditional foundation. Compliant towers can withstand significant torsion, typical in ocean currents, and are used in water depths ranging up to 1000 m.

Floating production systems

Floating production systems (FPSs) are used to support marine operations and do not, themselves, drill for or produce from existing wells; there are a number of types of FPSs including FPSOs (floating production, storage, and offloading systems), FSOs (floating storage and offloading systems), and FSUs (floating storage units).

Tension-leg platforms

Are floating platforms tethered to the seabed in ways that eliminate most lateral movements. Tension-leg platforms can be deployed in water depths to 2000 m.

Spar platforms

Spar platforms consist of a large cylindrical center tank with ballast weights and mooring tethers. They are highly stable platforms that can be deployed in depths in excess of 3000 m.

Using variants of the above deepwater technologies, offshore oil production dramatically increased in the US GoM since the 1990s (Figs. 2.2, 2.3, and 2.4). In the USA, oil production since the early 1990s has risen to a record of 653 million barrels in 2017 and was 634 million barrels in 2018. Over the past 25 years, the total oil production from the US GoM has cycled with economic conditions (demand), the degree of regulation, and other factors (Fig. 2.4). Notwithstanding the 2010 Deepwater Horizon accident and short-term impacts on the industry (National Commission on the BP Deepwater Horizon Oil Spill and Offshore Drilling 2011; Lubchenco et al. 2012), however, production increased steadily between 2013 and 2017 (Fig. 2.4). In 2010, GoM oil production accounted for nearly 30% of all domestic oil production in the USA including terrestrial and other ocean-derived sources. The proportion of total domestic production from the GoM has since declined to about 20% in 2017 as additional onshore supplies have been developed.

Total US crude oil production from the GoM and proportion of all US oil production coming from marine waters of the Gulf, 1990–2017. Data may be slightly higher than Table 2.1 because of incomplete reporting by lease

One of the most pronounced trends in US GoM production over the past two decades has been the rise in the contribution of ultra-deep oil sources to total oil removals (Figs. 2.2 and 2.3; Table 2.1). Since 2000, the fraction of total GoM production from ultra-deep wells has risen from about 15% (2000–2009) to, in 2017, 52% (Table 2.1; Figs. 2.2, 2.3, and 2.4). This trend has been fueled by additional discoveries of fields in 2–3000 m of water (Fig. 2.3). In recent years, the development of deep oil production facilities has allowed multiple well locations to be serviced on the same lease. Despite the extremely high costs to develop and deploy deepwater technologies, the average monthly lease production increases exponentially with lease depth (Fig. 2.5), and thus, depending on the break-even price for deepwater production, deepwater sources can be enormously profitable. For example, using 2017 data (Fig. 2.5), the average monthly production from a lease 200 m deep (on the continental shelf) is predicted to be about 20.9 thousand barrels per month, whereas an ultra-deep lease at 2200 m yields a predicted 374.9 thousand barrels per month – 18 times greater productivity. The highest producing lease in the US GoM in 2017 yielded 2.8 million barrels per month (Fig. 2.5). Of course, investment costs for deepwater operations are much higher than for shallower plays. Thus, depending on the cost-to-oil revenue ratio, offshore leases can be more profitable relative to traditional inshore sources. Higher productivity of the ultra-deep sources is due to the relatively large sizes of the underlying oil reservoirs and facilitated by the enormous reservoir pressures, which allow the oil to come to sea level without the aid of pumping equipment (N.B., overpressured wells also exist in shallower waters). This represents both a driver of the economics of deepwater production and a potential risk factor, as oil and gas mixtures are under enormous pressures and temperatures emanating from the source reservoirs.

Notwithstanding the increasing trend in oil production from the US portion of the GoM (Fig. 2.4), production of natural gas from the US GoM has plummeted since 1997 (Fig. 2.6). In the late 1990s, GoM gas comprised over 20% of all domestic gas production in the country. By 2017, the total quantity of gas produced from the GoM declined by 79% to just over 1 trillion ft3 (Fig. 2.6). The proportion of total domestic gas production from the GoM declined from 22% to just 3% during this period (Fig. 2.6). This enormous decline in gas production from marine waters of the GoM can be attributed to the steep decline in gas prices and increased supplies owing to the development of land-based hydraulic fracturing (“fracking”). Gas production in the Gulf is generally derived from shallower sources than for oil (e.g., Fig. 2.3); in 2017 and early 2018 30% of total gas production was from leases ≤100 m water depth, whereas only about 8% of oil came from ≤100 m (Fig. 2.3). Thus, many of the shallow-water, predominantly gas-producing, leases have been abandoned over the past decade, resulting in accelerated decommissioning of these plugged and abandoned structures, particularly in shallow waters off Texas and Louisiana (Fig. 2.1; GAO 2017). Since many of the deepwater structures have no permanent foundations or pillars, decommissioning will peak as the US industry continues its trend to ultra-deep oil production and reduced emphasis on shallow-water natural gas.

Total natural gas production from US waters of the GoM and proportion of the US total gas production, 1990–2017. (Data are derived from BOEM: https://www.data.boem.gov/)

In 2006 the US Congress enacted and then President George W. Bush signed the Gulf of Mexico Energy Security Act of 2006. This law placed a large section of the federal government’s Eastern Planning Area under a moratorium from oil and gas leasing, exploration, and development until 2022 (Fig. 2.1). The law was enacted ostensibly to limit offshore activities so as not to interfere with military training activities in the NE GoM and to address concerns about potential environmental harm to coastal tourism and fishing-centric economies off Florida.

Mexican Oil Industry

With its beginnings at the turn of the twentieth century, the Mexican oil industry was landlocked until the 1950s. This included nationalization of Mexican petroleum industries in 1938 (Haber et al. 2003) and the subsequent formation of the state-run Petróleos Mexicanos (PEMEX ), which had a monopoly on exploration, production, and distribution of oil, gas, and petrochemicals in Mexico. The development of the first offshore oil and gas wells off Mexico occurred in the 1950s off the city of Tampico in the northeastern state of Tamaulipas (adjacent to the USA). It was not until the 1970s, however, that significant offshore oil and gas resources off Mexico were identified and put into production. In 1972 fisherman Rudesindo Cantarell Jimenez noticed the presence of oil off the coast of Campeche, which eventually led in 1976 to the discovery of the massive Cantarell oil field complex (Guzmán 2013; Duncan et al. 2018; Fig. 2.1). The Cantarell field was for many years the primary production region for the Mexican industry (Fig. 2.7). Cantarell production increased steadily from its inception in 1976, to its peak of about 0.8 billion barrels 2004. The Cantarell field was the location of the Ixtoc 1 marine blowout in 1979–1980 (Soto et al. 2014), which resulted in, at that time, the largest marine blowout in history, leaking about 3.3 million barrels of crude oil over a 9-month period. The Ixtoc 1 blowout was in relatively shallow waters – 54 m water depth.

After the peak in crude oil production from the Cantarell field in 2004, crude oil production from the field has declined by 90% (Fig. 2.7). In the past decade, PEMEX has sought to sustain productivity of oil and gas at Cantarell by using a variety of techniques including nitrogen injection to increase yields from those aging fields. However, those strategies have not arrested declines. Resultantly, other shallow-water fields are now producing the bulk of crude oil and gas from the Mexican GoM, but overall oil production still declined from about 1 billion barrels in 2004 to about 0.6 billion barrels in 2017. For the first time in several decades, US crude oil production from the GoM slightly exceeds that of Mexico (Fig. 2.7). Overall production (Mexico+USA) of crude oil from the GoM was about 1.2 billion barrels in 2017, about 25% below the maximum production of 1.6 billion barrels in 2003 (Fig. 2.7).

Recognizing the need to develop its deepwater assets, in 2013 the Mexican government liberalized its monopoly on oil and gas production to allow joint ventures with international partners. This has led to the discovery of extensive new deep and ultra-deep reservoirs in the Perdido region off Tamaulipas (Fig. 2.1) and off the state of Veracruz. Significant production from these fields, however, will not occur until the 2020s, and thus crude oil production off Mexico may decline further in the next few years as shallow-water fields exhaust.

Cuban Oil Industry

Off Cuba the state-owned oil company Cuba Petrol Union (CUPET ) produces about 4 million barrel equivalents per year with about 50,000 barrels per day mostly coming from the coastal reserve areas east of Havana (Slav 2017). These wells are in very shallow coastal areas or at the coastal margin (Fig. 2.8). Beginning in 2013, Cuba undertook several cooperative ventures with other international state-run oil companies to explore deepwater regions in the GoM. These exploration wells have not yet identified economically recoverable quantities of oil, but interest in deepwater sources off NW Cuba continues.

3 The Future of Oil and Gas Development in the Gulf of Mexico

As noted above, the USA, Mexico, and Cuba are engaged in significant, ongoing efforts to identify, explore, and produce ultra-deepwater resources off their coasts. While only the USA now produces from ultra-deep wells, the share of total production from them has increased to more than half of all crude oil generated, and there is no indication of a reversal in trend. Much of the investment in exploration and expensive infrastructure for ultra-deep drilling in both the USA and Mexico occurred when crude oil prices were relatively low and profitability from ultra-deep was marginal. Given recent price increases (and recognizing the volatility in them), these facilities are now producing above break-even costs, and thus efforts directed to the ultra-deep GoM will likely intensify further.

Natural gas is produced both in wells specifically drilled into primarily gas-bearing formations and is a by-product of multiphase flow from predominantly oil fields. Over the next decade or two, investment in exclusive gas wells in the US GoM may be curtailed or phased out altogether, resulting in further declines in gas production for the USA and accelerated decommissioning of much of the shallow-water infrastructure along the Texas and Louisiana coasts (Fig. 2.9; GAO 2017). This scenario depends on market forces and developments in the terrestrial-based gas industries. Off Mexico, the situation is different since the country is a net importer of natural gas and fracking ashore is not yet prevalent in Mexico. Thus, predominantly shallow-water gas production will likely continue off Mexico for some time to come.

Deepwater fields in Mexico (e.g., Perdido; off Veracruz; Fig. 2.1) will come online in the 2020s. If the US example is pertinent, it is likely that the total Mexican crude oil production will thus increase as well. Given the large, relatively unexplored region in SW GoM >1,500 m deep (Fig. 2.1), it is likely that additional productive, ultra-deep plays will be discovered and produced there. Thus, concerns about the potential impacts of deepwater blowouts off Mexico will increase.

Off the USA, the directionalities of crude oil and gas production are clear. Extensive areas of BOEM’s Western and Central Planning Districts exist in 2–3000 m water depths (Fig. 2.9), but development of ultra-deep fields there has been stagnant relative to those in the eastern portion of the Central Planning District (Fig. 2.9; Locker and Hine 2020). Some of the most extensive new finds are in the Central Planning area south and east of the DWH site (Fig. 2.9), including Shell’s Appomattox field, and it is clear that the industry will press the western boundaries of the Congressional moratorium area (Fig. 2.9). What is unclear is the fate of the moratorium area post-2022. The moratorium area contains the majority of the Gulf’s shallow water, including about 53% of the US GoM ≤200 m and over 60% of the area from 200 to 500 m (Figs. 2.9 and 2.10). On the other hand, the isobaths between 100 and 3000 m are very compact along the eastern shelf edge (known as the Florida Escarpment) with only 14% of the US GoM between 2 and 3000 m within the moratorium boundaries (Fig. 2.10). The majority of US areas >3000 m (71%) lie within the moratorium boundaries. However, the maximum lease depth as of 2017 was 2960 m. While not currently being explored, areas >3000 m are likely to be technically workable in the future.

Bathymetric profile (black line) of the northern GoM. The profile is a cumulative plot of the proportion of the US GoM existing at the shallower depths (e.g., 46% is 0–200 m, 89% is ≤3000 m). The red line is the proportion of the Gulf in each depth interval that occurs in the Congressional moratorium area (Fig. 2.9; e.g., 53% of the area ≤200 m is in the moratorium area, but only 14% of the region between 2000 and 3000 m is under moratorium)

Politics and the balance of sectoral economic issues (e.g., opposition from tourism, coastal real estate and fishing business, support from energy sectors) will determine the ultimate fate of the moratorium area post-2022. However, one important consideration regarding oil and gas production in the Florida Escarpment region is the presence of the Loop Current and its cyclonic and anticyclonic rings (Weisberg and Liu 2017). The current systems run northwestward from the Yucatan Channel, looping east and doubling back near the edge of the West Florida Shelf (Fig. 2.9). The current regularly flows at 0.8 ms−1 and can reach 1.7 ms−1, which is be problematic for long pipe strings, particularly in ultra-deep waters. Thus, while the oil in this region may be technically recoverable, there are added risks associated with the much more dynamic oceanographic conditions in the moratorium area, and likewise, should a deep blowout occur at a well below the Loop Current, some modeling scenarios show that oil impact Florida’s east and west coasts, Cuba, and the Bahamas (Paris et al. 2020 and Berenshtein et al. 2020), depending on the strength and direction of the currents (Weisberg and Liu 2017) the well flow rate and duration of uncontrolled blowouts.

Recent developments in the land-based oil and gas industries have included various technological (well stimulation) approaches to increase productivity of marginal or abandoned fields by using various injection approaches. These have included fracking (fracturing shale formations with high-pressure fluids), nitrogen injection, and other approaches. While relatively rare in the marine environment (EPA 2017), some of these well stimulation approaches may be brought into greater use for under-producing GoM oil wells in the future. The ultra-deep sector will be dominated by large multinational companies with access to substantial capital resources necessary to explore and produce in that environment. What will the smaller, independent companies do then? While they may partner with larger companies, one strategy in the medium term may be to use these novel recovery techniques to put back into production fields abandoned as under-producing by the standards of ultra-deep wells (e.g., Fig. 2.6).

4 Global Deepwater Resource Development

The US Energy Information Administration currently estimates that about 30% of global oil production is derived from marine sources (EIA 2016). Five of the 50+ countries involved in offshore oil development – Saudi Arabia, Brazil, Mexico, Norway, and the USA – accounted for about 43% of marine oil production in 2015 (EIA 2016). Only three countries (Brazil, USA, and Angola) currently produce significant quantities from ultra-deep sources, with the USA and Brazil accounting for >90% of ultra-deep production, although this will change rapidly as the technical challenges of operating at extreme depths are resolved.

A number of oil companies and consultants have identified publically where they think viable ultra-deep resources will be produced either now or in the future (Fig. 2.11). Using maps by Reid (2014) and Guzman et al. (2013), we composited a map of these likely opportunities (Fig. 2.11). Consistently, the most favorable areas mentioned are within the so-called golden triangle between the Gulf of Mexico, Brazil, and West Africa. This is not surprising since these are proven oil fields with at least some current track record of ultra-deep plays and favorable administrative and regulatory environments. Whether ultra-deep oil and gas production is viable in regions such as East Africa, the Caspian Sea, off NW Europe, NW Australia, and in the South China Sea will depend on investment decisions for exploration, logistical considerations, and political issues.

5 Summary

Continued exploration and production of ultra-deepwater fields will be a persistent trend for the marine oil and gas industries in the GoM and elsewhere for the foreseeable future. Increased scrutiny of the deepwater sector will occur with the objectives of that oversight being to reduce the likelihood of catastrophic blowouts and more effective mitigation and more timely attenuation of uncontrolled blowouts if they occur. Assisting in these efforts will be an increasingly sophisticated body of science synthesized herein.

References

American Oil and Gas Historical Society (AOGHS) (2018) Offshore petroleum history. Published online: https://aoghs.org/offshore-history/offshore-oil-history/

Austin DE, Priest T, Penney L, Pratt J, Pulsipher AG, Abel J, Taylor J (2008) History of the offshore oil and gas industry in southern Louisiana. Volume I: Papers on the evolving offshore industry. U.S. Dept. of the Interior, Minerals Management Service, Gulf of Mexico OCS Region, New Orleans, LA. OCS Study MMS 2008-042, 264 pp

Berenshtein I, Perlin N, Ainsworth C, Ortega-Ortiz J, Vaz AC, Paris CB (2020) Comparison of the spatial extent, impacts to shorelines and ecosystem, and 4-dimensional characteristics of simulated oil Spills (Chap. 20). In: Murawski SA, Ainsworth C, Gilbert S, Hollander D, Paris CB, Schlüter M, Wetzel D (eds) Scenarios and responses to future deep oil spills – fighting the next war. Springer, Cham

Duncan T, Braathen BI, McCormack N, Stauble M, Campbell L, Cizek M, Rasmussen S, Khurana S, Wilson J (2018) One GoM: exploring cross-boundary synergies, challenges. Offshore (Published online): https://www.offshore-mag.com/articles/print/volume-78/issue-6/gulf-of-mexico/one-gom-exploring-cross-boundary-synergies-challenges.html

Guzmán AE (2013) The petroleum history of México: how it got to where it is today. Published online: http://www.searchanddiscovery.com/pdfz/documents/2013/10530guzman/ndx_guzman.pdf.html

Guzman R, Carvajal P, Thuriaux-Alemán B (2013) Opportunities and challenges for global deepwater players: an industry on the search for new growth areas. 2013. Published Online: http://www.adlittle.com/sites/default/files/prism/Global_deepwater.pdf

Haber S, Maurer N, Razo A (2003) When the law does not matter: the rise and decline of the Mexican oil industry. J Econ Hist 63:1–32

Locker S, Hine AC (2020) An overview of the geologic origins of hydrocarbons and production trends in the Gulf of Mexico (Chap. 4). In: Murawski SA, Ainsworth C, Gilbert S, Hollander D, Paris CB, Schlüter M, Wetzel D (eds) Scenarios and responses to future deep oil spills – fighting the next war. Springer, Cham

Lubchenco J, McNutt MK, Dreyfus G, Murawski SA, Kennedy DM, Anastas PT, Chu S, Hunter T (2012) Science in support of the Deepwater Horizon response. Proc Natl Acad Sci 109:20212–20221

National Commission on the BP Deepwater Horizon Oil Spill and Offshore Drilling (2011) Deep water: the gulf oil disaster and the future of offshore drilling. Report to the President, 398 pp. https://www.gpo.gov/fdsys/pkg/GPO-OILCOMMISSION/pdf/GPO-OILCOMMISSION.pdf

Nixon L, Kazanis E, Alonso S (2016) Deepwater gulf of Mexico, December 31, 2014. OCS Report BOEM 2016-057. Bureau of Ocean Energy Management, 89 pp

Paris CB, Vaz AC, Berenshtein I, Perlin N, Faillettaz R, Aman ZM (2020) Simulating deep oil spills beyond the Gulf of Mexico: key ingredients for successful oil transport prediction (Chap. 19). In: Murawski SA, Ainsworth C, Gilbert S, Hollander D, Paris CB, Schlüter M, Wetzel D (eds) Scenarios and responses to future deep oil spills – fighting the next war. Springer, Cham

PEMEX (2007) Statistical yearbook 2007. Published online: http://www.pemex.com/en/investors/publications/Paginas/statistical-yearbook.aspx

PEMEX (2016) Statistical yearbook 2016. Published online: http://www.pemex.com/en/investors/publications/Paginas/statistical-yearbook.aspx

Reid D (2014) Deepwater Gulf of Mexico emerging plays: the basin that continues to deliver. https://s3.amazonaws.com/images.hartenergy.com/Interactive+Article/Offshore+Optimism/docs/Shell%20Americas-Emerging%20Plays-Oct14.pdf

Slav I (2017) Cuba eager to develop offshore oil reserves. Published online: https://oilprice.com/Latest-Energy-News/World-News/Cuba-Eager-to-Develop-Offshore-Oil-Reserves.html

Soto LA, Botello AV, Licea-Durán S, Lizárraga-Partida M, Yáñez-Arancibia A (2014) The environmental legacy of the Ixtoc-1 oil spill in Campeche Sound, Southwestern Gulf of Mexico. Front Mar Sci 1:1–9

U.S. Energy Information Administration (EIA) (2016) Offshore production nearly 30% of global crude oil output in 2015. https://www.eia.gov/todayinenergy/index.php?tg=%20offshore

U.S. Environmental Protection Agency (EPA) (2017) Final National Pollutant Discharge Elimination System (NPDES) general permit No. GEG460000 for offshore oil and gas activities in the Eastern Gulf of Mexico. Region 4 permit

United States Government Accountability Office (GAO) (2017) Offshore oil and gas resources: information on infrastructure decommissioning and federal financial risk. Statement of Frank Rusco, Director, Natural Resources and Environment, Testimony Before the Subcommittee on Energy and Mineral Resources, Committee on Natural Resources, House of Representatives, Wednesday, May 17, 2017. GAO-17-642T, 23 pp

Weisberg RH, Liu Y (2017) On the Loop Current penetration into the Gulf of Mexico. J Geophys Res Oceans 122:9679–9694. https://doi.org/10.1002/2017JC013330

Acknowledgments

We very much appreciate the thorough manuscript review by Elmer (Bud) Danenberger and Ruth Perry, Shell Exploration and Production Company. This research was made possible by a grant from The Gulf of Mexico Research Initiative/C-IMAGE I, II, and III.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2020 Springer Nature Switzerland AG

About this chapter

Cite this chapter

Murawski, S.A., Hollander, D.J., Gilbert, S., Gracia, A. (2020). Deepwater Oil and Gas Production in the Gulf of Mexico and Related Global Trends. In: Murawski, S., et al. Scenarios and Responses to Future Deep Oil Spills. Springer, Cham. https://doi.org/10.1007/978-3-030-12963-7_2

Download citation

DOI: https://doi.org/10.1007/978-3-030-12963-7_2

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-12962-0

Online ISBN: 978-3-030-12963-7

eBook Packages: Earth and Environmental ScienceEarth and Environmental Science (R0)